31 minute read

Crop and Market Predictions

Compiled by Suz Trusty

Each year, Turf News invites suppliers to provide their input on the turfgrass seed and/or vegetative stock crop and market outlook based on: Their assessment of the impact of weather conditions on crops to-date and on the anticipated impact of weather conditions predicted in their area; Trends they are seeing in their market; The production they are anticipating in terms of quality and quantity; And their assessment of anticipated pricing for those crops as: stable, higher or lower.

Industry comments for the seed and vegetative stock crop outlook were provided from mid-May to the end of May. Please note that weather conditions can impact final yields, and that seed harvests in July and August may differ from the forecasts shared here. In addition, there are multiple factors, other than weather conditions, that impact the crop and the overall market within the sod industry. Turf News welcomed input from your seed and vegetative stock sources on these factors as well. Though no one can accurately predict the future, these industry perspectives provide insights into the outlook for these valuable crops.

Turf News thanks all those who provided the information for this article. That input is arranged in alphabetical order, by the respondent’s company name.

Note: In the fall of 2020 Barenbrug USA purchased Jacklin Seed Company. While you may see various branded products carry the Jacklin name in the market today, these brands are produced and managed under Barenbrug USA as part of an overarching portfolio of unique turfgrass genetics.

BARENBRUG USA Provided by David Johnson, Director of Production

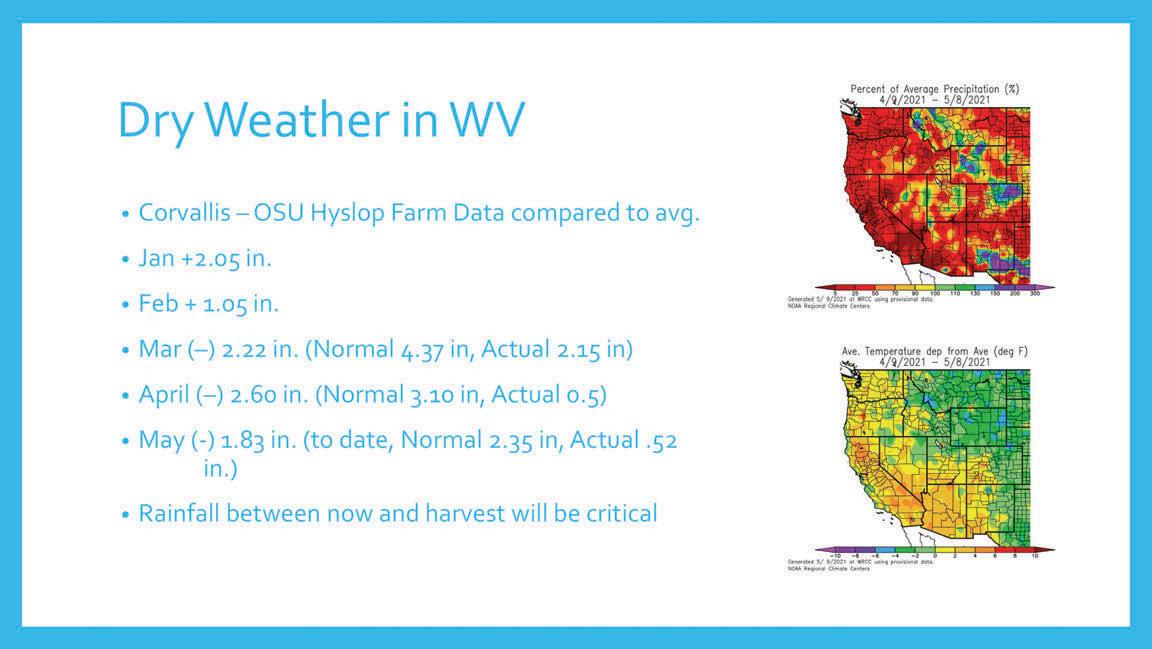

Weather extremes are going to affect crop yields in many production areas this year. The Pacific Northwest region has had one of the driest springs on record. According to the website Drought.gov, “Statewide total March and April precipitation ranks as the driest on record for Idaho, second driest for Oregon, third driest for Montana, and fourth driest for Washington since 1895.” One positive from the dry spring weather is that it has been good for chemical application timing, and fields are looking clean going into harvest. Kentucky Bluegrass: The dry spring is impacting the nonirrigated Kentucky bluegrass yields in the north-central area of Idaho. We finally saw some rain in late May, but it could be too little too late. With inadequate moisture we are predicting below average yields for dryland produced varieties. Irrigated production areas in the Columbia Basin region of Washington and Oregon are in better shape than the dryland areas, but extreme temperature fluctuations are affecting plant development. We expect average yields for most varieties grown in the irrigated production areas. Perennial Ryegrass: Drought in the Oregon production area is a concern for perennial ryegrass yields, but recent rains have given us hope for improving yields. The impact will not be completely known until further into harvest; it’s up to the plants to determine if it’s too little too late. Tall fescue: The primary concern with tall fescue is vole-damage in the South Valley, which could have some impact on yields. This is also a problem on some perennial ryegrass fields, but new rodent chemistry might be improving the situation.

