‘Minimal exposure’: Central Bank demands FTX report

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

BAHAMIAN bankers yes terday predicted the industry has minimal exposure to FTX after regulators demanded the sector disclose all business dealings with the collapsed crypto currency exchange.

Senior executives said the implosion of FTX and its local subsidiary, FTX Digital Mar kets, was highly unlikely to pose a systemic or widespread

risk to the Bahamian financial system with Tribune Busi ness able to reveal the Central Bank ordered all its bank and trust companies to swiftly report any exposures to it before last week’s end.

Kenrick Brathwaite, Bank of The Bahamas managing director, confirmed the Cen tral Bank had moved swiftly to gain a complete understanding of any potential FTX-related risks for the commercial bank ing system. He forecast that there was “minimal exposure”

Harbour woes ‘threaten life, immense damage’

•

•

• Battling

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

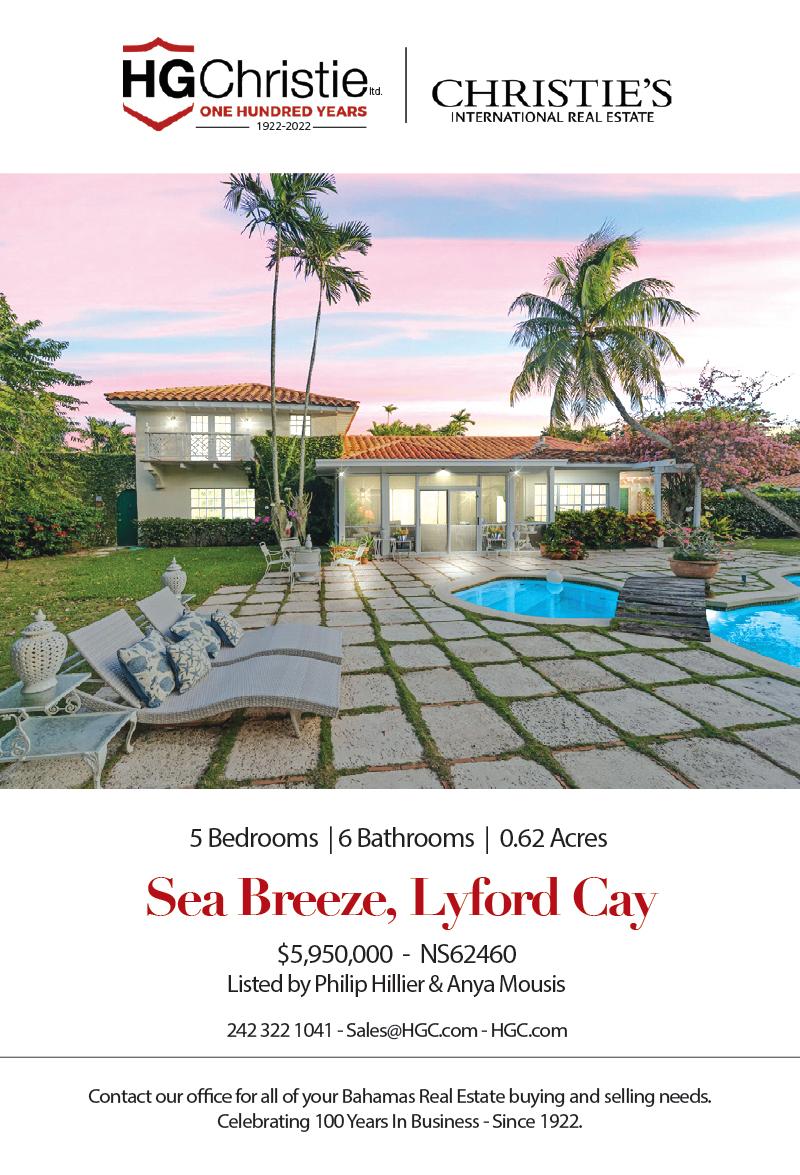

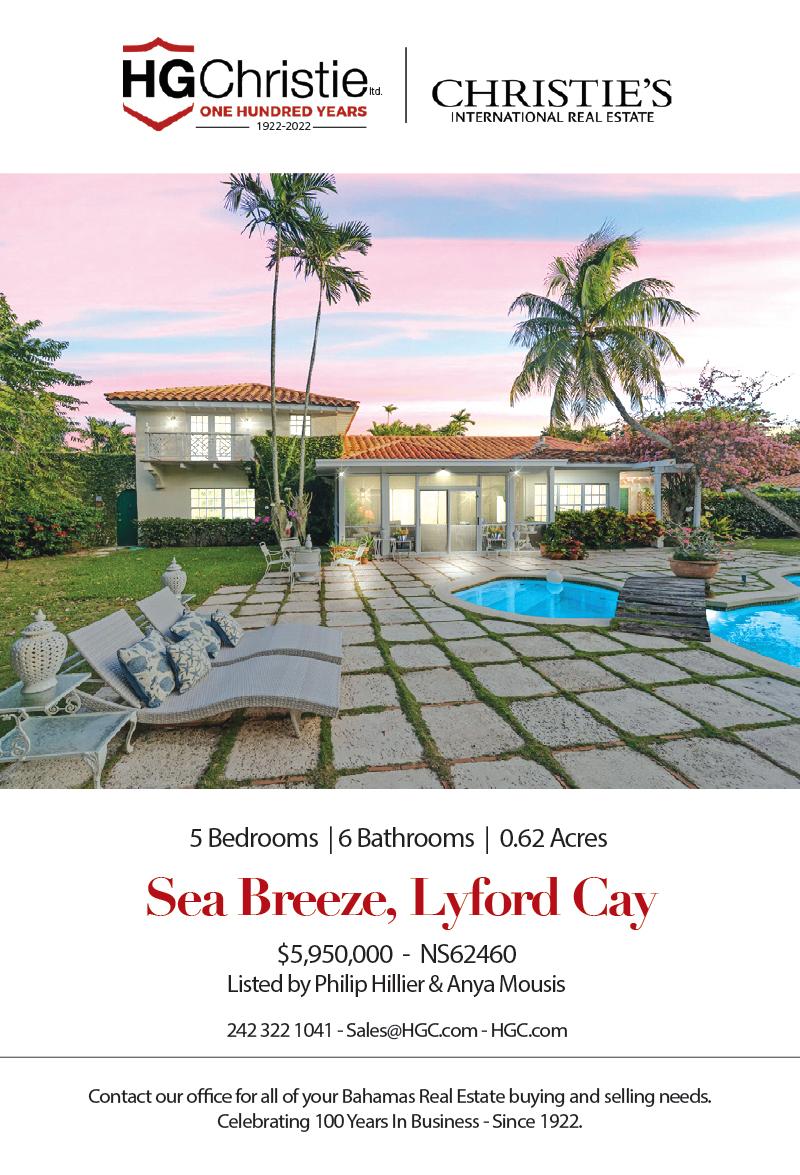

NASSAU’S main com mercial shipping port is renewing warnings that fail ure to repair the harbour’s western breakwater could “result in immense damage to, and threaten life”, in the city centre.

Arawak Port Develop ment Company (APD), in its just-released annual report, said reversing the continued deterioration of this protective barrier against storm surge and high seas remains on its “front burner” given the danger posed not just to its own commercial viability but Nassau’s cruise tourism product.

The BISX-listed port owner and operator, repeat ing an annual call for action that goes back at least five years, said it had “an obli gation” to continue working with the Government in a bid to see repair work begin during its current financial year which closes at endJune 2023.

“For the new fiscal year and beyond, the res toration of the Nassau Harbour western breakwa ter will remain on the front burner for APD, owing to the threat this vital bar rier’s ongoing degradation poses to the safety of ships entering the harbour to do business with Nassau Container Port and Nassau Cruise Port,” the Arawak Cay port owner said.

“Furthermore, this situa tion impacts the efficiency of, and profitability of, both entities as well as that of the tourism/hospitality plant and other coastal busi ness ventures. Moreover, if erosion of this essential barrier continues, as sci ence and observation have shown us, failure to rebuild could result in immense damage to the city itself and threaten life. We take it as an obligation to continue to work with government to see the project launched in 2022-2023.”

Nassau Container Port and its senior executives have constantly urged that

for the sector that focuses on domestic Bahamian and resi dent customers.

“That was sent out,” the BISX-listed bank’s chief said of the Central Bank’s infor mation interrogatory. “I don’t think a lot of banks were involved with that. One other bank had some dealings with them [FTX], and another bank was about to have dealings with them, but I don’t think there’s a lot of exposure from the banking side. No, no.”

He was backed by Gowon Bowe, Fidelity Bank (Baha mas) chief executive, who voiced doubt there would be “any surprises for the Central Bank” in terms of licensees who transacted business with FTX. Confirming that all licensees had to provide the requested information by last Thursday night, he said: “The query was custodian, operational or other expo sures, be it credit or otherwise.

•

•

•

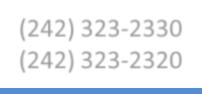

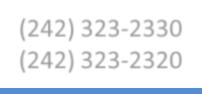

Manufacturer duty-free approvals shift to online

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE GOVERNMENT yesterday moved to fur ther enhance the ease and efficiency of doing business by giving Bahamian manu facturers a January 1, 2023, “drop dead date” to start applying for renewal of their duty-free concessions online.

Pintard to take BPL woe to Public Accounts Committee

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE OPPOSITION’S leader says he will place Bahamas Power & Light’s (BPL) up to 163 percent fuel charge increase before Parliament’s spend ing watchdog in a bid to uncover how much government “errors” are costing Bahamians.

Michael Pintard told Tribune Business he will today “raise” BPL’s fuel hedging and $535m bond refinancing before the House of Assembly, as well as when the Opposition-controlled Public Accounts Committee (PAC) meets this week.

He added that the main objective was to establish “some actual figures” for what the Government’s failure to execute the trades underpinning BPL’s fuel hedge have cost Bahamian busi nesses and households, especially since they will be required to pay “on both ends” - first as taxpayers, then as consumers.

Taxpayers essen tially financed BPL’s ability to keep fuel charge at a relatively low 10.5 cents per kilowatt

hour (kWh) for so long, despite the hedge’s unravelling, via government loans to the state-owned utility. With the law now blocking the Government from offering straight subsidies, as it has in the past, those loans must now be paid back by BPL consumers via the inflated fuel charges being imposed over the next 14 months.

Alfred Sears, minister of public works and utilities, who has responsibility for BPL, previously said the Government has agreed to pay Shell some $90m over the next nine months to eliminate debts owed by BPL for its fuel supplies. While this provides an insight into how much the fuel hedging lapse has cost Baha mians, Mr Pintard suggested the total figure was likely much higher.

