By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

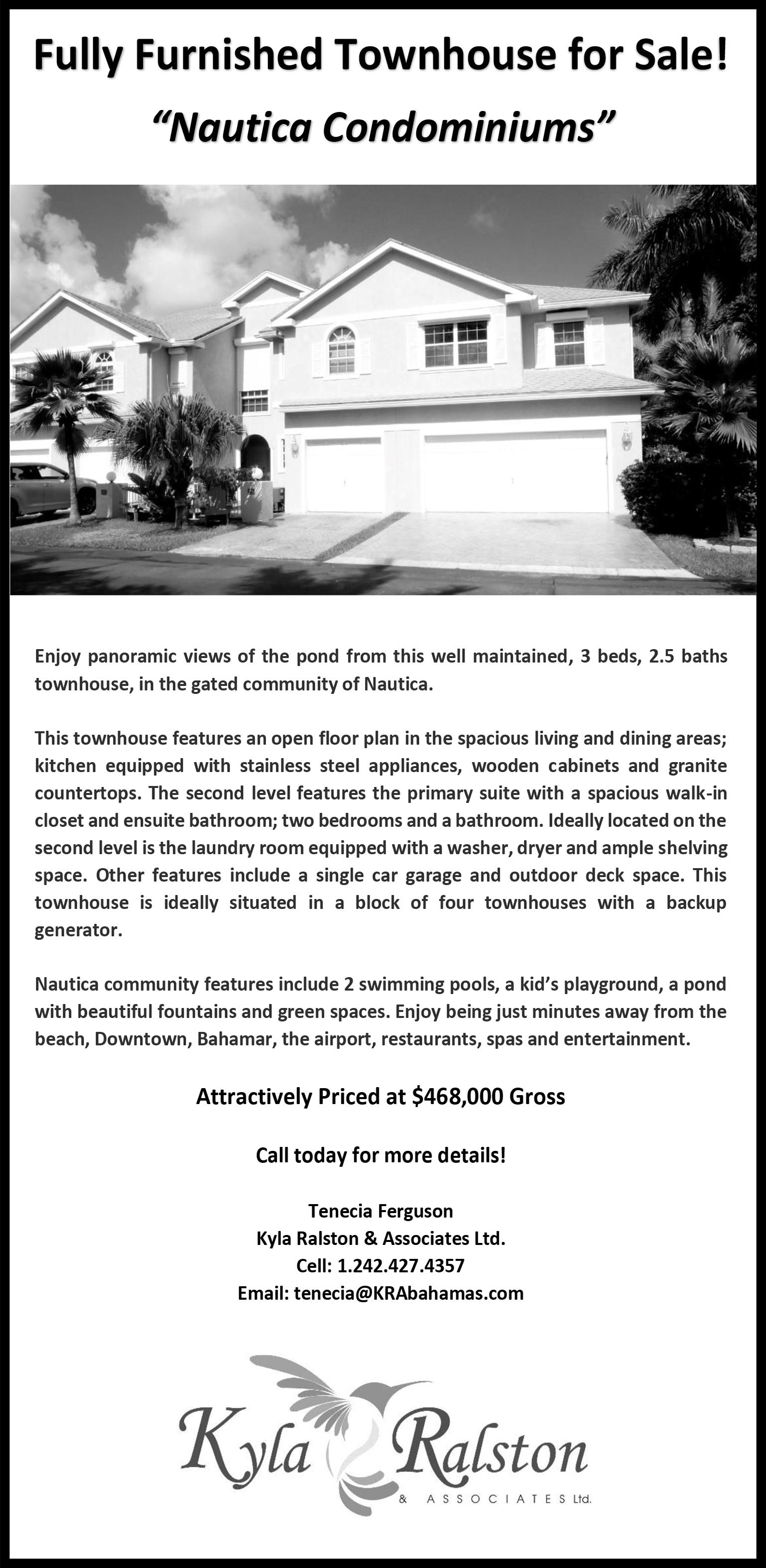

BAHAMASAIR is targeting an initial $2m annual revenue boost from launching bulk cargo services, it has been revealed, with the number of passengers transported in 2022 set to almost double year-over-year.

Tracy Cooper, the national flag carrier’s managing director, told Tribune Business that passenger numbers have already outstripped last year’s 440,000 total by 61 percent with three weeks - including the hightravel Christmas holiday season and its build-up - remaining in 2022.

Predicting that Bahamasair will move just over 800,000 travellers for the full year, he added that this placed the airline within striking distance of the 940,000 it served during the “bumper” pre-COVID year of 2019.

Confirming that the carrier is seeking to add extra routes in 2023 as its expands its fleet, the Bahamasair chief told this newspaper that its imminent entry into the bulk aviation cargo sector was “a natural flow” given that The Bahamas imports virtually all it

consumes. Acknowledging that it perhaps should have entered this market sooner, Mr Cooper said the airline is also seeking to transport cargo onwards from The Bahamas to Cuba and Haiti.

However, while seeking to serve travel demand from Florida airports that it was “unable to properly meet” this summer through the addition of another jet in 2023, he admitted

Fair share: Hotel rental unit tax not in effect yet

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

A KEY Budget measure designed to ensure hotel rental pool units pay their fair share of taxation has yet to be implemented amid the wait for legislation to give it lawful effect.

Robert Sands, the Bahamas Hotel and Tourism Association’s (BHTA) president, speaking after the proposed Condo Act Hotels (Amendment) Bill 2022 was discussed at the body’s Friday annual general meeting (AGM), told Tribune Business the industry has held extensive discussions with the Davis administration to ensure

its members “weren’t disadvantaged” by the extra taxation.

Predicting that 2023 “is poised to be the new record year for Bahamian tourism”, he added that the resort industry had

‘Banner year’: Resorts beat revenue target by 10% pts

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

RESORTS on major Family Islands are targeting “a banner year” in 2023 after room revenues through to end-October beat the industry’s postCOVID target by ten percentage points.

Kerry Fountain, the Bahamas Out Island Promotions Board’s executive director, told Tribune Business that room revenues for its 37 member properties stood at 96 percent of 2019’s pre-pandemic numbers for the first ten months of 2022 compared to the 86 percent target set at the year’s start.

And, while collective room nights sold for the same period were slightly off-target, standing at 83 percent of pre-COVID numbers from 2019 as opposed to the 95 percent goal, he voiced optimism

