Bahamas liquidators detect ‘serious fraud’ signs at FTX

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

FTX’s Bahamian provi sional liquidators have yet to gain control of all its assets amid signs that “serious fraud and mismanagement” may have caused the group’s col lapse, it has been revealed.

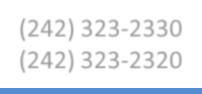

Brian Simms KC disclosed in a November 15, 2022, affi davit filed with the southern New York federal bankruptcy court that the provisional liquidators presently cannot determine the financial posi tion of FTX Digital Markets, the group’s Bahamian subsidi ary, because they lack access to the necessary documents and other information.

The Lennox Paton senior partner, who is working with PricewaterhouseCoopers (PwC) duo, Kevin Cam bridge and Peter Greaves, on FTX Digital Markets’ provisional liquidation made the disclosures in legal fil ings requesting that the US court recognise them and

the Bahamian liquidation as “a foreign main proceed ing” under American federal bankruptcy laws.

This will affirm the trio as FTX Digital Markets’ foreign representatives in the US, and thus enable them to secure bank accounts and other assets; trace money flows; issue any subpoenas that are necessary; and obtain all rel evant documents that will aid with the Bahamian sub sidiary’s likely full liquidation and winding-up.

And the Bahamian provi sional liquidators’ filings also hint at a potential battle for control of FTX’s insolvency

proceedings, and the group’s remaining assets, with the Chapter 11 bankruptcy pro tection proceedings initiated by the failed crypto exchange last Friday.

Those proceedings are before the Delaware federal bankruptcy court, and Mr Simms’ affidavit alleged that only he could have authorised the Chapter 11 filing given his appointment as provisional liquidator by the Bahamian Supreme Court the day prior. Such permission was not granted, and he “rejects the validity” of any efforts to place FTX’s affiliates in Chap ter 11 protection.

Mr Simms argued that con trol of FTX Digital Markets and the crypto exchange’s worldwide operations resided in The Bahamas since Sam Bankman-Fried, its cofounder and chief executive until last Friday, together with senior management all resided here.

As a result, the focal point of efforts to wind-up FTX in an orderly fashion should be The Bahamas rather than the

Sebas: $6.4m Abaco dome contract leaves ‘bitter taste’

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

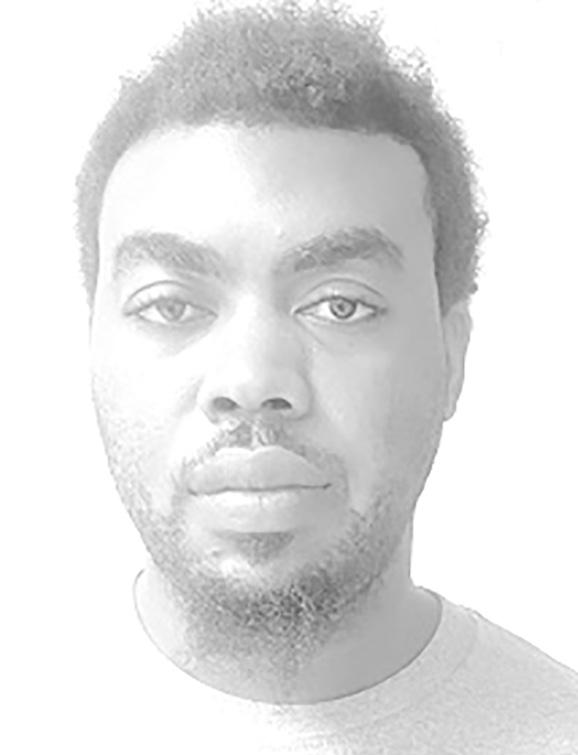

SEBAS Bastian last night said his Brickell Management Group (BMG) had “a bitter taste in our mouth” after losing money on the $6.4m contract to construct 213 dome homes in Abaco post-Hurri cane Dorian.

The Island Luck principal told Tribune Business that Brickell was still owed funds by the Government after seeking to perform what he branded “a national service” through acquiring - then installing - “a massive housing solution” in the aftermath of the devasta tion inflicted by the Category Five storm.

He added that constant changes demanded by the Government to “the scope

of work”, as well as the fail ure to make timely payments to Brickell, led to the group walking away from the dome home construction deal. Mr Bastian, though, said the group handed over all the construc tion materials it had imported to the Government’s agencies, and provided invoices that could account “for every single screw”.

‘Not out of woods’ despite lowest deficit for 10 years

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE Prime Minister yes terday warned Bahamians “we are not yet out of the woods” as he hailed the lowest first quarter fiscal deficit “in more than ten years”.

Philip Davis KC, address ing the House of Assembly after the deficit for the three months to end-September 2022 shrank by some 85 percent year-over-year, urged that “we must not lower our guard” despite the improved outturn given that multiple global head winds and economic risks confront The Bahamas.

The deficit, which measures by how much

government spending exceeds its tax and fee income, contracted from $136.4m in the three months to end-September 2021 to just $20.6m for the 2022-2023 fiscal year’s first quarter. The marked improvement was driven

BTC revenue growth slows to only 1.3%

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE Bahamas Telecom munications Company’s (BTC) year-over-year rev enue growth slowed to just 1.3 percent year-over-year for the 2022 third quarter even though it remained ahead of prior year com paratives for the first nine months.

The Bahamian carrier’s ultimate parent, Liberty Latin America (LiLAC), unveiling its quarterly and year-to-date results for the nine months to end-Sep tember 2022, revealed that BTC’s top-line income grew

by less than $1m for the former period when meas ured against 2021 figures.

Revenues for the three months to end-September were just 1.3 percent higher year-over-year at $48.4m, as opposed to $47.8m in the prior year’s third quarter. For the first nine months, BTC’s revenues are 2.8 percent ahead of 2021 at $144.5m compared to $140.5m in 2021. The year-over-year top line rise is some $4m, with the car rier likely on course to deliver full-year revenue of between $190m and $200m with the busier Christmas

