220 Legendary jobs for ‘hazardous’ site

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

AN $80M marina invest ment for southern New Providence is pledging to transform “a hazard ous location” blighted by trash dumps and stolen boats via a project that will create 220 permanent jobs at full build-out.

Legendary Marina Resort at Blue Water Cay, which is targeting a 20-acre site at the southern end of Fox Hill Road past Check ers Cafe and the Freedom Farm Baseball Park, is forecasting that it will attract 16,500 extra annual visitors to The Bahamas

once the phased nine-anda-half construction process is completed.

More details on the development, which is presently seeking both its planning and environmen tal approvals, are disclosed in the Environmental

Impact Assessment (EIA) produced by Baha mian consultancy, Bron Ltd, which states that the Florida-headquar tered developer plans to overhaul an area purport edly being used for the

dumping of waste includ ing dog faeces.

The April 2022 eco nomic impact assessment for Legendary Marina Resort, prepared by Tour ism Economics (Oxford Economics), calculates the project will have a total $789m economic impact and boost annual Bahamian gross domestic product (GDP) by $483m over a 25-year period. This translates to an aver age total annual impact of $31.56m, and GDP effect of $19.32m, over that period.

The assessment also predicted that the marina,

Fears FTX freeze order was violated

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

FEARS were raised yes terday that the Supreme Court order freezing all assets of FTX’s Bahamian subsidiary was violated when some of the col lapsed crypto currency exchange’s clients with drew their monies late last week.

Well-placed Tribune Business sources, speaking on condition of anonym ity because they were not authorised to speak pub licly, suggested those involved could be prose cuted for contempt of court and be forced to repay the funds removed since the transactions represent a so-called “fraudulent pref erence” where they gain undue advantages over

other FTX clients whose assets remain frozen.

This newspaper con firmed that some clients of FTX Digital Markets, the entity licensed and reg istered by the Securities Commission of The Baha mas, were able to retrieve their assets - which the crypto exchange was hold ing for them on trust or in escrow, in a fiduciary capacity - starting around the time that the Supreme Court issued its Order last Thursday shutting down all local operations.

FTX, in a Twitter tweet sent out at 2.08pm on Thursday, November 10, barely hours before the Securities Commission’s announcement of the asset freeze and provisional liq uidator’s appointment, wrote: “Per our Baha mian HQ’s (FTX Digital Markets) regulation and

Collapse ‘bewilders’ FTX Bahamas staff

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

FTX’s 40 Bahamian staff have been left “bewil dered and beleaguered” by the speed of the crypto exchange’s collapse, a senior executive says, amid hopes its $74m real estate outlay will prove a key recovery source for local creditors.

Valdez Russell, FTX Digital Markets’ vice-pres ident of communications, told Tribune Business that “many” of the expatriate workers brought in by the Bahamian subsidiary have already left the country after the company last week imploded in one of the most rapid and spectacular

corporate collapses in world history.

Confirming that FTX’s co-founder and former chief executive, Sam BankmanFried, remains holed up in The Bahamas will regula tors, police and provisional liquidators comb through the wreckage of an empire valued at $32bn just weeks ago, he added that local staff “remain engaged” at present albeit facing a very uncertain immediate future.

“I believe it’s fair to suggest that staff are bewil dered and beleaguered by what has happened, while at the same time being appreciative of the oppor tunity afforded to transform the digital assets space right

Bahamas told: Don’t pause digital assets plan on FTX failure

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

HALTING its digital assets growth strategy due to FTX’s collapse would be “the worst thing The Baha mas could do”, an industry entrepreneur says, even though the failed crypto exchange now faces a local criminal investigation.

Kevin Hobbs, chief executive and founder of Aventus Ventures, and a blockchain inves tor for ten years, told

business@tribunemedia.net MONDAY, NOVEMBER 14, 2022

Tribune Business that paus ing the country’s ambitions to become a regional digi tal assets hub immediately following FTX’s debacle could be interpreted as “an admission of guilt” when

regulators, we have begun to facilitate withdrawals of Bahamian funds. As such, you may have seen some withdrawals pro cessed by FTX recently

as we complied with the regulators.

“The amounts with drawn comprise a small

SEE PAGE B3 SEE

SEE

PAGE B8

PAGE B6

•

SEE PAGE B3

Would lose ‘global respect’ if did so

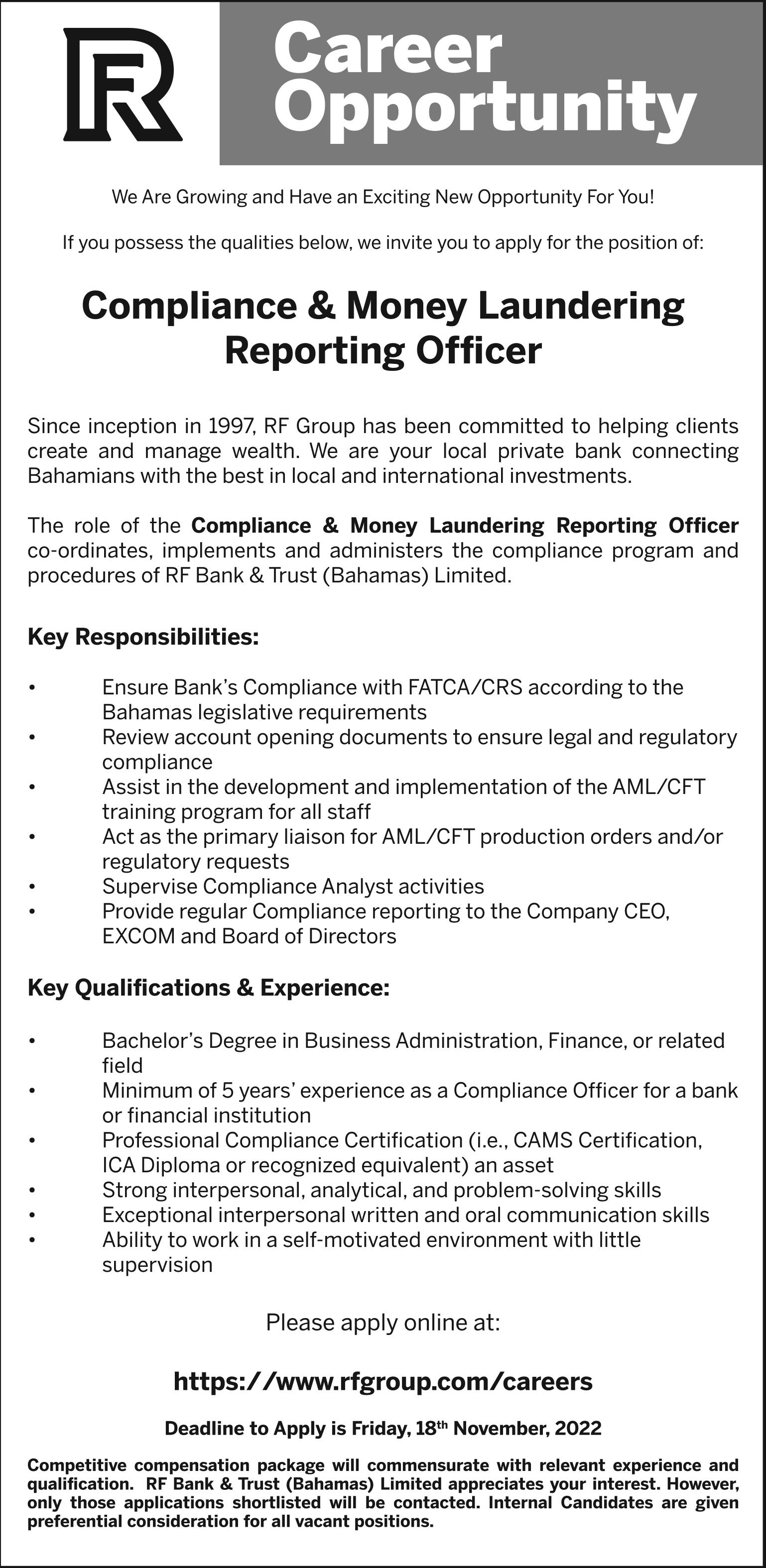

PRIME Minister Philip Davis KC at the groundbreaking for FTX’s proposed Bahamas headquarters earlier this year. Seen imme diately to the right is FTX co-founder, Sam Bankman-Fried, and right next to him is Christina Rolle, the Securities Commission’s executive director. Allyson Maynard-Gibson KC, former attor ney general and FTX attorney, is third from left, and contractor Jimmy Mosko is second right.

