By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

NASSAU’S main commer cial shipping port is targeting an $808,000 year-over-year increase in net profits for its 2023 financial year after first quarter net income exceeded forecasts by some 56 percent.

Arawak Port Development Company (APD), the BISX-listed owner and operator of Nassau Container Port, gave sharehold ers a boost ahead of this week’s

annual general meeting (AGM) by revealing that profits for the three months to end-September 2022 were almost $1.2m ahead of projections.

It attributed the bottom line performance to increased import activity driven by The Bahamas’ continued economic reflation after fully emerging from COVID-related restrictions, with higher revenues generated in stor age fees, twenty-foot equivalent (TEU) container throughput vol umes and vehicle imports.

The Arawak Cay-based port operator also disclosed that it is projecting a 10.9 percent increase in full-year net income to $8.226m - a target that again seems in danger of being beaten if the first quarter trends persist for the full 12-month period to end-June 2023.

But, despite revenues for the three months to end-September tracking 23 percent or $1.728m ahead of forecast, with TEU vol umes for the period almost 4 percent over budget, APD man agement said they are being “extremely conservative” in not

projecting any major increase in imports related to multiple foreign direct investment (FDI) driven construction projects in 2023.

“For the 2023 fiscal year, we are budgeting gross revenue of $30.619m or 2.2 percent more than the prior year’s actual gross rev enue,” APD told investors in its annual report. Full-year revenues

VAT’s ‘real’ 15% rise since January’s cut

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE BAHAMAS’ bid to achieve full compliance with all global antifinancial crime standards before year-end may have been endan gered by the implosion of the FTX crypto currency exchange, it can be revealed.

For one of the two outstanding standards, on which The Bahamas was hoping to achieve fully “com pliant” status this month after remedying previously-identified defi ciencies in its supervisory regime, relates directly to regulation of the digital assets industry.

A Caribbean Financial Action Task Force (CFATF) discussion paper, dated September 20, 2022, recommended that The Bahamas be upgraded from “partially compliant” to “compliant” on both its antimoney laundering/counter terror financing regulation of both the digital assets sector and non-profits

(charities, advocacy groups and the like) when the body meets to ratify such a move at its end-November meeting.

The CFATF paper, produced less than two months before FTX’s spec tacular collapse into provisional

liquidation in The Bahamas and Chapter 11 bankruptcy protection in the US, even hailed this nation’s digi tal assets regulatory regime. Of the improvements made, it said: “All of which would suggest that The Baha mas has acquired a very sound understanding of the digital assets/ digital asset services providers sector and its associated risks.”

Part of The Bahamas’ efforts to enhance its regulatory regime involved a “risk assessment” under taken by the Securities Commission on the digital assets space. “The Commission notes that the risk assessment finding is that the risk of fraud and scams was low,” the CFATF document noted.

That verdict could soon be sub ject to reappraisal given the ongoing criminal (police) and regulatory probes in The Bahamas and else where into whether “misconduct” was involved in FTX’s spectacular week-long collapse. No such findings

Don’t let FTX woe ‘arm enemies’ of Bahamas

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE OPPOSITION’S leader yesterday warned that the Government’s silence over the FTX crypto exchange’s implosion could “arm enemies of The Baha mas” with ammunition to inflict more damage on its financial services industry.

Michael Pintard told Tribune Business the Davis administration’s failure to “speak definitively” on the company’s collapse, and the actions The Baha mas has taken to protect investors, risks creating a “vacuum” that will be filled by the likes of the European Union (EU) and Organisation for Economic Co-Operation and Devel

opment (OECD) spinning “their own narrative”.

Both bodies have never hesitated to target and ‘blacklist’ The Baha mas in the past, and the Free National Movement (FNM) urged this nation to “guard” against allow ing the duo and their fellow travellers using the FTX situation to further their

Workplace dispute stirs at Pharmachem

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

A WORKPLACE dispute is brewing at a Freeport manufacturer over assertions that plans to implement a 12-hour shift system could put impacted staff “at risk” and amount to a “unilat eral variation” of their employment terms.

Obie Ferguson KC, the Trades Union Con gress (TUC) president and labour attorney, in a November 11, 2022, letter warned Pharmachem that requiring one person to cover a 12-hour shift repre sented “a health and safety concern” and alleged it could lead to liabil ity under the Health and Safety at Work Act.

Purporting to repre sent the electrical and instrument staff at the bulk manufacturer of pharmaceutical drugs, Mr Ferguson argued that the proposed shift system would lead to employees working more hours and less receiving less pay.

Randy Thompson, Phar machem’s chief executive, and to whom Mr Ferguson’s letter

was addressed, confirmed to Tribune Business the company is implement ing a new shift system. However, he declined to comment on the letter or respond to the TUC chief on the basis that it would be “premature” to do so as the change has yet to happen.

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE DAVIS administra tion last night said real VAT revenues increased by 15.1 percent year-over-year fol lowing the New Year’s Day rate cut with the deficit for the 2022-2023 fiscal year’s first quarter slashed by $116.4m.

The Ministry of Finance, unveiling the Government’s financial performance for the three months to endSeptember 2022, sought to further enhance its case that the VAT rate reduc tion from 12 percent to 10 percent - together with the elimination of a host of ‘zero ratings’ and exemp tions - had delivered increased revenues with a measurement that stripped out inflation’s impact.

Arguing that its reforms had improved “equity in the domestic tax structure”, the Ministry of Finance added: “Inflationary pres sures continued to intensify over the quarter, marking

July 2022 prices as the highest recorded in The Bahamas in recent years. Accounting for the 7.9 per centage change in inflation year-over-year, real VAT receipts grew 4 percent over the quarter and 15.1 per cent over the nine months following the policy change.

“Despite the reduction in the nominal VAT rate, revenue outturn from VAT receipts grew period-overperiod by 11.9 percent ($35.2m) to $330.5m for the first three months of fiscal year 2022-2023. The same total increased over the first quarter of fiscal year 2021-2022 by $160.7m (119.3 percent) when com pared to the depressed fiscal year 2020-2021 figure of $134.7m.

“Representing 23.4 per cent of the Budget target, improved first quarter VAT collections are attributed to improved economic conditions as compared to the year prior during the early stages of the

business@tribunemedia.net TUESDAY, NOVEMBER 15, 2022

SEE

SEE

PAGE B8 SEE PAGE B4

PAGE B8

SEE PAGE B6 FTX implosion threatens perfect ‘40 of 40’ in financial crime fight

SEE PAGE B5 Arawak port beats Q1 profits target by 56%

• Bahamas set to be upgraded on digital assets regulation.... • Nation was hailed for ‘sound understanding of sector risks’.. • But that was two months before crypto exchange’s collapse

