Go further with Finsure

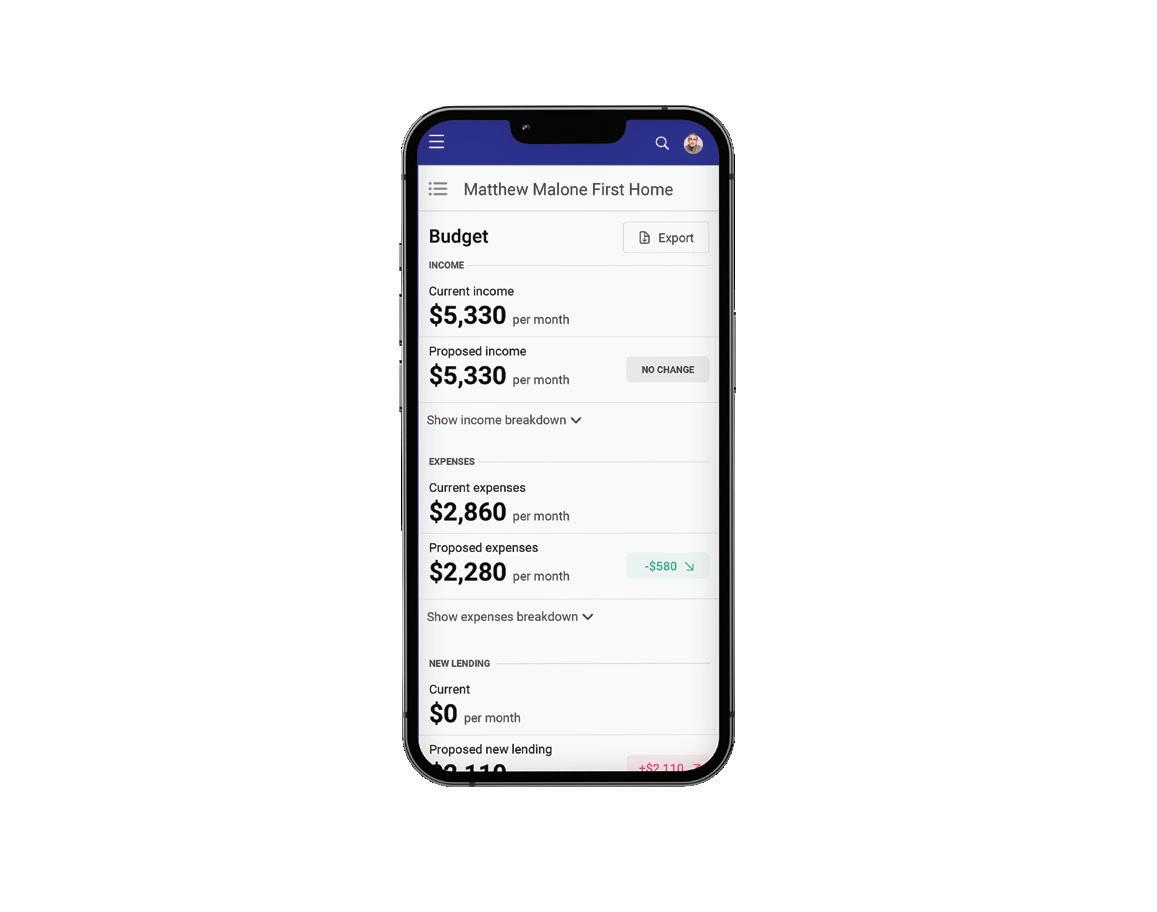

Our Infynity CRM is the latest and most advanced aggregator software in the market, utilising cutting-edge technology to enhance both the adviser and customer experience.

Intuitive user experience

Automated processes to save time

Sophisticated marketing tools

Third-party integrations

Inbuilt compliance functionality

And much more!

If you would like to discover how Finsure can help you unlock your full potential, scan the code below to book your FREE Infynity demo with our team!

TO BOOK YOUR FREE DEMO

Contents.

Following Resimac’s shock decision to shut down its New Zealand operations to new business, Jenny Ruth checks in with other non-bank lenders to see what’s happening.

Making

the Resimac

A round up of news

Michael Hewes from the FMA talks about what the regulator found from its first ever FAP review.

New appointments at Loan Market and NZFSG, Liberty, FMT and The Adviser Platform.

MARKET UPDATE

Buyers sitting on their hands in a sea of for sale-signs.

How much influence do short-term rentals really have on house-prices and rents?

NZ Home Loans chief executive reveals what clients are saying.

To AI or die; That is the question.

Partners Life presents a case study on how three experts worked together to get a great client outcome.

Former columnist, and now adviser coach, Steve Wright says it’s time to insure yourself. Not just the house.

Sally Lindsay finds out what opportunities exist

MAKING SENSE OF THE RESI SHUT DOWN

The decision to shut down Resimac’s New Zealand operations took the market by surprise.

It blindsided their hardworking New Zealand staff who had no forewarning. It stunned advisers.

And it raised the inevitable question about the future of non-banks in New Zealand.

They came in droves before the Global Financial Crisis. Then left suddenly.

Resimac New Zealand has been a success. Currently its loan book is around $620 million, but it got close to $1 billion a few years back in a different economic environment.

It had a good suite of unique products designed for different customers and borrowing scenarios.

The non-bank question

The question about the future on nonbanks is also amplified by Bluestone’s decision last year to pull back from the New Zealand market and focus on its white-label Select Home Loans, offered exclusively through NZFSG advisers. (Bluestone has form for being in and out. Before the GFC, it was a significant player: besides home loans, it had a home-equity-release product. After the GFC, it folded its cards, only to come back again some years later).

While this looks like bad news, a look across the non-bank sector shows a strong industry that has weathered the storms and continues to grow.

The likes of Avanti, FMT and Fico are examples of solid businesses. But there are many smaller players.

It’s always hard to put a number on how much home-loan lending the sector is responsible for, but here at TMM we reckon the total book size could well be around $5 billion.

On top of that there is the consumer lending and asset finance done by nonbanks.

Why, Resimac?

Coming back to Resimac New Zealand, the big question is: Why? No one will talk, and questions must be asked if there are bigger issues with ASX-listed Resimac, what with the chief executive resigning and taking gardening leave till his official last day, only days after the New Zealand announcement.

The hope is that Resimac tries to find a buyer for its New Zealand book, but it doesn’t appear – at least from our sources – that much is happening with a sale.

We are told Resimac would make more money by winding down its book as opposed to a sale. Resimac had some good products and hopefully other non-banks will get into these spaces.

What can we take out of this? Firstly, it appears more of a company-specific issue as opposed to a sector/non-bank issue.

As Basecorp chief financial officer John Moody said in a TMM Podcast, non-banks need to stay in their lane and not try to compete with the big banks. Doing the latter only has one outcome, and it’s not good.

While it is quite right people ask questions, we say the nonbank space is here to stay - and that advisers and borrowers should continue to use non-banks.

Philip Macalister Publisher

Publisher Philip Macalister

Learnings from Our Clients

BY KIP HANNA

Compared to OECD standards, financial literacy and uptake of financial advice in New Zealand is low. The challenging economic environment makes understanding clients' wants, needs, and support requirements crucial to providing meaningful advisory services.

At NZHL, our annual client surveys are purposely in-depth to give a real measure of our performance and service and a deep understanding of our clients and what they are looking for from their advisers.

The 2024 NZHL Client Survey highlighted the importance of advisers who assist their clients through their changing circumstances. Findings include:

• 40% say they are in a better financial situation than 12 months prior (unchanged from 2023).

• Optimism for the next 12 months has risen somewhat, with 13% believing they will be worse off (down from 19% in the year prior).

• Changes in financial situations were largely driven by the cost-of-living and interest rate increases, and inflation.

• Just under half (45%) made a major financial decision over the last 12 months with purchasing a new home or investment property remaining top of the list.

• Clients who paid down debt increased by 7% - overtaking those who took on more debt.

One of the most powerful insights from the survey is that New Zealanders are looking to financial advisers to support them not only with advice around lending, insurance, and wealth creation but also with more tools, support, and advice on basic budgeting and financial management.

