BPL to end deal covering 50% of Nassau electricity

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

Bahamas Power & Light (BPL) is ending a deal that supplies around 50 percent of New Providence’s base load electricity generation despite concerns its own staff are not trained to operate the engines involved.

Shevonn Cambridge, BPL’s chief executive, confirmed to Tribune Business that Wartsila’s contract to operate 132 Mega Watts (MW) of generation capacity at the Clifton Pier power station and provide routine maintenance will not be renewed after it expires at year-end. The state-owned utility instead will take these responsibilities back inhouse in the New Year,

with Clifton Pier’s Station A “integrated” back into its own generation operations.

The BPL, chief, though dismissed concerns that the monopoly power provider’s staff lack the training to operate engines that were manufactured and supplied by Wartsila itself in early 2019 for $95m. He asserted that their operation was not

complex, and that BPL has multiple mechanics - especially in the Family Islands - who are trained to operate such four-stroke, mediumspeed diesel engines.

Wartsila formed its own Bahamas-based team to operate and maintain the 132 MW it provided, which was equivalent to around half New Providence’s 260 MW peak energy demand. But some BPL insiders criticised their performance in alleging that “blackouts” occurred when the contractor’s staff failed to prevent the engines tripping. They also argued it was unwise to permit an outside contractor to have control over such a large portion of BPL’s New Providence generation.

Mr Cambridge replied “that’s pretty accurate” when asked by Tribune Business if Wartsila’s Station A service and routine

URCA ‘out of their minds’ for BPL 163% fuel hike backing

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

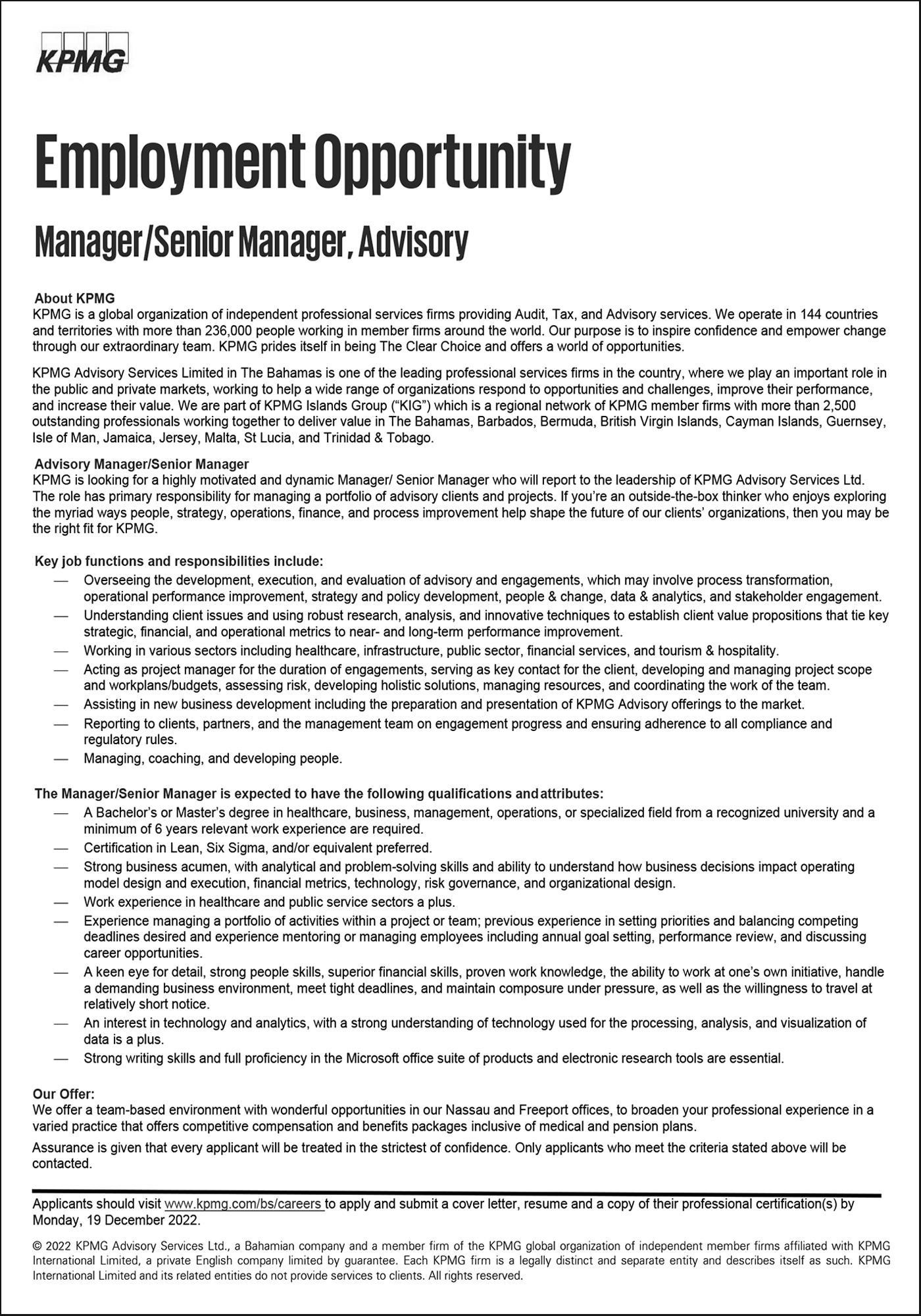

A former Democratic National Alliance (DNA) leader yesterday blasted that electricity regulators “have got to be out of their minds” to determine Bahamas Power & Light (BPL) has made the case for up to 163 percent fuel charge hikes.

Branville McCartney told Tribune Business that “I suck my teeth” after the Utilities Regulation and Competition Authority (URCA) said the state-owned

energy monopoly’s decision to massively increase its fuel charge via a series of rolling rises throughout 2023 - a move that will allegedly impose $100m

Fears FTX ‘a game changer’ for financial services sector

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

FTX could be “a game changer” for the Bahamian financial services industry’s growth prospects, a wellknown businessman warned yesterday, with the country facing “severe attack” over its implosion.

Sir Franklyn Wilson, the Arawak Homes and Sunshine Holdings chairman, told Tribune Business that the crypto currency exchange’s collapse and subsequent arrest and indictment of its founder, Sam Bankman-Fried, had placed The Bahamas under global scrutiny like never before.

Arguing that much of this is based on misleading information that has “no basis in fact”, he added that it was impossible for The Bahamas to afford the kind of public relations (PR) spend that is necessary to counter the battering this country’s integrity and reputation took before Congress during the US House of Representatives Financial Services Committee’s Tuesday probe into FTX’s failure.

John Ray, head of the 134 FTX entities in Chapter 11 bankruptcy protection in Delaware, told that hearing that The Bahamas’ provisional liquidation proceedings “lack transparency” while again implying that the Securities Commission and the Government

were colluding with Mr Bankman-Fried. This was despite him being provided with an explanation for why the Bahamian regulator moved $300m in digital assets for their own protection - a move authorised by the Supreme Court.

“The FTX matter is such that I honestly believe it’s a game changer for us,”

Sir Franklyn told Tribune Business. “A lot depends on how we survive this FTX matter. It’s not conventional banking, but obviously the banking community I suspect are watching it. The Bahamas is very much in the regulatory light, and the brand of the country is being subject to severe attack.

“I think anyone with a degree of objectivity would justly be concerned. There’s a legitimate basis for concern. I don’t seek to be a pessimist, but there’s risk.

One or two names out there, known banks, their

in unnecessary costs on Bahamian businesses and households - was justified.

URCA, in a short threeparagraph statement, said it had undertaken a “comprehensive review” of BPL’s proposal to drastically increase the fuel charge component of its bill over the next 12 months as it seeks to repay a $90m debt to Shell, its main supplier, as well as taxpayer financing (loans and/or subsidies) provided by the Davis administration.

“As the regulator for the country’s electricity sector, URCA conducted a comprehensive review of BPL’s

fuel charge increase proposal. At the conclusion of that review, URCA determined that it is satisfied that BPL has made an adequate case for the rate increases outlined in its press statement dated October 4, 2022,” URCA said.

Seeking to soften the blow from its verdict, URCA promised to undertake ongoing monitoring and reviews of BPL’s fuel charge during 2023 to ensure that the utility is operating efficiently and levying the correct charges on customers.

‘Disaster for business’: Village Road works in up to 46% loss

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

Village Road companies have branded the area’s ten-month long roadworks “a disaster for business” with income losses running as high as 46 percent and damaged properties urgently needing repairs.

Some 15 firms signed a December 9, 2022, letter detailing the economic impact, and their grievances, to Alfred Sears KC, minister of works and utilities, whose ministry has oversight of the road improvement project. They outlined how contractors have taken over more space on their premises than initially promised, and damages to parking lots and buildings that will have to be repaired.