Market Outlook: We are seeing a grower trend away from elite-type Kentucky bluegrasses. Growers are looking for big yield numbers to incentivize them to place acreage in Kentucky bluegrass, and they are pushing for higher prices on lower-yielding varieties. Fertilizer and commodity prices are also trending up, which means there will be competition for acres. As a whole, corn prices are high, wheat prices are high, and fertilizer costs are high. This puts a tremendous amount of pressure on production to place acres for turfgrass varieties, but it will also help to clean up some of the inventory issues on dryland varieties.

The continuing story on perennial ryegrass is that inventory is extremely short, and everyone still wants it. In addition to short inventory, growers are moving away from perennial ryegrass production to tall fescue. Tall fescue is easier to produce and has better stand longevity. Fields can remain in for seven to ten years for tall fescue versus two years for most perennial ryegrasses. We also anticipate prices on tall fescue to move up a little as customers look for something to replace the shortfall on perennial ryegrass.

Barenbrug gained some excellent field representatives with the acquisition of Jacklin Seed last fall. Our combined production team is unique with field reps working closely with growers in every growing region Being in the field every day with growers means our reps can identify issues with the farmers before they become serious problems.

Bethel Farms’ latest venture, Bethel Innovations, is dedicated to research and development of new products. It was prompted by Bethel Farms collaborative relationships with university turfgrass researchers.

BETHEL FARMS Provided by Will Nugent, President

Observations and Expectations: We are thankful for the past years’ success and are expecting continued growth in 2021 and beyond. Our prediction is that growth will be driven by new Post-Pandemic Gardeners, Builder Demand, and continued e-commerce growth.

The rise in time consumers spent at home directly correlated to a desire to have a beautiful outdoor space. This has resulted in more garden spend as well as an increase in consumer confidence. The work-from-home dynamic also inspired younger homeowners to garden. As consumer needs have changed, we have adapted. This spring we launched our new SodPods Brand which will help educate consumers on the benefits of grass plugs. Overall, consumers plan to continue to garden, we feel this is great for all lawn and garden providers.

Housing demand has driven the builder market to new heights. In turn, our industry has seen increased demand for sod and related products. Sports turf has also benefited from this boom, with emphasis on the latest innovations. Our Bimini Bermuda turfgrass bookings continue to drive our sports turf growth. All indications are these trends will continue for the foreseeable future.

E-commerce growth continued into 2021, the increase in online marketing techniques continues to fuel this trend. Online platforms are evolving to meet consumer needs at an increased speed. Having an online presence has become a consumer expectation and has driven the need for improved content. Evolving with the latest media formats will be imperative to a company’s success.

Investments: As our company grows, we will continue to invest in the future. Our organization is focused on creating products that meet consumer needs. Our latest venture, Bethel Innovations, is a testament to our commitment to invest in new products. Our collaborative relationships with key Universities have helped fuel our Research and Development efforts. As the company expands, so does our team. Our HR initiatives to find, lead, and develop the best talent, are a key focus for us. Our investments in efficient systems, infrastructure, and distribution methods are imperative for our success.

We look forward to The Landscape Show in August to reconnect with our partners in the industry. The future is bright for us all!

BRETTYOUNG Provided by Erik Dyck, Forage and Turf Senior Product Manager

The Western Canadian seed production region experienced drought or less than adequate moisture conditions last year. Subsoil moisture has been depleted from these dry conditions. A prolonged, dry spring has delayed crop development. End of spring showers have provided much needed moisture giving stands a chance to produce a decent seed crop. More timely rainfall is needed to ensure viability of production. Dry conditions have resulted in some fields coming out of production and there will be fewer acres to harvest in 2021.

We are forecasting below-average seed yields on perennial ryegrass, annual ryegrass, and tall fescue. In the Peace River Region, we are expecting an average seed production year for creeping red fescue. Adequate fall moisture and stable acres have set the stage for average creeping red fescue yields.

Columbia River Seed’s Black Tail Turf-Type Tall Fescue is looking great in this production field.

COLUMBIA RIVER SEED Provided by Ryan Jeffries, North American Sales Director, and Paul Hedgpeth, General Manager

The grass seed crop (Kentucky Bluegrass, Perennial Ryegrass, Fine Fescue and Tall Fescue) in the lower Columbia River Basin is looking very good. We might be a tad late as of late May. We did lose a few places within some circles/fields due to wind desiccation over the winter

on some juvenile plants. Rouging crews have been out working and seed growers have been spraying fields. Those services will stop shortly as we get closer to harvest. We should start to receive some Kentucky Bluegrass in our plant around June 11 or so. The tall fescue crop in the middle to upper Columbia River Basin looks pretty good. Spraying and roguing crews are also about done. Yields in the Columbia River Basin for most grass seed crops look to be average to slightly above average. Right now, the crop in the basin looks to be very nice which means it will combine great and process great. Dryland grass seed production in the Grande Ronde Valley (Kentucky Bluegrass and Fine Fescue) of Eastern Oregon does not look very good due to the lack of precipitation. Grass seed crops in Western Oregon are under stress where water has not been applied. Very little supplemental irrigation is used in Western Oregon. The grass seed industry is anticipating a below average yield on most items coming out of Western Oregon though mother nature has a way of correcting herself. Grass seed movement around the globe has been above average the last 12-18 months and looks to continue this fall. It is safe to say going into harvest 2021 in North America for cool-season grass seed species, inventories are at historic lows from the processing side of the equation

DLF Pickseed’s Banfield Perennial Ryegrass is developing well in this production field.