Speaking after he publicly released a letter to the Prime Minister, asking how much of the fuel charge increase is intended to repay Shell and the Govern ment (taxpayer) plus other questions, Mr Pintard told this newspaper: “We also want to know where they got the funds from [to pay BPL initially] and where they were diverted from. We’re putting a series of questions to them. We’re asking them the same question through every possible means to get an answer....

“The decisions made by the Gov ernment, both on the fuel hedging programme and Rate Reduction Bond, two separate issues... the first has cost the Bahamian people in excess of $100m, and we don’t know how deep

Ministry of Economic Affairs officials, in a webi nar for local producers to update them on the reforms, revealed that from New Year’s Day they will have to seek renewal of their existing Indus tries Encouragement Act tax breaks via Baha mas Customs’ Electronic Single Window (ESW) or Click2Clear.

Designed to replace the existing manual, paperbased approvals system, officials promised that it will “reduce the waiting time in some instances” when it comes to manu facturers receiving their renewed approvals and “allow for a smooth tran sition” to the digital, electronic world.

Brickell Pinder, the Min istry of Economic Affairs’ director of trade and indus try, said: “We are currently working with Customs to try and make the portal accessible from Decem ber 1 so you would have access to it in the next few weeks, but as of January 1, 2023, all renewal applica tions have to come through Click2Clear.

“For those persons ready to provide renewals we will have the portal ready on December 1 to accept applications, but definitely the drop dead date is Janu ary 1, 2023.” The biggest change for Bahamian manufacturers is that they will now have to estimate

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE GOVERNMENT has slashed the debts owed by the Water & Sewerage Corporation to its main supplier by almost 30 per cent or $6.3m during the first nine months of 2022.

BISX-listed Consoli dated Water, in filing its 2022 third quarter results with the US Securities & Exchange Commis sion (SEC), revealed that the debts owed by the

state-owned water distrib utor have been cut from $21.5m at year-end to $15.2m at end-September 2022.

The Blue Hills and Windsor reverse osmo sis plant operator, which supplies all the water consumed by the Corpo ration’s New Providence customers, said in its 10-Q filing: “At December 31, 2021, Consolidated Water (Bahamas) accounts receivable balances (which

business@tribunemedia.net WEDNESDAY, NOVEMBER 16, 2022

SEE PAGE B2 SEE PAGE B5

SEE PAGE B7

supplier

by 30%

Water Corp debts to top

slashed

SEE PAGE B4

WATER & SEWERAGE CORPORATION HQ

SHOWN is the impact from continued degradation of the western breakwaters in Nassau Harbour due to storm surge and high seas.

on licensee

with crypto exchange

Sought info

dealings

PwC accountants join Bahamian provisional liquidation

Over 1m creditors caught in ‘unprecedented’ collapse

Breakwater repairs

front burner’

Port operator:

‘on

wage

Staff search hit by ‘extraordinary

expectation’

truckers bypassing safety

through ‘fraud’

SEE PAGE B5 $5.95 $5.97 $6.07 $5.62

MICHAEL PINTARD

CONCERNS THAT HOTEL TAX BREAKS UNDULY EXPLOITED

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

A BAHAMIAN busi nessman has voiced concerns that foreign inves tors are unduly exploiting Hotels Encouragement Act incentives to obtain tax breaks on construction materials for large vacation rental properties.

Ramon Darville, Darville Lumber’s general manager, told Tribune Business he is concerned about over seas investors accessing tax breaks designed to encour age resort investment to instead build “monster” homes at much-reduced costs.

“I know of two homes being built right now by foreigners that are huge homes, but they clearly are not hotels,” he asserted. “These people are bringing

in their goods under the Hotel Encouragement Act and it has to stop. They have up to 10 bedroom home,s and I know a couple of foreigners who are build ing more than two homes.

“These are not subdivi sions. They are building them in different places. It’s just that the houses are so huge and I don’t think they fit the criteria of the Hotels Encouragement Act the way I have read it.”

Separately, speaking to the proposed $73m Club Ki’ama project on Eliza beth Island, which is now seeking its Certificate of Environmental Compli ance, Mr Darville said: “I want to know when Baha mians will get the same treatment foreigners get for their projects.

“They are under the Hotels Encouragement Act and they are allowed to build. I want the same thing for my development when I

ABACO BUSINESSES SEE MINIMAL NICOLE IMPACT

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

ABACO businesses say they largely fared well during Hurricane Nicole with little to no damage reported, although water had yet to be restored to the island’s north before press time last night.

Javal McIntosh, owner/ operator of 3J’s Construc tion in North Abaco, told Tribune Business: “The 70 miles per hour wind they projected, I feel we had more than that. But the power is back on as it came back on last night (Wednesday).

“We don’t have water back up as yet, but the power is on. One or two pieces of debris was in the road and stuff like that, but we are good. Flooding took place in the Blackwood com munity. A lot of flooding was out there, and also on the front street in Coopers Town, water came up across the road. But, other than that, Blackwood had the brunt of the flooding.”

Basil Hall, owner/operator of Abaco Communications & Security Services, said

there was little to no impact from Nicole other than plenty of rain - but no flood ing - when it passed over the island still at tropical storm strength. He added: “Eve rybody around me is doing fine. [It’s] just that we have a few fences down and we helped to get them back up.”

Power was restored to Central Abaco by 1am on Thursday morning, and Mr Hall said: “The power wasn’t off for very long. It went off at around 4pm at the height of the storm. But I would rather this than Hurricane Dorian. I was here during Dorian and the island still isn’t fully 100 percent from where Abaco was.”

Lance Pinder, Abaco Big Bird’s operations manager, said the business had little to no impact from Nicole. “We are two-and-a-half miles from the ocean at the closest point, so we are pretty far inland and we really didn’t have anything,” he added.

“I’m 10 miles away from town but I know for Marsh Harbour in the front streets, like Bay Street, they had some minor flooding come up. But all of my staff were able to come to work from Marsh Harbour.”

get ready to launch before the end of the year. From what I heard it was highend homes. So we will get a couple of jobs off of that. I wonder how much things the Government is going to give them, and if they are going to bring in everything duty free?”

O’Brian Strachan, owner/ operator of Strachan’s Service Station, said he “welcomes” developments such as Club Ki’ama. “I don’t see anything wrong with it as long as it creates a few jobs and more oppor tunities. Elizabeth Island had a personal thing on it, but now it is really going to blow up,” he added.

Of the 85 long-term jobs that project is expected to create, he added: “That’s probably long-term and not for the construction of the hotel. When you are work ing on an island like that you have to take into con sideration the sailing back

and forth as well as the lack of electricity over there. So they will need quite a few people involved to ensure the project becomes a success.”

The Ki’ama Bahamas project, in an Environ mental Impact Assessment (EIA) viewed by Tribune Business, said its plans to develop a 36-acre commu nity on the southern third of Elizabeth Island will create permanent employ ment for 80-85 Bahamians as well as 45-60 local jobs during the three to fouryear construction period. It is aiming to attract 36,000 guests per year at full buildout of a “zero carbon” residential and yacht com munity just three miles from Georgetown.

Describing their vision for a “first-class, fully sus tainable, zero carbon, solar-powered residence and yacht community”, the developer consortium

said: “Resort guests and owners will have the abil ity to enjoy the world’s most pristine and undiscov ered destinations without negatively impacting the environment.....

“Ki’ama Bahamas’ pro ject construction timeline is anticipated to be up to five years. Total development costs are anticipated to be up to $73m. At full build, the project anticipates annually accommodating up to 36,000 guests span ning nearly 10,000 occupied room nights, or a projec tion of nearly 5,000 round trips to The Bahamas. The annual guest projection equates to roughly 100 average guests per day on both land and sea.

“Even if all guests were on land, this would equate to approximately three guests per acre. Despite the low-density nature of the project’s occupancy, to mitigate potential impact

to the environment during operations by utilising elec tric golf carts, restriction of single-use plastics, signifi cant way-finding signage to ensure guests remain on gravel roads or established trails, and abundant waste and recycling receptacles reducing potential litter.”

Research by Tribune Business revealed that the Ki’ama Bahamas devel opment is a joint venture between three entities who have formed Ecoisland Development. They are Mauritius-headquartered Silent Resorts, billed as “the world’s first integrated land/sea, ultra-sustainable, private, secure, 100 percent solar-powered, luxury and adventure brand”, together with Equity Residences, a real estate investment fund, and Elite Alliance, a resi dence club owner.

how much of those raw materials they are seeking Customs duties exemptions on will be used during the year.

They will also have to enter the correct HS (Har monised System) code for the relevant raw materials in the Click2Clear system. Manufacturers were told that if they under-estimated the amount of raw materi als required, and use up the quantity imported duty-free before the year is out, they will have to submit either a “supplementary” or new exemption approval appli cation via Click2Clear.

Customs officials explained that while man ufacturers can use their original approval letter “multiple times”, when the tax-exempt quantity of raw materials “gets down to zero the system will prompt us that there are no more items under the approval”. All duty-free renewal appli cations, whether they are the original or “supple mentary”, first have to be approved by the Ministry of Economic Affairs’ trade and industry unit.

Responding to manu facturer concerns over

difficulties in estimating how much imported raw materials they will use in a given year, since this will depend on sales and demand, Rochelle Smith, first assistant secretary in the Ministry of Economic Affairs’ trade and industry unit, said they should still have “a fair idea” of their needs. And, if companies exhausted their duty-free supply, they still have the option to apply for the tax exemption on any top-up.

“What we’re saying is that if you don’t have an exact amount you should be able to give a pretty fair idea of what it is you would use for the calendar year,” she said. “As a guiding post, select the amount put in the application. You should have a fair idea of what you consume in any given year, so use that as a starting point.

“The system draws down on what is approved by the Ministry of Economic Affairs until you get to zero. Submit a new or supple mentary approval request. It has to go to the Ministry of Economic Affairs before the Customs Department can act. The system will be mandatory from January 1, 2023.”

Jonathan Cartwright, president of the Bahamas Light Industries Devel opment Council, who attended the webinar, told Tribune Business that while there will likely be an initial “learning curve” the switch to an electronic-based approvals process should improve efficiency and ease of doing business for local manufacturers.

The Cartwright’s Bedding president said: “I think it’s a positive move. It’s a lot of paperwork involved now, even when Customs comes to your place to inspect a trailer. Typically, when things go online it tends to be easier and more efficient.

“They say they want us to estimate beforehand what materials we use for the year. That’s a little different from now, which is when we tell them the material we use and it’s just approved. They want us to list each tariff and estimate how much we’re going to use for the year, and said if we go over that we can do a sup plemental application.

“I guess it will take some getting used to, but I imag ine it will be more efficient.