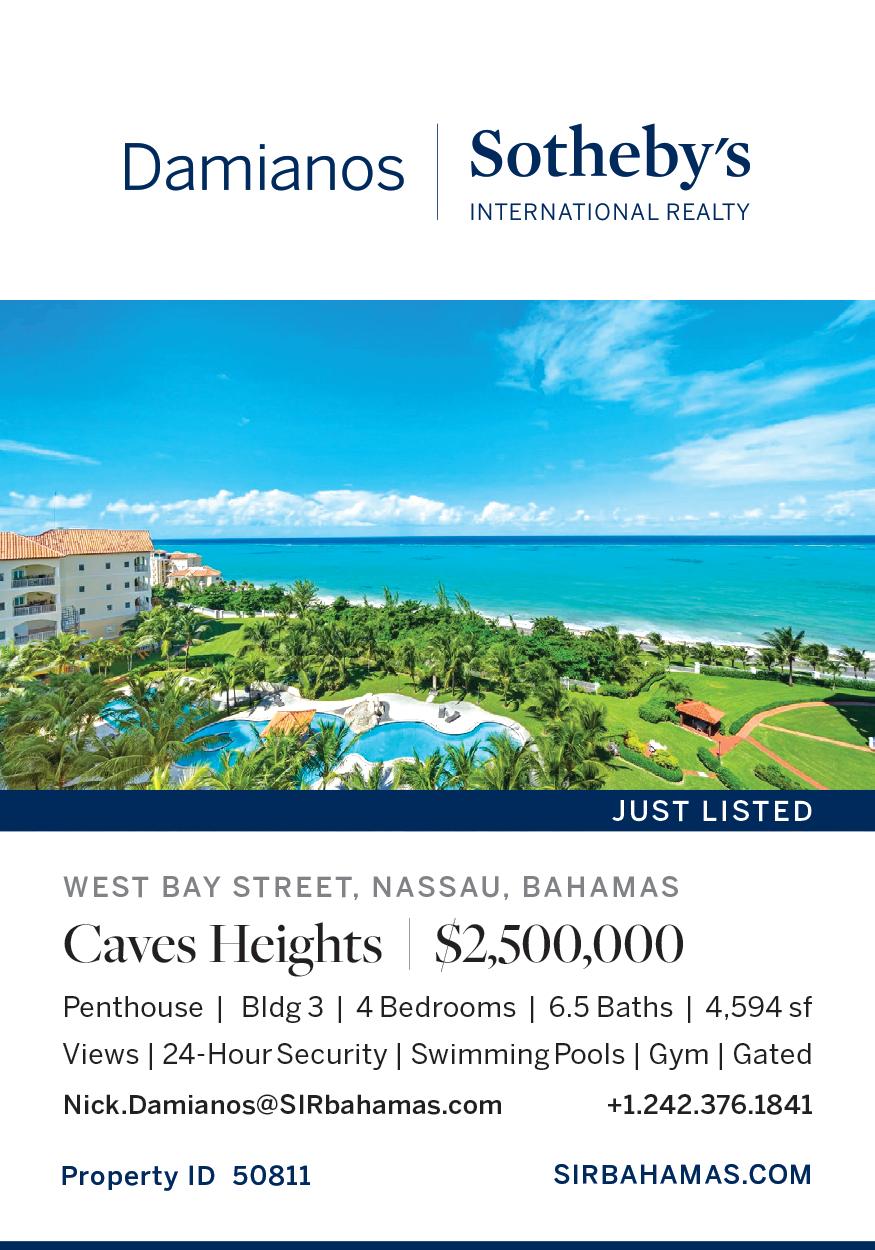

NASSAU Container Port at

Cay. • Net income $1.2m above forecasts • And revenue ahead 23% or $1.73m • Company eyes 11% annual profit rise MICHAEL PINTARD $5.95 $5.97 $6.07 $5.62

THE

Arawak

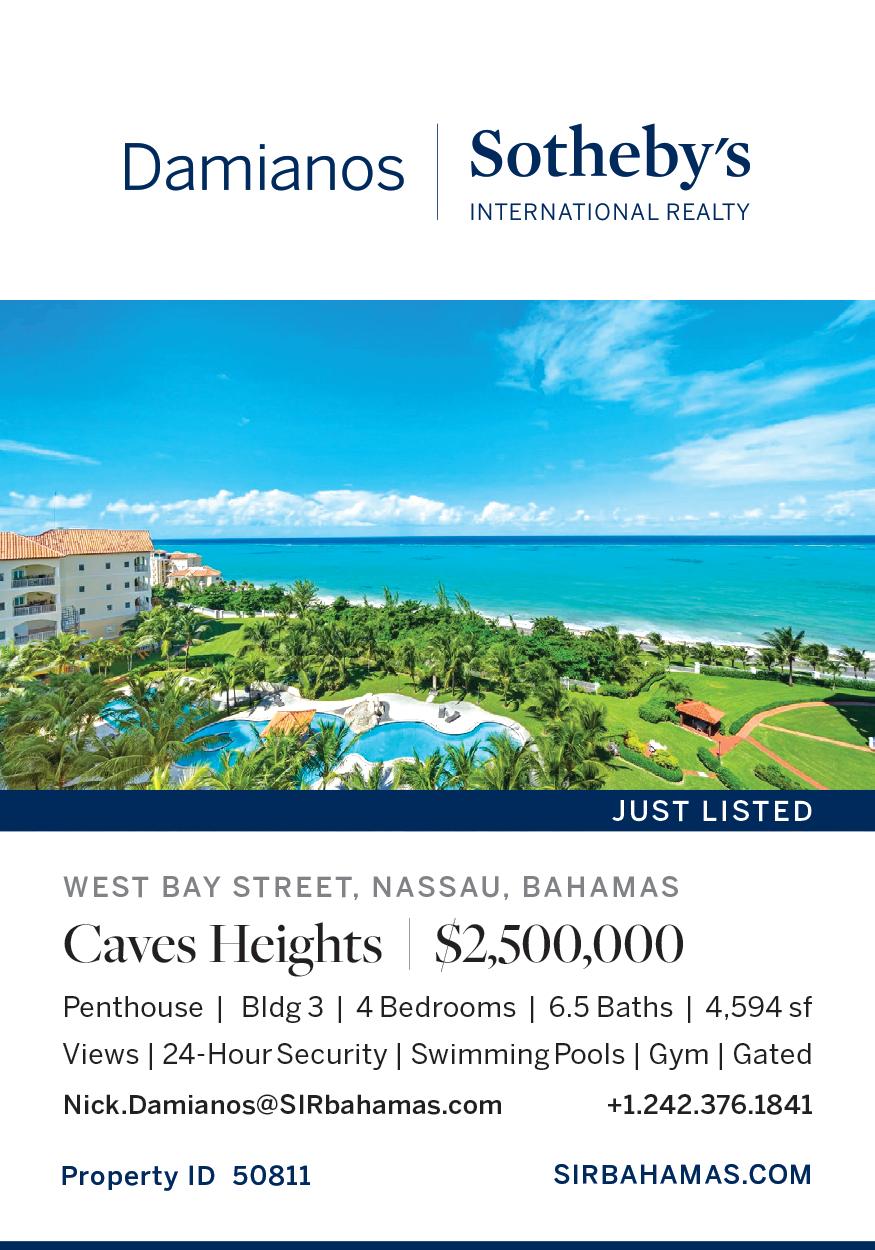

PI developer sells majority stake in banking subsidiary

THE DEVELOPER of Paradise Island’s Hur ricane Hole project has sold a majority stake in its bank and trust company subsidiary as part of a strat egy to take it to “the next trajectory”.

Sterling Global Finan cial Group (SGF), headed by David Kosoy, said in a statement that it is sell ing the majority interest in Sterling Bank & Trust to IIHL Capital. The latter is a subsidiary of IndusInd International Holding, a Mauritius based invest ment holding company with

investments in finance and banking. It is also the pro moter entity of IndusInd Bank, the fifth-largest listed bank in India.

“IIHL Capital provides not only the capital but also brings the global experience of financial services and an extensive network of ultra high net worth clients,” Sterling said of the ration ale for the deal, indicating it will give its bank and trust company greater reach and the ability to expand.

“This would put Sterling Bank & Trust in the next trajectory, enabling it to

offer world-class products and services, apart from traditional mortgage loans, in The Bahamas, the US, Grand Cayman and the UK. We also believe neobanks may occupy close to 40 percent of the overall market by 2030. Therefore, our strategic objective is to provide innovative, cut ting edge technology-based, end-to-end digital-based solutions to customers globally.”

Peter Charrington, former global head, private banking for Citi will be chairman of Sterling Bank

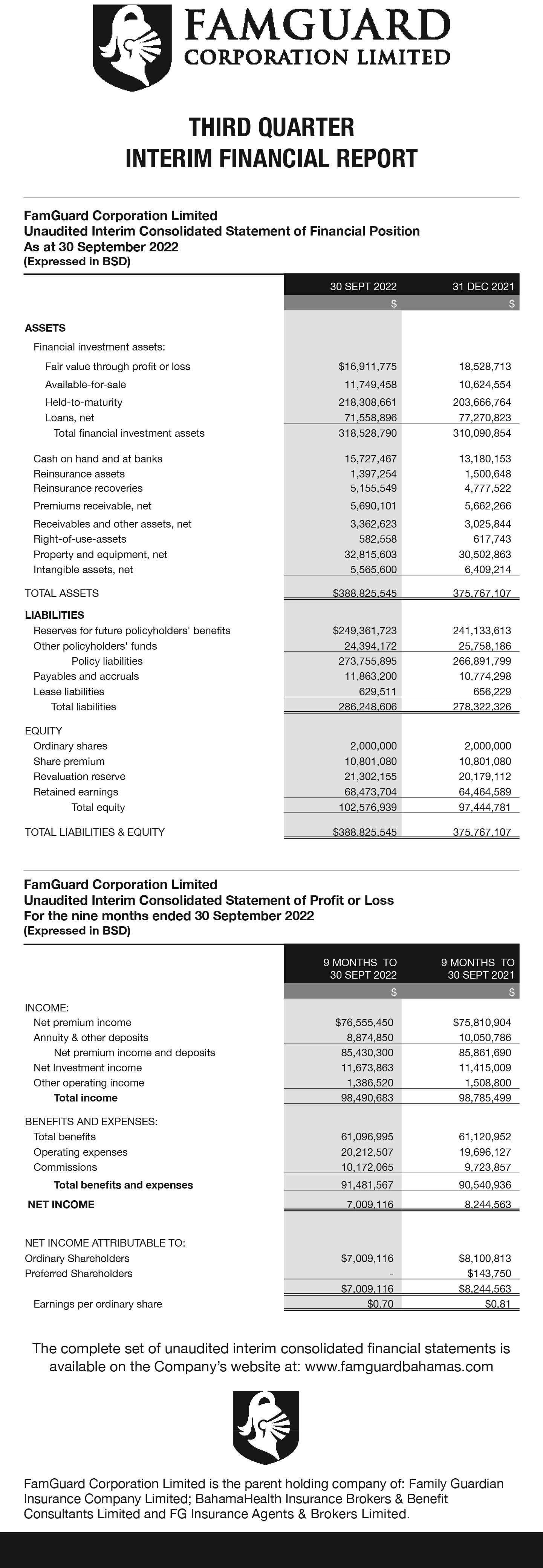

Colina shareholders in 21.8% income decline

& Trust’s revamped Board. The position of managing director and chief execu tive is being taken by BRS Satyanarayana, a 34-year veteran from State Bank of India, the 49th largest bank globally.

