Pulse Infra Analytics – Where Intelligence Meets Infrastructure

Who Are We?

• We’re not new. We've operated globally as Risk Gear Ltd. (UK-registered) since 2006. What defines us is not our name but our 120+ years of cumulative experience in AM, digital transformation, and precision delivery.

• Hands on strategic consultants specialising in transforming asset data into information intelligence specifically for organisations managing complex infrastructure portfolios

• Our team has delivered more than 110 complex transformation programmes across 20+ countries, enabling sovereign-critical change for clients including UK Ministry of Defence, NEOM, Singapore’s Smart Nation, DP World, ENOWA, Thames Water, Tenaga Nasional Berhad, SEC (D&CS, NGSA & SEPC), MAHB, Highways Agency, and Transport for London (TfL)

What Do We Do?

We embedded delivery partners with real airport, utility, and giga-project operations behind us were not resellers or slide-makers.

Leadership credentials include Chartered Engineer (CEng), Chartered Management Consultant (ChMC), Fellow of the Institute of Asset Management (FIAM), IAM Endorsed Trainer, ISO 55001 Assessor, and direct contributions to international standards through the IAM, ISO, and GFMAM.

Why Pulse?

• Real-World Impact: Delivered AM transformation across major airports and sectors

• Deep Expertise: Chartered engineers, IAM trainers, ISO 55001 assessors, ex-AMCL/SEC leaders

• Maturity Methodology: Field-tested playbooks from IAM L0 to ISO-level systems

• Execution-Focused: We deliver systems, governance, data, and team capability not just advice

• Scalable Muscle: We activate a local and global network of 30 consultants, analysts, engineers, and integrators

• Offshore Capability: Pulse has over 50 expert data scientists, technologists, data wranglers not just a small bench

Our Difference: We design, embed, and exit leaving behind a functioning AM capability, not a system shell.

We don’t just adopt global best practices we’ve authored and operationalised them at scale.

