By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

BAHA MAR’S main contractor asked the son of Perry Christie’s top policy adviser to intervene when his father proposed changing The Pointe’s Heads of Agreement over how many Bahamian construction workers would be employed.

E-mails tabled in the New York State Supreme Court on Friday reveal that Daniel Liu, China Construction America (CCA) Bahamas senior vice-president, made an urgent request for help within days of Sir Baltron Bethel altering the agreement’s wording to make clear that The Pointe’s 70:30 labour ratio in favour of Bahamians applied to construction workers only.

The documents, filed as part of Sarkis Izmirlian’s $2.25bn fraud and breach of contract claim against the Chinese state-owned contractor over Baha Mar’s failure, disclose that the person he reached out to for help was Sir Baltron’s son, Leslie.

He advised that the issue was “politically problematic for the Prime Minister”, given the Government’s stance about ensuring Bahamians must come first in all areas of life - especially on job and economic opportunities. He

suggested that, rather than focus on labour ratios, CCA instead stipulate “a dollar amount” that would be awarded to Bahamian contractors and assert it would hire more locals than had been engaged at Baha Mar.

Mr Bethel later described his father as “one of CCA’s biggest supporters”,

Bran: ‘Don’t abandon’ digital assets on

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE Democratic National Alliance’s (DNA) former leader is urging The Bahamas not to “abandon” the digital assets industry in the wake of FTX’s implosion but instead promote the jurisdiction with “even more vigour”.

Branville McCartney told Tribune Business that to “give up” on its ambitions for the sector now would simply provide critics attacking The Bahamas in the wake of the crypto currency exchange’s collapse with extra ammunition, while any work done to restore the country’s

tattered reputation would “be in vain”.

Calling on the Davis administration to “pull out all the stops” to counter the negative onslaught sparked by FTX’s now-US chief executive, John Ray, and

‘Permit restricted US dollar holdings without approval’

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

BAHAMIANS should be permitted to hold a limited amount of US dollars in their account without needing Central Bank approval as part of wider reforms to the commercial banking industry, a report has recommended.

A public consultation document, crafted for The Bahamas Think Tank following presentations by both the Central Bank governor and Securities Commission’s head, calls for the introduction of a series of measures to boost financial inclusion, access and the provision of lower-cost capital to small

businesses that “drive the economy”.

Edison Sumner, principal of Sumner Strategic Partners, who compiled the report for the Think Tank told Tribune Business that by the end of the 2023 first quarter he hoped to have sufficient public and banking

BPL fuel hike: Pintard asserts URCA ‘endorses’ law breach

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE Opposition’s leader is challenging whether electricity regulators are “endorsing” Bahamas Power & Light (BPL) breaking the law by asserting it has made an “adequate case” to hike its fuel charge by up to 163 percent.

Michael Pintard told Tribune Business that the Utilities Regulation and Competition Authority’s (URCA) short three-paragraph statement affirming that BPL’s rolling fuel charge increases are justified was “quite

puzzling” given that the October 4 plan unveiled by both the utility regulator and the Davis administration seemingly breaches the Bahamas Electricity Corporation (Amendment) regulations.

These were issued in the Government’s gazzette on June 26, 2020, and the Free National Movement (FNM) leader asserted that they do not permit BPL to create two distinct fuel charge rates for consumers as set out in the October plan that has now been implemented.

Mr Pintard, emphasising that he was “not

business@tribunemedia.net MONDAY, DECEMBER 19, 2022

adding that there were “others” in the Cabinet “who might not see things the same as OPM (Office of the Prime Minister)” where Sir Baltron worked as Mr Christie’s senior policy adviser and, ultimately, as the Government’s lead

SEE PAGE B6

FTX

CCA put son of PM’s top policy adviser on Pointe

SEE PAGE B11 SEE PAGE B8 SEE PAGE B4

BRANVILLE MCCARTNEY

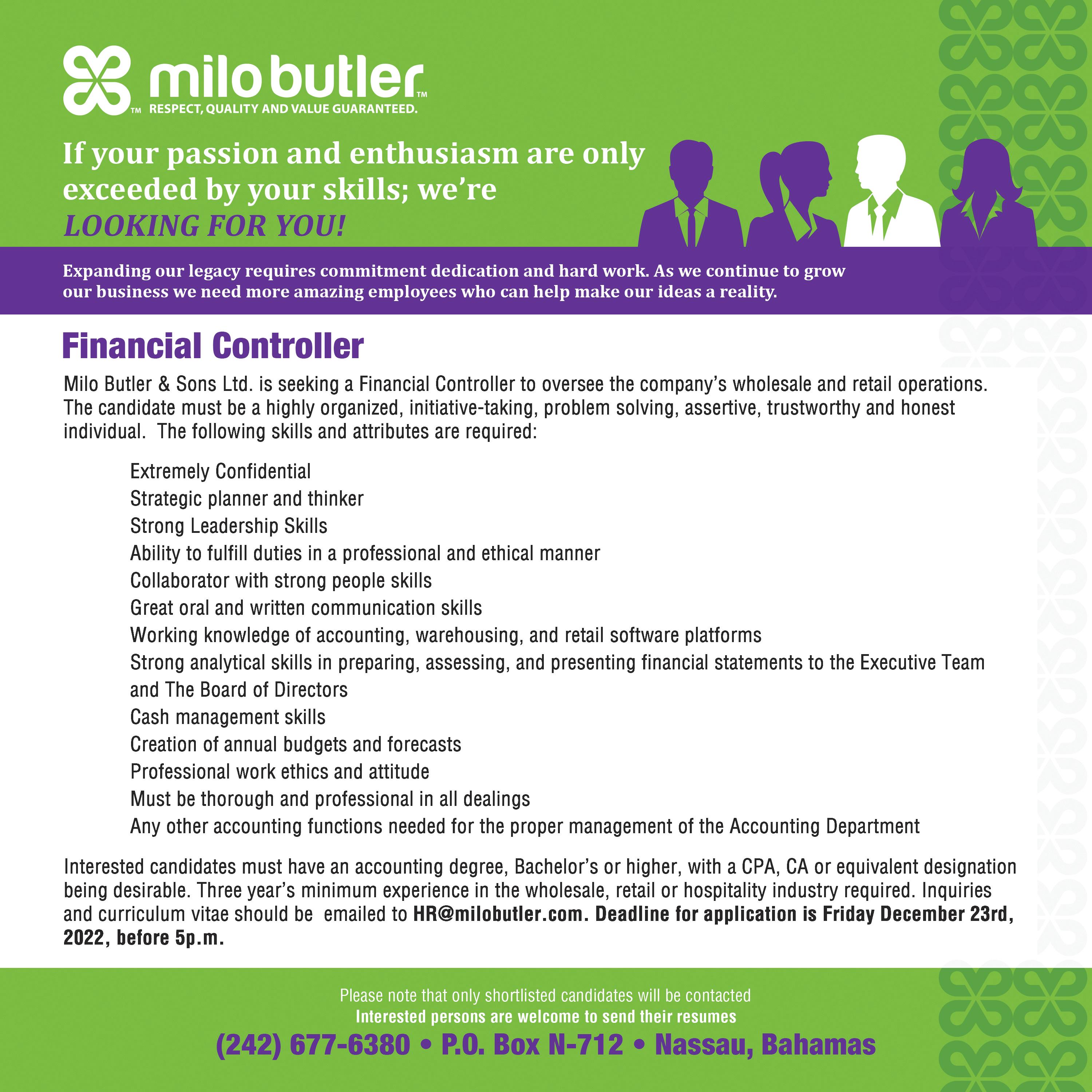

• Intervention sought on Sir Baltron’s labour changes • ‘Can’t hit’ 70% Bahamian construction employment • Son said father among CCA ‘biggest supporters’ SIR BALTRON BETHEL LESLIE BETHEL BAHAMAS POWER & LIGHT (BPL) HEADQUARTERS $5.85 $5.86 $5.97 $5.21

EDISON SUMNER

DON’T IGNORE RISKS WITH DIGITAL ASSETS

According to the International Association of Compliance (ICA), “the global virtual assets regulatory landscape is a patchwork of differing approaches, reflecting, in turn, the cultural, political and social differences

of many different jurisdictions”. Against this backdrop, it should be no surprise that both unregulated and regulated virtual asset service providers (VASPs) appear not to know what practices to follow (when unregulated) and are questioning the validity of what is expected (when regulated).

In the first of this twopart series, this writer discussed the significance of a risk-based approach by supervisory bodies in their regulation and monitoring of virtual assets and associated service providers. In the final part of this series, there will be an overview of the obligations facing entities involved in providing virtual asset services, and suggestions for their integrated risk management environments or lack thereof.

Responsibility of the providers under Financial Action Task Force (FATF) guidance

What is extremely helpful is that the Financial Action Task Force (FATF) has updated its guidance, clarifying the definitions of ‘virtual assets’ and ‘virtual asset services providers’; which providers should be licensed and/or registered; wire transfers and the travel rule; and how to approach customer due diligence (“CDD”). It confirmed that its Recommendations one, and nine through 21, should apply to regulated digital asset entities in the same manner that they apply to financial institutions.

However, there were two qualifications:

1. First, the occasional transaction threshold above which virtual asset services providers are required to conduct customer due diligence is 1,000 US dollars or euros (rather than 15 000).

