Advantages

•

•

•

•

ITA Executive Committee

Martin Pike

ITA President President ATI Specialty Materials

Sam Stiller

ITA Vice President VP Commercial Howmet Aerospace

Directors

David Beddome

ITA Director Chief Executive Officer STS Metals

Steve Chavez

ITA Director CEO All-Met Recycling

Jeffrey Easto

ITA Director Vice President Purchasing TIMET, Titanium Metals Corporation

ABOUT THE ITA:

Brett Paddock

ITA Secretary / Treasurer President & C E O Titanium Industries Inc

Markus Holz

ITA Past President Professor, ITA Academic Member Academic Individual Member

Olivier Maillard

ITA Director

Vice President Metallic Raw Material, Forgings & Castings and Fasteners

Procurement - PMM Airbus SAS (France)

Michael Marucci ITA Director Chief Technology Officer Kymera International

Frank Perryman

ITA Director President, Chief Executive Officer Perryman Company

John Scherzer

ITA Director Vice President – Medical Markets Carpenter Technology Corporation

ITA (https://titanium.org/) is a membership-based international trade association dedicated to the titanium metal industry. Established in 1984, the ITA’s main mission is to connect the public interested in using titanium with specialists from across the globe who may offer sales and technical assistance. Working through its extensive membership resources, the ITA seeks to expand the knowledge base for the metal, providing technical literature and sponsoring seminars and conferences.

That’s why when it comes to the design and manufacture or the repair and reconditioning of crucibles, molds, and hearths for your ESR, VAR, EBM, or PAM installations, we draw on our more than 135 years of design, engineering and manufacturing excellence to ensure that your copper-based melting equipment is operating at peak efficiency.

Quality vessel repair services to keep you running at high production levels.

A reputation for quality work and on-time delivery. Our staff of expert millwrights, welders and machinists can tear down, assess, repair and test your valuable melting equipment.

Additionally, our manufacturing capabilities are fully supported by our staff of over 50+ engineers.

Our services include:

• Machining, welding, straightening, and sizing of stainless steel, copper, nickel, aluminum, bronze, and carbon steel

• Preventative maintenance, including cleaning, re-sizing, straightening and seal replacement

• Crucible diameter and size modifications

• New crucibles, molds, base assemblies, water jackets, etc.

To learn more about our rebuilding and manufacturing services,call (330) 337-0000, visit www.ButechBliss.com or email cu@butech.com.

Medical Technology

Dr. Colin McCracken

Product Manager, Biomedical, Titanium Oerlikon Metco (Canada) Inc

Colin McCracken gained his B Sc , M Phil and Ph D in Metallurgy from Brunel University of West London, UK in 1992 . Colin then joined AVX Ltd - Tantalum Division working on capacitor grade tantalum powders and left in 2005 as Head of R&D Colin then moved to the USA to join Reading Alloys Inc . as Development Manager - Powder Products and in 2011 Colin was appointed to Director of Product and Market Development at Ametek SMP - Reading Alloys In 2013 Colin relocated to Ontario Canada to work with H C Starck Canada Inc and then later joined Tekna Advanced Materials before finally joining Oerlikon Metco Canada Inc in 2017 as a Product Manager for Biomedical and Titanium products In 2016 Colin was awarded a Fellow from the UK Institute of Materials, Minerals and Mining

Global Industrial Markets POSITION OPEN –contact ITA for more details

Safety Education

Robert Lee (Co-Chair) President Accushape™ Inc

Robert G Lee is the President and Owner of Accushape™ Inc Mr Lee is Chair of the ITA Safety and Compliance Committee During the past 50 years, Robert Lee has been directly involved in the processing of titanium and other special metals in many forms including, machining, welding, forging casting, screening, pressing and sintering of titanium powder Accushape™ was started in 1987 by Robert Lee for the purpose of scaling up the production of knife handles for Buck Knives made by pressing and sintering (P/S) of titanium sponge granules (titanium powder) (TSG) to produce a net shape finished knife handle Accushape has produced over 500,000 titanium P/S parts including knife handles, golf club inserts, hex nuts and washers . Accushape™ has processed and screened 100’s of thousands of pounds of titanium sponge fines to customer’s special requirements More recently, Mr Lee has been issued 7 patents for a new titanium based material system TiCarbonite® and the ODAK™ tile system TiCarbonite® is a light weight, extremely hard and tough material finding applications for ballistics armor ODAK™ tiles create many types of systems with no increase in thickness and no through gap, making possible flexible material systems that can fit contours

ITA Contributor

Michael Gabriele is an independent freelance writer on behalf of the International Titanium Association (ITA)

Peter

Zimm Principal Charles Edwards Management Consulting

Jeff

Easto Vice President, Purchasing TIMET, Titanium Metals Corporation

Michael Marucci (Co-Chair)

Division President Advanced Solutions and Surface Technologies business units Kymera International

Michael Marucci serves as Division President at Kymera International, a global leader in specialty materials Kymera produces silicon carbide, titanium powders, aluminum powders, copper powders, specialty alloys for titanium production, and surface technology solutions

Mike joined Kymera in March 2020, following the company’s acquisition of Reading Alloys, Inc from AMETEK In his current role, he oversees Kymera’s Surface Technologies and Advanced Solutions business units

The Surface Technologies unit specializes in high-quality thermal spray services, anticorrosion coatings for global navies, thermal spray materials, and advanced spray equipment and automation solutions The Advanced Solutions unit produces high-purity master alloys for titanium production, processes high-purity titanium scrap, and manufactures titanium powders, tantalum, ferro-titanium, copper, and bronze powders

Ing. Uwe Haissl

Vice President Special Metallurgy Division

INTECO melting and casting technologies GmbH

Colin McCracken Product Manager, Biomedical, Titanium Oerlikon Metco (Canada) Inc

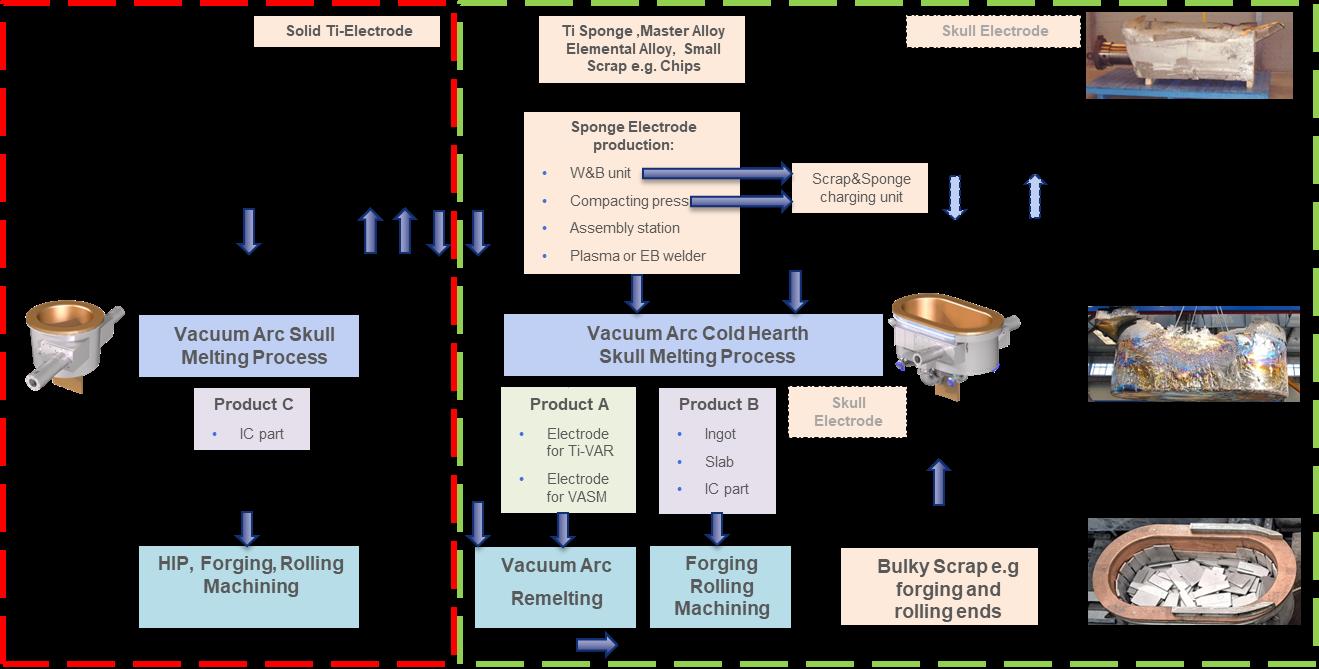

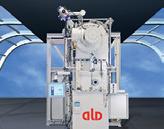

Are you aiming to increase the recycling rates in your titanium production shop?

INTECO´s new innovative vacuum arc cold hearth skull melting and casting furnace

› can achieve recycling rates of up to 100% by feeding virgin and scrap material (e.g. compacted chips) between melting & casting cycles

› can achieve an improved energy ef ciency compared to other cold hearth technologies

› allows static casting of ingots and slabs as well as dynamic casting of complex investment cast parts

› can achieve pouring weights from 250kg up to 3.000kg in one cast

› More than 20 years of experience as a premium supplier in the titanium industry

› Supply of melting and casting equipment for titanium including auxiliaries

› Engineering studies, project- and technology consulting for entire titanium production lines

› Know-how transfer, from selections of raw material up to aerospace certi cation

› Customized process and production management systems (IMAS) for titanium production lines

By Peter Zimm, Principal Charles Edwards Management Consulting

The aerospace industry entered 2025 breathing a sigh of relief that the Boeing strike had been settled and that it could look forward to the resumption of build rates out of Puget Sound again. This was the latest in a series of production recovery setbacks in the last half decade and although it was not the most severe, it felt like a hard blow in 2024. This setback came after a half decade of stymied aircraft production increases due to a combination of workforce replenishment issues, inflation, sub tier supply chain production constraints and a dearth of investment capital to support the production ramp.

Not that the start of 2025 was entirely smooth either. Just before President Donald Trump’s inauguration, he threatened to impose tariffs, a threat he made good on in the weeks following his inauguration. In addition, on February 17, the world’s largest aerospace fastener facility burned to the ground—Precision Castparts’ SPS facility in Jenkintown, PA. In addition to being a large production site, this set of plants was vertically integrated and supplied many sole source fastener part numbers to the industry, raising the specter of supply shortages of an already constrained aerospace

product.

