Hyatt

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

SARKIS Izmirlian received more than three months’ warning from his major resort partner that it would only begin accepting book ings from June 1, 2015, as the resort’s target opening was “not a viable option”.

Hyatt’s alarm-sounding letter is among a batch of previously undisclosed docu ments revealed by China Construction America (CCA) in its bid to prove that Baha Mar’s original developer had known for months - even years - that the revised March 27, 2015, opening dead line would be impossible to achieve.

However, some of the evidence the Chinese stateowned contractor is relying upon appears to torpedo its own case - and strengthen Mr Izmirlian’s $2.25bn fraud and breach of contract claim before the New York state courts - as it reveals CCA was

not “achieving the revised targets” agreed by the par ties in November 2014 as they sought to get the Cable Beach mega resort back on track.

In particular, a February 2, 2015, report by Martyn Bould, chairman of Rider, Levett, Bucknall (Carib bean), project monitor for the China Export-Import Bank, Baha Mar’s then-$2.45bn financier, said there had been “a consistent failure” by CCA to meet its schedule such that there was a “strong likelihood” that substantial construction completion of the resort’s core could be delayed by a full year.

And Baha Mar’s own December 2014 monthly construction progress report, written just one month after Mr Izmirlian agreed to release $54m to the Chi nese contractor to resolve their payment dispute, dis closes that CCA’s completion schedules were already “in direct contradiction” to the November Memorandum of Understanding (MoU) signed by the two parties.

“CCA do not appear to be abiding by their commitment as outlined in the November 17, 2014, MoU... although Baha Mar have honoured their part of the accord in the

payment of funds to CCA in order to resolve the outstand ing commercial disputes to CCA’s satisfaction,” Baha Mar’s report stated.

“In short it is Baha Mar’s opinion that there is little evi dence of the paradigm shift in CCA’s overall performance that is required in order for CCA to up hold their commit ment to achieve ‘substantial completion and to achieve operational start for paying guests in hotels including

SEE PAGE B4

Property insurance costs ‘no doubt’ higher in 2023

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

BAHAMIAN families and businesses were yesterday warned that property insur ance costs will “no doubt be higher” in 2023 even though the country “dodged a bullet” with Hurricane Nicole.

Patrick Ward, Bahamas First’s president and chief

executive, told Tribune Busi ness the only issue is “by how much” premium prices for property-related catas trophe cover will rise as a result of the “hard” reinsur ance market conditions faced by local underwriters and counterparts throughout the global.

Asserting that the increases are largely beyond the con trol of Bahamian insurers,

he explained that the main driver is reinsurance demand outstripping supply at a time when the market was already cutting back its exposure to hurricane-prone nations in the Caribbean and wider region.

Local property and casualty underwriters are currently in the middle of negotiations to acquire sufficient reinsur ance in time to renew these

treaties for January 1, 2023. As a result, Mr Ward told this newspaper it was too early to determine the extent of next year’s insurance premium hikes for Bahamian consum ers as the industry was still working to pin down its own costs.

The prospect of further cost increases is among a

SEE PAGE B8

UN’s tax mandate vote may end ‘gallows walk’

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE BAHAMAS may have “some light on the horizon” in its tax bat tles against the European Union (EU) and Organi sation for Economic Co-Operation and Devel opment (OECD) via a new United Nations (UN) resolution.

The resolution, voted on Wednesday, paves the way to potentially wrest control of international tax policy from the OECD and devel oped countries by creating a pathway for a UN con vention on taxation and a new global tax body.

This is something pre sent Cabinet ministers such as Alfred Sears KC, minister of works and utili ties, have been urging for years while in private prac tice as it would provide a fairer forum for resolving

Salvation Army in Sand Dollar boost

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

THE SALVATION Army yesterday announced that it will be accepting Christmas donations via the Sand Dollar, the Baha mian digital currency, with help from Omni Financial Group.

Roodolph Meo, divi sional commander of the Salvation Army in The Bahamas, told Tribune Business that despite the Central Bank’s commit ment to any donation paid dollar for dollar with the digital currency they still

need more help on the ground.

“We need more vol unteers. We usually have around 35 volunteers, but we only have 25. We need ten more to man the sta tions around the island, including people on Grand Bahama and Eleuthera,” he said. “Donations are coming slowly this year, but we continue to trust the Bahamian people as they have come through for us last year, and we believe they will come through for us again this year with the $250,000. This Sand Dollar

Sir Frankyn: FTX is ‘not our first rodeo’

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

A well-known businessman yesterday urged the Bahamas to “stand united” in the face of FTX’s implosion as he blasted the Opposi tion’s leader for trying to “score cheap political brownie points” over the affair.

Sir Franklyn Wilson, the Arawak Homes and Sunshine Holdings chairman, told Trib une Business that some of Michael Pintard’s comments were “worthy of condemnation” as he warned that a divided political leadership will make it much harder for The Bahamas to withstand international criticism over the crypto exchange’s failure.

Arguing that the Free National Movement (FNM) leader was effectively now shunning a digital assets regulatory regime that was passed, and implemented, by an administra tion in which he was a Cabinet minister, Sir Franklyn said FTX was not The Bahamas’ “first rodeo” when it came to high-profile cross-border corporate failures on an interna tional scale.

Recalling his appointment as liquidator for Commodore Computers, which in the 1980s and early 1990s was arguably that industry’s biggest name, Sir Franklyn said himself and his attorney, the late Paul Adderley, were able to reach an agreement with US creditors over how the company was to be wound-up.

Noting that FTX’s Bahamian courtappointed provisional liquidators face the same situation today, namely competition for control and assets with the group’s USappointed chief executive and Chapter 11 bankruptcy process, he added that this nation must ensure the outside world sees only “competence” from its judges, attorneys and

business@tribunemedia.net FRIDAY, NOVEMBER 25, 2022

SEE PAGE B5

SEE PAGE B3

warned Sarkis: ‘You’ll never meet opening target’

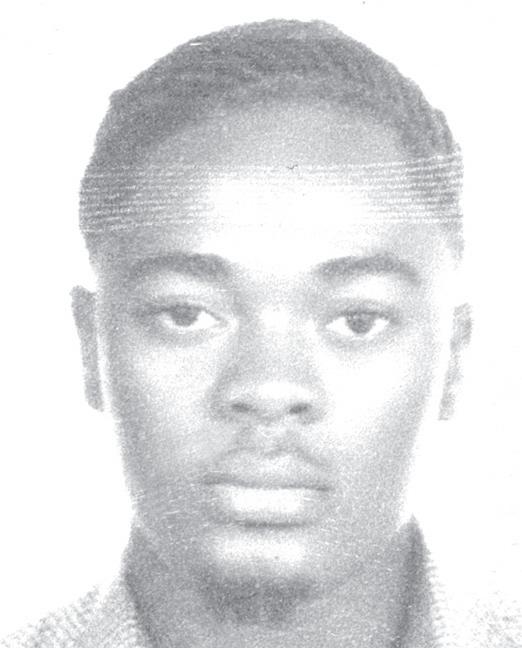

SEE PAGE B6 PAUL MOSS

• Multiple alarms over Baha Mar’s March 27 miss • Yet CCA’s undermines itself with own evidence • ‘Consistent failure’: Contractor off-target by year • Recalls similarities with Commodore Computers • Blasts Opposition on ‘brownie points’: ‘Must unite’ • Pintard: Criticism ‘off-base’; we’re filling a vaccum $5.95 $5.97 $6.07 $5.87

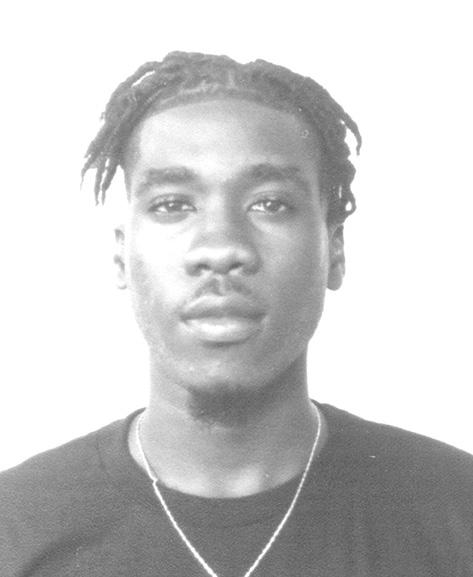

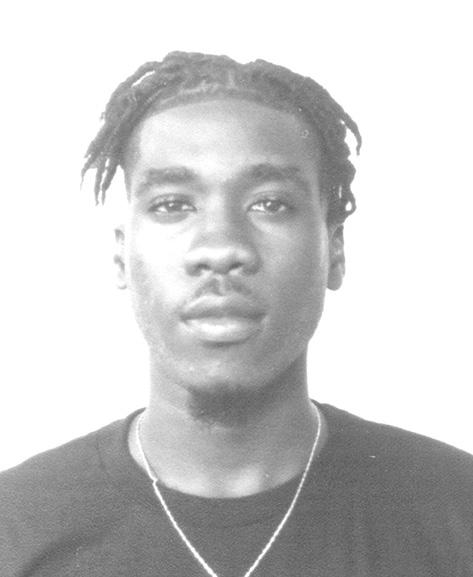

SARKIS IZMIRLIAN

HOLDING YOUR ENTIRE TEAM ACCOUNTABLE

Accountability pro

vides assurance that an individual or company is evaluated on their performance and/or behaviour related to some thing for which they are responsible. A great exam ple of accountability is when you are able to limit distractions, and remain focused on achieving your goals and tasks. Creating work teams that have a higher degree of account ability is crucial to our ongoing success as a nation. This week, we will focus on ways leaders can hold themselves and others accountable to higher standards.

