Also in this issue:

– Michael W. Dunagan: A Look Back at TIADA Legislative Successes

– How to Leverage Artificial Intelligence at Your Dealership – Transparency in the Car Buying Process – Take

Also in this issue:

– Michael W. Dunagan: A Look Back at TIADA Legislative Successes

– How to Leverage Artificial Intelligence at Your Dealership – Transparency in the Car Buying Process – Take

Never before have there been this many robust solutions at your fingertips. From acquiring to merchandising, ACV brings you the capabilities to be an unstoppable force in your market. Get more cars, market them to a wider audience, and sell them for higher grosses than ever before.

TIADA Board of Directors

PRESIDENT

Ryan Winkelmann/BJ’s Autohaus

5005 Telephone Road Houston, TX 77087

PRESIDENT ELECT

Eddie Hale/Neighborhood Autos

PO Box 1719

Decatur TX 76234

CHAIRMAN OF THE BOARD

Mark Jones/MCMC Corporate

264 Exchange Burleson, TX 76028

SECRETARY

Vicki Davis/A-OK Auto Sales

23980 FM 1314 Porter, TX 77365

TREASURER

Greg Phea/Austin Rising Fast 8024 IH 35 North Austin TX 78753

VICE PRESIDENT, WEST TEXAS (REGION 1)

Brad Kalivoda/Fiesta Motors 2599 74th Street Lubbock, TX 79423

VICE PRESIDENT, FORT WORTH (REGION 2)

Greg Reine/Auto Liquidators

39670 LBJ Freeway Dallas TX 75237

VICE PRESIDENT, DALLAS (REGION 3)

Chad Lancaster/Chacon Autos

11800 E. Northwest Hwy Dallas TX 75218

VICE PRESIDENT, HOUSTON (REGION 4)

Russell Moore/Top Notch Used Cars

900 East Davis Conroe, TX 77301

VICE PRESIDENT, CENTRAL TEXAS (REGION 5)

Robert Blankenship/Texas Auto Center

6809 Suite B S IH35 Austin, TX 78744

VICE PRESIDENT, SOUTH TEXAS (REGION 6)

Armando Villarreal/McAllen Auto Sales, LLC

4215 S. 23rd St McAllen, TX 78503

VICE PRESIDENT AT LARGE

Lowell Rogers/11th Street Motors

1355 N 11th St, Beaumont, TX 77702

VICE PRESIDENT AT LARGE

Every New Year’s Day, I get together with my wife and children, and we discuss our personal and professional goals for the new year. It’s a time when we reflect on the good and the bad events and experiences of the previous year. We discuss and make new plans for improvement, and we exchange ideas on how we can implement our new goals.

As car dealers, we could benefit from a similar process. As I ponder what the year 2023 will bring to the car business, I ask myself these four questions: 1) What do I need to plan and prepare for this year? 2) What trends will impact my business? 3) What are the pertinent things that I need to focus on to keep the business thriving? 4) What is the most meaningful aspect of the work that I do?

For those of you who know me, I have a rather unconventional way of viewing things, and in my search for answers to these questions, I thought about four things that I believe car dealers should watch carefully in 2023. Here are the four “I’s” that we should watch this year (sorry for the pun).

With the onset of the pandemic, an increase in extreme weather, computer chip shortages, supply/chain management interruptions, rising costs, etc., our inventory has likely been the most unstable it has been since many of us have been in business. We have all had to pivot to find new sources of inventory and even change our typical inventory to avoid having an empty lot. Forging new relationships and thinking outside of the box is what helped many of us weather the inventory storm. We have had to become “forward thinking “ in approaching and assessing a steady and reliable flow of inventory.

As the owner of a retail shop, I am constantly aware of interest rates and fees. The more inventory I have, the more interest I have to pay, so static inventory is not an option. On rare occasions, I may finance an in-house deal, but generally, I have funding resources to finance my cars. Interest payments (curtailments) can be a profit killer. Those of us who use outside sources have to be flexible to markdown and incentivize all old inventory to move it as soon as possible. In 2023, this becomes a larger issue due to the rising costs of cars. Let’s face it, many of us probably bought our first house for the cost of a current new luxury car. My mentor of over 30 years (Don Wilson), would always say that “my first loss is my best loss.” The message he was sharing was that the faster you can clear out unprofitable merchandise, the faster you can stop high-interest loss and use funds towards more profitable inventory.

Make no mistake, times have changed since I started in the car business approximately 35 years ago. I can’t say that I know very many car dealerships that are not making full use of the internet and social media platforms. I have to admit that I have spent more money on online advertising than I have ever spent on advertising before. Investing in a strong online presence has been one of the hardest decisions we have had to make. How much to spend, how often, and which platforms should we use or prioritize? Do we hire in-house or outside sources? My recommendation is that you find the advertising medium that will work best for the growth and profit goals that you have set for your company. As with my annual family goals, you will need to assess the good

and bad and plan a budget and platform according to what has been proven to be successful for your company.

Having an annual budget for advertising will prepare you for the high costs that occur in this area. You never want to spend more on advertising than its return on sales. A review of last year’s budget will help you determine where your advertising dollars were most effectively spent. The internet, Craigslist, Facebook, Google, Yelp, etc., are the way of the world. Without a good online presence, your business can become dismal. The Internet has become a very necessary tool in the car business toolkit.

People are the most important part of our business. The formula that has worked for me has been my faith because I believe that God blesses me daily, so I put Him first. Next, my family, friends, employees, and customers. In the car business, our families make a sacrifice due to our long hours and impulsive nature to always be ready to sell or purchase a car at almost any time of the day. The support from our families can help ease the stress of running a car dealership, and it is truly a blessing when we can work together. Having my daughter come to work with me has made me a better businessman. For the past six years, my daughter Chloe has been working by my side, keeping me updated, social media savvy, and better organized. Though she has a degree in Neuroscience and I realize that she may not remain in the car business,

I know that while she is here, the company has a loyal, honest, dedicated employee who has a vested interest in the success of the company. Many of us can attest to the immeasurable benefits of family members joining the car business and helping us run our stores.

Through the years, I have had amazing mentors whom I consider forever friends. Everyone needs to have someone knowledgeable of the business, who can provide honest, straightforward feedback. As the world changes around us, a good friend remains steadfast and true. People you can truly trust are rare, and surrounding yourself with people you love and trust can make you a better person and businessman.

Good employees are hard to find. When the pandemic hit, the employment market changed. Staffing became more challenging, and employers were faced with shortages. Over the past few years, it has become more difficult to retain employees, and car dealers are not alone in this trend. I have learned that to retain employees, you have to compensate them well, and provide a safe, respectable environment, and when they prove to be loyal, dedicated employees, you treat them like family — because they are.

When I reflect on the most important things in life, it hits me that change is inevitable, and I’ve had to adjust accordingly. As car dealers, we have to move with the flow of change to remain viable and profitable. I hope that watching the 4 “I’s” will help you prepare your car business for a future that will support sailing into the future.

Now that work is under way in the 88th Texas Legislative Regular Session, it might be worthwhile to review some of the legislative activities of TIADA over the past 46 years that I have been involved. This is my 24th legislative session, and as might be imagined, I’ve seen many changes on the legislative front since my first visit to the capitol in 1977 as a 20-something fresh-out-of-lawschool green attorney.

While TIADA may not rank with the most powerful groups at the legislature, its reputation and ability to effectively carry out members’ goals have grown exponentially in the last few sessions. Executive Director Jeff Martin and his staff, including Director of Compliance and Business Development Earl Cooke, know the importance of legislative work and allocate their resources and time accordingly. Despite the fact that the legislature is in session only six months every two years, TIADA’s legislative work goes on year-round with advance planning to avoid surprises. Plus, Martin and his staff understand and participate in the state agency rule-making process, which can often have as great an impact on dealers as laws passed by the legislature.

Martin is also assisted by a professional leglisative consultant, Mario Martinez, and many active dealer-members who will appear at the capitol on short notice and express their views to their representatives or even testify before committees, if necessary. The high level of organization also makes it

easier to mount an attack on proposed legislation that is considered to be detrimental to our members’ interests.

Here is a summary of a few of TIADA’s legislative successes — some from decades ago, and some more recent. It’s not a complete list, but it reflects the work of a lot of dedicated folks who have given their efforts and talents to improving the situation of independent dealers in Texas.