• $80m marina aims to transform ‘blighted’ area • Trash dumps, stolen boats hurting Yamacraw • But ex-BREA president voices storm concern $5.95 $5.97 $6.07 $5.62

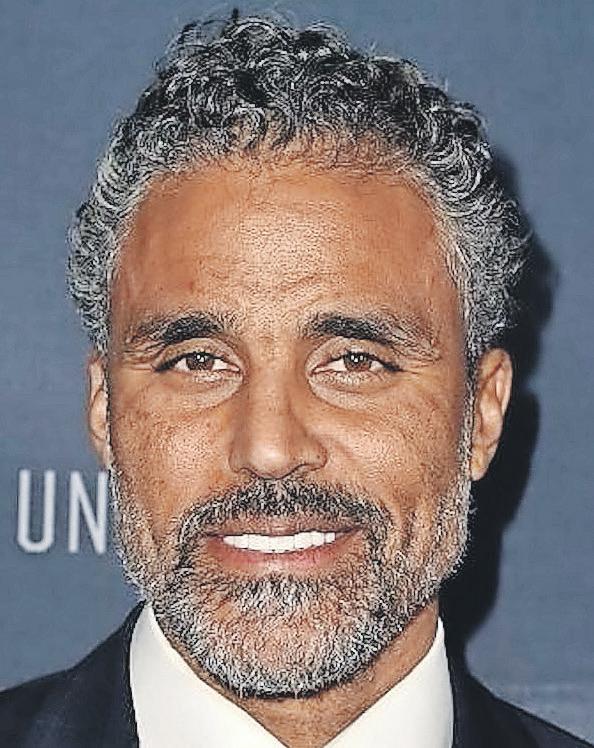

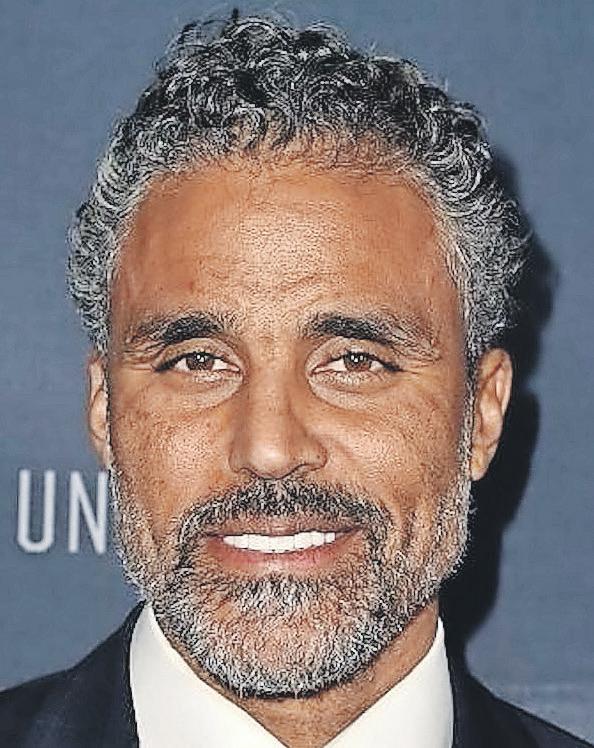

Ex-Bahamian NBA winner unveils Middle East deal

AN EX-NBA title winner, who is leading a $50m investment to build the world’s first carbon-neg ative housing community in The Bahamas, has signed a deal with a leading developer of regenerative tourism projects.

Rick Fox, the former Los Angeles Laker who is now one of The Bahamas’ sports ambassadors, used the United Nations (UN) COP27 climate change conference to unveil a Memorandum of Under standing (MoU) between his Partanna Bahamas and Red Sea Global. Part of the agreement will see the two sides explore ways for Partanna to establish pro duction facilities on Saudi Arabia’s Red Sea coast, in addition to its existing manufacturing facilities on Bacardi Road in Nassau.

“It’s time for action,” said Mr Fox. “Whilst others use COP27 to talk and promote themselves, we’re here to do business with develop ers who share our vision of changing how the world builds. We’re moving quick because humanity can’t afford to wait.

RICK FOX

“Red Sea Global share our vision and wanted to move quickly to make it a reality. We’re delighted to strike up an agreement with one of the world’s most ambitious and innovative developers and see this as the start of our work in the Middle East.”

Partanna’s concrete technology is designed to eliminate carbon emissions, absorb carbon from the atmosphere and generate tradeable carbon credits. Its concrete is made with a brine technology that sequesters carbon like a tree, and is as durable, versatile and scalable as tra ditional products.

Carlos M. Duarte, pro fessor at King Abdullah University and Technol ogy, said: “I am delighted to see Partanna and Red Sea Global announce a collabo rative programme today. Partanna has developed ground-breaking technol ogy to produce concrete that absorbs carbon diox ide and is, therefore, climate positive.

“However, most impor tantly, they have developed a system that mimics how corals, the great cement producers of the biosphere, do it, as they incorporate brine as an essential feed stock of Partanna concrete. This is a game changer, as the Arabian peninsula pro duces about 60 percent of the world’s brine, and we were lacking a solution to avoid delivering it to the ocean, where it may impact marine life.

“With Partanna and Red Sea Global working together, Red Sea Global buildings will be climate positive and embody brine to make them more resist ant and conserve marine life. A win-win for the Red Sea Global, Partanna, the ocean and the planet. Most

importantly, this is inspired by our beautiful corals.” Concrete is said to be associated with 9 percent of worldwide man-made emis sions. It is also the world’s most widely used building material, with the Middle East and North Africa accounting for 21 percent of cement production in 2021.

John Pagano, Red Sea Global’s group chief execu tive, said: “Through this partnership with Partanna, Red Sea Global is continu ing its efforts to accelerate green technologies that can lead the world to a more sustainable and even regen erative future.

“We are on track to be carbon neutral from day one of operations at The Red Sea when we welcome our first guests in early 2023. This material, which can be manufactured utilising recycled raw materials, and which can generate carbon credits, could be key to achieving our even more ambitious goal of creating carbon negative tourism destinations.”

Red Sea Global is the developer behind two regenerative tourism pro jects, The Red Sea and

Amaala in Saudi Arabia, both of which will be com pletely off-grid and powered by 100 percent renewable solar energy.

The Red Sea is set to welcome its first guests early next year when the first three hotels and inter national airport open. A further 13 resorts will com plete by early 2024. The first phase of Amaala will comprise nine hotels, deliv ering 1,300 hotel rooms. It is on track for completion in 2024.

Partanna, Mr Fox’s ven ture in partnership with architect Sam Marshall, has already constructed a proto type carbon-negative house in New Providence. The company’s Memorandum of Understanding (MoU) with the Government of The Bahamas, which will lead to the creation of 100 jobs during the pilot phase, was also unveiled at the COP27 climate conference in Egypt.

It is undertaking a ‘pilot project’ to construct 30 affordable homes using its technology - an initia tive that could ultimately extend to 1,000 such prop erties over the following

three years provided the carbon-related benefits can be verified. Mr Fox, speak ing at that unveiling, said of The Bahamas: “We’re in the hot zone, we’re in the front line. Together, Sam and I got to work and we devel oped a technology that has the potential to change the way we build in the world.

“If you know anything about the construction industry, 38 percent of all emissions are generated from the construction indus try. Nine percent alone coming from the cement we create. We need to build better. We need to delink development from pollu tion. Partanna provides the opportunity for us to do that; for us to build in a more nature-positive way.

“We use recycled mate rials, which allows it to be carbon negative over its life cycle Our technology is affordable, scalable and completely sustainable, and for people living in coun tries like my country, homes can be built using Partanna and can create hurricaneresilient regenerative homes because our products get stronger when we’re exposed to seawater.”