2. Second, the wire transfer rules set out in FATF recommendation 16 apply to virtual asset services providers and virtual asset transfers in a modified form (the ‘travel rule’).

Risk management

Virtual assets services providers should have a multi-faceted approach to their governance and risk management environment. It is imperative to have a documented strategy; assessment of risks; responses to those risks through controls; effective communication and reporting; monitoring of the enterprise; and ensuring the technological business structure is aligned with identified risks.

The issue many virtual asset services providers face is their lack of implementation and strategic risk management. This stems from their belief that, because the business is not a traditional financial institution, it does not need the same levels of accountability surrounding

risk management processes, which is a fundamental mistake. The world is experiencing evidence of these mistakes, seemingly quarterly, through the implosion of many actors in the crypto currency arena. Virtual asset services providers should not get caught up in minutiae but, rather, define, understand and conceptualise the risks they face.

How a GRC professional can help virtual asset services providers

As regulatory frameworks and market trends evolve, governance, risk and compliance (GRC) specialists can provide guidance on the design and implementation of your business strategy. More precisely, they are able to offer:

· Updated compliance control frameworks and policies through assessment and guidance.

· Risk assessment assistance for financial crimes.

· A review of client files and a plan for remediation (Know Your Customer)

· Anti-money laundering and counter-terror finance training

Conclusion In short, both regulators and virtual asset services providers have substantial roles to play in the latter’s success. The rapid growth of virtual asset technologies and associated products is likely to lead to new laws and regulations being implemented by regulators around the world if they have not already done so. Equally, this rapid growth must be internally managed through agile risk management approaches and solutions.

• NB: About Derek Smith Jr

Derek Smith Jr. has been a governance, risk and compliance professional for more than 20 years. He has held positions at a TerraLex member law firm, a Wolfsburg Group member bank and a ‘big four’ accounting firm. Mr Smith is a certified anti-money laundering specialist (CAMS), and the compliance officer and money laundering reporting officer (MLRO) for CG Atlantic’s family of companies (member of Coralisle Group) for The Bahamas and Turks & Caicos.

PAGE 2, Monday, December 19, 2022 THE TRIBUNE

Derek Smith By

‘Real concern’ about $800m project’s environment impact

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

Abaco’s Chamber of Commerce president says there is a “real area of concern” about the potential environmental impact from an $800m mixed-use resort project targeted at South Abaco.

Daphne DegregoryMiaoulis told Tribune Business that while south Abaco’s economy would receive a much-needed potential boost from the Kakona South Abaco development, its location in proximity to 22,000 acres of Bahamas National Trust (BNT) property in the Abaco National Park - a key breeding ground for the Abaco parrot - needed to be carefully assessed.

“I would encourage the Government to put some real focus and emphasis on whatever they do [so as] not to be damaging to the environment. That’s the real

area of concern for that project,” she warned. “I would think the general population are excited about the prospect of having more revenue coming into the area, and the spin-offs that it’s going to create.

“But anyone who is basically environmentally conscious, I think they’re all going to be concerned about how it’s going to affect the area.” Few details were revealed on the project at Friday’s Heads of Agreement signing with the Davis administration, other than it will incorporate a marina that will accommodate boats up to 250 feet in length along with multiple home sites.

The developers were also said to have invested $50m in a project that has been on the drawing board for some 15 years, with the development taking options to acquire some 700 acres of south Abaco real estate - split into two parcels, 300 acres and 400 acres, respectively, in 2007. The Kakona development will also be near neighbours of another

multi-million dollar project, namely that oRa’anan ‘Ronnie’ Ben-Zur, the principal behind Tyrsoz Family Holdings.

John Pinder, the central and south Abaco MP, and parliamentary secretary at the Ministry of Tourism, Investments and Aviation, said at the project signing: “The full cost of the project is well over $800m. It’s nearing a billion dollars. The start is going to be within months as best I can say. There are some finalisations that have to do with certain governmental approvals.

“However, we’ll have shovels in the ground within months, and the finalisation is dependent on how quickly we could develop the skill set within our people to make it happen and supply chains and so on, so forth.”

Describing the project as a “monumental step forward” in Abaco’s development, Mr Pinder said: “The community and the people of South Abaco are behind this. It involves

hundreds of room keys. It has a marina that will be able to accommodate boats up to 250 feet, which goes in line with the ever-developing and increasing demand for yachting facilities.

“The workforce in South Abaco will have somewhere to go besides driving all the way to central where the economy is now centric. So it is important for the people of South Abaco to be able to feed their families, to be able to have a career and the youth to have a future right there in South Abaco.”

“It’s a significant undertaking to build, but it’s also going to be hundreds of jobs to sustain long-term, and there’s a skill training component to it. So we won’t be only looking for skilled workers outside of this country; we’ll be training our people to do the right jobs, and the skills will evolve as the project evolves.”

Mrs Degregory-Miaoulis, who is also the sales and marketing manager for Abaco Neem, said: “I’m

a farmer and all of my stuff is totally certified organic, so it should tell you where I am coming from. But when I see some of the prints of the project then I would be able to feel comfortable with it. But if the government has signed the Heads of Agreement then that means they are happy with it.

“I just hope this developer has all of his funding in place, because we don’t want what happened in Treasure Cat. That has ended up in a tragic stalemate and in court. It basically has the people in Treasure Cay held hostage.”

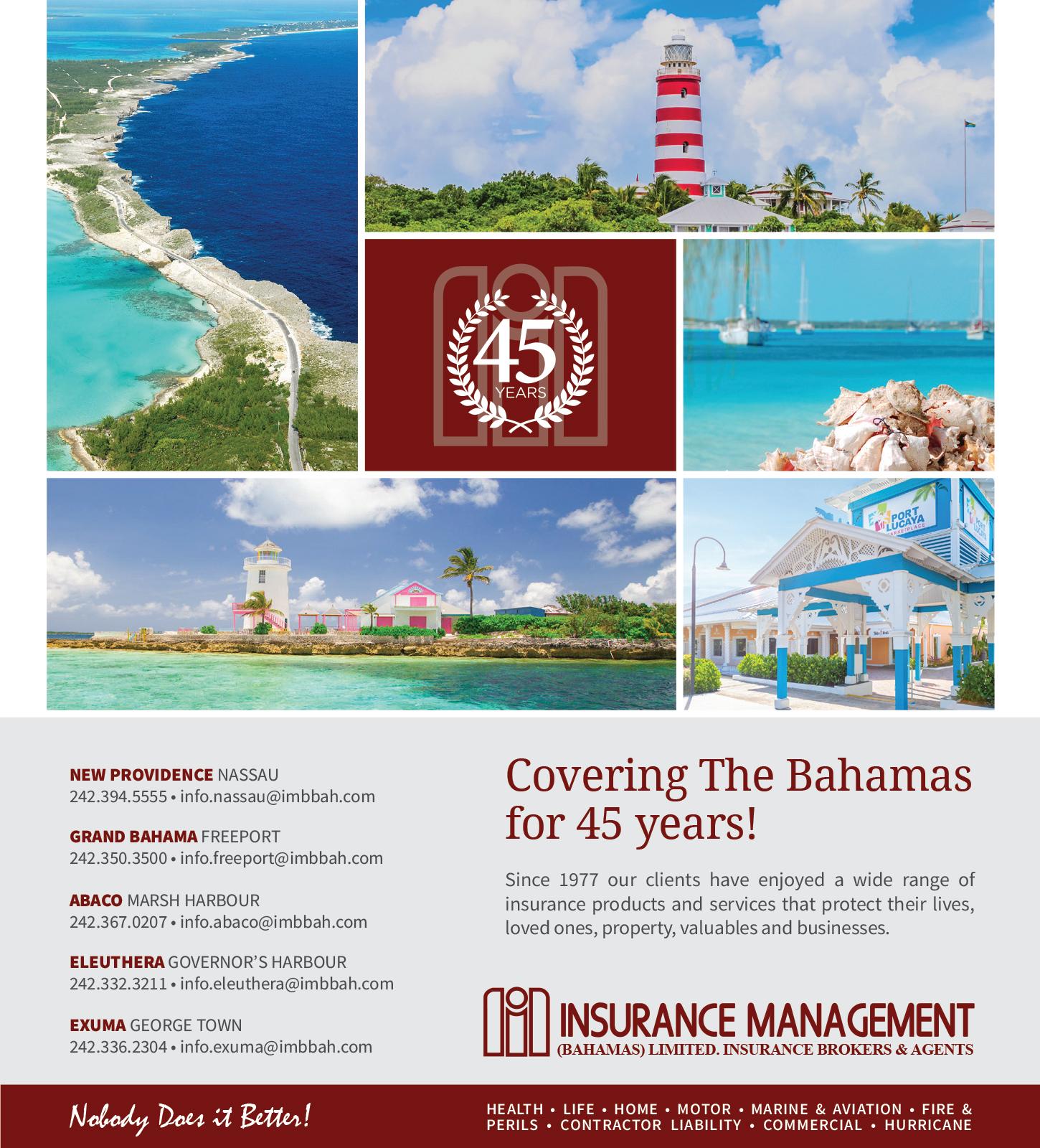

One Abaco development that is progressing is Montage Cay, which is moving ahead at pace with more than $60m in sales during the last 12 months of operation.