Bahamian liquidators fear FTX cut-off harm

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

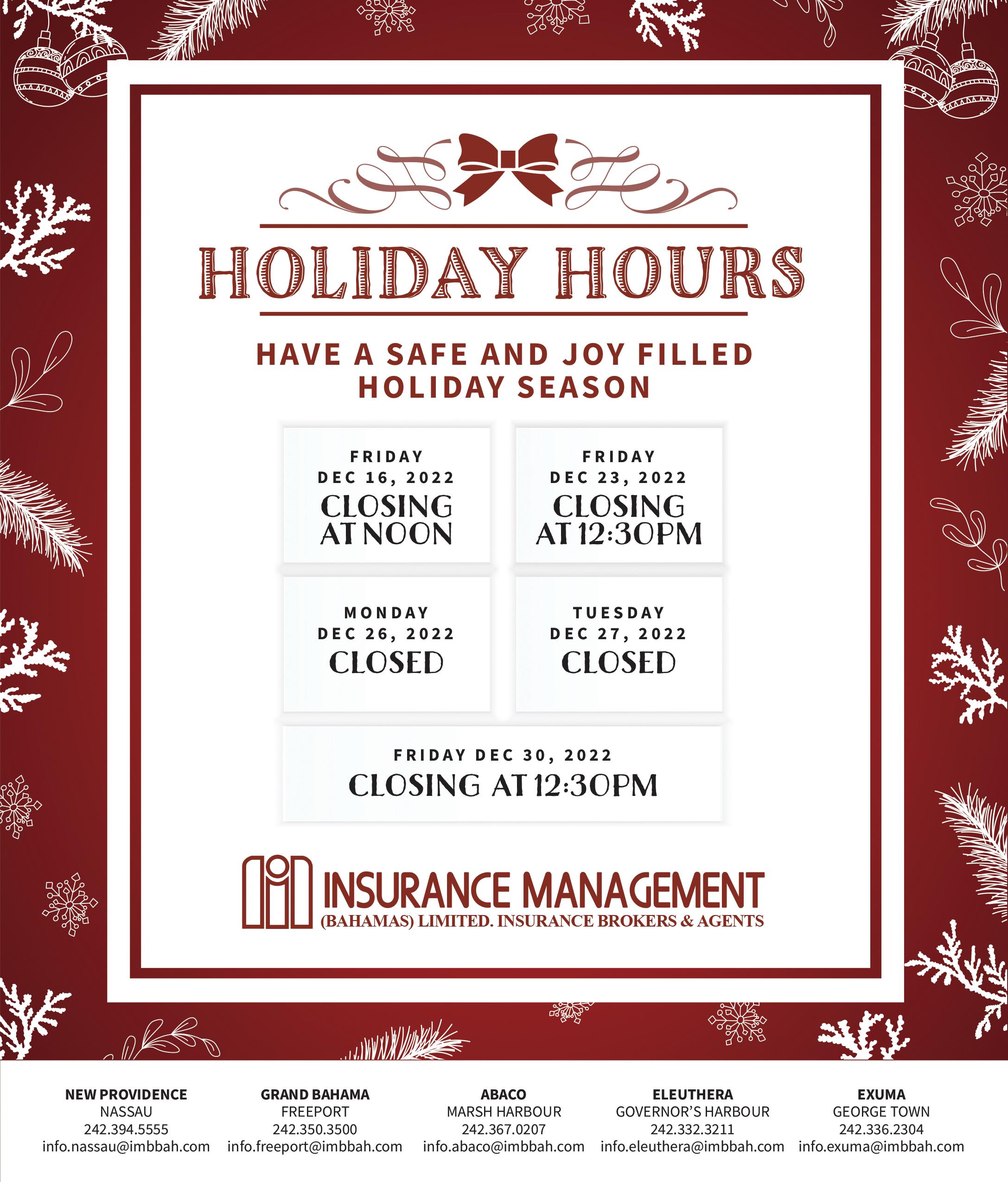

THE JOINT provisional liquidators for FTX’s Bahamian subsidiary have revealed a month-long block on access to the company’s records is “frustrating” their efforts to secure and protect assets.

Blaming John Ray, chief executive of the 134 FTX entities subject to Chapter 11 bankruptcy protection, over the access denial, the provisional liquidation trio are warning it is becoming time-critical that this be

restored given that some documents related to the collapsed crypto exchange “expire” after a 60-day period and will be permanently lost.

Asserting that negotiations with Mr Ray have made little to no progress, Brian Simms KC, senior partner with the Lennox Paton law firm, and Kevin Cambridge and Peter Greaves, the PricewaterhouseCoopers (PwC) accounting duo, on Friday night filed an emergency motion with the Delaware

business@tribunemedia.net MONDAY, DECEMBER 12, 2022

SEE PAGE B7

Bahamasair targeting $2m bulk cargo boost

SEE PAGE B8 SEE PAGE B11 SEE PAGE B6 • Passenger count to near-double to 800k • Eyes route, Cuba/ Haiti cargo ‘expansion’ • Subsidy cut ‘about 50%’ from COVID-19

BOEING 737

BAHAMASAIR

SAM BANKMAN-FRIED BRIAN SIMMS

ROBERT SANDS

$5.95 $5.86 $5.97 $5.87

KERRY FOUNTAIN

The new normal

By RODERICK A. SIMMS II Past Chamber of Commerce Family Island division director

THE past two years have been an economic and social roller-coaster. The COVID pandemic, subsequent global supply chain crisis, inflation and fears

of an imminent economic recession have forced leaders and policymakers to act outside of their comfort zone to adapt to unusual circumstances. The concept

of mandatory lockdowns required our leaders to make tough decisions on the impact this would have on student learning, small to medium-sized enterprises (SMEs), foreign direct investment (FDI), tourism and crime. After all was said and done, there were lessons and opportunities that came out of this series of events. But what did our leaders take away from all of this? In this segment, we will discuss the importance and role of learning agility in leadership.

The role of learning agility in leadership

Learning agility is a term commonly used within leadership circles. It refers to an individual’s ability to adapt and be open to innovative thinking in the face of a new challenge. Agile learners are usually catalysts for change. Leadership often requires unlearning old ways of doing things and creating new responses to meet the challenges that lie ahead, or to get the best value out of opportunities. We sometimes make the mistake of over-extending merit to leaders based on previous achievements. But since growth is ever-changing, we should challenge ourselves to expect more from our leaders outside their previous successes. This is sometimes difficult to do because we place value on certain outcomes that were directly tied to a specific leader or government. However, we must analyse how these

achievements have benefited society over time.

The new normal

While it may be a hard pill to swallow, the world will never be the same as it was prior to the COVID pandemic. But, under agile leadership, this is not necessarily a bad thing. This can allow for a smooth transition to the ‘new normal’ post-pandemic. Being innovative is important in how a country’s government responds to social and economic needs. For instance, tourism is one of the most impacted sectors because of COVID19. The United Nations’ World Tourism Organisation (UNWTO) estimates that small and mediumsized enterprises (which make up around 80 percent of the tourism sector) are expected to be particularly affected. Do we really think that our country’s largest source of revenue should not be reviewed or challenged going forward?

This is where agility comes into play. The Bahamian tourism sector’s recovery will require more than new hotel bookings and lifted restrictions. The United Nations Conference on Trade and Development (UNCTAD) points out that countries may be able to weather economic storms by relying on additional debt or using available foreign reserves. “However, access to global capital markets is increasingly tight, more so for small countries such as small island developing

states (SIDS), which are often highly indebted and not well diversified... Many of the SIDS, like Jamaica and The Bahamas, also face high external debt burdens which require complementary external debt suspension or relief programmes,” it said. This reality shows that, as global economic conditions worsen, SIDS such as The Bahamas need to diversity their economy rather than rely on developed countries for financial security. While this has always been an easy way to go, countries will prioritise in the midst of post-pandemic conditions. The ‘new normal’ will require our leaders to find innovative ways to be less reliant on the help of other nations.

Planning Ahead A little planning goes a long way. One of the tools that agile leaders possess is planning. Planning allows for us as a nation to use the right policies, procedures and access to funding ahead of unforeseen disasters. The Bahamas should truly be masters at economic planning considering our exposure to natural disasters, which have proven to be extremely costly over

PAGE 2, Monday, December 12, 2022 THE TRIBUNE

email: RASII@ME.com

II SEE PAGE B5

RODERICK A SIMMS

BPL FUEL CHARGE HIKE TO RECOVER $76M COST

and Competition Authority (URCA) before being appointed to head BPL earlier this year.

BAHAMAS Power & Light (BPL) is hiking its fuel charge to recover $76m in costs that it failed to pass on to customers after the late 2021 oil purchases designed to underpin its hedging strategy were not executed.

Shevonn Cambridge, BPL’s chief executive, admitted to the Bahamas Hotel Tourism Association’s (BHTA) annual general meeting (AGM) that major electricity consumers - including resorts - will see the fuel charge component of their electricity bills increase by up to 163 percent during summer 2023 as the stateowned utility seeks to recoup “under-recovered” fuel costs related to its hedging strategy over an 18-month period.

This was explained to BHTA members in highly-guarded, technical language, with Mr Cambridge referring to the situation as “a perfect storm”. However, his comments confirm the only way BPL was able to maintain the 10.5 cents per kilowatt hour (kWH) fuel charge for as long as it did - until October 2022 - was through not passing the full fuel cost on to households and businesses after it failed to execute the trades that would have supported this price.

BPL’s fuel costs are supposed to be totally passed on 100 percent to consumers. By electing not to do so, BPL breached the Electricity Act regulations implemented in 2020 to facilitate its fuel hedging strategy. Mr Cambridge at the time was chief of electricity regulation at the Utilities Regulation

“As the world opened up and the market opened up, the price of fuel went up, consumption went up and, as hedging goes, one hedges as you go out into the future,” Mr Cambridge explained. “One tends to do a declining volume hedge, and our volumes were going down. That created kind of a perfect storm… with the right-sizing effect resulting in the glide path strategy that we’re now in.”

The “glide path strategy” is the rolling, phased-in increases to BPL’s fuel charge that Bahamian households and businesses will have to endure throughout 2023. While BPL’s initial hedging structure, implemented in summer and December 2020, remains in place, the Davis administration elected not to execute oil purchases in September and December 2021 - known as ‘call options’ - that would have secured more cut-price fuel and sustained the charge at 10.5 cent per kWh.

Mr Cambridge, meanwhile, added: “So the extreme increases in fuel costs on the market, and increasing fuel volumes, have resulted in fuel costs exceeding the amount being charged… and as a result of that difference, we wound up with some under recovered amount.

“As we said, it was a direct pass through as we seek to recover that amount since the glide path has been place. So the fuel charge, after holding the fuel charge constant for that period of time, at the end of August, we had some $76m in under recovered fuel. The glide path is going to allow us to try and zero that out in the next 18 months.”

The Government’s political opponents have accused the Davis administration of making a serious blunder by deciding not to execute the fuel hedge-supporting oil purchases shortly after it was elected to office in September 2021. They claim this will cost Bahamian businesses and households a combined $100m over the course of 2023 via soaring electricity bills that need not have been incurred if these trades were executed.

