“The

- Mark Twain

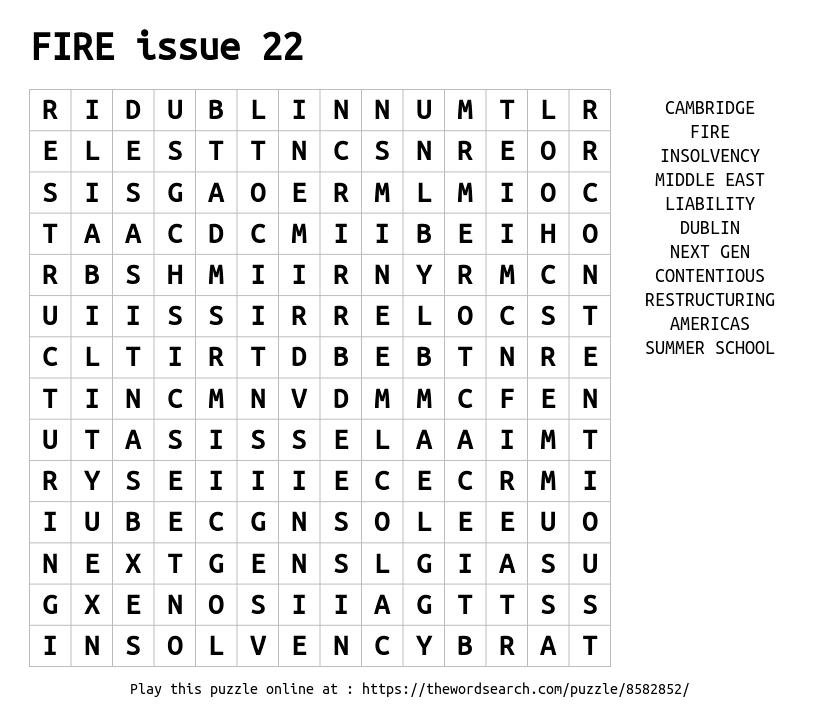

Now summer is coming to an end, we are delighted to present Issue 22 of the FIRE magazine, the Contentious Insolvency Edition. Our authors dive into all the pertinent issues facing practitioners in multiple jurisdictions, from the limits of unrecognised foreign judgments in English insolvency proceedings to adopting a new pre-insolvency framework in Japan. Thank you to all of our corporate partners, authors and members for their ongoing support to this ever-growing community. We hope you enjoy this thought-provoking issue.

The ThoughtLeaders4 FIRE Team

Paul Barford Founder/Managing Director

020 7101 4155

email Paul

Danushka De Alwis Founder/Chief Operating Officer 020 7101 4191 email Danushka

Chris Leese Founder/Chief Commercial Officer 020 7101 4151

email Chris

3398 8545

Amelia Gittins Senior Strategic Partnership Executive 020 3059 9797 email Amelia

Matthew McGhee - Twenty Essex

Tony Beswetherick KCTwenty Essex

Mark Baldcock - Twenty Essex

Karen Petch - Twenty Essex

Neil Chauhan - HFW

Jonah Cowen - Asserson Law Offices

David Leibowitz - Mishcon de Reya

Nick Payne - Mishcon de Reya

Matthew Morrison KC - Serle Court

Matthew Innes - Serle Court

David Johnson - PCB Byrne

Frances Jenkins - PCB Byrne

Nataliya Yankovska - PCB Byrne

Cherrene BalasanthiranPayne Hicks Beach

Karin Troiani - Payne Hicks Beach

Gareth Bell - Collas Crill

James Tee - Collas Crill

Edmund Carter - Collas Crill

Midori Yamaguchi - Mori

What an insightful morning at “Mareva, Then, Now and Into the Future: The Art of Freezing Injunctions” — hosted by ThoughtLeaders4 and Twenty Essex.

Thank you to everyone who joined us to reflect on the evolution of the Mareva injunction, 50 years since its landmark introduction. From its origins to its pivotal role in today’s commercial disputes, the discussions offered deep insight into one of the most powerful tools in civil fraud litigation.

We were honoured to hear from:

• Professor Sir Bernard Rix, Arbitrator, Twenty Essex

• Andrew Ayres KC, Barrister, Twenty Essex

• Andrew Barns-Graham, Barrister, 3 Hare Court Chambers

• Karen Petch, Barrister, Twenty Essex

We were thrilled to have launched FIRE Channel Islands & Isle of Man in Guernsey with a vibrant two-day programme. The event began with a Networking Walk, where attendees explored Guernsey’s rich history and stunning views, followed by the Women in FIRE x IWIRC Brunch, kindly supported by BDO and Carey Olsen, which brought together our community of women and allies to celebrate achievements and build meaningful connections.

Across both days, delegates took part in thoughtprovoking panel sessions covering everything from managing asset recovery costs and freezing injunctions to enforcement strategies, director’s liabilities, trust structures, fraud prevention, and the future challenges shaping the FIRE landscape.

A special thank you to our speakers, our hosts, and all attendees who made the event such a success.

We were delighted to work alongside our event partners Collas Crill, 4 New Square Chambers, BDO, Appleby and IWIRC, and we extend a huge thank you to our excellent chairs, speakers, and delegates who made the launch such a success.

We look forward to reconnecting with our FIRE Community again very soon!

TL4 X SERLE COURT X ASSERSON - FROM ROBES TO RICHES: WHAT INTERNATIONAL LAWYERS SHOULD KNOW ABOUT ENGLISH

What an excellent time we had at TL4 x Serle Court x Asserson - From Robes to Riches: What International Lawyers Should Know About English Courts.

Our FIRE and Disputes communities came together for an afternoon tea and panel discussion, exploring some distinctive features of the English court system.

The panel discussed several aspects, including:

• Litigation funding and After-TheEvent insurance

• Strategic importance of legal costs

• English judges’ attitudes to case management

• The English approach to confidentiality and professional secrecy in the context of document disclosure

A huge thanks to Serle Court and Asserson for hosting us, and to our engaging panel speakers, Baruch Baigel FCIArb, Daniel Lightman, Shimon Goldwater and Christiane Deniger.

FIRE Star ter s: Summer School

17 - 19 S eptember 2025 | Downing College, Cambridge

FIRE Amer icas

22 - 23 S eptember 2025 | Kimpton Hotel Monaco, Washington D.C.

Sovereign & States Litigation Summit USA

23 - 24 S eptember 2025 | Kimpton Hotel Monaco, Washington, D.C.

The Inter national Ar bitration and Enforcement For um

8 October 2025 | Carpenters' Hall, London

Asset Recover y & Enforcement Circle

9 - 10 October 2025 | University Ar ms Hotel, Cambridge

FIRE Middle East

9 - 11 November 2025 | Shangri-La Hotel, Dubai

FIRE Asia Circle

24 - 26 November 2025 | Four S easons Hotel, Kuala Lumpur, Malaysia

Women in FIRE presents Asset Recover y in Action

27 November 2025 | Carpenters' Hall, London

FIRE Star ter s: Global Summit

25 - 27 February 2026 | Conrad Hotel, Dublin, Ireland

FIRE Inter national

19 - 21 May 2026 | EPIC SANA Algarve Hotel, Vilamoura, Portugal

To register for the events and speaking opportunities

What Do You See As The Most Important Thing About Your Job?

Firmly wearing 2 different hats (at different times). Privately, you need to explain to the client the relative merits of their case and the options available to them, so that they can make an informed choice. That involves identifying weaknesses and explaining your personal view on the likely outcome. Publicly, you must present the client’s case as clearly and stridently as possible. Crucially, it is important not to let private misgivings limit your ability to present the public case, and it is equally important not to get carried away with the public case and so be unable to give dispassionate advice in private.

What Motivates You Most About Your Work?

I have always enjoyed the puzzle of putting together a case, or sometimes even just working out what the case should be. Even if a new case looks the same as a previous one, the pieces are always differently shaped when you get into the detail. It is very satisfying when you (think you have) put it all together correctly, whether that is to advise the client as to how a tricky issue will be resolved or to best present their position before a tribunal.

Dead Or Alive, Which Famous Person Would You Most Like To Have Dinner With?

Robert Jordan – as a child, I was very invested in his genuinely epic ‘Wheel of Time’ series, but he (the author) died before completing it.

