‘FTX Bahamas chief confessed to fraud’

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE head of FTX’s Bahamian subsidiary sparked an “urgent” police probe into possible criminal misconduct when he confessed to local regulators about the misuse of multi-billion dollar client funds.

Christina Rolle, the Securities Commission’s executive director, in a November 10, 2022, affidavit said the admissions by Ryan Salame during the final hours of the crypto currency exchange’s implosion sealed the decision to

place FTX Digital Markets in provisional liquidation under the Supreme Court’s supervision.

The freshly-unsealed affidavit revealed that the outcome of the previous day’s conference call with Mr Salame, which was also attended by Allyson

Commission ‘cannot condone’ FTXs $100m Bahamas payout

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

A DELAWARE bankruptcy judge was yesterday told that the Securities Commission’s vehement rejection of Sam BankmanFried’s Bahamian creditor preferential payout plan proves there was no “collusion” with the FTX founder.

Christina Rolle, the regulator’s executive director, asserted in a November 10, 2022, affidavit that the digital assets regulator “cannot condone” the now-jailed FTX chief’s plan to prioritise Bahamian withdrawals over all other clients as set out in his November 9, 2022, e-mail to attorney general Ryan Pinder KC.

This stance, and Ms Rolle’s assessment that such payments would be fraudulent preferences subject to “claw back” in any court-supervised liquidation, were held up before Judge John Dorsey as evidence to refute claims that the Securities Commission, Bahamian government and joint provisional liquidators were all working together “in cahoots” with Mr Bankman-Fried to frustrate the US Chapter 11 bankruptcy protection process.

However, John Bromley, the attorney representing the 134 FTX entities in bankruptcy protection and John Ray, their outspoken chief executive, again repeated the

Cable unveils its first dividend in five years

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

CABLE Bahamas’ top executive yesterday voiced optimism that it has “set the foundation” to become a dividend-paying stock once again with the unveiling of a first capital return to shareholders for five years.

Franklyn Butler, the BISX-listed communications provider’s president

and chief executive, told Tribune Business that it “wouldn’t start paying a dividend if we didn’t feel we could maintain it” after declaring a collective $2.5m payout to investors on New Year’s Eve.

The six cents per share dividend, payable to ordinary shareholders on record as at December 19, 2022, will be a welcome

Maynard-Gibson KC, the former attorney general, in her capacity as FTX Digital Markets’ local attorney, “exacerbated the need for the intervention” of the Supreme Court given revelations that will place Sam Bankman-Fried and

ROLLE

his inner circle in further legal peril.

Mr Salame, FTX Digital Markets’ president and chief executive, effectively provided more evidence to support the multiple US fraud-related charges against Mr Bankman-Fried by confirming that monies belonging to clients of the crypto exchange had been misappropriated without their permission to cover massive losses incurred by Alameda Research, the

RBC’s 3-day digital woes an ‘absolute catastrophe’

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

ROYAL Bank of Canada (RBC) yesterday pledged it is “working diligently” to restore its digital banking platform with businesses branding the three-day woe as “an absolute catastrophe” for commerce.

Multiple Bahamian companies told Tribune Business that the “crazy” situation had left them unable to make or receive payments, and conduct transactions vital to the smooth functioning of business, after they were “locked out” of their accounts when RBC’s online and mobile banking platform went down.

“Business has not been conducted for three days now due to RBC

Online Banking being out of order,” one irate businessman, speaking on condition of anonymity, said. “This the equivalent to Bahamas Power & Light (BPL) being out of fuel for three days, and the generator can’t run. It’s an absolute catastrophe. Please let us know why this is happening when everything now is done now online.”

RBC’s problems come at a time when the Central Bank, and the entire commercial banking sector, are driving Bahamian businesses and consumers to increasingly conduct business electronically via the Internet and mobile phones. The industry regulator is pushing to eliminate cheques by year-end 2024, and

business@tribunemedia.net THURSDAY, DECEMBER 15, 2022

SEE PAGE B10

SEE PAGE B7 SEE PAGE B15 • Admitted client funds

Securities

• Regulator requested ‘urgent’ police

same day • Revelations increase

Fried’s

jeopardy

SEE PAGE B4

misuse to

Commission

probe on

Bankman-

legal

$5.95 $5.86 $5.97 $5.87

CHRISTINA

PROTECT WHISTLEBLOWERS TO PREVENT FUTURE FTXS

A BAHAMIAN crowdfunding platform yesterday called for a Whistleblowers Act to be included among any future reform package designed to prevent FTXtype corporate implosions.

ArawakX, in a statement, argued that such legislation - properly benchmarked against, and modeled on, international bet practices - would provide protection for individuals who come forward to reveal corruption, fraud and other criminal misconduct.

Besides giving such persons confidence to publicly ‘blow the whistle’ through such an Act, which could help stop future FTX-style events from happening, ArawakX also suggested that the regulatory powers afforded to the Central Bank of the Bahamas and

Securities Commission be further strengthened.

“There was an Integrity Commission Bill in 2017 that was primarily for persons in the Government. There is a section in there on whistleblowers that could apply to regulated financial services entities,” said D’Arcy Rahming Jr, chief technology officer and co-founder of ArawakX.

“The reality is our jurisdiction has taken a reputational hit globally [due to FTX], but we are a nation of laws and enforcement. I think the regulators and law enforcement are doing the best they can given the enormity of the situation. I believe a proper system that protects whistleblowers will strengthen existing laws that are already in place. This law would give whistleblowers the comfort

D’ARCY RAHMING JR

to come forward, and not to worry about being victimised by industry and powerful people.

“When an instance of abuse occurs, which no one wants to talk about, it can get swept under the rug. When it blows up, it affects all of us. There are good, hard-working people in this industry

that are trying to add value to their customers’ lives. For me, I think it’s ridiculous that projects that are creating jobs and growing the economy can be affected by a powerful person or group’s actions,” Mr Rahming Jnr added.

“This is a really important issue for me. Many of the senior staff at ArawakX have been whistleblowers in the past, and the system did not protect them. There are gaps in our laws, and we as a jurisdiction need to make meaningful steps to improve our framework. No one can stop bad actors, but we as a jurisdiction are obligated to fill in the gaps that these people sit in. The laws work once they are implemented. But without the power of law, regulators are powerless to prevent abuses.

“I just finished law school. There are good regulators and law enforcement that are trying to improve our country, and they need more teeth and more autonomy. The perception is that our regulators are under too much influence [from] powerful people.”

Besides passing a Whistleblowers Act, where persons who reveal genuine misconduct receive a percentage of any fines levied on the wrongdoers, ArawakX urged that Bahamian financial services regulators be given more autonomy and space “to investigate, discipline and prosecute regardless of how wealthy or powerful the person is being investigated”.