Among the individual businesses testifying to their losses, The Place For Art disclosed that its earnings were down by 46 percent when compared to the same six-month pre-COVID period in 2019. “Our accountant

Tax breaks call as Village Road avoided ‘like plague’

By YOURI KEMP and NEIL HARTNELL Tribune Business Reporters ykemp@tribunemedia.net

Village Road businesses are seeking VAT credits, plus Business Licence and real property tax waivers, to compensate for the damage inflicted by roadworks that have caused consumers to avoid the area “like the plague”.

Some 15 companies, all impacted by the now-ten month project that seems likely to extend into the New Year, set out their cry for help via tax breaks and other concessions in a December 9, 2022, letter to Alfred Sears KC, minister of works and utilities, whose ministry has oversight responsibility for the project.

Authored by Michael Fields, president of Four Walls Squash and Social Club, it also suggested that the Government provide “refurbishment grants” for residents and business owners to repair damaged premises, vehicles and other facilities impacted by the project. It also called for Bahamas Power & Light (BPL) bill discounts, and “full sponsorship” of a collaborative marketing campaign to entice consumers back to the Village Road area.

business@tribunemedia.net FRIDAY, DECEMBER 16, 2022

* To take over 132 MW operated by Wartsila

* BPL chief dismisses fears staff not trained

* Move has no bearing on Shell, other deals

PAGE B7 SEE PAGE B4

SHEVONN CAMBRIDGE,

BPL’s chief executive.

SEE

SEE PAGE B4

BRANVILLE McCartney

SEE PAGE B6

ROAD works on Village Road pictured recently.

SEE PAGE B8 $5.95 $5.86 $5.97 $5.21

SIR Franklyn Wilson

Don’t suffer Xmas hangover through financial indiscipline

The holiday season is almost upon us, and while Christmas is a wonderful opportunity to spend time with friends and family, it is also an occasion when a person’s “jolly spending” can create financial hardships for months to follow. Christmas spending is one of the biggest reasons people find themselves buried in credit card debt. People spend freely on gifts for friends, family or even themselves at the end of the year, and then are obligated to spend the next 12 months paying for all those gifts.

Bahamians, in common with persons throughout the world, typically disregard financial prudence and savings habits, abandoning all discipline in favour of impulse buying and the satisfaction of extensive wish lists.

One only needs visit the banks, malls, car lots and retail shopping districts, in and outside the country, to see Bahamians making their holiday moves. While consumer spending is necessary for economic vitality, everything must be done in moderation.

A brief conversation with a young banking executive this week revealed the truth about the excesses of Bahamians, who suffer temporary insanity for an entire month before slumping into complete and utter postDecember depression for the entire first quarter of the following year.

This discourse thus offers five tips on responsible holiday buying and spending.

1. Amid the steady flow in consumer goods, it is wise for locals to begin their spending diet. The wise Bahamian has a healthy ‘rainy day’ fund that can be accessed only in dire situations. With Christmas bonuses, extra tips and gratuities flowing this season, Bahamians are encouraged to up their savings game.

2. ‘Buy Bahamian’ has become so ‘cliché’ that many simply turn a deaf ear and book their tickets in search of great Florida buys. A secondary school lesson in economics provides sufficient evidence that supporting your local suppliers helps you in the long and short-term. We must guard against the ‘foreign is better’ mindset in our spending this season and always.

3. The cardinal sin this season is impulse buying. The best way to avoid such whimsical and irresponsible spending is to determine what you are going to

spend, create a list of what you will purchase and stick to the plan. The marketing plans and gimmicks set up during this season are well-devised ploys to entice, ensnare and trap you in debt and despair. Buyer Beware.

4. Repeat this statement and make it your mantra. Spend only what you have. That means no loans, no credit, no stealing and no begging. If you do not have it, do not spend it. Be content this Christmas, and teach your children this valuable lesson. Our parents and generations before us lived with a lot less and they were the better for it.

5. This final encouragement is one which perhaps expresses the true meaning and spirit of the season. It is to focus your buying on ‘giving’. No one in our country has to look long, hard or far to find the unfortunate or disadvantaged among us. Without casting judgment or overanalysing the causes for their dilemma, give love in the form of something tangible this year.

• NB: Ian R Ferguson is a talent management and organisational development consultant, having completed graduate studies with regional and international universities. He has served organsations, both locally and globally, providing relevant solutions to their business growth and development issues. He may be contacted at tcconsultants@coralwave.com.

PAGE 2, Friday, December 16, 2022 THE TRIBUNE

Arawak Cay vendors hit by gate’s closure

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

Arawak Cay vendors yesterday said the closure of the venue’s eastern gate entrance is creating a “turn off” for visitors to the Fish Fry and a drop in their income.

Rodney “Snapper” Russell, president of the Arawak Cay Conch, Fish and Food Vendors Association, told Tribune Business that this “near 20-year problem” has become worse with the gate now

closing at 6m every evening. As a consequence, potential patrons are “clearly” opting to bypass the destination rather than turning around and going to the main entrance.

“Since this new government came into power they have stepped up security,” Mr Russell explained. “Whereas the gate used to be locked sporadically by the previous government, with this government the police officers are being told to lock the gate as 6pm every evening.

“Because of the gate being locked a lot of people have decided that it doesn’t make sense coming

into Arawak Cay because I don’t want to drive past the Fish Fry and then have to turn back into the Fish Fry. That doesn’t make sense.”

Mr Russell said the gate closure has resulted in Arawak Cay vendors “losing business”. He added: “With the lockdown we had during COVID-19, some of the businesses have just now returned.”

The Association chief said that, besides the gate closure woe, Arawak Cay is suffering from a perception problem because patrons do not like their conch salad being made by non-Bahamians. “A lot of

INVESTMENT FUND BILL TO BOOST GOV’T RETURNS

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

The Attorney General yesterday hailed the National Investment Funds Bill (IFB) for providing a structure that will allow the Government’s ownership interests in private companies to be professionally managed.

Ryan Pinder KC, speaking in the Senate during his contribution to the debate on legislation that will replace the existing Sovereign Wealth Fund Act, said: “We promise to have an equity investment fund where government’s private sector shareholdings are held and managed in a professional and transparent manner.

“This National Investment Bill establishes the framework to deliver on all these promises to the Bahamian people in a transparent and internationally-recognised manner of good governance.” The Government and its agencies hold equity stakes in numerous companies, including the Bahamas Telecommunications Company (BTC), Aliv, the Arawak Port Development Company (APD) and Bank of The Bahamas.

Mr Pinder said the Bill incorporated corporate governance best practices, as well as holding out the possibility for the Bahamian public to take ownership positions in some of the National Investment Fund’s sub-funds and investments. He added that the Bill was drafted to be in compliance with the Santiago Principles, which promote transparency, good governance, accountability and prudent investment practices for sovereign wealth funds.

The Sovereign Wealth Fund Act 2016, which was created to receive potential royalties from oil exploration in Bahamian waters, has been little used over the past six years. Its replacement is

designed to give new direction and purpose to the intent of maximising returns on the country’s natural resources for the benefit of the Bahamian people.

Mr Pinder added: “The natural resource assets of The Bahamas generally consist of valuable land, aggregate and other materials. Additionally, the implementation of the Carbon Credits Trading Act 2022 has established revenue derived from carbon credit trading as a potential revenue base for the country, based on our natural fauna and climate activism and reform.

“As the various elements of this administration’s economic diversification plan continue to advance, a robust sovereign fund regime will be required for the proper management of existing and future natural resource wealth of The Bahamas. The National Investment Fund Bill sets the framework to ensure that all these purposes are structured recognising global standards in good governance, transparency and independent management.

Mr Pinder continued: “To ensure that there is professional management and advice, the Bill provides for an Investment Committee with majority membership not being members of the Board but being private sector participants who have substantial professional expertise and experience.

“These requirements of

the Investment Committee are set out in the Second Schedule of the Bill. Furthermore, the engagement of professional asset managers is prescribed, such asset managers being licensed and regulated by the Securities Commission of The Bahamas.”

The Bill is also designed to help the Government tap into private capital to ensure the viability of the Bahamas Resilient Infrastructure Fund (BRIF) that is targeted primarily at Family Island development. “Our Government seeks to advance a private capital mobilisation (PCM) strategy for The Bahamas and will establish, operationalise and fund the BRIF to accomplish this,” Mr Pinder said.

“The PCM strategy aims at optimising private capital for building sustainable and resilient infrastructure, with a focus on the Family Islands. This strategy follows several studies that indicate infrastructure investment is a key tool for improving productivity, stimulating economic growth, generating jobs, addressing inequalities and building resilience.

“An investment platform supporting the PCM strategy for infrastructure investment is comprised of the BRIF and three sector specific funds, namely the renewable energy fund, the fund for the Family Islands, and food security fund. These were chosen based on sector analysis and policy priorities of the Government,” he continued.

