By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

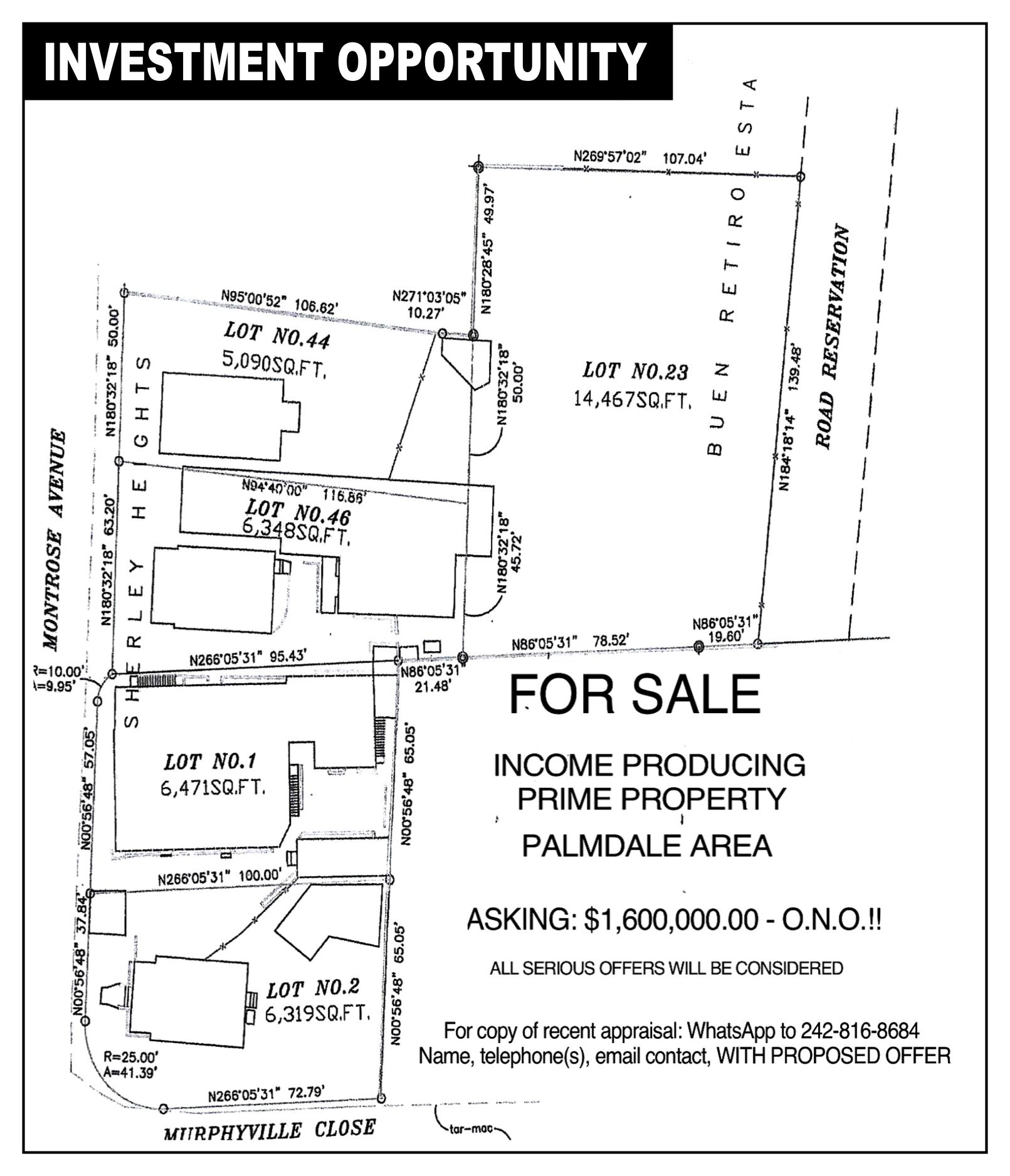

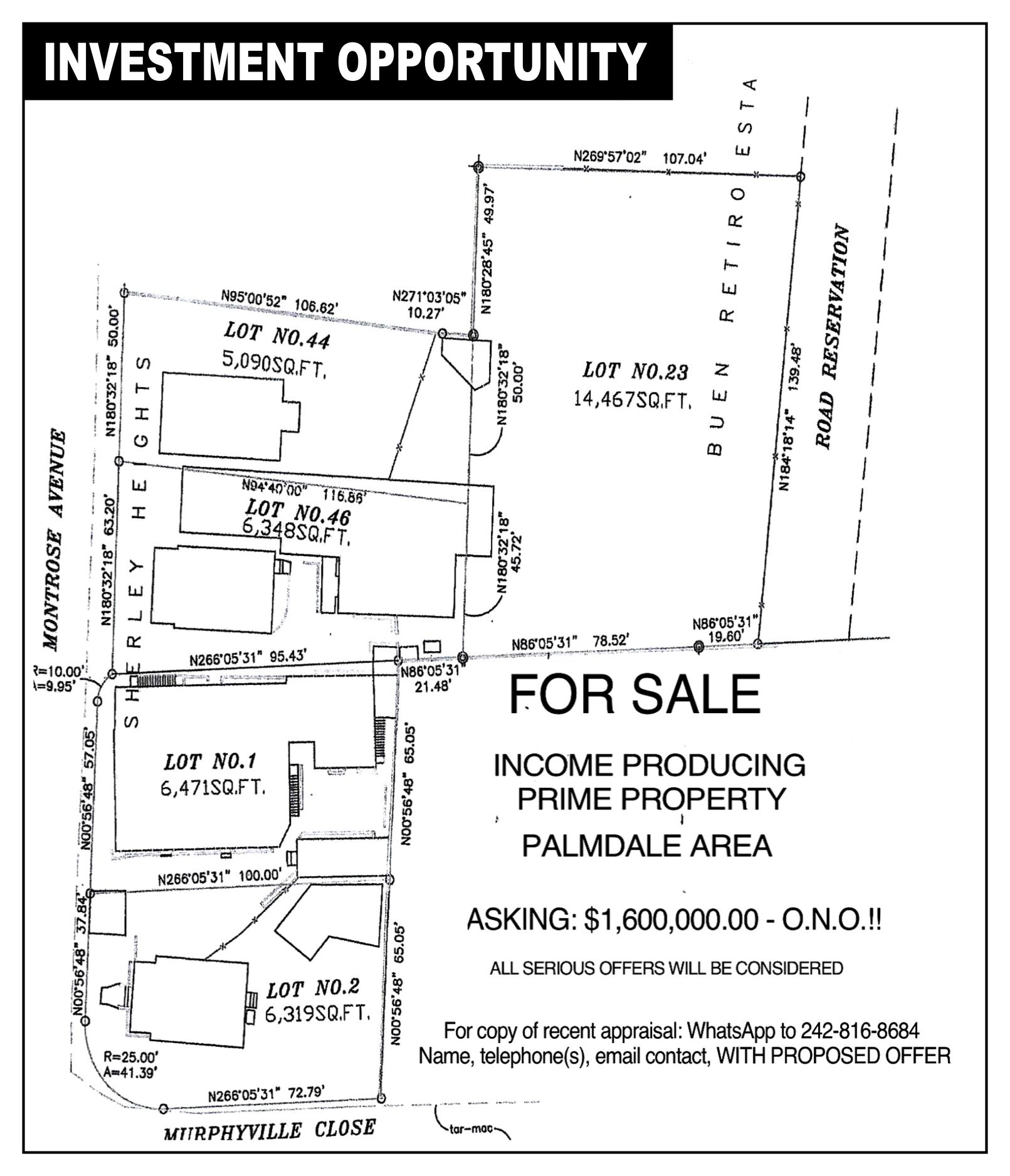

A BISX-listed fund is reviving ambitions to “more than double” total assets to over $100m by “look ing more aggressively” for property acquisitions following its recent pref erence share refinancing.

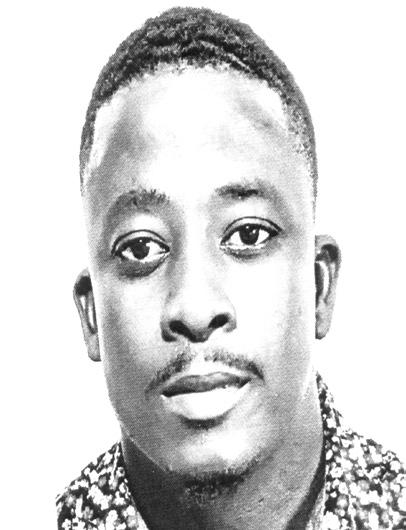

Michael Anderson, RF Bank & Trust’s president, told Tribune Busi ness the $8m recapitalisation has given the Bahamas Property Fund the “balance sheet strength” required to resume its growth strategy follow ing a long period of inactivity.

The investment bank chief, who acts as the Fund’s administrator, said the elimination of long-term bank debt and growing rental income through improved occupancies at its flagship Bahamas Financial Centre property have provided the combina tion of borrowing space and cash flow to fund potential purchases if the right properties become available.

Besides the Bahamas Financial Centre, the Fund’s portfolio has remained three-strong for largely a

decade with Paradise Island’s One Marina Drive and Providence House on East Hill Street comprising the other two. Total assets at end-Sep tember 2022 stood at $41.179m, and Mr Anderson said the Fund is now poised to dust-off long-held ambi tions to expand this to $100m.

“I’m still looking to get to $100m,” he told this newspaper. “We’re look ing to more than double the size of the fund if we can find suitable

properties. We actually now have the capital to move forward with various transactions we’re looking at in terms of potential property acquisitions.

“We’re starting to look more aggressively; we’re not in actual negotiations, but we’re starting to look more aggressively at opportuni ties than we have been. One of the key benefits to getting the capital structure sorted out is the opportu nity to acquire assets as well as the payment of dividends.”

Food price control negotiations silent

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

NEGOTIATIONS with the Government over expanding price controls on the Bahamian food distri bution industry have gone silent for more than two weeks much to the sector’s relief.

Philip Beneby, presi dent of the Retail Grocers Association (RGA), which represents more than 130 food store operators, con firmed to Tribune Business yesterday the industry had received no response to its last 1,000-product strong proposal since sector rep resentatives met Cabinet

ministers on Tuesday, November 9.

