Regulator warned 127 on financial crime compliance

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

BAHAMIAN regulators issued warnings to 127 law and real estate firms over noncompliance with anti-financial crime mandates while giving this nation’s $306m-plus resi dential real estate sales a clean bill of health.

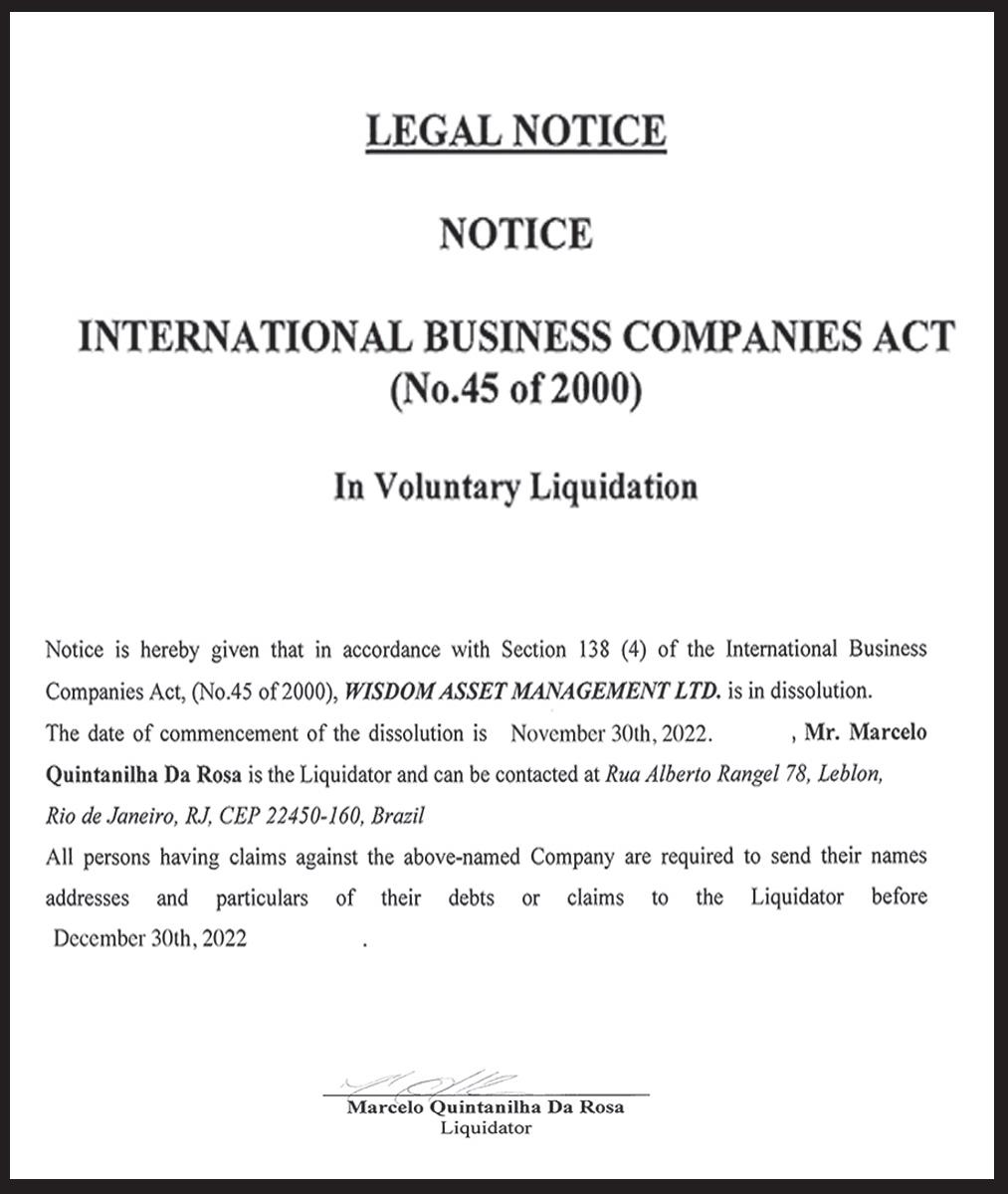

The Compliance Com mission, which supervises non-financial services institu tions over their compliance with anti-money laundering and counter terror financing laws, revealed in a recentlypublished report that it was forced to write to multiple companies in both industries for failing to supply a risk assessment and/or register with it.

Disclosing that three unnamed law firms were fined during 2019-2020 for failing to answer questions about the potential financial crime risks they and their clients pose, the Compliance Com mission said it had “detected

a significant change” where companies falling within its regulatory purview were recognising their legal obliga tions to register rather than doing so under the threat of “enforcement” measures being applied.

The revelations came in a Compliance Commission report that concluded The Bahamas was “unlikely” to be “a real estate-based money laundering centre” because there were sufficient checks and balances at multiple stages of the property pur chasing process to properly

identify clients and the source of funds used to finance their acquisitions.

The document, obtained by Tribune Business, drew on numerous sources includ ing the Bahamas Real Estate Association (BREA), Cen tral Bank, Immigration Department and Bahamas Investment Authority (BIA) in affirming that 2021 was likely the strongest year ever for real estate sales with more than $306m worth of residen tial properties said to have been sold.

Total Bahamian real estate sales for that year were later pegged at $500m, or half a billion dollars, by the report - a figure shown to be some $200m higher than the $300m worth of activity estimated in 2017. The total value of avail able real estate inventory, or stock, was put at more than $3bn.

The Compliance Commis sion, acknowledging that real estate purchases are known to be “attractive for potential misuse by money launder ers and terrorist financiers” throughout the world, added: “Real estate is often chosen globally as a vehicle for crimi nals to launder ill-gotten gains because property offers a path to legitimacy and will appreciate over time. This allows criminals to enjoy their property and eventually the proceeds of sale.”

The Bahamas, with its pri vate islands and high-end homes in gated communi ties and condominiums that

SEE PAGE B4

Gov’ts deficit jumps $75m but below full-year run rate

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE GOVERNMENT incurred a $75m October deficit after it was yester day revealed that monthly spending on goods and ser vices more than doubled to drive a 24.5 percent yearover-year recurrent spending increase.

The Ministry of Finance, in unveiling the October fiscal performance report, gave no explanation for why spend ing on goods and services had risen by more than 100 percent year-over-year - from $31.2m in October 2021 to $63.1m this year - although it could simply be related to “timing issues” and when invoices and bills come due for payment.

Still, it represented the major factor driving the $56.7m year-over-year increase in total recurrent (fixed cost) spending for the month. This more than offset the 20.9 percent year-overyear jump in tax revenues, which increased from $169.8m to $205.3m, to result in the Government’s deficit for the first four months of the 20222023 fiscal year more than

quadrupling compared to the end-September position.

The $74.9m worth of ‘red ink’ incurred during Octo ber, representing by how much government spending exceeded revenues, took the fiscal deficit from $21.3m at end-September to $96.2m at the end of the following month. Personal emoluments, meaning public sector salaries