“The establishment of the BRIF and the sector funds, in the context of the larger PCM strategy, will provide the proper signals to international and domestic investors about the investment opportunities in The Bahamas. When fully implemented, the PCM will have introduced a robust and transparent way to finance infrastructure developments in The Bahamas and to create sustainable wealth for Bahamians.”

people feel as though Bahamians are no longer making conch salad, and they are drifting away from Arawak Cay,” he explained.

“So Arawak Cay is no longer seen as the place where persons come for conch salad.

“The other thing is there is a lot of conch salad being made all over the island now, so why should patrons come into this congestion to Arawak Cay.”

Despite the Saxons Junkanoo Group making Arawak Cay their weekly practice site, business has still not been as robust as Mr

Russell anticipated. “Yes, the Saxons have their practices on the eastern end of Arawak Cay, but I guess Arawak Cay has gone into the doldrums because things are not the way they used to be, and it as if we have lost our edge because people feel as if they don’t want to get conch salad from anyone else other than Bahamians,” he added.

The Ministry of Agriculture, Marine Resources and Family Island Affairs is ultimately government oversight of the Arawak Cay.

EFFORTS TO REBUILD TREASURE CAY’S SEWERAGE SYSTEM HIT BY ‘PROCUREMENT, SHIPPING DELAYS’

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

The Water and Sewerage Corporation (WSC) yesterday conceded that efforts to rebuild Treasure Cay’s sewerage system have been hit by “procurement and shipping delays” in COVID-19’s aftermath.

The state-owned water supplier, responding to Tribune Business inquiries after residents of the Abaco community complained about the rate of progress on the Treasure

Cay Sewerage System Rehabilitation Project (TCSSRP), said the delays were “justifiable” and largely beyond its control following the award of a works contract in May 2022.

“In March 2022, following a competitive bidding process, Water & Sewerage Corporation engaged APEX Underground Utilities and Construction Company to install new sewer force mains, 14 lift stations, and upgrade the pump station electrical supplies from single phase to three phase

power, which is more efficient for heavy industrial scale electronic equipment,” the water supplier said.

“The contract amount for the project was $2.433m (VAT included). The project commenced on May 25, 2022, and the projected original completion date was December 30, 2022. As of December 8, 13 of the 14 lift station wet wells have been installed (Top Cider, Sand Dollar, main Roundabout, Rock Point, administration,

THE TRIBUNE Friday, December 16, 2022, PAGE 3

SEE

ATTORNEY General Ryan Pinder.

PAGE EIGHT

compiled a comparison of income for the year 2019 and 2022,” the company told Mr Sears.

“Since the Village Road Improvement Project only began to impact our revenue starting June 2022, the comparison was made between June 1 to November 30, 2019, and June 1 to November 30, 2022. We were shown a spreadsheet that revealed a loss of income of 46 percent caused by the Village Road Improvement Project.”

Pointing out that the company was still trying to rebound from its three-month COVID closure in 2020, The Place For Art added: “Since the trenching began on the northern section of Village Road in June, The Place For Art saw a drastic decline in people coming to have their art, photos, diplomas and much more custom framed.

“The ever-changing roadblocks and diversions were a challenge for most people familiar with the alternate routes through Blair/ Harmony Hill Road and Montagu Heights. Since our business attracts clients from all parts of New Providence, those people not familiar with this area of the island were discouraged to come to our framing boutique for custom picture framing..... The inconvenience of not being accessible has had a significant impact on our 2022 sales income.”

Similar stories were voiced by other businesses. The Four Walls Squash and Social Club revealed it has had to lay-off all event-related staff “until further notice” due to

‘Disaster for business’: Village Road works in up to 46% loss

the disruption and loss of business caused by road closures, diversions and roadworks dust.

“Four Walls has seen a 30-40 percent decline in new and existing business with walk-in customers falling off completely,” the company revealed. “During the summer, the road closures and excessive dust forced us to suspend our weekend brunch, which was hosted on our outdoor patio; delay the planned roll-out of our dine-in lunch; suspend special events and promotions; and scale back our operations overall.

“We had to completely suspend all weekly outdoor events including our very successful Rhythm Village live music night on the patio, and scale back our monthly Moonlight Market backyard pop-up and shopping experience. All associated staff with these events had to be laid off until further notice.

“The premises is full of dust including the interior carpets and furniture, which will have to be washed or replaced. The external walls of the building will have to be pressure washed and repainted after the roadworks are complete. There has been significant damage to the parking lot directly adjacent to Village Road, which was used to redirect traffic around the open trenches. This area will have to be repaved and repainted.”

Tropical Nursery said contractors have taken over “almost double” the amount of space in its parking lot that was originally proposed. “Tropical Nursery has seen a decline of 35 percent in customer interaction and business since the commencement of Village Road Improvement Project,” Mr Sears was told.

“The lack of organisation and efficiency to provide flow-through traffic has severely impeded our schedule of shipments and supplies. The reconstruction of our boundary wall and gate took an entire month, leaving an opened trench in our parking lot, thus blocking the entry way which did not allow containers to be delivered. Needless to say, this has caused a great deal of frustration but, more importantly, an increase in operational expenditure.

“In the planning stages of Village Road Improvement Project, we were told that a portion of our parking lot would be needed to ensure a successful outcome of the project. To our dismay, this portion grew in size throughout the project, and at its current ‘completed’ stage is almost double the amount that was initially proposed.

“Unfortunately, we still await confirmation on fair compensation. Due to the shrinkage of our parking lot, we are not able to host the same amount of customers at

our business. In addition to this, our gate was poorly reinstalled and is not working properly, adding a security threat to the ordeal.” Tropical Nursery accused contractors of using its parking lot “for the dumping of material without prior permission”, while the dust from the roadworks had impacted its greenhouses.

Meanwhile, The Computer Store added: “The Village Road Improvement Project has been a disaster for business. There were days when the parking lot was trenched off completely and customers wishing to access the store would have to park and walk in through the dust or mud, depending on the weather.

“The fill from these trenches were placed on to the surface of our parking lot, and then when the work was finished, heavy equipment was seen in our yard scraping the ground and pushing it back into the trench.

“This has completely destroyed the parking lot. We would respectfully ask that the parking lot be repaved to repair the damages done to it.

“We do not own the property, but our landlord has said that due to the condition of the area the rentals are down (only two out of six units) and they are not in a financial position to repave the parking lot that has been damaged, as they are also struggling to pay the real property tax which has tripled within the last year.”

Besides having to deal with the dust, The Computer Store added: “Our phones and Internet have been disrupted on numerous

occasions, sometimes for up to a week at a time. A computer business without Internet service is almost impossible. When I do get to talk to customers,their concern is often ‘How can I get to you?’ Or ‘I was told I can’t come that way’, sometimes even “I’m sorry I don’t want to take my car into that mess’.

“I have done my best to keep my staff employed through these difficult times, even where some months we aren’t even breaking even with current expenses. This has proven to be a very difficult year for us; a year when we needed growth.”

It was a similar story at The Village Deli, which said its sales have declined by 30-40 percent due to the roadworks. A small business and food truck vendor, it added: “We experienced disruptions in traffic flow, parking restrictions, noisy machinery, dirty construction zones and a change in the habits of even our most loyal customers.

“Despite our attempts to be creative and resourceful to stay profitable during the road construction project, our efforts failed forcing us to shut our food truck down for weeks before relocation.”

The 15 companies signing the letter also include Pam Burnside and Doongalik Studios Art Gallery; Graham Weatherford’s Sure Alarm; Branville McCartney’s Halsbury Chambers and fellow law firm, Providence Law; The Village Dental Centre; Village Office Suites; the Life Chiropractic Centre; and Da Craft Cottage.

URCA ‘out of their minds’ for BPL 163% fuel hike backing

“The regulator notes that BPL’s justification for the changes to the fuel charge is based on conditions that are likely to change,” URCA added. “Therefore, it is URCA’s intent to revisit that matter to ensure that BPL is operating efficiently and charging customers appropriately. URCA has advised its licensee (BPL) of its intent to review its fuel charge again during the projected glide path fuel charge recovery period, and it will make public notice of the same as necessary.”

URCA did not disclose the full analysis, or review, that it conducted to justify its conclusion that BPL fuel charge hikes of up to 163

percent are warranted. And the timing of its review, and news release, is more than one month after BPL had already begun to implement the phased increases.

Mr McCartney questioned whether URCA’s assessment took into account that the fuel charge increases would have been unnecessary, and not have occurred, if the Davis administration had executed the trades to purchase more cut-price oil immediately after taking office to underpin BPL’s existing hedging strategy.

“This administration completely dropped the ball on that,” the ex-DNA leader told this newspaper.

“I’m sorry, URCA can say all they want in that regard,

but that certainly doesn’t alleviate the Bahamian people from spending extra money on their electricity bill. I’m sorry; that doesn’t wash....

“Justifying that increase, I’m curious if the review that URCA did made mention of the fact this could all have been avoided. That would be interesting to know. The summary of that report, saying it’s OK for the Government to drop the ball and cost the Bahamian people money, they’ve got to be out of their minds. Please. I suck my teeth.