Since then, the Govern ment’s agenda has likely been dominated by Tropi cal Storm Nicole, which ultimately became a hur ricane, plus the Grand Lucayan sale’s collapse and the ongoing fall-out caused by the implosion of its flag ship digital assets investor, the FTX crypto currency exchange.

“I think it’s a good thing that it’s gone quiet. That’s why nobody is saying anything,” Mr Beneby con firmed to this newspaper. “Nothing has been said subsequent to that meet ing. That’s correct. They

S&P’s ‘shot in the arm’ exposes growth fears

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

STANDARD & Poor’s (S&P) has given The Baha mas “a shot in the arm” while further exposing that “additional taxation” will almost certainly be needed to hit the Government’s fiscal targets, a governance reformer warned yesterday.

Hubert Edwards, head of the Organisation for Responsible Governance’s (ORG) economic devel opment committee, told Tribune Business the rating agency’s decision to main tain The Bahamas’ ‘B+’ credit rating and ‘stable’ outlook had provided “a

level of validation” that the Davis administration’s eco nomic and fiscal policies are on the right track.

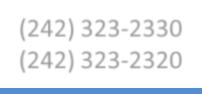

However, both he and Kwasi Thompson, former minister of state for finance in the Minnis

Bahamas ‘under attack’: Do more to combat FTX

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

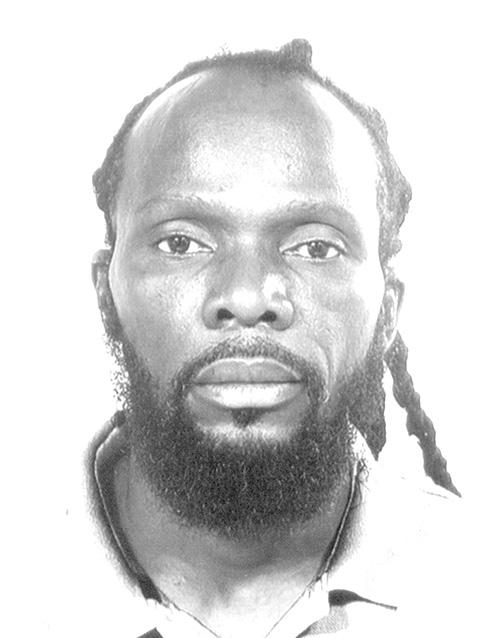

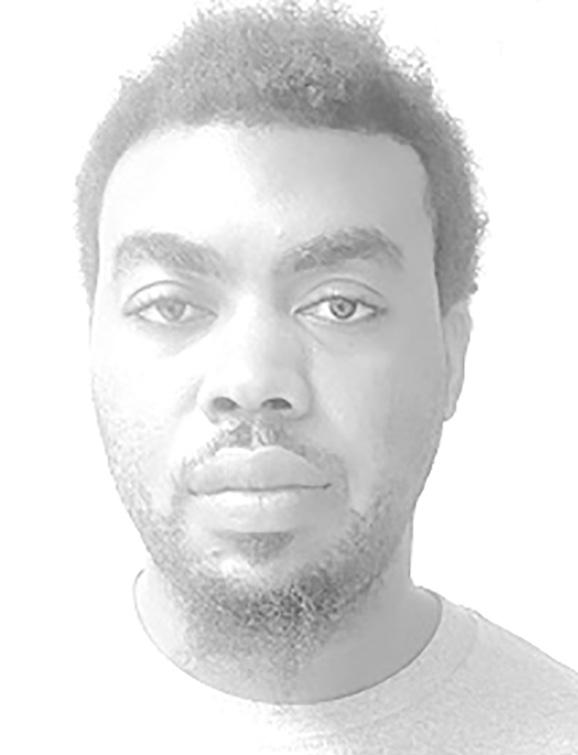

A FORMER finance minister yesterday argued that not enough is being done to protect The Baha mas’ integrity - and that of its entire financial services industry - which is “under attack” from all sides over FTX’s implosion.

Kwasi Thompson, min ister of state for finance in the former Minnis admin istration, warned in the House of Assembly that the country’s failure to properly defend itself from international criticism over the crypto currency

exchange’s collapse was enabling outsiders to promote the narrative it was a “poorly-regulated jurisdiction”.

Fearing that this could deter high quality invest ment from seeking out The Bahamas, he added that “if we do not tell our story others will tell it for us”. The east Grand Bahama MP added that the attacks were not coming from “rinky dink persons”, but individuals of the calibre of a former Securities & Exchange Commission (SEC) chairman - a status that gives their views

business@tribunemedia.net THURSDAY, NOVEMBER 24, 2022

SEE PAGE B4

BISX-listed fund targets asset-doubling to $100m

SEE PAGE B7 SEE PAGE B5 SEE

EDWARDS

PAGE B8 HUBERT

• Property Fund ‘aggressively’ seeking acquisitions • Targeting 90% occupancy at the Financial Centre • Downtown parking solution ‘not simple transaction’

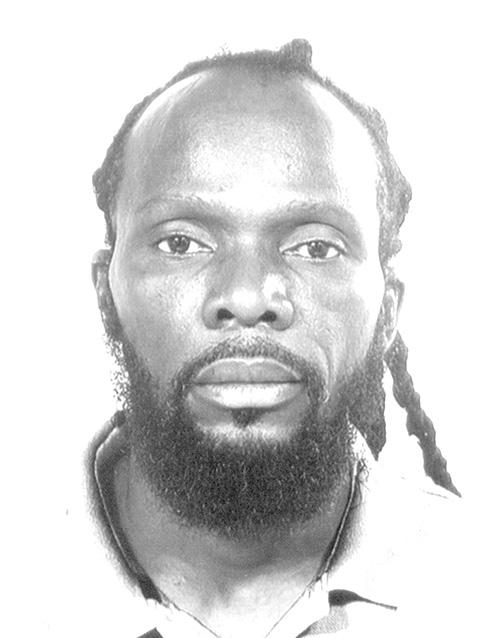

SAM BANKMAN-FRIED KWASI THOMPSON

$5.95 $5.97 $6.07 $5.87

MICHAEL ANDERSON

BEWARE THE PITFALLS OF WORKER TERMINATION

Have you ever been terminated? Have you ever had to terminate anyone? You may have hired someone who “aced” their inter view, but soon noticed their behaviour starts to negatively impact the office environment. Employment termination can trig ger traumatic emotions on both sides, even if you are expecting it. You may expe rience shock, anger, sadness and fear about the future,

along with the thought of being written off as “dam aged goods”.

Justifications for termination

While the specifics related to termination might differ, usually the reason falls into one of a few specific categories. For employers, knowing when you can and cannot fire an employee is important. What is employee termination?

Employee termina tion can be referred to by several other terms, includ ing “letting an employee go” or simply “firing an employee”. It indicates that you are ending the profes sional working relationship with them, and they are no longer employed at your company. The pro cess for terminating an employee depends on a company’s rules and guide lines but, more important, the laws that govern fair

employment practices. The most common reasons for employee termination are as follows:

Incompetence Employees who are unable to perform their duties as directed, even with assistance, are regarded as incompetent. Firing an employee for incompetence, such as poor performance, normally happens after a series of warnings and interventions.

Insubordination Insubordination is the refusal to follow instruc tions, usually paired with aggressive or disagreeable language. Insubordinate employee behaviour can impact their colleagues’ comfort at work and nega tively affect the company’s culture.

Work Attendance

Employees who are con stantly late, take more days off than the company allows or do not complete work assignments on time are guilty. Employees with

attendance issues often put a strain on co-workers, which sometimes leads to low morale.

Theft Theft is illegal. Steal ing from the company or co-workers can result in criminal charges and court actions. Stealing includes petty theft, such as taking office supplies home, or stealing cash.

Confidential information Employees who violate company policy by sharing confidential information warrant termination. In these cases, most compa nies require the employee to sign a non-disclosure form for protection.

Sexual harassment Sexual harassment can vary in severity from unwanted comments, or physical touch, which may also be punishable by law.

Violence Violence in the workplace, from dam aging a company’s equipment or property to

DEIDRE BastiaN By

physical violence towards a co-worker, is an offence worthy of termination. Most companies have a zero tolerance policy for vio lence at work, and dismiss the employee immediately.

Threats

If an employee threatens another employee or the company, whether verbally,

PAGE 2, Thursday, November 24, 2022 THE TRIBUNE

SEE PAGE B9

BAHAMAS PAYMENT APP SIGNS UP 1,500 VISITORS

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

A digital payments pro vider says more than 1,500 visitors who will arrive in The Bahamas for the Thanksgiving and Christ mas holidays have signed up to use its “tourism app”.

Jeffrey Beckles, Island Pay’s managing director, said the app will enable micro, small and mediumsized businesses (MSMEs) as well as sole entrepreneurs to be paid electronically for the products and services they deliver to tourists. He explained that it was a natural extension to its existing electronic payment solution for merchants.

“Our solution at Island Pay allows, and enables, small businesses in our Family Islands to receive merchant payments as a small merchant, manage their funds and have access to the funds at the end of the day, and that is a game changer,” Mr Beckles said.

“One of the things we must keep in mind is that the tourists that are coming back to The Bahamas in this rush are digitised tour ists. We can’t ignore that fact. So the longer we sit in our silo thinking that they have a pocket full of cash, we’re going to fool our selves. It is incumbent that we take advantage of these kinds of resources.

“With the small busi ness app, we now have a tourist app… A tourist

app that can handle Sand Dollar. That’s amazing because what it allows tour ists to do is to access Sand Dollar before they come to The Bahamas,” Mr Beckles added.

“What that means for the hair braider or the small merchant downtown, or on the beach, is a huge game changer because now that merchant can inter act with tourists and keep that money in our local economy. That is truly what a game changer is. That’s what we’re doing at Island Pay.”

The company’s ‘tour ist app’ was launched one month ago, and is avail able in the Apple Store and the Google Play Store.

“We’ve already begun to see people download it

Treasure Cay ‘can’t

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

TREASURE Cay home owners yesterday warned they “can’t afford” for the development to be “tied up for years” by a $3bn claim against the Government.

