There’s never been a more dynamic time to be in retail. Yes, I said that. The store is no longer just a convenient shopping destination — it’s a brand lab (think CVS and Walgreens with health tech and wearables), a marketing platform (Amazon Go), a theater of consumer behavior (Ulta, Target), and a place of cross-category discovery (Costco, Walmart).

From my vantage point — after decades in this business — the best new ideas happen when retailers and suppliers collaborate with a common goal.

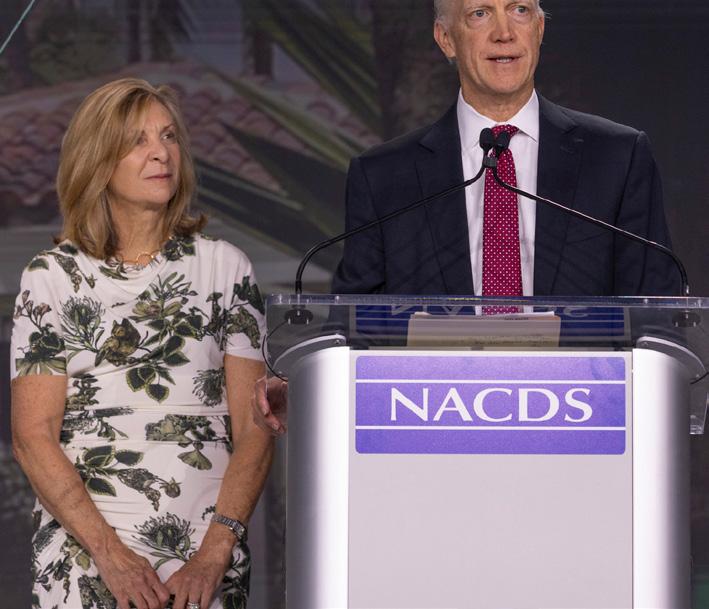

The retailers I spoke with at the NACDS Annual Meeting echoed a clear message: “Give us new. Give us better. And let’s work together to engage our customers.”

Innovation without clarity doesn’t stick. That’s why this issue of Retail Brand Discovery highlights not just products, but purpose. Whether you’re a category manager or a supplier, the shared question is the same: How does this product pull a shopper in? Does it earn its space on the shelf — and the consumer’s attention?

Here’s what’s on our radar this month:

1. Bold Brand Reformulations

Whether it’s cleaner labels, more potent actives, or more inclusive positioning, brands are reimagining their offerings to meet today’s consumer (and retailer) expectations — without losing the trust they’ve built.

2. Green & Clean Packaging

Design is doing more than just catching the eye (see Tropicana’s recent redesign) — it’s solving real problems. Think: refillable formats, 100% recyclable materials, and on-the-go portability that reflects how and where products are actually used.

3. Cross-Category and Incremental Opportunities

The walls between departments are blurring. Crossover products — like beauty meets wellness or food meets function — are reshaping planograms and redefining what shoppers expect from a category.

4. Localized Discovery

National scale still matters, but so does local relevance. Brands are experimenting with regional formulations, limited drops, and targeted rollouts to spark discovery and build loyalty. Retailers like Meijer and Hy-Vee are supporting smaller brands through demographic or geographic-first distribution.

5. The Return of Storytelling

Today’s shopper is skeptical of paid influencer hype. Facts matter — but so does context. Brands that communicate their origin, mission, and social proof are building connections that go beyond price. Look at brands like Happy Coffee, Cheers Health, Soapbox, or Dude Wipes — all great examples of storytelling in action.

At Retail Brand Discovery, our role is simple: to spotlight the smart, the new, and the next — and to do it in a way that helps both buyers and sellers move faster and think clearer.

Chris Stanton Publisher chris@themosaicgroup.org

Held once again at The Breakers in Palm Beach this past April, the NACDS Annual Meeting brought together thousands of retail decisionmakers and CPG companies for high-level discussions and dealmaking in a setting unlike any other.

Photos from ECRM’s Dallas session capture three packed days of one-on-one meetings where sun and skincare brands connected with retailers in search of category innovation.

Retail Brand Discovery sat down with Dan O’Connor, Executive Fellow at Harvard Business School, who shared his perspective on AI’s growing impact across healthcare, retail—and the consumer mindset.

Held in Palm Beach, the NACDS Annual Meeting is the premier gathering for mass retail decision-makers and brand leaders. It remains one of the most powerful opportunities to connect with top-tier executives, align on key trends and critical industry issues. The NACDS Annual Meeting is one of the most productive gatherings of the year.