One of the first dealer calls I took at the TIADA office was a question about a vehicle that the buy-herepay-here dealer had financed that had been sold by his debtor to a salvage yard. Despite the dealer’s recorded lien, the vehicle was crushed without the knowledge or permission of the lien holder (the thought of a vehicle being squeezed in a crusher evoked images of a

by Michael W. Dunagan TIADA COUNSELvehicle in the James Bond movie Goldfinger being hydraulically reduced to a three-foot cube — with one of the villain’s enemies inside). Our dealer was told by the salvageyard owner that he didn’t need to get permission to crush a vehicle over 10 years old. The police and DMV had indicated that there was nothing they could do. The bill that we crafted to address this deficiency in the law was passed. We were successful in obtaining legislation that required salvage yards to obtain title to vehicles before parting out or crushing them, regardless of age.

That legislative effort took on more significance when a bill was filed in the 2021 session that would eliminate again the requirement of obtaining title or inquiring as to lien status to a vehicle over 10 years old before parting-out or crushing. The bill would have absolved the salvage yard from any liability to a lien holder if the

Many, if not most, BHPH dealers probably don’t even know that there was a time when deferred sales tax didn’t exist. Those dealers who led the charge deserve our heart-felt appreciation.

person selling the vehicle signed a statement declaring that he or she owned the vehicle and had the authority to sell it. Based largely on TIADA efforts, the bill didn’t pass. However, it appears that it will be resurrected in this session.

For years, Texas buy-here-payhere dealers faced an unpleasant dilemma: (1) advance 100 per cent of sales tax up front and lose profitability; or (2) don’t pay sales tax up front and risk being put out of business by a sales tax audit. Many dealers took their chances with the latter option and got caught, resulting in several million-dollar assessments. One dealer faced a felony criminal charge for not transferring deals that went bad.

The late Jim Watson of Dallas knew there had to be a better way. Watson organized the Fair Tax Committee and convinced Bill Plaster of Dallas to chair it. Facing impossible odds, Watson and Plaster, with the help of the late Roy Carlson of Fort Worth and Don Fincher of Houston, and too many others to name, raised the necessary money, and undertook to achieve what had been described as an impossible task (we were told by many knowledgeable and experienced legislative experts that what we were trying to accomplish couldn’t be done). After a series of meetings with Comptroller and DMV staffers, we came up with a plan that would benefit not only BHPH dealers, but the state as well. Comptroller John Sharp signed off on the deferred-sales-tax approach for seller-finance dealers, which eliminated the last obstacle. After the tax reform bill passed and went into effect, TIADA’s membership shot up to one of its highest levels ever.

Many, if not most, BHPH dealers probably don’t even know that there was a time when deferred

sales tax didn’t exist. Those dealers who led the charge deserve our heart-felt appreciation.

Prior to 1989, vehicle lien holders had no legal claim to insurance proceeds paid to their customers by insurance carriers who had insured a third party that caused the accident. With damaged collateral and a debtor flush with insurance money to buy another car, the lien holder was left holding the bag. But then TIADA supported legislation that would place a lien on liability proceeds for recorded lien holders. That is, if a liability carrier paid a debtor without including the lien holder on the check, the carrier violated the interest of the lien holder in the proceeds and could be made to pay again. In terms of benefit-tocost, this bill surely ranks up there as dealers have collected untold amounts that would have been lost under prior law.

After passage of the 1993 tax reform bill, BHPH dealers were able to avoid fronting sales tax at the time of transfer and would only have to submit sales tax on amounts actually collected, and pay no tax on unpaid balances. At about the same time, another problem arose when the U.S. Internal Revenue Service ruled that dealers who financed sales would in most cases have to use the accrual method of accounting for income (as opposed to the cash method which most dealers had used). This meant that the entire amount of a contract would have to be taken into income in the year in which it was signed. This change resulted in a substantial increase in the amount of income tax owed and an acceleration of income tax liability. Although a deduction could later

be taken on bad debt, many dealers were forced to take out large loans to pay income tax on uncollected receivables.

To counter the burdens of having to advance large amounts of income tax, some dealers set up separate corporations to sell receivables to at a discount. This process reduced the over-all tax obligation since the finance company could use the cash basis of accounting.

The problem was that a provision in the original deferred-sales-tax law required acceleration of sales tax on retail installment contracts that were sold or assigned to third parties. This provision was intended to limit deferred sales tax to dealers who selffinanced. Unfortunately, the Texas Comptroller’s Office took the position that assignment of receivables to a separate corporation, even if it had identical stock ownership as the dealership, caused the loss of

deferred sales tax treatment. The dealer was then required to accelerate sales tax on each assigned contract, in effect off-setting the federal income tax advantage of having a related finance company.

To overcome this dilemma, TIADA supported legislation in the 2007 session of the Texas Legislature that would allow a finance company with at least 80% common ownership with a dealership to continue to defer sales tax on assignments taken from that dealership. The TIADA bill was passed and signed by the governor, in effect saving BHPH dealers with related finance companies huge amounts of both sales and income taxes.

One of the biggest headaches that dealers faced through much of the 90’s was the convergence of (1) the requirement that dealers handle all

title transfers on vehicles they sold, and (2) the requirement that proof of liability insurance in a buyer’s name be presented with all title transfers. When buyers failed to bring in proof of insurance by the time title had to be transferred, dealers were unable to record their liens and became sitting ducks for state enforcement officers who issued fines for failure to timely transfer title.

Working with the Texas Automobile Dealers Association, we pushed for legislation that would exempt dealers from being the liability-insurance police. Upon passage of this legislation, dealers were freed up to transfer title and record liens, without being held hostage by their customers who didn’t provide proof of liability insurance.

TIADA-sponsored bills passed in 2009 and 2015 have helped

car creditors fight off the sting of fraudulent mechanic’s lien claims. While a valid mechanic’s lien is still superior to a prior recorded mortgage lien, the two bills have made it easier to challenge fraudulent or fictitious claims. Also, the bills made it harder for third-party repair-financing companies, set up to take assignment of mechanic’s liens, to claim liens superior to a car-creditor’s lien.

Prior to passage of Senate Bill 876 in the 2021 legislative session, a dealer was required to have each buyer sign at closing a form VTR 136 in which the buyer could designate any of the 254 counties in the state as the place the dealer would have to file the transfer paperwork. The 2021 law now authorizes a dealer to file transfer papers in any county where the tax assessor-collector agrees to

accept the paperwork. This change also eliminated the need to have a VTR 136 filled out, signed and placed with the dealer’s file.

In 1983, the dealer license was little more than a permit that authorized the holder to use metal dealer tags and to avoid sales tax on the purchase of inventory. There was no prohibition on anyone else buying and selling cars as a business or otherwise. Curb-stoning was a legal way to do business. Working with TADA, the state’s franchised-dealer association, TIADA pushed for and passed legislation that set minimum premises requirements, and limits on unlicensed sales. Additionally, the requirement that independent dealers have a $25,000 bond was imposed for the first time (it’s now been raised to $50,000). An immediate effect of that new law was that

the number of dealer licenses declined (indicating some casual and non-dealer licensees gave up their licenses). The law also, for the first time, gave the DMV enforcement tools to go after curb-stoners. There are many other legislative (and non-legislative) successes that come to mind in reviewing 46 years of TIADA memories, but we don’t have the time or the space to discuss them all. My hope is that maybe this list also offers a guide to anyone who asks the question: What has TIADA ever done for me, and why should I be a member?

Michael W. Dunagan is an attorney in Dallas, Texas who has represented the Texas Independent Automobile Dealers Association for over 45 years. He has written a number of books and hundreds of articles for trade journals and law reviews. His clientele includes dealers, banks, finance companies, auto auctions and credit unions.

This is a first class facility that meets all dealer requirements and zoning.

You will not find another location like this!

The 88th Legislative Session has seen an usher back to normalcy after the 87th Session was so unique due to COVID. TIADA is back to running around the halls of the Capitol and physically meeting with the legislature and their staff members, unlike the days of COVID, where physical meetings were often not possible. TIADA is still busy following bills, meeting with members of the legislature, and making sure dealers’ voices are heard at the Capitol. TIADA will host its first day of the Capitol since COVID on February 7th. Below you will find a few key bills we are watching:

HB 718 (Goldman) This bill would replace temporary tags with metal plates assigned to a dealer. TIADA is monitoring this bill.

