Palm Beach County

Tourist Development Council Board Book

May 9, 2024

Palm Beach County

Tourist Development Council Board Book

May 9, 2024

1. TDC Baord Meeting Attandance 05.09.2024

2. TDC Board Agenda 05.09.2024

3. TDC Board Meeting Minutes 04.11.2024

4. CONSENT ITEMS

4.A. DTPB Activity Report

4.B. Cultural Council Activity Report

4.C. Sports Commission Activity Report

4.D. Film & TV Monthly Newsletter

4.E. Film & TV Production Report

4.F. Convention Center Income Statement & Financial Operations Analysis Compared to Budget & Prior Year

4.G. Convention Center Marketing Update

4.H. Convention Center Pace Revenue Report

4.I. ERM Project Status Report

4.J. PBI Traffic Report

4.K. Contract Tracking Report

4.L. Agencies Quarterly Reports 12.31.23

4.M. Marketing Agencies And Convention Center Diversity Reports 2024

4.N. Semi-Annual Performance Measures 12.31.23

5. OLD BUSINESS

5.A. - 1. TDC Dashboard Current Month & FY2024

5.A. - 1.a. Bed Tax Collections

5.B. 1st and 4th Cent Overview

6. NEW BUSINESS

6.A. FY2023 TDC Audit Reports

6.B. - 1. The Transparent Media Partners, LLC Contract

(1)Mayor Maria Sachs, Chair (1/14/21)

(4) Jim Bronstien, Vice Chair(9/30/26) Appt(3/1/95) ReApp(9/18/18) Dis.3

(2)Joseph Fisher Appt(9/30/25)Dist. 1

(3) Jim Mostad (9/30/20) Appt (10/16/19), Dis. 2, St 3

(5)Daniel Hostettler(0930/23) Appt (05/18/21). Dis 4.

(6)Commissioner Adam Frankel (9/30/24) Appt (03/08/22)[Dis.5]

(7)Don Dufresne (9/30/23) Apt(6/5/12) ReAp(5/3/16)&(8/20/19) Dis6

(8) Davicka N. Thompson (9/30/2024) Appt(12/6/16)RdAppt(8/25/20) [Dis.7]

(9) Commissioner Christina Lambert Appt (10/01/22)- (9/30/26) At-Large

Isami Ayala Collazo, Assistant County Administrator

Liz Herman, Assistant County Attorney

Dave Lawrence, Culture

George Linley, Sports

Michelle Hillery, Film & TV

Milton Segarra, Discover

Deborah Drum, ERM

Dave Anderson, PBCCC

Kathy Griffin, PBCCC

Emanuel Perry, TDC

Joan Hutchinson, TDC

Vannette Youyoute, TDC

NA- Does not count towards attendance.

Thursday, May 9, 2024 – 9:00 A.M.

2195 Southern Boulevard

West Palm Beach, Florida 33406 AGENDA

MOTION TO RECEIVE AND FILE CONSENT ITEMS FOR MAY 2024*

MARKETING AGENCIES REPORTING

A. DTPB ACTIVITY REPORT*

B. CULTURAL COUNCIL ACTIVITY REPORTS*

C. SPORTS COMMISSION ACTIVITY REPORT*

D. FILM & TV MONTHLY NEWSLETTER*

E. FILM & TV PRODUCTION REPORT*

PBC CONVENTION CENTER OPERATING REPORTS

F. CONVENTION CENTER INCOME STATEMENT & FINANCIAL OPERATIONS ANALYSIS COMPARED TO BUDGET & PRIOR YEAR*

G. CONVENTION CENTER MARKETING UPDATE*

H. CONVENTION CENTER “PACE” REVENUE REPORT*

OTHER TDC-SUPPORTED AGENCY/DEPARTMENT REPORTS

I. ERM PROJECT STATUS REPORT*

J. PBI TRAFFIC REPORT*

K. CONTRACT TRACKING REPORT*

L. AGENCIES QUARTERLY REPORTS 12.31.2023*

M. MARKETING AGENCIES & CONVENTION CENTER DIVERSITY REPORT 2024*

N. SEMI-ANNUAL PERFORMANCE MEASURES 03.31.2024*

5. OLD BUSINESS – DISCUSSION ITEMS

A. TDC TOURISM PERFORMANCE METRICS

1. TDC DASHBOARD CURRENT MONTH & FY2024* - Emanuel Perry a. Bed Tax Collections*

B. 1st & 4th CENT OVERVIEW* – Emanuel Perry

C. TOURISM MASTER PLAN UPDATE – Emanuel Perry

D. PBI UPDATE – Nichole Hughes

6. NEW BUSINESS – DISCUSSION ITEMS

A. MOTION TO APPROVE THE FY2023 TDC AUDIT REPORTS* - Emanuel Perry & David Zamora

B. DISCOVER THE PALM BEACHES

1. Motion To Approve The Transparent Media Partners, LLC Contract for $663,075* -– Milton Segarra/Bryan Glynn

2. Update – Milton Segarra

C. ERM

1. Update – Deb Drum

D. CULTURAL COUNCIL

1. Update – Dave Lawrence

E. SPORTS COMMISSION

1. Update – George Linley

F. FILM & TV

1. Update – Michelle Hillery

G. CONVENTION CENTER

1. OVG Venue Management

a. Update - Dave Anderson

2. OVG Hospitality

b. Update - Kathy Griffin

The next Meeting will be on June 13, 2024. *Attachment included.

Thursday, April 11, 2024 – 9:00 A.M.

Present

Mayor Maria Sachs

Jim Bronstien

Jim Mostad

Commissioner Adam Frankel

Don Dufresne

Staff

Absent

Joseph Fisher

Daniel Hostettler

Davicka Thompson

Commissioner Christina Lambert

Isamí C. Ayala Collazo, Assistant County Administrator

Liz Herman, Assistant County Attorney

Emanuel Perry, TDC

Joan Hutchinson, TDC

Vannette Youyoute, TDC

Patricia Ramirez, TDC

Lauren Perry, Cultural Council

Geoge Linley, Sports Commission

Michael Zeff, Sports Commission

David Fontanarosa, Sports Commission

James Taylor, Sports Commission

Michelle Hillery, Film & TV Commission

Alberto Jordat, Film & TV Commission

Milton Segarra, DTPB

Bryan Glynn, DTPB

Erika Constantine, DTPB

Evan Lomrantz, DTPB

Sergio Piedra, DTPB

Gustav Weibull, DTPB

Deb Drum, ERM

Mat Mitchell, ERM

Dave Anderson, Convention Center/Spectra Venue Management

Katherine Griffin, Convention Center/Spectra Hospitality

Nicole Hughes, Airports

Andrew Gamboa, Airports

Paul Connell, Parks & Recs

Other

Derrick Steinour, Hilton WPB

Chris Inman, Hilton WPB

2. MOTION TO APPROVE AGENDA ADDITIONS AND DELETIONS*

Motion to approve the April 2024 Agenda was made by Jim Bronstien and seconded by Commissioner Adam Frankel. Motion carried 5-0 with Joseph Fisher, Daniel Hostettler, Davicka Thompson, and Commissioner Christina Lambert absent.

3. MOTION TO APPROVE MARCH 14TH TDC MEETING MINUTES*

Motion to approve the March 2024 TDC Meeting Minutes was made by Commissioner Adam Frankel and seconded by Jim Mostad. Motion carried 5-0 with Joseph Fisher, Daniel Hostettler, Davicka Thompson, and Commissioner Christina Lambert absent.

4. MOTION TO RECEIVE AND FILE CONSENT ITEMS FOR APRIL 2024*

MARKETING AGENCIES REPORTING

A. DTPB ACTIVITY REPORT*

B. CULTURAL COUNCIL ACTIVITY REPORTS*

C. SPORTS COMMISSION ACTIVITY REPORT*

D. FILM & TV MONTHLY NEWSLETTER*

E. FILM & TV PRODUCTION REPORT*

PBC CONVENTION CENTER OPERATING REPORTS

F. CONVENTION CENTER INCOME STATEMENT & FINANCIAL OPERATIONS ANALYSIS COMPARED TO BUDGET & PRIOR YEAR*

G. CONVENTION CENTER MARKETING UPDATE*

H. CONVENTION CENTER “PACE” REVENUE REPORT*

OTHER TDC-SUPPORTED AGENCY/DEPARTMENT REPORTS

I. ERM PROJECT STATUS REPORT*

J. PBI TRAFFIC REPORT*

K. CONTRACT TRACKING REPORT*

Motion to receive and file the Consent Items for April 2024 was made by Commissioner Adam Frankel and seconded by Don Dufresne. Motion carried 5-0 with Joseph Fisher, Daniel Hostettler, Davicka Thompson, and Commissioner Christina Lambert absent.