1. Assess where you are…

Be brutally honest with the current state your team is in. Subjectively evalu ate each team member, identifying strengths and weaknesses. Use any assess ment documents available to you.

2. Talk to your team… Set up a meeting to talk through your collec tive sense of the group’s strengths and weaknesses. Identify gaps where you could be stronger. These conversations should be both group and individual.

3. Increase the clarity... Accountable teams clearly understand their business context,

company’s strategy, stake holder expectations and top priorities. Create an envi ronment where it becomes easy to give and receive feedback.

4. Define your team’s obligations Work with your team to come up with a clear sense of their primary obligations. Create clear job descrip tions and communicate standard operating proce dures. Your team should know the ‘what’ and the ‘how’ to do what they are required to do.

5. Do not avoid the tough conversations

Many teams struggle because they avoid deal ing directly with tough

inter-personal issues. Create a safe environment where your colleagues can talk openly about their challenges and commit to tackling them.

6. Help your team get to know one another… Personal relationships are critical to accountable teams. Ensure everyone has a chance to work together. Make space in meetings for a little social time. Be sure to fix strained relationships. Poor relationships are a sure way to have a weak and mediocre team.

7. Celebrate successes… Do not underestimate the power of expressing gratitude and celebrating success. Take the time

Bahamas targets Asia for financial business

THE Bahamas targeted Asia for new financial services business by spon soring a leading regional conference attended by key advisers and interme diaries to high net worth individuals.

Michael Halkitis, min ister of economic affairs, and a team of officials promoted this nation’s financial products and ser vices at the Society for Trust and Estate Practitioners (STEP) Asia conference. They used the event, held in Singapore on November 15-16, to introduce attend ees to alternative private wealth management prod ucts such as SMART funds and ICONs (investment condominiums), as well as the country’s ambitions to become an international arbitration centre.

Mr Halkitis, in his address at the annual STEP Asia gala, highlighted The Baha mas’ strengths as a “safe harbour” for financial ser vices. “Our SMART Funds and ICONs function as flexible, market-driven innovations that are pur posely designed to meet a wide range of region-specific investor needs. Through these, and other innova tions, we have remained competitive as the global financial services industry evolves,” he said.

The Bahamas also had its own display table at the conference, where attendees spoke with financial services representatives and Min istry of Economic Affairs officials to learn more about

the potential competitive advantages from doing busi ness in this nation.

“As we target the Asian financial services market, we are pulling from our play book that led to success in the Latin American market by fine-tuning our approach to market needs,” said Mr Halkitis. “Moving forward, we will continue to engage international prospects while working with local stakeholders to ensure that our financial services prod uct maintains its competitive edge on the global stage.”

Brandace Duncanson, director of financial ser vices, added: “Conference attendees were very excited to learn about our innova tive product selection, and the ways that our legislative framework accommodates client needs. There was also very specific interest in our digital assets frame work. Many investors still see digital assets as the wave of the future. The Bahamas is well-positioned to take advantage of this increasing interest.”

Seeking to maximise the benefits of its time in Singapore, the Ministry of Economic Affairs del egation also met with the Singapore International Arbitration Centre (SIAC) and International Cham ber of Commerce (ICC) Arbitration and ADR (alternative dispute reso lution) representatives as the Government makes progress on its long-term goal of establishing The

to talk about your wins together. Start at least one meeting a month by having everyone share something a team member did that they are grateful for. 8. Set the tone for others…

Others will notice your impact as a leader as you set the tone of accountable leadership for your entire company. As the adage says, leaders must prac tice what they preach and model the behaviours they want to see.

• NB: Ian R Ferguson is a talent management and organisational development consultant, having com pleted graduate studies with regional and international

universities. He has served organsations, both locally and globally, providing relevant solutions to their business growth and devel opment issues. He may be contacted at tcconsultants@ coralwave.com.

Bahamas an international arbitration centre.

ICC Arbitration and ADR was represented by Tejus Chauhan (director, ICC Arbitration & ADR, South Asia); Hazel Tang (counsel, SICAS, Inc); and Irene Mira (deputy director, ICC Arbitration & ADR, South Asia). SIAC was rep resented by Lee Yoke Peng (chief operating officer, SIAC), Andres Larrea Savi novich (deputy counsel, SIAC); and Hannah Wee (manager (legal), strategy and development, SIAC).

Mr Halkitis and his team discussed opportu nities for collaboration, which included training programmes; technical assis tance with changes to laws; the establishment of the arbitration centre, and joint hosting of locally-based conferences and events to further promote The Baha mas as a preferred arbitral seat in the Americas.

Theominique Nottage, arbitration consultant, led

VACANCY

the talks for The Bahamas. “Establishing The Baha mas as an international arbitration and alternative dispute resolution hub has the potential to generate sig nificant revenues and bring in new opportunities for Bahamian professionals, as well as complement every industry in The Bahamas,” she said.

“It will also give corpo rate entities and investors considering The Bahamas as a base for their operations confidence in knowing that the nation is committed to addressing any disputes that arise in the most efficient and cost effective way with due observation of the rule of law, while maintaining privacy and confidentiality.

“The sooner we can bring our arbitration goals into fruition, the sooner we can all benefit from having an alternative means to address disputes beyond the more lengthy, costlier process of formal litigation proceedings.”

HUMAN RESOURCES MANAGER

Higgs & Johnson, a full-service corporate and commercial law firm serving clients around the globe, is seeking a progressive Human Resources Manager who will lead and direct the routine functions of the Human Resources (HR) department while developing effective relationships with attorneys, managers, and staff, resulting in optimal client experiences.

The responsibilities include:-

Partnering with the leadership team to understand and execute the organization’s human resource and talent strategy particularly as it relates to current and future talent needs, recruiting, retention, and succession planning.

Providing support and guidance to management, and staff when complex, specialized, and sensitive questions and issues arise; may be required to administer and execute routine tasks in delicate circumstances such as investigating allegations of wrongdoing, and terminations.

Analyzing trends in compensation and benefits; researches and proposes competitive base and incentive pay programs to ensure the organization attracts and retains top talent.

Creating learning and development programs and initiatives that provide internal development opportunities for employees.

Maintaining compliance with local employment laws and regulations and recommended best practices; reviews policies and practices to maintain compliance; prepare and maintain office policy and procedure manuals.

Maintaining knowledge of trends, best practices, regulatory changes, and new technologies in human resources, talent management, and employment law.

Ensuring a smooth flow of communication among all employees.

Facilitating employee engagement strategies and employee events (including the reward and recognition program

Candidates must possess:

Bachelor’s degree in Human Resources, Business Administration, or related field

Minimum five (5) years of human resources management experience preferred Strong human capital management knowledge and experience in HR frameworks

Superior interpersonal, coaching, communication, negotiation, and conflict resolution skills

Demonstrated commitment to health, safety and environmental policies and procedures

Thorough knowledge of employment-related laws and regulations

Proficient with Microsoft Office Suite and HR related software

Qualified candidates interested in this exciting and rewarding opportunity, should forward their resume to dbarnes@higgsjohnson.com by Monday, December 5, 2022. Only qualified, short-listed applicants will be scheduled to interview

PAGE 2, Friday, November 25, 2022 THE TRIBUNE

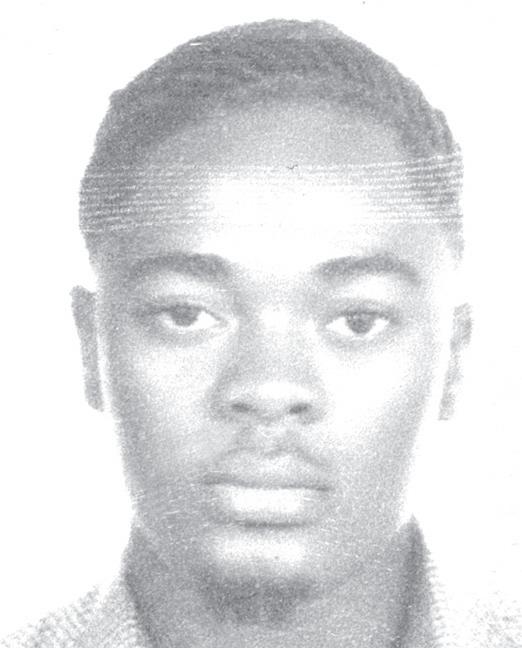

FERGUSON IAN

MICHAEL Halkitis addresses attendees at the Society for Trust and Estate Practitioners (STEP) Asia conference.

