‘Heard it before’ on GB airport

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

THE Grand Bahama Chamber of Commerce (GBCC) president has “heard it all before” on the Grand Bahama International Airport (GBIA) partner being secured and sees the new target date as an extension of the previous date for the end of December, 2022.

James Carey, told Tribune Business that the government has forgotten that they promised Grand Bahamian residents that the GBIA partner would be selected before the end of 2022

and promising they will have one by the first quarter of next year is just deflecting from any reference of earlier promises to have it done by the December 2022 date.

Chester Cooper, Deputy Prime Minister and Minister for Tourism, Investments and Aviation, told reporters in September that a partner being selected was “weeks away” as the board was making their final selection and an announcement would be made.

Mr Carey said, however: “I guess tell us now why it’s delayed?”

ORG suggests changes to procurement laws

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

THE ORGANISATION for Responsible Governance (ORG) has given recommendations to the government on amendments to public procurement legislation.

Matt Aubry, ORG’s executive director, told Tribune Business that the “foremost and current” piece of legislation for

completion by the Philip Davis, KC, government is the amendment to the Public Procurement Act, because it is something that needed to be made “fair and transparent”.

He said: “The bill actually has some interesting elements in it. They’ve added on more specificity so that owners of Family Island businesses and women-owned businesses and youth-owned businesses can now get a special weight so that they

can get greater advantage and opportunity. We recommended that they include folks with disabilities as well.

“But the current bill also removes the specific review, appeal commission and tries to blend it in with the tax appeal commission. The reality is that the Procurement Review Commission is going to be critical to build trust and ensure that when contracts are not awarded

FTX lawyers apply for creditors stay

By YOURI KEMP Tribune Business Reporter

FTX’s Chapter 11 lawyers applied for a motion for the enforcement of an automatic stay from creditors in FTX proceedings due to shuffling of funds days prior to the chapter 11 filing, new court filings state.

Adam G Landis, partner at Landis Rath & Cobb LLP and team in Delaware, along with lawyers from Sullivan & Cromwell LLP, filed documents in the Delaware District Court last week asking for the enforcement of an automatic stay from creditors trying to get their money back from the failed cryptocurrency exchange as a result of its collapse.

#While The Bahamas was not mentioned in the motion, the motion asks to block a non-debtor defendant company registered in Antigua and Barbuda, Emergent Fidelity Technologies Ltd, which is 90 percent owned by Sam Bankman-Fried, FTX’s former chief executive officer, from receiving 56 million nominal shares held in a separate company, Robinhood Markets.

Due to the fact that Emergent Fidelity is essentially owned by Bankman-Fried, the now disgraced former CEO, the motion is asking that this special purpose holding company not be treated like other creditors to

FTX but that the company - FTXsubstantially owns Emergent now.

#Robinhood’s shares are frozen in an account at ED&F Man Capital Markets Inc (EDFM) in New York City.

#The court filing also said: “Since the commencement of these chapter 11 cases, three different competing stakeholders of the debtors have filed court actions in different jurisdictions to gain control of the Robinhood Shares to collect on claims against the debtors, including BlockFi Inc, BlockFi Lending LLC, and BlockFi International LLC (together, “BlockFi”) (a prepetition creditor of Alameda seeking to sell the Robinhood Shares to pay BlockFi’s claim), Yonathan Ben Shimon (a prepetition creditor of FTX Trading who

has successfully appointed a receiver in Antigua to obtain control of and sell the Robinhood Shares under the supervision of a court in Antigua), and Mr Bankman-Fried himself (who has repeatedly sought a source of payment for legal expenses). For their part, the debtors instructed EDFM to freeze the shares promptly after commencement of these chapter 11 cases, which EDFM confirmed has been done.”

#It added that due to the new management at FTX conducting investigations into the crypto-exchange’s collapse, the investigation has led them to conclude that the Robinhood shares are property of the debtor’s estates and only

Reformer predicts ‘great year’ for economy

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

THE New Year is expected to “crystalise the reconsolidation of the economy”, says a governance reformer as 2023 foretells a year of “great performance” for the economy.

Hubert Edwards, head of the Organisation for Responsible Governance’s (ORG) economic development committee, said in a release to the media that despite the headwinds ahead for The Bahamas and the wider Caribbean region predicated on the possibility of a US recession in addition to lower global growth, The

Bahamas can still weather the storm if it sticks to the “facilitation of sectorial reforms and institutional strengthening”.

Mr Edwards said: “The prediction of global growth in the region of 2.7 percent

is indicative of serious headwinds ahead for the global economy and the Caribbean region, having regard for the expected impact on the US economy.

“This means that the country could face headwinds which will negative impact its ability to secure much needed improved growth levels beyond historical averages.

“The US economy is expected to decline, performing within a band of 0.5-1 percent for 2023, with mild recession beginning in late 2023 and a longer-term average annual growth rate of 1.8 percent. Despite this expectation of decline the economic reconsolidation in The Bahamas which continues to move at a greater than anticipated

rate will serve to blunt the effect. The current momentum in tourism could mitigate the effect by delaying the generally anticipated reversion to average growth rates. It is predicted that growth in 2023 for the country will be around 1.1 percent.

“Should tourism continue at the current pace of performance any such decline could be pushed well towards the latter part of 2023. Caution must be take of the potential impact that developments in the US could have on the market. A recessionary period would create downward pressure on disposable income and

Kovats ‘not selling’ despite $3bn lawsuit dispute

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

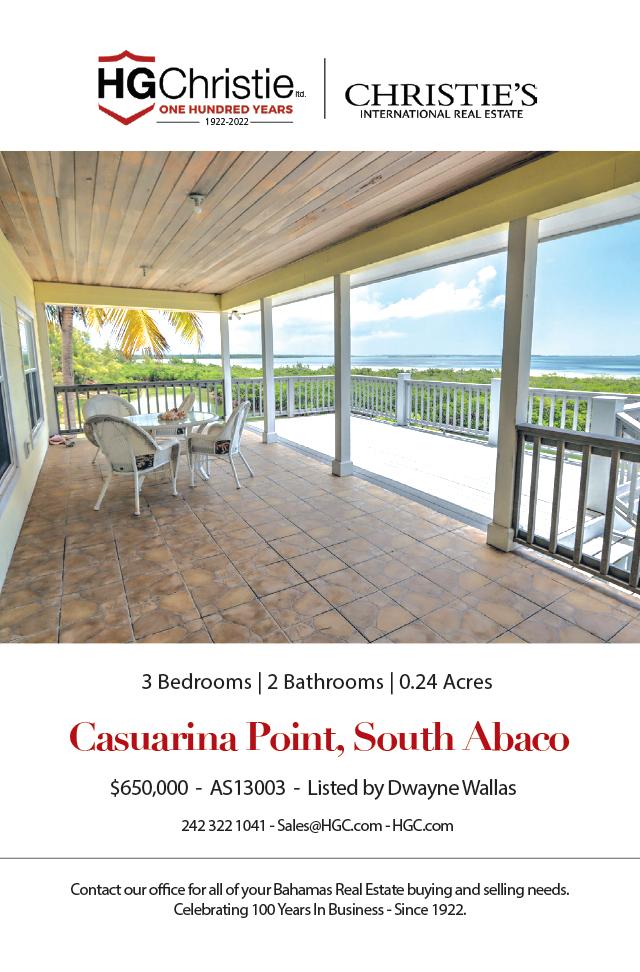

A DEVELOPER suing the Bahamas government for $3bn is moving forward with other projects despite the volatility surrounding his interests.

Dr Mirko Kovats is not planning on selling any of his Bahamas-based properties amid his $3bn lawsuit against the government - while there have been claims of vendors not being paid.

Dr Wolfgang Groeger, speaking on behalf of the Kovats family office, told Tribune Business they would “like to set the records straight” on some of the misunderstandings about their interests in The Bahamas.

He said with regard to the Treasure Cay vendors and acquisition of property: “Mr Charles Nafie (the architect for the project) has been paid 100 percent and exactly as per agreement.”

Dr Groeger was responding to complaints from a vendor who was employed by Charles J Nafie Architecture and Design he had

not been paid for renderings he did.

Dr Groeger added: “You seem to confuse payments due by Mr Nafie to his subcontractor with payments due by Dr Kovats to Mr Nafie which even have been paid weeks before having been due following Mr Nafie’s begging for early prepayment.”

However, in emails seen by The Tribune, the architect asserted that the payments had been made.