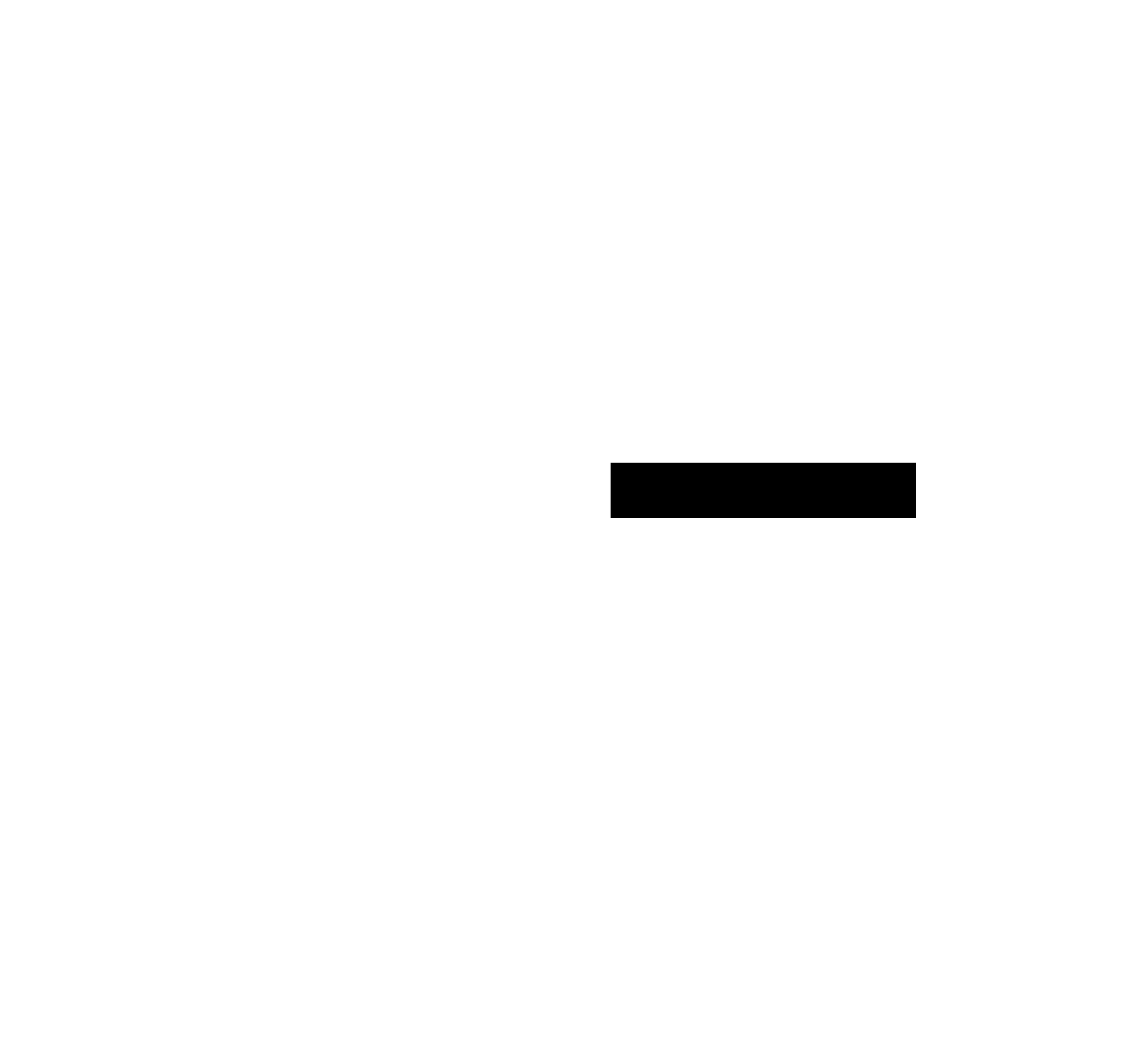

Pintard says minister ‘misled House’ on BPL fuel hedging

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

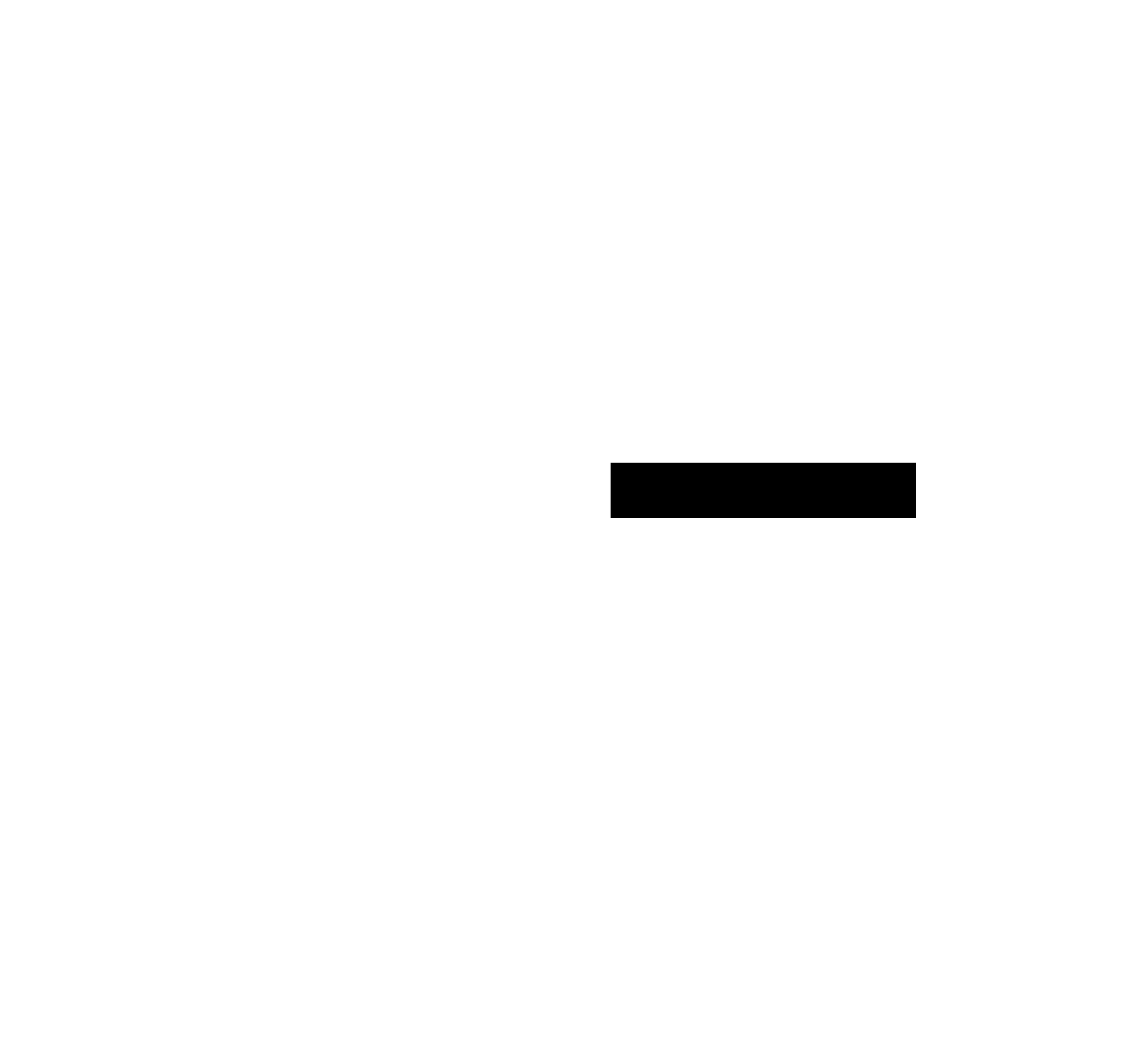

THE Oppo sition’s leader yesterday accused a Cabinet minis ter of “misleading Parliament” after he admitted the Davis adminis tration rejected proposals “that had the poten tial to save the Bahamian people $100m”.

Michael Pintard yesterday told Tribune Business that himself and other Opposition MPs were left “stunned” after Alfred Sears KC, minister of works and utilities, conceded that the Ministry of Finance - headed by Prime Minister Philip Davis KC - had dismissed recommendations to continue the trades underpinning Bahamas Power & Light’s (BPL) fuel hedging initiative as “not in the interests of the country at that time”.

The Free National Movement (FNM) leader said that apart from placing the blame on the Ministry of Finance, and seemingly throwing the Prime Minister under the proverbial bus, Mr Sears had also admitted that which he and Mr Davis have spent weeks denying - that they ever saw, and/or reviewed, recommendations to execute the rolling series of BPL fuel pur chases that were scheduled for September and December 2021.

Executing these trades would have secured BPL extra fuel volumes at below-market prices, just as global oil costs were starting to spike, enabling it to keep its fuel charge in a

business@tribunemedia.net THURSDAY, NOVEMBER 17, 2022

SEE PAGE B8

SEE

SEE PAGE B5

PAGE B7

SEE PAGE B4

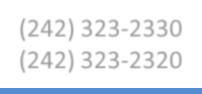

SEBAS BASTIAN

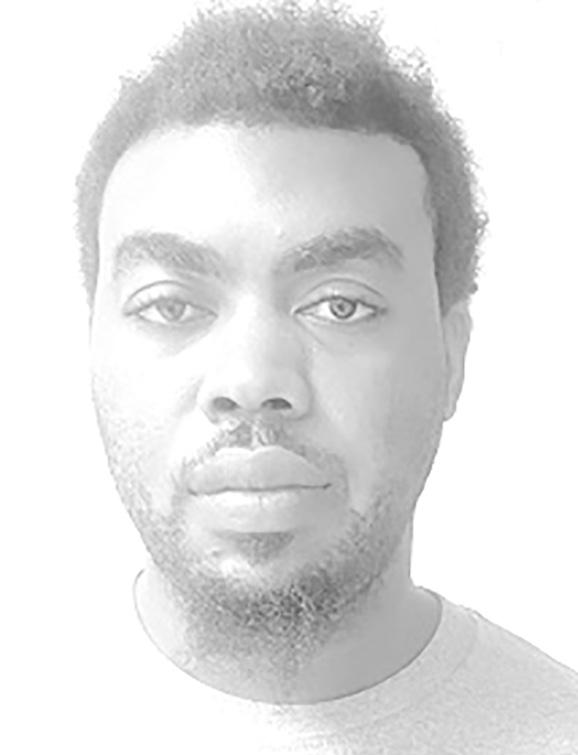

PHILIP DAVIS KC

• Yet to gain full control of local subsidiary’s assets • Legal filings hint

control

• SBF

law

collapse • Gov’t ‘rejected’ plan ‘to save Bahamians $100m’ • Sears: Strategy ‘not in best interest’ of country • Blames PM, finance for decision long denied

BRIAN SIMMS KC SEE PAGE

B13

at

battle with Chapter 11

probed for US

breaches before

$5.95 $5.97 $6.07 $5.62

MICHAEL PINTARD

GB’S WATER SUPPLIER IN $6.5M INVESTMENT

GRAND Bahama’s water supplier yesterday unveiled a $6.5m capital investment plan that began when its new financial year started on November 1, 2022.

Grand Bahama Util ity Company (GBUC), in a statement, said the new investments will sup port what it described as “a multi-year asset improvement plan focused on sustainability, climate change resiliency and auto mation” that will improve service quality for its clients.

It added that the fresh investment is in addition to GB Utility’s $5 million outlay on the three mil lion gallon reverse osmosis (RO) system, which was

commissioned in October 2021 to help overcome the wellfield contamination caused by Hurricane Dori an’s storm surge.

Philcher Grant-Adderley, GB Util ity’s chief operating officer, said: “There is no denying that Dorian had a longlasting impact – not only our infrastructure but, most critically, on our freshwater lens. Our biggest wellfield was inundated with over 20 feet of seawater for three days, and the consequences to the fresh water supply were devastating.”

GB Utility worked with several non-governmental agencies, and interna tional and local experts, and conducted numerous hydrological studies to find

new sources of freshwater in higher ground areas that were not impacted by the Category Five storm.

“It was important that we not only repair the system but ensure that it was built back in ways to give the utility greater resil iency should we experience another major hurricane or significant storm event,” Mrs Grant-Adderley said.

“We added 75 new wells, and were able to restore potability to 70 percent of the island by July 2020.

“As a result of the dev astating blow to our largest wellfield, we made the decision to invest in a $5m mobile reverse osmosis system that enabled us to return full potability to the island in December 2021.”

Mrs Grant-Adderley said reverse osmosis systems are extremely expensive to run, with the invest ment adding $2.5m to the utility’s annual operating costs. It also incurred $2m in uninsurable losses associ ated with Dorian, including more than $500,000 in costs to operate the free water depots for residents and 25 percent discounts given to residents for water usage. She added that GB Util ity has learned some tough lessons from Dorian, and has made changes to its business model to ensure the system’s health and longevity. While the water supplier has been able to achieve and maintain potability at World Health Organisation (WHO)

standards, it has also had to enact conservation measures to safeguard the freshwater lens for future generations.