His editor (who was also his wife) knew the plan for what remained, so she arranged for another author to finish the series, but it still left some unanswered questions which I would enjoy asking!

Where Has Been Your Favourite Holiday Destination And Why?

I would love to return to Italy. It has everything – amazing countryside, architecture, and culture (including viniculture…) I have also found Italy to be actively familywelcoming, which makes it all the easier to enjoy my time there.

What Songs Are Included On The Soundtrack To Your Life?

I have 2 small children. So currently – and whether I want it or not – my life at home is soundtracked by Disney songs. But I won’t complain; we all enjoy the sing-along and accompanying boogie.

What Personality Trait Do You Most Attribute To Your Success?

I would say a willingness to accept uncertainty and deal with matters as they come. Litigation is inevitably uncertain, as there are so many moving parts and it is impossible to resolve every unknown. I therefore see it as important to (try to) maintain equanimity, and in the event of something unexpected or unpleasant happening to adapt to that as necessary.

What Is The One Thing You Could Not Live Without?

I have always enjoyed the physical and mental freedom of a bike ride – whether it is just around the corner from home or crossing borders. The headspace is hugely valuable, and the community that I have met along the way has left me with some lasting friendships.

What Would You Be Doing If You Weren’t In This Profession?

I have previously dabbled in teaching and I have always enjoyed it (though less so the marking). So I would most likely be a university lecturer. It is fun returning to core legal concepts with students who are exploring them for the first time.

What Do You Like Most About Your Job?

The variety – I have always sought to keep my practice relatively broad, which means that it rarely feels as though I am in a rut. It did make for a steep learning curve initially, when getting familiar with some very different practice areas, but now I like to think that it allows me to bring a broader range of experiences to bear on each case that I work on.

If You Could Only Eat One Takeaway For The Rest Of Your Life, What Would It Be?

The pizza cannot be beaten. Perfect for sharing (or not), and you can change toppings to meet your taste – pineapple included.

“It is well known and self-evident that a liquidator comes to an insolvent company as a stranger. His duty is to investigate its failings, collect-in and distribute its assets to the creditors of the Company ...”. 1

Crucial to the office-holder’s ability to effectively discharge their duty is the power to gather information from “insiders” as well as those who might hold relevant information as to a company’s affairs. Given the nature of business is more international than ever, an English office-holder’s investigation does not start and end within the confines of this jurisdiction; there is frequently a need to gather information from persons located or resident abroad.1

Section 236 of the Insolvency Act 1986 is a critical tool. It gives the Court a power, on application by an officeholder, to order a broad category of person to “submit of an account of his dealings with the company or to produce any books, papers or other records in his possession or under his control” relating to the company

1 Barnett v Litras [2022] EWHC 855 (Ch), [29].

or its promotion, formation, business, dealings, affairs or property. Those categories of person extend to cover any (a) officer of the company, (b) person known or suspected to have in his possession any property of the company or supposed to be indebted to the company, or (c) person whom the court thinks capable of giving information concerning the promotion, formation, business, dealings, affairs or property of the company.

The utility of that power has been impaired since Sir Geoffrey Vos C’s decision in Re Akkurate Limited (In Liquidation), in which it was concluded2, reluctantly, that s.236(3) does not have extra-territorial effect, meaning that office-holders cannot obtain orders against persons who are not within the court’s territorial jurisdiction.3 The Judge said that he was constrained by the decision of the Court of Appeal in In Re Tucker4 to hold that the provision was not intended to be extra-territorial in its reach.

In seems likely, that were it not for Tucker, the Judge would have followed the view that s.236(3) does have extraterritorial effect, expressing his agreement with the view of the Judge in MF Global5 that there would be a

2 Contrary to the conclusion in two other first instance decisions: see Re Omni [2015] BCC 906 and Re Carna Meats [2020] 1 WLR 1176.

3 [2020] EWHC 1433 (Ch); [2021] Ch.73. Vos C concluded that section 236(3) did permit the Court to make an order requiring persons resident outside the jurisdiction to produce books and papers and an account of their dealings with the company, if (a) the company has its centre of main interests in England and Wales; and (b) the respondent is resident in an EU member state (on the basis that the EU Regulation on Insolvency Proceedings expanded the reach of the provision). This avenue will not be available in relation to insolvency proceedings commenced following the UK’s withdrawal from the EU.

4 [1990] Ch 148

5 [2016] Ch 325

“good deal to be said for concluding that section 236 was intended to have extraterritorial effect, leaving it to the discretion of the court to keep its use within reasonable bounds”.

The current law in England may be contrasted to other common-law jurisdictions, such as the BVI6 and the Abu Dhabi Global Market7, which have taken a different approach to extraterritoriality of the office-holder’s investigatory powers.8 Express in both the BVI and ADGM positions is the recognition that a liquidation in those jurisdictions is likely to have global reach and “more often than not” targets of an office-holder’s investigation (or helpful informants) are outside of the jurisdiction.

While the decision in Akkurate as to the limited scope of s.236 is unhelpful to office-holders, we wonder whether other options remain. In particular, English office-holders might be able to rely upon s.235 of the Insolvency Act 1986 as an alternative:

• Section 235(2) obliges certain third parties to furnish the office-holder with “such information concerning the company and its promotion, formation, business, dealings, affairs or property” as may be “reasonably require[d]”.

• The parties to which it applies are primarily insiders, i.e., officers of the company or those who have been involved in its formation (s.235(3) (a)-(b)). However, importantly, the duties under s.235 also extend to employees or those “under a contract for services” within (essentially) the year prior to the company’s entry into the insolvency process” (s.235(3)(c)).

• Those under “contract for services” would seemingly extend the obligation under s.235 to “outsiders”, potentially including lawyers and providers of secretarial and office functions, and possibly even financial institutions providing advisory services. Given that such outsiders need to have provided services in the year preceding the start of the insolvency, the timing of the start of the liquidation/ administration can be critical.

• While s.235 itself does not give the Court the power to make an order, rule 12.52(1)(e) of the Insolvency (England and Wales) Rules 2016 provides that the Court may “make such orders as it thinks necessary” for the enforcement the obligations imposed by s.235.

• The question then becomes whether s.235 is intended to have extraterritorial effect. It bears a close resemblance to s.135 (the Court’s power to order a public examination) which does have extraterritorial effect (see Seagull Manufacturing Limited (in liquidation) (No.3)).9 It is certainly arguable that the obligation under s.235 should be construed as applying equally to persons outside England and Wales.

• A hurdle to obtaining an order against persons outside of England and Wales is serving any application out of the jurisdiction. Practice Direction 6B, para 3.1(20)(a) gives the Court discretion to permit service out of the jurisdiction of a claim “under an enactment which allows proceedings to be brought”. In that regard, (i) the claim is arguably made “under” s. 235, that being the source of the obligation, (ii) further, to the extent that the application is made under the Insolvency Rules, those might be characterised as an “enactment” for the purposes

of the gateway (being a statutory instrument), and (iii) additionally, paragraph (8) of Schedule 4 to the Insolvency Rules allows the Court to modify CPR Part 6 such that it is hard to see why the Court would not do so if it considered that s.235 had extraterritorial effect.

Recognising that such an argument would be novel, Art 21(1)(d) of the UNCITRAL Model Law on Cross-border Insolvency (the Model Law) might be available to officeholders in jurisdictions where it has been implemented in local law. Art 21(1)(d) gives the court a power to make an order, at the request of the foreign representative,

“providing for the examination of witnesses, the taking of evidence or the delivery of information concerning the debtor’s assets, affairs, rights, obligations or liabilities”.

Courts outside of the UK have granted document and information production orders (and in some cases discovery) where the relief granted would not have been available in the applicant’s home jurisdiction: for example, Platinum Partners Value Arbitrage Fund L.P., 583 B.R. 803 (Bankr. S.D.N.Y. 2018); McGrath, in the matter of IE CA 3 Holdings Ltd [2025] FCA 635. Whilst dependent on the law of the relevant jurisdiction, that would suggest that such an order might be obtainable via in jurisdictions enacting the Model Law against those outside of England and Wales notwithstanding the limitations of s.236.

