LEADING LADIES IN BANKING Obi Dumps Abure, Backs Moves to Salvage Party SPECIAL EDITION • APRIL 1, 2024 • VOL . 4 NO. 16 THEWILLNIGERIA THEWILLNG THEWILLNIGERIA BATTLE FOR CONTROL OF LABOUR PARTY: Price: N250 www.thewillnews.com OJY OKPE Inspiring Change Through Media PAGE 32 PAGE 38 Access Corporation Grows Assets by 78% to N26.68trn, Retains Grip on Industry Leadership PAGE 33 Air Peace Lagos-London Route Eases Pressure on Naira, Says Keyamo...

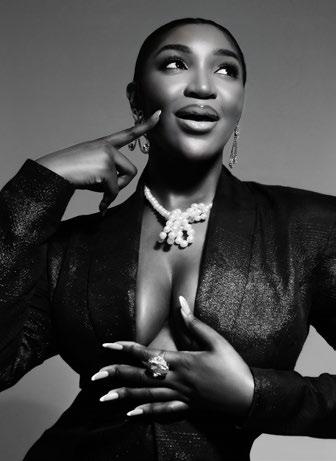

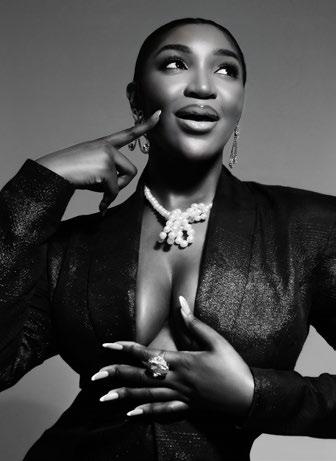

Ojy Okpe never envisioned being a journalist; she always wanted to be a filmmaker because that was what she studied. Her journey in journalism started in 2013 when she got hired to be a producer for Arise News’ flagship show, Arise Entertainment 360 This was in New York. She eventually started producing short features and short documentaries for the documentary unit. In 2015, they won a NY Emmy for the documentary Game Changers: How the Harlem Globetrotters Battled Racism. According to Okpe, this was the game-changer in her career. It led her to realise that she was drawn to human-angle stories. She now anchors her show on Arise News, What’s Trending With Ojy Okpe, where she treats human-angle stories and other stories.

When it comes to challenges she has faced in her career, Okpe says she has faced a couple of challenges from women and that men have been more supportive of her career than women. Read her story on pages 8 through 10.

Men make fashion mistakes that can be avoided. While it is advised that you should experiment when trying fashion trends, there are rules to follow. We have listed some fashion faux pas for men in this week’s fashion pages. See pages 4 and 5.

Our beauty page highlights steps to take while choosing the right serum, from determining your skin type to choosing the suitable serum for your age.

Don’t forget to click on the instructions beneath the QR codes on page 16 to download the playlist.

Happy Easter, everyone!

Until next week, enjoy your read.

SPECIAL EDITION APRIL 1, 2024 THEWILL NEWSPAPER • www.thewillnews.com PAGE 2 THEWILLNIGERIA THEWILLNG THEWILLNIGERIA

Photo: Kola Oshalusi @insignamedia Makeup: Zaron

OnahNwachukwu OnahNwachukwu Editor, THEWILL DOWNTOWN @onahluciaa +2349088352246

VOL 4 NO. 13 • MARCH 31, 2024 OJY OKPE Inspiring Change Through Media Scan the QR Code to Download current edition Scan The QR Code to Read on Website Or Visit www. thewilldowntown.com Scan The QR Code to Read on Issuu New Edition Available Every Sunday @ 6am Nigerian Time

Digital

SPECIAL EDITION APRIL 1, 2024 THEWILL NEWSPAPER • www.thewillnews.com

SPECIAL EDITION APRIL 1, 2024 THEWILL NEWSPAPER • www.thewillnews.com

SPECIAL EDITION APRIL 1, 2024 THEWILL NEWSPAPER • www.thewillnews.com PAGE 5 THEWILLNIGERIA THEWILLNG THEWILLNIGERIA

COVER

BATTLE FOR CONTROL OF LABOUR PARTY:

Obi Dumps Abure, Backs Moves to Salvage Party

BY AMOS ESELE

The ongoing tussle for power and control of the Labour Party between the Nigeria Labour Congress, NLC, and the National Working Committee, NWC, of the party, entered a critical stage last week when the NLC formally announced its decision to take over the party as the LP presidential candidate in the 2023 general election, Petter Obi, may have dumped embattled National Chairman, Julius Abure and backs moves to salvage party.

But the newly 'elected members' of the NWC of the party have stuck to their guns, staring eyeball to eye-ball with the union leaders.

Shortly after the Labour Party’s Board of Trustees, BoT, declared the controversial convention that returned Julius Abure as National Chairman of the party, the Independent National Electoral Commission, INEC, which is supposed to give legal backing to the convention by monitoring it, declared it a “charade” and washed its hand off the event, thus effectively adding fuel to a simmering situation.

Contacted for further explanation, Mr Rotimi Oyekanmi, Chief Press Secretary to the INEC Chairman, Professor Mahmood Yakubu, restated his earlier position to THEWILL that the Commission did not monitor the convention. He refused to be drawn into further questioning about the implications of the Commission’s non-observance for the emergence of the party’s NWC.

Even so, the basis of the Commission’s absence cannot be far-fetched as Section 82(1) of the Electoral Act, 2022, states that political parties shall give INEC at least 21 days’ notice of convention, congress, conference or meeting. This includes the convention or meeting convened for “merger” and electing members of its executive committees and other governing bodies or nominating candidates.

The change of venue at short notices by the NWC, which at first planned the convention for Benincity, then changed it to Umuahia in Abia State until Nnewi in Anambra State was finally chosen, is said to be the main reason for the absence of

the electoral umpire at the convention.

THEWILL contacted the National Publicity Secretary of the party, Obora Ifo, on this. He was cautious in his response.

“We choose what we reply here,” he said, in response to INEC’s statement. When asked if INEC’s absence does not pose a legal problem for the party, he simply replied, “Thank you so much.”

OBI REACTS

Presidential candidate of the party in the 2023 general election, Peter Obi has described the Nnewi convention in uncomplimentary terms.

Speaking on his absence at the National Convention, Obi said Abure and other leaders failed to consult widely. Obi, who spoke during an X Space session hosted by Parallel Facts on Friday, said the time had now come for Abure and the leadership of the party to do the right thing in order to salvage it.

PAGE 6 THEWILLNIGERIA THEWILLNG THEWILLNIGERIA

COVER ...Backs Moves to Salvage Party

Efforts to get a reaction from the NLC failed. The General Secretary of the union, Mr Emmanuel Ugboaja, failed to answer his call or respond to messages.

THE CRACK BEGINS

While the combatants are still in the trenches, the crisis has begun to take its toll on the party and its supporters.

A day after the controversial convention took place, six members of the Enugu State House of Assembly on the platform of the LP defected to the Peoples Democratic Party, PDP last Thursday. The lawmakers are Ejike Eze, representing Igbo-Eze North 1; Johnson Ugwu, representing Enugu North; Princess Ugwu; Enugu South Rural; Pius Ezeugwu, Nsukka West; Amuka Willams, representing Igbo-Etiti East and Osita Eze, representing Oji River.

The defectors cited the “existence of irreconcilable division, an ongoing crisis within the Labour Party at the national level and across the state chapters,” in a letter read during plenary by the Speaker of the House, Uche Ugwu.

in the presence of INEC officials on June 27, 2022, to stick to the mandate as directed by the judgement.

In a detailed reaction, however, the Abureled NWC of the party expressed surprise at the existence of a BoT for the party.

According to Ifo, the last time they heard of Comrade Ejiofor was two decades ago when he was the first National Chairman of the party. Since then, he maintained, “Ejiofor is not even known in his ward and he has not paid a single dime as membership dues which qualifies him as a member.”

He argued that the 350 delegates that participated in the Nnewi convention was more representational of the membership of the party as they included Governor Alex Otti of Abia State who was represented by his deputy, Ikechukwu Emetu, the Deputy Minority Whip in the House of Representatives, Hon. George Ozodinobi, who led 10 other members of the National Assembly to the event, the Deputy Minority Leader in the Imo State House of Assembly, Hon. Clinton Amadi, as well as their counterparts from the Enugu State House of Assembly.

He contended that since the Labour Party is, according to article 77 (1) of the Electoral Act, a corporate body with perpetual succession and a common seal which may be sued and can be sued in its corporate name, the party cannot be taken over by a union like the NLC.