Dr Groeger also said: “The Treasure Cay development is held up by undue government interference

business@tribunemedia.net WEDNESDAY, DECEMBER 28, 2022

ykemp@tribunemedia.net SEE PAGE B3 SEE PAGE B2

SEE

B2

PAGE

SEE

PAGE B2

MATT AUBRY

HUBERT EDWARDS

DR MIRKO KOVATS

• Call for explanation of delays • Chamber wants PM meeting • Questions over hospital plan SEE

$5.85 $5.86 $5.83 $5.21

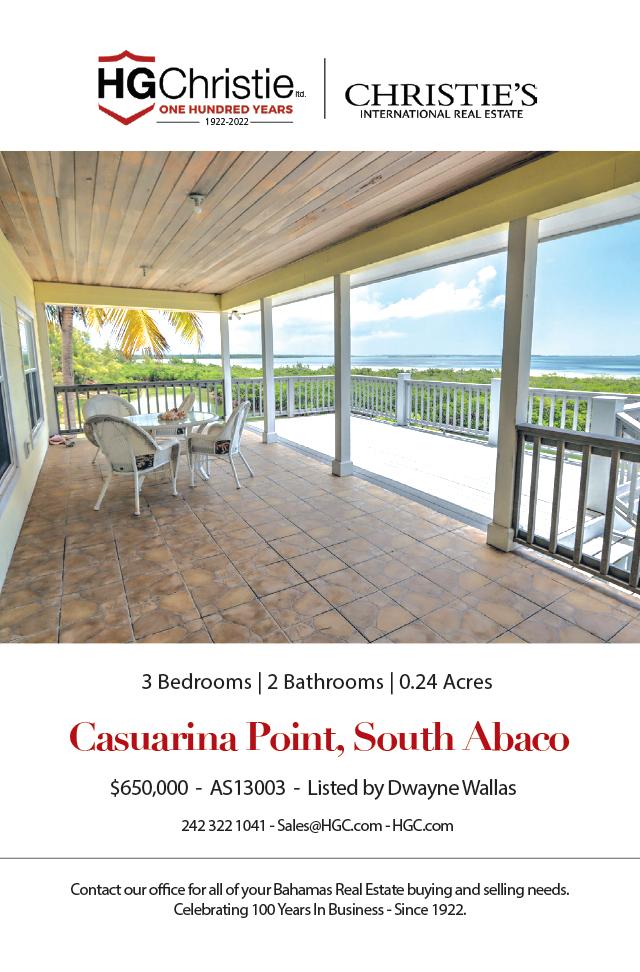

GRAND BAHAMA INTERNATIONAL AIRPORT (GBIA) AFTER DORIAN

PAGE B2

‘Heard it before’ on GB airport

FROM

He added: “It could be for legitimate reasons and I expected that but as a consuming public and community, tell us what it is?”

Referencing other broken promises by the Philip “Brave” Davis administration, Mr Carey also noted that ground was supposed

to be broken on a hospital for Grand Bahama by the end of December, 2022 but now he understands this will happen in the first quarter of next year. He said “we have to assume that there was some veracity in the initial announcement” and was not just made to “appease the electorate”.

Mr Carey added: “I have not heard who the prospective partner is at the airport. That is something I have been trying to find out, but everyone is tight-lipped on it. I have been leaning on my contact at the Grand Bahama Port Authority, but they are not involved anymore and they claim not

to know anything about it. I know a few people on the Freeport Airport Development Company, but they aren’t telling me anything either.”

A meeting with the Prime Minister is essential for the GBCC to see their way clear for the development of the island, he said.

“Talking to the Minister for Grand Bahama is good, but ultimately we’d really love to sit down with the Prime Minister for him to tell us what exactly is in store for Grand Bahama and what can we do together to move the island along?”

Mr Carey also said: “There is a continued effort

ORG suggests changes to procurement laws

FROM PAGE B1

that there’s a fair space for people to understand why something wasn’t awarded, as well as an opportunity to review the determinants of it and that effective procurement legislation is key. So that’s one area that we put recommendations. We hope that changes.”

ORG will also spend time working on benchmarking the Public Disclosure Act as well.

Mr Aubry said: “That’s key to really start to build out again that concept of

public trust and make it easier for the leaders and for the elected officials to put out their information, but also build in more independence so that there’s greater monitoring and ensuring that things like conflict of interest, which, of course, can be a problem when we only have a population of 400,000, are appropriately looked at.”

The Davis administration in its Blueprint for Change outlined legislation for an ombudsman, anticorruption legislation and

reviewing and updating the Fiscal Responsibility Act, but nothing on these matters has come to the floor of Parliament.

The Attorney General, Ryan Pinder, in his June update on the legislative agenda for the government for this 2022/2023 fiscal year, mentioned nothing about anti-corruption or fiscal responsibility legislation.

Mr Aubry, still hopeful for ORG’s interventions, said: “I think that there’s also a number of other

Kovats ‘not selling’ despite $3bn lawsuit dispute

opportunities that are going to be coming up, things like campaign finance and ensuring that whatever comes out of the FTX issue that there are legislative and policy changes that ensures that the burgeoning technology industries can continue to be supportive, but there’s also appropriate levels of regulation.”

He added: “Obviously, pushing for things like a land use plan, which will open the door and ensure environmental responsibility, but also give clarity for

FROM PAGE B1

into a ‘private commercial transaction’.

“It is the government of The Bahamas’ full responsibility for all damages done to The Bahamas, especially North and Central Abaco stakeholders, including local employment and investors. You should be aware of the judicial review filed, quoting damages of precisely $3,127,157,550.00 eventually due.

“Bondholders have been made aware of this contingent sovereign debt risk. US court filings will result in more interesting disclosures.”

Turning to another property currently under scrutiny, the South Ocean property that was alleged to have been permanently stalled, Dr Groeger noted that “seven to 10 years, and after hearing several witness testimonials under oath, there might be a final judgement, at least more disclosure of special interest.

“Please be aware of the fact that the 2013 development profit assumptions outlined in the CBRE Information Memorandum presented by order of the vendors CCIWPP (Canadian Commercial Industrial Workers Pension Plan) will be much higher as per 2022 or even 2023, not lower…”

all those people who are waiting to be able to access land that they put bids in and ensuring how we can use our land appropriately.

“Then I think finally, what we want to look at is the full enactment of freedom of information. That to us is a real key priority and it’s one that is long since due, there’s been progress made and now we need to bring that to bear.”

In February, the Freedom of Information Unit, talked about being able to have ten agencies that received

He continued: “2022 real estate prices in New Providence have skyrocketed by 30 percent, even in Sandyport which by no means is comparable to Albany, South Ocean and other upscale developments.

“Albany West could generate around $500,000,000 developer profit for Albany/ Joe Lewis/CCIWPP, thus strongly supporting our damages calculation.

“We simply took as a basis of our damages claim the excellent and professional CBRE information memorandum, consisting of the development of three hotels, including one condo hotel, condos, golf course residences, marina, golf course, commercial marina village, staff quarters, employing thousands of Bahamians once fully operational.

“Quite different from Albany West a sleepy condo and land subdivision project with the only goal to generate hundreds of millions of quick cash.”

With regard to the equally controversial “The View at Love Beach,” project, Dr Groeger said: “We are in the process of ‘modernising’ the overall design of the development, working with a successful Miami developer to become more ‘contemporary South Florida’ style.

FTX lawyers apply for creditors stay

nominally held by Emergent Fidelity.

“The debtors’ ongoing investigation establishes that the debtors have at least a ‘colourable’ claim to ownership of the Robinhood shares, such that the automatic stay under section 362(a) of the Bankruptcy Code should be enforced and the shares should remain frozen at EDFM by order of this court pending resolution of competing claims by the diverse stakeholders of the debtors.”

The court documents also state: “BlockFi has been a lender to Alameda for at least three years. With news of FTX’s imminent collapse making headlines worldwide, just two days before the debtors (including FTX Trading and Alameda) filed for bankruptcy, BlockFi scrambled to protect itself from impending losses on antecedent loans by threatening to seek remedies against Alameda if Alameda did not pledge additional collateral for those loans. In response to those threats, and despite the perilous financial position of Alameda and the other debtors, Alameda’s then-CEO Caroline Ellison, with knowledge and encouragement from Mr Bankman-Fried, purportedly agreed to pledge over

to try and push some things along. We are still very engaged with trying to push small businesses because small business ends up to big business. There are a number of initiatives we are working with the GBPA and in respects the Minister of Grand Bahama to achieve those initiatives.”

and can respond to a Freedom of Information request by the Bahamian people. “I know there’s been a little a few delays but I think if that becomes a key priority for policy, it will achieve something that a lot of the public has been looking for,” Mr Aubry said. There also a need to revisit the national development plan. There is a draft in place and a structure by which the government can build upon, but needs to be updated to “reflect current circumstances”.

“Current volatility of skyrocketing prices and unreliable construction materials supplies and costs, as well as financing costs deterring prospective buyers result in us monitoring the 2023 developments.

“While being in the design development phase, construction commencement will be decided by the markets.”

Despite the challenges facing these respective projects, Dr Kovats does not plan to sell any of its properties in The Bahamas and plans to “develop all properties including Treasure Cay and South Ocean at the appropriate time”.