He has served as coun try head of the sate bank’s Japan operations for many years, and was also on the boards of banks in Indone sia and Nepal. Both of them bring the best governance practices, operational expe rience and global outlook.

“Sterling Bank & Trust is a wonderful opportunity

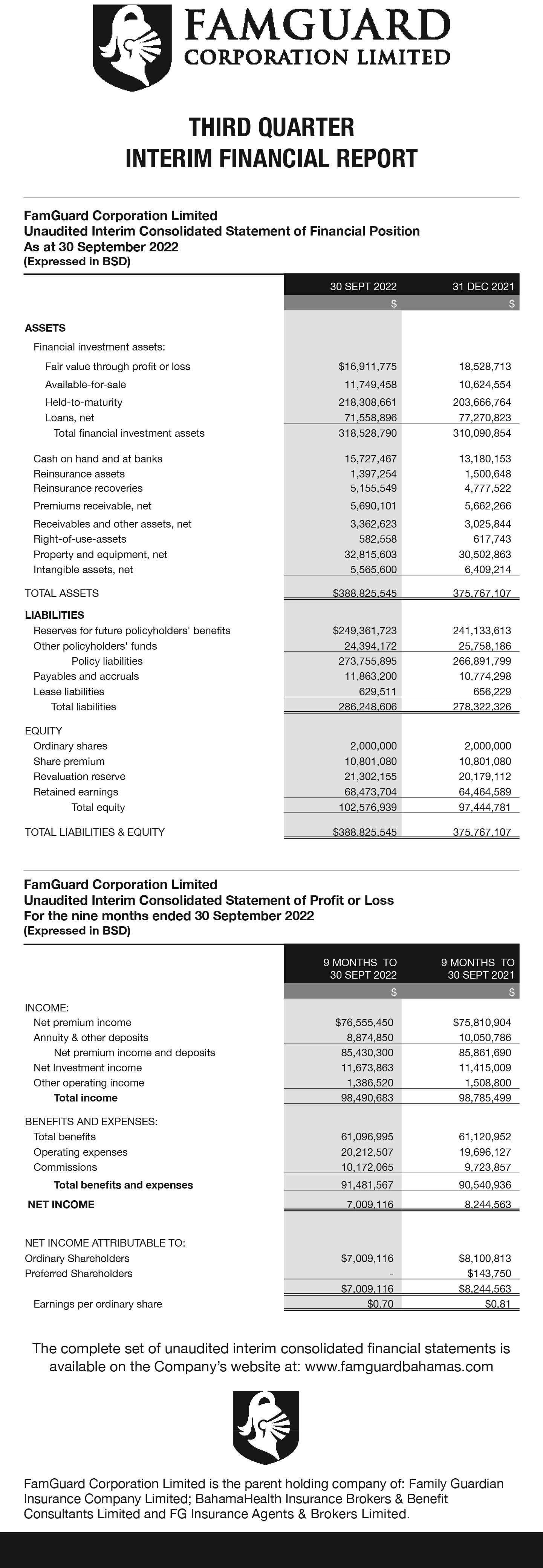

SHAREHOLDERS in Colina Holdings (Baha mas) suffered a 21.8 percent decline in their collective comprehensive income for the nine months to-end September despite a $22.9m jump in premium revenues. The BISX-listed life and health insurance hold ing group, in a statement unveiling its unaudited results for the first nine months of 2022 revealed that net income attributable to ordinary shareholders declined by 58.9 percent over the period.

This fell to $5.1m or $0.21 per ordinary share com pared to $12.4m or $0.50 per ordinary share for the same period during 2021. And comprehensive income attributable to ordi nary shareholders totalled $6.1m or $0.25 per ordinary share for the nine-month period ended September 30, 2022. This compared to $7.8m or $0.32 per share for the same period during the prior year.

Premium revenues stood at $119.3m, increasing by 23.8 percent compared to the prior year’s gross written premiums of $96.4m. “Premium revenue growth is attributed to new lines of medical and gen eral insurance business in 2022,” said Terence Hilts, Colina Holdings (Bahamas) chairman.

“As a result of the addi tional insurance business, net policyholder benefits have similarly increased,

for IndusInd International Holding (IIHL) to continue its journey of international excellence and innova tion,” said Ashok Hinduja, its chairman. “We see the Bahamas and Sterling Bank & Trust as a stepping stone for banking into the Americas.”

“This investment in Ster ling Bank & Trust is an endorsement of The Baha mas, and Sterling Bank & Trust’s people, strategy and the future,” said Mr Kosoy, founder of Sterling Global Financial Group. “For our clients and our team, this

totalling $69.9m for the nine months ended Septem ber 30, 2022, compared to $64.4m for the same period in 2021.” The main driver of the decline in shareholder earnings, though, appears to have been the 42.3 per cent or $9.6m drop in net investment income over the period.

Net investment income totals $13.1m for the nine months ended Septem ber 30, 2022, compared to $22.7m for the same period in the prior year. Colina Holdings (Bahamas) said net investment income has been negatively impacted by market movements resulting from rising US interest rates, which has caused bond prices to fall. These market movements have generated unrealised fair value mark-to-market losses on the company’s for eign currency investment securities.

Meanwhile, the insurer said it has increased its invested assets from $598.9m at December 31, 2021, to $636.6m at Septem ber 30, 2022.

“The Company received some significant repay ments of certain of its receivable balances result ing in large cash balances held at quarter end,” said Mr Hilts. “As a result, the company is well-posi tioned to take advantage of additional purchases of investment securities aligned with the compa ny’s long-term investment

is excellent news as we can now benefit from our new relationship with IIHL”.

Stephen Tiller, Sterling Global Financial’s chief executive, added: “In order to compete in the global environment, you need world-class partners. IIHL has proven that they can grow profitable businesses around the world, and their philanthropic focus bodes well for The Bahamas and Sterling Bank & Trust.” Sterling Global Financial currently has $9bn in assets under management and administration.

TERENCE HILTS

strategy as such opportuni ties become available.”

Shareholders’ equity as at September 30, 2022, totalled $197.4m and is net of dividend distribu tions of $1.8m and $5.9m to the Class ‘A’ prefer ence shareholders and ordinary shareholders, respectively. “The com pany’s balance sheet and capital position remain strong, and posi tion Colina Holdings (Bahamas) to weather uncertainties resulting from mark-to-market fluctua tions and claims volatility,” said Mr Hilts.

“Colina Holdings (Bahamas) continues to concentrate on strate gies that will strengthen its balance sheet and capi tal position to provide the company with the flexibility necessary to consistently meet the needs of poli cyholders and customers within these shifting eco nomic conditions.”

Bahamas targets Canada’s ‘infinite tourism potential’

THE BAHAMAS sought to tap into the “infinite potential” of the Canadian tourism market through a three-day series of promo tional events and meetings

aimed at boosting visitor arrivals from that country.

The Ministry of Tourism, Investments & Aviation, in a statement on its latest global sales and marketing mission, said it launched at Calgary’s Fairmont Pal liser Hotel with a sample of Bahamian culture and cuisine. Chester Cooper, deputy prime minister (DPM) and minister of tourism, investments and aviation, then led a del egation of senior tourism officials to participate in three events.

These included meet ings with key stakeholders from across the tourism industry in a media event on November 1 at the Park Hyatt Toronto, and a trade event the following day at Universal EventSpace in Vaughan. The last occa sion was held in Montreal, Quebec, on November 3 at the Four Seasons Hotel.

Mr Cooper, along with min istry executives, destination representatives and hotel partners, hosted more than 500 guests.

“There is infinite poten tial in Canada – we consider the country an extremely important market,” said Mr Cooper. “With new direct flights from Toronto and Montreal to Grand Bahama coming this December, and frequent flights from Toronto and Montreal to Nassau, visit ing our beautiful islands is easier than e 0ver.

“We are so pleased to also add in a weekly direct non-stop flight from Cal gary to Nassau, as well as a weekly direct flight from Toronto to Exuma.

Weekly service from Mon treal to San Salvador will also be offered this winter - a charter with Club Med.

DR KENNETH ROMER

Canadians should keep island-hopping in The Bahamas top of mind for their next vacation.”

Dr Kenneth Romer, tourism’s deputy directorgeneral, added: “I am elated to see up close and personal all the possibili ties available for Grand Bahama from Canada, and look forward to how tour ism at large will benefit from the invaluable con nections and opportunities advanced from these global missions. I invite all of you to come to Grand Bahama and experience our diverse product offerings. Indeed, Grand Bahama is on a direct trajectory to being grand again.”

The series of global sales and marketing missions began in September in the US. The Ministry of Tour ism will also be heading to Atlanta, Houston and Los Angeles in the future. Once the US and Canadian tour is completed, the Ministry of Tourism delegation will visit Latin America and Europe.