6 The Eastern Caribbean Supreme Court has concluded that ss.284 and 285 of the (BVI) Insolvency Act 2003 have extraterritorial effect: Crumpler & Anor v Davies & Anor (Unreported, Claim No BVIHC (COM) 2022/0119, 5 April 2023); (compare Wallbank J’s decision to the contrary in Chu Kong v Greenwood & Anor in Unreported, Claim No BVIHC (COM) 0065 of 2016, 18 May 2022).

7 The Court of First Instance concluded that s.256 of the ADGM Insolvency Regulations 2022, a provision modelled on s.236 of the IA 1986, did have extraterritorial effect: Cairns & Anor v Neopharma LLC & Anor [2023] ADGMCFI 0022, [68].

8 Contrast s.301 of the Cayman Islands Companies Act (2025 Revision), which enables the Court to order any person, “whether or not resident in the Islands or elsewhere”, who has a relevant connection to a company in liquidation (including as a director, officer and certain professional service providers) to transfer or deliver up any property or documents belonging to the company. It seems on the face of the provision that this is extraterritorial in its scope.

9 [1993] Ch. 345

As one of the world’s most active disputes practices, litigation is our DNA.

Our experienced team of commercial litigators are relentless in pursuing our clients’ interests and frequently litigate in courts around the world.

Clients come to us for our track record in complex, multi-jurisdictional litigation, and for our creative solutions: We pioneered the Mareva Injunction.

When the stakes are high, you need a trusted, first-class firm to deliver a successful outcome.

Get in touch with our team at FIG@hfw.com

In a unanimous landmark judgment handed down in May 2025, the UK Supreme Court has confirmed that liability for fraudulent trading under s.213 of the Insolvency Act 1986 is not simply confined to those involved in the management or control of the fraudulent company (such as directors and shadow directors) but extends to any third party who knowingly participates in or facilitates fraudulent business1

The decision is not only relevant to liquidators (who are the only parties entitled to bring applications under s.213) but also creditors, who can take some comfort from the Supreme Court’s willingness to confirm the wider ambit of those who might be held liable for fraudulent trading.

In the summer of 2009, Bilta UK Ltd, Weston Trading UK Ltd, Nathaneal Eurl Ltd, Vehement Solutions Ltd and Inline Trading Ltd (the Group Companies/ Claimants) were together involved in a substantial VAT fraud known as “missing trader intra-community” fraud (MTIC Fraud).

In what Europol describes as a “highly complex form of tax fraud”2,

causing billions of euros annually in tax losses, a typical MTIC Fraud involves some form of the following arrangement:

• Traders import goods from EU Member States (free from VAT);

• The goods are then sold within the country into which they have been imported (with VAT added);the traders choose not to satisfy VAT liabilities to HMRC, instead paying VAT receipts to third parties; and

• After a while, the traders abandon the company and permit it to become insolvent.

In this case, the fraud centered on spot trading in carbon credits under the EU Emissions Trading Scheme. The Group Companies entered liquidation between November 2009 and June 2015.

In November 2017, the Claimants issued a claim under s.213 of the Insolvency Act 1986 (s.213) against Tradition Financial Services Ltd (Tradition). S.213 imposes liability on “any persons who were

knowingly parties to the carrying on of the business” with intent to defraud creditors (in this case, HMRC). Tradition had acted as a broker in the trades, introducing counterparties and negotiating the terms on which carbon credits were bought and sold. The Claimants argued, among other things, that Tradition had knowingly participated in the fraudulent scheme and should therefore be required to contribute to the liquidation.

Tradition contended that s.213 only applies to persons with managerial or controlling roles within the company which had perpetrated the fraud (e.g. directors and shadow directors), such that s.213 did not apply in this case as Tradition merely acted as a broker. The Claimants, however, argued that s.213 applies to anyone, so long as they knowingly assisted or contributed to the carrying on by the company of any business which has been carried on with the intent to defraud creditors. The entire issue, therefore, fell on the interpretation of s.213.

statute as a whole and the historical context in which the statute was enacted…” Key points included:

In contrast to the wording of s.213, the wording of surrounding provisions in the Insolvency Act 1986 referred to clearly defined categories of persons. For example, s.212 provides for remedies against delinquent directors; s.214 refers to wrongful trading against a director; s.216 prohibits directors and shadow directors from re-using company names after a period of time; and s.217 (personal liability for debts) applies to those involved in the management of the company. It follows that if Parliament intended to restrict s.213 to those with management or control of the fraudulent business, it would have done so (as it did with the surrounding sections).

There was nothing in the legislative history of s.213 which militated against a plain reading of the words “any persons who were knowingly parties to the carrying on of the business…”.

The Court was not shy in its willingness to confirm the scope of s.213, citing the well-known quote from Templeman J in In re Gerald Cooper Chemicals Ltd [1978] Ch 262, 268:

“a man who warms himself with the fire of fraud cannot complain if he is singed.”

The Supreme Court decisively rejected Tradition’s narrow interpretation of s.213. It held that liability for fraudulent trading is not restricted to those exercising management or control over the company. Instead, any third party who knowingly participates in the fraudulent business of a company may face personal liability in the event of the company’s insolvency. This interpretation firmly places brokers, intermediaries, and other third parties within the scope of liability if they are found to have knowingly participated in or facilitated fraudulent business activity.

In reaching its conclusion, the Supreme Court applied well-rehearsed and established principles of statutory interpretation, emphasising that the Court must consider the “context of the

Importantly, however, the Court confirmed that active involvement is required to establish liability. Omissions by way of failure to advise or passive association with the fraudulent business would not be sufficient to attract liability under s.213.

The Supreme Court’s ruling is a welcome one for creditors and victims of financial fraud. Where a party knows of fraud and participates in it, they cannot absolve themselves from liability simply by asserting that they were an outsider. So long as they knowingly participated in the fraud, they will potentially be subject to liability and may have to make a personal contribution to the company’s assets in the event of the company becoming insolvent. The ruling serves as a warning to financial intermediaries, including brokers and trading platforms, who may have thought that they were otherwise protected.

Our employment lawyers specialise in complex employment and partnership matters with high stakes. We provide support and services to employers, executives and partnerships & LLPs.

The work we do

Below are our key services, however, if you do not f ind what you are looking for, pick up the phone and give us a call, or email us.

Discrimination Exits and Restructures

Investigations

LLPs, Partnerships and Regulated Professions Policies and Procedures

Scan below for more information

With offices in the UK, Israel and the US, we are well-positioned to partner with other law firms as trusted co-counsel in complex crossborder disputes. Our proven track record in handling high-stakes international litigation and arbitration—under both English and US law —makes us a valuable ally in delivering seamless, strategic support across jurisdictions.

Excellent commercial acumen, responsive and co-ordinated team. Very good with difficult clients and cross-border elements of the dispute.

Asserson Law Offices is extremely client focused, very strategically minded and very sophisticated.

Litigation in the High Court, Court of Appeal and Supreme Court of the United Kingdom

International Arbitration - All Major Institutions and Ad Hoc

Alternative Dispute Resolution (ADR)

US Disputes - Federal and State Court

Asset Recovery and Enforcement

Civil Fraud

Commercial and Financial Disputes

This round-up of recent case law and legislation goes through some key developments in insolvency litigation. Two recent Supreme Court cases and a case from the Privy Council are discussed below, as well as some important legal updates arising from the Economic Crime and Corporate Transparency Act 2023.

The Privy Council has ruled (in Sian Participation Corp (In Liquidation) v Halimeda International Ltd (Virgin Islands) [2024] UKPC 16) that debts covered by an arbitration agreement can still be the subject of a winding-up petition.

Overruling Court of Appeal precedent from 2014, the Board ruled on what it described as the conflict between two points of public policy. On the one hand, parties should be allowed to have their disputes resolved through arbitration if they wish. On the other hand, it is in the public interest for there to be a simple method of winding up insolvent companies who cannot pay undisputed debts.

Previously, where a debt was covered by an arbitration agreement the courts would stay any winding-up proceedings if the debtor company disputed the debt at all. This opened the door for debtor companies to dispute all debts if they were covered by an arbitration agreement.

The Privy Council has ruled that this is wrong. The Court must apply the usual test and consider whether the debt is genuinely and substantially disputed. Merely disputing the debt and pointing to an arbitration clause will not be enough for the Court to stay the petition.