“We are here to stay,” Dr Groeger said. “We strongly believe in The Bahamas’ potential, being aware of considerable improvement potentials which we expect to come one way or the other.

“We are uncorrupt and unpolitical which naturally makes matters more challenging.

“Funding of any project is not an issue, however may depend on findings of background ‘vetting’ of certain actors.

“We believe 2023 - the year of 50 years anniversary of independence will be a wonderful ‘New Day’ for our beautiful Bahamas and their wonderful people.”

$1 billion worth of additional Alameda assets to secure Alameda’s outstanding loan obligations to BlockFi. The Robinhood shares were included in these pledged assets by Alameda’s then-CEO, despite the fact that the Robinhood shares were nominally held by Emergent, because Alameda had then, and continues to have, a property interest in the Robinhood shares.”

All of these transfers post chapter 11 filing coincide with the transfer of Bahamian-owned assets of FTX to a cloud system, but prior to which a withdrawal was made from them for $100m to Bahamian creditors, it has been reported.

While this latest motion of extending the automatic stay mentions The Bahamas, it will put a wrinkle to the liquidation proceedings here as the joint liquidators try to gain access to the books of FTX to secure repayment for their own creditors to FTX.

PAGE 2, Wednesday, December 28, 2022 THE TRIBUNE

PAGE B1

CALL 502-2394 TO ADVERTISE IN THE TRIBUNE TODAY!

FROM PAGE B1

Reformer predicts ‘great year’ for economy

FROM

would therefore slow touristic activities.”

The likelihood of a US recession in 2023 has been distinguished due to the fact that the US Federal Reserve raised interest rates earlier this month by a half of a point to a range between 4.23 and 4.40, the highest benchmark rate in 15 years.

There are also discussions around more interest rate increases in the US for 2023 as the Fed tries to dampen inflation that has rocked the Americas.

Mr Edwards also said: “The US Treasury appears still fully committed to fighting inflation through continuing tighten monetary policy. This is expected to terminate within a rage of 4.75-5 percent. This represents a significant shift in interest rates which less than a years ago was less than 1 percent. While this effort to fight inflation represents good news for the country the impact on borrowing cost, which currently stands at more than 15 percent of total expenditure, should definitely be an area of concern for policy makers.

“The Bahamas demand for debt, while declining is still relatively significant. It will be crucial for the government to be able to leverage announced initiatives, early in 2023, to tap into the domestic market

credit in order to secure much needed reduction in the cost of borrowing. With a $1.8bn borrowing requirement for the fiscal year 2022/23, of which less than $500M has been borrowed to date, the implications of not securing cheaper debt will have significant effect on government plans and would weigh negatively on economic outcomes despite positive performance to date.”

The national debt is $10.4bn, nearly the size of the current GDP estimated at 11.88bn, this puts the country at a position where borrowing may become more difficult as the threat of defaulting becomes more possible.

Mr Edwards ultimately said: “There is need for broad-based reforms across many sectors. As the new administration approaches its second year in office it will become critical that these issues are addressed early. Delays are likely to create tensions for making changes as the administration matures deeper into the five year cycle.

“2023 is expected to crystalise the reconsolidation of the economy. The New Year has the potential to be a productive one for The Bahamas, not necessarily in growth terms but through the facilitation of sectorial reforms and institutional strengthening. The tourism sector, together

with recently announced investments, have already demonstrated a trajectory for great performance. This will, however need support, greater and improved contribution from other sectors. From a macro perspective there will be headwinds and challenges driven largely by a combination of global development, energy cost, inflation and fears of recession. There will also be challenges and obstacles to growth due perennial lack of reforms.

“Energy cost will represent an important factor for the productive sector. The cost of food and quality of social support will bear heavily on the minds of consumer and vulnerable segments respectively. The management of the debt stock will be very critical for government and economic outcomes. 2022 demonstrated the limited and narrowing fiscal space and policy options available to government. For 2023 the options will remain limited but presents great opportunities to focus on areas of long neglect and those in need of serious and urgent reform, financial and otherwise. Despite any significant growth the country may realise, reforms are an imperative to finding the path to sustainable economic resiliency. We would be delighted to see this journey started in earnest in 2023.

2023 tax credits for EVs will boost their appeal

By HOPE YEN AND TOM KRISHER Associated Press

STARTING Jan. 1, many Americans will qualify for a tax credit of up to $7,500 for buying an electric vehicle.

The credit, part of changes enacted in the Inflation Reduction Act, is designed to spur EV sales and reduce greenhouse emissions.

But a complex web of requirements, including where vehicles and batteries must be manufactured to qualify, is casting doubt on whether anyone can receive the full $7,500 credit next year.

For at least the first two months of 2023, though, a delay in the Treasury Department's rules for the new benefit will likely make the full credit temporarily available to consumers who meet certain income and price limits.

The new law also provides a smaller credit for people who buy a used EV.

Certain EV brands that were eligible for a separate tax credit that began in 2010 and that will end this year may not be eligible for the new credit. Several EV models made by Kia, Hyundai and Audi, for example, won't qualify at all because they are manufactured outside North America.

The new tax credit, which lasts until 2032, is intended to make zero-emission vehicles affordable to more people. Here is a closer look at it:

The credit of up to $7,500 will be offered to people who buy certain new electric vehicles as well as some plug-in gas-electric hybrids and hydrogen fuel cell vehicles. For people who buy a used vehicle that runs on battery power, a $4,000 credit will be available.

But the question of which vehicles and buyers will qualify for the credits is complicated and will remain uncertain until Treasury issues the proposed rules in March.

What's known so far is that to qualify for the credit, new EVs must be made in North America. In addition, caps on vehicle prices and buyer incomes are intended to disqualify wealthier buyers.

Starting in March, complex provisions will also govern battery components. Forty percent of battery minerals will have to come from North America or a country with a U.S. free trade agreement or be

recycled in North America. (That threshold will eventually go to 80%.)

And 50% of the battery parts will have to be made or assembled in North America, eventually rising to 100%.

Starting in 2025, battery minerals cannot come from a "foreign entity of concern," mainly China and Russia. Battery parts cannot be sourced in those countries starting in 2024 — a troublesome obstacle for the auto industry because numerous EV metals and parts now come from China.

There also are batterysize requirements.

Because of the many remaining uncertainties, that's not entirely clear.

General Motors and Tesla have the most EVs assembled in North America. Each also makes batteries in the U.S. But because of the requirements for where batteries, minerals and parts must be manufactured, it's likely that buyers of those vehicles would initially receive only half the tax credit, $3,750. GM says its eligible EVs should qualify for the $3,750 credit by March, with the full credit available in 2025.

Until Treasury issues its rules, though, the requirements governing where minerals and parts must be sourced will be waived. This will allow eligible buyers to receive the full $7,500 tax incentive for qualifying models early in 2023.

The Energy Department says 29 EV and plug-in models were manufactured in North America in the 2022 and 2023 model years. They're from Audi, BMW, Chevrolet, Chrysler, Ford, GMC, Jeep, Lincoln, Lucid, Nissan, Rivian, Tesla, Volvo, Cadillac, Mercedes and Volkswagen. Yet because of price limits or battery-size requirements, not all these vehicle models will qualify for credits.

To qualify, new electric sedans cannot have a sticker price above $55,000. Pickup trucks, SUVs and vans can't be over $80,000. This will disqualify two higher-priced Tesla models. Though Tesla's top sellers, the models 3 and Y, will be eligible, with options, those vehicles might exceed the price limits.

Kelley Blue Book says the average EV now costs over $65,000, though lowerpriced models are coming.

It depends on your income. For new EVs, buyers cannot have an adjusted gross income above $150,000 if single, $300,000 if filing jointly and $225,000 if head of a household.

THE TRIBUNE Wednesday, December 28, 2022, PAGE 3

PAGE B1

By FATIMA HUSSEIN Associated Press

A SECTION of the $1.7 trillion spending bill passed Friday has been billed as a dramatic step toward shoring up retirement accounts of millions of U.S. workers. But the real windfall may go to a far more secure group: the financial services industry.

The retirement savings measure labeled Secure 2.0 would reset how people enroll in retirement plans — from requiring them to opt into plans, to requiring them to opt out. The provision is designed to ensure greater participation.

It also allows workers to use their student loan payments as a substitute for their contributions to their retirement plans — meaning they can get matching retirement contributions from their employers by paying off that debt — increases the age for required distributions from plans, and expands a tax-deductible saver’s credit.

But as with so many far-reaching spending bills that get little public consideration, provisions of the legislation also benefit corporate interests with a strong financial interest in the outcome.

“Some of these provisions are good and we want to help people who want to save — but this is a huge boon to the financial services industry,” says Monique Morrissey an economist at the liberal Economic Policy Institute in Washington. Some parts of the bill, she says, are “disguised as savings incentives.”