PAGE 2, Monday, November 14, 2022 THE TRIBUNE

220 LEGENDARY JOBS FOR ‘HAZARDOUS’ SITE

and associated ameni ties including hotel, condominiums, mixed-use retail/office facility, boat storage, fuel and Customs/ Immigration post, will boost Bahamian worker income by a cumulative $154m over that same 25-year period and create “an average of 375 additional full-time equivalent jobs” both directly and indirectly. When the 25-year aver age is calculated, the wage impact is a more modest $6.16m per year.

“Government revenues from the additional eco nomic activity would total $158m (in 2022 figures) and would outweigh proposed concessions by a factor of 2.4,” Tourism Econom ics calculated. The study showed that, over Legend ary Marina’s first 25 years, the developer estimates that it will receive tax breaks totalling some $66.3m, con sisting of $38.2m in waived real property tax payments and $28.1m in foregone VAT and import duties on construction materials.

It then argues, though, that this will be more than offset by increased rev enues elsewhere that the Government will not other wise gain, including $47.8m

worth of VAT and some $74m in Stamp duties.

However, Patrick Stra chan, a two-time former Bahamas Real Estate Asso ciation (BREA) president, has voiced his misgivings over the Legendary Marina Resort at Blue Water Cay project. Disclosing that he was familiar with the loca tion and surrounding area, having once been hired as a realtor to sell lots in the subdivision originally planned for that site, he argued that it remains too exposed to storm surge and flooding should a major hurricane strike New Providence.

“I have several concerns about this proposed devel opment,” he told Tribune Business. “I’m familiar with that area; that subdi vision has been around for at least 20-plus years. Ini tially it couldn’t get off the ground. Five to six persons may have bought lots in there, but the concern was that it was so narrow and so low that if people were build out there storm surge would overwhelm that entire tract of land.

“That was one of the main concerns, and why the subdivision could never get off the ground. What have the Bahamas Investment Authority (BIA) given

approval in principle on? I have my concerns. I am going to be watching this very carefully.”

The original plan for the Bluewater Cay subdivision, labelled “a boater’s para dise”, which has been seen by this newspaper shows the same peninsula-type tract of land upon which Legendary Marina will con struct its project as being divided into 40 lots with prices as high as $360,000. The first developer was Alan Winner of Grosham Properties.

Tribune Business pre viously revealed that Mr Winner’s estate, together with Bahamian business men Tony Myers and Peter Andrews, and Star Insurance, have now col lectively sold the property to Legendary Marina for a combined $4.15m. The new developer, though, seemingly shares none of Mr Strachan’s concerns as the centrepiece of its ambi tions is a 600-vessel boat storage facility capable of withstanding Category Five hurricanes.

“Total investment will amount to $80m spread out over nine years. The investment includes con struction of rental villas and the hotel, boat storage facil ity, marina, marine service

centre and store, fine dining options, and on-site employee living facilities. Only local expenditures are included in the modelling for economic impact pur poses,” Tourism Economics said.

This was broken down into a $50m spend on the marina, and $22m on the hospitality units, with the balance targeted at ameni ties, utilities, staff areas and common areas. “New visitor volume will stabilise at 16,500 annual visitors,” Tourism Economics added. “Partial marina operations will begin in Year two and partial hotel operations in Year seven, with the villa component operational in Year nine.

“Project managers expect initial occupancy of the rental units and the hotel to be 55 percent, and ramp up to 70 percent at stabi lisation after four years of operations for both hos pitality components. The new capacity and pro jected occupancy would correspond to a stabilised volume of 16,500 annual visitors to The Bahamas.”

Thus the full economic impact of Legendary Mari na’s project will take some years to materialise. “Pro viding service and parts availability will keep boat

owners from taking their boats to Florida for service. This will bring an exist ing revenue stream to the Bahamas that is currently going elsewhere,” the EIA added.

“The in-direct benefits of the Project would be in the order of three to four times’ the direct benefits, based on experience with similar pro jects.” The developers are also promising “to make every effort to achieve an employment ratio of 80 percent Bahamian to 20 percent non-Bahamian”.

Touting the project’s advantages for the area’s environment, the EIA added: “The existing site has been abandoned for several years and has become a hazardous loca tion to the neighborhood. There are trash dumps on site and stolen boats have been found in Yamacraw Lake. The project will enhance the surrounding environment by bring ing a security presence to the area and cleaning up a blighted site.

“The developer is also proposing to dredge the very shallow entrance to Yamacraw Lake, which will allow residents to access the lake with their vessels as well as enhance the water circulation and exchange

Bahamas told: Don’t pause digital assets plan on FTX failure

From pg B1

no blame is attached to this jurisdiction.

Warning that such a move would also likely take The Bahamas “out of considera tion on a global scale” as a welcoming destination for digital assets companies, he argued that both the Secu rities Commission and the Government “could not foresee” both the collapse of Sam Bankman-Fried’s empire and the speed with which it occurred.

Speaking before it was yesterday confirmed that the Royal Bahamas Police Force has launched a crimi nal probe into FTX’s rapid unravelling in the space of a week, Mr Hobbs told this newspaper that local regu lators likely need to ask “a different set of questions” for incoming digital assets businesses and conduct due diligence scrutiny more appropriate to this niche than traditional bank and trust companies.

In FTX’s wake, he called on Bahamian regulators to pay especially close atten tion to companies with their own digital “native” tokens and make sure these were not being used as collateral to “prop up” assets they do not have. Mr Hobbs also revealed that he and other digital assets operators had become increasingly uneasy about FTX and Mr Bankman-Fried’s trad ing company, Alameda Research, earlier this year as “something weird was going on”.

The Royal Bahamas Police Force, in a statement issued yesterday, said it was working closely with FTX’s principal, regulator, the Securities Commission, to probe whether any “crimi nal misconduct” was involved in FTX’s spectacu lar collapse.

“In light of the collapse of FTX globally and the pro visional liquidation of FTX Digital Markets, a team of financial investigators from the Financial Crimes Inves tigation Branch are working closely with the Bahamas Securities Commission to investigate if any criminal misconduct occurred,” the police said.

Meanwhile, Mr Hobbs, who said he established “a couple” of digital assets companies in The Bahamas because of “the strides” made with the Digital Assets and Registered Exchanges (DARE) Act and implementing a robust regulatory framework, argued that it was “to early to tell” the precise impact FTX’s woes will have on the jurisdiction.

“I think the Commission did a really good job with acting rapidly in freezing the assets of FTX in The Bahamas. That’s a very good move on their part,” he told Tribune Business. “I also saw some people were going to bail-out some of those assets and have been following it closely with my team to see what it would be for The Bahamas.

“If The Bahamas comes out, and the Government comes out..... The Securities

Commission could not have foreseen what would happen. I wouldn’t put it on the Government here.... I’m hoping with the swift move from what the Secu rities Commission did, and how many assets they have here in The Bahamas, The Bahamas won’t get hurt. It doesn’t seem like a lot came from The Bahamas or the headquarters here. A lot seems to have come from Chicago and US offices.”

Mr Hobbs argued that the factors behind FTX’s collapse were driven by issues internal to the crypto exchange, and decisions taken by Mr BankmanFried and the tight-knit group around him, rather than any actions taken by The Bahamas or deficien cies in its regulatory regime.

However, the Bahamasdomiciled entrepreneur revealed there had been growing digital assets indus try concerns surrounding FTX for some months. These centred on Alam eda Research, the trading firm owned by Mr Bank man-Fried, and which was inextricably linked to the crypto exchange.

Media reports have sug gested some $10bn in FTX client funds were transferred to Alameda Research, which were then used by Mr Bankman-Fried to acquire struggling digi tal assets entities such as Blockfi and Voyager. Mr Hobbs said he was “prop ping up the market” with borrowed funds (FTX client monies) secured by the crypto exchange’s own FTT

THE BANKRUPTCY ACT, 1870

In the Supreme Court of the Bahamas, Bankruptcy Division. In the matter of a bankruptcy petition against Raymond Rolle, of 39 East St North, Nassau, P.O. Box SS-19462, on the island of New Providence.

UPON the hearing of this petition this day, and upon proof, satisfactory to the Court, of the debts of the petitioner, and of the act or acts of the bankruptcy alleged to have been committed by the said Raymond Rolle having been given, it is ordered that the said Raymond Rolle be and he is hereby adjudged bankrupt. --- Given under the seal of the Court this 27th day of May, 2021.