SEE PAGE B6

FTX payout probe urged as US trustee intervenes

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

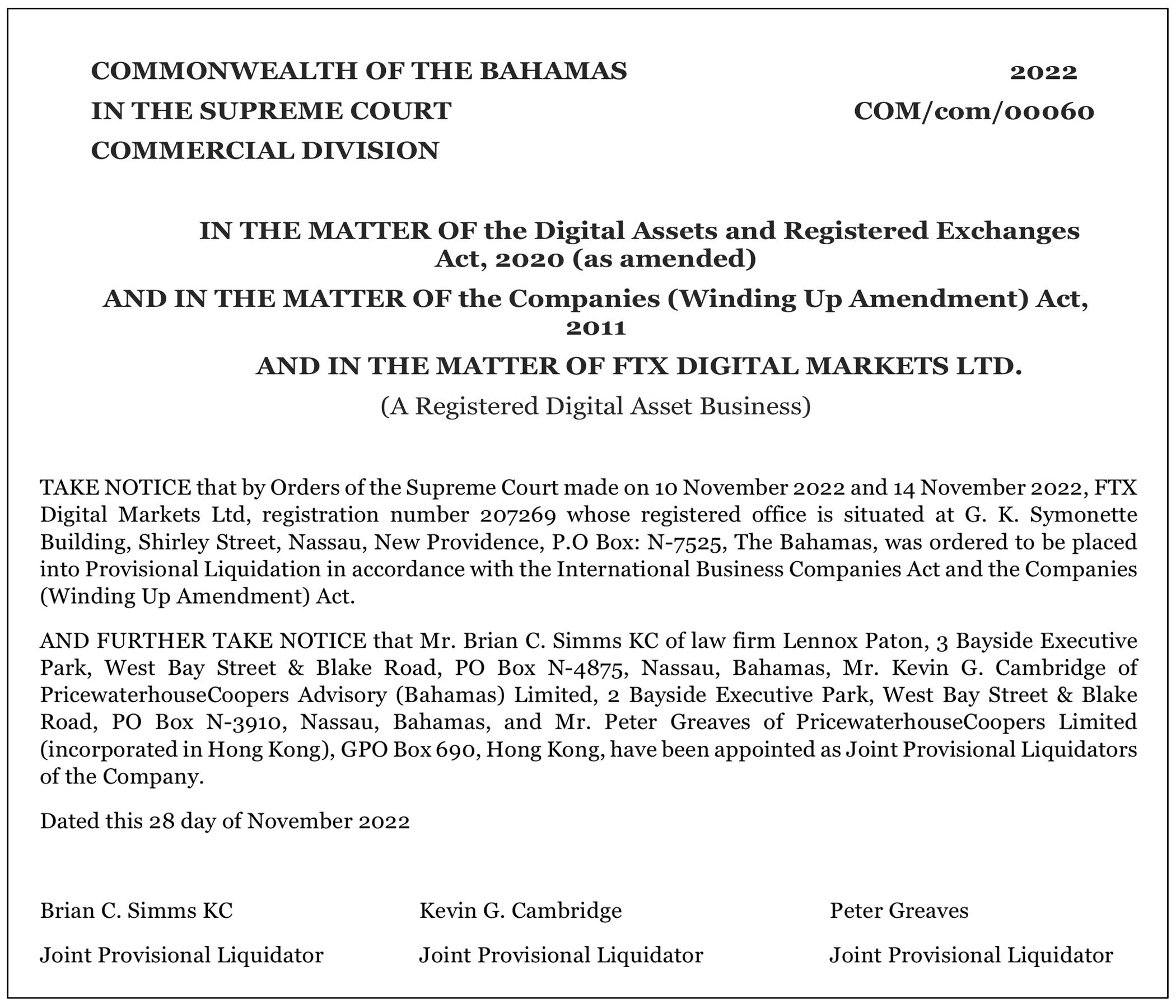

FTX’s Bahamian pro visional liquidators were yesterday urged to “thor oughly investigate” any payouts to local investors that violated the Supreme Court asset freeze as the US Justice Department moved to intervene in Delaware.

Local insolvency prac titioners told Tribune Business that the trio appointed to take charge of FTX Digital Markets, the collapsed crypto exchange’s Bahamian subsidiary, have “massive powers” to recover and “claw back” any withdrawals found

to represent a so-called fraudulent preference that disadvantages other credi tors and investors.

The call came as the US trustee, who represents the US Justice Department in bankruptcy cases, moved for the appointment of an “independent examiner” to investigate the claims of “fraud, dishonesty and mis management” surrounding FTX’s spectacular collapse from a worth of $32bn to zero in just over a week.

Andrew Vara, in a filing with the Delaware Bank ruptcy Court, argued that such an appointment would allow John Ray, appointed

Cruise port targeting 4.5m arrivals in 2024

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

NASSAU Cruise Port’s top executive yesterday predicted that the facility will receive around 4.5m passengers in 2024, rep resenting around a 12.5 percent increase on arrivals projected for the upcoming year.

Michael Maura, who have the Prime Minister and other government offi cials a tour of the $300m Prince George Wharf trans formation, told reporters that the facility is expecting year-over-year growth in cruise passenger numbers of some 25 percent in 2023.

That will take cruise arrivals to some four mil lion, as compared to this year’s 3.2m, with the Nassau Cruise Port chief executive explaining that passenger numbers will grow faster than vessels berthing because the latter are get ting ever-bigger with larger occupancies.

The port, which is scheduled to complete its transformation by next May and have its grand opening towards the end of that month, is eyeing a 4.5 percent rise in cruise ship arrivals next year compared to pre-pandemic numbers. And, for 2024, it expects to

‘Season survival’ fears on 50% lobster price plunge

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

FEARS were yesterday voiced that some Bahamian fishermen “may not survive the season” as the industry seeks to “weather the storm” created by lobster tail prices plunging by up to 50 percent.

Paul Maillis, the National Fisheries Associa tion’s (NFA) secretary, told Tribune Business that fishermen who invested heavily in their vessels and operations in expectation that last year’s prices “of upwards of $20 per pound” will be maintained are especially vulnerable to the drop-off.

Disclosing that seafood processors are paying fishermen as little as $10 per pound for lobster in some parts of The Bahamas, he attributed the “suppressed prices” to increased supply as rival sources such as South Africa ramp up production back to pre-pandemic levels with the lifting of COVID restrictions.

While catch volumes have held at 2021 levels, Mr Maillis told this newspaper that Family Island communities were being espe cially hard hit by the price fall-off. Besides having fewer sales outlets outside of proces sors and exporters, they are also feeling the general squeeze from inflation and cost pres sures far more than New Providence.

With “the price of everything going up” bar lobster, he added that some fishermen are now struggling to “pay their bills” and still hoping that the Government can provide some relief on fuel costs - possibly by diversifying supply sources if the US eases sanctions on Venezuela and allows the South American country to resume production in earnest once again. With one alternative income source cut-off for Bahamian fishermen yesterday through

business@tribunemedia.net FRIDAY, DECEMBER 2, 2022

SEE PAGE B5

SEE PAGE B8 SEE

PAGE B6

• Bahamian fisherman having to ‘weather the storm’ • Those who bet on prices staying high vulnerable • Grouper season close limits alternative options • Nation’s $306m residential property sales in all-clear • Bahamas ‘unlikely to be real estate laundering centre’ • But three law firms fined over risk assessment failure MARINE INSURANCE LIFE INSURANCE AUTO INSURANCE HOME INSURANCE Nobody Does it Better! (BAHAMAS) LIMITED. INSURANCE BROKERS & AGENTS INSURANCE MANAGEMENT Covering The Bahamas for 45 years. $5.95 $5.97 $6.07 $5.87

EXPLOIT PUBLIC RELATIONS TO DRIVE CUSTOMER TRAFFIC

Clarity is criti

cal in all kinds of business communi cations, yet can be difficult to achieve. Unlike paid marketing programmes such as advertising, public relations is focused on earned media and can take advantage of unpaid com munications channels.

Public relations is about managing perceptions, namely how people think about your business.

Aside from helping companies gain positive publicity, strong public rela tions allows firms to set the narrative with custom ers, prospects, investors, and current and potential employees. A public rela tions department supervises and assesses public atti tudes, and maintains mutual relations and understanding between a company and its customers. It improves channels of communication, and sets up a two-way flow of information.

FERGUSON IAN

1. Use press releases to spread the word

When your brand is fea tured in magazines, news publications, websites, blogs and other outlets, it simply increases people’s confidence in your brand.

Press releases can help you create awareness for your brand, a particular event, milestone or product

launch, and attract people to your website in the process.

2. Targeting local TV sta tions and media outlets If your goal is to reach as many people as possible when sharing your brand story, you might already have your eyes set on major media outlets. Although there is nothing wrong with this aspiration, the reality is that it can be incredibly challenging to get coverage in national media.

3. Using PR stunts to get coverage

Publicity stunts have been getting a lot of heat in recent years thanks to brands using them for shock value and little else. Even though public rela tions stunts can be tacky and annoying sometimes, when done right they can really help your brand get noticed. In order for your PR stunt to be effec tive, it needs to be creative and clever. It has to push boundaries and go against

THE DEPUTY Prime Minister and Minister of Tourism, Investments and Aviation, the Hon. Chester Cooper partici pated in a Panel Discussion at the World Travel and Tourism Council (WTTC) Global Summit in Riyadh, Saudi Arabia.

Bahamas eyes travel ease for Saudi and Middle East

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE deputy prime min ister has suggested that visa waivers and electronic visas will be some of the tools employed to boost travel to The Bahamas from Saudi Arabia and other Middle East states.

Chester Cooper, deputy prime minister and minis ter of tourism, investments and aviation, told the 22nd World Travel & Tourism (WTTC) Global Summit: “I think we are going to see more digital e-visas and more waivers of visas for places like the King dom of Saudi Arabia for travel to The Bahamas, where guests can have a

multi-destination experi ence and can also travel on to the US having gone through pre-clearance, and have a continuous seam less transition from start to finish of their travel.”

He was speaking as a guest panellist discuss ing the topic, ‘Is the future seamless and contactless?’

Besides Mr Cooper, the three-member panel, mod erated by Eleni Giokos, a CNN anchor and cor respondent, featured Jeni Mundy, global head, mer chant sales and acquiring, Visa; and Emily Weiss, global travel industry lead at Accenture.

Mr Cooper said COVID-19 had created dig ital opportunities for many Bahamians. He added that more have embraced digital

transactions, particularly the use of mobile wallets, as a necessity, adding that the hassle-free factor and con venience of doing business online continue.

He was quick, how ever, to caution on tourism becoming contactless as it is a people business. “I think a part of experiencing the people and the location that you visit is about the love that people have for their country,” he said.

He envisioned that that the increasing inter-opera bility of digital wallets will allow travellers to seam lessly convert their currency into that of the host nation.

“I think this is an evolution and I think we in The Baha mas will get there,” he said.

the trend in some way to get media coverage and the attention of the general public.

4. Participating in com munity and industry events Events are a great way to promote your brand, network with important players in your industry, and interact with your target audience. It does not mean that you can just host your own events and call it a day. It pays to contribute and participate in events organ ised by other brands in your community, too. The easiest way to do so is to speak on topics you are knowledge able about, ask questions during panel discussions, or set up an information booth. Doing things such as this will help you gain more visibility.

to hang out. This is mostly because social media helps to increase brand visibility, spread your message fur ther, and avert potential PR crises by correcting the narrative and taking control of the situation in realtime. Do not just set up an account and forget about it. The key is to actively engage with your network, join relevant conversations, and share valuable content that your audience will find useful and informative.

traffic and conversions for your brand.