Daniel Halperin, a Harvard law professor who specializes in tax policy and retirement savings, said one of the most clear benefits to industry is the provision that gradually increases the age for mandatory distributions from 72 to 75. “The goal is to leave that money there for as long as possible,” in order to collect administrative fees, he said. “For people who have $5 to $7 to $10 million saved, firms keep collecting fees. It’s crazy to allow them to leave it there.”

Companies like BlackRock Funds Services Group, Prudential Financial, Pacific Life Insurance and business lobbying groups such as the Business Roundtable and American Council of Life Insurers are only some of the entities that lobbied lawmakers on Secure 2.0, Senate lobbying disclosures show.

Spending bill aids retirees, and boosts financial industry

accounts. The new accounts let workers create tax-protected rainy day funds. The legislation also expands the saver’s credit, which provides a 50 percent tax credit on savings up to $2,000, that will be deposited directly into a taxpayer’s IRA or retirement plan.

Morrissey and other retirement experts also say the provisions are a reminder of the need to shore up Social Security — the social program that benefits more than 70 million recipients — retirees, disabled people and children. The annual Social Security and Medicare trustees report released in June says the program’s trust fund will be unable to pay full benefits beginning in 2035.

For many Americans, Social Security — financed by payroll taxes collected from workers and their employers — is their only means of retirement savings.

In the sweeping spending package passed Friday, lawmakers authorized roughly half of the $1.4 billion spending increase proposed by the Biden administration for Social Security.

“Funding for the Social Security Administration has steadily eroded over the past decade, while the number of people it serves has grown,” said Nancy LeaMond, AARP executive vice president. “This has resulted in longer wait times, overwhelmed field offices and disability processing times that have skyrocketed to an all-time high.

“More must be done,” she said.

Katherine DeBerry, a representative from Prudential, said the firm applauds the passage of Secure 2.0, stating that it “will help ensure employees’ retirement savings last a lifetime.”

A representative from Blackrock declined to comment and Pacific Life, the Business Roundtable and American Council of Life Insurers did not respond to Associated Press requests for comment. The disclosure forms require only minimal information about the outcome the lobbyists sought.

Retiring Sen. Rob Portman (R-Ohio) and Sen. Ben Cardin (D-Md.) had been ushering Secure 2.0 through the massive spending

bill known as an omnibus. Nearly half of the 92 provisions in Secure 2.0 come, in full or part, from Cardin-Portman legislation that was approved unanimously by the Senate Finance Committee in the summer.

“Senator Cardin is proud of his role producing a balanced package that is supported by business, labor and consumer groups,” Cardin spokesperson Sue Walitsky said in a statement. “It protects and encourages retirement savings among the most vulnerable, particularly lowerincome individuals.”

Mollie Timmons, a spokeswoman for Portman said the provisions of Secure 2.0 will “help

part-time workers and help more small businesses offer retirement plans to their workers, which is where most lower-income workers are employed.”

Both lawmakers’ campaigns have received large contributions from firms tied to the retirement industry, according to OpenSecrets — with Cardin receiving $329,271 from the securities and investment industry from 2017 to 2022 and Portman receiving $515,996 from the same industries in the same period.

There are good provisions in the legislation for average Americans, experts say, like the creation of employer emergency savings accounts alongside retirement

In a Pew Research Center poll in January, 57 percent of U.S. adults said that “taking steps to make the Social Security system financially sound” should be a top priority for the president and Congress. Securing Social Security got bipartisan support, with 56% of Democrats and 58% of Republicans calling it a top priority. Nancy Altman, co-director of Social Security Works, an advocacy group, said Congress should be adequately funding Social Security if “the goal was to really help middle income families.”

Still, the latest legislation is a small step meant to assist the millions of Americans who haven’t saved for retirement.

U.S. Census data show that roughly half of Americans are saving for their retirement. In 2020, 58% of working-age baby boomers owned at least one type of retirement account, followed by 56% of Gen X-ers, 49% of millennials and 7.7% of Gen Z-ers.

Florida crops appear to escape damage from unusual cold

ORLANDO, FLA. Associated Press

FLORIDA'S citrus, fruit and vegetable crops appear to have escaped any widespread damage from some of the coldest weather in years, officials with state growers' associations said Tuesday.

A cloud cover helped protect citrus trees in areas where the thermometer hovered around or below

freezing, though there may be some pockets of damage, said Matt Joyner, CEO of Florida Citrus Mutual.

"Indications so far are that the industry fared fairly well," Joyner said in an email. "It appears that we were right on the edge of what could have been a devastating event."

Florida's fruit and vegetable growers also reported no widespread damage to crops, though growers

are still assessing the cold weather's impact, said Christina Morton, director of communications for the Florida Fruit & Vegetable Association.

"Early reports are showing growers were pretty fortunate considering how cold it got and for how long it hung around," Morton said in an email.

Over the weekend, parts of the Florida Panhandle had wind chills

that dipped into the single digits, and interior parts of central Florida had temperatures plunging as low as 27 degrees Fahrenheit (minus 2.7 degrees Celsius).

At Tampa International Airport, the thermometer dipped below freezing for the first time in almost five years.

Florida is the primary supplier of fresh fruits and vegetables for the rest of the country during the winter, and growers last week harvested as much of their crops as possible ahead of the Arctic blast.

In the state's midsection, where blueberries, strawberries and blackberries are grown, growers used overhead irrigation to spray a protective coat of ice around the fruit.

Florida agriculture already was battered this fall by two hurricanes — Ian and Nicole. Hurricane Ian hit citrus groves hard, as well as the state's large cattle industry, dairy operations, vegetables like tomatoes and peppers, and even hundreds of thousands of bees essential to many growers.

Citrus is big business in Florida, with more than 375,000 acres (152,000 hectares) in the state devoted to oranges, grapefruit, tangerines and the like for an industry valued at more than $6 billion annually. Most Florida oranges are used to make juice, and this season's drastically lower harvest, combined with the slam from Ian, will press prices upward and force producers to rely even more heavily on California and imported oranges from Latin America.

PAGE 4, Wednesday, December 28, 2022 THE TRIBUNE

A COUPLE walks down the Bacon Gallery at the Erie Art Museum, in Erie, Pa., Jan. 7, 2014. A section of the new $1.7 trillion spending bill from Congress has been billed as a dramatic step toward shoring up retirement accounts of millions of workers.

Photo:File/AP

Commonwealth of The Bahamas In The Supreme Court Common Law and Equity Side In the Matter of the Quieting Titles Act 1959 AND IN THE MATTER OF all piece parcel or lot of land being a portion of Lot No. 54, Malcolm Allotments situate in the Southern District of the Island of New Providence, Commonwealth of The Bahamas AND IN THE MATIER OF the Petition of Loreen Leonora Russell 2022 CLE/qui/00821 NOTICE The Petition of Loreen Leonora Russell in respect of:ALL THAT piece Lot of land situate in the Southern District of the Island of New Providence and being a portion of Lot No. 54 Malcolm Allotments on the said plan of the said Subdivision LOREEN LEONARA RUSSELL claims to be the owner of the fee simple estate in possession of the said land and has applied to the Supreme Court of The Bahamas under S.3 of the Quieting Titles Act, 1959 in the above action to have its title to the said land investigated the nature and extent thereof determined and declared i n a Certificate of Title to be granted by the c ourt in accordance w i th provisions of th e said Ac t. C opies of the s aid P lan may be inspected during normal office ours at the Registry of the Supreme Court, Bridsh American Bank Building, Marlborough Street in the City of Nassau, and at the Chambers of E.D. M Law Group, Suite 2 upstairs Workers House, Harrold Road, Nassau Bahamas NOTICE IS HEREBY GIVEN that any person having dower or a right to dower or any adverse claim not recognized in the Petition shall before the 23rd day of J anuary A.D., 2023 file in the said Registry of The Supreme Court and serve the Petitioner o r the above E D.M. Law Group a statement of such claim in the prescribed form verified by an Affidavit to be filed herewith. Failure of any such person to file and serve a statement of such claim by the above time will operate as a bar to such claim E D.M. Law Group Suite 2 upstairs Workers House Harrold Road Nassau The Bahamas Attorneys for the Petitioner

HOLIDAY SALES UP 7.6% DESPITE THE SQUEEZE OF INFLATION

NEW YORK Associated Press

HOLIDAY sales rose this year as American spending remained resilient during the critical shopping season despite surging prices on everything from food to rent, according to one measure.

Holiday sales rose 7.6, a slower pace than the 8.5% increase from a year earlier when shoppers began spending the money they had saved during the early part of the pandemic, according to Mastercard SpendingPulse, which tracks all kinds of payments including cash and debit cards.

Mastercard SpendingPulse had expected a 7.1% increase. The data released Monday excludes the automotive industry and is not adjusted for inflation, which has eased somewhat but remains painfully high.

