TRADEBANK TIMES

EDITORIAL CONTRIBUTIONS

Articles

Articles

Articles

Articles

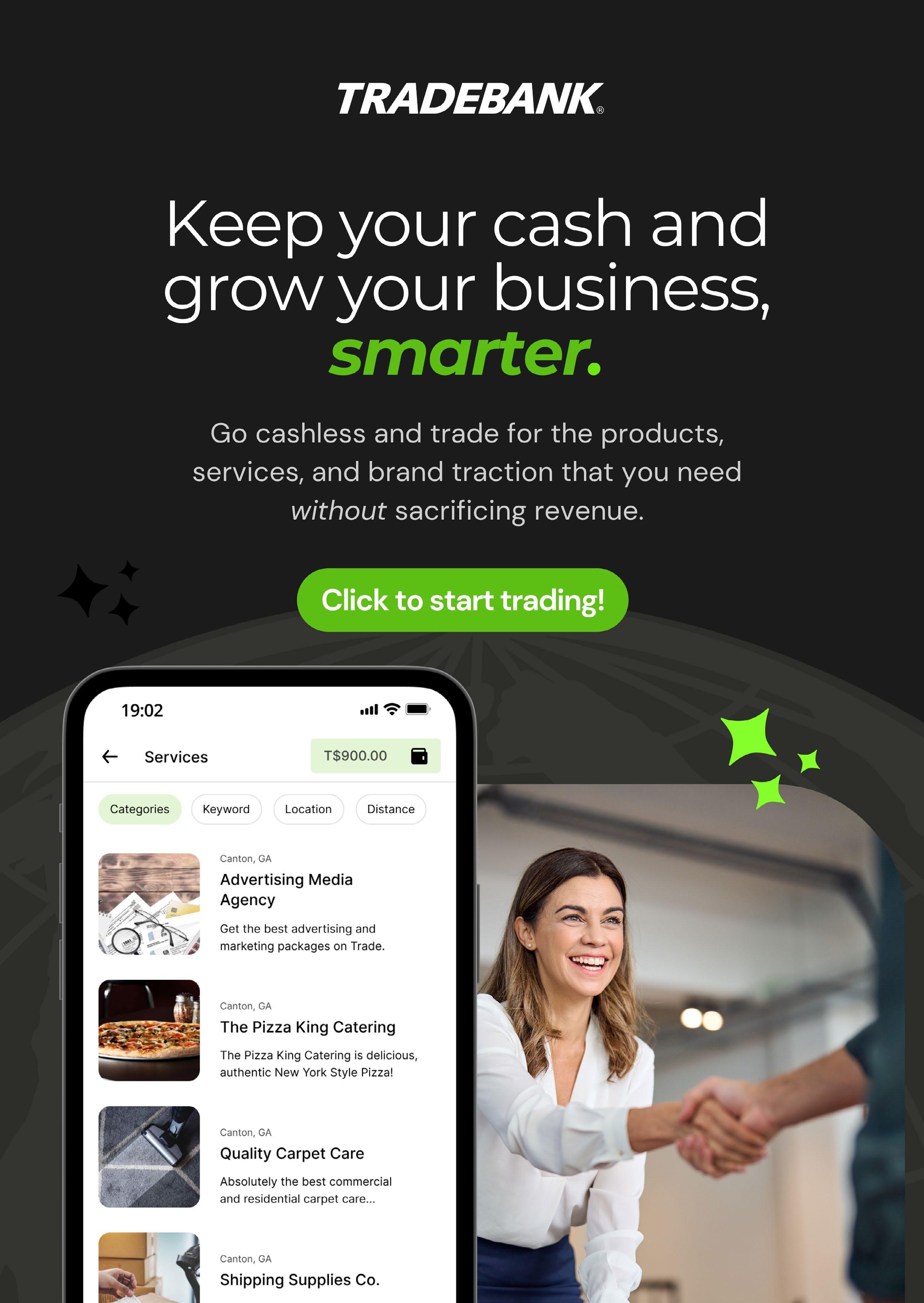

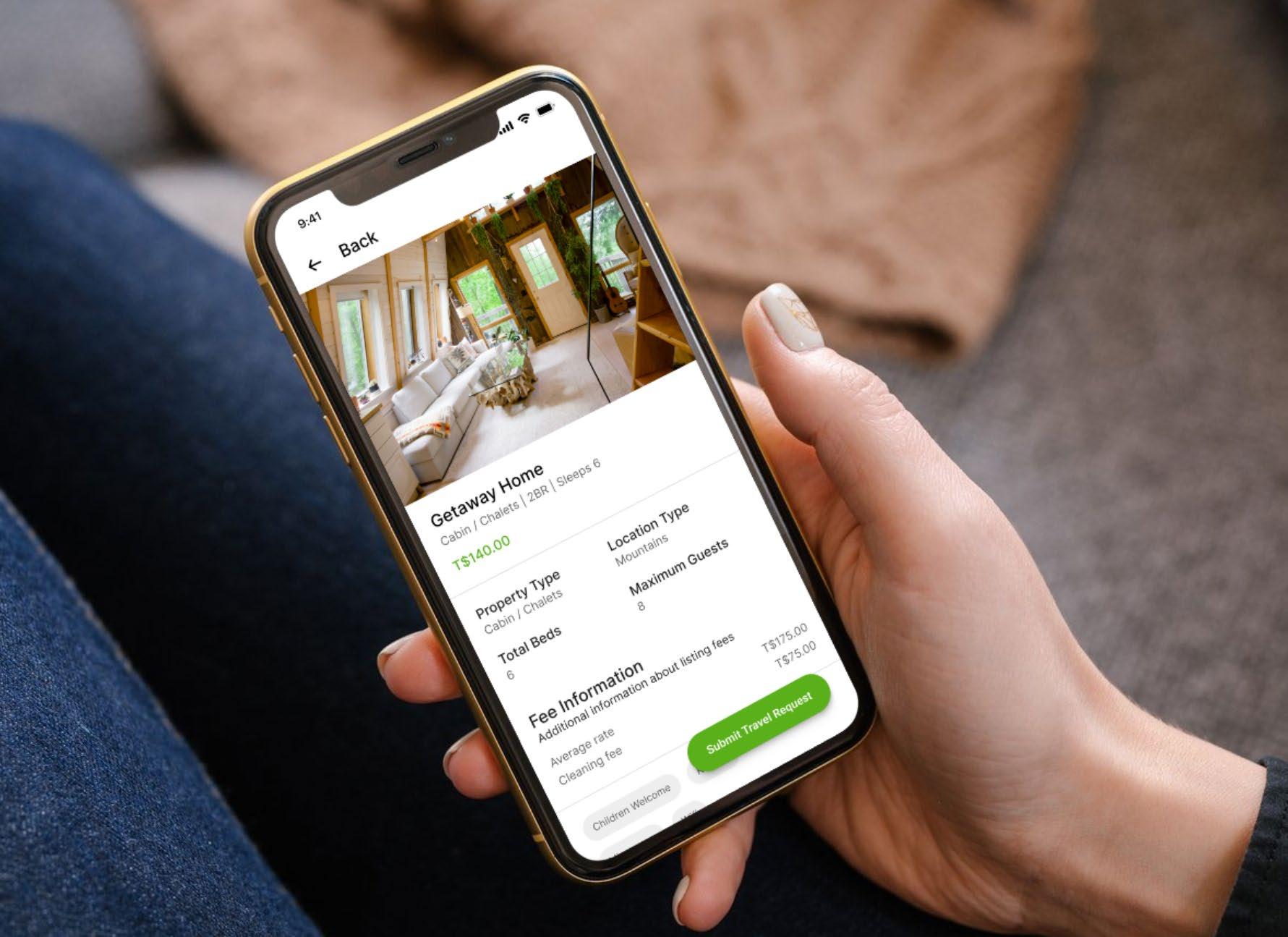

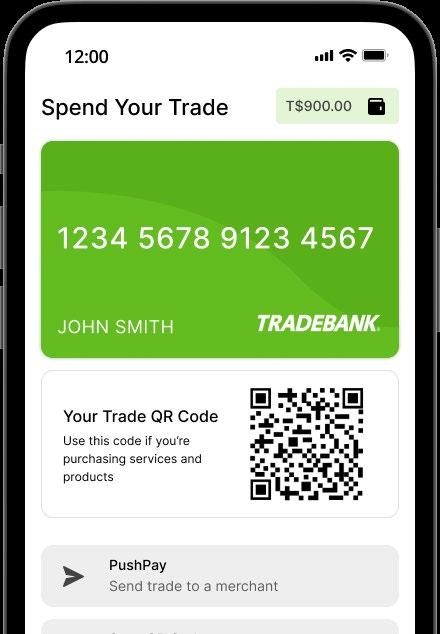

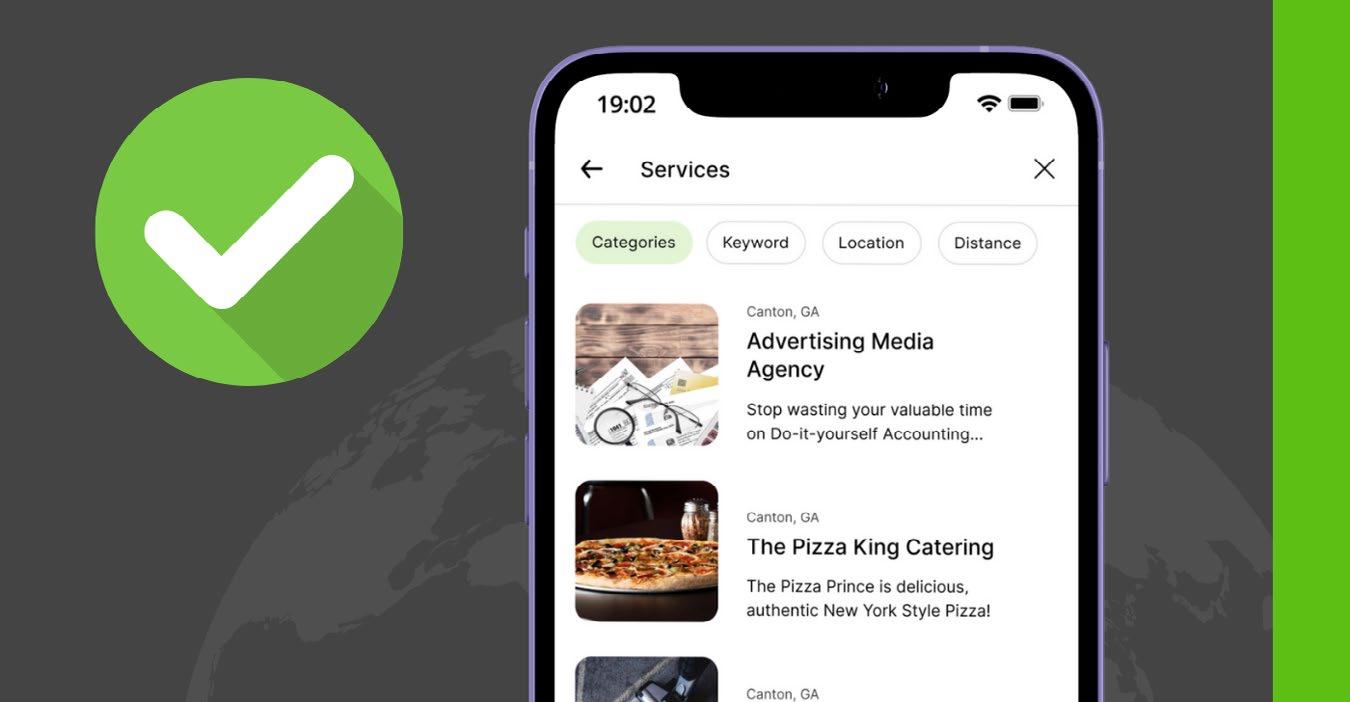

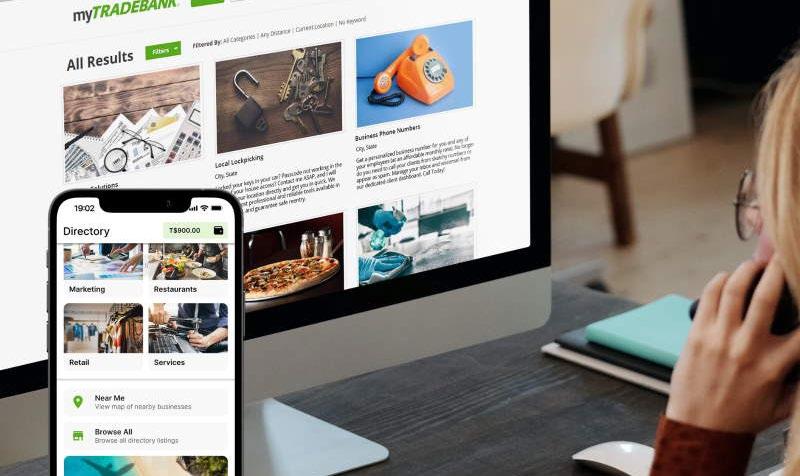

Tradebank Mobile is the best way to take your trade dollars on-the-go, with powerful features like PushPay, Near Me, Travel Requests, and more!

A celebration of life for Tradebank’s esteemed founder and former CEO.

May 27, 1944 - April 25, 2024

John P. Davis Jr., the esteemed founder and CEO of Tradebank for nearly 30 years, passed away on April 25th, 2024. The entire Tradebank family mourns the loss of this industry pioneer who devoted over four decades to revolutionizing the barter industry.

John, the eldest of four boys, began his journey in Tennessee, where he served as the police chief in Graysville, TN. He later moved his family to Macon, Georgia to open a hotel franchise, and eventually settled in Atlanta. It was there in the early 80s that he