5. OLD BUSINESS – DISCUSSION ITEMS

A. TDC TOURISM PERFORMANCE METRICS

1. TDC DASHBOARD CURRENT MONTH & FY2024* - Emanuel Perry

a. Bed Tax Collections*

Perry

Bed Tax Collection – February 2024 collected in March was $11.6M compared to the same month last year at $11.2M, a 4% increase. Actual February was 18% above budget and 30% above the prior month at $8.9M. Actual February was 17% higher than in 2022. Revenue from non-hotels continues to support bed tax collection.

FYTD24 Collections at $44M, were lower than last fiscal year to date at $44.5M by (1%). FYT collections are 2% above the Approved Budget and 14% higher than 2022 collections

The Rooms sold for February were 452,372, 3% higher than last year. Rooms available for February at 556,423 are 5% higher than last year. Hotel Rooms Active today in the County, 19,187

Occupancy for February 2024 was 81.3%, (2%) lower than last year. Occupancy for February 2023 was 83.1%. February 2022 was 81.3%. The average daily rate for February was $363.53, (1%) lower than last year, and 1% above 2022. The Revenue/Available Room for February 2024 was $295.50 lower than the prior February (3%)

Hotel room net sales FY24 year over year February increased (3%) to $159M compared to $154M. Non-hotel room sales FY24 year over year February increased 17% at $35M compared to $30M. Hotel room net sales FYTD 2024 decreased (2%) from $602M compared to $614M Non-hotel room sales FYTD 2024 increased 19% at $144M compared to $121M. FYTD 2024 Taxable Revenues Fiscal Year over FY2023 increased 2% at $746M compared to $735M. FYTD 2024 Taxable Revenues Fiscal Year over FY2022 increased 17% at $746M compared to $637M.

Airport passengers for February 2024 were 779,967. 12% higher than in February 2023, and the Total Estimated Seat Capacity at 18% higher than last February 2023 with 978,286 seats. PBI Passenger 12-month rolling is a 14% increase at 7,891,396 over last year.

Leisure & Hospitality Employment for February, 96,900, decreased (0.3%) over the same month last year. Accommodation employment (3%) is lower than last year at 11,500 employees. F&B was up 1% at 63,200 employees. Arts & Entertainment employment is (4%) lower than last year at 22,200 employees.

For December 2023, we had 771,420 total passengers with a seat capacity of over 1.014M seats.

We had 6,150 air carrier ops with 10,600 general aviation operations. The total operations were just 16,761 compared to December 2022 a decrease of (2.7%) For January 2024 we had 744,000 total passengers with a seat capacity of 1,027,000. 6,176 air carrier operations with 11,216 general aviation operations. For a total of 17,392 compared to January 2023, it is a decrease of (3%) in total operations. In February 2023, we had 694,000 total passengers. In February of 2024, we had 780,000 passengers, an increase of 12.3%.

Seat capacity for February 2023, we had 831,920. For 2024 we had 978,386, an increase of 17%. For air carrier operations in 2023, we had 5,208. In 2024 so far, we have 6,110 an increase of 17%. General aviation traffic is still decreasing In 2023, we had 12,381, and in 2024, we had 11,867, a decrease of (4.2%).

Our total operations were up in 2023 with 17,589. In February 2024 17,977. We had another record for PBI for the last 12 months with 8M passengers for the first time in our airport's history.

American Airlines is part of and continues with the growth of our passengers and has extended our service to Chicago almost year-round, it is only doing a month pause. It will be extended throughout the summer until September 3rd, 2024, and then it will resume in October 2024.

It is also increasing our flights to Charlotte throughout the whole summer from four to five daily. Delta is now offering up to 12 daily flights to Atlanta on peak days. That is a number that we have not seen Silver Airways just began offering flights to Tampa, Tallahassee, Pensacola, and the Bahamas.

Frontier will begin non-stop service to San Juan, Puerto Rico on June 2nd. For March, we had a five-weekly flight to St. Louis, Missouri with Southwest. Yesterday we had our first two flights to Augusta, Georgia for the Masters golf tournament operated with Delta.

Mayor Sachs

How do we monitor the flights that arrive for our events?

Gamboa

The only way that we have been able to track this is when you go on Delta's website and look at the agenda. You can see a seat map of what seats are available and you can see what seats have been filled. However, we will not get a specific percentage number until Delta uploads that information to the USDOT.

Dufresne

On the general aviation, was that down at PBIA due to a move up to North County?

Gamboa

It has been a steady, overall flow. The North County project has not started yet, I do not know how much of that traffic is shifting there yet, but we still do see, a big general influx of traffic into PBI.

C. FY24 FORECAST & FY25 BUDGET* - MOTION TO APPROVE - Emanuel

Perry

Perry

We are anticipating our forecast for 2024 to come in at relatively flat at 8,000. We are setting our conservative budget for FY 2025 at $84M. In your board book, there are the program administration budgets for each agency that allow each agency to move forward and be relatively competitive within the markets in which they operate, as well as their performance measures.

We analyzed on Monday at the finance committee, we wanted to ensure that our agencies stayed on track and increased year over year as related to their metrics that were included in your board book.

And the organizational charts, no agency is adding any personnel. We feel comfortable moving forward as presented. I am seeking four separate motions. All of these items will come back before the board as an amendment to each agency's contract before going to the BCC for approval.

Motion to approve the FY24 Forecast & FY25 Budget was made by Jim Bronstien and seconded by Commissioner Adam Frankel. Motion carried 4-1-0 with Don Dufresne opposed and Joseph Fisher, Daniel Hostettler, Davicka Thompson, and Commissioner Lambert absent.

Bronstien

It is a flat budget, but we also sent out to everybody the history of Bed Tax over the last several years, which is not in this packet but was sent out. Just for perspective, in 2016 we had $47M, in 2019 was $54M, in 2021 $51M. And 2023 $84M. From 2021 to 2023, we have made $33M.

Dufresne

Hence my objection. To articulate, as you have heard, I believe if we took a 2019 budget and went 5% year over year, we would be at about $68.5M for an operating budget, and the money between that and what we are bringing in now, we are not getting a lot of bang for the buck, versus redirecting that money toward facilities, something more tangible than just spending it on marketing and not getting a significant return on it.

Mostad

You are referring to a third of that tax going towards facilities now I would like to have a reconciliation of the $28M or $26M to $28M against the current bonds.

That is all 100% allocated. Concerning two baseball stadiums, parking garage Convention Center I think that is untouchable. You are suggesting a reallocation of the funds that have been established for quite some time. Costs for the agencies have gone up exponentially.

Dufresne

I am not saying we stay at $54M. But 5% year-over-year is a significant increase in our operating budgets I think it is worth the exercise to at least look at the difference between that number because in 2019 we said we are going to do 5% year over year for the next 5 years, and everybody was over the moon. We are way beyond that, and I believe that we are not getting the return on the dollars that we were just spending for general marketing I mean $10M in revenue Annual revenue buys us about $100 to $120M in bonding capability.

We are wasting an opportunity here to do something of significance rather than just spending money with zero investment in facilities. We are tapped. We cannot do

anything with a facility or add a facility right now because we just do not have the cash to do it.

Bronstien

First and fourth cents, those bonds start to be completed. They do not go away.

Perry

The first bond is completed by 2031 and that is the Convention Center. And the second closest bond is 2036, which is the Convention Center's garage.

Dufresne

In 12 years, we could be doing something great.

Mostad

The financing for the CACTI Park of the Palm Beaches was backloaded in conjunction with the 2031. Those dollars are untouchable in the future. I agree with Don. It is worth a conversation concerning what would those funds be utilized for. You are talking about a major transition, but what is on the docket for that? Saving for a rainy day is not necessarily the best use of these dollars.

I do support the dollars spent from a marketing perspective. I can vary my opinion on that. There is a return on investment. It is much more complex, and more measurable now than it ever has been in the history of these agencies.

Dufresne

And we are talking about $15M annually at that $68.5M level than we were in 2019 It is not like we are not spending more.

Mostad

I would say that half of that is just increased cost of doing business. There could be something there, but it needs a lot of thought. I agree with Don. I do not think that any of us have an answer to how that would go, and that would involve some heavy lifting.

Bronstien

Part of the timing of this master plan will flush a lot of that out

Dufresne

I agree, but here is another $10M that we have already wasted. When I say we are just spending it on additional marketing over that $68.5M level. It is a wasted opportunity at minimum.

Bronstien

There is a little imbalance. There are a lot more rooms coming online.

Dufresne

Yes, but I think you get more bang for your advertising buck. I would like to have a discussion about it at some point. I am not sure if we should just have another Finance Committee meeting once we can start discussing it.

Segarra

Don, we met and discussed this, and we have some points on which we agree, and some others that we look at differently

One of them is the return on investment of the marketing we have been able to put here, which is responsible for getting to the $84M we have been able to collect. There is a correlation between dollars invested to the overall collection. But the most important part is as Jim said, I think the opportunity to include this approach into the master planning process will be a great opportunity.