Whitney Heastie, BPL’s ex-chief executive, told the former Board that the fuel charge component of customer bills had been stabilised at no more than 11.5 cents per kWH through to 2024 if those trades were continued. But without them, BPL had increasingly been purchasing its oil at spot market prices from late 2021 onwards, yet not passing the full cost on to customers for some months, as now admitted by Mr Cambridge

With BPL’s mounting debts to Shell, its fuel supplier, increasingly unsustainable, the Government has reached an agreement to pay the global oil giant $90m over a nine-month period at $10m per month. It is this payment, and BPL’s huge hiking of the fuel charge to recover this debt and government loans previously made to support the 10.5 KwH price, that has prompted Opposition charges that the Davis administration has cost the Bahamian people over $100m.

However, the Government and BPL were last year said to lack the $40m in free cash needed to finance cut-price oil purchases that would have saved electricity consumers millions.

Government officials, speaking on condition of anonymity because they

NASSAU/PI HOTELS ENJOYING 136% ROOM REVENUE JUMP

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

ROOM revenues for Nassau/Paradise Island hotels have increased by 136 percent year-overyear in 2022, it has been revealed, with non-US source markets also producing triple digit percentage increases in visitors.

Ian Ferguson, the Tourism Development Corporation’s executive director, told the Bahamas Hotel and Tourism Association’s (BHTA) annual general meeting (AGM) that the country’s largest industry had maintained strong post-COVID recovery momentum throughout 2022.

“Hotel occupancy and revenue numbers across major resorts in Nassau and

Paradise Island showed a steady rebound with a 64 percent and 136 percent increase in occupancy and revenue respectively,” he said. “Here’s what we’ve already seen through October. This year there was an impressive increase of 346 percent in air and sea arrivals as compared to 2021.

“Stopover arrivals, which

make up a part of the foreign air and sea arrivals, were up by 61 percent for October year-to-date compared to the same period in 2021, with the US accounting for 90 percent of all stopover arrivals. Canada arrivals are experiencing significant increases, and we’re up by almost 461

were not authorised to talk publicly, told Tribune Business the cash-strapped position at both the Public Treasury and BPL when the Davis administration took office in September 2021 meant there was simply no liquidity available to finance the acquisition of more below-market oil to further underpin BPL’s fuel hedge.

While the Opposition has attacked the Government failure to execute the trades, this newspaper

was told that this does not account for the bigger picture BPL faced at that time with a $246m loan due to mature in February 2022 and no funds to repay it. Any failure to meet this obligation, and even default, would have caused serious repercussions for both the country’s and BPL’s creditworthiness.

Mr Cambridge also told the BHTA: “As we go on long-term, we’re looking to improve on our energy mix. So we have plans to put in

place a utility-scale solar plant for New Providence… about a 60 Mega Watt (MW) station. We’re looking at putting that in the vicinity of Blue Hills power station as well.

“What that will do is provide us with 60 MW of power during the daylight hours, which is projected to have some $25m to $30m fuel cost savings for us. And, if all goes well, that’s about a 24-month to commercial power type operation.”

THE TRIBUNE Monday, December 12, 2022, PAGE 3

YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

By

SEE PAGE B5 PUBLIC NOTICE Will be holding its Annual General Meeting on Thursday 15th December at the Phoenix Restaurant on the corner of Bay Street Elizabeth Avenue at 5:30 pm The Bahamas Cycle Company

BAHA MAR’S XMAS BOOKINGS UP 40%

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

BAHA Mar’s booking pace for the Christmas and New Year period is some 40 percent ahead of 2021 comparatives, a senior executive has revealed, with group bookings for 2023 up by 33 percent.

Mr Sands, Baha Mar’s senior vice-president of government and external affairs, told the Bahamas Hotel and Tourism Association’s (BHTA) annual general meeting: “This past year at Baha Mar has been a record-breaking year in terms of occupancy for the resort, and for the year ahead.”

Looking towards a “strong festive season” aided by several events being hosted by the resort, Mr Sands added: “We have seen our booking pace for the same time in 2021 ahead by some 40 percent. Group bookings for next

year, also ahead by some 33 percent.”

Mr Sands, who is also the BHTA’s president, said the Bahamian hotel industry is “surpassing” pre COVID-19 business volumes as “pent up demand” drives a “record-breaking year”.

He added: “Many of us, but not all, are now approaching or even surpassing pre COVID-19 occupancy levels, which have held firm and we have held firm our average room rates. We are benefiting from the power of pent-up demand.”

Stopover visitors are staying longer and spending more per capita. “We are seeing a reverse resurgence of cruise passengers. We are seeing a surge in foreign direct investment, and a significant level of new investments and developments in the pipeline. We are definitely seeing a

resurgence in the group business,” Mr Sands said.

Jackson Weech, vicepresident and general manager of operations at Atlantis, said the mega resort has had an “equally successful year” with 2022 exceeding expectations in many areas.

He said: “Indeed, we’ve returned to pre-COVID levels and achieved rates that have been unprecedented. Again, we’ve been able to surpass those that we would have attained in 2019. The booking pace, certainly insofar as 2023 is concerned, is very resilient and levels of occupancy are projected again to continue to surpass those in 2019.”

Atlantis is also set to undergo major renovations for 2023 at the Royal Towers. The East tower was completed this year, and Atlantis is on track to complete 1,200 rooms in the West Tower by April.

THIRTY

THIRTY

Kanoo, the Bahamian digital payments provider, and Crypto Isle, the digital assets co-working space, said the top performers from the Kanoo Innovation Hub will be announced today with those named moving on to the initiative’s second phase.

Participants ranged in age from 22 to 62 yearsold, and came from sectors including information and communications technology (ICT), hospitality, cyber security, education, tourism and hospitality and agribusiness. Besides The Bahamas, they come from Trinidad and Tobago,

Jamaica, St Lucia, the British Virgin Islands, Barbados, Chile, Grenada, Saint Vincent and the Grenadines, and the US.

Supported by advisors from Arrowlynk, the students attended an array of virtual classes facilitated by Draper University in Silicon Valley. These classes covered harnessing the power of Web3 for business; blockchain and online community building; sales and growth; how to value a company; and business modelling. The presenters are successful entrepreneurs who have turned start-ups into successful businesses.

Davinia Bain, co-founder of the Kanoo Innovation Hub, said of today’s selection: “It’s easy to talk about innovation. It’s become a buzzword all around the world, particularly in regard to business start-ups and disruptive

entrepreneurship. It’s another thing entirely to watch innovation unfold, and that’s what we’re doing here at the Kanoo Innovation Hub.

“Not only are we helping our start-up participants to innovate, but we are innovating ourselves. Demo Day is bound to be exciting for us, if only because we’re proving that innovation is alive and well in our region.”

Nicholas Rees, cofounder of Kanoo Pays, added: “What we are doing here is almost unprecedented. The incredibly high level of participation, and the amazing business ideas and innovations we’ve seen from around the region, tells us that the Caribbean is quite possibly the next frontier in terms of business innovation, and we’re on the cutting edge of that frontier right here, right now.”

Khalil Brathwaite, cofounder of Kanoo Pays and member of the Hub’s Board of DIrectors, said: “The Hub is a brilliant opportunity for early investors to get eyes on what we anticipate to be extremely lucrative and successful start-ups. They’ll get information first, and the opportunity to be hands-on with these start-ups in early days.

“That’s a priceless advantage in the investment world, and we are excited to be able to offer that advantage to our investor partners. Demo Day is the first chance we’ll have to show the investing world that we mean business, and that our region’s innovators are indeed among the finest in the world.”

Ms Bain continued: “We are looking forward to pairing each candidate moving to the next stage with one of our mentors from around the region. We believe it’s time to unleash the power of our region to innovate in business, and these extraordinary mentors will help our founders do just that.”

Outreach Officer

Bahamas National Trust New Providence, Bahamas

The Bahamas National Trust (BNT) has an exciting opportunity for an environmental professional to help the BNT advance its outreach program. The successful candidate will be responsible for stakeholder engagement and the execution of departmental programs and projects.

•

•

•

•

•

•

•

•

•

Required

•

or Natural Resource Management. An advanced degree is considered an asset.

• At least three years’ work experience

• Excellent oral and written communication skills and demonstrable computing skills.

• Excellent organizational skills, attention to detail, and the ability to multi-task

• Capable of working independently and as part of a team.

• Knowledge and understanding of communication principles.

• Good understanding of basic research techniques.

• Great interpersonal skills and relationship building proficiencies

• Capable of working flexible hours including weekends; ability and willingness to travel nationally and internationally as needed.

• Prepared to work in remote areas.

• Data collection and analysis grant and project management experience are all considered a plus.

PAGE 4, Monday, December 12, 2022 THE TRIBUNE

Caribbean entrepreneurs were last night said to have completed the first phase of a business accelerator initiative launched as a joint venture between two Bahamian companies.

ENTREPRENEURS

BUSINESS ACCELERATOR

Outreach Officer Bahamas National Trust New Providence, Bahamas The Bahamas National Trust (BNT) has an exciting opportunity for an environmental professional to help the BNT advance its outreach program The successful candidate will be responsible for stakeholder engagement and the execution of departmental programs and projects. Responsibilities: • Plan and execute socio-cultural surveys among relevant stakeholders

Collate, analyze, and report on survey results.