founded World Trade Exchange, which would later evolve into Tradebank. With his wife, Leonora, who managed broker activities while he focused on client acquisition and sales training, John launched Tradebank’s first franchise in Macon, Georgia. From these humble beginnings, he expanded Tradebank to sell franchises across the United States, Canada, and the Czech Republic.

John was not just an entrepreneur but a visionary known for his innovative spirit. When asked what drew him to the

John was a true trailblazer in the barter industry, boasting over four decades of invaluable experience. His visionary leadership and unwavering commitment to Tradebank’s mission have left an indelible mark on our organization.

barter business, John remarked,

“I have always wanted to make a difference in people’s lives. Barter provides the opportunity to help people with the two most important things: the survival of their business and the improvement of their personal lives.”

He understood the vital role Tradebank played as a business tool, especially for small business owners facing competition from larger stores and corporations. John often advised,

“By being a part of Tradebank, you attract new customers. When you provide quality service at a fair price to Trade clients, they will refer new cash business to you. Know the actual cost of your trade dollar

to make wise purchasing decisions. Use the trading tools we provide— speak with your broker frequently, read your emails and newsletters, participate in Trade University, open houses, and networking events. Those who put forth the most effort gain the most, and it is no different with Tradebank.”

John’s compassion for people stood out above all. He dedicated countless hours to mentoring, befriending, and supporting clients and colleagues. Former franchise owners Marc Caldwell and Mark Davis considered John

a father figure. Since his passing, many have shared stories of his impact. One client called him “a beacon of entrepreneurial force,” while another described him as “an exceptional human being” and “the best salesperson I’ve ever met.”