Craig Roberts, an Abaco hotelier, told Tribune Busi ness that residents “really can’t afford two or four years or more of litiga tion” after this newspaper revealed that controver sial Austrian investor, Dr Mirko Kovats, is seeking an astronomical sum in damages after the Davis administration rejected his bid to acquire the project from the Meister family.

Mr Roberts, who is leading a counter-offer to acquire Treasure Cay, said: “This is a very sad time for all of us in Treasure Cay. Our tiny community needs the hundreds of jobs and millions of dollars new resort construction will bring to this island. Three billion dollars in damages on a $31.5m investment sounds weak. I hope the Government has some good lawyers who can bring the issues to a head quickly.”

Dr Kovats, a Lyford Cay homeowner who has permanent resident status in The Bahamas, is alleg ing that his Treasure Cay acquisition and other local real estate deals “have

been subject to undue influ ence by the Government”, which he is accusing of “interference in a private commercial transaction”.

Eric Bethel, prop erty owner and Treasure Cay amenities board member, and the devel opment’s former head of security, yesterday said of the legal battle: “This is going to tie up Treasure Cay for years to come. We can’t afford that.”

Warning that this may result in residents leav ing Treasure Cay, he added: “The people in Abaco are really going to suffer over this, especially the people in North Abaco and the homeowners, too. There is nothing going on in Treasure Cay now, and the Meisters aren’t going to do anything, and now there’s not going to be a sale, so it means no rental incomes coming in, so it’s bad all around.”

No other prospective buyer will go near purchas ing Treasure Cay until the legal battle is resolved. Mr Bethel, understanding this, urged the Government to “fix this problem” as soon as possible because “this isn’t going to be good.”

Mr Roberts, meanwhile, challenged Dr Kovats’ claim that the Meister family has not returned his $2.33m deposit. “I know that Kovats’ deposit was returned a month ago,” he charged. The Austrian financier has also initiated

legal action against the Meisters and their com pany, Family Adventure Holdings, demanding that they uphold the February 2021 sales contract or, in the alternative, return his $2.233m deposit equivalent to 10 percent of the pur chase price

Legal filings in the US and The Bahamas, which have been obtained by Tribune Business, reveal that the Austrian, who lives at McCullough on Clifton Bay Drive, initiated Judi cial Review proceedings against the Government on October 27, 2022, after the Bahamas Investment Authority (BIA) rejected his efforts to acquire the remaining 1,600 acres at Treasure Cay from Robert and Stefan Meister via a $22.325m deal.

Documents detail a series of meetings with the Prime Minister, Cabinet ministers and other senior govern ment officials, with Philip Davis KC at one point pur portedly telling Dr Kovats: “Don’t let me down” were the Government to approve the Treasure Cay sale. The Davis administration ulti mately decided against this, confirming its decision to Dr Kovats in the BIA’s June 16, 2022, letter.

The Lyford Cay resident appears especially unhappy with the Government’s escalating demands that he post a performance bond to guarantee the Treasure Cay redevelopment he promised

because they’re excited. You’ll be surprised to know the number of tourists that come here and want Baha mian dollars,” Mr Beckles added.

“In a single month since we launched we’ve been out about three-and-a-half weeks we’ve had well over 1,500 tourists download the wallet because they plan to come here at some point during the Thanksgiving break, or the holiday break, and that’s exciting for us.”

While Island Pay’s ‘small business’ app has not proven as popu lar as the tourist version yet, Mr Beckles believes this will change as com panies become more attuned to new ways of con ducting business and seek

to minimise costs associated with inflationary pressures.

Mr Beckles said: “There’s no doubt the inflation impact will be felt mostly by small businesses. I don’t think any of us are going to be insulated. But as it relates to small businesses, because we are small in nature, we do have less cushion…

“We will definitely feel that, and this is why we’ve been really advocating for small businesses to under stand what’s coming in terms of the inflationary impact and how do we miti gate it. How do we make changes now before the real impact sets in?”

Companies can employ various strategies to miti gate the fall-out from a widely-predicted US

will actually happen. The sum required rose from an initial $5m to $25m by the time that Dr Kovats’ commercial attorney, Greg Cottis, met with the Prime Minister on August 24, 2022, in a final bid to avoid litigation and move the pro ject forward.

It is unclear how the total $3.127bn damages sought by Dr Kovats have been calculated, although they appear to represent lost sales revenues and profits that would accrue to him if his Treasure Cay plans were approved. They seem to have been calculated using a report produced by the CBRE Group, an interna tional real estate firm, for “updated Albany/South Ocean development plan proceeds” as well as based on property values at Aba co’s Baker’s Bay project.

Many observers are likely to be highly sceptical at the damages calculation sub mitted by Dr Kovats and his attorney, Damian Gomez KC, the former minister of state for legal affairs, as well as their prospects of Judi cial Review success. One source, speaking on con dition of anonymity, told Tribune Business: “How he can take the Government to court and expect to win is beyond me. They can turn anyone down. That’s the nature of the beast.”

The concern for The Bahamas is that prime tracts of real estate, extremely valuable for driving future develop ment, investment and job creation, face being poten tially tied-up for years in

recession, he added. “We try to look at the structure of the organisation, struc ture of the operation, and one of the greatest impact is costs. How do we make adjustments in our costs to mitigate the impact?” Mr Beckles asked.

“And then, at the same time, we still have to live. So while we’re talking about the impact of costcutting measures, we also need to focus on how do we expand our customer base, because we need that rev enue still coming in. People still need to live, people still need services. So it’s a balancing between improv ing our revenue streams, expanding revenue streams and also controlling costs.”

expensive, time-consuming court fights. Several sources have suggested that litiga tion is frequently employed as a hardball negotiating tactic by Dr Kovats as a means to an end in securing his desired outcome.

•

•

•

•

THE TRIBUNE Thursday, November 24, 2022, PAGE 3

afford’

$3bn legal battle’s fall-out

Executive Assistant/Office Administrator Job Specifics - Local Auto Mechanic Garage Requirements & Qualifications

Work experience as an executive assistant, personal assistant, or similar role

Excellent organization skills

Excellent verbal and written communication skills

Basic knowledge in QuickBooks and MS Office Please email submissions to newcareer591@gmail.com Cut off for submissions – December 2nd, 2022 JOB OPPORTUNITY

Bahamas ‘under attack’: Do more to combat FTX

credibility and allows them to gain traction in interna tional markets.

Mr Thompson, who called on the Government to hire an international public relations (PR) firm specifically to counter nega tive FTX-related coverage, voiced his concerns as the crypto currency exchange’s 40 Bahamian staff continue to grapple with “tremen dous uncertainty” over their immediate fate.

This newspaper was informed that while FTX Digital Markets staff have not been formally termi nated, or released, they remain “in limbo” and “a holding pattern” with no work to do some two weeks’ after the Bahamian subsidiary was placed into joint provisional liquidation by the Supreme Court upon the Securities Commission’s petition.

Well-placed sources told Tribune Business that the joint provisional liquidators have yet to meet formally with Bahamian employees, although there were sug gestions conversations may have taken place with indi vidual staff on as-needed basis.

The joint provisional liquidators could not be reached for comment before press time last night.

However, Brian Simms KC, senior partner at the Lennox Paton law firm, and PricewaterhouseCoop ers (PwC) accounting duo, Kevin Cambridge and Peter Greaves, will likely have been pre-occupied to-date with securing FTX Digital Markets’ assets, books and papers, as well as dealing with cross-border issues related to the US Chapter 11 proceedings involving other FTX entities.

The full impact of FTX’s implosion, one of the fast est and most spectacular corporate collapses ever given that it took place in just one week, is yet to be determined when it comes to the Bahamian economy. However, it is likely that multiple local businesses and their employees, espe cially those owed money, may have been caught in its wake. “They touched every sector,” one source said simply of FTX.

Mr Thompson, mean while, acted the Davis administration’s relative silence on FTX by demand ing that “we must act to protect our industry”. The Government has largely

allowed the Securities Com mission to take the lead, apart from a brief statement in Parliament last week by Prime Minister Philip Davis KC, even though The Baha mas’ financial services and investment reputation con tinues to take a pounding from so-called international ‘experts’ and media.

“Our entire financial ser vices industry reputation is under attack,” Mr Thomp son said. “I recently watched an interview with a former SEC chairman, not some rinky dink person, but a former SEC chairman. He suggested offshore financial jurisdictions like the Baha mas are not well regulated. I know that is not true. What is important and worrisome is he did not make the dis tinction between crypto and traditional financial services or investment.

“The Prime Minister sug gested that we act in the interest of patriotism. On this point he’s right. This is why I make these com ments. The Bahamas is under attack. We are a wellregulated jurisdiction with the best talent in the world and, in the interests of our country, we must act to pro tect our industry.

“We are not saying enough to protect our

industry. We are not saying enough about the overall direction of regulation in the crypto space. If we say we are leaders, then we should lead. Where are our experts speaking positively about The Bahamas, our laws and our future? Where is the communication strat egy? Have we engaged an international PR firm to combat what is being said about us internationally?”

Mr Davis last week said FTX’s stunning col lapse could not have been foreseen, or prevented, by regulatory action from the Securities Commission or The Bahamas gener ally even though digital assets industry players told Tribune Business they had become concerned about the crypto exchange - especially the value of its in-house FTT tokens - as far back as February/March this year.

He added that he was convinced that The Baha mas will emerge from the FTX debacle with its regu latory and digital assets reputation enhanced, but that is being put to the test like never before. While Standard & Poor’s (S&P), in maintaining The Baha mas’ sovereign credit rating at ‘B+’ with a ‘stable’ out look, said this nation will suffer no “material adverse impact” from FTX but also warned that its failure is a “setback” to its digital assets ambitions.

Mr Thompson yester day argued there was a disconnect between the House of Assembly, where MPs “pound their fists on tables” talking about how wonderful The Bahamas is, and international percep tions over FTX’s collapse. “There are real people out there in the international community who are saying The Bahamas is not a wellregulated place and do not invest in The Bahamas.

“Why hasn’t the Gov ernment met with the

Opposition and, more importantly, met with industry to manage the international message in a non-partisan way? This issue is that big. Any forum where The Baha mas’ investment climate is mentioned, we will have to address FTX in any place in the world.