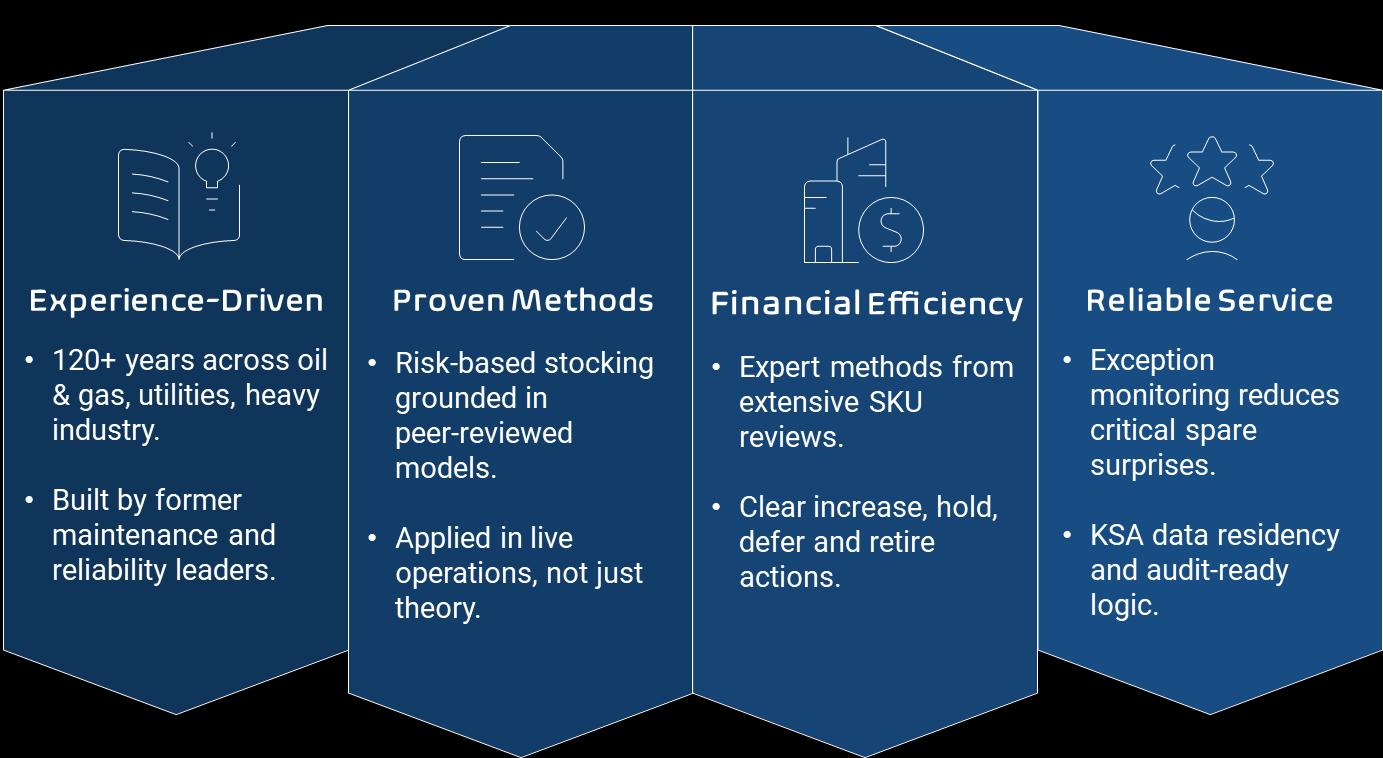

Why choose RiskSpare?

Category(whatit means)

Total-cost engine (finance-first spares economics)

Outage risk model (failure-driven, intermittent demand)

Scenario ranges (P10/P50/P90 outcomes)

Portfolio/budget optimizer (ranked ROI buy lists)

Write-off horizon analysis (finitehorizon obsolescence)

Expedite cost logic (acceleration thresholds)

Audit-ready versioning (assumptions, versions, reports)

Exception next-best actions (guided ops actions)

Fast spreadsheet onboarding (days, not months)

KSA data residency (Saudi-hosted data in 2026)

Using risk to manage assets is a key principle of asset management. The same also applies to how an organisation manages its critical spare inventories.

We have developed a simple risk-based Asset Management tool to help with this.

It simply does the following:

• Reduces operational and safety risk by predicting potential failures before they occur.

• Optimizes spare parts inventory through data-driven prioritization and cost efficiency.

• Integrates asset performance and maintenance data into a unified decision platform.

• Improves asset reliability and availability across complex infrastructure systems.

• Supports lifecycle investment planning with evidence-based risk insights.

• Delivers measurable value by minimizing downtime and total cost of ownership.

Inventory Management Benefits

RiskSpare Outcomes

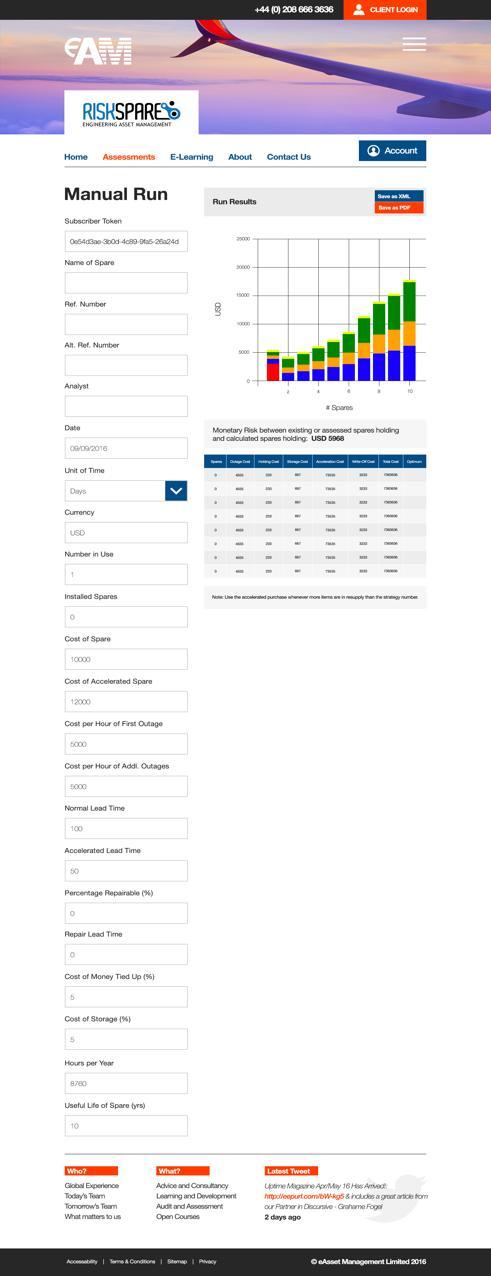

Our Risk Spare analysis tool considers multiple factors, including:

▪ The cost of being caught without a spare, and needing it;

▪ The cost of the spare itself;

▪ The number of machines (or assets) in use;

▪ How often we are likely to need the spare;

▪ The cost of money tied up in purchasing and holding the spare;

▪ How long it takes to get a spare - the 'leadtime’;

▪ How much longer we intend to keep this plant in operation;

▪ Whether some of the failures are repairable;

▪ What proportions are repairable;

▪ How long it takes to repair; and

▪ Premium cost for fast spares delivery.