DLF PICKSEED Provided by Sean Chaney, Vice President, Professional Turf Division

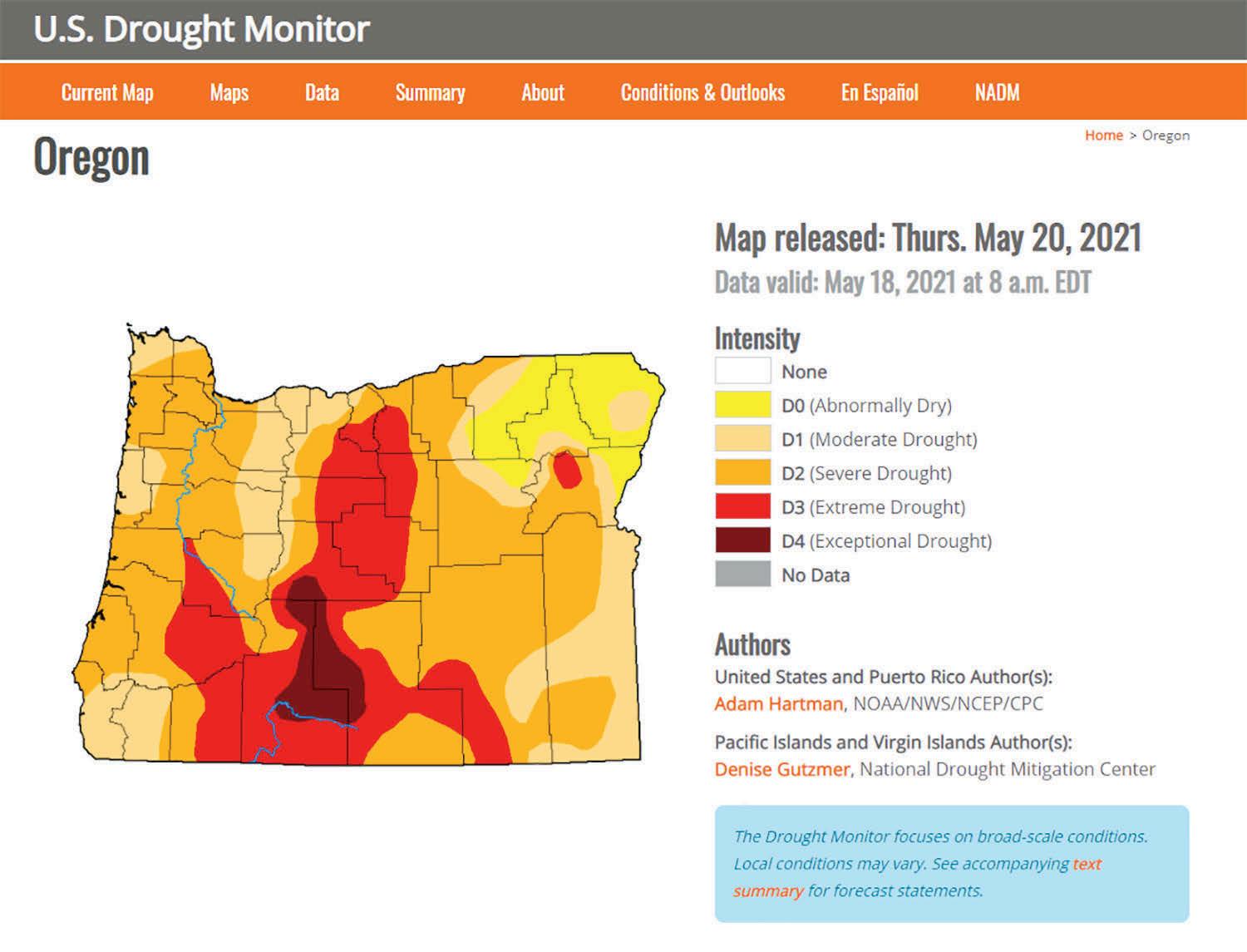

Weather Impact: In the Willamette Valley of Oregon and Southeast Washington state, we are in either moderate or severe drought according to the late May drought monitor. Acres that are not irrigated are experiencing stress in these areas. In Oregon, this will affect turf products the most as they normally need more moisture later in the season than earlier maturing forages. In Washington, the drought will affect dryland Kentucky Bluegrass production, which is generally the higher acreage in Kentucky bluegrass and is where most mid-range varieties and common 98/85 comes from. With 2021 acres in this area already sharply reduced for crop ‘21, further reduction of the crop due to drought will surely cause bluegrass prices to continue to strengthen. Market Trends: Global usage of grass seed products during the pandemic has been historically high. Usage in the U.S. continues to be high due in part to distributors and their customers trying to position seed with the anticipation of a strong Fall season and rising prices. Golf, retail consumers, and residential landscapers have largely led the way for the grass seed industry over the past year. We anticipate that continuing to an extent, even with some discretionary spending going to other areas like travel with the removal of Covid-19 restrictions in full swing.