The judgment also makes clear that the same would apply if the relevant contract had an exclusive jurisdiction clause providing for jurisdiction outside

of England and Wales. Before staying or dismissing any winding up petition the Court will still consider whether there is a genuine dispute about the debt.

Although this was a case involving the British Virgin Islands, the Privy Council made what is known as a ‘Willers v Joyce direction’, ruling that this decision should be binding in English courts as well.

In Bilta (UK) Ltd (in liquidation) and others v Tradition Financial Services Ltd [2025] UKSC 18, the Supreme Court confirmed that liability for fraudulent trading can extend to a third party.

The companies in question engaged in a complex fraud known as MTIC in which traders would make multiple transactions at high speed between group companies in order to hide VAT receipts from the tax authorities. All the VAT liability would be left with a single company which would then

declare insolvency. The companies in liquidation in these proceedings all had very large VAT liabilities to HMRC, and the liquidator sought to recover assets from the companies’ financial advisers, known as Tradition.

It was held that Tradition had knowingly been party to fraudulent activity. The Supreme Court ruled that it therefore fell in scope of section 213 of the Insolvency Act 1986, and they were therefore liable in the company’s insolvency. Section 213 applied not only to directors and shadow directors, but even “third parties/outsiders who participate in, facilitate or assist fraudulent transactions by a company when they know that the company’s business is being carried on for any fraudulent purpose” (paragraph 58).

The Cross-Border Insolvency Regulations 2006 also allow for the recognition of certain foreign insolvency proceedings – these did not apply in this case as Mr Bedzhamov did not have his centre of main interests (COMI) in Russia at any relevant time.

Notably, the Supreme Court held that a nearly 100-yearold case which seemed to contradict its findings was wrongly decided. In the case of In re Kooperman [1928] WN 101, on an unopposed application, the High Court allowed a Belgian receiver to take control of English property.

The Supreme Court overruled this case; the application had been unopposed, there appeared to have been no real discussion as to the immovables rule and there was no reasoned judgment.

In the case of Kireeva v Bedzhamov [2024] UKSC 38 the Supreme Court refused to assist a recognised Russian trustee in bankruptcy to take control of land in England, applying the ‘immovables rule’.

Mr Bedzhamov was made bankrupt in Russia in 2018. His Russian trustee in bankruptcy, Ms Kireeva, applied to have the bankruptcy order recognised at common law and for an order entrusting her with Mr Bedzhamov’s property in Belgrave Square in London.

The Supreme Court held that Mr Bedzhamov’s interest in his London property was unaffected by the Russian bankruptcy order. Under common law the ‘immovables rule’ applied, so that questions of interests in English land could only be resolved in English courts. This could only be altered by statute. For example, section 426 of the Insolvency Act 1986 allows the courts to recognise foreign insolvency practitioners in specified countries – these are mainly commonwealth countries and former British colonies.

The wide-ranging provisions of Economic Crime and Corporate Transparency Act (ECCTA) 2023 continue to be implemented gradually. Some key new changes for insolvency lawyers to be aware of include:

(a) The Registrar of Companies will have the power to strike off a company if its application for registration (or any application for restoration to the register) contained materially misleading, false or deceptive information. This came into force on 18 March 2025.

(b) ECCTA expands the circumstances under which a director can be disqualified to include persistent breaches of certain provisions of companies legislation. These provisions are not yet in force.

(c) There will be a new ‘failure to prevent fraud’ offence, which applies to specified large organisations whose employees or agents commit fraud. The organisation will be guilty of an offence if it did not have reasonable fraud prevention procedures in place. This will come into force on 1 September 2025.

A litigation powerhouse, recognised as a market leader in complex and high-value disputes

Our award-winning, international team offers a comprehensive specialist service covering all aspects of complex litigation, arbitration and dispute resolution,civil fraud and asset recovery.

We boast a leading multi-disciplinary team in jurisdictions across the UK, Europe, the Middle East, and the Asia Pacific regions. We are uniquely positioned to advise on complex, big-ticket mandates. Our disputes lawyers work alongside our growing team of forensic accountants and e-data specialists to enable us to provide a holistic approach and bring about pragmatic solutions.

Our extensive services include conducting internal investigations for businesses, advising on the available interim remedies, assisting our clients to reach commercial settlements, proposing and implementing tailored litigation strategies all the way up to trial and (often crucially in fraud cases) assisting our clients in navigating the challenges of enforcing judgments.

Alan Sheeley Partner, London

+44 (0)20 7054 2626

+44 (0)7971 871 229

alan.sheeley@pinsentmasons.com

Jennifer Craven Partner, London

+44 (0)20 7054 2596

+44 (0)7545 426 770

jennifer.craven@pinsentmasons.com

www.pinsentmasons.com

© Pinsent Masons

The International Fraud Group (“IFG”) is a network of international lawyers who are experts in Asset Recovery and Fraud Investigation.

We have members spanning over 56 jurisdictions and we cover the globe.

In 1994 a Bank that Mishcon de Reya were working for in the international recovery space expressed a need to access like minded and similarly skilled lawyers across the globe to help them when their and their client’s assets had gone astray. The IFG was born in response to that need.

The ethos of the IFG is based on responsiveness, know how and commerciality.

In the Asset Recovery & Fraud Investigation space there is no time to lose when a problem is discovered. Sometimes injunctions are needed on an immediate basis. IFG’s members know that every second is valuable when chasing crooks and understand that responsiveness is critical.

There is a huge difference between knowledge and know how. It is the practical application of the law to get a result that the client wants which is at the very core of the IFG.

Knowing what to do and how to do it is not enough. What lawyers in this space need to understand is that clients want and are right to insist on a return on their investment. The costs that a client incurs in an Asset Recovery scenario and/or Fraud Investigation represent an investment. IFG Members know that to justify their existence they must produce a return on that investment in terms of funds or assets recovered.

The IFG also has in-depth expertise in the following sectors which are represented by 5 sub-groups namely Crypto Currency, White Collar Crime & Investigations, Arbitration, Shipping and Insolvency.

Contact:

Gary Miller

Partner, Mishcon de Reya LLP

T +44 20 3321 6294

E gary.miller@mishcon.com

Our sponsors

Introduced just five years ago, the restructuring plan regime set out in Part 26A Companies Act 2006 has rapidly become the route of choice for large corporations looking to navigate challenging financial circumstance.

A key attraction is the ability to impose the restructuring on dissenting creditors. However, doing so is, inevitably, highly contentious. There have been a number of challenges to proposed Part 26A Plans by dissenting creditors. The Court of Appeal has reviewed decisions sanctioning Part 26A Plans in two cases in this year alone. Most recently, in Saipem S.P.A. & Ors v Petrofac Limited & Anor [2025] EWCA Civ 821, the Court of Appeal overturned the High Court’s approval of the plan.

Given the high-stakes nature of these plans, companies pursuing them will need to look carefully at the lessons that can be learned from this decision.

A proposing company must demonstrate that the proposed plan meets the following minimum thresholds:

1. Any “dissenting class” (ie. class of creditors of which less than 75% support the plan) would be “no worse off” under the “relevant alternative” (Condition A, or the “No Worse Off” Test); and

2. The plan has been approved by at least 75% of a creditor class which would have a “genuine economic interest” under the “relevant alternative” (Condition B).

However, meeting these thresholds does not guarantee that a plan will be sanctioned. It merely means that the court “may” sanction the plan. When considering whether to do so, the key question for the court is whether the Plan is “fair”.

The “relevant alternative” is a key concept. It describes the counterfactual scenario that is most likely to occur if the plan is not sanctioned. Determining this necessarily requires a degree of speculation on the part of the court. As such, it is a major battleground in challenges.

Usually, the proposing company argues that the relevant alternative is an insolvency process in which the dissenting creditor class(es) would receive nothing. As such, the dissenting creditors cannot possibly be “worse off” under the proposed plan, and Condition A is satisfied.

The dissenting creditors, on the other hand, will seek to argue that they will be worse off under the plan. Often, this is on the basis that the true “relevant alternative” is a different restructuring plan under which they obtain a better outcome.

The High Court sanctioned the Petrofac Plans.