▪ Maintenance cost for the spare once in inventory

Defensible, data-backed decisions:

The Risk Spare analysis tool uses these inputs to help arrive at financial decision on whether spares need to be held, and if so, the optimum amount. It produces ranked buy lists, scenario comparisons, and ready to load policy files for ERP or EAM systems enabling fast, data-backed action.

What Data Do I Need?

This table captures the key inputs we need to assess your spare-part strategy costs, lead times, repairability, and downtime impact. With standardized fields and simple drop-downs, it makes data entry easy and ensures consistent, accurate results for your reports.

name will appear in your list of calculations and output

of the person who undertook the analysis

the analysis was run (default = today)

Offshore Drilling Provider (Norway)

Pulse Infra Analytics used RiskSpare’s finance-first risk model to optimise spares for Archer/Seawell’s newbuild rig in New Zealand. Quantifying outage risk and total cost for a unique hydraulic Top Drive secured approval for a €1.12M investment, including a second gearbox, while right-sizing other OEM spares from four to two, saving €200K and reducing risk by millions.

Client Challenge

Archer/Seawell required a defensible spares strategy for a newbuild modular drilling rig mobilising to New Zealand. High-criticality, long-lead items, especially a unique hydraulic Top Drive, made OEM recommendations costly. Leadership needed a finance-first risk model and auditable evidence to approve significant spend while ensuring availability and safety.

Scope of Work

Pulse Infra Analytics was tasked with:

• Developing a finance-first spares model tailored to the rig’s operating profile, logistics, and New Zealand lead-time constraints.

• Performing risk and downtime cost analysis for the hydraulic Top Drive and other critical assemblies.

• Benchmarking OEM recommendations using RiskSpare to right-size quantities.

• Producing audit-ready justification packs for executive approval, covering assumptions, scenarios, and expected risk reduction.

• Advising procurement sequencing and inventory policy for mobilisation and early operations.

Pulse Solution

Pulse delivered:

Project Value

• RiskSpare Decision Model: Built a transparent, state-based risk model quantifying outage risk, lead time exposure, and total cost of ownership for the Top Drive and associated critical spares.

• Targeted Right Sizing: Approved a 1.12M EUR investment in Top Drive spares, including the manufacture and addition of a second gearbox to the spares inventory. Reduced several other OEM recommended items from four to two, delivering immediate cost savings of over 200K EUR.

• Governance and Sign off: Delivered an audit ready business case demonstrating several million EUR in risk reduction. This enabled management to overturn an initial block on the second gearbox purchase.

Key Outcomes & Benefits Delivered

• Enhanced Availability & Lower Risk: Quantified several million euros in risk reduction via selective increases (second gearbox) and targeted reductions.

• Finance-First Justification: Approval of €1.12M Top Drive spares holding with clear ROI aligned to contract obligations.

• Optimised Inventory: OEM quantities reduced from four to two where appropriate, saving €200K+ without compromising resilience.

• Executive Confidence: Transparent, audit-ready rationale converted initial resistance into board-level support and accelerated procurement.

• Mobilisation Readiness: Right-sized, documented policies ensured the rig departed with a resilient, defensible spares posture for New Zealand operations.

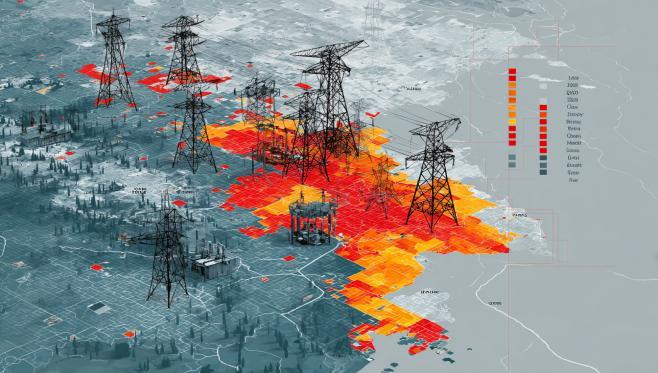

Integrated Power Utility

(Malaysia)

Pulse Infra Analytics applied RiskSpare’s finance-first risk model to TNB’s Strategic Grid division to determine optimal transformer spares by location and model. The analysis quantified outage risk, logistics, and replacement lead times, supporting targeted stocking at critical nodes and demonstrating risk reductions exceeding £50M across differing transformer models.