This has included run ning the water pressure at lower levels than Grand Bahama residents are his torically used to, although still within the company’s level of service.

“We know what our cus tomers were accustomed to, and we understand their expectations,” said Mrs Grant-Adderley. “It has been a long journey, and GB Utility has been here with customers through it all. We promise to continue working hard to provide the quality service they deserve.

Realtor duo celebrate 50 years in industry

TWO Island Living real estate brokers are celebrat ing a combined half-century in the industry with both having begun their careers some 25 years ago.

Rachel Pinder and Chris tine Wallace-Whitfield began their careers when there were no online list ings, the Internet was in its infancy and cell phones still evolving. Both reflected on how the industry has changed over the past quarter-century, while also giving advice to new entrants.

“When I started in real estate, I was just doing residential property man agement,” said Ms Pinder. She switched to sales in 1999. The following year, the market soared. “You didn’t have to work real estate. Real estate came to you. It was booming,” she added.

Mrs Wallace-Whitfield agrees. “It was crazy,” she recalled. “It was like last year with the pandemic when you would just get calls and calls, and you could hardly keep up. Eve ryone wanted to buy in this market.”

Both these peaks, though 20 years apart, were caused by similar environments an external fear that drove business to a safe haven such as The Bahamas. In 2000, it was the fear of a technology collapse, Y2K, the millennium bug. In the end, nothing happened but that did not make the fear any less real, Mrs Wallace-Whitfield said.

She remembers, too, a boom in Grand Bahama where she started out in 1997. “Back then there were no Airbnbs, no Inter net. People would walk into the office with a cheque and hand you a deposit. They

wanted to buy a lot, mostly. I look back and it was so easy,” Mrs Wallace-Whit field said.

While property ‘shopping’ has now become easier for buyers,

real estate professionals have to work harder and smarter. “Today’s buyer is a lot savvier than they used to be,” said Mrs WallaceWhitfield, who served five terms as president of the

Bahamas Real Estate Asso ciation (BREA). “They’ve shopped around online, they know more about the market, they’ve done their research.”

“You have to be on your game 24/7. You have to demonstrate that they can they can trust your level of knowledge and you will steer them in the right direction.”

“We have to monitor trends, know what is going

“We are thrilled to say that, as part of this latest $6.5m capital invest ments programme, we are planning an additional state-of-the-art one-mil lion gallon per day reverse osmosis plant for the west ern district, continuation of the meter change-out programme, and strategic island-wide pipe and infra structure upgrades.

“Investments in these areas will not only allow us to improve the water pressure for all customers, particularly those in the western end of the island, but also provide more capacity for the island’s growth, especially with major investment projects coming on-stream.”

to happen before it even happens,” says Ms Pinder. Much of that information comes from specialising in a particular community or area of real estate.

Ms Pinder is principal broker for Island living, and her focus is on the management of the com pany and its agents based in Nassau, Exuma, Eleuthera and Grand Bahama. She specialises in sales and property management. Mrs Wallace-Whitfield’s focus is residential, and she holds multiple certifications, including in the luxury market. Based on qualifica tions and performance, she is one of only 20 percent of industry professionals to hold the title of “Realtor”.

Webinar to focus on economic resilience

A WEBINAR focused on how Bahamians can build economic resilience against the twin threats of inflation and possible recession will be held next Thursday from 10.30am to 12pm.

The event, organised by TCL Group, will be held on Zoom and is free to those who register beforehand. K. Karlos Mackey, president of MoneyMaxx Company, and principal of Prime Financing & Consulting, will host a panel featuring several financial services executives.

They are Gowon Bowe, Fidelity Bank (Bahamas) chief execu tive; Roger Archer, vice-president and district head, Scotiabank Baha mas; Molly MacIntosh, general manager, Bluff House Beach Resort & Marina, Green Turtle Cay, Abaco; and Chandrice Ferguson, second vice-pres ident, Bahamas Red Cross, who will discuss the topic from the social services standpoint.

Joan Albury, president of TCL Group, and chief organiser of the company’s webinars, said: “It pays to be prepared. A week ago, the following advice was offered in Forbes magazine, one of the major media

players in world of finance: ‘With a downturn in the near future, executives must prepare their compa nies to weather the storm and to come back stronger once it subsides’, so we’re preparing by offering Baha mians quality, balanced information, opinion and expert advice.

“It’s important to try to stay ahead of the game as much as we can, especially as our country’s economy is based primarily on tourism and, secondly, on financial services. Both industries are heavily dependent on the health of the economy of the US, our major trad ing partner and source of tourists.

“If there is growing con cern among Americans regarding the current infla tionary climate, we need to take heed and act. Forbes very fairly notes that while there are no guarantees in economics, ‘a recession appears likely to hit in full force by the second quarter of 2023, and many Ameri can families are already living the reality of a reces sion thanks to inflation and rising interest rates’.”

Those interested in attending can register at tclevents.com

PAGE 2, Thursday, November 17, 2022 THE TRIBUNE

DESPITE major changes in how real estate is viewed and acquired, the one constant re mains the strength of - and demand for - Bahamian prop erty, say Island Living Real Estate’s Christine WallaceWhitfield (left) and Rachel Pinder, as they each mark 25 years in the profession.

PM ORDERS FTX PROBE TO BE ‘OF HIGHEST ORDER’

By NEIL HARTNELL

THE Prime Minister yes terday said he has ordered that the probe into the col lapsed FTX crypto currency exchange “be of the high est order” given that The Bahamas’ integrity and rep utation as a financial centre is at stake.

Breaking the Govern ment’s silence on the spectacular implosion of its flagship digital assets inves tor, but saying very little, Philip Davis KC told the House of Assembly that no deficiencies had been uncovered in The Bahamas’ regulatory regime which could have prevented the exchange’s failure.

Asserting that “a key pri ority” is for The Bahamas to minimise any losses and fall-out caused by possible “misconduct” at FTX, he also seemingly downplayed one of history’s most-rapid corporate collapses by list ing multiple other company failures that have recently

occurred in the global digital assets and crypto space.

Mr Davis also made an attempt to dampen down debate and discussion of FTX’s implosion, urging persons to “tread care fully” in what they say given the implications for the country’s financial services standing and warning that persons who “seek to score cheap political points are no patriots”.

Voicing optimism that The Bahamas will emerge from the FTX debacle “with an enhanced reputation as a solid digital assets juris diction”, although some observers will doubtless beg to differ, the Prime Minister said the country’s existing regulatory regime - espe cially the flagship Digital Assets and Registered Exchanges (DARE) Actwas what had empowered the Securities Commission to act as swiftly as it had.

“There are reports that FTX has mismanaged cus tomer assets, and numerous investigations have begun into the reported actions

and actors in several coun tries, including by our own Securities Commission and the Financial Crimes Inves tigation Branch of the Royal Bahamas Police Force. I note that The Bahamas did not have sole oversight of FTX’s worldwide opera tion,” Mr Davis told the House of Assembly.

“I repeat that The Baha mas did not have sole oversight of FTX’s world wide operations. I have given directions that these proceedings and investiga tions are to be of the highest order and given precedence, given the amounts involved and because committed and rigorous oversight is of national importance.

“We will be co-ordinating these efforts with dulyappointed authorities in other jurisdictions. A key priority for us, of course, is the full and absolute pro tection of the rights and remedies of The Bahamas and our citizens, to minimise losses and to mitigate the overall impact caused by any misconduct.”

While global market capi talisation has fallen from a peak of $3trn to around $800m amid the so-called “crypto winter”, Mr Davis added: “I believe, as do many others, that blockchain technology and smart con tracts will continue to play an important and growing role in the world’s financial architecture.

“Further, I have every confidence that The Baha mas will emerge from the proceedings involving FTX – proceedings taking place here as well as in other juris dictions - with an enhanced reputation as a solid digital assets jurisdiction. Based on the analysis and understand ing of the FTX liquidity crisis to-date, we have not identified any deficiencies in our regulatory framework that could have avoided this.

“In fact, it was because The Bahamas already had in place a regulatory frame work for digital assets and digital asset businesses that the regulator was able to take immediate steps in order to protect the interests

of clients, creditors and other stakeholders globally.”

Mr Davis continued: “The Bahamas was already on track to update the regu latory framework before year’s end to address les sons learned as a result of this year’s ‘crypto winter’. No doubt, as the vari ous jurisdictions involved unravel the actions that led to this moment, we will be among the first jurisdic tions to gain and put to use valuable insights, allowing us to further strengthen our framework.”

Then, in what appeared an attempt to dampen dis cussion surrounding FTX’s implosion, the Prime Minis ter said: “What I would ask, Madam Speaker, is for all those who care about our country’s reputation to tread carefully when they speak about matters that are very complex and still unfolding.

“There is a reason that The Bahamas won inter national praise for the approach we have taken to date on digital assets, and there is also plenty of room

to have a healthy debate about the industry, but this is a story that has the world’s attention, and those who use it to mislead and score cheap political points are no patri ots. I invite all of us to tread carefully as we speak about this matter. Things are still unfolding.”

Suggesting that FTX was far from alone in its woes, Mr Davis said: “Numerous crypto tokens and compa nies around the world have collapsed in the past few months, including Terra/ Luna, Celsius, 3 Arrows Capital, and Voyager Digi tal, setting off a series of reverberations.