The Judge held that agreeing an alternative plan with a greater return for the Dissenting Creditors would require the entire plan to be re-negotiated. They were not persuaded that this would be possible. Therefore the “relevant alternative” was insolvency.

Two companies in the Petrofac group proposed plans (the Petrofac Plans). The Petrofac Plans were challenged by dissenting creditor companies in the Saipem and Samsung corporate groups (the Dissenting Creditors). Given the interrelated nature of the Petrofac Plans, they were considered by the court together.

The Dissenting Creditors argued that the Petrofac Plans should not be sanctioned either:

1. because either:

a. the true “relevant alternative” was a different, more favourable, restructuring arrangement, and so the “no worse off” test was not satisfied; or

b. If the “relevant alternative” was insolvency, the Dissenting Creditors would nevertheless be better off in that alternative because insolvency would remove Petrofac, a competitor of theirs, from the market; and/or

2. as a matter of discretion and/or fairness.

The judge accepted that the Dissenting Creditors would receive “indirect economic benefits” from Petrofac’s insolvency. They held that such indirect benefits could be taken into account when considering the “no worse off” test. However, this should be subject to a “remoteness” test. In this case, the Judge held, the benefits were too remote to be taken into account. Accordingly, the “no worse off” test was satisfied.

Finally, the judge held that the plan was fair and should be sanctioned. In particular, the judge held that the fact that providers of “new money” under the plan would receive a larger share of the benefits of the restructuring was justified: they were taking on a new and significant risk in exchange, one which they had no obligation to take on.

off” test should be assessed solely by reference to the “direct” interests of the creditors (eg. contractual rights against the plan company).

The Dissenting Creditors also challenged the finding that the benefits of the restructuring were shared fairly. The Court of Appeal agreed. It held that the judge had failed to take into account the fact that the “new money” would only be provided if the plans were approved. At this point, the evidence indicated that the Petrofac entities would be relatively low risk, high value businesses. Accordingly the plan gave an unfairly high proportion of the benefits to the “new money” providers.

This decision raises two key points. First, “indirect” benefits of the “relevant alternative” are not relevant to the “no worse off” test. This significantly narrows the scope for arguments in relation to this test. However, these indirect benefits may still be raised in relation to fairness and the courts’ discretion.

Secondly, courts must look carefully at the position of parties involved both before and after the proposed plan goes into effect when considering fairness. A party that has no significant exposure to the “relevant alternative” should not be allowed to obtain an unfairly large portion of the benefits in exchange for investing in the post-restructuring entity.

It should be borne in mind, however, all restructuring plans will turn on their own facts. Whilst high level principles can be extracted from these judgments, they must always be applied to the facts with care.

The Dissenting Creditors challenged the first instance judge’s decision that the “indirect economic benefits” were too remote. The Court of Appeal rejected this appeal. However, it also overturned the judge’s reasoning, holding that indirect benefits should never be taken into account for the purposes of the “no worse off” test. Instead, the “no worse

Mob: +44 (0)7879 018 014

Serle Court offers a variety of skill sets that others can’t provide, and houses some of the biggest names at the Bar

Civil Fraud

Commercial Litigation

Company

Insolvency

International and Offshore

Partnership and LLP

Private Client Trusts and Probate

Property

Mediation Arbitration

One of the most important questions for any newly appointed liquidator or administrator is whether there are any claims which can and should be pursued to recover value for the company’s creditors. One option, alongside claims to challenge the previous directors’ misconduct and in respect of reviewable transactions, is to bring a Quincecare claim against the company’s former bank. The claim, whose name derives from the decision of Steyn J in Barclays Bank plc v Quincecare [1992] 4 All ER 363, is available where the circumstances give rise to a duty of care, and a bank permits a transaction to take place when a reasonable and honest banker would not have done so without making further enquiries.

debate as to whether it was right as a matter of policy to impose upon banks a duty to prevent fraud.

However, the judgment of Lord Legatt JSC in Philipp now authoritatively establishes that a Quincecare claim does not require the implication or other finding of a fraud prevention duty. Instead, “it is simply an application of the general duty of care owed by a bank to interpret, ascertain and act in accordance with its customer’s instructions. Where a bank is “put on inquiry” in the sense of having reasonable grounds for believing that a payment instruction given by an agent purportedly on behalf of the customer is an attempt to defraud the customer, this duty requires the bank to refrain from executing the instruction without first making inquiries to verify that the instruction has actually been authorised by the customer” (at [97]).

instance of where there will be a lack of actual authority. And if the Bank is “on inquiry” because of circumstances suggestive of such a lack of authority (which would include, but is not limited to, where there are indicia of fraud), the bank is obliged to make reasonable inquiries to establish that the payment is in fact authorised as part of the duty of care it owes to act in accordance with a customer’s instructions.

Quincecare claims have long been attractive in theory but difficult in practice. An institutional defendant will often be a better target for an officeholder, in terms of likely recovery, compared to the former directors and shareholders of the company. This factor is particularly strong when there is reason to think that the company may have been the victim of or implicated in fraud, when the potential defendants may already have taken steps to put their assets out of the liquidator’s reach.

Prior to the decision of the Supreme Court in Philipp v Barclays Bank UK plc [2023] UKSC 25, [2024] AC 346, it was thought that the circumstances in which such a duty of care will arise is where a bank is on notice that a customer is being defrauded. That led to much

Such lack of authority will exist where the customer (individual or corporate) is being defrauded. But that is simply one

Those potential advantages, however, have to be set against the substantial challenges of bringing a successful claim. The claimant has the burden of showing that the defendant bank was put on inquiry, and will inevitably be met with the argument that the fraud or other circumstances indicative of a want of authority could only be detected with the benefit of hindsight. In the early stages of a liquidation or administration, an office-holder (often with no first-hand knowledge of the company and limited assistance from those with contemporaneous knowledge) may also have little material with which to decide whether to bring a claim. On top of that, a claimant seeking to advance a Quincecare claim (which derives from the tort of negligence) may be faced with difficult points based on causation (potentially involving complex counterfactual defences as to what would have happened had inquiry been made), as well as defences based on contributory negligence and limitation.

The difficulties set out above go some way to explain why successful Quincecare claims have been rare. Until the very recent decision in Hamblin (discussed below), there was only one reported English case, Singularis Holdings Limited v Daiwa [2020] AC 1189, in which a Quincecare claim succeeded. In that claim, the liquidators of a company brought a claim against its former brokerage company in respect of around $204 million misappropriated by its sole shareholder (who was also a director, president, chairman, and treasurer). The bank was aware that the company was in dire financial straits, with other potential creditors, and was alert to the general risk of inappropriate transactions. Despite this, faced with transactions with no apparent legitimate rationale (such as funding the management of a large hospital in Saudi Arabia), the bank permitted the fraudulent payments to be made. The facts of Singularis are unusual, not only because of how obvious the potential fraud was (both at the time as well as with hindsight) but also because it involved a brokerage company, catering to a limited number of clients, rather than a large clearing bank.

Even here, a reduction of 25% of the damages awarded was made to reflect the directors’ contributory negligence in permitting the fraud to continue.

However as well as freeing such claims from the baggage of the “fraud prevention” policy debate, a further important implication of the Supreme Court’s decision in Philipp is that a customer no longer has to establish the constituent elements of the tort of negligence in order to prevail.

That is so, because in accordance with well-established agency principles, where a bank is on inquiry as to a lack of actual authority (whether because of indicia of fraud or otherwise) a bank will be unable to rely upon apparent authority and will be acting in breach of mandate in permitting the transaction to take place unless reasonable inquiries are made to establish that the transaction is authorised. As a result the bank will not have been entitled to debit the payment from the customer’s account, and is liable in debt to the customer for the amount in question. The customer accordingly remains free to demand repayment of the sum which, despite the purported debit, actually remains due.

claimants which avoids many of the obstacles posed by a Quincecare negligence claim. Because the claim is in debt, there is no need to prove loss. Neither can the defendant rely on contributory negligence, and time will not start to run for limitation purposes until the customer demands the money from the Bank after discovering the lack of authority. All of these factors have the potential significantly to reduce the claimant’s burden.