Anticipated Production Quality and Quantity: Overall production will likely be down on most turf species from what we received in 2020. The droughts experienced in the main production areas are significant and are likely to lead to significant yield reductions. Perennial ryegrass production looks in good shape in the northern Minnesota production region, but just north of that in Canada, there is significant drought stress that will limit production for them once again. Already fields have been removed due to insufficient establishment.

In short years, quality does take a bit of a hit overall. There are generally different reasons for it though. In drought stressed years, there are more opportunities for weeds and other crop seed to grow into that space that otherwise wouldn’t have been available. Labor is also a major challenge for our farmers. Many growers can achieve the best quality when they can hire crews to remove unwanted plants from fields through spot spraying, but it is harder than ever to find workers to do that job. Additionally, because the farmers and seed processors need to make sure they get every usable pound they can, this means some will likely not try quite as hard to get everything out in order to avoid throwing away good seed.

Assessment of Anticipated Pricing: The carryover levels of our cool-season turf species are at record lows. Even species like tall fescue and Kentucky bluegrass that started the year at reasonable levels have been depleted. Perennial ryegrass shortages have been well known throughout the year, and this same level of shortage currently applies to tall fescue, Kentucky bluegrass and all fine fescues. Naturally, this has put upward pressure on prices. Seed dealers are bracing for the 2021 crop to be the most expensive in history.

GO SEED Provided by Jerry Hall, President

The 2021 crop is going to be very interesting as inventory stocks on many turf, forage, and cover crop seed species are at all-time lows. There will certainly be a lot of jockeying for position on cleaners by a lot of companies for a lot of different species. The Oregon seed industry will be working diligently to try to get as much seed out as quickly as possible but there will be issues. Distributors can help by trying to give suppliers accurate demand schedules. When palletized seed loads are slow to ship, the warehouse will clog up quickly which in turn slows down seed that can be moved in from the farm. Once the cleaning warehouses see slow movement they will move on to a different species, so it is important to give your supplier an accurate time frame of when you need product and then receive the product on the agreed upon schedule. Production fields looked rough going into the winter and many fields didn’t look a whole lot better coming out of it. The damage last summer/fall from voles was real and devastating, in some areas, leaving fields lacking in plant population. Below is the late May status of the drought situation in Oregon. Not a bright outlook for late May when we are at the period moisture is critical for seed development.