We will have not only the input of this board, and some other boards, which is so important, but our boards, stakeholders, and communities need to be part of this conversation. That will be the best way to revisit a change in how we distribute the dollars.

Mayor Sachs

To Don's point, this conversation should be with the entire board. Because there are agencies represented here that have something to say about it. I do think we do have some issues with facilities. We do need to expand some of them. We do need to invest money in facilities. And this is a conversation that everybody needs to participate in.

Dufresne

I would also add that if the master plan is not taking into consideration this ability to at least look at and fund facilities, then it is not going to show up in the master plan. That needs to be a direction that the master plan needs to consider.

Perry

Yes, it will. We are going to circle back. I have to update the board as far as the master plan process. But yes, that is my general sense and direction that I want to go for facilities.

Dufresne

I just do not want to waste two more years and $25M.

Mayor Sachs

Mr. Perry, would you suggest that we have a meeting to talk about these issues and a full and open discussion on this issue?

Perry

Absolutely. The team and I will brainstorm a couple of different things, activities, and initiatives, and we will bring them forward before this board for open discussion.

Mayor Sachs

That way, everybody will be prepared to put forth what your agency's needs are so that we can address them

Dufresne

We ought to approach it with a figure you have got $12M less to spend in the budget. Go from there.

Mayor Sachs

Isami will also be available to give us an update on facilities, which is a big deal for many of our facilities here as well.

Bronstien

Needs, but also wants and things we do not know about. It is not just improving what we have. There are things out there that we do not know yet that might be whatever opportunity arises.

Mostad

The $14M allocated between the two, first, and fourth cent, just on one page, you are showing where that is going right now.

Dufresne

Just for clarification, when you say reserves, you are not talking about the agency operating reserves, you are talking about other reserves? I do not know if we are talking about the operating reserves of the agencies.

Mayor Sachs

I would suggest that instead of moving forward on approval of these old business items, we hold them in advance until the next meeting and we have an open discussion about budget items.

To do that, someone who voted for this will have to move to revisit that vote. We have a second on the motion to reconsider the vote to approve it.

Bronstien

We can run some timelines

Mayor Sachs

A month, and then we revisit this motion. I have a first, I have a second. All those for a motion to reconsider so that we can have an, uh, open discussion on the budget items. Okay, is anybody opposed to reconsidering the motion and voting on the budget?

Motion to reconsider the approved FY24 Forecast & FY25 Budget was made by Commissioner Adam Frankel and seconded by Jim Bronstien. Motion carried 3-2-0 with Don Dufresne and Jim Mostad opposed on the 11th ballot and Joseph Fisher, Daniel Hostettler, Davicka Thompson, and Commissioner Lambert absent.

Mayor Sachs

If you vote yes on this roll call, it means that you are voting to reconsider the acceptance of the budget as presented today. You are voting for a discussion about the budget before we have the vote on the budget as part of that old business. If you vote no, means we approve the budget as it is.

Bronstien

I would agree, it is a bigger topic than a 30-minute session. We will solve the next 30 years with the master plan being done. It seems that all this comes into play next year rather than this year because you have a master plan. If you guys want to make a defined point that this all comes into play for next year

Segarra

I respectfully ask this board to reconsider that motion. We, as an organization, have put months in the making of this budget. They were presented and approved to and from our boards. We brought them here; we discussed those budgets with the finance committee. Mr. Perry did a one-by-one budget with the opportunity to ask for every single line item in those budgets. I understand Don's idea, and concern, but that approach should not stop this process which has taken months in the making and we have made plans and commitments based on those numbers.

Ayala-Collazo

Just a point to consider in alignment with what Mr. Bronstien mentioned, we are in the budget cycle. Certainly, there is value in the discussion. But if that discussion leads to adjustments to what was submitted, the board might be cutting it very, very tight with submission to the Board of County Commissioners. Because you will decide the policy level, to speak, then will need to revert it to numbers and resubmit it here.

Dufresne

I am willing to meet as often as we need to flush this out if we want to do this over the next couple of weeks or have more than one meeting. It is a significant dollar amount and has a significant impact on our ability to enhance the facilities that we have in Palm Beach County. It is an opportunity that should not slip away, and I think it should be discussed, and I am happy to discuss it sooner than later.

Hillery

I would like to say that this is not a new topic of conversation, it has been going on for many years. But it is a huge conversation. And when you open up the distribution of the bed tax dollars you are talking about people coming out from the woodwork, wanting to tap into those dollars. We have to be very careful about this and I do not see this discussion being resolved in a month. It is my humble experience here at the table to suggest that we approve the budget as is.

Dufresne

If I can get a commitment from every department head here today, every agency head, that you will be prepared to have two different budgets presented next year, one with a reduced amount with an increase in facilities, then I am happy to put it off for a year.

I am happy to put off the discussion until next year. I do not want to be sitting here having the same discussion and putting it off another year again. I want you to make the commitment now and tell me you are willing to work with two different budgets.

Hutchinson

Please, correct me if I am wrong, but if we decided to reallocate dollars, that would still have to be approved by the County Commission before we could even consider the budget numbers. Therefore, you are not even meeting a budget deadline, you are meeting a policy deadline that has to happen before the budget, which I do not believe we can meet.

Linley

You could always amend budgets but based on this timeline it would be better to approve a budget and then you could come back and amend it, just so you do not get stuck in a place where you are without a budget and then there is a more difficult situation that we all might be up against.

I am happy to create as many different versions of a budget as Don suggested.

Mayor Sachs

Is there a motion to approve this budget as presented today? We would have to withdraw the last motion.

Commissioner Frankel I withdraw the motion.

Mayor Sachs

Everybody else voted yes to approve the budget as presented today. And as Mr. Linley said, we can always go back through the year and amend the budget as presented to move forward for the County Commission. The vote stays as it was done a few minutes ago. We have approved the budget as presented with one opposition.

Motion to approve the FY24 Forecast & FY25 Budget was made by Jim Bronstien and seconded by Commissioner Adam Frankel. Motion carried 4-1-0 with Don Dufresne opposed and Joseph Fisher, Daniel Hostettler, Davicka Thompson, and Commissioner Lambert absent.

D. FY25 PROGRAM ADMINISTRATION BUDGETS* - MOTION TO APPROVE – Emanuel Perry

Motion to approve the FY25 Program Administration Budgets was made by Jim Mostad and seconded by Don Dufresne. Motion carried 5-0 with Joseph Fisher, Daniel Hostettler, Davicka Thompson, and Commissioner Lambert absent.

E. FY25 PERFORMANCE MEASURES* - MOTION TO APPROVE - Emanuel Perry

Motion to approve the FY25 Performance Measures was made by Commissioner Adam Frankel and seconded by Jim Mostad. Motion carried 5-0 with Joseph Fisher, Daniel Hostettler, Davicka Thompson, and Commissioner Lambert absent.

Emanuel Perry

Motion to approve the FY25 Organizational Charts was made by Commissioner Adam Frankel and seconded by Jim Mostad. Motion carried 5-0 with Joseph Fisher, Daniel Hostettler, Davicka Thompson, and Commissioner Lambert absent.

A. ERM

1. Update – Deb Drum

Drum

We had a state record last year of over 230, 000 nests surveyed statewide for all of the sea turtles. That is an increase of over 57, 000 nests.

Our emergency dune restoration projects for Singer Island and Coral Cove are complete, and the native dune plantings were completed for both projects at the end of March. There are a couple of headlines that you will see, but we do have a massive wastewater release happening about a contractor that hit a 36-inch sewer line, if you have any questions about that, please give my office a call.

I wanted to offer to TDC and Discover The Palm Beaches it is that time of year when we work on our crisis communications plan related to both hurricane impacts and blue-green algae outbreaks. It is in our best interest to coordinate and dust off our crisis plan because there are many staff involved in this stuff. We have had a quiet couple of years, and I am sure a lot of those names and faces have changed. We work on a protocol when things happen, and how you get talking points to hoteliers and other tourism-based agencies.

1. Update – Lauren Perry

L. Perry

Dave Lawrence and Jennifer Sullivan are at a local arts agency summit today and tomorrow.

Last month we participated in Discover’s Pride Fest in downtown Lake Worth Beach. We also presented an artist lecture in partnership with the Square in downtown West Palm Beach. This month we are pleased to be opening a new exhibition in our galleries. Beyond Blossom, Power of Pollinators is opening a week from today, and you are welcome to join us for the opening reception.

For professional development, we will have our Coffee and Culture session, you are welcome to send any new employees to come and get to know what we do. It is networking and we learn about the local art agencies here in the county, that will be on April 23rd .

