By Georgette Gouvei a / ggouveia@westfairinc.com

– After being denied a special permit and having its coastal site plan rejected for The Hamlet at Saugatuck mixed-use hotel and apartment complex... • Page 11

By Georgette Gouvei a / ggouveia@westfairinc.com

– After being denied a special permit and having its coastal site plan rejected for The Hamlet at Saugatuck mixed-use hotel and apartment complex... • Page 11

By Gary Larkin / glarkin@westfairinc.com

STAMFORD – Pickleball has been such a hit at Stamford Town Center that the founders of Pickleball America have added a padel court in front of the venue. It now shares the distinction with the pickleball courts as the only such court in a shopping mall in America

The freestanding two-story padel venue surrounded by glass walls is now open and can be found in the newly created wellness wing of the Stamford Town Center located outside Pickleball America.

"We are thrilled to pioneer ‘Padel in a Mall’ soon after being the frst to repurpose an anchor store in a mall with Pickleball,” said Jay Waldner, co-owner and founder of Pickleball America. Padel, which is popular in Europe and Latin America, is a hybrid of tennis and squash. The game is fast paced, strategic and could include long rallies due to wall play. Players use a solid paddle with holes and a ball that is pressurized, like a tennis ball but slightly smaller.

Stamford Mayor Caroline Simmons and Stamford Chamber of Commerce President and CEO Heather Cavanagh got to “break in” the court Monday, Aug. 11, following a ribbon-cutting ceremony of the

venue on the fourth level of the mall.

“It’s really exciting,” the mayor said after a set with Cavanagh and Pickleball America ofcials. “I’ve played pickleball here before with my kids. The [padel court] turf felt like Astroturf but a little bit thicker. However, I wore the wrong shoes [high heels] for the occasion.”

The mayor also pointed to other sports- and family-activity venues that have been added over the past couple of years. In addition to Pickleball America, there is a Soccer Zone, Angel Land (for children), and A Dance Space.

“We plan on adding a roller rink (Roller Land on Level 5) and golf (mini-golf),” Stolzenbach said.

Like the new padel court, Stolzenbach plans to recreate some of the ornate seating areas into other sports-related venues.

“A lot of work went into building this,” he said of the padel court. “We had to completely scrape a seating area of marble.”

As for the signifcance of the new padel court in conjunction with the successful two-year-old 13-court pickleball facility, both Simmons and Cavanagh called it important to the future of the mall.

"We are thrilled to pioneer ‘Padel in a Mall’ soon after being the frst to repurpose an anchor store in a mall with Pickleball."

“This installation marks a major step in the reimagining retail spaces for modern active (lives),” Cavanagh said. “This space aims to be more than just a space for play. It’s a new community hub. This is where ftness and recreation meet retail.”

Simmons believes mall General Manager Dan Stolzenbach’s plan for the aging mall has “reactivated” it into more of a social gathering place.

“We are thrilled about the repurposing of this mall,” she said. “We know that malls across the country have been struggling, particularly with brick and mortar retail at this mall. We also want to make sure we give people a reason to go out and shop in person and make it a lively social place.”

Padel, in the U.S., has moved from virtually invisible to high-growth status with around 100,000 players, over 650 courts, and nearly 2,000 ofcial USPA members.

Since Pickleball America’s inception in the fall of 2023, they have attracted more than 10,000 members and guests, 500+ corporate team building and special event groups and tournaments to their venue to engage in the sport.

A large percentage of players are new to the game and sports in general and tactical skills training is in high demand with more experienced players. The most popular programs have been intimate clinics with the professional team from “Three and Me” to “Coached Open Play.”

Mia Schipani, co-founder and Pickleball America CMO, said she the company is thrilled to be a destination for Stamford and that the addition of the padel court will add to the allure.

— Jay Waldner, co-owner and founder of Pickleball America

“We continue to grow our oferings as well as our business – the latest being a Pro Shop ofering an array of top paddles and accessories to include Joola, Selkirk, Diadem, Master Athletics, Pikkl, Gearbox, CRBN, Holbrook and Wilson and next will be a dedicated Padel Lounge,” she said.

Padel at Pickleball America is located in the center of the Stamford Town Center on Level 4. Operating hours are 6 a.m. to 10 p.m. daily. Padel court reservations can be made after a free guest account is created.

By Peter Katz / pkatz@westfairinc.com

The bakery café outlet Paris Baguette has opened at 3333 Crompond Road in the Yorktown Heights shopping center housing BJ's Wholesale Club. Local o cials and Paris Baguette CEO Darren Tipton were on hand for an August 8 ribbon-cutting ceremony to mark the formal opening. The store had first opened its doors on July 25.

Paris Baguette is a bakery café operation that says it has more than 4,000 units globally. It frst franchised in the U.S. in 2015 and reports having awarded 163 franchises in 35 states.

"We are reestablishing the neighborhood bakery-café as the heart of the community throughout North America,” said Tipton during the Yorktown ribbon-cutting ceremony.

The outlets feature a host of items including freshly baked pastries and breads, cookies, artisan cakes and made to order beverages.

The company says the cost for a franchisee open a location involves a $727,000 to $1,825,000 initial investment including a $50,000 franchise fee.

Paris Baguette was founded in 1988 by Hur Young-in, founder of the company SPC Group, a South Korean subsidiary of Shani Co., Ltd. Paris Baguette has reported operating in 10 countries including South Korea, China, France and the U.S. Its frst location was reported to have been in Seoul, South Korea.

“I’ve been in Europe many times because my daughter lives there, and this place is very European,” said Yorktown Supervisor Ed Lachterman during the August 8 event. “The cakes, the pastries, everything is light, airy and delicious. We’re happy that Yorktown is becoming the destination for businesses like Paris Baguette and for people who want to come into a great community because you bring jobs.”

The new Paris Baguette has about 50 employees with more hiring expected. There are two other Paris Baguette locations in Westchester County, one at 1771 Central Ave. in Yonkers and the other 385 Central Ave. in Hartsdale.

“There have been so many other businesses that have recognized the success of Yorktown, and the value that Yorktown brings,” said deputy Supervisor Sergio Esposito. “I had the caramel latte, hot with skim milk, and it was absolutely delicious. Everybody should try it.”

By Peter Katz / pkatz@westfairinc.com

"Reducing the AMI

percentages makes these apartments afordable to many more — workforce families, teachers, frefghters, nurses, police ofcers, and hospital staf."

The White Plains Common Council by a unanimous vote has adopted revisions to the city's a ordable housing program that it hopes will increase the number of a ordable units being created in the city while at the same time increasing the number of a ordable units a developer can opt not to provide and instead pay a fee to the city's A ordable Housing Assistance Fund. The changes become e ective Sept. 15.

According to the city's Planning Commissioner Christopher Gomez, there are four major features to the changes that have been adopted by the Common Council.

— Councilman Justin Brasch

The frst major change involves adjusting the income levels served by the program. The program previously was aimed at people with income levels of 50% to 80% of the Westchester Area Median Income (AMI). With the changes, the program now requires afordable units to be available for households earning between 40% and 60% of the AMI.

The second major change establishes an eligibility preference for White Plains residents, and employees of the City of White Plains, White Plains Housing Authority, White Plains Urban Renewal Agency, and White Plains School District.

The third major change involves increasing the cap in the number of units that a developer can opt not to provide and instead pay a fee-in-lieu. The cap had been 25 units and was increased to 35 units. The fee for each afordable unit not provided was increased from 125% of the Westchester County HUD (U.S. Department of Housing and Urban Development) AMI for a four-person household to 130% of that AMI.

The Westchester County HUD AMI currently is $119,000 for one person and goes up to $197,200 for a family of six people.

The fourth change adjusts when the amount of a fee-in-lieu to be paid by a developer is calculated and when the payment can be made. Payment now can be made at any time between site plan approval and the issuance of the frst temporary or fnal Certifcate of Occupancy. The amount due will be calculated at the time of the payment.

Gomez said that the city's afordable housing regulations have so far resulted in 401 afordable units being built, with 32 more currently under construction. In addition, projects that are due to bring another 129 afordable units have been approved. The mix of units now available or under construction includes 96

studios, 207 one-bedroom units, 119 two-bedroom units and nine three-bedroom units.

Gomez also noted that there are about 5,000 housing units at below market rates in White Plains, about 22% of the total number of housing units in the city.

"We've done a lot of data crunching and what really has come to fruition here is that the AMI numbers have been increasing exponentially post-Covid and that in turn obviously has increased both the incomes and eligibility criteria for the program to a level that a lot of the folks on our waiting list are missing out," Gomez said.

Gomez said that about 60% of the people that are in afordable units came from outside of White Plains while 40% were White Plains residents before moving into an afordable unit. Twenty-three percent came from places in Westchester other than White Plains, while 11% came from the Bronx, 4% were from Long Island, 3% were from Connecticut and 2% were from New Jersey.

Gomez said that developers of projects that have been completed or are now under construction have paid fees instead of providing a total of 75 afordable units. The payments to the city's Afordable Housing Assistance Fund have totaled $11,593,125. He said the city committed $9,402,000 of those funds to support fve developments that

will create a total of 473 afordable units. These include the White Plains Housing Authority's Brookfeld Commons project, the 99 Church St. development, AME Zion's Lake Street project and a development at 60 S. Kensico Ave.