Client Challenge

TNB needed a defensible, location-specific spares strategy for high-value transformers across the national grid. OEM recommendations and historical rules lacked financial rigor, while long lead times and network criticality demanded auditable justification to balance availability, cost, and resilience.

Scope of Work

Pulse Infra Analytics was tasked with:

• Modelling transformer failure risk, lead times, and network impact by location and model family.

• Evaluating business cases for stocking complete units at critical substations and depots.

• Comparing OEM recommendations to optimisation outputs to right-size holdings.

• Producing audit-ready decision packs with assumptions, scenarios, and quantified risk outcomes.

• Advising stocking placement, rotation strategy, and governance for periodic review.

Pulse Solution

Pulse delivered:

Project Value

$Confidential

• RiskSpare Decision Model: Built a transparent model quantifying outage cost, restoration time, logistics constraints, and probability of failure across transformer classes and sites.

• Targeted Stocking: Identified critical network locations where stocking full transformers materially reduced risk, while de-emphasising low-impact sites.

• Governance and Sign-off: Delivered audit-ready business cases supporting location-specific transformer holdings with quantified benefits and review cadence.

Key Outcomes & Benefits Delivered

• Enhanced Network Resilience: Risk reductions exceeding £50M across differing transformer models and priority locations.

• Finance-First Justification: Transparent, auditable rationale aligning stocking decisions with outage economics and regulatory expectations.

• Optimised Inventory: Right-sized transformer holdings by site and model, reducing overstock while protecting critical reliability.

• Executive Confidence: Clear decision packs accelerated approvals and aligned operations, planning, and finance.

• Operational Readiness: Defined placement, rotation, and review policies ensured sustained, defensible spares posture.

Water Utility (UK)

Client Challenge Pulse Infra Analytics applied RiskSpare’s finance-first model to evidence Anglian Water’s strategic spares holding for regulator scrutiny. By quantifying outage risk, service-impact costs, and lead-time exposure, the analysis underpinned submissions to the Government Regulator and supported regulated income across the three-year Asset Planning programme.

Anglian Water needed auditable justification for critical spares that directly affect service continuity, customer outcomes, and compliance. Traditional stocking rules lacked regulator-grade evidence linking holdings to risk reduction, performance commitments, and efficient expenditure.

Scope of Work

Pulse Infra Analytics was tasked with:

• Modelling failure likelihood, restoration times, and service penalties across priority asset classes.

• Quantifying location-specific risk exposure and minimum defensible holdings for high-impact sites.

• Comparing existing policies with RiskSpare optimisation to right-size inventory against cost and risk.

• Producing audit-ready evidence packs aligned to regulator expectations and AMP planning cycles.

• Aligning governance for periodic review, assurance, and board sign-off.

Pulse Solution

Pulse delivered:

Project Value

• Regulator-Ready Risk Model: Transparent assumptions, versioned inputs, and scenario ranges (P10/P50/P90) evidencing the link between spares holdings, risk reduction, and service metrics, with audit trails and governance checkpoints throughout.

• Strategic Holdings Justification: Location-specific recommendations that defend essential spares while releasing non-essential stock for reinvestment, prioritising service outcomes and cost efficiency.

• Planning Integration: Outputs structured to feed the three-year Asset Planning programme and support regulated income cases, aligning with regulatory milestones and board approvals.

Key Outcomes & Benefits Delivered

• Evidence for Regulator: Defensible, audit-ready rationale for strategic spares adopted in regulatory submissions.

• Support for Regulated Income: Clear, quantified link between holdings, risk reduction, and performance commitments within the 3-year planning horizon. Optimised Inventory: Right-sized critical spares by site and asset class while protecting service resilience.

• Executive Assurance: Versioned decisions and governance strengthened board oversight and regulatory confidence. Operational Readiness: Repeatable methodology and review cadence embedded for ongoing compliance and value.