Pleasingly, our client satisfaction is on the rise despite a higher cost of

ONE OF THE MOST POWERFUL INSIGHTS FROM THE SURVEY IS THAT NEW ZEALANDERS ARE LOOKING TO FINANCIAL ADVISERS TO SUPPORT THEM ... WITH MORE TOOLS, SUPPORT, AND ADVICE ON BASIC BUDGETING AND FINANCIAL MANAGEMENT.

living and affordability challenges due to the personalised ongoing local support offered by NZHL advisers. Our clients told us that having the ability to build an ongoing relationship with an adviser rather than dealing with ever changing bank employees or selfservice advice is key.

Client satisfaction is largely influenced by the frequency of contact and ongoing service, with those contacted at least once per year almost twice as likely to indicate a high level of satisfaction and consider NZHL for future use - those who have had a review within the last 12 months were almost another 20% more likely.

Additionally, the survey emphasised the value of a holistic approach, with clients utilising their adviser for both their home loan and insurance needs indicating a great level of client satisfaction and financial well-being.

When looking at why our clients would (or wouldn’t) recommend our services, and what they value most, our clients chose:

• Helpful and knowledgeable staff.

• Good advice and communication.

• Great customer service and experience.

• A good relationship with their adviser and personalised service.

• The ability to pay off their mortgage quicker and save money.

Our clients are placing increased value on consistency in service, trusted relationships, availability and time when needed, and personalisation. In exchange, 76% are willing to recommend their adviser to

their friends, families, and colleagues as they see a tangible benefit to the service provided.

Maintaining a regular contact programme and taking the time to listen to and have a solid understanding of clients, their priorities, sentiments, and any changes over time, allows for an enhanced service offering and client experience resulting in client loyalty and business growth, a priority for all advisers.

ABOUT NZHL GROUP

NZHL Group is a Kiwi-owned, respected, and trusted brand – a purpose-driven (financial freedom, faster) home loan and insurance network that offers a solution to support advisers and help put Kiwis in a better financial position.

Part of Kiwi Group Capital Ltd (KGC) which is 100% Government owned, NZHL Group operates with an Independent Board and local business owners nationwide.

ABOUT THE NZHL 2024 CLIENT SURVEY

About the NZHL 2024 Client Survey

The NZHL survey was run by Key Research from April 15 to May 26, 2024. Current clients and clients who left NZHL within the last two years were invited to participate. Findings were based on 4,177 responses. The data collected has an expected 95% confidence interval (margin of error) of +/- 1.48% at an aggregate level. ✚

Kip Hanna is the CEO at NZHL and has written this opinion piece based on his experience. This article is intended to be general in nature and should not replace personalised business or career advice.

Xceda steps into Resi breach

Niche lender Xceda has rolled out a 10 year property investment loan.

Resimac previously offered a specialist property investment loan which was popular with investors and advisers. Chief executive Daniel McGrath says the product was in development prior to Resimac announcing it was closing its New Zealand operations to new business.

Recently Xceda has been added to the approved lists of Kiwi Adviser Network and Link Financial Group.

McGrath expects that new regulations around deposit takers will assist companies like Xceda to grow.

From July next year a deposit guarantee scheme starts. Under the scheme deposits of up to $100,000 will be guaranteed.

Final details of the plan are yet to be released but deposit taking institutions including banks will have to pay a levy

into a fund managed by the Reserve Bank.

McGrath says Xceda is funded through term deposits and with its growth and the guarantee scheme it has “a lot more confidence around its long term funding.”

He says the company is getting a lot more interest from depositors and its book currently sits at around $125 million.

To help with its growth Xceda has appointed two business development managers. Ex-Bluestone business development manager Monique Riley has joined the firm as a senior lending manager.

The other appointment is Tracey Topp who previously was with ASB. Prior to that she had worked as a mortgage adviser mainly with Vega. The company is also offering a home equity release product and it has teamed up with Generate to offer KiwiSaver.

Lender closes down

Christchurch-based Specialised Capital Solutions has closed its doors.

In a LinkedIn post it says: "After much consideration and with a heavy heart, we must announce that Specialised Capital Solutions will be closing its doors for good."

SCS billed itself as a one-stop shop for property for property developers.

It was founded in Australia in 2019 and leveraged technology to connect commercial, development and property funding applicants with lenders.

Applicants submitted loan "scenarios" through an online portal which was then submitted to accredited lenders.

"This journey has been amazing, with lots of highs, challenges, and unforgettable moments and we are grateful to everyone who has supported Specialised Capital Solutions over the years," the post said. "However, due to an internal realignment of business focus in a different direction, sadly we must close this chapter. "

Chief executive Sacha Doyle continues to operate as an independent commercial adviser to assist with any ongoing and future transactions.

Shepherd herds new flock Bizcap opens portal

Marty Shepherd has ended a long career with Cressida Capital to take up a role as associate director at Pallas Capital.

Sydney-based Pallas is a privatelyheld property finance company, with a strong mid-market lending focus primarily for property developers and investors.

It focusses on larger property finance transactions, typically between $3 million to $20 million. In April it settled eight transactions totalling $45 million.

Pallas currently offers five primary lending products with a focus on the Auckland, Christchurch, Hamilton, Tauranga, Wellington and Queenstown property markets. Other locations are considered on a case-by-case basis. Its products include; residual development stock, investment assets, pre-development,

construction, and vacant land loans.

Shepherd said it was time to move on from Cressida. The Pallas offering is different to other non-bank lenders, he said.

Small business leader Bizcap has launched its new Partner Portal.

The portal brings advisers a suite of powerful new features.

- Bulk Lead Uploads: Save time and effort by easily uploading multiple leads at once, streamlining your workflow and increasing the speed in which deals get to our team.

- Visual Snapshots of Monthly Activity: Get a clear, visual overview of your monthly performance, making it easier to track progress and identify opportunities.

- Live Status Updates of Ongoing Deals: Stay informed in real-time with live updates on the status of your deals, ensuring you’re always in the loop.

- Easier Access to the Bizcap Lead API: Enjoy seamless integration with our updated API, providing you with even more functionality and ease of use. ✚

•

•

• Strong industry knowledge, experience and relationships developed from over 25 years in the

FMA monitoring gives FAPs eight out of 10

Think about proportionality says the FMA in the wake of its financial advice provider monitoring report.

The regulator’s monitoring team visited 60 class one and class two financial advice providers (FAPs) the length of New Zealand in preparing the report, says FMA director deposit taking, insurance and advice Michael Hewes.

Regardless of size there was a consistency across both classes of FAP in adhering to code requirements and standard conditions.

The FMA monitoring approach focuses very much on what is appropriate for the size of the business, says Hewes, but from a findings perspective, there was consistency across class ones and class twos.

“Our expectation is that if you are a larger FAP you will have the resources to undertake the oversight, supervision and monitoring of financial advisers.”

Hewes rates both classes a solid 8 to 8.5 out of 10. “It’s important to recognise the amount of work that the FMA, the industry and industry associations have undertaken over a long period of time. There weren't any surprises. We have a very active market engagement strategy even

outside monitoring.”

When it comes to professional development, Hewes says FAPs should broaden their horizons.

“Think about your business and the learning that is appropriate to you. Rather than being focused on one line like insurance, think about other inputs specifically around insurance. That might be opportunities to learn about the broader economy and what feeds into and is driving insurance premium rates.”

On the topic of suitability of advice, Hewes discusses the recent case in which the FMA censured AucklandFAP deVere for breaching its licence obligations. In the report, the FMA said deVere failed to adequately consider the client’s investing experience and their financial product knowledge.

This has led to commentary that the case takes the suitability question further than its description in Code standard three.

“It’s about having that broader horizon and lens,” says Hewes. “While you have Code standard three, it’s appreciating that in this case there needed to be that focus on client outcomes and client harm.”

So does the adviser having to go in and question and explore the client’s knowledge around products add up to something new? Not necessarily new,

says Hewes. “We are saying don’t use a templated question set or rely on a tick box exercise. It’s going one step further and finding out in more detail about their knowledge.