PAGE 2, Tuesday, November 15, 2022 THE TRIBUNE

BAHAMAS CRYPTO EXCHANGE TO ‘PROVE’ FINANCIALLY SOUND

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

A SECOND Bahamasbased crypto currency exchange yesterday pledged to publicly disclose “proof” of its financial soundness and reserves in a bid to reassure jittery investors following the implosion of rival FTX.

Tim Byun, global gov ernment relations officer at OKX, told Tribune Business that FTX’s collapse into provisional liquidation in The Bahamas, and Chapter 11 bankruptcy protection in the US, was having a “devastating effect” on the global digital assets sector, operators in the space and their clients/customers.

“Crypto was founded on the principles of decentrali sation and transparency, with the goal of restor ing financial power to the people. When companies deviate from this, it has devastating effects on the industry and investors, as we’ve seen with FTX,” Mr Byun said.

“While OKX has been committed to the princi ples of decentralisation and transparency since day one, and maintains a mis sion of giving our customers the technology to trade and invest responsibly, we understand that it’s now more important than ever to help people understand why they can feel comfort able using OKX.

“OKX will share proof of our reserves in the coming weeks to provide clarity

on the funds we hold,” he added. “The OKX reserves will be audited and veri fied through an advanced cryptographic accounting procedure in order to prove our solvency without com promising data security.

“The crypto industry, overall, is at a point where companies need to priori tise transparency in order to repair customer trust in the industry, and OKX intends to champion this movement.” OKX had barely been licensed and registered under the Digi tal Assets and Registered Exchanges (DARE) Act, and permitted to operate from The Bahamas by the Securities Commission, before FTX imploded.

The rival crypto currency exchange, which had no connection to events at its

competitor, is thus moving swiftly to do its part to bolster shaky investor confi dence that has been rocked by its rival’s failure. The collapse of Mr BankmanFried’s sprawling crypto empire, which just months ago was valued at around $32bn, in just one week will likely go down in history as one of the most spectacu lar corporate implosions in history.

The episode is being com pared to both Enron’s crash in 2001, amid a series of accounting and corporate governance scandals, and the Lehman Brothers fail ure in 2008 that triggered the global financial crisis and subsequent recession.

Among the most serious allegations facing FTX and Mr Bankman-Fried is that around $10bn belonging

to the crypto exchange’s clients was transferred to Alameda Research, his trading firm, without their permission. These funds were then employed to bailout other troubled crypto businesses such as Blockfi (a $240m option to buy and $400m credit facility) and Voyager ($1.3-$1.4bn) which had run into trouble during the so-called ‘crypto winter’.

However, the only collat eral for this $10bn transfer subsequently turned out to be FTX’s own token, FTT, which was essentially worthless. Besides an $8bn liquidity shortfall at FTX, with liquid assets of $900m compared to $9bn in liabili ties, reports at the weekend alleged that between $1bn to $2bn of the sums

transferred to Alameda were missing.

This, though, was denied by Mr Bankman-Fried, who told the Reuters news agency that he “disagreed with the characterisation” of the transfer, saying: “We had confusing inter nal labelling and misread it.” When asked about the missing customer funds, he replied via Twitter: “???” And, to further compli cate a confusing picture, there were suggestions that another $515m had disap peared from FTX - either as a result of a hack or “inside job”.

Either way, unlike the Lehman Brothers saga, global attention is now fixated on The Bahamas because FTX’s international headquarters are based here.

Pharmacies ‘doing good’ on price control changes

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

PRIVATE pharmacies have “been doing good” and “progressing” since reaching their price control deal with the Government, the Bahamas Pharmaceu tical Association’s (BPA) president said yesterday.

Shantia McBride told Tribune Business that most, “if not all”, pharmacies in the association were com plying with the letter and spirit of the compromise agreement reached with the Davis administration. She added that members will be able to determine the impact on their revenues, cash flow and profits by the end of the next VAT filing period.

“We’ve been doing good. We’ve been progress ing,” Ms McBride said, adding that the sector had implemented the agreed price and margin/markup changes. “Well, the only challenge, primarily, was our pharmacy sys tems, because the drug categories.... our pharmacy system doesn’t necessarily put our items in based on categories.

“So we had to create new mechanisms of putting it in. So we just sat down and decided among ourselves

how to strategically input that information.” Aside from that, it is still “too early to tell” if the addi tional price control measures will affect phar macy profits after the deal with the Government was struck two weeks ago.

“I think we’re just going into two weeks, so we haven’t fully dealt with that in terms of that data. So I’m assuming by the end of this first VAT period we would know but, based on our forecasts, we recognise profit won’t be the same but we would still be within margins of operating,” Ms McBride said.

The Bahamas Pharma ceutical Association (BPA) and the Davis adminis tration traded-off higher mark-ups for the indus try with an expanded list of price controlled items that has increased by ten medications.

Pharmaceutical wholesal ers and retailers now have one set mark-up across the board, at 20 percent and 40 percent respectively, for all price-controlled items in a move that will also simplify the structure. This places the price control markups for wholesalers at a slightly higher level than the Government was ini tially proposing, between 15-18 percent, but some five percentage points less

Artists team with union body to place culture at forefront

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

A BAHAMIAN artists and entertainers’ union has joined the Trades Union Congress (CBTUC) after a two-and-a-half-year wait for recognition, with a labour leader asserting yes terday: “You can’t have a country without culture.”

Anita Ellis-Tynes, the United Artists Bahamas Union’s president, said the move was made pos sible after the union finally achieved “recognition status” under the Industrial Relations Act. Through aligning with the Common wealth of The Bahamas Trades Union Congress (TUC), the group indicated it will push for Bahamian entertainers to play a greater role in the tourism product.

Obie Ferguson, the CBTUC’s president, pledged that the addition of the United Artists union will place Bahamian enter tainers back at the forefront of local culture. He said: “The role of Bahamian art ists, Bahamian entertainers will be completely different from what it is today. I want to make that clear. The Minister of Tourism (Ches ter Cooper) will be told in no uncertain terms culture rests to a great extent with our entertainers.

“The Minister of Tourism will be told in no uncertain terms that the entertainers in The Bahamas will have a say, and no entertainer will

be allowed to come to The Bahamas unless you clearly show this distinguished body, the UABU. That will not happen any more. I can assure you that will not happen any more.

“You can’t have a coun try without a culture. I see no Bahamian entertainers involved and displaying to the tourists who we are. The ships come in. They have entertainment on board, you know. They have limbo dancing and they have fire dancing. But you go there if you can get on board, and then who do you see doing it in The Bahamas?”

Mr Ferguson said cruise ships are supposed to adopt Bahamian laws and policies once they reach five miles inside this nation’s territo rial waters, but rarely abide by this. “At 1.5 miles out of The Bahamas, everything comes to an end until you get here,” he added.

Reviving the moribund nightclub scene is a chal lenge, given that half of central Bay Street is dilapi dated and the Over-the-Hill plagued by crime and vio lence. Mr Ferguson added: “Entertainers are critical in any country. So I am here with my colleagues, and we are going to do some things. We are going to make some people uncomfortable. But sometimes that’s necessary, and this is necessary.”

than the 25 percent they have enjoyed for the past 40 years.

As for retail pharmacies, the agreed 40 percent is at the top end of the range initially proposed by the Government. The Davis administration had sought a cut to between 35 per cent to 40 percent, but the new mark-up is some ten percentage points less (a 20 percent reduction in per centage terms) than the 50 percent that pharmacies have enjoyed for the past decade.

In return for the Gov ernment keeping the margins at the upper end of its target range, the phar macy industry agreed to expand the price-controlled medications by ten items to include cancer and kidney treatment drugs. The higher margins mean that pharma cies are no longer on the edge and in fear they may have to close their doors.

Ms McBride added: “The first document we actu ally saw had us at about 20 percent, and then the next day the signed docu ments said 35 percent and 40 percent. So we were lost as to what was transpiring behind closed doors, and remember, the price con trol list didn’t have items for pharmacy; it only had anti-diabetic, anti-cardio vascular categories only.

just didn’t know what they were

The Association had warned the initial mark-ups were too low, and that many of the smaller pharmacies would be forced to shut down because they would

be operating at a loss. This led to weeks of negotiations with the Government over a revised strategy to imple ment the expanded price control measures.

THE TRIBUNE Tuesday, November 15, 2022, PAGE 3

“So we were trying to understand: What did they mean? Were they referring to everything? Because that is like saying oil, with out clarifying if they mean Wesson oil or Olive oil. We

talking about.”

CALL 502-2394 TO ADVERTISE IN THE TRIBUNE TODAY!

have been made yet, but the crypto currency exchange’s implosion - and presence of its international headquar ters in The Bahamas - is likely to shine a fresh spot light on the strength of the country’s regulatory regime.

And, while there is noth ing yet to suggest money laundering or terror financing offences have been committed at FTX, recent developments may give other Caribbean nations who make up the CFATF’s membership alongside The Bahamas pause for thought before giving this nation a clean

bill of health when it comes to combating financial crime.