By the Court, The Hon. Madam Justice Diane Stewart, Judge

The first general meeting of the creditors of the said Raymond Rolle is hereby summoned to be held at the Court of the Registrar on the 14th day of December 2022, at 11:00 o’clock of the fore-noon, also online at https://us06web.zoom.us/j/81708684199?pwd=SXZLeEJMUk5GQ

lZoRktVblRkK09xUT09 and that the Court has ordered the bankrupt to attend thereat in person for examination, and to produce thereat a statement of his affairs as required by the statute.

Until the appointment of a trustee, all persons having in their possession any of the effects of the bankrupt must deliver them, and all debts due to the bankrupt must be paid to the Registrar.

Creditors must forward their Proofs of Debts to the Registrar.

tokens, which were essen tially “worthless”.

He added that Mr Bank man-Fried engaged in this activity “when he had noth ing in the tank and should have been taking care of his own house”. Mr Hobbs con tinued: “A lot of us in the industry saw this a long time ago. I got out of FTT tokens in mid-April.

“There was something weird going on with FTX and Alameda. There was too much weird stuff going on. It didn’t feel right. I told people on my own team about it. I have some people on my team who have got hurt because they still have FTT tokens.”

While many will argue that The Bahamas should adopt a conservative approach, and slow the flow of licensing/registration of digital assets businesses in the wake of FTX’s col lapse, Mr Hobbs argued that it should instead stick to the present growth strat egy - albeit with a modified, enhanced approach to due diligence.

“That would be the worst thing The Bahamas could do,” he replied, when asked if this nation should pause

its digital assets expansion. “If The Bahamas paused its digital assets strategy it would probably take them out of consideration on a global scale for this emerg ing growth technology.

“The Bahamas has been able to attract global talent with the DARE Act and how transparent it is to talk to the Government and the Securities Commis sion. If they were to pause their strategy, The Bahamas would lose all global respect because it looks like an admission of fault. There’s no fault to pay.

‘If The Bahamas was to pause its strategy it would be the worst thing to do. They’d lose business where they have been attract ing business. My advice to the Government is to keep moving forward with what you’re trying to do. This

flow with the sea, thus enhancing the water quality of the lake........ The devel oper intends to construct unimpeded public access to a public beach location at the south-west corner of the project.

“The project site (northern peninsula) has previously been cleared, and the canals have pre viously been dredged for boats within the area. Other than the physical changes to this environment there is human influence seen in the garbage and fishing equipment found within the canals,” the EIA continued. During the marine surveys there were a number of debris seen, suggesting that this site might be used for dumping in certain areas, in particular, where a whole car was found.

“During the marine survey, residents expressed concerns pertaining to the current land use of the area by neighbours who were discarding various forms of waste within the marine area inclusive of dog faeces. Additionally, there were a number of fishing cages found and also fishing line and ropes. This shows that people use this site as a fish ing ground which would affect the fish population of the area.”

is an opportunity to learn more.”

With OKX, another major crypto currency exchange, just having been licensed to operate in The Bahamas and another two on the way, Mr Hobbs said: “This is an opportunity to work at the ground level with industry leading play ers and to say we’re not going to let this happen again and we will be global leaders in how we manage ourselves.”

He suggested that The Bahamas tweak its regula tory regime to conduct due diligence and scrutiny more specific to the digital assets industry, especially when it came to companies with their own tokens such as FTX’s. “It’s about creating a new set of guidance and a few more questions,” Mr Hobbs added. “We want to know more about what you want to do with applica tions specific to the crypto industry.”

THE TRIBUNE Monday, November 14, 2022, PAGE 3

From pg B1 TO ADVERTISE TODAY IN THE TRIBUNE CALL @ 502-2394

10” X 10” OFFICE SPACES available at OFFICE SPACES FOR RENT Harbour Bay Plaza in the Peachy Flamingo Ltd. unit as of December 2022. Rent is set at $950.00 excluding VAT, per month All interested persons should contact Jason Pinder @ Jpinder@stargeneralnp.com

Bahamas in COP27 panel on tourism climate change

THE Bahamas last week participated in talks on how tourism-based economies can mitigate and adapt to cliate change at the United Nations (UN) COP27 conference, Tarran Simms, coordinator within the Ministry of Tourism, Invest ments and Aviation’s sustainability department, was among the panellists in discussions between national tourism entities as part of the United Nations Forum on Youth.

“I am excited to represent The Bahamas as a member of the small island develop ing states community and speak on the ministry’s sus tainability initiatives, which are all public-private part nerships undertaken with stakeholders representing local, national and interna tional organisations,” Mr Simms said.

He spoke on sustain ability programming currently being undertaken by the ministry in climate mitigation and adaptation, plus community-based tour ism, which is underpinned

by the ESG principles of environmental conservation, socio-cultural heritage pres ervation and governance.

Among the initiatives cited by The Bahamas is the Mission for the Mangroves Project, which was devel oped to mitigate the negative impacts of climate change in vulnerable communities on Grand Bahama that were decimated by Hurricane Dorian. The Category Five storm eradicated 60 per cent of the island’s mangrove cover.

The project is supported by public and private sector tourism and civil society, with a focus on mangrove replenishment and refor estation that rebuilds coastal resilience and the protec tion of coastal communities exposed to climate impacts.

The partnership initiative facilitates the training of BahamaHost certified trans portation providers in the mangrove life cycle and their purposes, as well as mangrove replenishment and environmental stew ardship, for their eventual

designation as ‘Stewards of The Environment’ (SOTEs). Additional capacity building in the use of digi tal technology will create a destination tour experience for visitors interested in nature-based experiences, or fostering environmental protections and volunteer ism during their travels.

The use of digital technol ogy in booking these tours is intended to ease the burden of conducting business in a digital space for stakehold ers on the islands of Abaco and Grand Bahama.

Meanwhile, a governance-related ini tiative, Destination Stewardship, involves a partnership between the Ministry of Tourism, Invest ments & Aviation and the Global Sustainable Tourism Council to bring sustain able tourism standards and leadership in destination management to the commu nity level within the Family Islands.

It is designed to foster more inclusive approaches to tourism governance through the formation of destination

stewardship councils (DSCs) as legal entities. Once estab lished, councils undergo capacity building in sustain ability standards, visitor expectations in tourism product and service delivery, and good governance in des tination management and competitiveness.

They also undertake projects in areas such as culture and heritage pres ervation, environmental/ waste management and safety and security based on their unique attributes and tourism priorities. The first group of five DSCs, located on Andros, Eleuthera, Har bour Island and Exuma, were legally formed in 2020.

Some have deployed branding strategies that have already attracted interna tional partnerships. This year, another five islands, namely Grand Bahama, Cat Island, Long Island, Abaco and Bimini, are engaging in sustainability training as a step towards Council formation. The Ministry of Tourism, Investments and Aviation said it aims to facil itate destination stewardship

council development on each of the 16 islands it promotes Councils are exposed to knowledge products and capacity-building webinars in tourism planning and management, and sample case studies in international tourism sustainability; the formation of legal entities in The Bahamas; sustainable waste management for des tinations; preserving local heritage and handicrafts; grant writing, international community-based tourism networks (Planeterra) and international best practices in destination sdtewardship.

In the New Year, coun cils will participate in local programming in commu nity tourism to improve their knowledge of dis aster risk management policies and practices via the Caribbean Tourism Organisation’s (CTO) online training platform.

The Ministry of Tourism, Investments and Aviation has also spearheaded an aluminium recycling pilot project within its headquar ters with Cans for Kids and

NOTICE is hereby given that DESHANDA GODIN of Adderley Street & Grants Town, Nassau, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 7th day of October, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE is hereby given that WALLACE PETIT of #48 Miami Street North, Nassau, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 7th day of October, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

Wastenot Bahamas, whichs seek to change attitudes and influence behaviours. Educational campaigns were launched to sensitise staff, and enlighten their households, on the longterm benefits of recycling to reduce solid waste in landfills.

Collections of thirty cents for each pound of alumin ium recycled is returned to the community to support essential children’s pro grammes. The programme has expanded to include festivals and local events in New Providence, and there are plans to roll them out on the Family Islands in the near future.

Elsewhere, the Andros community-based Tourism (CBT) cluster project seeks to position the island as the premier ecotourism destina tion within The Bahamas. It brings together stakeholders from various sectors working with a cluster of businesses within the four districts of Andros to execute a cluster development plan.