Held over three highly productive days in Dallas, the ECRM Sun & Skin Sessions brought together retailers across all retail platforms along with some of the most exciting and innovative brands in the skincare category. It remains one of the most powerful forums for brand discovery, strategic conversations, and high-impact networking that runs from morning well into the evening.

12-15 .... ECRM Cosmetic, Fragrance and Bath ........ Chicago

13-16 ECRM Cough, Cold & Allergy Chicago 21-23 Cosmoprof Miami Miami

30-Feb 2 FMI Mid Winter Marco Island

3-5 ECRM Convenience Session Orlando

4-6 ECRM Impulse, Front End Orlando

4-6 ECRM Hardware, Automotive Orlando

11-13 ..... ECRM VMS, Nutrition, GLP-1 .............. Rosemont (Chicago)

16-18 ECRM Beverage, Snack Rosemont (Chicago)

4-7 ...... Expo West .................................. Anaheim 17-19 .... CHPA SLS ............................... San Antonio

7-9 ...... ECRM Private Label Food & Bev . Rosemont (Chicago) 7-9 ...... ECRM Private Label Health & Beauty ..... Rosemont (Chicago)

9-10 ECRM Contract Manufacturing Rosemont (Chicago) 26-29 NACDS Annual Meeting Palm Beach, FL

MAY

4-6 ...... ECRM Household Cleaning ....Ponte Verda Beach, FL

5-8 ECRM Pet Ponte Verda Beach, FL

6-8 ECRM, Hair Care & Multicultura Ponte Verda Beach, FL

5-8 ECRM Home Health Care/Diabetes Jacksonville 13-15 .... Sweets and Snacks....................... Indianapolis

13-16 .... ECRM Personal Care/ Baby & Infant ............ Dallas 14-16 ECRM Health Care Dallas 17-17 Cosmoprof Las Vegas Las Vegas 16-18 ECRM Contract Mfg OTC Dallas 20-23 ... ECRM Snack & Beverage ....................... Dallas

11-14 ECRM School & Home Office Rosemont (Chicago) 11-14 ECRM Consumer Tech & Toys Rosemont (Chicago) 23-25 .... NACDS TSE ................................ San Diego

7-10 ECRM Vitamin, Supplements & Nutrition Palm Beach Gardens. FL 7-10 ..... ECRM Contract Manufacturing VMS ................. Palm Beach Gardens. FL

14-17 NACS Chicago

NOV

13-13 CHPA Marketing Forum Philadelphia 16-18 PLMA Trade Show Rosemont (Chicago)

www.ecrm.marketgate.com www.nacds.org www.chpa.org www.sweetsandsnacks.com

www.expowest.com www.nacsshow.com www.fmi.org.org

By the Retail Brand Discovery Editorial Team – June 2025

Beauty care isn’t just holding its own in mass retail — it’s driving the category forward. From derm-backed skincare to TikTok-fueled lip oils, today’s HBA category is where high-touch trends meet high-traffic opportunity. And while prestige channels and DTC platforms battle for attention online, retailers like Walgreens, CVS, and Target are redefining beauty discovery where it matters most: in store.

This isn’t the lipstick wall of five years ago. It’s a curated, fast-moving battleground of price-point performance, social buzz, and ingredient-savvy shoppers. And it’s forcing category managers to think like editors, curators, and conversion specialists — all at once.

While the legacy names still anchor the aisle — from L’Oréal and Maybelline to Neutrogena and OGX — the surge of indie-style disruptors has reshaped expectations. Gen Z-driven brands like Bubble, Topicals, KISS, and Wet & Wild aren’t just turning

heads — they’re turning shoppers into followers and advocates.

At the same time, ingredient fluency has exploded. Shoppers know what niacinamide, salicylic acid, hyaluronic acid, and bond repair do. They’re less brandloyal and more benefit-seeking, which levels the playing field for emerging names — and challenges established ones to reformulate, repackage, or reposition.

Retailers are taking notice, integrating social-media fueled brands with shelf resets that feel both editorial and efficient. Beauty isn’t just sold — it’s told, through design, placement, and messaging that earns a second look.

While e-commerce platforms offer fluidity and endless choice, they also come with a downside: instability. Brands can be here today, gone a second later — buried by shifting algorithms, outbid by competitors, or lost in a sea of sameness. In contrast, brick-and-mortar beauty offers permanence, presence, and trust.