STATUS: TIADA is working hard to ensure that members of the legislature are aware that this bill would burden dealers who would have to retrieve tags from customers, as some customers are irresponsible in returning to the dealership after the sale.

HB 914 (Hefner) This bill would clarify that it is a criminal offense to issue a temporary tag fraudulently. TIADA is monitoring this bill.

STATUS: TIADA is working to make sure members of the Legislature understand that license holders should not face criminal charges for minor offenses,

by Earl Cooke TIADA DIRECTOR OF COMPLIANCE AND BUSINESS DEVELOPMENT

such as issuing a second temporary tag to a customer when the tax office has not processed the title application. NOTE: Please apply for a 30-day permit, and you should never issue a second temporary tag. However, TIADA believes such a mistake by a dealer should not be criminal.

HB 1235 (Thompson) This bill would require an insurance company to pay for any diminution of value as a result of the accident. TIADA supports this bill.

STATUS: TIADA is working to ensure that members of the legislature understand the loss caused by a crash is more than just the cost to repair a vehicle and includes diminished value related to a bad vehicle history report and less marketability after the repair is made.

HB 1437 (Clardy) This will would create an appraisal process that could be used when an insurance company unfairly evaluates the value of a loss. TIADA supports this bill.

STATUS: TIADA is working with the author of this bill to see if we can extend the availability of this process to lienholders.

SB 224 (Alvarado, Whitmire) This bill would criminalize the possession of 2 or more catalytic

TIADA is back to running around the halls of the Capitol and physically meeting with the legislature and their staff members...

The TIADA Website: www.txiada.org

Members can log in with their username/password and access our Dealer Member Directory, Legislative Action Center, Compliance Consultation Service and much more. Register for all upcoming TIADA events online through the Calendar of Events, access our online membership application, find contact information for all our Local Chapters, and access many additional resources through our Knowledge Base.

License Renewal Certificate

TexasDealerEducation.com

Texas Department of Motor Vehicles

888.368.4689

www.txdmv.gov

Office of Consumer Credit Commissioner

800.538.1579

occc.texas.gov

Texas Comptroller

800.252.1382

comptroller.texas.gov

NIADA

817.640.3838

www.niada.com

REPOSSESSIONS

American Recovery Association

972.755.4755

www.repo.org or contact

TIADA state office

FORMS

Burrell Printing

512.990.1188

www.burrellprinting.com

converters that have been removed from 2 or more different vehicles because law enforcement often stops thieves with catalytic converters in their possessions but are unable to prosecute them due to the inability to trace them back a particular theft. TIADA supports this bill.

STATUS: TIADA has worked with Sen. Alvarado to ensure legitimate reasons for having numerous removed catalytic converters are exempted and is working with members of the legislature to ensure everyone is aware of the issues related to catalytic converter theft.

SB 528 West This bill would allow a metal recycler or used automotive parts recycler to purchase a vehicle for crushing or parting without obtaining title to the vehicle or notifying the lienholder if the vehicle is at least 12 years old if the lien is 6 years

or older or has been released. TIADA opposes this bill.

STATUS: TIADA is working hard to ensure members of the legislature are aware that 12-yearold vehicles are very common and not clunkers and that this bill would hurt the ability of lienholders to ensure their collateral is safe from bad actors. We are working with the author of this bill in an effort to find a solution, but as written, TIADA opposes this bill.

Your best source of up-tothe-minute information on legislative issues that will affect your industry is the Legislative Action Center, found under Advocacy at the TIADA website, www.txiada.org. As always, we welcome the input of our members regarding legislative matters. TIADA’s legislative team will work diligently to keep you abreast of the issues and call on you to act when needed.

Please fill out the form on the next page to help our efforts out at the Capitol!

Thank you to all those who contributed to INDEPAC in 2022!

We want to take a moment to thank all of those who have made a contribution to INDEPAC. Due to your generous efforts, we collected over $89,000 in donations in 2022.

Because of these contributions, INDEPAC can continue to protect the rights and interests of independent automobile dealers across the state of Texas. There are many issues confronting the industry right now, and we appreciate your dedication to ensuring we continue to have a strong voice at the Capitol.

We are looking forward to representing the interests of all independent dealers along the road ahead. Thank you for your support!

Sincerely, INDEPAC

by Sean Toussi CEO of Glo3D

by Sean Toussi CEO of Glo3D

The key to any strong relationship is trust and being open with one another. This seems to be overlooked by some professionals in almost every industry. But car buyers often feel they need more transparency in their buying process than they do with other products because vehicles are a much more complicated product. As today’s car shoppers are more informed than ever, it is increasingly important for dealerships to focus on building trust with their customers.

A recent survey by Marchex indicated that 91% of consumers say “trust” is important to them when deciding which dealership to purchase from. More importantly, trust and price are equally weighted in the dealership selection process from the customers’ perspective. This highlights the need for dealers to create trusting relationships with their customers. Dealerships need to promote transparency in

their activities in order to create a better customer experience.

Customers should be able to trust that the dealership is being truthful about things like vehicle pricing, trade-in values, and so on. If there are any questions that come up during the sales process, the dealership should be able to provide clear and concise answers. Therefore, car dealerships adapt to evolving customer journeys and find new ways to establish more transparent relationships with them.

In any industry where consumers are often skeptical and have negative preconceptions, transparency builds trust and can help sell cars. If customers feel they can trust a dealership during their car-buying journey, the dealership will be more likely to stand out among the competition. Here are suggestions to improve transparency among dealerships and their potential customers.

Understanding that a personal connection with each customer is the foundation of trust is essential. Building trust requires time and effort, so dealers must respect the customer’s investment by being prepared with the correct information before connecting. Car dealers need to make sure that every aspect of customers’ experience is personalized and tailored just for them, from the moment they first visit dealers’ websites to the time they select a car. Advanced digital marketing tools can help dealers significantly with understanding the source customers came from, confirming their vehicle preferences, and offering details.

Sales agents also need to establish a sense of openness and accessibility when communicating with customers using the formats your customers prefer. Creating transparency through communication will be much easier if shoppers believe you’re approachable.

According to BuyACar research, only one-third of people say that car financing options are “completely clear” to them, with many remaining confused or unaware of the different options available to them. It is important for shoppers to understand the nuances of their financing package, including fees and annual percentage rates, which will greatly affect their final decision to purchase. This way, potential buyers can determine if they can afford the car and avoid any last-minute surprises or disappointments. Dealers and lenders should improve their tools to make it more explicit to get financing and make the car-buying experience less complicated.

A recent study from the National Automobile Dealers Association (NADA) showed that the majority of consumers want more transparency from dealers, especially when it comes to pricing. Upfront pricing and financing options give customers a sense of control over the buying experience, which builds trust with the

dealership and leads to higher vehicle sales and gross profits.

Most dealers are hesitant to show blemishes, especially online. Yet, by not showing these blemishes or simply editing them out of their photos, dealers

are missing the mark when it comes to transparency, which is a key element in the consumer-dealer relationship. A study from Cox Automotive found that 77% of consumers who shop online want to see flaws or damage on a vehicle. In addition, 74% of consumers who shop online want to see a vehicle’s interior, and 73% want to see close-up photos of the vehicle. Indicating the vehicle’s flaws, especially for used or reconditioned vehicles, is so important, and this will help build trust between the dealer and the consumer.

360-car photography plays a significant role here. A few applications allow users to add hotspots and damage reports to their photos. Not only will the audience see the car from every angle, but they can also be given real insights into its condition to estimate the cost of repair.

If you have any questions or comments regarding this article, please email Sean@Glo3D.com . Glo3D.com Content Team, AI-based, Digital Merchandising.

ALLIANCE AUTO AUCTION ABILENE

www.allianceautoauction.com

6657 US Highway 80 West, Abilene, TX 79605 325.698.4391, Fax 325.691.0263

GM: Brandon Denison

Friday, 10:00 a.m.

$AVE : $200

C.M. COMPANY AUCTIONS, INC.

www.cmauctions.com

2258 S. Treadaway, Abilene, TX 79602

325.677.3555, Fax 325.677.2209

GM: Gregory Chittum

Thursday, 10:00 a.m.

$AVE : $200

IAA ABILENE*

www.iaai.com

7700 US 277, Hawley, TX 79601

325.675.0699, Fax 325.675.5073

GM: Shawn Lemke

Thursday, 9:30 a.m.