“One of the things we’ve always said, and you’ll hear this theme come through in a lot of the FMA communications - is about proportionality - making sure you have the processes in place that are right sized for your business. So where there’s someone using a combination of a template or tick box, what overarches and underpins it and what else is there to ensure you are delivering good outcomes?”

Does that mean proportionality is a subjective judgement of the FMA?

“Where we are visiting a class one FAP our expectation would not be a client assurance programme or framework built and designed for a large FAP class three FAP. It’s making sure what you put into your business is appropriate for your business and that has been the clear and concise message the FMA has always given.

Class three monitoring is about to start. Some of these may have multiple types of license so the FMA will go in once and look at all licenses together. ✚

TO LISTEN TO THE FULL PODCAST go to tmmonline.nz/podcast

People on the move

Loan Market builds support team

Loan Market has appointed Devaney Davis as its Aucklandbased relationship manager, with Karina Reardon stepping into the role of national support lead.

Devaney is from Loan Market Central, where she started in 2019 as a client-service manager, before becoming operations manager and then transitioning to an adviser.

Loan Market director Nicole Ferguson says Devaney will use her experience to help grow and enhance other Loan Market businesses in the Auckland region.

“She’s passionate about delivering on our promises to advisers – saving you time, keeping you safe, diversifying

NZFSG adds technology and innovation leader to its board

your revenue, helping you find and keep clients, growing your business and boosting the Loan Market brand.”

Reardon is another familiar face at

New Zealand Financial Services Group (NZFSG) has added leading technology and customer-solutions advocate Nicola Riordan to its board as its new non-executive director.

Riordan’s appointment adds to the renewal of NZFSG’s board, with Thérèse Singleton appointed to a separate non-executive board role.

Riordan has more than two decades of experience and leadership, across innovation, technology, data and

The Adviser Platform turns on the tap and adds two new staff

The Adviser Platform (TAP) has added two new team members: Taz Alnahas as Key Account Manager and Meryll Villaver as Client Engagement Manager.

The expansion comes on the heels of TAP's growth since the start of the year, driven by increasing demand from financial advisers seeking to streamline and simplify their businesses.

To meet this growing demand and ensure continued excellence in service, TAP has strengthened its team.

TAP managing director Ryan Edwards says Alnahas and Villaver join the business “at an exciting time.”

"With their expertise and passion for supporting adviser businesses, they

will play a pivotal role in ensuring we continue to deliver exceptional support and resources to our expanding member base."

Alnahas will focus on deepening relationships with existing members, providing tailored training and support to help advisers maximise the benefits of TAP's platform.

He brings extensive experience in the insurance industry to the role, having spent more than seven years at Partners Life. More recently, he did a short shift at Auto Finance Direct as brand development manager.

Villaver will be the first point of contact for new and prospective members. Her expertise in clientrelationship management will ensure

Loan Market, having earlier worked as a business development executive at NZFSG and Loan Market.

Ferguson says Reardon has helped advisers sharpen their sales, marketing and business-management skillsand more recently has led a team of advisers in Loan Market’s topperforming New Zealand office.

“With over two decades of mortgage advice and leadership experience, Karina is a well-respected and popular figure in the advice community. She has built a strong network of mortgage and insurance advisers, who frequently seek her mentorship to grow their own businesses.”

marketing, with expertise gained through global brands including Xero, Skype and TweetDeck.

She also has extensive corporategovernance experience and is currently a board member for Kordia and the Real Estate Institute of New Zealand.

NZFSG chairman Brendon Smith says Riordan’s contribution would further support the group’s commitment to providing advisers with leading technology and industry insights.

advisers receive the support and resources they need to thrive.

Not from a financial-services background, she was most recently an account manager at Cloudstaff. Before that, she was Sales Engineer Channel Sales Manager for a division of LG Electronics in the Philippines.

DEVANEY DAVIS

TAZ

ALNAHAS

Liberty adds Wellington-based BDM

Liberty has appointed Grant Parker as a business-development manager for Wellington and the midlower North Island, strengthening the non-bank’s adviser support.

Parker comes to Liberty with a background in business development and relationship management, in both the private and public sectors.

"His passion for helping others grow, and his unique skillset has helped him build a large network within the financial services industry," the company says in a statement.

"With almost 15 years in business development and relationshipmanager roles within the insurance industry, Parker brings a fresh perspective to the role at Liberty. He has a proven track record in training and development, sales, and building and nurturing successful relationships – not only in a professional sense,

but with over a decade as a basketball coach within the community."

Parker cites culture and communication as essential elements for success in any profession.

“I look forward to using my strengths in these areas to connect with advisers, better understand their business and goals, and help them grow.”

Equity release firm gets new director

Christine Brownfield has joined the board of directors of Lifetime Home Limited, a subsidiary of Retirement Income Group, which offers a debt-free way to access the value of your home for retirement income.

Brownfield has an actuarial, strategy and finance background, and was the Chief Actuary at ING Australia for five years.

For the past 13 years, she has also been involved in pricing, valuation, strategy and stakeholder engagement

for HomeSafe Solutions, the Australian leader in debt-free equityrelease solutions.

She will work alongside Ralph Stewart, the founder and managing director of Retirement Income Group, Susie Staley, the group's director, and Chelsea Devlin, the group's chief marketing officer.

Ralph Stewart says Brownfield’s expertise in home-equity release, a relatively new product in the New Zealand market, is a great asset for Lifetime Home.

First Mortgage Trust creates another new role

First Mortgage Trust (FMT) has appointed Charlie Oscroft as Investment Relationship Manager.

Oscroft spent 24 years at Colliers International, with the past two as an investment adviser at Taurangabased Mackersy Property.

He brings experience in investment management and capital raising across real estate markets in both New Zealand and overseas.

FMT chief executive Paul Bendall says the latest new role, recently created, demonstrates growth and strategic vision.

“In spite of a challenging economic environment, FMT is performing well and continues to grow.

“We’ve just hit $1.7 billion in funds under management and we’re launching our new wholesale fund, which allows us to meet the growing needs of our borrowers and creates a more diverse and funding pool for all our investors.”

Hurt to come from DTIs

Property accountant Matthew Gilligan says while the DTI ratios appear to be roughly similar to the amount of servicing required under current bank testing, the hurt will come from the restricted bank discretion – limiting how many people are allowed to ‘push the envelope’ and exceed the ratio.

In particular, he says, DTIs will make it much harder than it already is for first-home buyers and investors to get started.

“At present the banks can look at the character of someone and give them the

benefit of the doubt,” says Gilligan.

“For example, a young professional with a good job, a double-income household and no kids, is a good bet for a banker to back over time. But now this discretion, and ability to help such people, is being interfered with; only 20% of lending can exceed the ratio, and in practice the banks will seek to stay well under that.

“The main banks have proven to be responsible in their lending practices; why do we need to shut down their discretion, which helps younger people get going?”

Gilligan says many new homeowners and investors have to push their limits: DTIs will curtail them, unless they are buying new builds (which are exempt).

In the long run, under DTIs, capital growth will be moderated by the link

between income and the ability to borrow, he says.

“Incomes will lag capital growth during boom times, so DTIs will inhibit bubbles from forming. And house-price growth will become linked to long-term income growth, which is sobering for investors and homeowners.”

He says while socially this may well be quite progressive, it will take the shine off growth and potentially cause reduced investment into the sector over the longer term.

“There won’t be a crash due to DTIs, because the exemptions are well thought through, but there must be reduced housing activity, and significant pain for people with stretched servicing.”

Short-term rentals have little influence on rents and house prices

New analysis by Infometrics has found that the shortterm rental accommodation (STRA) sector has a limited effect on rental prices - and no significant effect on house prices.

Population and interest rates are having the greatest influence on accommodation costs, Infometric’s independent expert study says.

Commissioned by Airbnb, the study identified a range of factors that could impact rental prices and house prices, including population growth, interest rates, incomes and STRA numbers (sourced from AirDNA).

Infometrics chief executive Brad Olsen says analysis of these factors shows short-term rental accommodation has only a limited influence on rental prices in the areas

looked at in the study.