A well-placed skincare endcap or a clearly labeled ingredient callout isn’t just shelf décor — it’s a retail signal that stays put. When a shopper learns about a product instore, the education sticks. They can touch it, compare it, and walk away with it. That’s a level of immersion even the slickest digital platform struggles to replicate.

Done right, the in-store HBA aisle becomes a channel for education, trial, and trade-up. It brings the digital buzz into a tangible, brand-building environment — one that earns repeat traffic, not just clicks. One of the challenges is getting younger shoppers into stores, especially drug or grocery stores.

Retailers that frame HBA as fast-moving consumer inspiration — not just replenishment — are winning the foot traffic battle. Because let’s face it: no one walks into a store just to browse cough drops, but they will for a fresh concealer or a new hair serum.

Today’s HBA aisle spans much more than makeup. Hair care is having a clinical moment (hello, scalp serums and peptide shampoos). Lip and nail care are riding the viral wave, while skincare is doubling down on derm-grade formulas at mass prices.

There’s also space to grow. Clean fragrance, clinicallyproven skin care, acne treatments, and microbiome-friendly products are gaining relevance — and shelf space. Once a niche category, Men’s grooming is now a firmly established destination.

Retailers across every channel are actively looking for what’s next — not just what’s performing today, but what will resonate tomorrow. Discovery is no longer a nice-to-have; it’s a strategic imperative. And for brands, the assignment is clear: show up with something new, meaningful, and ready to compete.

That’s the core of what Retail Brand Discovery was built to do — spotlight relevant, emerging CPG innovation and make it easier for buyers to discover what’s next. Because in beauty care, as in retail, new isn’t just exciting — it’s essential.

Lip Oils are driving growth in Lip Gloss, particularly across value brands appealing to shoppers seeking affordable cosmetics.

& COLOGNES/ BODY POWDER

Despite economic uncertainty, fragrance trends remain strong as consumers seek out small luxuries to enhance their daily lives. Beauty influencers also play a pivotal role in driving engagement.

The rise in popularity of shampoo & conditioner combo packs is driven by mass-market brands that provide value and convenience for a streamlined hair care solution.

Discover OOTD Beauty’s Overnight Hydrogel Masks thinner, fast-absorbing gel masks that turn transparent for a breathable, snug fit. Choose collagen for hydration and elasticity or vitamin C to target dark spots—your innovative K-beauty secret for glowing, visible results overnight.

Dr. Scholl’s® Adapts To You Insoles feature 360°(tm) Self-Molding Technology that adapts to your unique foot shape, delivering personalized all-day arch support and comfort - no foot knowledge required.

Nipskin: Stick-to-Skin Beauty Solutions Women Can’t Stop Talking About

Our best-selling reusable nipple covers are designed to solve daily style dilemmas—available in inclusive shapes, shades, and sizes to help every body feel confident.

With presence in 20+ countries and booming demand across the U.S., Nipskin is a high-margin, high-turn essential for retailers. Retailers—get a free sample box and discover why customers love nipskin!

Pack Less, Travel Lighter, Travel Smarter. With our aluminum-free deodorant, each Tini takes up almost no space, fitting discreetly in your pocket. Each scent is subtle, providing effective odor protection ideal for both travel and daily use. Our innovative container uses 60% less plastic compared to traditional travelsize containers, helping reduce plastic waste while offering the same amount of product.

St. Moriz Suncare – Protects with our range of SPF 50 & 30 face and body lotions packed with skin loving Aloe Vera & Vitamin E. NEW and now available now in CVS.

www.stmoriz.com/en-us

Made with clinically studied probiotic Lactospore® and prebiotic fiber, Nature Made Probiotic + Prebiotic Fiber Gummies nourish good bacteria to support your gut health†.

† These statements have not been evaluated by the Food and Drug Administration. This product is not intended to diagnose, treat, cure, or prevent any disease.

St. Moriz Self-Tan – Get ready to glow with our complimentary body mousses and NEW face lotion. Dermatologically tested and with skin-loving Aloe Vera and Vitamin E. Available now in Walgreens.

www.stmoriz.com/en-us

By the Retail Brand Discovery Editorial Team – June 2025

In mass retail, OTC products are not just shelf fillers — they’re ta destination category that drive traffic, grow shopper’s baskets, and margin leaders. From pain relief and allergy to digestive and pediatric care, this category remains a bedrock of consumer trust and essential for all retailers from Walmart to CVS to regional chains like Meijer and Coburn.