John’s charisma, knowledge, and stories were legendary; he could command any room he entered. Affectionately known as “Big Bad John” for his larger-thanlife presence and quick wit, he was a man who genuinely cared about people. His legacy of compassion and dedication continues to inspire us all.

Beyond Tradebank, John enjoyed metal detecting, collecting coins, driving fast to his favorite music, stopping frequently at Dairy Queen for his favorite thick Chocolate Malt Milkshakes, and attending church. Above all, he cherished his wife, Leonora, his three daughters, six grandchildren, and four great-grandchildren.

As his daughter and CEO of Tradebank, I feel extremely fortunate to have worked alongside my father, to have been mentored by him, and to witness his passion for this industry and its positive impact on so many lives. This

company was his second love, and we will carry forward John’s vision and passion, ensuring that his legacy lives on within the Tradebank family.

“As his daughter and the CEO of Tradebank, I feel extremely fortunate to have worked alongside my father, been mentored by him, and witnessed his passion for this industry and its positive impact on so many lives. This company was his second love, and we will carry forward John’s vision and passion, ensuring that his legacy lives on within the Tradebank family.”

Written by Valerie Hale, Tradebank CEO

A fool-proof list of services often avaliable on Tradebank

Advertising

Television

Radio

Newspaper

Magazines

Consumer Trade

Flyer Distribution

Direct Mail

Market Research

Public Relations

Ad Agencies

Printing

Web Press

Graphic Designers

Production Houses

Audio

Video

Television

Illustrators

Photographers

Transit Ads

Billboards

Coupons

Signs

Banners

Decals

Promotion Items

Corporate Identity

Administrative

Accounting

Financial Planning

Management

Marketing

Credit Services

Personal

Taxes

Credit Services

Payroll Services

Daycare

Cash Registers

Legal

Office Services

Catering

Coffee

Employee Training

Motivational

Programs

Transport

Moving

Software

Consultants

Programmers

Training

Consulting

Resume Writing

Banquets

Seminars

Real Estate Services

Equipment

Copy Machines

Fax Machines

Supplies

Telephone Systems

Alarm Systems

Furniture

Contractors

Home Services

Asphalt

Basement

Waterproofing

Bathroom

Brick

Cabinet Makers

Carpenters

Concrete

Repair

Resurfacing

Fences & Decks

Drywalling & Taping

Electrical

Excavating

Floors

Installation

Refining

Gutters,

Handyman

Heating & A/C

Masonry

Painting & Wallpaper

Plumbing

Construction

Cleanup

Power Washing

Remodeling

Roofing

Sealing & Stripping

Tile Installation

Pools & Spas

Security

Windows

Woodwork

Carpet Cleaning

Janitorial

Landscapers

Maintenance

Lawn Sprinklers

Window Cleaning

Interior Design

Glass & Mirrors

Art Pieces

Paintings & Prints

Artists

Fine

Commercial

Carpet

Paint

Restaurants

Bars & Clubs

Bistros/Cafes

Casual Dining

Fine Dining

Pizzerias

Specialty Foods

Catering

Travel & Hotels

Bed & Breakfasts

Hotels

Limousines

Car Rentals

Fashion

Accessories

Formal Wear

Casual Fashion

Dry Cleaning

Footwear

Jewellery

Leather Goods

More Services

Automotive

Cooling & A/C

System

Alarms

Trim & Upholstery

Batteries & Electrical

Collision & Painting

Tires & Brakes

Auto Repair

Classic & Sports

Repair

Convertible Tops

Detailing & Car Care

Engine Building

Glass

Muffler & Exhaust

Oil & Lubrication

Parts & Accessories

Radiators

Transmissions

Rentals

Repair Service

Rust Protection

Spring & Alignment

Electronics

Car Audio Computers

Music Equipment

Television & Stereo

Flowers & Gifts

Florists

Gift Boutiques

Gift Certificates

Gift Baskets

Antiques & Collectibles

Appliances

Bedroom & Studio

Carpet Cleaning

Upholstery Cleaning

Carpet Dyeing

Draperies & Blinds

Fine Art & Framing

Furniture

Garden & Patio

Home Accents

Interior Decorating

Lighting

Garden & Patio

Your Tradebank membership gives you direct access to a totally new economy; one that’s abundant with cash-saving and network building opportunities. That being said, it might not always be obvious which steps to take first. We’ve put together this guide, and plans for future follow-up content, to ease the learning curve and give you a much better understanding of your unique leverage as a member.

At the heart of our network is the trade dollar. It’s a real, spendable currency that you earn by doing business on Tradebank. As a member, you can earn trade dollars in a variety of ways:

• selling items on the marketplace

• trading your products and services with other members

Did you know that you can earn trade dollars simply by referring other business owners to the Tradebank network? Simply visit our referrals page, send us their information, and *we’ll send you T$200 once they sign up!

• referring other business owners you know to the network

To enjoy all of the best features, opportunities and events on Tradebank, you’ll want to familiarize yourself with two tools:

myTradebank: Your primary login portal, containing our full business Directory, travel destinations, marketplace goods, and other important account management features. Best viewed on desktop devices.