I can’t see it being less effi cient. The first year year will be the most difficult,” Mr Cartwright continued.

“They want us to apply for the benefits every year. Every year we applied and gave them the raw materials. They’d approve it and give us a blanket

exemption. However much foam you needed, they’d approve it.

“Now we have to list the tariff headings and they want us to estimate how much we will use each year. They made it seem that if you under-estimate it’s not a big deal. Initially there will be a bit of a learning curve, but I don’t see any particular problems with it.”

Ms Pinder yesterday said manufacturers applying for “approved” status under the Industries Encourage ment Act for the first time will still have to submit a manual, paper-based appli cation to the Ministry of Economic Affairs although there are plans to take this online too.

Under the present system, those seeking renewal of the duty-free concessions under the Act must supply the minis try with a formal letter of request, place their exist ing Business Licence and Tax Compliance Certificate. These documents as of New Year’s Day 2023, will all have to be uploaded elec tronically via Click2Clear with approvals coming via the same route.

The duty-free concessions cover raw materials and machinery, plus construc tion tools and materials for building, renovating or expanding a manufacturer’s

PAGE 2, Wednesday, November 16, 2022 THE TRIBUNE

premises. MANUFACTURER DUTY-FREE APPROVALS SHIFT TO ONLINE

PAGE B1 CALL 502-2394 TO ADVERTISE TODAY! IN THE ESTATE OF JAMES HAROLD BRADLEY late of 502 Covebrook Lane, Knoxville in the state of Tennessee in The United States of America.

NOTICE is hereby given that all persons having any claims against the above-named Estate are required on or before the 16th day of December A. D., 2022 to send their names and addresses and particulars of their debts or claims to the undersigned in writing or in default thereof they will be excluded from the benefit of any distribution AND all persons indebted to the said Estate are hereby requested to pay their respective debts to the undersigned on or before the date above mentioned. AND NOTICE is hereby also given that at the expiration of the time period above mentioned, the assets of the late JAMES HAROLD BRADLEY will be distributed among the persons entitled thereto having regard only to the claims of which the Executors shall then have had notice in writing. Dated this 16th day of November, A. D. 2022 Roberts, Isaacs & Ward, Unit No.2, Cable Beach Court Professional Centre, 400 West Bay Street, Nassau, Bahamas. NOTICE NOW HIRING Culinary Manager Executive Chef Assistant General Manager Apply Today www.HR@THE-ISLAND-HOUSE.com

FROM

Deceased.

DPM: WE CAN SURVIVE ‘CURVEBALL’ FROM FTX

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

THE Deputy Prime Minister yesterday voiced confidence that the Baha mian financial services will survive the latest “curve ball” thrown at it by the FTX crypto exchange’s sudden implosion.

Chester Cooper, also minister of tourism, invest ments and aviation, told media ahead of the weekly Cabinet meeting that he was “confident” the Securi ties Commission and Royal Bahamas Police Force can handle the fall-out from a sudden corporate collapse that has sent shockwaves through the global digital assets industry and wider financial markets.

And, seemingly responding to calls for the Government to break its silence on the matter, he added that Prime

Minister Philip Davis KC and the “regulators” will be addressing the concerns surrounding FTX and its potential fall-out for The Bahamas’ reputation in the near future although no date was given.

“I am confident about the regulators,” Mr Cooper said. “I’m confident about the laws governing financial services in The Bahamas. We’ve had cur veballs thrown at us before in financial services and we’ve persevered. We’ve pivoted in financial services many times, and I expect that we’re going to do like wise in the digital assets business.”

The Royal Bahamas Police Force is working with the Securities Com mission to determine if possible “criminal miscon duct” was involved in FTX’s collapse into provisional liquidation in The Bahamas and Chapter 11 bankruptcy protection in the US.

Wayne Munroe, minister for national security, said “no one has been detained by the police” in relation to FTX’s collapse. He added that the police must con duct their investigations and take whatever steps are necessary based on the evi dence they uncover.

Sam Bankman-Fried, FTX’s co-founder and now-former chief execu tive, who remains holed up in The Bahamas, and those

executives close to him are said to also be under inves tigation by the US Justice Department and Securities & Exchange Commission (SEC) as well as a host of global regulatory bodies.

Mr Cooper, meanwhile, also told once-jailed Billy McFarland, organiser of the infamous Fyre Festival in 2017, that he needed to talk to Bahamian police rather than seek to hold another event on Exuma.

Multiple Bahamian vendors have yet to receive a cent of what is owed to them from the fraud-ridden event, and the deputy prime minister added: “I believe there are several complaints with the Royal Bahamas Police Force. I think he should have a conversation with them.”

Mr McFarland, in a voice note circulating on social media yesterday, promised that he will seek to raise funds to repay impacted Bahamian vendors and make them whole. How ever, he indicated that doing so will take time and many will not be hold ing their breath that any compensation will come through given the Fyre Festival organiser’s track record.

Mr Cooper also reiter ated his previous position on efforts to sell the Grand Lucayan, saying: “I have listened intently to a lot of people speculating. I have listened intently to many

members of the former Board speaking to matters which they have no infor mation on.

“Let me just say that we have laid out the circum stances as it relates to the Grand Lucayan. Suffice to say we are in the final stages of selecting the provider for the rebuilding of the Grand Bahama Airport, so I am not going to get into a back and forth with persons who had a mandate to sell the property and didn’t do so.

“They must give account for their stewardship. We will give account for ours. We will do what’s in the best interest of the Bahamian people, we will do what’s in the best interest of Grand Bahama, and suffice to say as we’ve laid out before we are pressing forward. I am confident that we will be able to do a transaction, or a pivot, as it relates to the Grand Lucayan resort that’s going to be in the best inter est of the people.”

BTC prize to finance US expansion for runner-up

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

THE runner-up in the Bahamas Telecommunica tions Company’s (BTC) Inknowvation pitch chal lenge is planning to use their $3,000 cash prize to expand into the US market.

Randia Coakley, owner/ operator of Pedi In A Bag, told Tribune Business this

Christmas will be “huge” for her business as it will mark the first full festive season since the COVID-19 pandemic.

Pedi In A Bag is an athome pedicure experience. Its starter kit contains a sixpiece nail tool set and two pairs of infused booties for foot care. This formula is designed to accelerate the removal of hard, dead skin without painful scrubbing.

Building on her newfound confidence from

finishing second in the BTC challenge, Ms Coakley said: “What is great is we have one retailer confirmed at the moment. Because of that we sold out of the starter kit and we had to restock.

“Right now we’re trying to gather new retailers to go to, be it either additional beauty stores or nail salons and then, of course, in food stores. It’s something you can take in carry-out form. I think it’s going to be great

for Christmas because the truth, when it comes to the Christmas season, is book ing beauty appointments is very hard.”

Beauty salons are now being booked for Christ mas week right through to New Year’s, placing Pedi in A Bag in prime position to take advantage of the season. Ms Coakley hopes to build on a strong Christ mas season, and use it as a platform to launch into the US market next year.

“Winning second place feels amazing. Our goal for the next quarter is to expand to do US distribu tion. Seeing that I’m based in The Bahamas, it makes sense to do it through a third-party logistics man agement company that does packing and shipping. That is what the funds are going for,” Ms Coakley said.

Competing against US rivals that offer the same services remains an obstacle, but Ms Coakley

believes she has a strat egy to remain competitive. “The biggest competitor, the original competitor, is another company and the difference between us and them is price point and value. So our biggest com petitor, their price point is $25 for one pair, but with our central kit, you get two pairs for $25,” she added.

BPL partners to remove 630k pounds of debris from Abaco

BAHAMAS Power & Light (BPL) was yesterday said to have completed the largest recycling project in Abaco’s and the company’s history with the removal of 630,450 pounds of Hurri cane Dorian-related debris.

The waste, which was packed in ten fully-loaded 40-foot containers and five 40-foot flat racks, was taken off Abaco through BPL’s partnership with US-based recycler, Cadwell. The latter, in a statement issued yesterday, described the project as “the first largescale recycling project of many to come throughout The Bahamas”.

AFRICAN BANK EXECUTIVE MEETS PM AND HIS TEAM

Ayman El Zoghby, the bank’s head of trade and corporate finance, and other representatives from the African ExportImport Bank called on Philip Davis KC at his office. Also present were Fred Mitchell, minister of foreign affairs and the public service; David Davis, permanent secretary in the Office of the Prime Minister; Simon Wilson, the Ministry of Finance’s financial secretary; Wayde Watson, parliamentary sec retary in the Ministry of Economic Affairs; Jerome Fitzgerald, senior policy advisor to the Prime Min ister; Nathaniel Beneby, special advisor; and Quin ton Lightbourne, chairman of the Bahamas Develop ment Bank (BDB).

Photos:Eric Rose/BIS

The debris removal was also said to have prevented the waste causing further damage during Hurricane Nicole. “BPL undertook the biggest recycling project in our company’s history. We are proud of the team that made this happen and look forward to the future of working together with Cadwell for more sustain able solutions for BPL and the Bahamian people,” said

Shevonn Cambridge, BPL’s chief executive.

Cadwell added: “The ini tial stage of BPL’s largest recycling project was com pleted in October 2021, but recycling projects continue to this day. The barge car ried away five 40-foot flat racks, and ten 40-foot con tainers, loaded from top to bottom and from front to back.

“These containers included a variety of der elict items, such as air conditioning units, downed wire, engine blocks,

transformers, genera tors, heavy machinery and a variety of scrap metal. Additionally, barrels of used oil were removed. The number of items removed could be described as a little more than the length of a football field and weighed 630,450 pounds.

“Such corrosive material has great potential to pol lute the land and sea.... The storage yard containing the discarded transformers had been submerged by a storm surge and was a toxic mess.” This was cleaned

up by Cadwell and SNJ Recycling.

“It’s important to part ner with entities who can complement and advance your productivity, and miti gate the negative impact on your environment. This has been a key benefit to our partnership with Cadwell,” said Baron Von Rose, BPL procurement engineer overseeing the project.

“I look forward to part nering with Cadwell Inc. to help clean up all the Family Islands and assist with our vision to go green.”

THE TRIBUNE Wednesday, November 16, 2022, PAGE 3

CHESTER COOPER WAYNE MUNROE

A SENIOR Inter-African Bank executive on Monday met with the Prime Minis ter and senior government officials.

ADVERTISE TODAY! CALL THE TRIBUNE TODAY @ 502-2394

demands FTX report

That was the Central Bank seeing if there was anything significant.”

Mr Bowe declined to comment, or speculate, on the size of the bank and trust company sector’s potential exposure to FTX given that there were multi ple types of relationship the collapsed crypto exchange could have formed with various institutions.