Councilman Justin Brasch, who is running for mayor, noted that reducing the AMI percentages "makes these apartments afordable to many, many more: workforce families; teachers; frefghters; nurses; police ofcers; people working in our hospital, whatever the case may be. I think it's a fantastic thing."

Mayor Tom Roach said that the city has been trying to have afordable housing units built without chasing away developers.

"We are a sought-after city. People want to live here; at every income level this is a great city to be," Roach said. "We can all as a community be proud of the work that we've all done together to make that so. But, what comes with that is pressure on prices. Supply and demand tells you that if you do not feed the market that need will push out into other places and that's how you have gentrifcation and loss of multi-level rents."

DEC 4 6 - 8:30PM

(Noam Pollack has been looking into the reasons for business success and business failure and is a resident of Scarsdale.)

By Noam Pollack

In 2024, two small businesses that my family and I visited often in my hometown of Scarsdale, Current Home and Via Forno, closed. This isn't something that is unusual. In fact, many other small businesses have faced a similar fate.

These business closures made me start to wonder why so many small businesses fail. What are successful business owners doing diferently that enables their success?

For many people, small business ownership is the pathway to the American Dream. “It is a pathway to economic independence, to income generation, to wealth generation,” said Jane Vernon, a former mayor of Scarsdale and currently the CEO of The Acceleration Project (TAP), a nonproft dedicated to providing advice to small business owners. However, many people who attempt to start a business of their own ultimately fail, losing all hope for their big dream.

According to the U.S. Bureau of Labor Statistics, about 24.2% of U.S. businesses fail after one year, about 48.5% after fve years, and about 65.1% fail after ten years of operation. The problems that lead to failure often are related to poor customer service, a lack of digital marketing, and making small fnancial mistakes.

To help understand what sets survivors apart, I spoke with three successful business owners based in

"People frst, product and sales second — single most important thing."

signifcant success with it.

Wilson, for one, uses Search Engine Optimization (SEO), a process that is supposed to improve a website's presence in search engine results. The idea is for Wilson & Son to be the frst jewelry store to come up when someone does an online search for “best jewelry store near me” or something similar.

Even with the best eforts at creating good customer relationships, many small businesses often make small, avoidable mistakes that quickly add up and can have signifcant efects on their businesses' long-term potential.

— Mike Wilson, Wilson & Son Jewelers

Scarsdale: Ken Giddon from Rothmans; Michael Rosen from the Eye Gallery; and Mike Wilson from Wilson & Son. Rothmans is a men's clothing store; Eye Gallery provides vision care and eyewear; and Wilson & Son Jewelers has been in operation since 1905.

The most common theme I noticed when interviewing these three business owners was how strongly they emphasized the importance of customer service. Customers are the foundation for a successful business. For this reason, “people frst, product and sales second…single most important thing,” said Wilson.

Each business owner stressed that when a customer walks through the door, they have to be the number one priority. A customer should never walk into a store without someone saying hello. They should always feel welcomed. By getting to know customers better, businesses will be better able to understand their needs and provide them with the best products and services. This is vital for a business to grow and become successful since, as Giddon said, "If you treat your customers right, they’re going to come back.”

Great customer service goes beyond just what happens in the storefront.

The three business owners stressed the importance of community involvement. This can include sponsor-

ing events, supporting local causes, and donating to charity. This allows businesses to connect with customers and build positive feelings that will make them more likely to want to shop there. By building a relationship with customers both inside and outside the store, these businesses have created a good experience that will make customers more likely to support their business.

In order to showcase a business’s customer service, it frst needs to attract customers. This is possible through efective marketing, yet so many businesses are falling short with their eforts. In fact, according to the U.S. Bureau of Labor Statistics, 22% of failed businesses didn’t implement the correct marketing strategy. Businesses need to recognize that we are living in a period of fast-growing technology, which can be seen in the use of marketing through social media. Social media is a great way to make people aware of a small business, its mission, and its products.

According to the University of Maine, about 60% of the global population uses social media, with 410,000 new social media users each day. For this reason, it's crucial for businesses to use social media platforms such as Instagram, TikTok, and Facebook to maximize the amount of sales for their business. Social media marketing is something that the three business owners that I interviewed currently use, and they have seen

Vernon explained that many business owners "don't necessarily have the background in the fundamentals of making sure a business is generating revenue and that you’re operating with good margins and making good proft,” which is a big part of why small businesses fail. Without a basic understanding of how to manage fnances, owners may overspend, have poor margins, mismanage inventory, or take on too many fxed costs.

Rosen expressed his concern, saying the most common mistakes he sees small businesses make are “biting of more than they can chew and spending too much money that they can't recoup.”

These types of mistakes, often because of a lack of business knowledge and experience, can have costly consequences. This is where Vernon and TAP might help. TAP's mission is to help small businesses grow and succeed by giving them support in strategy, fnance, operations, and marketing. In creating TAP, Vernon “saw the gap between these incredibly industrious, determined individuals and the access to knowledge.”

Many small businesses have a limited budget, which typically does not allow an owner to hire a dedicated team to help with fnances, employee management, and marketing. Through hands-on consulting, TAP may help to fll these gaps. As noted by Vernon, a business owner has to be willing to recognize the challenges and have the appetite to fx them.

Giddon advised, “You have to be able to know you’re going to get knocked down, and you just gotta have the fortitude to get back up.”

By Gary Larkin / glarkin@westfairinc.com

WESTPORT – After being denied a special permit and having its coastal site plan rejected for The Hamlet at Saugatuck mixed-use hotel and apartment complex, Roan Development Ventures used a tactic some developers throughout Fairfield County have used – appeal and refile under the state a ordable housing statute.

The initial proposal included 57 housing units, 57 hotel rooms and building heights up to 62 feet at 601, 606, 609 Riverside Ave., 91 and 96 Franklin St., and 2 and 16 Railroad Place. The property is owned by Robert Sloat, Hanes Realty Corp, TGN Properties LLC, Railroad Place of Westport LLC. They were seeking a Special Permit/Coastal Site Plan approval for a mix of non-residential, hotel and residential uses as part of an integrated site development, for property located in the General Business District/Saugatuck Marina.

The Westport Planning and Zoning Commission on July 28 voted 4-0, with 3 abstentions to deny the permit and site plan. Among the reasons giving for the denial were that the project did not comply with the new zoning regulations that they had previously approved for the Saugatuck River waterfront area and its lack of a "traditional New England feel."

On Aug. 6, FLB Law PLLC attorney Eric Bernheim fled an appeal on behalf of Roan of the July 28 denial by the PZC. The developer seeks an order by Bridgeport Superior Court fnding the commission acted illegally, arbitrarily and in abuse of discretion, an order sustaining the land use appeal, and an order awarding costs to the company incurred in the appeal process.

Specifcally, Roan claims erred in its decision-making process by including a parcel not owned by or under contract for purchase by Roan. The appeal also states the commission was wrong in stating the proposal failed to comply with a regulation that states “at least 25% of the frontage of any site adjacent to the water shall allow views of the water from the street,” and that the proposed development will result in the demolition of 16 Railroad Place when the commission said it would grant setback relief permitted in the regulations.

Prior to the July 28 vote, Town Attorney Ira Bloom told the PZC his advice on going ahead with the denial. He also included a caveat in a lesson learned from a recent Bethel Planning & Zoning Commission decision regarding an afordable housing development.

“I can only repeat what I have said before about the standards that you can apply,” Bloom said. “I’m back to that same Bethel case. Last time you identifed several specifc regulations that in your judgment that the applicant did not comply with them. You have the option at looking at the general permit conditions. But in that case you really do need to cite substantial evidence in the record. It can’t just be mere worries.”

At the end of the July 28 PZC meeting, Chair Paul Lebowitz told the commission he would leave open the possibility of an approval by Roan if it submitted another application that addressed the commission's issues.

"There might be much better chance for more people (on the commission) to look favorably upon it" (the new application), Lebowitz said.

Two days after the appeal was fled, Roan Ventures announced Friday, Aug. 8, its intention to move forward with a development application under the state 8-30g afordable housing statute for its Saugatuck site.

“My client is very disappointed with the Commission’s denial of The Hamlet, especially after working with the Commission and Town on The Hamlet over a long period of time,” said Chris Smith, zoning attorney for Roan Ventures. “However, my client understands that Westport has been receptive to residential communities with housing opportunity components in the past.”

Prior to fling the application, Roan said it had collaborated with P&Z and made design updates in accordance with preferences by the local community. The Westport Representative Town Meeting (RTM) upheld the original rezoning decision for Saugatuck in favor of The Hamlet project via a 33-1 vote citing the possibility of a state-mandated afordable housing development if they did not approve the rezoning.

Afordable Housing Proposal – “The Alliance for Saugatuck Housing Opportunity”

Westport had a moratorium on such 8-30g afordable housing applications that ended in March 2023.

Connecticut's 8-30g statute was enacted with the goal of increasing the supply of afordable housing across the state, particularly in municipalities where less than 10% of the housing stock meets the state's defnition of afordable.