$AVE : up to $200 Sell Fee

Amarillo

IAA AMARILLO*

www.iaai.com

11150 S. FM 1541, Amarillo, TX 79118

806.622.1322, Fax 806.622.2678

GM: Shawn Norris

Monday, 9:30 a.m.

$AVE : up to $200 Sell Fee

Austin

ADESA AUSTIN

www.adesa.com

2108 Ferguson Ln., Austin, TX 78754

512.873.4000, Fax 512.873.4022

GM: Michele Arguijo

Tuesday, 9:00 a.m.

$AVE : $200

ALLIANCE AUTO AUCTION AUSTIN

www.allianceautoauction.com

1550 CR 107, Hutto, TX 78634

737.300.6300

GM: Brad Wilson

Wednesday, 9:45 a.m.

$AVE : $200

AMERICA’S AA AUSTIN / SAN ANTONIO

www.americasautoauction.com

16611 S. IH-35, Buda, TX 78610

512.268.6600, Fax 512.295.6666

GM: Jamie McCollum

Tuesday, 1:30 p.m. / Thursday, 2:00 p.m.

$AVE : $200

IAA AUSTIN*

www.iaai.com

2191 Highway 21 West, Dale, TX 78616 512.385.3126, Fax 512.385.1141

GM: Geoffrey Rabb

Tuesday, 9:00 a.m.

$AVE : up to $200 Sell Fee

METRO AUTO AUCTION AUSTIN

www.metroautoauction.com

8605 Cullen Ln., Austin, TX 78748 512.282.7900, Fax 512.282.8165

GM: Brent Rhodes

3rd Saturday, monthly

$AVE : $200

Corpus Christi

CORPUS CHRISTI AUTO AUCTION

www.corpuschristiautoauction.com

2149 IH-69 Access Road, Corpus Christi, TX 78380 361.767.4100, Fax 361.767.9840

GM: Hunter Dunn

Friday, 10:00 a.m.

$AVE : $200

IAA CORPUS CHRISTI*

www.iaai.com

4701 Agnes Street, Corpus Christi, TX 78405 361.881.9555, Fax 361.887.8880

GM: Patricia Kohlstrand

Wednesday, 9:00 a.m.

$AVE : up to $200 Sell Fee

ADESA DALLAS

www.adesa.com

3501 Lancaster-Hutchins Rd., Hutchins, TX 75141 972.225.6000, Fax 972.284.4799

GM: Allan Wilwayco

Thursday, 9:30 a.m.

$AVE : $200

AUTO AUCTION DALLAS

www.allianceautoauction.com

9426 Lakefield Blvd., Dallas, TX 75220 214.646.3136, Fax 469.828.8225

GM: Robert Kersh

Wednesday, 1:30 p.m.

$AVE : $200

www.americasautoauction.com

219 N. Loop 12, Irving, TX 75061 972.445.1044, Fax 972.591.2742

GM: Ruben Figueroa

Tuesday, 1:00 p.m. / Thursday, 1:00 p.m.

$AVE : $200

IAA DALLAS*

www.iaai.com

204 Mars Rd., Wilmer, TX 75172

972.525.6401, Fax 972.525.6403

GM: Bob Bannister

Wednesday, 9:00 a.m.

$AVE : up to $200 Sell Fee

IAA DFW*

www.iaai.com

4226 East Main St., Grand Prairie, TX 75050 972.522.5000, Fax 972.522.5090

GM: Julissa Reyes

Tuesday, 9:00 a.m.

$AVE : up to $200 Sell Fee

IAA FORT WORTH NORTH*

www.iaai.com

3748 McPherson Dr., Justin, TX 76247 940.648.5541, Fax 940.648.5543

GM: Jack Panczyk

Tuesday, 9:00 a.m.

$AVE : up to $200 Sell Fee

MANHEIM DALLAS**

www.manheim.com

5333 W. Kiest Blvd., Dallas, TX 75236 214.330.1800, Fax 214.339.6347

GM: Rich Curtis

Wednesday, 9:30 a.m.

$AVE : $100

MANHEIM DALLAS FORT WORTH**

www.manheim.com

12101 Trinity Blvd., Fort Worth, TX 76040 817.399.4000, Fax 817.399.4251

GM: Nicole Graham-Ponce

Thursday, 9:30 a.m.

$AVE : $100

METRO AUTO AUCTION DALLAS**

www.metroaa.com

1836 Midway Road, Lewisville, TX 75056 972.492.0900, Fax 972.492.0944

GM: Scott Stalder

Tuesday, 9:00 a.m.

$AVE : $200

El Paso

AMERICA’S AUTO AUCTION EL PASO

www.epiaa.com

7930 Artcraft Rd., El Paso, TX 79932 915.587.6700, Fax 915.587.6700

GM: Luke Pidgeon

Wednesday, 10:00 a.m.

$AVE : $200

IAA EL PASO*

www.iaai.com

14651 Gateway Blvd. W, El Paso, TX 79927 915.852.2489, Fax 915.852.2235

GM: Jorge Resendez

Friday, 10:30 a.m.

$AVE : up to $200 Sell Fee

www.manheim.com

485 Coates Drive, El Paso, TX 79932

915.833.9333, Fax 915.581.9645

GM: JD Guerrero

Thursday, 10:00 a.m.

$AVE : $100

www.iaai.com

900 N. Hutto Road, Donna, TX 78537

956.464.8393, Fax 956.464.8510

GM: Ydalia Sandoval

Tuesday, 9:00 a.m.

$AVE : up to $200 Sell Fee

BIG VALLEY AUTO AUCTION**

www.bigvalleyaa.com

4315 N. Hutto Road, Donna, TX 78537

956.461.9000, Fax 956.461.9005

GM: Lisa Franz

Thursday, 9:30 a.m.

$AVE : $200

Houston

ADESA HOUSTON

www.adesa.com

4526 N. Sam Houston, Houston, TX 77086

281.580.1800, Fax 281.580.8030

GM: Brian Wetzel

Wednesday, 9:00 a.m.

$AVE : $200

AMERICA’S AA HOUSTON

www.americasautoauction.com

1826 Almeda Genoa Rd., Houston, TX 77047

281.819.3600, Fax 281.819.3601

GM: Ben Nash

Thursday, 2:00 p.m.

$AVE : $200

AMERICA’S AA NORTH HOUSTON

www.americasautoauction.com

1440 FM 3083, Conroe, TX 77301

936.441.2882, Fax 936.788.2842

GM: Buddy Cheney

Tuesday, 1:00 p.m.

$AVE : $200

AUTONATION AUTO AUCTION - HOUSTON

www.autonationautoauction.com

608 W. Mitchell Road, Houston, TX 77037

822.905.2622, Fax 281.506.3866

GM: Juan Gallo

Friday, 9:30 a.m.

$AVE : $200

HOUSTON AUTO AUCTION

www.houstonautoauction.com

2000 Cavalcade, Houston, TX 77009

713.644.5566, Fax 713.644.0889

President/GM: Tim Bowers

Wednesday, 11:00 a.m.

$AVE : $200

IAA HOUSTON*

www.iaai.com

2535 West. Mt. Houston, Houston, TX 77038

281.847.4700, Fax 281.847.4799

GM: Alvin Banks

Wednesday, 9:00 a.m.

$AVE : up to $200 Sell Fee

www.iaai.com

16602 East Hardy Rd., Houston-North, TX 77032

281.443.1300, Fax 281.443.4433

GM: Aracelia Palacios

Thursday, 9:00 a.m.

$AVE : up to $200 Sell Fee

IAA HOUSTON SOUTH*

www.iaai.com

2839 E. FM 1462, Rosharon, TX 77583

281.369.1010, Fax 833.595.8398

GM: Adriana Serrano

Friday, 9:30 a.m.

$AVE : up to $200 Sell Fee

MANHEIM HOUSTON

www.manheim.com

14450 West Road, Houston, TX 77041

281.924.5833, Fax 281.890.7953

GM: Brian Walker

Tuesday, 9:00 a.m. / Thursday 6:30 p.m.

$AVE : $100

MANHEIM TEXAS HOBBY

www.manheim.com

8215 Kopman Road, Houston, TX 77061 713.649.8233, Fax 713.640.6330

GM: Darren Slack

Thursday, 9:00 a.m.