“I think that for them it would be for information purposes to see if there was any sort of impact to finan cial stability,” the Fidelity chief executive said. “It was information gathering to understand what was there, but I don’t expect there was any surprise for the Central Bank.”

Mr Bowe based this on the fact that, under interna tional as well as Bahamian law and regulations, the Central Bank receives regu lar quarterly updates on its licensees’ capital adequacy; market risk exposure; liquidity risk exposure and other critical benchmarks.

Likening the regulator’s move to the data gather ing exercise it undertook earlier this year to gauge industry exposure to Rus sian clients as a result of the sanctions imposed over the Ukraine conflict, he added: “We are caught by the Basle III accords, and from that perspective I think the Cen tral Bank will have a fairly detailed understanding.”

John Rolle, the Central Bank’s governor, did not respond before press time last night to Tribune Busi ness inquiries on how many of its bank and licensees have potential exposure to FTX or the total value of these liabilities.

However, another banking industry source, speaking on condition of anonymity because there were not authorised to speak publicly, said: “From last week the Central Bank asked all of its licensees whether they have expo sure. By Friday they had to explain whatever exposure they may have had.

“FTX was trying to deal in the local market. I know they were speaking to people with businesses here, asking them if they wanted to raise capital, go public and list on the exchange. Clearly there were links in to Bahamian customers. There were clearly Bahamians playing in that space. Whether they were allowed to be there is another question.”

Speaking further to FTX’s implosion, and the implications both in The Bahamas and internation ally, the source added: “It’s an absolute mess. It’s just the idea of whether people are exposed to FTX. Are there going to be ramifica tions in the banking sector? It just creates uncertainty in the marketplace, and sends out not ripples but waves. It concerns me, these ripple effects moving outwards.

“I don’t think we’ve seen the end of this. I think entities related to FTX, whether in the crypto space or not, will be impacted by this. It’s not helpful in the financial arena to have people saying all these things. Take it from me: We don’t have any FTX expo sure, we don’t have any crypto exposure. There’s nothing to worry about.”

Deltec Bank & Trust was earlier this week forced to vehemently deny specu lation, which circulated

widely at the weekend, that it was exposed to FTX by virtue of the crypto cur rency exchange having financed its purchase of Ansbacher (Bahamas) that closed in March 2022.

Deltec described the assertion as “malicious and completely baseless. The latest independent auditor’s report shows that Deltec Bank is well capitalised. Additionally, the bank car ries no debt and is not a creditor to FTX....

“While we are all saddened by the news sur rounding FTX, we urge the financial services commu nity to act responsibly and not spread rumours that are frivolous and attempt to damage the reputation of financial institutions in the jurisdiction. During such a fragile point in our industry, we must focus on facts and actual events.”

Meanwhile, as previ ously revealed by Tribune Business, it was confirmed that one of the ‘Big Four’ accounting firms is joining Brian Simms KC, senior partner at the Lennox Paton law firm, as joint provisional liquidators of FTX’s Bahamian subsidiary, FTX Digital Markets.

The Securities Commis sion, in a statement, said PricewaterhouseCoopers (PwC) Bahamian partner, Kevin Cambridge, and his Hong Kong-based col league, Peter Greaves, were on Monday approved by the Supreme Court to work with Mr Simms in that capacity.

While FTX’s interna tional headquarters was based in The Bahamas, it had only moved here in September 2021 from Hong Kong. Besides this connec tion, the appointment of

Mr Greaves will also give the provisional liquidation team global reach through having someone based in a different timezone as they begin their efforts to trace and secure assets on behalf of clients and investors who may yet end up with billions of dollars in losses.

The Securities Com mission, FTX’s primary Bahamian regulator, added: “Given the magnitude, urgency and international implications of the unfold ing events with regard to FTX, the Commission recognised it had to, and moved swiftly, to use its regulatory powers under the Digital Assets and Reg istered Exchanges (DARE) Act 2020 to further pro tect the interests of clients, creditors and other stake holders globally of FTX Digital Markets.

“Over the coming days and weeks, the Commis sion expects to engage with other supervisory authorities on a regulatorto-regulator basis as this event is multi-jurisdictional in nature.” It added that its probe was extending beyond the Bahamian entity to focus on other key companies in the FTX group, including FTX Trad ing and Alameda Research.

Asserting that their “main interest, direction and management” resided in The Bahamas, the Securities Commission con cluded: “The investigations into these events are ongo ing, and the Commission will extend its full assis tance to the police if and when required.”

Most of the court docu ments relating to FTX Digital Markets’ provi sional liquidation have been sealed and thus cannot

be accessed by the public. However, papers filed in the Delaware federal bankruptcy court relating to FTX’s Chapter 11 pro tection reveal that it could have as many as one million creditors scattered through out the world including in The Bahamas.

This number will likely include numerous micro, small and medium-sized (MSME) Bahamian enter prises who previously benefited from the lavish spending by FTX Digital Markets, its executives and the exchange’s co-founder, Sam Bankman-Fried, plus the tight coterie around him. Those entrepreneurs will now be starting to feel “the pinch” of any unpaid debts and loss of FTXrelated revenues. Two restaurants this newspaper knows of earned $5,000 and $2,000, respectively, per week from FTX.

The crypto exchange, in its Delaware filings, branded the extent and speed of its collapsewhich effectively turned Mr Bankman-Fried from hero to zero in just one week - as “unprecedented”. It added that the FTX cofounder decided to “step aside” as chief executive at 4.30am last Friday morning after the situation became untenable.

“The events that have befallen FTX over the past week are unprecedented,” the crypto exchange said. “Barely more than a week ago, FTX, led by its co-founder Sam BankmanFried, was regarded as one of the most respected and innovative companies in the crypto industry.

“The debtors operated the world’s second largest cryptocurrency exchange (through its FTX.us and FTX.com platforms), oper ated one of the largest market-makers in digital assets (through Alameda Research LLC and its affiliates), and conducted diverse private investment and other businesses.

“FTX faced a severe liquidity crisis that

necessitated the filing of these cases on an emer gency basis last Friday. Questions arose about Mr Bankman-Fried’s leader ship and the handling of FTX’s complex array of assets and businesses under his direction. As the situ ation became increasingly dire.... at approximately 4:30 am on Friday, Novem ber 11, after consultation with his own legal coun sel, Mr Bankman-Fried ultimately agreed to step aside.”

John J. Ray, who took over at failed energy specu lator, Enron, almost two decades ago was named to replace Mr Bankman-Fried and lead the restructuring. He and his team were said to have “worked around the clock” since taking over to secure assets for the ben efit of creditors.

“As set forth in the debt ors’ petitions, there are over 100,000 creditors in these Chapter 11 cases. In fact, there could be more than one million credi tors in these Chapter 11 cases,” FTX revealed in its filings. “The statutory stay and its enforcement are critical to ensuring that FTX, under the leader ship of Mr Ray, can secure and marshal its assets, and conduct an orderly process under centralised manage ment to reorganize or sell FTX’s complex array of businesses, investments and property around the world for the benefit of its stakeholders.

“Immediately upon appointment, Mr Ray began working with FTX’s external legal, turna round, cyber security and forensic investigative advi sors to secure customer and debtor assets around the world, including by removing trading and with drawal functionality on the exchanges and moving as many digital assets as pos sible to a new cold wallet custodian, while simultane ously responding to a cyber attack that occurred on the petition date.”

PAGE 4, Wednesday, November 16, 2022 THE TRIBUNE

FROM PAGE B1 NOTICE INTERNATIONAL BUSINESS COMPANIES ACT, 2000 RIMURU LTD. Registration number 207134 B Notice is hereby given in accordance with Section 138 (4) of the International Business Companies Act, 2000, the Dissolution of RIMURU LTD. commenced on

The Liquidator is Henrique Diesel

Henrique Diesel Dietrich LIQUIDATOR

‘Minimal exposure’: Central Bank

November 11, 2022.

Dietrich, whose address is Rua Mato Grosso 2687, Apto 901 T1, Cascavel, PR CEP85812-020, Brazil.

PINTARD TO TAKE BPL WOE TO PUBLIC ACCOUNTS COMMITTEE

FROM

the financial effect is for the Bahamian people. Our con cern on the fuel surcharge is we do not know what the exposure is, and we’re trying to estimate that.

“That’s why we’re going to go to the Public Accounts Committee, raise similar questions and try to get documents. The arrears to Shell is an example. It’s but an indication of how massive the exposure is. We want to drill down to some actual figures. It’s very important because Baha mians have been paying at both ends because of the errors in judgment;

bad judgment, by this administration.”

Mr Sears, responding to Mr Pintard’s letter earlier this week, said a forensic probe on events at BPL over the previous five years - including the Minnis administration’s term in office - is now underway and the results will be made public.

However, the Opposi tion’s leader branded as an “absolute farce” the Gov ernment’s insistence that it never saw or reviewed rec ommendations to execute the trades that would sus tain BPL’s fuel hedge and 10.5 cents per kWh fuel

charge for all its custom ers. “Additional documents prove it even more,” he said, referring to e-mails between government minis ters and officials on the fuel hedge which the Opposition is threatening to publicly disclose.

“There has to be conse quences not only for bad decisions but attempts to cover up bad decisions,” Mr Pintard blasted. “We will raise it again this week, and have a meeting on it this week at the Public Accounts Committee. They have missed their window on two important actions, and we are going to pay.”

The Davis administration and BPL have repeatedly said the initial fuel hedg ing structure, put in place by the Inter-American Development Bank (IDB) remains in place, which is correct. The December 2020 hedge covered a total 3.565m barrels of oil for BPL that were priced at $40 each and split into three tranches.

This transaction hedged 75 percent of BPL’s fuel needs for 2022, 50 percent of its requirements for 2023, and 25 percent of 2024’s needs via the IDB’s upfront hedge. These were were not hedged 100 percent because

BPL needed to monitor global oil price movements so that it did not end up hedging at a price above market costs and thus end up losing money.

The Government, though, is not giving the full story. BPL was supposed to “backfill” the original IDB hedge by purchasing the extra fuel volumes to fully address its needs. This was to be done via the series of trades, known as call options, referred to by Mr Pintard that would have enabled BPL to obtain fuel - covering the 20 percent balance for 2022, 50 percent for 2023 and 75 percent for

2024 - at prices below thenprevailing oil market rates had they been executed.

It was these trades, sched uled to have been executed in tight windows in Septem ber 2021 and December 2021 just after the Davis administration took office, that were not carried out. As a result, BPL has increasingly been buying fuel at higher market rates with the fuel charge artifi cially held at 10.5 cents per kWh via the combination of government subsidies and $90m Shell non-payment. This can no longer be sus tained, and consumers must pay up as a result.

and Sewerage Corpora tion’s delinquent accounts receivable.