Minister meets with latest crypto exchange investor

THE BAHAMAS has moved swiftly to put FTX’s implosion behind it through a Cabinet minis ter meeting with the latest crypto currency exchange to become licensed to con duct business in this nation.

This nation sent a strong signal that, far from aban doning its digital assets ambitions as a result of FTX’s failure, it is dou bling down on them after Michael Halkitis, minister of economic affairs, and officials from his minis try made a courtesy call on the Singapore offices of crypto exchange, OKX. The meeting occurred while the minister and his team were in Singapore for the Society of Trust and Estate Practitioners’ (STEP) Asia financial services conference.

OKX, the world’s second largest cryptocurrency exchange, recently reg istered as a digital assets business under the Digi tal Assets and Registered

Exchanges (DARE) Act so that it can oper ate from within The Bahamas. The company has announced plans to use The Bahamas as a regional hub to meet the needs of a growing population of crypto currency users and investors within the Carib bean and Latin America.

Mr Halkitis said: “As we move forward with our agenda of economic growth and diversification, we are fully embracing the digi tal economy opportunities coming through the vari ous Fintech, digital assets and Web3-based busi nesses who are interested in The Bahamas due to our robust financial services and digital assets legislative framework.”

The minister was accom panied by Brandace Duncanson, director of financial services, as well as other Ministry of Economic Affairs officials. The OKX team hosting the Baha mian delegation included

Ben Bowden, global head of OKX Compliance; Kairi Azmi, Singapore general manager of OKX’s sister company, OKCoin; and Kenneth Lo, deputy gen eral counsel for OKCoin’s licensing and regulatory department.

The visit included a tour of OKX’s Singapore office, as well as a dinner meeting in which OKX discussed its plans for The Bahamas and the rest of the Caribbean and Latin America.

“While we were in Sin gapore for the STEP Asia conference, it was very important for us to take the time to visit OKX as a major investor in The Bahamas. OKX has dem onstrated a commitment to The Bahamas with its recent appointment of a Bahamian chief executive, Dr Jillian Bethel, and the hiring of Bahamians in key positions,” Mr Halkitis said.

“These are the kind of high-level employment opportunities we believe

UN’S TAX MANDATE VOTE MAY END ‘GALLOWS WALK’

FROM PAGE B1

tax-related disputes and potentially blunt the ‘black listing’ and ‘naming and shaming’ tactics employed by the likes of the EU to force The Bahamas to change its laws and under mine financial services competitiveness.

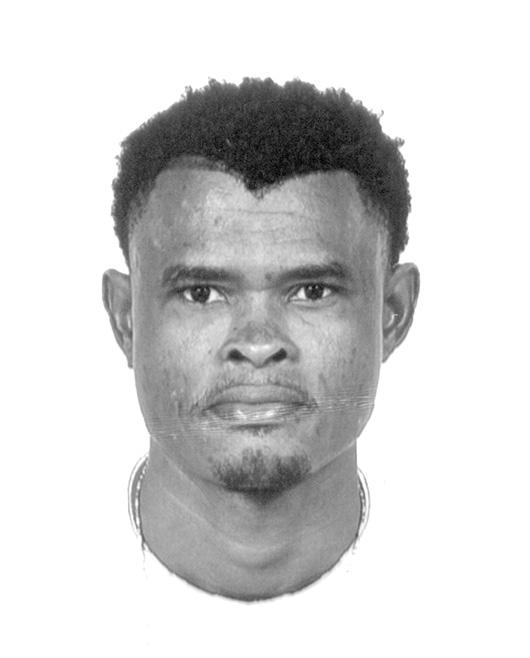

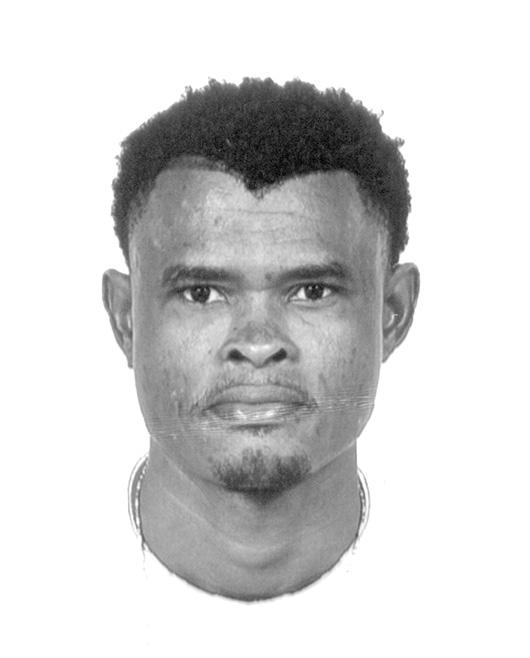

Paul Moss, president of Dominion Management Services, one of the few Bahamian-owned busi nesses in the international financial services sector, told Tribune Business that while it was a promising development he remained sceptical that any good will come from it until the UN and smaller nations “show they’re not going to be bullied” by developed countries.

“It quite possibly could be the answer so long as the UN is not hijacked by some old OECD players,” he said. “If this could be on the basis of one coun try, one vote, that would be great but it remains to be seen. Obviously the EU and OECD are biased in their approach to this whole issue, and everything they do and recommend is against international finan cial centres (IFCs).

“This will certainly be a welcome sight because we spread it across all the countries who potentially have an equal say in what happens. What happens today is that the OECD and EU force us to change our laws, and we all go march ing down to the gallows to change them.

“But if the UN oper ates as it should be, and countries have their own impact, perhaps we’d get a fairer approach as opposed to being forced to change our laws. I’m not confident in that. There has to be some demonstration by the United Nations (UN) to show they’re not going to be bullied themselves. I’m not confident till I see that.”

International reports said the vote on a UN tax man date was heavily opposed by the US and major devel oped countries, which are reluctant to lose control of a global tax policy debate they have dominated for decades to the detriment of The Bahamas and other IFCs.

While there is merit to Mr Moss’ concerns, he added: “It does represent progress; there’s no ques tion. When you look back 22 years to when we were first blacklisted, there’s now some light on the horizon. But we have procrastinated and missed the mark by not forming our own alliance against the OECD and EU.

“This may be an opportu nity for IFCs to get together and form a group so that when this happens they will be united, and there will be more IFCs than the

G-7, so we will have a sub stantial say in what goes on. Whenever we have been blacklisted we have ended up changing our laws, even if it goes against our consti tution. It doesn’t matter to us; we change it.

“We’re too late in stand ing up, but I’m not sure it’s too late in allowing the UN to have a stab at it. Every one wanted to fight it their own way, deal with it their own way, and at the end of the day we played right into their [OECD and EU] hands. It was divide and conquer.”

The UN resolution was presented by Afri can nations, with those countries wanting an inter national agreement on measures such as a floor for corporate tax rates, so countries cannot undercut one another, and forcing multinationals to report

NOTICE

In the Estate of THOMAS WILLIAM JOHNSON late of the Settlement of James Cistern in the Island of Eleuthera one of the Islands of the Commonwealth of The Bahamas, deceased.

NOTICE IS HEREBY GIVEN that all persons having any claim against the above named Estate are required on or before the 30th day of December, 2022 to send their names and addresses and particulars of their debts or claims to the undersigned and if so required by notice in writing from the undersigned to come in and prove such debts and claims or in default thereof they will be excluded from the benefits of any distributions made before such debts are proved AND all persons indebted to the said Estate are asked to pay their respective debts to the undersigned.

HAILSHAMS LEGAL ASSOCIATES

Counsel and Attorneys at Law

RENALDO HOUSE

10 Queen’s Highway Palmetto Point, Eleuthera, Bahamas P. O. Box SS 5062, Nassau, Bahamas Attorneys for the Administratrix of the above Estate Tel: 242-332-0470

email: hailshams@1stcounsel.com

will become the norm given The Bahamas’ high levels of talent and ideal regulatory environment for Fintech. We are very keen to maintain relationships with investors like OKX who are setting the pace with the inclusion of Baha mians at every level of the organisation.”

OKX is a lead sponsor of the inaugural Bahamas Fintech Festival, D3 Baha mas, which is taking place at the Atlantis resort from January 23-26, 2023. D3 Bahamas will be co-hosted by the Securities Commis sion of The Bahamas. The event will include a venture capital forum, a milliondollar pitch competition, and dialogue with global regulators.