Develop the Stakeholder Matrix • Lead, development, and implement the Stakeholder Engagement Strategy

FINISH

HUB

•

•

Organize and host major events for various stakeholder groups

Organize a Partners Communication and Training Workshop

Support stronger collaboration with fishing associations and major fishing communities

Provide logistical management and support for project activities

Execute aspects of other grants or projects managed by the organization.

Liaise with BNT colleagues and key stakeholders as needed.

Represent the BNT at internal and external meetings.

Write and review reports, papers, articles, and educational materials as needed.

Participate in strategic departmental planning.

Skills & Qualifications:

Bachelor’s degree in Environmental Education, Sociology, Psychology,

Please visit bnt.bs/get-involved/join-the-team/ to apply by 5:00 PM December 12th, 2022

Market outlook for 2023

By RICARDO EVANGELISTA ActivTrades

THIS year has been a fertile one for market volatility. After decades of relative price stability, inflation returned with a vengeance, forcing a policy shift by developed country central banks and triggering interest rate hikes around the world.

The impact on investors, who had become used to years of cheap money, made them drop risk-related assets and turn to safe havens instead. At the same time, the war in Ukraine caused a commodities crisis. The shockwaves from this conflict will continue to ripple around the world, influencing the sentiment of traders well into 2023.

So, given the current scenario, what can be expected next year? Here are a few ideas on how key assets may perform in 2023.

The US dollar has been the star performer among major currencies in 2022, but the greenback’s dominance is unlikely to continue. The markets have all but pricedin the Federal Reserve’s cycle of monetary policy tightening, with the US central bank expected to take its foot off the gas in the new year. With US inflation stabilising, and other major

central banks still fighting to control rising consumer prices, the dollar’s supremacy could start to fade over the course of next year.

A roller-coaster would be a fitting description for the price of gold during 2022, as it oscillated between a maximum of $2,070 and a minimum of $1,614. The precious metal has been trapped in a tug of war, with a strong dollar capping the upside created by inflation and geopolitical tensions. As we head into 2023, the Federal Reserve is expected to pivot in its rate hiking drive and the dollar is likely to soften, benefiting gold due to the inverted price correlation between the two assets.

Meanwhile, geopolitical instability and inflation are unlikely to disappear from investors’ radar, potentially increasing gold demand due to the precious metal’s refuge-asset status.

Stock markets experienced a tough 2022.

War in Eastern Europe,

THE NEW NORMAL

from page two

the past two decades. But we may not have entirely learnt our lesson. No matter the extent of the disaster, we are constantly peddling the same knee-jerk approaches such as last-minute committees, seeking funding from international groups and putting in temporary solutions that prove to be more costly in the long run.

National Development

Plan

The National Development Plan (NDP) provides the Government with a road map for making informed decisions, and reduces potential risks ahead of unforeseen events and crises. The NDP’s main goal is to help leaders communicate with their teams on what is needed to drive change. Communication is essential for leadership, especially when having to adapt to

zero-COVID policies in China, inflation and monetary tightening all contributed to the significant drop in investor risk appetite, which at some point saw the S&P500 drop by 26 percent. Looking ahead to next year, many of the bearish factors that weighed on stocks have already been priced-in, so a stabilisation is expected. This is a likely scenario, but it is by no means guaranteed to happen. It all depends on whether the Fed and its peers can orchestrate a soft landing, avoiding a deep recession. The first half of 2023 will be crucial. If a meaningful economic contraction can be avoided, there will be significant upside for stocks, especially in sectors such as technology which now look underpriced after the heavy losses of 2022.

Finally, we look at oil. If there is a sector where the volatility of 2022 was especially felt, it was in the oil market. Prices rose

40 percent during the first half of the year, boosted by war in Ukraine and the postpandemic surge in demand. However, the second half was different. OPEC, the cartel of oil producing countries, increased output to ease supply-side pressures. The strength of the US dollar also fed into lower prices, as did the situation in China, where the zero-COVID policy capped demand. All this looks set to change again. The American currency is expected to weaken in 2023, boosting the value of the dollar-priced barrel. Changes in Beijing improved the outlook for oil demand, as China finally accepted that strict lockdowns and a functioning economy cannot co-exist. With no end in sight for the war in Ukraine, the geopolitical arm-wrestling between Moscow and the West will continue to generate anxiety over supply, thus supporting oil prices. Against this background a return to the $100 per barrel level could be a realistic target.

complex, quickly-changing environments. The NDP will also provide direction that has been thoroughly researched and vetted. This is important in the face of disasters or unforeseen crises because it will help us avoid making knee-jerk decisions.

Conclusion

COVID is just one of many global crises that can arise. We must observe and learn the trends, mistakes

NASSAU/PI HOTELS ENJOYING 136% ROOM REVENUE JUMP

from page three

percent for October yearto-date 2022 compared to the same period last year.

“After seeing a significant drop-off in European arrivals in 2021, caused by the travel restrictions imposed by many European countries, arrivals have begun to rebound and were up by over 246 percent.” Arrivals from Latin American markets have increased by more than 45 percent for the year to October 2022, with the healthy gains coming as little surprise given the continual easing of COVID-related travel restrictions.

“The return of cruising has given The Bahamas’ tourist sector a huge boost with an 810 percent increase in arrivals

year-to-date, which has brought tremendous benefit to local businesses, shops,

restaurants, excursions tour operators,” Mr Ferguson added.

and changes that are occurring. Using the NDP to prepare The Bahamas as a competitive nation is a great first step. But it requires our leaders to be deliberate about wanting to change the way in which we respond to such events. Unless leaders become more agile and start to plan, we will use the same tools and procedures that have proven to have little to no effect in developing our nation.

JOURNEYMAN PLUMBER

JOB

Job Title - Mechanic Helper Reference - 9769 Department - Nassau Equipment Ops Bahamas - Nassau Supervisor - Mario Butler | Phone: 424-1194

JOB SUMMARY Assists with various maintenance responsibilities as part of the training required to develop job knowledge essential for full time employment as a mechanic in one of the company functional maintenance departments. JOB SCOPENo supervisory or budgetary responsibilities

PRINCIPAL DUTIES AND RESPONSIBILITIES Performs basic preventative maintenance on all equipment. Assists with checking and ensuring that all machines are serviceable. Assists Maintenance Supervisor when required. Makes quality fabrications as needed, Performs fueling duties when required. Makes service calls to warehouse. Keeps work area and tools/equipment clean. Reports all recurring problems to Maintenance Supervisor. Participates in training sessions and technical oriented workshops. Continually supports the Quality Improvement efforts in the company. Performs all other duties as assigned. MINIMUM EDUCATION Certification, Experience and Physical Requirements EDUCATION: High School Diploma or equivalent EXPERIENCE Six(6) months experience preferred. License: Valid local driver’s license Travel N/a

IN THE SUPREME COURT Common Law and Equity Division

IN THE MATTER OF ALL THAT piece parcel or lot of land comprising Three Thousand Four Hundred Seventy-Three (3,473) square feet situate on the Dunmore Harbour in Dunmore Town on the Island of Harbour Island one of the Islands of the Commonwealth of The Bahamas (“Dockside Cottage Property”) and

IN THE MATTER OF ALL THAT piece parcel or lot of land comprising Three Thousand Three Hundred and Eighty-nine (3,389) square feet situate on the said Dunmore Harbour in Dunmore Town on the said Island of Harbour Island of the said Commonwealth of The Bahamas (“Shoreline Cottage Property”) (“collectively the properties”)

AND

IN THE MATTER OF The Quieting Titles Act, 1959 AND

IN THE MATTER OF the Petition of Laura Dodge

NOTICE

Laura Dodge, the Petitioner claims to be the owner in fee simple possession of ALL THOSE pieces parcels or portions of land hereinbefore described as the properties and have made application to The Supreme Court of the Commonwealth of the Bahamas under Section 3 of The Quieting Titles Act, 1959 to have the title to the said pieces parcels or portions of land investigated and the nature and extent thereof determined and declared in a Certificate of Title to be granted by the Court in accordance with the provisions of the Act.

Copies of a diagram or plan showing the position boundaries and shape marks and dimensions of the said pieces parcels or portions of land may be inspected during normal working hours at the following places:-

(a) The Registry of the Supreme Court, Ansbacher Building, City of Nassau, New Providence, The Bahamas.

(b) KLA Chambers, No. 48 Village Road, Nassau, The Bahamas, Attorneys for the Petitioner.

NOTICE is hereby given that any person or persons having a right of Dower or an adverse claim not recognized in the Petition shall within thirty (30) days after the appearance of the Notice herein file in the Registry of The Supreme Court in the City of Nassau aforesaid and serve on the Petitioner or the undersigned a statement of his claim in the prescribed form, verified by an Affidavit to be filed therewith.