7. Creating some contro versy around your brand Another effective way to grab the public’s attention is to create some contro versy around your message. People love a good debate, so if you can give them that, you’ve basically got a winning public relations campaign right there. You can generate lots of cover age from different audience segments analysing your story and giving their two cents on the subject.

5.

Taking advantage of social media platforms

Any brand that is seri ous about its PR strategy must maintain a presence on social media platforms where its audience likes

6. Partnering up with influencers Research shows that 92 percent of people are more likely to trust recommen dations from other people over advertisements and messaging from actual brands. This is why influ encer marketing is one of the fastest-growing cus tomer acquisition channels.

By partnering with influenc ers, you can tap into their extensive network of loyal and engaged followers to drive increased awareness,

• NB: Ian R Ferguson is a talent management and organisational develop ment consultant, having completed graduate studies with regional and interna tional universities. He has served organsations, both locally and globally, pro viding relevant solutions to their business growth and development issues. He may be contacted at tccon sultants@coralwave.com.

Bahamas positions itself as aviation hub for Middle East

THE BAHAMAS discussed the future of post-COVID travel, and plans to make this nation a hub for multi-destination Caribbean travel from the Middle East, at a major tourism summit held in Saudi Arabia this week.

The Ministry of Tourism, Investments and Aviation, in a statement, said the Bahamian delegation led by Chester Cooper, deputy prime minster, attended a series of discussions at the World Travel and Tour ism Council’s (WTTC) Global Summit where they detailed the strength of the country’s post-COVID travel rebound.

Data from Forward Keys, the analyst of global ticketing data from online bookings, travel agencies and airlines, revealed that the Caribbean is recovering from the pandemic faster than anywhere else in the world with The Bahamas reporting a 16 per cent growth month-on-month compared to 2019.

With the conference taking place in Saudi Arabia, Mr Cooper was keen to share plans to grow the Middle East market and articulated his vision for Nassau to become an aviation hub for Middle Eastern travel to the

Western Hemisphere. With an increase in airlift from London, and a weekly schedule of 11 flights, he said there was huge poten tial for The Bahamas to fulfill this role.

Mr Cooper said: “The World Travel and Tourism Global Summit has been a great opportunity for myself, and fellow minis ters and delegates, to share knowledge, experience and ideas on a global level across the tourism sector.

Following the COVID19 pandemic, tourism and travel is definitely back on the agenda and, speaking on the behalf of the islands of The Bahamas, tourism is returning to the islands with a vengeance.

“Airlift is the oxygen for tourism and we are delighted to now have that increased flight uplift from London to our hub, Nassau, enabling us to wel come more visitors to our 30 government-owned air ports and 16 major island destinations.”

“We have much expe rience in this sector with Bahamasair already ser vicing our major island destinations. We are

discussing using our insight to make The Bahamas the hub of multi-destination travel across the Carib bean, making it even easier for the world to experience our beautiful islands. Baha masair will be a key asset in this initiative. With our proximity to the US as the most northerly Caribbean country, with US pre-clear ance and TSA pre-check, we are ideally positioned.”

Mr Cooper shared infor mation indicating that travellers to The Bahamas are now choosing to spend longer in the country, and are travelling further afield to discover more of the archipelago’s 16 inhabited islands.

The Ministry of Tourism, Investments and Aviation team also held a number of meetings on investments, with sustainability at the forefront due to The Baha mas’ marine environment of 100,000 square miles, 700 islands and 2,400 cays. The islands have set a target of 30 percent renewable energy by 2030 alongside other initiatives to support The Bahamas’ sustainabil ity plans.

BAHAMAS SIGNS TOURISM DEAL WITH SAUDI ARABIA

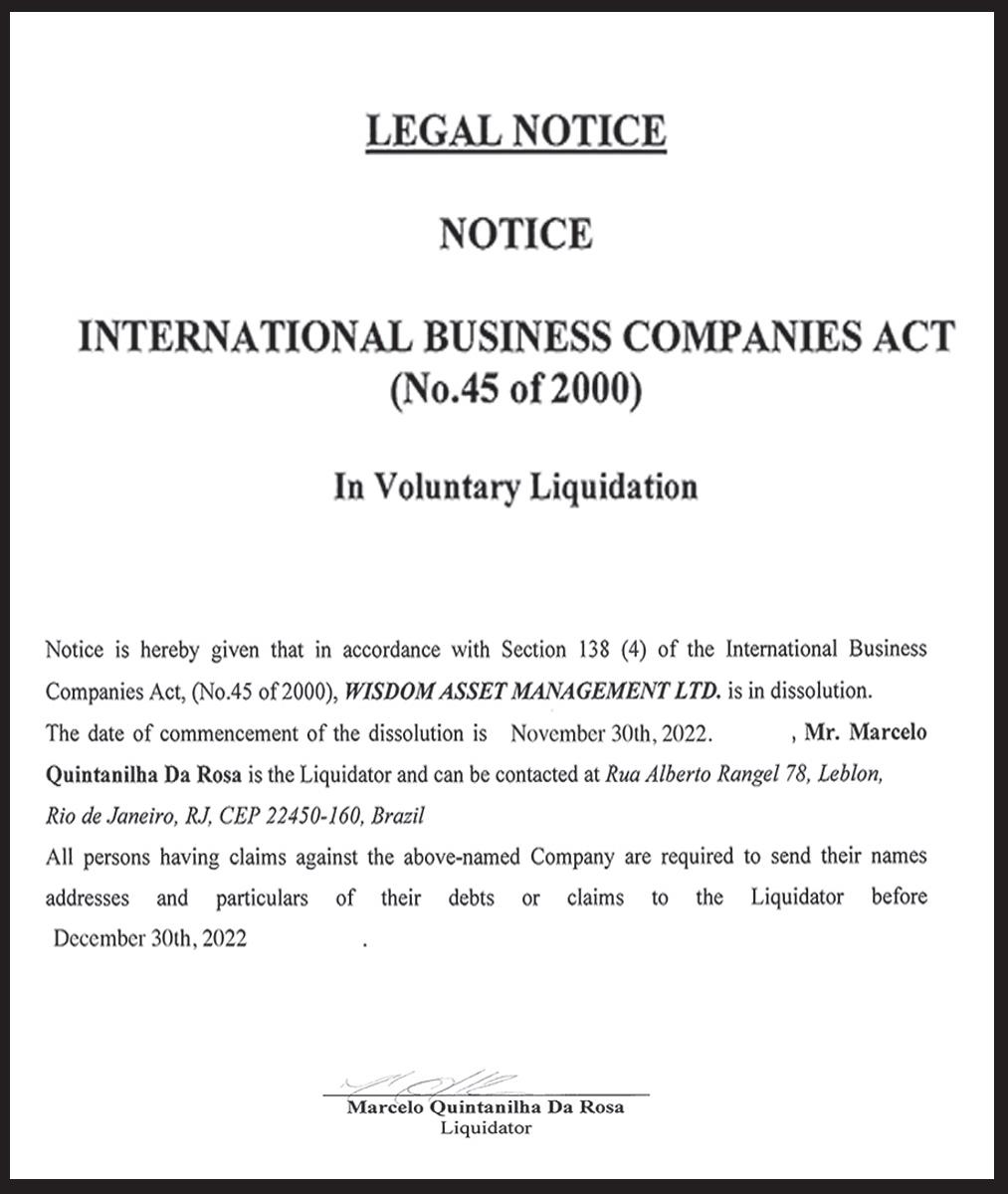

THE Bahamas has used its presence at the World Travel and Tourism (WTTC) Global Summit to sign a Memorandum of Understanding (MoU) that deepens tourism co-opera tion with Saudi Arabia.

The Ministry of Tourism, Investments & Aviation (BMOTIA), in a statement, said the agreement will coordinate the two countries’ efforts to drive sustainable tourism development while still recognising local tradi tions and social values.

Chester Cooper, deputy prime minister, was said to have been eager to use The Bahamas’ attendance at the Riyadh conference to bring the two nations through the exchange of information and expertise across the tourism industry.

“The World Travel and Tourism Global Summit has been a great opportunity

for myself, and fellow min isters and delegates, to share knowledge, experi ence and ideas on a global level across the tourism sector,” Mr Cooper said.

“We are delighted to be forging these inter national relations to the benefit of global tourism, and the Memorandum of Understanding between The Bahamas and Saudi Arabia is a clear way to demonstrate that interna tional collaboration. We have much experience in the tourism sector, and this agreement will enable us to share our insight whilst working towards the same global goals.”

Besides sustainable tour ism practices, the Saudi agreement will also focus on the management of tour ism facilities and sharing of insights and data.

PAGE 2, Friday, December 2, 2022 THE TRIBUNE

THE DEPUTY Prime Minister and Minister of Tourism, Invest ments & Aviation, the Hon. Chester Cooper signs a memoran dum of understanding with Saudi Arabia’s Minister of Tourism, His Excellency Ahmed Al Khateeb.

AVIATION OPTIMISTIC OVER ‘BOOKED SOLID’ CHRISTMAS

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

BAHAMIAN avia tion operators yesterday said they were optimistic a “booked solid” Christmas period will escape the flight delays and clogged airport ramp that impacted last year’s festive period.

Anthony Hamil ton, Southern Air’s director of administration, and president of the Baha mas Association of Air Transport Operators, told Tribune Business: “Busi ness has indeed improved, progress is certainly being made. For this season we are seeing a good indication of improvement.”