$AVE : $100

ALLIANCE AUTO AUCTION LONGVIEW

www.allianceautoauction.com

6000 East Loop 281, Longview, TX 75602 903.212.2955, Fax 903.212.2556

GM: Chris Barille

Friday, 10:00 a.m.

$AVE : $200

IAA LONGVIEW*

www.iaai.com

5577 Highway 80 East, Longview, TX 75605 903.553.9248, Fax 903.553.0210

GM: Edgar Chavez

Thursday, 9:00 a.m.

$AVE : up to $200 Sell Fee

IAA LUBBOCK*

www.iaai.com

5311 N. CR 2000, Lubbock, TX 79415 806.747.5458, Fax 806.747.5472

GM: Chris Foster

Tuesday, 9:00 a.m.

$AVE : up to $200 Sell Fee

TEXAS LONE STAR AUTO AUCTION**

www.lsaalubbock.com

2706 E. Slaton Road., Lubbock, TX 79404 806.745.6606

GM: Dale Martin

Wednesday, 9:30 a.m

$AVE : $75/Quarterly

LUFKIN DEALERS AUTO AUCTION

www.lufkindealers.com

2109 N. John Reddit Dr., Lufkin, TX 75904 936.632.4299, Fax 936.632.4218

GM: Wayne Cook

Thursday, 6:00 p.m.

$AVE : $200

IAA PERMIAN BASIN*

www.iaai.com

701 W. 81st Street, Odessa, TX 79764 432.550.7277, Fax 432.366.8725

Thursday, 11:00 a.m.

$AVE : up to $200 Sell Fee

ONLINE

ACV AUCTIONS**

www.acvauctions.com

800.553.4070

$AVE : $250

E-DEALERDIRECT**

www.e-dealerdirect.com

chris@edealerdirect.com

$AVE : Up to $500/month

San Antonio

ADESA SAN ANTONIO

www.adesa.com

200 S. Callaghan Rd., San Antonio, TX 78227 210.434.4999, Fax 210.431.0645

GM: Clifton Sprenger

Thursday, 10:00 a.m.

$AVE : $200

IAA SAN ANTONIO*

www.iaai.com

11275 S. Zarzamora, San Antonio, TX 78224

210.628.6770, Fax 210.628.6778

GM: Paula Booker

Monday, 9:00 a.m.

$AVE : up to $200 Sell Fee

MANHEIM SAN ANTONIO**

www.manheim.com

2042 Ackerman Road

San Antonio, TX 78219

210.661.4200, Fax 210.662.3113

GM: Mike Browning

Wednesday, 9:00 a.m.

$AVE : $100

SAN ANTONIO AUTO AUCTION**

www.sanantonioautoauction.com

13510 Toepperwein Rd. San Antonio, TX 78233

210.298.5477

GM: Brandon Walston

Tuesday, 10:00 a.m. / Thursday, 1:30 p.m.

$AVE : $200

GREATER TYLER AUTO AUCTION

www.greatertyleraa.com

11654 Hwy 64W, Tyler, TX 75704 903.597.2800, Fax 903.597.3848

GM: Wayne Cook

Tuesday, 5:00 p.m.

$AVE : $200

ALLIANCE AUTO AUCTION WACO

www.allianceautoauction.com

15735 I-35 Frontage Road

Elm Mott, TX 76640

254.829.0123, Fax 254.829.1298

GM: Christina Thomas

Friday, 10:00 a.m.

$AVE : $200

Acquisitions can often have a major impact on the independent automobile industry. In December of 2022, America’s Car-Mart acquired Taylor Auto Credit, bringing their BHPH brand into the market in Taylor, Texas. The company made similar moves in 2021, acquiring Smart Auto Inc. (based in Tennessee). In total, Car-Mart owns over 150 locations in various regions throughout the United States.

“We expect acquisitions to continue to generate outstanding returns for our shareholders, an exit strategy for owner-operators, and future growth opportunities for their associates,” said Chief Executive Officer Jeff Williams in a press release. “In our markets, the best competitors have generally been a subset of the owneroperated dealerships — those operated by individuals who have chosen not to borrow excessively, focus on getting a sound automobile to their customers on reasonable terms, and provide both friendly service and disciplined collections. We believe we have developed a successful acquisition template which works for both parties.”

“Taylor Auto Credit has called Taylor, Texas home for over 30 years. With that being said, we are elated to announce America’s CarMart’s acquisition of Taylor Auto Credit. This acquisition is exciting news for Taylor, and all surrounding areas,” said Keith Hagler. Keith has not only been the owner and operator of Taylor Auto Credit for the past 30 years. He has also served as the TIADA President and NIADA President. As you can see, Keith has always been a leader in the industry, but his focus has always been to provide a good product and great customer service. “Our goal at Taylor Auto Credit has always been to keep our customers on the road, while providing the best customer experience from day one; America’s Car-Mart

will continue to do just that. My wife, Marcia, and I are thankful that we have the opportunity to join one of the largest publicly held automotive retailers in the United States in our industry. After 30 years, seeing the end of Taylor Auto Credit is sad, but giving our team a future is the main priority. America’s Car-Mart is superior and will provide a better future for all associates and future customers. We are thankful for the leadership within Car-Mart; they have a heart for people which has resulted in success and will continue to do so for generations to come. We are thankful for this opportunity and ready for what lies ahead.”

Earlier in 2022, Carvana purchased KAR Global’s ADESA U.S. auto auction business for $2.2 billion, which includes the online auction market on ADESA. com. The deal shows Carvana’s desire to accelerate the growth of its business model by entering into the wholesale auction space. “We believe the future is digital, and the channel shift towards digital across our industry is gaining momentum. KAR is now better positioned than ever to lead this evolution and capture the broad opportunities ahead,” said CEO of KAR Global in a press release. “Our new, more simplified business model allows us to focus our strategy, energy and investments on developing and deploying the digital solutions our customers want, need and value the most. We believe expanding our capabilities and the portfolio of services we provide will generate the greatest benefits for those customers, increase our market share and, ultimately, deliver the greatest value to our shareholders.”

Acquisitions like these will undoubtedly make a long-term impression on the independent automobile industry in Texas in terms of market competition, revenue generation, and operations. These deals are

"As more big companies start to understand and move into this space, it provides an opportunity for good operators if they so choose. Our goal is to help educate dealers and make sure there is an efficient, compliant way to transfer ownership."

~Jeff Martin, TIADA Executive Director

G.R. Moore

The Car Shack

(dates announced at www.txiada.org)

EL PASO

Cesar Stark

S & S Motors

Meeting – 3rd Friday (Monthly)

FORT

Jerry Smith

H J Smith Automobiles

(dates announced at www.txiada.org)

HOUSTON

Robert Edenfield

Mi Pueblo BRP

Meeting – 2nd Tuesday (Monthly)

reminiscent of Vroom’s acquisition of Texas Direct Auto in 2015, which Vroom purchased after raising $95 million in Series C funding. At the time, Vroom was in the process of accelerating its online car-buying footprint, and it remains one of the largest e-commerce automobile dealers in the country. These recent acquisitions indicate a further broadening of the online car-buying experience as these companies expand into new markets.

But acquisitions are not foreign to the independent automobile ecosystem. Most independent dealers will be familiar with the name Cox Automotive, a subsidiary of Cox Enterprises, which is based in Atlanta. According to Cox, their “brands [reach] every aspect of car acquisition, retail, ownership and use” except for manufacturing. And Cox has a long history of expansion.

In 1968, Cox purchased Manheim Auto Auction, which was then based in Pennsylvania. Since the acquisition, Manheim has become one of the largest wholesale auto auctions in the world, including a sizeable footprint in Texas. Then, in 2010, Cox Automotive purchased Kelley Blue Book, vAuto, and HomeNet to provide software solutions for car dealers and manufacturers. Finally, in 2015, Cox acquired Dealertrack and its subsidiary, Dealer.com, for $4 billion.

current assets nearly double current liabilities, and debt-to-equity is at historically low levels. Despite multiple unknown variables facing auto retail, the majority of dealers are looking to redeploy their tremendous cash flow back into the industry they know and love, resulting in more demand than supply of dealerships on the market today.” All told, and as Automotive News reports, Texas leads the country when it comes to dealership acquisitions in 2021. Their analysis indicates the Lone Star State “led both in the number of buy-sell transactions completed and the number of individual dealerships in the state sold in 2021.”