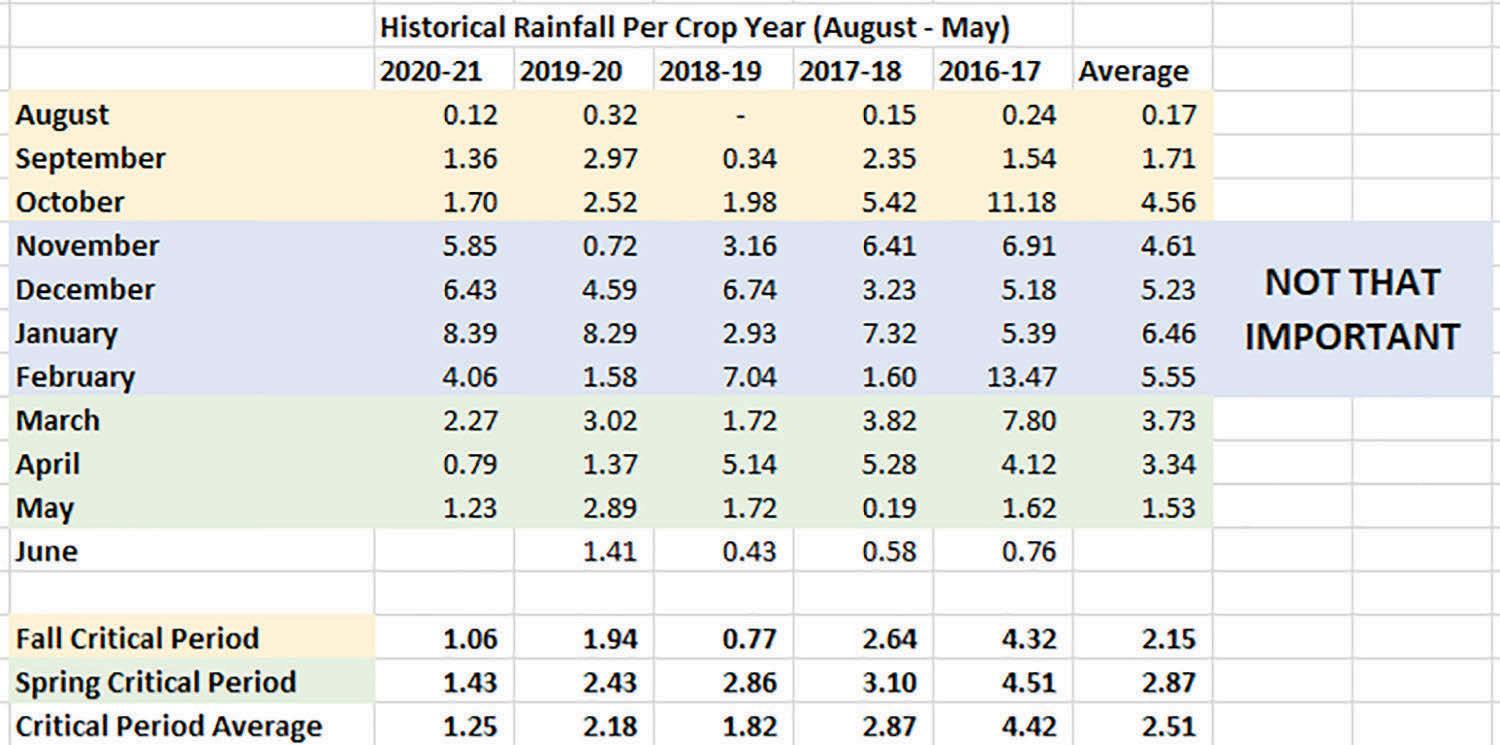

However, to really understand how the crop is looking we need to examine the rainfall over the growing year. To the right is a table that shows the precipitation in Salem, Oregon, over the last five crop years.

When looking at precipitation, there are two critical periods for seed production, fall and spring. The rainfall that is received between November-February is largely irrelevant as the grass plants are generally in winter dormancy and not actively growing. The Fall critical period is more important for tall fescue than other grasses as the precipitation is needed to develop new tillers prior to vernalization. Seed yield from tall fescue can be estimated by the number of new tillers heading into the middle of January. The Spring critical period is important as that is the precipitation that ultimately allows the seed crop to develop.

So, when you look at the 2020-21 averages compared to the five-year average you will see that during the Fall critical period, we only received 45 percent of the average rainfall. That spells potential bad news for the tall fescue crop. Then when we look at the Spring critical period, we are only at 48 percent of the five-year average with six days left in May. These two deficits are likely to lead to a smaller crop than average on the dryland acres which constitute the bulk of the Willamette Valley production.

There is however a glimmer of hope as much of the rainfall in May has been concentrated during the third week. This should provide enough moisture in the soil for the tall fescue crop to get through pollination and keep the perennial ryegrass from getting too stressed at the current head emergence stage. Average to above average precipitation in the first half of June is needed for the perennial ryegrass crop to develop and to maximize the tall fescue crop. The good news is that the seed that we will harvest should be cleaner than normal as growers have had a plethora of dry days for spot spraying out contaminants. I cannot recall when the last year was that I saw so many spot spraying crews out in March and April removing annual ryegrass and other troublesome weeds from the field. The Oregon farmer has really stepped up and is spending money to make the best out of a potentially bad situation.

JONATHAN GREEN, INC. Provided by Bruce Rose, Cascade International Seed Company and Barry Green

Western Oregon has had a rough year. Wildfires in September burned over 100,000 acres of forest and filled our valleys with smoke.

Then there was the ice storm in February that closed roads and ripped down power lines.

With that all being said, fall planting was pushed back several weeks resulting in some very weak stands of Perennial Ryegrass and Tall Fescue. Also, western Oregon experienced a drier and warmer winter. Due to this, we expect the grass seed yields at harvest time to be below average with persistent weed issues. As is usual, the contaminants of most concern in “sod-quality” grass seed production are Poa annua and Annual Ryegrass.

Perennial Ryegrass: Perennial Ryegrass is the cool-season turfgrass that is in the shortest supply. With everyone staying home and working on their lawns during the pandemic the already short supply of Perennial Ryegrass was exhausted months ago. The acres will be increased after the harvest this year; however, this will not help in the short term.

Perennial Ryegrass acres are up only marginally from a year ago and supply of good quality seed will be on the tight side. Pricing is trending much higher. As of this writing it is anticipated to be $0.25-$0.30 per pound higher at the farm-gate contract price. The high price for Perennial Ryegrass will continue until the new crop of 2022. Fortunately, Perennial Ryegrass is not a big component in sod growers’ seed mixtures.

Tall Fescue: More acres of Tall Fescue were planted in the fall; however, the seed was planted late and the fall growing season was not favorable. Tall Fescue is currently the number one cool-season turfgrass in production in Oregon, however “old crop” sod-quality Tall Fescue seed is in very short supply. As of mid-May our supplies were over 90 percent exhausted.