U.S. sales between Nov. 1 and Dec. 24, a period that is critical for retailers, were

fueled by spending at restaurants and on clothing.

By category, clothing rose 4.4%, while jewelry and electronics dipped roughly 5%. Online sales jumped 10.6% from a year ago and in-person spending rose 6.8%. Department stores registered a modest 1% increase over 2021.

“This holiday retail season looked different than years past,” Steve Sadove, the former CEO and chairman at Saks and a senior advisor for Mastercard, said in a prepared statement.

“Retailers discounted heavily, but consumers diversified their holiday spending to accommodate rising prices and an appetite for experiences and festive gatherings post-pandemic.”

Some of the increase reflected the impact of higher prices across the board.

Consumer spending accounts for nearly 70% of U.S. economic activity, and Americans have remained

resilient ever since inflation first spiked almost 18 months ago. Cracks have begun to show, however, as higher prices for basic necessities take up an increasingly large share of everyone’s take-home pay.

Inflation has retreated from the four-decade high it reached this summer, but it’s still sapping the spending power of consumers.

Prices rose 7.1% in November from a year ago, down from a peak of 9.1% in June.

Overall spending has slowed from the pandemicinfused splurges and shifted increasingly toward necessities like food, while spending on electronics, furniture, new clothes and other non-necessities has faded. Many shoppers been trading down to private label goods, which are typically less expensive than national brands. They’ve been going to cheaper stores like dollar chains and big box stores like Walmart.

Facebook parent Meta will pay $725M to settle user data case

SAN FRANCISCO Associated Press

FACEBOOK'S corporate parent has agreed to pay $725 million to settle a lawsuit alleging the world's largest social media platform allowed millions of its users' personal information to be fed to Cambridge Analytica, a firm that supported Donald Trump's victorious presidential campaign in 2016.

Terms of the settlement reached by Meta Platforms, the holding company for Facebook and Instagram, were disclosed in court documents filed late Thursday. It will still need to be approved by a judge in a San Francisco federal court hearing set for March.

The case sprang from 2018 revelations that Cambridge Analytica, a firm with ties to Trump political strategist Steve Bannon, had paid a Facebook app

developer for access to the personal information of about 87 million users of the platform. That data was then used to target U.S. voters during the 2016 campaign that culminated in Trump's election as the 45th president.

Uproar over the revelations led to a contrite Zuckerberg being grilled by U.S. lawmakers during a high-profile congressional hearing and spurred calls for people to delete their Facebook accounts. Even though Facebook's growth has stalled as more people connect and entertain themselves on rival services such as TikTok, the social network still boasts about 2 billion users worldwide, including nearly 200 million in the U.S. and Canada.

The lawsuit, which had been seeking to be certified as a class action representing Facebook users, had asserted the privacy breach

proved Facebook is a "data broker and surveillance firm," as well as a social network.

The two sides reached a temporary settlement agreement in August, just a few weeks before a Sept. 20 deadline for Meta CEO Mark Zuckerberg and his long-time chief operating officer, Sheryl Sandberg, to submit to depositions.

The company based in Menlo Park, California, said in statement Friday it pursued a settlement because it was in the best interest of its community and shareholders.

"Over the last three years we revamped our approach to privacy and implemented a comprehensive privacy program," said spokesperson Dina El-Kassaby Luce. "We look forward to continuing to build services people love and trust with privacy at the forefront."

Consumers also waited for deals. Stores expected more procrastinators to hit stores in the last few days before Christmas compared with a year ago when people began shopping earlier due to a global disruption of the supply chain that created thousands of product shortages.

“Consumers are trying to spread out their budget, and they are evaluating and shopping at different stores,” said Katie Thompson, the lead of

consultancy Kearney’s Consumer Institute.

In November, shoppers cut back sharply on retail spending compared with the previous month. Retail sales fell 0.6% from October to November after a sharp 1.3% rise the previous month, the government said in mid-December. Sales fell at furniture, electronics, and home and garden stores.

A broader picture of how Americans spent their money arrives next month when the National Retail

Federation, the nation’s largest retail trade group, comes out with its combined two-month results based on November-December sales figures from the Commerce Department.

The trade group expects holiday sales growth will slow to a range of 6% to 8%, compared with the blistering 13.5% growth of a year ago.

Analysts will also be dissecting fourth-quarter financial results from major retailers in February.

THE TRIBUNE Wednesday, December 28, 2022, PAGE 5

A SHOPPER carries bags down Fifth Avenue on Black Friday, Nov. 25, 2022, in New York. Holiday sales rose as shoppers showed some resilience during the most important shopping season despite surging prices on everything from food to rent.

Photo:Julia Nikhinson/AP

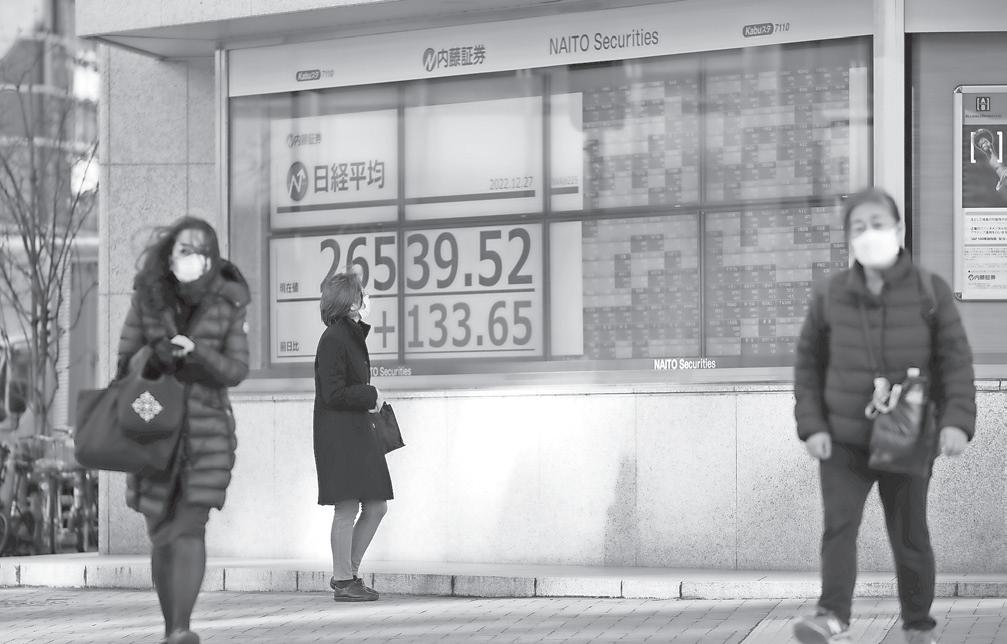

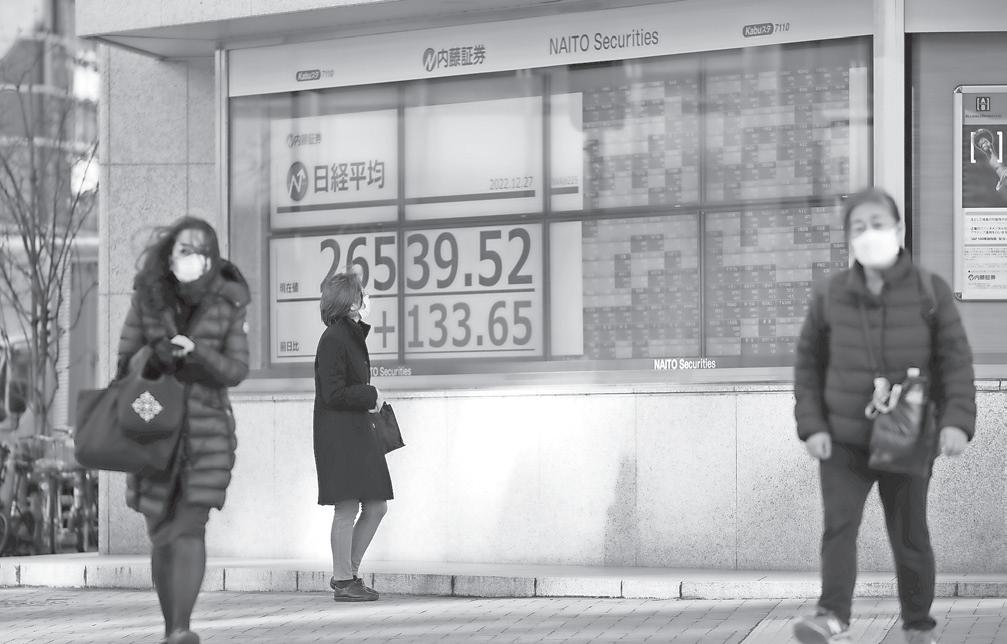

Stocks mostly fall on Wall Street, adding to recent losses

By ALEX VEIGA AP Business Writer

STOCKS were mostly lower Tuesday afternoon after the long holiday weekend, adding to the market’s recent losses as Wall Street counts down its final days of trading in 2022 after a painful year for investors.