SAN ANTONIO

Jose Engler

Irving Motors Corp

(dates announced at www.txiada.org)

The pace at which dealerships are involved in buy/sell transactions also seems to be accelerating, according to a 2022 report by Kerrigan Advisors. According to Erin Kerrigan, Founder and Managing Director, the rise of acquisitions can be attributed to positive cashflows at dealerships, despite the difficult economic conditions dealers have faced over the past several months.

“Today, dealership balance sheets are flush with cash, with

“For years, independent dealers have talked about the lack of an exit strategy,” said TIADA Executive Director Jeff Martin. “As more big companies start to understand and move into this space, it provides an opportunity for good operators if they so choose. Our goal is to help educate dealers and make sure there is an efficient, compliant way to transfer ownership.” TIADA has been in conversations with TxDMV and OCCC about this new move toward acquisitions and how it affects the licensing process. It was almost nonexistent in Texas to see a used car dealership close one day and open as a different used car dealership the next, this has created some challenges with licensing. “The good news is there is some precedent for this in the franchise world,” said Martin. “And DMV and OCCC have been very receptive to working with us to make this a smooth seamless transaction for both dealers.”

We have yet to see how these acquisition trends will affect the independent automobile industry, but it is certainly worth keeping an eye on.

For good reason, more and more independent dealers are jumping into the Buy-Here, Pay-Here space.

When managed effectively, this lucrative business model yields a much higher ROI than the retail model, while providing a valuable service to subprime consumers.

NIADA’s BHPH New Dealer Academy is focused on the key drivers to operate a BHPH business succesfully.

During this comprehensive two-day in-person workshop, you will learn highly effective strategies for marketing, sales, deal structure, underwriting, collections, and asset management designed to help dealers start and grow an in-house finance program the right way.

• BHPH automobile dealers/owners or staff needing a comprehensive refresher on BHPH principles.

• Entrepreneurs looking for their next investment.

• Franchise or independent retail dealers looking to enter the BHPH market.

by Navin Bathija CEO of Neo

by Navin Bathija CEO of Neo

Target made headlines about a decade ago when it was revealed that their AI-based marketing program built to target pregnant women had correctly sent coupons for baby products to a pregnant teenager even before her family knew she was pregnant. While this raised various privacy concerns, it showcased the immense power of artificial intelligence (AI) and machine learning to make accurate predictions based on data. Target was looking to determine which women were pregnant based on their buying habits. Target knew that if they got a pregnant woman to buy products from Target, the woman would become a loyal customer for a long time.

By tracking and analyzing purchases tied to credit card and email address, and any demographic information Target collected from the customer or bought

from other sources, Target was able to leverage AI and machine learning to figure out that when someone suddenly starts buying lots of scent-free soap and extra-big bags of cotton balls, in addition to hand sanitizers and washcloths, it signals they could be getting close to their delivery date. The program Target built was able to identify purchasing patterns across 25 products that, when analyzed together, allowed them to assign each shopper a “pregnancy prediction” score. More importantly, Target could also estimate a woman’s due date within a small window and send coupons timed to very specific stages of her pregnancy. Target captured a significant portion of the baby-on-board market in the early 2000s by leveraging AI and machine learning.

This story demonstrates how large companies in the past leveraged the power of AI to drive sales, but AI has

also come a long way since. There are now tools and resources for businesses of all shapes and sizes to help support their business operations.

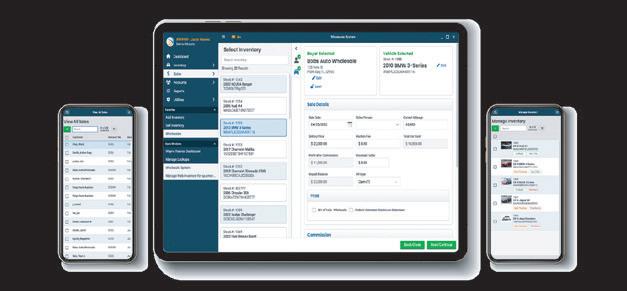

AI and machine learning can help optimize a dealership’s operations across sales, marketing, inventory sourcing, and staffing. This can be done in five steps:

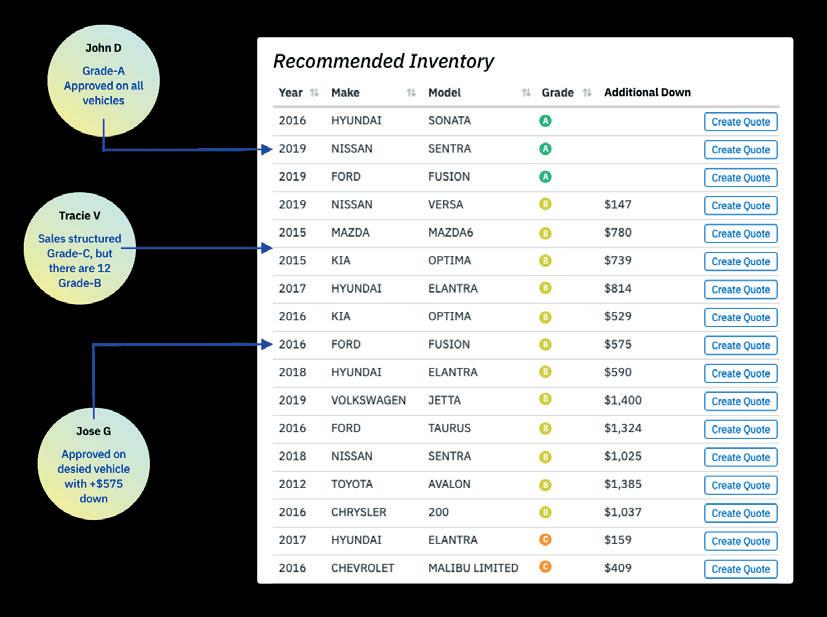

In order to increase sales and profits, it is first important to identify the characteristics of approvable customers. An AI system can crunch through past application data to identify what combination of customer, deal structure, and vehicle information leads to approvals and even segment them by various profit tiers. This is a critical step as it forms the basis of every decision the dealership organization will make with regard to sales priority, marketing, inventory sourcing, and staffing in order to maximize the chances of

increasing sales to the most profitable customer tiers. There is also the avenue to purchase consumer data that can augment data stored in-house. There is an abundance of consumer data available to collect, analyze, and use for your dealership’s benefit. However, a typical dealership staff is usually not equipped to collect data and set up machine learning algorithms to find actionable insights from large amounts of data. You will have to partner with a machine learning expert, and when picking one, be sure they are experienced with building AI scoring models that comply with various consumer protection laws like GLBA and FCRA.

A well-designed AI system can not only segment customers instantly into various profit tiers but also make suggestions on what down payment, loan term, monthly payment, or vehicles will make the customer approvable and more profitable, all based on your historical data and available vehicle inventory. Such actionable insights can help a dealership gain a competitive edge over other dealers in their local market. Imagine being able to customize

approvals for each customer based on each individual customer’s characteristics and getting competitive on, say, down payment and term on customers that get categorized into more profitable tiers while either eliminating customers characterized as less profitable or providing the right callback to get less profitable customers to a desired profitability level.

Knowing the right profit tier and approvable terms for a potential customer is half the battle. It would be best if you made sure that insight translates into intelligent sales actions for your staff to ensure sales to the most profitable customer prospects are maximized. To achieve this, it is very important to pick the right AI CRM that can,

categorize leads as they come in into appropriate profit tier by executing customer profitability predictor developed in step one gauge how close a prospect is to make a purchase, thus separating serious buyers from casual ones who are just looking around

intelligently schedule the next best action for serious buyers so the sales team can focus their energy and engagement on ready-to-purchase customers automate repetitive tasks so the sales team is freed up from routine tasks to focus on revenuegenerating ones automate intelligent follow-ups with casual buyers who are just looking around track all sales activity in the organization to provide 360-degree visibility to management

AI insights can empower your marketing teams to build cost-effective campaigns that deliver timely and actionable promotions and incentives to leads that are approvable. As you are running marketing programs, sending detailed customer journey information on the most profitable customers to your marketing channels, like Google, is important. Your marketing channels can then optimize marketing dollars toward presenting suitable offers and inventory to attract profitable customers. This creates a powerful feedback loop between sales and marketing to ensure that you continue to increase sales penetration to profitable customers on an ongoing basis. To further your advantage, having an AI CRM that can update your marketing channels in real-time with detailed customer journey information, rather than building offline data feeds periodically, means that you won’t miss a beat and will always attract the best available customers in your geography all the time.