Tradebank Mobile: Access all of the same great Tradebank features from your phone. It also contains your digital card and payment capabilities such as PushPay. Available on both iOS and Android!

Do you have employees or partners that need to process trade transactions, but don’t have an account? Tradebank MobilePAY is a lightweight payment processor that can be utilized without a Tradebank login. This app is designed for your employees or business partners that don’t have direct access to your account, but need to process trade dollar transcations for customers. We wrote a more in-depth resource for Tradebank MobilePAY that you can read here.

We’ve spent decades refining and improving the technology available to our members, and we encourage each of you to explore both of these platforms to maximize your trading experience. Your feedback is important to us – if there’s a trade tool or feature you’re not satisfied with, we welcome direct suggestions.

Tradebank Brokers are trained experts, dedicated to finding you new deals within the network and promoting your business. Every Tradebank member is assigned a broker, so ensure that your broker

Not a member?

Discover how barter can grow your business at tradebank.com

knows exactly what your business offers, what products or services are available for trading, and what you need! We know that your time as a business owner is limited throughout the day, but try to be active in your communications — collaborate with your Tradebank Broker to achieve the best results.

Schedule regular check-ins: Set up recurring meetings or calls with your Broker to discuss your business goals, inventory updates, and any specific needs or priorities.

Provide detailed information: Supply your Broker with comprehensive details about your products, services, pricing, and any unique selling points. The more they understand your business, the better they can position you within the network.

Seek recommendations: Your trade broker has an in-depth understanding of the network’s dynamics.

Don’t hesitate to ask your Broker for their insights and recommendations on potential partnerships, cross-promotional

opportunities, or untapped markets within Tradebank.

Treat your trade dollars like cash in terms of budgeting and allocation. Spend just a few minutes each week auditing your business expenses. Identify areas where you can allocate trade dollars instead of cash, such as office supplies, marketing services, professional development courses, or even employee perks. This exercise will help you visualize the potential cost savings and cash flow improvements.

Beyond covering routine expenses, consider using your trade dollars for strategic investments that can drive your business forward.

Trying to scale up? Invest your trade dollars into upgrading your equipment, expanding your inventory, or hiring consultants to help streamline processes or develop new product lines.

Our blog center and client tips center contain countless articles and guides if you want

to stretch your Tradebank knowledge further! Ultimately, your trade dollars are an additional revenue for you to spend freely. With frequent audits, spending strategies and open communication, you can maximize your Tradebank membership and set yourself up for serious long-term growth. You can access your Tradebank account at anytime by signing into our client portal, myTradebank.

John Perry Pellegrino Marketing Director

Follow us on Facebook to stay informed on industry trends, official events, trading tips, and so much more!

Ian Charnock, Trade Director of Tradebank Canada, presenting an award at the 2024 Kickoff Conference. Also pictured: Christine Kaundart

In response to the ongoing economic challenges facing Canadian businesses, Tradebank officially expanded its operations into Canada back in May, 2023. Since then, they’ve built a strong foundation of active barter clients, as well as established a new franchise location in Kitchener-Waterloo—led by Dwayne King and Tanya King.

Tradebank’s introduction to the Canadian market came at a critical time when SMB’s (smallto-medium sizes businesses)—the backbone of the economy—were facing decreased profits and cash constraints.

By facilitating the exchange of goods and services without the immediate need for cash, Tradebank is capable of providing a vital lifeline to these businesses, helping to stabilize and stimulate economic activity across various sectors. No matter what industry you may be in, Tradebank Canada boasts the unique ability to create a custom barter plan, specifically for your business.

Tradebank Canada is also providing SMB’s with an opportunity to leverage unused inventory or capaticity. “Our barter system not only helps in managing cash flow but also in fostering real, sustainable business growth.” says Ian Charnock, Director of Tradebank Canada. “Our goal is to level the playing field for smaller businesses and equip them with the tools to thrive in a competitive market.” The Tradebank network encourages a cycle of economic activity, one that’s less dependent on traditional cash transactions, which are often scarce during economic downturns. By enabling businesses to engage in

trade, Tradebank injects liquidity and opens up new avenues for growth and expansion. The Canadian network also extends beyond local markets, allowing Canadian businesses to connect with Tradebank’s established networks in the United States.

Tradebank’s model emphasizes community and cooperation, and their franchise opportunities remain a lucrative choice for those with seasoned sales, marketing and commerce skills.

In the U.S., Tradebank operates across 15+ franchised locations, and Canada is poised to see similar growth by offering the same proven franchising model.

“Tradebank is more than a trading platform; it is a community builder that promotes sustainable economic practices and fosters relationships among businesses,” adds Richard Reist, Director of Business Development. “We’re very excited to see how our platform can help revitalize local communities and bring in new talent to assist us in expanding across Canada in target new regions.”

By opening a Tradebank Franchise, you unlock a secondary revenue stream through trade dollars, as well as direct access to international team members with decades of combined industry experience.

Tradebank Canada offers full training, as well as proprietary technology and tools (no off-the-shelf barter software here) to assist in building up a strong client base.