The S&P 500 was down 0.5% as of 2:31 p.m. Eastern, while the Nasdaq composite was down 1.4%. Both indexes are coming off their third straight weekly loss. The Dow Jones Industrial Average rose 7 points, or less than 0.1%, to 33,212.

Technology stocks, automakers and communication services companies accounted for a big share of the decliners in the S&P 500. Apple fell 1.5%, Ford slid 1.3% and Netflix was off 2.9%.

Airlines stocks were broadly lower after a massive winter storm caused widespread delays and forced several carriers to cancel flights over the weekend. Delta Air Lines fell 1.1%, American Airlines dropped 1.1% and JetBlue was 1.4% lower.

Southwest Airlines slid 5.6% after the company had to cancel roughly

NOTICE is hereby given that JEANCILIA PIERRE of P.O Box Kennedy Subdivision Road, Nassau, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 21st day of December, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE

NOTICE is hereby given that ELVIS CHARLES of Pinedale, Eight Mile Rock, Freeport, Grand Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 21st day of December, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

two-thirds of its flights over the last couple of days, which it blamed on problems related to staffing and weather. It is a rare stumble for Southwest, an airline typically known as one of the more reliable carriers in good times and bad.

Energy stocks were the biggest gainers among S&P 500 companies as crude oil and natural gas prices headed higher. Hess rose 1.1%.

Treasury yields mostly rose as the U.S. bond market reopened. The yield on the 10-year Treasury, which influences mortgage

rates, rose to 3.85% from 3.75% late Friday.

Trading on Wall Street is expected to be relatively light this holiday-shortened week as investors look ahead to 2023 after a dismal year for stocks.

Uncertainty about how far the Federal Reserve and other central banks would go to fight the highest inflation in decades has kept investors on edge. The Fed raised its key interest rate seven times this year and has signaled more hikes to come in 2023, even though the pace of price increases has been easing.

Seeking Position

I am a resourceful, innovative, and proactive female seeking the position of Executive Administrative and P.A.

I

I

I also facilitate customer training workshops and programs. Resume and References are available by request. Please contact me via email for further information at customfocus@live.com

NOTICE

NOTICE is hereby given that WILLIAM KAJOKAYA of P.O Box SP 60178 High Vista, Nassau, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 21st day of December, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

The high rates, which weigh heavily on prices for stocks and other investments, have fueled concerns that the economy could slow too much and slip into a recession next year.

The benchmark S&P 500 index set an all-time high at the beginning of January, but is now down nearly 20% for the year. The techheavy Nasdaq is down nearly 34%.

Elsewhere around the world, shares advanced Tuesday after China announced it would relax more of its pandemic restrictions despite widespread outbreaks of COVID-19 that are straining its medical systems and disrupting business.

China’s National Health Commission said Monday

that passengers arriving from abroad will no longer have to observe a quarantine, starting Jan. 8. They will still need a negative virus test within 48 hours of their departure and to wear masks on their flights.

But it was the latest step toward dropping once-strict virus-control measures that have severely limited travel to and from the world’s No. 2 economy.

“With economic activity floundering, and multinationals questioning the viability of China as a sourcing location, policymakers have — as so many times in the past — adopted a very business-like approach,” Stephen Innes of SPI Asset Management said in a commentary.

NOTICE

www.bisxbahamas.com

(242)323-2330 (242) 323-2320

THIS IS TO INFORM THE GENERAL PUBLIC THAT THE PRVATE ROADWAYS AND PARKING AREAS SITUATED IN THE HARBOUR BAY SHOPPING PLAZA BETWEEN EAST BAY STREET AND SHIRLEY STREET WILL BE CLOSED ON SUNDAY 1ST JANUARY 2023 IN ORDER TO PRESERVE THE RIGHT OF WAY OWNERSHIP THEREOF.

PAGE 6, Wednesday, December 28, 2022 THE TRIBUNE

A WOMAN looks at Japan’s Nikkei 225 index and stock prices shown at a securities firm as others walk across an intersection in Tokyo, Tuesday, Dec. 27, 2022. Shares advanced Tuesday in Asia after China announced it would relax more of its pandemic restrictions despite widespread outbreaks of COVID-19 that are straining its medical systems.

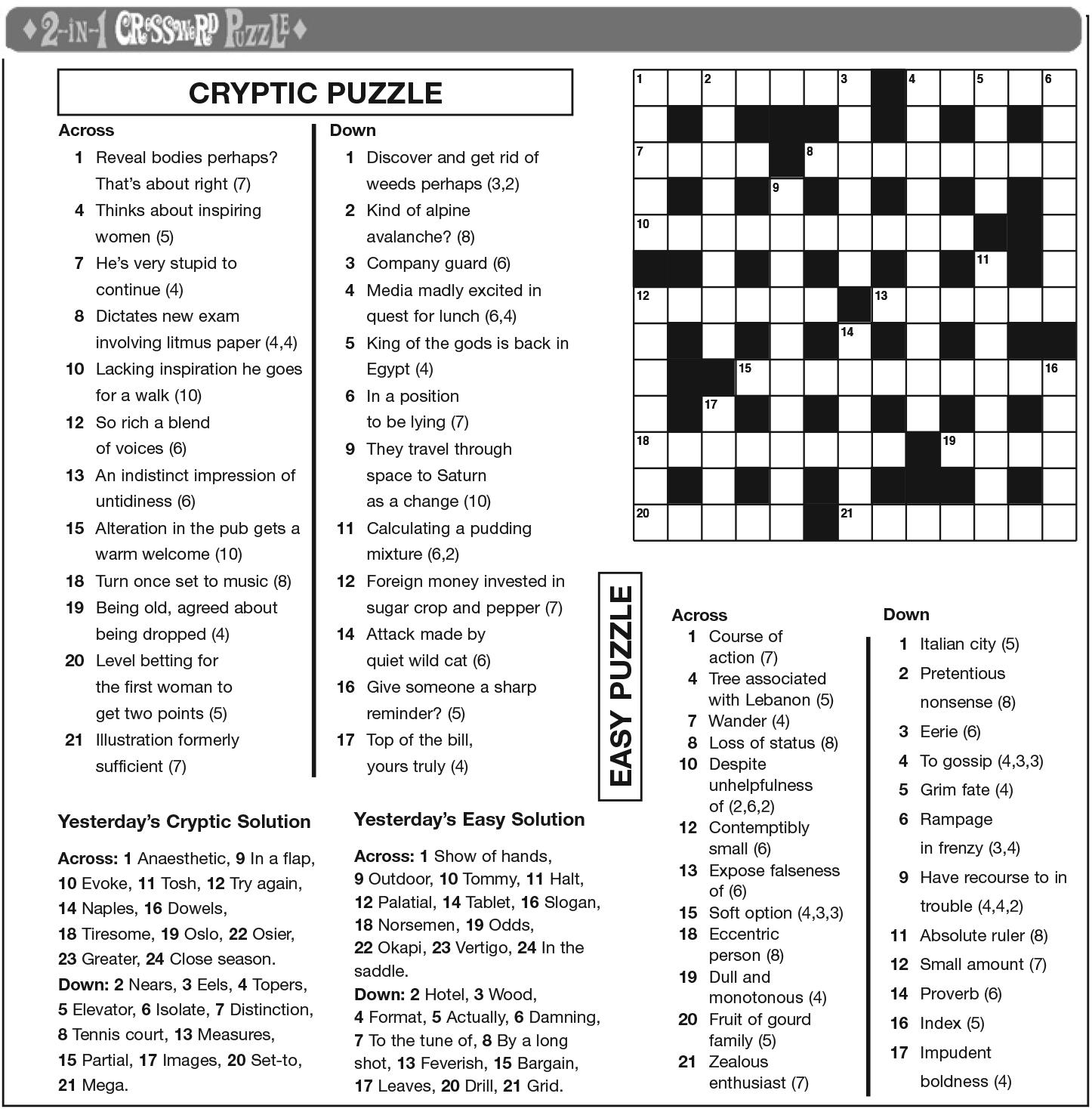

FRIDAY, 23 DECEMBER 2022 CLOSECHANGE%CHANGEYTDYTD% BISX ALL SHARE INDEX: 2647.730.140.01419.4918.83 BISX LISTED & TRADED SECURITIES 52WK HI52WK LOWSECURITY SYMBOLLAST CLOSECLOSECHANGE VOLUMEEPS$DIV$P/E YIELD 7.005.30 AML Foods Limited AML 6.95 6.950.00 3000.2390.17029.12.45% 53.0040.03 APD Limited APD 39.95 39.950.00