“When we looked across the range of possible factors that could influence rental prices, STRA only had a limited influence on rents and no real influence on house prices, providing some important evidence to add to the debate about housing, rents, and the STRA sector.

“The housing market fundamentally suffers from a lack of supply, which has caused house prices and rents to rise over time,” Olsen says.

Focusing on the Auckland, Wellington city, Queenstown-Lakes District and Christchurch city territorial authorities, an econometric analysis found the main drivers of rental and house price increases are population growth and interest rates.

“For example, our analysis for Queenstown-Lakes District found that STRA contributes negligibly to monthly rental-price increases, with the average

amount being an additional 35c/ month. Over the period January 2018 to September 2023, population growth influenced around a $101-per-week increase in weekly rent, while STRA only influenced $11 per week.

“Although people often focus on STRA as a key reason for higher rents and housing costs in some areas, this analysis clearly finds other factors have a much greater influence.”

There has been an historic shortage of new properties, coupled with record migration, low borrowing costs, and high construction costs, Olsen says.

The analysis also found that before the pandemic, the combination of strong population growth, low mortgage interest rates, and insufficient supply of new housing, resulted in house-price inflation peaking at 15% a year in the June 2016 quarter, compared with a 1.9% a year increase in household incomes.

Property millionaire maker machine

Over the past decade, the Kiwi property market has minted many millionaires.

From 2013 to 2023, New Zealand appears in the top-10 fastest-growing millionaire populations in the world.

The country’s millionaire population grew 48% - ahead of Switzerland and Australia at 38% and 35%.

Most New Zealanders hold their wealth in property. Almost 60% of all household assets were in housing and land in March 2021 (before the peak of the housing market), says Simon Angelo, Wealth Morning chief executive and publisher.

Since the early 2000s, housing has risen to become almost five times the value of the country’s GDP. By way of comparison, in the US, that multiple is

only around 1.9 times.

Americans have grown much more wealth in equities. About 30% of Americans own a stock portfolio worth more than US$500,000. This wealth increase has come even as interest rates rise.

Over the past five years – May 2019 to May 2024 – New Zealand home prices have far lagged the S&P 500, which was up more than 80%.

On average, Kiwi properties have increased 5.5%. This includes peak-totrough drawdowns in 2023 of 19% in Auckland and 25% in Wellington.

Residential property has delivered much better over a 10-year period, Angelo says. Over that time frame, prices have about doubled.

However, New Zealand home prices (by multiple of median household

income) are still among the most expensive in the world. Auckland homes still sold for 8.2 times the median income last year, when affordability is generally considered to be around three times income.

This has led to the Government demanding councils live zone enough land for 30 years of housing growth and ditch urban rural boundaries after research showing that urban growth boundaries alone add a staggering $600,000 to the cost of land for houses on Auckland’s edges.

The Government says ensuring abundant developable land within and around cities, will prevent the artificial scarcity that drives up prices. This is in contrast to housing affordability policies that are limited to densification strategies. ✚

individual people

finances

Buyers sitting on their hands in a sea of for-sale signs

Thanks to soaring listings and sluggish sales, there are more homes on the market than at any other time in the last decade

BY SALLY LINDSAY

Alarge overhang of unsold properties is casting a huge shadow over the property market, with the amount of stock available at a 10-year high.

While listings soared, sales slumped to the lowest for a June month since the Global Financial Crisis in 2008, and prices flattened.

Many house-hunters are in hibernation until conditions improve, potentially on the other side of winter, maybe even longer, says QV.

CoreLogic figures measured across agent-led and private-sale transactions show there were just 4,744 deals done in June: that’s 22.1% down from the same time last year, and breaks the consecutive run of growth since April 2023 (-9.6%).

In contrast, the total stock on the market is more than 20% above the same time last year, leading to a market that is firmly in buyers' favour, with more people wanting to sell properties than there are people who are willing and able to buy them.

Buyers cautious

Kelvin Davidson, CoreLogic’s chief property economist says the sluggishness of sales is driven by cautious or restrained buyer demand, not a lack of choice.

“It would appear that some pent-up reluctance by sellers to list in the final few months of last year is now coming forward and turning into available stock this year. That’s creating more choice for buyers and feeding into

weaker price pressures.”

The glut of properties on the market also comes as regulatory changes at the beginning of July are bound to have an impact: new debt-to-income ratios (DTIs), loosened loan-to-value ratios (LVRs) and the Brightline Test falling back to two years. Earlier in the year, interest deductibility was also reinstated.

Total stock is up in all regions, increasing nationally by 28.6% yearon-year in June, while prices fall, according to figures from property website realestate.co.nz.

Although stock was down by 2.6% compared to May, the total number of homes has remained above 30,000 for five consecutive months.

New listings also rose by 25.5% yearon-year during June. However, this is a return to normal after low listing levels in 2023.

Big supply of rentals

Realestate.co.nz chief executive Sarah Wood says the new regulations, together with existing market conditions, should make buying an investment property attractive, but with a big supply of rentals available, new investment buyers will need to understand rental demand in their area.

She says those investors choosing to sell also need to price realistically. Some may struggle to get their desired price, especially if they bought at the peak of the market and potentially face selling for less than they purchased.

“For first-home buyers, understanding

their local market will be more important than ever, now that DTI ratios will cap how much a buyer can spend, at six times their income.”

REINZ data also show listings have risen dramatically, while property prices crashed in June.

Nationally, listings increased by 25.5% year-on-year from 6,218 to 7,805.

The number of properties newly listed for sale was almost 80% higher than the number sold in June.

Twelve of the 15 regions REINZ monitors had a rise in new listings year-on-year, with significant increases in Wellington, up a staggering 50.3%; Hawke’s Bay, up 35.6%; Gisborne, up 34.8%; Bay of Plenty and Canterbury up 33.6%; Auckland, up 33%; and Otago, up 23.4%.

Only two regions had a drop in new listings: Northland, down 26% for the year, and Marlborough, down 11.8%.

At the end of June, the national inventory level had risen 28.6% from 24,676 to 31,745 year-on-year, and dropped 2.6% to 32,598 month-onmonth.

REINZ chief executive Jen Baird says the increasing number of listings continues the trend seen all year due to high interest rates, cost of living pressures and changing employment circumstances.

Massive slump in sales

While listings soared, sales collapsed in June, dropping by 25.6% year-on-

year, from 5,854 to 4,356 and down a third on May, REINZ figures show.

The drop in sales was across the entire country - with the exception of Northland, which was up by 11.9%.

The biggest falls were on the West Coast, down 51.2%, Tasman, down 41.7%, Gisborne, down 39.4% and Auckland, down 35.1%.

Baird says there was a notable drop in buyer activity in June, and a reduced sense of urgency.

“As more listings come to a wellstocked market, those who are in the position to buy are taking their time to carefully select their ideal home,” she says.

Davidson says even the reduced pool of buyers who have the finance, and who can afford 7% mortgage rates, are seemingly being selective on finding the right property.

However, first-home buyers (FHBs) show no signs of pulling back, with their activity continuing to hover at recordhighs, especially in Auckland (27%) and Christchurch (29%).

First-home buyers just keep rolling on, with their market share holding firm nationally at 26%, Davidson says.

“It’s never easy to buy that first home, but, at the moment, that group is enjoying lower house prices than at the

peak, less competition from other buyer groups, as well as other supports such as access to KiwiSaver for the deposit.”

He says it will be interesting to see whether the recent loosening in loanto-value ratio rules adds an extra boost to FHB activity, given those buyers are already making full use of the banks’ low-deposit lending allowances.

House prices stay flat

Frosty economic conditions are causing home values to dip with the temperature in most main centres.

QV’S House Price Index shows the average home value now sitting at $916,285. That figure is still 2.8% higher than last year and 13.9% ($147,480) lower than the market’s peak in late 2021.

Data from REINZ shows the national median price declined by 1.3% year-onyear, from $780,000 to $770,000.

Taranaki and Gisborne stood out, with Taranaki’s median price increasing by 10.7% year-on-year, from $570,000 to $631,000 and Gisborne up by 7%, from $575,000 to $615,000.