The D3 Bahamas festi val is expected to generate more interest from Fin tech investors and further solidify The Bahamas’ posi tion as an emerging Fintech (financial technology) hub.

how much tax they pay in each country.

António Guterres, the UN secretary general, now has to write a report on the problems in the global tax system. “History was made today. We commend UN members on their bold action today to move rulemaking on global tax into the daylight of democ racy at the UN,” said Alex Cobham, chief executive at the Tax Justice Network, in a statement.

“The inter-governmen tal discussions next year will be crucial in setting the path for this new era of international tax. It is vital that countries in each region of the world follow the African leadership that underpinned this success, and engage together to gen erate common positions on an ambitious agenda.”

PUBLIC NOTICE

TO CHANGE NAME BY DEED POLL

The Public is hereby advised that I, JENNAWADE CHRISTINA

PRATT (NEE PAUL) Yamacraw Beach Estates, P.O. Box 17341 , Nassau, The Bahamas, Mother and legal guardian of KADEN AMIR PAUL A minor intend to change my child’s name to KADEN AMIR PRATT If there are any objections to this change of name by Deed Poll, you may write such objections to the Deputy Chief Passport Officer, P.O. Box N-742, Nassau, Bahamas no later than thirty (30) days after the date of publication of this notice.

LEGAL NOTICE

NOTICE Volabant Limited (the “Company”)

NOTICE IS HEREBY GIVEN as follows:

(a) Volabant Limited is in dissolution under the provisions of the International Business Companies Act, 2000.

(b) The dissolution of the said Fund commenced on the 10th day of November, 2022 when its Articles of Dissolution were submitted to and registered by the Registrar General.

(c) The Liquidator of the said company is Shareece Scott of Deltec Bank & Trust Ltd, Deltec House, Lyford Cay, P. O. Box N-3229, Nassau, Bahamas.

Shareece Scott Liquidator

LEGAL NOTICE

NOTICE AT4 Limited (the “Company”)

NOTICE IS HEREBY GIVEN as follows:

(a) AT4 Limited is in dissolution under the provisions of the International Business Companies Act, 2000.

(b) The dissolution of the said Fund commenced on the 10th day of November, 2022 when its Articles of Dissolution were submitted to and registered by the Registrar General.

(c) The Liquidator of the said company is Shareece E. Scott of Deltec Bank & Trust Ltd., Deltec House, Lyford Cay, P. O. Box N-3229, Nassau, Bahamas.

Shareece Scott Liquidator

THE TRIBUNE Friday, November 25, 2022, PAGE 3

INTENT

Hyatt warned Sarkis: ‘You’ll never meet opening target’

amenities by March27, 2015, as memorialised in the November 17, 2014, MoU.”

The Rider, Levett, Buck nall report, in particular, given that it was written for a financier that shares common ownership with CCA - the Beijing govern ment - potentially serves to strengthen Mr Izmirlian’s case against Baha Mar’s contractor, and its failure to fulfill its primary obligation of completing the project on-budget and on-time.

However, the papers again raise questions as to why all bar seemingly Mr Izmirlian and his manage ment team failed to realise the March 27, 2015, open ing would not be hit given CCA’s reported failings to hit key construction mile stones essential to obtaining a temporary occupancy cer tificate (TCO) that would allow Baha Mar to accept paying guests.

Hyatt’s letter, dated December 17, 2014, and written by Myles McGourty, its senior vice-president for Latin America and the Caribbean, made clear the resort brand’s belief that March 27, 2015, was not “an appropriate opening date” for the Grand Hyatt property.

“Based on everything we observe and note at the site, we believe that date is best estimated to be June 1, 2015,” he wrote. “This

opening depends, of course, on the delivery and installa tion of all FF&E, (furniture, fixtures and equipment), all areas duly “handed over”and punched in a timely manner to allow for on-site training, receipt of a Certificate of Occupancy, all systems fully installed and the related appropriate training completed, as well as other completion items.

“Of course,Hyatt will continue to make every effort to work with Baha Mar to get the hotel open as soon as possible, but we cannot see the pro posed date of March 27 as a viable option at this point. We also noted with concern your suggestion that the property will begin taking reservations in Janu ary 2015 for an opening of March 27,2015. Hyatt’s res ervations system will not be taking reservations for bookings prior to June I, 2015 at this juncture.”

Calling for due caution, Mr McGourty added: “To fully achieve everyone’s expectations for the hotel, it is crucially important that the Grand Hyatt at Baha Mar open successfully. We believe this success will be dependent on ensuring that the hotel and other key components of the project are, in fact, ready to accept guests and that the hotel is able to deliver exceptional guest experiences from the outset.”

It has never been clear why senior Baha Mar

management clung on so long to the belief they could hit the March 27, 2015, opening. An April 13, 2015, e-mail in which Tom Dunlap, Baha Mar’s then-president, describes CCA executive Tiger Wu as “commercial, cagey, and stubborn”, revealed he had “a low comfort level as to the ability to achieve a full occupancy by end of May” with March now firmly in the rear view mirror.

Noting that Mr Wu “won’t put on paper that they have two more months of work in his view”, Mr Dunlap shared with Mr Izmirlian a proposed letter he planned to share with staff, third-party opera tors and providers and the resort brands regarding the missed March 27, 2015, opening.

“It has been a whirlwind since we missed our muchawaited soft opening this past March 27. Like all the hurdles over Baha Mar’s life, it is filled with lessons to be learned, and learn we have,” Mr Dunlap wrote.

“First, I want to say that the buck stops with me. I assume full responsibility for not recognising soon enough that we were not far enough along to be ready to open on March 27.

“It is my job to gather facts and make informed decisions. There were many smart individuals advising that we were not going to make it. I believe that I fell into the trap of seeing what

would be, and not what was actually there. For this I apologise to all of you and to our guests whose plans were displaced.

“Baha Mar has been a dream for nearly a decade, of which half of that time has been spent building that dream. From foundations in the ground to concrete towers to a golf course to the colorful facades we see today. Inside and out, that dream evolved daily. Suffice to say, I was mesmerised by its beauty and the thought of it finally coming to frui tion (or near fruition as was the case).”

However, Mr Bould’s report to the China ExportImport Bank and its agent, Citicorp, goes directly to why the March 27, 2015, opening was missed in its first line. “CCA do not appear to be achieving the revised targets that were agreed during meetings in Beijing on 17 and 18 November, 2014. This puts the agreed revised date of substantial completion of March 27, 2015, in jeop ardy,” he wrote.

“Very limited informa tion has been provided to Rider, Levett, Bucknall to allow it to understand and assess the basis of this new agreement, particularly what is excluded from the targeted date. From the limited information pro vided and from its direct observations, the project monitor considers progress remains slower than the

current schedule/s and thus, without acceleration, com pletion is likely to be later than the dates in the cur rent schedule/s.

“In the absence of further information, Rider, Levett, Bucknall remains of the view that the earliest real istic date for a partial soft opening to the public would be June 1, 2015, with the earliest full opening of all areas by August 2015,” Mr Bould continued.

“The introduction of additional direct Baha Mar contractors/resources to undertake final punch list rectification may improve upon this assessment, but we are still of the view that, based on CCA’s con sistent failure to meet a current schedule, there is a strong likelihood of an even greater delay to the contract date, in the order of one year, to substan tial completion of all core works.”

Baha Mar’s own report, meanwhile, contrasted the strong performance of Bahamian workers as compared to their Chinese counterparts. “Regard less of the veracity of the CCA claimed labor count (CCA currently claiming just under 2,600 Chinese workers onsite comple mented by over 1,200 local and other expat workers), the fact remains that what Chinese labour is allo cated to the project remain extremely unproductive due to the fact that they are

inadequately supervised, badly organised and poorly motivated (evidenced by large swathes of the work force actually sitting around during normal working hours and the extended break times),whereas the local labour managed by CCA sub-contractors is well organised, motivated and efficient.”

And, bizarrely, in seeking to prove its assertion that Mr Izmirlian and his team knew March 27, 2015, could not be met, CCA is rely ing on a letter Baha Mar’s original developer wrote to Yuan Xingyong, the China Export-Import Bank’s vice-president, in which he stated he had been “clear for years that CCA’s under performance would lead to exactly the delays and qual ity issues the project is now experiencing”.

The Tribune wants to hear from people who are making news in their neighbourhoods. Perhaps you are raising funds for a good cause, campaigning for improvements in the area or have won an award. If so, call us on 322-1986 and share your story.

PAGE 4, Friday, November 25, 2022 THE TRIBUNE

FROM PAGE ONE

• Bachelors degree in accounting or finance • CPA Designation • Previous work as a senior accountant or a senior auditor • In depth knowledge of IFRS Accounting Standards is a must (specifically IFRS 9, IFRS 15 and IFRS 16) • Experience preparing financial statements • Experience overseeing year end audit engagements • Advanced knowledge of Microsoft Excel • Good Communication skills – written and verbal Please submit all resumes to humanresources@airportsbahamas.com on or before November 8th 2022. JOB OPPORTUNITY SENIOR ACCOUNTANT (6 MONTH CONTRACT) QUALIFICATIONS AND REQUIREMENTS

Share your news

regulators in how the crypto exchange’s fate is dealt with moving forward.