Tradebank Canada Contacts: Ian Charnock

Director of National Sales ian.charnock@tradebank.ca

Richard Reist

Director of Business Development richard.reist@tradebank.ca

When it comes to embracing new challenges and seizing opportunities, Robyn Nelson is no stranger to taking the road less traveled. Hailing from the rural town of Camperdown in Victoria, Australia, this accomplished professional has journeyed halfway across the globe and is now embarking on her newest venture: leading the Tradebank Wichita Franchise.

With a diverse background that spans from growing up on a cattle farm to owning a country pub and teaching at the university level, Robyn’s path has been anything but ordinary. Armed with an impressive set of degrees – including a Bachelor of Information Technology, a Bachelor of Business, an MBA, and a Master of eDiscovery – she brings a unique blend of technical expertise and business acumen to the table.

It was in 2013 when Robyn’s journey with Tradebank began, a fortuitous encounter orchestrated by a mutual acquaintance who introduced her to Edward Fox, the visionary behind the brand. Little did she know that this chance meeting would pave the way for

her to join the Tradebank family just two years later, on April 27, 2015.

“I’ve often laughed that my experience owning a country pub back home was GREAT training for a Tradebank Broker!” Robyn quips, her infectious enthusiasm and wit shining through.

Before embarking on her Tradebank odyssey, Robyn’s professional history was as diverse as her educational background. From serving as the IT Manager, Personnel Director, and Desktop Publisher for the Walnut Valley Association in Winfield, Kansas, to taking on the role of Executive Director for a non-profit organization, her versatility and adaptability have been put to the test time and time again.

But what truly sets Robyn apart is her unwavering commitment to helping others – a driving force that fuels her both professionally and personally. “Helping people is my way of giving thanks for the fortunate life I am blessed to have,” she explains, her passion evident in every word.

This genuine desire to make a difference extends far beyond the confines of the boardroom. Robyn’s

involvement with organizations like Kiwanis, Winfield Area Habitat for Humanity, and the Winfield Saddle Club (where she serves as Secretary) underscores her dedication to uplifting her community and empowering those around her.

And when she’s not immersed in her professional or philanthropic endeavors, you can find Robyn indulging in her love for horses – a passion she shares with her husband. Together, they care for a small herd of eight equines, including three full-sized horses, four miniature horses, and a recent addition, Tigger, a mini mule that came as a delightful surprise.

But horses aren’t Robyn’s only source of joy; she also finds solace in the open road, reveling in the rumble of her cherished 1978 Pontiac Trans Am and the freedom it represents.

As she embarks on her new role

as Tradebank Wichita’s Franchise Owner, Robyn’s aspirations are as grand as her accomplishments.

“I believe Tradebank of Wichita was once one of THE Regions in Tradebank,” she enthuses. “It is my goal to grow it back to being the top Region, through not only growing the number of quality members but also by bringing the best possible service to our members.”

With a steadfast commitment to excellence and an unwavering belief in Tradebank’s ability to ignite business success and community impact, Robyn is poised to leave an indelible mark on the region she now calls home. Her journey from rural Victoria to the heart of Wichita is a testament

to her resilience, her adaptability, and her unwavering drive to make a lasting difference.

John Perry Pellegrino Marketing Director TradebankA special ‘Thank You’ to Robyn, for her unwavering dedication to the success of the Tradebank brand, as well as the growth and prosperity she brings her clients.

We look forward to hearing from

In the vibrant city of Birmingham, Alabama, a new dynamic duo has been welcomed in to the Tradebank family. Meet Juli and Ricky Shoup, the newest Franchise Owners of Tradebank Birmingham, whose combined expertise and passion promise to revolutionize the way businesses in the region grow and connect.

Juli’s journey began in South Alabama, where she was raised before embarking on a personal and professional odyssey that eventually led her to Birmingham 14 years ago. With a background in Human Resources, Juli’s true calling was ignited during her time as a Paraprofessional in Special Education at Vestavia Hills

High School. It was there that she discovered her love for onboarding and guiding individuals through new chapters in their lives –a passion that would prove invaluable in her future endeavors.

Ricky hails from Mississippi, where he first honed his skills in the construction industry. For 25 years, he has been the driving force behind Shoup Masonry and Specialties, a testament to his entrepreneurial spirit and unwavering dedication. Ricky’s favorite part of his work? Watching a project transform from a mere estimate on paper to a stunning, tangible reality – a process that, although often stressful, always yields a rewarding result.

It was Ricky’s foray into the Tradebank network through his contracting company that initially introduced the couple to the world of bartering and cashless transactions. Juli, initially uncertain about the concept, quickly became a convert as they experienced the benefits firsthand – from enjoying dinner and healthcare services on Trade to securing a weekend getaway at a lakeside house, all without dipping into their cash reserves.

Ricky’s appreciation for Tradebank’s ability to alleviate business expenses, particularly in the realm of advertising, solidified their commitment to the platform. As they delved deeper into the network, they discovered a world of opportunity that extended far beyond mere transactions – a community of like-minded individuals united by a shared desire for growth, collaboration, and mutual success.

When not immersed in their professional pursuits, Juli and Ricky revel in the joys of family

life. With a blended household comprising four children – Chase (22), Samuel (19), Brady (19), and Mary Elizabeth (soon to be a high school senior) – their spare time is a cherished opportunity to create lasting memories. Juli’s love for plants, albeit unrequited, adds a touch of green to their lives, while Ricky’s passions for hunting and competitive tennis provide a welcome respite from the demands of entrepreneurship.