Mosaic is the Month of Shows, Art, Ideas, and Culture. We do this every year in May. This is our seventh annual campaign. We work together with our cultural organization partners. We gather deals and discounts from them and use that to promote visitation to the Palm Beaches during May. We are in a drive market advertising campaign targeting two cities in Florida and South Florida. We are going to be on billboards in Orlando and the North Broward market.

In partnership with Discover the Palm Beaches this year we are on all the Brightline trains and in the stations. When you ride the train look for our videos and digital signs. During April and May, we will be advertising MOSAIC specifically.

This year we are distributing lanyards that say Mosaic, and people can keep collecting the pins this year. Hopefully, that will encourage people to visit more than one Mosaic partner, because there are going to be different pins at different places. We are also going to have selfie slots. Some of our hotel partners this year are taking up pool floats and we will have our big giant shades of culture during May.

I have been working hard to get more of our cultural partners to participate and we have broken our record again this year. We have 26 partners. We are going to do a localized press release next week to encourage our local media to spread the word to get locals to participate. If you are traveling, you may see my face on a paid broadcast during CBS or ABC morning shows.

All of our deals are going to be launched next week. You can go to our website, and sign up to get our Mosaic email, and when all the deals are turned on, you get that instant notification when they are turned on.

And then as a reminder, we also started our Palm Beach County Open Studios program. This year it is on May 18th and 19th . The Open Studios landing page and the Mosaic landing page connect This year we had over 90 artists sign up.

We have passed 100 at this point, more than 50 locations. Several artists are going to come together in some strategic locations like Arts Warehouse where they have a big space and are going to be doing a big Google show. This year we will have an interactive Google map ad in the Palm Beach Post the week before Open Studios Those locally can see where to go. We will have T-shirts and hats for all the artists. We are doing a social media contest. We are encouraging them to get creative and to use our Open Studios logo and branding.

Are you forwarding the activities that are coming up this month to the PBI so the incoming passengers can see what is going on in the Palm Beaches?

L. Perry

We have our digital signs in the baggage claim at Palm Beach International that run all year round, and we use that as a co-op program. Our ad is there and three other ads. We also have two static panels that are in the waiting area

1. Marketing Technology Update – Bryan Glynn

2. Update – Milton Segarra

Segarra

Over the last three years, we have changed the approach and strategy within Discover regarding marketing technology and digital marketing. That led to a series of evolutions within the organizations to make it more effective and have a better return on every single investment that we are doing in that particular space. That led to a plan to create a solid and robust platform. Which includes the necessary infrastructure to keep growing as a destination within that particular segment.

Brian is going to take you through the actual path we are proposing to take this cover and the entire community, which means all of us, to a different level with the possibility to maximize all digital investments that we are doing.

Mr. Bryan Glynn went over a Marketing Technology Presentation – Please see attached.

Perry

This was an informal presentation and the contract as it relates to this initiative will still come before this board. I will send it out and we will talk about it at the next meeting.

Bronstien

Once you deployed how does work?

Glynn

The cost of the engineering stuff is a one-time cost Everything's built. The $400,000 that was associated with the software will be a recurring cost every year. A lot of that cost is associated with the load. The team that worked on this does this with 500 companies. They can estimate where they think we are going to go. They would say it will not be over this, it could be under this. That will be recurring, but it will also offset. Right now, approximately $100,000 in other fees that we have for products or software will be replaced by that. A little bit of a gain, that we are paying yearly, but for what it is enabling, it is incredibly cost effective

Mayor Sachs

With the new laws regarding privacy. Will your contract with us also bring into context what would happen if the new laws in Florida impact some of the information data that you are processing?

Glynn

That is an important component. The Florida law as it stands now is targeted toward big tech. It is for companies that have robust revenue. It is really for Meta and TikTok and all these big organizations. The other states though like New York are working things through. Connecticut passed something last year. We have to operate within the confines of those laws in each state.

If the Florida law becomes more robust or we exceed the threshold of processing of records within any of those individual states, yes. This will make sure that we are compliant across the board. We would be protected with that software across any state that we are operating in. And they make sure that you stay up to date.

Segarra

The other component of our presentation is an update on some activities. And Gustav will provide some feedback about the current state of business.

We have some information for March and very positive updates on what we see is going to happen in summer.

Mr. Weibull went over the current state of business.

Segarra

In group sales, we are seeing a positive trend. Our booking group business is 2% higher. For 2025 it is 74 % higher. If we factor in 2026 with the potential World Cup coming, we should have a good year.

The World Cup will take our summer and transform that into something positive. The average size of the group is (9%) lower, but they are booking more and with a short-term booking window.

We now have a travel trade portal, which is how we are going to get all the wholesalers, and travel agents, to train and certify them in all the cultural attractions, hotels, etc. that could happen in our county. Normally you bring and hire someone to do this for you. Based on the capabilities that we have in our marketing team, this will save us $200,000 to $250,000 in the next few years, having this inside.

The conversion ratio is 76% and we have 85 destinations reviewed, which is how we showcase our destination. We have a partnership in the group business with the Incentive Research Foundation, which is one of the leading organizations in the world in incentive travel, they are bringing to our destination 10 qualified meeting planners who will be writing a white paper on international incentives business.

Constantine

We completed our new campaign, the Promises Collection, in New York. We did a great mini media session with journalists in New York, where Milton sat down with the editors of Condé Nast Traveler, and Ombre Magazine, had a freelance journalist for the New York Post, The Wall Street Journal, Travel Leisure, Munch Journal, some great

publications, and then Travel Weekly as well. We were able to come to them and tell the story about the Palm Beaches and make those connections.

We have had over 45M earned media impressions to date. We have had some great coverage with Southern Living, Forbes, and People Magazine. People highlighted Palm Royale. We have been able to capitalize on that show and flip it to talk about coming to the Palm Beaches, traveling here, and experiencing it for yourself.

We have got a lot of great releases going out. We are doing our What is New for Spring 2024. Information about all the developments in the destination. Our new travel trade portal that we are promoting.

Smart Women in Meetings. A shout out to Kelly Cavers and Aly Fernandez on our team who won awards with that magazine. The Providencia Award is now out. The public is invited to vote. That is our annual award. We will announce the winner at Travel Rally Day in May. We are releasing spring into savings in the Palm Beaches to capitalize on that accessible affordability that we have in the summer.

We are also working on a beach cleanup with Loggerhead Marine Life Center on April 20th in celebration of Earth Day. Everyone's welcome to join us.

Tomorrow at the Boca Raton, we are hosting our second hospitality and tourism career day. We partnered with the Palm Beach County School District. The event scheduled for tomorrow is about four hours. We have about 70 high school students who come from seven schools. They are going to do a behind-the-scenes tour of the Boca Raton and get an understanding of the food and beverage, the banquet, and how the day-to-day operations work.

There is going to be a panel discussion with good speakers coming to talk about careers in tourism. We have some examples of people who decided to start in the front line at hotels and worked their way up to management. In some cases, general management.

There is going to be a total of 15 businesses in the hospitality field, doing some demonstrations, like a culinary pastry demonstration, cosmetology, floral arrangements for events, there are going to be meeting planners there, etc.

We want to expose them to not only how a career can be lucrative, but also how tourism affects their local community, and it enables them to have a better life. The Boca Raton has been a fabulous partner of ours. They are excited to host this, and they hope to continue this every 6 to 12 months.

D. SPORTS COMMISSION

1. Update – George Linley

Linley

Thanks to everybody around the table, because you are all a major reason why the county received this recognition, the Sports Business Journal recognized the Palm Beaches as a top five sports destination. We are all home to professional sports. It surely shows the commitment that the county has made over the years for sports and this TDC board, which has had to make tough decisions on sports investments, infrastructure, and resources, including resources for our sports community.

In the article, they mentioned the Breakers and the fact the NHL, and NFL meetings are hosted here. Essentially, it was six years of research that they conducted. They looked at every type of event from youth sports to collegiate events, Olympic-related events, professional sports, communities with the sports commission, a convention and business bureau, sports venue that had a specific dedication of resources to lower sporting events were considered a stand-alone market.

Bronstien

Who was in the top five?

Linley

Cities with a big buy were, 1. Orlando, 2. Las Vegas, 3. Los Angeles, 4. Atlanta, and 5. Indianapolis. Smaller cities, Fort Worth was 1. Greensboro, 2. North Carolina, 3. Birmingham, 4. Louisville, and 5. Palm Beach County

There was a total of 50 destinations recognized, and Florida had Broward County, Miami Dade, and Orlando. They are one of our greatest competitions. When you have 200,000 hotel rooms in the greater Orlando area, you can always find a decent rate, even when we are at our high, in tourism, because of their hotel inventory.

April is a strong month for sports. We are supporting a total of 24 events. I think it is a conservative forecast that we should have close to 28,000 room nights, which would be more than last year's April. It would be about a 5% increase.

This week Convention Center was home to the American Cornhole League, that was televised on CBS for an hour. In addition to Cornhole, there was also an APP Tour event in Delray Beach.