“All previous delinquent accounts receivable from the Water and Sewerage Corporation, including accrued interest thereon, were eventually paid in full. Based upon this payment

history, Consolidated Water (Bahamas) has never been required to provide an allowance for doubt ful accounts for any of its accounts receivable, despite the periodic accumulation of significant delinquent balances,” the BISX-listed reverse osmosis plant opera tor continued.

“In February 2022, Consolidated Water (Bahamas” received cor respondence from the Ministry of Finance of the Government of The Baha mas that set forth a payment schedule providing for the gradual reduction over the course of 2022 of Consoli dated Water (Bahamas) delinquent accounts receiv able due from the Water and Sewerage Corporation.

“Such correspondence also indicated that the Gov ernment intends to return all of Consolidated Water (Bahamas) accounts receiv able from the Water and Sewerage Corporation to

current status. As of September 30, 2022, Con solidated Water (Bahamas) accounts receivable from the Water and Sewerage Corporation amounted to $15.2m.”

However, for the three months to end-September 2022, Consolidated Water’s “interest income decreased by approximately $112,000 compared to 2021 primar ily due to the decrease in Consolidated Water (Baha mas) accounts receivable balance”. The company also saw repairs and mainte nance costs at its Bahamas operations jump by $361,000

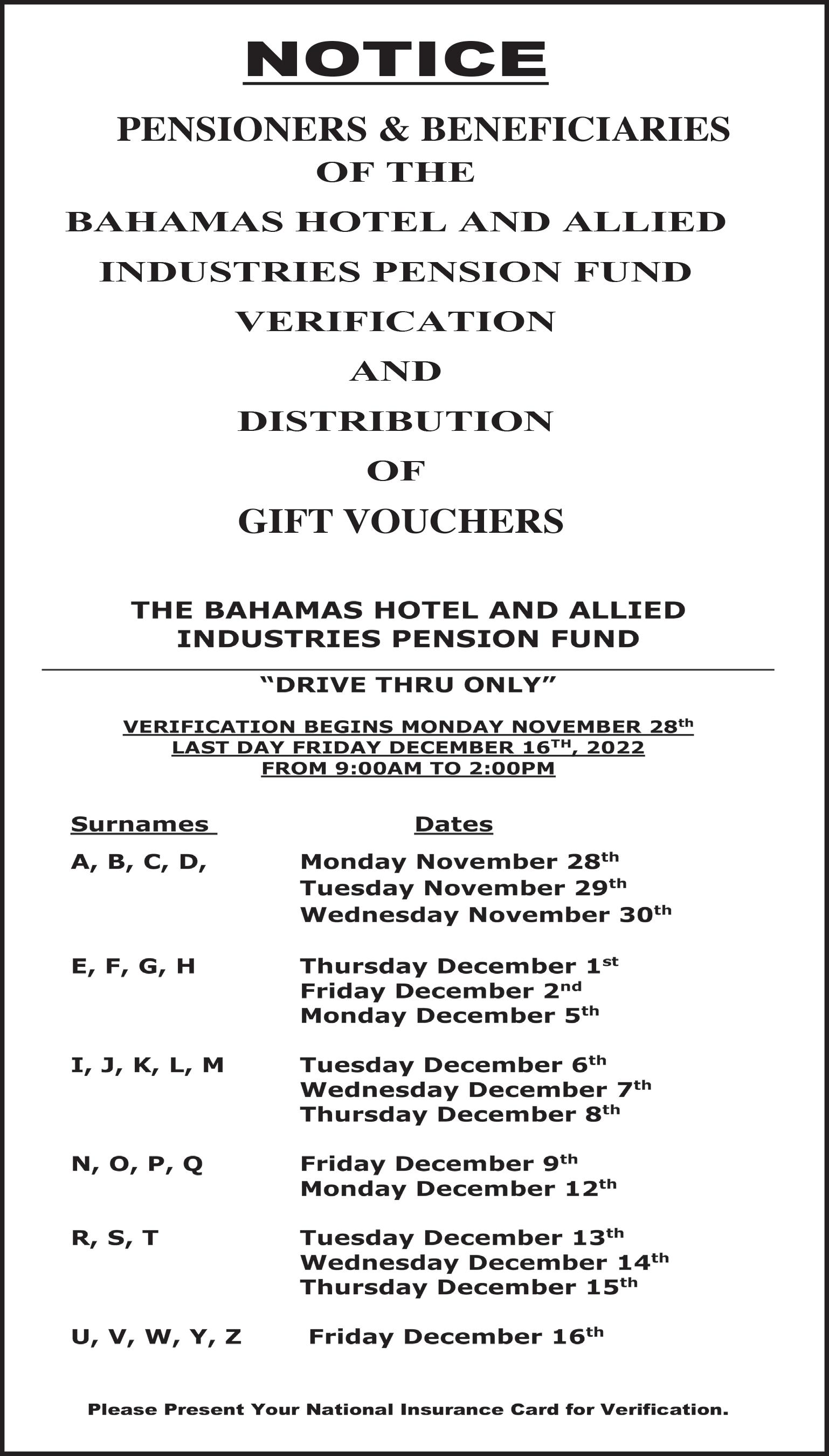

NOTICE

during the 2022 third quarter.

“Bulk segment revenue was $8.668m and $6.868m for 2022 and 2021, respec tively. The increase in bulk segment revenue is attrib utable to an increase in energy costs for Consoli dated Water (Bahamas), which increased the energy pass-through component of Consolidated Water (Baha mas) rates,” the BISX-listed water supplier said. The volume of water sold to the Water & Sewerage Corpo ration also increased by 4 percent.

“Our contracts to supply water to the Water &

Sewerage Corporation from our Blue Hills and Windsor plants require us to guaran tee delivery of a minimum quantity of water per week. If the Water & Sewer age Corporation requires the water and we do not meet this minimum, we are required to pay the Water & Sewerage Corporation for the difference between the minimum and actual gallons delivered at a per gallon rate equal to the price per gallon that Water & Sewerage Cor poration is currently paying us under the contract.

NOTICE is hereby given that MARVENS DELHOMME of Central Pines, Dundas Town, Abaco, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 16th day of November, to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

APD 39.95 39.950.00 0.9321.26042.93.15% 2.761.60Benchmark BBL 2.76 2.760.00 0.0000.020N/M0.72% 2.462.26Bahamas www.bisxbahamas.com

(242) 323-2320

CAB 3.95 3.950.0011,260-0.4380.000-9.0 0.00% 10.657.50Commonwealth Brewery CBB 10.25 10.250.00 0.1400.00073.20.00% 3.652.27Commonwealth Bank CBL 3.49 3.490.00 0.1840.12019.03.44% 8.526.05Colina Holdings CHL 8.50 8.500.00 0.4490.22018.92.59% 17.5010.25CIBC

CWCB 3.50 2.74 (0.76) 0.1020.43426.915.84% 11.2810.06Doctor's Hospital DHS 10.50 10.500.00 0.4670.06022.50.57% 11.679.16Emera Incorporated EMAB 9.31 9.29 (0.02) 0.6460.32814.43.53% 11.5010.00Famguard

10.85 10.850.00 0.7280.24014.92.21% 18.3014.05Fidelity Bank

18.10 18.100.00 0.8160.54022.22.98% 4.003.50Focol FCL 3.98 3.980.00 0.2030.12019.63.02% 11.509.50Finco

11.38 11.380.00 0.9390.20012.11.76% 16.2515.50J.

0.0000.0000.0000.00%

0.0000.0000.0007.00%

1.75%

100.00100.000.00 100.00100.00BGS: 2014-12-30Y

19-Oct-2022 20-Nov-2029 31-Jul-2022 31-Jul-2022 6.95%

31-Mar-2022 31-Aug-2022 4.50% 6.25% 5.60% 15-Jul-2049

31-Aug-2022 31-Aug-2022

31-Aug-2022 31-Jan-2022 31-Jan-2022 31-Jan-2022 31-Jan-2022

31-Mar-2021 31-Mar-2021

THE TRIBUNE Wednesday, November 16, 2022, PAGE 5

PAGE B1

WATER CORP DEBTS TO TOP SUPPLIER SLASHED BY 30%

NOTICE is hereby given that

should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 9th day of November, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas. NOTICE TUESDAY, 15 NOVEMBER 2022 CLOSECHANGE%CHANGEYTDYTD% BISX ALL SHARE INDEX: 2623.14-0.70-0.03394.9017.72 BISX LISTED & TRADED SECURITIES 52WK HI52WK LOWSECURITY SYMBOLLAST

YIELD

AML Foods Limited

APD Limited

First Holdings Limited BFH

of Bahamas BOB

Property Fund

Waste

S. Johnson JSJ

PREFERENCE SHARES 1.001.00Bahamas First Holdings PreferenceBFHP 1.00 1.000.00 0.0000.0000.0000.00% 1000.001000.00 Cable Bahamas Series 6 CAB6 1000.001000.000.00 0.0000.0000.0000.00% 1000.001000.00 Cable Bahamas Series 9 CAB9 1000.001000.000.00

1.001.00Colina Holdings Class A CHLA 1.00 1.000.00

10.0010.00Fidelity Bank Bahamas Class A FBBA 10.0010.000.00

1.001.00Focol Class B FCLB 1.00 1.000.00 0.0000.0000.0006.50% CORPORATE DEBT - (percentage pricing) 52WK HI52WK LOWSECURITY SYMBOLLAST SALECLOSECHANGEVOLUME 100.00100.00Fidelity Bank (Note 22 Series B+)FBB22 100.00100.000.00 100.00100.00Bahamas First Holdings LimitedBFHB 100.00100.000.00 BAHAMAS GOVERNMENT STOCK - (percentage pricing) 115.92104.79Bahamas Note 6.95 (2029) BAH29 107.31107.310.00 100.00100.00BGS: 2014-12-7Y BG0107 100.00100.000.00 100.00100.00BGS:

BG0207

BG0130

BG0230

BG0307

BG0330

FL BGRS95032 BSBGRS950320100.45100.450.00

FL BGRS97033 BSBGRS970336100.19100.190.00 100.0089.62BGRS FX BGR129249 BSBGR129249389.6289.620.00 100.0089.00BGRS FX BGR131249 BSBGR1312499100.00100.000.00 100.9890.24BGRS FX BGR132249 BSBGR1322498100.00100.000.00 100.0090.73BGRS FX BGR136150 BSBGR1361504100.00100.000.00 MUTUAL FUNDS 52WK HI52WK LOW NAV YTD%12 MTH% 2.552.11

4.833.30

2.241.68

207.86164.74

MARKET TERMS BISX ALL SHARE INDEX - 19 Dec 02 = 1,000.00 YIELD - last 12 month dividends divided by closing price - Highest closing price in last 52 weeks Bid $ - Buying price of Colina and Fidelity 52wk-Low - Lowest closing price in last 52 weeks Ask $ - Selling price of Colina and fidelity Previous Close - Previous day's weighted price for daily volume Last Price - Last traded over-the-counter price Today's Close - Current day's weighted price for daily volume Weekly Vol. - Trading volume of the prior week Change - Change in closing price from day to day EPS $ - A company's reported earnings per share for the last 12 mths Daily Vol. - Number of total shares traded today NAV - Net Asset Value DIV $ - Dividends per share paid in the last 12 months N/M - Not Meaningful P/E - Closing price divided by the last 12 month earnings TO TRADE CALL: CFAL 242-502-7010 | ROYALFIDELITY 242-356-7764 | CORALISLE 242-502-7525 | LENO 242-396-3225 | BENCHMARK 242-326-7333 4.50% 6.40% 4.31% 5.55%

FUND CFAL Bond Fund CFAL Balanced Fund CFAL Money Market Fund CFAL Global Bond Fund

NAV Date

“The Blue Hills contract expires in 2032 and requires us to deliver 63m gallons of water each week. The Wind sor contract expires in 2033 and requires us to deliver 16.8m gallons of water each week.”