Failure of any such person to file and serve a statement of claim within thirty (30) days herein will operate as a bar to such claim.

KLA CHAMBERS No. 48 Village Road Nassau, The Bahamas.

Attorneys for the Petitioner

THE TRIBUNE Monday, December 12, 2022, PAGE 5

OUTLOOK

MARKET

MINIMUM 5 YEARS EXPERIENCE EMAIL: hr@palmcay.com

JOB OPPORTUNITY

OPPORTUNITY Please send resume to MButler@tropical.com Tel: (242) 397-7235

COMMONWEALTH OF THE BAHAMAS

2022/CLE/QUI/00084

I am a resourceful, innovative, and proactive female seeking the position of Executive Administrative and P.A. I assist and help CEO’s and other Executive Leaders stay organized by managing their schedules and keeping up with correspondence based on their needs. I am an independent thinker and I make good decisions. I have excellent verbal and communication skills and work efficiently and effectively. I am able to act as the point of contact among Executives, Employees, Clients and other external partners. I also facilitate customer training workshops and programs. Resume and References are available by request. Please contact me via email for further information at customfocus@live.com Seeking Position

that Bahamasair’s newlylaunched route from Raleigh, North Carolina, to Grand Bahama was “not up to expectations” yet and more work is required to build traveller numbers.

Still, asserting that Bahamasair has “a good forecast for the next 24 months”, Mr Cooper said the taxpayer subsidies that keep the national flag carrier in the air have been slashed by 50 percent compared to outlays that peaked at more than $78m during the height of the COVID pandemic. And, while declining to disclose figures, he added that the carrier is “slightly ahead” of target for a financial year that began on July 1.

“We are having, as usual, an uptick this time

of the year,” Mr Cooper told Tribune Business of the approaching Christmas season. “We’re not complaining. Right now, suffice to say, we are doing as expected for the Christmas season.

“Every month this year we have surpassed what we did last year. Last year we moved about 440,000 passengers, and this year we’re up to 700,000 and counting already. We’re seeing somewhere around a 61 percent improvement over last year’s numbers with another three weeks of operations to go.

“I’m thinking we’ll be a little over 800,000, and when you compare it to 2019, we moved 940,000. We’re not far off the comparison between preCOVID and where we’re at now. Just coming from

the Out Island Promotion Board’s annual general meeting [on Thursday], and the Bahamas Hotel and Tourism Association’s (BHTA) the following day, and everybody is predicting that 2023 is possibly going to surpass 2019, which was a bumper year.”

The sharp jump in Bahamasair’s passenger count, which matches the rest of the tourism and aviation industries, comes as little surprise given that both sectors were last year still grappling with multiple COVID restrictions that included border entry measures as well as testing that impacted the ease of travel.

Affirming that Bahamasair was “looking forward to 2023 with great anticipation”, Mr Cooper said the tourism

and aviation rebound “speaks to the strong branding of The Bahamas’ product”. He added: “We are looking to do some expansion. We’re looking to develop in 2023 and introduce our international cargo component, both from the US to The Bahamas and from The Bahamas to Cuba and Haiti.

“Initially, and like all ideas you go into you have to build it, in 2023 we’re projecting somewhere around a $2m impact on earned revenues. We think it’ll be really strong, the Bahamasair brand, when it comes to moving parcels and stuff of that magnitude, so once we start with that and the public becomes aware of what it is we think we’ll have a lot of buy-in.” The airline has previously indicated it is targeting 10 percent annual growth in these revenues.

Mr Cooper said the national flag carrier was targeting the market for non-hazardous bulk cargo that could be transported in its jet fleet. “We’ve considered it for some time. I guess we should have been doing it for a little bit,” he told Tribune Business. “We just think it’s a natural flow. The Bahamas imports most of its consumable products, and there’s a big demand for stuff going from The Bahamas to Cuba and Haiti. We don’t think we’ll have an issues with it.”

Route expansion is also on Bahamasair’s agenda, although Mr Cooper declined to identify those it was targeting as negotiations are continuing. Prince Storr, the national flag carrier’s deputy managing

director, previously said that besides direct service between Georgetown and Fort Lauderdale to service Exuma’s expanding tourism market, the airline is “in the early stages” of exploring the opening of new routes from The Bahamas to Antigua and Barbados.

Bahamasair has ambitions to add one place to its fleet every year between now and 2025, taking its available aircraft from the present eight to 11, with all the new planes set to be leased. Mr Cooper described this, rather than acquiring aircraft outright, as “more palatable postCOVID. There’s been a struggle for capital”.

“There are some things we have in the business plan and we’re executing on that plan,” he added.

“We’re bringing on one jet in 2023, and that’s to meet the ever-expanding demand for post-COVID travel. We were not able to properly meet the demand we saw in the summer. That additional plane is our main focus along with the cargo component.

“There was expanded demand on the international side for The Bahamas from Orlando and Fort Lauderdale mainly where we simply did not have sufficient seats to meet that demand. Some of that had to do with American Airlines, Jet Blue scaling back a bit, so overall there was much demand in the market. We weren’t complaining; just disappointed a little bit that we were not able to meet all the opportunities. That has now been addressed.”

Mr Cooper, though, conceded that more work is required to develop Bahamasair’s latest route from

Raleigh, North Carolina, to Freeport and onwards to Nassau, which was launched on November 17. “It requires some building, some additional work,” he admitted. “It’s not up to expectations at this time, but we expect to eventually get it to where it needs to be.

“For Christmas it’s not too bad, and that’s because of some specials and so forth, but once we get past Christmas we recognise we’ve got some building work to do on it. That routs is very important for the tourism community in Grand Bahama. That’s why we worked with the Ministry of Tourism in putting that route together because it is there to help with the tourism product in Grand Bahama.”

Bahamasair’s fleet expansion is focusing on the jets segment for the moment, although this could shift to its turbo prop planes “because that side of the business is growing as well”. Still, despite the boost from entering the bulk cargo market and route expansion, the airline will likely continue to inflict losses on Bahamian taxpayers.

Including the $32m estimate for the current fiscal year, Bahamasair will have required more than $140m in taxpayer subsidies to keep it in the air and ensure its survival over the past three fiscal years fromand including - 2020-2021’s $78m-plus injection. However, Mr Cooper said of the subsidy: “It has been cut down. I think in COVID times, when everything was really depressed, what we’re getting now is about 50 percent of what we got then.

“We’re in 2022-2023 as it is now. Right now, what I’ll tell you - and I won’t tell you actual numbers - is that we are slightly ahead of budget. We are doing better than budget for this year.”

PAGE 6, Monday, December 12, 2022 THE TRIBUNE

BAHAMASAIR TARGETING $2M BULK CARGO BOOST FROM PAGE B1 TO ADVERTISE TODAY IN THE TRIBUNE CALL @ 502-2394 FINISH PAINTER MINIMUM 5 YEARS EXPERIENCE EMAIL: hr@palmcay.com JOB OPPORTUNITY

Bahamian liquidators fear FTX cut-off harm

bankruptcy court requesting that it order Mr Ray to grant the necessary access that has been denied since November 12, 2022.

Otherwise, the joint provisional liquidators assert, their work will be severely curtailed without access to FTX Digital Markets’ books and records, and they will be unable to fulfill their Supreme Court-ordered mandate to protect assets and maintain their value for the benefit of the Bahamian company’s numerous creditors.

“As a fundamental part of their court-mandated duties, the joint provisional liquidators urgently require access to certain electronic records related to FTX Digital’s property and financial affairs so that they can identify the company’s assets, investigate potential claims and maintain value available to FTX Digital’s creditors,” Mr Simms and the PwC duo alleged.

“Access to this information, however, was abruptly cut off on or about November 12, 2022, and the US debtors [Mr Ray] have the ability to restore it. Despite some encouraging statements from US debtors’ counsel, no progress has been made in restoring that access, frustrating the ability of the joint provisional liquidators to perform their duties mandated under Bahamian law.

“Since the first day hearing, the joint provisional liquidators have engaged with the US debtors in an attempt to find a mutually agreeable solution, but so far no access to the systems or other information has been shared.” The Delaware legal filings thus explain the November 30 statement in which the joint provisional liquidators said their work had been “hampered” by the inability to access the company’s books and financial records stored on “cloud-based servers”.

Mr Ray was not identified as the alleged culprit then, but the latest documents claim the entities under his control denied the joint provisional liquidators and FTX’s Bahamian employees access within 24 hours of his appointment as chief executive for the imploded crypto exchange’s US entities to replace embattled founder, Sam BankmanFried, on November 11.

The joint provisional liquidators did not respond to Tribune Business’ request for comment before press time last night, but their filings confirmed that all FTX’s worldwide entities used the same Google and Amazon cloud-based web services to perform their daily tasks and provide services to clients. These formed the underlying

technology platform for the FTX.com website, meaning that the Bahamian subsidiary used the same IT “architecture” as the rest of the group.