Incoming flights for Southern Air are “booked solid” with just a few avail able seats still left, and Mr Hamilton added: “I don’t think there will be any back-ups at the airport this year. We’ve made some adjustments and we have been dialoguing with the air traffic controllers and avia tion leadership from the air traffic end of it. The chem istry, the environment and atmosphere has definitely gotten a positive shift.”

Citing a “lack of effective communication” in prior years with air traffic con trol, he continued: “There’s some other things. There’s work still to be done, and we’re making some progress with the com munication, things being unearthed that weren’t

shared previously, so we can address them now.

“Other than that there is a bucket list of items we need to continue working on because there is always room for improvement in the business. We have experienced the downside of things and now we are in the recovery process, and this requires proper plan ning, organising ourselves and then implementation.

“So we are going through that implementation pro cess for some of the changes we have predicted. Then we will continuously evaluate this, and determine whether we’re going ahead or going backwards, but I would say right now we’re going on an upward skid here.”

Maintaining this momen tum depends on ongoing

dialogue and consultation over legislation that governs the sector, Mr Hamilton added. “Normally in the past we’ve had this cut and paste kind of situation, and you get things shoved at you. That was not a good environment. So automati cally there was retaliation because the rules were dif ficult to enforce or practice what was actually being pushed out,” he said.

“But now we have turned the corner. Not that we are totally happy, but there is an improvement. We want to advocate change not just for New Providence, but for the entire Commonwealth of The Bahamas, because we can all share from the growth of the aviation industry.”

Grand Lucayan: Focus on buyer not maximum price

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

THE Grand Bahama Chamber of Commerce’s president yesterday argued that the Government should drop its obsession with maximising the Grand Lucayan’s sales price and instead focus on finding the right buyer.

James Carey told Trib une Business that Grand Bahama would be better off long-term if the Govern ment selected the correct purchaser to transform the resort into the economic and tourism ‘anchor’ it needs to be even if it gave the property away for a peppercorn price such as $1.

MINISTER

Photos:Kemuel Stubbs/ BIS

He added: “They are talking about getting $100m for this property. If some body is going to buy it they have to put $100m together to get it, and they have to have the funds in place or raise funds to do the reno vations that’s necessary and make it the class act that it ought to be.

“During that process, no doubt successive gov ernments, as they have demonstrated in the past, they give away huge con cessions, whether it be exemptions or promotion or whatever they do. So, we get $100m for it, and we give away $100m to support the venture with getting going. That $100m up front depletes the pockets of the investor in terms of what they can spend, and this is not just for small investors but even for large multina tional companies.

“I said all of that to say this: Why doesn’t the Gov ernment give someone the property; don’t give all of the concessions but also make the agreements as such that if they don’t com plete what they promised to do, and operate as they promise to do, the property reverts to the Bahamian government and they owe the $100m or so to the Gov ernment. This thing they keep talking about getting $100m for the hotel, but they are spending millions every month to keep it going as it is.”

Bahamian taxpayers have spent more than $150m to acquire and keep the Grand Lucayan open since it was purchased by the Govern ment in September 2018. It is spending around $1.2m per month in subsidies to keep the resort open.

Mr Carey said: “The Government tends to do these things because they are not a commercial oper ation, they are not in the business of profit. I won’t say it was a mistake buying the resort, but I think suc cessively there has been some missteps about this. We’ve been too focused on selling the hotel more than getting the hotel open. I think we should be looking at getting this hotel open rather than how do we get it sold and opened.”

“They must have a man ager in place. They have a Board that takes its general direction from the Govern ment, and they will pass that on to the management. The hotel should not be closed down at this stage, but it needs to be disposed of.”

THE TRIBUNE Friday, December 2, 2022, PAGE 3

GRAND LUCAYAN RESORT

Senator Michael Halkitis, minister of economic affairs, stood in on behalf of the Prime Minister at a promotion ceremony for Customs offic ers on November 30 at the agency’s University Drive headquarters in Nassau. Mr Halkitis and Wayde Watson, parliamentary secre tary in the Ministry of Economic Affairs, presented the officers with their letters of promotion.

TAKES PM PLACE AT CUSTOMS

PROMOTIONS

Regulator warned 127 on financial crime compliance

remain attractive to for eign buyers, was potentially exposed to such abuse.

“The large sums associated with this market, along with the enhanced lifestyle make Bahamian luxury property

a potentially attractive option for laundering the proceeds of crime,” the Compliance Commission added.

“For this reason, the high-end real estate market continues to present a sub stantial potential money

laundering/ terror financ ing/ proliferation risk to the economy.” The report defined “high-end” real estate as involving property worth $2m and upwards and lots worth $1m and more.

Drawing on data from BREA, individual realtors and the Bahamas Multiple Listing Service, the latter of which captures around 50 percent of property sales, the Compliance Commis sion report looked at data from 2015-2021. “In the

CAREER OPPORTUNITY

DIRECTOR OF CRUISE PORT & TRANSPORTATION

luxury market, total resi dential sales were highest in 2021 ($215m), while total lot sales were highest in 2020 at $18.7m,” it said.

Responsible

Responsible

DIRECTOR OF CONSTRUCTION SERVICES

EXECUTIVE STEWARD

Responsible for overseeing the daily operation of the Stewarding department by ensuring overall cleanliness and maintenance of all kitchen areas, dishware, equipment and outlets. Minimum of 4 years experience in commercial kitchen maintenance.

WAREHOUSE MANAGER

Responsible for managing all warehouse inventory items and procedures. Optimizes efficient layouts, workflows and utilization of warehouse space and monitors the safety and security of company s assets. Minimum of 5 years experience in warehouse management, preferably in Hospitality and Bachelor ’s degree in Business Management or another related field.

“One lot was sold for $12m in 2020, representing an anomaly compared to other years. Average resi dential total sales for this period were approximately $81m while average total lot sales were $8.3m. In the non-luxury market, total residential sales increased significantly from 2015 ($38.8m) to 2016 ($70.5m), with slight variances from 2016 through 2019. 2021, like the luxury market, saw a sharp increase in residen tial sales, as total sales were $91.2m.

“It should be noted that this increase can be attributed to the closing of transactions that were started in 2020. Total sales for lots increased margin ally from 2015 through 2019, decreasing in 2020 and 2021. Average resi dential total sales for this period were approximately $65m while average total lot sales were $6.4m.”

However, based on esti mates said to have been provided by Bahamian realtors, the Compliance Commission document report concluded that high-end sales “flowing through real estate brokers typically amount to a few hundred per year, much less than is the case in larger countries”. Luxury sales volumes, too, were rela tively low.

“One private island was sold every year between 2017 and 2020. Four were sold in 2021. From 2017 to 2021, total private island sales were between $650,000 and $35,” it added. “While there were fewer luxury residential properties and lots sold yearly from 2015-2021 than non-luxury residential properties and lots, luxury market average total resi dential and lot sales is significant. Average total sales through brokers amounted to approximately $90m.”

Given the sums involved, previous research by the Central Bank showed that “deposits received from real estate brokers and agents, attorneys and legal firms, and land and real estate developers” posed the greatest potential antifinancial crime. Attorneys and law firms were shown to attract by far the greatest deposit inflows at around $2.5bn, with much of this destined for the financing of real estate deals.

However, the Compliance Commission concluded that the involvement of multiple professionals in real estate deals - attorneys, realtors, developers and bankers, plus numerous government agencies such as the BIA and Immigration Depart ment - each doing their respective Know Your Cus tomer (KYC) due diligence and other scrutinies repre sented sufficient safeguards against financial crime.

“Under the guidance and supervision of financial services regulators, strict controls have been imposed

at all levels of the real estate transaction process,” the regulator said. “There has been no evidence for many years that foreign real estate purchases are a major money laundering conduit.

“There are extensive con trols present throughout the real estate transaction process in The Bahamas..... Based on this study and other information to hand, the Compliance Com mission is satisfied that, although luxury real estate requires constant monitor ing as a potential money laundering risk, The Bahamas currently has sat isfactory controls in place to mitigate money laun dering and other financial crime risks flowing through luxury real estate, and par ticularly cross border real estate.”

Industries such as the legal profession and real estate come under The Bahamas’ anti-money laundering regime because they typically hold monies in escrow on behalf of cli ents. They have to comply with the KYC and recordkeeping requirements of the Financial Transactions Reporting Act (FTRA) and Proceeds of Crime Act, and the Compliance Commis sion’s findings between 2018 and 2021 indicated there is room for improvement.

The report said there had been “a significant increase” in the number of real estate brokers and developers registered with the Compliance Commis sion, whose numbers had risen from just 11 in 2018 to 120 as at September 2021. “As for law firms, the number of registrants with the Compliance Com mission increased from 88 in July 2018 to 167 as of September 2021,” it added, attributing the increase to enforcement and detection by the regulator.

Some 63 Bahamian law firms, and seven realtors, were issued “warning let ters.... for failing to register despite providing services that required registra tion with the Compliance Commission. All firms that received warning letters are registered and compliant”.

Along with bringing these 70 into line, the report also revealed that another 84 law firms and 43 realtors were also con tacted between 2018 and 2021 over their failure to provide a risk assessment to the Compliance Com mission. “For the period 2018-2021, the Compliance Commission detected and sent letters to 84 law firms and 43 real estate brokers and land developers for failing to produce informa tion,” it added.