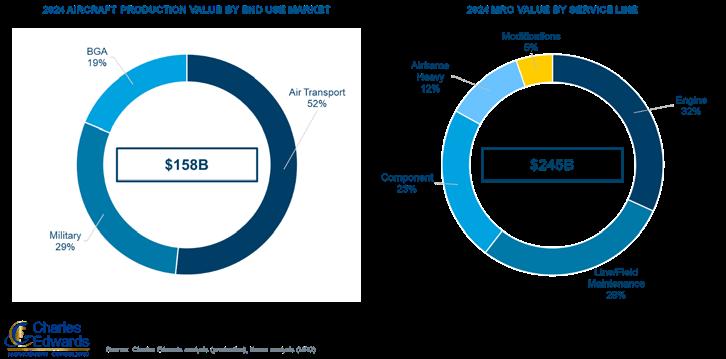

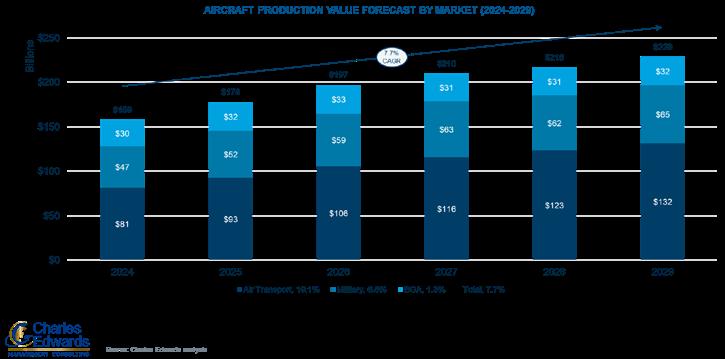

Total aircraft production value grew 7.5 percent in 2024, from $147 billion to $158 billion. Military production grew an astonishing 32.4 percent and business and general aviation grew about 15.3 percent from 2023 to 2024. As a result of the production shutdown in Boeing’s Seattle operations from the strike, as well as quality and production system implementations, 2024 commercial air transport value actually decreased by about 5 percent.

come from those discussions:

The supply chain is still recovering, constraints persist in certain key areas, and there is not yet a line of sight to schedule harmonization. That’s the bad news. The good news: suppliers were upbeat. The news that Boeing had produced 38 737 MAX aircraft in May was encouraging, raising the prospect that MAX build rates would soon begin to rise above the upper 30s. (For the record, we will feel increasingly encouraged as consistent upper thirties production

Now that over half the year has passed, how is the recovery progressing? In our discussions at the Paris Air Show in June, we asked several key questions: What is the state of the aerospace supply chain? Do we have a line of sight to harmonizing the schedules of individual suppliers? What are supplier sentiments about OEM build rates and aspirations? Lastly, are we seeing any impact from the fire at SPS Technologies?

The conclusions provided here

rates are consistently achieved.) Suppliers were also happy about continued build rate increases at Airbus despite 2024’s lower than planned A350 production.

In terms of fasteners, we did not hear of significant impacts from the SPS fire, but the market is expecting constrained supply in the fourth quarter of 2025. Fastener lead times remain long and overseas supply is being subjected to tariffs.

[Editor’s note: On February 17, 2025, a fire broke out at SPS

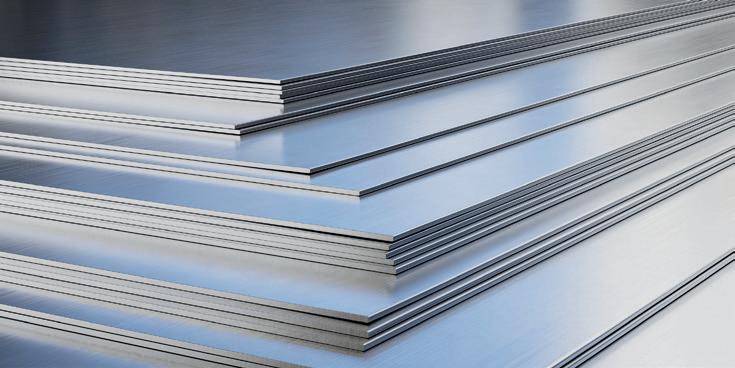

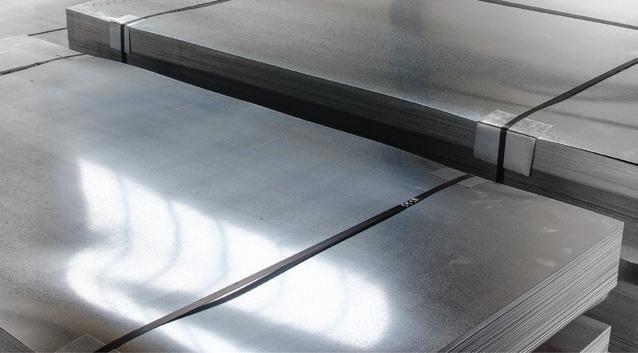

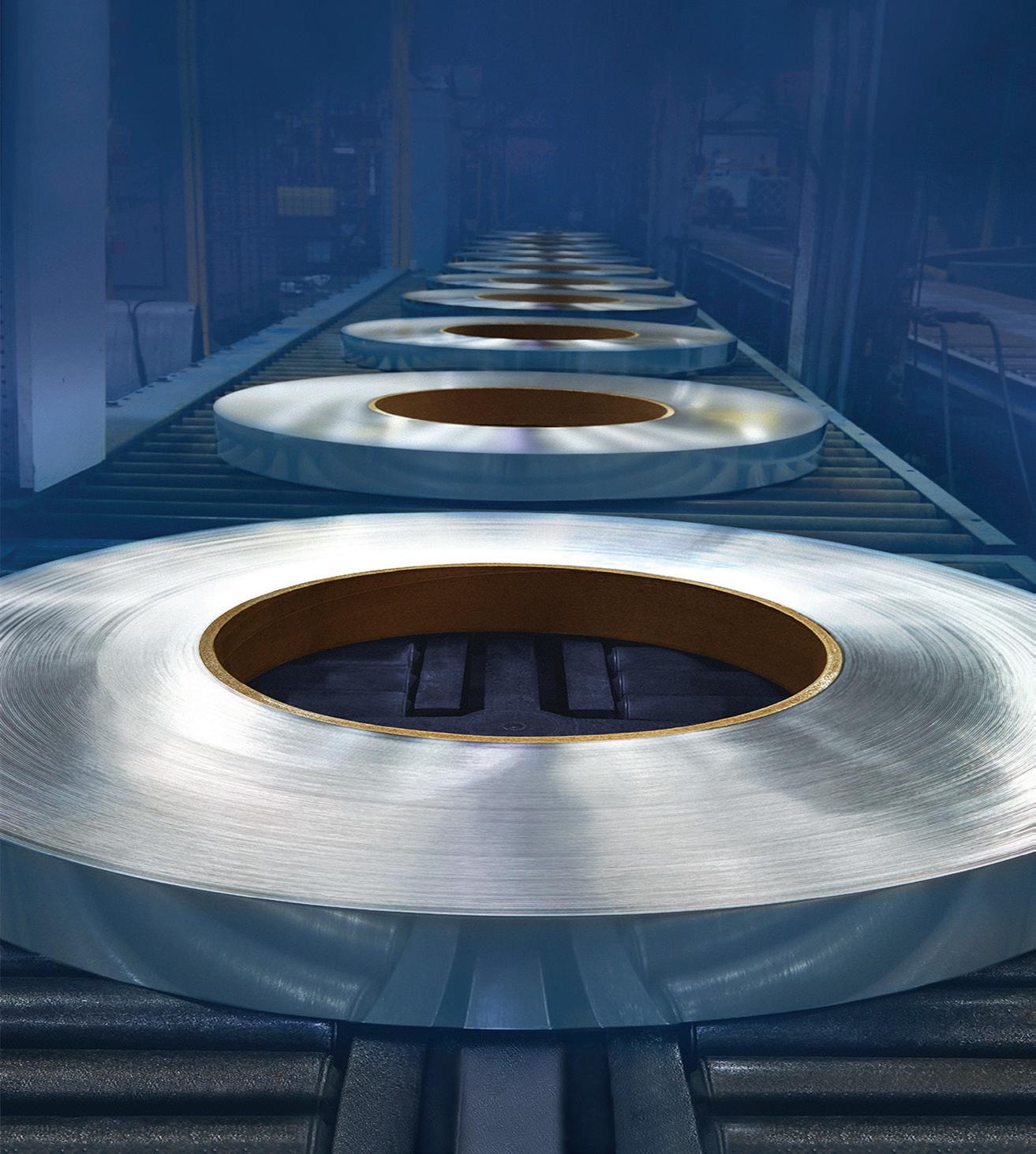

Titanium Mill Products:

Sheet, Plate, Bar,Pipe,Tube,Fittings, Fasteners, Expanded Sheet & Ti Clad Copper or Steel.

Titanium Forgings and Billet:

Staged intermediate ingot & billet to deliver swift supply of high quality forgings in all forms and sizes including: rounds, shafts, bars, sleeves, rings, discs, custom shapes, and rectangular blocks.

Titanium, Zirconium, Tantalum & High-Alloy Fabrication & Field Repair Services: Vessels, Columns, Heat Exchangers, Piping, Anodes, Custom Fabrications, Field & In-House Reactive-Metal Welding & Equipment Repair Services Available 24/7.

Plate Heat Exchangers:

Plate Heat Exchangers to ASME VIII Div 1 Design, Ports from 1” through 20” with Stainless Steel, Titanium and Special Metals, Plate Heat Exchanger Refurbishing Services & Spare Parts.

Two Service Centers & Fabrication Facilities in Ohio & Texas with Capabilities in: Waterjet, Welding, Machining, Sawing, Plasma Cutting & Forming.

Serving a Wide Variety of Industries: Chemical Processing, Mining, Pulp & Paper, Plating, Aerospace, Power and others.