THEWILL however gathered that the ‘Obidient Movement,’ now has what can be called partisan and non-partisan members. The partisan members, according to a reliable source, are those who have joined forces with the embattled National Chairman of the LP, Julius Abure, while the non-partisan members still retain the core leadership of the movement at inception in 2023. These stalwarts include Aisha Yesufu, Prof Chris Nwakobia, Dr Paul Moses, Dele Famoroti,

“

The Labour Party never pledged to deliver a new Nigeria nor did it promise transparency, integrity and efficiency. The party never vowed to transition from consumption to production or dismantle the structures of criminality. Mr@Peter Obi did. So, this is not a moment for blind outrage or aimless uproar, it is time for clarity, focus and unwavering determination

March Oyinki. They have reacted to the fallout of the convention stoically.

In a note made available to THEWILL, Dr Moses paints a picture of this group. He recounts how he had been overwhelmed with calls and messages “in the aftermath of the Labour Party Convention”, by those who “feel disheartened, disillusioned and drained by the outcome.”

He said, “The Labour Party never pledged to deliver a new Nigeria nor did it promise transparency, integrity and efficiency. The party never vowed to transition from consumption to production or dismantle the structures of criminality. Mr@Peter Obi did. So, this is not a moment for blind outrage or aimless uproar, it is time for clarity, focus and unwavering determination.”

Moses called on fellow ‘Obidients’ to exercise patience and restraint, “For in due time, our revered leader, Mr @Peter Obi, will guide us with wisdom and clarity. Our journey towards a better Nigeria continues, fueled by hope, resilience and an unwavering belief in our collective potential. Together, we shall forge ahead, undeterred by momentary setbacks, towards the brighter tomorrow we envisioned.”

The general thinking now within the party and movement is that Obi may leave the party, even though leaders of the NLC are said to be persuading him to stay.

But his influence in the party appears to be waning. At the peak of the crisis, before the controversial convention, Obi had intervened and called for the postponement of the convention, wider consultations over the lingering problems, until frayed nerves had calmed down.

According to the spokesperson of the Obi/Datti Campaign Organisation, Tanko Yunusa, the party’s 2023 presidential candidate met with the warring parties at an Asaba meeting alongside party members at the House of Representatives to wade into the crisis.

WAY FORWARD

The NWC looks prepared not to concede defeat, ready to stick to its gun and have its way. Mr Ifoh told THEWILL that the newly elected members will go for the Easter holidays when asked, “Where do you go from here?”

He said, “After the holidays, we will all resume duties.”

For the ‘Obidients,’ investigations further show that the aforementioned non-partisan members are only waiting on Peter Obi to make a decision on what a dependable source called, “the next step”.

Many comrades within the NLC think this is the time to reform the Labour Party and turn it into a fee paying mass movement that is representative of the welfarist aspirations of workers drawn from 48 –affiliate members of the union and Nigerians at large.

PAGE 7 THEWILLNIGERIA THEWILLNG THEWILLNIGERIA

Easter: Tinubu Felicitates Christians, Says Nigeria Will Triumph Over Challenges

President Bola Tinubu has felicitated with Christians in Nigeria and around the world, on the occasion of the 2024 Easter, a significant moment and glorious celebration of the triumph of life over death.

In a statement issued on Friday by Ajuri Ngelale, his Special Adviser on Media and Publicity, President Tinubu emphasised "love, sacrifice, and compassion as the patent themes of this solemn season".

The President noted the sacrifice of Jesus Christ for humanity as a lesson for leaders and Nigerians to yield to selflessness and compassion and be steadfast in the pursuit of a united, peaceful and prosperous nation.

Commending Nigerians for the sacrifices they made in the past few months for the nation to be steered to the path of recovery and sustainable growth, President Tinubu further assured that "the seeds of patience, which they have sown are beginning to sprout and will, in no time, bring forth an abundance of good fruits.

“As Christians celebrate the victory of life over death as exemplified by the resurrection of Christ, President Tinubu assured all citizens that Nigeria will triumph over its challenges as his administration remains firmly committed to this end.”

National Grid Successfully Restored – TCN

The Transmission Company of Nigeria (TCN) says the national grid has successfully been restored following a ‘system disturbance’ that occurred at about 4:28pm on Thursday, March 28.

A statement by the TCN General Manager, Public Affairs, Ndidi Mbah, said full recovery was achieved by 10:00pm that same day.

According to Mbah, a report from the National Control Centre (NCC) in Osogbo, Osun State, indicated that the "system disturbance" was triggered by a significant reduction in generation capacity, primarily due to gas constraints.

Most Wanted Boko Haram Commander Surrenders to Troops

Most wanted Boko Haram commander, Mallam Yathabalwe, who has been terrorising Gwoza and the surrounding Mandara Mountain communities, has surrendered to the troops of Operation Hadin Kai. The Emir of Gwoza in Gwoza Local Government Area of Borno State, Alhaji Mohammed Shehu Timta, disclosed this to journalists on Friday.

Yathabalwe had been fingered in a series of attacks and killings, including the attacks of farmers on their farmlands in Gwoza LGA and its environs.

While the military has not officially confirmed the development, the Emir said Yathabalwe willingly came out from his enclave on Friday morning with two AK47 rifles and some ammunition and surrendered to the troops of Operation Hadin Kai.

“We are happy to confirm and inform you that the most wanted top commander of Boko Haram, who has been terrorising Gwoza and other surrounding Mandara Mountain communities in my domain, Mallam Yathabalwe, has surrendered to troops of ‘Operation Hadin Kai’ in the NorthEast.

“He willingly came out from his enclave on Friday morning with two AK47 rifles and some ammunition. He was then handed over to the troops of the Nigerian military in Gwoza, after which he may be taken to Maiduguri, the Borno State capital, for further questioning or action.

“Yathabalwe, before surrendering, has been terrorising my people for many years, especially making it very difficult for farmers to access their farmlands. With this new development, we are hopeful that total peace will return to Gwoza and its environs,” he said.

Senate Leader, Bamidele, Salutes Tinubu at 72

Senate Leader, Opeyemi Bamidele, has congratulated President Bola Tinubu on his 72nd birthday.

In a congratulatory message, Friday, titled, Ode to People's President, the Senate Leader described President Tinubu as ''my leader and mentor,'' saying he is ''a timeless doyen of democracy and an astute mentor of many leaders.'' The message reads: ''Today, I celebrate a timeless doyen of democracy and an astute mentor of many leaders, President Bola Ahmed Tinubu, GCFR. By global standards, Asiwaju is truly a man of the people and the visionary of our times, who devoted his life to pursuing the greatest goods to the greatest number of people. This has been the core of his heart and life from when he was a boardroom guru in the 1980s to when he joined partisan politics in the 1990s.

''Born on March 29, 1952, Asiwaju’s foray into politics in 1991 was never a mistake, though it came with a huge sacrifice that cost dearly. As a Senator of the Federal Republic of Nigeria, I celebrate how Asiwaju firmly stood with the people rather than dining with the military oligarchy that annulled the outcome of the June 12, 1993 presidential election ostensibly won by Chief M.K.O Abiola (now of blessed memory), an annulment that set our fatherland back to the pre-colonial era.

''I also celebrate how Asiwaju teamed up with the progressives to establish the National Democratic Coalition, a movement of likeminds and progressives that fiercely challenged the regime of the late tyrant, General Sani Abacha; mobilised support for the restoration of democracy to our fatherland and campaigned for the recognition of Chief M.K.O Abiola as the winner of the June 12 presidential election. And this conviction and pursuit eventually earned him exile from the land of his birth.

'' Yet, he was undaunted in his quest to see his fatherland liberated from the era of locusts that pitched us against the comity of nations.

''I celebrate how Asiwaju returned to Nigeria in 1998 when the darkest era of the late tyrant finally folded into the abyss of extinction after fighting doggedly on the side of the people. The end of the dark era culminated in his election as the third civilian governor of Lagos State in January 1999.

''Though faced with diverse heinous challenges at the inception, Asiwaju came out strong and victorious, setting Lagos on the path of irreversible progress, reforming the coastal state to a globally competitive smart city and turning it to a constant destination of strategic investment.

THEWILLNIGERIA THEWILLNG THEWILLNIGERIA •Continues online at www. thewillnews.com •Continues online at www. thewillnews.com

SPECIAL EDITION APRIL 1, 2024 WWW.THEWILLNEWS.COM 8 NEWS

Governor of Lagos State, Mr. Bababjide Sanwo-Olu (middle): Chairman, Senate Committee on Works, Senator Barinada Mpigi (left) and Chairman, House of Representatives Committee on Works, Hon. Akin Alabi (right), during the committees courtesy visit to the Governor at Lagos House, Marina on March 28, 2024.

Insecurity: NSCDC Unveils ‘Information Not Disinformation’ Campaign in Imo

FROM SAMPSON UHUEGBU, OWERRI

s part of efforts to fight insecurity in Imo State, the state’s Command of the Nigeria Security and Civil Defence Corps (NSCDC) has unveiled the ‘Information Not Disinformation’ campaign.