QV operations manager James Wilson says downward price pressure has spread across all segments of the market, with investors, owner occupiers

and even first-home buyers – still the most active group in the market today –all taking a noticeable step back.

“There are some pockets of modest growth, most notably in the South Island. However, that also appears to be waning now, with even Christchurch and Queenstown – two of our more ‘bullish’ housing markets in recent years – now experiencing little or no growth whatsoever,” he says.

“Tough economic conditions are continuing to make it extremely difficult for potential buyers to save a sizeable deposit for a home, secure finance from the bank and service a mortgage.”

Wilson says sellers are having to be increasingly patient. “Many residentialproperty sales are now conditional on other sales occurring. This has been causing chain reactions in many instances, which is often extending sales periods or causing deals to fall over altogether.”

He expects home values to soften further throughout winter.

“There’s nothing to suggest house prices will take off again in the near future, while there’s everything to suggest that they will remain flat to gently falling.” ✚

While Resimac has called it quits in New Zealand and the country's economic environment is clearly at a low ebb, other nonbank institutions see that decision as peculiar to Resimac and not indicative of any imminent demise of the sector.

The departure of Resimac's chief executive Scott McWilliam announced on July 9 after 15 years with the company, including six years as sole chief executive executive and three years before that as joint chief executive does suggest problems internal to Resimac.

Non-bank lending sector reviewed

Jenny Ruth looks into the state of the non-bank a sector following Resimac’s surprise departure from New Zealand.

BY JENNY RUTH

Still, although Resimac's decision to stop writing loans in New Zealand did take the market by surprise, its ASX-listed Australian parent's results showed it lost A$2.2 million before tax in New Zealand in the six months ended December, down from a profit of A$1.5 million in the previous first half and despite revenue rising 21.3% to $28.3 million.

The local arm also lost A$2.3 million in the year ended June last year and its loan book had fallen to A$686.2 million at December 31, 2023 from A$839.7 million six months earlier at June 30, 2023. The loan book appears to have

peaked at A$953.34 million at Dec 31, 2022

By contrast, the Australian business reported a pre-tax profit of A$31.7 million, although that was down 41.8% on the same six months a year earlier, while the Australian loan book stood at A$13.94 billion, down from A$14.09 billion at June 30 last year.

Writing on his website, Opes Partners' Peter Norris offered some clue as to what went wrong for Resimac in New Zealand.

“They were about as close to a bank as a non-bank lender can be. If you can get a 6.80% interest rate from a main bank,

Resimac might charge 7.50%,” or 70 basis points more, Norris wrote.

“Now that Resimac is out, the next lowest non-bank interest rate is 8.50%.”

So, it does look like Resimac was trying to compete head on with the major banks and its losses in this market suggest that its pricing was unsustainably low.

Knock on effects from Resimac shutdown

Squirrel Mortgages is one organisation impacted to some degree because its Launchpad offering had been financed by Resimac.

With Launchpad, those with as little

‘[Resimac] were about as close to a bank as a non-bank lender can be’

Peter Norris, Opes Partners

as a 5% deposit can use Squirrel to bump their deposit up to 20% so they could qualify for a mortgage.

Squirrel chief executive David Cunningham says the existing loans financed by Resimac will continue but they are generally refinanced with a bank once the borrower has sufficient equity.

“Obviously, they will honour the existing agreements so there's no issue for existing clients,” Cunningham says.

Most of the business done with Launchpad has been with those with at least 10% deposits and “generally they're high income borrowers so servicing isn't the issue,” he says.

In future, Squirrel will use its peerto-peer platform to cater to such clients.

They come and they go

Cunningham points out that Australian non-banks have dipped in and out of the New Zealand market, which is very much smaller than their home market, when conditions favour them.

“My gut feel is that New Zealand organisations, such as Avanti and Basecorp will be here forever.”

And they usually come into the New Zealand market to fill a gap that the major banks have chosen not to fund.

“Most of these lenders are financed by securitisation and you need certain

‘My gut feel is that New Zealand organisations, such as Avanti and Basecorp will be here forever.’

David Cunningham, Squirrel

margins to make it work. When you have a credit crisis like the GFC, funding goes 200 [basis points] over and your whole business is screwed.”

Unlike securitisation, which is funded by wholesale investors, Squirrel's peer-to-peer business, which is worth about $250 million now, aims to attract retail investors – “most of us working at Squirrel have a retail background – it's a different model that's more sustainable through the cycle,”

Cunningham says.

“It's a long, slow process because you're building trust, but it's a sustainable rate. Any business that grows rapidly is likely to fail rapidly as well.”

Cunningham says he can't foresee a situation in which Squirrel would become a deposit-taking institution and he says the concept of the planned deposit guarantee scheme which is due to kick in from July 1 next year is “fundamentally flawed” because it is mis-pricing risk.

Basecorp isn't a deposit taker either. Chief financial officer John Moody says his firm uses a combination of wholesale funding via commercial banks, securitisation and private funding.

“Our view is that the wholesale model has served non-banks will in New Zealand,” Moody says.

Basecorp focuses on “second-chance”

DAVID CUNNINGHAM

business which offers those with a poor credit history can rebuild their creditworthiness, bridging finance and financing the self-employed or those whose income is difficult to verify.

Most of the time the banks eschew such lending because it's too complicated, although Moody says they've become more aggressive recently.

Possibly, that reflects current high interest rates that have greatly diminished appetite for borrowing.

But Basecorp is seeing “a small recovery in volumes” currently. “We're pretty confident that the bottom is in and volumes should pick up materially,” he says.

“We want to position ourselves to meet demand and to ensure we have capital to fund it and to be a strong player in that recovery.”

Moody is expecting to see more private credit in the New Zealand market.

“That's certainly a feature overseas and we're starting to see it coming into New Zealand, particularly in development finance.”

Like Basecorp. most of the non-bank financial institutions operating in New Zealand don't even try to compete with the major banks but operate in niche areas – indeed,

Heartland Bank also avoids direct competition with the major banks, even though it's considerably larger than the non-bank financial institutions.

‘We want to position ourselves to meet demand and to ensure we have capital to fund it and to be a strong player in that recovery’

John Moody, Basecorp Finance

For example, First Mortgage Trust chief executive Paul Bendall says his company will lend anything propertyrelated “so long as it's not CCCFA,” or subject to the Credit Contracts and Consumer Finance Act.

In other words, FMT avoids lending on owner-occupied residential mortgages.

It also mostly avoids lending on rural land, although it will consider lifestyle blocks.

The mainstay of its business is lending to property investors or small business owners and the self-employed and it finances a small amount of property development, although it won't lend more than a 47% loan-tovaluation ratio.

Because FMT operates a managed investment scheme, it isn't classed as a deposit taker and so isn't regulated by the Reserve Bank and it won't be affected by the Deposit Takers Act and its associated deposit insurance scheme which it comes into effect in July next year

Nevertheless, Bendall says FMT does use the one-year bank deposit rate as its benchmark and that it aims to outperform by at least 100 basis points.

In the June quarter, it delivered pre-tax annualised returns of 7.43%, the highest since the December 2008 quarter.

ANZ Bank NZ is currently offering 5.70% on a one-year term deposit while Westpac is offering 5.50%, BNZ 5.80%

and ASB 5.60%.

“For us, it's all about the premium we can produce,” Bendall says.

Nevertheless, Bendall says RBNZ has started to take an interest in FMT and that it's been reporting data quarterly to the central bank for about the last year.

FMT's fund is currently $1.7 billion and its loan book is $1.5 billion.

Bendall says he was surprised by Resimac's withdrawal from NZ.

“I think it's something peculiar to Resimac. We're still seeing good opportunities and we have a strong pipeline,” he says.

We don’t want to be called non-banks

But like others in the sector, Bendall doesn't like the term “non-bank.” “We think it devalues what we do.”

That attitude resonates with Gold Band Finance chief executive Martin Brennan.

“If I'm subject to the same rules as banks within the same bucket (it is regarded as a category three institution along with two of the smaller banks), how come they get to call themselves a bank and I don't,” Brennan says.