“On or about November 12, 2022, access to the recorded information of FTX Digital was restricted,” Mr Greaves alleged in an affidavit. “The joint provisional liquidators instructed FTX Digital employees to attempt to gain access, but they were denied. After multiple attempts by employees, the joint provisional liquidators asked their counsel to communicate access requests with the US debtors’ counsel.”

He added that White & Case, their US attorneys, sent two letters to Mr Ray’s attorneys and also had two conversations in which the restoration of access was discussed. “While I am not sure who abruptly cut off access to the recorded information or why access has not been restored, I understand the US debtors have the ability to restore FTX Digital’s access to this information promptly,” Mr Greaves added.

“In order to perform our court-appointed duties to identify, preserve and maintain the value of FTX Digital’s assets, the joint provisional liquidators urgently require access to the recorded information.”

The documents sought

include trading data, as well as e-mail and Slack chat records for FTX Digital Markets employees, documents stored on Google Drive and the accounting systems.

“The US debtors refusal to provide access to the recorded information is frustrating the ability of the joint provisional liquidators to carry out our duties under Bahamian law, and placing FTX Digital’s assets at risk of dissipation,” Mr Greaves alleged.

“The US debtors’ refusal also creates the risk that critical information will be automatically deleted and irretrievably lost, as I understand that certain information expires after a fixed period of time, for example, 60 days.”

White & Case, on the joint provisional liquidators’ behalf, had demanded that their access be restored by last Thursday, a deadline that has come and gone with no reply, thus provoking Friday’s legal move. The only response was allegedly a “vague request” for a meeting this week. “The joint provisional liquidators have been cut off from those systems and their access must be immediately restored,” Brian Pfeiffer, a White & Case partner, wrote.

“Without access, there are potentially severe adverse impacts and possible damage to the company

because the company’s assets are at real risk of dissipation. Moreover, information key to the joint provisional liquidators’ investigation is expected to be automatically wiped over time if not preserved.” Mr Pfeiffer added that access to a cloned copy of the information requested would be acceptable.

The situation, if it persists, threatens to bring the provisional liquidation of FTX Digital Markets to a nearstandstill. It also highlights the complex cross-border jurisdictional issues surrounding the imploded crypto currency exchange’s restructuring, winding-up and potential sale of viable entities and technology.

The alleged cut-off suffered by FTX’s Bahamian subsidiary occurred two days after it was placed into Supreme Court-supervised provisional liquidation on November 10, 2022. It also came one day after FTX posted on social media that it was “prioritising” Bahamian withdrawals, and amid rumours of a

Bahamas-based ‘back door’ channel through which investors could access their funds.

The access denial also coincided with the Securities Commission of The Bahamas, the very same day, obtaining a Supreme Court order authorising it to transfer FTX Digital Markets’ assets to a secure electronic wallet amid fears they were about to be hacked or stolen.

It is unclear whether the records block is related to this. It could also be a further sign of the competition for assets, and control of FTX’s winding-up, between Mr Ray and the Chapter 11 process in Delaware and the joint provisional liquidators in The Bahamas. The access bar would give Mr Ray leverage to use in negotiations with the Bahamian trio over the information sharing protocol they are seeking to negotiate with him, establishing his primacy

“The joint provisional liquidators have been, and remain willing, to explore an information

sharing protocol with the US debtors, though any such protocol would be subject to authorisation by the Bahamian court and it is not certain such relief will be granted,” Mr Simms and the PwC duo added.

“Because time is of the essence, however, and FTX Digital’s assets are at risk of dissipation, the joint provisional liquidators have requested the US debtors to immediately restore access to the recorded information.... While the joint provisional liquidators are happy to engage in dialogue with the US debtors, their refusal to promptly restore access has frustrated the ability of the joint provisional liquidators to carry out their duties under Bahamian law and placed FTX Digital’s assets at risk of dissipation. The US debtors’ refusal also creates the risk that critical information will be automatically deleted and irretrievably lost.”

NOTICE is hereby given that RACHELLE ABRAHAM P.O Box N7060 of St.James Road, Nassau, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 12th day of December, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

THE TRIBUNE Monday, December 12, 2022, PAGE 7

FROM PAGE B1

NOTICE FINISH CARPENTER MINIMUM 5 YEARS EXPERIENCE EMAIL:

JOB OPPORTUNITY

hr@palmcay.com

FAIR SHARE: HOTEL RENTAL UNIT TAX NOT IN EFFECT YET

wanted to ensure the socalled ‘minimum tax’ on hotel units placed in rental pools did not deter investment or undermine the tax breaks and other incentives/ concessions available to developers and unit owners.

Confirming that the legislation to give effect to this measure has yet to be implemented more than six months after Prime Minister Philip Davis KC unveiled it in the May Budget, Mr Sands said it was a “forward looking Bill” and will not be made retroactive back to July 1 this year.

“The Government is hoping to ensure that where there are condos as part of the hotel rental pool, they’ve devised a way to figure out the minimum revenue that will be earned, which is 80 percent of the property’s real property tax,” Mr Sands explained. “That will be paid through the VAT on the room sales and rentals, and if the

VAT doesn’t meet that [80 percent] threshold, the payment will be made as real property tax.”

The minimum threshold was set at 75 percent when unveiled by Mr Davis in the 2022-2023 Budget.

The “minimum tax fee”equivalent to 75 percent of the subject unit’s assessed value for property tax purposes - was billed as a means to extract revenues from condos, apartments and other high-end real estate that are normally exempt from that levy under the Hotels Encouragement Act levy because they are placed in hotel rental pools.

The Prime Minister explained that this “minimum tax fee” will only kick-in if the unit’s real property tax value is greater than the VAT levied on the rental income generated. This meant, Mr Davis said, that if a property was assessed for $100, for example, and failed to generate VAT equivalent to or greater than this value, its

owner would pay $75 as the “minimum tax fee” to the Government.

“We are trying to close the loopholes we have, and for high-end properties this is one way of doing it,” Mr Davis told the House of Assembly during his Budget presentation. “We are now imposing a minimum tax fee of 75 percent of the real property tax assessment for highend properties, which are exempt from property tax because they are in a rental pool, if these properties do not generate VAT revenue equivalent to the real property tax assessment.

“If part of a rental pool, and your condo and apartment is being rented, we expect VAT to be paid on the rental.” The “minimum tax fee” will likely capture unit owners in high-end mixed-use resort developments such as Albany and Baker’s Bay, where such properties are placed into a rental pool and leased out to other visitors when the proprietor is not there.

Several observers have argued that there has been an increasing trend of mixed-use resorts featuring a small hotel component, but placing residential units in a rental pool, just to enable their owners access to the real property tax exemptions under the Hotels Encouragement Act. While this may stimulate investment and real estate purchases, it also means the Public Treasury collects less revenue.

Tribune Business sources have revealed that government officials privately admit capturing taxes on such arrangements is problematic because it is almost impossible to determine when such units have been placed in the rental pool and/or are being leased.

Mr Sands, meanwhile, said the Government will “use a residential formula versus a commercial formula” to calculate real property tax for this initiative. “It hasn’t been made law yet,” he confirmed to Tribune Business of the

proposed Bill. “They’re still working on the legislation. The industry made a number of interventions, and a number of recommendations have been accepted.”

Declining to comment on those that have been adopted by the Davis administration, saying that should be disclosed by the Government, Mr Sands said the industry was anticipating that the legislation will move forward at some point in 2023.

“We wanted to have a seat at the table to make sure we weren’t disadvantaged and to express the concerns of the industry because this would be another layer of expense not anticipated, and it may have had an impact on investment and the concessions hotels would have received,” he told this newspaper.

Earlier, Mr Sands had told the BHTA AGM: “We have been pleased to provide input and recommendations which have resulted in certain favourable conclusions. We recognise with the emergence of any new law, there will continue to be work to be done. However, we are pleased to have been part of the conversation.”

Other items on the BHTA’s agenda include “modernisation” of the decades-old Hotels Act and upgrades to streamline the hotel licensing process so that it is “more red carpet, less red tape”. Mr Sands said the BHTA will be working with members of its executive committee and the Bahamas Out Islands Promotion Board to develop recommendations on how the former law can be amended and upgraded.

“The reality is that Act has not been addressed for many, many years,” he told Tribune Business. “It needs to be modernised. The terminology, the type of hotels and the nuances of hotel operations are different from 30-40 years ago. We think it is time. There are a number of issues.”

As for hotel licensing, Mr Sands said the timeliness of inspections as well as licence issuance, and “the possibility of creating one designated unit” to oversee inspections were among the most critical priorities. “Right now, multiple government agencies must do inspections before the licence is granted, and we’ve made good headway in this area. More red carpet, less red tape,” he added.