2.761.60Benchmark BBL 2.76 2.760.00

2.462.31Bahamas First Holdings Limited BFH 2.46 2.460.00

2.852.25Bank of Bahamas BOB 2.61

Property Fund BPF

9.808.78Bahamas Waste BWL

4.502.82Cable Bahamas CAB

10.657.50Commonwealth Brewery CBB

Bank CBL

Holdings CHL

FirstCaribbean Bank CIB

3.251.99Consolidated Water BDRs CWCB

11.2810.05Doctor's Hospital DHS 10.50

11.679.16Emera Incorporated EMAB

11.5010.06Famguard FAM 11.22

18.3014.50Fidelity Bank (Bahamas) Limited FBB

4.003.55Focol FCL

11.509.85Finco FIN 11.00

16.2515.50J. S. Johnson JSJ

PREFERENCE SHARES 1.001.00Bahamas First Holdings PreferenceBFHP 1.00 1.000.00

1000.001000.00 Cable Bahamas Series 6 CAB6 1000.001000.000.00

1000.001000.00 Cable Bahamas Series 9 CAB9 1000.001000.000.00

1.001.00Colina Holdings Class A CHLA 1.00 1.000.00

10.0010.00Fidelity Bank Bahamas Class A FBBA 10.0010.000.00

1.001.00Focol Class B FCLB 1.00 1.000.00

CORPORATE DEBT - (percentage pricing) 52WK HI52WK LOWSECURITY SYMBOLLAST SALECLOSECHANGEVOLUME 100.00100.00Fidelity Bank (Note 22 Series B+)FBB22 100.00100.000.00 100.00100.00Bahamas First Holdings LimitedBFHB 100.00100.000.00 BAHAMAS GOVERNMENT STOCK - (percentage pricing) 115.92104.79Bahamas Note 6.95 (2029) BAH29 107.31107.310.00 100.00100.00BGS: 2014-12-7Y BG0107 100.00100.000.00 100.00100.00BGS: 2015-1-7Y BG0207 100.00100.000.00 100.00100.00BGS: 2014-12-30Y BG0130 100.00100.000.00 100.00100.00BGS: 2015-1-30Y BG0230 100.00100.000.00 100.00100.00BGS: 2015-6-7Y BG0307 100.00100.000.00 100.00100.00BGS: 2015-6-30Y BG0330 100.00100.000.00 100.00100.00BGS: 2015-10-7Y BG0407 100.00100.000.00 102.07102.07BGRS FX BGR105026 BSBGR1050263 102.07102.070.00 102.73100.97BGRS FX BGR141230 BSBGR1412307 102.73102.730.00 103.16103.16BGRS FX BGR142231 BSBGR1420318 103.16103.160.00 100.71100.01BGRS FL BGRS70023 BSBGRS700238 100.71100.710.00 91.9191.91BGRS FX BGR127139 BSBGR1271398 100.00100.000.00 92.6792.67BGRS FX BGR131239 BSBGR1312390 92.5592.550.00 90.9890.98BGRS FX BGR132249 BSBGR1322498 90.9590.950.00 94.8094.80BGRS FX BGR134140 BSBGR1341407 93.9493.940.00 100.39100.39BGRS FX BGR138230 BSBGR1380306 100.39100.390.00 96.8496.84BGRS FX BGR138240 BSBGR1380405 96.1096.100.00 100.32100.32BGRS FL BGRS81035 BSBGRS810359 100.66100.660.00 100.34100.34BGRS FL BGRS81037 BSBGRS810375 100.17100.170.00 100.57100.57BGRS FL BGRS84033 BSBGRS840331 100.15100.150.00 MUTUAL FUNDS 52WK HI52WK LOW NAV YTD%12 MTH% 2.582.11 2.583.48%3.87% 4.883.30 4.884.49%5.32% 2.261.68 2.262.74%3.02% 205.22164.74 190.45-6.40%-6.95% 212.41116.70 169.68-20.12%-15.15% 1.761.71 1.762.49%2.79% 1.941.78

1.881.79

1.030.93

11.228.45

N/A N/A MARKET TERMS BISX ALL SHARE INDEX - 19 Dec 02 = 1,000.00 YIELD - last 12 month dividends divided by closing price 52wk-Hi - Highest closing price in last 52 weeks Bid $ - Buying price of Colina and Fidelity - Lowest closing price in last 52 weeks Ask $ - Selling price of Colina and fidelity Previous Close - Previous day's weighted price for daily volume Last Price - Last traded over-the-counter price Today's Close - Current day's weighted price for daily volume Weekly Vol. - Trading volume of the prior week Change - Change in closing price from day to day EPS $ - A company's reported earnings per share for the last 12 mths Daily Vol. - Number of total shares traded today NAV - Net Asset Value DIV $ - Dividends per share paid in the last 12 months - Not Meaningful P/E - Closing price divided by the last 12 month earnings TO TRADE CALL: CFAL 242-502-7010 | ROYALFIDELITY 242-356-7764 | CORALISLE 242-502-7525 | LENO 242-396-3225 | BENCHMARK 242-326-7333 5.60% 17-Nov-2030 15-Feb-2031 15-Jul-2039 15-Jun-2040 4.53% 5.00% 29-Jul-2023 15-Jan-2039 15-Oct-2049 17-Jan-2040 15-Jun-2030 5.65% 5.35% 5.00% 5.35% 6.25% 30-Sep-2025 30-Sep-2022 6.25% 4.50% 6.25% 4.25% NAV Date 4.87% 4.68% 4.55% 4.81% 5.40% 5.14% FUND CFAL Bond Fund CFAL Balanced Fund CFAL Money Market Fund CFAL Global Bond Fund 15-Dec-2021 30-Jul-2022 15-Dec-2044 30-Jul-2045 26-Jun-2022 26-Jun-2045 15-Oct-2022 25-Nov-2022 22-Sep-2033 25-Jul-2026 26-Jul-2037 26-Jul-2035 31-Dec-2021 30-Nov-2022 30-Nov-2022 31-Oct-2022 30-Nov-2022 30-Nov-2022 30-Nov-2022 30-Nov-2022 31-Oct-2022 31-Oct-2022 INTEREST Prime + 1.75% MARKET REPORT 31-Dec-2021 31-Dec-2021 MATURITY 19-Oct-2022 20-Nov-2029 30-Nov-2022 30-Nov-2022 6.95% 4.50% 30-Sep-2022 31-Oct-2022 4.50% 6.25% Colonial Bahamas Fund Class D Colonial Bahamas Fund Class E Colonial Bahamas Fund Class F CFAL Global Equity Fund Leno Financial Conservative Fund Leno Financial Aggressive Fund Leno Financial Balanced Fund Leno Financial Global Bond Fund RF Bahamas Opportunities Fund - Secured Balanced Fund RF Bahamas Opportunities Fund - Targeted Equity Fund RF Bahamas Opportunities Fund - Prime Income Fund RF Bahamas International Investment Fund Limited - Equities Sub Fund RF Bahamas International Investment Fund Limited - High Yield Income Fund RF Bahamas International Investment Fund Limited - Alternative Strategies Fund

Photo:Hiro Komae/AP

0.9321.26042.93.15%

0.0000.020N/M0.72%

0.1400.08017.63.25%

2.610.00 0.0700.000N/M0.00% 6.306.00Bahamas

6.30 6.300.00 1.7600.000N/M0.00%

9.75 9.750.00 2000.3690.26026.42.67%

4.50 4.500.00 750-0.4380.000-10.3 0.00%

10.25 10.250.00 0.1400.00073.20.00% 3.652.54Commonwealth

3.60 3.600.00 0.1840.12019.63.33% 8.547.00Colina

8.53 8.530.00 0.4490.22019.02.58% 17.5012.00CIBC

15.99 15.990.00 0.7220.72022.14.50%

2.97 2.96 (0.01) 0.1020.43429.014.66%

10.500.00 0.4670.06022.50.57%

9.26 9.410.15 0.6460.32814.63.49%

11.220.00 0.7280.24015.42.14%

18.10 18.100.00 0.8160.54022.22.98%

3.98 3.980.00 5,0000.2030.12019.63.02%

11.000.00 0.9390.20011.71.82%

15.75 15.760.01 1,3540.6310.61025.03.87%

0.0000.0000.0000.00%

0.0000.0000.0000.00%

0.0000.0000.0000.00%

0.0000.0000.0006.25%

0.0000.0000.0007.00%

0.0000.0000.0006.50%

1.935.71%7.96%

1.863.39%3.91%

0.93-8.94%-9.55% 9.376.41 10.107.82%9.00% 11.837.62 13.4413.58%15.81% 7.545.66 7.712.57%2.83% 16.648.65 13.25-20.10%-19.25% 12.8410.54 12.03-4.50%-4.64% 10.779.57 10.59-0.55%-1.61% 16.279.88 16.27N/AN/A

11.223.00%25.60% 14.8911.20 N/A

NOTICE

NOTICEis hereby given that STEVE HESRON GLASGOW of P.O Box N4505 Commonwealth Drive, Nassau, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 21st day of December, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

assist and help CEO’s and other Executive Leaders stay organized by managing their schedules and keeping up with correspondence based on their needs.

am an independent thinker and I make good decisions. I have excellent verbal and communication skills and work efficiently and effectively. I am able to act as the point of contact among Executives, Employees, Clients and other external partners.