He agrees that with legislation covering all institutions that take deposits from the public, the definition of what constitutes a bank is becoming blurred.

Brennan is particularly exercised by Gold Band's lack of access to RBNZ's

JOHN MOODY

Exchange Settlement Account System (ESAS).

The major banks can park any excess funds with ESAS and are paid overnight interest at whatever the official cash rate (OCR) is, currently 5.5%.

But finance companies such as Gold Band are forced to use bank accounts that pay significantly less than the OCR – ANZ and BNZ currently pay 2.75% on a business premium call account while ASB offers 2.7% and Westpac is offering 2.3%.

Brennan isn't sure whether Gold Bank being included in the deposit guarantee scheme, which will guarantee deposits up to $100,000 per institution, will help or hurt his company and says he will need to see the fine print on how it will work.

But he doesn't think comparing it to the temporary scheme the government instituted in 2008 as the GFC was unfolding is a fair comparison.

That scheme was instituted in a tearing hurry and was in reaction to Australia introducing a similar scheme.

Finance companies, notably South Canterbury Finance, admitted to that scheme experienced a flood of new deposits but lacked sufficient sound lending propositions to put that money to work.

It is reasonable to assume that depositors, knowing their money is guaranteed, will tend to gravitate to institutions paying the highest interest rates.

“It's not apples with apples. The sector

is a lot more regulated than it was preGFC,” Brennan says.

It was only after many finance companies had already collapsed that the Reserve Bank was charged with regulating non-bank deposit takers (NBDTs) and the rules, including prudential and liquidity requirements, have been progressively tightened.

Brennan struggles with the fact that the NBDT category covers such a wide range of quite different institutions from not-for-profit credit unions and building societies to those still called finance companies.

Unlike banks, which must be accredited by RBNZ before they can call themselves a bank, “anyone can call themselves a finance company,” he says.

“The challenge I have talking to investors is that they can't differentiate” between the different types of companies.

While any institution covered by the deposit guarantee scheme will present “a moral hazard” in that their depositors will be covered regardless of risk, “I would suggest there are going to be sufficient mitigations in place.”

But it still isn't clear what levies the different institutions will have to pay into the scheme – it's planned to be financed over a 20-year period by levies on each institution and RBNZ has proposed the amount of the levies be determined by factors such as degrees of risk.

“If that brings our costs down, it will enable us to move into markets

we've previously haven’t been able to compete in.”

Until the Deposit Takers Act has been fully implemented, finance companies that do take deposits still have to have a trustee, so the levies they are charged will only temporarily be an added expense.

Massey University banking professor David Tripe, who is also a Gold Band director, says there are far fewer nonbank participants than pre-GFC but that there is definitely a need for them.

“There's a variety of things the banks aren't doing such as bridging finance –it doesn't look very tidy for banks – and there are a lot of transactions that don't match bank criteria,” Tripe says.

“People who can get finance through banks probably will but the banks have got so lazy about anything nonstandard.” The banks are also lacking the expertise required to write nonstandard business.

Tripe cited his knowledge of a $3 million deal that BNZ's parent, National Australia Bank which was “too hard for NAB to understand. They ended up going to Macquarie which saw it was a bankable transaction.”

He says that's why mortgage advisers are originating more and more mortgages because origination has become “a bit hard” for banks to do themselves.

“As long as banks become more and more focused on doing the plainest vanilla lending only, there will be a future for the [non-bank] sector.” ✚

‘I think it's something peculiar to Resimac. We're still seeing good opportunities and we have a strong pipeline’

Paul Bendall, FMT PAUL BENDALL

Property investment on the cusp of recovery

Property investors are jumping off the fence following big changes in the housing market, boosting business for mortgage advisers

BY SALLY LINDSAY

On the first day of July, the Brightline test was scaled back from 10 years to two, the loan-to-value ratio (LVR) was loosened, and the debt-to-income ratio (DTI) caps came into force.

Prior to that, tax deductibility was reintroduced on residential investment property.

But that isn’t all. A raft of other changes have been signalled by the National-led coalition Government, in a bid to make house prices more affordable: Granny flats of up to 60m2 will be able to be built on urban and rural sites without consent; councils will be forced to live-zone 30 years of land for housing; urban-rural boundaries will be scrapped, along with minimum apartment and balcony sizes; transport corridors will be identified for intensification; and mixed-use zoning will be required.

The biggest deal for property investors is the change in LVRs and the Brightline Test.

Banks can do 5% of investor lending at 30%, previously 35% - and, after two years of owning a property, investors are exempt from capital gains tax if they sell.

Even for an investor with, say, 33% equity, who suddenly finds themselves now able to satisfy the LVR rules, there is still the issue of high mortgage rates and relatively low rental yields.

Auckland-based Kris Pedersen, managing director of Kris Pedersen Mortgages, says of more concern to investors is loan affordability, servicing and equity issues.

“I am not running into too many people with equity issues, so will loosened LVR rules help? Yes. Will they be a game changer? No.”

While DTIs will play a significant role

in the longer term, tying house prices more closely to incomes and slowing down the rate at which investors can build a portfolio, right now they will do little, because high mortgage rates are already limiting how much debt people can secure.

Behind the scenes, banks have been using DTIs in their lending calculations for some time.

New-build properties are exempt from both the LVR and DTI regimes, as are non-bank lenders.

Enquiry surge

The changes have not resulted in an immediate flood of investor buying or selling, as predicted by some market commentators, but Pedersen, in Auckland, and NZ Mortgages owner and head of lending Nathan Miglani, in Christchurch, have both seen a surge in inquiry.

Pedersen says a lot of people are feeling mortgage pain, which means there are quite a few properties potentially being sold at discounts, but it’s hard to tell whether the wave of new listings across the country is from investors having to sell because of cashflow problems, or baby boomers cashing up for retirement.

Problems for investors arose after the previous Labour Government’s anti-investor rhetoric and changing of the tax rules, which, combined with a higher interest-rate market, drove them out of the market. Investors sat on the fence for about three years until July’s transformations.

But they kept talking with mortgage advisers because of the need to manage mortgage-interest-rate fixing, in an environment where the underlying expectation is that the next sizeable

change will be downward.

Many economists believe that could be by November. Financial markets have fully priced in a Reserve Bank cut to the OCR in November, and a 50/50 chance it could be in October.

Pedersen says even though the property market seems to be quiet, he has noticed investors are back in full swing.

“That doesn't actually mean they're all transacting. A lot want to get preapproved for mortgages, as they realise interest rates have peaked.

“And while the economy is not in good shape, the general perception is that house prices have probably bottomed out.”

Crash in June

However, there could still be further price drops, after the housing market crashed to 2008 Global Financial Crisis (GFC) levels in June, according to REINZ data.

Just 4,356 houses were sold in June, down 25.6% compared to June last year and exactly a third lower compared to May this year.

At the same time, listings have soared. Some 7,805 properties were newly listed for sale in June, up 25.5% compared to a year ago.

The new June listings were almost 80% higher than the number sold in the same month.

This is causing a huge overhang of unsold properties sitting on the market.

New investors

While only 5% of Nathan Miglani’s NZ Mortgages business comes through writing mortgages for investment properties, the sudden lurch in the

‘While the economy is not in good shape, the general perception is that house prices have probably bottomed out’

Kris Pedersen

market hasn’t stopped first-time investors knocking on his door. He says the game changer for the market is the Brightline Test being pulled back to the original two years –the time-period which was introduced by a previous National Government but ramped up under Labour’s six years in office.

“New investors wanted to come to the market before the July 1 changes, but they couldn't be bothered with the 10year Brightline test and negative media. Now we are seeing a huge number of existing clients looking to invest for the first time, mainly in existing property.”

Miglani says new builds are not on their radar. First-time investors are targeting three-bedroom, standalone homes on established sites in good school zones, selling for up to $750,000.

“Although rents may only be in the $650-a-week range, and the mortgage needs to be topped up by about $300 a week, they are happy to do this, because the mortgage on their primary home is low, they have a good income, and their aim is to hold the investment property long-term, in the belief values will jump up next year,” Miglani says.