Suggesting that the enforcement budgets for all financial services regulators

Abaco project generates $60m sales in one year

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

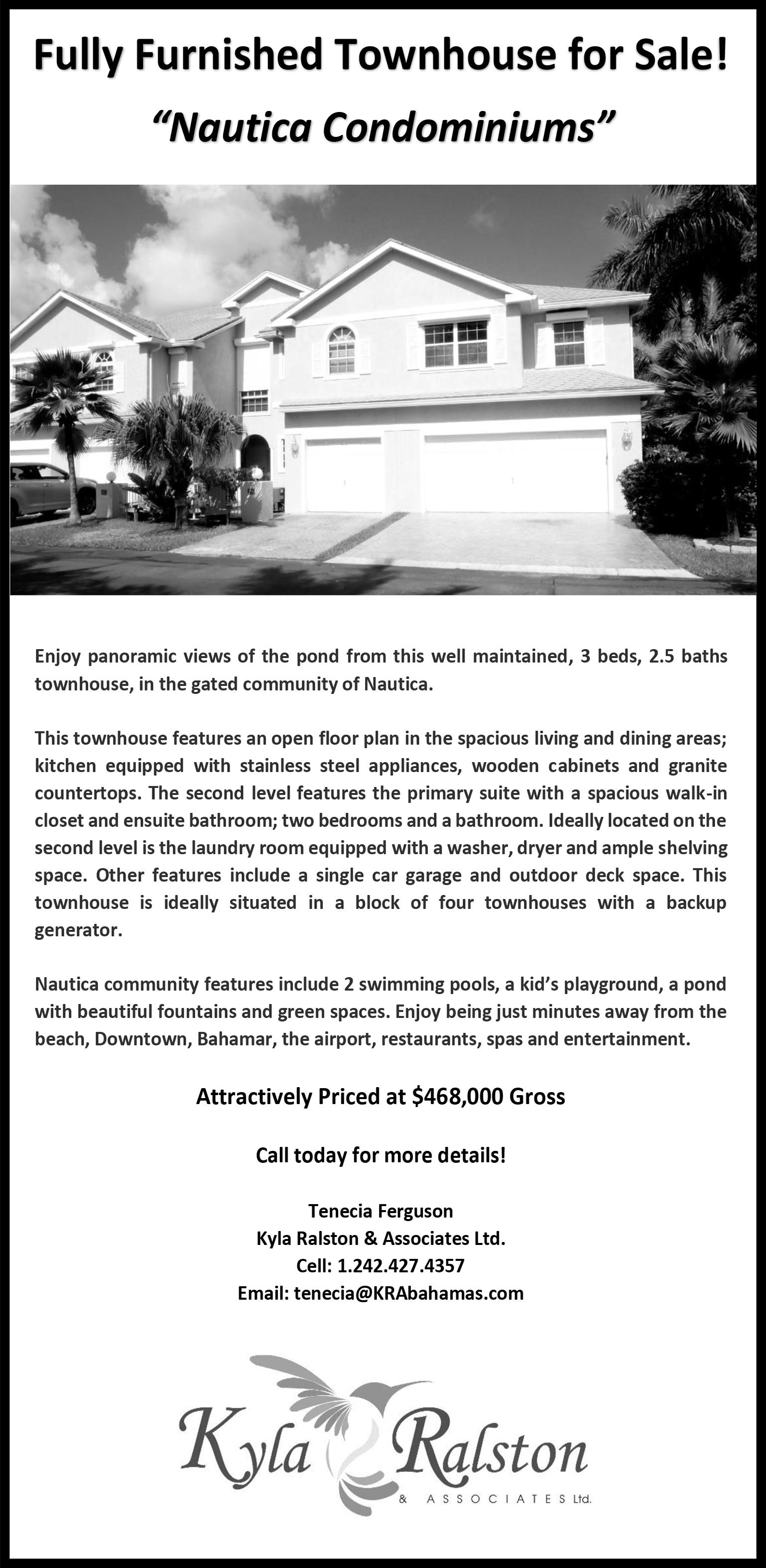

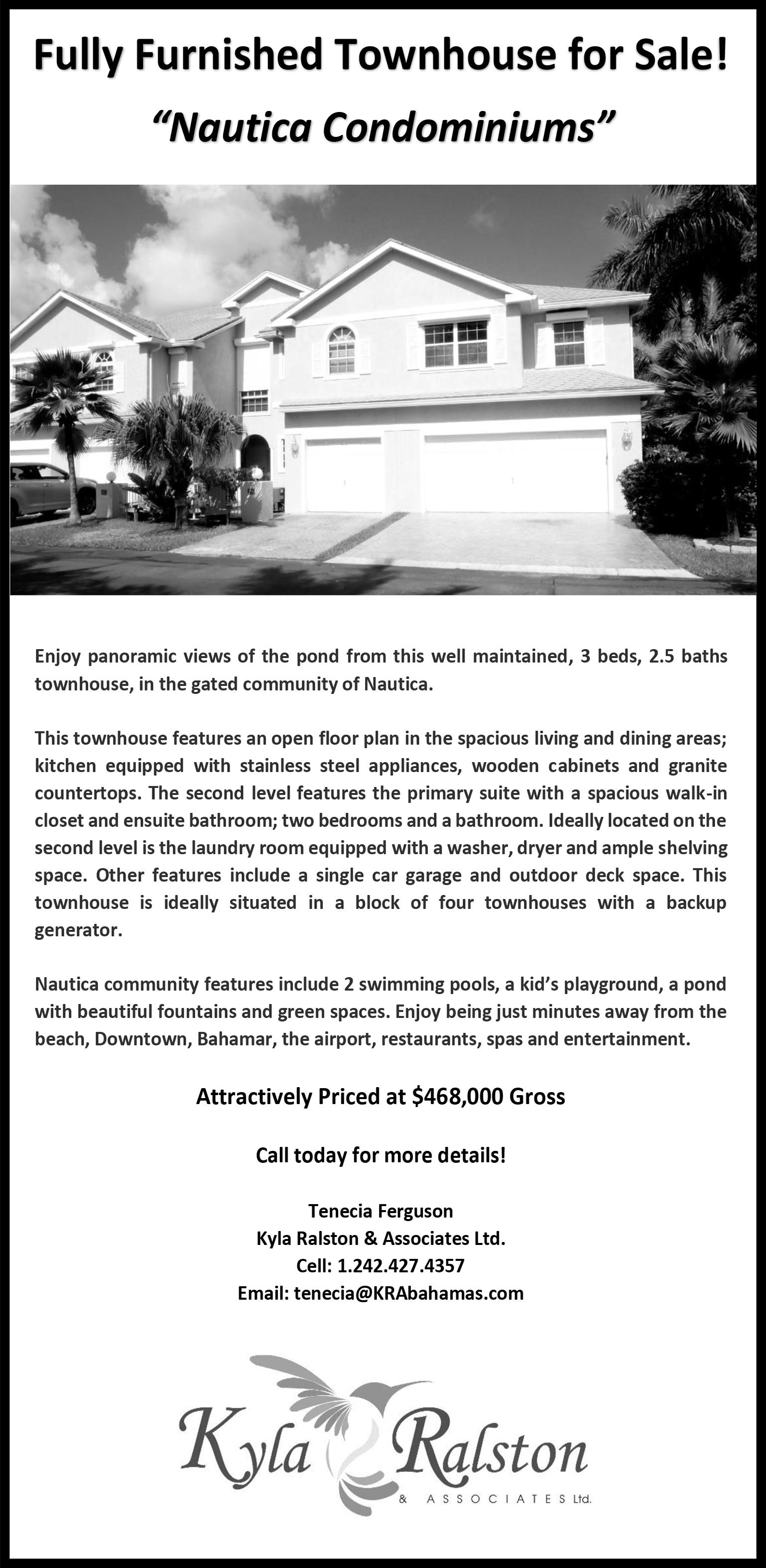

A HIGH-END Abaco resort project was yesterday said to have generated more than $60m in real estate sales in little over a year as its build-out gathers pace

following the COVID-19 pandemic’s easing.

Charlotte Jones, a spokesperson for the agency promoting Montage Cay, told Tribune Business the developers are aiming to complete the project in 2024.

She added that construction has been on pace despite the two-year COVOD interruption, and said:

“Development and sales on the island have rapidly accelerated. Since launching sales in 2021, Montage Cay has achieved over $60m to-date, with more residences under contract.

Sterling Global Financial, the Nassau-headquartered developer chaired by David Kosoy, and its partner, Montage Hotels & Resorts,

had set a mid-2023 target date for opening. Ms Jones said: “Everything’s going to be completed by 2024 and everything is tracking on time. The development has been moving along pretty steadily.”

Residences include the Hibiscus Estate Residence, pegged at $16m and described as one of the

“crown jewels” of Montage Cay. Mr Kosoy told the media in August that sales were already in the high eight-figures.

The Montage Cay project is designed to revive the Abaco economy by bringing a high-end, luxury development to the island. Building on infrastructure left behind

be increased, and the independence of the Royal Bahamas Police Force’s (RBPF) financial crimes unit enhanced, the crowdfunding platform also called for the creation of a financial services ombudsman post to provide greater consumer protection and a mechanism to redress complaints. The latter project has been on the Central Bank’s radar for some time.

“Our markets are nascent and need protecting. We are happy that thousands of first-time investors and growing businesses are using our services. The management of ArawakX views its role as protecting these people. Honest, hardworking and law-abiding people should not be exposed to the actions of a self-serving few,” said Mr Rahming.

by previous developers, the former Matt Lowe’s Cay’s already had a marina trench dug in and fibre optic cable infrastructure as well.

The private island resort will feature 50 all-suite accommodations and a limited 46-slip marina accommodating vessels up to 110 feet. Boating, fishing and water sports activities will be among the activities offered to guests.

PAGE 2, Thursday, December 15, 2022 THE TRIBUNE

BAHAMIAN LIQUIDATORS PLEDGE $100M FTX PAYOUT RECOVERY

FTX’s Bahamian provisional liquidators yesterday pledged to “claw back” the $100m payout to 1,500 Bahamian clients as they blasted the failed crypto exchange’s US chief for “inflaming and untrue” statements.

Brian Simms KC, the senior Lennox Paton partner, and PricewaterhouseCoopers (Pwc) accountant duo Kevin Cambridge and Peter Greaves, hit back at John Ray, chief executive of the 134 FTX entities currently in Chapter 11 bankruptcy protection in Delaware, by accusing him of “stringing out” negotiations over their ability to access cloud-stored data for FTX’s Bahamian subsidiary.

The trio, in legal filings ahead of yesterday’s bankruptcy court hearing (see article on Page 1B), slammed Mr Ray’s “insinuation” that the Securities Commission had helped FTX’s now-jailed

BRIAN SIMMS KC

and indicted founder, Sam Bankman-Fried, to access digital assets despite the freezes imposed by both the Supreme Court and Chapter 11.

Blasting this as a falsehood, the Bahamian provisional liquidators accused the FTX US chief of using this to justify cutting off their access to data vital to progressing the winding-up of Bahamasbased FTX Digital Markets.

Referring to the e-mail sent by Mr BankmanFried to Ryan Pinder KC, the attorney general, on

November 10, 2022, where he revealed his plan to permit Bahamian clients to withdraw funds through what are likely to be deemed fraudulent preferences, the provisional liquidators said Mr Ray had failed to produce any evidence proving the Securities Commission was in “close and frequent contact” with the FTX founder.

“Mr Ray went so far as to tell Congress that the e-mail evidenced ‘collusion’,” they added. “The insinuation here is that the Commission assisted Mr Bankman-Fried in the disposition of assets, and therefore the joint provisional liquidators should be stripped of their rights to access their own information. That allegation is equally inflaming and untrue.

“That very e-mail referenced was the same e-mail that the Commission used as evidence to obtain authorisation to commence FTX Digital’s insolvency proceeding in The Bahamas. In the declaration, which has now been

Treasure Cay ‘one missed pump away from sewerage nightmare’

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

TREASURE Cay homeowners yesterday complained they still lack a proper sewerage system more than three years after Hurricane Dorian despite contributing “hundreds of thousands” to the Water and Sewerage Corporation (WSC).

Daniel Proctor, a resident at the Abaco development, told Tribune Business that despite homeowners collectively raising “hundreds of thousands of dollars” to help cover the state-owned utility’s costs in rebuilding

sewer infrastructure much of the work remains unfinished to-date.

It initially took more than a year for the Water & Sewerage Corporation to formally accept the $320,000 raised by the homeowners. That obstacle was ultimately resolved, with the Water & Sewerage Corporation acknowledging receipt of the donation and promising to start work.