Thus achieving perfect “40 out of 40” compliance with all recommendations by the CFATF’s parent, the Financial Action Task Force (FATF), could be delayed beyond the former’s endNovember plenary meeting in the Cayman Islands given FTX’s ill-timed woes and the connection to digital assets regulation.

Ryan Pinder KC, the attorney general, has repeatedly said achieving “40 out of 40” compliance with the FATF’s crime fight ing standards would place The Bahamas among a

small select group of coun tries to achieve such status. And that ambition, as at September 20, 2022, was very much in The Bahamas’ grasp as the CFATF discus sion paper recommended that delegates “confirm the conclusion to upgrade the rating from ‘partially com pliant’ to ‘compliant’ in both areas.

“Based on the infor mation provided by The Bahamas, it is concluded that recommendation eight (non-profits) and 15 (digital assets) should be upgraded from ‘partially compliant’ to ‘compliant’,” concluded the CFATF, the

FATF’s Caribbean regional affiliate.

The report, which has been obtained by Tribune Business, said the previ ously-identified deficiencies in The Bahamas’ digital assets regulatory regime included the absence of “specific provisions for licensees and registrants of the Securities Com mission to assess money laundering/terror financ ing risks of new business practices, including new delivery mechanisms or the use of new or developing technologies for both new and pre-existing products.

“Additionally, there were no measures for Securi ties Commission licensees and registrants to assess associated risks prior to launch or use of new prod ucts, or to take measures to manage and mitigate the risks. Adequate guidance should have been provided to the insurance, securi ties and investment fund industries.”

The CFATF added that The Bahamas as a country also previously lacked the procedures to identify money laundering and terror financing risks posed by the digital assets sector, and there were no mechanisms for identi fying rogue persons and operators who conducted digital assets business with out being licensed and registered.

However, prior to the FTX saga, the CFATF report said upgrades to The Bahamas’ flagship Digi tal Assets and Registered Exchanges (DARE) Act and other reforms to its regulatory infrastructure had sufficiently addressed the deficiencies to enable

the country to be re-rated upwards. It put significant store in the Securities Com mission’s risk assessment of the industry, completed on May 25, 2022, which con cluded the “overall assigned risk rating to the sector is low”.

At that time, The Baha mas was said to have just three DARE Act regis trants - one of which was almost certainly FTX, which moves its interna tional headquarters to The Bahamas from Hong Kong in September 2021 - as well as eight licensees and a further eight applications under consideration.

“The Bahamas reit erates that the risk assessment concluded very recently on May 25, 2022, and will continue to regu larly risk assess the digital assets/digital assets services provider sector, and take measures to address any threats identified in the risk assessment reports,” the CFATF said of this coun try’s response.

“As at May 18, 2022, there were three regis trants under DARE, which were all licensed and are operating in the jurisdic tion since September 2021 (eight months or less). They were initially risk rated at the application stage, which included a fit and proper assessment, review of operational risk as well as anti-money laundering, counter-terror financing and nuclear proliferation risk.”

FTX will have been among the entities to undergo such processes, which would have assessed verification of client beneficial owner identi ties; volume of transactions; client typologies; and prod ucts and services. “Based on the initial risk rating, two registrants were assessed as low risk and one registrant assessed as medium risk,” the CFATF report said.

“Currently, one of the three digital asset service providers registered with the Commission is sched uled for examination in the third quarter of 2022.....

During the process to select registrants to be examined for the 2022 calendar year, the risk assessment scores and profiles were taken into account and a digital assets provider was selected based on the determination of its risks relative to the others. The Commission is currently onsite conduct ing the examination of the registrant.”

Again, it is unclear whether this was FTX. If so, it would mean the crypto exchange would have been subject to regu latory examination by the Securities Commission just before it fell apart. The regulator’s FinTech (finan cial technology) hub, which provided a focal point for all digital assets-related matters, received 75 inquir ies in 2021 with 64 percent of those relating to DARE Act policies.

“Through responding to these policy queries related to practical cases, the Secu rities Commission is better able to understand the risks of digital assets and apply mitigating measures where appropriate,” the CFATF report added.

“There has been a consid erable amount of training undertaken by staff at the Securities Commis sion in the area of digital assets. As of May 31, more than 50 percent of the staff and 100 percent of supervision staff attended training programmes on crypto currency, block chain or regulation of digi tal assets and digital assets services providers deliv ered by credible, academic institutions.....

“In 2021, four officers of the Royal Bahamas Police Force received training on crypto currency investiga tions and five attended the fifth global conference on crypto currencies. All of which would suggest that The Bahamas has acquired a very sound understand ing of the digital assets and digital assets services provider sector and its asso ciated risks.”

PAGE 4, Tuesday, November 15, 2022 THE TRIBUNE

FTX IMPLOSION THREATENS PERFECT ‘40 OF 40’ IN FINANCIAL CRIME FIGHT FROM PAGE B1 TO ADVERTISE TODAY IN THE TRIBUNE CALL @ 502-2394

Arawak port beats Q1 profits target by 56%

for 2022 came in at $29.96m, meaning the company is forecasting just a $623,000 year-over-year top-line increase, although the impact on profits is forecast to be much more.

“Net income is pro jected to be approximately $8.226m or approximately $808,000 more than the 2022 actual net income of $7.418m,” the BISX-listed port operator revealed. “Our net income is currently 56 percent or $1.197m over budget as of September 30, 2022. This is attributable to the increase in storage fees, and TEU and vehicle vol umes, being over budget.

“Ongoing projects cur rently include Global Port Holdings (Nassau Cruise Port) and downtown redevelopment; the US Embassy; Goldwynn Condo Hotel and Residences; and South Ocean resort. All these projects are in pro gress. Management remains extremely conservative and does not foresee any signifi cant project volumes during financial year.”

APD added that total TEU container through put volumes for the 2023 full-year are forecast to be 9,000, or 7 percent higher, than 2022’s 127,000 forecast. Container volumes for the 12 months to end-June 2022 came in slightly above fore cast at 128,995, which also represented an 8 percent jump over 2021’s 118,962 TEUs.

“Nassau Container Port’s TEU volumes as of Sep tember 30, 2022, are tracking 3.94 percent over budget. Total revenues as of September 30, 2022, are tracking about 23 per cent over budget,” APDs annual report revealed. “Total market volumes are estimated to be around 136,000 TEUs for 2023 or 9,000 TEU above the 2022 budgeted volumes of 127,000 TEUs.

“Our total revenues as of September 30, 2022, are over budget by approximately $1.728m or 23 percent. Total expenses as of September 30, 2022, were over budget by $665,625 driven mainly by increase in terminal han dling fees related to import volumes and storage.”

Turning to the full-year performance for the 12 months to end-June 2022, the Nassau Container Port operator confirmed that it “exceeded budgeted net income projections. Budgeted net income was $6.208m while actual net income for 2022 was $7.418m, which is $1.21m

or 19 percent more than budget.

“The company’s total revenues for 2022 were $29.96m, which is $1.185m or 4 percent higher than the prior year’s $28.775m. Net income for 2022 totalled $7.418m, which is 11 per cent higher than the prior year. This was largely attrib utable to the rebound of economic activities from COVID-19 on our local economy and projectrelated cargo.

“Our direct operating margin (DOM) for 2022 was 50 percent. Our budgeted DOM for 2022 was 48 per cent. For the period ended September 30, 2022, our DOM is 53 percent, which is 2 percent more than our budgeted DOM for the same period. During the year, APD declared and paid dividends to ordinary shareholders of $5.497m (2021: $4.997m) representing $1.11 per share. As of June 30, 2022, basic and diluted earnings per share were $1.48. The prior year’s were $1.34.

Breaking down import activity for the year to end-June 2022, APD said: “Actual TEU volumes for 2022 of 128,995 were over budget by 1,995 TEUs or 2 percent compared to our budgeted 2022 volumes of 127,000 TEUs. Additionally, bulk car volumes of 10,056 were 456 or 5 percent more than 2022 budgeted car vol umes of 9,600.

“This resulted in revenues of approximately $1.911m from landing and security fees for vehicles. Addition ally, revenues from reefer fees were approximately 56 percent over budget during financial year 2022. Stevedoring revenue was over budget by $263,724 during financial year 2022.”

Looking ahead to poten tial port projects in 2023, APD said there was “a clear indication” that the Govern ment is ready to move ahead with constructing a Customs freight station at its prop erty for the clearance and inspection of flagged cargo. It added that the previous “sticking point” on how the project will be financed appeared to have been resolved through importers being asked to pay Customs fees direct to APD to reim burse its initial outlay.

“The construction of a dedicated Customs freight station at the port to facili tate the inspection and clearance of flagged cargo has been under discussion at APD for several years in keeping with the company’s growth strategy and national

NOTICE

NOTICE IS HEREBY GIVEN as follows:

(a) BO HOLDING LTD. is in dissolution under the provisions of the International Business Companies Act 2000.