“We shouldn’t even have been in this position in the first place. For URCA to even have to do a report, we shouldn’t have been in this position in the first

place. No, please. What do young people say? SMT (suck my teeth)? Unfortunately, it’s a position that the administration has put the people in where they’ve got to pay more for electricity at a time when they cannot afford it at all with the other increases going on.”

Mr McCartney, calling for URCA to publish its full review, said: “If they’re going to put out a release and say it’s justified, how is that so, and have they taken into consideration or has the report indicated it could have been avoided? You are justifying something that could have been avoided. The question is: Did the report focus on that aspect as well?”

NOTICE

Notice is hereby given that all persons having any claim or demands against the above named Estate are required to send their names, addresses and particulars of the same duly certified in writing to the undersigned on or before the 29th day of December A.D., 2022, and if required, prove such debts or claims, or in default be excluded from any distribution; after the above date the assets will be distributed having regard only to the proved debts or claims of which the Administrators shall then have had Notice.

And Notice is hereby given that all persons indebted to the said Estate are requested to make full settlement on or before the aforementioned date.

MICHAEL A. DEAN & CO., Attorneys for the Administrators

Alvernia Court, 49A Dowdeswell Street P.O. Box N-3114 Nassau, The Bahamas

JOB OPPORTUNITY

A Telecommunications company is seeking to employ persons to assist in the installation of Fibre Optic Cables. Persons will be trained in the installation and testing of Fibre Optic networks and will be required to work in the field. Successful candidates must possess the following criteria: -

• High School graduate

• Ability to perform manual work in cabling

• Carry out instructions and work well in teams

• Good work ethics and desire to learn

• Computer skills is an asset

NOTICE

In the Estate of THOMAS WILLIAM JOHNSON late of the Settlement of James Cistern in the Island of Eleuthera one of the Islands of the Commonwealth of The Bahamas, deceased.

NOTICE IS HEREBY GIVEN that all persons having any claim against the above named Estate are required on or before the 30th day of December, 2022 to send their names and addresses and particulars of their debts or claims to the undersigned and if so required by notice in writing from the undersigned to come in and prove such debts and claims or in default thereof they will be excluded from the benefits of any distributions made before such debts are proved AND all persons indebted to the said Estate are asked to pay their respective debts to the undersigned.

HAILSHAMS LEGAL ASSOCIATES Counsel and Attorneys at Law RENALDO HOUSE 10 Queen’s Highway Palmetto Point, Eleuthera, Bahamas P. O. Box SS 5062, Nassau, Bahamas Attorneys for the Administratrix of the above Estate Tel: 242-332-0470 email: hailshams@1stcounsel.com

He voiced doubt that URCA’s review would have “changed anything” should it have determined that BPL’s fuel charge hike was not justified, as the Government and state-owned utility would likely have pressed ahead anyway. However, Mr McCartney said the regulator’s apparent blessing of BPL’s plan “isn’t going to hold water with the Bahamian people”.

“Every month the Good Lord sends, and those electricity bills are astronomical, the Bahamian people will feel it and any type of report by URCA justifying it will be of no consequence to them or the money coming out of their pocket,” he told Tribune Business. “The Bahamian people have been given a sack of coal in terms if electricity bills for Christmas and New Year.”

The fuel charge component of BPL bills is set to increase by up to 163 percent compared to the stable 10.5 cents per kilowatt (KwH) enjoyed by the utility’s customers for the just over two-year period to October 2022.

Without the cut-priced fuel produced by those trades, BPL has increasingly been purchasing its oil at spot market prices from late 2021 onwards but not passing the full cost on to customers - in contravention of the Electricity Act regulations - for some months.

With BPL’s mounting debts to Shell, its fuel supplier, increasingly unsustainable, the Government has reached an agreement to pay the global oil giant $90m over a nine-month period at $10m per month.

It is this payment, and BPL’s huge hiking of the fuel charge to recover this debt and government loans previously made to support the 10.5 KwH price, that has prompted Opposition charges that the Davis administration has cost the Bahamian people over $100m.

Michael Pintard, the

Free National Movement’s (FNM) leader, yesterday told Tribune Business that URCA’s brief statement was noticeably silent on how the revenues generated by BPL’s fuel charge hikes will be used.

The rolling series of increases will generate more monies than are needed to cover BPL’s fuel costs, which are supposed by law to be passed on 100

percent to customers, and he questioned what proportion will act as “a claw back” from businesses and households to repay the debts and unpaid bills incurred from maintaining the fuel charge at 10.5 cents per kWH for so long.

“What URCA did not say in its brief statement, which we expect to be detailed in their report, is the amount of funds being applied,” Mr Pintard explained. “What is the nature of the funds? What percentage of that is to claw back from consumers that, up to this time, BPL has not passed on? What percentage is to replenish the funds made available to BPL as subsidies?”

He reiterated that the Government has “no standing in law” to subsidise BPL’s fuel charge, and said: “All of this should have been part of the consideration for BPL’s explanation of the increasing fuel charge.”

LEGAL NOTICE

NOTICE INTERNATIONAL BUSINESS COMPANIES ACT (No.45 of 2000)

In Voluntary Liquidation

Notice is hereby given that, in accordance with Section 138 (4) of the International Business Companies Act, (No.45 of 2000), RBMH Investment Fund Ltd. (the “Company”) is in dissolution. The date of commencement of the dissolution is 9th day of December, 2022. Rafael Baldi De Moraes Horta is the Liquidator and can be contacted at Al Gabriel Monteiro Da Silva 1310 AP 71, CEP: 01442-000, SP,São Paulo, Brazil. All persons having claims against the above-named Company are required to send their names, addresses and particulars of their debts or claims to the Liquidator before the 30th December, 2022.

Baldi De Moraes Horta Liquidator

Baldi De Moraes Horta Liquidator

PAGE 4, Friday, December 16, 2022 THE TRIBUNE

PAGE B1

FROM PAGE B1

FNM Leader Michael Pintard.

FROM

calatelhr@gmail.com on or before Dec 21st,

Interested persons may email resume at

2022

IN THE ESTATE of MARY ELIZABETH HIGGS late of Yellow Elder Gardens Subdivision in the Southern District of the Island of New Providence, one the Islands of The Commonwealth of The Bahamas, deceased.

Rafael

Tax breaks call as Village Road avoided ‘like

FROM

It is not unheard of for the Government to provide tax breaks and other concessions for businesses impacted by long-running roadworks projects.

Asia stocks follow Wall St down as Fed warns of higher rates

sank 1.1% to 19,449.15. The Kospi in Seoul gave up

The Shanghai Composite index fell 0.3% to 3,167.73 and Australia’s S&P/ASX

Shares fell in Taiwan and Bangkok but rose in

As expected, the central term rate by 0.50 percentage points on Wednesday. It was its seventh hike this year. The Fed also said it expects rates to be higher over the coming few years

tion has eased had stoked optimism that the Fed might signal the possibility of rate cuts in the second half of next year. But during a press conference, Fed Chair Jerome Powell

0.3690.26026.42.67%

-0.4380.000-8.7 0.00%

0.1400.00073.20.00%

0.1840.12019.53.35% 8.547.00Colina

0.7220.72022.14.50%

0.1020.43430.613.91%

0.4670.06022.50.57%

0.6460.32814.93.40%

0.7280.24015.42.14%

0.8160.54022.22.98%

0.2030.12019.63.02%

The last Christie administration did so for the New Providence Road Improvement Project, and Michael Halkitis, minister of economic affairs, yesterday said he would assess their plight - and requests - if submitted to him.

emphasized that the full effects of the central bank’s efforts to slow the economy to bring down inflation have yet to be fully felt.

“The Fed did not welcome the disinflation trends that have just started to emerge and focused on robust job gains and elevated inflation. Any hopes of a soft landing disappeared as the Fed seems like they are committed to taking rates much higher,” Edward Moya of Oanda said in a commentary.

Acknowledging the roadworks’ importance, Mr Fields nevertheless said “an economic stimulus package” will be a vital tool in helping the area’s businesses to rebound in the New Year. “The sprawling construction and protracted delays have placed a crippling strain on local businesses, which employ hundreds of Bahamians,” he wrote.

The S&P 500 lost 0.6% to 3,995.32, giving up an earlier gain of 0.9%. The Dow Jones Industrial Average fell 0.4% to 33,966.35, and the Nasdaq composite gave back 0.8%, closing at 11,170.89.

“The Government has recognised the importance of business relief in the past, and the risks of unwieldy roadworks literally putting Bahamians out of business completely.

Roughly 70% of the stocks in the S&P 500 closed lower Wednesday, with technology companies, banks and retailers among the biggest weights on the benchmark index. Apple fell 1.6%, Goldman Sachs dropped 2.3% and Best Buy slid 3.9%.

The current losses come at a time when the ordinary cost of doing business continues to rise, on top of the fact that we have all just barely emerged from the full impact of the pandemic.