Construction began earlier this year, with unit owners pooling their finances so they could offer to pay for the equipment needed to rebuild the pumping station and sewage network. “The homeowner associations have offered to pay for 100

percent of the cost of the lift station equipment,” Mr Proctor said.

“Contracts were let and work commenced in late spring of this year. The contract called for multiple crews and completion within six months, a date which has now passed. While many roads and areas of the community have been dug up, the system is largely unfinished and no homes have been connected. In fact, as recently as a couple of days ago, another sewerage back-up occurred when a temporary lift station was not pumped.

“As is true in Nassau and on other islands, the Christmas/New Year’s holiday period represents a time

unsealed, the Commission stated that it “cannot condone the preferential treatment of any investor or client of FTX Digital or otherwise” in the liquidation.

“Notwithstanding the US debtors’ incorrect aspersions, it is the goal, too, of the joint provisional liquidators to investigate and potentially claw back the alleged $100m in cryptocurrency withdrawals that occurred between November 10, 2022, and November 11, 2022 from 1,500 individuals, which the joint provisional liquidators believe were all from FTX Digital’s assets for FTX Digital’s customers,” the trio continued.

“It seems at best that the US debtors, who continue to employ employees and legal counsel who were indisputably present while frauds were committed, lack comity in refusing to produce FTX Digital information to the courtappointed fiduciaries of the company on the basis that it appears (contrary to any evidence) that the

of maximum occupancy of second homeowners and tourists. Treasure Cay is a mess, and one missed pump-out from a sewerage nightmare.”

There are 340 total units on Treasure Cay where homeowners are currently flushing into pits, which then need to be pumped out and the waste removed. They have been pumping their own sewerage since Hurricane Dorian hit in 2019, destroying the previous infrastructure, and these pits often overflow.

The Water & Sewerage Corporation had contracted Bahamian engineering and environmental consulting firm, BRON Ltd, to conduct the necessary site evaluation. Robert Deal, its acting general manager, did not return Tribune Business calls up to press time, while BRON Ltd could also not be reached for comment.

wrongdoer here was the Bahamian government.”

The Bahamian joint provisional liquidators added that Mr Ray’s legal filings, and public statements, were “replete with factual errors and erroneous allegations ranging from the extreme to the mundane, all of which improperly attack the Bahamian government, the Bahamian Attorney General [Mr Pinder], the Commission, the Bahamian court and the joint provisional liquidators.

“But, to be clear, all are distinct entities, just as the US government, the US Attorney General, the US Securities Exchange Commission, the US Bankruptcy Court, and US debtors are here.” The trio also argued that they had been willing to compromise with Mr Ray over access to the FTX Digital Markets data, and had reached out to begin negotiations more than one month ago.

THE TRIBUNE Thursday, December 15, 2022, PAGE 3

NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

By

SEE PAGE B16

latter’s hedge fund/trading entity.

While this had long been suspected, Mr Salame’s conference call with Ms Rolle likely marks the first time a high-ranking insider has admitted to conduct that could see the fallen FTX founder jailed for up to 115 years if found guilty on all charges at trial.

“On November 9, 2022, I had a call with Ryan Salame, Allyson-Maynard Gibson KC (in her capacity as local counsel on behalf of FTX Digital Markets) and Ryne Miller, counsel for FTX US, in an attempt to gather further information,” Ms Rolle revealed.

The Securities Commission was becoming increasingly alarmed at Mr Bankman-Fried’s failure to respond to its questions over FTX’s liquidity crunch, which had already forced the crypto exchange to suspend client withdrawals following a $6bn run, and its failed potential acquisition by rival Binance. Mr Salame’s disclosures, though, merely unnerved the Bahamian digital assets regulator even more.

“The statements made by Mr Salame have exacerbated the need for the intervention of this honourable court on an urgent basis,” Ms Rolle asserted. “Specifically, Mr Salame advised that clients’ assets which may have been held with FTX Digital Markets

were transferred to Alameda Research to cover financial losses of Alameda.

“Alameda and FTX Digital are related companies, that is, Sam Bankman-Fried is the beneficial owner of both. I understood Mr Salame during the call as advising the Commission that the transfer of clients’ assets in this manner was contrary to the normal corporate governance and operations of FTX Digital Markets. Put simply, that such transfers were not allowed or consented to by their clients.”

However, the FTX Digital Markets chief quickly sought to distance himself from any fraudulent misappropriation allegations by seeking to pin the blame firmly on Mr BankmanFried and his inner circle.

“Mr Salame further advised the Commission that there were only three persons who had the necessary codes (or passwords) to transfer clients’ assets to Alameda in this manner,” Ms Rolle asserted.

“That is, the founders of FTX, namely Sam Bankman-Fried, Nishad Singh and Zixiao (Gary) Wang. Given such actions may be deemed criminal, the Commission has requested by way of letter dated November 9, 2022, that the Royal Bahamas Police Force carry out an investigation related to the same.”

The misuse of FTX client assets to cover multi-billion

losses at Mr BankmanFried’s Alameda Research is at the heart of the fraudrelated charges brought against him by the US Justice Department, as well the separate civil lawsuits initiated by both the Securities and Exchange Commission (SEC), the US capital markets regulator, and the Commodities Futures Trading Commission (CFTC).

Ms Rolle, in her November 9, 2022, letter to Royal Bahamas Police Force (RBPF) commissioner, Clayton Fernander, likely written within hours of Mr Salame’s revelations, called for an “urgent” probe into the potential criminal misconduct.

“The RBPF may be aware of the reports in both the international and local media, which directly relates to and impacts FTX Digital, including the possible mishandling of clients’ assets,” Ms Rolle wrote.

“Regrettably, the Commission was informed today by Ryan Salame, who is the chairman (sic, president and chief executive) of FTX Digital that clients’ assets, which may have been held with FTX Digital, were transferred to Alameda Research. Alameda and FTX Digital are related companies. Specifically, Samuel Bankman-Fried is a founder of both FTX Digital and Alameda.

“The Commission understood Mr Salame as advising that the transfer of

clients’ assets in this manner was contrary to the normal corporate governance and operations of FTX Digital. Put simply, that such transfers were not allowed and therefore may constitute misappropriation, theft, fraud or some other crime,” the Securities Commission chief continued.

“Given this possible unlawful activity and the ramifications associated with same, we wish for the RBPF to investigate this matter on an urgent basis. Based on the Commission’s knowledge, Mr BankmanFried, Mr Nishad Singh and Mr Zixiao (Gary) Wang are presently on the island of New Providence and all normally reside at Albany. Mr Salame is not in the jurisdiction and is reportedly in Washington DC at present.”

The Securities Commission’s action against FTX Digital Markets, which included revocation of its licence under the Digital Assets and Registered Exchanges (DARE) Act and, ultimately, successfully petitioning the Supreme Court for the appointment of provisional liquidators, built over several days. It was triggered by global media reports on the embattled crypto exchange’s financial woes, which had prompted it to seek a deal with rival Binance.

Ms Rolle asserted that FTX Digital Markets was in breach of its legal DARE Act obligations to respond to the Securities Commission’s questions and concerns in a timely manner prior to the conversation with Mr Salame.

With Ms Rolle pressing for a meeting that same day, Mr Bankman-Fried gave the vaguest of responses. His November 8 reply stated: “Hey! I’m pretty pressed for time but will make sure that we talk to you ASAP. I’ll briefly say that, as of now, no sale has happened or been finalised although there are active talks. We’ll keep you updated about those.”

Ms Rolle replied: “Thank you for your note, Sam We are keen to understand the issues as they specifically relate to the regulated entity including potential impact for clients. Please get in touch soonest.” The Securities Commission chief then set out the regulator’s concerns in a detailed set of questions sent to Mr Bankman-Fried and Mr Salame the following morning.”

With global media reports questioning the links between FTX and Alameda Research, and potential misuse of the former’s client monies to finance speculative and risky investments by the latter, Ms Rolle asked the duo to provide “details of the connection between” the two entities, including the services provided to each other and the related party transactions with them.

“The Commission regards the lack of responsiveness on the part of FTX Digital Markets and its officers as a breach of their statutory obligations under the DARE Act, including but not limited to the duty to provide information relevant to the operations of the business as the Commission may require, and to deal openly, honestly and co-operatively with the Commission.”

Ms Rolle pointed to Mr Bankman-Fried’s admission in his November 10, 2022, e-mail to Ryan Pinder KC, the attorney general, that he had yet to brief the Securities Commission as confirmation of her position. “Ultimately there is a paucity of information available to the Commission at this stage, including the financial affairs of FTX Digital,” she continued.

DIVIDEND

She initially contacted Mr Bankman-Fried and Jessica Murray, FTX Digital Markets’ Bahamian compliance officer and money laundering reporting officer, on November 8 to set up a meeting on the reported liquidity woes and Binance deal. Ms Murray, who was subsequently said to have resigned, responded to say she would try to confirm a time and date.

She also sought information on “the extent to which FTX Digital Markets’ clients’ assets may have been invested, loaned, used as collateral or otherwise hypothecated or encumbered on behalf of FTX Digital Markets, Alameda, other related parties and/ or third parties”. Details on client numbers and the collective value of their assets, whether FTX Digital Markets kept them separate from its own, and total client withdrawals over that week were also requested. No such answers were provided, and Ms Rolle asserted: “The Commission has grave concerns as a result of the lack of responsiveness on the part of Sam Bankman-Fried (and FTX Digital Markets generally) to the correspondence from the Commission.