The campaign was unveiled by the NSCDC Commandant in Imo, Mr Matthew Ovye, at the command’s headquarters

THEWILL reports that the ‘Information Not Disinformation’ campaign is a brainchild of the Correspondents’ Chapel of the Nigeria Union of Journalists (NUJ), Imo council , aimed at effective partnerships with security agencies in the state to fight insecurity through responsive journalism and accurate reporting.

The commandant, who commended the chapel for the “apt initiative, “ said that it couldn’t have come at a better time than now when the state is grappling with the effects of misinformation and disinformation in the fight against insecurity. He expressed confidence that the campaign will correct disinformation so as to enhance economic activities for growth and development of the state.

According to him, the corps remained committed to the protection of critical national assets, using its anti-vandal and agrorangers units, as well as the Special Intelligence Squad of the Commandant-General (C-G), Ahmed Abubakar-Audi.

going to flag off the coastal road. So we will combine it.

“The most important thing is the lane marking. The moment the lane marking is done we open the road unofficially. In seven days Nigerians will be able to ply this road.

"We also discovered that there is a need to put CCTV both on top of the bridge and under the bridge and we don’t want to put CCTV that is powered by diesel generator so we are going to be procuring solar generator and we are putting CCTV all through the 11.8 kilometres and we are going to install CCTV under the deck to watch the illegal mining of the sand, which is a problem we have encountered as far as the integrity of the pipes that were driven by skin friction is concerned and so tomorrow when we go there we will look at it.

"The bridge before now and over the years and administrations, was being maintained by overlaying asphalt upon asphalt on top of the concrete decks and the dead loads designed for the concrete deck is just two inches of asphalt. So over the years we have had asphalts overlay between 10 cm to 30 cm and so it shot dead weight on the bridge.

“Let me say that part of this bridge has undergone some measure of depletion. But we have removed the dead weight. So when we came on board Mr. President went through this bridge and he directed for immediate rehabilitation of the bridge.

“So we started with a contract of milling just two inches. We thought it was two inches that had failed and so we procured the bridge as follows: milling of two inches of asphalt, 8 lanes of 11.8 km and replacing it, you know, changing 90 percent of the expansion joints, painting the parapet capes, changing all the electric poles and changing them to solar poles that were the initial scope.

FRSC Sets up Over 200 Mobile Courts Operations to Check Traffic Offences

BY ANTHONY AWUNOR

The Federal Road Safety Corps (FRSC) is conducting aggressive road safety enforcement with over 200 Mobile Courts to check a wide range of traffic offences across the country.

With the mobile courts, offences such as Speeding and Dangerous Driving/Overtaking; Lane indiscipline/Route violation; Road Obstructions; Use of Phone while Driving; Overloading; Seat Belt/Child restraint Use Violations; Passenger’s Manifest Violation; Operation of mechanical deficient and rickety vehicles; Latching and Twist-Locks Violation and Illegal use of the Spy Number Plates will be legally handled.

To achieve this, over 743 patrol vehicles, 184 administrative vehicles, 92 ambulances, 23 tow trucks and 144 motorbikes are being deployed as part of the patrol logistics.

Furthermore, reflective jackets, traffic cones, tyre pressure gauges, several extricating machines and digital breathalysers are part of the tools for special operations.

Added to the above is, a total of 23 Help Areas mobilised to ensure prompt removal of obstructions, and rescue operations during the period. This, he said, is in addition to the 15 traffic control camps which will be dedicated solely to identifying traffic gridlock areas to be manned by our personnel on a 24/7 basis.

This is in addition to 28 Road Traffic Crash Clinics and 53 Zebra points located along the major routes. This would be covered by 92 ambulances to be fully utilised for prompt response to crashes and rescue of injured victims to hospitals for more professional attention.

The plan and FRSC readiness for the Easter season were made known in an official statement issued Wednesday and signed by the Assistant Corps Marshal,

PAGE 9 THEWILLNIGERIA THEWILLNG THEWILLNIGERIA *Continues online at www. thewillnews.com

NEWS

POLITICS

Edo, Ondo Polls Raise Issues of Trust in Electoral Process

BY AMOS ESELE

As the Independent National Electoral Commission, INEC prepares to conduct two-off season elections in Edo and Ondo States this year, two months after it issued a comprehensive report on the 2023 General Election, issues of apathy, trust and accountability in the electoral process are being raised in the polity.

In the days and years ahead, polls will hold in Edo and Ondo polls on September 21, 2023 and November 16, 2024 respectively, and then Osun and Anambra State in 2026 before the general poll in 2027.

On Saturday, March 30, 2024, INEC published the names of political parties and their approved candidates that will participate in the Edo State governorship poll on September 21, this year.

INEC’s National Commissioner and Chairman of its Information and Voter Education Committee, Sam Olumekun, said the Commission, in keeping with the provisions in Section 29 (3) of the Electoral Act, has to publish the personal particulars of the governorship candidates and their running mates on March 30, a week from the last date for the submission of nominations by the political parties.

He said the 17 parties that fulfilled the requirements are the following: Peoples Democratic Party, the All Progressives Congress, Labour Party, Accord Party, Action Alliance, African Democratic Congress, All Progressives Grand Alliance, and the Allied Peoples Movement.

Others are Action Peoples Party, Boot Party, New Nigeria Peoples Party, National Rescue Movement, Peoples Redemption Party, Social Democratic Party, Young Progressives Party, African Action Congress and Zenith Labour Party.

While electioneering kicks off on April 24, 2024 in Edo State, primary elections are about to be held in Ondo State on April 6-27, 2024, with the campaign date fixed for June 19, 2024.

During these outings, the electoral process and institutions, including political parties, candidates, voters, security personnel, government and civil society organisations will come under scrutiny.

“The 2023 Election Report has sufficiently addressed what happened during the General Election and INEC will continuously improve with every election that it conducts henceforth,” Professor Ayobami Salami told

“Salami, who is the Resident Electoral Commissioner in Lagos State, added, “With the feedback the Commission has got from the public and other outcomes, we are better prepared to improve on the conduct of the next round of election in the Edo and Ondo States

THEWILLNIGERIA THEWILLNG THEWILLNIGERIA

SPECIAL EDITION APRIL 1, 2024 WWW.THEWILLNEWS.COM 10

...Issues of Trust in Electoral Process

THEWILL, when asked about the Commission’s preparedness to handle the upcoming Edo and Ondo governorship polls amid some gaps disclosed in the report.

Salami, who is the Resident Electoral Commissioner in Lagos State, added, “With the feedback the Commission has got from the public and other outcomes, we are better prepared to improve on the conduct of the next round of election in the Edo and Ondo States.”

He disagreed with the suggestion that the generality of Nigerians have lost trust in INEC over “Whatever you say will not be agreed to by everybody. You can only explain to the best of your ability and people will still stick with their opinion.”

For Mr Ajanya Esrom, an operational officer with the Kukah Centre, which often gets candidates and their political parties to sign and commit to pre-election peace agreements, trust in the political process is not a given.

He told THEWILL in an interview, “It must be earned. It can be taken and it can be given.”

Speaking from experience during his interaction with political parties, Esrom said the country is at a point where political parties and other stakeholders in the electoral process have to begin to earn the trust of Nigerians.

He however maintained that the process of earning trust is not an overnight task because it must be demonstrated by evidence. “That is part of the work we are doing at the Kukah Centre, to help political parties demonstrate that evidence. They have to show the Nigerian citizens through manifestoes that they can be trusted with the position of governance which they must administer inclusively.”

He submitted that the elected politicians must be held accountable through a multi-stakeholder approach of different state institutions, which operate at every layer of the electoral process before, during and after the conduct of elections. “For example, during elections politicians will present their party manifestos to Nigerians, who should interrogate the contents. During voting, INEC, the security agents, voters and the media should be involved. The issue of democracy is a contested process.”

This multi-stakeholder approach on rebuilding trust in the electoral process, institutions and election was the focus of a workshop in Lagos last week. Organised by the International Press Centre, IPC, with its co-partner, the Centre for Media and Society, CEMESO, under the European Union Support to Democratic Governance in Nigeria Project, the workshop drew participants from the academia, media, civil society organisations and the security agencies.

Isaac Olawale Albert, a Professor of Peace and Conflict Studies and the pioneer Dean of the Faculty of Multidisciplinary Studies at the University of Ibadan, who gave the lead presentation, titled, ‘The Role of Critical Stakeholders in Rebuilding Trust in the Electoral Process, Institutions and Elections in Nigeria,’ said, “There is no alternative to democracy and elections are important in the process. Without trust, democracy is a façade.”