Small company stocks also fell. The Russell 2000 index slid 0.7% to 1,820.45.

The Fed’s latest hike is smaller than the previous four 0.75 percentage point increases and comes a day after an encouraging report showed that inflation in the U.S. slowed in November

Costs

“Small businesses have recently faced increases in electricity costs, property taxes, wages and inflation. When the work is complete, businesses will also incur high costs to clean up our properties, repair damages, and re-engage customers.”

Mr Fields continued: “Between the open trenches, unpaved roads, detours, strained traffic management and dust, customers are avoiding Village Road like a plague. The original target for completion, which was September 2022, and even the revised date of November, would have allowed local businesses to benefit from the holiday bump that most rely upon.

“Each missed deadline has serious implications

for businesses, and there is little belief that the latest end-of-month forecast for completion will be met given the lack of clear communication and the conditions on the ground. With no clear end in sight, our reserves are depleted, our business planning efforts have become futile, and we continue to experience tremendous losses.

for a fifth straight month, to 7.1%.

Powell said the Fed plans to hold rates at a level high enough to slow the economy “for some time” to ensure inflation really is crushed. He said the Fed’s projections released Wednesday do not include any for rate cuts in 2023.

Mr Fields yesterday told Tribune Business that some businesses on Village Road have already closed down after access to their companies was choked off.

“The inflation data received so far for October and November show a welcome reduction in the monthly pace of price increases, but it will take substantially more evidence to give confidence that inflation is on a sustained downward path,” Powell said.

Letter

“We received a letter in February that the road improvement project would commence, and the target date for completion was September, but then they switched it to December. But we heard that the completion date is now in January,” he said.

“I wouldn’t see the committee cutting rates until we’re confident that inflation is moving down in a sustained way,” Powell said.

The latest increase brings the Fed’s federal funds rate to a range of 4.25% to 4.5%, its highest level in 15 years.

Fed policymakers forecast that the central bank’s rate will reach a range of 5% to 5.25% by the end of 2023. That suggests the Fed is prepared to raise rates by an additional 0.75 percentage points next year.

There have also been disruptions to electricity, telecommunications and water supplies. One shopping plaza has been without telecommunications for over a month to the point where its provider has had to issue cellular phones to tenants.

The Fed also signaled it expects its rate will come down by the end of 2024 to 4.1%, and drop to 3.1% at the end of 2025.

Mr Fields said: “The businesses are struggling, and what we submitted to the Government - and this goes for future projects as well - is that if they are going to do any substantial road improvement projects, if they plan tax incentives for the businesses that would keep them alive and stimulate them to get them back in their feet.

NOTICE is hereby given that BENJAMIN JOSEPH CATO of Blue Hill Road, South, Nassau, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 15th day of December, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

“There is no paving being done now. None. Right now I think they are working on the water and sewerage side and doing connections, so they are still trenching and they are still working. All of us were in shock when we heard the new date for completion, because it was bad enough as it is for the December completion because we would have missed Christmas. There’s no end in sight.”

NOTICE is hereby given that WESLEY PIERRE of Bacardi Road, Nassau, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 15th day of December, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

ACL LTD.

Notice is hereby given that in accordance with Section 138(8) of the International Business Companies Act 2000, the dissolution of ACL LTD., has been completed. A Certificate of Dissolution has been issued by the Registrar General on the 22nd day of November, 2022.

PAGE 6, Friday, December 16, 2022 THE TRIBUNE

plague’

PAGE B1

LIQUIDATOR NOTICE

Augusto Carlos de Almeida Goncalves

INTERNATIONAL BUSINESS COMPANIES ACT, 2000

Registration number 202266 B PAGE 14, Thursday, December 15, 2022 THE TRIBUNE

NOTICE WEDNESDAY, 14 DECEMBER 2022 CLOSECHANGE%CHANGEYTDYTD% BISX ALL SHARE INDEX: 2637.23-0.050.00408.9918.35 BISX LISTED & TRADED SECURITIES 52WK HI52WK LOWSECURITY SYMBOLLAST CLOSECLOSECHANGE VOLUMEEPS$DIV$P/E YIELD 7.005.30 AML Foods Limited AML 6.95

53.0040.03 APD Limited APD 39.95

2.761.60Benchmark BBL

2.462.31Bahamas First Holdings Limited BFH

2.852.25Bank of Bahamas BOB

Property Fund BPF

Waste BWL

Holdings

FirstCaribbean Bank CIB

Water BDRs CWCB

Hospital DHS

Incorporated EMAB

FAM

Bank (Bahamas) Limited FBB

FCL

FIN

16.2515.50J. S. Johnson JSJ

PREFERENCE SHARES 1.001.00Bahamas First Holdings PreferenceBFHP

1000.001000.00 Cable Bahamas Series 6 CAB6

1000.001000.00 Cable Bahamas Series 9 CAB9

1.001.00Colina Holdings Class A CHLA

10.0010.00Fidelity Bank Bahamas Class A FBBA

1.001.00Focol Class B FCLB 1.00 1.000.00

CORPORATE DEBT - (percentage pricing) 52WK HI52WK LOWSECURITY SYMBOLLAST SALECLOSECHANGEVOLUME 100.00100.00Fidelity Bank (Note 22 Series B+)FBB22 100.00100.000.00 100.00100.00Bahamas First Holdings LimitedBFHB 100.00100.000.00 BAHAMAS GOVERNMENT STOCK - (percentage pricing) 115.92104.79Bahamas Note 6.95 (2029) BAH29 107.31107.310.00 100.00100.00BGS: 2014-12-7Y BG0107 100.00100.000.00 100.00100.00BGS: 2015-1-7Y BG0207 100.00100.000.00 100.00100.00BGS: 2014-12-30Y BG0130 100.00100.000.00 100.00100.00BGS: 2015-1-30Y BG0230 100.00100.000.00 100.00100.00BGS: 2015-6-7Y BG0307 100.00100.000.00 100.00100.00BGS: 2015-6-30Y BG0330

2015-10-7Y BG0407

97.5197.51BGRS FX BGR106036 BSBGR1060361

200 97.5097.50BGRS FX BGR107036 BSBGR1070360

10 94.9994.99BGRS FX BGR120037 BSBGR1200371

2 91.9891.98BGRS FX BGR125238 BSBGR1252380 91.98100.008.02 500 91.9191.91BGRS FX BGR127139 BSBGR1271398 91.91100.008.09 138 92.6792.67BGRS FX BGR131239 BSBGR1312390 92.6792.55 (0.12) 131 90.9890.98BGRS FX BGR132249 BSBGR1322498 90.9890.95 (0.03) 23 94.8094.80BGRS FX BGR134140 BSBGR1341407 94.8093.94 (0.86) 88 100.39100.39BGRS FX BGR138230 BSBGR1380306 100.39100.390.00 100 96.8496.84BGRS FX BGR138240 BSBGR1380405 96.8496.10 (0.74) 300 100.32100.32BGRS FL BGRS81035 BSBGRS810359 100.32100.660.34 100 100.34100.34BGRS FL BGRS81037 BSBGRS810375 100.34100.17 (0.17) 150 100.57100.57BGRS FL BGRS84033 BSBGRS840331 100.57100.15 (0.42) 225 MUTUAL FUNDS 52WK HI52WK LOW NAV YTD%12 MTH% 2.572.11

MARKET TERMS BISX ALL SHARE INDEX - 19 Dec 02 = 1,000.00 YIELD - last 12 month dividends divided by closing price 52wk-Hi - Highest closing price in last 52 weeks Bid $ - Buying price of Colina and Fidelity 52wk-Low - Lowest closing price in last 52 weeks Ask $ - Selling price of Colina and fidelity Previous Close - Previous day's weighted price for daily volume Last Price - Last traded over-the-counter price Today's Close - Current day's weighted price for daily volume Weekly Vol. - Trading volume of the prior week Change - Change in closing price from day to day EPS $ - A company's reported earnings per share for the last 12 mths Daily Vol. - Number of total shares traded today NAV - Net Asset Value DIV $ Dividends per share paid in the last 12 months N/M - Not Meaningful P/E Closing price divided by the last 12 month earnings TO TRADE CALL: CFAL 242-502-7010 | ROYALFIDELITY 242-356-7764 | CORALISLE 242-502-7525 | LENO 242-396-3225 | BENCHMARK 242-326-7333 5.35% 5.00% 5.40% 5.22% 5.14% 5.60% 26-Aug-2036 15-Dec-2037 15-Jul-2039 15-Jun-2040 5.00% 5.00% 15-Oct-2038 15-Jan-2039 15-Oct-2049 17-Jan-2040 15-Jun-2030 5.65% 6.25% 30-Sep-2025 30-Sep-2022 FUND CFAL Bond Fund CFAL Balanced Fund CFAL Money Market Fund CFAL Global Bond Fund 6.25% 4.50% 6.25% 4.25% NAV Date 4.87% 4.68% 5.40% 15-Dec-2021 30-Jul-2022 15-Dec-2044 30-Jul-2045 26-Jun-2022 26-Jun-2045 15-Oct-2022 28-Oct-2022 22-Sep-2033 4-Aug-2036 26-Jul-2037 31-Mar-2021 30-Nov-2022 30-Nov-2022 31-Oct-2022 30-Nov-2022 30-Nov-2022 30-Nov-2022 30-Nov-2022 31-Oct-2022 31-Oct-2022 INTEREST Prime + 1.75% MARKET REPORT 31-Mar-2021 31-Mar-2021 MATURITY 19-Oct-2022 20-Nov-2029 31-Oct-2022 31-Oct-2022 6.95% 4.50% 30-Sep-2022 31-Oct-2022 4.50% 6.25% 4.81% 26-Jul-2035 Colonial Bahamas Fund Class D Colonial Bahamas Fund Class E Colonial Bahamas Fund Class F CFAL Global Equity Fund Leno Financial Conservative Fund Leno Financial Aggressive Fund Leno Financial Balanced Fund Leno Financial Global Bond Fund RF Bahamas Opportunities Fund - Secured Balanced Fund RF Bahamas Opportunities Fund - Targeted Equity Fund RF Bahamas Opportunities Fund - Prime Income Fund RF Bahamas International Investment Fund Limited - Equities Sub Fund RF Bahamas International Investment Fund Limited - High Yield Income Fund RF Bahamas International Investment Fund Limited - Alternative Strategies Fund (242)323-2330 (242) 323-2320 www.bisxbahamas.com