“There have been both booms and busts in the world of crypto, and this year has been a significant bust with total market capitalisation falling from $3trn to $800m or lower. The steep sell-offs and declining volumes have led analysts to describe this time as a ‘crypto winter’. Technology companies have laid off thousands. These are challenging times.”

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

A BAHAMIAN bakery yesterday said it plans to seek out more wholesale accounts after “explosive growth” in its school busi ness, with sales picking up heading into the Christmas season.

Gregory Collie, owner/ operator of the Cookie Caterer, told Tribune Business that sales have increased since the company began selling its products at wholesale. “We’re going to be, next year, explor ing a lot more wholesale accounts. So we’re going to be reaching out to more schools, restaurants, bars and anyone that sells

food or beverages,” he explained.

“We want to approach them to see if they’d be interested in carrying our cookies in their establish ment, and reselling them for profit and diversifying their menu offering. I’m doing really well with the schools now.”

Cookie Caterer has had both public and pri vate school accounts since it began operating in 2018, but this year has seen “explosive growth” in that segment as wholesale capacity picks up.

Mr Collie added: “We’re going to really put a focus on wholesale for next year. It’s not something brand new that we started just recently. Actually, we got into our first school in 2018 just before we opened our

first storefront location, but we didn’t really branch out for many schools at that time. We just really started reaching out to more schools at the beginning of this year and it’s been pretty successful. So we’re going to continue to pursue that.

“I’m still looking right now to diversify and expand our menu offering. We just

started offering fraps and sandwiches. Last year we introduced our homemade whipped ice cream, and so we want to continue to expand our menu offer ings and then branch out to more locations and future expansion.”

The additional stores will be “dialled back” in order for Mr Collie to focus on

the wholesale business, but he is eyeing a 2024 start for new locations. “Part of our strategy for next year is to get our cookies into all of the major grocery stores and gas stations,” he said.

“We’re still working on

getting the best possible packaging to get the best shelf life without compro mising the quality of the product. That’s a big chal lenge as well.”

THE TRIBUNE Thursday, November 17, 2022, PAGE 3

Tribune Business Editor nhartnell@tribunemedia.net

BAKERY ENJOYING ‘EXPLOSIVE GROWTH’ IN SCHOOL ACCOUNTS

10” X 10” OFFICE SPACES available at OFFICE SPACES FOR RENT Harbour Bay Plaza in the Peachy Flamingo Ltd. unit as of December 2022. Rent is set at $950.00 excluding VAT, per month All interested persons should contact Jason Pinder @ Jpinder@stargeneralnp.com NOW HIRING Culinary Manager Executive Chef Assistant General Manager Apply Today www.HR@THE-ISLAND-HOUSE.com

Sebas: $6.4m Abaco dome contract leaves ‘bitter taste’

The Government, though, failed to properly secure the construction materials that were handed over and some “got legs”, Mr Bastian added. This was confirmed by the Disaster Reconstruction Authority’s (DRA) accounts for the 19-month period between December 1, 2019, and endJune 2021, which revealed the disappearance is under investigation while the remaining materials have been deemed “obsolete” and totally written-off via a $1.525m one-time hit.

The audited financial statements, tabled in the House of Assembly yester day, revealed that Brickell received $4.6m - or 71.9 per cent - of the total contract

amount despite complet ing just 34 or 16 percent of the dome home target.

Mr Bastian’s group was also reported to be locked in back-and-forth nego tiations with the DRA over the remaining payments it alleges are owed.

The DRA’s deal with Brickell “did not require ‘specific performance’”, the audited financial state ments revealed, raising questions over the terms of the contract and whether it was sufficiently robust to prevent the contractor from walking away when it did on April 30, 2020, when the COVID pandemic and associated lockdowns were at their peak.

“At the time, only 34 of the 213 domes were fully

erected on homeown ers’ properties,” the DRA financials disclosed. “Of the contract sum of $6.4m, $4.6m had already been paid to Brickell in the pur chase of the domes and other materials that were to assist in the set-up of the ‘Family Relief Centre’ and toward the management of the contract at that stage.

“The balance of the con tract, $1.8m, remained in possession of the Bahamas Disaster Relief Fund under the control of the National Emergency Management Agency (NEMA). The DRA was later charged to manage the completion of the dome installations and undertook an exercise to determine the inventory of materials on hand and the

value received on the Brick ell contract, with a view to assessing any liability or recoverable amount that may exist.”

The Authority said it had determined that nothing further was due to Brick ell, but the latter’s “initial position was that they were owed $1.129m. They were prepared to settle for a sum of $1m, which was further reduced to $600,000. Nego tiations are continuing on this matter, but as at June 30, 2021, the DRA had a contingent liability to pay up to $600,000 to settle the claim by Brickell”. No pro vision, though, was made in the DRA’s accounts for the period.

Mr Bastian last night confirmed Brickell’s posi tion that it is “still owed money” by the Government over the Abaco domes, adding: “Who knows when we’re going to get paid?” While not revealing the sum involved, he added that the deal had been “a fixed price” contract where the Government paid “what ever it cost us” to acquire the construction materials, hire the labour and install the domes.

“As a result of the devastation of Hurri cane Dorian, few homes remained unscathed,” the DRA’s financial statements added. “The Government determined that a mas sive housing solution was required quickly. Following the presentation of sev eral proposals, the solution offered by Brickell Manage ment Group was accepted and a contract for $6.4m was agreed.”

This initially called for the installation of all infra structure, including site preparation, utilities (water, sewerage and electricity) and pathways together with construction of the 213 domes at a site in cen tral Abaco. Work began in October 2019, but within a month it was decided that the site “did not meet cer tain environmental criteria” and a second location. That, too, was ultimately deemed

unsuitable as Abaco resi

dents wanted the domes at the site of their destroyed homes.

Mr Bastian, confirm ing this version of events, said the domes homes were initially earmarked for an 18-acre site in Spring City. However, the Minnis administration “changed its mind” and decided only 50 would be located there, with no immediate decision taken on what to do with the remainder.

Brickell, he added, con structed the 34 at Spring City as the then-govern ment mulled what to do with the others - including whether to send some to Grand Bahama. It eventu ally decided to place them with individual homeown ers, but Mr Bastian said this plan did not suit Brick ell which had “mobilised to do one big job” and not individual installations where there would be gaps between construction starts.

“This was a time when there was zero to no housing on Abaco. The con struction team down there had limited housing, and had a limited time to do one job. Working in Abaco at that time was extremely difficult. Everything had to be barged in, there was no power,” Mr Bastian said.

“We only took that job to help and it was definitely outside our scope.

“They kept changing the scope of works, and we were not getting timely payments. It got to the point where we handed over the materials to them, said this is not what we were contracted for, and it would be better if you go and find a different contrac tor and pay us what you owe us up to that time. We’re a professional company, and couldn’t work under those conditions of confusion.

“We were under a con tract where every single thing we brought in we had invoices for. In all the invoices we had, we accounted for everything we bought and imported into the country, and handed over the materials

and invoices to them for every single screw. We were out-of-pocket for the management fees and some materials we bought on their behalf. My under standing is they left the materials on the site for sev eral months, and they got legs.”

Mr Bastian likened Brick ell’s involvement as akin to “national service”, and said it was “probably a mischar acterisation” to describe the domes deal as a contract. He said the $6.4m sum was supposed to cover labour costs, Brickell’s manage ment fee and materials including “trailers and trail ers of lumber”.

“We couldn’t continue to carry the load,” Mr Bastian told Tribune Business. “We were paying invoices on behalf of the Government and not being reimbursed in a timely fashion. We had a very small margin on this, only a 10 percent manage ment fee, and if I remember we weren’t even paid that.

“We lost money trying to help, which has left a bitter taste in our mouths over that. It’s unfortunate that three years later we’re still talking about domes. It’s the most incredible thing ever.”

John Michael Clarke, the DRA’s former chairman under the Minnis adminis tration, yesterday backed Mr Bastian by agreeing that the scope of work involving the dome homes “changed not once but twice”. He added, though, that before stepping down he believed the DRA had made a rea sonable settlement offer to Brickell over the payments it claims to be owed.

“The DRA reconciled the account, and a settlement of the Brickell account was proposed to Brickell. We did a full reconciliation of the account. At the time I left, the reconciliation was finished and, to the best of my knowledge, a settlement offer was made commen surate with the work they completed. The DRA, to me, made an equitable offer for the work they actually completed,” Mr Clarke said.

PAGE 4, Thursday, November 17, 2022 THE TRIBUNE

FROM PAGE B1

BTC revenue growth slows to only 1.3%

FROM PAGE B1

and Thanksgiving period ahead.

BTC’s subscriber num bers remained flat yet again during the 2022 third quar ter, with an increase of 200 mobile pre-paid customers more than offset by a 400 fall in the more lucrative post-paid segment. This made for a total mobile subscriber decline of 200 as BTC remains locked in fierce competitive battle for market share with its rival, Aliv.

On the fixed-line side, a 100 subscriber increase in Internet customers was out weighed by an 800-strong decrease on fixed-line voice, resulting in a net decrease of 700 fixed-line customers. Total fixed-line customer numbers for BTC was pegged at 5,200.

As a result of this slow, continued attrition and whittling away, BTC’s mobile subscriber base remained flat at 173,000 at end-September 2022. This consists of 141,900 pre-paid and 31,100 postpaid subscribers. On the TV, Internet and fixed-line voice side, it presently has some 72,300 total revenue generating units (RGUs).