(b) The Dissolution of said Company commenced on November 15, 2022 when its Articles of Dissolution were submitted and registered by the Registrar General.

(c) The Liquidator of the said company is Zakrit Services Ltd. of 2nd Terrace West, Centreville, Nassau, Bahamas.

(d) All persons having Claims against the above-named Company are required on or before December 15, 2022 to send their names and addresses and particulars of their debts or claims to the Liquidator of the company or, in default thereof, they may be excluded from the benefit of any distribution made before such debts are proved.

November 15, 2022

ZAKRIT SERVICES LTD.

LIQUIDATOR OF THE ABOVE-NAMED COMPANY

mandate,” the annual report said.

“ However, previous government administra tions were not minded to engage in this project. The good news is that there has been a clear indication that government is ready to move forward on our proposal. Formerly, the sticking point was repay ment to APD for the funds that would be expended to bring this project to fruition. Now, the idea is to author ise importers to pay certain Customs fees directly to APD to amortise the costs.”

Spotting similar hints of progress with the proposed vehicle inspection facility, the port operator added: “When APD acquired the franchise to land imported vehicles at Nassau Con tainer Port, almost immediately the notion arose to create a building for the Road Traffic Depart ment that would facilitate vehicle inspection, licensing and insurance providers.

“The idea is to allow importers to drive vehicles off the dock fully up to code in all respects. There is also indication that government is ready to move on this pro posal as well.” Dion Bethell, APD’s president and chief executive, also disclosed that the Prime Minister’s Office had demanded that shipping companies explain the huge cost increases they passed on due to rising global fuel prices and post-COVID supply chain bottlenecks.

“In a letter from the Office of the Prime Minister, shippers serving The Baha mas were asked to explain cost increases. It came as no surprise that justifica tions referred to the cost of fuel for all aspects of the

movement of goods shipped on sea and trucking inland,” Mr Bethell added.

And Michael Maura, APD’s chairman, disclosed that upgrades to the compa ny’s corporate structure are also in motion. “As we look ahead the company will transition once again, build ing upon the great work of the past and advancing new Environmental, Social and

Governance (ESG) initia tives,” he wrote.

“The Board has retained KPMG Bahamas to assist in the design and imple mentation of this new corporate framework. The objective is to further enshrine and align necessary environmental, social and governance practices within the company’s internal and external engagements

with employees, customers, shareholders, our commu nity, and our environment.

“The commitment to the ESG framework ensures that APD’s future contin ues to be bright. Lenders, shareholders, supply chain partners, regulators and more consider ESG adop tion and implementation as a measure in a company’s risk profile.”

THE BANKRUPTCY ACT, 1870

In the Supreme Court of the Bahamas, Bankruptcy Division. In the matter of a bankruptcy petition against Raymond Rolle, of 39 East St North, Nassau, P.O. Box SS-19462, on the island of New Providence.

UPON the hearing of this petition this day, and upon proof, satisfactory to the Court, of the debts of the petitioner, and of the act or acts of the bankruptcy alleged to have been committed by the said Raymond Rolle having been given, it is ordered that the said Raymond Rolle be and he is hereby adjudged bankrupt. --- Given under the seal of the Court this 27th day of May, 2021.

By the Court, The Hon. Madam Justice Diane Stewart, Judge

The first general meeting of the creditors of the said Raymond Rolle is hereby summoned to be held at the Court of the Registrar on the 14th day of December 2022, at 11:00 o’clock of the fore-noon, also online at https://us06web.zoom.us/j/81708684199?pwd=SXZLeEJMUk5GQ lZoRktVblRkK09xUT09 and that the Court has ordered the bankrupt to attend thereat in person for examination, and to produce thereat a statement of his affairs as required by the statute.

Until the appointment of a trustee, all persons having in their possession any of the effects of the bankrupt must deliver them, and all debts due to the bankrupt must be paid to the Registrar.

Creditors must forward their Proofs of Debts to the Registrar.

THE TRIBUNE Tuesday, November 15, 2022, PAGE 5

PAGE B1

FROM

VAT’S ‘REAL’ 15% RISE SINCE JANUARY’S CUT

post-COVID-19 economic rebound. Efforts of the reconstituted Revenue Enhancement Unit have also aided in tax administra tion to support timely tax collections.”

The Government thus conceded that much of the VAT and overall tax col lection improvement was driven by the economy’s continued reflation and rebound from the COVID lockdowns and associated restrictions that impacted 2020 and much of 2021. Still, increased income cou pled with ongoing spending containment and near-end to COVID-related spending helped shrink the Govern ment’s deficit by some 85 percent during the three months to end-September 2022.

“Central government’s operations for the first quarter of the 2022-2023 fiscal year indicate a nar rowing of the fiscal deficit to $20.6m from $136.4m in the year prior for the same period. This outcome is largely due to growth in revenue receipts while expenditure was contained due to the significant easing of extreme COVID-19 fiscal measures,” the Ministry of Finance added.

“Mirroring the contin ued accelerating pace of the economic rebound, rev enue receipts during the first three months of fiscal year 2022-2023 improved by $57.8m (9.7 percent) as compared to the same period of the prior year. At an estimated $654.3 mil lion, total revenue stands at 23.3 percent of the Budget target.

NOTICE

NOTICE is hereby given that CHRISTOPHER VICTOR of Springfield Road, New Providence, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 15th day of November, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE is hereby given that SAUL DELVA of Dundas, Abaco, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 15th day of November, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

“Year-to-date rev enue collections are consistent with pre-Dorian/ pre-COVID-19 fiscal rev enue trends as evidenced by first quarter 2018-2019 rev enue collections of $471.8m, representing 21.5 percent of 2018-2019 total revenue.

The positive revenue per formance was supported by increases in tax revenue of $54.1m (10.4 percent) to $574.4m (23 percent of Budget) while non-tax rev enue firmed by $3.7m (4.9 percent) to $79.9m (25.8 percent of the Budget).”

Breaking down revenue performance into its Budget line items, the Ministry of Finance said: “Taxes on spe cific services (gaming taxes) increased by $2.3m (22.2 percent) to total $12.8m and 24.2 percent of the Budget target. Improved gaming tax revenue reflects

increased activity in the sector as economic and employment levels improve as compared to the prior year when COVID-19 emergency orders remained in effect, limiting business activity.

“Taxes on international trade and transactions broadened by $49.4m (42.7 percent) to $165m during the period compared to the prior year. This rebound is supported by rebounds in the travel industry with the elimination of COVID19 emergency orders and health & safety restrictions which remained in place during the prior year.

“Reflecting 32.5 percent of Budget projections, per formance in this category is largely explained by excise and export duties firming by $23.6m (55.6 percent) to $66.2m reflecting 41 percent

NOTICE

NOTICE is hereby given that WILNISE SAINTIL of Acacia Avenue, Pinewood Gradens, New Providence, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 15th day of November, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE

NOTICE is hereby given that SCHENEIDER HEURTELOU of Fowler Street, New Providence, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 15th day of November, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

of Budget, and departure tax collections in-creased by $26.9m (253.9 percent) to total $37.5m, representing 41 percent of budget largely as a result of improved air lift as the tourism industry rebounds,” the Ministry of Finance added.

“Overall improvements in other areas of international trade and transactions were slightly offset by a $1.2m (2 percent) decline in Cus toms and import duties, which totalled $61.1m (24.5 percent of Budget) largely owing to tariff reductions.”

On the spending side, the end of COVID-19 restrictions and support resulted in subsidy cuts for state-owned enter prises (SOEs) and reduced social services support.

“Government subsidies, which include transfers to government-owned and/or controlled enterprises that provide commercial goods and services to the public, narrowed by $16.7m (14.2 percent) to $100.5m, which equalled 24.6 percent of the Budget,” the Ministry of Finance said.

“Subsidies to public non-financial corporations declined by $20.5m (17.7 percent) to $95.7m. Owing to the ending of emergency orders and the reduced need for COVID-19 sup port, transfers tightened for Bahamasair ($2.7m); Water and Sewerage Cor poration ($4.7m); and the Public Hospitals Authority ($13.4m).

“Subsidies to private enterprises and other sec tors rose by $3.9m (412.4 percent) to equal $4.8m owing to payment of the $4m equity contribution to Baha Mar, suspended during the prior year.” The end to COVID’s pandemic phase also coincided with a near-$42m drop in social welfare benefits.

“Social benefit pay ments declined by $41.9m to aggregate $6.5m and 12.7 percent of the Budget as COVID-19 emergency orders ended and domestic economic conditions con tinue to improve, obviating the need for related govern ment support,” the Ministry of Finance said.

“Social assistance ben efits, elevated in the prior year as a result of the continued provision of COVID-19 assistance, declined by $41.9m (86.5 percent) to more moder ate levels of $6.5m and 12.7 percent of the Budget. The current spend represents a 12.1 percent increase over the first quarter 20192020 pre-COVID-19 and pre-Hurricane Dorian social assistance levels of $5.8m as the Department of Social Services prepares to relaunch its RISE social support programme.”