Mrs Degregory-Miaoulis said: “We’re excited about it. We met with the project developer and he’s very anxious to support Bahamian business. They actually came to look at our

Accountants unveil launch of internal audit specialist

TWO accountants have launched a company focused on providing internal audit services to Bahamian businesses.

Nekeisha Smith and Otimia Pennerman, who are both certified internal auditors (CIAs), and a former and current president of the Institute of Internal Auditors (IIA) Bahamas chapter, respectively, said in a statement that they have formed Internal Audit Solutions as an affiliate of The Solutions Group.

The duo, who are both licensed and registered with the Bahamas Institute of Chartered Accountants (BICA), said they recognised the market’s need for a specialist company dedicated to providing internal auditing services to help clients meet stakeholder and regulatory expectations.

Central Bank of the Bahamas, unveiled on December 6, 2022, provide a significant regulatory framework for internal auditing in The Bahamas. They set out the Central Bank’s expectations for effective internal audit functions in its bank and trust company licensees. They are required to implement an internal audit function, and conduct an independent review of this every five years.

Ms Smith and Ms Pennerman said many persons do not understand the differences between external and internal auditing, and often confuse and conflate the two roles. External auditors focus on providing independent assurance on the financial reporting of a company, whereas internal auditors provide independent assurance on a company’s ability to manage financial, strategic,

place and look at our landscaping, and what we have available, etc… They’re also going to be opening a spa and they were looking at the Neem products for the spa. They want to develop something that’s unique.”

“These are high end. They’re going to add that Baker’s Bay level of quality to the island, and eventually they will have a small hotel that can house prospective buyers and that sort of thing. And I think that what they’re going to be is environmentally sustainable, and we definitely are excited about anything that’s bringing new business and new energy to Abaco.”

Montage Cay was formerly known as Matt Lowe’s Cay, and is less than ten minutes by ferry from mainland Abaco. “You can literally see the cay from the mainland,” she said.

operational and compliance risks.

Internal Audit Solutions, they added, will help internal audit departments with a risk-based approach to internal auditing that focuses limited finances, time and human resources on the risks that matter most while balancing stakeholders’ and regulatory expectations. The duo said The Bahamas needs more trained internal auditors.

A CRUISE ship brought 152 passengers to Freeport during its first-ever visit to the city on Friday. Passengers on the Star Legend, a part of Windstar Cruises, disembarked to participate in various onshore activities.

Captain Krasimir Ivanov welcomed Ministry of Tourism officials, including the manager of its Freeport office, Sanique Culmer, who along with officials from the Grand Bahama Harbour Company and Bahamas Customs toured the ship following a plaque exchange.

The Star Legend will now head to Miami from Grand Bahama. Prior to arriving in The Bahamas,

The recently-implemented Internal Audit Guidelines from the

THE TRIBUNE Monday, December 19, 2022, PAGE 3

CALL 502-2394 TO ADVERTISE IN THE TRIBUNE TODAY!

the passengers were on a 14-day crossing of the Atlantic.

FIRST EVER FREEPORT VISIT

CRUISE SHIP IN

WHILE in port at Freeport Harbour, staff of the Ministry of Tourism welcomed the captain of Star Legend and participated in a plaque exchange to commemorate the occasion. This was the first time the luxury cruise line has called on Freeport. Shown from left are Sanique Culmer, manager of the Ministry of Tourism, Investments and Aviation’s Freeport office; Captain Krasimir Ivanov; and Nuvolari Chotoosingh, manager, niche markets and maritime tourism, Ministry of Tourism

I am a resourceful, innovative, and proactive female seeking the position of Executive Administrative and P.A. I assist and help CEO’s and other Executive Leaders stay organized by managing their schedules and keeping up with correspondence based on their needs. I am an independent thinker and I make good decisions. I have excellent verbal and communication skills and work efficiently and effectively. I am able to act as the point of contact among Executives, Employees, Clients and other external partners. I also facilitate customer training workshops and programs. Resume and References are available by request. Please contact me via email for further information at customfocus@live.com Seeking Position

Photo:Andrew Miller/BIS

CCA PUT SON OF PM’S TOP POLICY ADVISER ON POINTE

in resolving the Baha Mar dispute that ultimately led to Mr Izmirlian’s ouster as developer/owner.

Tribune Business previously revealed that how CCA paid $2.4m to Mr Bethel’s company, Notarc Management Group, and threw business its way at the Baha Mar dispute’s peak. Sir Baltron, though, denied to this newspaper that CCA’s payments influenced his stance towards the controversy and its participants, or his advice to the Government and its actions, after Mr Izmirlian filed for Chapter 11 bankruptcy protection in summer 2015.

The latest disclosures, though, shed fresh light on the links between Sir Baltron, his son and CCA. They will also raise questions as to whether Mr Bethel should have intervened by providing advice to the Chinese state-owned contractor in a matter involving his father given how close his family ties were to a then-key government official.

The e-mail chain covers a week-long period between May 13-21, 2015, a period which coincides with Baha Mar hurtling towards insolvency and its Chapter 11 bankruptcy protection filing at end-June 2015. They prove that Sir Baltron, and the Christie administration, were pursuing parallel or twin tracks simultaneously - trying to act as impartial arbitrators, or mediators, in the Baha Mar dispute while at the same time negotiating with CCA over The Pointe.

Other revelations also indicate that CCA sought to exploit the Christie administration’s desire to have Baha Mar fully open, and operational, before May 2017 knowing that its general election changes would likely hinge on several thousand

Bahamians being employed by the Cable Beach mega resort.

Mr Liu, in a July 6, 2017, e-mail to fellow CCA executives Tiger Wu and Dawei Wang, as well as the contractor’s ultimate boss, Ning Yuan, wrote: “We should take advantage of the Bahamas government. If the Government, Export-Import Bank of China and CCA join forces, we can turn passive into active.” This is being interpreted by Mr Izmirlian and his legal team as evidence of CCA’s desire to oust Baha Mar’s original developer at any price.

The issue of how many Bahamian contractors and construction workers were employed at The Pointe, a $200m development now featuring the Margaritaville resort, condo hotel, parking lot, retail, office and other amenities, was a long-running controversy amid work that largely took place under the Minnis administration.

There were frequent complaints that Bahamians were largely being excluded from work they could perform by a Chinese-dominated workforce that Beijing insists accompanies its capital investments wherever they are located. Numerous calls were made for the Department of Labour to investigate whether CCA was breaching the project Heads of Agreement, and denying contractors and their employees muchneeded income.

However, the documents obtained by Mr Izmirlian during the legal discover process for his own claim, reveal that CCA was so insistent on a majority Chinese workforce that it threatened to “downsize” The Pointe project unless it got its way.

This was triggered by Sir Baltron’s May 13, 2015, e-mail to Mr Liu and CCA’s

COMMONWEALTH OF THE BAHAMAS IN THE SUPREME COURT

COMMON LAW AND EQUITY DIVISION

Bahamian attorney, Lourey Smith at McKinney, Bancroft & Hughes. “I refer to your May 7 e-mail and your suggested language relating to the 70:30 ratio of Bahamian to non-Bahamian labour,” Sir Baltron told Mr Liu. “This ratio applies only to persons employed in construction.”

He then proposed altering the draft Heads of Agreement text to reflect this, amending a version that stipulated the same 70:30 ratio in favour of Bahamian workers was also to apply to operations staff and management. Sir Baltron’s version confirmed that Bahamian sub-contractors “will perform at least 40 percent of the construction work”, and be included as part of the 70:30 split.

Yet Mr Christie’s senior policy adviser crossed out language that included operations and management staff in this ratio. This provoked fury from Mr Liu and CCA, with the former writing: “It’s impossible for us to employ 70 percent Bahamian construction workers on the project because that only leaves 30 percent left as Chinese construction workers.

“If we have 400 Chinese workers that means we’d have to employ over 900 Bahamians. Then employ a further 500 permanent staff to run the hotel. For a start we won’t need 1,300 people to build this project and, second, why are the permanent staff being excluded or described differently from construction workers........

Jobs are jobs, right?”

CCA argued that “the super structure and shell and base build, large MEP (mechanical, engineering and plumbing” were construction skills “most Bahamians do not possess”, indicating that the fit-out of

2022

CLE/Qui/No. 01200

IN THE MATTER OF ALL THAT piece parcel or lot of land containing 3,784 square feet on a plan No. 2018127-1 situate on the Eastern edge of Lexington Avenue approximately 206 feet South of Wulff Road in the Southern District of the Island of New Providence one of the Islands of the Commonwealth of The Bahamas.

AND

IN THE MATTER OF THE PETITION OF FREDERICK EMERSON ARNETT AND

IN THE MATTER OF THE QUIETING TITLES ACT, 1959

The Petition of FREDERICK EMERSON ARNETT of Jerome Avenue in the Eastern District of the Island of New Providence one of the Islands of the Commonwealth of The Bahamas, in respect of:-

ALL THAT piece parcel of lot of land containing 3,784 square feet on a plan No. 2018127-1 situate on Eastern edge of Lexington Avenue approximately 206 feet South of Wulff Road in the Southern District of the Island of New Providence one of the Islands of the Commonwealth of The Bahamas.