NOTICEThe plan focuses on improving business resil ience, marketing capacity, product quality, and pack aging and tour guiding to drive growth and re-position the destination to deliver increased income genera tion and improved demand for the destination’s product and service offering.

The project also promotes the importance of natural and cultural heritage con servation. It has targeted proven community-tourism initiatives such as flats fish ing and bird-based tourism, which are considered low carbon activities. And, through the addition of more nature-based and cul tural heritage experiences, it seeks to advance a vision for successful all-year naturebased tourism on Andros.

NOTICEKristal Bethel, senior director for sustainability at the Ministry, said: “This kind of programming also helps to simplify understanding of the complex issues and concepts around sustain ability within Family Island communities.

“Given the importance of our tourism GDP in promot ing positive and sustainable growth, we must take more seriously our national com mitments to climate change, the global realities emanat ing from the conference of the parties and how we at the Ministry can continue to progress these types of pro jects within The Bahamas.”

PAGE 4, Monday, November 14, 2022 THE TRIBUNE

Destruction of an icon

By CHRIS ILLING Chief Commercial Officer @ ActivTrades Corp

WHAT exactly happened? How could FTX go bankrupt almost overnight? And what does that mean for the entire market? We are trying to reconstruct the whole drama.

FTX is Sam Bank man-Fried’s (SBF) stock exchange. Sam is one of the products of the 2020-2021 bull market. He was previ ously virtually unknown, although he has been very successful in arbitraging tether dollars and introduc ing institutional investors with his trading firm, Alam eda Research.

In November 2017, he founded Alameda Research, a quantitative trading firm. As of 2021, SBF owned approximately 90 percent of Alameda Research. However, he became a legend in the ecosystem through his exchange FTX, which raised massive amounts of capital with the sale of its own token, FTT, and invested heavily in the crypto currency, Solana. Solana multiplied in value, and in an amazingly short amount of time SBF had amassed a fortune of just over $16bn

But then, on November 2, the website Coindesk published an article about a leak in Alameda’s balance sheet. Alameda listed assets of $14.6bn and liabilities of $8bn. That looks solid – at first glance. Yet if you look just a little closer, any impression of stability disappears.

The majority of Alam eda’s assets consisted of highly speculative coins and tokens: $3.66bn in FTT tokens; $2.16bn in ‘FTT col laterals’, $3.37bn in various cryptocurrencies - includ ing more than $1bn in Solana - as well as $134m and $2bn in “equity-related securities”.

At the time of publica tion, the FTT token price has already fallen. Their total market cap was

$3.35bn. Alameda had such a large chunk of the total amount on its balance sheet that it was impossible to liq uidate even a fraction of it in the markets without the price plummeting.

FTX issues one coin, FTT, and its sister com pany, Alameda Research, holds most of it. It is not very trustworthy that most of Alameda’s total capi tal consists of tokens that are centrally controlled by FTX, and created out of nothing really. The bal ance sheet was made even flimsier by the fact that the FTT tokens, whose value was ultimately pure fantasy, were still used as collateral to lend other coins or to engage in margin trading.

Monday, November 7, 2022

Binance breaks with FTX. Binance boss, Chang peng Zhao and FTX chief, Sam Bankman-Fried, were once closely con nected as pioneers in the industry and partners, but then developed into archrivals with their crypto exchanges and recently fell out over regulatory issues. SBF became more and more the mouthpiece of the crypto scene, and tried to lobby politicians and supervisors.

A tweet from Zhao stated: “Due to the recent revelations that have come to light, Binance has decided to liquidate all remaining FTT.” How ever, as Zhao explained in his tweet series, Binance was trying to manage sales in a way that did not affect the market. Therefore, the liquidation should take place over the next few months.

This action also affects Solana, the second strong est position in the Alameda portfolio. Solana drops sharply within 24 hours.

Tuesday

Binance wants to take over most of FTX’s busi ness. However, it is initially only a non-binding letter of intent (LOI), as Binance boss, Changpeng Zhao, emphasised.

The problems in FTX trigger an avalanche in the crypto market on Tuesday.

Investors withdrew around $6bn from FTX within 72 hours, exacerbating liquid ity problems. The world’s best-known crypto curren cies, Bitcoin and Ethereum, fell in value by double digits for the second day in a row due to the turmoil at FTX. This fuelled further con cerns about the health of FTX, and investors started withdrawing more money. The FTT token crashed 72 percent on Tuesday.

Wednesday

After the start of its due diligence audit, Binance quickly distance itself from the takeover plan. Binance backed out after reviewing FTX’s structure and books. It said in a statement to The Wall Street Journal: “Our hope was to be able to sup port FTX’s customers to provide liquidity, but the issues are beyond our con trol or ability to help.”

Thursday

To bring some clarity to the impending bankruptcy of his company, SBF now turned to his followers via Twitter. He writes: “I’m sorry ... I screwed up and should have done better.”

SBF files for personal bankruptcy. FTX faced a liquidity shortfall of $8bn “due to withdrawal requests”.

Friday Crypto exchange, Crypto. com, suspended withdraw als after two stablecoins, USDC and USDT, fell below the dollar. This shows how sensitive the markets have been since the announcement that

Binance was walking away from its FTX takeover.

During times of high market uncertainty, stable coins typically fall below their dollar parity. That is because investors are sell ing cryptocurrencies against stablecoins. However, this time it is different, as

investors are apparently preferring to leave the crypto market behind alto gether and consequently exchange their holdings for fiat.

FTX files for bankruptcy in the US, and SBF steps down as chief executive. Conclusion

This incident, and the speed with which it unfolded, is a clear exam ple of regulators concerned about the lack of guard rails in the free-roaming crypto space. Jurisdictions that have considered relaxing regulations may no longer do so.

THE TRIBUNE Monday, November 14, 2022, PAGE 5

Collapse ‘bewilders’ FTX Bahamas staff

here in The Bahamas,” Mr Russell told this newspaper. “That’s genuine. Persons are heartbroken.”

Another FTX worker, speaking on condition of anonymity, voiced much stronger emotions that Mr Russell. They expressed that they felt “betrayed” by Mr Bankman-Fried and the group of senior executives around him, having trusted him sufficiently to leave an existing well-paying job to help realise his crypto currency dreams for The Bahamas.

“Betrayal. Just an enor mous feeling of betrayal and that guts you,” they said. “I was speaking to a colleague and they feel as gutted as anybody else, as they fol lowed someone they trusted wholeheartedly only to be betrayed at an extraordinary level.”

Brian Simms KC, senior partner at the Lennox Paton law firm, who has been appointed as provisional liquidator for FTX Digital Markets by the Supreme

Court, will likely meet the Bahamian subsidiary’s staff this week after being locked in a series of meetings, brief ings and document reviews over the weekend in a bid to gain control of its assets (bank accounts) and get a grip on the task he faces.

Head of Lennox Paton’s litigation practice, he repre sented Baha Mar’s lender, the China Export-Import Bank, in the dispute over the $4.2bn project - an expe rience that will serve him in good stead given that this dispute has also ended up in the Chapter 11 bank ruptcy protection court in Delaware just like the Cable Beach mega resort.

Mr Russell, meanwhile, voiced optimism that FTX’s investments in western New Providence real estate will prove a valuable recovery source for what is owed to staff, Bahamian vendors and clients of FTX Digital Markets. Tribune Business reported last week how FTX has acquired some $74.23m in west New Providence real estate during 2022 alone.

Most of these purchases involved property in the high-end Albany com munity, along with the acquisition of units in the Veridian Corporate Centre, which was devel oped by Island Luck gaming tycoon, Sebas Bastian. The acquisitions by FTX Prop erty Holdings, the crypto exchange’s real estate arm, ranged in value from a high of $30m to $8.9m, $7.479m, $7.311m, $7m and $6.75m at Albany, according to the report, which was being widely circulated on social media.

Some $4.5m was also spent to acquire the Bayside Executive Park site for its planned $60m headquarters, which is now unlikely to pro ceed, but sits directly across from Mr Simms’ offices at Lennox Paton. A report also showed a $2.29m purchase at the Veridian Corporate Centre.