FROM PAGE B1 INTEREST Prime +

HENRY CLAUDE TIDOR of #18 Quintine Alley, New Providence, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization MARKET REPORT

CLOSECLOSECHANGE VOLUMEEPS$DIV$P/E MATURITY

7.005.30 4.50%

AML 6.95 6.950.00 1220.2390.17029.12.45% 53.0040.00 Colonial Bahamas Fund Class D Colonial Bahamas Fund Class E Colonial Bahamas Fund Class F CFAL Global Equity Fund Leno Financial Conservative Fund Leno Financial Aggressive Fund Leno Financial Balanced Fund Leno Financial Global Bond Fund RF Bahamas Opportunities Fund - Secured Balanced Fund RF Bahamas Opportunities Fund - Targeted Equity Fund RF Bahamas Opportunities Fund - Prime Income Fund RF Bahamas International Investment Fund Limited - Equities Sub Fund RF Bahamas International Investment Fund Limited - High Yield Income Fund RF Bahamas International Investment Fund Limited - Alternative Strategies Fund (242)323-2330

2.46 2.460.00 0.1400.08017.63.25% 2.852.25Bank

2.57 2.570.00 0.0700.000N/M0.00% 6.205.75Bahamas

BPF 6.20 6.200.00 1.7600.000N/M0.00% 10.058.78Bahamas

BWL

8.78 8.780.00 0.3690.26023.82.96% 4.342.82Cable

Bahamas

FirstCaribbean

Bank CIB 16.00 16.000.00 0.7220.72022.24.50% 3.251.99Consolidated

Water BDRs

FAM

(Bahamas) Limited FBB

FIN

15.55 15.550.00 0.6310.61024.63.92%

0.0000.0000.0006.25%

2015-1-7Y

100.00100.000.00 100.00100.00BGS: 2015-1-30Y

100.00100.000.00 100.00100.00BGS: 2015-6-7Y

100.00100.000.00 100.00100.00BGS: 2015-6-30Y

100.00100.000.00 100.00100.00BGS: 2015-10-7Y BG0407 100.00100.000.00 100.35100.00BGRS FL BGRS88028 BSBGRS880287100.35100.350.00 100.24100.00BGRS FL BGRS76024 BSBGRS760240100.00100.000.00 99.9599.30BGRS FX BGR142251 BSBGR142051699.9599.950.00 99.9599.95BGRS FL BGRS91032 BSBGRS91032499.9599.950.00 100.57100.11BGRS

100.5299.96BGRS

2.552.24%4.01%

4.833.42%7.26%

2.241.70%2.82%

197.44-2.97%-2.35% 212.41116.70 202.39-4.72%6.04% 1.751.70 1.751.96%2.84% 1.911.76 1.914.83%7.23% 1.871.77 1.873.48%4.44% 1.050.96 0.96-6.57%-8.29% 9.376.41 9.37-0.02%10.36% 11.837.62 11.79-0.33%18.23% 7.545.66 7.540.22%3.05% 16.648.65 15.94-3.89%14.76% 12.8410.54 12.47-1.04%-2.57% 10.779.57 10.740.81%4.20% 10.009.88 N/AN/AN/A 10.438.45 10.433.00%25.60% 14.8911.20 14.897.90%48.70%

18-Jan-2024 15-Feb-2051 17-Apr-2033 15-Apr-2049 4.37% 4.31% 15-Aug-2032 25-Sep-2032 6.25% 30-Sep-2025 31-Mar-2022

6.25% 4.50% 6.25% 4.25%

5.65%

5.69%

4.33%

15-Dec-2021 30-Jul-2022 15-Dec-2044 30-Jul-2045 26-Jun-2022 26-Jun-2045 15-Oct-2022 29-Jul-2022

21-Apr-2050

26-Jul-2028 15-Oct-2049 31-Mar-2021

31-Jan-2022 31-Jan-2022

NOTICE

NOTICE is hereby given that ESTHER DOCILMA of Podoleo Street, New Providence, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twentyeight days from the 9th day of November, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE

The Public is hereby advised that I, Nakisha Adderley, of Lincoln Boulevard, Nassau, The Bahamas, intend to change my daughter’s name from NAKETRA DINEK ANTONIQUE MEDEUS to NAKETRA DINEK ANTONIQUE ADDERLEY If there are any objections to this change of name by Deed Poll, you may write such objections to the Chief Passport Officer, P.O. Box N-742, Nassau, New Providence, Bahamas no later than thirty (30) days after the date of publication of this notice.

INTENT TO CHANGE NAME BY DEED POLL

PUBLIC NOTICE

NOTICE

is hereby given that DANILO RULLI of 6 Gunport Blvd ,Grand Bahama The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 16th day of November, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE

NOTICE

is hereby given that ALEXANDER ZAGO of Grand Bahama, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 16th day of November, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