Copies of the filed Plan may be inspected during normal office hours at the following places:

(a) The Registry of the Supreme Court, Ground Floor, British American Building, Marlborough Street, Nassau, Bahamas

(b) Michelle Y. Campbell & Co., Chambers #55 Mackey Street, Nassau, Bahamas

FREDERICK EMERSON ARNETT claims to be the owner in fee simple in possession of the parcel of land hereinbefore described free from encumbrances. And the Petitioner has made application to the Supreme Court of the Commonwealth of The Bahamas under Section 3 of the Quieting Titles Act, 1959 to have his title to the said tract of

land investigated and the nature and extent thereof determined and declared in a Certificate of Title to be granted by the Court in accordance with the provisions of the said Act.

Notice Is Hereby Given that any person having dower or right to dower or an Adverse Claim or a claim not recognized in the Petition shall on or before the expiration of thirty (30) days after the final publication of these presents, file in the Supreme Court and serve on the Petitioner or the undersigned a Statement of his claim in the prescribed form verified by an Affidavit to be filed therewith.

Failure of any such person to file and serve a Statement of his Claim on or before the expiration of thirty (30) days after the final publication of these presents will operate as bar to such claim.

Dated the 3rd day of November A. D., 2022

Michelle Y. Campbell & Co.

Chambers

#55 Mackey Street Nassau, Bahamas

Attorney for the Petitioner

The Pointe’s retail stores was more appropriate for locals.

Mr Liu justified the contractor’s stance by pointing to American and Mexican workers engaged on Baha Mar’s multi-storey car park and Atlantis’ MEP works, respectively, and added: “I think there is a misunderstanding at Cabinet level as to what’s possible on our project re: labour and also what’s available in the local work pool.”

The person he provided all this information to on May 16, 2015, was Sir Baltron’s son, Leslie. Mr Liu reiterated: “Our problem is we cannot hit the 70/30 [ratio]. We can sub-contract 40 percent work to locals, which is double Baha Mar’s commitment. My headquarters will not approve it; the 70/30 ratio.

“I drafted a revision which I think should work to include operation, training, management in the ratio. But Sir Baltron crossed out. So we are caught in [between a] rock and hard place. Because we cannot agree the Heads of Agreement, it [has] already impacted starting schedule. No Heads of Agreement, we cannot get work permits and material cleared from Customs.

“We [have] postponed our ground opening (originally by 6/1) till Heads of Agreement agreed, and considering downsizing the development. I am afraid it will hit to [the] press soon. I believe this is not what the Prime Minister want. Can you help?”

Mr Bethel replied three days later, saying he would “like to assist” but that himself and Notarc wanted to charge CCA for help with the contractor’s “advice and interaction with The Bahamas”. And he suggested: “We need to talk.... this is politically problematic for the Prime Minister. My suggestion is we reference a dollar amount to be awarded to local contractors and state also that, unlike Baha Mar, the Hilton project will employ mostly Bahamian labour.”

Sir Baltron’s son then e-mailed two days later, on

May 21, 2015, to reassure Mr Liu and CCA that his father was one of the contractor’s biggest supporters within the Christie administration.

“I think Sir B (Sir Baltron) is one of CCA’s biggest supporters.... There are others at Cabinet who might not see things the same as OPM (Office of the Prime Minister). Proceed as you deem best with the Prime Minister.... happy to assist you further if necessary.”

Mr Liu replied the very same day. “I am sure about Sir Baltron and yourself as our best friend. But we are between rock and hard place. It needs to be resolved quickly, it is hurting CCA and government now.”

Mr Izmirlian and his legal team, though, had no doubts about what this e-mail exchange and other evidence meant. “CCA interfered further with the project, to Baha Mar Properties’ detriment, through its improper efforts to influence Bahamian government officials, including Sir Baltron Bethel, through Notarc Management Group, whose chief executive is Sir Baltron’s son, Leslie Bethel.

“CCA’s interference culminated in its conspiracy with China Export-Import Bank to oust Baha Mar Properties from the project. Sir Baltron suggested ‘Izmirlian out’ and obtaining a new owner, but it should ‘come from bank and not government’; CCA coordinating separate meetings with Sir Baltron; [and] suggesting ‘join[ing] forces’ with the government and China Export-Import Bank to push out Baha Mar Properties.”

The latter reference is to a July 6, 2015, e-mail written by Mr Liu to his fellow executives shortly after Baha Mar and Mr Izmirlian had filed for Chapter 11 bankruptcy protection. Noting the Government’s threat to reclaim Crown Land and other assets granted to the project, as well as refusing to recognise the Chapter 11 process, he wrote: “The key is the attitude of the Export-Import Bank of China. The Government is in a hurry now.

“A good development is that local public opinion agrees that Sarkis has problems. Filing Chapter 11 in the US is an evasion of debt. The two tactics, reclaiming

the land and not recognising the Chapter 11, were fatal blows to Baha Mar. We should take advantage of the Bahamas government. If the Government, Export-Import Bank of China and CCA join forces, we can turn passive into active.”

CCA, though, vehemently denied that there was anything improper about its relationship with Mr Bethel and Notarc. “Baha Mar Properties asserts on the first page of its motion that ‘CCA paid illegal kickbacks to the family of Bahamian officials to protect CCA’s position’. Again, this assertion is not accompanied by a citation to any evidence because there is no such evidence,” it said, hitting back at Mr Izmirlian and his corporate vehicle.

“Throughout discovery, Baha Mar Properties has implied some sort of impropriety in CCA Bahamas payments to a consulting company called Notarc Management Group, a Panamanian-based entity that was co-founded by Leslie Bethel, the son of a Bahamian official. Defendants engaged Notarc to help establish a CCA Panama office and to otherwise explore construction projects throughout Latin America and the Caribbean.

“The invoices from Notarc show legitimate payments, many of which were made in 2016 and were reimbursable expenses that Notarc incurred on behalf of CCA Bahamas in connection with work in Panama. Ironically, while Baha Mar Properties attempts to create some impropriety in CCA Bahamas’ relationship with Notarc, Baha Mar itself retained Notarc in or around 2012 (two years before CCA Bahamas did) to perform ‘market research’ and other work specifically in connection with the project, using project funds to pay Notarc. Leslie Bethel also worked from 2006-2008 as a “business development consultant” for Baha Mar Development Corporation, Baha Mar’s predecessor entity that was controlled by Mr Izmirlian.”

PAGE 4, Monday, December 19, 2022 THE TRIBUNE

PAGE B1

FROM

Several important interest rate decisions, and accompanying statements by the central banks, are depressing the stock market mood.

So many rate decisions in one week are rare. The Federal Reserve, the European Central Bank (ECB), the Bank of England and the Swiss National Bank, which are among the world’s most important central banks, decided on their further monetary policy last week and undermined hopes of a quick stock market recovery.

The interest rate hikes themselves were expected in much the same way as they came. It was the outlook of monetary policymakers that acted as a damper on the mood in the stock markets, as many market observers concluded that a return to normal is probably not expected until 2024. Statements that the central banks will continue raising interest rates at a steady pace can only be interpreted to mean that there will be two more increases of 50 basis points each, and even a risk to the upside.

While investors had just dared to step out of hiding again in the past few weeks, and allowed prices to rise amid high demand, caution returned last week.

The German Dax index lost almost 1,000 points within a few days, from its multimonth high on Tuesday at almost 14,700 points to

13,800 during the day on Friday.

The US Federal Reserve tried with its statements to bring overly optimistic investors back down to earth. The American stock index, the S&P 500, was up almost 10 percent from the last Federal Reserve meeting to last week’s one alone. This is forcing the US central bank to do a balancing act between acknowledging declining inflationary tendencies and signalling that monetary policy must remain tight for longer. After the rate hike announcement, the S&P lost almost 10 percent until Friday.

The crypto world, meanwhile, is in further turmoil.

Sam Bankman-Fried is now in prison, and more and more details about the collapse of FTX are being pieced together. After the spectacular demise of FTX, investors and customers are increasingly concerned about the stability of the largest crypto currency trading platform, Binance.

The company said on Friday that accounting firm, Mazars, is suspending work with Binance and other crypto industry clients.

Insecure customers have been withdrawing their crypto currencies from the trading platforms for a few weeks. Binance alone has

faced daily outflows averaging $250m on estimated reserves of $60 billion.

Last Tuesday, customers had withdrawn the value of more than $1bn.

Values of the leading crypto currencies by market cap, Bitcoin and Ether, fell 2 percent and more than 4 percent, respectively, as the Mazars news broke.

Binance played a role in FTX’s collapse. It considered an emergency purchase, but cancelled it after a short review, which sealed the fate of its rival.

The crypto industry is generally coming under pressure as investors seem less inclined towards risky assets since the Federal Reserve started raising interest rates. Safe bonds, meanwhile, bring a return of more than 4 percent, and for solid corporate bonds, almost 6 percent. Bitcoin has lost nearly 60 percent of its value since March, when the Federal Reserve began tightening monetary policy.

One thing above all seems certain after this week: The uncertainty among investors will remain for a while, and with it high volatility on the stock exchanges.

THE TRIBUNE Monday, December 19, 2022, PAGE 5

Rocky Road By CHRIS ILLING CCO @ ActivTrades Corp ADVERTISE TODAY! CALL THE TRIBUNE TODAY @ 502-2394

• Pump Experience (Installing Repairing) • Filtration • PH Experience • Cleaning Experience • Pool Building Experience (ideally) • 6 days a week 8am -4pm EMAIL: hr@palmcay.com JOB OPPORTUNITY SWIMMING POOL TECHNICIAN & CLEANER JOB SPECIFICS:

ROCKY ROAD

BPL fuel hike: Pintard asserts URCA ‘endorses’ law breach

pushing for costs to be passed on to Bahamian consumers” unnecessarily, nevertheless argued that the Government and BPL plan to protect vulnerable and low income households by creating two energy consumption categories had no basis in law or the regulations.