The 8-30g application fled by Roan, now referred to as "The Alliance for Saugatuck Housing Opportunity," will pursue the updated development plans allowed under state law.

The afordable housing statute does not mandate public amenities, walkability and waterfront access as envisioned in The Hamlet proposal. Of-site improvements may be reconsidered to accommodate the target of delivering between 400 and 500 residential units to the community.

• Residential only (no hotel component)

• Projected: 400–500 housing units

• Fewer design restrictions than original Hamlet plan

• Focus: Meeting state a ordable housing criteria

By Peter Katz / pkatz@westfairinc.com

Gov. Kathy Hochul on August 11 traveled to Middletown in Orange County to continue her series of meetings and discussions on restricting the use of cellphones by students in New York’s schools when school goes back into session in a few weeks.

The roundtable included representatives of Middletown's public schools along with representatives of Orange-Ulster BOCES. It followed previous roundtables held by Hochul this summer in New York City, the Capital Region, Central New York and the Finger Lakes.

“Our kids succeed when they’re learning and growing, not clicking and scrolling — and that’s why schools across New York state will be ready to implement bell-to-bell smartphone restrictions this fall,” Hochul said. “We’re continuing to provide the resources and support to ensure that every school fnalizes and publishes their distrac-

tion-free policy in the coming days.”

As of August 11, nearly 1,000 public school districts, charter schools and BOCES in New York have submitted their distraction-free policy to state education ofcials. Hochul's ofce said that represents about 90% of the 1,098 total districts and schools covered by the statewide requirement. The remaining districts and schools are expected to fnalize their policy in the coming days at upcoming school board meetings.

Orange-Ulster BOCES COO Deborah Heppes said, "Reducing phone use during the day is a simple change that will have a big impact on student well-being. With support for implementation and a thoughtful approach, this transition will help students succeed socially, emotionally, and academically."

Middletown's Board of Education

President Edwin Estrada said, “By working together with state leaders,

By Peter Katz / pkatz@westfairinc.com

Members of the union 1199SEIU United Healthcare Workers East who work at Optum and Summit Health facilities in the Hudson Valley staged a rally in Middletown in Orange County that was attended by some local o cials. They expressed concern about the consolidation of health care in the region under expanding corporate ownership. They also advocated for livable wages for workers, a ordable health care for consumers, and quality patient care.

educators, parents, and students, we’ve developed a policy that puts learning frst. This is about creating environments where focus comes naturally, interactions are genuine, and every student has the best chance to excel.”

The law prohibits unsanctioned use of smartphones and other internet-enabled personal devices on school grounds in kindergarten through high school for the entire school day (from “bell-to-bell”), including classroom time and during lunch and study hall periods. It leaves it up to schools to develop plans for storing students' cellphones or other devices during the day. The state will ofer $13.5 million in funding to help schools pay for storage cabinets for or other storage systems.

Access to cellphones and other electronic devices is allowed when they're used for instructional purposes. There are exemptions to the prohibitions such as when a student must have access to the internet to manage a medical condition or when access is required for individual educational purposes or for language translation, family caregiving or emergencies.

The August 9 rally was staged outside of the Optum's Crystal Run medical center location at 300 Crystal Run Rd., in Middletown, one of several Optum Crystal Run locations in the Hudson Valley. The union has charged that Optum and its parent company UnitedHealth were not negotiating with the union in good faith. Some workers at Summit Health, which has acquired a number of local medical service providers including Westmed in Westchester and Fairfeld voted to join the union.

Middletown rally. Photo courtesy of 1199SEIU.

Among those attended the rally were: State Assembly Members Paula Kay, Jonathan Jacobson, and Chris Eachus; Orange County Legislator Genesis Ramos; and Democratic Nominee for Orange County Executive Michael Sussman.

More than 1,100 workers at Optum Crystal Run this year voted to join 1199SEIU. Optum fled objections with the National Labor Relations Board (NLRB) but the NLRB certifed the election results.

“Summit Health and Optum have a responsibility to our communities – not just shareholders or investors,” Dolores

Lestor, a medical assistant at a Summit breast cancer practice, said during the rally. "We’re here today to say, enough! We are united, we are standing up for our patients, and we are fghting for the respect, pay, and working conditions we deserve.”

Vincent Mazzella, a medical assistant at Optum Crystal Run, called for better compensation for workers.

“Optum pulled in $253 billion in revenue in 2024," Mazzella said. "That’s billions from prescriptions, analytics, and clinics like mine. It’s time to take corporate greed out of health care.”

A representative of Optum told the Business Journal, “Providing high-quality care to people across the Hudson Valley is our top priority, and we believe the best outcomes happen when our teams work together in a respectful, collaborative environment. We will continue to bargain in good faith and in full compliance with labor laws, and believe the charge lacks merit.”

1199SEIU United Healthcare Workers East represents more 450,000 members throughout New York, New Jersey, Massachusetts, Maryland, Florida, and Washington, D.C.

By Georgette Gouvei a / ggouveia@westfairinc.com

It’s hard enough to understand the United States’ tax code, let along the modifications engendered by President Donald J. Trump’s One Big Beautiful Bill, signed into law on July 4. The bill is not without its controversy, with critics saying it cuts deeply into such safety net programs as Medicaid, the Supplemental Nutrition Assistance Program (SNAP) and housing assistance.

Recently, Citrin Cooperman – a premier accounting and advisory provider for private, middle-market businesses and high net-worth individuals that’s headquartered in Manhattan – held a webinar on the bill. With more than 3,300 professionals, Citrin Cooperman is recognized for being among the fastest-growing top 20 American frms. On Tuesday, Aug. 12, Citrin Cooperman announced that it has entered into an agreement to acquire substantially all the assets of Barkin, Perren, Schwager & Dola, LLP (BPSD), a full-service accounting and advisory frm in Woodland Hills, California.

Matthew Kuchinsky -- managing partner, White Plains and Connecticut ofces, Citrin Cooperman Advisors LLC; and partner, Citrin Cooperman & Co. LLP – took time to answer our questions:

Mr. Kuchinsky, thank you for your time. Aren't the tax cuts in the One Big, Beautiful Bill actually a continuation of the 2017 tax cuts?

“Largely, yes. Many of the individual and small business rate cuts were set to expire after 2025, and this bill keeps them alive. But it’s not a carbon copy. There are adjustments, new thresholds and some targeted add-ons that go beyond what 2017 delivered.”

What's in this for the individual fler, joint flers and families?

“Lower rates stick around, and the standard deduction stays elevated. Married couples keep the higher joint-fler brackets. Families in the low-to-middle-income range see more refundable credit potential.”

What's in this for small businesses and corporations?

“Small businesses operating as pass-through entities retain the 20% qualifed business income deduction, which acts as a bufer against higher efective rates. The bill extends immediate expensing under bonus depreciation rules, allowing 100% write-ofs of qualifying equipment and certain improvements in the year placed in service. It also increases and indexes the Section 179 expensing limit, which is a separate provision that lets businesses deduct the cost of certain property (often smaller-scale purchases).

“In addition, corporations keep the 21% federal rate, with some international tax changes designed to keep more profts taxed in the U.S. rather than shifted ofshore. There’s also an expansion of the qualifed small business stock (QSBS) rules, adding new but smaller exclusions for QSBS held for shorter periods. That efectively broadens the beneft beyond the traditional fve-year holding period, though the biggest tax break still goes to longer-term holders.”

When do the tax cuts kick in?

“Most start Jan. 1, 2026, right when the 2017 provisions would have sunsetted. A few targeted provisions, like certain disaster relief rules, start earlier.”

What are some of the new perks, particularly for hospitality workers and seniors?

“For hospitality workers, the bill refnes tip income rules to exclude more pooled or shared tip-outs from payroll tax calculations, reducing tax for workers who participate in tip-sharing arrangements. For seniors, there’s a temporary $6,000 additional standard deduction providing relief for many older taxpayers during the years it applies, but it does begin to phase out at higher income levels.”

Are there any tax cuts that have gone away?

“Yes. Most notably, there’s a clawback of certain energy-related credits that were enacted in the Infation Reduction Act. Some credits are reduced or eligibility narrowed for projects not already under construction. This

"Lower rates stick around, the standard deduction stays elevated, and families in the lowto-middleincome range see more refundable credit potential."

afects certain renewable energy property and clean vehicle incentives and creates a shorter runway for taxpayers who had planned multiyear projects.”

Is there any increase in the amount of money property owners can deduct from their income taxes?

“For many property owners in high-tax states, the answer is yes. Because property taxes often make up the largest share of state and local taxes paid, the expanded SALT cap can translate directly into bigger deductions for those owning real estate. The new rules temporarily raise the cap from $10,000 to $40,000, giving homeowners much more room to deduct the full amount of their property taxes along with other state and local taxes. While the higher cap begins to taper of for top earners, most property owners will still see a noticeable bump in their allowable deduction during the years it applies.”

— Matthew Kuchinsky, Citrin Cooperman

Based on the new bill, what should the average person's/ business owner's strategy be in fling year-end?