“The corporate offices for FTX are currently housed at the Veridian Corporate Centre, which was originally built and sold by Sebas Bas tian,” the document said.

“These are not rentals or leases. FTX has purchased these units outright.

“Additionally, there is one purchase of a condominium at One Cable Beach for $2m made by Sam BankmanFried directly in late 2021.” It is unclear whether the latter, especially given that it is in the FTX founder’s name, will be included in the provisional liquidation.

“We’ve made significant real estate investments on the western end of the island,” Mr Russell added. “These were designed to establish our home in The Bahamas. I’m banking on those investments being a key factor in allowing Bahamian employees, ven dors and customers to be attended to in the best pos sible way.

“As we try to make it right, the good thing is The Bahamas has an opportunity to demonstrate to the world that as a compliant jurisdic tion we will work within the law to ensure parties in our jurisdiction act in good faith in all regards.” In addi tion to FTX’s real estate,

Tribune Business under stands that another valuable source of recovery could be FTX’s technology platform, the exchange itself and its licence.

Meanwhile, Deltec Bank & Trust yesterday denied speculation circulat ing widely in the financial services industry that its acquisition in March 2022 of Ansbacher Bank & Trust was financed by a loan from FTX. “We have been made aware of the rumours related to the acquisition of Ansbacher (Bahamas) by Deltec Bank & Trust that are unfounded and unsub stantiated,” Deltec said.

“Firstly, we would like to make it clear that this rumour is malicious and completely baseless. The latest independent auditor’s report shows that Deltec Bank is well capitalised. Additionally, the bank car ries no debt and is not a creditor to FTX....

“While we are all saddened by the news sur rounding FTX, we urge the financial services commu nity to act responsibly and

not spread rumours that are frivolous and attempt to damage the reputation of financial institutions in the jurisdiction. During such a fragile point in our industry, we must focus on facts and actual events.”

Michael Pintard, the Opposition’s leader, last night urged the Government to speak publicly to the FTX collapse. He added: “The Government’s much-touted proposed carbon credit trad ing platform was announced to be facilitated through FTX’s exchange platform.

“Given current events, what impact will this development have on the potential for carbon trading. What alternative arrange ments are being made, and when will we see the first trade and benefit from this activity, if any? Has the Government begun to esti mate the loss exposure of the private sector as a result of FTX apparent collapse and the personal losses of Mr Bankman-Fried and his colleagues? What meas ures are being taken to protect Bahamians from any anticipated loss?”

PAGE 6, Monday, November 14, 2022 THE TRIBUNE

PAGE B1 • At least two (2) years’ experience in Fibre Optics installations • Fiber Optics cabling installations with bucket trucks on poles (electrical and others). • Fibre Optics cable pulling on conduit installations. • Outdoor installations of telecommunications equipment for Fibre Optics network. • Experience working in heights • Valid Driver’s license and experience driving bucket truck preferable • Excellent communication and team work skills. JOB OPPORTUNITY Telecommunications company is seeking suitable persons to fill the position of linemen. The following criteria are required:Interested persons may email resume to calatelhr@gmail.com on or before Friday, November 25th, 2022

FROM

SAM BANKMAN-FRIED’S DOWNFALL SENDS SHOCKWAVES THROUGH CRYPTO

By KEN SWEET AP Business Writer

SAM Bankman-Fried received numerous plau dits as he rapidly achieved superstar status as the head of cryptocurrency exchange FTX: the savior of crypto, the newest force in Democratic politics and potentially the world's first trillionaire.

Now the comments about the 30-year-old BankmanFried aren't so kind after FTX filed for bankruptcy protection Friday, leaving his investors and custom ers feeling duped and many others in the crypto world fearing the repercussions. Bankman-Fried himself could face civil or criminal charges.

"Sam what have you done?," tweeted Sean Ryan Evans, host of the

cryptocurrency podcast Bankless, after the bank ruptcy filing.

Under Bankman-Fried, FTX quickly grew to be the third-largest exchange by volume. The stunning col lapse of this nascent empire has sent tsunami-like waves through the cryptocurrency industry, which has seen a fair share of volatility and turmoil this year, includ ing a sharp decline in price for bitcoin and other digital assets. For some, the events are reminiscent of the dom ino-like failures of Wall Street firms during the 2008 financial crisis, particu larly now that supposedly healthy firms like FTX are failing.

One venture capital fund wrote down invest ments in FTX worth over $200 million. The crypto currency lender BlockFi paused client withdrawals

Friday after FTX sought bankruptcy protection. The Singapore-based exchange Crypto.com saw withdraw als increase this weekend for internal reasons but some of the action could be attributed to raw nerves from FTX.

Bankman-Fried and his company are under investi gation by the Department of Justice and the Securities

and Exchange Commission. The investigations likely center on the possibility that the firm may have used customers' deposits to fund bets at Bankman-Fried's hedge fund, Alameda Research, a violation of U.S. securities law.

"This is the direct result of a rogue actor break ing every single basic rule of fiscal responsibility,"

said Patrick Hillman, chief strategy officer at Binance, FTX's biggest competitor.

Early last week Binance appeared ready to step in to bail out FTX, but backed away after a review of FTX's books.

The ultimate impact of FTX's bankruptcy is uncer tain, but its failure will likely result in the destruc tion of billions of dollars of wealth and even more skepticism for cryptocur rencies at a time when the

industry could use a vote of confidence.

"I care because it's retail investors who suffer the most, and because too many people still wrongly associate bitcoin with the scammy 'crypto' space," said Cory Klippsten, CEO of Swan Bitcoin, who for months raised concerns about FTX's business model. Klippsten is publicly enthusiastic about bitcoin but has long had deep skep ticism about other parts of the crypto universe.

THE TRIBUNE Monday, November 14, 2022, PAGE 7

SIGNAGE for the FTX Arena, where the Miami Heat basket ball team plays, is visible Saturday, Nov. 12, 2022, in Miami. Sam Bankman-Fried received numerous plaudits as he rapidly achieved superstar status as the head of cryptocurrency ex change FTX: the savior of crypto, the newest force in Demo cratic politics and potentially the world’s first trillionaire. Now the comments about the 30-year-old aren’t so kind after FTX filed for bankruptcy protection Friday, Nov. 11 leaving his inves tors and customers feeling duped and many others in the crypto world fearing the repercussions.

Photo:Marta Lavandier/AP

Fears FTX freeze order was violated

fraction of the assets we currently hold on hand, and we are actively working on additional routes to enable

withdrawals for the rest of our user base. We are also actively investigating what we can and should do across the world.”

This assertion, and the subsequent fall-out, eventu ally prompted the Securities Commission to clarify that it had not given FTX

Digital Markets permission to release customer funds or prioritise/give preference to Bahamian clients. In a statement issued at 6.13pm on Saturday evening, more than 48 hours after FTX’s original tweet, it warned that such payments would be treated as “voidable preferences” and likely subject to recovery by the provisional liquidator.

“The Commission wishes to advise that it has not directed, authorised or suggested to FTX Digital Markets the prioritisation of withdrawals for Baha mian clients,” the Securities Commission said.

“The Commission further notes that such transactions may be characterised as voidable preferences under the insolvency regime, and consequently result in clawing back funds from Bahamian customers. In any event, the Commis sion does not condone the preferential treatment of any investor or client of FTX Digital Markets or otherwise.”

Tribune Business sources, confirming that some FTX Digital Markets clients were able to successfully withdraw and obtain their monies around the time of the Supreme Court’s freezing Order and after, blamed this on the “chaos” and confusion surround ing the crypto exchange’s rapid collapse that took less than one week. Staff were said to have believed mis takenly that the Securities Commission had given “the go-ahead” to release funds rather than freeze them.

“Somehow in the chaos of wanting to do right and manage things it was

attributed to the regu lator, but it was not the regulator,” one well-placed contact said of the decision/ instruction to release funds and what occurred.

However, another added: “I don’t understand why they blocked all the trans fers in the US and allowed them here? Bahamians were acting as commission agents to convert tokens into cash. There was a freezing Order in place; it’s a breach of the Supreme Court’s injunction.

“They were doing indi rectly what can’t be done directly. The story I’m hear ing is that there were some named individuals involved in assisting these people to get their money - the Baha mian assisters and agents, and the foreign clients. That’s what I’ve heard from several sources.”