This, Sir Franklyn said, will be critical to protecting The Bahamas’ integrity and good name which is now “at risk”. Acknowledging that “there’s no doubt this has hurt us”, he added that the country must also “defend our laws” which have come under external attack after the Securities Commission obtained a Supreme Court Order to protect digital assets under the Bahamian FTX subsidiary’s control by having them transferred to “wallet” under its control.

Mr Pintard, though, last night hit back “in the strong est terms” at Sir Franklyn’s comments by describing them as “off base”. He added that both himself and the Opposition have been “measured” in their public comments on FTX, and said they had sought to fill the “vacuum” created by the Government’s relative silence on the affair through “aggressively” defending The Bahamas and its regula tory regime.

Sir Franklyn, meanwhile, said FTX’s collapse did not necessarily mean there were weaknesses or deficiencies in The Bahamas’ regulatory regime. “Sometimes busi nesses fail. The fact it’s a big business, so what?” he asserted. “They fail some times. Sometimes the chief executives, the leaders of companies, may act improp erly, sometimes criminally. That doesn’t mean the system is flawed or anything like that,” he told Tribune Business

“We can also tell the world this is not our first rodeo. We have done this before. I was the court-appointed liquidator for Commodore Computers in the early 1990s, which at one time was one of the world’s biggest names. The fact of the matter is that The Bahamas survived Com modore Computers. It was a New York Stock Exchange listed company, truly a global

company when that matter came up as being settled in the courts of The Bahamas.

“We had dozens of attor neys, maybe hundreds, in the courts. The creditors committee of the US subsidi ary came to The Bahamas, objected to The Bahamas being the centre for the liq uidation. It’s the same issue here,” Sir Franklyn argued of FTX. “We got through that. Myself, Paul Adderley and the creditors committee, we were able to negotiate an agreement where the liq uidation proceeded in both jurisdictions. The same prob lem here.

“When people come here they must see competent judges. They must see com petence within the judiciary. That’s what they must see. They must see our regulators holding the line. They must see that in our attorneys in The Bahamas they are equal to those on Wall Street or Bay Street, Toronto. That’s what they must see. They must see competence.

“I’m not getting into the merits or demerits of the case, but they must see we act in accordance with our law. Let us defend our law. Let us defend our regulators. Let us defend our country. Let’s stop seeking cheap brownie points. The leader of the Opposition needs to stand up, stand up and defend this country. We must stand united.”

Acknowledging that The Bahamas should be con cerned about reputational fall-out over the FTX implo sion, Sir Franklyn said the country’s cause would be helped if there was “no difference” between the positions taken by the Gov ernment and Opposition over the saga.

“Those that happen to find themselves in Opposition to the Government of the day should be far more judicious, thoughtful and just conscious of where we are,” he blasted, accusing Mr Pintard of giving “aid and comfort” to inter national media assaults on The Bahamas’ integrity and regulatory regime through

various comments made in interviews and at press conferences.

The Arawak Homes chair man, in particular, singled out the press conference given by Mr Pintard last Friday outside the Prime Minister’s Office, accusing him of engaging in “theat rics” and “gimmicks” in a bid to obtain a “headline story” for himself and FNM party chairman, Dr Duane Sands.

Sir Franklyn also sug gested Mr Pintard and the FNM are trying to distance themselves from a regula tory regime headlined by the Digital Assets and Reg istered Exchanges (DARE) Act, which passed into law under the former Minnis administration in 2020, and which was lauded by former minister of state, Kwasi Thompson, prior to FTX’s stunning fall from grace.

Mr Pintard, though, rejected Sir Franklyn’s criti cism of both himself and his party. He suggested that the Opposition had effectively been forced to do the Gov ernment’s job for it given the Prime Minister’s rela tive silence on the matter, which has threatened to allow “enemies of The Baha mas and competitors of The Bahamas to fill the vacuum with their own narrative and risk further damaging the reputation of The Bahamas”.

“We were quite measured in the comments that we made. Clearly he could not have sat and listened to the presentation in its entirety,” the Opposition leader said of Sir Franklyn. “He could have been more offended by some of the questions than if he had listened to the pres entation in its entirety.... Sir Franklyn Wilson is off-base in his concerns. I sat that in the strongest terms.

“We were fighting for the reputation of our jurisdic tion while the Government was quiet, holding their silence. What we said was the Prime Minister and the Government, through their silence for an extended period of time, given that the world’s attention is trained at our jurisdiction, has left a vacuum. We are duty-bound to protect our jurisdiction, and we have not done any thing to seek to damage that. We have been aggressive in doing that when the Govern ment was quiet.”

THE TRIBUNE Friday, November 25, 2022, PAGE 5

SIR FRANKYN: FTX IS ‘NOT OUR FIRST RODEO’ FROM PAGE B1

SALVATION ARMY IN SAND DOLLAR BOOST

FROM

is just an additional way of giving.”

The Central Bank donated an initial $2,500 in Sand Dollars to the Sal vation Army yesterday to mark the partnership’s start. Jermain Campbell, manager of its currency department, added: “The Central Bank is certainly delighted to be here to par ticipate and to share with the Salvation Army, such a wonderful organisation who

really looks after the poor and the underprivileged, and one of those civic soci eties that we should really patronise.”

Encouraging Bahamians to donate to the Salvation Army, Mr Campbell said: “We will begin by donating an initial $2,500, and we will certainly match all of those donations submitted via dig ital payments as well.”

Deirdre Andrews, busi ness development manager at Omni Financial Group, said the company is

“grateful” to be partnering with the Central Bank to assist the Salvation Army for its annual Christmas kettle bell drive.

She said: “With Omni Financial, we’ve been selected as the Sand Dollar wallet provider to the Sal vation Army and gave them their Sand Dollar app.

“I think this is a wonder ful tool that a lot of persons as well as companies should utilise during this year. One, because it’s a quick and seamless application, and two, also because there are lots of times when a lot of us are just running around shopping for the holidays, forgetting our wallets or don’t have the physical cash in our wallet at the time uti lising Sand Dollars.

Twitter, others slip on removing hate speech, EU review says

By KELVIN CHAN AP Business Writer

TWITTER took longer to review hateful content and removed less of it in 2022 compared with the previous year, according to European Union data released Thursday.

But the figures could fore shadow trouble for Twitter in complying with the EU’s tough new online rules after owner Elon Musk fired many of the platform’s 7,500 full-time workers and an untold number of con tractors responsible for content moderation and other crucial tasks.

NOTICE is hereby given that ALIYAH KHALILAH SAUNDERS of 7A Pioneer’s Way West, Grand Bahama, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 25th day of November, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

“It’s a seamless, quick, safe process where you can transmit money from your wallet to another person in a quick and safe fashion during this holiday because a lot of us don’t want to be walking around with cash.”

The EU figures were published as part of an annual evaluation of online platforms’ compliance with the 27-nation bloc’s code of conduct on disinformation.

Twitter wasn’t alone — most other tech companies signed up to the voluntary code also scored worse.

NOTICE is hereby given that GEDELIN ZAPORTE of #45 Podoleo Street, New Providence, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 18th day of November, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE

Registration number 205569 B

Notice is hereby given in accordance with Section 138 (4) of the International Business Companies Act, 2000, the Dissolution of STUDENT HOUSING INVESTMENTS LTD. commenced on November 24, 2022. The Liquidator is G5 ADMINISTRADORA DE RECURSOS LTDA., whose address is Av. Brigadeiro Faria Lima, 3311, conj. 102, Itaim Bibi, CEP: 04538-133, Sao Paulo - Brazil.

G5 ADMINISTRADORA DE RECURSOS LTDA LIQUIDATOR

NOTICE is hereby given that INGRID ETIENNE of College Gardens, New Providence, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 18th day of November, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

The EU report, car ried out over six weeks in the spring, found Twitter assessed just over half of the notifications it received about illegal hate speech within 24 hours, down from 82% in 2021.

In comparison, the amount of flagged material Facebook reviewed within 24 hours fell to 64%, Insta gram slipped to 56.9% and YouTube dipped to 83.3%.

TikTok came in at 92%, the only company to improve. The amount of hate speech Twitter removed after it was flagged up slipped to 45.4% from 49.8% the year before. Tik Tok’s removal rate fell by a quarter to 60%, while Face book and Instagram only saw minor declines. Only YouTube’s takedown rate increased, surging to 90%.

“It’s worrying to see a downward trend in review ing notifications related to illegal hate speech by social media platforms,” Euro pean Commission Vice President Vera Jourova tweeted. “Online hate speech is a scourge of a digital age and platforms need to live up to their commitments.”