“The right answer really depends on the taxpayer’s facts. Rates remain lower in 2026 than they would have been without the bill, so there’s less urgency to accelerate income into 2025 to avoid a rate hike. However, there may be other reasons to do so, like locking in credits before they sunset or leveraging losses while they

can still ofset higher-rate income. Businesses should revisit project timelines, depreciation schedules and fnancing structures in light of the extended expensing rules and energy credit changes.”

Don't the tax cuts add roughly $5 trillion to the defcit, so won't that hurt taxpayers in the long run?

“It really depends on your perspective. Supporters argue the economic growth will ofset part of the cost. Critics say the debt impact is inevitable. The math will play out over time.”

With the loss of thousands of federal employees, can taxpayers still expect to receive information and refunds from the Internal Revenue Service (IRS) in a timely manner?

“The IRS is full of skilled, dedicated public servants and, in our experience, the system is holding up well so far. That said, if stafng reductions continue, taxpayer service could eventually sufer, especially in peak fling periods or for complex cases requiring human review.”

(Editor's note: Since this interview was conducted, Billy Long, the sixth commissioner of the Internal Revenue Service this year, announced he was leaving the post. Treasury Secretary Scott Bessent is serving as acting commissioner.)

% Daily Value

How sweet it is?

By Georgette Gouvei a / ggouveia@westfairinc.com

With The Coca-Cola Co. (NYSE KO) and Purchase-headquartered PepsiCo (PEP: NASDAQ) each set to launch pure cane sugar colas for mass American consumption this fall, the question arises: What will these mean for consumers’ health and wallets?

The answer is complex, driven in part by the beverage giants’ desire to engage shifting demographics and greater health consciousness all while hedging their bets.

The idea of using import-taxed sugar – as opposed to high fructose corn syrup (HFCS), made from government-subsidized corn — is nothing new for either brand. While each has been using HFCS since 1984, they also produce colas with cane sugar for Passover as high fructose corn syrup is generally not considered kosher. (These colas are identifable by their yellow caps and kosher certifcation symbols.) And both companies produce cane sugar colas in glass bottles that are popular in Mexico and throughout Latin America. (This side of the border, you can probably fnd these in superstores like Costco, Target and Walmart as well as local bodegas.)

Indeed, Coca-Cola is a particular hit in Mexico, with the highest per capita consumption globally. On July 22, Coca-Cola – whose portfolio contains a variety of beverages but no snack foods — reported net revenue of $12.5 billion, up 1% for the same period (April to July) last year and in line with Wall Street. Net income for the quarter rose 58% to $3.8 billion. PepsiCo – with a variety of bevvies and snacks – saw second-quarter revenue rise about 1% to $22.73 billion, beating analysts’ estimates.

But in reporting on Pepsi’s new cane sugar cola, CNBC noted that the company’s “North American beverage volume shrank 2%. Its namesake soda was one of the few bright spots, helped by the success of Pepsi Zero Sugar.”

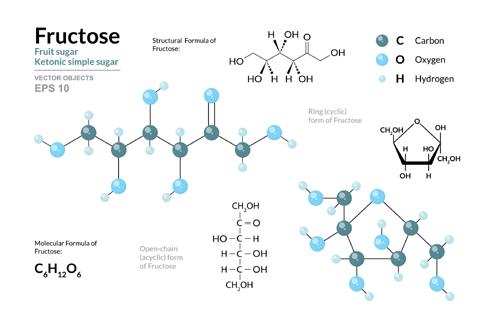

With Americans more health conscious – which is not to say necessarily healthier – plus pressure from the Trump Administration to use cane sugar; and an ascendant Hispanic population accounting for almost 20% of the U.S. population, the time for the Latin-popular, seemingly more “natural” Coke and Pepsi has arrived. Contrary to what President Donald J. Trump frst reported, Coca-Cola isn’t replacing HFCS Coke with cane sugar Coke; it’s just adding it to its stable. Similarly, Pepsi Prebiotic Cola – with fve grams of cane sugar, three of prebiotic (good bacteria-nourishing) fber and availability in cherry vanilla – will join a Pepsi portfolio that includes new $1.95 billion acquisition Poppi, a prebiotic soda. (Coke introduced its fruit-juicy Simply Pop prebiotic soda in February.) All well and good, but will these make a diference in people’s health? HFCS is made of 55% fructose and 45% glucose; cane sugar (sucrose) is half and half. While fructose and

glucose are simple sugars, fructose is considered harder to metabolize, particularly in excess consumption. (For a doctor's explanation and perspective, see Page 18.) There is the same number of grams of sugar in a 12-ounce can of Coke, Mexican Coke and Mexican Pepsi – 39, the equivalent of about 10 teaspoons of sugar. Pepsi is a bit sweeter, with 41 grams per 12 ounce can. All have 150 calories, except Coke, which has 140.

That would go along with our impromptu taste-test, with Coke and its south-of-the-border counterpart delivering a crisper fnish than the Pepsis. (Interestingly, we found Diet Pepsi has a crisper taste than Diet Coke.)

Will any of this matter to Health and Human Services Secretary Robert F. Kennedy Jr.’s war on sugar and artifcial sweeteners, this despite his Diet Coke-loving boss? And what about the bottom line, along with the waistline? A 12-ounce bottle of Mexican Coke or Pepsi will run you anywhere from $2 to $6. Those costs may drop when the sodas are present ed for mass consumption here.

But ultimately, will the average consumer bite – or rather, sip? Coke and Pepsi aren’t taking any chances, adding “healthier” options while sticking with their best sellers.

After all, many of us remember New Coke. Launched in 1985 partly to compete with a surging Pepsi’s sweeter taste, the soda replaced Co ca-Cola’s signature product, resulting in a backlash and public relations nightmare that echoed the Civil War, cola style – with Atlanta-based Coke, introduced in 1886, squaring of against its New York rival, introduced in 1893 — forcing Coca-Cola to bring back its fagship favor, a taste that has been considered as Amer ican as apple pie, blue jeans and rock’n’roll. For a while, Classic Coke and New Coke were both stocked so everyone could save face. New Coke fnally died in 2002 – only to reappear every so often in conspiracy theories, books, documen taries and, in 2019, the Netfix series “Stranger Things.”

Strange indeed, or maybe not so strange.

The public, with its power of the purse, had spoken. But the jury’s still out on whether sugar cane Coke and Pepsi will supplant their HFCS sisters in the U.S. or remain specialty footnotes to history.

By Georgette Gouvei a / ggouveia@westfairinc.com

For a medical take on cane sugar cola versus high fructose corn syrup (HFCS) cola, we reached out to Tammy Tavdy, D.O., an endocrinologist with the Scarsdale Medical Group in Harrison. (It is part of White Plains Hospital, which in turn is part of the Montefiore Health

Tavdy received her medical degree from the New York Institute of Technology College of Osteopathic Medicine, completing her residency in internal medicine at the Albert Einstein College of Medicine/Montefore Medical Center in the Bronx, where she was selected chief resident. As chief resident, she was a member of the Montefore Internal Medicine Residency Recruitment Committee and a preceptor for the Transition to Clerkship courses for the medical students. She remained at the institution to complete her fellowship in endocrinology, diabetes and metabolism.

Prior to joining Scarsdale Medical Group, Tavdy was a co-author for the ofcial question bank of the United States Medical Licensing Examination (USMLE-Rx) program, which also produces the “First Aid” book series. She has contributed to several peer-reviewed publications, including the American Association of Clinical Endocrinology, The Journal of Clinical Endocrinology & Metabolism and the Journal of the Endocrine Society.

hand, does lead to a ‘glucose spike,’ thereby triggering an insulin response. As a result, the byproducts of the sucrose (glucose and fructose) are used as energy sources by various tissues in the body. The caveat here is that if there is an excess intake in the sucrose, the body will store this into the adipose tissue, also leading to fat storage.”

How much sugar should we be consuming daily?

What about sugar substitutes: Are these and the diet sodas that contain them healthy alternatives?

“The American Cancer Society does not condemn artifcial sweeteners and does not explicitly state a direct link between sugar substitutes and cancer risk. Aspartame has been classifed as a ‘possible carcinogen,’ so use of a natural sweetener such as stevia in lieu of aspartame would have its benefts.

“For patients with diabetes, the American Diabetes Association recognizes nonnutritive sweeteners as acceptable alternatives as they do not afect glycemic control.”

Dr. Tavdy, thank you for your time. Why are we hearing so much about replacing high fructose corn syrup with cane sugar in sodas now?

“The increased prevalence of metabolic disease worldwide has heightened concerns about the adverse efects of excessive sugar consumption. Moreover, there has been much controversy concerning the diferences between sucrose and high fructose corn syrup with respect to their impacts on metabolic health.

“Sucrose and high fructose corn syrup (HFCS) are both considered to be sweeteners, but they difer in their origins and compositions. Sucrose (common forms including brown and white sugars) derives from the sugar cane plant. HFCS derives from corn starch, which via enzymatic processing breaks down into glucose and is then blended into the syrup. It is this “processing” component that sparks a great deal of controversy with respect to HFCS containing products.”

Is there a health beneft to using sugar as a "natural" ingredient? Isn't sugar just sugar?