Just three law firms failed to heed the warning. The Compliance Commis sion report said they were all fined at various dates between November 2019 and July 2020, although their identities were not revealed. The penalties, too, were little more than a ‘slap on the wrist’ with the maximum fine a mere $5,000.

Share your news

The Tribune wants to hear from people who are making news in their neighbourhoods. Perhaps you are raising funds for a good cause, campaigning for improvements in the area or have won an award. If so, call us on 322-1986 and share your story.

PAGE 4, Friday, December 2, 2022 THE TRIBUNE

PAGE B1

FROM

for directing and overseeing the Transportation and Marine Operation departments to ensure overall safety and compliance with established policies and procedures. Professional marine qualifications required and a minimum of 4 years management experience in Marine Operations and Maintenance.

for leading and overseeing various designs and construction projects to ensure all projects are completed in a timely manner and meets company standards and regulatory requirements. Bachelor ’s degree and a minimum of 10 years experience in construction management.

APPLY BY SUBMITTING YOUR RESUME TO JOBFAIR@RWBIMINI.COM BY

PLEASE INDICATE YOUR POSITION OF INTEREST IN THE SUBJECT HEADING OF YOUR EMAIL. FULLY FURNISHED HOUSING, LAUNDRY FACILITIES, WIFI AND MEALS PROVIDED. We are looking for enthusiastic and customer service driven professionals to join

TEAM!

DECEMBER 16, 2022.

our SUPER

‘Season survival’ fears on 50% lobster price plunge

the end of Nassau grouper season, Mr Maillis said fears of an economic reces sion in major consumer markets such as the US, coupled with China’s ‘zero COVID’ policy, could mean relatively low lobster prices persist for some time to come.

“In terms of production, there’s no noticeable differ ence between this year and last, but where it’s drasti cally different this year is in the price of lobster tails being purchased by the processors,” he told Trib une Business. “Last year, processors were paying upwards of $20 a pound in some places for the fish, but now the price has fallen in some parts of the country as low as $10 per pound. In other places, it is $15 a pound.”

Pointing out that market prices were typically around $16-$17 per pound, the Association secretary added: “It’s been a big chal lenge for fishermen this year. Some of them are really suffering because of the price drop, having antic ipated a good year price wise with the elimination of COVID lockdowns and restrictions on the global market. It has not turned out that way.”

Mr Maillis said excess supply was keeping lobster tail prices relatively low, with increased production from rivals such as South Africa and Australia raising market competition as they returned to pre-COVID output. And, having seen how lucrative 2021’s lob ster prices were, he added that fishermen from coun tries in South America and elsewhere had also entered the market and further depressed pricing.

“The supply is very high and suppressed the price,” he confirmed. “It’s been a huge problem for us. A lot of fishermen cannot pay their bills right now because

the price of lobster is so low. They set more condos in the off-season, invested more in their vessels, expanded their operations and then this year hit and it was a huge blow.

“When you compare the fact that the price of everything else is going up - the price of gear, the price of fuel - nothing else is decreasing in price apart from the price of lobster. It’s put a lot of fishermen in a very challenging situation, and I wouldn’t be surprised if some fishermen do not survive this season. Fish ermen that have massive investments, we’re hoping they’ll weather the storm, but that’s assuming the price improves.”

Mr Maillis said China’s ‘zero COVID’ policy and related lockdowns has caused demand for live lob ster exports to plummet, while local seafood export ers were also faced with the problem of selling down inventory they acquired at 2021’s high prices in a depressed market.

“I’m sure there’s losses on all sides right now,” he added, disclosing that many lobster trappers were mulling whether it is more profitable for them to focus on scale fish in the present time. “There’s places in The Bahamas like Long Island

and some of the Family Islands where prices are generally lower for fisher men,” Mr Maillis added.

“When you factor in this overall depression in price, the effect for some com munities is much worse. In New Providence there’s a lot more demand locally, so people can mitigate their losses by supplying local communities and restau rants. It’s a big challenge. It’s a hard time for lobster fishermen right now.

“As fishermen we weather many storms. Hopefully things will improve. All we can do is hold our end and hope

and pray things improve. There’s a lot of fishermen that have been asking for, in times like this because the situation is outside our con trol, if the Government can initiate policies to reduce the price of fuel to allevi ate some of these external burdens. Fuel is our second cost. Labour is number one, but fuel is right up there. Some fishermen want assis tance with fuel.”

Pointing out that the impact from “suppressed prices and greater costs” is felt more on the Family Islands than in Nassau, Mr Maillis said the Nassau grouper season’s closure

NOTICE

NOTICE is hereby given that ALIYAH KHALILAH SAUNDERS of 7A Pioneer’s Way West, Grand Bahama, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 25th day of November, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

yesterday limits the earn ing options for fishermen. “Normally this is a time when fishermen are OK with the closure of grouper season because they still

have lobster, and lobster is the more profitable prod uct, but with the fall in price they are going to feel the closure of grouper season in a major way,” he added.

PUBLIC NOTICE

NOTICE

NOTICE is hereby given that SAMLAY JOACHIM of Forest Drive, Dundas Town, Abaco, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twentyeight days from the 2nd day of December, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

COMMONWEALTH OF THE BAHAMAS IN THE SUPREME COURT

Common Law and Equity Division

IN THE MATTER OF ALL THAT piece parcel or lot of land comprising Three Thousand Four Hundred Seventy-Three (3,473) square feet situate on the Dunmore Harbour in Dunmore Town on the Island of Harbour Island one of the Islands of the Commonwealth of The Bahamas (“Dockside Cottage Property”)

and

IN THE MATTER OF ALL THAT piece parcel or lot of land comprising Three Thousand Three Hundred and Eighty-nine (3,389) square feet situate on the said Dunmore Harbour in Dunmore Town on the said Island of Harbour Island of the said Commonwealth of The Bahamas (“Shoreline Cottage Property”) (“collectively the properties”) AND

IN THE MATTER OF The Quieting Titles Act, 1959 AND

IN THE MATTER OF the Petition of Laura Dodge NOTICE

Laura Dodge, the Petitioner claims to be the owner in fee simple possession of ALL THOSE pieces parcels or portions of land hereinbefore described as the properties and have made application to The Supreme Court of the Commonwealth of the Bahamas under Section 3 of The Quieting Titles Act, 1959 to have the title to the said pieces parcels or portions of land investigated and the nature and extent thereof determined and declared in a Certificate of Title to be granted by the Court in accordance with the provisions of the Act.

Copies of a diagram or plan showing the position boundaries and shape marks and dimensions of the said pieces parcels or portions of land may be inspected during normal working hours at the following places:-

(a) The Registry of the Supreme Court, Ansbacher Building, City of Nassau, New Providence, The Bahamas.

(b) KLA Chambers, No. 48 Village Road, Nassau, The Bahamas, Attorneys for the Petitioner.

NOTICE is hereby given that any person or persons having a right of Dower or an ad verse claim not recognized in the Petition shall within thirty (30) days after the appear ance of the Notice herein file in the Registry of The Supreme Court in the City of Nassau aforesaid and serve on the Petitioner or the undersigned a statement of his claim in the prescribed form, verified by an Affidavit to be filed therewith.

Failure of any such person to file and serve a statement of claim within thirty (30) days herein will operate as a bar to such claim.

CHAMBERS No. 48 Village Road Nassau, The Bahamas.

Attorneys for the Petitioner

THE TRIBUNE Friday, December 2, 2022, PAGE 5

PAGE B1

FROM

2022/CLE/QUI/00084

KLA

The Public is hereby advised that I, JACQUELINE OSSAM AND ANNUEL VIRGILE of P.O Box SS 19756 Wilson Track, Nassau, The Bahamas, Parents of SCHNEYSON DAVIS A minor intend to change my child’s name to ADRIAN VIRGILE If there are any objections to this change of name by Deed Poll, you may write such objections to the Deputy Chief Passport Officer, P.O. Box N-742, Nassau, Bahamas no later than thirty (30) days after the date of publication of this notice.

INTENT TO CHANGE NAME BY DEED POLL

CALL 502-2394 TO ADVERTISE

FTX payout probe urged as US trustee intervenes

as chief executive for FTX Trading and the 133 other entities covered by the Chapter 11 bankruptcy proceedings, to focus on restructuring, selling-off or liquidating the group while leaving any probe to some one else.

He added that FTX’s failure was “exactly the kind of case that requires the appointment of an independent fiduciary to investigate and to report on the debtors’ extraordinary collapse”. Mr Vara’s filing also drew on assertions by Brian Simms KC, the Lennox Paton senior part ner, and one of the three Bahamian joint provisional liquidators, that “serious fraud and mismanagement may have been committed” at FTX Digital Markets.

“Over the course of eight days in November, beginning with reports of significant problems with one debtor’s (Alameda Research) balance sheet, the debtors suffered a virtually unprecedented decline in value - from a market high of $32bn just earlier this year - and a severe liquidity crisis after a

proverbial ‘run on the bank’ amid revelations of multi ple corporate failures and misuse of customer funds facilitated by ‘software to conceal’ it,” he alleged.

“The result is what is likely the fastest big cor porate failure in American history, resulting in these ‘free fall’ bankruptcy cases.

Debtors’ approximately one million worldwide cred itors, outside investors and regulators are demanding answers to what happened and how......

“The appointment of an independent examiner would be in the interests of the debtors’ creditors and other parties in inter est in the debtors’ estates.