These are split into 9,600 TV/video subscrib ers, 31,600 Internet clients and 31,100 fixed-line voice customers. This compares to 73,00 fixed-line revenue

generating units at endJune 2022, split between 31,500 broadband Inter net customers and 31,900 fixed-line voice subscribers, with 9,600 video/TV cli ents making up the balance then.

The figures illustrate the extent of the work that lies ahead for BTC’s newlyappointed chief executive, Sameer Bhatti, who took up his post only in September.

He recently told Tribune Business that the carrier will be increasingly relying on a fibre network roll-out that is 70 percent complete to drive revenue growth and market share.

“We’re looking to con tinue that roll out, and the fact that we’ve announced we’re continuing that rollout here in the fourth quarter and will do so through 2023,” he said.

“It’s not sufficient to have it in New Providence and have it in Grand Bahama, and to have it in Abaco and Exuma. We want to take it throughout the archi pelago.” BTC’s goal is that customers enjoy faster, better-quality broadband Internet and TV services when it completes the transition from its legacy copper infrastructure to fibre-to-the-home.

Mr Bhatti added that Cable Bahamas and Aliv are now following BTC’s lead in embracing fibre-to-the-home network

technology. “My perspec tive is we’re customer first. What are the needs of the customers? How do we super serve those needs?” he added.

“We have more speed right now. We have more value within our fibre offer ings as well as our post-paid, and we have every reason for our customers to con sider us to switch. So long as we stay on that path it’s good things for the Baha mian people and good things for the company.

“Strategy for revenue growth is about rolling fibre. That’s the future. Think about what we’ve all been through with the core of the pandemic. Inter net access is like oxygen to many people in our country, and so we’ve had a bit of a fast forward or pull forward of those experiences,” the BTC chief continued.

“To us, we know that the simultaneous usage within the home, be it for stream ing, be it for gaming, be it for video conferencing is only going to increase, and the bandwidth and the low latency that we enable with our fibre is key to enabling those future experiences. If we delight our customers, we meet their needs today and in the future, good things will follow. That said, we are growth-focused on growing the team, growing the network and strength ening management.”

SMALL BUSINESS CENTRE TO BOLSTER ‘ECOSYSTEM’

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

THE Small Business Development Centre (SBDC) yesterday said it is seeking to enhance the “ecosystem” it is develop ing to drive small businesses growth.

Samantha Rolle, the SBDC’s interim execu tive director of the SBDC, told a seminar hosted by the Bahamas Chamber of Commerce and Employers Confederation (BCCEC) that the agency is not dis regarding the domestic market as it seeks to nur ture local entrepreneurs and systems that support their micro, small and medium-sized enterprises (MSME’s).

She pointed to an “enhanced ecosystem”,

and further explained: “We understand that entre preneurship accelerates growth. We are frequently reminded of this from all aspects of local, regional and global perspectives. Evidence suggests MSMEs account for up to 70 percent of gross domestic product, so entrepreneurship must be a significant driver for our economy. It’s this vehi cle that drives investments to the Bahamas.

“I can say with sup port from established businesses, whether it’s through linkages, mentor ship, other in-kind support, newer entrepreneurs have an opportunity to create greater impact.”

Ms Rolle added: “All through this, entrepre neurship as a significant driver of our economic growth, and the culture of entrepreneurship through

education, more certainly banking policies, govern ment funding, and support from established businesses, lead to an enhanced eco system needed for future investments.”

“We at Access Accel erator believe a healthy, vibrant and well-supported entrepreneurial environ ment can easily address the challenges we face. That is why we exist.”

To-date the SBDC has approved and facilitated more than $73m in financ ing for over 19,000 clients across several sectors. The funding is also equally split between male and female entrepreneurs.

Leading Law Firm Seeking RECEPTIONIST

Responsibilities include: assisting the wider office with general administration and filing and providing an efficient and flexible service to our lawyers and support staff. The successful candidate should be adaptable, reliable and self-motived individual with some Receptionist experience, ideally gained within a law firm, or accountancy practice, and competent in the use of Microsoft Office software.

Requirements: Experience in the desired post, Competence with the Microsoft Office Suite and an ability to work with legal software. Outstanding interpersonal, time-management, and typing skills, excellent attention to detail and strong communication skills.

Please apply by email attaching current resume and cover letter outlining your suitability and salary expectations to legalrecruitment242@outlook.com

THE TRIBUNE Thursday, November 17, 2022, PAGE 5

ADVERTISE TODAY! CALL THE TRIBUNE TODAY @ 502-2394

BAHAMAS TELECOMMUNICATIONS COMPANY (BTC) HEADQUARTERS

Lawsuit accuses largest US meat producers of wage fixing

By COLLEEN SLEVIN Associated Press

THREE meat plant workers have filed a fed eral lawsuit accusing 11 of the United States' largest beef and pork producers of conspiring to depress wages and benefits.

The lawsuit, filed in fed eral court in Denver on Friday, seeks class-action status and alleges the producers have worked together since at least 2014 to keep workers' compensa tion lower than the market would allow, violating the Sherman Antitrust Act.

It was brought by two meat plant workers from Iowa and one from Geor gia but seeks to represent hundreds of thousands of other people who have worked in jobs from slaugh tering to production at the companies' collective 140 plants. Together the plants produce about 80% of the red meat sold to U.S. con sumers, according to the lawsuit.

The companies are JBS USA Food Company, Car gill Inc., Hormel Foods Corp., American Foods Group LLC, Triumph Foods LLC, Seaboard

Foods LLC, National Beef Packing Co. LLC, Iowa Premium LLC, Smith field Foods Inc., Agri Beef Co. and Perdue Farms Inc., along with some subsidiaries.

Cargill denied any wrongdoing.

"While we cannot com ment with specificity during the pendency of litigation, Cargill sets compensation independently to ensure that it pays fair and com petitive wages to employees in each of the company's plants," company spokes man Daniel Sullivan said.

Perdue Farms spokesper son Andrea Staub declined to comment, saying the company does not discuss pending lawsuits. Smithfield spokesperson Jim Monroe said the company has not had a chance to review the allegations and had no comment at this time. Rep resentatives of the other companies did not imme diately return emails and telephone messages seeking comment Wednesday.

Two consulting com panies that allegedly helped the meat producers exchange compensation information are also named as defendants in the lawsuit, which was filed by lawyers from Hagens Berman.

"Our firm has secured $195 million in the poultry processing industry for the same antitrust behavior. The meat industry's gravy train ends here," the law firm's managing partner,

GROUND Beef is on display in a market in Pittsburgh on Tuesday, July 12, 2022. A class-action federal lawsuit is accusing 11 of the United States’ largest beef and pork producers of conspiring to depress wages and benefits for its workers. The lawsuit was filed in federal court in Denver last week.

Gene J. Puskar/AP

Steve Berman, said in an announcement of the law suit on Wednesday.

The lawsuit alleges that the meat produc ers had secret meetings to discuss wages and com municated about them surreptitiously to avoid having any written records of the conversations.

PAGE 6, Thursday, November 17, 2022 THE TRIBUNE

ADVERTISE TODAY! CALL THE TRIBUNE TODAY @ 502-2394

Photo:

‘NOT OUT OF WOODS’ DESPITE LOWEST DEFICIT FOR 10 YEARS

largely by the economy’s continued post-COVID reflation and re-opening, and much more remains to be done to reduce a Baha mian national debt burden that is now more than $11.1bn.

“This deficit of $20.6m is the lowest first quarter defi cit in more than ten years,” Mr Davis told MPs, allowing himself a victory lap. “I’ll say that again: This is the lowest first quarter deficit in more than ten years. A new day has dawned in our Baha mas. We have been able to achieve this by holding fast to our commitment to fiscal prudence, and implementing sound policies to stimulate the economy and generate revenue....

“While the historically low deficit we have achieved is a great cause for celebra tion, I say to the Bahamian people as I have already said to members of my Cabinet: We are not as yet out of the woods. We have to remain prudent and disciplined. While the economy is now heading in the right direc tion, we must not lower our guard. World events remain unstable, and we have to remain vigilant in case there are other unforeseen future shocks to the global economy.”

Mr Davis said that despite soaring inflation, which increased by 30 basis points in September to hit 6.5 per cent on an annual basis in The Bahamas, and the cost of living crisis there are also continuing risks from global oil price volatility, the Rus sian invasion of Ukraine and the continued presence of COVID-19.

The Prime Minister spent much of his address dealing with the ongoing controversy surrounding the Government’s travel-related spending, which more than doubled during the 20222023 first quarter. “Outlays for travel and subsistence grew by $2.3m (122.7 per cent) to $4.2m for 26.8 percent of budget,” the Min istry of Finance’s own report disclosed.

While some increase in travel was expected follow ing the relaxation of COVID restrictions, and The Baha mas needs to make its presence felt on key issues on the world stage, there has been growing criticism - especially from Opposi tion circles - on the amount of time Mr Davis spends outside the country. Other concerns have focused on the size of government del egations and exactly who is permitted to travel at the taxpayer’s expense.

The Prime Minister yes terday insisted that when Cabinet ministers and offi cials travel “we do so for the good of The Bahamas and the betterment of the Bahamian people”. He added that “a significant portion of the travel spend” goes on inter-island travel in The Bahamas and visits abroad by public officials for increased training.

“The first quarter expend iture on travel is around 28 percent of the travel budget, marginally above the level of 25 percent for the year. This is not remarkable. Some quarters will be a little bit higher, others a little lower. But by year’s end it should be within budget,” Mr Davis said.