“Physiologically, we process sucrose and HFCS very diferently. Intake of HFCS does not lead to a ‘glucose spike.’ Therefore, insulin secretion is not stimulated, and the result is that fructose gets stored into adipose tissue (fat storage). Sucrose, on the other

“The American Heart Association (AHA) recommends that the total intake of free or added sugars from all sources should be kept below 25 grams per day (about 6 teaspoons) for optimal cardiometabolic health. A 12 ounce can of Coca-Cola contains HFCS as its primary sweetener – approximately 39 grams of added sugar. As you see, one can of soda very easily exceeds the daily recommended intake.”

What about those people who say that they never drink soda or eat dessert but like to drink red wine: Isn't there a lot of sugar in wine and spirits, which, as you know, have been classifed as carcinogens?

“When it comes to wine and spirits, their sugar content is very diferent when compared to sodas. For those who love dry red and white wines, the residual sugar levels are quite little (between 0 and 3 grams per bottle). The residual sugar refers to the ‘wine sweetness’ and is the byproduct of the natural grape sugars after alcoholic fermentation is completed. As expected, the more residual sugar remaining in a wine, the sweeter the wine is. A sweeter wine can contain more than 33 grams of residual sugar.

“Pure spirits such as vodka, whiskey and tequila do not contain any sugar as distillation removes all remaining carbohydrates. The high sugar content of favored spirits is due to the added favorings and syrups. As you see, for the sake of comparison, a glass of dry red or white wine does contain far less sugar than a can of soda.”

Is it equally dangerous to eliminate sugar altogether from our diets?

“There is a great amount of evidence supporting the complete elimination of sugar from the diet. Many publications comment on the overwhelmingly positive efects of eliminating sugar from the diet, as there is signifcant reduction in body weight, waist circumference, visceral adiposity, liver fat, serum triglycerides and improvements in insulin sensitivity even when total caloric intake is held constant.”

Fruit would seem to be a natural source of sweetness. What should be the daily requirement?

“Daily fruit recommendations for adults are at least two servings per day. It is always best to choose whole fruits over fruit juices as whole fruits help to retain fber. Low sugar fruits include berries, grapefruit and avocados. High sugar fruits include mango, grapes, pineapple, bananas. It is best to pair high sugar fruits with fber to help slow digestion. Smoothies are also a great option, but whole fruit is generally better as you do lose some fber from the fruit during the blending, which can lead to a higher glucose spike.”

For those of us who like our sweets, what are some healthy alternative beverages that ofer the crisp sweetness of a cola?

“A favorite alternative to that ‘crisp’ Coke sweetness is zero-calorie, sugar-free, low-sodium sparkling water (La Croix, Waterloo, etc.). This is a tip that I frequently share with my patients. If you prefer zero carbonation, ready-to-drink favored still waters (Hint) are tasty and contain no juice and are also sugar-free.”

And for those of us who can't quitcolasaltogether, is one a week a good rule of thumb?

“I believe in living in moderation. I tell my patients that to live sustainably, you must think wisely and intentionally about the foods you are eating and ask yourself: ‘Is this making a positive contribution to my overall nutrition?’ That being said, I do believe that constant restriction will backfre in the long run. The American Heart Association supports no more than one serving (approximately 200 to 455 milliliters, or one 12 fuid ounce can) of soda containing HFCS or other added sweeteners per week, which is a reasonable recommendation.”

CARLA ALFIERI

SVP, Director of Private Banking Orange Bank & Trust Company

THAMARA BARBOSA-TIRRI

Regional Vice President of Operations

The Bristal Assisted Living

PEGGY BOYCE Founder, Executive Producer Ladies of Laughter

ROSE CAPPA ROTUNNO Vice President Institutional Advancement Wartburg

SHYNAE DAVIS

CEO & Owner Honey Notes Affrmation & Candle Bar

JENNY DELORBE

Clinical Billing Liaison, Adjunct Professor Yale University, Sacred Heart University, College of Westchester

GERI EISENMAN PELL Co-Founder

Rise Private Wealth Management, a private wealth advisory practice of Ameriprise Financial Services, LLC

SUSAN GERRY

Deputy Mayor City of Yonkers

SHERYL HATWOOD Owner

TRUCE by SH, LLC and S.H.E.

JULIE KUSHNER

Democratic State Senator in Connecticut

Residents of her district, 24, and the state of Connecticut

MINERVA MARTINEZ

Sr. VP of Operations CT Housing Partners

LATA MCGINN Co-Founder & Co-Director Cognitive & Behavioral Consultants

STACIA MORRIS Founder & CEO

TrireMIS Solutions, LLC, dba Your Life TREK

CHEREESE JERVIS-HILL

CEO & Founder

Events To Remember + PR To Remember, divisions of Events by Chereese, Inc.

MICHELLE A. NICHOLAS Founder & CEO

The NICO Consulting

KRISTIN OKESSON SVP, Market Manager

Connoisseur Media CT, Greater Norwalk Chamber of Commerce

NAHEED QUAISAR

Co-Founder & CEO Health Products For You

CHRISTINA RAE

President Buzz Creators, Inc.

VICTORIA SHEYKO

Marketing Associate Valitana `

VIRGINIA TURNBULL

Sr. Vice President, Commercial Lending Team Leader Fairfeld County Bank

MARIA LISA ZYWOTCHENKO Owner & president Cyrus Contracting Corporation

VALERIE JENSEN Founder & Visionary The Prospector

By Peter Katz / pkatz@westfairinc.com

The applicant that is seeking approvals to build a 25-unit seven-story apartment building at 158-160 Stanley Avenue in Yonkers is asking for variances from the city's Zoning Board of Appeals so that the project can move forward in the approval process. The entity 160 Stanley Avenue LLC is asking for variances for front yard and side yard setbacks and the number of parking spaces.

The project would use two existing vacant lots that would be developed as one parcel. There would be two levels of parking, one below grade and the other at ground level that would provide 25 parking spaces. Above would be six foors of apartments consisting of 12 one-bedroom units, nine two-bedroom units and four three-bedroom units for a total of 25 apartments. There would be a total of 42 bedrooms in the building.

The Zoning Code requires 39 parking spaces for the 25 units and 42 bedrooms.

The engineering and architecture frm Kimley-Horn conducted a study that evaluated the proposed parking supply and determined the future maximum parking demand expected to be generated with the project. In addition, the projected trafc generated by the project was identifed and examined for potential trafc impact on the surrounding roadways.

"The project site is located in a densely developed, mixed use area of the City of Yonkers. Bee Line bus service is provided less than a 0.5 mile walk from the site on Riverdale Avenue, Hawthorne Avenue and South Broadway. In addition, the Ludlow Station of Metro-North’s Hudson line railroad is within a halfmile walk from the project," Kimley-Horn said.

Using guidelines from the Institute of Transportation Engineer for a midrise residential development located in a dense multi-use urban environment, close to rail, Kimley-Horn concluded

that the building would have a maximum demand of 18 parked vehicles. It said that the site’s proximity to the Ludlow train station and two bus routes (the Bee-Line 8 and 32), visitors and occupants are likely to opt for public transportation, reducing overall parking demand.

Kimley-Horn also found that the project would not be expected to have a signifcant trafc impact because it would generate only 6 vehicular trips in both the morning and afternoon peak hours.

A diferent view was presented in a written comment to the ZBA by a local resident, Philip Armstrong, who stated that a major quality of life issue in Yonkers is the search for parking.

"Here we have another developer who claims that the size of the building they desire to put at this location does not allow them to supply the necessary parking spaces," Armstrong said. "The area is extremely congested with parking today and even though there is public transportation in the area it is not adequate to carry the existing load never mind the added load these new buildings will place on it."

By Peter Katz / pkatz@westfairinc.com

Pace University on August 11 announced the appointment of Ajay Khorana as dean of the Lubin School of Business and professor of finance, e ective Sept. 1. Khorana comes to Pace from the U.S. Personal Banking and Global Wealth businesses at Citigroup, where he oversaw strategic financial planning, risk management, and capital allocation. He had a 20-year career at Citi. He had spent more than a decade in academia, including faculty appointments at Georgia Tech's Scheller College of Business and the University of Virginia's Darden School of Business.

“Ajay Khorana is a transformational leader who brings both real-world experience and academic depth to Pace,” said Pace President Marvin Krislov. “His global perspective and strategic vision will enhance Lubin’s programs and reputation and expand opportunities for our students and faculty,"

“It is an honor to join Pace University and lead the Lubin School of Business,” said Khorana. “Lubin has a strong foundation of academic excellence and career preparation. I look forward to collaborating with faculty, students, alumni, and industry partners to build on that legacy and drive continued innovation and impact. There’s no better place to

connect business education with the center of the fnancial world.”

Khorana earned his Ph.D. in fnance from the University of North Carolina’s Kenan-Flagler Business School and an MBA in fnance from Wake Forest University’s School of Business. He earned his bachelor's degree in economics from the University of Delhi.