NOTICE

NOTICE

any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 18th day of November, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE

NOTICE is hereby given that ODILES POLINICE of Carmichael Road, New Providence, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 18th day of November, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE is hereby given

N-8181,

registration/

not

send a written and signed statement of

PAGE 6, Friday, November 25, 2022 THE TRIBUNE

PAGE B1

NOTICE is hereby given that JEAN GUILLAUME JEAN-PIERRE of #3 East Beach Drive, Freeport, Grand Bahama, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 18th day of November, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICEis hereby given that DAMETRAID ROLLE of McKinney Drive off Fire Trail Road, New Providence, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows

NOTICE

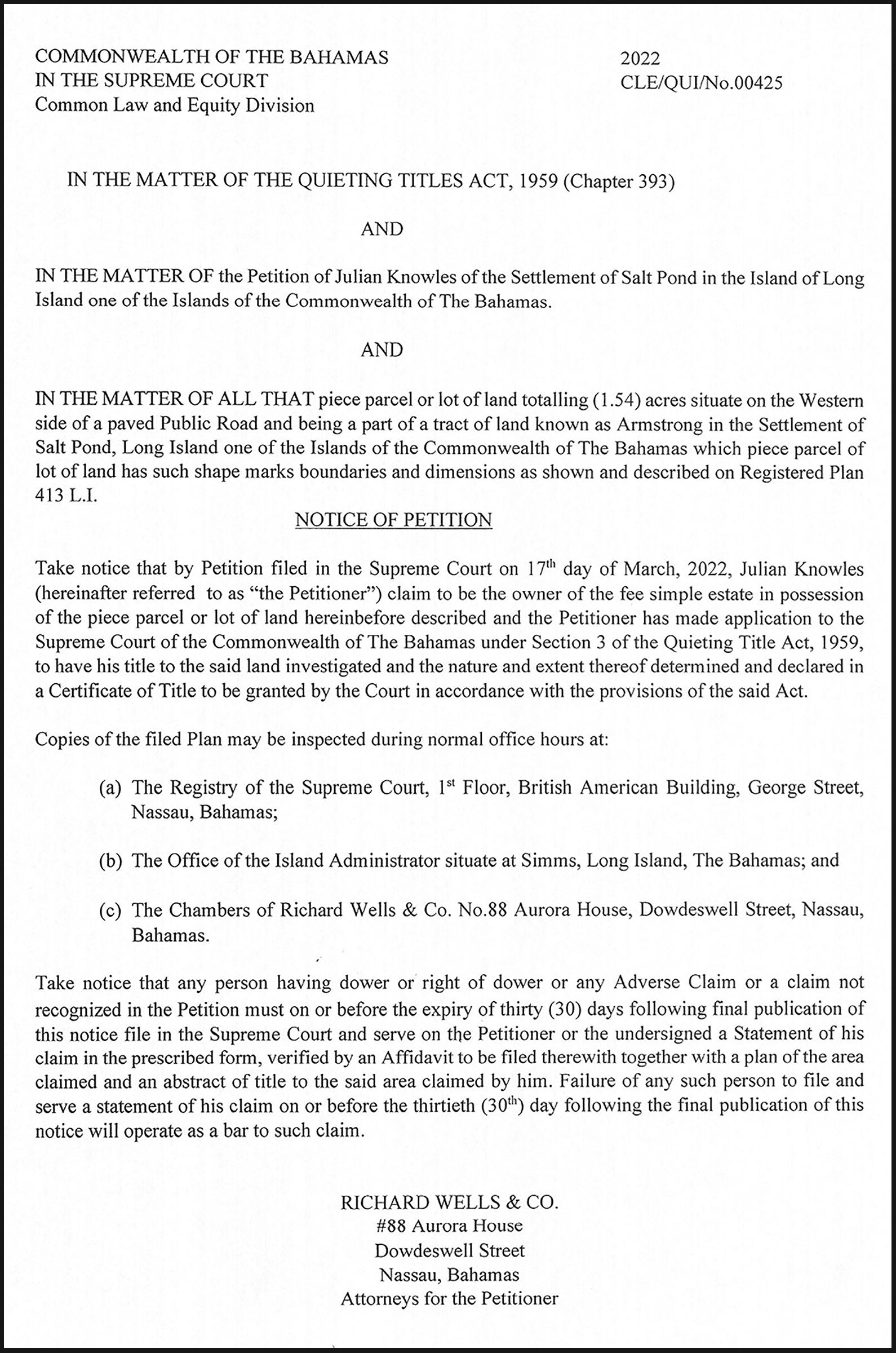

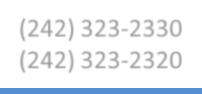

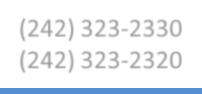

NOTICE THURSDAY, 24 NOVEMBER 2022 CLOSECHANGE%CHANGEYTDYTD% BISX ALL SHARE INDEX: 2624.49-0.27-0.01396.5217.78 BISX LISTED & TRADED SECURITIES 52WK HI52WK LOWSECURITY SYMBOLLAST CLOSECLOSECHANGE VOLUMEEPS$DIV$P/E YIELD 7.005.30 AML Foods Limited AML 6.95 6.950.00 7500.2390.17029.12.45% 53.0040.02 APD Limited APD 39.95 39.950.00 500.9321.26042.93.15% 2.761.60Benchmark BBL 2.76 2.760.00

2.462.26Bahamas First Holdings Limited BFH 2.46 2.460.00

2.852.25Bank of Bahamas BOB 2.57 2.53 (0.04)

6.205.75Bahamas Property Fund BPF 6.20

10.058.78Bahamas Waste BWL 8.78

4.342.82Cable Bahamas CAB 3.95

10.657.50Commonwealth Brewery CBB

3.652.46Commonwealth Bank CBL 3.50

8.527.00Colina Holdings CHL 8.52

17.5010.25CIBC FirstCaribbean Bank CIB 16.00

3.251.99Consolidated Water BDRs CWCB 2.88 2.880.00

11.2810.05Doctor's Hospital DHS 10.46 10.460.00

11.679.16Emera Incorporated EMAB 9.46 9.470.01

11.5010.00Famguard FAM 10.85 10.850.00

18.3014.05Fidelity Bank (Bahamas) Limited FBB 18.10 18.100.00

4.003.50Focol FCL 3.98 3.980.00

11.509.85Finco FIN 11.38 11.380.00

16.2515.50J. S. Johnson JSJ 15.55 15.550.00 0.6310.61024.63.92% PREFERENCE SHARES 1.001.00Bahamas First Holdings PreferenceBFHP 1.00 1.000.00 0.0000.0000.0000.00% 1000.001000.00 Cable Bahamas Series 6 CAB6 1000.001000.000.00 0.0000.0000.0000.00% 1000.001000.00 Cable Bahamas Series 9 CAB9 1000.001000.000.00 0.0000.0000.0000.00% 1.001.00Colina Holdings Class A CHLA 1.00 1.000.00 0.0000.0000.0006.25% 10.0010.00Fidelity Bank Bahamas Class A FBBA 10.0010.000.00 0.0000.0000.0007.00% 1.001.00Focol Class B FCLB 1.00 1.000.00 0.0000.0000.0006.50% CORPORATE DEBT - (percentage pricing) 52WK HI52WK LOWSECURITY SYMBOLLAST SALECLOSECHANGEVOLUME 100.00100.00Fidelity Bank (Note 22 Series B+)FBB22 100.00100.000.00 100.00100.00Bahamas First Holdings LimitedBFHB 100.00100.000.00 BAHAMAS GOVERNMENT STOCK - (percentage pricing) 115.92104.79Bahamas Note 6.95 (2029) BAH29 107.31107.310.00 100.00100.00BGS: 2014-12-7Y BG0107 100.00100.000.00 100.00100.00BGS: 2015-1-7Y BG0207 100.00100.000.00 100.00100.00BGS: 2014-12-30Y BG0130 100.00100.000.00 100.00100.00BGS: 2015-1-30Y BG0230 100.00100.000.00 100.00100.00BGS: 2015-6-7Y BG0307 100.00100.000.00 100.00100.00BGS: 2015-6-30Y BG0330 100.00100.000.00 100.00100.00BGS: 2015-10-7Y BG0407 100.00100.000.00 100.0089.02BGRS FX BGR127149 BSBGR127149789.7289.720.00 90.3689.01BGRS FX BGR129249 BSBGR129249389.4289.420.00 99.3098.65BGRS FX BGR141350 BSBGR141250599.3099.300.00 92.6891.69BGRS FX BGR124238 BSBGR124238191.6991.690.00 94.9993.54BGRS FX BGR120037 BSBGR120037194.9994.990.00 100.5299.96BGRS FL BGRS97033 BSBGRS970336100.19100.190.00 100.0089.62BGRS FX BGR129249 BSBGR129249389.6289.620.00 100.0089.00BGRS FX BGR131249 BSBGR1312499100.00100.000.00 100.9890.24BGRS FX BGR132249 BSBGR1322498100.00100.000.00 100.0090.73BGRS FX BGR136150 BSBGR1361504100.00100.000.00 MUTUAL FUNDS 52WK HI52WK LOW NAV YTD%12 MTH% 2.552.11 2.552.24%4.01% 4.833.30 4.833.42%7.26% 2.241.68 2.241.70%2.82% 207.86164.74 197.44-2.97%-2.35% 212.41116.70 202.39-4.72%6.04% 1.761.71 1.762.49%2.79% 1.941.78 1.935.71%7.96% 1.881.79 1.863.39%3.91% 1.030.93 0.93-8.94%-9.55% 9.376.41 9.37-0.02%10.36% 11.837.62 11.79-0.33%18.23% 7.545.66 7.540.22%3.05% 16.648.65 15.94-3.89%14.76%