Acknowledging that it was critical to “show a return on that investment”, Mr Davis added that he would never have met the Inter national Monetary Fund’s (IMF) managing direc tor, Kristalina Georgieva, at the COP27 climate con ference in Egypt, where an agreement in principle was struck for the Fund to work with The Bahamas in devel oping blue carbon credits, had he not been on a New York Times climate change panel discussion with her.

And, in a nod to con cerns and criticisms over the recent Bermuda trip by himself, several Cabi net ministers and members of the Progressive Liberal Party (PLP), the Prime Min ister promised to crack down on the use of taxpayer monies to finance politicallyrelated travel.

“In relation to travel for public officials, we have

recently learned of two instances where travel was conducted for political pur poses rather than official business,” Mr Davis said, though not identifying the incidents or the persons involved. “Although there has been the long-stand ing practice across several administrations of reimburs ing such expenditure, I have instructed a tightening of this practice so as to avoid even the appearance of impropriety.

“In the two cases I men tioned, the sums of money involved were very small, but it is the principle itself which I think is important.”

“Central government’s operations for the first quar ter of the 2022-2023 fiscal year indicate a narrowing of the fiscal deficit to $20.6m from $136.4m in the year prior for the same period. This outcome is largely due to growth in revenue receipts while expenditure was contained due to the significant easing of extreme COVID-19 fiscal measures,” the Ministry of Finance said in its first quarter report.

“Mirroring the contin ued accelerating pace of the economic rebound, revenue receipts during the first three months of fiscal year 20222023 improved by $57.8m (9.7 percent) as compared to the same period of the prior year. At an estimated $654.3 million, total revenue stands at 23.3 percent of the Budget target.

“Year-to-date rev enue collections are consistent with pre-Dorian/ pre-COVID-19 fiscal rev enue trends as evidenced by first quarter 2018-2019 rev enue collections of $471.8m, representing 21.5 percent of 2018-2019 total revenue. The positive revenue per formance was supported by increases in tax revenue of $54.1m (10.4 percent) to $574.4m (23 percent of Budget) while non-tax rev enue firmed by $3.7m (4.9 percent) to $79.9m (25.8 percent of the Budget).”

On the spending side, the end of COVID-19 restric tions and support resulted in subsidy cuts for stateowned enterprises (SOEs)

and reduced social services support. “Government subsidies, which include transfers to governmentowned and/or controlled enterprises that provide commercial goods and ser vices to the public, narrowed by $16.7m (14.2 percent) to $100.5m, which equalled

24.6 percent of the Budget,” the Ministry of Finance said.

“Subsidies to public non-financial corporations declined by $20.5m (17.7 percent) to $95.7m. Owing to the ending of emergency orders and the reduced need for COVID-19 sup port, transfers tightened for Bahamasair ($2.7m); Water

and Sewerage Corporation ($4.7m); and the Public Hos pitals Authority ($13.4m).

“Subsidies to private enterprises and other sec tors rose by $3.9m (412.4 percent) to equal $4.8m owing to payment of the $4m equity contribution to Baha Mar, suspended during the prior year.” The end to COVID’s pandemic phase also coincided with a near$42m drop in social welfare benefits.

THE TRIBUNE Thursday, November 17, 2022, PAGE 7

PAGE B1

FROM

relatively low range of between 10.5-11.5 cents per kilowatt hours (kWh). This compares to the phased-in increases that will result in consumers using over 800 kWh paying a fuel charge that will be some 163 per cent higher between June and August next year, when consumption is at its peak.

Mr Pintard yesterday again slammed the failure to execute the trades, and preserve BPL’s fuel hedge and previous monthly charge, as “bad judgment by the Davis administra tion” and “a dereliction of duty” that was now set to cost the Bahamian people and businesses millions of dollars in extra, unneces sary costs that were entirely avoidable.

With the Government set to pay Shell some $90m

over a nine-month period to cover BPL’s fuel debts, run-up after the trades were not executed, Mr Pintard accused the Government of imposing a $100m burden “on the backs of the Baha mian people”. He described rising electricity costs as inflicting “pressure” and “anxiety” on Bahamian households already strug gling with the cost of living crisis.

Mr Sears’ response, in which he admitted much of what himself and the Prime Minister have sought to deny for so long, appeared to have been prompted by concerns that Mr Pintard would try to lay e-mails and other documents in the House of Assembly to prove his allegations over BPL’s fuel hedging initiative.

Seemingly trying to preempt and get in front of this, the minister replied: “What the honourable member has not divulged is a hedge.... First of all, BPL, it’s a determination by the Ministry of Finance.

The Ministry of Finance, in October [2021], made a determination that the proposal the honourable member is referring to was not supported.

“Only the Ministry of Finance can support using the Public Treasury’s money in an undertaking. It was not persuaded at that time, before the Ministry of Finance.. it was not in the interests of the country at that time.”

Then, referring to the Opposition leader, Mr Sears added: “The honourable member has a draft Cabi net paper. It’s addressed to

the minister of finance [Mr Davis]. [That] indicates where the determination is to be made. The draft Cabinet paper is addressed to the minister of finance for the minister of finance’s consideration.

“The minister of finance communicated that based on what was presented, it was not supported. That determination was commu nicated in October 2021. What is the relevance of this new revelation?” Mr Sears declined to speak further on the matter when approached by reporters at the House of Assembly yesterday.

The reasons and rationale for the Ministry of Finance’s decision not to execute the trades, and effectively pull the rug from under BPL’s fuel hedging initiative, was never explained by Mr Sears. However, it backs Tribune Business sources who have revealed that senior Ministry of Finance officials opposed the trades, believing that the hedging strategy was not optimal, could be done better and was effectively “a subsidy for hotels and rich people”.

Mr Pintard, meanwhile, seized on Mr Sears’ admis sion by arguing that it contradicted previous asser tions by both himself and the Prime Minister when they told previous House of Assembly meetings they were unaware of recom mendations to execute the trades.

“In this House I raised the question whether the member for Fort Charlotte (Mr Sears) and the Prime Minister; were they aware of the recommendations made? The member for Fort Charlotte has just con firmed what I asked several weeks ago; were you aware of the recommendations that had the potential to save the Bahamian people $100m?

“The member answered on his feet, and the Prime Minister. They said ‘No’, they didn’t receive any recommendations. The member for Fort Charlotte just admitted the minister of finance was fully aware and rejected the recommen dations. He admitted on his feet the minister of finance saw the recommendations and rejected them. He also indicated he rejected the recommendations.”

Mr Sears replied by launching into a long

explanation of how parlia mentary questions should be asked, adding that Mr Pintard was treating the matter “as if in a court of law”. He added: “I have checked with the financial secretary [Simon Wilson], and I have confirmed with the financial secretary that the documents which were provided were also pro vided to the minister of finance.

“The Ministry of Finance, it was considered and com municated that based on what was presented to the Ministry of Finance the proposal was not accepted. Questions were asked that were not addressed satis factorily. What the Ministry of Finance explained to me is that any commitment to a hedge strategy, BPL was not in a financial position to cause that itself.

“Through the IDB [Inter-American Develop ment Bank] and Ministry of Finance, both of which have the requisite techni cal capacity, they reviewed what was put forward and did not accept it. That was a determination by the Minis try of Finance.” Quite why the IDB would recommend against executing trades to support a hedging initiative it was instrumental in put ting in place was never fully explained.

Mr Pintard, pressing on with the attack, added: “What the member for Fort Charlotte should have been answering is a question asked of the min ister a month ago. The question is, one, whether the fuel charge increase was inevitable.

“Second, he indicated on his feet, and so did the Prime Minister, that they were unaware of any rec ommendations about the hedging programme. On their feet. The member for Fort Charlotte has con firmed not only was he

aware but the Prime Minis ter was aware.”

The Davis administration and BPL have repeatedly said the initial fuel hedging structure, put in place by the IDB in 2020, remains in place. This is correct. The December 2020 hedge cov ered a total 3.565m barrels of oil for BPL that were priced at $40 each and split into three tranches.

This transaction hedged 75 percent of BPL’s fuel needs for 2022, 50 percent of its requirements for 2023, and 25 percent of 2024’s needs via the IDB’s upfront hedge. These were were not hedged 100 percent because BPL needed to monitor global oil price movements so that it did not end up hedging at a price above market costs and thus end up losing substantial money. The Government, though, is not giving the full story. BPL was supposed to “backfill” the original IDB hedge by purchasing the extra fuel volumes to fully address its needs. This was to be done via the series of trades, known as call options, referred to by Mr Pintard that would have enabled BPL to obtain fuel - covering the 20 percent balance for 2022, 50 percent for 2023 and 75 percent for 2024 - at prices below thenprevailing oil market rates had they been executed.

It was these trades, sched uled to have been executed in tight windows in Septem ber 2021 and December 2021 just after the Davis administration took office, that were not carried out. As a result, BPL has increasingly been buying fuel at higher market rates with the fuel charge artifi cially held at 10.5 cents per kWh via the combination of government subsidies and $90m Shell non-payment. This can no longer be sus tained, and consumers must pay up as a result.