As Lord Leggatt held at [96]:

“…a customer’s mandate is not to be construed as conferring authority on named signatories to instruct the bank to make payments on behalf of the customer for their own purposes, nor as conferring authority on the bank to make such payments on instructions given without the customers actual or apparent authority...The logical consequence of it is that a payment made without inquiry when the bank is on notice that the payment is being made for the signatories’ own purposes is not only a breach of the bank’s duty of care but is also outside the scope of its mandate. Hence the bank is not entitled to debit the amount to the customer’s account.”

That a debt claim will exist in these circumstances was expressly recognised by Lord Sumption, sitting in the Hong Kong Court of Final Appeal in PT Asuransi Tugu Pratama Indonesia TBH v Citibank NA [2023] HKCFA 3.

Lord Sumption’s judgment also demonstrates that a “Tugu” debt claim provides a route to success for

There is obviously scope for banks to protect themselves from liability of this nature by appropriately drafted exclusions or duty defining clauses in their terms and conditions. However, it may take some time for terms and conditions to catch up with the rerationalisation of Quincecare claims post Philipp, and any such modified terms and conditions will avail banks of nothing in respect of historical claims. This is exemplified by the recent decision of Marcus Smith J in Hamblin v Moorwand Ltd [2025] EWHC 817 (Ch) where Marcus Smith J agreed with the appellants’ contention that a bank’s exclusion clause was apt to cover claims in damages only, not debt, with the consequence that it did not bar a “Tugu” debt claim (at [25.i]).

While the difficulties of establishing liability, and in particular of demonstrating that a bank was on inquiry, should not be underestimated, it nevertheless remains the case that the Philipp and Tugu decisions have substantially enhanced their potential value to office-holders seeking to recover from banks through which fraudulent payments and other transactions lacking actual authority have passed.

Matthew Morrison KC and Matthew Innes, instructed by Triay Lawyers (assisted by Stewarts Law), acted for Kijani Resources Limited (in liquidation) and Ratio Limited (in liquidation) in the Quincecare/Tugu claims which their liquidators from PwC Cayman and PwC Gibraltar caused them to bring against The Royal Bank of Scotland International Limited (trading as Natwest). The claimants’ claims were resolved between the parties on confidential terms during the trial before the Supreme Court of Gibraltar in May 2025.

Proud to support FIRE. Experts at putting out fires…

We are delighted to be part o f t he F IRE community and look fo rwa rd to helping this next generation initiative grow from strength to strength.

Internationally known as true specialists in investigating and advising on fraud, asset recovery, insolvency and commercial disputes.

“The April 2021 merger of PCB Litigation LLP and Byrne & Partners saw ‘two top tier boutiques join forces’ to form the market leading civil fraud practice of PCB Byrne”, according to the Legal 500 United Kingdom 2022 edition.

PCB Byrne provides in-depth expertise and unparalleled service having decades of experience in dealing with complex UK and international disputes in the civil, criminal and regulatory sectors. PCB Byrne is a conflict-free firm delivering creative and commercially focused solutions. PCB Byrne builds the best bespoke teams for clients, whilst retaining its commitment to exceptional, hands-on service.

(The Times, 2021)

What’s The Most Important Quote You’ve Heard That You Have Adopted To Your Personal Or Professional Life?

“You can disagree without being disagreeable” (Ruth Bader Ginsberg). Although it’s an inevitable part of the job that we need to be assertive at points, I aim to avoid being unnecessarily aggressive. I think clients rarely if ever get a better outcome because their solicitor has been unpleasant to their counterpart.

If You Could Learn To Do Anything, What Would It Be?

File emails and deal with billing in my sleep …

What Has Been Your Most Memorable Experience During Your Career So Far?

Watching a defendant fake a heart attack in the RCJ when he realised judgment was going to be entered against him.

How Do You Deal With Stress In Your Work Life?

I’ve recently bought a puppy and taking her out for a walk in the woods always does the trick.

What Is The Most Significant Trend In Your Practice Today?

I’m currently dealing with a lot of insolvency issues arising from the sanctions imposed in 2022, which have been in issue for a while but are now starting to make their way into the courts.

What’s One Career Decision That Shaped Where You Are Today?

I qualified into the insolvency department of a full-service firm and had a varied workload of contentious and noncontentious work for the first few years of my career. At c.4pqe I decided to move to PCB to focus on high value fraud and contentious insolvency. That decision to move has massively shaped my career as I’ve picked up great experience and now have a purely contentious practice.

What Skills Have Been Most Valuable In Your Career So Far?

I’ve always approached things by trying to work out what the client or partner wants from me and working backwards from there, which has served me well both in terms of internal progression and securing

repeat instructions. I’m also always thorough in making sure I understand the factual and legal aspects on any new case at the outset, which always pays dividends as cases progress.

What cause are you passionate about?

Social mobility and prompt time recording.

If Your Career Were A TV Show Or Movie, What Would It Be Called?

The Office, with Tony Riem as David Brent.

If You Had To Sing Karaoke Right Now, Which Song Would You Pick?

I’m juggling various impending deadlines and hearings at the moment, together with wedding planning and a puppy, so probably “I Will Survive”.

As multinational corporations expand their operations, courts are increasingly faced with a significant question on parent company liability: in what circumstances might English jurisdiction be engaged in a claim against a UK company, for the harms facilitated by its foreign subsidiaries in foreign lands?

This article considers Limbu v Dyson1, which was handed down in December 2024, and relates to allegations of forced labour within the supply chain of the international technology group, Dyson. The two main defendants are English companies within the Dyson group (D1 and D2), while the third defendant is a Malaysian subsidiary (D3).

This decision reflects a growing judicial trend: in assessing the appropriate jurisdiction for parent company liability claims, English courts are prepared to look beyond corporate formalities and focus instead on the real “centre of gravity” of the alleged wrongdoing.

Twenty-four claimants of Nepalese or Bangladeshi nationality, employed at Malaysian factories operated by Malaysian subcontractors ATA Industrial and Jabco Filter System (the “Subcontractors”), reported being subjected to abusive employment practices. They allege that they were forced to work excessive overtime in breach of Malaysian employment law, for wages below the legal minimum, while being subjected to onerous production targets enforced through intimidation and physical violence.

D1 and D2 are English companies within the Dyson group which have operated at all material times from their office in Malmesbury, which was

the headquarters for the entire Dyson group until late 2019 (i.e. for the majority of the period covered by the Claimants’ claims). D3, known as Dyson Malaysia, is a Malaysian company that contracted with the Subcontractors for the manufacture of various Dyson components at the factories where the Claimants worked. The Claimants argued that Dyson UK exercised operational oversight over the factories through its supply chain management practices and its public commitments to ethical labour standards.

The causes of action brought by the Claimants are threefold2:

(1) negligence for breach of duty in relation to defects in Dyson’s policies and a failure to take steps to ensure their proper implementation and enforcement;

(2) liability for torts including false imprisonment, intimidation, and assault, allegedly committed by the Subcontractors and, in some instances, the Royal Malaysian Police; and

(3) a restitutionary claim for unjust enrichment.

The English High Court initially found that Malaysia was the “centre of gravity” due to the location of the alleged abuses, and therefore was the appropriate forum for the claims. However, the Court of Appeal overturned that decision.

In particular, the Court of Appeal noted that Dyson’s UK office remained the primary operational control centre for the Dyson group, employing approximately 3,500 staff, including most of its senior management and key personnel relevant to the claims. Crucially, the UK office hosts a UK based sustainability team which is responsible for developing and promulgating mandatory supply chain policies and standards, including the implementation, monitoring, auditing of, and ensuring compliance with, those policies and standards.

The Court of Appeal observed that ultimately the claim against the UK Dyson defendants is the primary claim:

“The

reality is that Dyson UK is the principal

protagonist and Dyson Malaysia a more minor and ancillary defendant”3.

Drawing on the principles set out in Vedanta Resources and another v Lungowe4, the Court found that proper consideration should have been given by the Judge (Clive Sheldon KC, as he then was) to the fact that the promulgation of the policies took place in England. These policies, which are central to key allegations of Dyson UK’s failure to act on known abuse, failure to enforce compliance, and unjust enrichment, were not failures that occurred in Malaysia, but rather within Dyson’s UK operations, where those policies were developed and maintained.

While the factual centre of the claim pointed to England, the Court of Appeal also had to consider the governing law of the causes of action which are governed by Malaysian law, which— with one exception—is said to be materially the same as English law.

