Issue 13; 2025 All Markets

Issue 13; 2025 All Markets

Advantages

•

•

•

•

Marty Pike President ATI Specialty Materials

Sam Stiller Vice President

Howmet Aerospace

Brett Paddock Secretary / Treasurer

Titanium Industries Inc

Dr. Markus Holz

Academic Member, Professor

Jeff Easto is a supply chain and procurement executive with deep expertise in the metals industry and strategic sourcing. Since joining Precision Castparts Corp in 2021, he has led global supply chain strategies and currently serves as Vice President of Purchasing for the Metals and Forgings segment. Prior to PCC, Jeff spent 10 years at GE Aviation in various leadership roles, specializing in global sourcing, materials planning, and supply chain management. He also served as a board member of the Michigan Aerospace Industrial Association, contributing industry insight and supply chain expertise.

Steve Chavez CEO

All-Met Recycling

Jeffrey Easto Vice President Purchasing

TIMET, Titanium Metals Corporation

Olivier Maillard

Vice President Metallic Raw Material, Forgings & Castings and Fasteners

Procurement - PMM

Airbus SAS (France)

Michael Marucci

Division President

Advanced Solutions and Surface Technologies business units

Kymera International

John Scherzer

Vice President – Medical Markets

Carpenter Technology Corporation

Edward Sobota

Vice President, New Product Development

STS Metals

That’s why when it comes to the design and manufacture or the repair and reconditioning of crucibles, molds, and hearths for your ESR, VAR, EBM, or PAM installations, we draw on our more than 135 years of design, engineering and manufacturing excellence to ensure that your copper-based melting equipment is operating at peak efficiency.

Quality vessel repair services to keep you running at high production levels.

A reputation for quality work and on-time delivery. Our staff of expert millwrights, welders and machinists can tear down, assess, repair and test your valuable melting equipment.

Additionally, our manufacturing capabilities are fully supported by our staff of over 50+ engineers.

Our services include:

• Machining, welding, straightening, and sizing of stainless steel, copper, nickel, aluminum, bronze, and carbon steel

• Preventative maintenance, including cleaning, re-sizing, straightening and seal replacement

• Crucible diameter and size modifications

• New crucibles, molds, base assemblies, water jackets, etc.

To learn more about our rebuilding and manufacturing services,call (330) 337-0000, visit www.ButechBliss.com or email cu@butech.com.

Medical Technology

Dr. Colin McCracken

Product Manager, Biomedical, Titanium Oerlikon Metco (Canada) Inc

Colin McCracken gained his B .Sc , M . Phil . and Ph D in Metallurgy from Brunel University of West London, UK in 1992 Colin then joined AVX Ltd - Tantalum Division working on capacitor grade tantalum powders and left in 2005 as Head of R&D Colin then moved to the USA to join Reading Alloys Inc as Development Manager - Powder Products and in 2011 Colin was appointed to Director of Product and Market Development at Ametek SMP - Reading Alloys In 2013 Colin relocated to Ontario Canada to work with H C Starck Canada Inc and then later joined Tekna Advanced Materials before finally joining Oerlikon Metco Canada Inc . in 2017 as a Product Manager for Biomedical and Titanium products In 2016 Colin was awarded a Fellow from the UK Institute of Materials, Minerals and Mining

Global Industrial Markets

Christopher Wilson Director of Research and Development NobelClad

Chris Wilson is the Director of Research and Development for NobelClad Chris has a degree in Metallurgical Engineering and a Masters in Business Administration from the University of Pittsburgh . Trained and certified as a Six Sigma Black Belt in Lean Manufacturing Chris has worked within the metals industry for more than 25 years in various functions such as operations, quality assurance, and technical service Chris has focused and specialized on the titanium metals industry Chris is the current Chairman of the ASTM B10 01 Titanium Committee; Recording Secretary of the ASTM B10 Reactive and Refractory Metals Committee; Vice Chairman of the NACE TEG120X Reactive Metals Committee; Member of the International Titanium Association’s Industrial Application Committee as well as a participating member of the Materials Technology Institute (MTI)

Safety Education

Robert Lee (Co-Chair)

President Accushape™ Inc

Robert G Lee is the President and Owner of Accushape™ Inc Mr Lee is Chair of the ITA Safety and Compliance Committee During the past 50 years, Robert Lee has been directly involved in the processing of titanium and other special metals in many forms including, machining, welding, forging casting, screening, pressing and sintering of titanium powder Accushape™ was started in 1987 by Robert Lee for the purpose of scaling up the production of knife handles for Buck Knives made by pressing and sintering (P/S) of titanium sponge granules (titanium powder) (TSG) to produce a net shape finished knife handle . Accushape has produced over 500,000 titanium P/S parts including knife handles, golf club inserts, hex nuts and washers Accushape™ has processed and screened 100’s of thousands of pounds of titanium sponge fines to customer’s special requirements More recently, Mr Lee has been issued 7 patents for a new titanium based material system TiCarbonite® and the ODAK™ tile system TiCarbonite® is a light weight, extremely hard and tough material finding applications for ballistics armor ODAK™ tiles create many types of systems with no increase in thickness and no through gap, making possible flexible material systems that can fit contours

Michael Marucci (Co-Chair)

Division President

Advanced Solutions and Surface Technologies business units

Kymera International

Michael Marucci serves as Division President at Kymera International, a global leader in specialty materials Kymera produces silicon carbide, titanium powders, aluminum powders, copper powders, specialty alloys for titanium production, and surface technology solutions

Mike joined Kymera in March 2020, following the company’s acquisition of Reading Alloys, Inc from AMETEK In his current role, he oversees Kymera’s Surface Technologies and Advanced Solutions business units

The Surface Technologies unit specializes in high-quality thermal spray services, anticorrosion coatings for global navies, thermal spray materials, and advanced spray equipment and automation solutions The Advanced Solutions unit produces high-purity master alloys for titanium production, processes high-purity titanium scrap, and manufactures titanium powders, tantalum, ferro-titanium, copper, and bronze powders

Are you aiming to increase the recycling rates in your titanium production shop?

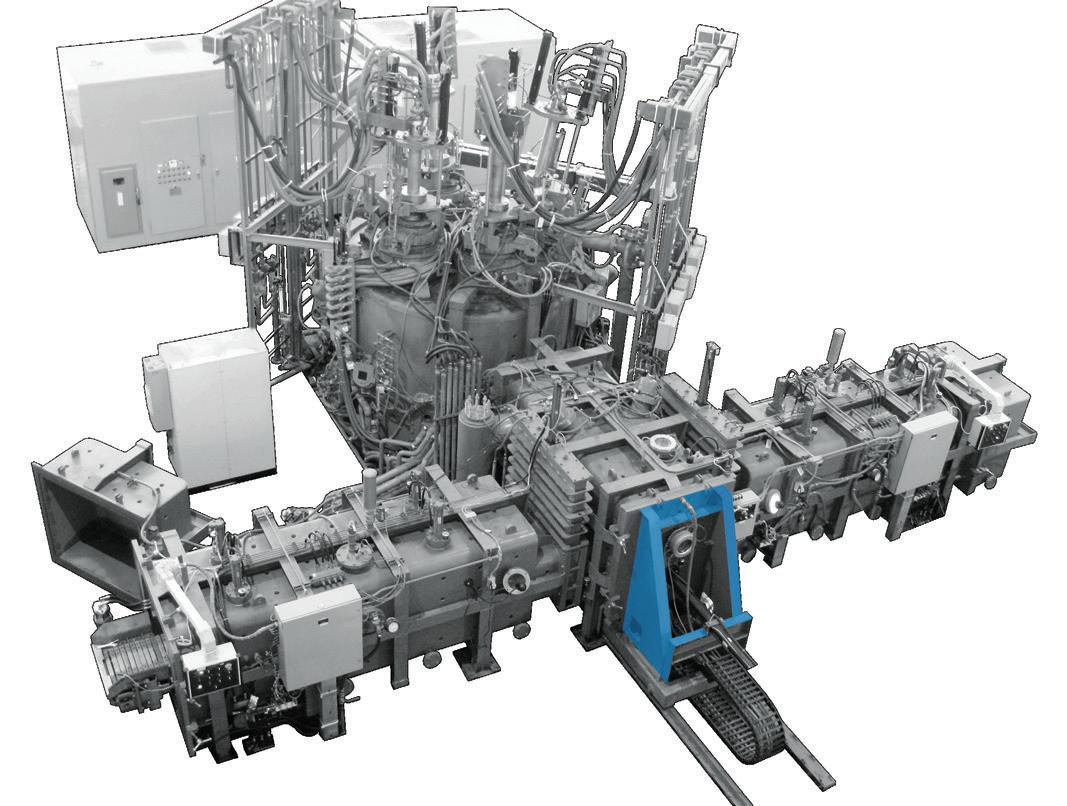

INTECO´s new innovative vacuum arc cold hearth skull melting and casting furnace

› can achieve recycling rates of up to 100% by feeding virgin and scrap material (e.g. compacted chips) between melting & casting cycles

› can achieve an improved energy ef ciency compared to other cold hearth technologies

› allows static casting of ingots and slabs as well as dynamic casting of complex investment cast parts

› can achieve pouring weights from 250kg up to 3.000kg in one cast

› More than 20 years of experience as a premium supplier in the titanium industry

› Supply of melting and casting equipment for titanium including auxiliaries

› Engineering studies, project- and technology consulting for entire titanium production lines