There has been growth in pickleball. It returned with the Vlasic Classic and was on CBS Sports Network. Coming up next week, we are hosting for the fifth year in collaboration with Parks and Recreation, the Palm Beaches Spartan Sprint Race, and 9,000 registered right now. The event has consistently generated over 4,000 room nights.

AAU's Karate event at Palm Beach Atlantic University is happening this weekend, along with the Sun Conference Lacrosse Championship at Kaiser University and there is a Sunshine State Conference Men's Golf Championship. The U.S. Men's National Team and U.S. Women's National Team for the 16U and 19U age groups will be training here for a couple of weeks.

From a development standpoint, there are a lot of good things happening that we are pursuing. We submitted the USA National Convention; they seem to like it and will be coming down for a site visit and the venue would be the Convention Center. We will have to do a good job on the site visit and follow through with the bid. If that happens, then we can host the team's conference, which is the Super Bowl of the trade shows, but then follow up with another big annual convention. U.S. National Convention has overseen 13 different sports since 1968

Mayor Sachs

Do you advertise at PBI with these events coming in?

Linley

We put together welcome messages when a group comes in. We have done it through the TDC. In terms of direct advertising, we have not specifically talked about it at our board.

Mayor Sachs

I also like the way you interact with the Convention Center and with events at Delray, I am sure this was all planned, that everything comes together at about the same time. It shows y'all are working together.

E. FILM & TV

1. Update – Michelle Hillery

Hillery

Tyler Cameron is back with his new show, and it was filmed in South Florida. Unlike the show Palm Royale, which we know was not filmed here. Nevertheless, we are getting a lot of attention.

The Tyler Cameron show is airing in April. It is on Amazon Prime Video. We facilitated permits for this show. Production-wise a UPS commercial filmed in Boca Raton at the Massey Tennis Academy with star Coco Gauff.

Shark Week is back, with a lot of shark shows, National Geographic and Cannibal Sharks, shot here at Riviera Beach. For the Palm Beaches TV and our Sponsorship and Development Program, things are very brisk, and a lot of projects are coming out. One is Parks and the Palm Beaches, which is a brand new six-episode show, that is going to be airing nationally on Destination America this month, which has a $10M potential reach. Another national show airing on the Travel Channel is called Pets in Paradise, a show that is going to be popular, it highlights the pet-friendly airport and green market amongst other locations here in Palm Beach County.

Two shows coming out, What’s Poppin PBC is a six-episode show, season two with Kitty Lundin and Day Tripping in the Palm Beaches is three, half-hour episodes that highlight a day itinerary utilizing the county's transportation system.

The Student Showcase of Films is coming up on April 26th . We have 650 RSVPs. Students come from all over the state of Florida. We will be presenting $29,000 in scholarships and awards. We have a record-breaking number of entries this year, 529 from 73 schools around the state of Florida. If you have not RSVP, please call my office.

1. OVG Venue Management

a. Update - Dave Anderson

Anderson

We continue just to be on fire. March was great. We are in the middle of a wonderful April. The Boat Show was great. And we had 500 Corn Holers that were going for four straight days. They started at 7:30 A.M. and were done at about 10:00 P.M. every night. Logistically it was amazing, one of the best organized competitions I have ever seen in my career. They did everything through an app on their phones. They just walk in, and everything is real-time. They were extremely happy. They want to bring a larger one back here, it was great.

We are rolling into the Americas Duty-Free Shops show These are people who own and manage the shops, from small ones to Dubai, which is the largest, duty-free in the world. That does about a billion dollars a year just for duty-free.

The rest of May is completely packed as well. We did our third Art Show at the end of March and was probably the best attended there. They've done that show for three straight years now in March, and the attendance was phenomenal. Even though they still wanted to be in January and February, they were pleased with the attendance.

Monday afternoon and Tuesday I was in Amelia Island, the Society of Independent Show Organizers, are the largest show organizers in the world. They produce about 4,000 events around the world and the economic impact is $122B a year. The largest one was Informa which owns the Boat Show here, Fort Lauderdale, Miami Beach, and Sarasota, they alone do a thousand events a year. They had 14 different members of their organization there because they are segmented all over the country. They are in all of our buildings, Dallas, Miami Beach, Chicago, Santa Clara, California, and of course, West Palm Beach as well. They are doing, the expansion of their events, and the investment in AI across the board with all of these people. They have no limit.

Something I thought was also interesting, that the conversation about infrastructure in Orlando was there, Houston, Dallas, Anaheim, and almost every single building is expanding, we are building in Dallas, and it is going to be $2B Houston is going to expand their building starting next year a $2B, San Antonio is looking at expanding, Orlando is going to expand, which is probably $2B and small markets are building arenas, theaters, sports places, a lot of investment is going on, and not just in these large markets, in these smaller markets where they want to be a sports tourism.

It shows the competitiveness on the tourism side, but on the facility side, it is fierce. We are taking over the Mobile Convention Center, which is a building the size of mine, but

Mobile is going to tear down their arena, and they are going to build a new $300M arena, and we are going to put money into it

Business, attendance, and per caps are good. On Sunday, we had an all-company call with every facility in the world that we manage, because some internal documents have come out from the agencies that monitor terrorism in the United States. The Moscow situation was unfortunate. Since that time, there has been a lot of chatter. They are looking for people to carry out something similar to the West, either in Europe or the United States. Is getting to a point where there are no specific threats, the chatter is all around public events, large-scale events, in any type of venue. In Moscow, it was in a theater, but they are looking at all of that. We are starting to look at just, not only our buildings, but around the world and just amping things up, but we do not have a specific threat yet. But it is something that we have to take very seriously.

Griffin

We are doing some educational development on the food and beverage side, starting at the end of the month. We are going to have the Inlet Grove culinary students out for a day. This is something we do every year we have them out. It is a very hands-on experience for them.

On top of getting them in the kitchen, touching, feeling, and interacting with our culinary staff, we serve them lunch and then we do a round table with our different supervisors and managers talking to the students from the high school level, we are now in the infancy stage of developing an internship program that I would like to roll out probably next year.

We have had our first meeting with FAU to talk about their program. We are working on that. On an inhouse level, we have just launched a leadership program within our staff. This is developed and geared towards the frontline employees and the next level up from them to give them the leadership and management skills to be able to progress in their career. We have chosen our first four candidates to go through. There are two for the front of the house, two for the back of the house. It is a very hands-on program, selfdriven. It is about three months long.

7. BOARD COMMENTS

No board comments.

8. PUBLIC COMMENTS

Mayor Sachs

George, is the first time we were in the top 5?

Linley

Yes, it is. And SPG is very respected. It is a pure sports business publication.

The meeting adjourned at 11:44 A.M.

The next Meeting will be on May 9, 2024. *Attachment included.

TO: Tourist Development Council

FROM: Milton Segarra, President/CEODATE: April 30, 2024

RE: Discover The Palm Beaches Monthly Activity Report April 2024

The following overview summarizes the noteworthy initiatives undertaken by DTPB in bolstering TDC Performance measures throughout the month of April 2024. This report serves as a thorough depiction of DTPB's achievements during this period, specifically in relation to TDC Performance Measures. It highlights our performance across key areas, including advertising impressions, the impact of website users, a newly implemented performance metric, engagement levels on social media platforms, the total number of room nights contracted in the future as well as those room nights actualized in the month of April

Hotel room night revenue was up slightly (+0.6%) with room demand down (-1.4%). Alternative lodging was up substantially in room night demand (+24%) and revenue (+20%). However significant increases in inventory (+15%) caused a decline in overall occupancy (-2.0%) and rate (3.7%). Total lodging was up selling 5.9% more room nights generating 3.6% more revenue to $218M.

Luxury hotels drove performance selling 5% more rooms (80k) at a 2% higher rate ($1,044) generating 6.8% more revenue ($84M). All other chain scales showed declines in occupancy, ADR and RevPAR, with budget dropping the furthest.

Total group room nights were down 14% from last year, making up 16% of total hotel room nights sold in March. Groups rates were up 4.8% to $347 compared to the leisure rate of $386 which was only up 0.8%.

Room demand

• Hotels: 480k (-1.4%), FL Market Share of 4.0% (+0 pts)

• Alt. Lodging: 239k (+24%)

• Total Lodging: 719k (+5.9%)

Room Night Revenue

• Hotels: $178M (+0.6%), FL Market Share of 6.2% (+0pts)

• Alt. Lodging: $39.7M (+20%)

• Total Lodging: $218M (+3.6%)

• Hotels: 80.9% (-2.0%), ranking 7th in growth

▪ Alt. Lodging: 75.0% (-2.0%)

▪ Total Lodging: 78.4% (-0.9%)

Average Daily Rate (ADR)

▪ Hotels: $372 (+1.9%), ranking 5th in growth

▪ Alt. Lodging: $395 (-3.7%)

▪ Total Lodging: $376 (+0.8%)

Revenue per Available room (RevPAR) was $293 down 3.1%

▪ Hotels: $301 (-0.1%), ranking 6th in growth

▪ Alt. Lodging: $297 (-5.3%)

▪ Total Lodging: $294 (-0.1%)

Research compiled and published by Discover The Palm Beaches (DTPB), can only be reproduced through expressed written approval from the DTPB Research Department. The underlining methodologies, algorithms, formulas and data used are considered a TRADE SECRET. For questions please contact research@thepalmbeaches.com.