Celebrating

Nomination

Do

Sponsorship

Award Categories

All In The Family

Cutting Edge

Female Innovator Promise For The Future

Urgent Care

Lifetime Achievement

Veterinarian

Power Couple

Outstanding Nurse

Doctor Without Boundaries

Physician Assistant Compassionate

Concierge Doctor

Team

Dentist

Hartford Yard Goats welcome Ridgefeld theater’s concession snack

By Gary Larkin / glarkin@westfairinc.com

RIDGEFIELD – The Hartford Yard Goats minor league baseball team will start o ering Prospector Popcorn at in-game concessions at Dunkin’ Park

The Prospector, a local nonproft movie theater and gourmet popcorn maker that focuses on hiring people with disabilities, will expand the reach of its popular snack by making them for sale at Yard Goats games through the end of the 2025 season and playofs. The two favors that will be sold are Classic Caramel and Cheddar & Caramel.

Each order is hand-popped, baked, favored, and packaged by Prospector’s skilled team of employees, known as “Prospects.”

“Prospector makes a delicious snack that our fans will be able to enjoy even more knowing it supports a great cause,” said Tim Restall, president of the Hartford Yard Goats. “Popcorn is the ultimate ballpark snack, and we’re excited to serve Prospector Popcorn at Dunkin’ Park.”

The arrangement marks the brand’s ofcial debut in the sports and entertainment stadium market.

“Baseball, popcorn, and jobs – truly a winning combination in America, “said Ryan Wenke, CEO of The Prospector. “The Yard Goats and their foundation have a long-standing commitment to community, and their shared values tie in with our mission. Our gourmet popcorn has become a vehicle for giving new audiences a literal taste of our mission in action, and we are incredibly grateful to the Yard Goats for the opportunity to connect with their fanbase.”

Prospector Popcorn’s journey accelerated during the COVID-19 pandemic, when movie theaters were shuttered. In response, the 10-yearold movie theater made investments in gourmet popcorn production, leveraging its kitchen space within the Prospector Theater. What started in a 325-square-foot kitchen has since grown into a booming business, with a new nearby 5,000-square-foot production facility on Ethan Allen Highway, national direct-to-consumer retail distribution, and a presence in over 360 hotels across 36 states.

By Gary Larkin / glarkin@westfairinc.com

FAIRFIELD – The Board of Selectmen will not be whole again until a group of Democrats elected in the last election cycle meet to decide who the new first selectman should be.

The elevation of Acting First Selectman Christine Vitale to permanent frst selectman cannot take place until those ofcials meet because Republican Selectman Brenda Kupchick (the former frst selectman) would not second a vote by Vitale at a special meeting on Aug. 5. The purpose of that meeting was to vote on making Vitale permanent frst selectman replacing the late Bill Gerber and consider nominations for the open selectman seat created by Vitale’s

anticipated elevation.

Kupchick cited the danger of leaving the decision for an important decision in the hands of just one person –Vitale. She cited the town charter, which calls for a group of elected ofcials from the same party as the frst selectman to make the decision if the board cannot vote.

State law – Connecticut General Statutes Section 9-222 – states that when a frst selectman dies in ofce, the replacement must be from the same political party.

“Ms. [Brenda] Kupchick expressed her position at the last Board of Selectmen meeting,” Lisa Clair, town communications director. “Therefore, we anticipate that the Board of Selectmen’s 30-day period to fll the vacancy will

expire without the vacancy being flled.”

A date for that meeting of those ofcials has not yet been set but it must occur within 60 days of July 15, Clair said.

“If Christine Vitale is named frst selectman, that will create another vacancy on the Board for the role of Selectman, and the entire process would begin again to fll that empty seat,” Clair said in an email.

In the meantime, Clair said, “Acting First Selectman Vitale remains focused on keeping the work First Selectman Bill Gerber started moving forward and supporting our community and town employees as the process moves forward.”

Gerber, who defeated Kupchick in a very close election in 2023, died after being diagnosed with a brain tumor on July 15.

U.S. Bankruptcy Court

White Plains and Poughkeepsie

Local business cases, Aug. 6 - 12

South Cole Holdings LLC, Monsey, Menachem Flohr, member, 25-22743-KYP: Chapter 11, assets and liabilities $500,000 - $1 million. Attorney: Vaness Rodriguez.

PBC Investment Group LLC: Spring Valley, 25-22748: Involuntary Chapter 7. Petitioner: Robin Kornitzer.

Be & Yo Realty Inc.: Monroe, Joel Brach, president, 25-35852-KYP: Chapter 7, assets and liabilities $0. Attorney: Michelle L. Trier.

Geovani Luciano, Middletown, codebtor Luciano Transportation Inc., 25-35857-KYP: Chapter 7, assets $35,968, liabilities $129,908. Attorney: Michelle L. Trier.

U.S. District Court, White Plains

Local business cases, Aug. 6 - 12

Brandi Oliver, Rockland County vs. Blue Chip Medical Products Inc., Suffern, et al, 25-cv-6514: Job discrimination. Attorney: Robert D. Salaman.

March Associates Construction Inc., Wayne, New Jersey vs. The Rav Group 2 LLC, Goshen, 25-cv-6516-NSR: Breach of contract. Attorney: Michael A. Conforti.

Items appearing in the Westfair Business Journal’s On The Record section are compiled from various sources, including public records made available to the media by federal, state and municipal agencies and the court system. While every e ort is made to ensure the accuracy of this information, no liability is assumed for errors or omissions. In the case of legal action, the records cited are open to public scrutiny and should be inspected before any action is taken.

Questions and comments regarding this section should be directed to:

Sebastian Flores Westfair Communications Inc.

4 Smith Ave., Suite 2 Mount Kisco, NY 10549

Phone: 914-694-3600

Epilepsy and Neurophysiology Management Services, White Plains vs. Anthem Blue Cross Blue Shield, Indianapolis, Indiana, 25-cv-6526-JGLC: U.S. Arbitration Act. Attorney: Debra A. Clifford.

Riverkeeper Inc., Ossining vs. Rockland County Solid Waste Management Authority, Nanuet, 25-cv-6565-KMK: Clean Water Act, Attorney: Julia K. Muench.

Gary Newcomb, Massachusetts, et al, vs. Eden Village Camp Inc., Putnam Valley, 25-cv-6579NSR: Personal injury. Attorney: Anna Berezovski.

Chengdu ShiQiaoShang Technology Co., People’s Republic of China, et al, vs. Pathway IP LLC, Montebello, 25-cv-6585PMH: Patent. Attorney: Wei Wang.

Naomi Demland, Phoenix, Arizona vs. Groomit for Pets LLC, Yonkers, 25-cv-6602-KMK: Unsolicited Telephone Sales, class action. Attorney: Sergei Lemberg.

Above $1 million

20 The Crossing LLC, Harrison. Seller: Kemper Doris C. Kemper, White Plains. Property: 20 The Crossing, Harrison. Amount: $1.2 million. Filed July 17.

21 Thorne LLC, Purchase. Seller: Robin Dixon, Rye. Property: 21 Thorne Place, Rye City. Amount: $1.7 million. Filed July 21.

35 Colonial LLC, Mount Vernon. Seller: Colonial Place Realty Corp., Bronx. Property: 35 Colonial Place, Mount Vernon. Amount: $2.6 million. Filed July 18.

4 Hardscrabble Heights LLC, Brewster. Seller: Thoulton Surgeon, Mount Vernon. Property: 1 Cottage Place, New Rochelle. Amount: $1.4 million. Filed July 15.

Cartus Financial Corp., Danbury, Connecticut. Seller: Yong Huang, Hartsdale. Property: 310 Old Colony Road, Greenburgh. Amount: $1.5 million. Filed July 21.

Corsun Holdings LLC, Scarsdale. Seller: Ma Yongmei, Scarsdale. Property: 65 Lincoln Road, Scarsdale. Amount: $1.9 million. Filed July 17.

Elizian V. Holdings LLC, New York. Seller: Marianna O’Dwyer, North Salem. Property: 344 Hawley Road, North Salem. Amount: $1.1 million. Filed July 21.

Kearney Land Holdings III LLC, New York. Seller: Twenty Eleven Real Estate LLC, North Salem. Property: 6-8 Front St., North Salem. Amount: $1.2 million. Filed July 15.

Kung, Geoffrey, Mamaroneck. Seller: 629 Shore Acres LLC, Mamaroneck. Property: 629 Shore Acres Drive, Rye Town. Amount: $1.8 million. Filed July 17.

Mead, Jeffrey, Scarsdale. Seller: Weaver Development Holdings LLC, Yonkers. Property: 17 Weaver St., Scarsdale. Amount: $2.7 million. Filed July 15.

Paddywalnuts7 LLC, Yonkers. Seller: Nile Street LLC, Rancho Mirage, California. Property: 606 Mile Square Road, Yonkers. Amount: $1.5 million. Filed July 18.

Post Street Revocable Trust, Hartsdale. Seller: Locraw LLC, White Plains. Property: 30 Post St., Yonkers. Amount: $9 million. Filed July 15.

Soil Mates Farm LLC, New Rochelle. Seller: US Bank NA, West Palm Beach, Florida. Property: 50 North Place, New Castle. Amount: $1.3 million. Filed July 21.

Taleb, Nassim N., Larchmont. Seller: Larchmont Units LLC, Garden City. Property: 2 Washington Square, Mamaroneck. Amount: $1 million. Filed July 17.

Wade, Ryan, Rye. Seller: 16 Franklin Avenue LLC, Rye. Property: 26 Chestnut St., Rye City. Amount: $2.6 million. Filed July 16.