Historically, investors have made up 30-40% of Wellington-based Velocity Finance’s mortgage business, but this has dropped away to 10-20%.

Velocity Finance director and financial adviser Brendon Ojala says those investors have been buying properties through investment companies selling new rental stock.

“They are the only real investors we have been working with over the past couple of years.”

Ojala says the buying figures on existing properties haven’t worked for investors for several years, but

he expects that to change with the Brightline Test being pulled back, interest deductibility back to 100% next year, and interest rates possibly dropping by the end of the year, leading to a confidence boost in the economy.

“Investors are also still looking for lower house prices.”

Putting the brakes on

Christchurch-based Brenda Murney, of Vega, says servicing mortgages is going to stop investors from flooding the market for some time, despite the changes.

“Until earlier this year, it just didn't make a good business sense for an investor to borrow money to buy an existing property, because they couldn’t claim the loan as a tax deduction,” she says.

“This year we've seen investors back buying both new and existing properties, but not going crazy.

“While mortgage rates are in the 7% range, this more than anything is putting the brakes on investors, because servicing costs are high. Many are having to top up repayments, as rents just don’t come anywhere near close to covering the outlay for mortgage, rates and insurance.”

Murney says tax deductibility back at 100% next year will help a lot of investors - who might have been looking at selling - ride through the economic storm until interest rates come down.

Demand for mortgages

Last year was the quietest Pedersen’s business has had in the investment market since the GFC.

“Nobody knew how high interest

rates would go, and if there would be a change in Government. That held things back,” he says.

Now, his advisers are running to keep up with investor demand for mortgages from banks and non-banks.

“Last year there was little appetite for non-bank mortgages. Now we are seeing investors saying, ‘Okay, if I can’t get bank finance for this property, which is a great buy at under-market value, I’ll be happy to get funding through a non-bank, in the hope I’ll be able to refinance back to a bank in six, 12 or 24 months.’”

As soon as the market gets the first sign interest rates are going to drop, Pedersen and Miglani expect investors to start competing seriously with other buyers.

Pedersen says he is seeing a bit of a Mexican stand-off between vendors and buyers.

“Over the next six months, some of those vendors are going to have to drop their prices, because they’ve just got to get out of the market because of cashflow issues.”

July, August and September will be a busy quarter for investors, says Miglani, but the real activity will kick into gear from February next year.

He is basing this on the number of calls from existing clients who were waiting for 2 July so they could make offers on investment properties - and the increasing number of inquiries for second-property mortgages.

New options

One of the popular and unique loan options for property investors was a product from Resimac – one that’s no longer available following the decision to close the business in New Zealand.

KRIS PEDERSON

However, Xceda has just launched a 10-year, property-investment loan, similar to what Resimac offered.

Chief executive Daniel McGrath says the product was in development before Resimac made its announcement.

He, like others, says there has been renewed interest from investors.

“It’s not happening overnight, but certainly we are seeing enquiries on the up.”

The new product allows purchasers to receive the initial two years of the facility interest-free, then amortise the balance of the loan up to year 10, over a 25-year profile.

“We are already seeing really good interest in this product. With investors, they want speed and certainty – which doesn’t always occur with the main banks. This is particularly where there are still good deals in the market if they can pounce on them quickly.”

Xceda’s ability to offer a longer-terminvestor mortgage product comes on the back of its increasing deposit book: Xceda is an RBNZ-licensed deposit taker.

“With the deposit compensation scheme due to start in July 2025, many depositors are looking to smaller

We are seeing a huge number of existing clients looking to invest for the first time, mainly in existing property’

Nathan Miglani

prudential institutions such as Xceda to take the benefits of the proposed $100,000 protection under the scheme. This is only available to RBNZ-licensed banks and deposit takers.”

Fear & greed

Pedersen says one hiccup on the horizon next year could be fear and greed returning to the market, as more buyers on the ground will push prices up.

“Some people will stick to their buying rules and other people will break their borrowing rules, and prices will be pushed up as investors acquire more property.”

Even if the market improves, Pedersen says quite a few people connected to the industry will fall over – builders, tradies and real-estate

agents getting out of the game, and mortgage advisers leaving because they’re running out of money –although there will be more activity and a little bit of capital growth.

The latest Reserve Bank figures for May show banks made $6.9 billion in new residential mortgage lending, the most in two years.

Lending to investors was a lowly $1.3 million, compared to $4 billion lent to owner-occupiers moving house, but this is expected to rise to new levels in the next six to 12 months.

Putting it bluntly, this will mean a better time for mortgage businesses to make money, Pedersen says.

Ojala agrees, saying increased activity means more profitability.

“It isn’t whether house prices are high or low, it’s the turnover of transactions that is key.” ✚

Add another string to your bow.

› Need to purchase new wheels, fund

consolidate

› Want to restructure

and

or consumer lending for home lending purposes.

› Are

› And more…

Taking care of the detail: A simple introduction from you, and our team of 20+ financial advisers take it from there.

Keeping you informed: The better finance™ Adviser Portal delivers real-time access to track loan progress, check settlements, commissions and more.

Offering strong commercial terms: Give the

The Queen of Straight-up Advice

Sarah Curtis is known for telling it like it is, whether turning away people she doesn’t think will be long-term clients, or informing the Commerce Commission – very publicly - that they’re just plain wrong.

BY SALLY LINDSAY

Setting up a new business when pregnant is a tall order for anyone.

For Kerikeri-based Sarah Curtis, of Sarah Curtis Mortgages & Insurance, it was a fraught time: used to operating at full speed, she continued at the same pace.

In a wide-ranging chat with TMM, she talks about the mortgage market; why she called out the Commerce Commission; and what she wishes she’d done differently when she’d just given birth - to both a business and a baby.

How did you get started in your own business?

Seven years ago, my husband and I decided we were going to move back home to Kerikeri. I had a two-anda-half-year-old and we wanted to be closer to family, so I transferred back with the bank.

I lasted about six weeks before

deciding to go out on my own.

I knew that being an adviser was something I wanted to do, and I saw that some of the people coming into the bank weren't getting the level of support that they needed.

So I quit - and then found out two weeks later that I was pregnant. It was hard, but in retrospect it was good.

Is there anything you would do differently if you were starting out again?

Take maternity leave.

At the time I was in the mindset of really needing to get out there and build a business. I’d be breastfeeding while talking on the phone to clients; I used to do late-night zoom calls once the baby had gone to sleep; and I took him to daytime meetings with realestate agents.

If I was starting again, I would not do any of that. I'd just sit at home with the baby. Because, as it turned out, business came in the door naturally.

Is it difficult to make your business profitable in the provinces?

I wouldn't say it's difficult; it’s the approach you take.

The trust level in the provinces is really high. There's not the same level of competition as in the cities, so if you have a good brand, and you do the right thing, people will trust you.

They see you in the supermarket and at the school, and they know you're good. We get a lot of word-of-mouth referrals.

People want to sit down and have a face-to-face conversation, so we’ve set up an office in town where clients can

‘We do turn people away, as we have quite clear expectations of what we want’

come and sit on the couch with us, eat a chocolate bar and have a discussion. There’s not as much formality in the provinces.

We do turn people away, as we have quite clear expectations of what we want – and it’s important the people we want to be working with want to work with us long term. We don’t want clients to just tap in for a mortgage and then we never see them again.

The client-relationship side of our business is important. If there’s loyalty, you go on a financial journey with them over years.

What advice would you give to somebody just starting out as a mortgage adviser?

Ten years ago you could jump in, hit the ground running and be cranking deals. It's not like that anymore. You need to have some strong relationships with lenders, with some clients or potential clients, and you need to do the hard yards to build a solid, trustworthy brand.

And all those things take time. Only do it if you really love what you do.

As a mortgage adviser in the provinces, it can feel a bit isolating, so whenever I travel I catch up with other advisers in other areas, such as Christchurch and Tauranga, to have a coffee and discuss the industry.

They’re good connections – and that’s what helps you get through the rest of the year.

How would you characterise the mortgage market?

We work in the first-home-buyer segment and we’re finding our clients are having a lot more success than they might have previously, because vendors are more open to negotiation.