› Know-how transfer, from selections of raw material up to aerospace certi cation

› Customized process and production management systems (IMAS) for titanium production lines

Michael C. Gabriele

ITA Contributor

Michael Gabriele is an independent freelance writer on behalf of the International Titanium Association (ITA)

Art Kracke President at AAK Consulting

An industry consultant

located in Charlotte, NC, Kracke entered the titanium industry in 1980 with Teledyne Allvac, working in many areas including the development and sale of titanium alloys, superalloys and vacuum melted specialty steels The company evolved into ATI Specialty Materials

Peter C. Zimm Principal Charles Edwards Management Consulting

Peter Zimm leads strategy, market positioning, and operations improvement consulting projects for aerospace companies A Principal for aerospace-focused management consulting firm Charles Edwards, he has delivered scores of projects for OEMs, Tier 1s, subtier suppliers, and raw materials companies across the world Peter is an internationallyrecognized market expert in aerospace raw materials, aircraft components, manufacturing process technologies, and aircraft emissions

Prior to joining Charles Edwards, Peter was a Principal at ICF Aviation’s Aerospace & MRO practice . He began his career at Timken Aerospace where he held various business development, marketing, and sales management positions and co-architected the company’s aftermarket entry strategy Peter has a Masters in Business Administration from Boston University and a Bachelor’s degree from Dartmouth College

Titanium Mill Products:

Sheet, Plate, Bar,Pipe,Tube,Fittings, Fasteners, Expanded Sheet & Ti Clad Copper or Steel.

Titanium Forgings and Billet:

Staged intermediate ingot & billet to deliver swift supply of high quality forgings in all forms and sizes including: rounds, shafts, bars, sleeves, rings, discs, custom shapes, and rectangular blocks.

Titanium, Zirconium, Tantalum & High-Alloy Fabrication & Field Repair Services: Vessels, Columns, Heat Exchangers, Piping, Anodes, Custom Fabrications, Field & In-House Reactive-Metal Welding & Equipment Repair Services Available 24/7.

Plate Heat Exchangers:

Plate Heat Exchangers to ASME VIII Div 1 Design, Ports from 1” through 20” with Stainless Steel, Titanium and Special Metals, Plate Heat Exchanger Refurbishing Services & Spare Parts.

Two Service Centers & Fabrication Facilities in Ohio & Texas with Capabilities in: Waterjet, Welding, Machining, Sawing, Plasma Cutting & Forming.

Serving a Wide Variety of Industries: Chemical Processing, Mining, Pulp & Paper, Plating, Aerospace, Power and others.

Tricor Metals, Ohio Division 3225 W. Old Lincoln Way Wooster, Ohio 44691

Phone: 330-264-3299

Fax: 330-264-1181

Tricor Metals, Texas Division 3517 North Loop 336 West Conroe, Texas 77304

Phone: 936-273-2661

Fax: 936-273-2669

Tricor Metals, Michigan Division 44696 Helm St. Plymouth, MI 48170

Phone: 734-454-3485

Fax: 734-454-7110

Astrolite Alloys California Division 201 Bernoulli Circle, Units B & C Oxnard, CA 93030

Phone: 805-487-7131 Fax: 805-487-9694

[Editor’s note: This article is based on a speech given by Peter Zimm last October at the Titanium USA Conference and Exhibition held in Austin, TX. Zimm is a principal at Charles Edwards Management Consulting and is co-author of “Aerospace Titanium—Global Market Outlook and Supply Risk Assessment,” a comprehensive report on the market for aerospace titanium mill products that is available at AeroOutlook.com. AeroOutlook offers premium aerospace industry market reports meticulously curated and authored by distinguished aerospace market experts. Zimm’s presentation at TI USA along with this article summarizes some of the key findings from that report.]

By Peter Zimm

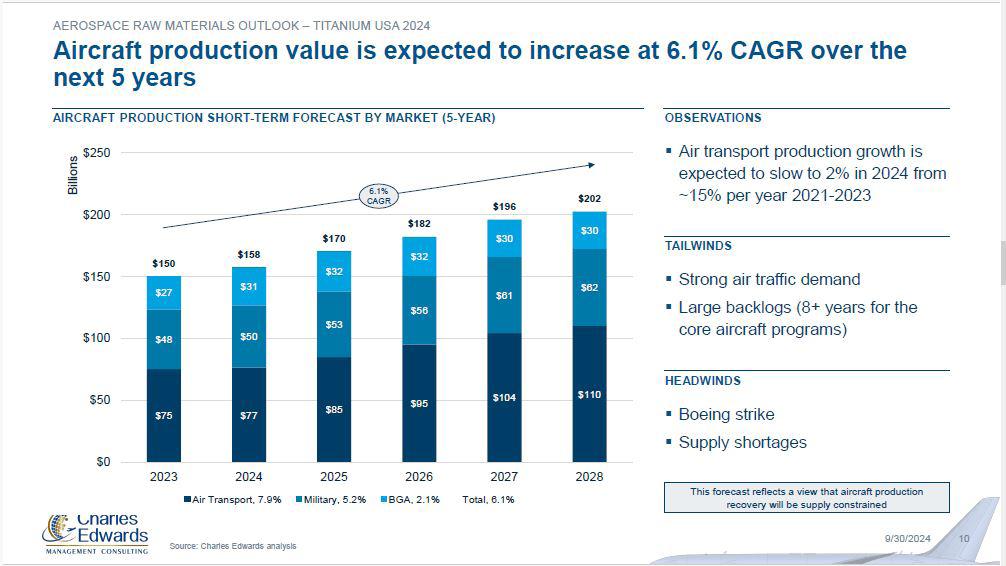

Total aircraft production value was $150 billion in 2023 and is expected to grow to $158 billion in 2024, a 5-percent increase from 2023 but still 13 percent below 2018’s peak of $181 billion. Commercial air transports are approximately 50 percent of global aircraft production value; military is about one third and business and general aviation are about one fifth. Aerospace entered 2024 hopeful for another year of double-digit growth, but those hopes were soon dashed when a mid-cabin door plug fell out of an Alaska Airlines’ Boeing 737MAX while in flight. Most importantly, however, Boeing’s Puget Sound machinists went on strike in September. The strike lasted 53 days and workers were called back in the middle of November. Production halted not only for the MAX but also for the Boeing 767 and 777.

The production troubles were not limited to Boeing. Supply chain disruptions which have been plaguing the aerospace industry seemed to worsen in 2024. By the end of the first quarter, it was clear that air transport deliveries for Airbus were also running well behind the rates needed to achieve double digit increases again. In April, the European airplane maker lowered its 2024 delivery target from 800 total aircraft to 770. Furthermore, they moved out their

Charles Edwards estimates 2023 aerospace titanium demand was about 160 million pounds. Engines (about 40 percent), equipment systems (about 25 percent), and aerostructures (about 30 percent) consumed most of aerospace titanium. Two-thirds of total aerospace titanium consumption ends up as finished parts on either an Airbus or a Boeing aircraft. The other one-third is ultimately consumed by the rest of the aircraft OEMs.

75 per month production goal for the A320 family from 2025 to 2027. Farnborough Air Show orders were among the lowest on record but given that production backlogs remain at 8 to 10 years (depending on assumed build rates), the paucity of orders is probably not a concern.

Of greater concern are the persistent sub tier supply chain and OEM operational challenges in the industry. Supply chain challenges are worse than OEM’s expected them to be a year ago and suppliers, confronted with changing customer schedules and the specter of poor performance

Established in France (Lyon), the stockist Acnis Group is one of the world leaders in the distribution of metal alloys especially in TITANIUM, in all forms : sheets, bars, tubes and powder for 3D printing.

ISO 13485 certified since 15 years , the family business has specialized in the medical field since its creation in 1991, to meet the demand of orthopedic manufacturers and dental implants, as well as surgical instruments.

ACNIS Group acts as a buffer between producers and users, thanks to its 600 to 700 tons rotating stock and 1,300 references of different origins. Our unique cut-to-size service center (15 machines: waterjet, high-definition waterjet, plate sawing, bar sawing, shearing, machining, chamfering) allows us to reduce your costs by optimizing scrap rates.

As a result, the company is able to deliver very quickly its customers, in barely a week , no matter the ordered quantity. Major implant manufacturers among the main American and European OEMs themselves call on ACNIS Group to source their metal alloys.

The last creation of ACNIS USA stock in 2023 in Chicago has changed the game. Acnis Group is now the only distributor that can stock and deliver any quantity in North America (ACNIS TITANIUM & ALLOYS USA-Chicago), South America (ACNIS DO BRAZIL-Sao Paulo), Europe (ACNIS FRANCE-Lyon), South Asia (ACNIS CHINAShanghai) for global worldwide contracts.

Acnis is your one-stop shop for all TITANIUM grades, stainless steel (316L, 420B, cobalt chrome, 17/4 PH, high nitrogen alloy, Custom 455, Custom 465…) and polymers

Our dental subsidiary BCS , a European leading distributor of CAD CAM products for additive manufacturing, is registered with the FDA for titanium powder & discs, and cobalt chromium powder.

ACNIS TITANIUM & ALLOYS

1940 E Devon Elk Grove Village 60007 - IL - USA

dfreitag@acnis-titanium.com

kragan@acnis-titanium.com

224-550-2422

by other suppliers, have to balance OEM build rate aspirations with the risk of over-investing (in inventory or tooling and machinery) if OEM production goals are not met. Ironically, the slow ramp in aircraft OEM build rates is providing much needed stability for sub tier suppliers, enabling at least some to recovery financially.