Definitions:

Hotel Rooms The number of hotel rooms that are available on any day of the week. This number increases as new properties open.

Hotel Room Nights Available The number of hotel rooms multiplied by the number of nights in a given period a room is available to sell, such as a month or week. This number represents the total available hotel lodging capacity for The Palm Beaches.

Hotel Room Nights Sold The number of rooms sold over a given period. This is the total demand for hotel rooms in The Palm Beaches.

Alternative Lodging is described as any accommodation other than typical hotels and resorts without front office staffing

Alternative Lodging Rooms The number of shared lodging properties multiplied by the number of rooms per property. This number represents all the alternative lodging options competing with hotel rooms.

Alternative Lodging Room Nights (RNs) Sold The number of shared lodging listings booked multiplied by the number of nights and number rooms. This is the total demand for alternative lodging options in The Palm Beaches.

Total Room Nights (RNs) Sold– The sum of Hotel Room Nights Sold and Shared Lodging Room Nights Sold. This is the total demand for overnight lodging in The Palm Beaches.

Room Nights (RNs) Market Share-The percentage of hotel room nights sold within the state of Florida. This indicates the size of The Palm Beaches hotel market and relative performance.

Revenue Per Available Room (RevPAR) - Total room revenue divided by the total number of available rooms. See Room Revenue, Rooms Available. Room Revenue/Rooms Available = RevPAR.

Total Lodging Revenue The number of room nights sold multiplied by the average daily rate (ADR)

12 Month Moving Average (12MMA) - The value of any given month is computed by averaging the value of that month and the 11 preceding months. This is used to eliminate seasonality

Rolling 12 Months The sum of the current month and 11 preceding months. This is used to eliminate seasonality

Average Daily Rate (ADR) - A measure of the average rate paid for rooms sold, calculated by dividing room revenue by rooms sold. ADR = Room Revenue/Rooms Sold. This indicates a travelers willingness to pay for lodging in The Palm Beaches

Occupancy Percentage of available rooms sold during a specified time period. Occupancy is calculated by dividing the number of rooms sold by rooms available. Occupancy = Rooms Sold / Rooms Available. This indicates the health of the lodging market in The Palm Beaches

Rank The placement of The Palm Beaches versus 14 Florida markets (Palm Beach, Monroe, Miami-Dade, Broward, Collier, Lee, Sarasota, Pinellas, Hillsborough, Brevard, Volusia, Orlando (Orange/Osceola), Jacksonville (Duval, St. Johns), Panhandle)

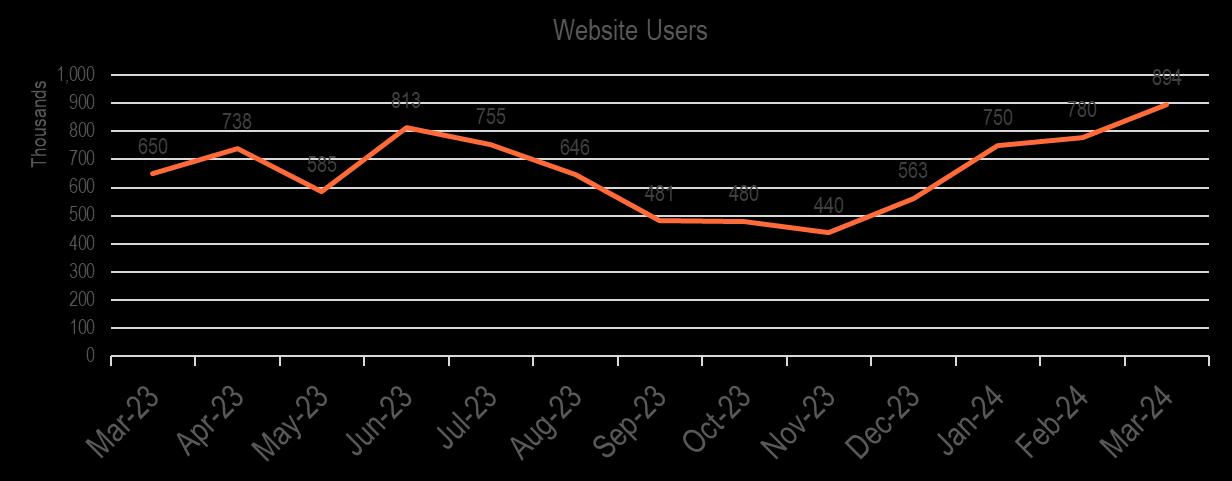

Website User The total number of unique individuals accessing ThePalmBeaches.com in a given month. This is a leading indicator of interest and intent to visit The Palm Beaches as a result of DTPB promotional efforts

Research compiled and published by Discover The Palm Beaches (DTPB), can only be reproduced through expressed written approval from the DTPB Research Department. The underlining methodologies, algorithms, formulas and data used are considered a TRADE SECRET. For questions please contact research@thepalmbeaches.com.

Leisure/Consumer

• Generate 1,000,000,000 Advertising Impressions

• Generate 4,000,000 in Website Users (New Metric)

• Increase Consumer and Travel Industry database to 420,000

• Generate 255,000,000 Earned Media Impressions

• Generate 10,000,000 Social Engagements

Meetings & Conventions

• Book 121,000 DTPB only room nights (Hotel Meetings Leads)

• Generate 50,000 Group Level Booked Room Nights Convention Center Shared

• Generate 40,000 Group Level Actual FY Room Night for Convention Center Shared

• Generate 90 participants in Destination Reviews

• Generate 100 Destination Site Participants

This metric is newly introduced, and currently, there are no prior figures available for comparison. We will monitor its performance and assess trends over time as data becomes available.

1,226,599,961 426,638,472 472,253,021 2,313,187,925 1,698,852,982

Sales & Destination Services Overview by Month FY 2022 - 2023

1 The Cultural Council starts FY24 above goal on these aggregate performance measures (which were conservatively estimated mid-fiscal FY23) due to effective tactics and additional stimulus funds employed before FY23 closed.

2 New performance indicators as of 10/1/23. Previous year totals were not measured.

In early April, the Council paused most of its cultural tourism campaign placements and focused on its drive market campaign to promote MOSAIC (Month of Shows, Arts, Ideas & Culture). Advertisements for Palm Beach County Open Studios, with its new standalone branding created by ad agency, Push, were put into heavy rotation in mid-April.

Placements promoting MOSAIC included digital, print, OOH, broadcast TV and radio, and social media platforms. Placements promoting Open Studios included digital, print, OOH, and social media platforms. Target audiences for both campaigns included Gen Z, Millennials, Boomers, and families in our drive markets, as noted in the Council’s FY24 Marketing Plan. While the MOSAIC and Open Studios promotions rely heavily on digital and social media placements, strategic print placements appeared in publications such as Cultured and PURE HONEY in April. The Council’s annual MOSAIC special section in Florida Weekly (a co-op advertising package) also published in late April/early May. OOH included billboards in northern Broward County along I-95 and in Orlando along I-4, as well as ride-share vehicle wraps (Circuit, Freebee) in downtown West Palm Beach and Delray Beach. Radio spots aired on Legends Radio and signage targeted visitors at Palm Beach International Airport and in Brightline stations and trains.

Landing pages for both campaigns (mosaicpbc.com and openstudiospbc.com) launched the first week of April, capturing email addresses from visitors interested in being alerted about MOSAIC offers. On April 16, all 30 MOSAIC offers went live on mosaicpbc.com, and an email was distributed announcing those offers on April 22. This year, to improve the visitor experience during Open Studios, the Council identified a solution to provide a Google-powered, interactive location map via openstudiospbc.com. Each artist’s location is plotted for easy navigation around the county. For those who prefer a printed listing, the Council printed a 3-panel, oversized brochure with map, and it will be updating a downloadable PDF version of the listing and map up until the week before the Open Studios event.

Partner and Artist Toolkits were created for the Council’s cultural partners and the Open Studios artists to help guide them through the promotional process, activating them to be ambassadors for each campaign. The cultural partners were invited to the Council’s headquarters on April 16 and 17 to pick up MOSAIC promotional

materials and signage. Open Studios participants also had pick-up opportunities at the Council on April 25 and 26, and additional opportunities for the artists to collect their signage and swag will occur in May.