Today’s shoppers aren’t just looking for relief. They want clean ingredients, modern packaging, multifunctional SKUs, and trusted stories. And in an era of DTC startups and online convenience, OTC has to work harder to pull consumers into stores — and give them a reason to stay.

Legacy Brands and New Momentum

Category leaders like Kenvue, Haleon, Bayer, and even 75 year old B.F. Ascher still command loyalty with brands like Tylenol, Claritin, Advil, Neo-Synephrine, and Iberogast. But they’re not resting. New formats, lifestyle-driven sub-lines, and shopper education are helping these stalwarts stay relevant with younger and wellness-minded consumers.

Meanwhile, focused players like Foundation Consumer Healthcare (Plan B, Bronkaid) and CrossingWell (PediaCare, Balmex, Sting-Kill) are building share with highly targeted products and above-average margins.

Natural, Homeopathic & High-Margin Emerging Brands

Shoppers looking for gentler or plant-based options are gravitating to brands like Boiron, Hyland’s, Zicam and Austin Texas-Based Organicare — now mainstream anchors in sleep, immunity, and personal care. These brands bring clean positioning and often stronger-than-expected performance at shelf.

Retailers should also watch for small OTC brands with big stories — products that might not have huge media budgets but deliver strong unit margins and partner well on promotions, sampling, adding to the destination category mindset.

Retail as a Health Destination

OTC is a natural trip driver — especially during seasonal spikes like allergy, back-to-school, or cold/flu. With the right curation and promotion, it becomes more than a stop — it becomes a reason to visit

Bottom Line:

OTC has always been essential. Now it’s strategic. Curated right, promoted smartly, and supported in-store, OTC can be a quiet powerhouse that keeps traffic steady and margins strong — while reminding consumers why physical retail still matters.

Top 3 fastest-growing categories

LIP BALMS AND TREATMENTS ......... 12%

Up double-digits vs the prior year, LIP BALM/TREATMENT is the top growth driver for Traditional OTC. Growth can be attributed to innovation focused on better-for-you offerings made with plantderived ingredients. New items targeting young and middle-aged men have also contributed to the segment’s growth.

ACNE TREATMENTS .................. +9%

With growth stemming from acne patches, Acne Treatments is the second fastest-growing segment in Traditional OTC. The preferred format provides a quick, discreet, or sometimes stylish solution, for spot treatments. Acne Treatments is among the segments where wellness and beauty connect.

LAXATIVES .......................... +22%

Laxatives is one of the fastest-growing segments in Traditional OTC. Growth is fueled by innovation, consumers’ increased focus on wholistic wellness, and individuals dealing with the side effects associated with GLP-1 medications.

2025 U.S. Self-Care Marketing Awards: Call for Nominations! Showcasing the best-in-class marketing campaigns for OTC medicines, dietary supplements, and OTC medical devices

Will you take home the gold?

Featuring 7 categories, including “Best Omni-Channel Shopper Solution” highlighting exceptional manufacturer-retailer collaborations

For more information visit chpa.org/marketingawards

WINNERS ANNOUNCED AT THIS YEAR’S GALA! Nov. 12 | Bellevue in Philadelphia

Learn more: chpa.org/Gala

ENTRY DEADLINE: JULY 11

Camilia Bedtime is a non-GMO, plant-based homeopathic medicine that relieves nighttime teething discomfort like restlessness, painful gums, irritability, and minor digestive upsets.* Twist and squeeze the pre-measured liquid doses for easy, mess-free teething relief for babies and toddlers at bedtime.

Always read and follow label instructions. *Claims based on traditional homeopathic practice, no accepted medical evidence. Not FDA evaluated.

By the Retail Brand Discovery Editorial Team – June 2025

Hydration used to mean water. Protein used to mean a shake. Today, the two are merging — and consumers love it.

Busy shoppers are looking for more from what they drink: faster recovery, longer energy, and better daily performance. The result? A wave of functional beverages and powders that hydrate and fuel.

• Protein2Go delivers portable protein that doesn’t require a blender — ideal for post-gym, mid-commute, or on-the-go snackers.

• Liquid I.V. has turned hydration into a lifestyle brand, expanding beyond electrolytes into energy and immune support.

• And Waterboy, a bold upstart, blends hydration with recovery benefits and a strong voice on social — think hangover relief meets Gen Z wellness.