“The vague representations in Sam Bankman-Fried’s e-mail does not quell the concerns on the part of the Commission.... The Commission has not received a response from Sam Bankman-Fried relative to the transfer of assets to Alameda. In light of the foregoing, particularly the representations made by Mr Salame, it is paramount that the Commission protect the welfare of investors, creditors and clients of FTX Digital, as well as maintain the integrity and reputation of The Bahamas in the digital assets space.

“In the circumstances, I hereby confirm that the Commission has determined that it is in the public interest of FTX Digital’s investors and clients, and the reputation of the Commonwealth’s finance industry generally, for a provisional liquidator to be appointed immediately to safeguard FTX Digital’s assets until further Order of this court....

“The evidence.. makes out a strong case that the assets of FTX Digital, including investors’ assets, need protection and that there may have been director misconduct and/or mismanagement. There is also a strong case for taking action in the public interest.” Mr Bankman-Fried, as FTX Digital Markets’ chairman, was just one of two directors. The other was Mr Salame.

PAGE 4, Thursday, December 15, 2022 THE TRIBUNE

‘FTX Bahamas chief

to fraud’ FROM PAGE B1 TO ADVERTISE TODAY IN THE TRIBUNE CALL @ 502-2394 JOURNEYMAN PLUMBER MINIMUM 5 YEARS EXPERIENCE EMAIL: hr@palmcay.com JOB OPPORTUNITY A

Dated:

confessed

semi-annual dividend of B$819,178.08 in the aggregate for the period ending December 31st 2022 is authorised to be paid upon the outstanding Series 13, 6.25% Non-Voting Cumulative Redeemable Preference Shares in the capital of the Company and the same is hereby declared payable on or before December 31st 2022 to holders of record on December 21st 2022 of the said preference shares.

December 15th 2022

NOTICE The Board of Directors of Cable Bahamas Ltd. have hereby declared:

US PROSECUTORS

yesterday voiced confidence they have sufficient evidence to convict FTX’s embattled founder, Sam Bankman-Fried, on charges that he “misappropriated billions of dollars of customer funds”.

Damian Williams, the US Justice Department attorney leading the prosecution before the southern New York federal court, told judge Ronnie Abrams that the FTX chief had taken investor monies for his “personal use” as well as to make political donations that violated US campaign finance laws.

Updating the judge on Mr Bankman-Fried’s arrest by the Royal Bahamas Police Force on Monday evening, and his court hearing before Chief Magistrate Joyanne Ferguson-Pratt yesterday, Mr Williams confirmed that a grand jury had indicted the crypto currency exchange’s founder on multiple fraud and financial crime-related charges on Friday, December 9.

The long list of alleged offences includes conspiracy to commit wire fraud; wire fraud; conspiracy to commit commodities fraud; conspiracy to commit securities fraud; conspiracy to commit money laundering; and conspiracy to defraud the US and commit campaign finance violations.

“The charges in the indictment arise from an alleged wide-ranging scheme by the defendant to misappropriate billions of dollars of customer funds

deposited on to FTX, the international crypto currency exchange founded by the defendant,” Mr Williams wrote in his December 13 letter.

“The Government expects that the evidence will show that the defendant defrauded FTX customers by misappropriating their funds for his personal use, including to invest for his own account, to make tens of millions of dollars of political contributions, and to cover billions of dollars in expenses and debts of Alameda Research, a crypto currency hedge fund also founded by the defendant.

“The evidence will further show that the defendant made affirmative misrepresentations about the relationship between FTX and Alameda Research, as well as about FTX’s and Alameda Research’s overall financial condition, thereby defrauding FTX’s equity investors as well as Alameda Research’s lenders.

“The Government expects the evidence will show that the defendant violated campaign finance

laws by causing political contributions to candidates and committees associated with both major political parties to be made in the names of co- conspirators, when in fact those contributions were funded by Alameda Research with misappropriated customer funds,” Mr Williams added.

“This alleged scheme enabled the evasion of contribution dollar limits, corporate donation limits, and donation reporting requirements, and was in service of the defendant’s desire to influence the direction of policy and legislation on the crypto currency industry.

Mr Williams, later addressing a press conference, added: “A grand jury here in Manhattan indicted Mr Bankman-Fried. Last week Friday, we obtained a warrant for his arrest, and that arrest was executed yesterday in the Bahamas.

“This investigation is very much ongoing and it is moving very quickly. But I also want to be clear about something else. While this is our first public announcement, it will not be our last. The indictment has eight

counts but, effectively, it outlines four different areas of misconduct.”

eral

networks in the probe, said: “These kinds of cases do not happen without that kind of co-ordination.

“I specifically want to note the assistance provided by the RBPF (Royal Bahamas Police Force) and I want to be clear, this case is about fraud. Fraud is fraud. It does not matter the complexity of the investment scheme. It does not matter the amount of money involved. If you mislead and deceive, to take what does not belong to you, we will hold you accountable.”

Mr Bankman-Fried, who was yesterday denied bail by Chief Magistrate Pratt on the basis that he is a potential flight risk, was remanded into custody in The Bahamas until February 8 next year. He faces up to 115 years in prison in the US if convicted on all charges.

THE TRIBUNE Thursday, December 15, 2022, PAGE 5

Michael Driscoll, the Fed-

Bureau of Investigation

(FBI) assistant director in charge, citing the role played by multiple US government agencies and criminal investigations

US PROSECUTOR CONFIDENT ON BANKMAN-FRIED CASE By NEIL HARTNELL and YOURI KEMP Tribune Business Reporters

A semi-annual dividend of B$2,499,634.25 in the aggregate for the period ending December 31st 2022 is authorised to be paid upon the outstanding Series 16, 6.00% Non-Voting Cumulative Redeemable Preference Shares in the capital of the Company and the same is hereby declared payable on or before December 31st 2022 to holders of record on December 21st 2022 of the said preference shares. Dated: December 15th 2022 DIVIDEND NOTICE The Board of Directors of Cable Bahamas Ltd. have hereby declared: • Pump Experience (Installing Repairing) • Filtration • PH Experience • Cleaning Experience • Pool Building Experience (ideally) • 6 days a week 8am -4pm EMAIL: hr@palmcay.com JOB OPPORTUNITY SWIMMING POOL TECHNICIAN & CLEANER JOB SPECIFICS:

SAM BANKMAN-FRIED

CHESTER COOPER

BAY STREET DEMOLITIONS TO BOOST DOWNTOWN’S REVIVAL

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

THE Deputy Prime Minister yesterday said the Government has demolished five derelict Bay Street properties over the past year to make way for downtown Nassau’s revival.

Chester Cooper, also minister for tourism, investments and aviation, speaking ahead of the full weekly Cabinet meeting said the Davis administration

will “continue the process” of eradicating dilapidated, rundown properties that represent an eyesore for tourists and Bahamians alike.

“There’s some short-term preliminary things that we’re doing through the Ministry of Tourism,” he explained. “We get a lot of complaints about downtown from many of our guests, and residents for that matter.....

“There has to be some sustained investment in downtown. The property owners are committed, certainly, to enhance their property values. Some of the property owners are

responding in kind in terms of the development and clean-up of the properties, others are not, and where there is non-compliance we will deal with it to the fullest extent of the law.

“There is a great opportunity for the revitalisation of downtown, and with the development and opening of the Nassau Cruise Port coming within the next few months, we’re confident that this is going to drive some energy. I hope it can be the catalyst to cause property owners to follow the path of what happens at the Nassau Cruise Port.”

The Ministry of Tourism’s proposed downtown incubation centre for “authentically made Bahamian products” is also part of the revitalisation strategy. “We’ll hopefully be able to give you a little bit more specifics on this soon,” Mr Cooper added.

“That plan is sufficiently advanced for me to be very confident and optimistic that, early in the New Year, we should be able to launch a marketplace for locallyowned businesses that are working with authentically Bahamian products and services, as well as some support for the creative arts and budding artists.”

Straw market vendors will not be impacted or displaced by this project as they are selling Bahamian souvenirs, whereas the incubation centre will focus on authentic Bahamian goods and services. “We have an issue where we want more tourists to come off the ship,” the deputy prime minister said.

“So if we have, at this moment, 20,000 guests come in to the Nassau Cruise Port and only 10,000 come off the ship, there’s still opportunity for the other 10,000. So we want to draw the people off the ship. So this isn’t competition… it’s really enhancing the product. Once we enhance the product, everyone will benefit.”

Mr Cooper said the Government was “very close” to confirming the private sector partner that will finance and oversee Grand Bahama International Airport’s redevelopment, as well as operate the facility. “I know people are very eager to have specific answers to this question and I told them then, as I will tell you now, that we’re very close, but I’m not in a position to make a statement at the moment,” he added.

“We are doing some final housekeeping on the process. It’s being finalised. We know who the winning bidder is, but I can’t tell you yet.” It was recently reported that Dublin Airport Authority, which manages Ireland’s Dublin and Cork airports, was among the contenders for the Grand Bahama airport deal along with an infrastructure financing partner.

PAGE 6, Thursday, December 15, 2022 THE TRIBUNE

Cable unveils its first dividend in five years

Christmas and New Year’s present for investors who have waited patiently for a return amid a restructuring that involved the $301m sale of Summit Broadband; repayment of virtually all bank debt; and restructuring of preference share debt from short-term maturities to long-term capital not due for repayment for 10-15 years.

Speaking ahead of tonight’s annual general meeting (AGM), Mr Butler told this newspaper: “It [the dividend] speaks to the fact that we have solidified the company, the structure of the business. We are really starting to gain confidence in the improvements in our EBITDA (earnings before interest, taxation, depreciation and amortisation) coming off the Summit investment and then Aliv.