We forecast total aircraft production value will grow at 6.1 percent compound annual growth rate (CAGR) from $150 billion in 2023 to $202 billion in 2028. This represents a shallower recovery ramp than we forecast last year.

On the aftermarket side (titanium demand is partly driven by titanium

replacement parts), the maintenance, repair and overhaul (MRO) market value was $226 billion in 2023 and is expected to grow over 8 percent to $245 billion in 2024. MRO continues to benefit from strong air traffic demand as well as under-delivery of new aircraft (old aircraft continue to fly for longer). However, MRO is also experiencing labor and parts shortages. In addition, MRO capacity is constrained and the return of air travel to pre-Covid levels is driving up wait times to get into overhaul shops.

Looking further out, we forecast MRO will grow at 3 percent compound annual growth rate (CAGR) from $245 billion in 2024 to $262 billion in 2028.

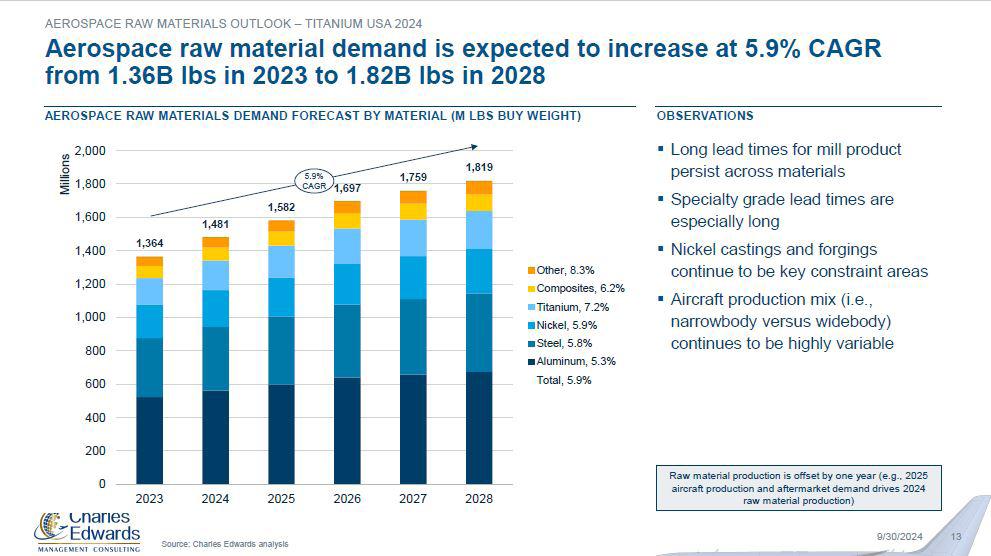

Aerospace raw material demand is based on material for aircraft production as well as material consumed in spare parts for MRO. Charles Edwards’ raw material model breaks down aircraft fly weight into material composition by material family (i.e., aluminum, steel, titanium, nickel, and composites), aircraft system (i.e., aerostructures, engines, equipment systems, interiors, etc.), and other distinctions.

Our forecast considers material substitution over time, changes in aircraft and engine OEM production mix, and other market dynamics. We then build up buy-to-fly ratios based on typical material removal during processes such as machining, forging, and melting. The result is a buy weight composition by aircraft which we apply to the production forecast to arrive at aggregate raw material demand based on production. MRO material demand is based on expected spares requirements for repair and overhaul events.

The aerospace industry demanded 1.36 billion pounds of raw materials in 2023 across all the raw material families (a relatively flat increase from 2022). We forecast aerospace raw material demand will grow at 5.9 percent CAGR from 1.36 billion pounds in 2023 to 1.82 billion pounds in 2028. The reason the CAGR is lower than overall production value is that raw material production precedes finished aircraft production by some period of time; therefore, raw material production is starting from a higher base in 2023 relative to final production.

Titanium is used throughout the aircraft: in the engine (e.g., compressor discs, blades and vanes, and cases), components/equipment systems (landing gear, ducting), and aerostructures (chords, spars, wing

boxes, and pylons). Titanium is also used in the nacelle, fasteners and brackets, and interior parts. Charles Edwards estimates 2023 aerospace titanium demand was about 160 million pounds. Engines (about 40 percent), equipment systems (about 25 percent), and aerostructures (about 30 percent) consumed most of aerospace titanium. Two-thirds of total aerospace titanium consumption ends up as finished parts on either an Airbus or a Boeing aircraft. The other one-third is ultimately consumed by the rest of the aircraft OEMs. A number of demand trends impacted the aerospace titanium market in 2024:

Aircraft production rates. Despite the production difficulties that plagued narrow-bodies in 2024, builds of titanium-rich “composite” wide-body aircraft (787 and A350) ticked upward during the year.

Aircraft production mix. Early in the post-COVID recovery, production was skewed to narrow-body aircraft more than usual due to a faster return of short-haul air traffic. However, as long-haul traffic has rebounded, the ratio of narrow-bodies to wide-bodies built was returning to pre-COVID ratios. With the interruption in MAX production due to the strike and the quality issues at Boeing, this proportion returned promptly to pre-

COVID levels but are skewed by the artificially low deliveries of MAX, 767, and 777 aircraft.

Charles Edwards forecasts that titanium demand will grow at a robust 7.2 percent CAGR from 160 million pounds in 2023 to 227 million pounds in 2028.

With Russia’s invasion of Ukraine in 2022, geopolitical risk suddenly reappeared as a factor that must be taken into account in our global industry. Civil unrest in the French island territory of New Caledonia and interruptions in shipping through the Suez Canal continue to remind us that the threats to steady supply remain real and are constantly changing.

Across all the aerospace metal families (titanium, aluminum, nickel, and steel), the various aerospace alloys that account for most of metal raw material demand are comprised of 15 different elements (e.g., chromium, cobalt, and magnesium, etc.). These elements are mined or refined in 55 different countries, one quarter to one fifth of which we consider to be high risk (risk is defined as the prospect of a force majeure event in the next three years). Because of the global nature of our industry’s sources of supply

and because of increasing global tensions, we include geopolitical risk assessments in each of our raw material market reports.

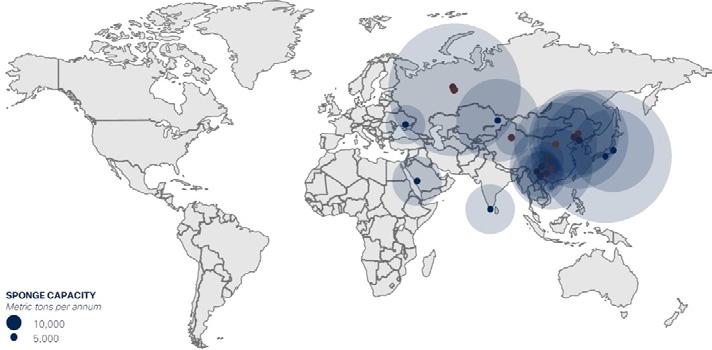

Titanium is extracted from ore, refined into sponge and then into primary metal, then melted into alloys used in aerospace production. The locations where all three levels of titanium production take place (mining, refining, and alloying) are important, but titanium is alloyed with other elements. The most-utilized aerospace titanium alloys include elements such as vanadium, aluminum, magnesium, and molybdenum. These elements are mined or refined in 36 different nations, seven of which are considered medium-high- or high-risk places to do business. The upstream supply risk assessment in our report helps consumers of titanium evaluate vulnerabilities and identify areas for which to develop contingencies.

Four titanium suppliers – ATI, Howmet, Timet (part of PCC), and VSMPO – supply the majority of titanium alloy mill product to the aerospace industry. Of course, ever since Russia’s invasion, there have been concerns about sourcing from Russia’s VSMPO. Those concerns seem to have lessened with time as neither specter— EU sanctions or Russian government export restrictions—has manifested itself to date. That said, a number of capacity expansions have been announced by Perryman, ATI, and Timet which will come online over the next several years.

Our aerospace titanium raw material report profiles aerospace market demand in detail for titanium mill product, assesses upstream supply risks, and comprehensively analyzes aerospace titanium supply. It’s available via the website www. aerooutlook.com n

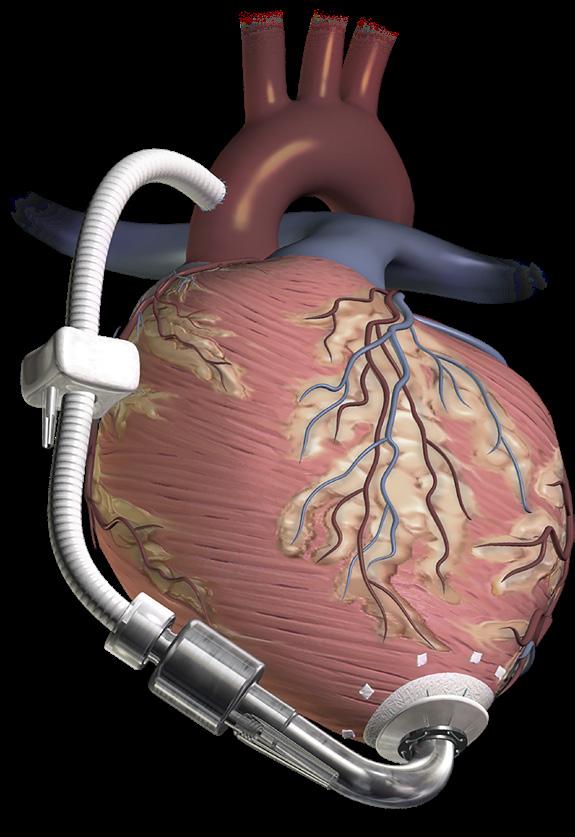

The medical and dental industries began using titanium and titanium alloys, referred to as titanium in this article, as far back as eight decades ago. The initial applications were niche dental implants. The volume was small, but it was the platform on which the interest in titanium for medical applications grew.