“We maintain the question of whether or not there were violations of the Electricity Act (sic, BEC Act) regulations,” the Opposition leader charged. “What they seem to have done is that they are providing a different rate for consumers based on consumption, and creating different categories of consumers. Our initial reading of the Act amendments is that it

does not make provision for different categories of consumers.

“URCA would seem to have endorsed BPL taking actions not supported by law, with different rates based on consumption levels.” BPL, in unveiling the rolling series of fuel charge hikes that businesses and households will see on their bills throughout 2023, segmented its customer base into two based on energy consumption in a bid to mitigate the impact on those who can least afford the impact.

Consumers who use less than 800 kilowatt hours (kWh) of energy per month, meaning small, low income and vulnerable households, will see quarterly increases of two cents per kWh whereas larger customers

NOTICE

NOTICE is hereby given that RACHELLE ABRAHAM P.O Box N7060 of St.James Road, Nassau, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 12th day of December, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE

NOTICE is hereby given that JESSICA DOLCE of Washington Street, Nassau, The Bahamas, is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twentyeight days from the 12th day of December, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE

IN THE ESTATE of MARY ELIZABETH HIGGS late of Yellow Elder Gardens Subdivision in the Southern District of the Island of New Providence, one the Islands of The Commonwealth of The Bahamas, deceased.

Notice is hereby given that all persons having any claim or demands against the above named Estate are required to send their names, addresses and particulars of the same duly certified in writing to the undersigned on or before the 29th day of December A.D., 2022, and if required, prove such debts or claims, or in default be excluded from any distribution; after the above date the assets will be distributed having regard only to the proved debts or claims of which the Administrators shall then have had Notice.

And Notice is hereby given that all persons indebted to the said Estate are requested to make full settlement on or before the aforementioned date.

MICHAEL A. DEAN & CO., Attorneys for the Administrators

Alvernia Court, 49A Dowdeswell Street P.O. Box N-3114 Nassau, The Bahamas

JOB OPPORTUNITY

A Telecommunications company is seeking to employ persons to assist in the installation of Fibre Optic Cables. Persons will be trained in the installation and testing of Fibre Optic networks and will be required to work in the field. Successful candidates must possess the following criteria: -

• High School graduate

• Ability to perform manual work in cabling

• Carry out instructions and work well in teams

• Good work ethics and desire to learn

• Computer skills is an asset

Interested persons may email resume at calatelhr@gmail.com on or before Dec 21st, 2022

(especially hotels and other businesses) using more than that amount will experience more than double that trajectory at 4.3 cents per kWh every quarter.

The former’s fuel charge is forecast to peak at 18.5 cents per kWh next summer, at the peak of consumption, while the latter’s will be almost 50 percent higher at 27.6 cents per kWh as the Government and BPL hope businesses bear the brunt of the hike.

However, the BEC (Amendment) Regulations make no provision for two separate fuel charge customer categories. They merely state that the fuel charge “shall be a monthly amount per kilowatt hour representing the total cost of fuel required to produce and deliver each kilowatt hour of electricity to consumers”, and add: “The fuel adjustment charge shall be the total cost of fuel consumed in the previous month’s billing period divided by the total amount of units billed for that corresponding period.”

They thus seem to back Mr Pintard’s contention that the regulations are being broken by BPL’s and the Government’s efforts to protect low income and vulnerable families from the worst of the blow. URCA, though, said that following its review it was “satisfied that BPL has made an adequate case for the rate increases outlined in its press statement dated October 4, 2022”.

Carlton Smith, URCA’s chief executive, was said to have been in a meeting on Friday when Tribune Business called for comment and did not return the call despite a detailed message

being left for him. A voice mail message left for Jonathan Hudson, the URCA official said to now be in charge of electricity regulation, was also not returned before press time.

The Opposition leader’s analysis was backed by an energy industry insider, speaking on condition of anonymity, who questioned how URCA reached its ‘no objection’ conclusion even though there was no provision in law or regulation for BPL to divide its consumer base into two categories with respect to the fuel charge.

Querying why the Government did not simply amend the regulations at the same time as it raised the VAT exemption on electricity bills to $400, the insider charged: “The question becomes for URCA how did it arrive at approving this when clearly it is in violation of the law. How do you square that circle?

“Can you please share the analysis that you are talking about. To say you have no problem with this, on what basis does this square with the law? If that’s put to

them [URCA], I don’t think they have a case because it’s a clear violation of the law. This doesn’t square with the law.”

The source said pressure will likely grow on URCA to publicly disclose its full assessment given that it is also responsible for consumer protection when it comes to the electricity sector. They queried how well URCA is upholding this aspect of its mandate given that it is Bahamian households and businesses that are set to increasingly pay the price for the Davis administration’s decision not to execute the trades that would have further strengthened BPL’s fuel hedging initiative.

“URCA is responsible for the consumer as well as the utilities. They have to play both sides and balance in the middle,” the source said. “Serious questions need to be asked.

Consumers are now being over-charged or unfairly charged because you’re putting the bulk of the fees on small businesses and larger consumers and that’s not fair.

“URCA should have been in there from day one. The consumer does not have a voice, and URCA gives them that voice. The question becomes: Are they fairly representing the consumer?” Mr Pintard, meanwhile, also queried whether URCA’s analysis had factored in that the fuel charge hikes would have been unnecessary if the Government had given the go-ahead for the hedging trades, asserting that there had been “a deafening silence” from the regulator on the issue.

The fuel charge component of BPL bills is set to increase by up to 163 percent compared to the stable 10.5 cents per kilowatt (KwH) enjoyed by the utility’s customers for the just over two-year period to October 2022. Without the cut-priced fuel produced by those trades, BPL has increasingly been purchasing its oil at spot market prices from late 2021 onwards but not passing the full cost on to customers - in contravention of the Electricity Act regulations - for some months.

With BPL’s mounting debts to Shell, its fuel supplier, increasingly unsustainable, the Government has reached an agreement to pay the global oil giant $90m over a nine-month period at $10m per month. It is this payment, and BPL’s huge hiking of the fuel charge to recover this debt and government loans previously made to support the 10.5 KwH price, that has prompted Opposition charges that the Davis administration has cost the Bahamian people over $100m.

PAGE 6, Monday, December 19, 2022 THE TRIBUNE

FROM PAGE B1

MICHAEL PINTARD

Asian stock markets sink under global recession fears

By JOE MCDONALD AP Business Writer

ASIAN stock markets fell again Monday as investors wrestled with fears the Federal Reserve and European central banks might be willing to cause a recession to crush inflation.

Shanghai, Tokyo, Hong Kong and Sydney declined. Oil prices rose by almost $1 per barrel but benchmark U.S. crude stayed below $80.

Wall Street fell Friday after the Fed raised its forecast of how long interest rates have to stay elevated to cool inflation that is near a four-decade high. The European Central Bank warned more rate hikes are coming.

That "hawkish rhetoric" indicates "mounting pipeline risks of a global recession," said Tan Boon Heng of Mizuho Bank in a report.

The Shanghai Composite Index lost 1.3% to 3,127.78 despite China's ruling Communist Party announcing Friday that it will try to reverse an economic slump by stimulating domestic consumption and the real estate market.

The Nikkei 225 in Tokyo sank 1.1% to 27,218.28 and the Hang Seng in Hong Kong shed 0.7% to 19,316.58.

The Kospi in Seoul retreated 0.4% to 2,350.27 and Sydney's S&P-ASX 200 was 0.2% lower at 7,137.00.

Singapore advanced while New Zealand and other Southeast Asian markets declined.

Wall Street's benchmark S&P 500 index turned in its second weekly decline after losing 1.1% to 3,852.36 on Friday for its third daily drop. It is down about 19% so far this year.

The Dow Jones Industrial Average dropped 0.8% to 32,920.46. The Nasdaq

composite lost 1% to 10,705.41.

More than 80% of stocks in the benchmark S&P 500 fell. Technology and health care stocks were among the biggest weights on the market. Microsoft fell 1.7% and Pfizer slid 4.1%.

U.S. inflation has eased to 7.1% over a year earlier in November from June's 9.1% high but still is painfully high.

The Fed on Wednesday raised its benchmark short-term lending rate by one-half percentage point for its seventh hike this year. That dashed hopes the U.S. central bank might ease off increases due to signs inflation and economic activity are cooling.

The federal funds rate stands at a 15-year high of 4.25% to 4.5%. The Fed forecast that will reach a range of 5% to 5.25% by the end of 2023. Its forecast doesn't call for a rate cut before 2024.

In energy markets, U.S. benchmark crude rose 94 cents to $75.23 per barrel in electronic trading on the New York Mercantile Exchange. The contract fell $1.82 on Friday to $74.29. Brent crude, the price basis for international oil trading, gained $1.01 to $80.05 per barrel in London. It lost $2.17 the previous session to $79.04.

The dollar declined to 136.25 yen from Friday's 136.56 yen. The euro gained to $1.0609 from $1.0600.