“I think it speaks to the fact we feel confident about the overall growth of the company and structure of the business for the foreseeable future. Before 2017 we’ve historically been a fairly strong dividend stock, so hopefully this will be setting the foundation for us to get there again. We have also reduced the debt on the balance sheet.”

Asked whether Cable Bahamas was now signalling it will become a consistent dividend payer once again, Mr Butler replied: “Let me put it this way. I cannot preempt the Board, but I can say this much: We wouldn’t start paying a dividend if we didn’t feel we could maintain it.

“We started in 2013 with Summit and ran things up to about $250m in revenue. When we eventually sold Summit we ploughed quite a lot into Alive in 2016, 2017 and 2018 to get going. We sold Summit in early 2020, and put more money into Aliv. We took those proceeds and paid off all the bank debt and really

Share your news

The Tribune wants to hear from people who are making news in their neighbourhoods. Perhaps you are raising funds for a good cause, campaigning for improvements in the area or have won an award. If so, call us on 322-1986 and share your story.

strengthened Aliv in terms of growth.”

The Cable Bahamas chief, saying that the collective dividend payout will be worth around $2.5m, added: “I think we expect to do it half-yearly, but don’t know yet. We can go back to quarterly eventually. I think the initial thinking is to get semi-annual.

“We’re delivering. If we’re paying a dividend it says that we’ve come a long way. We’re now at a point where leverage is close to three times’ target EBITDA.” Mr Butler said this had halved compared to when Aliv was in negative EBITDA territory, and leverage was six times’ the target operating income. Thanking shareholders for their patience, he added: “We believe we’re in a strong position moving forward.”

Cable Bahamas’ $2.814m net income for the 2023 first quarter, covering the three months to end-September 2022, was aided by a more than $2m, or near50 percent, year-over-year decline in interest expenses which fell from $4.31m to $2.173m.

Revenues rose slightly, improving by 4 percent from $53.402m in the prior year to $55.579m, while operating expenses narrowed by 2.6 percent from $35.589m to $34.654m. As a result, operating income before depreciation and amortisation jumped by more than $3m, rising by

17.5 percent from $17.813m to $20.925m. That, together with the reduction in interest expense, drove Cable Bahamas’ return to first quarter profitability.

Reaffirming that Cable Bahamas’ mid-2022 refinancing, which raised $219m compared to the target $169m, has provided a solid platform for the company’s growth ambitions by replacing higher-interest preference shares with lower cost ones, Mr Butler said previously: “We’ve completed the refinancing of long-term debt for Cable Bahamas, so we

don’t expect any shocks in that, as we have a ten to 15-year framework.

“We think we have a pretty decent capital structure in place that will allow us to build on what you see in the first quarter. We took on another $50m in refinancing over and above what we needed,” Mr Butler told Tribune Business of Cable Bahamas’ summer capital raise. “From a Cable shareholder perspective, we’re ready to assist Aliv with its refinancing. It has some long-term debt that has to mature at the end of the year.

LEGAL NOTICE

International Business Companies Act (No.45 of 2000)

SPA REAL ESTATE FUND LTD., SAC (the “Company”) In Voluntary Liquidation

Notice is hereby given that in accordance with Section 138 (4) of the International Business Companies Act, (No.45 of 2000) SPA REAL ESTATE FUND LTD. SAC (IBC No. 200283 B / SAC) is in dissolution. The date of commencement of the dissolution is the 9th day of December , 2022. Ely Hakim is the Liquidator and can be contacted at Av. Angelica 2346 cj 131, Sao Paulo, Brazil. All persons having claims against the above-named company are required to send their names, addresses and particulars of their debts or claims to the Liquidator before the 22nd day of December, 2022.

Ely Hakim Liquidator

“We’re working with HoldingCo and the Government to see if they want to use that [$50m] as a financing option for Aliv. Depending on where that ends up, we will use that to refinance Aliv or there’s the Series 13 preference shares on our balance sheet that we need to sort out. We have one series that we did not refinance, $26m or so.”

Cable Bahamas owns a 48.25 percent equity interest in its Aliv mobile subsidiary, but has Board and management control, with the Government holding the majority 51.75 percent. Both sides hold their ownership interests via HoldingCo, which effectively acts as Aliv’s immediate parent entity.

THE TRIBUNE Thursday, December 15, 2022, PAGE 7

PAGE B1

5 YEARS EXPERIENCE EMAIL:

FROM

FINISH PAINTER MINIMUM

hr@palmcay.com

JOB OPPORTUNITY

RBC’s 3-day digital woes an ‘absolute catastrophe’

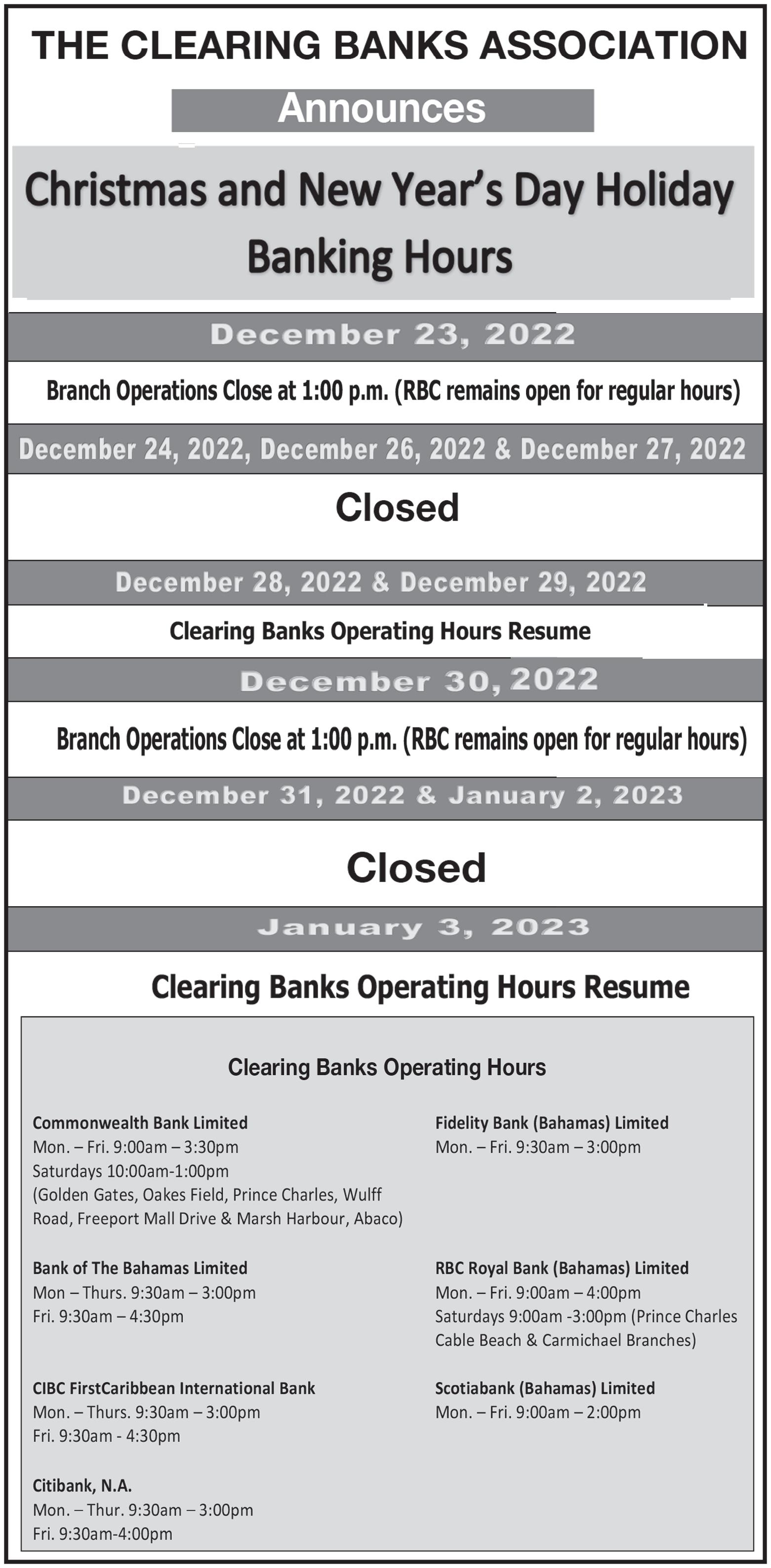

reduce reliance on other manual payment forms, but the issues encountered at RBC - long regarded as the Government’s bank and having the most corporate customers - adds weight to arguments this is too hasty and premature.

Another business owner, also speaking on condition of anonymity, shared a screen shot detailing an “unexpected outage” and saying: “RBC Caribbean Digital App is currently unable to launch. We will investigate the issue and try to resolve it as soon as possible.”

They added: “It’s crazy, and I can’t get any answer. We just cannot access our online accounts. I can’t pay my bills and am not sure how I am going to pay my staff tomorrow [today]. You cannot pay anybody. I am going to have to write my staff a cheque if this goes on like this. It’s been going on for three days.

“I cannot get into my account, I cannot pay anybody, I can’t see if I’ve been paid by anybody. If I go to the bank and get a ledger, they say they’ve been working on it around the clock but this is the third day. I see on Facebook that there

are a million people complaining they cannot get access to their account.

“People are complaining that they can’t pay anybody. Some people have tried to sign in and been locked out of their account. It spins and you get this ‘unexpected outage’, or something that appears to be wrong. I got in and paid one bill yesterday, and then it spins and spins and kicks you out.”

The businessman added: “If I can’t pay my bills, do we go back to writing cheques? I still have them, can locate them and dust them off. They want to eliminate cheques, don’t want you to come into the bank, but how can you do business if you cannot access your online account?