CNBC on Saturday reported that some FTX clients were accessing their funds via what was termed “a backdoor in The Bahamas”. The US busi ness TV channel added that research by data firm, Argus, showed “desperate” FTX clients were turning to users in the Bahamas for help in cashing out and getting their monies. It reported that Bahamians were receiving a percentage of the assets once success fully withdrawn from FTX.

Concerns that the Supreme Court asset freeze has been violated were among a series of fast-paced developments surrounding FTX’s collapse, which on Friday saw its co-founder and one-time crypto guru, Sam Bankman-Fried, resign as chief executive and place the group’s 134 companies - Bahamas-domiciled FTX Digital Markets exceptedinto Chapter 11 bankruptcy protection in the Delaware courts.

The filing, which revealed minimal details, listed parent company, FTX Trad ing, as having more than 100,000 clients. Assets were shown as being between $10bn-$50bn, as were liabilities. Among the enti ties placed into Chapter 11 were Crypto Bahamas LLC, likely the company that organised and owned the conference of the same name that was held in The Bahamas earlier this year, and Alameda Research (Bahamas) and Technology Services (Bahamas).

The failure of Mr Bank man-Fried’s sprawling crypto empire, which just months ago was valued at around $32bn, in just one week will likely go down in history as one of the most spectacular corpo rate implosions in history. The episode is being com pared to both Enron’s crash in 2001, amid a series of accounting and corporate governance scandals, and the Lehman Brothers fail ure in 2008 that triggered the global financial crisis and subsequent recession.

FTX’s collapse is already having a similar impact to Lehman Brothers for the global digital assets indus try, as valuations plummet. Mr Bankman-Fried was yesterday said to remain holed up in The Bahamas, likely in FTX’s offices and condos at Albany, with his shattered empire undergo ing criminal and regulatory probes both in this nation and the US.

It was last night sug gested that the Securities

Commission and Brian Simms KC, the Lennox Paton senior partner who has been named as FTX Digital Markets provisional liquidator, had spent much of the weekend grilling Mr Bankman-Fried and his senior executives over what had led to the company’s failure and how they can gain access to the necessary network systems, books and corporate/accounting records

However, both Mr Simms and Christina Rolle, the Securities Commission’s executive director, declined to comment when con tacted by Tribune Business yesterday. It is thought that the provisional liqui dator has also been sitting through an endless series of briefings and meetings, as well as reading multi ple documents, as he tries to get a grip on the FTX empire.

Among the most seri ous allegations facing FTX and Mr Bankman-Fried is that around $10bn belong ing to the crypto exchange’s clients was transferred to Alameda Research, his trading firm, without their permission. These funds were then employed to bailout other troubled crypto businesses such as Blockfi (a $240m option to buy and $400m credit facility) and Voyager ($1.3-$1.4bn) which had run into trouble during the so-called ‘crypto winter’.

However, the only collat eral for this $10bn transfer subsequently turned out to be FTX’s own token, FTT, which was essentially worthless. Besides an $8bn liquidity shortfall at FTX, with liquid assets of $900m compared to $9bn in liabili ties, reports at the weekend alleged that between $1bn to $2bn of the sums trans ferred to Alameda were missing.

This, though, was denied by Mr Bankman-Fried, who told the Reuters news agency that he “disagreed with the characterisation” of the transfer, saying: “We had confusing inter nal labelling and misread it.” When asked about the missing customer funds, he replied via Twit ter: “???” And, to further complicate a confusing picture, there were sugges tions that another $515m had disappeared from FTX - either as a result of a hack or “inside job”. Either way, unlike the Lehman Brothers saga, global attention is now fixated on The Bahamas because FTX’s international headquarters are based here. “I think everyone at this stage is scurrying for the lawyers. The chick ens are coming home to roost and it’s every man for himself,” one Bahamian attorney said yesterday of FTX’s implosion. “This is enormously tragic for the country and very embar rassing for the Government.

“They were hustling to take all the credit for digital assets and now it has back fired on them and there is huge egg on their face. You can bet your bottom dollar that there’s going to be a complete regulatory over haul led by the Securities & Exchange Commission (SEC) on this whole crypto industry. Consequently, there are going to be some people who pay the ulti mate price.”

PAGE 8, Monday, November 14, 2022 THE TRIBUNE

FROM PAGE B1

NOTICE CALL 502-2394 TO ADVERTISE TODAY!

NOTICE is hereby given that CLINT ALEXANDER GARDINER of Farrington Road, New Providence, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 14th day of November, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

www.bisxbahamas.com

2626.010.010.00397.7717.85

6.95 6.950.00 0.2390.17029.12.45% 53.0040.00

39.95 39.950.00 0.9321.26042.93.15% 2.761.60Benchmark BBL 2.76 2.760.00 0.0000.020N/M0.72% 2.462.26Bahamas

BFH 2.46 2.460.00 5000.1400.08017.63.25% 2.852.25Bank of Bahamas BOB 2.85 2.850.00 0.0700.000N/M0.00% 6.205.75Bahamas

Fund BPF 6.20 6.200.00 1.7600.000N/M0.00% 10.058.78Bahamas Waste BWL 8.78 8.780.00 0.3690.26023.82.96% 4.342.82Cable Bahamas CAB 3.95 3.950.00 1,800-0.4380.000-9.0 0.00% 10.657.50Commonwealth Brewery CBB 10.25 10.250.00 0.1400.00073.20.00% 3.652.27Commonwealth Bank CBL 3.49 3.490.00 5000.1840.12019.03.44% 8.526.05Colina Holdings CHL 8.50 8.500.00 0.4490.22018.92.59% 17.5010.25CIBC FirstCaribbean Bank CIB 16.00 16.000.00 0.7220.72022.24.50% 3.251.99Consolidated Water BDRs CWCB 3.67 3.50 (0.17) 0.1020.43434.312.40% 11.2810.06Doctor's Hospital DHS 10.50 10.500.00 5,1900.4670.06022.50.57% 11.679.16Emera Incorporated EMAB 9.39 9.590.20 0.6460.32814.83.42% 11.5010.00Famguard FAM 10.85 10.850.00 0.7280.24014.92.21% 18.3014.05Fidelity Bank (Bahamas) Limited FBB 18.10 18.100.00 0.8160.54022.22.98% 4.003.50Focol FCL 3.98 3.980.00 0.2030.12019.63.02% 11.509.50Finco FIN 11.38 11.380.00 0.9390.20012.11.76% 16.2515.50J. S. Johnson JSJ 15.55 15.550.00 0.6310.61024.63.92% PREFERENCE SHARES 1.001.00Bahamas

115.92104.79Bahamas

107.31107.310.00 100.00100.00BGS: 2014-12-7Y

100.00100.000.00 100.00100.00BGS: 2015-1-7Y BG0207 100.00100.000.00 100.00100.00BGS: 2014-12-30Y BG0130 100.00100.000.00 100.00100.00BGS: 2015-1-30Y BG0230 100.00100.000.00 100.00100.00BGS: 2015-6-7Y BG0307 100.00100.000.00 100.00100.00BGS: 2015-6-30Y BG0330 100.00100.000.00 100.00100.00BGS: 2015-10-7Y BG0407 100.00100.000.00 100.0091.33BGRS FX BGR129239 BSBGR129239491.3391.330.00 100.24100.00BGRS FL BGRS76024 BSBGRS760240100.00100.000.00 99.9599.30BGRS FX BGR142251 BSBGR142051699.9599.950.00 99.9599.95BGRS FL BGRS91032 BSBGRS91032499.9599.950.00 100.57100.11BGRS FL BGRS95032 BSBGRS950320100.45100.450.00 100.5299.96BGRS FL BGRS97033 BSBGRS970336100.19100.190.00 100.0089.62BGRS FX BGR129249 BSBGR129249389.6289.620.00 100.0089.00BGRS FX BGR131249