But it’s their shared drive and complementary strengths that truly set this power couple apart. Juli’s passion for helping others and connecting the dots is perfectly balanced by Ricky’s entrepreneurial spirit and business-building acumen, creating a formidable force poised to leave a lasting mark on the Birmingham community.

As they embark on their journey as Tradebank Birmingham’s Franchise Owners, Juli and Ricky’s aspirations are as bold as they are altruistic. “Our goal for Birmingham Tradebank is to have all of our members fully educated on how to use their Tradebank

dollars,” Juli explains. “We want to build a relationship with each member and also have them build relationships with each other.”

Ricky adds, “We aspire to listen to our members and grow our network so that needs and wants are attainable and that we build a strong community amongst ourselves.”

But their ambitions extend beyond the confines of the Tradebank network. With a shared commitment to giving back, Juli and Ricky plan to participate in and even create their own fundraisers for worthy causes, solidifying their position as pillars of the Birmingham community.

John Perry Pellegrino Marketing Director Tradebankand fill out a quick form. We look forward to hearing from you!

The new year started off with a jolt of excitement for the Tradebank team as we gathered for our annual kickoff conference in Huntsville, Alabama.

[Hosted by Lisa Smith, Regional Owner of Tradebank Huntsville] Staff members and regional owners from across our nationwide network of offices came together to get inspired, build camaraderie, explore new trends, and strategize for an inspiring 2024.

The three-day event featured engaging keynote speakers, breakout sessions covering everything from sales strategies to brokering, as well as highly educational speeches from our own Tradebank staff members.

Each Kickoff Conference,

we set aside time for an awards gala and banquet dinner, where team members who went above and beyond in the previous year are recognized. The barter industry requires a deep commitment to constantly improving the lives of business owners — these awards serve to shine a spotlight on our employees that truly make lasting dents in the industry.

To our Tradebank clients; thank you for believing in our innovative approach to the barter industry, and we hope to provide you the same exceptional services you’ve grown to love for decades to come.

Cheers to 2024 and beyond!

John Davis Award

Michelle Murdock

For Extraordinary Vision, Dedication, and Commitment to the Development of Tradebank

Top Gun Award

Lisa Smith

#1 in Sales Nationally

President’s Award

Lisa Smith

Excellence Achieved In the Operation of a Regional Office

Silver Award

Tyke Hillmer

#2 in Sales Nationally

Bronze Award

Teresa Watson

#3 in Sales Nationally

Rookie of the Year

Ray McBerry

For Exceptional Achievement in the Performance of a Tradebank Franchise Office during the First Year of Operation

Millionaire Club

Tradebank of Knoxville

#1 in Trade Volume Nationally

Half Million Dollar

Circle

Stacy White

For Producing Over Half Million Dollars in Trade Volume

Half Million Dollar

Circle

Bernadine Birdsong

For Producing Over Half Million Dollars in Trade Volume

Half Million Dollar Circle

Felicia Slattery

For Producing Over Half Million Dollars in Trade Volume

Half Million Dollar Circle

Tami Kent

For Producing Over Half Million Dollars in Trade Volume

Half Million Dollar Circle

Robyn Nelson

For Producing Over Half Million Dollars in Trade Volume

Half Million Dollar Circle

Jennifer Minchoff

For Producing Over Half Million Dollars in Trade Volume

Half Million Dollar

Circle

Charlotte Greathouse

For Producing Over Half Million Dollars in Trade Volume

Rising Star

Stacy White

For Producing Over Half Million Dollars in Trade Volume

Outstanding Growth Award

Tami Kent

For the highest increase in volume over the prior year

For Dan Toth at Mountain View Pure Water in Johnson City, Tennessee, Tradebank is a family affair.

In 2016, when starting his small, local business, cash flow was a challenge, and was one of the reasons he became interested in the barter system. As he shared, “From the beginning of my business, using trade allowed me to live better than my income said I could. I’d trade a water system, and then I could take my family out to dinner or get our vehicles serviced,” which were extras Dan said he couldn’t have otherwise afforded at the time.

Fast forward to today, with a thriving business that is expanding into Knoxville and throughout East Tennessee, Dan has a tough time pinpointing what he likes best about Tradebank. He matterof-factly explained, “Trade is my lifestyle. It’s hard to

pick out just one thing.” But talking to Dan Toth, one thing is clear: he’s a man who loves his family and loves using trade to provide for them in many ways.

One of his most memorable trades include the time his broker, Stacy White, who has been managing trade accounts in the Tri-Cities area of northeast Tennessee and southwest Virginia for seven years, found him a grand piano for his four children to take lessons on. “You just never know what you can find!” Other favorite trades include taking his family on vacation to the beach, watching them bounce out their energy in a trampoline park and in gymnastics, having professional photographs taken of his family, and sending all four kids to summer camp.

Dan’s wife, Denise Toth, is also actively engaged with

Tradebank, keeping an eye on the directory, marketplace, and promotional emails. When Denise sees something she is interested in, she’ll reach out to Stacy directly. Both Denise and Dan have built a relationship with their broker and know they can count on Stacy to work hard for them.