The deficit and debt blow out produced by COVID-19 saw the Government’s debt servicing (interest) pay ments increase by $10.5m or 11.4 percent to $102.7m for the three months to end-September 2022, repre senting 18.3 percent of the total Budget allocation.

“Net financing totalled $12.1m, a $142.5m (92.2 percent) decrease in the net liability as compared to the $154.6m experienced in the prior fiscal year for the same period,” the Ministry of Finance added of its first quarter 2022-2023 borrow ing activities.

While the national debt grew at a much lower rate, due to the shrunken $20m deficit, it still totalled $11.167bn at end-Septem ber 2022. The Government’s direct contribution to this was $10.775bn.

NOTICE

0.6460.32814.43.52%

PAGE 6, Tuesday, November 15, 2022 THE TRIBUNE

FROM PAGE B1

NOTICE is hereby given that YONEL PAUL of P.O. Box GT-2869, Fire Trail Road, New Providence, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 8th day of November, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE

NOTICE is hereby given that GILBERTO SHENTHUREAN REYTOR MARTIN of #91b Crawford Street, Nassau, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twentyeight days from the 8th day of November, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE

NOTICE

is hereby given that SANVANO FRANCIS of Queen’s Highway, Wemyss Bight, Eleuthera, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twentyeight days from the 8th day of November, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

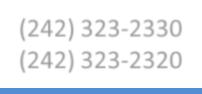

NOTICE MONDAY, 14 NOVEMBER 2022 CLOSECHANGE%CHANGEYTDYTD% BISX ALL SHARE INDEX: 2623.84-2.17-0.08395.6017.75 BISX LISTED & TRADED SECURITIES 52WK HI52WK LOWSECURITY SYMBOLLAST CLOSECLOSECHANGE VOLUMEEPS$DIV$P/E YIELD 7.005.30 AML Foods Limited AML 6.95 6.950.00

53.0040.00 APD Limited APD 39.95 39.950.00

2.761.60Benchmark BBL 2.76 2.760.00

2.462.26Bahamas First Holdings Limited BFH 2.46

2.852.25Bank of Bahamas BOB 2.85 2.57 (0.28)

6.205.75Bahamas Property Fund BPF 6.20

Waste BWL

Bahamas CAB

Brewery CBB

Bank CBL

Holdings CHL

17.5010.25CIBC FirstCaribbean Bank CIB 16.00

3.251.99Consolidated Water BDRs CWCB 3.50

11.2810.06Doctor's Hospital DHS 10.50

11.679.16Emera Incorporated EMAB 9.59

(0.28)

11.5010.00Famguard FAM 10.85

18.3014.05Fidelity Bank (Bahamas) Limited FBB 18.10

4.003.50Focol FCL 3.98

11.509.50Finco FIN 11.38

16.2515.50J. S. Johnson JSJ 15.55 15.550.00

PREFERENCE SHARES 1.001.00Bahamas First Holdings PreferenceBFHP 1.00 1.000.00

1000.001000.00 Cable Bahamas Series 6 CAB6 1000.001000.000.00

1000.001000.00 Cable Bahamas Series 9 CAB9 1000.001000.000.00

1.001.00Colina Holdings Class A CHLA 1.00 1.000.00

10.0010.00Fidelity Bank Bahamas Class A FBBA 10.0010.000.00

1.001.00Focol Class B FCLB 1.00 1.000.00

CORPORATE DEBT - (percentage pricing) 52WK HI52WK LOWSECURITY SYMBOLLAST SALECLOSECHANGEVOLUME 100.00100.00Fidelity Bank (Note 22 Series B+)FBB22 100.00100.000.00 100.00100.00Bahamas First Holdings LimitedBFHB 100.00100.000.00 BAHAMAS GOVERNMENT STOCK - (percentage pricing) 115.92104.79Bahamas Note 6.95 (2029) BAH29 107.31107.310.00 100.00100.00BGS: 2014-12-7Y BG0107 100.00100.000.00 100.00100.00BGS: 2015-1-7Y BG0207 100.00100.000.00 100.00100.00BGS: 2014-12-30Y BG0130 100.00100.000.00 100.00100.00BGS: 2015-1-30Y BG0230 100.00100.000.00 100.00100.00BGS: 2015-6-7Y BG0307 100.00100.000.00 100.00100.00BGS: 2015-6-30Y BG0330 100.00100.000.00 100.00100.00BGS: 2015-10-7Y BG0407 100.00100.000.00 100.35100.00BGRS FL BGRS88028 BSBGRS880287100.35100.350.00 150 100.24100.00BGRS FL BGRS76024 BSBGRS760240100.00100.000.00 99.9599.30BGRS FX BGR142251 BSBGR142051699.9599.950.00 99.9599.95BGRS FL BGRS91032 BSBGRS91032499.9599.950.00 100.57100.11BGRS FL BGRS95032 BSBGRS950320100.45100.450.00 100.5299.96BGRS FL BGRS97033 BSBGRS970336100.19100.190.00 100.0089.62BGRS FX BGR129249 BSBGR129249389.6289.620.00 100.0089.00BGRS FX BGR131249 BSBGR1312499100.00100.000.00 100.9890.24BGRS FX BGR132249 BSBGR1322498100.00100.000.00 100.0090.73BGRS FX BGR136150 BSBGR1361504100.00100.000.00 MUTUAL FUNDS 52WK HI52WK LOW NAV YTD%12 MTH% 2.552.11 2.552.24%4.01% 4.833.30 4.833.42%7.26% 2.241.68 2.241.70%2.82% 207.86164.74 197.44-2.97%-2.35% 212.41116.70 202.39-4.72%6.04% 1.751.70 1.751.96%2.84% 1.911.76 1.914.83%7.23% 1.871.77 1.873.48%4.44% 1.050.96

9.376.41

11.837.62

7.545.66

16.648.65

12.8410.54

10.779.57

10.009.88

14.8911.20

MARKET TERMS BISX ALL SHARE INDEX - 19 Dec 02 = 1,000.00 YIELD - last 12 month dividends divided by closing price - Highest closing price in last 52 weeks Bid $ - Buying price of Colina and Fidelity 52wk-Low - Lowest closing price in last 52 weeks Ask $ - Selling price of Colina and fidelity Previous Close - Previous day's weighted price for daily volume Last Price - Last traded over-the-counter price Today's Close - Current day's weighted price for daily volume Weekly Vol. - Trading volume of the prior week Change - Change in closing price from day to day EPS $ - A company's reported earnings per share for the last 12 mths Daily Vol. - Number of total shares traded today NAV - Net Asset Value DIV $ - Dividends per share paid in the last 12 months N/M - Not Meaningful P/E - Closing price divided by the last 12 month earnings TO TRADE CALL: CFAL 242-502-7010 | ROYALFIDELITY 242-356-7764 | CORALISLE 242-502-7525 | LENO 242-396-3225 | BENCHMARK 242-326-7333 4.50% 6.40% 4.31% 5.55% 18-Jan-2024 15-Feb-2051 17-Apr-2033 15-Apr-2049 4.37% 4.31% 15-Aug-2032 25-Sep-2032 6.25% 30-Sep-2025 31-Mar-2022 FUND CFAL Bond Fund CFAL Balanced Fund CFAL Money Market Fund CFAL Global Bond Fund 6.25% 4.50% 6.25% 4.25% NAV Date 5.65% 5.69% 4.33% 15-Dec-2021 30-Jul-2022 15-Dec-2044 30-Jul-2045 26-Jun-2022 26-Jun-2045 15-Oct-2022 29-Jul-2022 21-Apr-2050 26-Jul-2028 15-Oct-2049 31-Mar-2021 31-Jan-2022 31-Jan-2022 31-Aug-2022 31-Jan-2022 31-Jan-2022 31-Jan-2022 31-Jan-2022 31-Aug-2022 31-Aug-2022 INTEREST Prime + 1.75% MARKET REPORT 31-Mar-2021 31-Mar-2021 MATURITY 19-Oct-2022 20-Nov-2029 31-Jul-2022 31-Jul-2022 6.95% 4.50% 31-Mar-2022 31-Aug-2022 4.50% 6.25% 5.60% 15-Jul-2049 Colonial Bahamas Fund Class D Colonial Bahamas Fund Class E Colonial Bahamas Fund Class F CFAL Global Equity Fund Leno Financial Conservative Fund Leno Financial Aggressive Fund Leno Financial Balanced Fund Leno Financial Global Bond Fund RF Bahamas Opportunities Fund - Secured Balanced Fund RF Bahamas Opportunities Fund - Targeted Equity Fund RF Bahamas Opportunities Fund - Prime Income Fund RF Bahamas International Investment Fund Limited - Equities Sub Fund RF Bahamas International Investment Fund Limited - High Yield Income Fund RF Bahamas International Investment Fund Limited - Alternative Strategies Fund

NOTICE is hereby given that YANARA MARTIN RODRIGUEZ FERGUSON of #91b Crawford Street, Nassau, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 8th day of November, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