“It’s getting to the end of the week, end of the month, when bills have to be paid. I’ve already warned my staff they will have to get paid by cheque tomorrow if it’s not fixed. In this day of online banking and digital transfers, with them basically telling you to stop writing cheques and stop coming into the branch, commerce has stopped if you bank with RBC.

“I love the idea of online. I love it and embraced it,

but this has got to work. I love not standing in line like I used to, but it has got to work. It cannot be down for three days.” Their account was backed by other Bahamian corporate customers and online banking users, who revealed they have either been completely locked out or only enjoyed sporadic access to their accounts and digital payments over the past three days.

However, several said access had started to improve yesterday afternoon. RBC yesterday confirmed that the problems are Caribbean-wide, affecting all its territories

including The Bahamas, and stemmed from a system upgrade implemented at the weekend.

An RBC spokesperson, responding to Tribune Business inquiries, said: “I can confirm that RBC Royal Bank is currently experiencing some technology difficulties with our digital banking platform. As a result, RBC clients may have experienced slow response time, intermittently, while trying to log-on or transact via RBC Digital Banking (online banking and mobile app).

“We know this is a significant inconvenience and we are working diligently

to resolve this urgently. In fact, we are already seeing a significant improvement of our platform’s performance since this afternoon. In the interim, we suggest to try to transact via RBC Digital Banking during off-peak business hours, as we have seen greater success for digital transactions during those hours.

“Alternatively, clients can continue to make use

of our ATMs or pay with their cards at any point-ofsale device for most of their day-to-day transactions. For more complex transactions only, we invite clients to visit a branch closest to them. Again, we sincerely apologise for the inconvenience this is causing our clients and thank them for their patience.”

IN THE MATTER of the Quieting Titles Act, 1959 AND

IN THE MATTER of the Petition of RENIE BROWN AND

IN THE MATTER Of ALL THAT piece parcel or lot of land situate in the Western District of the island of New Providence containing 7,866 square feet, on the Eastern Side of Honey Combe Street approximately 275 feet South of Hay Street and 190 feet West of East Street New Providence Bahamas.

TO: HIS LORDSHIP THE HONOURABLE MR. JUSTICE IAN WINDER JUDGE OF THE SUPREME COURT OF THE COMMONWEALTH OF THE BAHAMAS.

NOTICE OF PETITION

NOTICE is hereby given that RENIE BROWN of Honey Combe Street situate in the Western District of the Island of New Providence one of The Islands of The Commonwealth of The Bahamas (hereinafter called “the Petitioner”) claims to be the owner of the unencumbered fee simple in possession of the land hereinafter described, that is to say:

ALL THAT piece parcel or lot of land situate in the Western District of the Island of New Providence containing 7, 866 square feet, on the Easter Side of Honey Combe Street approximately (275) feet South of Hay Street and (190) feet West of East Street.

A Plan of the said land may be in inspected during normal office hours in the following places:-

(a) The Registry of the Supreme Court in the City of Nassau, The Bahamas;

(b) The Chambers of Campbell-Ebong & Co., No. 51 Infant Road, Nassau The Bahamas;

NOTICE is hereby given that any person having dower or dower right of dower or any adverse claim or claim not recognized in the Petition shall on or before the 14 day of January A.D., 2023 file in the Supreme Court and serve on the Petitioner and the undersigned a statement of his claim in the prescribed form, verified by an affidavit to be filed therewith together with a plan of the area claimed and an abstract of his title to the said area claimed by him. Failure of any such person to file and serve a statement of claim on or before the 14 day of January A.D., 2023 will operate as a bar to such claim.

DATED this 24th day of November A.D., 2022

CAMPBELL-EBONG & CO.

Chambers No.51 Infant View Road Nassau, The Bahamas Attorneys for the Petitioner

PAGE 10, Thursday, December 15, 2022 THE TRIBUNE

FROM PAGE B1

COMMONWEALTH

OF THE BAHAMAS

2021/CLE/gui/00061

IN THE SUPREME COURT Common Law & Equity Division BETWEEN

FINISH CARPENTER MINIMUM 5 YEARS EXPERIENCE EMAIL: hr@palmcay.com JOB OPPORTUNITY I am a resourceful, innovative, and proactive female seeking the position of Executive Administrative and P.A. I assist and help CEO’s and other Executive Leaders stay organized by managing their schedules and keeping up with correspondence based on their needs. I am an independent thinker and I make good decisions. I have excellent verbal and communication skills and work efficiently and effectively. I am able to act as the point of contact among Executives, Employees, Clients and other external partners. I also facilitate customer training workshops and programs. Resume and References are available by request. Please contact me via email for further information at customfocus@live.com Seeking Position CALL 502-2394 TO ADVERTISE TODAY!

In the Estate of DENNIS LLOYD KNOWLES late of Unit No. 4 situate in “The 21 Condominium” in the City of Freeport, on the Island of Grand Bahama one of the Islands of the Commonwealth of The Bahamas, deceased.

NOTICE is hereby given that all persons having any claim or demand against the above Estate are requested to send their names, addresses and particulars of the same certified in writing to the undersigned on or before the 13th day of January, A.D” 2023 and if required, to prove such debts or claims, or in default be excluded from any distribution; after the above date the assets will be distributed having regard only to the proved debts or claims of which the Executor shall have had Notice. AND NOTICE is hereby given that all persons indebted to the said Estate are requested to make full settlement on or before the aforesaid date. Dated the 7th day of December, A.D. 2022

Edgar O. Moxey & Associates

No. 16, West Court - Off 9th Terr., Centerville P.O.Box N-3447 Nassau N.P., Bahamas Attorneys for the Executor

Asia stocks follow Wall St down as Fed warns of higher rates

By ELAINE KURTENBACH AP Business Writer

ASIAN shares skidded Thursday after a retreat on Wall Street as markets registered their dismay over the Federal Reserve’s warning that still higher interest rates are in store following its latest increase.

Oil prices fell while U.S. futures edged higher.

Japan reported its trade deficit in November surged to over 2 trillion yen ($15 billion) as higher costs for oil and a weak yen combined to push imports higher. It was the 16th straight month of red ink and a record high for the month of November.

Tokyo’s Nikkei 225 lost 0.3% to 28,058.42 and the Hang Seng in Hong Kong

sank 1.1% to 19,449.15. The Kospi in Seoul gave up 1.1% to 2,372.78.

The Shanghai Composite index fell 0.3% to 3,167.73 and Australia’s S&P/ASX 200 shed 0.6% to 7,208.80.

Shares fell in Taiwan and Bangkok but rose in Mumbai.

As expected, the central bank raised its key shortterm rate by 0.50 percentage points on Wednesday. It was its seventh hike this year. The Fed also said it expects rates to be higher over the coming few years than it had anticipated.

Recent signs that inflation has eased had stoked optimism that the Fed might signal the possibility of rate cuts in the second half of next year. But during a press conference, Fed Chair Jerome Powell

emphasized that the full effects of the central bank’s efforts to slow the economy to bring down inflation have yet to be fully felt.

“The Fed did not welcome the disinflation trends that have just started to emerge and focused on robust job gains and elevated inflation. Any hopes of a soft landing disappeared as the Fed seems like they are committed to taking rates much higher,” Edward Moya of Oanda said in a commentary.

The S&P 500 lost 0.6% to 3,995.32, giving up an earlier gain of 0.9%. The Dow Jones Industrial Average fell 0.4% to 33,966.35, and the Nasdaq composite gave back 0.8%, closing at 11,170.89.

Roughly 70% of the stocks in the S&P 500 closed lower Wednesday, with technology companies, banks and retailers among the biggest weights on the benchmark index. Apple fell 1.6%, Goldman Sachs dropped 2.3% and Best Buy slid 3.9%.

Small company stocks also fell. The Russell 2000 index slid 0.7% to 1,820.45.

The Fed’s latest hike is smaller than the previous four 0.75 percentage point increases and comes a day after an encouraging report showed that inflation in the U.S. slowed in November

for a fifth straight month, to 7.1%.

Powell said the Fed plans to hold rates at a level high enough to slow the economy “for some time” to ensure inflation really is crushed. He said the Fed’s projections released Wednesday do not include any for rate cuts in 2023.

“The inflation data received so far for October and November show a welcome reduction in the monthly pace of price increases, but it will take substantially more evidence to give confidence that inflation is on a sustained downward path,” Powell said.

“I wouldn’t see the committee cutting rates until we’re confident that inflation is moving down in a sustained way,” Powell said.

The latest increase brings the Fed’s federal funds rate to a range of 4.25% to 4.5%, its highest level in 15 years. Fed policymakers forecast that the central bank’s rate will reach a range of 5% to 5.25% by the end of 2023. That suggests the Fed is prepared to raise rates by an additional 0.75 percentage points next year.

The Fed also signaled it expects its rate will come down by the end of 2024 to 4.1%, and drop to 3.1% at the end of 2025.

NOTICE is hereby given that BENJAMIN JOSEPH CATO of Blue Hill Road, South, Nassau, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 15th day of December, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE

NOTICE is hereby given that WESLEY PIERRE of Bacardi Road, Nassau, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 15th day of December, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

0.6310.61025.03.87%

BIRD OF PARADISE

voluntary

under the provisions of Section 138 (4) of the International Business Companies Act 2000.