An examiner could - and should - investigate the substantial and serious alle gations of fraud, dishonesty, incompetence, misconduct and mismanagement by the debtors, the circumstances surrounding the debtors’ collapse, the apparent conversion of exchange customers’ property, and whether colorable claims and causes of action exist to remedy losses.”

US federal bankruptcy courts typically appoint such “independent

examiners” to probe exactly the kind of claims being made against FTX.

One Bahamian attorney, speaking on condition of anonymity, said the US Justice Department’s (effectively the federal government) intervention meant that the prospects of The Bahamas lead ing the way on the crypto exchange’s restructur ing and winding-up have become even dimmer.

“If you think for one solitary moment that the Bankruptcy Court and John Ray are going to allow the provisional liqui dators to get in their way, think again,” they added.

“There is no possibility of that happening. It’s going to get worse. This [FTX’s collapse] is not going to go away. This is not going to die. I’m afraid we’re on a collision course.”

Meanwhile, John Bain, the HLB Baha mas accountant and partner, who specialises in forensic accounting and receiverships/liquidations, told Tribune Business that if FTX Digital Markets moves to a full winding-up then the liquidators could “claw back” payments

made to investors and cred itors going back up to six months to a year before the collapse actually occurred.

Explaining that this would require proof that FTX Digital Markets’ directors knew the business was in trouble from then, Mr Bain said: “If they did move funds after the freeze order it would be a viola tion of the court’s order and the liquidators would have the power to claw back those funds.

“They possibly have the power to claw back funds from six months to one year if the liquidators have evi dence the directors knew, or ought to have known, of any solvency or going con cern problems or there were any signs the business was in trouble. There’s a provi sion to claw back funds paid out for any reason. The liquidators have massive powers to claw back.”

Another accountant, who also works in the insolvency field, told this newspaper it was “very important” that any fraudulent prefer ence payouts be recovered to protect The Bahamas’ reputation as well as the interests of other creditors and depositors.

inflationary pressures through September........., visitor arrivals remained strong,” the Ministry of Finance said in a statement.

Responding after Sam Bankman-Fried, the embat tled FTX chief, admitted to prioritising and making payouts to Bahamas-based clients around the time the freeze order was imposed, they said: “It’s not a good look. It’s totally outside the law to do that. It’s almost akin to insider trading. People in financial services and the liquidation com munity pretty much know that’s something that should not have been done, and should be investigated thor oughly whether made to Bahamians or not.”

This newspaper previ ously confirmed that some clients of FTX Digital Mar kets were able to retrieve their assets - which the crypto exchange was hold ing for them on trust or in escrow, in a fiduciary capacity - starting around the time that the Supreme Court issued its Order shutting down all local operations.

FTX, in a Twitter tweet sent out at 2.08pm on Thursday, November 10, barely hours before the Securities Commission’s announcement of the asset freeze and provisional liqui dator’s appointment, wrote:

owing to increases in pen sions, promotions and other benefits.

“Per our Bahamian HQ’s (FTX Digital Markets) regulation and regulators, we have begun to facilitate withdrawals of Bahamian funds. As such, you may have seen some withdraw als processed by FTX recently as we complied with the regulators.

“The amounts withdrawn comprise a small fraction of the assets we currently hold on hand, and we are actively working on addi tional routes to enable withdrawals for the rest of our user base. We are also actively investigating what we can and should do across the world.”

This assertion, and the subsequent fall-out, eventu ally prompted the Securities Commission to clarify that it had not given FTX Digi tal Markets permission to release customer funds or prioritise/give preference to Bahamian clients. In a statement issued more than 48 hours after FTX’s origi nal tweet, it warned that such payments would be treated as “voidable prefer ences” and likely subject to being “clawed back” by the provisional liquidator.

and benefits, also rose by $9m or 16.1 percent yearover-year, going from $55.9m to $64.9m, and likely reflecting new indus trial and wage agreements for workers at various agencies.

While October’s outturn took some of the gloss off what the Prime Minister previously hailed as the lowest first quarter fiscal deficit for more than a decade, the Government can point to other positive signs regarding its Budget performance. Both tax and total revenue for the first four months of the 20222023 fiscal year stood at 31.5

percent of full-year Budget forecasts with one-third of the year gone, placing them close to or on trajectory to hit target.

VAT revenue, represent ing September payments that included filings by both monthly and quarterly payers, was 13.3 percent or almost $14m ahead of the prior year at $118m - pro viding further evidence that the economy is continuing its post-COVID reflation with activity and trans actions picking up. And VAT, too, was close if not on target at 31.8 percent of full-year projected collec tions with one-third of the year gone.

All spending categories were either at, or below, one-third of projected fullyear spend. And, despite the October surge, the defi cit for the first four months of 2022-2023 is just 17.1 percent of the full year’s forecast $564m. That still places it on a trajectory to come in below forecasts, even though it was some $19.3m ahead of the $55.6m deficit incurred in October 2021.

“During the month of October, preliminary results indicate a continuation of a rebound in domestic eco nomic conditions from the COVID-19 induced eco nomic downturn. Despite the persistence of elevated

“During the month, rev enue receipts firmed $41.5m (22.4 percent) to $227.2m when compared to the prior year, driven by improved tax revenue performance of $205.3m. The $35.5m (20.9 percent) increase in tax revenue collections are explained by a $21.5m (54.7 percent) improvement in international trade and transactions, a $13.9m (13.3 percent) increase in VAT revenue, and $4.2m (31.1 percent) growth in other taxes on goods and services.

“On the expenditure front, total expenditure rose $60.8m (25.2 percent) to $302.1m. Recurrent spend ing increased $56.7m (24.5 percent) to $288.1m. Per sonal emoluments increased $9m (16 percent) to $64.9m,

“Other key areas of public spending include the acquisition of goods and services of $63.1m, other payments of $27.4m, the acquisition of nonfinancial assets of $13.4m and capital transfers of $0.6m. The net result was a deficit of $74.9m, a $19.3m increase from the deficit of $55.6m realised in the same period of the prior year.”

The

The Ministry of Finance added that the Govern ment’s net debt expanded by $50.8m during October, with borrowings of $476.6m offset to some extent by $425.7m in repayments.

“Proceeds of borrowings during the period totalled $476.6m, sourced in

Bahamian dollars via $229.4m in Bahamas Reg istered Stock, $247m in Central Bank advances, and $0.2m in Treasury Bill placements,” it added.

“Repayments totalled $425.7m, primarily driven by repayments of $206.5m of Bahamas Registered Stock, $167m in Central Bank advances, $33.2m in domestic loans and $19.1m for foreign currency loans. Central government’s net debt increased during the period by $50.8m, a 51.7 percent ($54.3m) decrease from the prior year.”

As for spending, the ministry added: “Capi tal expenditure firmed 41 percent ($4.1m) to $13.9m inclusive of $13.4m to acquire non-financial assets and $0.6m in capital transfers.”

0.1840.12019.03.44% 8.547.00Colina

0.4490.22019.02.58%

0.1020.43429.114.61%

0.8160.54022.22.98%

0.9390.20012.11.76%

0.0000.0000.0000.00%

0.0000.0000.0000.00%

0.0000.0000.0000.00%

0.0000.0000.0006.25%

0.0000.0000.0007.00%

PAGE 6, Friday, December 2, 2022 THE TRIBUNE

PAGE B1

FROM

Gov’ts deficit jumps $75m but below full-year run rate FROM

THURSDAY, 1 DECEMBER 2022 CLOSECHANGE%CHANGEYTDYTD% BISX ALL SHARE INDEX: 2627.380.100.00399.1417.91 BISX LISTED & TRADED SECURITIES 52WK HI52WK LOWSECURITY SYMBOLLAST CLOSECLOSECHANGE VOLUMEEPS$DIV$P/E YIELD 7.005.30 AML Foods Limited AML 6.95 6.950.00 0.2390.17029.12.45% 53.0040.02 APD Limited APD 39.95 39.950.00

2.761.60Benchmark BBL 2.76

2.462.31Bahamas First Holdings Limited BFH 2.46

2.852.25Bank of Bahamas BOB 2.57

6.205.75Bahamas Property Fund BPF

Waste BWL

Brewery CBB

Bank

Holdings CHL

FirstCaribbean Bank CIB

Water BDRs CWCB

11.2810.05Doctor's Hospital DHS

11.679.16Emera Incorporated EMAB 9.55

11.5010.06Famguard FAM 11.22

18.3014.05Fidelity Bank (Bahamas) Limited FBB

4.003.50Focol FCL 3.98

11.509.85Finco FIN 11.38 11.380.00

16.2515.50J. S. Johnson JSJ 15.75

PREFERENCE SHARES 1.001.00Bahamas First Holdings PreferenceBFHP 1.00 1.000.00

1000.001000.00 Cable Bahamas Series 6 CAB6 1000.001000.000.00

1000.001000.00 Cable Bahamas Series 9 CAB9 1000.001000.000.00

1.001.00Colina Holdings Class A CHLA 1.00 1.000.00

10.0010.00Fidelity Bank Bahamas Class A FBBA 10.0010.000.00

1.001.00Focol Class B FCLB 1.00 1.000.00

CORPORATE DEBT - (percentage pricing) 52WK HI52WK LOWSECURITY SYMBOLLAST SALECLOSECHANGEVOLUME 100.00100.00Fidelity Bank (Note 22 Series B+)FBB22 100.00100.000.00 100.00100.00Bahamas First Holdings LimitedBFHB 100.00100.000.00 BAHAMAS GOVERNMENT STOCK - (percentage pricing) 115.92104.79Bahamas Note 6.95 (2029) BAH29 107.31107.310.00 100.00100.00BGS: 2014-12-7Y BG0107 100.00100.000.00 100.00100.00BGS: 2015-1-7Y BG0207 100.00100.000.00 100.00100.00BGS: 2014-12-30Y BG0130 100.00100.000.00 100.00100.00BGS: 2015-1-30Y BG0230 100.00100.000.00 100.00100.00BGS: 2015-6-7Y BG0307 100.00100.000.00 100.00100.00BGS: 2015-6-30Y BG0330 100.00100.000.00 100.00100.00BGS: 2015-10-7Y BG0407 100.00100.000.00 97.4996.72BGRS FX BGR109036 BSBGR109036897.1597.150.00 250 90.3689.01BGRS FX BGR129249 BSBGR129249389.4289.420.00