What this means is that politics in Nigeria is business. It is not about service to the people. That is why it will be difficult to trust elected office holders,” he said, adding: “Today, if as a farmer or businessman you go to the bank for a loan, you will have to go from one end of Nigeria to the other to get the requirements “

preparation which focuses on long-term goals to drive the approach and set rules; engagement to mitigate tension while focusing on priorities and action plan to revisit goals and plan next step.

A former National Commissioner of INEC, Professor Okechukwu Ibeanu, held that trust is fundamental to elections and the society at large because it is about social solidarity. For Ibeanu, there are three critical factors in building and retaining trust in the electoral process.

“The first is a normative framework which provides for a system of rules, particularly for institutions because they are created by rules. The second is the ability to implement the rules by those who have the professional capacity to do so and thirdly is a robust system of redress for holding accountability and rewarding those who do the right thing. Trust is the basis of legitimacy,” he said.

Curiously, political parties, which are the major beneficiaries of the electoral process, ought to be the fulcrum of the views canvassed at the workshop were found wanting because of the view expressed about politicians by the National Chairman of the umbrella body of political parties in Nigeria, the Inter-Party Advisory Council, IPAC, Yusuf Dantalle.

According to Dantalle, many politicians in Nigeria see politics as business and political office transforms the economic status of the political office holder immediately after election.

“What this means is that politics in Nigeria is business. It is not about service to the people. That is why it will be difficult to trust elected office holders,” he said, adding: “Today, if as a farmer or businessman you go to the bank for a loan, you will have to go from one end of Nigeria to the other to get the requirements.

But the moment you are elected into office, the banks will come for you, to give you a loan that you did not seek or need. What this means is that the economic status of the elected person has been transformed and he would be able to pay the loan.”

Dantalle contended that democracy is only practised at the state and national levels, with the grassroots, where it matters most, being left out. The reason, he adduced, was the strangle hold governors maintain on the electoral process through state independent electoral commissions.

He said that plans are afoot by his administration which came into office in November 2023 to reorganise the parties through a well-articulated code of conduct for political parties before 2027 polls. He disclosed that some strategic plans on this had been drawn by the political parties with support of Westminster Foundation, adding that democracy as currently practiced in the country was still far from the reality let alone the ideal.

IPAC, he said, has also created a Directorate of women affairs and People with Disability for more inclusion clauses for parties.

Albert said public perception is key to effective participation in the electoral process, adding that key institutions and actors in the electoral process, such as INEC and the Judiciary, have to deal with institutional credibility, while politicians have to deal with procedural credibility and National Assembly have to deal with personal credibility.

He outlined a five-step approach to stakeholder engagement in the political process, viz; engagement strategy whereby vision is set for future appointment; stakeholders mapping dealing with definition criteria for identifying and prioritising stakeholder engagement;

“These challenges are part of the culture of impunity I have seen from the first to the second, third and now fourth republic, robbing me of my trust of the system; hence building trust is a multi-stakeholder problem,” said Dr Akin Akingbulu, Executive Director of CEMESO, co-host of the workshop.

“The task of building trust in the electoral system is a collective responsibility,” said Mr Lanre Arogundade, the Executive Director of IPC.

SPECIAL EDITION APRIL 1, 2024 THEWILL NEWSPAPER • www.thewillnews.com PAGE 11 THEWILLNIGERIA THEWILLNG THEWILLNIGERIA

POLITICS

PDP Appoints Caretaker Committees in 19 States, FCT

The National Working Committee (NWC) of the Peoples Democratic Party (PDP) has approved the appointment of the Executives whose tenures have expired in some State, Local Government and Ward chapters to serve as Caretaker Committees in the affected States, LGAs and Wards respectively, for three months

ABIA – LGA: With effect from March 22, 2024; Ward: With effect from March 15, 2024

AKWA IBOM – LGA: With effect from March 21, 2024 ; Ward: With effect from March 7, 2024

BAUCHI – LGA: With effect from March 22, 2024; Ward: With effect from March 14, 2024

BAYELSA – State: With effect from March 23, 2024; LGA: With effect from March 21, 2024; Ward: With effect from March 7, 2024

BENUE- LGA: With effect from March 21, 2024; Ward: With effect from March 7, 2024

CROSS RIVER – LGA: With effect from March 21, 2024; Ward: With effect from March 7, 2024

DELTA- LGA: With effect from March 21, 2024; Ward: With effect from March 7, 2024

EKITI – Ward: With effect from March 7, 2024

ENUGU – LGA: With effect from March 21, 2024; Ward: With effect from March 14, 2024

GOMBE- State: With effect from March 23, 2024; LGA: With effect from March 21, 2024; Ward: With effect from March 14, 2024

IMO – LGA: With effect from March 21, 2024; Ward: With effect from March 14, 2024

JIGAWA- Ward: With effect from March 16, 2024

KADUNA. – Ward: With effect from March 14, 2024

NIGER. – Ward: With effect from March 7, 2024

ONDO – LGA: With effect from March 21, 2024; Ward: With effect from March 7, 2024

PLATEAU – LGA: With effect from March 23, 2024; Ward: With effect from March 7, 2024

RIVERS- State: With effect from March 21, 2024; LGA: With effect from March 18, 2024; Ward: With effect from March 14, 2024

SOKOTO- Ward: With effect from March 16, 2024

TARABA- Ward: With effect from March 14, 2024

FCT- LGA: With effect from March 21, 2024; Ward: With effect from March 7, 2024

Governor Idris Seeks Review of Revenue Sharing Formula

GThe governor who said this in an interview with journalists at the weekend in Abuja, said the revenue sharing formula was lopsided in favour of the federal government to the detriments of the states.

He said the three arms of government have duties to people that elected them, adding that one arm should not therefore take a proportion that is disadvantaged to the rest.

He said, “A situation where the federal government takes 55 per cent of the total share of the revenue was to say the least unfair. We must look at the formula in order to meet our campaign promises to our citizens. When you look at it, the states and local governments are the closes to the people and most of the challenges faced directly by citizens are handled by the state and local government.

Revenue among the three arms of government sis shared in accordance with the vertical formula, as determined by the Revenue Mobilsation Allocation and Fiscal Commission and approved by the National Assembly. The formula allocates 52.68 per cent, 26.72 per cent, and 20 per cent to the Federal, State and Local Government, respectively.

Governor Idris said, “It is the at the state where you will find farmers, the artisans, the poorest of the poor and it is our responsibility as governors to make life meaningful and worth living for them. So, I believe that the federal government has fewer responsibility in terms of direct interaction with Nigerians. Governors and local government chairmen deal directly with the people and it is a huge burden on them. The revenues should be shared in such a way that state and local governments that often have direct interactions with the Nigerian people should collect higher percentage to meet their yearnings and aspirations.”

Sanwo-Olu, Oba of Benin Sue For Peace at Easter

Governor, Mr. Babajide Sanwo-Olu of Lagos State has rejoiced with Nigerians, particularly Christians and Lagos citizens, as they celebrate this year’s Easter. He urged Nigerians, especially Christians, to reflect on the sacrifice and love that Jesus Christ showed mankind through His crucifixion and resurrection.

Oba of Benin, Ewuare II, in the same vein, has asked God to heal Nigeria during the Easter celebrations.

Governor Sanwo-Olu made the plea at the weeken while speaking with newsmen after attending the Combined Special Prayers for Nigeria and President Bola Ahmed Tinubu in commemoration of the Easter and Ramadan celebrations at Lagos House, Ikeja.

He further urged Lagos residents to be peaceful and maintain the peace and tranquility for which Lagos is known. The governor appreciated Lagosians for their patience and understanding, wishing them all a happy celebration of Easter.

“I want to wish all Lagosians a happy celebration of Easter, as we have just ended the Christian Lenten season.

“I believe it has been a worthy journey for all our Christian brothers and sisters who have been fasting to ask for the strengthening of our state and country. And coincidentally, we are in the 19th day of Ramadan as well. So, everything around prayers and supplication is working very well.

“My wish is for all of us to enjoy the season. We need to be as peaceful as we have always been, do things in moderation, and ensure that we keep the peace and tranquility that Lagos is known for,” Governor Sanwo-Olu said.

Oba of Benin, Ewuare II, has asked God to heal Nigeria during the Easter celebrations.

In a prayer contained in a message of felicitation signed by Osaigbovo Iguobaro, the Chief Press Secretary to the Oba at the week, Oba Ewuare 11

The statement read, “The Oba of Benin, Ewuare II has called on God and his ancestors to heal Nigeria during the Easter celebration.

“The royal father also admonishes the Christian faithful, to be Christ-like and pray ardently to God for the forgiveness of sins and ask God to heal the nation.