Tricor Metals, Ohio Division 3225 W. Old Lincoln Way Wooster, Ohio 44691

Phone: 330-264-3299

Fax: 330-264-1181

Tricor Metals, Texas Division 3517 North Loop 336 West Conroe, Texas 77304

Phone: 936-273-2661

Fax: 936-273-2669

Tricor Metals, Michigan Division 44696 Helm St. Plymouth, MI 48170

Phone: 734-454-3485

Fax: 734-454-7110

Astrolite Alloys California Division 201 Bernoulli Circle, Units B & C Oxnard, CA 93030

Phone: 805-487-7131 Fax: 805-487-9694

Technologies, a manufacturing company in Jenkintown that produces fasteners and other materials for the aviation industry, located at Abington Township, Montgomery County, PA. For updates on this incident, visit Abington Township’s website: https:// www.abingtonpa.gov/departments/ fire-and-code-services/emergencymanagement-and-planning/spsfire; the SPS Technologies website is:https://www.spsupdates.com/.]

As an aside, Paris Air Show firm orders and options for large commercial transports totaled 192 aircraft; there was a memorandum of understanding (MOU) for another 150 aircraft. While these are modest numbers, given most program backlogs are eight-plus years in length, there isn’t reason for concern. Looking ahead, we project aircraft production value to increase at 7.7 percent compound annual growth rate (CAGR) from $158 billion dollars in 2024 to $228 billion in 2029. Air transport is expected to grow the fastest at 10.1-percent CAGR from $81 billion to $122 billion. More importantly commercial air transport goes from 51 percent to 58 percent of total production value (preCovid, it was 67percent). Military is expected to grow at 6.8 percent CAGR but business and general aviation (BGA) growth slows to 1.3 percent per annum. The return to higher growth rates is due to the lowerthan-expected 2024 results. This forecast reflects the view that aircraft production growth will continue to be supply constrained.

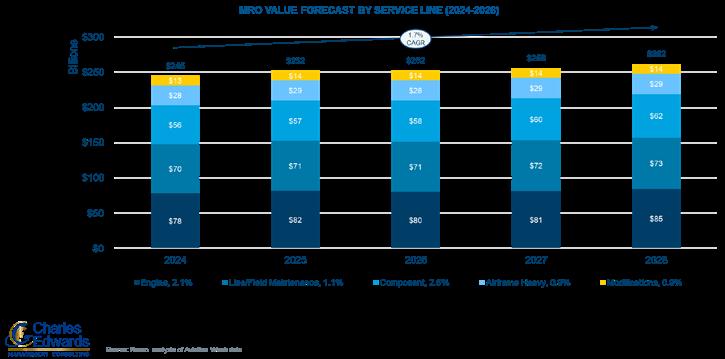

On the aftermarket side (titanium demand is partly driven by titanium replacement parts), the maintenance, repair and overhaul (MRO) market value was $245 billion in 2024 and is expected to grow at 2.9 percent to $252 billion in 2025. MRO continues

to benefit from strong air traffic demand as well as under-delivery of new aircraft (old aircraft continue to fly for longer). However, MRO is also experiencing labor and parts shortages. In addition, MRO capacity is constrained and the return of air travel to pre-COVID levels is driving up wait times to get into overhaul shops. Looking further out, we forecast MRO will grow at 1.7 percent CAGR from $245 billion in 2024 to $262 billion in 2028.

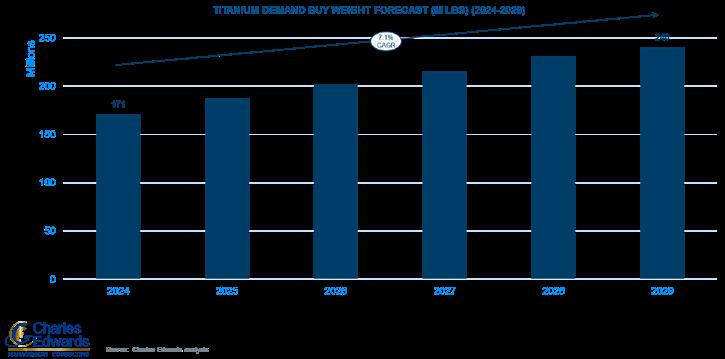

Aerospace raw material demand is based on material for aircraft production as well as material consumed in spare parts for MRO. Charles Edwards’ raw material model breaks down aircraft fly weight into material composition by material family (i.e., aluminum, steel, titanium, nickel, and composites),

aircraft system (i.e., aerostructures, engines, equipment systems, interiors, etc.), and other distinctions. Our forecast considers material substitution over time, changes in aircraft and engine OEM production mix, and other market dynamics. We then build up buy-to-fly ratios based on typical material removal during processes such as forging, machining, and forming. The result is a buy weight composition by aircraft which we apply to the production forecast to arrive at aggregate raw material demand based on production. MRO material demand is based on expected spares requirements for repair and overhaul events.

The aerospace industry demanded 1.43 billion pounds of raw materials in 2024 across all the raw material families, a 5.1 percent increase from 2023. We forecast aerospace raw material demand will grow at 5.5

Established in France (Lyon), the stockist Acnis Group is one of the world leaders in the distribution of metal alloys especially in TITANIUM, in all forms : sheets, bars, tubes and powder for 3D printing.

ISO 13485 certified since 15 years , the family business has specialized in the medical field since its creation in 1991, to meet the demand of orthopedic manufacturers and dental implants, as well as surgical instruments.

ACNIS Group acts as a buffer between producers and users, thanks to its 600 to 700 tons rotating stock and 1,300 references of different origins. Our unique cut-to-size service center (15 machines: waterjet, high-definition waterjet, plate sawing, bar sawing, shearing, machining, chamfering) allows us to reduce your costs by optimizing scrap rates.

As a result, the company is able to deliver very quickly its customers, in barely a week , no matter the ordered quantity. Major implant manufacturers among the main American and European OEMs themselves call on ACNIS Group to source their metal alloys.

The last creation of ACNIS USA stock in 2023 in Chicago has changed the game. Acnis Group is now the only distributor that can stock and deliver any quantity in North America (ACNIS TITANIUM & ALLOYS USA-Chicago), South America (ACNIS DO BRAZIL-Sao Paulo), Europe (ACNIS FRANCE-Lyon), South Asia (ACNIS CHINAShanghai) for global worldwide contracts.

Acnis is your one-stop shop for all TITANIUM grades, stainless steel (316L, 420B, cobalt chrome, 17/4 PH, high nitrogen alloy, Custom 455, Custom 465…) and polymers

Our dental subsidiary BCS , a European leading distributor of CAD CAM products for additive manufacturing, is registered with the FDA for titanium powder & discs, and cobalt chromium powder.

ACNIS TITANIUM & ALLOYS

1940 E Devon Elk Grove Village 60007 - IL - USA

dfreitag@acnis-titanium.com

kragan@acnis-titanium.com

224-550-2422

percent CAGR from 1.43 billion pounds in 2024 to 1.87 billion pounds in 2029. The reason the CAGR is lower than overall production value is that raw material production precedes finished aircraft production by some period of time; therefore, raw material production is starting from a higher base in 2025 relative to final production.

The supply chain is still recovering, constraints persist in certain key areas, and there is not yet a line of sight to schedule harmonization. That’s the bad news. The good news: suppliers were upbeat.

—Peter Zimm, Charles Edwards Management Consulting

7. Tariffs on imports from Canada, Mexico, and China were treated separately from the reciprocal tariff process.

From our discussions at the Paris Air Show it appears that there is an oversupply of raw material at the aircraft OEMs and in the channel. This again is due largely, but not wholly, to the work slowdown and eventual stoppage at Boeing— suppliers also reported finally receiving past due double orders placed in 2021-2022. We believe that this state of affairs mainly applies to aerostructures-destined material, including titanium.

There were weekly and sometimes daily tariff announcements in the first seven weeks of Donald Trump’s second term, culminating in the Liberation Day reciprocal tariffs announced on April 2, which were to have gone into effect on April 9th. Those were then deferred for 90 days (until July 9th) so that countries could negotiate trade agreements with the Trump Administration. In the lead up to the resumption of tariffs on July 9, some countries were warned with the specter of higher tariffs and everyone was given a reprieve until August 1. By that deadline the European Union, Indonesia, Japan, Pakistan, the Philippines, South Korea, the U.K., and Vietnam had come to terms with Trump but 92 countries who didn’t conclude agreements by August 1 saw levies go into effect on August

Relevant to aerospace, Section 232 tariffs on aluminum and steel, initially set at 25 percent in March, were raised to 50 percent in June (except for the UK whose tariffs remain at 25 percent). Tariffs on imports also impacted aerospace finished and semi-finished parts were also subject to tariffs, although over time many (most?) imports from Canada and Mexico were found to be exempt under the United States, Mexico, Canada (USMCA) trade agreement.

We also asked suppliers at the Paris Air Show how they are dealing with trade and tariff uncertainty. For the most part, suppliers have thrown their hands in the air and are waiting for the final answer, whatever it is (whenever it should come). Suppliers are being careful about purchases because no one wants to end up with raw material on their shelves with a

higher inventory value because of having paid tariffs; as a result, no one is buying ahead right now. In a few cases, we heard of suppliers shifting production or logistics in order to avoid tariffs. Still others are having to pay the tariffs and are seeking reimbursement from their customers, with mixed success. Some distributors are passing on the tariffs, others are not.

Titanium is used throughout the aircraft: in the engine (e.g., compressor discs, blades and vanes, and cases), components/equipment systems (landing gear, ducting), and aerostructures (chords, spars, wing boxes, and pylons). Titanium is also used in the nacelle, fasteners and brackets, and interior parts. Charles Edwards estimates 2024 aerospace titanium demand was about 171 million pounds. Engines (about 40 percent), equipment systems (about 25 percent), and aerostructures (about 30 percent) consumed most of aerospace titanium. Two-thirds of total aerospace titanium consumption ends up as finished parts on either an Airbus or a Boeing aircraft. The other one-third is ultimately consumed by the rest of the aircraft OEMs.

The European Court of Justice has overturned the European Union’s 2020 classification of titanium dioxide in certain powdered forms as a suspected carcinogen when inhaled. The ruling confirms an earlier decision by the General Court, which considered that European authorities had made a “manifest error” in their assessment.