NOTICE is hereby given that JEFRASON LIMA of Quintine Alley off Wulf Road, Nassau, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 8th day of December, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

6.950.00 0.2390.17029.12.45%

39.950.00 0.9321.26042.93.15%

2.76 2.760.00 0.0000.020N/M0.72%

2.46 2.460.00 0.1400.08017.63.25%

2.61 2.610.00 0.0700.000N/M0.00% 6.306.00Bahamas

6.30 6.300.00 1.7600.000N/M0.00% 9.808.78Bahamas

9.75 9.750.00

4.342.82Cable Bahamas CAB 3.80 3.800.00

10.657.50Commonwealth Brewery CBB 10.25 10.250.00

3.652.54Commonwealth Bank CBL 3.58 3.580.00

CHL 8.53 8.530.00 2400.4490.22019.02.58% 17.5012.00CIBC

15.99 15.990.00

3.251.99Consolidated

3.06 3.120.06

11.2810.05Doctor's

10.50 10.500.00

11.679.16Emera

9.78 9.65 (0.13)

11.5010.06Famguard

11.22 11.220.00

18.3014.05Fidelity

18.10 18.100.00

4.003.50Focol

3.98 3.980.00

11.509.85Finco

11.38 11.380.00 0.9390.20012.11.76%

15.75 15.750.00 0.6310.61025.03.87%

1.00 1.000.00 0.0000.0000.0000.00%

1000.001000.000.00 0.0000.0000.0000.00%

1000.001000.000.00 0.0000.0000.0000.00%

1.00 1.000.00 0.0000.0000.0006.25%

10.0010.000.00 0.0000.0000.0007.00%

0.0000.0000.0006.50%

100.00100.000.00 100.00100.00BGS:

100.00100.000.00

97.5197.49 (0.02)

97.5096.69 (0.81)

94.9994.990.00

2.573.15%3.89% 4.873.30 4.843.60%5.49% 2.251.68 2.252.43%2.92% 205.22164.74 190.45-6.40%-6.95% 212.41116.70 169.68-20.12%-15.15% 1.761.71 1.762.49%2.79% 1.941.78 1.935.71%7.96% 1.881.79 1.863.39%3.91% 1.030.93 0.93-8.94%-9.55% 9.376.41 10.107.82%9.00% 11.837.62 13.4413.58%15.81% 7.545.66 7.712.57%2.83% 16.648.65 13.25-20.10%-19.25% 12.8410.54 12.03-4.50%-4.64% 10.779.57 10.59-0.55%-1.61% 10.009.88 N/AN/AN/A 10.438.45 10.433.00%25.60% 14.8911.20 14.897.90%48.70%

NOTICE

N O T I C E IS HEREBY GIVEN as follows: (a) BIRD

LIMITED

The

Leeward Nominees Limited Liquidator N O T I C E BIRD OF PARADISE LIMITED

de

LIQUIDATOR NOTICE INTERNATIONAL BUSINESS COMPANIES ACT, 2000 ROTA CASAS LTD. Registration number 203646 B

NOTICE

OF PARADISE

is in voluntary dissolution under the provisions of Section 138 (4) of the International Business Companies Act 2000. (b)

dissolution of the said company commenced on the 23rd November, 2022 when the Articles of Dissolution were submitted to and registered by the Registrar General. (c) The Liquidator of the said company is Leeward Nominees Limited, Vistra Corporate Services Centre, Wickhams Cay II, Road Town, Tortola, British Virgin Islands. Dated this 15th day of December, 2022

Notice is hereby given that in accordance with Section 138(8) of the International Business Companies Act 2000, the dissolution of ROTA CASAS LTD., has been completed. A Certificate of Dissolution has been issued by the Registrar General on the 28th day of November, 2022. Arthur

Mattos Casas

maintenance contract will not be renewed once it expires at year’s end. He explained that the move was driven by “technical and financial” factors, with BPL looking to save the “several million dollars” it spends annually on the arrangement, as well as generate greater efficiency and economies of scale at Clifton Pier.

“There won’t be much change,” the BPL chief executive told this newspaper. “We’ll just integrate it back into our operations in the short-term. The reason just being that we have a lot of technical and financial objectives over the next two to three years. We thought it would be best integrating Station A back into BPL’s mix....

“We looked at the numbers, we looked at making the operations a bit more efficient, utilising the economies of scale we have at Clifton Pier, and seeing it as an opportunity to keep the cost down and improve the quality of production to the consumer.” Mr Cambridge declined to confirm how much BPL will save by allowing much of its Wartsila relationship to expire, but it is understood the contract is worth several million dollars per year.

While the service/ operations and routine maintenance aspects will not be renewed, the BPL

chief said there will “still be a role for Wartsila” when it comes to “major overhauls” of that 132 MW. “For the major maintenance, we’ll probably for the short-term be contracting that out to Wartsila and a number of other contractors that offer that service,” Mr Cambridge explained.

“I can tell you that even on major engines at Clifton we contract a lot of maintenance out and have had those for over 20 years. When we look at the amount of engines we have, it doesn’t lend itself to having a full maintenance complement on staff because of the volume of works. It makes sense to contract that work out, but for operational purposes we have 24/7 staff and it’s just a matter of integrating those operations back into our operations.”

However, one well-placed BPL source, speaking on condition of anonymity because they were not authorised to speak publicly, said the utility would likely need to hire Wartsila’s Bahamas-based staff to keep operating the 132 MW because its own employees were not trained to run the engines.

“It seems as if they have decided not to renew the maintenance contract for

Wartsila. The Wartsila contract technically expires on December 31. They want the BPL employees to run those engines, but those guys aren’t trained to run those engines,” the contact said.

“Those are very sensitive tri-fuel engines, and have very sensitive control systems. I don’t know how open Wartsila would be to training. We have guys that can come up to speed, but no BPL employee was trained on those engines; not a single one. They formed Wartsila Bahamas, formed a local team, but they were employed by Wartsila. Is BPL going to hire them?”

Mr Cambridge confirmed BPL is “prepared to have discussions” with those Wartsila Bahamas staff that want to switch to its operations, saying “we may have some opportunities for them”, although he stopped well short of offering castiron promises. Tribune Business understands that up to 35 Wartsila Bahamas staff, a mix of expatriates and locals, will be impacted by the contract’s nonrenewal although both parties are still discussing how their new relationship will look.

The BPL chief said there were “no concerns about”

the ability of BPL staff to operate and maintain the Wartsila engines, adding: “We have a number of mechanics on our staff who are trained on that fourstroke engine, medium speed diesel. There’s not much difference between one four-stroke diesel engine to another.

“We have a number of four-stroke diesel engines in our fleet, especially in the Family Islands. You start them, put them on load, monitor the voltage frequency and that’s pretty much whether the technology is gas turbine, slow speed, medium speed. The technology doesn’t vary that much, and we have no concerns about that.”

Yet one BPL source said of the transition: “I can tell you this right now: This is going to be interesting. The Wartsila guys who were trained on it had some challenges operating those things. It’s new technology; tri-fuel technology. They were separate and apart from BPL staff.

“When the Station A project was brought on, BPL refused to take on the new jobs with Wartsila. They were offered first preference, but they chose not to do so. Wartsila built its own local team. The idea was that Wartsila would take on

the liability of maintaining those engines knowing that they were going to be sold to Shell.