MARKET TERMS BISX ALL SHARE INDEX - 19 Dec 02 = 1,000.00 YIELD - last 12 month dividends divided by closing price - Highest closing price in last 52 weeks Bid $ - Buying price of Colina and Fidelity 52wk-Low - Lowest closing price in last 52 weeks Ask $ - Selling price of Colina and fidelity Previous Close - Previous day's weighted price for daily volume Last Price - Last traded over-the-counter price Today's Close - Current day's weighted price for daily volume Weekly Vol. - Trading volume of the prior week Change - Change in closing price from day to day EPS $ - A company's reported earnings per share for the last 12 mths Daily Vol. - Number of total shares traded today NAV - Net Asset Value DIV $ - Dividends per share paid in the last 12 months N/M - Not Meaningful P/E - Closing price divided by the last 12 month earnings TO TRADE CALL: CFAL 242-502-7010 | ROYALFIDELITY 242-356-7764 | CORALISLE 242-502-7525 | LENO 242-396-3225 | BENCHMARK 242-326-7333 5.55% 6.35% 4.31% 5.55% 15-Apr-2049 17-Nov-2050 17-Apr-2033 15-Apr-2049 5.06% 5.22% 13-Jul-2038 15-Dec-2037 6.25% 30-Sep-2025 31-Mar-2022 FUND CFAL Bond Fund CFAL Balanced Fund CFAL Money Market Fund CFAL Global Bond Fund 6.25% 4.50% 6.25% 4.25% NAV Date 5.65% 5.69% 5.50% 15-Dec-2021 30-Jul-2022 15-Dec-2044 30-Jul-2045 26-Jun-2022 26-Jun-2045 15-Oct-2022 29-Jul-2022 21-Apr-2050 15-Jan-2049 15-Oct-2049 31-Mar-2021 31-Jan-2022 31-Jan-2022 31-Oct-2022 31-Jan-2022 31-Jan-2022 31-Jan-2022 31-Jan-2022 31-Oct-2022 31-Oct-2022 INTEREST Prime + 1.75% MARKET REPORT 31-Mar-2021 31-Mar-2021 MATURITY 19-Oct-2022 20-Nov-2029 31-Jul-2022 31-Jul-2022 6.95% 4.50% 31-Mar-2022 31-Oct-2022 4.50% 6.25% 5.60% 15-Jul-2049 Colonial Bahamas Fund Class D Colonial Bahamas Fund Class E Colonial Bahamas Fund Class F CFAL Global Equity Fund Leno Financial Conservative Fund Leno Financial Aggressive Fund Leno Financial Balanced Fund Leno Financial Global Bond Fund RF Bahamas Opportunities Fund - Secured Balanced Fund RF Bahamas Opportunities Fund - Targeted Equity Fund RF Bahamas Opportunities Fund - Prime Income Fund RF Bahamas International Investment Fund Limited - Equities Sub Fund RF Bahamas International Investment Fund Limited - High Yield Income Fund RF Bahamas International Investment Fund Limited - Alternative Strategies Fund (242)323-2330 (242) 323-2320 www.bisxbahamas.com NOTICE is hereby given that HERNCY SANEUS of P. O. Box N-356, Shrimp Road off Carmichael Road, New Providence, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not

NOTICE

that GINO JOSEPH of P. O. Box

Meeting Street, New Providence, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why

naturalization should

be granted, should

the facts within twenty-eight days from the 18th day of November, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

0.0000.020N/M0.72%

0.1400.08017.63.25%

2,9250.0700.000N/M0.00%

6.200.00 1.7600.000N/M0.00%

8.780.00 0.3690.26023.82.96%

3.950.00 -0.4380.000-9.0 0.00%

10.25 10.250.00 0.1400.00073.20.00%

3.500.00 0.1840.12019.03.43%

8.520.00 0.4490.22019.02.58%

16.000.00 0.7220.72022.24.50%

0.1020.43428.215.07%

0.4670.06022.40.57%

0.6460.32814.73.46%

0.7280.24014.92.21%

0.8160.54022.22.98%

0.2030.12019.63.02%

0.9390.20012.11.76%

12.8410.54 12.47-1.04%-2.57% 10.779.57 10.740.81%4.20% 10.009.88 N/AN/AN/A 10.438.45 10.433.00%25.60% 14.8911.20 14.897.90%48.70%

be granted, should send a written and signed statement of the facts within twenty-eight days from the 18th day of November, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE INTERNATIONAL BUSINESS COMPANIES ACT, 2000 STUDENT HOUSING INVESTMENTS LTD.

NOTICE

Property insurance costs ‘no doubt’ higher in

multitude of unresolved issues that the Bahamian insurance industry has been trying to obtain clarity on for months. These include the Government’s plan to change the industry’s taxa tion structure, as well as the VAT treatment of pri vate medical claims paid by health insurers.

The 2022-2023 Budget sought to switch the entire industry - property and casualty insurers, as well as their life and health coun terparts - from the 3 percent tax paid by consumers on insurance premiums to a 2.25 percent annual Busi ness Licence fee based on “turnover”.

The sector has ever since been seeking clarification on the precise definition of “turnover”, and if it means “gross written premium” or “net premium earned”, as this is critical to deter mining how much tax will be paid. With no answers forthcoming on that, as well as the altered VAT treat ment of private medical claims, Mr Ward said the Bahamas Insurance Associ ation (BIA) is now awaiting a response from the Prime Minister to its latest letter. And, compounding the domestic uncertainties,

Bahamian insurers are also waiting to here whether pending changes in German law will force that coun try’s reinsurers to withhold a portion of their claims payouts as a result of the country’s latest ‘blacklist ing’ by the European Union (EU).

While Nicole largely spar ing The Bahamas has eased some of the reinsurance pressures, Mr Ward said the outcome will have no bearing on the fall-out from $60bn worth of insured losses and damage caused by Hurricane Ian in the US.

This, he indicated, will only make reinsurers even more reluctant to underwrite hurricane-related losses in The Bahamas and wider Caribbean.

“There is no doubt prices will be higher,” Mr Ward told Tribune Business of the insurance consequences for Bahamian homeowners and businesses. “By how much is yet to be determined.

The cost of insurance for catastrophe exposures will definitely be higher. I don’t think other classes will be impacted, but property coverage for catastrophe exposure definitely will be higher next year.”

Asked how much higher, he replied: “It’s too early to be definitive yet. We have

to pin down our own costs for next year. How much we charge next year will be driven by how much our own costs go up.” Baha mian property and casualty underwriters must acquire huge amounts of reinsur ance annually because their relatively thin capital bases mean they cannot cover the multi-billion dollar assets at risk in this nation.

As a result, reinsurers and their prices largely dic tate local premium pricing in The Bahamas. Mr Ward said this was not unique to this nation, adding that developed countries are facing the same situa tion “because of the acute nature of the capacity crunch.

“On a global basis, the reinsurance market in its totality is moving further away from the catastrophe exposure they took in prior years and are recalibrat ing their risk appetite,” he added. “The net effect is that the demand for rein surance capacity is higher than the supply of that capacity.

“I think that if there had been a major loss in The Bahamas market it would have made the cycle of rein surance contract renewals for 2023 more complicated than it already is. There’s

no question we are in a very hard market, and the availability of capacity is an issue at any price.

“The absence of a major loss so late in the season took a bit of the pressure that would have been there off the table, but even though we dodged a bullet with Nicole it’s still going to be a difficult renewal season.”

Hurricane Dorian’s dev astating $3.4bn in total losses and damage exposed the need for Bahamian families and businesses to protect what is often their greatest investment, namely homes and property, but the necessary coverage is becoming increasingly expensive and - in some cases - unaffordable for a growing percentage of the market.

Mr Ward, meanwhile, said resolving domestic taxation issues is also pre occupying the Bahamian insurance industry. On the switch from the premium tax, he said: “All I can say is that I know the BIA has written to the Prime Min ister and we are awaiting a response. If that response does not come in a specified timeframe, I suspect you will be hearing from the industry on a more formal basis.