We haven't necessarily seen a big reduction in house prices, but, rather than properties going to auction, there's more capacity for first-time buyers to be able to put

forward an offer - with a longer finance date so they can do their due diligence, get a builder’s report, and to do those things once they know that they'll actually be able to buy the property.

We work with our clients from an early stage – often two to three months before they are even looking to do anything – so we are confident when they’re putting in offers that they’ll be able to get finance.

What would you like to see change in the mortgage market space?

Banks making it easier for existing clients to be able to get mortgage topups.

We struggle with the time that goes into getting, say, a $20,000 top-up for a client to do some renovations.

It takes the same amount of time to do that as it does to do a full mortgage application for someone buying a brand new house. There’s no sale and purchase agreement, but a lot of time is taken up explaining the value of the property.

All the policies that used to be around existing lending - with banks easily able to see income going into the bank and clients under no pressure with repayments - got pulled away with the CCCFA and have not been re-established, even though the Government has scrapped the prescriptive lending rules.

What is the one thing you do consistently every day in your business?

Right from the start, I’ve been active on social media. I try to post every day, as it helps enormously with business.

The other thing I do every day is check in with my business partner, Gareth O’Brien. I do the face-to-face business with clients and he does everything else.

We catch up every day to see where our deals are, run through our CRM

Sarah Curtis

From

I grew up in West Auckland until I was 16, then the family moved to Kerikeri. At 21, I moved to Auckland to follow a boyfriend, who is now my husband.

Family

I am married to Shaun, who is an investment adviser for Craigs Investment Partners, and we have two children aged 10 and six. My parents are a huge part of family life, picking up the kids every day after school so I can run my business.

Outside Work

I chair the local business association and the school PTA, and then I watch TV and read.

TV show

Survivor and Trust on Netflix. Any reality television.

Favourite book

I had a mission to read 24 books in 2024 and I've read 30 so far. My favourite is Tomorrow, Tomorrow and Tomorrow by Gabrielle Zevin. Motto Que sera sera.

How has business been for you this year in the light of the raft of changes?

Both Gareth and I come from a banking background, so we're au fait with constant change.

We try and stay on top of everything that's happening in the market, from government regulatory changes to societal shifts – and we’ve worked really hard to consistently engage with the market and with our existing clients.

It feels sometimes like we're trudging through mud. Sometimes we'll get out of the mud for a bit, but then something else will change.

You describe your business as giving “straight-up advice”. How did that come about?

A few years ago, I had a client who commented on one of my Facebook posts that I was the “queen of straightup advice.” I was like, “Oh, I quite like that.”

I'm very upfront. Very to the point. People are able to be, “Okay, cool, she'll tell me the way it is.”

It seems to attract the type of people that we want to work with.

When the Commerce Commission made pointed comments about mortgage advisers and banks, why did you speak up?

I spend all day telling my kids to do the right thing and to stand up for what they believe in. And when I saw the comments that had been made, I knew they were basically just wrong. So I called them out on LinkedIn. I think we can be a little bit scared

in our industry, because sticking our heads up doesn't result in the greater good for us individually or as a business.

But I'm not the kind of person who can just sit by and leave something when I know it's wrong.

We've written submissions, been on all the webinars and sessions where the commission has wanted more information directly from us as advisers. We were also involved when all the banks and lenders got called on to comment on the original submissions.

It's taken a lot of hours and I can see now why people stay quiet, but it's still not something that I could ever do. It would be nice to be acknowledged that as advisers we do a good job. ✚

EMBRACE AI OR DIE

AI can make an adviser’s life significantly easier, taking care of marketing and administrative tasks. Ignore it at your peril if you want to keep up.

BY PAUL WATKINS

Artificial Intelligence is here - and I’m sure you’ve all had a few tries doing stuff with it.

AI tools will only keep getting better, and will have an increasing impact on the mortgage-adviser industry.

Some tools make you much more productive, while others may require strategic adjustments. Here’s how AI can help - and why it’s essential to embrace it.

Marketing with AI

One of the most obvious areas where AI can help is marketing, which is the focus of these articles.

Blog posts, social media posts, posters, brochures, logos and client emails can all be created in minutes with well-prompted AI tools.

Often, these AI-generated outputs are better than what you might create on your own. No offence, but the times I have used AI have resulted in incredible outputs.

AI can also create highly-compelling landing pages, or even entire websites, sales-funnels, e-book content and powerful descriptions of your services.

These tasks, which used to cost thousands of dollars using advertising professionals, can now be done in minutes, saving you a huge amount of time and money.

AI tools exist which can generate videos from text and apply a machinespoken voice over them. If you do not want to front your own videos, you don’t need to – with minimal production costs.

You can even critique your own

work by using AI tools, with prompts such as, “How can this be made more compelling, for… ?”

I did that with this article after I wrote it. Not only did it re-word some parts, but added the AI tools listed below – most of which had not been known to me before.

‘Personalised marketing is the buzz word right now. Every client wants to feel like... the only one you deal with’

Personalised for clients

AI is also being successfully used by service providers to personalise the client experience.

Personalised marketing is the buzz word right now. Every client wants to feel like he or she is the only one you deal with.

If you have a thousand clients, it’s not practical to break your database down to segments of one. But AI can personalise the experience for clients in minutes.

It can analyse complex data from your database, and segment your clients for focused targeting. This level of personalisation can significantly enhance client satisfaction and loyalty.

Simplifying admin tasks

AI tools can automate many administrative tasks, significantly reducing the workload for advisers. For instance, AI-powered processing software can quickly and accurately extract relevant information from various documents such as tax returns and bank statements.

This automation not only speeds up the process, but also ensures higher accuracy, minimising the risk of errors which could delay the application.

Faster credit checks

Assessing the creditworthiness of applicants is a critical aspect of the mortgage-application process.

Traditional methods often rely on manual reviews of bank statements and credit checks; AI can quickly analyse vast amounts of data to provide a more accurate and objective assessment.

Machine-learning algorithms can evaluate financial histories and other relevant data points to predict the likelihood of being a good risk – along with how much a client can afford.

Using AI-driven chatbots

AI-driven chatbots are becoming increasingly common. They can provide 24/7 support, answering common queries and guiding applicants through the process.

These chatbots use natural language processing (NLP) to understand and respond to customer inquiries effectively.

By offering instant support, AI

‘AI tools can automate many administrative tasks, significantly reducing the workload for advisers’

chatbots enhance the customer experience, making applicants feel more informed and supported throughout the application process.

Legal advice & compliance

Law firms around the world are currently grappling with AI as it impacts their baseline services, such as conveyancing, simple legal documents, wills and more.

I tested this myself in a very low-level way. We updated our wills and Powers of Attorney, so entered our wishes into an AI tool, asking it to word the documents appropriately and in line with New Zealand law.

We then showed it to a lawyer. His response was that it was “fully compliant with New Zealand law” and didn’t require his input.

The cost to us? Zero! Checking your increasingly necessary compliance documents could be another opportunity.

The importance of prompts

AI tools such as the ubiquitous ChatGPT, along with myriads of other specialist tools which seem to be popping up almost every day, require ‘prompts’. These are the questions you ask it. And there’s quite an art to doing so.

They are not just, “How can I…,” but should typically be lengthy, very specific and acknowledge the expertise you are after.

For example, a prompt could read: “As a world-leading mortgage adviser and marketing expert,

specialising in first-time home buyers aged 28 to 38 with a household income of $120,000 and $200,000 saved (mainly through KiwiSaver), I would like you to write a blog post for me. It must include the 10 most commonly searched-for terms used by first-home buyers. The aim is to attract prospects, with a compelling offer.”

The point here is this: what you put in dictates whet you get out. Be extraordinarily specific. This also meets the current trend of personalised marketing.

Learn how to write prompts well; they are nowhere near as straightforward as you might think.

AI tools for advisers

Six AI tools in particular are in use by mortgage brokers: they are US-based, but within no time each country will have its own variant (and by the time this article goes to print, there will probably be 106):

• Zest uses machine learning to enhance credit underwriting.