PAGE 8, Thursday, November 17, 2022 THE TRIBUNE

BPL

FROM PAGE B1

Pintard says minister ‘misled House’ on

fuel hedging

HIRING NOW A company is looking for an experienced accountant to take on the position of Financial Controller who will report to the CFO and management team. Duties include the following: • Supervise all activities and staff of the accounting department including accounts payable and receivable. • Review, analyse and provide monthly and yearly consolidated financial reports to senior management. • Developing financial reviews and providing investment and profitability advice • Quarterly VAT preparation and filing • Improving efficiencies and reducing costs across the business • Stakeholder management • Payroll processing • Working closely with management or executive teams to share reports and analysis findings • Prepare annual budgets • Establishing and maintaining internal control guidelines, policies and procedures for budget accounting, cash and credit management, administration, and other activities. • Serve as liaison agent with the bank if needed. • Prepare analysis for insurance when necessary QUALIFICATIONS/REQUIREMENTS • At least 5 years experience in a supervisory role in the accounting/finance field • Bachelor’s Degree in Accounting/Finance • CPA designation • Computer skills: MS Office, QuickBooks. • Strong controls background. • Knowledge of Bahamian culture, laws, customs, fiscal policies. • Strong analytical and organizational skills • Management and Leadership skills. • Ability to work in a fast-paced environment and meet reporting deadlines. • Communication skills • Attention to detail Email resume to chinainvestment1969@hotmail.com

ALFRED SEARS KC

EUROPEAN CENTRAL BANK: RECESSION ‘HAS BECOME MORE LIKELY’

By DAVID MCHUGH AP Business Writer

THE European Central Bank sees an increased likelihood of a recession in the 19 countries that use the euro currency, warning that soaring energy prices and high inflation fed by Russia’s war in Ukraine have raised risks for bank losses and turmoil on finan cial markets.

“People and firms are already feeling the impact of rising inflation and the slowdown in economic activity,” ECB Vice Presi dent Luis de Guindos said.

As the bank released its twice-yearly assessment of eurozone financial stability on Wednesday, de Guindos said that “risks to financial stability have increased, while a technical recession

in the euro area has become more likely.”

A chart published with the report indicated an 80% chance of recession in the eurozone and United Kingdom in the year ahead and a 60% probability in the U.S. Many economists and the European Union’s executive Commission have already predicted a techni cal recession for the last three months of year and the first part of next year as sky-high utility prices and food costs rob consumers of purchasing power.

A technical recession is two or more consecutive quarters of declining eco nomic output. Economists on the eurozone’s business cycle dating committee, however, use a broader range of information to determine recessions, such as unemployment

figures and the depth of the downturn. The eurozone economy eked out 0.2% growth in the July-Septem ber period.

Economists’ expectations are that growth should resume next spring as infla tion falls from peak levels and as wintertime pres sure on natural gas supplies eases.

High inflation is spread ing its effects through the economy, raising the like lihood that banks will see more losses from loans and that companies won’t be repaid, the ECB said in the report. Meanwhile, uncertainty about how high and how long infla tion will go “has heightened the risk of disorderly asset price adjustments in finan cial markets.” Beyond that, pressure has grown on people, companies and

governments that are more in debt than others.

Inflation, which came in at an annual rate of 10.7% in the eurozone in Octo ber, has been fed by Russia cutting off most natural gas to Europe amid the war in Ukraine. That sent natural gas prices sharply

higher and raised the price of electricity and industrial processes that use lots of heat or natural gas.

Politicians

gas

THE SUN sets behind the colefired power plant ‘Scholven’ of the Uniper energy company in Gelsenkirchen, Germany, Oct. 22, 2022. The European Union’s executive commis sion slashed its forecast for economic growth next year. It says that the 19 countries that use the euro currency will slide into recession over the winter as peak inflation hangs on for longer than expected and high fuel and heating costs erode consumer purchasing power.

exporter Gazprom has cited technical difficul ties and a refusal by some importers to pay in rubles. Before the war, Europe and in particular its larg est economy, Germany, depended on Russia as a major supplier of both oil and natural gas.

THE TRIBUNE Thursday, November 17, 2022, PAGE 9

call the cutoff an attempt by Russian President Vladimir Putin to undermine European governments’ support for Ukraine. Russian

Photo:Michael Sohn/AP

US RETAIL SALES ROSE 1.3% LAST MONTH, A SIGN OF RESILIENCE

By CHRISTOPHER RUGABER AP Economics Writer

AMERICANS stepped up their spending at retail ers, restaurants, and auto dealers last month, a sign of consumer resilience as the holiday shopping season begins amid painfully high inflation and rising interest rates.

The government said Wednesday that retail sales rose 1.3% in October from September, up from a flat

reading in September from August. The increase was led by car sales and higher gas prices. Still, excluding autos and gas, retail spend ing rose a solid 0.9% last month.

Strong auto sales may have been supercharged by the arrival of Hurricane Ian in late September, which destroyed up to 70,000 vehicles, according to econ omists at TD Securities.

Even adjusting for infla tion, spending increased at a solid pace. Prices rose

0.4% in October from Sep tember, much less than the overall sales figure. The government’s solid report contrasted with gloomy figures Wednesday from retail chain Target, which announced unexpect edly weak profits as its increasingly price-sensitive customers pulled back on spending.

Steady job growth, rising wages, and higher savings after many people cut back on travel and entertain ment during the pandemic

have enabled surprisingly steady spending by consum ers, particularly those with higher incomes.

Economists pointed to two other factors that likely contributed to the gain: Amazon held another Prime Day promotion last month, and California dis tributed inflation relief checks of up to $1,050.

Yet there are ongoing signs that cracks are form ing in consumers’ ability to keep up with the highest inflation in four decades. More households are rely ing on credit cards to pay bills, with nationwide credit card balances jumping 15% in the July-September quarter from a year ago, the largest year-over-year increase in two decades, according to a report Tuesday from the Federal Reserve Bank of New York.

“Consumers are likely turning to credit to support spending as wage growth lags inflation and high prices are eating away from the stock of savings,” said Jeffrey Roach, chief econo mist for LPL Financial.

And research last week from Bank of America found that consumers are increasingly seeking out cheaper options when it comes to groceries and dining out. Transactions by Bank of America custom ers, using credit and debit

cards, show that they are now visiting cheaper fast food restaurants more often than full-service restau rants, after eating at both equally for about a year after the spring of 2021.

The Bank of America report also found that, adjusting for inflation, grocery spending per house hold has fallen sharply, to below pre-pandemic levels, even though visits to gro cery stores haven’t fallen. That suggests many people are seeking out cheaper options when shopping for food.

Still, analysts said Wednesday’s government report on retail sales points to a healthier economy than previously expected.

Morgan Stanley revised its forecast for growth in the October-December quarter to 1.7% at an annual rate, up from an earlier projec tion of 0.7%.

Strong consumer demand could perpetuate infla tion, but other trends may work in the other direction.

Auto sales jumped 1.3% last month, the retail sales report showed, but that gain, in addition to people replacing cars in Florida, partly reflects a clearing of supply chain problems that have made more auto parts and semiconductor chips available. Auto production has rebounded, leading to

greater supply, which can push prices down.

Gas station sales jumped 4.1% last month, though that largely reflected higher prices. Online sales rose 1.2%, and restaurant and bar sales moved up 1.6%.

Still, the quick downturn at Target, which reported a 52% drop in profit in its third quarter compared with a year ago, shows how a combination of higher prices on food, higher interest rates, and grow ing economic uncertainty are taking its toll on some shoppers.

Sales weakened signifi cantly in the weeks leading up to Oct. 29, the end of the most recent quarter, with more customers refus ing to pay full price and waiting for sales, said Tar get’s Chairman and CEO Brian Cornell. They’re also buying smaller packages and trading down to instore brands. That trend pushed quarterly profit far below the expectations of both Target, and Wall Street.

By contrast, Walmart, the world’s largest retailer, reported strong sales growth Tuesday in its third quarter. Yet that likely occurred as more shoppers, including higher-income ones, sought out its cheaper groceries.

The company said that consumers are trading down to private brands in baby items and baking goods, among other cat egories. It is also seeing wealthier customers. About three-quarters of Walmart’s market share gains in food came from customers with annual household incomes of $100,000 or more, the company said. Inflation reached 7.7% in October from a year ago, down from a peak of 9.1% in June but still a level that hasn’t been seen in 40 years. There are some signs that prices are likely to keep declining as many supply chain snarls have unrave led, boosting stockpiles of goods at many stores.

PAGE 12, Thursday, November 17, 2022 THE TRIBUNE

BIG-screen television sets sit in packing boxes in a Costco ware house late Sunday, Nov. 13, 2022, in Sheridan, Colo.

Photo:David Zalubowski/AP

Airbnb aims to convince more people to rent out their homes

By DAVID KOENIG AP Business Writer

CONVINCED that the boom in leisure travel is permanent, Airbnb aims to expand its listings by con vincing more people to turn their homes into short-term rentals.

The company said Wednesday that it will increase the amount of liability coverage for hosts, up to $3 million, in a play for owners of nicer houses

in high-cost places such as California. It will also pair newbies with a “superhost” to guide them through the process of becoming a shortterm landlord, from signing up through welcoming their first guest.

More listings would not seem to be Airbnb’s biggest challenge.

CEO Brian Chesky says the San Francisco company is taking steps to make price more transparent when consumers browse Airbnb

listings, and he predicts that will reduce sky-high clean ing fees that many hosts tack on well into the booking process — a major com plaint of consumers.

The company also contin ues to try to crack down on large parties at rentals, a few of which have turned vio lent. And it faces efforts to increase regulation of shortterm rentals.

Through it all, Airbnb has fared better than most travel companies during

the pandemic. This month, it reported a record $1.21 billion profit for the third quarter. Its stock fell, how ever, because earnings and bookings were less than Wall Street expected and the company gave a cautious fourth-quarter outlook.

Investors worry that con sumers paying more for food, gas and housing — and facing predictions of recession — will cut back on discretionary spending like travel, hurting Airbnb.