“In times of crisis, our voice should be heard in the defence of our juris diction and the direction regulation should take, and the direction the industry should take and the role The Bahamas should play. If we do not tell our story, others will.” Mr Thompson called on the Government to “meet immediately” with the financial services indus try to co-ordinate strategy, then hire a PR firm to “combat the negative mes sage being put out”. The FTX debacle is becoming increasingly political. Its Bahamian subsidiary, FTX Digital Markets, was incorporated on July 22, 2021, when the Minnis administration was still in office. Dr Hubert Minnis earlier this week told Tribune Business he had no contact with FTX or its co-founder, Sam Bank man-Fried, prior to the September 16, 2022, general election, and nor did any member of his government.

That, though, does not mean there was no contact at a lower administrative or regulatory level. While the Davis administration fully embraced FTX and Mr Bankman-Fried within weeks of the election, and the crypto exchange pressed the accelerator on its Baha mas’ plans, it is clear that its presence straddles both governments.

Mr Bankman-Fried, meanwhile, issued another mea culpa to FTX’s world wide staff as he took the blame for its sudden col lapse. He also continued to grasp at straws by suggest ing there was still a chance

“to save the company”, seemingly not recognising that it is out of his hands due to the Bahamian pro visional liquidation and Chapter 11 bankruptcy pro tection proceedings.

Asserting that “poten tial interest” in providing billions of dollars in financ ing came in “eight minutes after I signed the Chapter 11 documents”, the FTX co-founder said: “Between those funds, the billions of dollars of collateral the company still held, and the interest we’d received from other parties, I think that we probably could have returned large value to customers and saved the business........

“Maybe there still is a chance to save the company. I believe that there are bil lions of dollars of genuine interest from new investors that could go to making cus tomers whole. But I can’t promise you that anything will happen because it’s not my choice.”

Pleading guilty to his role in FTX’s failure, Mr Bankman-Fried added: “I was chief executive, and so it was my duty to make sure that, ultimately, the right things happened at FTX. I wish that I had been more careful. I feel deeply sorry about what happened. I regret what happened to all of you. And I regret what happened to customers. You gave everything you could for FTX, and stood by the company - and me.

“I didn’t mean for any of this to happen, and I would give anything to be able to go back and do things over again. You were my family. I’ve lost that, and our old home is an empty ware house of monitors. When I turn around, there’s no one left to talk to. I disappointed all of you, and when things broke down I failed to com municate. I froze up in the face of pressure and leaks, and the Binance Letter of Intent, and said nothing.”

The Laboratory Technologist will report to the Laboratory Supervisor.

Letter of application and curriculum vitae should be forwarded to the Director of Human Resources, Corporate Office, Public Hospitals Authority, 3rd Terrace West, Centreville; or email to jobs@phabahamas.org no later than 2nd

PAGE 4, Thursday, November 24, 2022 THE TRIBUNE

FROM PAGE B1 PUBLIC HOSPITALS AUTHORITY ADVERTISEMENT VACANCY LABORATORY TECHNOLOGIST DEPARTMENT OF PATHOLOGY & LABORATORY MEDICINE PRINCESS MARGARET HOSPITAL The Public Hospitals Authority (PHA) invites applications from suitably qualified persons for the post of Laboratory Technologist, Department of Pathology and Laboratory Medicine, Princess Margaret Hospital (PMH). POSITION SUMMARY: The Laboratory Technologist is responsible for the technical trouble shooting, routine laboratory analysis, training of

KEY ACCOUNTABILITIES FOR THIS ROLE INCLUDE BUT ARE NOT LIMITED TO THE FOLLOWING: • Performs routine and complex laboratory procedures and records results in the hospitals Laboratory Systems; • Participates in quality control programs; • Performs routine maintenance of Laboratory equipment; • Assist with inventory control of supplies in Section; • Keeps abreast of developing and current laboratory procedures and participates in lectures and training conferences; • Follows explicitly

Infection control

Department

EDUCATION/ EXPERIENCE: • Bachelor’s Degree in Medical Technology; • Certification as American Medical Technologist (AMT), American Society of Clinical Pathologist (ASCP); • Health Professions Council Registration; • Proficient in Microsoft Office Suite.

: • Effective communication skills (oral and written); • Excellent analytical, interpersonal, organizational and leadership skills.

technicians, laboratory inventory and supervision of activities.

the

Guidelines of the

of Pathology and Laboratory Management Team.

COMPETENCY REQUIREMENTS

December 2022

Sterling’s mortgage fund eyes double digit returns

STERLING Global Financial’s chairman is fore casting a successful year-end for the group’s mortgage income fund as it marks its tenth anniversary with an unbroken record of double digit returns for investors since inception.

“We are very proud of our track record and our ability to provide investors with a consistent and stable

yield,” said David Kosoy. “Through volatile capital markets and various eco nomic shifts, the Sterling Mortgage Income Fund has succeeded in protect ing investor capital while providing a very attractive income stream.”

The fund has achieved consistent top rankings for inves tor security from fund

ratings institutes. Ste phen Tiller, Sterling’s chief executive, said the fund’s success was driven by both its ability to provide “quick, flexible and reliable financ ing” and its management’s operating expertise in real estate and construction.

Sterling currently has more than $1bn in investment projects underway, including the

Paradise Landing develop ment intended to create a ‘downtown Paradise Island’. The project, located at the Hurricane Hole site, features residential, retail and office space, dining and the Hurricane Hole Supery acht Marina.

While the group is also developing Montage Cay (the former Matt Lowe’s Cay) in Abaco, its real

S&P’S ‘SHOT IN THE ARM’ EXPOSES GROWTH FEARS

FROM PAGE B1

administration, both argued that a deeper analysis of S&P’s report highlighted significant concerns for The Bahamas beyond the immediate term. In par ticular, the duo pointed to the rating agency slashing its 2023 economic growth forecast for The Bahamas to just 1.1 percent as a sign this nation will return to anemic pre-COVID expan sion levels more rapidly than anticipated.

S&P also asserted that the Government will only hit its signature 25 percent revenue-to-GDP target by the 2025-2026 fiscal year if it introduces new and/ or increased taxes or intro duces major public spending cuts - options that the Davis administration is currently resisting. Mr Edwards warned that spending cuts, in particular, would be “a double-edged sword” as they could slow gross domestic product (GDP) growth if implemented too deeply.

The rating agency, despite giving The Bahamas some breathing room to demon strate its fiscal credibility, is thus already sounding the alarm about this nation’s short to medium-term growth prospects and ability to hit key consolidation tar gets. “The cut in the growth rate is one of the most sig nificant issues,” Mr Edwards told this newspaper. “It

seems as if The Bahamas, with some additional pres sure from inflation, is quickly going back to its normal growth level.

“That was expected to happen in 2024, and is now happening earlier. This is another signal we do not want to see. We’d like to see growth remain at least above 2 percent, but at 1.1 percent we’re moving rapidly back to normal growth, and that is a challenge because The Bahamas needs to grow well beyond the normal growth rate experiences for the last decade or so.”

His stance was echoed by Mr Thompson, who told Tribune Business: “We cannot deny that we are in a tourism-led recovery, and I believe the ‘stable’ outlook took into account the tour ism-led recovery. But the report also highlighted this recovery may not last for ever and be permanent. That is evidenced by the slash in growth projections to 1.1 percent.

“That is very concerning because 1 percent growth is really very, very close to no growth, and 1 percent growth is most certainly not sufficient to reduce unem ployment. It’s not where we want to be.... It causes us pause and causes us to be cautious. This thing slash ing growth to 1.1 percent, they are most clearly saying next year can be far more challenging and we are not

preparing adequately for what is to come.”

S&P’s forecast represents almost a three-quarters or 75 percent cut to the latest International Monetary Fund (IMF) estimate of 4.1 percent GDP growth for The Bahamas in 2023. It based its prediction on growing global risks and headwinds from continued inflationary shocks, a likely US recession and persistent post-COVID supply chain challenges.

“We expect global eco nomic challenges in 2023 will slow The Bahamas’ real GDP growth next year to 1.1 percent. We expect GDP per capita will be $33,740 in 2023. The pandemic, low his torical growth and repeated natural disasters have weighed on the country’s economy,” the rating agency continued.

“Despite good growth over the next two to three years, our assessment of the sovereign’s creditworthiness reflects its below-average long-term growth perfor mance compared with that of others at a similar level of development.” And S&P also asserted that the Gov ernment’s bid to achieve a 25 percent revenue-to-GDP ratio by 2025-2026 will be a tough ask without new and/or increased taxes and spending cuts.

It said: “The Government has announced its intention to collect revenue of 25 per cent of GDP, while shrinking

expenses and capital spend ing to 20 percent and 3.5 percent of GDP, respec tively, by fiscal 2025-2026.

“This would result in a fiscal surplus. However, we believe the Government’s goals will be hard to achieve absent new taxes or material spending cuts. The Govern ment has announced two new committees to review revenue policies and public debt strategy. Any recom mendations and new policies arising from these commit tees will take several years before they have a mean ingful impact on public finances.”

Mr Edwards told Tribune Business that S&P’s taxation assessment backed his take and that of other domestic analysts. “We fully appre ciate the fact 25 percent revenue-to-GDP is a good target, it’s an aspirational one, but I have always been mindful that it’s difficult to reach without additional taxation,” he said. “This is a validation of that point of view.

“The flip side of this, and where the double edged sword comes in, is if the Government can’t achieve that by taxation and seeks to do it by cutting expenditure. It would have a negative impact on the economy in an overall sense as the Govern ment is a significant driver. We’re coming out of a deep recession (COVID) and for there to be cut backs at this

estate financing activities stretch worldwide. It pro vides senior financing, bridge financing, mezzanine and development financing in key markets across North America and certain Euro pean markets.

Sterling has funded around 100 mortgages worth more than $350m col lectively since its launch in 2012, financing residential

point in time could have an adverse impact.

“And if they cut, and cut too deeply, you may get to that target but it’s sort of an artificial achievement. It’s a matter of managing numbers to hit the target. The more comprehensive and holistic solution lies in looking at the whole scope of revenue available to government and making decisions whether there are other avenues for taxation,” Mr Edwards said.