On April 29, the giant Shades of Culture were erected at CityPlace (formerly The Square) in downtown West Palm Beach on the corner of Rosemary Ave. and Okeechobee Blvd. to coincide with MOSAIC. The images in the Shades’ lenses feature Paris Ballet at the Kravis Center for the Performing Arts, a nod to their discounted MOSAIC ticket offers this year.

Also in April, the Council and Discover worked with local creative professional Lisa Kaw to finalize artwork for a Brightline train wrap branded to The Palm Beaches. The train wrap is expected to make its debut in May to coincide with MOSAIC. Discover invited the Council to participate in its #LoveThePalmBeaches campaign through contests it is promoting on social media and at SunFest in early May. The Council will provide prizes for special experiences at select MOSAIC cultural partner locations. The Film & Television Commission posted a MOSAIC-themed Watch Party on April 16 on YouTube featuring cultural organizations offering MOSAIC deals and an on-camera appearance by the Council’s CEO, Dave Lawrence.

Top Placements

- April 3, Global Newswire press release distribution: “This May, MOSAIC Returns to The Palm Beaches with Exclusive Offers and Expanded Open Studios Experience”

o Top 10 Placements Reach: 384,030,118

- April 11, Baby Center (UVM: 13,581,879): “10 best budget family vacations that give the best bang for the buck”

o Pickup in MSN: (UVM: 132,453,294)

- April 21, Mommy Poppins (UVM: 971,661): “24 Great Things to Do with Mom on Mother’s Day in Miami & South Florida”

- April 22, Miami on the Cheap (UVM: 50,708): “Enjoy Culture At A Discount With Mosaic In Palm Beach”

Other Highlighted Placements

- April 2, Hotels Above Par (UVM: 18,988): “This Palm Beach Boutique Hotel is What Palm Royale Dreams Are Made Of”

- April 11, Florida Weekly (Circulation: 10,500): “Beyond Blossoms: A pioneering exhibit of artwork explores the vital role of pollinators”

- April 17, PBS/Comtel “Know What Matters” paid broadcast (Viewership: 323,856):

o Atlanta “MOSAIC 2024 WANF Atlanta Aircheck”

o Fort Myers “MOSAIC 2024 WTSP Tampa Aircheck”

o Jacksonville “MOSAIC 2024 WJAX Jacksonville Aircheck”

o Miami “MOSAIC 2024 WFOR Miami Aircheck”

o Orlando “MOSAIC 2024 WKMG Orlando Aircheck”

o Tampa “MOSAIC 2024 WTSP Tampa Aircheck” - April 22, Flamingo magazine (UVM: 60,000): “Discover the Buzz in The Palm Beaches”

In early April, the Council’s PR agency of record, Sharp, distributed a national press release teasing MOSAIC (Month of Shows, Arts, Ideas and Culture) and Palm Beach County Open Studios, and conducted media outreach to drive markets including Atlanta, Fort Myers, Jacksonville, Miami, Orlando, and Tampa. The press release included five “top deals” from cultural partners participating in MOSAIC.

The PR agency secured two influencer FAM visits in April to promote MOSAIC. As previously reported, LGBTQ-focused travel influencers Shanna and Gabi of @27travels (94.4K) visited in early April through a collaboration with Discover The Palm Beaches. Aseky of @asekyb (72.3K) completed a FAM tour with her family at the end of April. In total, four influencer FAM tours to promote MOSAIC were completed, with posts, stories, and reels being pushed live in April and early May. The FAM itineraries included visits (and subsequent media exposure) for Mounts Botanical Garden, Norton Museum of Art, Ann Norton Sculpture Gardens, Jupiter Inlet Lighthouse & Museum, Busch Wildlife Center, Gay Polo, Cox Science Center & Aquarium, Loggerhead Marinelife Center, The Society of the Four Arts, Palm Beach Zoo & Conservation Society, and the Richard and Pat Johnson Palm Beach County History Museum.

Also in April: The Council’s PR consultant Linnea Bailey worked with Sharp and Discover The Palm Beaches to submit to VISIT FLORIDA’s “One Fun Day” social media campaign, highlighting the Palm Beach Zoo and Mounts Botanical Garden. MOSAIC information was submitted to Discover to support its “What’s New in The Palm Beaches for Spring 2024” press release distribution (UVM: 5,590,154). And the Council’s Art & Culture Insider, photographer and influencer Nick Mele, visited Benzaiten Center for the Creative Arts, Ann Norton Sculpture Gardens and Palm Beach Dramaworks to capture images and content to promote MOSAIC.

In April, the Council’s PR consultant distributed the MOSAIC and Palm Beach County Open Studios press release to local media outlets. Stet Media Group and other local news blogs responded with posts covering the upcoming May celebration. The Council’s main and solo gallery exhibitions featuring local creative professionals also received coverage by Flamingo magazine and Florida Weekly as well as a broadcast

story on WPBF. On April 20, the South Florida Sun-Sentinel published an article about the new Center for Arts Innovation in Boca Raton, featuring interviews with Council, TDC and County executives. (South Florida Sun-Sentinel (UVM: 2,602,921): “First look: Design plans for Boca Raton’s Center for Arts and Innovation”)

To further promote MOSAIC in the South Florida region, the Council hosted a FAM event for 12 influencers in Boca Raton on April 27th. The event included complimentary rides aboard Brightline (guests traveled from the West Palm Beach and Ft. Lauderdale stations to the Boca Raton station), an informational brunch at Kapow! featuring MOSAIC artist Allan Creary, a photo opp featuring the City of Boca Raton’s public art program, swag bags, and tours of the Boca Raton Museum of Art and the Boca Raton Historical Society’s Schmidt Boca Raton History Museum (pictured). The City of Boca Raton graciously provided transportation on Molly’s Trolley within its city limits for the entire group. The influencers in attendance shared their experience with their followers and via blog posts as a result, and the Council plans to connect them with MOSAIC cultural partners for additional FAM tour opportunities in May.

The Cultural Council was a proud sponsor of the Black Gold Jubilee in April. Belle Glade’s beloved annual festival brings in a crowd of thousands to enjoy and participate in events including the Harvest Queen Pageant, fishing and golf, a Main Street Parade, a green market, fireworks, family-friendly rides and games, and a 5K race. The Black Gold Jubilee also featured a circus act and live musical performances by local and international artists, plus a photography contest featuring images of life, scenery, and wildlife around Lake Okeechobee.

In support of the sector, members of the Council team attended exhibitions, performances, and special events in April at Kravis Center for the Performing Arts, Palm Beach Dramaworks, Boca Raton Museum of Art, Busch Wildlife Sanctuary, Schmidt Boca Raton History Museum, and Palm Beach Zoo, to name a few.

The Cultural Council invited the Racial Equity Institute (REI) to present its Phase I workshop in April and June for the local arts and cultural sector through generous funding from the Cornelia T. Bailey Foundation. REI’s two-day workshop is designed to develop the capacity of participants to better understand racism in its

institutional and structural forms. Moving away from a focus on personal bigotry and bias, the workshop presents a historical, cultural, and structural analysis of racism. The first workshop was held at Palm Beach Dramaworks on April 8 and 9, and a second is planned for June 24 and 25.

On April 23, the Council hosted another well-attended Coffee & Culture event at its headquarters, welcoming new employees from cultural arts organizations as well as creative professionals who are new to the area. Coffee & Culture is part of the Council’s Institute for Cultural Advancement (ICA) series and offers an opportunity for attendees to network with peers and learn about the Cultural Council’s role as the local arts agency for Palm Beach County TDC Executive Director Emanuel Perry also presented an overview of the county’s tourism agencies and initiatives.

Florida is leading the nation’s sports tourism economy, which was revealed by the Sports ETA (Events & Tourism Association) State of the Industry Report. Sports ETA, which is the trade association for the sports events and tourism industry, released its highly anticipated annual State of the Industry Report during the Sports ETA Symposium in Portland. The report underscores the strength of the sports tourism sector in the United States, showcasing a direct spending impact of $52.2 billion, which generated a total economic impact of $128 billion in 2023. This monumental contribution supported 757,600 full-time and part-time jobs and contributed $20.1 billion in taxes to various sectors of the economy. The number of sports travelers in America established a new high-water mark of 204.9 million in 2023. The sports tourism industry continued to grow in 2023, increasing by 7% over sports traveler volume in 2022.The association’s last benchmark State on the Industry report was released in 2022 to benchmark 2021, and concluded that U.S. sports-related travelers, event organizers, and venues spent a total of $91.8 billion.