FX BGR141350 BSBGR141250599.3099.300.00

FX BGR124238 BSBGR124238191.6991.690.00

FX BGR120037 BSBGR120037194.9994.990.00

FL BGRS97033 BSBGRS970336100.19100.190.00

FX BGR129249 BSBGR129249389.6289.620.00

FX BGR131249 BSBGR1312499100.00100.000.00

FX BGR132249 BSBGR132249890.9590.950.00

FX BGR136150 BSBGR1361504100.00100.000.00 MUTUAL FUNDS 52WK HI52WK LOW NAV YTD%12 MTH%

MARKET TERMS BISX ALL SHARE INDEX - 19 Dec 02 = 1,000.00 YIELD - last 12 month dividends divided by closing price - Highest closing price in last 52 weeks Bid $ - Buying price of Colina and Fidelity 52wk-Low - Lowest closing price in last 52 weeks Ask $ - Selling price of Colina and fidelity Previous Close - Previous day's weighted price for daily volume Last Price - Last traded over-the-counter price Today's Close - Current day's weighted price for daily volume Weekly Vol. - Trading volume of the prior week Change - Change in closing price from day to day EPS $ - A company's reported earnings per share for the last 12 mths Daily Vol. - Number of total shares traded today NAV - Net Asset Value DIV $ - Dividends per share paid in the last 12 months N/M - Not Meaningful P/E - Closing price divided by the last 12 month earnings TO TRADE CALL: CFAL 242-502-7010 | ROYALFIDELITY 242-356-7764 | CORALISLE 242-502-7525 | LENO 242-396-3225 | BENCHMARK 242-326-7333 5.55% 6.35% 4.31% 5.55% 15-Apr-2049 17-Nov-2050 17-Apr-2033 15-Apr-2049 5.06% 5.22% 13-Jul-2038 15-Dec-2037 6.25% 30-Sep-2025 31-Mar-2022 FUND CFAL Bond Fund CFAL Balanced Fund CFAL Money Market Fund CFAL Global Bond Fund 6.25% 4.50% 6.25% 4.25% NAV Date 5.65% 5.69% 5.40% 15-Dec-2021 30-Jul-2022 15-Dec-2044 30-Jul-2045 26-Jun-2022 26-Jun-2045 15-Oct-2022 29-Jul-2022 21-Apr-2050 3-Oct-2036 15-Oct-2049 31-Mar-2021 31-Jan-2022

INTEREST Prime + 1.75% MARKET REPORT

MATURITY 19-Oct-2022

6.95% 4.50%

4.50% 6.25% 5.60% 15-Jul-2049 Colonial Bahamas Fund Class D Colonial Bahamas Fund Class E Colonial Bahamas Fund Class F CFAL Global Equity Fund Leno Financial Conservative Fund Leno Financial Aggressive Fund Leno Financial Balanced Fund Leno Financial Global Bond Fund RF Bahamas Opportunities Fund - Secured Balanced Fund RF Bahamas Opportunities Fund - Targeted Equity Fund RF Bahamas Opportunities Fund - Prime Income Fund RF Bahamas International Investment Fund Limited - Equities Sub Fund RF Bahamas International Investment Fund Limited - High Yield Income Fund RF Bahamas International Investment Fund Limited - Alternative Strategies Fund (242)323-2330

www.bisxbahamas.com Notice is hereby given in accordance with Section 138 (4) of the International Business Companies Act, 2000, the Dissolution of TAKEOFF INVESTMENT COMPANY LTD. commenced on December 1st, 2022. The Liquidator is Carlos Augusto Siqueira Junqueira, whose address is R Salto 57, Ap. 104, CEP: 04001-130, Sao Paulo, Brazil. Carlos Augusto Siqueira Junqueira LIQUIDATOR NOTICE INTERNATIONAL BUSINESS COMPANIES ACT, 2000 TAKEOFF INVESTMENT COMPANY LTD. Registration number 204849 B Pursuant to the Provision of Section 138 (8) of the International Business Companies Act 2000 notice is hereby given that the above-named Company has been dissolved and struck off the Register pursuant to a Certificate of Dissolution issued by the Registrar General on the 14th day of November 2022. N O T I C E DOMO VENTURES FOREIGN INVESTMENTS LTD. AMICORP BAHAMAS MANAGEMENT LIMITED LIQUIDATOR Of DOMO VENTURES FOREIGN INVESTMENTS LTD.

PAGE B1

0.9321.26042.93.15%

2.760.00 0.0000.020N/M0.72%

2.460.00 0.1400.08017.63.25%

2.570.00 0.0700.000N/M0.00%

6.20 6.200.00 1.7600.000N/M0.00% 9.808.78Bahamas

9.65 9.650.00 0.3690.26026.22.69% 4.342.82Cable Bahamas CAB 3.95 3.950.0010,000-0.4380.000-9.0 0.00% 10.657.50Commonwealth

10.25 10.250.00 0.1400.00073.20.00% 3.652.54Commonwealth

CBL 3.49 3.490.00

8.53 8.530.00

17.5012.00CIBC

15.99 15.990.00 0.7220.72022.14.50% 3.251.99Consolidated

2.91 2.970.06

10.50 10.500.00 4,5000.4670.06022.50.57%

9.600.05 0.6460.32814.93.42%

11.220.00 0.7280.24015.42.14%

18.10 18.100.00

3.980.00 0.2030.12019.63.02%

15.750.00 0.6310.61025.03.87%

0.0000.0000.0006.50%

99.3098.65BGRS

92.6891.69BGRS

94.9993.54BGRS

100.5299.96BGRS

100.0089.62BGRS

100.0089.00BGRS

100.9890.95BGRS

250 100.0090.73BGRS

2.552.11 2.552.24%4.01% 4.833.30 4.833.42%7.26% 2.241.68 2.241.70%2.82% 207.86164.74 197.44-2.97%-2.35% 212.41116.70 202.39-4.72%6.04% 1.761.71 1.762.49%2.79% 1.941.78 1.935.71%7.96% 1.881.79 1.863.39%3.91% 1.030.93 0.93-8.94%-9.55% 9.376.41 9.37-0.02%10.36% 11.837.62 11.79-0.33%18.23% 7.545.66 7.540.22%3.05% 16.648.65 15.94-3.89%14.76% 12.8410.54 12.47-1.04%-2.57% 10.779.57 10.740.81%4.20% 10.009.88 N/AN/AN/A 10.438.45 10.433.00%25.60% 14.8911.20 14.897.90%48.70%

31-Jan-2022 31-Oct-2022 31-Jan-2022 31-Jan-2022 31-Jan-2022 31-Jan-2022 31-Oct-2022 31-Oct-2022

31-Mar-2021 31-Mar-2021

20-Nov-2029 31-Jul-2022 31-Jul-2022

31-Mar-2022 31-Oct-2022

(242) 323-2320

Cruise port targeting 4.5m arrivals in 2024

break the 1,300 vessel calls mark.

Asked about current and future cruise passenger numbers, Mr Maura said: “So we will handle this year; coming out if January, when we saw occupancies on those ships in the high 40 percents, in terms of occupancy percentage, to hitting around 105 percent I think it was in June or July this year, so we will handle about just over 3.2m pas sengers this year but again, that’s starting while we were still in the pandemic or con sequences of the pandemic.

“But going into next year we’re over four mil lion [passengers], and the year after that we’re closer to 4.5m, but the passen gers from a percentage standpoint grow more sig nificantly than the number of ships because the ships are larger.”

Nassau Cruise Port, Mr Maura said, will exceed the 1,206 vessel calls it received in 2019 prior to COVID with 1,260 next year and some 1,300 anticipated in 2024. He added that the cruise port’s transforma tion, which will enable it to accommodate six vesselsincluding three of the larger

Oasis or Icon class ships - at any one time has expanded daily passenger capacity by 65 percent - from a maxi mum of 20,000 to around 33,000.

Mr Maura said construc tion costs had increased from an initially anticipated $250m to around $300m as a result of building mate rials inflation and price increases stemming from COVID, plus subsequent supply chain backlogs, as well as difficulties in bring ing in expatriate labour amid the pandemic restric tions. Of the 300-strong construction workforce onsite at present, around half are Bahamian.

He added that Prince George Wharf will provide

more employment than the 45 jobs at Nassau Cruise Port, as there will be some 40 persons engaged by its port security contractor along with staff hired by retail, restaurant and mar ketplace tenants.