“Nobody wants to push for additional taxation, but at some point the Government and population will have to step back and ask: What does it cost to run these min istries? How can we have growth and buoyancy if we are not implementing these reforms?”

Mr Thompson, mean while, told the House of Assembly that S&P’s analy sis was bluntly stating that “relying on the tourism recovery alone and attempt ing to collect unrecovered revenue is not sufficient” to achieve the economic growth and fiscal consoli dation that The Bahamas needs post-COVID. He also demanded that the Govern ment “sacrifice” by cutting discretionary spending, and blasted: “They just don’t get it.”

Michael Halkitis, minister of economic affairs, did not respond to a detailed list of Tribune Business questions before press time last night. However, the Ministry of Finance, in a statement said: “The Government remains committed to putting the

communities, mixed-use projects, retail centres and marinas.

“Maintaining a flexible approach with the capacity to act quickly and remain within an institutionalgrade risk management framework has been the basis by which the mort gage fund has operated, a model that will continue to serve as the foundation for future growth,” said Mr Kosoy.

country on a sustainable path to fiscal consolidation. Performance in the past fiscal year, 2022, and in the first quarter of this fiscal year, 2023, provides ample evidence of this.

“Fiscal 2022 saw deficits fall to 6 percent of GDP from 13.7 percent of GDP in fiscal 2021, and the first quarter of 2023 saw the nar rowing of the fiscal deficit to $20.6m - a $115.8m decrease from the deficit of $136.4m experienced in the year prior. The market has taken note of these improvements and has rewarded the coun try with improving bond yields....

“We continue to believe that as we execute the strat egy outlined in our Fiscal Strategy Report and our borrowing plan, there will be improvements in debt affordability and fiscal con solidation, which will put upward pressure on our ratings.”

Mr Edwards said S&P’s non-action, and maintenance of the current Bahamas sov ereign rating, was “more than a boost” as this nation could have been “signifi cantly challenged” if it had followed October’s Moody’s downgrade.

“It gives us a shot in the arm, and it gives the Gov ernment some level of validation of its plans and, as a result of that, they can be confident from an economic and fiscal point of view that if they continue doing what they’re doing down the road, they’ll be a stronger founda tion to build on,” he added.

VACANCY HUMAN RESOURCES MANAGER

Higgs & Johnson, a full-service corporate and commercial law firm serving clients around the globe, is seeking a progressive Human Resources Manager who will lead and direct the routine functions of the Human Resources (HR) department while developing effective relationships with attorneys, managers, and staff, resulting in optimal client experiences.

The responsibilities include:Partnering with the leadership team to understand and execute the organization’s human resource and talent strategy particularly as it relates to current and future talent needs, recruiting, retention, and succession planning.

Providing support and guidance to management, and staff when complex, specialized, and sensitive questions and issues arise; may be required to administer and execute routine tasks in delicate circumstances such as investigating allegations of wrongdoing, and terminations.

Analyzing trends in compensation and benefits; researches and proposes competitive base and incentive pay programs to ensure the organization attracts and retains top talent. Creating learning and development programs and initiatives that provide internal development opportunities for employees. Maintaining compliance with local employment laws and regulations and recommended best practices; reviews policies and practices to maintain compliance; prepare and maintain office policy and procedure manuals. Maintaining knowledge of trends, best practices, regulatory changes, and new technologies in human resources, talent management, and employment law. Ensuring a smooth flow of communication among all employees.

Facilitating employee engagement strategies and employee events (including the reward and recognition program

The Public Hospitals Authority (PHA) invites applications from suitably qualified persons for the post of Phlebotomist, Department of Pathology and Laboratory Medicine, Princess Margaret Hospital (PMH).

POSITION SUMMARY:

The Phlebotomist performs a variety of venipuncture techniques and collects blood specimens from patients in support of laboratory procedures used in the diagnosis and treatment of disease.

KEY ACCOUNTABILITIES FOR THIS ROLE INCLUDE BUT ARE NOT LIMITED TO THE FOLLOWING:

• Follows proper patient identification procedures before obtaining blood specimens and using proper technique;

• Draws blood from patients using accepted guidelines for venipuncture, heel sticks, (on infants) or finger sticks;

• Ensures that all specimens requirements are delivered to the laboratory in a timely manner;

• Ensures that patients are appropriately prepared for the procedure;

• Orders laboratory tests, cancelling laboratory request and updating specimens in the Laboratory Information System (LIS);

• Ensures that all tubes are labeled after the puncture and be aware of post-phlebotomy complications that may occur;

• Practices standard precautions always by using protective equipment in performing functions and specimen collection.

EDUCATION/EXPERIENCE:

• High School Diploma;

• Certification as American Medical Technologist (AMT),

American Society of Clinical Pathologist (ASCP) or any other recognized certification body;

• Proficient in Microsoft Office Suite.

COMPETENCY REQUIREMENTS:

• Effective communication skills (oral and written);

• Excellent analytical, interpersonal, organizational and leadership skills.

The Phlebotomist will report to the Laboratory Supervisor.

Letter of application and curriculum vitae should be forwarded to the Director of Human Resources, Corporate Office, Public Hospitals Authority, 3rd Terrace West, Centreville; or email to jobs@phabahamas.org no later than 2nd December 2022

Candidates must possess: Bachelor’s degree in Human Resources, Business Administration, or related field Minimum five (5) years of human resources management experience preferred Strong human capital management knowledge and experience in HR frameworks Superior interpersonal, coaching, communication, negotiation, and conflict resolution skills Demonstrated commitment to health, safety and environmental policies and procedures

Thorough knowledge of employment-related laws and regulations Proficient with Microsoft Office Suite and HR related software

Qualified candidates interested in this exciting and rewarding opportunity, should forward their resume to dbarnes@higgsjohnson.com by Monday, December 5, 2022. Only qualified, short-listed applicants will be scheduled to interview

THE TRIBUNE Thursday, November 24, 2022, PAGE 5

ADVERTISEMENT VACANCY PHLEBOTOMIST DEPARTMENT

& LABORATORY MEDICINE PRINCESS

PUBLIC HOSPITALS AUTHORITY

OF PATHOLOGY

MARGARET HOSPITAL

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

THE Small Business Development Centre yes terday sealed a $400,000 tie up with The Nature Conservancy (TNC) via a Memorandum of Under standing (MoU) for technical assistance.

Samantha Rolle, the SBDC’s interim executive director, said the MoU’s signing represents a finan cial injection into the “blue economy accelerator”.

She explained: “That’s $400,000 in the initial or pilot phase, and obviously going through that phase, as we identify where there may be any gaps, or as we would call them, kinks that we need to iron out, we will go ahead and make those adjustments so that we can have a more productive as well as successful pro gramme over the course of the remaining four years.”

Marcia Musgrove, The Nature Conservancy’s (TNC) northern Caribbean programme director, said the environmental group will bring its scientific quali ties to a project that aims to unlock the marine economy in a sustainable manner.

“So the Nature Conserv ancy’s role is to provide technical support and advice by way of science,” she added. “So one of the criteria for businesses who receive funding through the blue economy accelera tor programme is to ensure that their business model is one that has a positive impact on the marine envi ronment in terms of the way they do business, or even perhaps the type of product or service that the business provides.”

“We all know that the country has been grappling with and will continue to grapple with in the near future, the fallout on our economy, the social impact and environmental impacts from COVID-19, which

came on the heels of the most intense decade of hurricanes in our history between 2010 and 2020.

“As we sought to do our conservation work, we rec ognise that not only do we have impacts on nature and coral reefs, but people

around our country.... we are very dependent on these critical ecosystems for our livelihoods, for jobs to sustain our families for food security, and so we thought it a natural fit that conservation of this ecosys tem would go hand in hand

with supporting businesses around the country who are committed to sustainable use of marine resources.”

Ms Rolle said: “It has been proven that col laboration through trust, partnerships and unity are critical for achieving shared

goals confronting the chal lenges faced by MSMEs (micro, small and mediumsized enterprises) and supporting the develop ment of viable businesses, specifically in the blue economy sector.

“Today, the Access Accelerator, the SBDC, is excited to take our strate gic partnership with TNC from discussion and design ideation to agreement and action through the execu tion of a memorandum of understanding with the purpose of supporting the development and invest ment in MSMEs in the blue economy.”

PAGE 6, Thursday, November 24, 2022 THE TRIBUNE

PARTNERSHIP TO GIVE $400K BOOST FOR ‘BLUE ECONOMY’

TO ADVERTISE TODAY IN THE TRIBUNE CALL @ 502-2394

SAMANTHA Rolle (left) and Marcia Musgrove sign MOU.

Food price control negotiations silent

promised to get back to us and nothing has happened. I think they’ve had their hands full.

“It’s operations as normal. The talks haven’t been con cluded. We gave them our proposal and they promised to look at it and get back to us. That was the last list we gave to them. That’s where we are. We’re still waiting to hear back from them. I guess they’re probably studying it thoroughly before they get back to us.”

Rupert Roberts, Super Value’s owner, also con firmed that there has been no movement on the Gov ernment’s proposed price controls since industry repre sentatives met with Chester Cooper, then acting prime minister in Philip Davis KC’s absence, and Michael Halki tis, minister of economic affairs. “Nothing has been said,” he added.

In a meeting that was cut short by Nicole’s imminent arrival in The Bahamas, the

two ministers were said to have promised to consult further with their Cabinet colleagues on the matter and would report back to mer chants and wholesalers on the Government’s position in “due course”.

Few other food distri bution operators would comment for fear it would awaken the long-running controversy, one saying: “Like they say, let sleep ing dogs lie.” Another confirmed: “It’s gone totally quiet. Deathly quiet. As far as I’m aware there’s been no change. I think the Gov ernment finds itself really overwhelmed.”

Tribune Business con firmed that price control inspectors have made no moves to enforce the Government’s originally-pro posed list of price-controlled items, or levy sanctions against retailers and whole salers, even though the amendments are said to have been gazzetted.

The issue was yesterday picked up by the opposition

Free National Movement (FNM) as it sought to score political points in the House of Assembly. Kwasi Thomp son, former minister of state for finance and east Grand Bahama’s MP, said: “What has happened to the arrange ments that were so urgent and so impactful to the fight against inflation? Has there been an agreement with the Retail Grocers Association? Are the new regulations being enforced? The public would like to know.”