“The Oba urges Christians to emulate the virtues of Christ in their daily life and Implores them to draw strength from the message of hope offered by the sacrifice of Jesus and promote virtues of love and cohesion, irrespective of their challenges.”

SPECIAL EDITION APRIL 1, 2024 THEWILL NEWSPAPER • www.thewillnews.com PAGE 12 THEWILLNIGERIA THEWILLNG THEWILLNIGERIA POLITICS NEWS

L-R: National External Relations Director, Women in Energy Oil and Gas Nigeria (WEOG), Hasiya HassanAudu; Executive Vice President, Upstream NNPC Limited, Mrs Eyesan Oritsemeyiwa; Minister of Women Affairs, Mrs Uju Kennedy-Ohanenye and the President of WEOG, Dr Dunni Owo, during the Strategic Women in Energy Oil and Gas Leadership Summit and awards, Northern Region 2nd Edition in Abuja on March 26, 2024.

overnor Nasir Idris of Kebbi State has called for a review of the sharing formula of federal allocations to meet the democratic needs of citizens.

SHOTS OF THE WEEK

Photo Editor: Peace Udugba [08033050729]

SPECIAL EDITION APRIL 1, 2024 THEWILL NEWSPAPER • www.thewillnews.com PAGE 13 THEWILLNIGERIA THEWILLNG THEWILLNIGERIA

Minister of State for Gas Resources, Ekperikpe Ekpo (4th right); Permanent Secretary, Ministry of Petroleum Resources, Dr Sani Gwarzo (4th left); Minister of State for Petroleum Resources, Heineken Lokpobiri (3rd right); Chief Group Executive Officers, NNPC, Mele Kyari (2nd right) and others, during the opening ceremony of the 2024 Sectoral Retreat on the Ministerial Deliverables (2023-2027) for the Oil and Gas, Organised by the Ministry of Petroleum Resources in Abuja on March 26, 2024.

United States Congresswoman, Barbara Lee; Leader, US Congress delegation to Nigeria, Sen. Cory Booker and President Bola Ahmed Tinubu, during the visit of United States Congress delegation to Nigeria at the Presidential Villa Abuja on March 27, 20234.

L-R: Senator Asuquo Ekpenyong; Senator Natasha Akpoti-Uduaghan; Senate President and Executive Committee member of the International Organization of Parliaments (IPU), Godswill Akpabio; Director General of the WTO, Dr Ngozi Okonjo Iweala; Deputy Speaker, House of Representatives, Benjamin Kalu and Senator Jimoh Ibrahim, after a courtesy call on the WTO chief in Geneva, Switzerland on March 26, 2024.

L-R: Osun State Governor, Ademola Adeleke and the Managing Director, News Agency of Nigeria (NAN), Mr Ali M. Ali, during a courtesy visit to Governor Adeleke in Osogbo on March 25, 2024.

L-R: Chairman, Lagos SWAN, Debo Oshundun; Chief Executive Officer, White Collar Football League, Dave Jones and Chairman, WFCL Board of Trustees, Oba Moroof Oyekunle Amodu-Tijani, Olu of Iowa and Apapa Kingdom, during the signing of MoU between WFCL and Lagos SWAN in Lagos on March 28, 2024.

L-R: Manager, Research, Knowledge Management & Engagement, African Women on Board, Micheal E. Umoh; Assistant Brand Manager, Edrington Portfolio, Nigeria, Idorenyin Emmanson and Macallan Brand Educator and Ambassador, Lagos, Daniel Atteh, at the Annual African Women on Board Roundtable, Lagos on March 14, 2024.

It is sad and shameful that despite the huge sums of money and resources pumped into the power sector over the years, all we could boast of in this age and time is an abysmal 2,984 MW for a country of over 220 million people

Incessant Grid Collapse as National Embarrassment

Incessant national grid collapse in the country has become a national embarrassment, just as the state of the power sector itself.

Last week, the country suffered another grid collapse at a time many were preparing for the Easter holidays.

Although the grid has been totally restored, according to the Transmission Company of Nigeria (TCN), the effects are very damaging as the whole country was thrown into total darkness.

Last year, the national grid collapsed three times – September 14, 19 and December 11. We are at it again this year, the second time in three months. The last one happened on Thursday, March 28 at about 4 pm.

This time, power dropped from an embarrassing 2,984 megawatts (MW) to zero within just an hour as all the 21 plants connected to the grid simply packed up by 5 pm.

Attributing the development to what it described as a ''system disturbance’' TCN, in a statement signed by its General Manager, Public Affairs, Ndidi Mbah, said the grid was fully restored at about 10pm same Thursday.

Mbah told curious Nigerians that a report from the National Control Centre (NCC) in Osogbo, Osun State, showed that the "system disturbance" was caused by a significant reduction in generation capacity, primarily due to gas constraints.

“This reduction led to a rapid decline in system frequency. This created a sudden imbalance in the grid. The imbalance in grid stability was exacerbated by the sudden tripping of Egbin generation turbine 3, resulting in an additional loss of 167MW load and the subsequent collapse of the grid,” she said.

She added that the grid has since been recovered, stable and currently transmitting all the generated power to distribution load centres

nationwide.

“TCN emphasises its unwavering commitment to addressing grid challenges and actively working to mitigate disruptions. In instances where challenges extend beyond TCN’s control, the company collaborates with other stakeholders in the power sector value chain to minimise the impact and swiftly restore the grid to normal operation,” TCN added in the statement.

It is sad and shameful that despite the huge sums of money and resources pumped into the power sector over the years, all we could boast of in this age and time is an abysmal 2,984 MW for a country of over 220 million people.

We therefore call on the Federal Government to declare a total state of emergency in the power sector as Nigerians cannot continue to be fed with all the cock and bull stories coming from TCN which cannot manage less than 3,000MW in a country as huge as Nigeria.

THEWILLNIGERIA THEWILLNG THEWILLNIGERIA NIGERIA BUREAU: 36AA Remi Fani-Kayode Street, GRA, Ikeja. Lagos, Nigeria. info@thewillnigeria.com / @THEWILLNG, +234 810 345 2286, +234 913 333 3888 EDITOR: Olaolu Olusina @OLUSINA LETTERS/OPINIONS: opinion.letters@thewillnews.com Publisher/Editor-in-Chief Austyn Ogannah Editor – Olaolu Olusina Deputy Editor – Amos Esele Business Editor – Sam Diala Copy Editor – Chux Ohai Cartoon Editor – Victor Asowata Entertainment/Society Editor – Ivory Ukonu Photo Editor – Peace Udugba Head, Graphics – Tosin Yusuph Circulation Manager – Victor Nwokoh Guest Art Director – Sunny Hughes

SPECIAL EDITION APRIL 1, 2024 WWW.THEWILLNEWS.COM 14 EDITORIAL THEWILL NEWSPAPER TEAM

Geometric Power And Yoruba Omoluabi

BY DR KENNY ADENIRAN

he whole nation has been over the moon since Vice President Kashim Ibrahim commissioned the Geometric Power Group on Monday, February 24, 2024, designed to generate 188 megawatts and supply power to the Aba industrial city and the environs in Abia State as a ring-fenced area. The nation has been agog for three principal reasons, namely, the first time a part of Nigeria will have constant and quality electricity; Aba will serve as a model to be used in other parts of Nigeria, as Power Minister Adebayo Adelabu stated during the commissioning; and the Geometric Power takeoff shows the tenacity of its chief promoter, Professor Bart Nnaji, who has battled all manner of people in government and their minions for a whole 20 years to get to the Aba Independent Power project to this level. I join millions of Nigeria in congratulating Professor Nnaji, whose oneyear tenure as the Minister of Power from 2011 to 2012 achieved unprecedented heights in power development in Nigeria.

IT IS REGRETTABLE THAT DURING THE PRIVATISATION OF THE POWER HOLDING COMPANY OF NIGERIA (PHCN) SUCCESSOR COMPANIES IN 2013, CERTAIN POWERFUL INDIVIDUALS IN THE GOVERNMENT OF THE DAY BLUNTLY REFUSED TO RECOGNISE THE AGREEMENT SIGNED BETWEEN THE FEDERAL GOVERNMENT AND GEOMETRIC POWER IN 2005 AND, CONSEQUENTLY, SOLD IT AS PART OF THE ENUGU ELECTRICITY DISTRIBUTION COMPANY (EEDC) TO A CONSORTIUM OF CORE INVESTORS

After reading Nnaji’s speech, I came out with a strong conviction that the Yoruba omoluabi has always been at play from the inception of Geometric Power. The omoluabi principle made the Aba IPP

Omoluabi is a philosophical concept among the Yoruba that makes working for the common good a supreme good. It is the direct opposite of parochialism or self-centredness. Therefore, the new attempts by some politicians to sow seeds of enmity between the Igbo and the Yoruba since the 2023 general elections do not reflect who the Yoruba people are.