NOTICE is hereby given that JESSICA DOLCE of Washington Street, Nassau, The Bahamas, is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twentyeight days from the 12th day of December, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

PAGE 8, Monday, December 12, 2022 THE TRIBUNE

FROM PAGE B1

NOTICE

9.75 9.750.00 0.3690.26026.42.67% 4.342.82Cable

3.95 3.80 (0.15) 5,000-0.4380.000-8.7 0.00% 10.657.50Commonwealth

10.25 10.250.00 0.1400.00073.20.00% 3.652.54Commonwealth

3.49 3.500.0123,5000.1840.12019.03.43% 8.547.00Colina

8.53 8.530.0024,1880.4490.22019.02.58% 17.5012.00CIBC

CIB 15.99 15.990.00 0.7220.72022.14.50% 3.251.99Consolidated

CWCB 2.97 2.96 (0.01) 0.1020.43429.014.66% 11.2810.05Doctor's

DHS 10.50 10.500.00 0.4670.06022.50.57% 11.679.16Emera

EMAB 9.51 9.560.05 0.6460.32814.83.43% 11.5010.06Famguard FAM 11.22 11.220.00 0.7280.24015.42.14% 18.3014.05Fidelity

18.10 18.100.00 0.8160.54022.22.98% 4.003.50Focol FCL 3.98 3.980.00 0.2030.12019.63.02% 11.509.85Finco

11.38 11.380.00 0.9390.20012.11.76% 16.2515.50J.

15.75 15.750.00 0.6310.61025.03.87%

100.00100.000.00 100.00100.00BGS: 2015-1-7Y BG0207 100.00100.000.00 100.00100.00BGS: 2014-12-30Y BG0130 100.00100.000.00 100.00100.00BGS: 2015-1-30Y BG0230 100.00100.000.00 100.00100.00BGS: 2015-6-7Y BG0307 100.00100.000.00 100.00100.00BGS: 2015-6-30Y BG0330 100.00100.000.00 100.00100.00BGS: 2015-10-7Y BG0407 100.00100.000.00 97.4996.72BGRS FX BGR109036

BSBGR109036897.1597.150.00 90.3689.01BGRS FX BGR129249 BSBGR129249389.4289.420.00 99.3098.65BGRS FX BGR141350

BSBGR141250599.3099.300.00 92.6891.69BGRS FX BGR124238 BSBGR124238191.6991.690.00 94.9993.54BGRS FX BGR120037 BSBGR120037194.9994.990.00 100.5299.96BGRS FL BGRS97033 BSBGRS970336100.19100.190.00 100.0089.62BGRS FX BGR129249 BSBGR129249389.6289.620.00 100.0089.00BGRS FX BGR131249 BSBGR1312499100.00100.000.00 100.9890.95BGRS FX BGR132249 BSBGR132249890.9590.950.00 100.0090.73BGRS FX BGR136150 BSBGR1361504100.00100.000.00 MUTUAL FUNDS 52WK HI52WK LOW NAV YTD%12 MTH% 2.572.11 2.573.15%3.89% 4.873.30 4.843.60%5.49% 2.251.68 2.252.43%2.92% 207.86164.74 197.44-2.97%-2.35% 212.41116.70 202.39-4.72%6.04% 1.761.71 1.762.49%2.79% 1.941.78 1.935.71%7.96% 1.881.79 1.863.39%3.91% 1.030.93 0.93-8.94%-9.55% 9.376.41 9.37-0.02%10.36% 11.837.62 11.79-0.33%18.23% 7.545.66 7.540.22%3.05% 16.648.65 15.94-3.89%14.76% 12.8410.54 12.47-1.04%-2.57% 10.779.57 10.740.81%4.20% 10.009.88 N/AN/AN/A 10.438.45 10.433.00%25.60% 14.8911.20 14.897.90%48.70%

MATURITY 19-Oct-2022 20-Nov-2029

3-Oct-2036

15-Apr-2049 17-Nov-2050 17-Apr-2033 15-Apr-2049

15-Dec-2037

15-Jul-2049

21-Apr-2050

15-Dec-2021 30-Jul-2022 15-Dec-2044 30-Jul-2045 26-Jun-2022 26-Jun-2045 15-Oct-2022 28-Oct-2022

31-Oct-2022 31-Oct-2022

31-Mar-2022

31-Mar-2022 31-Oct-2022

31-Oct-2022 31-Oct-2022

31-Oct-2022 31-Jan-2022 31-Jan-2022 31-Jan-2022 31-Jan-2022

31-Jan-2022 31-Jan-2022

31-Mar-2021 31-Mar-2021

15-Oct-2049 31-Mar-2021

PAGE 10, Monday, December 12, 2022 THE TRIBUNE

The Public is hereby advised that I, JOHNLEE JOSEPH of Stapledon Gardens, Nassau, Bahamas, intend to change my name to JOHNLEE PAUL If there are any objections to this change of name by Deed Poll, you may write such objections to the Chief Passport Officer, P.O.Box N-742, Nassau, Bahamas no later than thirty (30) days after the date of publication of this notice.

PUBLIC

FRIDAY, 9 DECEMBER 2022 CLOSECHANGE%CHANGEYTDYTD% BISX ALL SHARE INDEX: 2626.51-1.09-0.04398.2717.87 BISX LISTED & TRADED SECURITIES 52WK HI52WK LOWSECURITY SYMBOLLAST CLOSECLOSECHANGE VOLUMEEPS$DIV$P/E YIELD 7.005.30 AML Foods Limited AML 6.95

53.0040.03 APD Limited APD

2.761.60Benchmark BBL

2.462.31Bahamas First Holdings Limited BFH

of Bahamas BOB

Property Fund BPF

Waste BWL

Bahamas CAB

Brewery

Bank

Holdings

Water

S. Johnson JSJ

PREFERENCE SHARES 1.001.00Bahamas First Holdings PreferenceBFHP

Cable Bahamas Series 6 CAB6

1000.001000.00 Cable Bahamas Series 9 CAB9

Holdings Class A CHLA

10.0010.00Fidelity Bank Bahamas Class A FBBA

1.001.00Focol Class B FCLB

CORPORATE DEBT - (percentage pricing) 52WK HI52WK LOWSECURITY SYMBOLLAST SALECLOSECHANGEVOLUME 100.00100.00Fidelity Bank (Note 22 Series B+)FBB22

100.00100.00Bahamas First Holdings LimitedBFHB

BAHAMAS GOVERNMENT STOCK - (percentage pricing)

Note 6.95 (2029) BAH29

BG0107

INTENT TO CHANGE NAME BY DEED POLL

NOTICE

6.950.00 0.2390.17029.12.45%

39.95 39.950.00 750.9321.26042.93.15%

2.76 2.760.00 0.0000.020N/M0.72%

2.46 2.460.00 0.1400.08017.63.25% 2.852.25Bank

2.57 2.610.04 7,0000.0700.000N/M0.00% 6.306.00Bahamas

6.30 6.300.00 1.7600.000N/M0.00% 9.808.78Bahamas

CBB

CBL

CHL

FirstCaribbean Bank

BDRs

Hospital

Incorporated

Bank (Bahamas) Limited FBB

FIN

1.00 1.000.00 0.0000.0000.0000.00% 1000.001000.00

1000.001000.000.00 0.0000.0000.0000.00%

1000.001000.000.00 0.0000.0000.0000.00% 1.001.00Colina

1.00 1.000.00 0.0000.0000.0006.25%

10.0010.000.00 0.0000.0000.0007.00%

1.00 1.000.00 0.0000.0000.0006.50%

100.00100.000.00

100.00100.000.00

115.92104.79Bahamas

107.31107.310.00 100.00100.00BGS: 2014-12-7Y

MARKET TERMS BISX ALL SHARE INDEX - 19 Dec 02 = 1,000.00 YIELD - last 12 month dividends divided by closing price 52wk-Hi - Highest closing price in last 52 weeks Bid $ - Buying price of Colina and Fidelity 52wk-Low - Lowest closing price in last 52 weeks Ask $ - Selling price of Colina and fidelity Previous Close - Previous day's weighted price for daily volume Last Price - Last traded over-the-counter price Today's Close - Current day's weighted price for daily volume Weekly Vol. - Trading volume of the prior week Change - Change in closing price from day to day EPS $ - A company's reported earnings per share for the last 12 mths Daily Vol. - Number of total shares traded today NAV - Net Asset Value DIV $ - Dividends per share paid in the last 12 months N/M - Not Meaningful P/E - Closing price divided by the last 12 month earnings TO TRADE CALL: CFAL 242-502-7010 | ROYALFIDELITY 242-356-7764 | CORALISLE 242-502-7525 | LENO 242-396-3225 | BENCHMARK 242-326-7333 5.55% 6.35% 4.31% 5.55%

5.06% 5.22% 13-Jul-2038

6.25% 30-Sep-2025

FUND CFAL Bond Fund CFAL Balanced Fund CFAL Money Market Fund CFAL Global Bond Fund

NAV

6.25% 4.50% 6.25% 4.25%

Date 5.65% 5.69% 5.40%

Prime +

MARKET REPORT

INTEREST

1.75%

6.95% 4.50%

4.50% 6.25% 5.60%

Colonial Bahamas Fund Class D Colonial Bahamas Fund Class E Colonial Bahamas Fund Class F CFAL Global Equity Fund Leno Financial Conservative Fund Leno Financial Aggressive Fund Leno Financial Balanced Fund Leno Financial Global Bond Fund RF Bahamas Opportunities Fund - Secured Balanced Fund RF Bahamas Opportunities Fund - Targeted Equity Fund RF Bahamas Opportunities Fund - Prime Income Fund RF Bahamas International Investment Fund Limited - Equities Sub Fund RF Bahamas International Investment Fund Limited - High Yield Income Fund RF Bahamas International Investment Fund Limited - Alternative Strategies Fund

www.bisxbahamas.com

(242)323-2330 (242) 323-2320

‘BANNER YEAR’: RESORTS BEAT REVENUE TARGET BY 10% PTS

that the industry will narrow the gap over the 2022’s final two months aided by relatively weak comparisons due to the fallout from Hurricane Dorian in the benchmark year.