THE TRIBUNE Monday, December 19, 2022, PAGE 7

9.75 9.750.00 0.3690.26026.42.67% 4.342.82Cable

3.80 4.000.20 1,000-0.4380.000-9.1 0.00% 10.657.50Commonwealth

10.25 10.250.00 0.1400.00073.20.00% 3.652.54Commonwealth

3.58 3.580.00 0.1840.12019.53.35% 8.547.00Colina

8.53 8.530.00 0.4490.22019.02.58% 17.5012.00CIBC

15.99 15.990.00 0.7220.72022.14.50% 3.251.99Consolidated

3.04 2.93 (0.11) 0.1020.43428.714.81% 11.2810.05Doctor's

10.50 10.500.00 0.4670.06022.50.57% 11.679.16Emera

9.53 9.39 (0.14) 0.6460.32814.53.49% 11.5010.06Famguard

11.22 11.220.00 0.7280.24015.42.14% 18.3014.50Fidelity

18.100.00 7850.8160.54022.22.98% 4.003.50Focol

3.98 3.980.00 0.2030.12019.63.02% 11.509.85Finco

11.38 11.380.00 0.9390.20012.11.76% 16.2515.50J.

1.00 1.000.00 0.0000.0000.0006.50%

BAH29 107.31107.310.00 100.00100.00BGS: 2014-12-7Y BG0107 100.00100.000.00 100.00100.00BGS: 2015-1-7Y BG0207 100.00100.000.00 100.00100.00BGS: 2014-12-30Y BG0130 100.00100.000.00 100.00100.00BGS: 2015-1-30Y BG0230 100.00100.000.00 100.00100.00BGS: 2015-6-7Y BG0307 100.00100.000.00 100.00100.00BGS: 2015-6-30Y BG0330 100.00100.000.00 100.00100.00BGS: 2015-10-7Y BG0407 100.00100.000.00 97.5197.51BGRS FX BGR106036 BSBGR1060361 97.4997.490.00 97.5097.50BGRS FX BGR107036 BSBGR1070360 96.6996.690.00 94.9994.99BGRS

94.9994.990.00

2.572.11 2.573.15%3.89% 4.873.30 4.843.60%5.49% 2.251.68 2.252.43%2.92% 205.22164.74 190.45-6.40%-6.95% 212.41116.70 169.68-20.12%-15.15% 1.761.71 1.762.49%2.79% 1.941.78 1.935.71%7.96% 1.881.79 1.863.39%3.91% 1.030.93 0.93-8.94%-9.55% 9.376.41 10.107.82%9.00% 11.837.62 13.4413.58%15.81% 7.545.66 7.712.57%2.83% 16.648.65 13.25-20.10%-19.25% 12.8410.54 12.03-4.50%-4.64% 10.779.57 10.59-0.55%-1.61% 10.009.88 N/AN/AN/A 10.438.45 10.433.00%25.60% 14.8911.20 14.897.90%48.70%

MATURITY 19-Oct-2022 20-Nov-2029

‘Permit restricted US dollar holdings without approval’

industry feedback to compile into a final document with the ultimate goal of having the recommendations incorporated into a reactivated National Development Plan.

“We wanted to examine what we see as some of the challenges with the banking industry of the country today,” the former Chamber of Commerce chief executive explained. “It has to do with exchange control, it has to to with regulation and the opening of bank accounts, and the level of Know Your Customer (KYC) and compliance to get this done....

there be greater competition in the commercial banking space. “Include in new legislation the terms for entrance of other international banks – regional, American, European, Asian, etc to increase competitiveness for Bahamian and non-Bahamian banks in The Bahamas,” it says.

The Bahamas Think Tank report focuses on broad reforms, without going into details, how they will be implemented or a proposed timetable for doing so. It does, though, note the challenges many Bahamians face in gaining access to credit as well as the predicament facing those who have over-borrowed.

4-Aug-2036

“Addressing the banking industry is critical to the further development of our economy. The banking industry is absolutely essential for the functioning of the economy, it’s essential for the growth and development of the national economy and increased domestic investment.”

26-Aug-2036 15-Dec-2037 15-Jul-2039 15-Jun-2040

15-Oct-2038 15-Jan-2039 15-Oct-2049 17-Jan-2040 15-Jun-2030

26-Jul-2037

22-Sep-2033

31-Oct-2022 31-Oct-2022

15-Dec-2021 30-Jul-2022 15-Dec-2044 30-Jul-2045 26-Jun-2022 26-Jun-2045 15-Oct-2022 28-Oct-2022

30-Sep-2022

30-Sep-2022 31-Oct-2022

31-Oct-2022 31-Oct-2022

31-Oct-2022 30-Nov-2022 30-Nov-2022 30-Nov-2022 30-Nov-2022

30-Nov-2022 30-Nov-2022

31-Mar-2021 31-Mar-2021

31-Mar-2021

Mr Sumner added that, if the recommendations in the report were adopted, “I think you’re going to see a more robust economy, more money flowing through the economy. You’re likely to see more funds become available to small businesses through the banks if we can get these recommendations considered by the Government and the industry. We’ll see a more streamlined process to get bank accounts opened up, especially for commercial clients, which at the moment is a little onerous for many of them”.

To ease the burden associated with exchange controls, the report calls for the introduction of “a US dollar/ foreign currency threshold per person (bank account) per month that does not require Central Bank preapproval in all banks and on all bank account types”.

Besides calling on commercial banks to tackle the red tape and bureaucracy created by KYC and anti-money laundering regulations, it also urges that

“Non-performing loans grow out of sustained low wages and the real inability to pay; a genuine lack of mortgage understanding; predatory lending by commercial banks for credit cards, credit lines, consumer and auto loans; an established culture of not paying; and lost or reduced income resulting from natural disasters and the global health crisis,” the report said.

“Average Bahamians won’t qualify for good loan and credit interest rates because most cannot afford to own anything to use as collateral. They start out with deficiency and insufficiency, and decline from there. Consider the majority of funds now being in checking accounts versus fixed and savings deposits as a sign of the times, with the average Bahamian making only enough to spend on some of the basic costs of living.

“Once the credit bureau is established, and there is better information to lend on, consider that a very large percentage of borrowers/loan applicants will not qualify to borrow at all. What then? How are banks currently evaluating loan worthiness? Is there a standardised system uniformly applied across the industry, or does it vary based on bank/bank manager?”

PAGE 8, Monday, December 19, 2022 THE TRIBUNE

FRIDAY, 16 DECEMBER 2022 CLOSECHANGE%CHANGEYTDYTD% BISX ALL SHARE INDEX: 2640.473.410.13412.2318.50 BISX LISTED & TRADED SECURITIES 52WK HI52WK LOWSECURITY SYMBOLLAST CLOSECLOSECHANGE VOLUMEEPS$DIV$P/E YIELD 7.005.30 AML Foods Limited AML 6.95 6.950.00

53.0040.03 APD Limited APD 39.95 39.950.00

BBL

2.462.31Bahamas First Holdings Limited BFH

2.852.25Bank of Bahamas BOB

6.306.00Bahamas Property Fund BPF

Waste BWL

Bahamas CAB

Brewery CBB

Bank CBL

FirstCaribbean Bank

Water BDRs

FCL

FIN

S. Johnson JSJ

SHARES

First Holdings PreferenceBFHP

Cable Bahamas Series 6 CAB6

Cable Bahamas Series 9 CAB9

1.001.00Colina Holdings Class A CHLA

10.0010.00Fidelity Bank Bahamas Class A FBBA

Class B FCLB

CORPORATE DEBT - (percentage pricing) 52WK HI52WK LOWSECURITY SYMBOLLAST SALECLOSECHANGEVOLUME

Bank (Note 22 Series B+)FBB22

First Holdings LimitedBFHB

BAHAMAS GOVERNMENT STOCK - (percentage pricing)

Note

BSBGR1322498

FX BGR134140 BSBGR1341407

FX BGR138230 BSBGR1380306

FX BGR138240 BSBGR1380405

FL BGRS81035 BSBGRS810359

FL BGRS81037 BSBGRS810375

100.57100.57BGRS FL BGRS84033 BSBGRS840331

MUTUAL FUNDS 52WK HI52WK LOW NAV YTD%12 MTH%

MARKET TERMS BISX ALL SHARE INDEX - 19 Dec 02 = 1,000.00 YIELD - last 12 month dividends divided by closing price 52wk-Hi - Highest closing price in last 52 weeks Bid $ - Buying price of Colina and Fidelity 52wk-Low - Lowest closing price in last 52 weeks Ask $ - Selling price of Colina and fidelity Previous Close - Previous day's weighted price for daily volume Last Price - Last traded over-the-counter price Today's Close - Current day's weighted price for daily volume Weekly Vol. - Trading volume of the prior week Change - Change in closing price from day to day EPS $ - A company's reported earnings per share for the last 12 mths Daily Vol. - Number of total shares traded today NAV - Net Asset Value DIV $ - Dividends per share paid in the last 12 months N/M - Not Meaningful P/E - Closing price divided by the last 12 month earnings TO TRADE CALL: CFAL 242-502-7010 | ROYALFIDELITY 242-356-7764 | CORALISLE 242-502-7525 | LENO 242-396-3225 | BENCHMARK 242-326-7333 4.81%