In the nationally well-received speech, Professor Nnaji noted that though the seed to build the thermal power plant was sown by the late World Bank President, James Wolfensohn, and Nigeria’s former Finance Minister, Dr Ngozi Okonjo-Iweala, when they visited Aba on March 7, 2004, to see firsthand the potential of Aba as an industrial city, it was the administration of President Olusegun Obasanjo which made the seed planting possible.

Until 2005 when the Power Sector Reform Act was enacted, the Federal Government, through the National Electric Power Authority (NEPA), had the monopoly of power generation, transmission and

distribution. Still, President Obasanjo went out of his way to carve out Aba as a kind of island for the Geometric Power team to generate its own electricity and distribute it. The whole idea was to accelerate Abia’s rapid development as Nigeria’s foremost indigenous manufacturing place. In taking this far-reaching and unprecedented measure, Obasanjo, a Yoruba, did not care about the part of the country from where Professor Nnaji hails.

As Nnaji revealed in his speech at the commissioning, ex-President Obasanjo has continued to support the Aba IPP with infectious enthusiasm, even out of office. In recognition of his preeminent role in the emergence of the project, the IPP promoters insisted that the statesman commission the imposing building of the Aba Power Electric Company, their electricity distribution subsidiary. Even when Obasanjo was not going to attend in person because he was in Namibia for the funeral of the country’s president, Hage Geinob, the Geometric Power team expressed satisfaction that he could be represented by a member of his family. Today, the Aba Power complex, which houses the corporate headquarters of the Geometric Power Group, proudly bears a plaque stating that it was commissioned by Obasanjo, who was represented at the commissioning ceremony by his son, Dr Seun Obasanjo. It is regrettable that during the privatisation of the Power Holding Company of Nigeria (PHCN) successor companies in 2013, certain powerful individuals in the government of the day bluntly refused to recognise the agreement signed between the Federal Government and Geometric Power in 2005 and, consequently, sold it as part of the Enugu Electricity Distribution Company (EEDC) to a consortium of core investors.

The sale was despite the fact that the Bureau of Public Enterprises (BPE) stated clearly in all documents presented to the EEDC bidders that the Aba Ring-fenced Area was not part of the EEDC. Analysts point out that the National Council of Privatisation (NCP) took this strange stance because of Nnaji’s opposition to secret moves by top government officials during the PHCN successor companies’ privatisation to corner the national assets when he was the Minister of Power.

The Yoruba omoluabi was demonstrated fully again during the Enugu Electricity Distribution Company’s privatisation. Bola Onagoruwa, the Director-General of the BPE, one of the FG agencies that signed the 2005 agreement between the Federal Government and Geometric Power, put her foot down against perversion of justice, arguing that the NCP must respect the agreement over the Aba IPP. Ms Onagoruwa, a lawyer and niece of Nigeria’s former Attorney-General and Minister of Justice, Dr Olu Onagoruwa, SAN, is imbued with conscience and a fighter for justice. She was fired instantly for her insistence on justice and due process. The senior Onagoruwa had earlier in 1995 been fired as the justice minister for opposing Sani Abacha’s dictatorship gravitation towards malevolent dictatorship.

The Yoruba omoluabi came to play again in the resolution of the nine-year-old legal battle between the Geometric Power Group and Interstate Electrics over the ownership of the Aba Ring-fenced Area which comprises nine of the 17 local government areas in Abia State.

In his speech at the commissioning ceremony of 26 February 2024, Prof Nnaji noted that the resolution was done during the President Muhammadu Buhari administration and quickly attributed the heavy lifting to Vice President Yemi Osinbajo and Power Minister Babatunde Fashola. In other words, these two Yoruba persons ended, at least legally, the mess that became the EEDC privatisation in 2013 which caused Geometric Power a decade of waste. Interestingly, the mess occurred during the presidency of the man some politically exposed Igbo persons used to call an Igbo when he was in office because of their private gains.

•Dr Adeniran writes from Ile-Ife, Osun State.

Children in Agriculture

BY DAVID SANNI

Children's participation in agriculture reflects a blend of historical practices, economic necessities and modern challenges, especially in some regions of Nigeria. Historically, agriculture has been fundamental to human existence, with traditional farming methods shaping societal norms and cultural practices.

In many areas, communal farming was common, with families collaborating or hiring labourers for mutual aid in tending to their fields. Children often participated in these activities, learning valuable skills from an early age.

However, the advent of industrialisation and mechanisation brought significant changes to the agricultural landscape. Mechanised farming methods, while increasing efficiency and productivity, also marginalised traditional practices, particularly among small-scale farmers.

Yet, due to the high costs associated with modern equipment, many small-scale farmers continue to rely on manual labour, with children playing essential roles in farm work, including land preparation, planting and harvesting.

Economic factors further drive children's involvement in agriculture, particularly in regions facing economic instability and food insecurity. In Nigeria, where agriculture serves as a vital source of income and sustenance, families depend on farming to meet their basic needs. Inflation and market fluctuations compel families to maximise agricultural output, making children's labour crucial for farm success and family survival.

Political leaders, recognising the importance of agriculture for economic empowerment and food security, have encouraged citizens to embrace farming. Former Nigerian President Muhammadu Buhari, for instance, announced that all citizens should go back to farm making agriculture a means of poverty reduction and employment creation.

This encouragement reinforces the significance of farming in national development agendas and motivates children to engage in agricultural activities alongside their educational pursuits.

In rural areas with ample land access, children have greater opportunities to participate in farming activities. Many rural families own or have access to large tracts of land, enabling children to contribute to agricultural endeavors alongside their parents.

This involvement not only supplements household income but also imparts valuable skills and knowledge to the younger generation, ensuring the continuity of agricultural traditions.

*Continues online at www. thewillnews.com

EQUIPPING CHILDREN WITH THE SKILLS AND RESOURCES NEEDED FOR MODERN FARMING PRACTICES EMPOWERS THEM TO SUCCEED IN AGRICULTURE. BY NURTURING THEIR ENTREPRENEURIAL SPIRIT, POLICYMAKERS, EDUCATORS AND COMMUNITY LEADERS CAN PROMOTE SUSTAINABLE ECONOMIC DEVELOPMENT AND POVERTY ALLEVIATION IN RURAL COMMUNITIES

Despite challenges, such as limited access to education and resources, children involved in farming demonstrate resilience and determination. They leverage their understanding of local agricultural practices and their willingness to work hard to create livelihoods for themselves and their families.

Their contributions sustain agricultural livelihoods, foster economic resilience, and contribute to community development.

To support young farmers, investment in agricultural education, training, and infrastructure is crucial. Equipping children with the skills and resources needed for modern farming practices empowers them to succeed in agriculture. By nurturing their entrepreneurial spirit, policymakers, educators and community leaders can promote sustainable economic development and poverty alleviation in rural communities.

•Nwaogbe contributed this piece from Umuahia.

*Continues online at www. thewillnews.com

THEWILLNIGERIA THEWILLNG THEWILLNIGERIA

SPECIAL EDITION APRIL 1, 2024 WWW.THEWILLNEWS.COM 15 OPINION

Heirs Technologies Set to Make Nigeria Africa’s Leading BPO Destination

As Nigeria strives to excel in the world of technology, Heirs Technologies, a subsidiary of the Tony Elumelu majority-owned holding company, has said it will make the country a leading Business Process Outsourcing (BPO) destination in Africa.

The firm also said it wants to become like Tek Experts which outsources IT support for businesses whose cores are not techoriented but need tech for their operations.

The Heirs Technologies management team disclosed these at a media parley in Lagos led by its Managing Director/CEO, Obong Idiong.

Idiong said the firm intends to offer these service through the Managed IT Services segment of its business, which will aim to offer infrastructure management services. Others are IT monitoring, software update and patch management, cybersecurity, cloud services management and monitoring, network management, data analytics, backup and disaster recovery.

He noted that the recent launch of Heirs Technologies has ignited excitement and anticipation in the African tech community, heralding a new era of groundbreaking solutions and transformative impact.

He added that the firm is at the verge of training up to 100,000 young people on digital skills, this year

“We are set to provide businesses with a seamless and secured IT environment, allowing them to concentrate on their core operations while the technology aspect is expertly handled”, he said.

According to him, the company will model its business after the success of India, Eastern Europe, and a couple of other local companies that have made progress in outsourcing talents for companies.

He said Heirs Technologies is banking on Nigeria’s youth population and growing developer population, which rose by 45 percent in 2023, to help create a sustainable pipeline of available tech talents.

The CEO highlighted that the new tech company will also build “campuses across the country to support outsourcing initiatives on the continent” to grow its pipeline.

Dr Fumbi Chima, Chairman of Heirs Technologies, emphasised the vision of the firm at the forum..