This verdict is a victory for industrial lobby groups who have resisted the classification and a major setback for public health, according to a statement by the EU consumerwatch organization ‘foodwatch.’ The group issued a statement on this ruling by the court: Link to original foodwatch press release: https://www.foodwatch.org/ en/eu-court-overturns-titaniumdioxide-classification

Natacha Cingotti, foodwatch international senior campaigns strategist, said that “this is an undeniable victory for the powerful industrial lobbies that have put significant pressure on the European authorities throughout the classification process and refused to provide authorities with adequate information on the nanoforms of the substance.”

The legal battle originated when multiple industry groups challenged the classification adopted by the European Commission in 2020 under the EU Regulation on the Classification, Labelling and Packaging of chemicals (CLP). The classification was based on a

‘This is an undeniable victory for the powerful industrial lobbies that have put significant pressure on the European authorities throughout the classification process and refused to provide authorities with adequate information on the nanoforms of the substance.’

—Natacha Cingotti, foodwatch international senior campaigns strategist

scientific opinion from the European Chemicals Agency (ECHA), which considered that the available scientific evidence indicated that the inhalation of certain forms of titanium dioxide particles could pose cancer risks to humans.

For foodwatch, the court’s final judgment is contradictory and could invite further legal challenges of hazard classifications by industry lobby groups in the future. While the ruling acknowledges that the General Court exceeded its legal competences by questioning the scientific methodology behind ECHA’s decision, it nevertheless upholds the annulment of the safety classification.

In February 2025, the court’s own

advocate general had supported the original classification, considering that it was not for the General Court to question ECHA’s scientific approach and that there was no manifest error of assessment in the way the agency reviewed and weighed the scientific evidence.

The ruling could establish a dangerous precedent for future legal battles on chemicals’ safety classifications, potentially emboldening industry challenges towards regulators’ decisions following complex assessments. In the case of titanium dioxide, industry groups refused for years

to provide ECHA with adequate information on the nanoforms of the substance, which critically hampered their evaluations. The EU consumerwatch group warned that “one can expect that this situation will happen again in the future, especially for nano-substances.”

Consumer advocates indicated that this may compromise the EU’s ability to protect public health from hazardous substances, according to foodwatch. The CLP Regulation serves as a cornerstone of consumers and workers protection. Its classifications lead to harmonized labelling and packaging throughout the value-chain and they can inform restrictions in sectoral regulations, such as for cosmetics and toys.

While the judgment concerns the hazard classification of the substance and its labelling and packaging throughout the value chain, it does not affect the existing bans on the use of titanium dioxide in food additives. The additive, known as E171, was banned across the EU in 2022 following a risk assessment by the European Food Safety Authority (EFSA), which concluded that its safety could not be guaranteed, including due to the impossibility to rule out the risk of genotoxicity. The court ruling on the carcinogenicity of titanium dioxide serves as “a stark reminder that the battle between industry interests and public health protection remains far from resolved in European chemical regulation,” according to foodwatch. foodwatch is a non-profit, member-driven organization. To maintain its independence,

foodwatch refuses state and EU funds, financing itself through contributions from supporting members and donations. foodwatch has a strong presence across Europe, with national offices in France, Austria, Netherlands, Germany and a representation in Brussels. The role of foodwatch international is to oversee and streamline the collaboration of these national offices.

According to the mission statement on its website, foodwatch fights for safe, healthy and affordable food for all people. “We give consumers a loud voice, speak up for transparency in the food sector and defend our right to food that harms neither people, nor the environment. We uncover and challenge food industry practices that violate the rights or interests of consumers, with the aim of forcing political decision makers to address loopholes in European and national food policies. By conducting research, exposing scandals, mobilizing consumers and lobbying governments, foodwatch provides an important counterweight to the power of the food industry. Our campaigns have raised awareness on a range of vital topics and led to successful legal challenges and some significant changes in food industry practices and governmental policy.”

Natacha Cingotti joined the foodwatch international team in February 2024 to strengthen the strategic development and implementation a cross-country advocacy and campaigning towards a safer, healthier, more sustainable, and democratic food system. She brings with her over a decade of advocacy and campaigning

experience in civil society networks engaged for social and environmental justice.

Between 2017 and 2024, Cingotti led the health and chemicals program at the Health and Environmental Alliance (HEAL), which involved following and opposing the authorization and renewal processes of harmful chemicals used in industrial and agriculture settings and advocating for overhauled regulations in those fields (e.g. endocrine disruptors, PFAS, pesticides, biocides), taking legal action to promote faster restrictions of known environmental pollutants, translating scientific knowledge on chemicals for policy uptake, working closely with investigative journalists to increase public awareness on the societal challenges of chemical pollution. n

[Editor’s notes: foodwatch uses a lower-case “f” as its official organization name, which is why it appears that way in this article. Here is a link to the press release (No. 99/25) for the Court of Justice of the European Union, Luxembourg, Aug. 1, 2025: “Court of Justice upholds the annulment of the classification of titanium dioxide in certain powder forms as a carcinogenic substance:”

https://curia.europa.eu/jcms/upload/ docs/application/pdf/2025-08/ cp250099en.pdf

Here’s a link to foodwatch website: https://www.foodwatch.org/en/ foodwatch-international]

efficiency

More reliability: Built robust, with high precision as the benchmark Innovation and reliability for your success: The KASTOtec

More innovation: Intelligent control and user friendly operation

Smarter storage for maximum space efficiency: UNITOWER More space

More efficiency: Save time with direct access—no additional lifting equipment needed

More flexibility: Modular, heightadjustable supports for up to 3 loading heights

Low in price, high in performance: KASTObloc

More precision: excellent performance for smaller block dimensions or lower plate weights

More safety: perfect for cutting remnant pieces

By Michael C. Gabriele

As current headlines track political and economic discussions over tariffs, trade policies and geopolitical uncertainties, the status of supply chains remains a focus for business in the titanium industry. The disruption of international supply chains became a critical issue during the years of the Covid-19 pandemic. Today, questions and concerns still exist as U.S. titanium industry weighs the near-term possibilities (and risks) of “reshoring” some links in its supply chain.

Jeffrey Easto, vice president of supply chain for PCC Metals and Forgings, who leads the global supply chain strategy for that business group, including TIMET, is one executive who shared his thoughts on this complex topic. TIMET (website: https://www.timet.com/), with headquarters in Warrensville Heights, OH, is a pioneering U.S. company and a cornerstone of the titanium industry, founded in 1950 as the Titanium Metals Corporation of America.

TITANIUM TODAY contacted Easto to obtain his insights regarding current business conditions and industry trends for titanium supply chains. The following is a question and answer format that presents his feedback.

Describe your role and responsibilities at TIMET. What are your primary assignments in terms of business in the titanium industry?

My responsibilities span the oversight of raw material procurement, MRO (Maintenance, Repair, and Operations), and capital development projects. I drive strategic alignment across supply chain functions to support operational efficiency, cost optimization, and long-term growth.

There are many concerns regarding supply chain issues for American business; both in general and specifically for the titanium industry. What are the primary issues these days when it comes to the titanium industry’s supply chain?

There are several areas of concern regarding the titanium industry’s supply chain. Currently, economic uncertainties surrounding tariffs are likely the most significant factor. As the raw material landscape continues to evolve, it is crucial to understand how these tariffs will affect the supply chain, particularly in China, which is becoming an increasingly important supplier of titanium sponge to the U.S. industry. Additionally, substantial melt capacity in the United States has either recently been activated or will be coming online within the next 12 months, which may lead to constrained raw material markets as the raw material manufacturers move to increase their capacity.

Are these supply chain issues due to the “hangover” from the days

of Covid-19?

Are they related to recent geopolitical dynamics regarding the war in Ukraine?

The residual effects of the Covid-19 pandemic and the geopolitical dynamics resulting from the conflict in Ukraine have become more stable across the industry over the past year. The current emphasis will likely be on how economic uncertainties related to tariffs influence demand within the aerospace sector, as well as potential adjustments in supply chain strategies to mitigate tariff-related risks.

The business press reports on challenges for industry supply chains, but we hear virtually no potential solutions to address the situation. From your perspective as a TIMET executive, what are some practical, real-world ways for companies in the titanium industry to adjust/overcome these issues?

TIMET is implementing several practical measures to enhance our supply chain and believes that we are well prepared to support the industry both in the near and long term. Firstly, it begins with obtaining accurate demand signals from our customers, enabling us to collaborate with them to better position their businesses for future success. The war in Ukraine has caused significant shifts in the U.S. titanium supply chain, making it crucial to understand not only

Fe, Ni, Co, & Cu Alloys

600 Pound Capacity

6" Rounds or 6” x 11” Slabs

Vacuum Arc Remelting

Reactive and Non-Reactive Alloys

6”–20” Crucible Diameters

100–5000 Pound Ingots

R&D Melting

300

Bar Peeling - 0.5" - 6" Diameter

Bar Polishing - 0.5" - 8" Diameter

Lathe Turning - up to 17" Diameter

Saw Cutting - up to 30" Diameter x 5,000 Pounds

aggregate demand but also the mix of various alloys. Details are essential when building a resilient downstream supply chain.

Next, it is vital to partner with our suppliers so they can undertake similar activities in preparing their supply chains and investing in CAPEX and capacity expansion. I believe that the macroeconomic indicators in the aerospace market remain incredibly strong, and overall, I am optimistic about longterm growth within the titanium industry. I encourage the supply base to critically evaluate their internal strategies to ensure they are positioned to compete for the anticipated growth in the coming years.

Finally, given the uncertainty surrounding tariffs, we are focusing on creating a more agile supply chain. Although this can be a labor-intensive process, it is important to continually qualify new suppliers and ensure diversification across our entire supply chain. This practice not only helps to ensure continuity of supply but also provides more options for potential tariff mitigation and cost control.

Do supply chain worries put a premium on domestic titanium scrap? Are supply chain worries spurring expanded efforts to collect scrap?

Several factors influence the titanium scrap market, with overall scrap supply and demand being paramount. Additionally, an effective scrap segregation and collection process is crucial for recycling into the aerospace industry. With increased melt capacity coming online, there is likely to be a rise in scrap demand and a potential shift in preferred forms. It is essential to minimize the amount of scrap entering the sacrificial market, which

is currently mitigated by low ferrotitanium prices. These prices provide financial incentives for producers to segregate scrap effectively. Finally, I would like to encourage the industry to collaborate with melters, specifically TIMET, as we are confident in our position as industry leaders in revert utilization and closed loop processes.