While the discussion so far has been on leveraging AI to attract

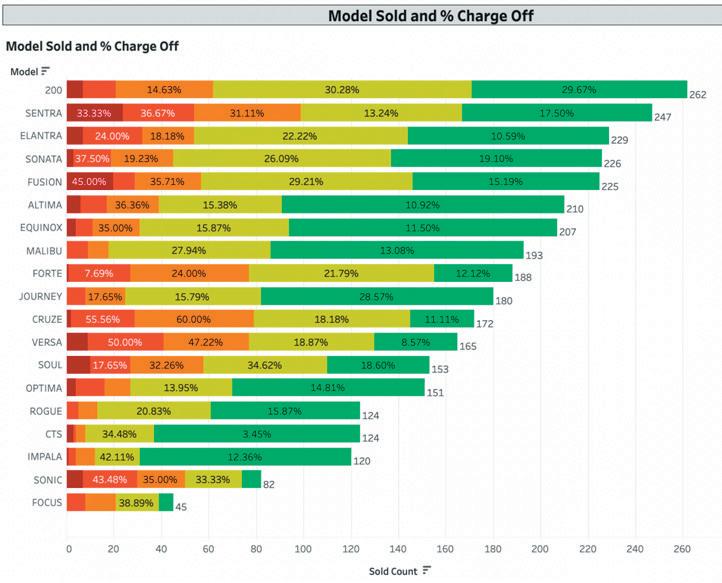

and sell to profitable customers, AI and machine learning can also have a significant impact on what inventory choices you should present at your dealership.

AI insights can help optimize inventory selection and profits by identifying, vehicles that are most desirable to your target customers

profit variance among various types of desirable vehicles availability (costs) of desirable vehicles

Leveraging AI and data and executing steps one through four will make you a good operator who generates far more profits than you ever have. But to

Did

become a great operator, you must embark on a continuous learning and improvement process based on AI that takes years to master. AI insights should drive immediate priorities (sales) and investment in longerterm strategic projects that truly make your organization very profitable. Depicted above is the three-year and ongoing journey of one of your peer operators who leveraged AI to drive decisions across customer experience, sales process, marketing, inventory, and even staffing to increase sales to their top two profitable customer tiers from 35% of portfolio to 85% of portfolio while maintaining monthly sales volume.

For more information on using AI to increase sales and maximize profitability, visit https://neoverify.com/

Visit TexasDealerEducation.com

the ownership at your dealership change and you need to renew your dealer ’ s license?

He’s on the front lines of vehicle repossession, skip tracing, identity theft, and to an extent — thwarting organized crimes.

James Waldron, CEO of 1st Adjusters, Inc., says there is an ever-growing organized effort to defraud automotive retailers and a host of simultaneous challenges for recovery industry professionals.

Waldron has been in the collateral recovery industry for more than 25 years, having started in New York State before moving to Texas, where he started his own company. Today, his company is a professional full-service collateral recovery company headquartered in Austin, Texas, with nine offices in Austin, Dallas, San Antonio, Houston, Del Rio / Eagle Pass, and Corpus Christi.

He relates a recent success story that exemplifies the challenges dealers, finance companies, and recovery agents face in an environment with an ever-more sophisticated criminal element.

1st Adjusters was contracted to repossess a high-end, late-model Mercedes Benz. Given the vehicle’s value and other considerations, Waldron, a licensed private investigator, took on the recovery himself.

“Fortunately, the vehicle had been equipped with a GPS unit, and we were able to get a good location,” Waldron said.

This vehicle was sold through a dealership, financed by a third-party lender, and rushed at the customer’s

insistence. Many “bells and whistles” were added, including an extended service contract. The first-payment default resulted in the repossession order.

“Because of the GPS data, we were able to locate the vehicle efficiently,” he said. “That’s a real plus for us when it comes to being profitable.”

Increased insurance rates, difficulty securing insurance, higher recovery equipment costs, difficulty hiring and keeping quality employees, and rising diesel prices have left many with no other option than to exit the business, Waldron said. Today, fewer businesses are handling more repossessions, even though repossessions generally have declined during and after the Covid-19 pandemic.

“GPS limits the number of addresses we have to check,” Waldron said. “The quicker and easier we can secure the collateral, the fewer expenses we incur. Regardless of how much our expenses are, we’re only paid what was agreed on upfront. If we don’t secure the unit, we don’t get paid.”

In this case, not only was Waldron able to locate the Mercedes, he saw something suspicious. The apartment lot where he found the vehicle also had other late-model vehicles, each had temporary plates. These included three Mercedes, a BMW, and a Jaguar. It turns out all the vehicles were purchased fraudulently.

“What was very concerning to me was that inside the one vehicle I recovered was a folder loaded with stolen

"It’s incumbent on dealers and lenders to verify stips, use technology like GPS and the data the units generate to combat a growing and expensive problem."

~James Waldron, CEO, 1st Adjusters, Inc.

IDs, credit cards, and other personal information,” he said. “Think about a large binder, the kind you might use to collect and secure a baseball card collection. In the one binder, I found 167 real IDs. The other vehicles had the same type of binders in them as well. I never got into those.”

Waldron was shocked when he phoned the dealership that sold one of the cars financed by a thirdparty finance company. After finding a manager, he was told, “Oh, that vehicle was fully funded. We don’t know anything else.”

As disheartening as that was for Waldron, contacting the county sheriff may have been worse.

“He got on the case relatively quickly but told me that his department was understaffed and did not have the resources to investigate what was obviously organized fraud activity,” Waldron said. “The IDs included a federal ID, and I called authorities. The Feds were at my door in 37 minutes. That gave me some hope.”

Waldron noted that “door knocks” are part of what can make the recovery process successful. His employees take the time to try to make contact with the car buyer or at least with whoever answers the door.

Many lenders do not want to do door knocks, as they typically cost more and may lead to an altercation.

“We’re paid when we locate and recover the vehicle for our client,” he said. “We do what we know works.”

A longtime member of the American Recovery Association, Waldron said the work the association has done to raise awareness of the challenges facing recovery professionals, as well as legislative and regulatory advocacy, has been tremendously helpful to agents across the country.

Waldron noted that dealers must take an active role in preventing fraud and what amounts to vehicle theft.

“They must abide by the Red Flag rules,” he said. “It’s incumbent on dealers and lenders to verify stips, use technology like GPS and the data the units generate to combat a growing and expensive problem.”

Fraud affects everyone, Waldron noted.

“I have to say that after what I saw in that vehicle with the IDs, credentials, credit cards, and gift cards that were removed from mailboxes, I stopped mail coming to my home. I use a P.O. Box.”

For more information on finding solutions for GPS tracking and automotive telematics, please visit https://advantagegps.com/

in partnership with Dealer Academy

This has been one of the most challenging years in the Buy Here, Pay Here industry. Dealers are finding that every collection opportunity needs to be capitalized on and that’s where this seminar can help.

Collect The Cash, Not The Car is designed to help you and your collection teams maximize your collection opportunities. Through this 1-day course you can expect to learn:

• How to maximize the collectability of every customer

Time 9:00am - 4:00pm

$249 Members, Each Additional $199 (must be from same dealership) $498 Non-members

Contact patty.huber@txiada.org for educational seminar sponsorship opportunities

• Effective skip tracing methods and tools

• How to overcome the common and not so common customer objections

• Effective phone collection techniques

Monday, March 20, 2023

San Antonio

Marriott San Antonio Airport Hotel 77 NE Loop 410 | San Antonio, TX 78216 210.600.0777

We have put together a very strong course outline that includes a wide array of role playing, classroom learning and interactive activities that will allow your collection team to soak up the information and come back to your dealership ready to collect the cash and not the car.

To register visit Txiada.org or by phone at 512.244.6060 .

Brent Carmichael, Executive Conference Moderator, 20 Groups. NCM Associates, Inc.W h y C h o o s e U s ?