EDITOR

Sam Diala

Alternative Finance: VFD Group Mulls SplitXchange For Creative Industry

Lagos Mulls Pro-Health Levy on SSBs to Boost Public Health

Access Corporation Grows Assets by 78% to N26.68trn, Retains Grip on Industry Leadership

BY SAM DIALA

BY SAM DIALA

In an unyielding bid to maintain the lead in Nigeria’s banking industry space, Access Corporation Plc recorded a 78 percent growth in assets, which rose to N26.68 trillion in 2023 from N14.99 trillion in the prior year. This remarkable balance sheet growth consolidates the group’s status as the largest financial services institution by assets which it has maintained over the years.

The impressive performance accrued from various segments of the group’s operations which reflected sterling results amid a challenging environment that triggered punching headwinds in the economy.

The group last week reported N729 billion profit before tax (PBT) in its financial results and accounts for the full year ended December 31, 2023, a significant increase of about 335 percent from the N167.68 billion reported in 2022.

The Tier-1 financial services institution also declared N619.3 billion profit in 2023, the last financial year in which the late Group CEO, Dr. Herbert Wigwe was at the helm of affairs. This represented an increase by 307 percent compared with the N152.2 billion reported in 2022.

The significant increase was also part of the foreign exchange revaluation windfall enjoyed by the banks, following the unification of the foreign exchange market in June 2023.

Access Corporation reported N628.93 billion foreign exchange gain, reflecting a growth of 87.44 percent from the N335.55

billion reported in 2022.

The group also recorded significant growth at both net interest incomes of N555.8 billion and net fee income of N207.7 billion revenue lines. while fair value gains on non-hedging derivatives, equity investments and fixed income securities brought in a further N512.3 billion.

The impressive performance comes on the heels of raging inflation among other economic headwinds which have made business activities more challenging

Deposit from customers increased by 65.62 percent YoY to N15.32 trillion from N9,25 trillion (Dec 2020: N4.9 trillion) reaffirming the group’s strong market access and robust funding base reflected in the expansion in loans and advances to customers which rose to N8 trillion from N6.1 trillion in the previous year, reflecting an increase of 31.6 percent.

THEWILL had reported that the group’s Q3 robust performance mirrored acceleration towards the 2023 targets as contained in its five-year strategic plan (2023-2027).

It also underlines the group’s corporate strategies in forming a holco structure two years ago (March 2022) during which it recorded enhanced expansion that would consolidate its grips on industry leadership as Nigeria’s largest quoted firm

THEWILLNIGERIA THEWILLNG THEWILLNIGERIA

Thewillnigeria Thewillng thewillnigeria 32

SPECIAL EDITION APRIL 1, 2024 • VOL . 4 NO. 16 WWW.THEWILLNEWS.COM / PAGE 34 / PAGE 34

Continues on page 33 B C D A 0 100BN 500BN 1TRN 10TRN Assets (N'trn) PAT (N'bn) Gross Earnings (N'trn) 2019 2020 2021 2022 2023 E A B C D E Source; Annual Report 7.14 trn 666 bn 8.67 trn 104.68 bn 764 bn 11.73 trn 158.20 bn 971 bn 14.99 trn 153.79 bn 1.38 trn 26.68 trn 619.32 bn 2.59 trn ACCESS HOLDINGS 5-YEAR FUNDAMENTALS 2019-2023 93.04 bn 50TRN

BUSINESS WEEKLY

...Assets by 78% to N26.68trn, Retains Grip on Industry Leadership

The customer acquisition drive to hit 100mn for the Retail Business by 2027 will continue, as we emigrate the majority of customers to digital platforms by 2027 across touch-points

by assets.

At the presentation of the five-year strategic plan in Lagos in January 2023, the then Group Chief Executive Officer (CEO), Access Corporation, Mr Herbert Wigwe, emphasised that its expansion programme would be driven by technological innovation. Apparently to maintain its industry leadership narrative.

“By the end of 2027, we expect to be in at least 26 countries and in at least 3 Organisation for Economic Co-operation and Development (OECD) countries supporting trade (in the United Kingdom, France and the United States of America).

“The customer acquisition drive to hit 100mn for the Retail Business by 2027 will continue, as we emigrate the majority of customers to digital platforms by 2027 across touch-points.”

He added, “We want to be a global player with African heritage. We are a growthoriented organisation and we will continue to invest in our people amid changes.”

Access Corporation closed its last trading day (Thursday, March 28, 2024) at N24.50 per share on the Nigerian Exchange (NGX), recording a 2.1 percent gain over its previous closing price of N24.00. Access began the year with a share price of N23.15 and has since gained 5.83 percent on that price valuation..

Access Holdings is the third most traded stock on the Nigerian Exchange over the past three months (Jan 2 - Mar 28, 2024), It has traded a total volume of 1.93 billion shares—in 36,754 deals—valued at N48.3 billion over the period, with an average of 30.6 million traded shares per session. A volume high of 117 million was achieved on January 10th, and a low of 6.07 million on February 13th, for the same period, according to data from the NGX.

The Board of Directors of Access Holdings on February 13, 2024 had announced the appointment of Ms Bolaji Agbede as the Acting Group Chief Executive Officer of the Company, following Wigwe’s tragic demise.

In like manner, pioneer Group Managing Director/CEO of Access Bank Plc., Mr Aigboje Aig-Imoukhuede, was recently appointed Chairman of Access Holdings.

Wigwe owned 2.58 billion direct and indirect shares in Access Holdings, equivalent to 7.27 percent of the bank as at the end of 2023.

Air Peace Lagos-London Route

BY ANTHONY AWUNOR

The Minister of Aviation and Aerospace Development, Mr Festus Keyamo, has commended Air Peace for their Lagos-London route, which he said has helped to reduce the pressure on the Nigerian currency: the Naira as against the US Dollars.

Keyamo made the observation Friday night, during Air Peace's inaugural flight ceremony held at Terminal 2 of the Murtala Muhammed International Airport (MMIA) in Lagos.

Air Peace on Friday, 29th March commenced its daily flight to Gatwick London with its Boeing 777 fully loaded with passengers.

Eases Pressure

...Africa’s Leading BPO Destination

She reiterated that Heirs Technologies is here to answer the Africapitalism call-to-action for businesses to make decisions that will increase economic and social wealth, and promote innovation.

According to her, the company aims to herald the concept of Africapitalism – the economic philosophy developed by Mr. Tony O. Elumelu, the founder and chairman of Tony Elumelu Foundation which is predicated on the belief that Africa’s private sector can and must play a leading role in the continent’s development..

As Nigeria wants to become an outsourcing hub in the coming years and Anant Rao, Executive Director of Heirs Technologies, believes that the government initiative on outsourcing of technology will help private sector effort in the space too.

Dr Chima further explained that Heirs Technologies emerged on the scene with a vision that transcends conventional boundaries, aiming to revolutionize diverse sectors through cuttingedge technology solutions.

Founded by visionary leaders with a passion for innovation, she said, “Heirs Technologies is built on a foundation of creativity, expertise, and a relentless drive to push the boundaries of what’s possible”.

At the core of Heirs Technologies’ mission is a commitment to addressing key challenges and driving positive change.

Idiong said, with the adoption of a multidisciplinary approach, the company specialises in several key areas, namely Artificial Intelligence, Cyber-security and Data Privacy, Cloud Computing and Infrastructure, IoT and Connectivity Solutions.

He said Heirs Technologies harnesses the power of AI and ML to develop intelligent systems that optimize processes, enhance decision-making, and unlock actionable insights from data.

He noted that recognising the critical importance of cybersecurity in today’s digital landscape, Heirs Technologies offers robust solutions to safeguard sensitive information and mitigate cyber threat

Leveraging cloud technologies, Heirs Technologies enables scalability, flexibility, and efficiency for businesses, empowering them to embrace digital transformation seamlessly, he added.

He explained that with a focus on the Internet of Things (IoT), Heirs Technologies designs interconnected systems that drive innovation, improve operational efficiency, and create new avenues for growth.

“Heirs Technologies understands the power of collaboration and partnerships in driving innovation and fostering growth.

“We actively engage with industry leaders, academic institutions, startups, and government bodies to create a vibrant ecosystem of knowledge sharing, co-creation, and collective impact”, Idiong said. “By forging strategic alliances and alliances, Heirs Technologies accelerates the pace of innovation and expands its reach across diverse markets and sectors”.

In his comment, Anant Rao, the executive director, Heirs Technologies, said, beyond technological advancement, the company is committed to sustainability, ethical practices, and social responsibility.

He highlighted how the company integrates principles of environmental stewardship, diversity, equity, and inclusion into its operations, aiming to make a positive difference in the world while delivering value to stakeholders and communities.