Winged Foot Golf Club Inc., Mamaroneck. Seller: Jenny Welling-Palmer, Scarsdale. Property: 227 Griffen Ave., Mamaroneck. Amount: $3 million. Filed July 15.

Zhang, Linda P., Yonkers. Seller: Cartus Financial Corp., Danbury, Connecticut. Property: 310 Old Colony Road, Greenburgh. Amount: $1.5 million. Filed July 21.

22 Ridge Boulevard II LLC, Mamaroneck. Seller: Anne M. Capeci, New York. Property: 22 Ridge Blvd., Rye Town. Amount: $700,000. Filed July 18.

299 Peekskill Hollow Road LLC, Brooklyn. Seller: Hawthorne 2B Partners LLC, Scarsdale. Property: 826 John St., Peekskill. Amount: $600,000. Filed July 17.

423 Union Avenue LLC, Dobbs Ferry. Seller: Carlos Ramirez, Scarsdale. Property: 423 Union Ave., Rye Town. Amount: $950,000. Filed July 16.

466 Midland Avenue LLC, Yonkers. Seller: John D. Girardi, Apex, North Carolina. Property: 466 Midland Ave., Yonkers. Amount: $415,000. Filed July 21.

515 S Second Avenue LLC, Mount Vernon. Seller: Levie Fleming, Great Neck. Property: 509 S. Second Ave., Mount Vernon. Amount: $125,000. Filed July 21.

Bonilla, Melvin, Yorktown Heights. Seller: Baez Commercial Real Estate LLC, Yonkers. Property: 227 California Road, Yorktown. Amount: $730,000. Filed July 17.

Bronx Modern Homes Inc., Scarsdale. Seller: Morris W. Candace, Scarsdale. Property: 332 Tecumseh Ave., Mount Vernon. Amount: $340,000. Filed July 15.

Cabeca Group RE Investors Corp., Briarcliff Manor. Seller: Arlene Udeagha, Yonkers. Property: 89 Patmore Ave., Yonkers. Amount: $170,000. Filed July 17.

Cascade Funding Mortgage Trust HB11, West Palm Beach, Florida. Seller: Michael P. Amodio, White Plains. Property: 3746 Mill St., Yorktown. Amount: $419,000. Filed July 15.

Friend, Charlene. Seller: Bank of America NA. Property: 89 Clinton Ave., New Rochelle. Amount: $560,000. Filed July 16.

Gooman, Rajcoomarie, Bronx. Seller: H2d Realty LLC, Yonkers. Property: 402 Homestead Ave., Mount Vernon. Amount: $800,000. Filed July 15.

Gruenfelder, Cynthia, Rye. Seller: JD Morris LLC, Port Chester. Property: 1 Landmark Square 609, Rye Town. Amount: $290,000. Filed July 15.

Iker Propiedades LLC, Maspeth. Seller: Doris C. Mann, Mount Vernon. Property: 360 Seventh Ave., Mount Vernon. Amount: $270,000. Filed July 18.

Inocente, Alejandro D., White Plains. Seller: Coin Only LLC, White Plains. Property: 6 McBride Ave., White Plains. Amount: $850,000. Filed July 17.

Legacy Management & Realty LLC, New City. Seller: 29 Burling Lane Inc., White Plains. Property: Burling Lane, New Rochelle. Amount: $200,000. Filed July 15.

Mollo, Eric M., New Rochelle. Seller: Evergreen Remodeling Inc., Yorktown Heights. Property: 410 Sherman Ave., Mount Pleasant. Amount: $800,000. Filed July 18.

Pan, Lujia, New Rochelle. Seller: D2g Realty LLC, Yonkers. Property: 79 Orchard St., Yonkers. Amount: $710,000. Filed July 21.

Pearl Street Renos LLC, Port Chester. Seller: Polly Herring, New Fairfield, Connecticut. Property: 130 Pearl St., Rye Town. Amount: $550,000. Filed July 18.

Scenic Settings LLC, Port Chester. Seller: Josh Vedantham, White Plains. Property: 45 Thompson Ave., White Plains. Amount: $698,000. Filed July 21.

Schoen, Kevin, White Plains. Seller: Greater International Pentecostal Holiness Church Inc., White Plains. Property: 77 Hillcrest Ave., Greenburgh. Amount: $803,000. Filed July 15.

Sia & Alex LLC, Port Chester. Seller: 20 28 Main Hill LLC, White Plains. Property: 20 N. Main St., Rye Town. Amount: $810,000. Filed July 15.

Titley, Monique, Bronx. Seller: Apri & Associates LLC, Mohegan Lake. Property: Third Hampton Court, Yorktown. Amount: $350,000. Filed July 17.

Vernon Dell Elite LLC, Rego Park. Seller: Michael Gabriel, Mount Vernon. Property: 27 Dell Ave., Mount Vernon. Amount: $350,000. Filed July 16.

Federal Tax Liens, $10,000 or greater, Westchester County, Aug. 6 - 12

20 Robinson Corp.: South Salem, 2020 - 2022 quarterly, corporate taxes and failure to file correct information, $19,216.

Alo-Mannarino, S.: Cortlandt Manor, 2024 personal income, $66,1324.

Araman, Paul: South Salem: 2024 personal income, $149,536.

Billingsley, Justin and Heather Billingsley: North Salem, 2023 personal income, $145,875.

Breiling, Andrea Marie: Port Chester, 2018, 2022 - 2023 personal income, $288,520.

Camaj, Artan and Arjana Camaj: Chappaqua, 2021 personal income, $168,517.

Camal, Berta: Ossining, 2024 personal income, $11,282.

Cazazian, E.A.: Bedford Hills, 2021, 2023 personal income, $153,770.

Clement, Eric A.: Bedford Hills, 2021, 2023 personal income, $153,770.

County Fabricators LLC: Pleasantville, 2023 - 2024 quarterly taxes, $386,278.

Crana Electric Inc.: Mount Vernon, 2025 quarterly taxes, $26,603.

David, Shoshana: Harrison, 2023 personal income, $103,456.

DeGeorgio, Michael: Pleasantville, 2016 - 2017, 2022 - 2023 personal income, $71,436.

Dellajacono, John F.: West Harrison, 2023 personal income, $100,509.

Donnery, Patrick J. and Marie Donnery: Hawthorne, 2019, 2024 personal income, $24,339.

Eisen, Joshua: Harrison, 2023 personal income, $103,456.

Flintlock Construction Service LLC: Mamaroneck, 2021 quarterly taxes, $18,871.

Gainor, Christopher: Ossining, 2014, 2016, 2018, 2023 personal income, $31,871.

Georgio, Robert and Patricia Georgio: Harrison, 2020 - 2021, 2023 personal income, $101,814.

Giahn, Ashley: New Rochele, 2023 personal income, $188,253.

Gjonpalaj, Astrit and Eleonora Gjonpalaj: Bronxville, 2021 - 2023 personal income, $244,994.

Haase, Stacy L.: South Salem, 2021, 2023 personal income, $670,435.

Hodge, Robin: Cortlandt Manor, 2010, 2012 personal income, $24,222.

Horak, Miriam: New Rochelle, 2023 personal income, $156,411.

Lagana, Pasquale and Domenica Lagana: Port Chester, 2021, 2023 personal income, $117,582.

Liotta, Barbara: Yonkers, 2018 - 2023 personal income, $159,912.

Loren, Craig: New Rochelle, 2023 personal income, $156,411.

Maat, Sekou and Courtney Maat: Pelham Manor, 2023 personal income, $92,067.

Mannarino, Richard: Cortlandt Manor, 2024 personal income, $66,1324.

Manor Paving Company Inc.: Mount Vernon, 2024 quarterly taxes, $28,996.

Marrone, Vincent and Carol Bridges: New Rochelle, 2022 personal income, $159,940.

Monigan, Raymond J.: Shrub Oak, 2021 - 2023 personal income, $63,211.

Mwelu, Jemela: New Rochelle, 2023 personal income, $147,018.

Ozkurt, Hal: Yonkers, 2021 collection information statement, $119,306.

Park Avenue Real Estate Management Inc.: Mount Vernon, corporate taxes, $41,334.

Perez, Jeudy: Yonkers, 2022 - 2023 personal income, $180,326.

Ramirez, Juriel A.: Yonkers, 2017 restitution, $389,648.

Rodriguez, Arelis: Mount Vernon, 2014 - 2019, 2021 - 2023 personal income, $59,832.

Rodulfo, Roman: Pelham, 2018 personal income, $243,981.

Saccente, Michael and Brooke M. Saccente: Yorktown Heights, 2022 - 2023 personal income, $193,146.

St. John - Foster, Dylan and Jennifer L.: Harrison, 2015, 2019, 2021, 2023 personal income, $325,670.

Stroligo, John and Erika Stroligo: Tarrytown, 2023 personal income, $190,465.

Vogt Jr., William R.: White Plains, 2023 personal income, $170,171.

Williams, Byran R.: Cortlandt Manor, 2010, 2012 personal income, $24,222.

Wisel, Allyson: White Plains, 2023 personal income, $170,171.

10 Days Grocery Corp., Valhalla. Amount: $21,000.

Abalon Precision Manufacturing Corp., Mount Vernon. Amount: $3,500.