The application that brought titanium to prominence in the medical industry was orthopedic implants. Implants were initially made from stainless steel. Stainless steel worked, but it was found that nickel ions were migrating out of the stainless implant into the body and becoming sights for inflammation. The solution was titanium, specifically Ti 6Al-4V. Ti 6Al-4V was replaced by Ti 6Al-4V ELI. ELI means extra low interstitial, specifically lower oxygen content. The lower oxygen content results in the alloy having greater ductility.

Replacing stainless steel with titanium solved the nickel ion problem. It also brought to bear the multiple beneficial properties of titanium. The advantages of using titanium in the human body are numerous and have become well known. They include: lighter weight than stainless steels, nickel alloys, and cobalt alloys which improve implants as well as medical tools; high strength to withstand the stresses placed upon implants; corrosion resistance to human bodily fluids; temperature resistance at elevated sterilization temperatures; and unlike many other metals titanium is biocompatible with the human body.

These advantages make titanium a good solution for medical applications

and often result in improved patient outcomes after implant surgery. Improved outcomes can be defined as faster recoveries, reduced risk of complications, and a greater probability of returning to an active, pain-free life for an extended period of time. Titanium helps achieve this through its biocompatibility with the human body. Bone tissue will grow into titanium, a process known as osseointegration, helping ensure that implants remain securely in place and function effectively. Biocompatibility is considered by the vast majority of people to be titanium’s most important property for medical applications.

The consumption of titanium for medical applications has grown to become a recognized and significant part of the titanium industry. While the pounds consumed for medical applications are small when compared to pounds consumed by the aerospace industry, the average cost to produce products for medical applications exceeds that of products for aerospace, and therefore commands a higher average price. The economic value of titanium for medical applications punches over its weight class, to borrow a phrase. Improved patient outcomes are

the bottom line for the medical industry. Improved outcomes are the sum of the parts required to treat a patient. Titanium is playing an important role in the material portion of the process but is secondary to the talents of the numerous surgeons, scientists, and engineers involved in the medical industry and procedures. Titanium usage in the medical industry varies across its segments. Major applications and the primary titanium used for applications include:

• Dental implants and orthodontic wires: CP, Ti 6Al-4V (grade 5), Ti 6Al-7Nb (vanadium allergies) nitinol (orthodontic wires)

• Bone, joint, spinal, and heart valve implants, bone plates, screws, intramedullary nails: Ti 6Al-4V ELI (grade 23), Ti 6Al-7Nb, CP

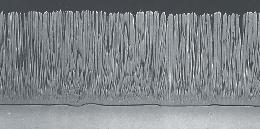

• Titanium powder overlays thermally sprayed onto the metalto-bone surfaces of implants to improve bone adhesion: CP, Ti 6Al-4V

• Trauma devices: Ti 6Al-4V ELI

• External fixation devices: Ti 6Al4V ELI

• Pacemaker wire: Nitinol (titanium nickel alloys) for its super elastic properties.

• Patient moving devices such as wheelchairs: Ti 6Al-4V

• Stents: Nitinol for its shape memory properties

• Surgical tools, prosthetics, scalpels, forceps, and fixtures: Ti 6Al-4V, CP, and the beta titanium alloys

efficiency

More reliability: Built robust, with high precision as the benchmark Innovation and reliability for your success: The KASTOtec

More innovation: Intelligent control and user friendly operation

Smarter storage for maximum space efficiency: UNITOWER More space

More efficiency: Save time with direct access—no additional lifting equipment needed

More flexibility: Modular, heightadjustable supports for up to 3 loading heights

Low in price, high in performance: KASTObloc

More precision: excellent performance for smaller block dimensions or lower plate weights

More safety: perfect for cutting remnant pieces

such as Ti 15-333 where higher strength is required.

Titanium’s light weight, strength, and corrosion and temperature resistance make it an ideal material for medical tools. The titanium product forms used to make medical devices are smaller dimensionally than products used in aerospace and industrial applications. The reason for this is obvious: People are smaller than airplanes and industrial vessels. But there are a lot of people on earth and our numbers are growing. The list that follows contains many of the typical titanium products forms and the parts they are used to manufacture:

• Rolled bar forged into hip stems and cups and to a lesser degree knee femoral and tibia parts

• Round, rectangular, and shaped rolled bar to be machined into bone and joint replacement parts, bone plates, screws, as well as internal and external fixation devices

• Powder metals for additively manufacturing into spinal implants, customer specific and trauma implants, custom surgical tools, and others

• Powder metals for metal injection molding (MIM) into spinal cages, surgical equipment and tools, orthodontic brackets and others

• Wire for pacemaker lead wires and stamped sheet for cases, and

• Formed wire for stents.

Titanium consumption has grown year-over-year in the medical and dental industries since its inception except for 2020 and 2021 when it stagnated due to the impact of the pandemic. The industry rebounded rapidly after medical professionals and hospitals overcame the surge of viral hospitalizations. It is important to keep in mind that medical procedures requiring titanium are not elective surgeries. The compound annual growth rate, CAGR, is around 4-5% in recent years and is projected to continue at this growth rate.

Long-term agreements are signed that allow producers to allocate their production to meet anticipated

demand in a timely fashion. Finished mill products are purchased and strategically placed in warehouses to meet unexpected, immediate demand and volumes not large enough to warrant a mill run. New alloys are in development to meet the expanding needs from new and innovative applications.

Powder titanium provides the foundation for metal injection molding (MIM) and additive manufacturing. Medical applications are believed to be the largest consumer of Ti 6Al-4V ELI powder. Additive manufacturing builds complex geometries that are not practical or possible using subtractive manufacturing processes.

Innovative titanium powder making processes are being developed and moving towards initial production that promise to increase the availability of titanium powder and lower the cost of powder making. Additive manufacturing also facilitates patient-specific implants. These implants are built by melting very small spherical powder particles one voxel at a time creating an

Fe, Ni, Co, & Cu Alloys

600 Pound Capacity

6" Rounds or 6” x 11” Slabs

Vacuum Arc Remelting

Reactive and Non-Reactive Alloys

6”–20” Crucible Diameters

100–5000 Pound Ingots

R&D Melting

300

Bar Peeling - 0.5" - 6" Diameter

Bar Polishing - 0.5" - 8" Diameter

Lathe Turning - up to 17" Diameter

Saw Cutting - up to 30" Diameter x 5,000 Pounds

implant’s cross section. This process is performed repeatedly building an implant one thin layer at a time. The implants have unique geometries that closely match a patient’s body geometry. Powder is expected to erode the consumption of rolled bar products, however the impact of additive manufacturing will be buffered by regulations, the high liability aspect of and growth the medical industry.

Additive manufacturing can enhance bone in-growth. Implants are being designed and built with surfaces that have specifically design “pores”. Bone tissue will grow into the pores simulating what occurs in nature when a broken bone heals. The number of additive manufacturing businesses building medical parts is growing. The driving force is improved, innovative implants and better patient outcomes. The spinal implant segment of the implant industry is perhaps the medical segment benefiting the most from additive manufacturing and implementing it at the greatest rate.

Additively manufactured patient-specific implants will grow significantly as the additive industry matures. It is likely that the building of patient-specific implants will become a service performed in hospitals that focus on orthopedic implant surgeries.

Implants surgeries have been performed primarily in developed nations but as health care improves around the world the number of implants is expected to grow. Robots are becoming a surgical tool preferred by a growing number of surgeons. The reasons vary but can be summarized as robots can improve patient outcomes. Improved outcomes

make it desirable for more people to choose to have implant surgery thereby increasing the consumption of titanium.

The number of implant surgeries is expected to grow as people live longer, stay more physically active, and surgeries continue to be less invasive. Innovative surgical techniques, implant design, and tools by surgeons, hospitals, and implant manufacturers will drive growth of the implant market and titanium usage. The high liability aspect of the medical market will moderate the rate of change.

Growth by acquisition will continue to be an important business dynamic for OEMs as well as companies in the medical supply chain.

consumption will grow. n

Titanium producers must continue to work closely with OEMs and medical professionals to relentlessly innovate, to paraphrase an ATI registered trademark and to provide improved alloys and product forms. The bottom line is that the properties of titanium and titanium alloys make it a foundational technology for the medical industry. When used in conjunction with the diverse skills of medical professionals, titanium

[Editor’s note: Art Kracke, an industry consultant located in Charlotte, NC, led the effort to compile the information in this article, along with members of the International Titanium Association’s Medical Technology Committee. Kracke entered the titanium industry in 1980 with Teledyne Allvac, working in many areas including the development and sale of titanium alloys, superalloys and vacuum melted specialty steels. The company evolved into ATI Specialty Materials.]