“The contract included all of the maintenance, all of the operations, and specified that the engines be maintained according to the manufacturer’s recommendations to preserve their value. It is an operational and maintenance risk. If BPL is doing minor maintenance, are they doing it in accordance with the manufacturer’s recommendations? That’s one of the challenges,” they continued.

“It was a pretty sizeable contract. It was several million dollars a year. It included parts, operations, labour, everything.” The source questioned whether BPL would achieve the economies of scale it is seeking from the deal’s end, given that 35 Wartsila staff have been operating 132 MW of generation capacity compared to some 100 BPL staff overseeing the remaining 70 MW at Clifton Pier.

Under the former Minnis administration, Wartsila’s 132 MW were ultimately supposed to be on-sold to Shell North America and incorporated in its proposed 220 MW multi-fuel Clifton Pier power plant intended to provide most

of New Providence’s base load generation. The power plant was supposed to be accompanied by a liquefied natural gas (LNG) regasification terminal so that the plant could use a cheaper, cleaner fuel.

Mr Cambridge, though, denied that BPL’s decision to reintegrate Station A back into its own operations meant that the Shell deal - or outsourcing of base load generation - will not proceed. “That’s no indication of that,” he replied, “and has no bearing on it. The opportunities are still available for some type of management agreement or PPA (power purchase agreement). However the deal ends up being structured at the end of the day, the opportunity still exists.” Another BPL source, also speaking on condition of anonymity, suggested that the utility will unlikely have the capacity to take on all Wartsila staff. Confirming issues with the engines, they added: “That’s why we had blackouts. The engines tripped, and Wartsila’s people did not know what to do. Our people, if they see the frequency dropping, they know what to do and make adjustments. You can’t have a separate entity controlling your generation; you can’t.”

Tuesday Wednesday Thursday

1:10 a.m. 2.1 7:14 a.m. 0.8 1:20 p.m. 2.3 7:49 p.m. 0.3 2:04 a.m. 2.3 8:15 a.m. 0.7 2:12 p.m. 2.3 8:36 p.m. 0.2

2:58 a.m. 2.5 9:15 a.m. 0.5 3:06 p.m. 2.2 9:25 p.m. 0.0 3:50 a.m. 2.7 10:14 a.m. 0.3 4:01 p.m. 2.3 10:14 p.m. ‑0.2

4:42 a.m. 2.9 11:10 a.m. 0.1 4:55 p.m. 2.3 11:04 p.m. ‑0.4

5:34 a.m. 3.2 12:03 p.m. ‑0.2 5:48 p.m. 2.4 11:55 p.m. ‑0.7 6:25 a.m. 3.3 12:56 p.m. ‑0.4 6:41 p.m. 2.4 ‑‑‑‑‑ ‑‑‑‑‑

THE TRIBUNE Friday, December 16, 2022, PAGE 7

BPL TO END DEAL COVERING 50% OF NASSAU ELECTRICITY FROM PAGE B01 Shown is today’s weather. Temperatures are today’s highs and tonight’s lows. ORLANDO Low: 49° F/9° C High: 70° F/21° C TAMPA Low: 53° F/12° C High: 72° F/22° C WEST PALM BEACH Low: 65° F/18° C High: 78° F/26° C FT. LAUDERDALE Low: 68° F/20° C High: 78° F/26° C KEY WEST Low: 71° F/22° C High: 79° F/26° C Low: 69° F/21° C High: 82° F/28° C ABACO Low: 69° F/21° C High: 78° F/26° C ELEUTHERA Low: 71° F/22° C High: 82° F/28° C RAGGED ISLAND Low: 72° F/22° C High: 83° F/28° C GREAT EXUMA Low: 73° F/23° C High: 82° F/28° C CAT ISLAND Low: 70° F/21° C High: 84° F/29° C SAN SALVADOR Low: 70° F/21° C High: 84° F/29° C CROOKED ISLAND / ACKLINS Low: 71° F/22° C High: 82° F/28° C LONG ISLAND Low: 71° F/22° C High: 83° F/28° C MAYAGUANA Low: 71° F/22° C High: 82° F/28° C GREAT INAGUA Low: 71° F/22° C High: 83° F/28° C ANDROS Low: 70° F/21° C High: 83° F/28° C Low: 67° F/19° C High: 79° F/26° C FREEPORT NASSAU Low: 68° F/20° C High: 79° F/26° C MIAMI THE WEATHER REPORT 5-Day Forecast A couple of afternoon showers High: 82° AccuWeather RealFeel 86° F The exclusive AccuWeather RealFeel Temperature is an index that combines the effects of temperature, wind, humidity, sunshine intensity, cloudiness, precipitation, pressure and elevation on the human body—everything that affects how warm or cold a person feels. Temperatures reflect the high and the low for the day. Cloudy with a few showers Low: 69° AccuWeather RealFeel 71° F A t‑storm around in the afternoon High: 82° AccuWeather RealFeel Low: 70° 87°-70° F Partly sunny with a few showers High: 80° AccuWeather RealFeel Low: 70° 83°-67° F Breezy; occasional morning rain High: 79° AccuWeather RealFeel Low: 68° 78°-66° F Breezy with a shower and t‑storm High: 80° AccuWeather RealFeel 81°-66° F Low: 70° TODAY TONIGHT SATURDAY SUNDAY MONDAY TUESDAY almanac High 81° F/27° C Low 68° F/20° C Normal high 79° F/26° C Normal low 67° F/19° C Last year’s high 82° F/28° C Last year’s low 68° F/20° C As of 1 p.m. yesterday 0.00” Year to date 55.66” Normal year to date 39.05” Statistics are for Nassau through 1 p.m. yesterday Temperature Precipitation sun anD moon tiDes For nassau Last Dec. 16 New Dec. 23 First Dec. 29 Full Jan. 6 Sunrise 6:48 a.m. Sunset 5:23 p.m. Moonrise none Moonset 12:36 p.m.

High Ht.(ft.) Low Ht.(ft.)

Today Saturday Sunday Monday

marine Forecast WINDS WAVES VISIBILITY WATER TEMPS. ABACO Today: NW at 8 16 Knots 3 6 Feet 10 Miles 78° F Saturday: NE at 6 12 Knots 4 7 Feet 5 Miles 78° F ANDROS Today: S at 6 12 Knots 0 1 Feet 10 Miles 78° F Saturday: SE at 6 12 Knots 0 1 Feet 6 Miles 78° F CAT ISLAND Today: S at 6 12 Knots 3 6 Feet 10 Miles 78° F Saturday: ESE at 4 8 Knots 3 5 Feet 10 Miles 78° F CROOKED ISLAND Today: SE at 6 12 Knots 3 5 Feet 10 Miles 81° F Saturday: ESE at 7 14 Knots 2 4 Feet 10 Miles 81° F ELEUTHERA Today: SSW at 6 12 Knots 3 5 Feet 10 Miles 79° F Saturday: SE at 3 6 Knots 3 5 Feet 10 Miles 79° F FREEPORT Today: NNW at 7 14 Knots 2 4 Feet 10 Miles 76° F Saturday: ENE at 7 14 Knots 1 3 Feet 5 Miles 77° F GREAT EXUMA Today: S at 6 12 Knots 0 1 Feet 10 Miles 80° F Saturday: SE at 4 8 Knots 0 1 Feet 10 Miles 80° F GREAT INAGUA Today: E at 6 12 Knots 2 4 Feet 10 Miles 81° F Saturday: E at 7 14 Knots 1 3 Feet 10 Miles 81° F LONG ISLAND Today: SE at 6 12 Knots 1 3 Feet 10 Miles 81° F Saturday: ESE at 6 12 Knots 1 3 Feet 10 Miles 82° F MAYAGUANA Today: SE at 6 12 Knots 4 7 Feet 10 Miles 81° F Saturday: ESE at 7 14 Knots 4 7 Feet 10 Miles 81° F NASSAU Today: SSW at 6 12 Knots 1 2 Feet 10 Miles 79° F Saturday: SE at 4 8 Knots 0 1 Feet 10 Miles 79° F RAGGED ISLAND Today: SE at 6 12 Knots 1 3 Feet 10 Miles 80° F Saturday: E at 7 14 Knots 1 3 Feet 10 Miles 80° F SAN SALVADOR Today: SW at 6 12 Knots 1 3 Feet 10 Miles 81° F Saturday: ESE at 4 8 Knots 1 2 Feet 10 Miles 81° F uV inDex toDay The higher the AccuWeather UV Index number, the greater the need for eye and skin protection. Forecasts and graphics provided by AccuWeather, Inc. ©2022 H tracking map Shown is today’s weather. Temperatures are today’s highs and tonight’s lows. N S W E 10 20 knots N S E W E 8 16 knots N S E W 10 20 knots N S E W 6 12 knots N S E W 6 12 knots N S W E 6 12 knots N S E W 6 12 knots N S E W 6 12 knots | Go to AccuWeather.com

Companies urged to build investor sustainability trust

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

A Bahamian accountant says it is vital that investors have trust in a company’s sustainability reporting in an environment where increasing emphasis is being placed on climate action

Kevin Cambridge, advisory and ESG (environmental, social and governance) partner at PricewaterhouseCoopers (PwC) Bahamas, speaking after the firm released its 2022 Global Investor Survey, said it was critical that companies build trust in such reporting through the provision of hard data that can be tested.