The study was conducted by Tourism Economics, with support from Northstar Meetings Group, the leading multi-platform brand for dedicated meeting and business planners and sports event organizers, and the presenting sponsor of the association’s “Annual State of the Industry” research report. The analysis draws on a variety of data sources to quantify sports tourism, which includes adult and youth amateur events and collegiate tournaments (the economic impact

analyses conducted within the report exclude professional sports and collegiate regular season games):

• Sports ETA: destination membership survey data

• Longwoods International: traveler survey data, including spending and visitor profile characteristics for sports tourism nationwide

• Bureau of Economic Analysis and Bureau of Labor Statistics: employment and wage data, by industry

• Bureau of Transportation Statistics: U.S. domestic average itinerary fares

• U.S. Travel Association: domestic travel data

• STR: lodging data

• Sports attendance data

Key Highlights from the 2023 Sports ETA State of the Industry Report include:

• Sports travelers spent $52.5 billion dollars in 2023 on the following:

o $13.5 billion on transportation

o $10.9 billion on lodging

o $9.7 billion on food and beverages

Recreation, retail, and tournament operations rounded out spending, registering $6.9 billion, $6.5 billion, and $4.7 billion, respectively. The nation’s lodging sector accounted for 21% of all sports-related travel spending. In 2023, sports-related travel generated 73.5 million room nights, which is an important factor given that hotel taxes are a primary funding source for many entities.

For the first time ever, the Sports ETA State of the Industry Report has identified the Top 10 list of states in terms of the economic impact generated by sports tourism in 2023. Data provided by sports tourism industry stakeholders and economic data were utilized in the ranking analysis. Sports tourism marketing funds and other initiatives, such as bid fees and local grants, also influence how states perform. They are:

1. Florida

2. Texas

3. California

4. Pennsylvania

5. Illinois

6. Ohio

7. New York

8. Tennessee

9. Georgia

10. Virginia

The Palm Beaches’ sports tourism landscape greatly contributed to Florida’s top ranking for generating the most economic impact through sports tourism. Palm Beach County was recently recognized by the Sports Business Journal (SBJ) as one of the elite sports destinations in the United States per the Sports Business Journal (SBJ), which announced its second year of rankings for Best Sports Business Cities (BSBC). The Palm Beaches ranked number five in the “Cities Without a Big Five Team” category, which represents destinations without a local sports franchise participating in the NFL, MLB, NBA, NHL, and MLS.

The Palm Beach County Sports Commission hosted 196 events, representing over 40 different types of sports during the last year. Palm Beach County’s sports resume is robust and diverse. Equestrian show jumping and baseball are two of the top-producing sports in The Palm Beaches. The Palm Beaches represent the only county that is home to two MLB Spring Training facilities that each accommodate two teams. In addition to hosting one out of four MLB Spring Training games in Florida, Palm Beach County is also home to one the largest collection of national baseball tournaments compared to any other destination in the United States. Home to the PGA Tour, ATP Tour, Billie Jean King Cup, FIP Polo World Championships, NCAA Championships, the Boca Raton Bowl, and an array of the largest youth sports events taking place in the nation, Palm Beach County is one of the preeminent sports destinations on the globe. This year, Palm Beach County was home to the first Olympic Qualifier to take place in the United States for the 2024 Summer Olympics Games in Paris (Federation of International Gymnastics – World Cup of Trampoline & Tumbling). The entire sports event industry traveled to The Palm Beaches this October, by hosting the 25th edition of the TEAMS Conference + Expo.

The Palm Beach County Sports Commission’s semiannual report for FY 23 (October 1, 2023 –March 31, 2024) indicates an effective performance in elevating sports tourism for The Palm Beaches. The report shows the Palm Beach County Sports Commission is on pace to meet and exceed its FY 24 performance measures. During the first six (6) months of FY 24, the Palm Beach County Sports Commission’s event portfolio includes 103 events, creating 195,785 room nights for the county’s lodging industry. In total, the Sports Commission hosted events generated an estimated $48,002,566 in hotel revenue and $2,880,154 in bed tax revenue. Moreover, the Sports Commission events spurred an estimated $186,492,800 in visitor spending

Semiannual Performance Measures- FY 24

Palm Beach County Sports Commission

Sports-related room nights

Perfect Game World Wood Bat Association (WWBA) World

Perfect Game World Wood Bat

Perfect Game 12U & 14U WWBA World

Perfect Game Ultimate Baseball Championship

Perfect Game 13U WWBA National Championship

Perfect Game Endless Summer Classic

Perfect Game 17U Florida World Series

Perfect Game World Wood Bat Association (WWBA) Florida Invitationals

Perfect Game 13U & 14U National Showcase

Minority Baseball Prospects All-American Game

FCSAA Division II/NJCAA South Atlantic District Volleyball Championship

FCSAA Division II/NJCAA Region 8 Men's Basketball Championship

USA Pickleball - World Pickleball Open

5 v 5 Warrrior Soccer National Championship

One Hockey - Feast on the Beach

Battle Youth National Championship

National Junior College Athletic Association (NJCAA) Basketball Invitational

Major League Soccer - Nashville Soccer Club Pre Season Team Training

Major League Soccer (MLS) - Toronto Football Club Preseason Team Training

7v7 Elite Championships Southeast Regional

Jamacian U20 Men's National Team Training

USSSA Florida Baseball State Qualifier

CEO Gaming Fight Championships

RUSSMAT Collegiate Baseball Spring Training

USSSA Spring Break Bash

Florida East Coast Travel League/USSSA Wood Bat Classic

FL Women's Hockey League Spring Series

American Cornhole League Kick-off Battle

Men's Senior Baseball League (MSBL) Fall Classic

Men's Senior Baseball League (MSBL) Memorial Day Classic

World Wake Association (WWA) Florida State Championship

International Tennis Federation (ITF) Senior World Championship

2024 Hydrodrags Nationals/World Championships

American Junior Golf Association (AJGA) UNIQLO / Adam Scott Junior Championship

USA Gymnastics Rhythimic Development Championships

First Responder Games

FLETL/USSSA Wood Bat Championship

World Wake Association (WWA) - Wake Park National Championships

Sunshine State Amateur Golf Association Championships

Association of Pickleball Players (APP) Tour September Open

Association of Pickleball Players (APP) Vlasic Classic

AVP (Association of Volleyball Professionals) Pro League Beach Championships

Amateur Athletic Union (AAU) Karate Florida Gold Karate Championships

Lynn Lewis Foundation - Flag Football Championship

PGA TOUR - Pathways to Progression

Youth Impact Center Wrestling

International Rush Cup

OneHockey Winter Series

USA BMX Sunshine State Nationals

USA Fencing Regional Championship

Bridgestone Collegiate Invitational

USA BMX Florida State Championship

National Academy League presented by 3Step 2025 National Showcase

National Negro Golf Association (NNGA) Invitational

Baseball

Baseball

Baseball

Baseball

Baseball

Baseball

Baseball

Volleyball

Basketball

Pickleball

Soccer

Ice Hockey

Football

Basketball

Soccer

Soccer

Flag Football

Soccer

Baseball

E-Sports

Baseball

Multi-sport

Baseball

Ice Hockey

Cornhole

Baseball

Baseball

Wakeboarding

Tennis

Water sports

Golf

Gymnastics

Multi-sport

Baseball

Wakeboarding

Golf

Pickleball

Pickleball

Beach Volleyball

Karate

Flag Football

Golf

Wrestling

Soccer

Ice Hockey

BMX

Fencing

Golf

BMX

Dance

Golf

Sunshine State Games Lacrosse Lacrosse

Prospectwire Southeast Championships

Baseball

United States Specialty Sports Association (USSSA) Annual Convention Conference

USA Gymnastics Men's Development Program Eastern National Championships

PGA Works Collegiate Championships (NCAA Division I & II Collegiate Golf Event)

Mid-American Conference - Men's Golf Championship

NCAA Division 1 Men's Southeast Golf Invitational

2027 NCAA DI Women's Golf Regional Championship

Gymnastics

Golf

Golf

Golf

Golf

2027 NCAA DII Women's Golf National

2027 NCAA DI Women's Golf National Championship

2027 NCAA DI Men's Golf Regional Championship

2027 NCAA DI Men's Golf National Championship

2027 NCAA DII Men's Golf National Championship

2028 NCAA DI Women's Golf Regional Championship

2028 NCAA DI Women's Golf National Championship

2028 NCAA DII Women's Golf National Championship

2028 NCAA DI Men's Golf Regional Championship

2028

2028

7v7

International Tennis Federation

Major League Soccer - Nashville Soccer Club (SC)

Major League Soccer - Toronto Football Club (FC)

Northstar Meetings Group

COPABE (Pan American Baseball Confederation

World Baseball Softball Confederation (WBSC)

USA Baseball

USA Judo

USA Field Hockey

Conference + Media

USA Water Ski & Wake Sports Water Ski & Wake Sports

Perfect Game USA

Florida Sports Foundation

5v5 Warrior Soccer Soccer

World Wake Association

Sports ETA (Events & Tourism Association)

USA Gymnastics

United States Olympic & Paralympic Committee (USOPC)

United Soccer League (USL)

US Virgin Island Lacrosse