Last year Sen. Catherine Cortez Masto (D-Nev.) led a bipartisan group of Senate colleagues including Senator Marsha Blackburn (R-Tenn.), Shelley Moore Capito (R-W.Va.), Joe Manchin (D-W.Va.), and Thom Tillis (R-N.C.) in introducing bill S. 4025 “The Securing America’s Titanium Manufacturing Act of 2024” to support America’s titanium supply chain and promote investment in the U.S. defense industrial base: [Link]

A spokesman from Sen. Masto’s office, contacted via email in late February, confirmed that Sen. Masto’s bill is still in play in Congress. “Sen. Masto introduced the legislation in the last Congress, which ended on January 3, 2025. It was referred to the Senate Finance Committee. She has yet to reintroduce the bill in the 119th Congress. However, we are working to reintroduce the bill in the coming weeks/

months once a new lead for the bill is found in the House of Representatives. The previous lead retired at the end of the last Congress.”

The Securing America’s

Titanium Manufacturing Act would remove the existing 15-percent tariff on titanium sponge imports from nations with preferential trade status until the end of 2031, according to a press release from the office of Sen. Cortez Masto. The legislation would also require the President to monitor any efforts by China or other hostile countries to move into the U.S. titanium supply chain, and would give authority to the President to reapply the tariff if it becomes necessary to support U.S. businesses, workers, or national security in the

This link provides the full text of Masto’s bill: [Link]

Masto stated that the legislation is supported by Nevada company Timet, the United Steelworkers, the Aerospace Industry Association, as well as other American titanium companies. Restructuring titanium sponge tariffs to strengthen U.S. national security was also a recommendation of the Titanium Sponge Working Group, an interagency commission established during the first term of President Donald

Echoing concerns expressed in “The Securing America’s Titanium Manufacturing Act of 2024” (bill S. 4025), attendees at the 2023 TITANIUM USA Conference and Exhibition, held in Colorado, weighed the potential for titanium metal shortages in the near term.

As reported, the situation is complex and involves many industry (and geopolitical) developments, not the least of which is that the United States no longer is a domestic producer of titanium sponge. The Covid-19 pandemic snarled supply chains and upended many business operations around the world. Russia invaded Ukraine in February 2022 causing turmoil among two major titanium producers. The United States Geological Survey recently discontinued its titanium report.

In March 2022 ATI announced the termination of Uniti, LLC, its joint venture with Russian-based VSMPO-AVISMA [Link].

A Financial Times article posted online on May 3, 2023, quoted Guillaume Faury, the chief executive officer of Airbus [Link]. The story indicated that Airbus still sees problems in the global supply chain for titanium and aluminum, a hangover from the pandemic years, as well due to disruptions from the current Ukraine/Russia conflict. Faury,

At Kymera International, we’re at the forefront of advanced titanium solutions for the aerospace industry, delivering precision-engineered materials that power the future of flight. Our titanium powders, master alloys, and fully integrated titanium metallurgical products are trusted by leading aerospace manufacturers worldwide to meet the most demanding performance standards.

• Superior Strength & Lightweight Performance – Ideal for critical aerospace applications

• Unmatched Purity & Consistency – High-quality titanium powders and alloys

• Global Manufacturing & Supply Chain Strength – Delivering reliability at scale From high-performance jet engines to structural airframe components, Kymera International is the trusted partner for aerospace engineers and manufacturers looking for cutting-edge titanium solutions.

Trump, and led by the secretaries of Defense and Commerce: [Link]

The U.S. titanium industry imports virtually 100 percent of its titanium sponge, a product which is made into titanium metals and alloys. Those materials are critical components of military fighter aircraft, submarines, satellites, and many other defense technologies. Almost 90 percent of titanium sponge is imported from Japan, a key national security partner. However, Masto said that an outdated tariff on titanium sponge is putting U.S. producers at a disadvantage relative to foreign titanium producers in hostile nations including China and Russia, who do not pay this tax. This bipartisan legislation would remove the 15-percent tariff on titanium sponge imports, cutting millions of dollars in unnecessary costs for U.S. companies that produce critical defense materials.

“American manufacturers rely on titanium sponge to build everything from fighter jets to satellites, and my bipartisan bill will ensure we have a safe, secure, and reliable supply chain for these critical components,” Sen. Masto said. “By eliminating this burdensome tariff, my commonsense legislation would cut costs for U.S. producers, protect our national security, and support jobs in Nevada and across the country.”

“Titanium sponge is critical for both commercial and military manufacturing. Dropping tariffs on these imports, the majority of which come from Japan, will make titanium more affordable, Sen. Blackburn said. “This legislation will reduce prices for

consumers and American companies while ensuring that titanium sponge from our allies keeps an edge over material made in Communist China.”

Sen. Capito said West Virginia is known for its manufacturing

‘American

manufacturers rely on titanium sponge to build everything from fighter jets to satellites, and my bipartisan bill will ensure we have a safe, secure, and reliable supply chain for these critical components. By eliminating this burdensome tariff, my common-sense legislation would cut costs for U.S. producers, protect our national security, and support jobs in Nevada and across the country.’

—Sen. Catherine Cortez Masto

capabilities and has a proud tradition of involvement within the titanium industry. “West Virginia hosts operations that create titanium products to strengthen national security through domestic supply chains and boost our aerospace industry. This legislation would help ease costs on this vital industry, increase access to materials, and encourage economic development

while maintaining U.S. authority to adjust tariffs as needed,” Sen. Capito said.

“I am proud to introduce the Securing America’s Titanium Manufacturing Act with senators Cortez Masto and Blackburn, Sen. Joe Manchin said. “Titanium is a critical mineral essential for engines, military fighter aircraft, satellite parts, and many other military technologies, and our bipartisan legislation would help ensure the United States has a reliable titanium sponge supply chain from countries that share our values, like Japan. I will continue working with my colleagues on both sides of the aisle to get this commonsense bill across the finish line and signed into law.”

“We must do everything we can to protect jobs in North Carolina and across the country,” Sen. Tillis said, “I’m proud to co-introduce this bill that will ensure America’s titanium supply chain and defense industrial base remains strong.”

“Timet wants to express its sincere appreciation for Senator Cortez Masto’s critical work and leadership in introducing the Securing America’s Titanium Manufacturing Act. This bill will enhance American competitiveness in the global titanium market and strengthen our American national security supply chain,” Ryan Ramsey, general manager of Timet Henderson said, quoted in the press release. “In addition to helping the U.S. industry; this effort will also have a positive effect on Timet’s hardworking employees in Henderson, NV.” n

Editor’s note: Sen. Cortez Masto introduced bill S. 4015 to the Senate on March 21, 2024. The text of a similar bill (H.R. 8912; “Securing America’s Titanium Manufacturing Act of 2024”) was introduced last year in the House of Representatives by Rep. Brad R. Wenstrup (R-OH). Wenstrup’s bill can be found here: [Link]

IperionX is a leading American titanium metal and critical materials company - using patented metal technologies to produce high performance titanium alloys, from titanium minerals or scrap titanium, at lower energy, cost and carbon emissions.

in the article, described supply chain delays as an “overall challenging situation that would last all along 2023 and potentially till (2024).”

Willy Shih, a senior contributor to Forbes and a teacher at Harvard Business School, penned an online article, posted March 2, 2022, stating that “the terrible war in Ukraine and subsequent sanctions placed on many Russian organizations have raised questions about potential supply chain vulnerabilities. While Russia is mostly an exporter of resources like oil, gas, and metals, one market where it is a dominant player is for titanium and titanium forgings. Many people are waking up to the potential consequences of a longerterm stoppage in the flow of these critical materials” [Link].

Takeshi Nakashima, the deputy general manager of the titanium division of Toho Titanium Co. Ltd., Japan, a producer of titanium sponge, during his presentation at TITANIUM 2023, warned that the global aerospace supply chain will face a sponge shortage. “The sponge demand and supply gap will keep increasing, even if OEMs ramp up production gradually. A shift of sponge allocation from the industrial market to the aerospace market might occur to catch up with increasing demand.”

The worry is that these developments, taken as a whole, are altering the U.S. titanium industry landscape, which might result in a supply pinch. Underlying all these dynamics is that titanium remains a

“strategic” metal for U.S. industrial and military manufacturing. However, concerns on this topic are not new and have been raised by industry and government agencies in recent years.

The Federal Register, in an online post dated Oct. 26, 2021, indicated that the Bureau of Industry and Security (BIS) published a report completed on November 29, 2019. The report’s executive summary stated that “titanium sponge is essential to the manufacturing and maintenance of U.S. defense systems. Titanium sponge is the intermediate product resulting from the conversion of titanium ore into a form of titanium metal that can be melted to manufacture slab or ingot, which in turn is used to produce finished titanium products. Consequently, titanium sponge production is essential to the production and sustainment of many U.S. defense systems, and preserving this critical capability is imperative to the national security” [Link].

The Titanium Sponge Working Group (TSWG), established under the Trump administration in 2020, released an online report, dated August 3, 2023 and posted on the Washington Tariff and Trade Letter, which highlighted the increased dependence of the United States on imported titanium sponge. The report came in the wake of the closure of the Timet’s Henderson, NV, plant, marking the end of domestic sponge production [Link].