John Bostwick, attor ney for the Retail Grocers Association (RGA), told this newspaper on Novem ber 9 that the industry had expanded its list of price-controlled items to “more than 1,000 individ ual products”, a significant increase on the 20 items and categories included in its initial October 26, 2022, counter-proposal but still some way short of the Government’s initial 38 categories and 5,000-plus products.

The Government’s ini tial proposal capped food wholesale margins, or markups, at 15 percent for all 38 product categories listed, while those for retailers were set at 25 percent across-theboard. The move, which was designed to ease the cost of living crisis currently batter ing thousands of middle and lower income Bahamians, employed the blunt tool of price controls - albeit on a “temporary” six-month basis - to achieve this.

The goods impacted, some of which are already price controlled, were baby cereal, food and formula; broths, canned fish; condensed milk; powdered detergent; mustard; soap; soup; fresh milk; sugar; canned spa ghetti; canned pigeon peas (cooked); peanut butter; ketchup; cream of wheat; oatmeal and corn flakes.

The remainder were macaroni and cheese mix; pampers; feminine nap kins; eggs; bread; chicken; turkey; pork; sandwich meat; oranges; apples; bananas;

limes; tomatoes; iceberg lettuce; broccoli; carrots; potatoes; yellow onions; and green bell peppers.

However, the move blindsided Bahamian food merchants and their whole sale suppliers, who had received no advance warn ing or consultation on the Government’s plans. They warned that the 38 selected categories included more than 5,000 product line items, and would lead to between 40-60 percent of a retailer’s inventory becoming price controlled with markups below their cost of sales.

This would result in a large portion, or the majority, of their inventory being sold at a loss. Besides threatening hundreds of industry jobs, and the very survival of many operators, the RGA and its members also warned that the original proposal could result in food shortages as retailers/wholesalers decline to stock loss-making items while also increasing prices on non-controlled items, thereby further fuelling already soaring inflation.

However, the Government has since agreed to some of

what the food distribution industry has been request ing, namely higher mark-ups for Family Island retailers and perishable products that have a shorter shelf-life and go bad much quicker.

While the Association had supported 25 percent on all dry grocery items, it requested that this be increased to 30 percent for Family Island businesses due to the extra shipping, logistics and overall business costs they endure compared to New Providence.

And, due to “the rising costs of electricity and shrinkage (spoilage), the food retailers had called for a 35 percent mark-up in Nassau, and 40 percent in the Family Islands, for perish able goods as opposed to the Government’s originally pro posed 25 percent limit.

The Government has agreed to a five percent age point increase in the mark-up for price-controlled perishables, such as meats and vegetables, along with “a slight increase for the Family Islands to cover transportation”.

Tuesday, 29th November 2022 7:30 PM EST

St. Andrews Anglican Community Center on Queens Highway (opposite Peace & Plenty) in George Town, Great Exuma

Google Meet Link: https://meet.google.com/ckn-bgkr-qkw

Hard copies of the EIA can be viewed at the Administrator’s Office in George Town Exuma, at the Department of Environmental Planning and Protection (DEPP) in Nassau during normal working hours, or at https://www.kiamabaha mas.com/EIA. The public is invited to send written comments to inquiries@depp. gov.bs or EIAPublicComments2022@kiamabahamas.com no later than 21 days after the date of the public meeting as noted above.

THE TRIBUNE Thursday, November 24, 2022, PAGE 7

FROM PAGE B1

The general public and residents of the Exumas are cordially invited to attend a virtual and in-person Public Town Meeting to discuss the findings of the Environmental Impact Assessment (EIA) for the Ki’ama Bahamas project, scheduled for the southern portion of Elizabeth Island, Gt. Exuma. The Developers intend to establish an environmentally sustainable, low-carbon, solar residential resort and solar powered yacht community on 35 acres of private land.

PUBLIC CONSULTATION ON THE ENVIRONMENTAL IMPACT ASSESSMENT FOR KI’AMA BAHAMAS PROJECT • Bachelors degree in accounting or finance • CPA Designation • Previous work as a senior accountant or a senior auditor • In depth knowledge of IFRS Accounting Standards is a must (specifically IFRS 9, IFRS 15 and IFRS 16) • Experience preparing financial statements • Experience overseeing year end audit engagements • Advanced knowledge of Microsoft Excel • Good Communication skills – written and verbal Please submit all resumes to humanresources@airportsbahamas.com on or before November 8th 2022. JOB OPPORTUNITY SENIOR ACCOUNTANT (6 MONTH CONTRACT) QUALIFICATIONS AND REQUIREMENTS

BISX-listed fund targets asset-doubling to $100m

FROM

The first dividend pay ment for more than a decade was made to the Fund’s “patient sharehold ers” during the 2022 third quarter, and Mr Ander son said its net equity of $31.413m - assets of $41.179m far exceeding lia bilities of $8.369m - had left it well-positioned to take on greater debt financing for the funding of acquisitions.

“The truth is that the market has been fairly flat over the last couple of years with COVID,” he added. “There have not been a lot of opportunities coming

to market. Everyone has been waiting. It’s possible we might see more activ ity in the property space with people looking to raise capital.

“Business activity is pick ing up. People were holding off on making decisions, and this year we’ve seen people start to move for ward with things that they have put off for a while. We’re in good shape. That’s [the preference share refi nancing] the piece that sets us up to borrow; a good equity stake and cash flows from existing buildings improving, which gives us

N O T I C E

SHNOOKUMS ENTERPRISES LTD. (In Voluntary Liquidation)

Notice is hereby given that the above-named Company is in dissolution, commencing on the 21st day of November 2022. Articles of Dissolution have been duly registered by the Registrar. The liquidator is (Amicorp Bahamas Management Limited) whose address is Bahamas Financial Centre, 3rd Floor, Shirley & Charlotte Street, P.O. Box N-4865, Nassau, Bahamas.

Dated this 21st day of November 2022

(AMICORP BAHAMAS MANAGEMENT LIMITED) LIQUIDATOR

COMMONWEALTH OF THE BAHAMAS 2021/CLE/gui/00061

IN THE SUPREME COURT

Common Law & Equity Division

BETWEEN

IN THE MATTER of the Quieting Titles Act, 1959 AND

IN THE MATTER of the Petition of RENIE BROWN AND

IN THE MATTER Of ALL THAT piece parcel or lot of land situate in the Western District of the island of New Providence containing 7,866 square feet, on the Eastern Side of Honey Combe Street approximately 275 feet South of Hay Street and 190 feet West of East Street New Providence Bahamas.

TO: HIS LORDSHIP THE HONOURABLE MR. JUSTICE IAN WINDER JUDGE OF THE SUPREME COURT OF THE COMMONWEALTH OF THE BAHAMAS.

NOTICE OF PETITION

NOTICE is hereby given that RENIE BROWN of Honey Combe Street situate in the Western District of the Island of New Providence one of The Islands of The Commonwealth of The Bahamas (hereinafter called “the Petitioner”) claims to be the owner of the unencumbered fee simple in possession of the land hereinafter described, that is to say:

ALL THAT piece parcel or lot of land situate in the Western District of the Island of New Providence containing 7, 866 square feet, on the Easter Side of Honey Combe Street approximately (275) feet South of Hay Street and (190) feet West of East Street.

A Plan of the said land may be in inspected during normal office hours in the following places:-

(a) The Registry of the Supreme Court in the City of Nassau, The Bahamas;

(b) The Chambers of Campbell-Ebong & Co., No. 51 Infant Road, Nassau The Bahamas;

NOTICE is hereby given that any person having dower or dower right of dower or any adverse claim or claim not recognized in the Petition shall on or before the 14 day of January A.D., 2023 file in the Supreme Court and serve on the Petitioner and the undersigned a statement of his claim in the prescribed form, verified by an affidavit to be filed therewith together with a plan of the area claimed and an abstract of his title to the said area claimed by him. Failure of any such person to file and serve a statement of claim on or before the 14 day of January A.D., 2023 will operate as a bar to such claim.

DATED this 24th day of November A.D., 2022

CAMPBELL-EBONG & CO. Chambers No.51 Infant View Road Nassau, The Bahamas

Attorneys for the Petitioner

the ability to take on more debt.”

Mr Anderson said commercial property acqui sitions in the Bahamian market were often difficult to close because sellers typ ically seek too high a price. “We struggle in a space where most people trying to sell want unrealistic prices,” he explained. “We just have to wait and see what comes up. We’re optimistic in terms of the Fund and opportunities. It’s a matter of seeing what’s out there.

“We’re one of the few buyers of commercial prop erties in the market. Much depends on where people are. Interest rate increases are going to be problem atic generally, as the cost of funds will go up if you are in the US dollar space. I think we can access capital at a reasonable price, so our opportunity to buy build ings might be different from how other people other see capital raising oppor tunities. We’ll see going forward whether people get impacted by rates or not.”

The Fund has previously mulled whether to diver sify its real estate portfolio away from sole reliance on office space, and into other commercial property types such as shopping centres. It also remains interested in solving downtown Nassau’s parking woes by redevelop ing the Registrar General’s former home in the Rodney Bain Building into a multistorey facility, complete with residential apartments on top.

“We’re still waiting to hear back as to whether there’s any interest on behalf of the Government,” Mr Anderson disclosed on the parking proposal. “It’s not a simple transaction for sure. We’ll wait and see.” The Fund’s results for the nine months to endSeptember 2022 showed net income was flat yearover-year at $771,197, although revenues were ahead by 7.6 percent at $2.386m.

Total expenses, though, jumped by 26 percent to $1.482m compared to

$1.176m the year before. This was driven largely by a 10.3 percent rise in landlord expenses to $1.065m, likely related to upgrades at the Bahamas Financial Centre, while legal and professional fees almost quadrupled to $210,345 due to the prefer ence share refinancing.

“We had some new leases become effective in the third quarter that are not yet reflected in rental income,” Mr Anderson told Tribune Business, referring to a Central Bank unit that moved into the Bahamas Financial Centre in Octo ber. “That will start to be reflected in rental income going forward. I think the fourth quarter will be a better quarter that reflects the space rented at the Bahamas Financial Centre.