Titanium is a strategic metal, and the United States gets titanium sponge from Japan and other countries. We also know there’s a demand for “premium-grade” sponge needed for aerospace manufacturing. Is the U.S. titanium industry is potentially at risk because there’s no longer any domestic sponge production? Are there any discussions in the titanium industry to restart domestic sponge production? Is it economically feasible?

In 2019, TIMET made a significant effort to retain sponge production capability at our facility in Henderson, NV. However, those efforts were ultimately unsuccessful, leading to the closure of the last domestic sponge production facility. I’m aware of ongoing discussions exploring the feasibility of reestablishing sponge production in the United States. That said, this is a complex issue—building the necessary infrastructure is both capital-intensive and timeconsuming.

While aerospace-grade sponge is produced in several countries, the United States currently imports the majority of its supply from Japan. Given the strong trade relationship between the United States and Japan, this supply chain is considered highly stable. With demand continuing to grow, we are seeing investment in capacity expansion by Japanese producers. At the same time, there has been a noticeable increase in

Chinese sponge imports to the United States, which may be an early indicator of emerging concerns around global capacity and pricing pressures.

Earlier this year TITANIUM TODAY published an article on a bipartisan bill by Sen. Catherine Cortz Masto (D-Nev.) “The Securing America’s Titanium Manufacturing Act of 2024” to support America’s supply chain and promote investment in the U.S. defense industrial base [https://issuu.com/titaniumtoday/ docs/titanium_today_ issue_13_2025_all_markets]

Is this potential piece of legislation on target? Is this a bill that the titanium industry could/should support?

The bipartisan bill introduced by Sen. Cortez Masto is an important and beneficial piece of legislation for the industry. Currently all U.S. producers are at an economic disadvantage when competing globally as they are subject to a 15-percent import tariff on titanium sponge even though there is currently no domestic capability to produce sponge. The tariff is impactful as it hinders the U.S. producers when competing globally not only for titanium ingots but downstream products such as mill products and forgings. I see this as a key piece of legislations that will further strengthen the U.S. titanium manufacturing industry focusing on keeping jobs and production in the United States.

We’ve tracked various news stories on Ukrainian titanium: [https://www.barrons.com/news/ ukraine-titanium-mine-hopes-usdeal-will-bring-funds-de886863 [barrons.com]

https://www.cnn. com/2025/02/27/europe/ukraine-

titanium-mine-rare-earth-trumpdeal-intl-hnk/index.html [cnn.com]

https://www.france24.com/en/ live-news/20250306-ukrainetitanium-mine-hopes-us-deal-willbring-funds [france24.com]]

Does any of this titanium mining in Ukraine play into the needs of the U.S. titanium industry?

Ukraine has developed titanium feedstock deposits as well as the capability to produce titanium sponge. The recent agreement between President Donald Trump and Ukrainian President Volodymyr Oleksandrovych Zelenskyy makes this a very interesting region with a potential for further development and growth in the future. What I currently don’t know is the impact the war in Ukraine has had on those facilities and what effort would be required to have them once again supply sponge in the U.S. aerospace market.

Finally, how are supply chain concerns having an impact on nearterm business trends? Have there been any “spot shortages” when it comes to titanium demand in aerospace, industrial, automotive business sectors?

Overall, I see very positive macroeconomic indicators within the aerospace and titanium industries. Passenger travel data continues to be strong and both Boeing and Airbus have incredibly strong backlogs. Although we may see some puts and take in the near term, overall we are still incredibly bullish in the titanium industry as a whole and TIMET feels we are well positioned for market growth with bringing our new state of the art melt shop online in Ravenswood, VA, in 2026. n

[Editor’s note: As stated on its website, TIMET is a manufacturer of titanium melted and mill products, including ingots, billets, bars, plates, and sheets. The company plays a critical role in supplying high-performance titanium materials to industries such as aerospace, defense, and industrial manufacturing. With production facilities in both the United States and Europe, TIMET maintains a strong global presence. It operates as a subsidiary of Precision Castparts Corp. (PCC), acquired TIMET in 2012, contributing to PCC’s broader portfolio of advanced metal components. PCC is a leading manufacturer of complex metal components for aerospace, energy, and industrial market, known for high-performance castings, forgings, and fasteners.]

Titanium demand grew at 13.3 percent from 2023 to 2024 in anticipation of the resumption of aircraft build rates. Most impactful to titanium demand in 2024 were:

• Aircraft production rates. While 787 production grew in 2024, by our estimates A350 aircraft actually fell.

• Aircraft production mix. The slowdown and eventual stoppage of 737 MAX production changed the mix of what was actually consumed. Note that manufacture of the 767 and 777 were also halted during the strike.

Charles Edwards forecasts that titanium demand will grow at a robust 7.1 percent CAGR from 171 million pounds in 2024 to 240 million

pounds in 2029.

Four titanium suppliers—ATI, Howmet, Timet (part of PCC), and VSMPO—supply the majority of titanium alloy mill product to the aerospace industry. Beginning with Russia’s full scale invasion of Ukraine in 2022, buyers have moved to reduce their dependence on VSMPO. At the same time, other suppliers have made physical plant capacity investments (with more to come, especially in the case of Timet) but have likely not made up fully for the loss of VSMPO’s capacity.

Our aerospace titanium raw material report profiles aerospace market demand in detail for titanium mill product, assesses upstream

supply risks, and comprehensively analyzes aerospace titanium supply. It is available at www.aerooutlook. com. n

[Editor’s note: Peter Zimm is a principal at Charles Edwards Management Consulting, Gilbert, AZ, and is co-author of “Aerospace Titanium - Global Market Outlook and Supply Risk Assessment,” a comprehensive report on the market aerospace titanium mill product that is available at AeroOutlook. com. AeroOutlook offers premium aerospace industry market reports meticulously curated and authored by distinguished aerospace market experts. This article summarizes some of the key findings from the 2025 edition of that report.]

At Kymera International, we’re at the forefront of advanced titanium solutions for the aerospace industry, delivering precision-engineered materials that power the future of flight. Our titanium powders, master alloys, and fully integrated titanium metallurgical products are trusted by leading aerospace manufacturers worldwide to meet the most demanding performance standards.

• Superior Strength & Lightweight Performance – Ideal for critical aerospace applications

• Unmatched Purity & Consistency – High-quality titanium powders and alloys

• Global Manufacturing & Supply Chain Strength – Delivering reliability at scale From high-performance jet engines to structural airframe components, Kymera International is the trusted partner for aerospace engineers and manufacturers looking for cutting-edge titanium solutions.

By Ing. Uwe Haissl, Vice President Special Metallurgy Division, INTECO melting and casting technologies GmbH

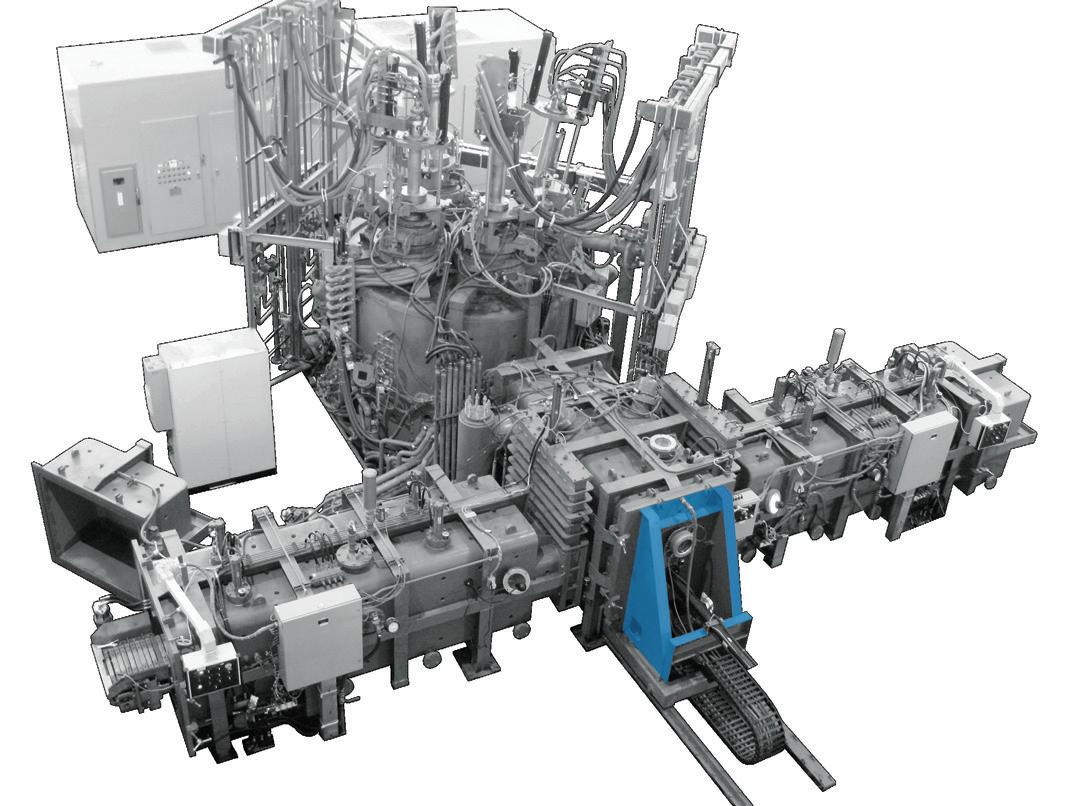

INTECO Melting and Casting Technologies GmbH, (website: https:// www.inteco.at/) is an Austria-based engineering company specializing in the supply of equipment and technology for the titanium and steel industries. Driven by the current challenges on the titanium and raw materials market and in line with the global target of reducing carbon emissions and primary raw materials consumption, the trend for titanium producers to increase the recycling rates in their production processes is on the rise.

Following this demand of the industry, INTECO has developed a new “Vacuum Arc Cold Hearth Skull Melting and Casting” (VA CH SM) process and design concept, which is based on the well-established skull melting and casting process and industrially proven cold hearth technologies. This new plant design concept, which allows the semi-continuous feeding of scrap (e.g., compacted chips) or other raw material (e.g., master alloys, titanium sponge) into the melting and casting process without breaking the vacuum between the melting and casting cycles. Two different casting techniques (static and dynamic casting) can be applied, allowing highest flexibility in production. With this new concept, recycling rates of up to 100 percent can be achieved as the process is able to produce its own melting electrode out of scrap, thus providing its own melting feedstock.