The TSWG reported that “U.S.

dependency on imported titanium sponge rose dramatically from 68 percent in 2020 to 100 percent today, emphasizing a severe reliance on overseas supplies. These findings underscore the urgency for measures ensuring access to this critical input, which plays a pivotal role in the defense and industrial sectors, particularly in aerospace applications. The top four global producers of the sponge since 2010 have been China, Japan, Russia, and Kazakhstan. The TSWG report found Japan has exhibited the capability and willingness to meet varying U.S. titanium demands. Similarly, six respondents cited Kazakhstan as a reliable alternative to Japan, offering high-quality sponge.” n

[Editor’s note: the following is a collection of recent press releases and news stories offering business forecast for the 2025 commercial aerospace industry—the showcase market for the titanium industry. The thought here is to provide readers with a variety of perspectives from authoritative sources for how business conditions might play out in the near term. Readers are encouraged to review the entire article from different sources to determine how these many projections might affect business conditions in the titanium industry.]

By Michael C. Gabriele

As airlines and the commercial aerospace industry embark on 2025, most outlooks weigh positive business conditions with some nagging concerns, especially regarding the global supply chain. What’s clear is that virtually all the forecasts applaud the aerospace sector for successfully gaining altitude following the dark days of the Covid years.

For the titanium industry, the basic equation is that a positive outlook for commercial aerospace would spur demand for more titanium, as airlines work to meet the demand for expanding business and leisure travel. The demand for titanium components and assemblies would occur in orders for new jets as well as well as for titanium parts needed for maintenance, repair and overhaul (MRO).

“We’re expecting airlines to deliver a global profit of $36.6 billion in 2025,” Willie Walsh, director general of the International Air Transport Association (IATA) said, quoted in a Dec. 10, 2024 press statement [Link]. The IATA, headquartered in Montreal, with executive offices in Geneva, Switzerland, is the trade association for the world’s airlines, representing 340 airlines and over 80 percent of global air traffic.

“This (projected profit) will be hard-earned as airlines take

Forbes reported that supply chain woes, with delays at OEMS and engine manufacturers remain the top concern for the 2025 commercial aerospace market. However, Forbes pointed out that “this may be the most important trend because, in truth, delays in aircraft delivery are saving the airline industry from itself. Normally in prosperous times, airlines acquire airplanes and add routes, some of which turn out to be unprofitable. Forbes added that overall aerospace demand remains strong, despite questions regarding the supply chain.

advantage of lower oil prices while keeping load factors above 83 percent, tightly controlling costs, investing in decarbonization, and managing the return to more normal growth levels following the extraordinary pandemic recovery. All these efforts will help to mitigate several drags on profitability which are outside of airlines’ control, namely persistent supply chain challenges, infrastructure deficiencies, onerous regulation, and a rising tax burden,” Walsh said.

Highlights for the IATA outlook include: net profits are expected to be $36.6 billion in 2025 for a 3.6 percent net profit margin, a slight improvement from the expected $31.5 billion net profit in 2024 (3.3% net profit margin). Average net profit per passenger is expected to be $7 (below the $7.9 high in 2023, but an improvement from $6.4 in 2024). Operating profit in 2025 is expected to be $67.5 billion for a net operating margin of 6.7 percent (improved from 6.4 percent expected in 2024). Passenger numbers are expected to reach 5.2 billion in 2025, a 6.7-percent rise compared to 2024 and the first time that the number of passengers has exceeded the five billion mark. Cargo volumes are expected to reach 72.5 million metric tons, a 5.8 percent increase from 2024.

According to the IATA, the

Master alloys for Titanium Industry.

Nickel based Master Alloys.

Ni, Co, Mo & Fe based Super Alloys Bar Stock.

Equiaxed, Super Alloy Bar Stock suitable for making

Directionally solidified Single Crytsal Investment Casting.

significant risks to the aerospace industry in 2025 include disruptions from military conflicts in Europe and the Middle East, uncertainties over tariffs and possible trade wars, ongoing supply chain issues and concerns over fuel costs.

The New York Times, in a Jan. 11 feature article [Link], found the outlook for U.S. airlines was upbeat, according to airline executives and industry analysts. The Times reported that many major airlines upgraded forecasts for the all-important last quarter of 2024. Delta Air Lines, one of the major U.S. carriers, said it collected more than $15.5 billion in revenue in the fourth quarter of 2024, a record. “As we move into 2025, we expect strong demand for travel to continue,” Delta’s chief executive, Ed Bastian, said in a statement.

Delta’s report offers a preview of what are expected to be similarly rosy updates from other carriers that will report earnings in the next few weeks, the Times reported. “That should come as welcome news to an industry that has been stifled by various challenges even as demand for travel has rocketed back after the pandemic.” However, the Times report added a word of caution. “Geopolitics, terrorist attacks, air safety problems and, perhaps most important, an economic downturn could tank demand for travel. Rising costs, particularly for jet fuel, could erode profits. Or the industry could face problems like a supply chain disruption that limits availability of new planes or makes it harder to repair older ones.”

The positive outlook for 2025 is probably strongest for the largest U.S. airlines: Delta, United and American. All three are well positioned to take advantage of buoyant trends, including steadily rebounding business travel and customers who are eager to spend more on better seats

and international flights. But some smaller airlines may do well, too. JetBlue, Alaska Airlines and others have been adding more premium seats, which should help lift profits. Business improvements and positive industry trends, along with the stabilization of fuel, labor and other costs, have created the conditions for what could be a banner 2025. “All of this is the best setup we’ve had in decades,” Ravi Shanker, an analyst focused on airlines at Morgan Stanley, said, quoted in the Times article.

Jet engine manufacturer GE Aerospace forecasted stronger profits in 2025, saying it is better prepared to meet jet engine demand with progress in resolving supply chain issues that previously had hobbled production, according to a report on Reuters. GE stated that the production of LEAP engines, which power Airbus and Boeing narrow-body aircraft, is expected to increase 15 to 20 percent this year after a 10 percent year-onyear decline in 2024.

An online Reuters wire story [Link] quoted GE Aerospace CEO Larry Culp, who said “we have obliterated countless constraints in the supply base,” and that primary suppliers are now shipping over 90 percent of the committed volume, compared with about 50 percent a year ago.

Forbes [Link] reported that “supply chain woes, with delays at Airbus, Boeing, engine makers and other suppliers,” remain the top concern for the 2025 commercial aerospace market. However, Forbes pointed out that “this may be the most important trend because, in truth, delays in aircraft delivery are saving the airline industry from itself. Normally in prosperous times, airlines acquire airplanes and add routes, some of

which turn out to be unprofitable. Also, employee costs rise due to added capacity and improved union contracts. This time, the contracts are clearly better, but capacity growth has slowed, despite strong demand.”

Forbes pointed out that demand remains strong, despite questions regarding the supply chain. “Every carrier has noted the continued strength on its most recent earning carrier. Strong demand explains the increase in new destinations or frequencies, particularly European, which the carriers have scheduled for the coming summer.

Honeywell, in its Global Business Aviation Outlook, forecasted up to 8,500 new business jets worth $280 billion will be delivered over the next decade, an increase in value from last year’s forecast [Link].

The five-year new jet purchase plans of business aviation operators surveyed remained on par with last year’s results, indicating that demand for new aircraft is stabilizing well above pre-pandemic levels, according to the Honeywell forecast. Its survey reveals ongoing plans by business jet manufacturers to ramp up production in response to strong backlogs and stable book-to-bill ratios persisting through 2024. According to information posted on its website (https://www.honeywell.com/us/en), “Honeywell Aerospace Technologies products are found on virtually every commercial, defense and space aircraft, and in many terrestrial systems.”

Separately, The Wall Street Journal, on Feb. 7, reported that Honeywell “plans to separate its aerospace division from its automation business and move ahead with plans to spin off its advanced materials arm.” The separation of Honeywell’s aerospace and automation units is slated to be finalized by the second half of 2026. The Journal article stated that

Honeywell gets “about 40 percent of its annual revenue from the aerospace business, which makes engines and cockpit systems. An independent Honeywell aerospace business would be one of the largest aerospace suppliers, having booked $16 billion in revenue in 2024.”

Representatives from the commercial aerospace giants weighed in on near-term business forecasts at the 2024 TITANIUM USA Conference and Exhibition, held Oct. 6-9, 2024 in Austin, TX. Olivier Maillard, Airbus vice president of metallic material procurement, offered a forecast that there would be a strong demand for 42,430 new commercial aircraft between 2024 and 2043. In addition, Maillard said the commercial aerospace market has recovered faster than expected (since Covid-19), “with a strong focus on Airbus’ single-aisle family, and an increasingly one over the past two years on the wide-body market. The continued steady ramp-up on all Airbus’ programs is calling on the titanium industry to prepare and anticipate demand in 2026 and beyond.”

Jeff Carpenter, senior director, supply chain contracts and operations, Boeing Commercial Airplanes, spoke to the TITANIUM USA audience virtually, reminding the “titanium world” that Boeing’s 787 is still operating normally and is still our major consumer of titanium.” News sources estimate that titanium accounts for about 14 percent of the

Carpenter stressed the importance of titanium scrap for Boeing’s manufacturing operations. “Our scrap utilization for melt operations has increased dramatically, especially due to sponge pricing and availability. Sponge is tight, but more producers are coming online. We need your help. We’re going to see you soon. If you’re a machine shop or a forger, we’re going to be buying back our titanium scrap and we’re going to be enforcing that.”