•40 Years Serving Texas Dealers

• 4.9 Star Avg. Customer Rating

• Independently Owned

V i s i t U s O n li n e f o r C u s t o m i z e d S o lu t i o n s & H e lp f u l I n s i g h t s

M

If you haven’t heard of Omnichannel marketing, it’s a buzzword that has been around for over tenplus years. This catchy phrase is used extensively in the automotive marketing industry and was known as Multichannel at first. Still, the people in charge of giving catchy names felt like that wasn’t broad enough, so it was renamed to ensure you KNEW how important it was.

So what does it mean? Essentially, it refers to having a marketing presence across many channels such as websites, social media, email as well as an offline presence such as your store or various events.

Don’t get me wrong; if done correctly, Omnichannel marketing can be a highly effective strategy for growing a dealership. Unfortunately, the execution of this strategy in the automotive advertising space has been poor at best. Industries that use Omnichannel marketing successfully will deliver unique advertising messages across

various channels. In automotive, however, the execution is typically the same, generic inventory ad spammed across a handful of digital platforms. So that 2005 Pontiac Aztec you’ve been struggling to sell will appear in paid search, social media, your website, and a few 3rd party listings. VOILA, Omnichannel advertising!

Consumer Lifecycle Marketing is more effective and efficient in generating your dealership’s short- and long-term revenue. To be effective with this advertising method, you must understand the basics.

Lifecycle Marketing delivers the right message to the right audience at the right time. These stages consist of Awareness (letting folks know you’re there!), Engagement (enticing them to interact with your ads), Evaluation (deciding that they want to do business with

you), Purchase (this is the part you are looking for!), and eventually, repeat business.

First, the CONSUMER is the channel. An effective advertising/marketing strategy HAS to start with an effective customer experience strategy and positioning your customer as the channel is the basis for a more profitable opportunity. With this baseline approach, you can execute Lifecycle marketing strategies that will eliminate friction points and lead to a memorable customer experience.

Now that we’ve placed the consumer where they belong, we need to leverage data and insights to ensure the most important aspects of the customer journey are working together effectively.

The first step is segmenting your current customers from your potential customers. Now, when we consider that the consumer is the channel, we have two channels we are working with, customers and potential customers. Each of these channels requires a different advertising reach approach. While our messages may be similar, they cannot and should not be the same.

“We just run inventory ads and drive them all to the VDP page, right?”

No, please just stop. Not every customer is a nail that needs to be hit over the head with the Vehicle Detail Page (VDP) hammer. This goes against the entire concept of Lifecycle marketing.

Let’s take that customer that bought a new pick-up from your local competitor about 12-15 months ago. Should we land them on your website VDP for a new truck? Most likely not. We know that if they are in your market area, but not doing business with you, we want to change that. We want to start educating the consumer about who you are as a dealership, what you represent, and why they should consider your dealership in the future. As they engage with your ads, you can define the consumer needs further and deliver personalized, targeted messaging, effectively creating a funnel of YOUR customers or potential customers.

We continue to segment our two channels (consumers and potential consumers) based on the data that we have. What vehicle are they driving, when did they buy it, how many miles are on it, how frequently do they trade their vehicles in, what is their financial situation, and more?

For example, customers who bought their vehicle from your dealership will be placed into a different campaign

strategy than those who bought elsewhere. Using these insights, we build a series of ads that speak directly to each specific consumer’s “most likely needs” and drive them to the appropriate page on your website.

Maybe, but only if it makes sense. Part of the goal is to remove friction points in the Lifecycle marketing process and make it easier for your customers to do business with you. We’re not driving customers focused on credit to a VDP page; why would we retarget them with an inventory ad?

Utilizing behavioral retargeting, we continue our Lifecycle marketing once they visit your site. A customer looking at a 2018 F150 should probably see an ad for that vehicle after they have left your site. But what if

they started filling out a credit form after looking at the car and never completed it? Do we still want to drive them back to the VDP, or do we perhaps want to speak to them about your credit approval process or online credit application? Similarly, someone visiting your trade evaluation page probably shouldn’t see an ad for your new car specials but rather something that speaks to the trade in process.

When implemented correctly, consumer Lifecycle marketing allows your auto dealership to communicate across all of your channels with messaging relevant to who the consumer is and where they are in the ownership cycle of their vehicle. Dealership branding, inventory targeting, financing, conquest and retention, ownership loyalty and vehicle acquisition all benefit from Lifecycle marketing.

Dealer OMG is a social media marketing agency that provides a varety of solutions for independent dealers. For more information, visit https://dealeromg.com/

May 13, 2023

{Applications and/or any required documents received after May 13, 2023 will NOT be accepted.}

1. Each applicant must be entering or currently enrolled in an accredited college or a trade school. Proof of enrollment must be included with this application.

2. Each applicant must provide a letter from their TIADA member sponsor that includes the sponsor’s address and phone number.

3. Each applicant must complete the application form.

4. A copy of high school transcripts is required for applicants who are college freshmen. If applicant is currently enrolled, provide college transcripts with official university imprint.

5. Provide a detailed description of participation in any academic, honorary, civic or extracurricular activities in college. In addition, a detailed description of high school activities is required from college freshmen along with a college acceptance letter.

6. Compose an essay of no more than two typed, double-spaced 8 ½” x 11” pages. The essay should discuss the applicant’s relationship with their TIADA scholarship sponsor, current education goals and future aspirations as it relates to the applicant’s subject/training area.

7. Provide at least two (but no more than three) letters of recommendation, no older than one year, from college/high school faculty, employers or other appropriate sources (not related).

Date:

Name:

Address:

DOB:

City: State: Zip:

Email:

(You will receive an email confirmation of receipt.)

Telephone Number:

High School Last Attended: Address:

City: State: Zip:

Dates of Attendance:

Date of Graduation:

Other High Schools Attended (Names and Addresses):

College(s) you are attending or plan to attend for admission:

Parents Name(s):

TIADA Member Name (Sponsor):

TIADA Member Company Name:

TIADA Member Address:

City: State: Zip:

Sponsor Signature

Should you have any questions, please contact TIADA at 512.244.6060. Please return the completed application with all required documents to:

TIADA

Attention: Scholarship Applications 9951 Anderson Mill Rd. Suite 101, Austin, TX 78750

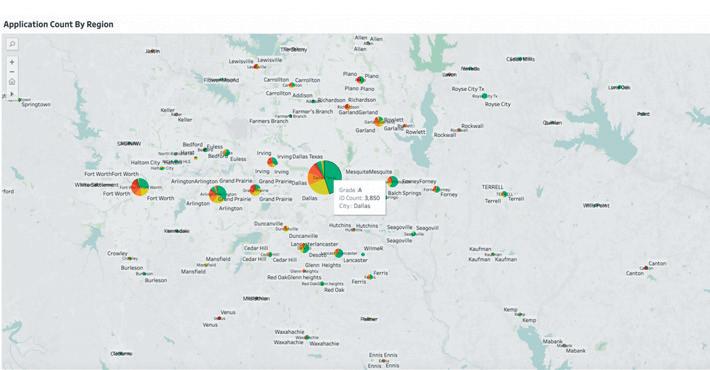

Have you ever wondered exactly how many vehicles you are selling compared to the other used car dealers in the state or in your market? Or, how about the hottest make and model vehicle in your area? Wouldn’t it be nice if year-over-year industry data was available for you to ana lyze and help you determine what inventory you may want to stock for the next quarter or next year?

If you answered yes to any of these questions, you will be excited to hear about the newest TIADA member benefit — The TIADA Used Car Industry Report port will include data on vehicles that have been reg istered by independent automobile dealers from month to month. Aggregated and presented correctly, these reports will allow our members a view of what is happing in the used car industry and, hopefully, an added advantage over dealers who do not belong to TIADA.

by Jeff Martin TIADA EXECUTIVE DIRECTOR

Your report will give you an overview of what’s going on statewide, but it will also be customized to market information in your area. Areas are determined by geography and the number of dealers in each area. We are still tweaking the map a bit, but we have identified 10 areas. You will receive a report based on the area your dealership is licensed.

Reports will be sent to your email address quarterly on the 15th of the month following each quarter. Expect your first report to be delivered on April 15th. We are also planning to have some training at the annual conference on how you can use the reports to better market your inventory. It’s going to be an exciting 2023 as we look forward to rolling out even more member benefits.

It’s going to be an exciting 2023 as we look forward to rolling out even more member benefits.

As the nation’s leading provider of end-to-end wholesale vehicle solutions, Manheim is here to help you be more successful with the in-lane and online tools you need.