These brands aren’t just quenching thirst — they’re redefining what hydration can be. And in a market where wellness is personal, multifunction wins.

For retailers, it’s a chance to cross-merchandise, test new formats, and lean into discovery. Because today’s shopper doesn’t just want to stay hydrated — they want to feel better, stronger, and ready for whatever’s next.

By the Retail Brand Discovery Editorial Team

June 2025

Vitamins and supplements may be a familiar category, but it’s not standing still.

The basics still matter — C, D, B-complex, and multivitamins — but the momentum is shifting toward condition-specific wellness: sleep, immunity, brain health, energy, digestion, and mood.

Shoppers want more than just a refill. They want to discover something new — and feel informed while doing it. That’s where brick-and-mortar has the edge.

Online works for bulk and auto-ship. But in-store is where education happens. People want to see the label, scan a QR code, or talk to someone in person. When the shelf tells a story — about sleep, stress, or smarter protein — they’re more likely to try, buy, and come back.

And brands are stepping up.

Nordic Naturals is branching into brain and prenatal health. Pharmavite’s Nature Made is innovating with melatonin blends and personalized formats. Nature’s Way leads with systems for stress and immunity.

Piping Rock’s Nature’s Truth is leaning into beauty and relaxation benefits. Windmill Vitamins is modernizing with cleaner formulas and trending formats. And newcomer TruLab brings performance hydration and protein out of the old sports aisle. Brands big and small are innovating and retailers and consumers are winning

The takeaway? Shoppers don’t just want vitamins — they want to understand them. Retailers that spotlight what’s new, mix basics with benefit-driven SKUs, and make space for innovation will stand out.

The category is moving fast. Will they find what they’re looking for in your store?

The growth in Nutritionals is primarily driven by heightened consumer awareness around the benefits of protein. GLP-1 users are also a contributing factor, as they seek protein sources to maintain muscle mass and support their overall health. MINERAL SUPPLEMENTS ..............

Growth stems from rising trends in self-care as shoppers want a customized approach to wellness. Magnesium is one of the leading drivers, providing benefits such as improved sleep, mood, and blood sugar regulation.

Shoppers are gravitating toward liquid vitamins due to the selection of products with better-for-ingredients that provide ease of consumption and enhanced absorption

Renew Life® has been a trusted name in digestive wellness for nearly 30 years. Backed by clinically studied ingredients and advanced product innovations, Renew Life offers complete gut health solutions anchored by its best-selling Ultimate Flora Probiotics and cleanses.*

*This statement has not been evaluated by the Food and Drug Administration. These products are not intended to diagnose, treat, cure, or prevent any disease.

Alive! multivitamins have gotten even better, with superfood antioxidants‡ from premium plant-based ingredients.

What Women’s Health Looks Like Now: Women drive most healthcare decisions and spending in the U.S. The categories they care about—menopause, mental clarity, libido—are no longer whispered about. They’re front and center. And they’re not going anywhere.

By the Retail Brand Discovery Editorial Team – June 2025

Women’s health has outgrown the tampon aisle. It’s now a fast-moving, culturally powerful category spanning hormonal balance, menopause, sexual wellness, vaginal care, and incontinence. And it’s forcing a rethink on how mass retailers stock, support, and spotlight these everyday essentials.

This isn’t niche. It’s overdue. Women aren’t just restocking—they’re looking for real solutions that meet their evolving needs. And they’re looking at the stores they already trust: Walgreens, Walmart, CVS, and Target. Legacy players like Kimberly-Clark are not just adapting—they’re innovating. And they’re doing it

alongside emerging brands with strong cultural voices. The Honey Pot Company has redefined feminine care with plant-based, pH-balanced products and unapologetic inclusivity. Femiclear, from Organicare (Austin, TX), is helping reshape vaginal health with natural OTC remedies. AZO, under iHealth, is a trusted name in UTI care and is now expanding with a clear, approachable menopause line that meets women where they are.

Sexual wellness continues to expand—not with controversy, but with confidence. Beacon Wellness Brands—makers of PlusOne—has earned space in mainstream retail with vibrators and lubricants that blend design, price accessibility, and relevance. Satisfyer, a global leader, supports the same idea: intimacy is part of wellness, and deserves to sit alongside categories like sleep, stress, and supplements.