The dissolution of the said company commenced on the 23rd November, 2022 when the Articles of Dissolution were submitted to and registered by the Registrar General. (c) The Liquidator of the said company is Leeward Nominees Limited, Vistra Corporate Services Centre, Wickhams Cay II, Road Town, Tortola, British Virgin Islands.

this 15th day of December, 2022

PAGE 14, Thursday, December 15, 2022 THE TRIBUNE

NOTICE WEDNESDAY, 14 DECEMBER 2022 CLOSECHANGE%CHANGEYTDYTD% BISX ALL SHARE INDEX: 2637.23-0.050.00408.9918.35 BISX LISTED & TRADED SECURITIES 52WK HI52WK LOWSECURITY SYMBOLLAST CLOSECLOSECHANGE VOLUMEEPS$DIV$P/E YIELD 7.005.30 AML Foods Limited AML 6.95 6.950.00 0.2390.17029.12.45% 53.0040.03 APD Limited APD 39.95 39.950.00

2.761.60Benchmark BBL 2.76 2.760.00

2.462.31Bahamas First Holdings Limited BFH 2.46

2.852.25Bank of Bahamas BOB 2.61

6.306.00Bahamas Property Fund BPF 6.30

9.808.78Bahamas Waste BWL 9.75

Bahamas CAB

Brewery CBB

Bank CBL

Holdings CHL

FAM

Bank (Bahamas) Limited FBB

FCL

FIN

16.2515.50J. S. Johnson JSJ 15.75 15.750.00

PREFERENCE SHARES 1.001.00Bahamas First Holdings PreferenceBFHP 1.00 1.000.00 0.0000.0000.0000.00% 1000.001000.00 Cable Bahamas Series 6 CAB6 1000.001000.000.00 0.0000.0000.0000.00% 1000.001000.00 Cable Bahamas Series 9 CAB9 1000.001000.000.00 0.0000.0000.0000.00% 1.001.00Colina Holdings Class A CHLA 1.00 1.000.00 0.0000.0000.0006.25% 10.0010.00Fidelity Bank Bahamas Class A FBBA 10.0010.000.00 0.0000.0000.0007.00% 1.001.00Focol Class B FCLB 1.00 1.000.00 0.0000.0000.0006.50% CORPORATE DEBT - (percentage pricing) 52WK HI52WK LOWSECURITY SYMBOLLAST SALECLOSECHANGEVOLUME 100.00100.00Fidelity Bank (Note 22 Series B+)FBB22 100.00100.000.00 100.00100.00Bahamas First Holdings LimitedBFHB 100.00100.000.00 BAHAMAS GOVERNMENT STOCK - (percentage pricing) 115.92104.79Bahamas Note 6.95 (2029) BAH29 107.31107.310.00 100.00100.00BGS: 2014-12-7Y BG0107 100.00100.000.00 100.00100.00BGS: 2015-1-7Y BG0207 100.00100.000.00 100.00100.00BGS: 2014-12-30Y BG0130 100.00100.000.00 100.00100.00BGS: 2015-1-30Y BG0230 100.00100.000.00 100.00100.00BGS: 2015-6-7Y BG0307 100.00100.000.00 100.00100.00BGS: 2015-6-30Y BG0330 100.00100.000.00 100.00100.00BGS: 2015-10-7Y BG0407

97.5197.51BGRS FX BGR106036 BSBGR1060361

(0.02) 200 97.5097.50BGRS FX BGR107036 BSBGR1070360

(0.81) 10 94.9994.99BGRS FX BGR120037 BSBGR1200371

2 91.9891.98BGRS FX BGR125238 BSBGR1252380 91.98100.008.02 500 91.9191.91BGRS FX BGR127139 BSBGR1271398 91.91100.008.09 138 92.6792.67BGRS FX BGR131239 BSBGR1312390 92.6792.55 (0.12) 131 90.9890.98BGRS FX BGR132249 BSBGR1322498 90.9890.95 (0.03) 23 94.8094.80BGRS FX BGR134140 BSBGR1341407 94.8093.94 (0.86) 88 100.39100.39BGRS FX BGR138230 BSBGR1380306 100.39100.390.00 100 96.8496.84BGRS FX BGR138240 BSBGR1380405 96.8496.10 (0.74) 300 100.32100.32BGRS FL BGRS81035 BSBGRS810359 100.32100.660.34 100 100.34100.34BGRS FL BGRS81037 BSBGRS810375 100.34100.17 (0.17) 150 100.57100.57BGRS FL BGRS84033 BSBGRS840331 100.57100.15 (0.42) 225 MUTUAL FUNDS 52WK HI52WK LOW NAV YTD%12 MTH% 2.572.11 2.573.15%3.89% 4.873.30 4.843.60%5.49% 2.251.68 2.252.43%2.92% 205.22164.74 190.45-6.40%-6.95% 212.41116.70 169.68-20.12%-15.15% 1.761.71 1.762.49%2.79% 1.941.78 1.935.71%7.96% 1.881.79 1.863.39%3.91% 1.030.93 0.93-8.94%-9.55% 9.376.41 10.107.82%9.00% 11.837.62 13.4413.58%15.81% 7.545.66 7.712.57%2.83%

MARKET TERMS BISX ALL SHARE INDEX - 19 Dec 02 = 1,000.00 YIELD - last 12 month dividends divided by closing price 52wk-Hi - Highest closing price in last 52 weeks Bid $ - Buying price of Colina and Fidelity 52wk-Low - Lowest closing price in last 52 weeks Ask $ - Selling price of Colina and fidelity Previous Close - Previous day's weighted price for daily volume Last Price - Last traded over-the-counter price Today's Close - Current day's weighted price for daily volume Weekly Vol. - Trading volume of the prior week Change - Change in closing price from day to day EPS $ - A company's reported earnings per share for the last 12 mths Daily Vol. - Number of total shares traded today NAV - Net Asset Value DIV $ - Dividends per share paid in the last 12 months N/M - Not Meaningful P/E - Closing price divided by the last 12 month earnings TO TRADE CALL: CFAL 242-502-7010 | ROYALFIDELITY 242-356-7764 | CORALISLE 242-502-7525 | LENO 242-396-3225 | BENCHMARK 242-326-7333 5.35% 5.00% 5.40% 5.22% 5.14% 5.60% 26-Aug-2036 15-Dec-2037 15-Jul-2039 15-Jun-2040 5.00% 5.00% 15-Oct-2038

5.65% 6.25% 30-Sep-2025 30-Sep-2022 FUND CFAL Bond Fund CFAL Balanced Fund CFAL Money Market Fund CFAL Global Bond Fund 6.25% 4.50% 6.25% 4.25% NAV Date 4.87% 4.68% 5.40% 15-Dec-2021 30-Jul-2022 15-Dec-2044 30-Jul-2045 26-Jun-2022 26-Jun-2045 15-Oct-2022 28-Oct-2022 22-Sep-2033 4-Aug-2036 26-Jul-2037 31-Mar-2021 30-Nov-2022 30-Nov-2022 31-Oct-2022 30-Nov-2022 30-Nov-2022 30-Nov-2022 30-Nov-2022 31-Oct-2022 31-Oct-2022 INTEREST Prime + 1.75% MARKET REPORT 31-Mar-2021 31-Mar-2021 MATURITY 19-Oct-2022 20-Nov-2029 31-Oct-2022 31-Oct-2022 6.95% 4.50% 30-Sep-2022 31-Oct-2022 4.50% 6.25% 4.81% 26-Jul-2035 Colonial Bahamas Fund Class D Colonial Bahamas Fund Class E Colonial Bahamas Fund Class F CFAL Global Equity Fund Leno Financial Conservative Fund Leno Financial Aggressive Fund Leno Financial Balanced Fund Leno Financial Global Bond Fund RF Bahamas Opportunities Fund - Secured Balanced Fund RF Bahamas Opportunities Fund - Targeted Equity Fund RF Bahamas Opportunities Fund - Prime Income Fund RF Bahamas International Investment Fund Limited - Equities Sub Fund RF Bahamas International Investment Fund Limited - High Yield Income Fund RF Bahamas International Investment Fund Limited - Alternative Strategies Fund (242)323-2330 (242) 323-2320 www.bisxbahamas.com • High School graduate • Ability to perform manual work in cabling

Carry out instructions and work well in teams

Interested persons may email resume at calatelhr@gmail.com on or before Dec 21st, 2022

Telecommunications company is seeking to employ persons to assist in the installation of Fibre Optic Cables. Persons will be trained in the installation and testing of Fibre Optic networks and will be required to work in the field. Successful candidates must possess the following criteria:JOB OPPORTUNITY

NOTICE is hereby given that JEFRASON LIMA of Quintine Alley off Wulf Road, Nassau, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 8th day of December, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

0.9321.26042.93.15%

0.0000.020N/M0.72%

2.460.00 0.1400.08017.63.25%

2.610.00 0.0700.000N/M0.00%

6.300.00 1.7600.000N/M0.00%

9.750.00 0.3690.26026.42.67% 4.342.82Cable

3.80 3.800.00 -0.4380.000-8.7 0.00% 10.657.50Commonwealth

10.25 10.250.00 0.1400.00073.20.00% 3.652.54Commonwealth

3.58 3.580.00 0.1840.12019.53.35% 8.547.00Colina

8.53 8.530.00 2400.4490.22019.02.58% 17.5012.00CIBC FirstCaribbean Bank CIB 15.99 15.990.00 0.7220.72022.14.50% 3.251.99Consolidated Water BDRs CWCB 3.06 3.120.06 0.1020.43430.613.91% 11.2810.05Doctor's Hospital DHS 10.50 10.500.00 0.4670.06022.50.57% 11.679.16Emera Incorporated EMAB 9.78 9.65 (0.13) 0.6460.32814.93.40% 11.5010.06Famguard

11.22 11.220.00 0.7280.24015.42.14% 18.3014.05Fidelity

18.10 18.100.00 0.8160.54022.22.98% 4.003.50Focol

3.98 3.980.00 0.2030.12019.63.02% 11.509.85Finco

11.38 11.380.00 0.9390.20012.11.76%

100.00100.000.00

97.5197.49

97.5096.69

94.9994.990.00

16.648.65 13.25-20.10%-19.25% 12.8410.54 12.03-4.50%-4.64% 10.779.57 10.59-0.55%-1.61% 10.009.88 N/AN/AN/A 10.438.45 10.433.00%25.60% 14.8911.20 14.897.90%48.70%

15-Jan-2039 15-Oct-2049 17-Jan-2040 15-Jun-2030

•

• Good work ethics and desire to learn • Computer skills is an asset

A

NOTICE (D. 8, 15)

N O T I C E IS HEREBY GIVEN as follows: (a)

Leeward Nominees Limited Liquidator N O T I C E BIRD OF PARADISE LIMITED

NOTICE

LIMITED is in

dissolution

(b)

Dated

Commission ‘cannot condone’ FTXs $100m Bahamas payout

conspiracy theories promoted by his client during a hearing on the Bahamian joint provisional liquidators’ bid to obtain an order giving them access to all data on FTX Digital Markets.