Some current hosts are worried that might already be happening. Last month, a post on a Facebook page for Airbnb “superhosts” asked, “Has anyone seen a huge decrease in bookings over the last 3 to 4 months? We went from at least 50% occupancy to literally 0% in the last two months.”

Other hosts on social media have suggested theo ries ranging from a fragile economy to pent-up travel demand finally running out, and some think the prob lem might be that Airbnb already has too many listings.

AirDNA, which tracks short-term-rental numbers, said Airbnb listed nearly 1.4 million rentals in the U.S. in September, a 23% jump

BAHAMAS LIQUIDATORS DETECT ‘SERIOUS FRAUD’ SIGNS AT FTX

FROM PAGE B1

Delaware bankruptcy court, especially since the “vast majority” of the exchange’s international (meaning non-US clients) are likely to be creditors of the Baha mian subsidiary.

“The joint provisional liquidators’ findings to-date indicate that serious fraud and mismanagement may have been committed with respect to FTX Digital and the FTX affiliates,” Mr Simms alleged, although no figures and few details were provided given that the probe is at an early stage.

“At the most basic level, the joint provisional liq uidators are presently unable to ascertain FTX Digital’s financial position, its assets and liabilities more generally, and does not have the totality of the information necessary to protect FTX Digital’s assets.”

Tribune Business can also reveal that Mr Bank man-Fried and FTX were already being investigated for potential violations of US securities laws prior to the crypto exchange’s spec tacular implosion last week, which has sent shockwaves through the global digital assets industry and wider financial services markets.

A class action lawsuit filed over FTX’s collapse on Tuesday in the south Florida court, naming Mr Bankman-Fried and a host of sporting and other celeb rities used to promote the crypto exchange as defend ants, disclosed that Texas securities regulators were probing if its interestbearing crypto currency accounts were an “offering of unregistered securities”.

The revelation was con tained in an October 14, 2022, declaration by Joseph

Rotunda, the Texas State Securities Board’s director of enforcement, that was filed in connection with Chapter 11 bankruptcy pro ceedings involving Voyager Digital Holdings - an entity that FTX and Mr BankmanFried has been hoping to acquire before their opera tions came crashing down.

“I am also familiar with FTX Trading, doing busi ness as FTX as described herein,” Mr Rotunda alleged. “As more fully explained throughout this declaration, I am aware that FTX Trading, along with West Realm Shires Services, doing business as FTX US, may be offering unregis tered securities in the form of yield-bearing accounts to residents of the US.

“These products appear similar to the yield-bearing depository accounts offered by Voyager Digital Ltd, and the enforcement division is now investigating FTX Trading, FTX US and their principals, including Sam Bankman-Fried.”

One Bahamian financial services industry source, speaking on condition of anonymity, said of the Texas revelations: “What did the Securities Commis sion of The Bahamas know and when should they have known it? What does the Securities Commission have to say about this unravelling at the same time.”

Mr Simms, meanwhile, said he had given no per mission for FTX Trading and 134 other group affili ates to file for Chapter 11 bankruptcy protection in the Delaware court despite being appointed provisional liquidator of the Bahamian subsidiary the day before.

Noting that FTX Digi tal Markets was not among the entities covered by the Chapter 11 proceedings,

the Lennox Paton part ner said: “As of the date of the Delaware petition, no person other than me, as provisional liquida tor, was authorised to take any act including, but not limited to, filing the Dela ware petition in connection with FTX Digital and FTX Digital’s subsidiaries to the extent the authority of FTX Digital’s directors and man agement was requisite.

“I did not authorise or approve - in writing or otherwise - any of FTX Dig ital’s officers, management or employees to file, or cause to be filed, the Dela ware petition...... I reject the validity of any purported attempt to place FTX affili ates in bankruptcy insofar as such filing required FTX Digital’s officers, directors or management to approve and authorise such action....

“Despite the seemingly complex structure of the FTX brand companies, the entire FTX brand was ulti mately operated from a single location: The Baha mas. All core management personnel likewise were located in The Bahamas,” Mr Simms continued.

“Sam Bankman-Fried has resided in The Bahamas since 2021 and has con firmed that he operated the entirety of the FTX brand in and from The Bahamas. In addition, the power to transfer the digi tal assets held by the FTX exchanges is centralised in The Bahamas, and the pos sessory, custodial, control and-equitable property interests in all FTX brand property is-believed to be maintained in The Bahamas.....

“It is believed the vast majority of international (non-US) account holders with accounts on the FTX crypto currency exchange

showing credits of crypto currency are creditors of FTX Digital. In addition, there are other creditors including investors of FTX Digital. FTX Digital is pres ently cash flow insolvent and is likely to be balance sheet insolvent.”

Confirming that the Bahamian provisional liqui dators have gained control of FTX Digital Markets’ corporate office at the Veridian Corporate Centre in west New Providence, and are seeking to secure all its assets and related documents, Mr Simms reit erated: “In the ordinary course of work as the joint provisional liquidators, we have learned that FTX Digital was headquartered in The Bahamas, that Sam Bankman-Fried effectively controlled and owned FTX Digital, that Sam Bank man-Fried resided in The Bahamas, that the power to transfer the digital assets held by the FTX exchanges is centralised in The Baha mas, that the operations of all FTX brand entities operated out of The Baha mas through FTX Digital, and that the possessory, custodial, control and equi table property interests in all FTX Digital prop erty is maintained in The Bahamas.”

Mr Simms’ affidavit highlights the complex cross-border issues that will at times dominate FTX’s winding-up. He indicates that The Bahamas, via the provisional liquidators and Supreme Court, will seek to exercise its authority and

lead the insolvency pro ceedings given that FTX’s controlling mind and man agement was exercised from this jurisdiction. This potentially sets the stage for a battle for control with the Delaware court’s Chapter 11 process.

Noting that FTX Digital Markets was incorporated in The Bahamas as an Inter national Business Company (IBC) on July 22, 2021, Mr Simms alleged: “FTX Digital operated a digi tal asset exchange, which offered functionality simi lar to traditional brokerage accounts. Digital asset exchanges typically gener ate revenue by collecting a fee for each trade they facilitate, but many also engage in trading (or other commercial use of) crypto currency that is transferred to them by customers.

“The FTX platform also appears to have offered customers the ability to take various leveraged or derivative positions, such as margin trading (loans), futures, options and volatil ity products, as well as the ability for one customer to buy or sell directly from another - serving customers outside of the US, Japan, Bahamas, Australia and Singapore.

“In addition, the owners and operators of FTX Digi tal created their own digital asset called the FTX token (FTT). This token allowed FTX Digital users to obtain discounts on trading fees, collateralise their futures positions and benefit from

from a year earlier and 9% over 2019. Nearly two-thirds were added since 2020. The trends are similar for global listings.

Chesky said in an inter view that Airbnb has enough hosts now — he didn’t say it has too many — but needs more because leisure travel will keep growing. And, he said, a recession could push more people to turn their homes into Airbnbs. After all, he likes to point out, Airbnb launched during the great recession in 2008.

“People are pulling back spending in tons of areas, but not travel,” he said. “And with a loom ing recession, we felt like more people than ever are going to want to make extra money.”

other exchange-centric uses.”

Mr Simms said recog nition of the Bahamian provisional liquidators in the US was “critical to the orderly and effective liq uidation of FTX Digital for the benefit of all credi tors and stakeholders”. He warned that crypto assets were especially susceptible to being converted into fiat currency and “dissipated” through wire transfers and other transactions

Besides determining whether FTX Digital Mar kets has inter-group claims against entities such as Alameda Research, Mr Bankman-Fried’s trad ing firm, Mr Simms added: “US records of FTX Digi tal and the FTX brand are likely to be of criti cal importance to the Bahamian liquidation for multiple reasons.

“For example, these documents could provide a clear picture of the rea sons for the insolvency of FTX Digital, and allow the joint provisional liquida tors to make an informed judgment as to the poten tial third-party claims available to FTX Digital, and to determine if FTX Digital holds additional, undisclosed assets.

“The books and records will provide valuable insight into the financial machina tions that led to the alleged dissipation of FTX Digi tal assets at the expense of creditors. The discov ery of these agreements and other financial documents will likely provide further insight into the financial engineering, which appears to have contributed to the insolvency of FTX Digital.”

THE TRIBUNE Thursday, November 17, 2022, PAGE 13

UK inflation accelerates to 41year high of 11.1%

By DANICA KIRKA Associated Press

BRITAIN’S inflation rate rose to a 41-year high in October, fueling demands for the government to do more to ease the nation’s cost-of-living crisis when it releases new tax and spend ing plans Thursday.

Consumer prices jumped 11.1% in the 12 months through October, compared with 10.1% in September, the Office for National Statistics said Wednesday. The new figure exceeded economists’ expectations of 10.7%.

Higher prices for food and energy drove Britain’s inflation rate to the high est since October 1981, the ONS said. It exceeds the record 10.7% inflation seen last month in the 19 Euro pean countries using the euro currency and the U.S. rate of 7.7%, which slowed in October.

The figures come a day before Treasury chief Jeremy Hunt is scheduled to unveil a new budget amid growing calls for higher wages, increased benefits and more spending on health and education as raging inflation erodes the spending power of people across the country.

Those demands are com plicating Hunt’s efforts to close an estimated 50 billion-pound ($59 billion) budget shortfall and restore the government’s finan cial credibility after former Prime Minister Liz Truss’

Hunt

disastrous economic poli cies undermined investor confidence and sparked tur moil on financial markets.