Colonial Bahamas Fund Class D Colonial Bahamas Fund Class E Colonial Bahamas Fund Class F CFAL Global Equity Fund Leno Financial Conservative Fund Leno Financial Aggressive Fund Leno Financial Balanced Fund Leno Financial Global Bond Fund RF Bahamas Opportunities Fund - Secured Balanced Fund RF Bahamas Opportunities Fund - Targeted Equity Fund RF Bahamas Opportunities Fund - Prime Income Fund RF Bahamas International Investment Fund Limited - Equities Sub Fund RF Bahamas International Investment Fund Limited - High Yield Income Fund RF Bahamas International Investment Fund Limited - Alternative Strategies Fund

Prime + 1.75% MARKET REPORT

FROM PAGE B1

0.2390.17029.12.45%

0.9321.26042.93.15% 2.761.60Benchmark

2.76 2.760.00 0.0000.020N/M0.72%

2.46 2.460.00 0.1400.08017.63.25%

2.61 2.610.00 0.0700.000N/M0.00%

6.30 6.300.00 1.7600.000N/M0.00% 9.808.78Bahamas

Holdings CHL

CIB

CWCB

Hospital DHS

Incorporated EMAB

FAM

Bank (Bahamas) Limited FBB 18.10

15.75 15.750.00 0.6310.61025.03.87% PREFERENCE

1.001.00Bahamas

1.00 1.000.00 0.0000.0000.0000.00% 1000.001000.00

1000.001000.000.00 0.0000.0000.0000.00% 1000.001000.00

1000.001000.000.00 0.0000.0000.0000.00%

1.00 1.000.00 0.0000.0000.0006.25%

10.0010.000.00 0.0000.0000.0007.00% 1.001.00Focol

100.00100.00Fidelity

100.00100.000.00 100.00100.00Bahamas

100.00100.000.00

115.92104.79Bahamas

6.95 (2029)

FX BGR120037 BSBGR1200371

91.9891.98BGRS FX BGR125238 BSBGR1252380 100.00100.000.00 91.9191.91BGRS FX BGR127139 BSBGR1271398 100.00100.000.00 92.6792.67BGRS FX BGR131239 BSBGR1312390 92.5592.550.00 90.9890.98BGRS FX BGR132249

90.9590.950.00 94.8094.80BGRS

93.9493.940.00 100.39100.39BGRS

100.39100.390.00 96.8496.84BGRS

96.1096.100.00 100.32100.32BGRS

100.66100.660.00 100.34100.34BGRS

100.17100.170.00

100.15100.150.00

26-Jul-2035

INTEREST

6.95% 4.50%

4.50% 6.25%

6.25% 30-Sep-2025

FUND CFAL Bond Fund CFAL Balanced Fund CFAL Money Market Fund CFAL Global Bond Fund 6.25% 4.50% 6.25% 4.25% NAV Date 4.87% 4.68% 5.40% 5.60%

5.00% 5.00%

5.65% 5.35% 5.00% 5.40% 5.22% 5.14%

www.bisxbahamas.com

(242)323-2330 (242) 323-2320

Malcolm Allotments on the said plan of the said Subdivision LOREEN LEONARA RUSSELL claims to be the owner of the fee simple estate in possession of the said land and has applied to the Supreme Court of The Bahamas under S.3 of the Quieting Titles Act, 1959 in the above action to have its title to the said land investigated the nature and extent thereof determined and declared i n a Certificate of Title to be granted by the c ourt in accordance w i th provisions of th e said Ac t. C opies of the s aid P lan may be inspected during normal office ours at the Registry of the Supreme Court, Bridsh American Bank Building, Marlborough Street in the City of Nassau, and at the Chambers of E.D. M Law Group, Suite 2 upstairs Workers House, Harrold Road, Nassau Bahamas

NOTICE IS HEREBY GIVEN that any person having dower or a right to dower or any adverse claim not recognized in the Petition shall before the 23rd day of J anuary A.D. 2023 file in the said Registry of The Supreme Court and serve the Petitioner o r the above E D.M. Law Group a statement of such claim in the prescribed form verified by an Affidavit to be filed herewith. Failure of any such person to file and serve a statement of such claim by the above time will operate as a bar to such claim

E D.M. Law Group Suite 2 upstairs Workers House Harrold Road Nassau The Bahamas

Attorneys for the Petitioner

Friday Saturday Sunday

3:50 a.m. 2.7 10:14 a.m. 0.3 4:01 p.m. 2.3 10:14 p.m. -0.2 4:42 a.m. 2.9 11:10 a.m. 0.1 4:55 p.m. 2.3 11:04 p.m. -0.4

5:34 a.m. 3.2 12:03 p.m. -0.2

5:48 p.m. 2.4 11:55 p.m. -0.7

6:25 a.m. 3.3 12:56 p.m. -0.4 6:41 p.m. 2.4

7:16 a.m. 3.5 12:47 a.m. -0.8 7:34 p.m. 2.5 1:48 p.m. -0.5

8:08 a.m. 3.5 1:40 a.m. -0.9 8:28 p.m. 2.5 2:40 p.m. -0.6 9:01 a.m. 3.5 2:34 a.m. -0.8 9:24 p.m. 2.6 3:33 p.m. -0.6

THE TRIBUNE Monday, December 19, 2022, PAGE 9 Shown is today’s weather. Temperatures are today’s highs and tonight’s lows. ORLANDO Low: 57° F/14° C High: 73° F/23° C TAMPA Low: 58° F/14° C High: 72° F/22° C WEST PALM BEACH Low: 64° F/18° C High: 76° F/24° C FT. LAUDERDALE Low: 68° F/20° C High: 77° F/25° C KEY WEST Low: 72° F/22° C High: 79° F/26° C Low: 71° F/21° C High: 80° F/26° C ABACO Low: 64° F/18° C High: 75° F/24° C ELEUTHERA Low: 70° F/21° C High: 79° F/26° C RAGGED ISLAND Low: 73° F/23° C High: 82° F/28° C GREAT EXUMA Low: 75° F/24° C High: 81° F/27° C CAT ISLAND Low: 72° F/22° C High: 81° F/27° C SAN SALVADOR Low: 73° F/23° C High: 81° F/27° C CROOKED ISLAND / ACKLINS Low: 73° F/23° C High: 83° F/28° C LONG ISLAND Low: 73° F/23° C High: 82° F/28° C MAYAGUANA Low: 73° F/23° C High: 82° F/28° C GREAT INAGUA Low: 73° F/23° C High: 83° F/28° C ANDROS Low: 71° F/22° C High: 80° F/27° C Low: 63° F/17° C High: 74° F/23° C FREEPORT NASSAU Low: 69° F/21° C High: 78° F/26° C MIAMI THE WEATHER REPORT 5-Day Forecast Rain and drizzle in the afternoon High: 80° AccuWeather RealFeel 80° F The exclusive AccuWeather RealFeel Temperature is an index that combines the effects of temperature, wind, humidity, sunshine intensity, cloudiness, precipitation, pressure and elevation on the human body—everything that affects how warm or cold a person feels. Temperatures reflect the high and the low for the day. Breezy early; patchy clouds Low: 71° AccuWeather RealFeel 69° F Breezy with a couple of showers High: 80° AccuWeather RealFeel Low: 70° 81°-69° F Partly sunny High: 82° AccuWeather RealFeel Low: 70° 88°-70° F Beautiful with sun and clouds High: 81° AccuWeather RealFeel Low: 70° 87°-72° F Pleasant with plenty of sunshine High: 81° AccuWeather RealFeel 85°-65° F Low: 66° TODAY TONIGHT TUESDAY WEDNESDAY THURSDAY FRIDAY almanac High 79° F/26° C Low 67° F/19° C Normal high 79° F/26° C Normal low 67° F/19° C Last year’s high 84° F/29° C Last year’s low 68° F/20° C As of 1 p.m. yesterday 0.16” Year to date 56.10” Normal year to date 39.13” Statistics are for Nassau through 1 p.m. yesterday Temperature Precipitation sun anD moon tiDes For nassau New Dec. 23 First Dec. 29 Full Jan. 6 Last Jan. 14 Sunrise 6:49 a.m. Sunset 5:24 p.m. Moonrise 2:42 a.m. Moonset 2:15 p.m.

High Ht.(ft.) Low Ht.(ft.)