This gave the Court confidence in its ability to proceed, drawing on expert evidence and its own experience with Commonwealth legal systems.

3 [2024] EWCA Civ 1564, paragraph [36]

4 [2019]

The Court noted5 that while these differences would ordinarily favour trial in Malaysia, “they are nevertheless issues which the English court is well equipped to deal with as a matter of expert evidence and using its own experience to analyse Malaysian and other Commonwealth authorities.”

In reaching this view, the Court relied on the reasoning of the Privy Council in Perry v Lopag Trust Reg6, which affirmed that English judges may draw on their domestic experience when interpreting foreign common law systems. This reflects a wider judicial willingness to engage with foreign legal systems where there is sufficient alignment in legal principles, reinforcing the capacity of English courts to contribute meaningfully to cross-border corporate accountability.

The clear trend is that courts are moving beyond formal corporate structures and jurisdictional defences. They are increasingly focused on:

• Operational reality over corporate form – Parent companies must assess not only their subsidiaries’ conduct but also how their own policies, and decisions influence those operations.

• Jurisdictional reach – Forum non conveniens arguments face growing scepticism where the parent and the claim has a material connection to the UK.

focusing solely on where the harm occurred, especially where corporate oversight and control are exercised within England and Wales.

The English court rejected the argument that the absence of a direct relationship between the parent company and foreign claimants should bar foreign claims for harm suffered abroad from being dealt with in England.

Overall, there is a growing body of case law7 which demonstrates a judicial shift toward assessing real-world control and parent company involvement. Where the parent company is UK-based, or where key aspects of the alleged misconduct occurred in the UK (such as policy-making), the courts have demonstrated a clear readiness to assert jurisdiction and focus on where the real control lies, rather than relying solely on territorial arguments.

This judgment illustrates the courts’ broader willingness to assess parent company behaviour through the lens of its operational centre, rather than

We are dedicated to advocating for your interests. With comprehensive expertise, full service and decades of experience we always remain focused on your goals. Learn more about our passionate way of providing legal excellence.

The best boutique practice in London. Wonderfully collaborative and technically superior to all its rivals.

Payne Hicks Beach operates at the intersection where a law firm steeped in history meets an innovative and dynamic team with bucketloads of commercial acumen.

LEGAL 500 UK

Fraud and asset recovery

Contentious insolvency and financial services

Shareholder, company and partnership disputes

Conflict free

Payne Hicks Beach LLP is a firm of solicitors who take pride in building strong client relationships based on trust, integrity and the vision to succeed.

What’s The Most Important Quote You’ve Heard That You Have Adopted To Your Personal Or Professional Life?

Action is the foundational key to all success” —Pablo Picasso. If You Could Learn To Do Anything, What Would It Be?

Speak a second language fluently.

What Is The Most Significant Trend In Your Practice Today?

The recent global events and resulting sanctions.

If You Had To Sing Karaoke Right Now, Which Song Would You Pick?

Macy Gray’s I try. It is in a lower register so it is a range I can reach.

What’s One Career Decision That Shaped Where You Are Today?

I started my career as a criminal barrister.

What Has Been Your Most Memorable Experience During Your Career So Far?

Witness proofing Peter Andre How Do You Deal With Stress In Your Work Life?

I talk to my colleagues

What Skills Have Been Most Valuable In Your Career So Far?

An ability to communicate complex ideas and bring clients on the litigation journey What Cause Are You Passionate About?

Access to representation If Your Career Were A Tv Show Or Movie, What Would It Be Called?

A work in progress

Can a sum awarded under a foreign court judgment, unrecognised in England, form, first, the basis for a statutory demand and ultimately found a bankruptcy petition in England?

That was the question before the Court of Appeal in Servis-Terminal LLC v Drelle [2025] EWCA Civ 62, a case that has now provided welcome clarification on a previously unsettled point of law. The ruling is particularly significant for foreign creditors looking to enforce a foreign judgment in England and Wales, and for debtors challenging such efforts.

At common law, foreign judgments are not enforceable until they are recognised through a separate cause of action, typically a claim in debt based on the judgment, or by operation of a statutory recognition regime such as the Foreign Judgments (Reciprocal

Enforcement) Act 1933.1 Recognition is a necessary step because English law does not automatically accept foreign judgments as binding or operative within its own courts.

Academic commentary, which was considered at length by the Court of Appeal in the case of Servis-Terminal LLC v Drelle, supports this position. Dicey2, provides that a “judgment of a court of a foreign country has no direct operation in England but may (1) be enforceable by claim or counterclaim at common law or under statute or (2) be recognised as a defence to a claim or as a conclusive of an issue in a claim”. Professor Briggs3 explained this as “The first rule of foreign judgments is that judgments of foreign courts have, as such, no legal effect in England, for foreign judges have no authority in England. Except where Parliament has provided otherwise,

1 Under section 6 of the Foreign Judgments (Reciprocal Enforcement) Act 1933: “No proceedings for the recovery of a sum payable under a foreign judgment, being a judgment to which this Part of this Act applies, other than proceedings by way of registration of the judgment, shall be entertained by any court in the United Kingdom”

2 Dicey, Morris & Collins, The Conflict of Laws (16th Ed)

3 Briggs, The Conflict of Laws (5th Ed) at 112

foreign judgments cannot be enforced in England by execution, and no person is in contempt of court, or otherwise in peril in England, if she fails to do what she has been ordered to do by a foreign judge.” That reflects both the idea of national sovereignty and the need to ascertain that foreign proceedings meet the English courts’ standards of justice.

Yet, tension arose when this principle met the procedural mechanics of insolvency law. The facts of the case are relatively straightforward. ServisTerminal LLC, a Russian company in liquidation (and its trustee in bankruptcy having brought the proceedings), had obtained a judgment against its former CEO, Mr Drelle, in the Arbitrazh Court for RUB 2 billion. Servis-Terminal LLC served a statutory demand for RUB 2 billion (approximately £19,845,309.40 in October 2020) on Mr Drelle, who was now resident in London, England. With the statutory demand remaining unsatisfied, Servis-Terminal LLC filed a bankruptcy petition.

Section 267(2)(b) of the Insolvency Act 1986 provides for a bankruptcy petition to be presented by the creditor, if the debtor owes a debt that is for a payable liquidated sum. It was argued by ServisTerminal LL that a foreign judgment, even if unrecognised, could meet this definition as it is a fixed and final obligation determined by a competent court. A bankruptcy order was made by ICC Judge Burton, which Richards J upheld on appeal on this basis.

Mr Drelle then appealed to the Court of Appeal.

In a unanimous decision, the Court of Appeal allowed the appeal and set aside the bankruptcy order. Newey LJ, delivering the leading judgment, held that a foreign judgment “has no direct operation in this jurisdiction”, and unless it is recognised, it does not constitute a debt that can found a bankruptcy petition.4 The court drew a distinction between using a foreign judgment as a “shield” and using it as a “sword.” In doing so, the court rejected ServisTerminal’s reliance on Dicey Rule 515 which provides that “a foreign judgment which is final and conclusive on the merits and not impeachable under any of Rules 52 to 55 is conclusive as to any matter thereby adjudicated upon, and cannot be impeached for any error either (1) of fact; or (2) of law”. The Court held that this principle is applicable only where the foreign judgment is invoked defensively. While such judgments may be conclusive on matters already adjudicated and can be raised in defence, they cannot be used offensively to initiate enforcement (or to found insolvency proceedings

which were considered by the Court to be a process of collective enforcement), unless and until they are formally recognised by an English court6

Newey LJ also relied on broader principles of English law. Drawing parallels with the “revenue rule”, it reasoned that enforcing an unrecognised foreign judgment through bankruptcy proceedings would be akin to enforcement of foreign tax debts, each involving an assertion of sovereign authority within England7

The decision affirms the traditional understanding that foreign judgments are not self-executing in English law. While this might seem formalistic, the requirement of recognition serves an important function in protecting the integrity of the legal system and ensuring that foreign judgments are subject to scrutiny before being given domestic effect.

The 2019 Hague Convention entered into force on 1 July in the UK, and so a new framework now exists for the recognition and enforcement of foreign judgments between the UK and other contracting states. This could eventually ease the burden on creditors and reduce the procedural friction involved in cross-border debt recovery. However, the Convention’s scope remains limited as it does not apply retrospectively and only governs judgments falling within its defined categories and between states that are parties to it.