INTECO’s new VA CH SM furnace has already been realized at BaoTi in Baoji, (China), which is

one of the largest titanium producers in China. The system was put in operation by INTECO beginning of 2023 and has been operating at 100 percent capacity (full production mode) ever since. To increase the productivity and consequently also the recycling rate, a batchwise scrap feeding system has been implemented, allowing an annual production capacity of approximately 2,000 metric tons of cast product.

consumable electrode, known as the “Mother Electrode,” from scrap. Thus, a recycling rate of up to 100 percent can be realized. In addition to high recycling rates, the vacuum arc cold hearth process operates with significantly lower energy consumption, approximately onethird less in kilowatt-hours per ton, compared to other cold hearth melting and casting processes.

The oval-shaped cold hearth

INTECO’s new VA CH SM furnace has already been realized at BaoTi in Baoji, (China), which is one of the largest titanium producers in China. The system was put in operation by INTECO beginning of 2023 and has been operating at 100 percent capacity (full production mode) ever since.

The total material turnover (recycling capability) of this installation exceeds 4,000 metric tons per year. With the integration of a specially designed oval-shaped cold hearth skull crucible, the feeding of cost-effective recycled material (such as compacted chips) and other raw material (e.g., titanium sponge, master alloys) between the melting and casting cycles can be realized.

Up to six melt and casting cycles can be conducted without breaking the vacuum inside the furnace atmosphere, allowing the usage of up to 5.000 kg of scrap per each melt sequence. With such high quantity of scrap material available for addition, the furnace has the capability to not only produce cast products but also generate its own

skull crucible is equipped with an integrated magnetic stirring coil system, offering additional metallurgical advantages. By inducing a magnetic field, a controlled movement of the liquid melt bath is provided, increasing the homogenization and dwell time of the material in the turbulent liquid phase for improved dissolving of lowdensity inclusions (LDI). The larger high-density inclusions (HDI) are effectively trapped within the mushy zone of the “cold hearth” through the gravity segregation effect inherent in the cold hearth process.

Additional advantages of the magnetic stirring coil are the stabilisation of the arc through the centering of the arc below the electrode tip which decreases the

IperionX is a leading American titanium metal and critical materials company - using patented metal technologies to produce high performance titanium alloys, from titanium minerals or scrap titanium, at lower energy, cost and carbon emissions.

risk of so-called side-arcing and reduction of voltage peaks during the melting process. The homogenization of the energy input is also further improved by horizontal movement of the oval shaped cold hearth skull crucible during the melting process. This motion allows the electrode to gradually cover the entire crosssection of the elongated crucible, respectively the metal scrap inside.

From technical, economic, and ecological perspectives, titanium scrap recycling is gaining importance. Besides lowering production costs, reducing carbon emissions is another driver for increasing recycling rates.

A key challenge is removing high-density inclusions (HDI, e.g., tungsten, molybdenum), low-density inclusions (LDI, e.g., titanium nitride), foreign particles, and interstitially dissolved non-metallic elements. While small LDIs can dissolve during the liquid phase’s dwell time, HDIs resist dissolution due to higher melting points and densities, even at sub-millimetre sizes. Therefore, extended dwell times combined with segregation trap mechanisms during melting and casting are proven methods to minimize foreign particle and inclusion transfer into cast products.

Electron-beam melting (EBM), plasma arc melting (PAM) and

vacuum arc remelting (VAR) (see Fig. 1 below) are the current recycling melting technologies for titanium, which are well established in the industry, especially in the United States.

An alternative cold hearth process using an electric arc power source was developed in the USSR (e.g., at VSMPO, Russia). This batchwise “Vacuum Arc Cold Hearth Skull Melting and Casting” process achieves casting capacities up to 7,000 kg.

Arc Hold Hearth Skull Melting, Casting

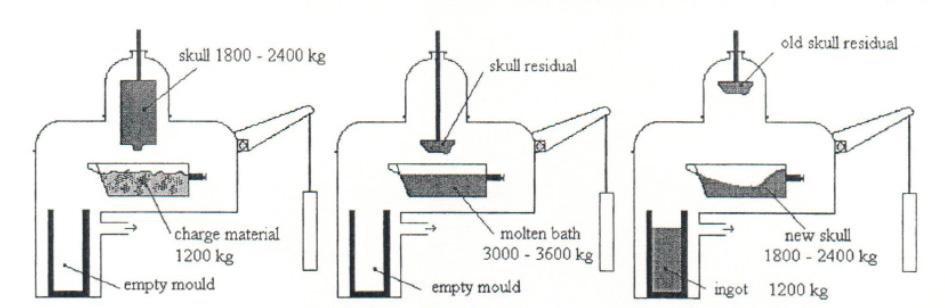

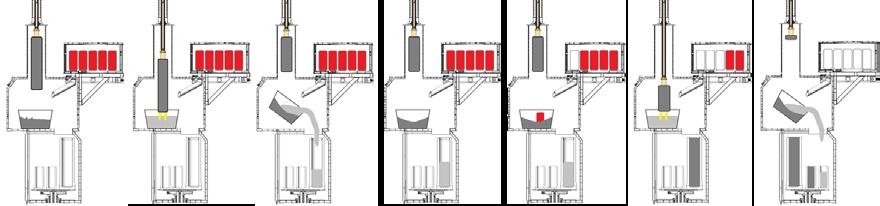

The Vacuum Arc Cold Hearth Skull Melting and Casting (VA CH SM) process is essentially a Vacuum Arc Remelting (VAR) process using a

rectangular water-cooled copper crucible, allowing molten material to be cast under vacuum into a steel or copper mold. Conducted in a vacuum-tight chamber, an electric arc is struck between a consumable electrode and the crucible, pre-filled with titanium scrap and/or other raw materials. Both the electrode and crucible contents are melted until a set fill level is reached. The arc is then shut off, and the remaining electrode rapidly retracted. The crucible is subsequently tilted to pour the melt into the casting mold (see Fig. 2).

Typical products are round ingots which are again remelted once or twice in a VAR plant or slabs which

can be directly hot processed by rolling (see Fig. 3).

The residual liquid metal left in the crucible after casting forms a “skull” on the copper surface. This skull is essential for refining and dissolving input materials, enabling efficient vacuum metallurgy. It also traps metallic impurities and reduces interstitial dissolved, non-metallic elements (Fig. 4). shows a skull from a rectangular copper crucible.

Standard vacuum arc skull melting in round crucibles leaves about 10 percent skull weight relative to the liquid volume. In contrast, the “classic” vacuum arc cold hearth process can retain up to 60percent skull weight to create a “skull electrode” for the next melting cycle (see Fig. 4). Thus, each cycle produces one ingot/semi-finished product and a consumable electrode for the next operation.

Developed in the mid-20th century, VA CH SM technology has seen few process improvements beyond increased casting capacities. It faces productivity limits due to plant design, intensive manual labour, and limited casting flexibility. These challenges, along with customer demands for higher recycling rates, prompted INTECO to rethink the established process and develop an innovative furnace concept with new features.

new VA CH SM furnace at BaoTi in China, as mentioned above.

To increase productivity and recycling rates, a batch-wise scrap feeding system and a specially designed oval-shaped cold hearth crucible were introduced. This enables feeding of cost-effective recycled material (e.g., compacted chips) and other raw materials (e.g., titanium sponge, master alloys) between melting and casting cycles. Up to six cycles can be performed without breaking the vacuum, using up to 5,000 kg of scrap per melt. The furnace can produce both cast products and a mother electrode from scrap, achieving up to 100-percent recycling rate.

The process also consumes about one-third less energy in kWh per ton than other cold hearth methods. The crucible integrates a magnetic stirring coil system, inducing controlled melt movement to improve homogenization and extend dwell time for better dissolving of low-

density inclusions (LDI). Larger high-density inclusions (HDI) are trapped in the mushy zone by gravity segregation. Magnetic stirring also stabilizes the arc by centring it beneath the electrode tip, reducing side-arcing and voltage peaks during melting.

Energy input homogenization is further improved by horizontally moving the cold hearth crucible during melting, allowing the electrode to cover the entire crucible cross-section and scrap material. Besides the new cold hearth melting process, the crucible can also be configured to attach a connecting “stub” to the skull, creating a “skull electrode” for the next heat, as in the classic process (see Fig. 4).

The new VA CH SM design offers maximum flexibility for different casting technologies. Alongside conventional static casting for ingots, slabs, and investment casting parts, it includes a centrifugal casting system with mold speeds up to 300 rpm for complex products with improved properties. An auto-balancing system detects and corrects any imbalance during rotation. Additionally, a vacuum slide gate separates the casting and melt chambers, allowing mold preparation without breaking the melt chamber vacuum.

Pictured in Fig. 5 is INTECO’s

The new VA CH SM plant can be vertically integrated into existing titanium production lines using the same auxiliary equipment (see Fig. 6). It supports both the standard vacuum arc skull melting process with a round crucible (circled in red) and the new cold hearth process (circled in green). Consumable electrodes can include self-produced solid

Master alloys for Titanium Industry.

Nickel based Master Alloys.

Ni, Co, Mo & Fe based Super Alloys Bar Stock.

Equiaxed, Super Alloy Bar Stock suitable for making

Directionally solidified Single Crytsal Investment Casting.

titanium, sponge electrodes, or skull electrodes. Existing weighing, blending, and compacting equipment can be used for scrap and raw material preparation.

A typical static casting sequence using the full capabilities of the new VA CH SM Process (as at BaoTi) proceeds as follows:

2. The consumable mother electrode is loaded and centered over the crucible. Molds are prepared and placed on the rotating casting table. Chambers are sealed and vacuum pumping initiated.

3. The electrode is lowered, an arc ignited with the skull material, and melting begins. Liquid titanium from the mother electrode, added materials, and partial permanent skull melting collects in the crucible.