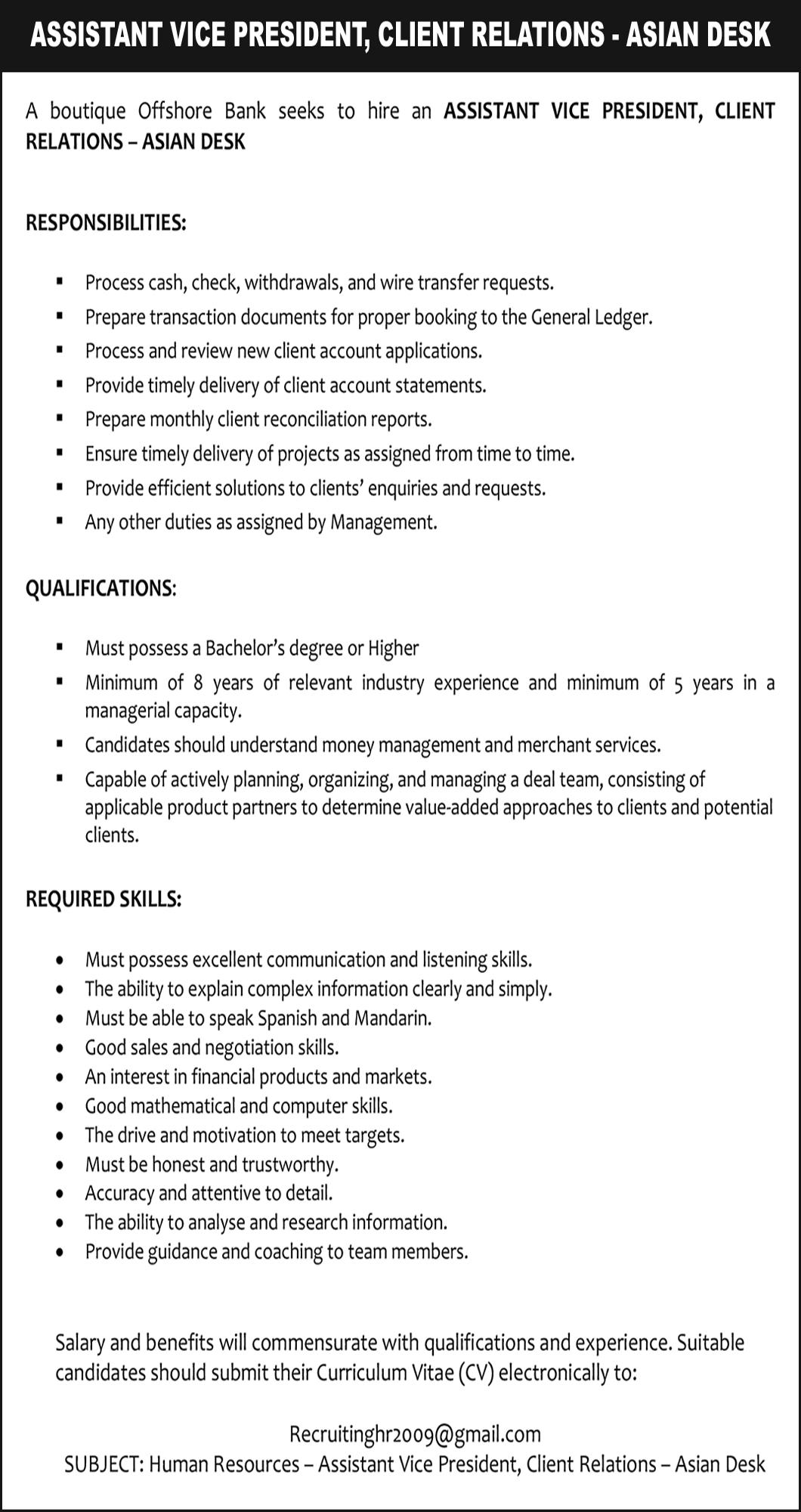

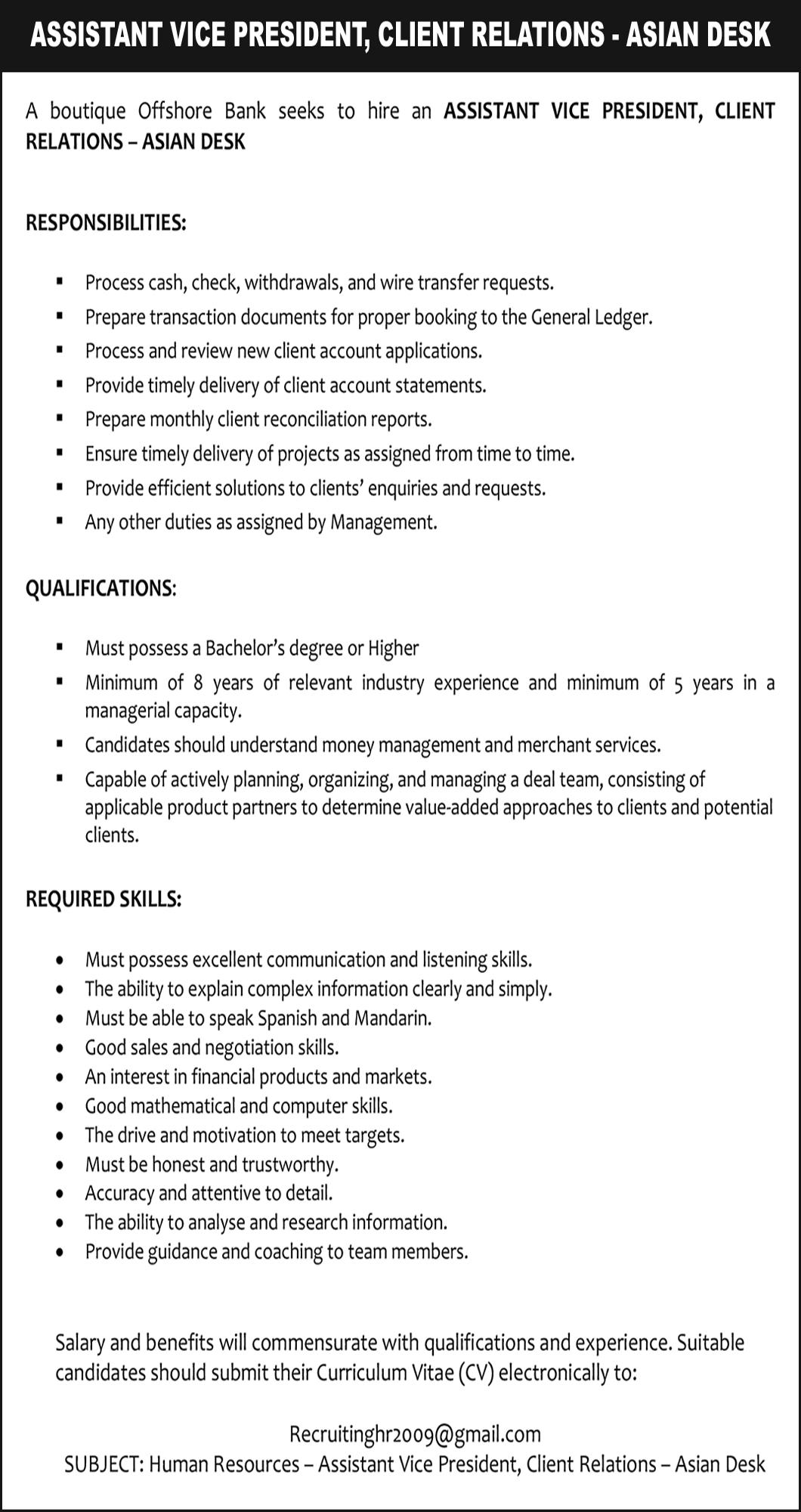

Asian shares fall on jitters over missile landing in Poland

By YURI KAGEYAMA AP Business Writer

ASIAN shares were mostly lower Wednesday, as investors got jittery over global risks after Poland said a Russian-made missile killed two people there.

Benchmarks fell in morning trading in Tokyo, Sydney, Seoul and Hong Kong, while shares were little changed in Shanghai.

Ukrainian President Volodymr Zelenskyy decried the blast as "a very significant escala tion" of the war. Details were unclear, including who fired the missile. The Polish government said it was investigating. President Joe Biden, in Indonesia for the Group of 20 summit, promised "full U.S sup port for and assistance with Poland's investigation."

Japan's benchmark Nikkei 225 lost 0.2% in morning trading to 27,924.63. Australia's S&P/ASX 200 slipped 0.3% to 7,121.60. South Korea's Kospi shed 0.3% to 2,472.97. Hong Kong's Hang Seng fell nearly 0.2% to 18,308.00, while the Shanghai Composite was little changed, inching up less than 0.1% to 3,135.88.

"Asian equities were defensive on Wednesday,

with geopolitical ten sions driving price action," said Anderson Alves at ActivTrades.

"Traders are waiting for further developments on the geopolitical front for direction for risk assets. Any signal of escalation in the volatile situation could see a reaction across mar kets," he said.

On Wall Street, stocks finished higher following more signs the nation's pun ishingly high inflation may be falling off faster than expected. Stocks momen tarily fell on the missile reports, but rebounded.

The S&P 500 climbed 0.9%, or 34.48 points, to 3,991.73. The Dow Jones Industrial Average veered from a gain to a loss, before closing at 33,592.92, up 56.22 points, or 0.2%. The Nasdaq composite led the market with a gain of 1.4%, or 162.19 points, to close at 11,358.41.

When Wall Street opened for trading, the overall mood was ebullience as stocks bounced following the latest data suggesting inflation continues to cool from its summertime peak. A meeting between the presidents of the world's two largest economies also raised hopes for an easing of U.S.-Chinese

tension after analysts called it better than expected.

The S&P 500 touched its highest level in two months, while Treasury yields eased on hopes a slowdown in inflation could mean the Federal Reserve's bitter, economy-crunching medi cine for it could taper as well.

"Inflation is still top of mind and market moving," said Nate Thooft, senior portfolio manager at

Manulife Investment Man agement. "Anything that potentially swings the infla tion story, the market is keen to react."

Such sharp hourly swings for stocks have almost become the norm on Wall Street this year, as high inflation and interestrate hikes by the Federal Reserve have heightened fears and triggered kneejerk reactions. "The market remains adrift looking for

a good narrative that will stick but seemingly not finding it," Thooft said.

Technology stocks con tinued to lead the way on Wall Street. They're usually some of the most sensitive to changes in interest rates, as rises in rates hit hardest on stocks seen as the most expensive, most risky or forcing investors to wait the longest for big growth.

Chipmaker Nvidia rose 2.3%, and Apple gained 1.2%.

Traders have been paring their bets for how big a hike the Fed will announce at its next policy meeting in December.

The Fed has already hiked its key overnight rate up to a range of 3.75% to 4% from virtually zero ear lier this year. It plans more, but the hope for markets is that improvements in infla tion data could mean the Fed holds rates at a level that's not as punishing for Wall Street.

Rate increases can cause a recession because they slow the economy, and they also drag down prices of stocks and other investments.

Bond yields, which have been hovering near multidecade highs, eased. The yield on the two-year Treasury fell to 4.34%

from 4.40% late Monday. The yield on the 10-year Treasury, which influences mortgage rates, fell to 3.76% from 3.85%.

Investors will get more updates on inflation's impact on businesses and consumers this week with corporate earnings from big retailers.

Walmart jumped 6.5% after reporting strong financial results, rais ing its profit forecast and announcing an opioid set tlement. Target reports its results on Wednesday, and Macy's reports its results on Thursday.

Wall Street will get a broader update on retail sales Wednesday when the government releases its report for October.

Prices for crude oil fell back after jumping the day before. A worsening war in Ukraine could cause spikes in prices for oil, gas and other commodities that the region produces.

In energy trading, bench mark U.S. crude fell 29 cents to $86.63 a barrel. Brent crude, the interna tional standard, fell 28 cents to $93.58 a barrel.

In currency trading, the U.S. dollar edged up to 139.88 Japanese yen from 139.27 yen. The euro cost $1.0382, up from $1.0349.

Tesla board chair testifies in Musk compensation lawsuit

By RANDALL CHASE AP Business Writer

THE head of Tesla's board of directors testified Tuesday in a shareholder lawsuit challenging a 2018 compensation plan for CEO Elon Musk potentially worth more than $55 billion that she was less concerned about how much time Musk would commit to the com pany than in the results he could bring.

"We didn't talk about time," Robyn Denholm said when asked about her dis cussions with Musk about the compensation plan, which didn't include any requirement on how much time he would devote to the company, as opposed to his other business ventures.

"He was focused on achieving results, not on any quantum of time he would need to spend," Den holm said. She added that she doesn't know how many

hours Musk — who last month took over Twitter after paying $44 billion for the social media platform — devotes to Tesla.

"I'm not concerned about time," added Denholm, who was a member of the compensation committee at the electric car and solar panel maker that developed the plan. "I know periods of time where he is sleeping on the factory floor."

The lawsuit alleges that the performance-based

stock option grant was negotiated by the com pensation committee and approved by Tesla board members who had conflicts interest due to personal and professional ties to Musk, including invest ments in his companies. It also alleges the shareholder vote approving the compen sation plan was based on a misleading proxy statement.

The lawsuit alleges that the proxy wrongly described members of the compensation committee as "independent," and charac terized all of the milestones that triggered vesting in the stock options as "stretch" goals meant to be difficult to achieve, even though

internal projections indi cated that three operational milestones were likely to be achieved within 18 months of the stockholder vote.

Attorneys for the defend ants have noted that two institutional proxy advising firms that urged shareholders to reject the plan nevertheless noted that it would require "sig nificant and perhaps historic achievements" and require growth that "appear stretch ing by any benchmark."

"I thought they, at the time, were quite auda cious," Denholm said of the milestones.

The plan called for Musk to reap billions if Tesla hit certain market

capitalization and opera tional milestones. For each incidence of simultane ously meeting a market cap milestone and an opera tional milestone, Musk, who owned about 22% of Tesla when the plan was approved, would get stock equal to 1% of outstand ing shares at the time of the grant. His interest in the company would grow to about 28% if the company's market capitalization grew by $600 billion. Each milestone in the plan includes grow ing Tesla's market capitalization by $50 bil lion and meeting aggressive revenue and pretax profit growth targets.

PAGE 6, Wednesday, November 16, 2022 THE TRIBUNE

A CURRENCY trader passes by a screen showing the Korea Composite Stock Price Index (KOSPI), right, at the foreign exchange dealing room of the KEB Hana Bank headquarters in Seoul, South Korea, Wednesday, Nov. 16, 2022. Asian shares were mostly lower Wednesday, as investors got jittery over global risks after Poland said a Russian-made missile killed two people there.

Photo:Ahn Young-joon/AP

Harbour woes ‘threaten life, immense damage’

repairs to the breakwa ter be a high-priority item given the potential threat to tourism, the cruise industry and commercial shipping - all three of which are industries that the Bahamian economy and society rely heavily on to provide a lifeline. Among other entities that could be impacted by waves and storm surge breaking through are The Pointe and its newly-opened Mar garitaville resort.