That access has now been cut for more than a month, with Mr Ray disconnecting their ability to access the cloud-stored data on FTX’s Bahamian subsidiary from November 12, 2022, and seemingly refusing to restore it without a further legal battle. Mr Bromley, describing this data as “dangerous information”, said: “We don’t trust the Bahamas government because of evidence we have obtained to-date...

“We don’t trust the joint provisional liquidators to hold this information and not provide it to the Bahamian government.” Mr Bromley again portrayed the Bahamian government, Securities Commission and Brian Simms KC, the Lennox Paton senior partner, and PricewaterhouseCoopers (Pwc) duo of Kevin Cambridge and Peter Greaves, in their capacity of joint provisional liquidators, as acting in concert even though they have separate and distinct roles.

And Mr Bromley, of the Sullivan & Cromwell law firm, pledged that he and Mr Ray “we will fight with all our strength” to prevent The Bahamas from becoming the main legal venue for resolving FTX’s insolvency woes over the Delaware Chapter 11 bankruptcy proceedings.

Judge Dorsey, who indicated he favoured granting the Bahamian joint provisional liquidators access to the FTX Digital Markets date they need, ultimately backed away amid opposition from Mr Bromley. Hoping the Bahamian trio and Mr Ray can resolve the dispute themselves, using mediation if they have to, he scheduled a “status” conference for Friday to see if the two sides can make progress without requiring a full court hearing with witnesses.

Access to the cloud-stored data, and FTX Digital Markets’ books and records, is vital to making progress on tracking and protecting assets for the benefit of Bahamian creditors. However, with Mr Ray presently blocking access, it is slowing the joint provisional liquidators’ progress considerably, obstructing their investigation and bringing the process to a near standstill.

Chris Shore, of the White & Case law firm, who was acting for the joint provisional liquidators, said Ms Rolle’s affidavit “belies the notion that what the Commission was doing was in collusion with BankmanFried” as she categorically rejected his offer to “open up withdrawals” and payout all Bahamian FTX creditors at the expense of other investors.

“Sam Bankman-Fried’s e-mail gives rise to further concerns on the part of the Commission,” Ms Rolle said of his communication to Mr Pinder. “Particularly, Sam Bankman-Fried has advised that FTX has ‘segregated funds for Bahamian customers’ and is willing to allow those customers to withdraw those funds.

“The question that ultimately arises is whether such transactions would be characterised as voidable preferences under the insolvency regime and subsequently result in attempts to claw back funds from Bahamian customers. In any event, the Commission cannot condone the preferential treatment of any investor or client of FTX Digital or otherwise.”

Both Ms Rolle and Allyson Maynard-Gibson KC, the former attorney general who was acting as FTXs Bahamian attorney, were copied on Mr BankmanFried’s e-mail to Mr Pinder. As a result, all three, as well as the wider government and Securities Commission, had advance notice of what the FTX chief planned to do.

Questions were raised yesterday was to what “overt and concrete” action, if any, was taken by

the Government, Securities Commission and Mrs Maynard-Gibson to prevent or dissuade Mr BankmanFried from this plan given that they had ample warning and knew any payouts would constitute fraudulent preferences.

Over a 25.5 hour period, much of which was covered by Supreme Court and Chapter 11 asset freezes, some $100m is alleged to have been withdrawn for the benefit of 1,500 purportedly Bahamian clients, and one source said: “What steps, if any, did they take to stop him. All would have known that under such circumstances those payments would have been fraudulent preferences.”

Meanwhile, Judge Dorsey yesterday said he requested the hearing on the Bahamian provisional liquidators’ bid to have their data access restored by bankruptcy court order if necessary. “I wanted to take the opportunity to talk to the parties in this case about where we are and what’s going on,” he said.

“I understand there’s a lot of heated debate between the parties as to what’s happening, but I believe there must be some path forward to resolve the concerns of everyone involved. I think the joint provisional liquidators are entitled to the data and information related to their entity in liquidation in The Bahamas. Is there any dispute, Mr Bromley.”

Mr Bromley, on Mr Ray’s behalf, had no hesitation in saying there was such a dispute. While indicating that the FTX US chief executive was willing to talk about “static” information being provided to the Bahamian trio, he argued that they were instead seeking “dynamic access” to a live system.

The American attorney then regurgitated Mr Ray’s conspiracy theory to justify their position, asserting that any access given to the joint provisional liquidators would be misused to provide information to the Bahamian government and Securities Commission - all

of whom were in collusion with Mr Bankman-Fried. This, though, ignores the latter’s request and his current status as an inmate in Fox Hill prison.

“The concern we have with any access to a live system; we believe is that dynamic access would be provided to the Government of The Bahamas and provided to the Securities Commission. To-date, any access the Securities Commission has had to our system has led to the removal of assets from our system,” Mr Bromley alleged.

This again refers to the action taken by the Securities Commission to protect assets for FTX Digital Markets creditors by transferring some $300m to a secure digital wallet under its control for fear they were about to be lost to a hack. Mr Ray has himself confirmed that a hacking attempt was made, but he has seemingly ignored the fact that the Bahamian regulator obtained Supreme Court approval for this even though the facts have been provided to him.

Mr Shore sought to explain that the Securities Commission and joint

provisional liquidators are independent of each other, with the former akin to the US SEC while the latter are officers of the Supreme Court running FTX on its behalf.

After Judge Dorsey questioned whether a full hearing on the data access issue with witnesses would be necessary, Mr Shore urged the court not to “set the bar that the joint provisional liquidators must prove there was no collusion between the Commission and Sam Bankman-Fried, and have everyone disappear for the holiday and be timed out”.

Adding that his clients had indicated they would accept access to “cloned” data, not the version upsetting Mr Bromley and Mr Ray, he said of the impasse: “It’s got to be resolved in the next couple of days, certainly not weeks and not months.” However, Judge Dorsey warned that the earliest hearing date in his calendar was January 6, 2023, meaning the joint provisional liquidators could remain frozen out until the New Year if negotiations are not successful.

Mr Shore, who asked that Friday’s status conference be used “as a control date”,

warned that FTX’s liquidation in the US and The Bahamas was in danger of “going off the rails” if the disputes persisted to the detriment of both the court’s time and creditors.

“We’re at least tilting on the rails,” he added. “It may come to that. It’s way too early in this case to devolve. There’s got to be a way for professionals to work this out without getting into the kind of accusations that are flying.” That was a reference to Mr Ray’s allegations that the Bahamian authorities were colluding with Mr Bankman-Fried.

Attorneys representing the Securities Commission said the Bahamian regulator was “not consenting to the personal jurisdiction of this court” after Mr Bromley urged that it participate in the negotiations to achieve greater co-operation - something that Judge Dorsey encouraged.

Yet Mr Bromley added: “If there’s an attempt to seize control and move the case to The Bahamas we will fight them with all our strength.”

THE TRIBUNE Thursday, December 15, 2022, PAGE 15

FROM PAGE B1

BAHAMIAN LIQUIDATORS PLEDGE

Digital,” they said. “The joint provisional liquidators began requesting access to the property of FTX Digital, through the employees of FTX Digital, as soon as they were appointed and

RECOVERY

access was cut off to FTX Digital employees.

“On or around November 15, 2022, an information sharing protocol was discussed between US debtors’ counsel, Sullivan & Cromwell, and the joint provisional liquidators’ then counsel, Holland & Knight.... Given concerns that the US debtors were simply stringing the process along, the joint provisional liquidators felt that filing the emergency motion would be prudent while the US debtors continued to find a suitable time to meet.

“At no point at any of these exchanges did the US debtors raise the joint provisional liquidators’ rights to FTX Digital’s information or whether it would be sent to the Commission or Messrs Bankman-Fried and Gary Wang.... Despite attempting to appear cooperative, the US debtors have been stringing the process along,” the Bahamian provisional liquidators continued.

“In the first paragraph of their objection, the US debtors state (with zero evidence) that, if the court grants the relief requested by the joint provisional liquidators in the emergency motion, ‘full and total access of debtors’ cloudbased systems....would be provided immediately to the Government of the Bahamas and to Messrs Samuel Bankman-Fried and Gary Wang’.

“That allegation is both false and irresponsible. Had the debtors just made clear from the start that legitimate requests for necessary information would be met with seriatim excuses for non-production, the joint provisional liquidators would have filed the emergency motion long before last week, and it could have been heard on normal notice.”

PAGE 16, Thursday, December 15, 2022 THE TRIBUNE

“The joint provisional liquidators have hardly sat on their hands and certainly did not ‘wait a month’ to request access to their own information of FTX

$100M FTX PAYOUT

FROM PAGE B3

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net