To seek advice on commercial litigation, please contact Lucas Moore or Karin Troiani, or alternatively, telephone on 020 7465 4300.

No

We’re

Maitland is one of the leading sets of barristers’ chambers in the UK. Based in London’s Lincoln’s Inn, we offer legal advice and advocacy of the highest quality both domestically and internationally.

We are consistently ranked as a leading set in all our areas of expertise across the civil fraud, commercial, corporate, insolvency, real estate, financial, chancery and related fields. We appear across a full range of UK civil courts and tribunals including the Supreme Court and Privy Council as well as in Caribbean, Asian and other jurisdictions.

“An impressively deep stable of elite silks and juniors”

For further information, please contact our Clerks using the details below:

John Wiggs - Senior Clerk

jwiggs@maitlandchambers com

+44 (0)20 7406 1251

Robert Penson - Deputy Senior Clerk

rpenson@maitlandchambers.com

+44 (0)20 7406 1258

Luke Irons - Deputy Senior Clerk lirons@maitlandchambers com

+44 (0)20 7406 1257

Practitioners will be all too familiar with striking headlines which declare that another household name business has ‘collapsed into administration’ and, certainly within the past decade, that phrase has heralded changes to consumer habits across the United Kingdom.

Often, at least in the public’s perception, administration represents the ‘end of the road’. It is seen as the first step towards an inevitable winding up of a company. However, that perception belies the true purpose of administration under the Companies (Guernsey) Law, 2008 (Law) (and indeed the English Companies Act, 2006).

In an important and informative recent decision, the Guernsey Royal Court has, for the first time, given guidance on when administration is appropriate and, conversely, when it is preferable to move straight into liquidation.

Pension Superfund Capital Holdings Limited (Company) is a Guernsey company engaged in the provision of financial services to pension schemes. The Company had suffered a ‘reversal of fortunes’ and its largest creditor, EJF Funding DAC (Creditor), had served a statutory demand in the substantial sum of £20,136,271.

The demand went unsatisfied and it was common ground that the Company was insolvent.

The Company brought an application for it to be placed into administration. The Creditor brought a competing application asking that the Company be placed into compulsory liquidation.

Section 374 (1) of the Law empowers the Royal Court to make an administration order if it is satisfied that ‘the company …does not or is likely to become unable to satisfy the solvency test’ and the administration of the company may achieve one of the statutory purposes set out in the Law.

Those purposes are ‘the survival of the company, and the whole or any part of its undertaking, as a going concern’ or ‘a more advantageous realisation of the company’s… assets than would be effected on a winding up’. In that sense, liquidation should be seen as the default and administration should only be pursued where there is a particular reason to do so.

The sole issue of law for the Court to grapple with was the threshold at which the Court would be satisfied that one of those outcomes could be achieved.

The Company submitted that the use of the word ‘may’ within the Law was deliberate and indicated a lower threshold than that under the Companies Act (which requires it to be ‘reasonably likely’ that the statutory purposes would be met).

The Court ultimately found that there was no distinction between these two phraseologies and held that for any Guernsey company to be placed into administration there must be a ‘sensible and reasonably significant prospect of achieving the stated purpose’ although this prospect need not be more likely than not or indeed 50:50.

On the basis of the evidence submitted by the Company, the Jurats (who determine matters of fact in the Royal Court of Guernsey) were not satisfied that there was a sufficiently real prospect that either of the statutory objectives would be reached.

The Jurats also concluded that liquidation was more likely to deliver short term cash to meet the main creditors’ rights, with the creditors’ rights being paramount.

It was also worth noting that the Jurats considered that if the liquidators were to conclude that continuing the business of the Company were a more beneficial way forward they would have the power to do so under the law.

The Company’s administration application was therefore dismissed and the Creditor’s liquidation application was granted.

Persons considering applying for a Guernsey company to be placed into administration should note that the Court will require evidence that there is a reasonably significant prospect of one of the two purposes under the Law being reached. Whilst this burden is likely to be particularly acute wherever there is a competing application seeking the liquidation of the Company, the Court will no doubt be alive to the costs to be incurred by pursuing an ultimately non-productive administration.

Applicants would be advised to carefully consider their rationale for seeking an administration order and to document fully the evidential basis for that rationale. Mere aspiration, however well intentioned, must be grounded in a realistic analysis.

The decision in Pension Superfund makes clear that administration is not a necessary ‘treatment’ for ailing companies. Save where administration presents a genuinely preferable and demonstrable means of managing a delinquent company’s affairs, liquidation ought to be considered in the first instance.

The Chambers UK Guide

CONFLICTS OF LAW

CONSTRUCTION & ENERGY DISPUTES

COMMERCIAL CONTRACTUAL DISPUTES

ENFORCEMENT

FRAUD, ASSET TRACING & RECOVERY

INSURANCE COVERAGE CLAIMS

JOINT VENTURE DISPUTES

PROFESSIONAL NEGLIGENCE CLAIMS

RESTRUCTURING & CORPORATE INSOLVENCY

james.duncan-hartill@gatehouselaw.co.uk

Authored by: Midori Yamaguchi (Senior Associate) - Mori Hamada & Matsumoto

In June 2025, Japan enacted a new legislative framework designed to support enterprises at risk of falling into financial distress but not yet insolvent. Commonly referred to as the Early Business Recovery Act (official English title pending; Act No. 67 of 2025), this legislation establishes a hybrid pre-insolvency mechanism that combines court approval with oversight by a neutral third-party organisation, ensuring both expertise and procedural legitimacy. It enables supermajorityapproved financial debt restructuring while maintaining confidentiality and minimising disruption.

Set to come into force by the end of 2026, the Act is expected to transform Japan’s corporate debt restructuring landscape. This article outlines the economic background and procedural features of the new regime. The views expressed are the author’s own and do not necessarily represent those of any affiliated organisations.

Japan has experienced a rise in corporate debt, an increase of around 120 trillion yen since before the COVID-19 pandemic.

With ongoing challenges such as rising costs for raw materials and labour shortages, the number of bankruptcies in 2024 has surpassed 10,000 for the first time in 11 years. In this context, there is a growing concern that the debt burden will become a hindrance to business activities to improve profitability, causing companies to miss opportunities for business growth and leading to more bankruptcies.

Japan’s corporate debt restructuring regime has historically relied on two tools:

• Court-led insolvency procedures (e.g., civil rehabilitation), which enables majority-vote debt restructuring while it often causes reputational and commercial harm due to their public nature; and

• Out-of-court workouts, which preserve confidentiality in principle but require unanimous creditor consent, limiting their effectiveness.

Recognising this gap and drawing inspiration from the UK’s Scheme of Arrangement and Restructuring Plan as well as Germany’s StaRUG, the Ministry of Economy, Trade and Industry (METI) developed a new pre-insolvency framework that enables enterprises at risk of falling into financial distress but not yet insolvent to restructure only their financial debts, under the oversight of a neutral third-party organisation and the court, thereby ensuring transparency, fairness, and minimal business disruption.

The Act applies to enterprises at risk of falling into financial distress, which is the stage preceding the “economically distressed” status required under incourt insolvency procedures such as civil rehabilitation. This scope reflects the Act’s objective of promoting early and timely business recovery before insolvency occurs. It is industry-agnostic and size-neutral but is expected to be used mainly by large and mid-sized enterprises with a relatively large number of financial creditors.

The claims eligible for modification under the Act are limited to financial debts held at the time of commencement by certain types of creditors, including financial institutions, insurance companies, licensed money lenders, governmentaffiliated entities, local governments, and licensed debt collection companies (servicers) that have acquired claims held by these entities.

While the secured portions of claims are excluded from modification by majority vote, they may be subject to procedural stays to prevent asset enforcement.

After confirmation, the third-party organisation must request all affected creditors to voluntarily suspend enforcement or preservation of claims. Also, the court may grant a legally binding temporary stay, suspending enforcement actions or realisation of security interests, if necessary.

Within six months of confirmation, the debtor must submit:

• A written proposal setting out the terms of the claim modifications, excluding secured portions; and

• An early business recovery plan, which includes:

o The business background;