Carpenter also noted that the global fleet for commercial jets has seen constrained capacity by Boeing and Airbus, delaying retirements of aging fleets. “It’s not a demand problem; it’s a capacity problem. Average fleet age is rising. We’re flying older airplanes longer. But our planes are safe. Markets are resilient and the industry is recovering (from Covid). Long-term growth looks promising.”

Flightplan Forecast, the aerospace analysis group based in Sandy Hook, CT [Link], reported that Boeing and Airbus finished 2024 on a high note both in terms of orders and aircraft shipments, which could signal a positive momentum for 2025. “Boeing’s deliveries jumped to 30,

compared to just 13 in November and 14 in October. Meanwhile, Airbus delivered 123 units, up from 84 in the prior month.”

Flightplan reported that Boeing’s jet deliveries rebounded in December following a labor strike that disrupted production last fall. However, the company’s annual deliveries in 2024 fell to their lowest level since the COVID-19 pandemic. The company delivered 348 commercial jets last year, down from 528 in 2023. New orders also declined significantly in 2024 compared to the prior year. Boeing recorded 569 gross orders and 377 net orders after accounting for cancellations and conversions.

Airbus delivered 766 commercial aircraft to 86 customers worldwide in 2024, a slight increase from the 735 delivered in 2023. The company also secured 878 gross new orders, resulting in a year-end backlog of 8,658 aircraft. “Key highlights of 2024 included the first-ever delivery of the A321XLR and the first A330neo and A350 deliveries to several new customers. Airbus CEO of Commercial Aircraft, Christian Scherer, acknowledged the sustained demand for new aircraft and the strong momentum in wide-body orders. He also emphasized the significant team effort required to achieve these results and expressed gratitude to both the Airbus team and their customers for their continued trust and partnership.” n

This program will open for applications again beginning April 3.

Please return then to view the updated Eligibility and Awards! If you are an applicant who would like to discover more scholarship opportunities you might qualify for, please continue to the Scholarship America Hub and sign up!

�

Oak Brook, Illinois – January 8, 2025 – A. M. Castle & Co.™, a global leader in the supply of highperformance metals and valueadded services, proudly announces the launch of its new unified brand identity. This strategic rebranding effort reflects the company’s commitment to delivering specialized solutions across its core industries— Aerospace, Industrial, and Medical— while enhancing its global service capabilities and optimizing supply chain operations.

The rebranding comes a little over a year after the November 2023 merger of Castle Metals and Banner Industries under the ownership of MiddleGround Capital, a private equity firm specializing in industrial investments. This milestone marks the integration of eight specialized divisions—Banner Commercial™, Banner Medical™, Banner P&M Supply™, Castle Metals Aerospace™, Castle Metals Industrial™, Edge International™, National Kwikmetal Service® (NKS), and Supra Alloys™— under the historic A. M. Castle & Co. name, a legacy that dates back to 1890. Each division will maintain its name and specialized focus, with updated branding that reflects a cohesive corporate identity.

This rebranding aligns the company’s operations by leveraging expertise across three industry-focused verticals:

• Aerospace: Supported by Castle Metals Aerospace and Supra Alloys.

• Industrial: Represented by Banner Commercial, Banner P&M Supply, Castle Metals Industrial, and NKS.

• Medical: Led by Banner Medical and Edge International.

This new structure is further supported by operations across five global regions: APAC (Asia-Pacific), Canada, EMEA (Europe, Middle East, and Africa), Mexico, and the USA.

The rebranding will also improve cross-industry collaboration and provide customers with broader access to A. M. Castle & Co.’s complete portfolio of highperformance metals and processing capabilities. Notably, the company’s newly integrated supply chain structure will enable more efficient logistics, faster response times, and expanded access to specialized materials in key markets. Customers will benefit from:

• Localized, responsive service tailored to regional needs.

• Cross-selling opportunities enabling customers to benefit from a comprehensive range of solutions.

• Enhanced supply chain operations to reduce lead times and ensure consistent product availability.

• Updated sales materials and resources to reflect the unified brand and current offering.

“Our commitment to quality, innovation, and service remains unwavering,” said Dan Stoettner, CEO of A. M. Castle & Co. “This rebranding isn’t just about refreshing our look—it’s about aligning our operations, supply chain, and resources to serve our customers and partners more effectively. Under the leadership and support of

MiddleGround Capital, we are better positioned to meet the evolving needs of the industries we serve.”

The transition to the unified brand begins today and will occur in phases through early 2025. Customers, vendors, and partners can expect continuous communication and support during this transition to ensure a seamless experience.

Founded in 1890, A. M. Castle & Co. is a leader in the supply of highperformance metals and value-added processing services. With over 30 locations worldwide, the company serves industries across Aerospace, Industrial, and Medical market verticals, delivering expertise, innovation, and a legacy of excellence. The company operates through eight specialized divisions—Banner Commercial ™, Banner Medical™, Banner P&M Supply™, Castle Metals Aerospace™, Castle Metals Industrial™, Edge International™, National Kwikmetal Service® (NKS), and Supra Alloys™—and serves customers through five global regions: A. M. Castle & Co. APAC™ (AsiaPacific), A. M. Castle & Co. Canada™, A. M. Castle & Co. EMEA™ (Europe, Middle East, and Africa), A. M. Castle & Co. Mexico™, and A. M. Castle & Co. USA™.

MiddleGround Capital is a private equity firm specializing in middlemarket industrial investments. As experienced operators with a handson approach, MiddleGround serves as a reliable partner, working alongside portfolio companies across all organizational levels to drive growth and build sustainable, long-term value.

Kenosha, Wis., February 27, 2025 –Bahco is expanding its portfolio with a line of reciprocating and bandsaw blades designed for the pallet disassembly saws used in the pallet dismantling business. Bahco is a world leader in the bandsaw market with more than 140 years of experience manufacturing saw blades and cutting tools. The company provides tailored solutions to meet the changing needs of highperforming professionals.

These new Pallet Dismantler Blades are designed to easily cut through the nails and staples found in pallets while standing up to the shock of interrupted cuts. These tough bimetal blades can withstand the cutting heat that can quickly destroy the temper of carbon steel blades traditionally used to cut wood pallets and skids.

• The M42 Pallet Dismantler Bandsaw blades are 1-1/4” x .042” (34 x 1.1mm) with 5/8 teeth per inch.

• Welded loops are sold in bulk packs of 20 and are offered in a variety of lengths to cover numerous applications. Lengths include: 18’6”, 19’, 20’, 20’6”, 22’, 22’4”, 23’, 23’8”, 24’ and 25’4”. The 3840 Pallet Dismantler Reciprocating Bimetal Saw Blades

have a unique design that prevents the blade from getting stuck in the closed position when cutting nails in damaged parts of the pallet. The tooth design allows for excellent rate removal in wooden material with nails, and its elevated strength prevents tooth breakage.

• The 7-1/2” (190mm) Reciprocating Bimetal Saw Blades come in 10/14 teeth per inch and 10 teeth per inch and are sold in packs of 100.

• The 8” (210mm) Reciprocating Bimetal Saw Blades come in 10 teeth per inch and are sold in packs of 100 or 500.

• The 10” (269 mm) Reciprocating Bimetal Saw Blades come in 10 teeth per inch and are sold in packs of 100.

For more information on this latest line of Pallet Dismantler Reciprocating and Bandsaw Blades from Bahco, visit www.bahco.com.

About Bahco

Bahco is a leading manufacturer of tools, cutting tools, saws and other equipment tailored to the

most demanding professionals and industries. As innovators for more than 165 years, Bahco has introduced the most advanced tools in the world and sell through distributors with whom we build long-term partnerships. Bahco products are overwhelmingly manufactured in our own factories located across Europe and offered by our partner distributors to the professionals. Visit www.bahco.com/us_en.

About Snap-on Industrial

Snap-on Industrial is a division of Snap-on Incorporated, a leading global innovator, manufacturer and marketer of tools, diagnostics, equipment, software and service solutions for professional users. Products and services include hand and power tools, tool storage, diagnostics software, information and management systems, shop equipment and other solutions for vehicle dealerships and repair centers, as well as customers in industry, government, agriculture, aviation and natural resources. Products and services are sold through the company’s franchisee, company-direct, distribution and Web-based channels. Founded in 1920, Snap-on is a $4.25 billion, S&P 500 company headquartered in Kenosha, Wisconsin.

This past year IperionX achieved transformational progress, accomplishing a step change in our growth with the development of our Virginia Titanium Campus and the fast-tracked innovation activities there. We are rebuilding an industry that America once led – ushering in a new era where we manufacture high-performance titanium with ground-breaking, low cost, and energy efficient technologies – right here in the United States.

The ‘Wonder Metal’

that is inherently challenging

Titanium has long been recognized as a superior metal – stronger than steel and aluminum, with low density and nearly impervious to corrosion. Yet the current standard method of production, the Kroll process, developed in the 1940s, remains an energy-intensive, batchbased and high-cost method that is inherently challenging to scale. These inefficiencies have consigned titanium to use in only specialized, high-performance and high-cost applications. That is about to change.

The Breakthrough That Titanium Has Been Waiting For

Industrial history shows that when a new scientific breakthrough reduces the cost of a superior material, entire industries emerge around it. We saw this with steel in the 19th century and then aluminum in the 20th century.