Getting cruise passengers off the vessel when docked in Nassau, and increas ing their per capita spend with Bahamian businesses, will be key. The Prime Minister yesterday voiced concern over whether the cruise port’s attractions will

impact the desire of pas sengers to venture beyond what it provides.

Telling port executives that the “competition has to be fair”, Mr Davis said: “We need to drive some of those people to the Straw Market and they will not be driven there if you are sell ing straw here too.”

Mr Maura responded: “Tourism and Minister Sears have already started that conversation… but we are not the ones select ing the applicants or the occupants of this space. It’s coming from the Gov ernment. The only thing I would say in the interest of all of us is that everybody that is proposed needs to go through the committee to make sure in fact that (what) they’re selling is Bahamian and not foreign.”

Average vessel occupan cies for ships calling on Nassau Cruise Port have risen from 45 percent in January, when the industry and entire world were hit by COVID’s Omicron vari ant, to 54 percent and 71 percent for February and March 2022, respectively. This steadily improving trend continued with 78 percent and 85 percent for April and May, followed by 102 percent for June and 105 percent for July to-date.

Mr Maura previously explained that ships could achieve greater than 100 percent occupancy as this indicator was pegged to “dual occupancy per cabin”. With a family of three, they could all stay in such a cabin and thereby help take occupancy above that percentage threshold.

Tuesday Wednesday Thursday

a.m. 0.4 3:12 p.m. 2.7 9:36 p.m. 0.0 3:56 a.m. 2.8 10:15 a.m. 0.3 4:09 p.m. 2.5 10:26 p.m. 0.0 4:48 a.m. 2.9 11:12 a.m. 0.2 5:01 p.m. 2.5 11:12 p.m. -0.1 5:36 a.m. 3.0 12:02 p.m. 0.1 5:49 p.m. 2.4 11:56 p.m. -0.1

6:20 a.m. 3.0 12:48 p.m. 0.1 6:33 p.m. 2.3

7:01 a.m. 3.0 12:37 a.m. -0.1 7:15 p.m. 2.3 1:31 p.m. 0.0 7:40 a.m. 3.0 1:16 a.m. -0.1 7:56 p.m. 2.2 2:11 p.m. 0.0

PAGE 8, Friday, December 2, 2022 THE TRIBUNE

PRIME Minister and Minister of Finance, the Hon. Philip Davis received a tour of Nassau Cruise Port, today. Prime Minister Davis was accompanied by the Hon. Alfred Sears, Minister of Works and Utilities; Leon Lundy, Parliamentary Secretary in the Office of the Prime Minister; Bacchus Rolle, Parliamentary Sec retary for Public Works and Utilities; Jerome Fitzgerald, Senior Policy Adviser in the Office of the Prime Minister; David Davis, Permanent Secretary, Office of the Prime Minister; Luther Smith, Permanent Secretary in the Ministry of Works and Utilities; Dr. Kenneth Romer, Deputy Director General, MOTIA and Acting Di rector of Aviation; Mike Maura, Jr., CEO and Director of Nassau Cruise Port Ltd.; and other government officials and executives of Nassau Cruise Port.

PAGE B1 Shown is today’s weather. Temperatures are today’s highs and tonight’s lows. ORLANDO Low: 62° F/17° C High: 80° F/27° C TAMPA Low: 62° F/17° C High: 82° F/28° C WEST PALM BEACH Low: 69° F/21° C High: 82° F/28° C FT. LAUDERDALE Low: 72° F/22° C High: 81° F/27° C KEY WEST Low: 74° F/23° C High: 82° F/28° C Low: 72° F/22° C High: 81° F/27° C ABACO Low: 67° F/19° C High: 79° F/26° C ELEUTHERA Low: 71° F/22° C High: 80° F/27° C RAGGED ISLAND Low: 74° F/23° C High: 83° F/28° C GREAT EXUMA Low: 76° F/24° C High: 82° F/28° C CAT ISLAND Low: 74° F/23° C High: 81° F/27° C SAN SALVADOR Low: 74° F/23° C High: 82° F/28° C CROOKED ISLAND / ACKLINS Low: 73° F/23° C High: 82° F/28° C LONG ISLAND Low: 73° F/23° C High: 83° F/28° C MAYAGUANA Low: 73° F/23° C High: 82° F/28° C GREAT INAGUA Low: 74° F/23° C High: 83° F/28° C ANDROS Low: 73° F/23° C High: 81° F/27° C Low: 66° F/19° C High: 80° F/27° C FREEPORT NASSAU Low: 73° F/23° C High: 82° F/28° C MIAMI THE WEATHER REPORT 5-Day Forecast Variably cloudy, a shower; windy High: 81° AccuWeather RealFeel 84° F The exclusive AccuWeather RealFeel Temperature is an index that combines the effects of temperature, wind, humidity, sunshine intensity, cloudiness, precipitation, pressure and elevation on the human body—everything that affects how warm or cold a person feels. Temperatures reflect the high and the low for the day. Mainly clear with winds subsiding Low: 72° AccuWeather RealFeel 69° F Partly sunny with winds subsiding High: 82° AccuWeather RealFeel Low: 71° 83°-69° F Sunshine with winds subsiding High: 82° AccuWeather RealFeel Low: 69° 82°-66° F Sunshine and patchy clouds High: 83° AccuWeather RealFeel Low: 70° 85°-67° F Mostly sunny and pleasant High: 84° AccuWeather RealFeel 86°-68° F Low: 70° TODAY TONIGHT SATURDAY SUNDAY MONDAY TUESDAY almanac High 81° F/27° C Low 72° F/22° C Normal high 80° F/27° C Normal low 68° F/20° C Last year’s high 83° F/28° C Last year’s low 59° F/15° C As of 1 p.m. yesterday 1.14” Year to date 55.52” Normal year to date 38.59” Statistics are for Nassau through 1 p.m. yesterday Temperature Precipitation sun anD

tiDes For nassau Full Dec. 7 Last Dec. 16 New Dec. 23 First Dec. 29 Sunrise 6:39 a.m. Sunset 5:20 p.m. Moonrise 1:57 p.m. Moonset 1:29 a.m. Today Saturday Sunday Monday High Ht.(ft.) Low Ht.(ft.) 2:56

Photos:Kemuel Stubbs/BIS

FROM

moon

a.m. 2.7 9:11

marine Forecast WINDS WAVES VISIBILITY WATER TEMPS. ABACO Today: NE at 15-25 Knots 6-10 Feet 9 Miles 79° F Saturday: E at 12-25 Knots 6-10 Feet 10 Miles 79° F ANDROS Today: NE at 15-25 Knots 1-3 Feet 8 Miles 80° F Saturday: ENE at 12-25 Knots 1-3 Feet 10 Miles 78° F CAT ISLAND Today: ENE at 15-25 Knots 5-9 Feet 9 Miles 82° F Saturday: ENE at 15-25 Knots 8-12 Feet 10 Miles 82° F CROOKED ISLAND Today: ENE at 15-25 Knots 4-8 Feet 10 Miles 83° F Saturday: ENE at 15-25 Knots 6-10 Feet 7 Miles 82° F ELEUTHERA Today: ENE at 20-30 Knots 6-10 Feet 8 Miles 81° F Saturday: ENE at 15-25 Knots 8-12 Feet 10 Miles 81° F FREEPORT Today: ENE at 12-25 Knots 3-5 Feet 10 Miles 79° F Saturday: E at 10-20 Knots 2-4 Feet 10 Miles 76° F

EXUMA Today: NE at 12-25 Knots 1-2 Feet 9 Miles 81° F Saturday: ENE at 15-25 Knots 1-3 Feet 10 Miles 81° F

INAGUA Today: NE at 15-25 Knots 4-7 Feet 8 Miles 83° F Saturday: ENE at 12-25 Knots 4-7 Feet 8 Miles 83° F

ISLAND Today: ENE at 15-25 Knots 4-7 Feet 10 Miles 83° F Saturday: ENE

Knots 5-9 Feet 9 Miles 83° F

Knots 5-9 Feet 10 Miles 82° F Saturday:

Knots 8-12 Feet 8 Miles 82° F NASSAU

Knots 2-4 Feet 9 Miles 81° F Saturday: ENE

Knots 2-4 Feet 10 Miles 81° F RAGGED ISLAND Today: NE at 15-25 Knots 4-7 Feet 9 Miles 82° F Saturday: ENE

Feet 7 Miles 82° F SAN SALVADOR Today: NE

Knots 2-4 Feet 8 Miles 82° F Saturday: ENE at 15-25 Knots 3-5 Feet 10 Miles 82° F uV inDex toDay The higher the AccuWeather UV Index number, the greater the need for eye and skin protection. Forecasts and graphics provided by AccuWeather, Inc. ©2022 H tracking map Shown is today’s weather. Temperatures are today’s highs and tonight’s lows. N S W E 12-25 knots N S W E 15-25 knots N S W E 15-25 knots N S W E 15-25 knots N S W E 12-25 knots N S W E 15-25 knots N S W E 15-25 knots N S W E 15-25 knots | Go to AccuWeather.com

GREAT

GREAT

LONG

at 20-30

MAYAGUANA Today: ENE at 15-25

ENE at 15-25

Today: ENE at 20-30

at 12-25

at 15-25 Knots 4-8

at 15-25

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net