Normally, we are able to carry over six to eight sod grade Black Beauty Tall Fescue varieties in reasonable amounts, but this year we have only four Tall Fescue varieties and these are likely to be sold out before the new crop acres become available. At this time, we predict that pricing will also be higher for sod-quality Tall Fescue and seed yields will be below normal. The drier and warmer winter in Oregon did not help seed farmers in their quest to produce Tall Fescues that will achieve sod-quality.

Kentucky Bluegrass: The entire Kentucky Bluegrass crop is much smaller than it was twenty-five years ago. The rise in interest for turf-type Tall Fescues put a damper on the demand for Kentucky Bluegrass. It has become increasingly difficult to produce sod-grade seed in western Oregon due to Annual Ryegrass and Annual Bluegrass issues. This has meant that most of the high-quality Kentucky Bluegrass production has moved to the high desert irrigated fields in eastern Oregon and Washington.

Much of Kentucky Bluegrass is grown as a rotational crop under pivots on one-year crop rotations to ensure that the seed harvest will be the best possible. This means that the supply of sod-quality seed and varietal availability can vary greatly from one year to the next. Kentucky Bluegrass production acres seem to be stable at present and are about the same as last year. However, most of the dryland acres have taken a hit with such a dry winter and spring and we don’t expect much of a seed yield. Pricing for sod-quality Kentucky Bluegrass will be stable this year, however we expect higher prices for 2022. As usual, the very best varieties are in short supply since they usually yield the least amount of seed. This is most likely with our new Hybrid Texas Bluegrasses which were in great demand with sod growers in 2020 and spring 2021.

Fine Fescues: The acres of Creeping, Chewings, and Hard Fescue are stable but, due to the timing of the wildfires coming soon after harvest, most of the Fine Fescue fields were unable to be burned. The Silverton Hills in Oregon, which is a major production region for sod-quality seed, was severely impacted by these wildfires. Much of the Hard Fescue production is grown here; achieving sod-quality is almost always a challenge even during a normal year.

We anticipate that Fine Fescue yields will be much lower than normal, and contaminants could be a problem. Pricing will clearly increase with lack of seed yield and strong demand.

LANDMARK TURF & NATIVE SEED Provided by John Brader, Director

Turfgrass seed and sod producers face many of the same risks and challenges. Weather, pests, freight, fuel, and fertilizer costs, along with forces of supply and demand, and agronomic, logistic, labor, and fiscal management are part of our everyday business routines. Strong markets in other crops increase land rent costs, and both must plan and plant a crop that won’t be marketable for 1 to 3 years after seedling emergence. But we are both motivated and rewarded for our risks with the valued long-term relationships we share, and in the Turfgrass industry that provides for our businesses and families that we are passionate about.

There is no year in recent memory with similar supply shortages across all major cool-season turfgrass species. Our seed production team is reporting at this time that yield potential of the 2021 Crop is expected to be “reduced to average at best” across all North American Sod seed production regions. Reduced yields and increased weed pressure are anticipated.

Species Supply Outlook

Bentgrass Sod Good

Bluegrass:

Elite Economy Sod Good Good to Limited

Fine Fescue Sod Good to Limited

Turf-Type Tall Fescue

Sod Good to Limited

Perennial Ryegrass Sod Limited

Chart provided by Landmark Turf & Native Seed.

MOUNTAIN VIEW SEEDS Provided by Duane Klundt, Vice President of Turf

As we go into another season, many are left wondering “what just happened, what was that we just went through?” The 2021 crop may be more of the same, after record consumption of grass seed from the 2020 harvest, which led to higher prices and limited availability, conditions in Oregon have not been ideal. At the time this was written, we were roughly five to six inches below normal on rainfall this spring, at one of the most critical times of seed development. This will put pressure on the pounds produced and the yields the farmers get per acre.

Another concern in the vole problem. Last year these tiny rodents wreaked havoc on some fields devastating the total pounds produced. With the dry conditions we are experiencing, we could see a repeat of last year, but the farmers are doing their best to make sure it stays at a minimum. Now for some good news, because we have been dryer, and with prices being higher, many farmers have been able to spot spray their production fields a few times, which should result in better availability of high-quality seed. The farmers who started irrigation earlier than normal will be extremely happy with the results. Overall, the grass seed growers are doing all they can to deliver the most and highest quality seed they can.

As for the crops, as with most everything these days, expect to see higher prices across the board.

Kentucky Bluegrass dryland production will be down quite a bit for the 2021 crop. Not that sod farmers use this type of material, but it will impact high end varieties as the demand for bluegrass overall will be increased.

Tall Fescue demand has continued to increase over the years and as some inventory still exists, acres are about the same as previous years. Overall, if demand stays steady, all should be just fine with supply and quality.

Perennial Ryegrass has proven to be a challenge as consumption outpaced supply this last year, which in turn will put tremendous pressure on getting the new crop processed and moving this fall. Prices right now are at an all-time high, and these numbers could become the new benchmark, within reason of course.