0.2390.17029.12.45%

0.9321.26042.93.15%

0.0000.020N/M0.72%

2.460.00 0.1400.08017.63.25%

1,0000.0700.000N/M0.00%

6.200.00 1.7600.000N/M0.00% 10.058.78Bahamas

8.78 8.780.00 0.3690.26023.82.96% 4.342.82Cable

3.95 3.950.00 -0.4380.000-9.0 0.00% 10.657.50Commonwealth

10.25 10.250.00 0.1400.00073.20.00% 3.652.27Commonwealth

3.49 3.490.00 9000.1840.12019.03.44% 8.526.05Colina

8.50 8.500.00 0.4490.22018.92.59%

16.000.00 0.7220.72022.24.50%

3.500.00 0.1020.43434.312.40%

10.500.00 0.4670.06022.50.57%

9.31

10.850.00 0.7280.24014.92.21%

18.100.00 0.8160.54022.22.98%

3.980.00 0.2030.12019.63.02%

11.380.00 0.9390.20012.11.76%

0.6310.61024.63.92%

0.0000.0000.0000.00%

0.0000.0000.0000.00%

0.0000.0000.0000.00%

0.0000.0000.0006.25%

0.0000.0000.0007.00%

0.0000.0000.0006.50%

0.96-6.57%-8.29%

9.37-0.02%10.36%

11.79-0.33%18.23%

7.540.22%3.05%

15.94-3.89%14.76%

12.47-1.04%-2.57%

10.740.81%4.20%

N/AN/AN/A 10.438.45 10.433.00%25.60%

14.897.90%48.70%

(242)323-2330 (242) 323-2320 www.bisxbahamas.com

NOTICE

Don’t let FTX woe ‘arm enemies’ of Bahamas

FROM

anti-international financial centre (IFC) attacks.

“The Government has to speak to this issue to allay growing concerns that exist within the jurisdiction, par ticularly among Bahamian professionals and compa nies that have decided to do business here, even in the traditional financial ser vices sector,” Mr Pintard said of FTX’s collapse into provisional liquidation and Chapter 11 bankruptcy pro tection in the course of a week.

“What the Government has to guard against is being slow to speak definitively to those that have concerns so we can allay any fears they have. We have a fairly solid regulatory environment, and have sought to comply with international require ments to guard against legal and reputational damage.

“What the Government must also guard against is not speaking to these recent developments and allow people to fill the

vacuum with comments and speculation that can have unintended consequences; not just for the digital assets space but the whole financial services sector,” the Opposition leader continued.

“As a separate but related point, we don’t want to arm enemies of inter national financial centre jurisdictions, in this case The Bahamas.... We don’t want to give them space to write their own narrative about what is happening in this environment. We are a blue chip jurisdiction with having this regulatory environment.”

Asked whether by “ene mies” he was referring to the likes of the EU and OECD, Mr Pintard replied: “I would make it broader than that. Those that make unfair demands of this juris diction; those that compete with this jurisdiction; those that don’t mean well to this jurisdiction.

“We want to make sure we speak clearly to all

stakeholders looking at the state of affairs with this company, and by them having their international headquarters here are looking at our jurisdiction. The concerns have been expressed by persons in the sector and we share their concerns. The Government has a role to play here, and ought to move with a sense of urgency in speaking to the myriad of concerns raised.”

The Bahamas is pres ently in the cross-hairs of both the EU, which has blacklisted this nation for allegedly being non-coop erative on international tax matters, and the OECD. The latter has branded this nation ‘non-compliant’ on aspects of automatic tax information exchange, and Mr Pintard has previously warned that both will likely try and drive this coun try out of the digital assets business.

The Government has thus far maintained a neartotal silence over FTX’s

collapse, and the placement of its Bahamian subsidi ary, FTX Digital Markets, into the care of a provi sional liquidator overseen by the Supreme Court. It has largely been content to leave any public utterances to the Securities Commis sion, as FTX’s primary regulator, who successfully obtained the appointment of Brian Simms KC, senior partner at the Lennox Paton law firm, to take control.

The fact the crypto exchange’s fate is now a court matter complicates the Government’s ability to speak on the collapse given that it could potentially prejudice the outcome of the provisional liquidation. Tribune Business under stands that the Supreme Court case file on FTX has been completely sealed so as to prevent details of the company’s failure being accessed by the public.

Voicing confidence in the Securities Commission and other Bahamian regulatory

agencies, Mr Pintard argued that Prime Minister Philip Davis KC cannot shy away from the FTX issue given that the Government’s blue carbon credit plans were “interwoven” with their listing and trading via the platform provided by the crypto exchange.

“He’s not in a position to delay addressing this and other pressing issues,” the Opposition leader argued.

Much international media coverage, meanwhile, yes terday focused on reports that Sam Bankman-Fried, the FTX co-founder who has since resigned as its chief executive, alleg edly placed a $40m penthouse at the Albany development up for sale on Friday which was when the crypto exchange filed for Chapter 11 bankruptcy protection in the Delaware courts.

However, Tribune Busi ness sources, speaking on condition of anonym ity because they were not authorised to speak

Workplace dispute stirs at Pharmachem

Acknowledging that the new system was set to be implemented imminently, Mr Thompson said: “We’re not prepared to make a statement. We’ve not exe cuted the rotation. It’s due to start next week. I’m not going to pre-empt any thing. We will, if necessary,

make some statement in the future but not at this time.

“No event has happened, so I’m not going to go out there in a premature way. There’s nothing for me to respond to at this time. I would be premature and getting ahead of myself.”

Mr Ferguson, in a letter sent on behalf of Phar machem’s mechanical,

electrical and instrument staff, called on the company to meet and negotiate over its planned shift system “to the benefit of all within the four walls of the company to prevent costly litigation”.

Pharmachem is nonunionised, but Mr Ferguson alleged that the last paragraph of the firm’s October 28, 2022, letter to staff on the new rotation “implies that if persons refuse to adhere to this new shift arrangement, it means that they wish to leave the company, which is coercion. Clearly this cannot be toler ated in any circumstances”.

Setting out the alleged grievances over the Octo ber 28 letter, the TUC president said: “This letter amounts to unilateral vari ation of their individual contract of employment and exposes the company to both wrongful and unfair dismissal claims. Their con tract of employment since 2005 requires them to work 40 hours per week pursuant to the law as provided for in the Employment Act 2001 without having to work on weekends consistent with the law.

“The proposed shift as provided for in the sched ule the company has provided requires them to work 12-hour shifts per day, leading to 168 hours per normal month and working weekends and holidays. Further, for those

months with five weeks, the hours can be as much as 228 hours (compared to 192 hours at the low-end). This is in stark comparison to the 160 hours they pres ently work.”

Mr Ferguson alleged that Pharmachem was seeking to “remove” better benefits from impacted staff “in that they will work more hours and obtain less pay, in that the excess overtime will only be paid at time-and-ahalf and they will have to work weekends and holi days, thereby increasing the possibility of accidents”.

“The issue of a one-man shift covering 12 hours is a health and safety concern,” the TUC president asserted.

“The electrician and instru mentation responsibilities put technicians at risk when working heights and

publicly, said the ‘Orchid’ property was owned by FTX’s real estate arm, FTX Property Holdings, rather than Mr Bankman-Fried individually. This raises questions as to whether this could be sold, as it is likely that FTX Property Holdings is covered by the Bahamian provisional liquidation or Chapter 11 proceedings.

If so, its assets would be frozen and unable to be transacted. Surprise was also voiced by some that the ‘Orchid’ penthouse was being marketed by an Exuma-based realtor, Sea side Real Estate, rather than one of the high-end realtors in Nassau.

Seaside’s principals are Vernon Curtis and Pedro Rolle, the Exuma Chamber of Commerce president and Bahamas Power & Light (BPL) chairman. Sources said Albany liked to deal with particular realtors, making Seaside a seem ingly odd choice for such a property.

working alone. To ignore technicians working with out back-up or unable to require assistance of knowl edgeable persons when needed can clearly put staff in extreme danger.

“The same goes for mechanics working in confined spaces and vessel entry jobs. The Health and Safety at Work Act in article 4 provides for the duties of employers to their employees, and article 6(5) provides for items and substances used with regards to safety and health.

“One man coverage of operations over 12 hours will lead to fatigue and increase the risk of acci dents, particularly in the current environment, which will make the com pany liable under article 17 of the Health and Safety at Work Act Chapter 321C.”

PAGE 8, Tuesday, November 15, 2022 THE TRIBUNE

PAGE B1

ADVERTISE TODAY! CALL THE TRIBUNE TODAY @ 502-2394 The Public is hereby advised that I, CHARLENE INGAR NATASHA JOHNSON of The Eastern District, Nassau, Bahamas, intend to change my name to CHARLENE INGAR NATASHA KNOWLES If there are any objections to this change of name by Deed Poll, you may write such objections to the Chief Passport Officer, P.O.Box N-742,

Bahamas no later than thirty (30) days after the date of publication of this notice. INTENT TO CHANGE NAME BY DEED POLL

FROM PAGE B1

Nassau,

PUBLIC NOTICE