Aztlan Auto Collision Corp., Yonkers. Amount: $21,000.

Empire Shell Inc., Yonkers. Amount: $9,000.

FC Underground Inc., Peekskill. Amount: $13,000.

Harbor Island Contracting Inc., White Plains. Amount: $31,500.

Kosmuj Corp., White Plains. Amount: $2,500.

Maintenance By Bueno Brothers Inc., Yonkers. Amount: $3,000.

Mamaroneck Convenience Corp., Mamaroneck. Amount: $22,000.

Monmore of New York Inc., Mount Vernon. Amount: $16,000.

Nick’s International Commercial Kitchen, White Plains. Amount: $43,000.

Shorehaven LLC, Hastingson- Hudson. Amount: $42,000.

Anderes, Jaime, Pelham. $8,314 in favor of JPMorgan Chase Bank NA, Wilmington, Delaware. Filed June 24.

Awawdeh, Naser T., Yonkers. $1,375 in favor of Westchester Community College, Valhalla. Filed June 17.

Bargellini, Mario J., Eastchester. $15,187 in favor of Capital One NA, Columbus, Ohio. Filed June 24.

Batiste Jr., Delbert M., Mount Vernon. $4,133 in favor of Bank of America NA, Charlotte, North Carolina. Filed June 25.

Baxter, Sharlene, Mount Vernon. $6,010 in favor of Cavalry Spv I LLC, Greenwich, Connecticut. Filed June 24.

Benjamin, Zaria E., Ossining. $1,217 in favor of Westchester Community College, Valhalla. Filed June 18.

Berek, Samuel, Somers. $2,132 in favor of Capital One NA, Columbus, Ohio. Filed June 27.

Betz, Giavonna, Newburgh. $6,512 in favor of Westchester Community College, Valhalla. Filed June 18.

Bonet, Nelson R., Valhalla. $3,034 in favor of Westchester Community College, Valhalla. Filed June 18.

Brito, Michael B., Yonkers. $3,918 in favor of Capital One NA, Columbus, Ohio. Filed June 24.

Calvo, Laritza, Yonkers. $1,887 in favor of Westchester Community College, Valhalla. Filed June 18.

Carapella, Melissa, Tuckahoe. $11,520 in favor of JPMorgan Chase Bank NA, Wilmington, Delaware. Filed June 24.

Cardenas, Rogelio, Port Chester. $4,713 in favor of Discover Bank, Columbus, Ohio. Filed June 23.

Castaing, Aaliyah M., New Rochelle. $1,235 in favor of Westchester Community College, Valhalla. Filed June 18.

Castro, Yasirah A., Monroe. $3,457 in favor of Westchester Community College, Valhalla. Filed June 18.

Cheek, Anthony J., Mahopac. $3,139 in favor of Westchester Community College, Valhalla. Filed June 18.

Cogle, Blossom M., Mount Vernon. $9,229 in favor of Citibank NA, Sioux Falls, South Dakota. Filed June 24.

Cumberland, John I., Irvington. $11,882 in favor of JPMorgan Chase Bank NA, Wilmington, Delaware. Filed June 24.

DeBartolo, Christina, New Rochelle. $7,896 in favor of Cavalry Spv I LLC, Greenwich, Connecticut. Filed June 24.

Dedvukaj, Nickolaus, Bedford. $5,962 in favor of JPMorgan Chase Bank NA, Wilmington, Delaware. Filed June 23.

Diaz, Tatiana, Ossining. $4,830 in favor of Capital One NA, Columbus, Ohio. Filed June 24.

Fonfrias, Richard E., Hastings-on-Hudson. $3,009 in favor of Westchester Community College, Valhalla. Filed June 18.

Gentile, Carmela, Eastchester. $1,050 in favor of Westchester Community College, Valhalla. Filed June 18.

Giraldo, Samantha, Port Chester. $1,171 in favor of Westchester Community College, Valhalla. Filed June 18.

Graham, Ahesha E., Pelham. $1,335 in favor of Westchester Community College, Valhalla. Filed June 18.

Greene, Joel, Mahopac. $2,496 in favor of Westchester Community College, Valhalla. Filed June 18.

Guaman, Jefferson P. F., Ossining. $2,901 in favor of Westchester Community College, Valhalla. Filed June 18.

Hinkley, Brittany, Yorktown Heights. $4,913 in favor of Capital One NA, Columbus, Ohio. Filed June 24.

Ishaq, Faud G., Yonkers. $5,247 in favor of Cavalry Spv I LLC, Greenwich, Connecticut. Filed June 27.

Ivey, Kevin, Yonkers. $1,831 in favor of Cavalry Spv I LLC, Greenwich, Connecticut. Filed June 27.

Kim, Yung M., Flushing. $103,772 in favor of JPMorgan Chase Bank NA, Wilmington, Delaware. Filed June 25.

Klotzko, Patricia, White Plains. $5,860 in favor of Cavalry Spv I LLC, Greenwich, Connecticut. Filed June 25.

Lacayo, Sashi, Yonkers. $2,371 in favor of Barclays Bank Delaware, Wilmington, Delaware. Filed June 27.

Liles, Joycelyn, Hartsdale. $3,380 in favor of Cavalry Spv I LLC, Greenwich, Connecticut. Filed June 25.

Lin, Ai Chu, White Plains. $4,832 in favor of Cavalry Spv I LLC, Greenwich, Connecticut. Filed June 24.

Lopes, Justin, South Salem. $3,054 in favor of Westchester Community College, Valhalla. Filed June 18.

Martinez, Angela M., Mount Vernon. $8,907 in favor of JPMorgan Chase Bank NA, Wilmington, Delaware. Filed June 24.

Mattavous, Kamaal T., White Plains. $2,951 in favor of Capital One NA, McLean, Virginia. Filed June 23.

Michel, Jennifer M., Cortlandt Manor. $9,534 in favor of Capital One NA, Mclean, Virginia. Filed June 25.

Morgan, Jaida C., White Plains. $1,495 in favor of Westchester Community College, Valhalla. Filed June 17.

Naranjo, Carlos A., White Plains. $8,028 in favor of Cavalry Spv I LLC, Greenwich, Connecticut. Filed June 24.

Nazario, Angela B., Bronxville. $10,440 in favor of Bank of America NA, Charlotte, North Carolina. Filed June 23.

Ortega, Omar D., Mount Vernon. $17,544 in favor of Barclays Bank Delaware, Wilmington, Delaware. Filed June 27.

Ortiz, Hipolito A., Yonkers. $15,850 in favor of Capital One NA, Columbus, Ohio. Filed June 24.

Peterson, Reign, Hastingson- Hudson. $2,416 in favor of Capital One NA, Columbus, Ohio. Filed June 23.

Quintuna, Nataly V., Ossining. $1,350 in favor of Westchester Community College, Valhalla. Filed June 18.

Ramirez, Joharry, Yonkers. $1,916 in favor of Capital One NA, McLean, Virginia. Filed June 24.

Rodriguez, Nilda L. A., Yonkers. $15,844 in favor of Capital One NA, McLean, Virginia. Filed June 27.

Ross, William R., Mount Vernon. $7,946 in favor of JPMorgan Chase Bank NA, Wilmington, Delaware. Filed June 24.

Rustici, Michael J., Yonkers. $3,453 in favor of Capital One NA, Mclean, Virginia. Filed June 24.

Salyga, Bartosz, Port Chester. $21,842 in favor of Capital One NA, Columbus, Ohio. Filed June 23.

Sanchez, Angel, Yonkers. $3,141 in favor of Midland Credit Management Inc., San Diego, California. Filed June 18.

Shelton, Clifford, New Rochelle. $11,343 in favor of JPMorgan Chase Bank NA, Wilmington, Delaware. Filed June 24.

Shemin, Susan R., Crotonon- Hudson. $4,902 in favor of Barclays Bank Delaware, Wilmington, Delaware. Filed June 23.

Smalls, Chela K., Elmsford. $3,074 in favor of Westchester Community College, Valhalla. Filed June 18.

Smith, O’Neil, White Plains. $5,365 in favor of Capital One NA, Columbus, Ohio. Filed June 23.

Sparks, Tyiana L., Yonkers. $1,627 in favor of Westchester Community College, Valhalla. Filed June 18.

Thomas, Jennifer, Cortlandt Manor. $946 in favor of Midland Credit Management Inc., San Diego, California. Filed June 16.

Tyler, Elsie, Mount Vernon. $3,793 in favor of Midland Credit Management Inc., San Diego, California. Filed June 18.

Valdovins, Elsie A., Port Chester. $1,593 in favor of Cavalry Spv I LLC, Greenwich, Connecticut. Filed June 24.

BCB Community Bank, as owner. Filed by Deutsche Bank National Trust Co. Action: Foreclosure of a mortgage in the principal amount of $444,000 affecting property located at 193 Tibbetts Road, Yonkers. Filed June 24.

Bethoney, Ana G., as owner. Filed by JPMorgan Chase Bank NA. Action: Foreclosure of a mortgage in the principal amount of $2,183,110 affecting property located at 606 Walton Ave., Mamaroneck. Filed June 19.