Bentgrass should be about the same as previous years with a slight increase in price.

Regarding Fine Fescues, last year’s fires did not allow for normal practices to occur which will influence this year’s production yields. This, coupled by increased demand, has caused product to be limited and it will probably remain that way until the 2022 harvest.

Overall, with higher prices and limited inventories, the 2021 crop could turn out to be one of the most interesting years in my 30-plus years in the industry. As I say every year, talk to your seed provider, work with them for the long term, and not the quick fix. Planning and preparation will help all of us avoid the pitfalls of times like these.

Sod Production Service’s Tahoma 31 Bermudagrass thrives in this home lawn. Photo by Lance Maxwell Sod Solutions’ Tobey Wagner (left in photo) is shown here with pallets of CitraBlue St. Augustine sod which will be installed on this home lawn.

SOD PRODUCTION SERVICES Provided by Chad Adcock, Vice President of Business Development

Market Trends:This past year, we had another cold winter with record low temperatures. In the south-central region of the United States specifically, cold damage and winterkill on older bermudagrasses was widespread. Golf courses and sports fields alike lost massive amounts of grass, especially in Oklahoma and northwest Texas. Yet, Tahoma 31 Bermudagrass, with its excellent cold hardiness, did really well. Demand to replace older bermudagrass varieties with Tahoma 31 is so high that our growers in the region can’t grow enough to replace all of their customers’ lost bermudagrass. As you can imagine, our Tahoma 31 licensed growers are trying to balance harvesting and selling the acreage they have with expanding sod farm field acreage to meet future demand. Tahoma 31 is really taking the market by storm along the Eastern Seaboard. We are gaining a lot of traction in the northeast as the grass is planted in many more locations on sports fields and on golf courses. We are seeing this from Maryland to Georgia as turf professionals realize it’s a great grass and they’re talking about it with their colleagues. Superintendents tell other superintendents. Sports turf managers talk to other sports turf managers. When the word on the street is good, it starts to snowball. That's what we’re seeing now.

Anticipated Production Quality and Quantity: Inventory of Tahoma 31 is on the upswing. Demand for the grass is high, so our growers continue to expand their acreage to serve future projects. As of May, we have about 1,000 acres of Tahoma 31 in production, with more coming online this summer. We currently have approximately 45 licensed Tahoma 31 sod producers globally in markets such as China, Australia. and Japan. Around 30 of our growers are in the United States. With licensed Tahoma 31 producers located from California to New Jersey, and Colorado to Texas, we are still offering a limited number of licensing opportunities in strategically placed markets here in the U.S.

SOD SOLUTIONS Provided by Tobey Wagner, President

General Update – 2021: Sales of warm- and cool-season turfgrass are setting records across most of the nation. Reports from growers have many at maximum harvesting and trucking capacity with some farms on the cusp of cutting out all inventory by early summer. Many farms are limiting quantities of pickup/delivery to longtime customers and not accepting new customers. Sod Solutions has seen rapid growth of existing and new varieties. Mature varieties EMPIRE® Zoysia, Celebration® Bermuda, Palmetto® St. Augustine, NorthBridge® Bermuda and Latitude 36® Bermuda are in high demand. A grower recently reported over 40 acres of EMPIRE Zoysia harvested and sold in just a few weeks in early spring, breaking all previous records. Additionally, pricing is up significantly across the industry with some regions up as much as 20 percent year to date.

Sod Solutions Innovation® Zoysia, developed by Texas A&M and Kansas State, has surged in popularity as it performed very well through the major cold event throughout the Midwest and Texas in mid-February. Innovation has also performed well both in drought and through regional floods this past year. It is a tough and persistent grass and is having major positive impacts throughout the southern half of the United States. Acres are increasing and demand is strong.

CitraBlue® St. Augustine, developed by the University of Florida, is one of our fastest-growing programs. Demand is outpacing supply as the grass has improved disease resistance, drought tolerance, and exhibits a stunning blue-green color. It only takes one lawn in a neighborhood to create envy throughout the street. Customers have complained about growers “painting” the grass, mistakenly thinking the color is not natural! CitraBlue is both a beauty and a beast and is poised to have a significant impact on the Sunshine State and beyond.

Palmetto® St. Augustine continues to be a steady and true St. Augustine for the South. Palmetto has been found to be resistant to Lethal Viral Necrosis (LVN), the result of a combination of viruses devastating lawns in Florida. Palmetto is a time-tested variety with thousands of acres in production throughout the world. Supply is very short this year with many Florida growers completely running out of inventory. It will be mid-summer to the early fall before new fields are ready for harvest.

NorthBridge® Bermuda has surged in use as well. NorthBridge performed exceptionally well this year in areas affected by the major freeze, separating it from other grasses. Demand is high and availability is short. A highlight use has been on the new PGA headquarters golf courses, which are on track to open next summer in Frisco, TX.