Incontinence care is also being reframed—less clinical, more considered. It’s a category where form, function, and dignity can coexist. And the retailers paying attention to that are seeing loyalty across age groups, especially among millennial caregivers and aging Gen X.

This isn’t expansion for expansion’s sake. It’s a shift in how women shop—and how they expect brands and retailers to show up. Discovery matters. So do language, education, shelf adjacencies, and access.

After decades of listening to both retailers and suppliers, our team sees the shift clearly: women are no longer shopping for symptoms. They’re shopping for solutions that align with their lives. And the smartest retailers are meeting them there.

• Product design that speaks to modern shoppers

• Brands that support education and shelf storytelling

• Cross-category adjacencies (wellness + intimacy + supplements)

• Innovation from both emerging and legacy players

Our underpads offer premium, washable protection for every stage of life—children, adults, and pets. Durable, eco-friendly, and ultra-absorbent, our pads are designed for comfort, reliability, and peace of mind. Trusted by thousands, loved nationwide.

orders@improviausa.com www.improviausa.com 1-800-418-0361

plusOne’s new line of water-based personal lubricants offers four pH-balanced, hormone-free, and fragrancefree formulas. Designed to elevate intimate wellness, this range caters to the growing demand for products that prioritize comfort and wellness.

FemiClear is a natural, scientifically proven effective, portfolio of products providing effective solutions for women’s intimate health concerns like Yeast Infections, Bacterial Vaginosis (BV), Genital Herpes, and Urinary Health. Proven to drive category growth, FemiClear meets rising consumer demand for clean, science-backed feminine care products that work with her body, not against it.

I had the pleasure of sitting down with Dan O’Connor, a longtime industry leader and Executive Fellow at Harvard Business School, to talk about how artificial intelligence and consumer-controlled ecosystems are reshaping health, retail, and everything in between. Dan’s perspective challenges conventional thinking and offers a forward-looking view on how data, trust, and innovation will drive value in the decade ahead.

How is AI changing the way consumers access healthcare?

The biggest shift is the rise of intelligent agents—voice-enabled tools that use personal health data to guide care decisions. Consumers will no longer toggle between apps; they’ll simply speak their needs—whether it’s booking a doctor, ordering supplements, or choosing a diet plan. It’s frictionless, and it empowers the individual to take control of their wellness.

What’s the opportunity for retailers in this evolving health ecosystem? Retailers will move from being passive sellers to proactive health partners. AI will let them tailor products, services, and even in-store experiences around the shopper’s health profile. Think subscription-based wellness plans, precision nutrition programs, or pharmacy-driven food

guidance—all powered by data.

Can regional or independent retailers compete with tech giants like Amazon or Apple?

Yes, but only by leaning into their strengths—local knowledge, human connection, and trust. Big tech may dominate infrastructure, but smaller players can win in service, empathy, and community-based solutions. Partnering creatively and delivering hybrid digital-physical experiences will be key.

What’s ahead for the healthcare workforce in the next five to ten years?

We’ll see a hybrid workforce of tech-enabled humans, AI agents, and even humanoids for physical tasks. Automation will relieve clinicians from repetitive work, while patient engagement and empathy will become core human skills. Education will shift toward managing and collaborating with AI, not competing with it.

How will food, pharmacy, and health intersect in practical ways?

Food will become prescriptive. Retailers will use health data to recommend meals, build shopping lists, and even tie pharmacy visits to nutrition planning. Chronic care management will expand to include what’s on your plate, not just

what’s in your medicine cabinet. And in that system, physicians may refer patients to a registered dietitian (RD), who will prescribe diets aligned with the treatment goals of both physician and patient. Since most physicians receive limited training in nutrition, RDs are essential experts in the care team.

At the same time, retailers that create a more positive food environment—elevating transparency, awareness, and inspiration—stand to gain market share while promoting health. Retailers such as ADUSA (Ahold Delhaize) and Kroger are leading with food scoring systems aligned with the FDA’s definition of “healthy,” helping guide consumers to better-foryou choices.

Are there barriers to consumer adoption of AI in healthcare?

Trust is the biggest. Consumers need confidence that their data is private, secure, and being used for their benefit. There’s also concern about AI misdiagnosis or bias. Transparency, responsible design, and clear regulation will be critical for widespread adoption.

What separates the future winners from everyone else in this space?

The winners will shrink the distance between data and decisions—without sacrificing trust. They’ll offer seamless integration of services, personalized value, and operational agility. The question every business should ask is: how do we serve the consumer as they gain control?