NOTICE THE OWNERS

PUBLIC

FOREIGN FIRMS: CHINA ‘TURNS CORNER’ BY ENDING QUARANTINE

By JOE MCDONALD Associated Press

FOREIGN companies welcomed China’s decision to end quarantines for travelers from abroad as an important step to revive slumping business activity while Japan on Tuesday joined India in announcing restrictions on visitors from the country as infections surge.

The ruling Communist Party’s abrupt decision to lift some of the world’s strictest anti-virus controls comes as it tries reverse an economic downturn. It has ended curbs that confined millions of people to their homes and sparked protests, but hospitals have been flooded with feverish, wheezing patients as the virus spreads.

The announcement late Monday that quarantines for travelers from abroad will end Jan. 8 is the biggest step toward ending limits that have kept most foreign visitors out of China since early 2020. Quarantines were reduced last month from seven days to five.

Also Monday, the government downgraded the official seriousness of COVID-19 and dropped a requirement for people with the virus to be quarantined. That added to a rapid drumbeat of steps to dismantle controls that had been expected to stay in place at least through mid-2023.

“It finally feels like China has turned the corner,” the chairman of the American Chamber of Commerce in China, Colm Rafferty, said in a statement. He said ending the quarantine “clears the way for resumption of normal business travel.”

Business groups have warned companies were shifting investment away from China because foreign executives were blocked from visiting.

The American chamber said more than 70% of companies that responded to a poll this month expect the impact of the latest wave of outbreaks to last no more than three months, ending in early 2023.

The British Chamber of Commerce expressed hope China will restart normal processing of business visas to allow “resumption of crucial people to people exchanges.” It said that will “contribute to restoring optimism and reinstating China as a priority investment destination.”

The move “will potentially boost business confidence,” but companies are likely to “wait to see how the situation on the ground evolves” before making long-term decisions, the European Chamber of Commerce in China said in a statement.

Meanwhile, Japan announced visitors from China will undergo virus tests starting Friday as a “temporary emergency measure.”

Visitors who test positive will be quarantined for one week, Prime Minister Fumio Kishida announced. He said Japan also would reduce a planned increase in the number of flights

between Japan and China “just to be safe.”

That follows India’s decision last week to begin requiring a negative virus test for travelers from China, Japan, Hong Kong, South Korea and Thailand.

India also randomly tests 2% of airline passengers arriving from abroad. Visitors who test positive or have symptoms will be quarantined.

A foreign ministry spokesman defended China’s handling of the latest outbreaks.

“The Chinese government has always followed the principle of science-based and targeted measures,” said Wang Wenbin. He called for a “science-based response and coordinated approach” to keep travel safe and “promote a steady and sound recovery of the world economy.”

China kept its infection rate low with a “zero COVID” strategy that aimed to stamp out virus transmission by isolating every case. That prompted complaints controls were too extreme and counterproductive.

Starting last month, the ruling party has gradually joined the United States and other governments that are trying to live with the virus by treating infections instead of imposing blanket quarantines on cities or neighborhoods.

The ruling party announced changes Nov. 11 it said were aimed at reducing disruptions after economic activity slid. More changes were announced following protests that erupted Nov. 25 in Shanghai and other cities.

The government has stopped reporting nationwide case numbers but announcements by some cities indicate at least tens and possibly hundreds of millions of people might have been infected since the surge began in early October.

The outbreaks prompted complaints Beijing relaxed controls too abruptly. Officials say the wave began before the changes.

The government “should have done the job in a more meticulous way,” said Lu Haoming, a Beijing architect. “Although the death rate of this disease is not as serious as at the beginning, the first shock has still been quite severe.”

But he agreed with the decision to open up. “You have to import and export, right?” Lu said. “Although we did a good job of epidemic control this year, the economy was greatly harmed.”

China only counts deaths from pneumonia or respiratory failure in its official COVID-19 toll, a health official said last week. That excludes many deaths other countries would attribute to COVID-19.

Experts have forecast 1 to 2 million deaths in China through the end of 2023.

The National Health Commission announced a campaign Nov. 29 to raise the vaccination rate among older Chinese. Health experts say that is crucial to avoiding a health care crisis.

THE TRIBUNE Wednesday, December 28, 2022, PAGE 7

PASSENGERS in protective gear are directed to a flight at a Capital airport terminal in Beijing on Dec. 13, 2022. Companies welcomed China’s decision to end quarantines for travelers from abroad as an important step to revive slumping business activity while Japan on Tuesday, Dec. 27, announced restrictions on visitors from the country as infections surge.

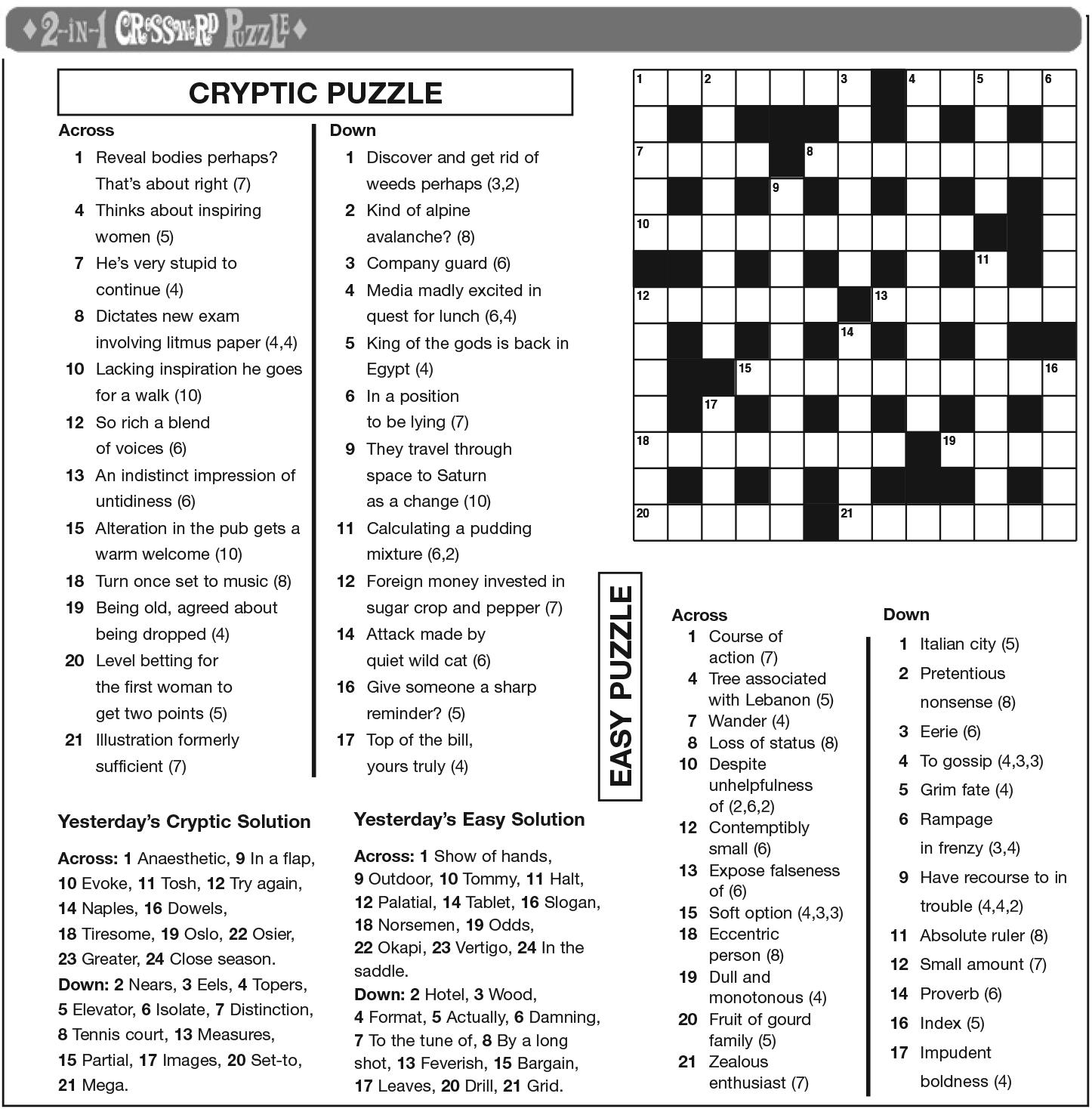

Monday, December 26, 2022 CROSSWORD PUZZLE Tuesday, December 27, 2022 CROSSWORD PUZZLE

Photo:Ng Han Guan/AP