The team maintains that the firm will be driven by innovation by concentrating on solving client’s real problems in a non-conventional manner that works on the answer to the question:

“What does the client want?”

For the training beneficiaries, the team maintained, “We are not just teaching them about hardware and software, we are setting them on the path of soft skills for them to unleash their creative thinking, design thinking and become more relevant in today’s workplace and entrepreneurship.”

on Naira, Says Keyamo at Inaugural Flight

Speaking at the ceremony, Keyamo said that the Tinubu-led government is going to ensure that they support local operators in accessing aircraft lease arrangements like what Air Peace is doing.

Keyamo pointed out that Nigeria had been on the blacklist when it comes to dry lease arrangements because of the previous experiences of the lessors.

He said, "Nigeria is on a blacklist to get these dry leases. That is part of what I have been undertaking since I came. I have been trying to assure the world and aircraft manufacturers, like

Airbus, that we can protect their assets when they bring them into Nigeria. This is because what they want is whether we can allow them to take these assets when there are breaches of agreements".

"The problem they always face is that when they bring their assets into the country, and there is a breach sometimes, because of court injunctions and local politics, they can no longer take their aircraft away. It is a huge loss to them. What they want is that they should be able to take these assets away when there is a breach. How do we do this? It is the government that will assure these creditors that please bring in your aircraft."

Keyamo also noted that with Air Peace on the London route, there will be no problem with trapped funds, adding that the aviation company is a local company and that the government does not have to repatriate the sale of tickets to the Central Bank of Nigeria (CBN).

By doing so, the Minister stated that under such a situation, Nigeria would be liquid enough in terms of foreign exchange to repatriate those funds.

He said: "All the airlines that come into Nigeria, what they experience is massive repatriation of funds that puts pressure on the Naira because they have to seek for dollars, both the commercial banks and CBN. This new development eases the pressure on Naira because this is a Nigerian company that deals in naira and buys in naira. The only problem is that they still have to go abroad whenever they want to service their aircraft.

So one of my major objectives is to bring the MRO into Nigeria.

SPECIAL EDITION APRIL 1, 2024 THEWILL NEWSPAPER • www.thewillnews.com PAGE 33 THEWILLNIGERIA THEWILLNG THEWILLNIGERIA

*Continues online at www. thewillnews.com

Alice Onyema, Vice Chairman, Air Peace, (5th left); Allen Onyema, Chairman (6th left); Festus Keyamo, Minister of Aviation and Aerospace Development (7nd right) flanked by some crew members during Air Peace Lagos-London inaugural flight ceremony from the Murtala Muhammed International Airport, Ikeja, Lagos on Friday.

L-R: GCEO-designate, Airtel Africa, Sunil Taldar; Chairman, Airtel, Sunil Bharti Mittal, KBE; Minister of Communications, Innovation, and Digital Economy, Dr Bosun Tijani; GCEO, Airtel Africa, Dr Segun Ogunsanya and CEO, Airtel Nigeria, Carl Cruz, at their meeting with the Minister in Abuja on March 27, 2024.

Alternative Finance: VFD Group Mulls SplitXchange For Creative Industry

VDF Group Plc has stressed the need for increased financing for the entertainment and media industry to boost foreign exchange earnings and economic development.

The Managing Director of Splitar Limited, Mr Folagbade Adeyemi, stated this while speaking at the Capital Market Correspondents Association of Nigeria (CAMCAN) quarterly Forum, sponsored by VFD Group Plc.

Adeyemi noted that the group is actively pursuing an exchange platform tailored to the media and entertainment sector, offering diverse investment opportunities for both domestic and international investors.

He disclosed that SplitXchange, currently in development stage by the group, would offer a platform for financing the media and entertainment industry, among other alternative assets.

Adeyemi noted that seeing the huge potential in the alternative assets, Splitar Holdings through the Split Exchange, would drive the alternative assets space with its revolutionary digital exchange.

With Nigeria's estimated population at 208.8 million people, Adeyemi highlighted the increasing demand for Nigerian content.

Speaking on the theme: "Beyond Tradition: Increasing Relevance of Alternative Assets in Capital Market," Adeyemi lamented the absence of robust funding pillars in the country. Adeyemi noted that funding for the Nigerian entertainment sector primarily originates from outside the country.

According to him, the new market in alternative assets, include Arts and Commodities, Real Estate and Entertainment and Media (E&M).

Speaking on the potential of Entertainment and Media, specifically, Adeyemi noted that globally there is an average market size of $41 billion as at 2021 with an estimated growth 4.2 per cent. However, the country earns $5 billion from the E&M, while the United States earn $750 billion from same sector; and United Kingdom, $140 billion.

Adeyemi whilst pointing out investments by Netflix and Amazon which had churned out blockbuster movies that have gained viewership and streams across the globe noted that Nigeria’s biggest investor in the form of Pension Assets was yet to invest in the entertainment or streaming services.

He stressed the need to solve the problems of liquidity, efficiency, and barriers to entry in the country.

“In today’s market, the quick conversion of assets into cash is a challenge due to the absence of a well-structured marketplace that oversees and regulates these assets.

“The automation of processes such as compliance, escrow account management, dividend distribution, corporate action management, and drag-along actions technology presents a significant challenge in today’s alternative market.

"The high initial cost of assets in this market restricts participation to only affluent individuals and corporate investors,” he said.

Adeyemi explained that the entertainment sector as a self-starter is dependent on the banking sector as the primary provider of funding.

*Continues online at www.

Lagos Mulls Pro-Health Levy on SSBs to Boost Public Health

The Lagos State Government is considering a pro-health levy on Sugar-Sweetened Beverages (SSB) to boost public health and lower the rising non-communicable diseases (NCDs) burden.

Commissioner for Health Prof. Akin Abayomi noted that an SSB levy would contribute to driving the state’s human capital agenda – healthier children and good nutrition – and positively impact its health and education sectors.

The global public health expert spoke Tuesday during a meeting with transparency watchdog Corporate Accountability and Public Participation Africa (CAPPA), United States-based Global Health Advocacy Incubator and the Centre for the Study of Economies of Africa (CSEA). Prof. Abayomi’s comments followed the delegation’s presentation of a simulation study of the “Potential Fiscal and Public Health Effects of SSB tax in Nigeria”.

Nigeria is the 4th highest soft drinks consuming country in the world, and the study proposes, among others, that to wean Nigerians off their addiction to SSBs and bring down the NCDs burden, the federal government ought to increase the SSB Tax to N130 per litre, from the current N10. Nigeria

The policy could also earn the government an estimated N729 billion in tax revenue, which CAPPA and other stakeholders propose could be allocated to strengthening the health sector. CAPPA’s Executive Director Akinbode Oluwafemi explained the health and fiscal benefits of the policy for Lagosians.

He said: “We think that this is one of the tools that we can use to lower NCDs that are becoming a big burden in Nigeria - including obesity, high blood pressure, etc.

“The government imposed a N10 per litre tax on SSBs in 2021, which is actually five kobo for 50cl of SSBs. At that time, it (SSBs) was selling for N100. It is a fixed tax. Today, it is selling for N300. The government tax is still N10. And if you look at the inflation rate, that, in itself, needs to have been improved.”

“We commissioned the Centre for the Study of Economies of Africa (CSEA) to look at the potential health and fiscal impacts of SSB tax. We did a simulation, and even before the floating of the naira when this study was completed, the simulation projected that N130 should be the appropriate tax per litre of SSBs in Nigeria.”

Oluwafemi expressed delight at engaging policymakers like the health commissioner, adding, “We see Lagos as one of the champions of public health policies, and how we can take this further.

“We are looking for support because we will soon be looking at a national legislation that will make Sin Tax a much more sustainable law rather than every year and at that point we will be looking at champions to speak for this.”

Responding, the commissioner acknowledged the problems caused by NCDs and advised that localised legislation through the House of Assembly would align with the state’s immediate health goals.

Prof Abayomi reasoned that funds raised through such a policy could be “channelled specifically to the areas of the consequence of those consumptions. So, it can go to health and education, because we're now using it to drive a human capital agenda, which is healthier children and good nutrition.

*Continues online at www. thewillnews.com

SPECIAL EDITION APRIL 1, 2024 THEWILL NEWSPAPER • www.thewillnews.com PAGE 34 THEWILLNIGERIA THEWILLNG THEWILLNIGERIA BUSINESS NEWS

thewillnews.com

Before CBN Dabbles in Murky Waters of Agriculture Again

BY MARCEL OKEKE

In what could be seen as an outright volte-face, the Governor of the Central Bank of Nigeria (CBN), Olayemi Cardoso, on Wednesday, March 13, 2024, doled out a whooping N100 billion (worth of fertilizer) to the Federal Ministry of Agriculture and Food Security (FMAFS) “to boost food production across the country.”