Beyond things for his family, Dan uses his trade dollars for business expenses like advertising, marketing, business lunches, printer ink, and for giveaways like customized bottled water. As he says, “There’s tons of opportunities,” to use trade dollars.

Rather than considering the trade dollars he earns as his paycheck, Dan emphasizes, “Trade is frosting. It’s the extra beyond what you can get with general advertising… I can do so much like plumbing, HVAC, electrical, roofing... There’s not a lot of limits to what I can do with trade.”

Dan’s advice for new members is to adhere to the philosophy that Tradebank often shares with its members and to “think trade first.” He explains, “I think people get excited at the beginning,” but when they don’t know what to do with their trade dollars, he reminds them, “It doesn’t do any good to let it sit in your account.”

Often hosting Tradebank events at his retail location, Dan loves to meet new members. As he explains, “I’m always looking for the next business I can try on trade.” He credits Tradebank with bringing him customers he

would not have otherwise.

Mountain View Pure Water, which Dan started in 2016, the same year he began trading, has flourished in part thanks to bartering with the network. Dan’s story is a testament to the power of trade in enhancing both his personal and professional life. His enthusiasm and strategic use of Tradebank show how barter can create opportunities and enrich lives in unexpected ways. By thinking trade first, Dan has been able to give his family experiences and comforts that would have been out of reach, proving that trade is not just a business tactic but a lifestyle.

Written by: Felicia Slattery

Written by: Felicia Slattery

What is the investment required for a new franchise?

Typical investments for a new franchise can range anywhere from $50,000 to $1,000,000. It largely depends on the scale of the franchisor’s brand, their growth goals, and other factors such as location, industry, and even popularity.

Knowing the full investment requirements of a new franchise allows you to evaluate if you have enough capital or need to secure financing. This helps you plan accordingly and avoid underestimating the costs.

How do I make money as the franchisee?

Nobody wants to run a business that isn’t profitable. If this information isn’t already provided to you, ask the franchisor how you’re expected, as a franchisee, to make profits. What is the business model?

Knowing how revenue flows in allows to you fairly evaluate if the franchise’s business model aligns with your expectations and capabilities.

What is the franchisor’s reputability?

Long story short, a company with a troubled history raises red flags. While they’re not an immediate disqualifier, you should base your purchase decision on the reputability and trust factor of the franchisor at all times.

Do they have a proven operating system and are spoken highly of?

Do they have a long-established brand that’s credible and appealing?

Do they offer support and training?

Instagram is one of the best tools to implement for your small business strategy. With over 2 billion active users, each and every post is a chance to visually connect with your audience; and more importantly — drive new sales. If you’re hesitant and how to use Instagram to grow your small business and engage customers – this guide is for you.

Instagram is one of the best platforms to create buzz around your brand. Around 80% of marketers plan on using it for influencer marketing alone, in 2024. Several years ago, Instagram lacked a substantial amount of buyer and seller features, focused on simply pushing entertaining content to the right eyes. Today, over 70% of online shoppers choose Instagram for their next purchasing decision.

In addition to the suite of new commerce features, video content on Instagram, in the form of Reels, has surpassed every other type of post, generating an average reach rate of 30.81%.

Did you know? Instagram Reels generate 2x more reach than any other type of content on the platform – recorded in 2023.

Video content on Instagram, compared to photos or graphics, provides a unqiue opportunity to visually tell a story, increase your engagement rates, and access a broader audience. Luckily, Instagram marketing for small businesses has never been easier; let’s find out how!

Before posting any content, define specific, measurable goals for your business’s Instagram account. This could be in

the form of follower count, number of leads generated, or total engagements. Define your business goal, and have a clear understanding of how to get there through your content. If your goal is to gain followers, you should plan on posting content that’s valuable and educational.

- If your goal is to increase engagements, your content should be funny, relatable, or interactive.

- If your goal is to generate leads or drive sales, your content should show off the true value proposition that underlies your product or service.

There are a multitude of social media strategies to employ, but start by aligning yourself with one business goal, and one implementable strategy. Follower count is a great first metric to track — if the number goes up, you’re doing something right!

The biggest mistake you can make with marketing your small business Instagram is failing to engage with your followers and customers.

For each post, use a few relevant hashtags to your business. Collaborate with other companies on Instagram that are posting similar content to you. Engage with their communities, too!

Spend some time each week to analyze the Instagram algorithms. What kind of content are my competitors posting? What posts of mine are getting the most engagements?

Thank you for reading this Tradebank Times edition! Tradebank Times is a bi-annual publication that showcases our network of clients, community occurences, and valuable trading strategies and insights.

If you’d like to share your story or be featured in the next edition of Tradebank Times, please reach out to us below.

For questions about your Tradebank account: operations@tradebank.com

For features and feedback: marketing@tradebank.com

Did you know you can earn T$200 for every referral?

Simply refer business owners or professionals you know to the Tradebank Network by using this form. Once they sign up for a membership, we’ll send you T$200 trade dollars!

See tradebank.com/referrals for all official rules and requirements.

Thank you for helping us grow the Tradebank Network!