4. When a set electrode length is consumed and maximum melt level reached, power is switched off

1. Each cycle begins with manual installation of the permanent skull/cold hearth (e.g., Grade 5 skull plus scrap, titanium sponge, master, and elemental alloys). If unavailable, the crucible is filled with scrap to form a working skull.

and the electrode rapidly retracted. The crucible is tilted quickly to pour the melt into a mold.

5. The crucible returns to melting position, leaving a semi-solidified working skull.

6. A scrap batch is added via the revolver feeding system, and melting continues until the molds are filled.

7. Once the electrode and scrap batches are consumed, melting ends, casting cools, vacuum is broken, and cast products removed. The permanent skull is either reused or replaced in case of a grade change.

In late 2023, over 50 hot tests and production heats were conducted using round and cold hearth skull melting crucibles. Most melts were CP grades (commercially pure) and grade 5 (Ti-6Al-4V). Notably, several successful Zirconium melts and casts were also performed, demonstrating the INTECO VA CH SM furnace’s capability for other highly reactive metals.

During the hot test phase, static ingot casting, investment casting, and centrifugal casting were performed. The following products are examples of each method, highlighting the process’s diverse casting capabilities.

Product: Material: Melting operation: Valve body Grade 5 Titanium Round skull melting crucible

Product:

Product weight:

Added scrap weight: Total casting cycles: Material: Melting operation:

Multi-cast ingot, D 800 mm

5.542 kg

2.835 kg

6

CP Grade 2 VA CH SM with scrap addition

Product: Material:

Rotational speed: Melting operation: Rotor

CP grade 2 45 rpm Round skull melting crucible

Alongside metallurgical results, the specific energy consumption of the VA CH SM operation was closely evaluated. Five test melts using a cold hearth skull crucible and batch-wise scrap addition were conducted with TA2 (Commercially Pure Grade 2) titanium. Initial results show an energy consumption of around 1000 kWh/t (Fig. 8), about one-third that of other cold hearth technologies like electron beam and plasma arc melting (Table 1). This low consumption is mainly due to the insulation effect of the initial scrap/skull base charge and the enthalpy of liquefied titanium.

The stirring coil’s positive effect and efficiency are visible via two video cameras monitoring the melting process from above (Fig. 9). The controlled swirl movement of the liquid melt and its direction change when the coil polarity switches every ~15 seconds are clearly observed. Operating data for the magnetic stirring coil is provided in Table 2.

Table 2. Operating data of the magnetic stirring coil.

Summary and Future Outlook

INTECO has developed a new Vacuum Arc Cold Hearth Skull Melting and Casting furnace by redesigning and enhancing the proven process. A specially designed oval-shaped cold hearth crucible and scrap feeding system enable costeffective recycled and raw material feeding between cycles. By producing

its own consumable Mother Electrode from scrap, up to 100 percent recycling is achievable. The process consumes about one-third of the energy (kWh/t) compared to Electron Beam and Plasma melting. An integrated magnetic stirring coil enhances melt bath movement, improving homogenization, dwell time, and dissolving of LDIs.

The plant design combines static and dynamic casting methods in one system, offering maximum flexibility. The new VA CH SM process also enables large-batch production of special titanium alloys like γ-TiAl and NbTi for superconductors. Beyond titanium, it can melt and cast other reactive and high-end alloys (Zr, Ni-, Co-based) under vacuum in various shapes. Future developments include improved solidification control for hot topping, macrostructure (equiaxed, directional, or single crystal), and crystal growth, plus expanded pouring capacity beyond 5,000 kg to match the largest existing installations. n

SYSTEMS FOR AVIATION INDUSTRIES MELTING SYSTEMS � VIM Master Melting � VAR � ESR � EB Melting � PA Melting

�

�

�

�

�

NEAR NET SHAPE TECHNOLOGY COATING SYSTEMS

CASTING SYSTEMS

� VIM-IC � Leicomelt with Cold Crucible

� VAR Skull Melting HOT ISOTHERMAL FORGING (HIF)

METAL ADDITIVE MANUFACTURING

� EIGA: Ceramicfree Metal Powder Production

� VIGA: Inert Gas Atomization Equipment

� EB-PVD SYSTEMS

Electron Beam Physical Vapour Deposition (EB-PVD) of Thermal Barrier Coatings (TBC)

TREATMENT SYSTEMS

SYNCROTHERM® Total Integration of Heat Treatment into Component Manufacturing

NEW DELHI, India—The International Air Transport Association (IATA) announced updates to its 2025 airline industry financial outlook, showing improved profitability over 2024 and resilience in the face of global economic and political shifts. Highlights from the expected 2025 financial performance include:

• Net profits at $36 billion, improved from the $32.4 billion earned in 2024, but slightly down on the previously projected $36.6 billion (December 2024).

• Net profit margin at 3.7 percent, improved from the 3.4 percent earned in 2024 and the previously projected 3.6 percent.

• Return on invested capital at 6.7 percent, improved from the 6.6 percent earned in 2024 and largely unchanged from previous projections.

• Operating profits at $66 billion, improved from an estimated $61.9 billion in 2024, but down from the previously projected $67.5 billion.

• Total revenues at a record high of $979 billion (+1.3 percent on 2024, but below the $1 trillion previously projected).

• Total expenses at $913 billion (+1 percent on 2024, but below the previously projected $940 billion).

• Total traveler numbers reaching a record high 4.99 billion (+4 percent on 2024, but below the previously projected 5.22 billion).

• Total air cargo volumes reaching 69 million tons (+0.6 percent on 2024, but below the previously projected 72.5 million tons).

“The first half of 2025 has brought significant uncertainties to global markets. Nonetheless, by many measures including net profits, it will still be a better year for airlines than 2024, although slightly below our previous projections,” Willie Walsh, IATA director general, said. “The biggest positive driver is the price of jet fuel, which has fallen 13 percent compared with 2024 and 1 percent below previous estimates. Moreover, we anticipate airlines flying more people and more cargo in 2025 than they did in 2024, even if previous demand projections have been dented by trade tensions and falls in consumer confidence. The result is an improvement of net margins from 3.4 percent in 2024 to 3.7 percent in 2025. That’s still about half the average profitability across all industries. But considering the headwinds, it’s a strong result that demonstrates the resilience that airlines have worked hard to fortify.”

Walsh delivered his forecast at the IATA’s 81st annual general meeting and World Air Transport Summit, which was held June 1-3 2025 at the Bharat Mandapam Convention Center in New Delhi.

“Perspective is critical to put into context such large industry-wide aggregate figures. Earning a $36-billion profit is significant. But that equates to just $7.20 per passenger per segment. It’s still a thin buffer and any new tax, increase in airport or navigation charge, demand shock or costly regulation will quickly put the industry’s resilience to the test. Policymakers who rely on airlines as the core of a value chain that employs 86.5 million people and supports 3.9 percent of global economic activity, must keep this clearly in focus,” Walsh said.

Gross Domestic Product (GDP) is the traditional driver of airline economics. However, although global GDP growth is expected to fall from 3.3 percent in 2024 to 2.5 percent in 2025, airline profitability is expected to improve. This is largely on the back of falling oil prices. Meanwhile, continued strong employment and moderating inflation projections are expected to keep demand growing, even if not as fast as previously projected.

Efficiency is another significant driver of the outlook. Passenger load factors are expected to reach an all-time high in 2025 with a full-year average of 84.0 percent, as fleet expansion and modernization remains challenging amid supply chain failures in the aerospace sector. Overall, total revenues are expected to grow by 1.3 percent, outpacing a 1.0 percent increase in total expenses, shoring up industry profitability. Industry revenues are expected to reach a historic high of $979 billion in 2025 (+1.3 percent on 2024).

Passenger revenues are expected to reach $693 billion in 2025 (+1.6 percent on 2024), an all-time high. This will be bolstered by an additional $144 billion in ancillary revenues (+6.7 percent on 2024).

Passenger growth (measured in Revenue Passenger Kilometers/ RPK) is expected to be 5.8 percent—a significant normalization after the exceptional double-digit growth of the pandemic recovery.

It is expected that passenger yields will fall by 4.0 percent compared

with 2024. This is largely reflective of the impact of lower oil prices and strong industry competition. This will continue the trend of travelers benefiting from ever-more affordable air travel. The real average return airfare (in 2024 U.S. dollars) is expected to be $374 in 2025. This is 40 percent below 2014 levels.

IATA’s April 2025 polling data supports projections for demand growth:

• Some 40 percent of respondents expect to travel more over the next 12 months than they did in the previous 12-month period. The majority (53 percent) said that they expect to travel as much as they did in the previous 12 months. Only 6 percent reported that they expect to travel less.

• Some 47 percent of respondents expect to spend more on travel over the next 12 months than they did in the previous 12 months. An almost equal proportion (45 percent) expects to spend the same on travel over the next 12 months while only 8 percent expect to spend less.

• Although 85 percent expected trade tensions to impact the economy in which they reside and 73 percent expect to be personally impacted, 68 percent of business travelers (50 percent of those polled) expected increased business travel amid trade tensions to visit customers, and 65 percent said trade tensions would have no impact on their travel habits.

Cargo revenues are expected to be $142 billion in 2025 (-4.7 percent on 2024). This is primarily based on the expected impact of reduced GDP growth largely influenced by tradedampening protectionist measures, including tariffs. As a result, air cargo growth is expected to slow to 0.7 percent in 2025 (from 11.3 percent in

‘The first half of 2025 has brought significant uncertainties to global markets. Nonetheless, by many measures including net profits, it will still be a better year for airlines than 2024, although slightly below our previous projections. Moreover, we anticipate airlines flying more people and more cargo in 2025 than they did in 2024, even if previous demand projections have been dented by trade tensions and falls in consumer confidence.’

—Willie Walsh, IATA director general

2024). The cargo yield is also expected to reduce by 5.2 percent, reflecting a combination of slower demand growth and lower oil prices. Although significant uncertainty remains on how trade tensions will evolve over the year, as of April cargo demand was holding up well with a 5.8 percent year-on-year increase.

Industry expenses are expected to grow to $913 billion in 2025 (+1 percent on 2024). Jet fuel is expected to average $86/barrel in 2025 (well below the $99 average in 2024), translating into a total fuel bill of $236 billion, accounting for 25.8 percent of all operating costs. This is $25 billion lower than the $261 billion in 2024. Recent financial data show minimal fuel hedging activity over the past year, indicating that airlines will generally benefit from the reduced fuel cost. It is not expected that fuel will be impacted by trade tensions.