“The total space occu pied is somewhere north of 80 percent; 81-82 per cent. I thought we would be around 85 percent, but we lost 3,000 square feet as another tenant decreased the amount of space they are renting. We were going to be around 85 percent; now we’re closer to 82 per cent. The Financial Centre is going well.”

Elevator renovations and window replacements are currently taking place

at the 100,000 square foot property, located at the corner of Shirley and Char lotte Streets in downtown Nassau, and Mr Ander son added: “The building should be significantly improved by the first quar ter of next year. It’s nice to see the building getting filled up.

“One Marina Drive, we struggle with that building trying to get new tenants. We’ve hired some help, and will see what we can do with it. We have a new employee, a broker, identi fying rental prospects and new opportunities. I think we’re ready to try and move forward.

“Our balance sheet is much stronger and rental income close to where we anticipated. It’s taken us longer to get where we are, but it always take longer to get tenants in buildings. We’re looking to get the Financial Centre up to the low 90s, around 90 per cent occupancy. The main opportunity is One Marina Drive. The building is only 30 percent occupied, so we have 15,000 square feet to rent.”

N O T I C E

FCC PATRIMONIAL LTD. (In Voluntary Liquidation)

Notice is hereby given that the above-named Company is in dissolution, commencing on the 21st day of November 2022. Articles of Dissolution have been duly registered by the Registrar. The liquidator is (Amicorp Bahamas Management Limited) whose address is Bahamas Financial Centre, 3rd Floor, Shirley & Charlotte Street, P.O. Box N-4865, Nassau, Bahamas.

Dated this 21st day of November 2022

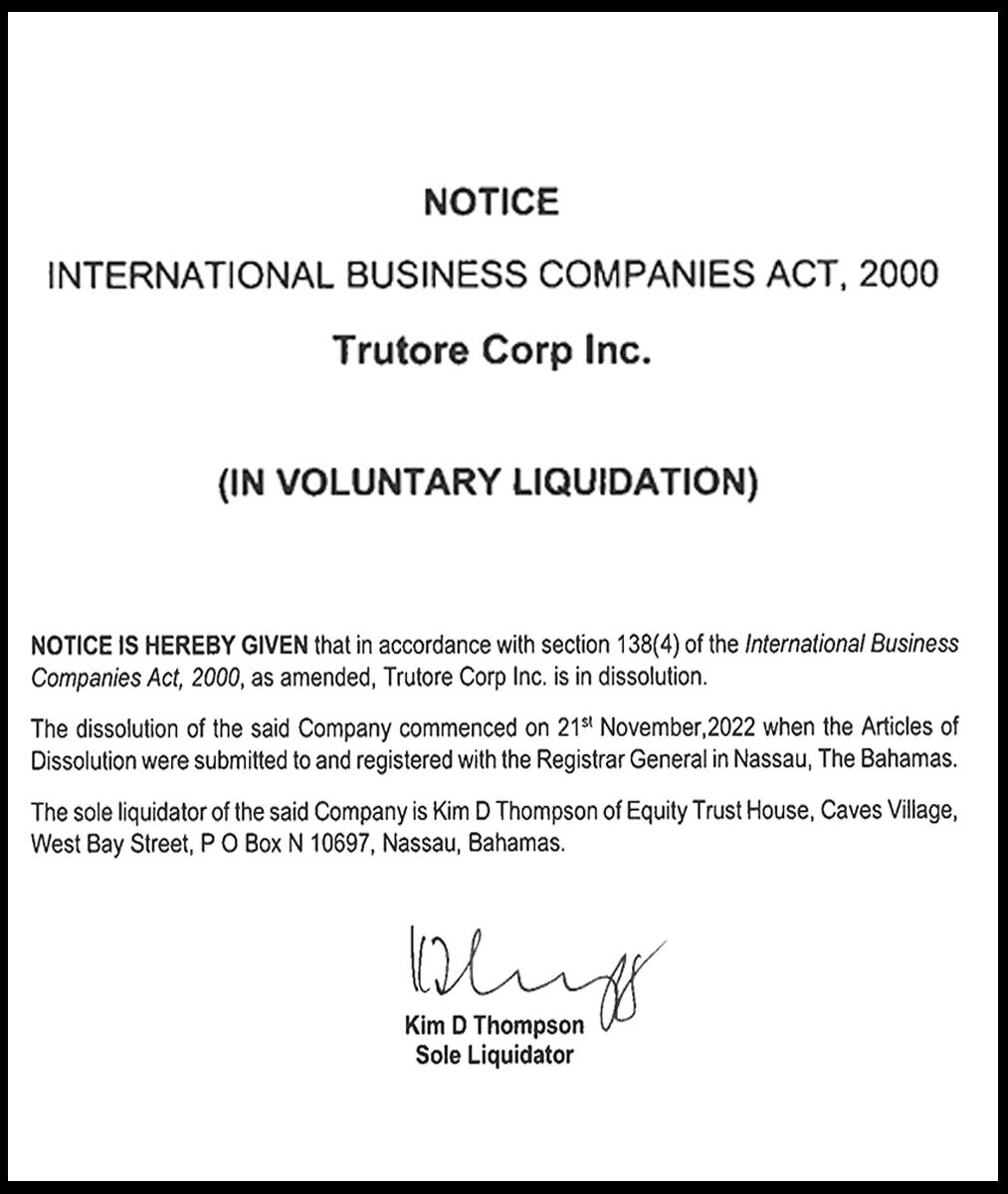

INTERNATIONAL BUSINESS COMPANIES ACT, 2000 QUANTUM INVEST LTD.

In Voluntary Liquidation

NOTICE is hereby given that in accordance with Section 138(4) of The International Business Companies Act, 2000, QUANTUM INVEST LTD. is in dissolution.

The date of commencement of the dissolution was the 22nd day of November A.D., 2022.

Mr. Michael C. Miller, P.O. Box EE-17971, Nassau, Bahamas is the liquidator of Quantum Invest Ltd.

Michael C. Miller Liquidator

(AMICORP BAHAMAS MANAGEMENT LIMITED) LIQUIDATOR

N O T I C E

JPM MOTORSPORT INC. (In Voluntary Liquidation)

Notice is hereby given that the above-named Company is in dissolution, commencing on the 21st day of November 2022. Articles of Dissolution have been duly registered by the Registrar. The liquidator is (Amicorp Bahamas Management Limited) whose address is Bahamas Financial Centre, 3rd Floor, Shirley & Charlotte Street, P.O. Box N-4865, Nassau, Bahamas.

Dated this 21st day of November 2022

(AMICORP BAHAMAS MANAGEMENT LIMITED) LIQUIDATOR

Notice is hereby given that all persons having any claim or demand against the above Estate are required to send their names, addresses and particulars of the same certified in writing to the undersigned on or before the 6th day of December, A.D., 2022, and if required, prove such debts or claims, or in default be excluded from any distribution; after the above date the assets will be distributed having regard only to the proved debts or claims of which the Executrix shall then have had Notice.

And Notice is hereby given that all persons indebted to the said Estate are requested to make full settlement on or before the aforementioned date.

WHITE LAW CHAMBERS Attorneys for the Executrix Building 9A Village Road P.O.Box SS-19619 Nassau, The Bahamas

PAGE 8, Thursday, November 24, 2022 THE TRIBUNE

PAGE B1

In the Estate of DEBORAH ELIZABETH RAINE late of #29 Harmony Hill off Village Road in the Eastern District of the Island of New Providence one of the Islands of the Commonwealth of The Bahamas, deceased.

NOTICE

Beware the pitfalls of worker termination

FROM PAGE B2

written or any other form, it can be a violation that warrants termination.

Substance abuse Substance abuse includes using alcohol or any other illegal drugs in the work place. Some businesses may also perform random drug tests to ascertain if employ ees are abusing drugs outside the workplace.

Damaging property Property damage might include intentionally break ing equipment or company property.

Falsifying records

The specifics of records falsification is both an ille gal and dismissal offence. Depending on the offence,

the human resources rep resentative might issue a notice of termination (pink slip) several days before the employee’s last day of work.

Fired employees are enti tled to certain rights under the Employment Act and other laws following their termination. While the spe cifics may vary depending on the country, some of the more common entitlements an employee should inquire about before receiving are a final pay cheque, extended health insurance, character reference, continuing bene fits and severance pay. The National Insurance Board (NIB) must also be notified so they receive unemploy ment benefits.

By and large, every employee deserves a fair, honest and transparent pro cess when being terminated from a company. Being aware of all intricacies can result in a smoother transi tion. Until we meet again, fill your life with memories rather than regrets. Enjoy life and stay on top of your game.

NB: Columnist welcomes feedback at deedee21bas tian@gmail.com

ABOUT COLUMNIST: Deidre M. Bastian is a pro fessionally-trained graphic designer/brand marketing analyst, author and certi fied life coach

RESEARCHERS: AI IN CONNECTED CARS EASED RUSH HOUR CONGESTION

By TRAVIS LOLLER Associated Press

AS millions of people travel the interstates this Thanksgiving, many will encounter patches of traf fic at a standstill for no apparent reason — no construction or accident. Researchers say the prob lem is you.

Human drivers just don't do a good job of navigating dense traffic conditions, but an experiment using artifi cial intelligence in Nashville last week means help could be on the way. In the experi ment, specially equipped cars were able to ease rush hour congestion on Inter state-24, researcher Daniel Work said on Tuesday. In addition to lessening driver frustration, Work said less

stop-and-go driving means fuel savings and, by exten sion, less pollution.

The professor of civil and environmental engineering at Vanderbilt University is one of a group of engineers and mathematicians from universities around the U.S. who have been studying the problem of phantom traffic jams after a simple experiment in Japan a dozen years ago showed how they develop. Researchers there put about 20 human drivers on a circular track and asked them to drive at a constant speed. Before long, traffic went from a smooth flow to a series of stops and starts.

"Phantom traffic jams are created by drivers like you and me," Work explained. One person taps the brakes for whatever reason.

The person behind them takes a second to respond and has to brake even harder. The next person has to brake even harder. The wave of braking con tinues until many cars are at a standstill. Then, as traffic clears, the drivers accelerate too quickly, causing more braking and yet another jam.

"We know that one car braking suddenly can have a huge impact," Work said.