“Having trust in sustainability reporting is critical for investors,” he added.

“Independently assured information helps to build trust in capital markets, and in business performance on key issues.

“But to build trust effectively, assurance must be of a high quality, with strong professional standards and a combination of audit and subject matter expertise.”

While investors see inflation (67 percent) and macroeconomic volatility (62 percent) as the biggest threats facing business over the next 12 months, the PwC survey found that investors want corporate management to continue to make climate change a focus.

Over the next five years, investors expect the threats stemming from climate change and cyber crime (including hacking and disinformation) to rise considerably.

Almost half (44 percent) of the global investor community surveyed believes that tackling climate change by reducing greenhouse gas emissions should be a top five priority for business.

This contrasts with lower scores for societal ESG issues such as protecting worker health and safety (27 percent), and improving workforce diversity and inclusion (25 percent).

The chief priority identified for business is innovation (83 percent), which is even higher at 86 percent for insurance industry investors; followed by maximising profitability (69 percent).

Data security and privacy ranks third (51 percent), and effective corporate governance is fourth (49 percent).

Arthur Wightman, PwC’s ESG Leader for the Caribbean, said: “Unsurprisingly, investors want companies to keep a sharp focus on innovation and financial performance. And, even in a challenging economic environment, climate focus is a commercial priority for investors.

“Delivering net zero transformation is critical in achieving commercial imperatives and attracting capital.

“Today’s investors expect business to be able to change in ways that enhance profitability, build trust and deliver sustained outcomes.”

However, investors are dealing with a difficult information environment and have a low degree of trust in corporate sustainability reporting. They largely believe such reporting contains unsupported claims about a company’s sustainability performance.

Over three-quarters (78 percent) said ‘unsupported claims’ were present to a moderate, large or very large extent.

Just 2 percent said corporate reporting does not contain unsupported claims about sustainability performance.

Information from ESG ratings agencies is not filling the trust gap, with just 22 percent of investors surveyed saying they use them to a large or very large extent.

Nadja Picard, PwC’s global ESG reporting leader, said: “When almost eight out of ten investors tell us they suspect greenwashing in corporate sustainability reporting, companies and regulators should take note.

“The lack of trust is troubling as sustainability information becomes increasingly important to both investors’ and other stakeholders’ decisions. There is a need for companies to improve their data, systems and governance, and for regulators to continue the move towards globally aligned and interoperable reporting and assurance standards.”

On the subject of assurance, threequarters (75 percent) of investors say that reasonable assurance (the level provided in financial statements) would give them confidence in corporate sustainability reporting.

Investors also have clear views about what they want from

assurance practitioners. Seven in ten (72 percent) said it is important that assurers are subject to independence and ethical standards, and 73 percent highlighted the importance of professional scepticism.

One in five (22 percent) believe companies will be highly or extremely exposed to climate risk in just the next 12 months, and the number reaches 37 percent over a five-year time horizon, matching concern about geopolitical conflict (also 37 percent).

Over a ten-year horizon, the energy transition (50 percent) almost ties with technology change (53 percent) as the trend most likely to have a large or very large impact on profitability.

Investors are supportive of significant public policy measures to tackle climate change.

By a margin of 28 points, they are more likely to think that imposing taxes on unsustainable activities would be ‘effective’ rather than ‘ineffective’ in encouraging corporations to take action on sustainability issues. The margin for support of strong reporting requirements is 34 points, and for targeted subsidies it is 20 points.

PwC said 66 percent of investors believe companies should disclose the monetary value of the ‘effect their operations or other activities have on the environment or society’, as this would help companies understand the full economic effect of their business decisions. Only 13 percent disagreed.

Additionally, nearly three-quarters (73 percent) of investors want companies to report the cost to meet the sustainability commitments they have set.

Fears FTX ‘a game changer’ for financial services sector

FROM PAGE B1

names are being called and who knows what the implications will be?”

Sir Franklyn, who did not identify the banks he was referring to, added: “This is serious stuff. When you have the attention of the US Congress and Senate, and in a way where politicians are grand-standing and playing loose with the truth, where facts don’t really matter and it’s easy to condemn and indict countries like The Bahamas......

“There are a number of US legislators who don’t care about telling the truth. If they’re standing before a large audience, it gives them a chance to appear strong before a crowd. The country doesn’t have the budget to correct all the misstatements and misrepresentations. It takes a hell of a lot of money to offset a lot of the negative talk that we hear from various members of the US congress. That takes a big budget.”

Asked whether he has reached out to Congresswoman Maxine Waters, chair of the House financial services committee, and other US legislators that he knows, Sir Franklyn declined to disclose the details of specific contacts and conversations.

However, he added: “I will endeavour to do all I can to encourage people not to take an adverse view of The Bahamas on the basis of misinformation. I encourage all Bahamians, and all friends of The Bahamas, to do likewise; call anybody they know and say a lot of what is being said is unfair and the truth is not being told.”

Sir Franklyn then reiterated that The Bahamas “has a long history of dealing with the liquidations of large companies”, recalling his appointment as liquidator for Commodore Computers, which in the 1980s and early 1990s was arguably that industry’s biggest name. He said

himself and his attorney, the late Paul Adderley, were able to reach an agreement with US creditors over how the company was to be wound-up.

“We have the experience, we know this. We’re tested,” Sir Franklyn told this newspaper. “It’s unfair to our jurisdiction for persons in the US and elsewhere to paint a picture of us not being up to it.. There’s no reason to say a judge in the US is more capable than a judge in The Bahamas. We have to ensure people don’t think like that.”

He had previously told Tribune Business: “I was the court-appointed liquidator for Commodore Computers in the early 1990s, which at one time was one of the world’s biggest names. The fact of the matter is that The Bahamas survived Commodore Computers. It was a New York Stock Exchange listed company, truly a global company when that matter came up as being settled in the courts of The Bahamas.

“We had dozens of attorneys, maybe hundreds, in the courts. The creditors committee of the US subsidiary came to The Bahamas, objected to The Bahamas being the centre for the liquidation. It’s the same issue here,” Sir Franklyn argued of FTX. “We got through that. Myself, Paul Adderley and the creditors committee, we were able to negotiate an agreement where the liquidation proceeded in both jurisdictions. The same problem here.

“When people come here they must see competent judges. They must see competence within the judiciary. That’s what they must see. They must see our regulators holding the line. They must see that in our attorneys in The Bahamas they are equal to those on Wall Street or Bay Street, Toronto. That’s what they must see. They must see competence.”

“Approximately 65 percent of the sewer force main has been installed.

Eight of the 14 lift stations have been connected to the force main and three are being prepped for connection,” the Water & Sewerage Corporation continued.

“Bahamas Power & Light (BPL) has now provided three-phase power to nine of the 14 pumping stations. Of the remaining five stations, four are being co-ordinated with BPL to receive three-phase power supply from a nearby power pole or transformer, and [for] one station BPL has a three-phase transformer on site ready for installation.

“Since commencement, the project has experienced justifiable delays beyond the control of the Water & Sewerage Corporation, BRON, the project’s engineering consultant, and the contractor.

“As per similar projects post COVID-19, the Treasure Cay project had experienced both material procurement and shipping delays,” the state-owned utility added.

“However, the majority

of the lift stations have previously been delivered to Abaco, and more recently the last lift station was delivered to the project and has been secured in the project laydown yard. The only materials that await shipment prior to final commissioning are the three-phase meter cans and disconnect switches required to start the lift stations.

“This was due to a backlog from the suppliers, who advised that these components should be available in the beginning of January 2023. Additionally, unexpected underground conditions and utilities needed to be accounted for.

“There were also unforeseeable weather delays, including Hurricane Nicole and other similar tropical formations, which resulted in approved project completion timelines.”

Treasure Cay residents have been without a functioning sewer system since Hurricane Dorian devastated the island in 2019. Currently, homeowners have to manually pump their sewage on a daily basis and one missed pump can spell disaster for the community.

The homeowners have also donated more than $300,000 to the Water & Sewerage Corporation to have the problem rectified.

PAGE 8, Friday, December 16, 2022 THE TRIBUNE

Garden Villas, sales office, Harbour House, marina roundabout, Royal Palm, Marina Cove, Ocean Villa 2, Ocean Villa 1) throughout Treasure Cay.

EFFORTS TO REBUILD TREASURE CAY’S SEWERAGE SYSTEM HIT BY ‘PROCUREMENT, SHIPPING DELAYS’ FROM PAGE B3

KEVIN CAMBRIDGE, advisory and ESG (environmental, social and governance) partner at PricewaterhouseCoopers (PwC) Bahamas.

Baldi De Moraes Horta Liquidator

Baldi De Moraes Horta Liquidator