Today Tuesday Wednesday Thursday

marine Forecast WINDS WAVES VISIBILITY WATER TEMPS. ABACO Today: NE at 10-20 Knots 4-7 Feet 10 Miles 78° F Tuesday: ENE at 12-25 Knots 4-8 Feet 9 Miles 77° F ANDROS Today: NE at 12-25 Knots 1-2 Feet 10 Miles 77° F Tuesday: E at 10-20 Knots 1-2 Feet 9 Miles 75° F CAT ISLAND Today: NE at 12-25 Knots 3-6 Feet 8 Miles 81° F Tuesday: E at 12-25 Knots 4-8 Feet 6 Miles 81° F CROOKED ISLAND Today: ENE at 7-14 Knots 2-4 Feet 10 Miles 81° F Tuesday: ESE at 8-16 Knots 3-5 Feet 10 Miles 80° F ELEUTHERA Today: NE at 12-25 Knots 4-8 Feet 10 Miles 80° F Tuesday: E at 15-25 Knots 5-9 Feet 10 Miles 80° F FREEPORT Today: ENE at 10-20 Knots 2-4 Feet 10 Miles 78° F Tuesday: E at 12-25 Knots 2-4 Feet 10 Miles 75° F GREAT EXUMA Today: NE at 12-25 Knots 1-2 Feet 8 Miles 80° F Tuesday: E at 10-20 Knots 1-2 Feet 10 Miles 80° F GREAT INAGUA Today: NE at

Miles

F

Miles 82° F

8-16 Knots 1-3 Feet 10

82°

Tuesday: E at 10-20 Knots 2-4 Feet 8

Miles

F

Miles

F

LONG ISLAND Today: ENE at 6-12 Knots 1-2 Feet 8

81°

Tuesday: E at 8-16 Knots 2-4 Feet 6

81°

Miles

F

F

F

10 Miles 81° F

Feet 7 Miles 80° F

Knots

Feet 8 Miles 81° F Tuesday: E

12-25 Knots 2-4 Feet 8 Miles 80° F uV inDex toDay The higher the AccuWeather UV Index number, the greater the need for eye and skin protection. Forecasts and graphics provided by AccuWeather, Inc. ©2022 H H tracking map Shown is today’s weather. Temperatures are today’s highs and tonight’s lows. N S W E 10-20 knots N S W E 10-20 knots N S W E 10-20 knots N S W E 12-25 knots N S W E 12-25 knots N S W E 8-16 knots N S W E 7-14 knots N S W E 12-25 knots | Go to AccuWeather.com Commonwealth of The Bahamas In The Supreme Court Common Law and Equity Side In the Matter of the Quieting Titles Act 1959 AND IN THE MATTER OF all piece parcel or lot of land being a portion of Lot No. 54, Malcolm Allotments situate in the Southern District of the Island of New Providence, Commonwealth of The Bahamas AND IN

Loreen

Russell 2022 CLE/qui/00821

Loreen

Russell

ALL THAT piece Lot of land situate

Southern

New Providence and being

Lot

54

MAYAGUANA Today: NE at 7-14 Knots 3-5 Feet 10

81°

Tuesday: E at 8-16 Knots 4-8 Feet 7 Miles 81°

NASSAU Today: NE at 15-25 Knots 2-4 Feet 7 Miles 80° F Tuesday: E at 12-25 Knots 2-4 Feet 7 Miles 80°

RAGGED ISLAND Today: NE at 7-14 Knots 1-2 Feet

Tuesday: E at 8-16 Knots 2-4

SAN SALVADOR Today: NE at 12-25

2-4

at

THE MATIER OF the Petition of

Leonora

NOTICE The Petition of

Leonora

in respect of:-

in the

District of the Island of

a portion of

No.

Bran: ‘Don’t abandon’ digital assets on FTX

members of the US congress, he warned it “not to tarry” given that The Bahamas’ integrity was being unfairly “sullied” by widespread international media coverage.

“The fact is the reputation of The Bahamas has been sullied as a result of it, and we ought to do whatever is necessary to try and regain that reputation, telling people how it’s safe to invest in our financial services industry,” Mr McCartney told this newspaper of FTX’s implosion and the subsequent arrest/ jailing of its founder, Sam Bankman-Fried.

“I think they [the Government] need to pull out all the stops in that regard. I think overall they’ve been fairly quiet. I think a lot more can be done. I think they ought not to tarry; they ought to act as quickly as possible, recognising we need to build trust in the international sector in terms of investing in The Bahamas.

“Speak about the situation, show they’re doing everything to remedy it. What they want to do is instill and ensure confidence in persons. That is done by being open about the situation, explaining

exactly what happened. A lot of people around the world hear The Bahamas is involved, but many find the need to paint The Bahamas in an unfair light. This could have happened anywhere. It just so happened we’re the country where it happened.”

Mr McCartney, who declined to give specifics on how The Bahamas should counter the FTX spotlight, added: “Negative publicity spreads quicker than positive. We have to show the positive light of investing in The Bahamas and how you go about it.”

Asked whether he believes FTX’s failure will deter, and prevent, The Bahamas from realising its ambitions to establish itself as a digital assets hub for the Caribbean and wider Western Hemisphere, Mr McCartney replied: “I hope it doesn’t. I think we need to pursue it with even more vigour and vibrancy. It is lucrative, it attracts investors and that is what we need.

“The fact we have had this incident should not cause us to close down. You go and advertise and promote The Bahamas, bring our reputation back. To abandon the crypto industry, then all your work to get the reputation of The

MUSK POLLS TWITTER USERS ABOUT WHETHER HE SHOULD STEP DOWN

By MATT O’BRIEN AP Technology Writer

ELON Musk is asking Twitter’s users to decide if he should stay in charge of the social media platform after acknowledging he made a mistake Sunday in launching new speech restrictions that banned mentions of rival social media websites.

In yet another drastic policy change, Twitter had announced that users will no longer be able to link to Facebook, Instagram, Mastodon and other platforms the company described as “prohibited.”

But the move generated so much immediate criticism, including from past defenders of Twitter’s new billionaire owner, that Musk promised not to make any more major policy changes without an online survey of users.

“My apologies. Won’t happen again,” Musk tweeted, before launching a new 12-hour poll asking if he should step down as head of Twitter. “I will abide by the results of this poll.”

The action to block competitors was Musk’s latest attempt to crack down on certain speech after he shut down a Twitter account last week that was tracking the flights of his private jet.

The banned platforms included mainstream websites such as Facebook and Instagram, and upstart rivals Mastodon, Tribel, Nostr, Post and former President Donald Trump’s Truth Social. Twitter gave no explanation for why the blacklist included those seven websites but

not others such as Parler, TikTok or LinkedIn.

Twitter had said it would at least temporarily suspend accounts that include the banned websites in their profile — a practice so widespread it would have been difficult to enforce the restrictions on Twitter’s millions of users around the world. Not only links but attempts to bypass the ban by spelling out “instagram dot com” could have led to a suspension, the company said.

A test case was the prominent venture capitalist Paul Graham, who in the past has praised Musk but on Sunday told his 1.5 million Twitter followers that this was the “last straw” and to find him on Mastodon. His Twitter account was promptly suspended, and soon after restored as Musk promised to reverse the policy implemented just hours earlier.

Musk said Twitter will still suspend some accounts according to the policy but “only when that account’s (asterisk)primary(asterisk) purpose is promotion of competitors.”

Twitter previously took action to block links to Mastodon after its main Twitter account tweeted about the @ElonJet controversy last week. Mastodon has grown rapidly in recent weeks as an alternative for Twitter users who are unhappy with Musk’s overhaul of Twitter since he bought the company for $44 billion in late October and began restoring accounts that ran afoul of the previous Twitter leadership’s rules against hateful conduct and other harms.

Bahamas back will be in vain.

“Just like any business, if something goes bad you don’t give up. You learn from it, maybe improve on it, learn from your mistakes and go full throttle ahead in trying not to make the same mistake again. I do believe that, at the end of the day, we’ll come out from it but we cannot give up. We do need to push forward and work on enhancing the country.”

Many observers will argue that The Bahamas needs to guard against more investors of Mr Bankman-Fried’s type after the FTX co-founder was charged with a litany of fraud and other financial crimes, including money laundering, by US Justice Department prosecutors in the southern New York

federal district. He also faces civil lawsuits from US regulators, the Securities & Exchange Commission (SEC) and Commodities Futures Trading Commission (CFTC).

Meanwhile, representatives for FTX’s Bahamian joint provisional liquidators and the Securities Commission last Thursday met counterparts representing Mr Ray and the 134 entities in Chapter 11 bankruptcy protection in Delaware in a bid to try and resolve their differences and tone down the heated rhetoric between them as they battle for jurisdictional control of the crypto exchange’s winding-up and its assets.

The parties reported the talks to Judge John Dorsey, sitting in the Delaware Bankruptcy Court, the following day. John Zakia, a

US attorney representing the joint provisional liquidators, revealed his clients had modified their demands over the restoration of their access to cloud-stored data on FTX Digital Markets that was previously cut-off by Mr Ray.

He confirmed Brian Simms KC, the Lennox Paton senior partner, and PricewaterhouseCoopers (PwC) accounting duo of Kevin Cambridge and Peter Greaves, would be “seeking static access, not live access” to this data. It is unclear what “static” access means, although it likely restricts the joint provisional liquidators to simply looking at documents and files rather than downloading them or taking copies.

With Judge Dorsey prepared to hear witness testimony and evidence on

January 6, 2023, if the two sides cannot agree on data access, Mr Zakia added: “We want your honour to be able to deal with all of these issues in a timely manner. It’s going to prejudice our clients if these matters get pushed off indefinitely.”

John Bromley, the attorney for Mr Ray, had earlier objected to hearing the joint provisional liquidators’ bid for Chapter 15 recognition as the main bankruptcy proceedings on January 13, 2023, due to the need to take discovery from witnesses who were in The Bahamas.

“It sounds like the parties are talking to each other.... Hopefully the parties can resolve it. If not, I’m prepared to go forward on the 6th,” Judge Dorsey asserted.

Nov. 1,

THE TRIBUNE Monday, December 19, 2022, PAGE 11

A TWITTER logo hangs outside the company’s San Francisco offices on Tuesday,

2022. The Washington Post’s Taylor Lorenz has become the latest journalist to be banned from Twitter. Lorenz says she and another Post technology reporter, Drew Harwell, were researching an article concerning Twitter CEO Elon Musk.

Photo:Noah Berger/AP

FROM PAGE B1

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net