Last week's experiment showed that a few cars driv ing slowly and steadily could have an impact as well, for the better.

The experiment utilized 100 cars that travelled in loops on a 15-mile section of I-24 from about 6 a.m. to 9:45 a.m. each morning.

THE TRIBUNE Thursday, November 24, 2022, PAGE 9

By KEN SWEET AP Business Writer

THE company tasked with locking down the assets of the failed cryp tocurrency exchange FTX says it has managed to recover and secure $740 million in assets so far, a fraction of the potentially billions of dollars likely missing from the company’s coffers.

The numbers were dis closed on Wednesday in court filings by FTX, which hired the cryptocurrency custodial company BitGo hours after FTX filed for bankruptcy on Nov. 11.

The biggest worry for many of FTX’s custom ers is they’ll never see their money again. FTX failed because its founder and former CEO Sam Bankman-Fried and his lieutenants used customer assets to make bets in FTX’s

closely related trading firm, Alameda Research. Bank man-Fried was reportedly looking for upwards of $8 billion from new investors to repair the company’s bal ance sheet.

Bankman-Fried “proved that there is no such thing as a ‘safe’ conflict of inter est,” BitGo CEO Mike Belshe said in an email.

The $740 million figure is from Nov. 16. BitGo estimates that the amount of recovered and secured assets has likely risen above $1 billion since that date.

The assets recovered by BitGo are now locked in South Dakota in what is known as “cold storage,” which means they’re cryp tocurrencies stored on hard drives not connected to the internet. BitGo provides what is known as “qualified custodian” services under South Dakota law. It’s basi cally the crypto equivalent

PUBLIC NOTICE

INTENT TO CHANGE NAME BY DEED POLL

The Public is hereby advised that I, GEORGANA YOUNG AND GEORGINA CURTIS of #7 Aloe Road, Winton Meadows, Nassau, Bahamas, intend to change my name to GEORGIANA CURTIS If there are any objections to this change of name by Deed Poll, you may write such objections to the Chief Passport Officer, P.O.Box N-742, Nassau, Bahamas no later than thirty (30) days after the date of publication of this notice.

of financial fiduciary, offer ing segregated accounts and other security services to lock down digital assets.

Several crypto compa nies have failed this year a s bitcoin and other digital currencies have collapsed in value. FTX failed when it experienced the crypto equivalent of a bank run, and early investigations have found that FTX employees intermingled assets held for custom ers with assets they were investing.

“Trading, financing, and custody need to be differ ent,” Belshe said.

The assets recovered include not only bitcoin and ethereum, but also a collection of minor cryp tocurrencies that vary in popularity and value, such as the shiba inu coin.

California-based BitGo has a history of recovering and securing assets. The company was tasked with securing assets after the cryptocurrency exchange Mt. Gox failed in 2014. It is also the custodian for the assets held by the govern ment of El Salvador as part of that country’s experi ment in using bitcoin as legal tender.

FTX is paying Bitgo a $5 million retainer and $100,000 a month for its services.

Reputable and Growing Gaming Company, accepting resumes for Senior C#/.net Developer

Essential Duties & Functions: (Includes but not limited to)

•

•

• To work alongside

Technical Product Manager team to set the roadmap, aligning all programming resources behind a common goal Work with external technical partners to ensure best practice is being followed and provide support while internalizing much that legacy knowledge to provide redundancy

• Work with UI/UX resources to ensure the technical feasibility of designs

• Develop API for new lottery games to enable them to do integrated into 3rd party RGS Create all API documentation.

•

and inquisitive mind set with the ability to translate business cases and analysis into tangible outcomes

• High levels of commitment and enthusiasm

• Interest in and knowledge of the latest technology and media trends

• Highly organized and self motivated, with a desire to see a job through to conclusion

• Excellent communication skills, both verbal and written and comfortable operating at all levels

• High proficiency in use of MS Excel and Office suite in general

• Ability to be proactive and work with minimal supervision

• Degree in Computer Science

PAGE 12, Thursday, November 24, 2022 THE TRIBUNE

IN CRYPTO ASSETS RECOVERED IN FTX BANKRUPTCY SO FAR

$740M

THE FTX Arena name is still visible where the Miami Heat basketball team plays Saturday, Nov. 12, 2022, in Miami. Lawyers for FTX disclosed Tuesday that a “substantial amount” of assets have been stolen from the accounts of the collapsed cryptocurrency exchange, diminishing the odds that its millions of investors will get their money back.

Photo:Marta Lavandier/AP

Must have experience in building and leading technical teams within a lean/agile development environment within the Gaming industry ideally with exposure to the B2B world Strong knowledge of the NET framework, C#, OOP and SQL a must • Also Java, HTML5, ASP NET, Web API, MVC / MVVM, JSON • Familiarity with various design and architectural patterns • Ability to work with turn basic requirements and user stories into meaningful, reliable tasks • A background in Sports betting and/or Lottery industry with the ability to output technical design documents suitable for use by 3rd parties Ability to maintain a good balance between short term delivery and longer term planning • An analytical

Interested candidates are required to possess the following managerial skills and qualifications: Interested qualified candidates may submit their resume via email to info@242careers.com Deadline for submissions December 9th, 2022 Only successful candidates will be contacted.

To work alongside the Technical Product Manager to develop new lottery betting products for the B2B market, translate user stories and use cases into functional applications Lead the technical delivery of new products from concept and discovery through to launch, working with existing external teams to maximize code re use where appropriate

internal and external development resources to ensure you deliver engaging experiences for our customers

Work with

the

Holiday cornucopia: NY produce market supplies the goods

By BOBBY CAINA CALVAN Associated Press

IT was the wee hours of the morning, and the docks at New York’s largest pro duce market were bustling in the cold. Thanksgiv ing was inching closer, and sacks of onions, potatoes and carrots were flying off the shelves.

Amidst the whir, buyers and sellers were finalizing deals on tomatoes, man goes and lettuce. Trucks stood ready to haul away the bounty — a cornuco pia of fruits and vegetables destined for supermarket produce aisles, household refrigerators and, eventu ally, millions of mouths across the Northeast during the gluttonous holidays.

“This time of year is our busiest. We have Thanks giving, we have Christmas and New Year’s. All of these are very big family and big-eating holidays,”

said Stefanie Katzman, the executive vice president of S. Katzman Produce, one of the country’s largest and oldest produce dealers, which operates at the Hunts Point Produce Market.

The market is a sprawling collection of wholesalers that make it the nation’s busiest distribution center for fruits and vegetables, responsible for more than 60% of the daily stock for New York City and feeds over 30 million custom ers, according to another Hunts Point wholesaler, E. Armata Inc.

Thanksgiving is espe cially busy time of year because the quintessentially American feast is widely celebrated across the United States.

“Our market as a whole does about three times as much business as normal on a day like today,” Katz man said while leading a tour Tuesday morning of her company’s cavernous

warehouse, which extends a quarter mile (0.4 kilome ters) and room for produce across nearly two football fields.

In one huge room, the whiff of onions filled the cold air. In another, the scent of berries wafted through the room — although Katzman’s biggest seller, strawberries, were in short supply because of inclement weather that wreaked havoc on the growing season.

“Our market is really unique. It’s kind of like the stock market, but a little bit more intense. Because our ‘stocks’ are perishable, we can’t hold on to them for too long hoping they go up in value,” Katzman said.

Not only can the place be likened as a stock market, but it is also a Grand Cen tral station of sorts with delivery trucks in and out of the Bronx facility.

In all, Hunts Point’s wholesalers distribute 2.5

billion pounds of produce a year, with about 30 mil lion pounds having moved on Tuesday alone. The pro duce ends up at places like Whole Foods, high-end

grocers and specialty markets, as well smaller mom-and-pop outlets.

Michael Rubinsky, a buyer from Market Basket, a gourmet grocery, makes

VACANCY

the hour’s drive from Frank lin Lakes, New Jersey, three times a week to inspect the goods.

“I come for the basics — everything like celery, lettuce, strawberries and potatoes — but quality is No. 1,” he said. “I check the quality and load everything on the truck.”

Charlie Mule, one of Katzman’s produce sales men, said consumers don’t realize where their produce comes from.

“You’ve eaten our stuff without you even know ing you’ve eaten our stuff,” said Mule. “If you go to a restaurant or store you probably don’t realize the whole scope of how it got there before you put it in your refrigerator or on your plate.”

LITIGATION ASSOCIATE (ABACO OFFICE)

Higgs & Johnson, a full-service corporate and commercial law firm serving clients around the globe, is seeking a qualified Litigation Associate for our expanding Abaco location.

Candidates must possess:

- Minimum three (3) years’ experience

- Specialization in the area of real property and commercial law.

- Demonstrated ability to work independently

- Possess thorough working knowledge and technical competence in the areas mentioned

Qualified candidates interested in this exciting and rewarding opportunity, should forward their resume to dbarnes@higgsjohnson.com by Monday, December 5, 2022. Only qualified, short-listed applicants will be scheduled to interview

THE TRIBUNE Thursday, November 24, 2022, PAGE 13

A CLIENT walks at the onion section to shops at S. Katzman Produce inside the Hunts Point Produce Market on Tuesday, Nov. 22, 2022, in the Bronx borough of New York. Hunts Point's wholesalers distribute 2.5 billion pounds of produce a year, with about 30 million pounds having moved on Tuesday alone. The produce ends up at places like Whole Foods, high-end grocers and specialty markets, as well smaller mom-and-pop outlets.

Photo:Andres Kudacki/AP

AVERAGE LONG-TERM US MORTGAGE RATE SLIPS TO 6.58%

By ALEX VEIGA AP Business Writer

THE average long-term U.S. mortgage rate has edged lower for the second time in as many weeks, though it remains more than double what it was a year ago —- a significant hurdle for many would-be homebuyers.

Mortgage buyer Freddie Mac reported Wednesday that the average on the benchmark 30-year rate fell to 6.58% from 6.61% last week. A year ago the aver age rate was 3.1%.

The rate for a 15-year mortgage, popular with those refinancing their

homes, fell to 5.90% from 5.98% last week. It was 2.42% one year ago.

Late last month, the average long-term U.S. mortgage rate breached 7% for the first time since 2002. It climbed to 7.08% again earlier this month, but has pulled back in the two weeks since.