Pandemic Impact What a difference a year makes! One year ago, the nation was locked down with major uncertainty regarding Covid-19, with impacts to the economy and general impacts in the United States and throughout the world caused by the worldwide pandemic. Fortunately, turfgrass production and sales were allowed to continue under agriculture exemptions. Although the impacts varied from state to state, many turf farms remained open. Many regions experienced record sales as people were locked down at home and used the opportunity to do landscape projects.

Managed by ClickSod™ technology, Sod Solutions and its partner farms’ e-commerce sales increased substantially during Covid. Demand for Turf Logistics® software also soared during the pandemic. There were farms that due to Covid outbreaks had to shut down and work remotely. For growers, it was an eye-opening experience that highlighted their level of readiness to shift to remote work and digital sales. Growers that were prepared with Turf Logistics were able to completely operate their businesses from homes with minimal to no personnel requirements at the farm. Growers without technology struggled to keep basic operations running. One of the revelations of the pandemic has been a reshaping of the office workforce. Employees working in an office environment with traditional 9 am-5 pm hours has potentially changed forever. Companies have learned through the pandemic better ways of getting work done with a mix of time working in the office and time working at home.

Fast forward to today. A booming economy, labor shortages, major trucking issues, unprecedented money infusion by the government, consumer demand beyond expectations, and shortages of basic materials is changing the landscape of the turf industry. Inflation is no longer a theory. Current inflation rates are reported to be over 4 percent. Some recent data show it to be much higher. All these factors contribute to the status of the Turfgrass Seed and Vegetative Stock reports for 2021 and beyond. Trends: Many farms are transitioning and adopting a new e-commerce model. They are now selling grass, palletized products, and other services online that they previously had not been capable of organizing. This is changing the business operations for many growers as the public expects the ease of buying online post-pandemic. The Turf Logistics team has been extremely busy signing up new farms to sell online through our custom-built ClickSod websites and platform.

Several university research programs that Sod Solutions is involved with will impact new grass production over the next year or two, with multiple new grass introductions taking place. The best is yet to come, and the future is bright for the natural turfgrass industry.

Future: Sod Solutions is passionate about the natural turfgrass industry. Faith, passion, innovation, commitment, and hard work are critical to success. In my opinion, it all starts with faith and passion. 2020 was a difficult year for many. As we roll through 2021, we want to express our appreciation to everyone who works and serves in this industry. We need to recognize more often those who work tirelessly for our businesses and associations. The status of the industry is strong and will get stronger with cooperation and looking after each other. Now let’s all make 2021 the best year yet as we leave the pandemic in the rearview mirror!

Sod Solutions’ Latitude 36 Bermudagrass greets players on the golf course at The Loxahatchee Club in Jupiter, FL.

TMI’s BlueMagic America type bluegrass is thriving in this production field.

TURF MERCHANTS, INC. (TMI) Provided by Nancy Aerni, Vice President

A Quick Spring 2021 Overview: Oregon is in need of RAIN! Dry conditions in March and April have increased concerns about summer drought impacts across most of the state. Pollination time determines everything. The story goes, an early crop is a light crop, and if we don’t see rain in May, this could be the outcome for our 2021 crop.

This Pandemic has caused turfgrass seed usage like no one has ever witnessed. It truly is staggering the amount of seed that has been pushed through the system and into the marketplace, with many species and varieties sold out at the wholesale level until after this coming harvest.

This coming season, our number one priority here at TMI is all about processing, testing, and getting seed into the marketplace. With virtually no carryover, we can predict a bottleneck to meet fall planting requirements. Coupled with that, transportation issues continue to abound, and are not predicted to get any better in the next “while.” We appreciate the opportunity to serve our clients, and quick decisions and patience will be needed as the industry, as a whole, does its best to fill the pipeline.

In addition to waiting for product to be processed, expect higher seed costs across the board compared with last fall. You may as well go to your banker now and get your credit line increased if you haven’t done so already. Specifically, Tall Fescue: Sod Quality seed will be available as it is processed at the cleaners. There’s no carryover of Sod Quality seed to speak of. The mature production fields—where the Sod Quality normally comes from—look in good condition at this time. The new plantings are a bit thin. This writer believes overall yields will be average to below average.

Kentucky Bluegrass: Sod Quality: This past year, we saw Sod Quality Bluegrass inventories clean up—we will be waiting on new crop availability. The stands of irrigated elite bluegrass are looking good.

Perennial Ryegrass: Overseeding: Testing facilities (labs) will be overrun with samples to test out of the gate. Until a new fluorescence test is developed, delays in reporting (thus also shipping) will continue to be the norm. The crop looks like it will yield around average.

Fine Fescues: There are a few wholesale suppliers with product on hand, though most have been sold out over the past month. Production acres look like they should have an average yield.

Voles: These little pests are again a concern for the Willamette Valley. The restrictions for vole and mouse baiting have been lifted, providing farmers a fighting chance to eradicate these hungry little guys.

All photos and graphics were provided by the supplier company unless otherwise noted.