“It is becoming more critical from a time basis. Nothing has been resolved, and we are pressing as hard as we can on our side to clarify the position.”

Both Mr Ward and Anton Saunders, RoyalStar Assur ance’s managing director, described Nicole as a “very minimal event” in terms of payouts for the Baha mian insurance based on the number of claims and level of damages reported to-date.

“We can all thank our lucky stars that with all the things going on in the insur ance market right now this is not something we have to deal with,” the Bahamas First chief said. “Let’s put it this way. If something had happened it would have made it worse because we have a cycle of negatives that we have to deal with. It [Nicole] doesn’t add to the stress; let’s put it that way.”

German reinsurers may have to withhold up to 15 percent of claims payouts to Bahamian underwriters with effect from January 1, 2023, under a new law in that country designed to deter companies from doing business with so-called ‘tax havens’. The Bahamas, in Germany’s eyes, falls into that category as a result of being blacklisted by the EU

for being non-cooperative in tax matters. Mr Saunders said he understood The Baha mas’ compliance with the EU’s substance report ing requirements will be reviewed in February next year, which would be too late for the insurance industry. He added that the sector, as well as their German reinsurance coun terparts, are analysing the implications and will know more come December 15.

“The Bahamas govern ment is not going to have any bite at the pie until February because that’s when the next review hap pens,” the RoyalStar chief said. “We will see what ourselves and our German partners can come up with to resolve the matter. We are where we are on the blacklist. How we got there, whose fault it is, is not my concern. We are there and need to get off it.”

| Go to AccuWeather.com

N S

N S

E W 6 12 knots

N S

E W 6 12 knots

N S

N S

E W 6 12 knots

E W 7 14 knots N S

tracking map Shown is today’s weather. Temperatures are today’s highs and tonight’s lows.

8:42 p.m. 2.6 2:55 p.m. ‑0.2 9:14 a.m. 3.6 2:46 a.m. 0.5 9:36 p.m. 2.6 3:47 p.m. 0.2 10:08 a.m. 3.5 3:40 a.m. ‑0.3 10:34 p.m. 2.5 4:43 p.m. ‑0.1 11:05 a.m. 3.3 4:38 a.m. ‑0.1 11:36 p.m. 2.5 5:41 p.m. 0.0

H

12:06 p.m. 3.1 5:42 a.m. 0.1 ‑‑‑‑‑ ‑‑‑‑‑ 6:41 p.m. 0.1 12:43 a.m. 2.5 6:50 a.m. 0.3 1:08 p.m. 2.9 7:42 p.m. 0.1 1:51 a.m. 2.6 8:02 a.m. 0.4 2:11 p.m. 2.8 8:41 p.m. 0.1 uV inDex toDay The higher the AccuWeather UV Index number, the greater the need for eye and skin protection. Forecasts and graphics provided by AccuWeather, Inc. ©2022 L L

E W 7 14 knots N S

N S

W E 10 20 knots

E W 7 14 knots

W E 10 20 knots

PAGE 8, Friday, November 25, 2022 THE TRIBUNE

FROM PAGE B1 TO ADVERTISE TODAY IN THE TRIBUNE CALL @ 502-2394 Shown is today’s weather. Temperatures are today’s highs and tonight’s lows. ORLANDO Low: 67° F/19° C High: 85° F/29° C TAMPA Low: 69° F/21° C High: 82° F/28° C WEST PALM BEACH Low: 71° F/22° C High: 86° F/30° C FT. LAUDERDALE Low: 72° F/22° C High: 85° F/29° C KEY WEST Low: 76° F/24° C High: 85° F/29° C Low: 73° F/23° C High: 86° F/31° C ABACO Low: 73° F/23° C High: 83° F/28° C ELEUTHERA Low: 73° F/23° C High: 84° F/29° C RAGGED ISLAND Low: 76° F/24° C High: 85° F/29° C GREAT EXUMA Low: 76° F/24° C High: 85° F/29° C CAT ISLAND Low: 73° F/23° C High: 86° F/30° C SAN SALVADOR Low: 73° F/23° C High: 86° F/30° C CROOKED ISLAND / ACKLINS Low: 75° F/24° C High: 85° F/29° C LONG ISLAND Low: 75° F/24° C High: 86° F/30° C MAYAGUANA Low: 75° F/24° C High: 85° F/29° C GREAT INAGUA Low: 76° F/24° C High: 86° F/30° C ANDROS Low: 74° F/23° C High: 85° F/29° C Low: 71° F/22° C High: 85° F/29° C FREEPORT NASSAU Low: 73° F/23° C High: 87° F/31° C MIAMI THE WEATHER REPORT 5-Day Forecast Warm and humid with clouds and sun High: 86° AccuWeather RealFeel 97° F The exclusive AccuWeather RealFeel Temperature is an index that combines the effects of temperature, wind, humidity, sunshine intensity, cloudiness, precipitation, pressure and elevation on the human body—everything that affects how warm or cold a person feels. Temperatures reflect the high and the low for the day. Clear and humid Low: 73° AccuWeather RealFeel 77° F Clouds and sun with a shower; warm High: 87° AccuWeather RealFeel Low: 73° 94°-77° F Partly sunny, a stray t‑storm; warm High: 86° AccuWeather RealFeel Low: 73° 94°-76° F Humid with a thun derstorm in spots High: 86° AccuWeather RealFeel Low: 74° 97°-77° F Periods of sun; breezy, humid High: 84° AccuWeather RealFeel 90°-70° F Low: 73° TODAY TONIGHT SATURDAY SUNDAY MONDAY TUESDAY almanac High 84° F/29° C Low 73° F/23° C Normal high 80° F/27° C Normal low 69° F/21° C Last year’s high 79° F/26° C Last year’s low 67° F/19° C As of 1 p.m. yesterday 0.00” Year to date 54.20” Normal year to date 37.99” Statistics are for Nassau through 1 p.m. yesterday Temperature Precipitation sun anD moon tiDes For nassau First Nov. 30 Full Dec. 7 Last Dec. 16 New Dec. 23 Sunrise 6:34

Sunset 5:20 p.m. Moonrise 8:25 a.m. Moonset 7:00 p.m.

Saturday Sunday

High Ht.(ft.) Low Ht.(ft.)

‑0.5

2023

a.m.

Today

Monday

8:23 a.m. 3.6 1:56 a.m.

Tuesday Wednesday Thursday marine Forecast WINDS WAVES VISIBILITY WATER TEMPS. ABACO Today: S at 6 12 Knots 4 7 Feet 8 Miles 81° F Saturday: NE at 7 14 Knots 3 5 Feet 8 Miles 81° F ANDROS Today: SE at 6 12 Knots 0 1 Feet 10 Miles 82° F Saturday: ENE at 7 14 Knots 0 1 Feet 10 Miles 82° F CAT ISLAND Today: ESE at 7 14 Knots 3 5 Feet 10 Miles 83° F Saturday: NE at 6 12 Knots 3 5 Feet 8 Miles 83° F CROOKED ISLAND Today: E at 8 16 Knots 2 4 Feet 10 Miles 83° F Saturday: ENE at 7 14 Knots 2 4 Feet 10 Miles 83° F ELEUTHERA Today: SE at 6 12 Knots 3 5 Feet 10 Miles 82° F Saturday: NE at 6 12 Knots 3 5 Feet 8 Miles 83° F FREEPORT Today: SSW at 6 12 Knots 1 3 Feet 8 Miles 80° F Saturday: NE at 7 14 Knots 1 3 Feet 8 Miles 81° F GREAT EXUMA Today: SE at 7 14 Knots 1 2 Feet 8 Miles 83° F Saturday: ENE at 7 14 Knots 0 1 Feet 8 Miles 83° F GREAT INAGUA Today: E at 10 20 Knots 2 4 Feet 10 Miles 83° F Saturday: ENE at 8 16 Knots 1 3 Feet 10 Miles 83° F LONG ISLAND Today: ESE at 8 16 Knots 2 4 Feet 10 Miles 83° F Saturday: E at 7 14 Knots 1 3 Feet 8 Miles 84° F MAYAGUANA Today: ESE at 8 16 Knots 3 6 Feet 9 Miles 83° F Saturday: ENE at 6 12 Knots 3 6 Feet 10 Miles 83° F NASSAU Today: SE at 6 12 Knots 1 2 Feet 10 Miles 80° F Saturday: NE at 6 12 Knots 0 1 Feet 8 Miles 80° F RAGGED ISLAND Today: E at 10 20 Knots 2 4 Feet 10 Miles 83° F Saturday: E at 8 16 Knots 1 3 Feet 8 Miles 83° F SAN SALVADOR Today: SE at 7 14 Knots 1 2 Feet 10 Miles 83° F Saturday: NE at 6 12 Knots 1 2 Feet 10 Miles 83° F