Dion Bethell, APD’s (APD) president and chief financial officer, last year said the company planned to “resubmit” to the Gov ernment a shortlist of two firms that could examine the extent of the breakwa ters’ erosion and determine the multi-million dollar repair/replacement costs.

The firms involved were Orion Marine Con struction and Bermello Ajamil & Partners, and he explained that the Nassau harbour safeguards - which have been in place since Majority Rule some 54 years ago - are “no longer

able to absorb the energy from the ocean” especially at high tide or during rough weather.

This impacts “the chan nel” cargo vessels use to access Nassau’s major commercial shipping port, and complicates the work of APD staff, service pro viders and ship’s crew in unloading and working on the boat. The “roll”, or pitch, of cargo vessels in such circumstances can be between “six to ten feet up and down”, which is “very unforgiving” on APD’s cranes and other equipment and results in significant wear and tear.

While vessels can still safely enter and exit the Arawak Cay-based port, Mr Bethell added that APD “won’t compromise” on safety. Junkanoo Beach, and the area in close prox imity to The Pointe, had previously been selected as one of the sites to benefit from a $35m InterAmerican Development Bank (IDB) loan designed to enhance coastal zone management and related infrastructure, and make

N O T I C E

DYNASTIC TREASURES LTD.

N O T I C E IS HEREBY GIVEN as follows:

(a) DYNASTIC TREASURES LTD. is in voluntary dissolution under the provisions of Section 138 (4) of the International Business Companies Act 2000.

(b) The dissolution of the said company commenced on the 10th November, 2022 when the Articles of Dissolution were submitted to and registered by the Registrar General.

(c) The Liquidator of the said company is Bukit Merah Limited, The Bahamas Financial Centre, Shirley & Charlotte Streets, P.O. Box N-3023, Nassau, Bahamas.

Dated this 16th day of November, 2022.

Bukit Merah Limited Liquidator

it more resilient to climate change impacts.

Elsewhere, APD revealed it has faced chal lenges recruiting new staff to replace those who departed during COVID due to the “extraordi nary expectations” that applicants have when it comes to their salaries and benefits. “APD expe rienced staff losses during the pandemic lockdowns, requiring human resources to focus on rebuilding manpower capacity,” the annual report said.

“There have also been new hiring challenges. Many job seekers present with extraordinary expec tations in terms of salaries and perks that are not con sistent with their skills and experience profiles. However, the manpower complement is now nearing pre-COVID levels.”

Many other employers will likely recognise APD’s difficulties in recruiting workers who possess the skills it requires to function with maximum operational efficiency. “Among the challenges in staffing for 2022-2023 will be retaining

top performers, making carefully reflected hires and training replacements where there have been losses,” the port operator added.

“A top concern will be to attract people who will provide the best fit. This will require APD to carefully review our corporate culture, com pensation, incentives for competitive performance, and operating policies and procedures relating to retention of good employ ees and attracting new ones.”

The BISX-listed port operator also disclosed its battle with truckers who used “fraudulent means” in a bid to bypass its checks and systems designed to ensure all vehicles admit ted meet the required safety standards.

“The protocol of inspect ing trucks continued to ensure roadworthiness and fitness to move about the port without compromising the safety of APD per sonnel and all port users. Here the challenge was to detect and defeat attempts of drivers who try to

N O T I C E

ARCHER ASSETS LIMITED

N O T I C E IS HEREBY GIVEN as follows:

(a) ARCHER ASSETS LIMITED is in voluntary dissolution under the provisions of Section 138 (4) of the International Business Companies Act 2000.

(b) The dissolution of the said company commenced on the 10th November, 2022 when the Articles of Dissolution were submitted to and registered by the Registrar General.

(c) The Liquidator of the said company is Bukit Merah Limited, The Bahamas Financial Centre, Shirley& Charlotte Streets, P.O. Box N-3023, Nassau, Bahamas.

Dated this 16th day of November, 2022.

Bukit Merah Limited Liquidator

defraud the system,” APD revealed.

“Another concern was barring from entering the port truckers who do not meet safety requirements to pass gate inspection. There were those who tried to use fraudulent means to bypass this necessary stage that protects port person nel and equipment, and contributes to the safety of the public when trucks are in code.”

COVID-related shocks to the shipping industry and global supply chain, APD added, were likely to drive increased demand for “more flexible ship ping services” that could provide new business opportunities. “Meanwhile e-commerce, acceler ated by the pandemic, has transformed consumer shopping habits and spend ing patterns, and driven the demand for distribution facilities and warehousing that are digitally enabled and value-added services,” Mr Bethell wrote.

“This could generate new business opportunities for shippers, Nassau Con tainer Port and affiliated

public and private mari time agencies. All the foregoing must be in active discussion to assess the potential challenges and opportunities to discover how this evolution can be exploited for the benefit of APD and the country at large......

“All told, COVID-19, in its continued evolu tions, has changed the face of the maritime industry fundamentally across all economic and social strata. It turned the spotlight on the company’s quality infrastructure, its stand ards, standard operating procedures, its teams, and management,” the APD chief continued.

“Continued profitability will hinge largely on our timely response to chang ing circumstances and the company’s ability to pivot and adopt new norms, especially in health pro tection, communications, and staff deployment. This is a global challenge, and the ones who are quickest off the blocks and into the race will reap the greater rewards.”

N O T I C E

PIMLEY LIMITED

N O T I C E IS HEREBY GIVEN as follows:

(a) PIMLEY LIMITED is in voluntary dissolution under the provisions of Section 138 (4) of the International Business Companies Act 2000.

(b) The dissolution of the said company commenced on the 10th November, 2022 when the Articles of Dissolution were submitted to and registered by the Registrar General.

(c) The Liquidator of the said company is Leeward Nominees Limited, Vistra Corporate Services Centre, Wickhams Cay II, Road Town, Tortola, British Virgin Islands.

Dated this 16th day of November, 2022.

Nominees Limited Liquidator

THE TRIBUNE Wednesday, November 16, 2022, PAGE 7

FROM PAGE B1

Leeward

Stocks rise on cooling inflation data after up-and-down day

By DAMIAN J. TROISE AND STAN CHOE AP Business Writers

STOCKS rose on Wall Street Tuesday following more signs the nation’s pun ishingly high inflation may be falling off faster than expected.

The S&P 500 climbed 0.9%, or 34.48 points, to 3,991.73, though it went on another unsettling ride to get there. A flare-up of worries about the war in Ukraine caused a brief pull back in markets during the afternoon, forcing the S&P 500 to swing from an early gain of 1.8% all the way to a loss of 0.1% before it recovered.

The Dow Jones Industrial Average veered from a gain of 450 points to a loss of 216 before closing at 33,592.92, up 56.22 points, or 0.2%. The Nasdaq composite led the market with a gain of 1.4%, or 162.19 points, to close at 11,358.41.

When Wall Street opened for trading, the overall mood was ebullience as stocks bounced following the latest data suggesting inflation continues to cool from its summertime peak. A meeting between the presidents of the world’s two largest economies also raised hopes for an easing of U.S.-Chinese ten sion after analysts called it better than expected.

The S&P 500 touched its highest level in two months, while Treasury yields eased on hopes a slowdown in inflation could mean the Federal Reserve’s bitter, economy-crunching medi cine for it could taper as well.

But the gains for stocks disappeared following reports that apparent Rus sian missiles crossed into Poland, which is a member of NATO.

Prices for crude oil jumped as stock prices fell, an indication trad ers were building bets for

aftershocks from an escala tion in the war in Ukraine.

Beyond the human toll, a worsening war could cause spikes in prices for oil, gas and other commodities that the region produces, which could worsen inflation.

Stocks then recovered and began climbing anew as the afternoon progressed.

“Inflation is still top of mind and market moving,” said Nate Thooft, senior portfolio manager at Manulife Investment Man agement. “Anything that potentially swings the infla tion story, the market is keen to react.”

Such sharp hourly swings for stocks have almost become the norm on Wall Street this year, as high inflation and interestrate hikes by the Federal Reserve have heightened fears and triggered kneejerk reactions. “The market remains adrift looking for a good narrative that will stick but seemingly not finding it,” Thooft said.

Through Tuesday’s swings, technology stocks continued to lead the way on Wall Street.

They’re usually some of the most sensitive to changes in interest rates, as rises in rates hit hardest on stocks seen as the most expensive, most risky or forcing investors to wait the longest for big growth.

Chipmaker Nvidia rose 2.3%, and Apple gained 1.2%.

Traders have been paring their bets for how big a hike the Fed will announce at its next policy meeting in December. Such specula tion started in earnest after a report last week showed inflation at the consumer level slowed more than expected in October.

On Tuesday, hopes built further after a separate report showed inflation at the wholesale level eased back to 8% in October from 8.4% a month earlier. That was even better than

the 8.3% economists were expecting.

“The improvement is simply encouraging,” said Mark Hackett, chief of investment research at Nationwide. “More impor tantly, what it’s doing is taking universal pessimism and starting to put some holes in that theory.”

The Fed has already hiked its key overnight rate up to a range of 3.75% to 4% from virtually zero ear lier this year. It has said it still plans to hike rates fur ther and then to hold them at that high rate for a while in order to grind down inflation. The hope for markets is that the recent improvements in inflation data could mean the Fed ends up holding rates at a

level that’s not as punishing for Wall Street.

Rate increases can cause a recession because they slow the economy, and they also drag down prices of stocks and other investments.

Bond yields, which have been hovering near multidecade highs, eased. The yield on the two-year Treasury fell to 4.34% from 4.40% late Monday. The yield on the 10-year Treasury, which influences mortgage rates, fell to 3.76% from 3.85%.

Investors will get more updates on inflation’s impact on businesses and consumers this week with corporate earnings from big retailers.

1:00 a.m. 2.1 6:58 a.m. 1.1 1:19 p.m. 2.6 7:57 p.m. 0.9

1:58 a.m. 2.2 7:59 a.m. 1.1

2:13 p.m. 2.5 8:46 p.m. 0.8

2:53 a.m. 2.3 9:00 a.m. 1.0 3:06 p.m. 2.5 9:31 p.m. 0.6 3:44 a.m. 2.6 9:56 a.m. 0.8 3:55 p.m. 2.6 10:15 p.m. 0.4

Sunday Monday Tuesday

4:31 a.m. 2.8 10:49 a.m. 0.5 4:43 p.m. 2.6 10:57 p.m. 0.1

5:16 a.m. 3.0 11:38 a.m. 0.3 5:30 p.m. 2.6 11:40 p.m. -0.1 6:01 a.m. 3.3 12:27 p.m. 0.0 6:16 p.m. 2.7

THE TRIBUNE Wednesday, November 16, 2022, PAGE 9

TRADERS work on the floor at the New York Stock Exchange in New York, Thursday, Nov. 10, 2022.