Asserting that the data showed the value of resorts not cutting room rates, Mr Fountain told this newspaper: “When we started this calendar year our goal was to have 2022, in terms of room nights sold, be at 95 percent compared to 2019, and then room revenues, we set our goal at 86 percent compared to 2019.

“I knew we were going to struggle at the beginning of the year because of the Omicron variant. Omicron really raised its ugly head around Christmas last year. It really impacted our holiday business last year and in January. But we didn’t change our goals of 95 percent and 86 percent, for if we compared it to 2019, Dorian negatively impacted the northern BahamasGrand Bahama and Abaco - in late 2019 and we all suffered from some hangover as a result.

“We left our goals at 95 percent and 86 percent

respectively. Right now, through the end of October, we’re at 83 percent in terms of room nights sold and at 96 percent in room revenues. We’re falling short in our room nights sold, but are surpassing our goals by 10 percentage points on room revenues,” he affirmed.

“We said at the beginning: ‘Do not cut your rates’. People are not travelling because the rates are too expensive. There’s tremendous demand for travel. People are saying after COVID: ‘Let’s go’. We definitely reached our room revenue goals through the end of October. And we feel November and December will now bring us closer to 95 percent in room nights sold. In 2019, Abaco was out of commission in November and December. We think we’re going to be very close to our goals.”

Mr Fountain added that the Promotion Board had taken a deeper dive into the statistics by studying like-for-like comparatives, meaning the performance of resort properties who were both members in 2019 and today. “The same member hotels, they’re at 79 percent in terms of room

Japanese company’s lander rockets toward moon with UAE rover

By MARCIA DUNN AP Aerospace Writer

A TOKYO company aimed for the moon with its own private lander Sunday, blasting off atop a SpaceX rocket with the United Arab Emirates’ first lunar rover and a toylike robot from Japan that’s designed to roll around up there in the gray dust.

It will take nearly five months for the lander and its experiments to reach the moon.

The company ispace designed its craft to use minimal fuel to save money and leave more room for cargo. So it’s taking a slow, low-energy path to the moon, flying 1 million miles (1.6 million kilometers) from Earth before looping back and intersecting with the moon by the end of April.

By contrast, NASA’s Orion crew capsule with test dummies took five days to reach the moon last month. The lunar flyby mission ended Sunday with a thrilling Pacific splashdown.

The ispace lander will aim for Atlas crater in the northeastern section of the moon’s near side, more than 50 miles (87 kilometers) across and just over 1 mile (2 kilometers) deep. With its four legs extended, the lander is more than 7 feet (2.3 meters) tall.

With a science satellite already around Mars, the UAE wants to explore the moon, too. Its rover, named Rashid after Dubai’s royal family, weighs just 22 pounds (10 kilograms) and will operate on the surface for about 10 days, like everything else on the mission.

Emirates project manager Hamad AlMarzooqi said landing on an unexplored part of the moon will yield “novel and highly valued” scientific data. In addition, the lunar surface is “an ideal platform” to test new tech that can be used for eventual human expeditions to Mars.

Plus there’s national pride — the rover represents “a pioneering national endeavor in the space sector and a historic moment that, if successful, will be the first Emirati and Arab mission to land on the surface of the moon,” he said in a statement following liftoff.

In addition, the lander is carrying an orange-sized sphere from the Japanese Space Agency that will transform into a wheeled robot on the moon. Also flying: a solid state battery from a Japanese-based spark plug company; an Ottawa, Ontario, company’s flight computer with artificial intelligence for identifying geologic features

seen by the UAE rover; and 360-degree cameras from a Toronto-area company.

Hitching a ride on the rocket was a small NASA laser experiment that is now bound for the moon on its own to hunt for ice in the permanently shadowed craters of the lunar south pole.

The ispace mission is called Hakuto, Japanese for white rabbit. In Asian folklore, a white rabbit is said to live on the moon. A second lunar landing by the private company is planned for 2024 and a third in 2025.

Founded in 2010, ispace was among the finalists in the Google Lunar XPRIZE competition requiring a successful landing on the moon by 2018. The lunar rover built by ispace never launched.

Another finalist, an Israeli nonprofit called SpaceIL, managed to reach the moon in 2019. But instead of landing gently, the spacecraft Beresheet slammed into the moon and was destroyed.

With Sunday’s predawn launch from the Cape Canaveral Space Force Station, ispace is now on its way to becoming one of the first private entities to attempt a moon landing.

Although not launching until early next year, lunar landers built by Pittsburgh’s Astrobotic Technology and Houston’s Intuitive Machines may beat ispace to the moon thanks to shorter cruise times.

Only Russia, the U.S. and China have achieved socalled “soft landings” on the moon, beginning with the former Soviet Union’s Luna 9 in 1966. And only the U.S. has put astronauts on the lunar surface: 12 men over six landings.

Sunday marked the 50th anniversary of astronauts’ last lunar landing, by Apollo 17’s Eugene Cernan and Harrison Schmitt on Dec. 11, 1972.

NASA’s Apollo moonshots were all “about the excitement of the technology,” said ispace founder and CEO Takeshi Hakamada, who wasn’t alive then. Now, “it’s the excitement of the business.”

“This is the dawn of the lunar economy,” Hakamada noted in the SpaceX launch webcast. “Let’s go to the moon.”

Liftoff should have occurred two weeks ago, but was delayed by SpaceX for extra rocket checks.

Eight minutes after launch, the recycled firststage booster landed back at Cape Canaveral under a near full moon, the double sonic booms echoing through the night.

nights sold but right on goal in terms of 86 percent in room revenues,” he revealed.

“Again, in November and December, we have the opportunity to those room nights sold closer to the goal of 95 percent. We lift up the hood to say: ‘OK: Which islands are doing well and which ones are still not on target?’ What we found is we determined islands like Abaco, Andros, Exuma and Harbour Island, those islands are at least at our goal of 93 percent room nights sold compared to 2019.

“Then the room revenue, the strong performers are Abaco, Andros, Bimini and Harbour Island. By doing that, we’re able to see exactly which islands are under-performing. It’s the

same story that I’ve been sharing with you for the past year. The islands that are under-performing are the islands that do not have the necessary airlift. It tells us exactly what we have to fix.”

Mr Fountain said Andros was performing well thanks to the introduction of new flights by Aztec and Makers Air from Fort Lauderdale’s Fixed Base Operations (FBO) facility. But he added: “Cat Island is still not where it should be compared to 2019. Long Island, they’ve had a good year thanks to the frequency of Bahamasair flights from Nassau and connections.

“San Salvador continues to struggle because of having to come to Nassau overnight and leave the next day, which adds to

the cost of the vacation. But most of the major islands are looking forward to a banner year in 2023.” Describing the mood among Promotion Board member hotels as “very positive”, Mr Fountain acknowledged that “we still have islands out there that are not enjoying the success that others are”.

Pointing to Acklins as an example, he added that infrequent airlift service as well as a lack of connectivity meant bonefishing enthusiasts heading for the island often have to overnight in Nassau “so that’s hindering growth on islands like Acklins”.

However, airlines present at last week’s Bahamas Out Island Promotions Board annual general meeting (AGM) confirmed that

airlift and available seats will match 2019 numbers in 2023. Noting that airlift remains critical to growing room nights sold, room revenues and visitor numbers, he added: “What we’re seeing is that there will be at least equal airlift in 2023 to what we had in 2019.

“The airlines that are not at what they delivered in 2019, it’s not because they don’t have an appetite to add the seats. There’s still lingering problems in the airline industry with a shortage of pilots and crew, and at reservation centres. Those airlines realise demand for The Bahamas is huge, and as they build capacity and add pilots and crews, and staff reservation centres, capacity will grow.”

THE TRIBUNE Monday, December 12, 2022, PAGE 11

FROM PAGE B1