Sustainable Aviation Fuel (SAF) production is expected to grow to two million tons (Mt) in 2025, accounting for just 0.7 percent of airline fuel use. SAF production will double from the 1 Mt produced in 2024 (all of which was purchased by airlines), but production needs

an exponential expansion to meet the demands of the industry’s commitment to net zero carbon emissions by 2050.

IATA estimates that the average cost of SAF in 2024 was 3.1 times that of jet fuel, for a total additional cost of $1.6 billion. In 2025, the global average cost for SAF is expected to be 4.2 times that of jet fuel. This extra cost is largely the result of SAF ‘compliance fees’ being levied by European fuel suppliers to hedge their potential costs as a result of European SAF mandates to include 2 percent SAF in the jet fuel supply.

The aircraft backlog exceeds 17,000 (sharply up from the 10,000-11,000 pre-pandemic), with an implied wait time of 14 years. Should states exit from a multilateral agreement exempting aircraft from tariffs, supply chain constraints and production limitations could be further aggravated.

Supply chain issues have had significant negative impacts on airlines: driving-up leasing costs, increasing the average fleet age to 15 years (from 13 in 2015), cutting the fleet replacement rate to half the 5-6 percent of 2020, and reducing the efficiency of fleet utilization (using larger aircraft than needed on some

From the narrowest to the widest widths, our light-gauge titanium strip delivers the precision demanded by the world’s most challenging applications. Ulbrich’s metallurgical expertise provides custom-engineered mechanical properties, while exceptional flatness and tight tolerances guarantee consistency. With global supply chain support, we o er reliable titanium solutions where and when performance matters most.

1-4

TITANIUM GRADE 5

TITANIUM GRADE 9

TITANIUM 15-3-3-3

routes, for example).

In 2025, 1,692 aircraft are expected to be delivered. Although this would mark the highest level since 2018, it is almost 26-percent lower than year-ago estimates. Further downward revisions are likely, given that supply chain issues are expected to persist in 2025 and possibly to the end of the decade.

Engine problems and a shortage of spare parts exacerbate the situation and have caused record-high groundings of certain aircraft types. The number of aircraft younger than 10 years in storage is currently more than 1,100, constituting 3.8 percent of the total fleet compared with 1.3 percent between 2015 and 2018. Nearly 70 percent of these grounded aircraft are equipped with PW1000G engines.

“Manufacturers continue to let their airline customers down. Every airline is frustrated that these problems have persisted so long. And indications that it could take until the end of the decade to fix them are offthe-chart unacceptable,” Walsh said. With ongoing geopolitical and economic uncertainties, the most significant risks to the industry outlook include:

• Conflict: The resolution of conflicts such as the Russia-Ukraine war would have a benefit for airlines in reconnecting de-linked economies and reopening airspace. Conversely, any expansion of military activity could have a dampening effect.

• Trade tensions: Tariffs and prolonged trade wars dampen demand for air cargo and potentially travel. Additionally, the uncertainty over how the Trump Administration’s trade policies will evolve could hold back critical business decisions that drive economic activity, and with it the demand for air cargo and business travel.

• Fragmentation: Global standards

have always been critical for aviation. Fragmentation of global standards or weakening of multilateral institutions and agreements could bring additional costs to airlines with a more complex or unstable regulatory environment. This includes the evolution of policies on climate, trade, facilitation and a myriad of other matters impacting airline strategic decision-making and operations.

• Oil prices: Oil prices are a major driver of airline profitability. The complex array of factors impacting oil prices (including economic growth projections, the amount of extraction activity undertaken, policies on decarbonization, sanctions, availability of refining capacity, and transport blockages) can produce quick shifts in pricing volatility with significant impact on airline financial prospects.

All regions are expected to deliver collective net profits in 2025. Most will see their financial performance improve compared with 2024, with Latin America being the exception. Profitability, however, varies widely by carrier and by region. The collective net profit margin of African airlines is expected to be the weakest at 1.3 percent while carriers in the Middle East are forecast to be the strongest at 8.7 percent. North America will generate the highest absolute profit among the regions even as it is expected to be affected by a slowdown in the U.S. economy, with increased tariffs likely to erode both consumer and business sentiment, dampening consumption and investment. The persistent shortage of pilots and engine reliability problems, particularly in the low-cost sector, will limit growth in the region. Europe is expected to benefit from strong passenger demand, driven by

growth in the low-cost sector. More of their aircraft fleet will return to service following engine-related grounding, and the EU’s open skies agreements with North Africa will provide market opportunities. A stronger Euro will boost profitability for all carriers in the region with costs (such as fuel) mainly denominated in U.S. dollars.

Asia Pacific is the largest market in terms of RPK, with China accounting for over 40 percent of the region’s traffic. Passenger demand is expected to be strong given the relaxation in visa requirements in several Asian countries, particularly China, Vietnam, Malaysia and Thailand. This will support both international tourism and travel within the region. However, the economic landscape poses some challenges, with the GDP forecast for the region, particularly China, having been revised down. Although flights between China and the United States are still limited to 100 weekly frequencies and significantly below pre-COVID levels, overcapacity issues are showing signs of improvement due to better fleet deployment between domestic and international travel. n

[Editor’s note: The IATA (website: https://www.iata.org/)—based in Montreal, with executive offices in Geneva, Switzerland—is the trade association for the world’s airlines, representing some 350 airlines comprising over 80 percent of global air traffic. Willie Walsh, who hails from Ireland, became the eighth person to lead the IATA when he took on the role of director general in April 2021. Prior to joining IATA, Walsh spent his entire career in the airline industry. A member of the IATA board of governors from 2005 to 2018, he served as chair of the organization in 2016 and 2017].

ARIES Manufacturing is dedicated to the supply of complex airframe structure components, in both titanium and aluminum alloys, to leading manufacturers in the aerospace industry.

ARIES Manufacturing is part of the ARIES Alliance, a group of companies focused on developing innovative technology that creates value for the aerospace industry.

Panel mechanical pocket milling, drilling and trimming

Superplastic Forming and Hot Forming for titanium airplane structural and engine components

HSF® process technology for titanium airframe components

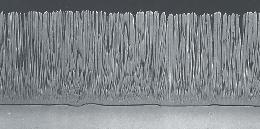

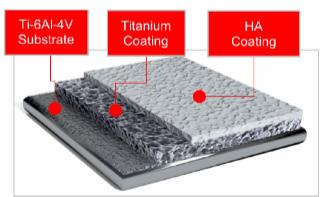

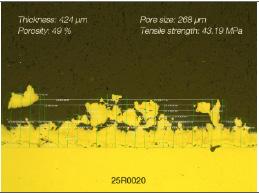

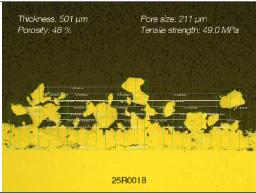

Oerlikon Metco’s (OM) thermal spray (TS) medical coating powders and systems are recognized worldwide for their high quality and reliability. OM also has over three decades of expertise and knowledge about medical thermal spray coating solutions. The company continues to develop and expand the medical coating platforms with innovative systems, materials and thermal spray gun technology, focused primarily at its in-house Coatings Solutions Centre (CSC) in Wohlen, Switzerland.

In recent years Oerlikon Metco Coating Service Center, based in Wohlen, Switzerland, has focused on bringing its newest thermal spray “cascaded arc” technology to the medical thermal spray coating industry, with the launch of both APS (Atmospheric Plasma Spray) and now VPS (Vacuum Plasma Spray) applications based on the successful SinplexPro thermal spray platform.

The F4-VB (VPS) and 9MBM (APS) guns have been the foundation of the medical TS coating industry in recent decades, however both gun platforms have their limitations. They have been recently updated to incorporate the latest cascaded arc technology, as OM launches the SinplexPro (APS) and now the SinplexPro CA (Controlled Atmosphere) guns. These guns are not only capable of producing high quality coatings to meet industry specifications but can do so with Argon-only plasmas, no secondary

Medical thermal spray coatings have been designed and optimized to create a surface layer that promotes osseointegration or connection between living bone and the surface of a load-bearing artificial implant. This process does not require any artificial “bone cement” to create long-term fixation and is widely used in the manufacture of total and partial hip and knee replacement implant and many other implantable devices such as spine and other extremity devices.

gasses required.

Medical thermal spray coatings have been designed and optimized to create a surface layer that promotes osseointegration [1] or connection between living bone and the surface of a load-bearing artificial implant. This process does not require any artificial “bone cement” to create long-term fixation and is widely used in the manufacture of total and partial hip and knee replacement implant and many other implantable devices such as spine and other extremity devices.

calcium, phosphorus, oxygen and hydrogen; they can also be used in combination as shown in Fig.1.

The medical thermal spray coating may be either metallic (titanium/titanium alloy) or non-metallic hydroxyapatite [2] (HA). HA is an organic chemical compound that accounts for 60-70 percent of the human bone mass and is comprised of the four elements

Both the titanium and hydroxyapatite coatings are optimized to create the ideal open and closed porosity. This is to help maximize surface roughness, create the highest adhesion strength and highest abrasion resistance. The coating chemistry must be correct, and in the case of HA coating, demanding crystallinity (phase) and purity values must be met. These

requirements are outlined in many ASTM and ISO coating standards.

The coating thickness requirements will determine the particle size distribution (PSD) of the starting thermal spray materials and the corresponding process parameters used. This has resulted in a standard range of approved PSD for both titanium and HA powders used across the medical coating industry with some customer specific (proprietary) PSD powders. The different HA powder PSD is determined depending on whether it is used in combination with or without a titanium sub-coating. A current list of OM medical TS Ti powders is shown in Table 1.

The standard F4VB gun has two significant deficiencies, i.e. maximum plasma power limitations and also power fluctuations resulting in reduced adhesion strength. Different coating strategies have therefore been developed, using either secondary gasses such as helium and/or hydrogen and specific bond coats to increase the adhesion strength while optimizing the other

coating property requirements. The cascaded arc TS gun technology has been developed to eliminate power fluctuation and increase overall power without the need for secondary gasses.

Previously Oerlikon has

Metco 4010H CP Ti Grade 4 -250+75