• The Bessemer process transformed steelmaking in the 1850s by reducing production costs by 80% and dramatically increasing scale. This scientific breakthrough not only made steel affordable for railroads, bridges, and skyscrapers, but catalyzed the rapid industrial growth that drove the U.S. economy.

• The Hall-Héroult process did the

same for aluminum in the late 19th century. Previously a precious metal, used only sparingly, a single industrial process innovation made aluminum cheap enough to be used widely- in automobiles, aircraft and packaging.

In both cases, the companies that adopted and innovated with new production processes - Carnegie Steel, Bethlehem Steel and ALCOA - recognized that technological breakthroughs could not rely on fragmented supply chains or distribution channels. These companies built fully-integrated supply chains, controlling the raw material supply to their final products, to improve efficiency and lower costs.

Titanium’s equivalent transformation requires its own revolutionary process. This is where IperionX, with its proprietary technologies, believes it will revolutionize the titanium

industry.

The traditional Kroll and subsequent ingot melting processes are inherently inefficient.

Kroll relies on titanium minerals first being subjected to a carbothermic chlorination process to produce titanium tetrachloride (TiCl4), a high energy, high carbon intensive and highly corrosive material.

The TiCl4 is then reduced with molten magnesium metal and subjected to a lengthy distillation process (often more than 2 weeks) to manufacture titanium metal sponge, a porous intermediate material that must be melted multiple times in a vacuum furnace to form titanium ingots.

These large ingots must then go through numerous high-temperature

ARIES Manufacturing is dedicated to the supply of complex airframe structure components, in both titanium and aluminum alloys, to leading manufacturers in the aerospace industry.

ARIES Manufacturing is part of the ARIES Alliance, a group of companies focused on developing innovative technology that creates value for the aerospace industry.

Panel mechanical pocket milling, drilling and trimming

Superplastic Forming and Hot Forming for titanium airplane structural and engine components

HSF® process technology for titanium airframe components

process steps to fabricate titanium bar, plate and sheet to produce semifinished titanium products, often with substantial yield losses.

To manufacture a final titanium component, a surprisingly wasteful and expensive manufacturing step takes place. Manufacturers typically must machine away up to 80-90% of the titanium plate, bar or rod to create a final titanium component. This machining step alone can be responsible for ~50% of the final titanium part cost according to joint study by the U.S. Department of Energy’s Oak Ridge National Laboratory (ORNL) and Boeing.

In short, the Kroll process and its subsequent ingot melting process require a chain of complex, capitalintensive, and high-cost steps to produce titanium metal parts. This lengthy chain of process steps leads to long lead times for products that can extend well over a year.

IperionX can eliminate the complex process steps, thereby reducing inefficiencies and costs.

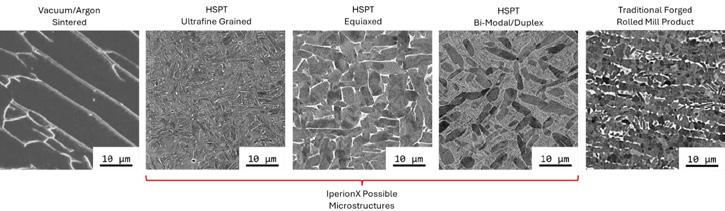

Our Hydrogen-Assisted Metallothermic Reduction (HAMR™) process produces lowcost titanium powder directly from either recycled titanium scrap or domestic mineral feedstock— completely eliminating the need to make titanium metal ingots. Instead, IperionX makes a high purity “ingot” in a powder form that transforms into metal products with traditional powder metallurgy techniques and our Hydrogen Sintering and Phase Transformation (HSPT™) process. Combining the efficiency of traditional powder metallurgy processes like cold isostatic and uniaxial press operations (a widely

used manufacturing method to produce high-volume and low-cost steel parts for the automotive to energy industries) with our HSPT process, allows us to achieve high quality and low-cost near-net-shape and final parts at a fraction of the cost of the traditional titanium metal supply chain.

Historically, titanium parts made via the traditional argon sintering process resulted in products with inferior properties compared to forged titanium metal parts. The incumbent industry could not find a way to take advantage of traditional powder metallurgy to produce lowcost and high-performance titanium metal parts.

IperionX’s technologies revolutionize this outdated model. Our process is

designed to produce mill products like bar, plate and sheet, and also produce near-net-shape titanium components that reduce manufacturing yield losses (in some cases from 10% yield to 90% yield, an order of magnitude improvement) and the significant costs associated with machining the parts.

Our revolutionary process fundamentally changes the economics of titanium production.

For decades, use of titanium has been constrained by its manufacturing complexity and high costs. With our patented technologies, we reduce waste,

For decades, use of titanium has been constrained by its manufacturing complexity and high costs. With our patented technologies, we reduce waste, energy use, and slash costs - making titanium viable for industries that previously did not find it economical

from these two countries, creating unacceptable vulnerability not only to critical industries like aerospace and defense, but also to U.S. national security.

energy use, and slash costs - making titanium viable for industries that previously did not find it economical.

The Boeing 787 is an illustrative example. The 787 requires around 53 tons (116,000 pounds) of semifinished titanium (‘buy’) to yield just 9 tons (19,000 pounds) of finished titanium components (‘fly’)

A 2012 study by ORNL and Boeing1 found that lowering this ‘buy-to-fly’ ratio from 6:1 (six tons purchased for every one ton used in the aircraft) to 2:1 could deliver substantial cost savings in both material and machining - especially given that machining can account for up to 50% of a part’s total cost. Boeing is but one example of how critically industry needs a way to make titanium less costly.

The Boeing 787 is an illustrative example. The 787 requires around 53 tons (116,000 pounds) of semifinished titanium (‘buy’) to yield just 9 tons (19,000 pounds) of finished titanium components (‘fly’). A 2012 study by ORNL and Boeing1 found that lowering this ‘buy-to-fly’ ratio from 6:1 (six tons purchased for every one ton used in the aircraft) to 2:1 could deliver substantial cost savings in both material and machining - especially given that machining can account for up to 50% of a part’s total cost. Boeing is but one example of how critically industry needs a way to make titanium less costly.

1 Bowden, David M and Peter, William H. “Near-Net Shape Fabrication Using Low-Cost Titanium Alloy Powders.” , Mar. 2012. https://doi.org/10.2172/1040632

IperionX believes it can unlock even greater cost benefits than in the 787 example. In addition to reducing the buy-to-fly ratio and associated machining costs, our production process eliminates the high-energy ingot melting and hot working steps required to produce semi-finished titanium. The same ORNL/Boeing study indicated that hot working from ingot to semi-finished product can represent nearly half of its cost - or about 25% of a final machined titanium part’s cost.

Using this logic, at the point where IperionX produces titanium at the same cost as conventional titanium

IperionX believes it can unlock even greater cost benefits than in the 787 example. In addition to reducing the buy-to-fly ratio and associated machining costs, our production process eliminates the high-energy ingot melting and hot working steps required to produce semi -finished titanium. The same ORNL/Boeing study indicated that hot working from ingot to semi -finished product can represent nearly half of its cost - or about 25% of a final machined titanium part’s cost.

1 Bowden, David M and Peter, William H. "Near-Net Shape Fabrication Using Low-Cost Titanium Alloy Powders." , Mar. 2012. https://doi.org/10.2172/1040632

ingots, we estimate the potential for a ~75% reduction in the cost of a titanium part. In applications with buy-to-fly ratios of 10:1 or higher - such as consumer electronics, fasteners, and other small or complex components - cost savings may exceed 90%.

4

Using this logic, at the point where IperionX produces titanium at the same cost as conventional titanium ingots, we estimate the potential for a ~75% reduction in the cost of a titanium part. In applications with buy-to-fly ratios of 10:1 or higher - such as consumer electronics, fasteners, and other small or complex components - cost savings may exceed 90%.

IperionX aims to build an uninterruptible titanium supply chain - in America, for America. Our twin-feedstock strategy eliminates dependency on foreign sources through two complementary approaches: sourcing unused American-generated titanium scrap metal, or using titanium mineral feedstocks from our 100% owned and permitted Titan Project in Tennessee, once developed.

IperionX Titanium Product Cost Reduction Potential Boeing 787 Airframe

Part Machining

Mill Product Hotworking

Kroll-Ingot Melting / HAMRHSPT

Titanium Ore

Re-Shoring an Uninterruptible American Titanium Supply Chain

For far too long the United States has depended on foreign sources for its titanium, with global supply chains dominated by China and Russia. Over 70% of the world’s titanium sponge production comes from these two countries, creating unacceptable vulnerability not only to critical industries like aerospace and defense, but also to U.S. national security

IperionX aims to build an uninterruptible titanium supply chain - in America, for America. Our twinfeedstock strategy eliminates dependency on foreign sources through two complementary approaches: sourcing unused American-generated titanium scrap metal, or using titanium mineral feedstocks from our 100% owned and permitted Titan Project in Tennessee, once developed

The Titan Project is America’s largest fully permitted, undeveloped source of titanium and rare earth minerals hosted in a simple, low-cost sand deposit. The Titan Project ensures that IperionX controls a key feedstock solution to establish an end-to -end uninterruptible titanium metal supply chain. Once developed, the Titan Project has the potential to supply IperionX’s metal production processes with titanium minerals at a significantly lower cost than even purchased titanium scrap metal

For far too long the United States has depended on foreign sources for its titanium, with global supply chains dominated by China and Russia. Over 70% of the world’s titanium sponge production comes