BSBGR1312499100.00100.000.00 100.9890.24BGRS

2.552.11 2.552.24%4.01% 4.833.30 4.833.42%7.26% 2.241.68 2.241.70%2.82% 207.86164.74 197.44-2.97%-2.35% 212.41116.70 202.39-4.72%6.04% 1.751.70 1.751.96%2.84% 1.911.76 1.914.83%7.23% 1.871.77 1.873.48%4.44% 1.050.96 0.96-6.57%-8.29% 9.376.41 9.37-0.02%10.36% 11.837.62 11.79-0.33%18.23% 7.545.66 7.540.22%3.05% 16.648.65 15.94-3.89%14.76% 12.8410.54 12.47-1.04%-2.57% 10.779.57 10.740.81%4.20% 10.009.88 N/AN/AN/A 10.438.45 10.433.00%25.60% 14.8911.20 14.897.90%48.70%

MATURITY 19-Oct-2022 20-Nov-2029 31-Jul-2022 31-Jul-2022

6.25% 5.04% 4.50% 6.40% 4.31% 5.55%

4.37% 4.31%

6.25% 30-Sep-2025 31-Mar-2022 5.65% 5.69%

6.95% 4.50% 31-Mar-2022 31-Aug-2022

15-Apr-2039 15-Oct-2049 4.50% 6.25% 4.25% NAV Date

15-Aug-2032 25-Sep-2032

18-Jan-2024 15-Feb-2051 17-Apr-2033 15-Apr-2049

21-Apr-2050 FUND CFAL Bond Fund CFAL Balanced Fund CFAL Money Market Fund CFAL Global Bond Fund

31-Aug-2022 31-Jan-2022 31-Jan-2022 31-Jan-2022 31-Jan-2022

31-Jan-2022 31-Jan-2022

31-Mar-2021 31-Mar-2021

4.50% 6.25% 31-Mar-2021

THE TRIBUNE

BISX ALL SHARE INDEX:

BISX LISTED & TRADED SECURITIES 52WK HI52WK LOWSECURITY SYMBOLLAST CLOSECLOSECHANGE VOLUMEEPS$DIV$P/E YIELD

AML Foods Limited

APD

First

First Holdings PreferenceBFHP

Holdings Class A CHLA

Bank Bahamas Class A FBBA

Class B FCLB

CORPORATE DEBT - (percentage pricing) 52WK HI52WK LOWSECURITY SYMBOLLAST

(Note 22 Series

First Holdings LimitedBFHB

STOCK - (percentage pricing)

FRIDAY, 11 NOVEMBER 2022 CLOSECHANGE%CHANGEYTDYTD%

7.005.30

AML

Limited APD

Holdings Limited

Property

1.00 1.000.00 0.0000.0000.0000.00% 1000.001000.00 Cable Bahamas Series 6 CAB6 1000.001000.000.00 0.0000.0000.0000.00% 1000.001000.00 Cable Bahamas Series 9 CAB9 1000.001000.000.00 0.0000.0000.0000.00% 1.001.00Colina

1.00 1.000.00 0.0000.0000.0006.25% 10.0010.00Fidelity

10.0010.000.00 0.0000.0000.0007.00% 1.001.00Focol

1.00 1.000.00 0.0000.0000.0006.50%

SALECLOSECHANGEVOLUME 100.00100.00Fidelity Bank

B+)FBB22 100.00100.000.00 100.00100.00Bahamas

100.00100.000.00 BAHAMAS GOVERNMENT

Note 6.95 (2029) BAH29

BG0107

FX

FX BGR136150

MUTUAL FUNDS 52WK HI52WK LOW NAV YTD%12 MTH%

MARKET TERMS BISX ALL SHARE INDEX - 19 Dec 02 = 1,000.00 YIELD - last 12 month dividends divided by closing price 52wk-Hi - Highest closing price in last 52 weeks Bid $ - Buying price of Colina and Fidelity 52wk-Low - Lowest closing price in last 52 weeks Ask $ - Selling price of Colina and fidelity Previous Close - Previous day's weighted price for daily volume Last Price - Last traded over-the-counter price Today's Close - Current day's weighted price for daily volume Weekly Vol. - Trading volume of the prior week Change - Change in closing price from day to day EPS $ - A company's reported earnings per share for the last 12 mths Daily Vol. - Number of total shares traded today NAV - Net Asset Value DIV $ - Dividends per share paid in the last 12 months N/M - Not Meaningful P/E - Closing price divided by the last 12 month earnings TO TRADE CALL: CFAL 242-502-7010 | ROYALFIDELITY 242-356-7764 | CORALISLE 242-502-7525 | LENO 242-396-3225 | BENCHMARK 242-326-7333 5.60% 15-Jul-2049 Colonial Bahamas Fund Class D Colonial Bahamas Fund Class E Colonial Bahamas Fund Class F CFAL Global Equity Fund Leno Financial Conservative Fund Leno Financial Aggressive Fund Leno Financial Balanced Fund Leno Financial Global Bond Fund RF Bahamas Opportunities Fund - Secured Balanced Fund RF Bahamas Opportunities Fund - Targeted Equity Fund RF Bahamas Opportunities Fund - Prime Income Fund RF Bahamas International Investment Fund Limited - Equities Sub Fund RF Bahamas International Investment Fund Limited - High Yield Income Fund RF Bahamas International Investment Fund Limited - Alternative Strategies Fund INTEREST Prime + 1.75% MARKET REPORT

BGR132249 BSBGR1322498100.00100.000.00 100.0090.73BGRS

BSBGR1361504100.00100.000.00

31-Aug-2022 31-Aug-2022

15-Dec-2021 30-Jul-2022 15-Dec-2044 30-Jul-2045 26-Jun-2022 26-Jun-2045 15-Oct-2022 29-Jul-2022

(242)323-2330 (242) 323-2320

Asian benchmarks mixed as markets eye COVID, inflation risks

By YURI KAGEYAMA AP Business Writer

ASIAN shares were mixed in Monday trading as momen tum faded from last week’s rally on Wall Street amid varied sentiments about coronavirus restrictions easing in China and global interest rate increases.

Benchmarks fell in Japan and South Korea, while rising in China. Analysts say some inves tors are being cheered by signs inflation is abating in the U.S. ear lier than initially thought, while they warn factors remain that could refuel inflation, including geopolitical risks.

“But it is far too hasty to declare a decisive conclusion to infla tion risks,” said Venkateswaran Lavanya at Mizuho Bank.

Japan’s benchmark Nikkei 225 slipped 0.8% in morning trad ing to 28,047.58. Australia’s S&P/ ASX 200 was little changed, inch ing up less than 0.1% to 7,163.10. South Korea’s Kospi lost 0.2% to 2,479.52. Hong Kong’s Hang Seng jumped 2.1% to 17,688.84, while the Shanghai Composite rose 0.4% to 3,099.19.

“We also have the Demo crats holding the Senate while the Republicans look likely to

control the House. Policy paraly sis at a time of economic crisis is not a good look for what may lay ahead over the next two years.

The current stock rally may have only days to run,” said Clifford Bennett, chief economist at ACY Securities, referring to the U.S. midterm election results.

Wall Street closed last week with a rally, amid hopes infla tion pressures had eased. That would make the Federal Reserve less likely to keep raising interest rates. But some analysts said the Wall Street rally was overdone.

The S&P 500 rose 36.56 points, or 5.5%, for its best day in more than two years, to 3,992.93. Its

5.9% gain for the week was its third in the last four and its big gest since June.

The Dow rose 32.49, or 0.1%, to 33,747.86, and the Nasdaq climbed 209.18, or 1.9%, to 11.323.33. Both also notched hefty gains for the week.

Markets are getting a boost from China’s relaxing some of

A PERSON wearing a protective mask walks in front of an electronic stock board showing Japan’s Nikkei 225 in dex at a securities firm Monday, Nov. 14, 2022, in Tokyo. Asian shares were mixed in Monday trading, as some momentum of a rally on Wall Street last week lost steam, amid varied sentiments about coronavi rus restrictions easing in China and global interest rate hikes.

its strict anti-COVID measures, which have been hurting the world’s second-largest economy. Easing of restrictions translates to potentially more growth in China, a definite plus for the Asian region.

A report last week showed inflation in the United States slowed by more than expected last month. The Fed has already lifted its key overnight interest rate to a range of 3.75% to 4%, up from basically zero in March. The likely scenario is still for further hikes into next year.

In energy trading, benchmark U.S. crude gained 22 cents to $89.18 a barrel. U.S. crude gaining 2.9% to $88.96 per barrel Friday. Brent crude, the international standard, added 29 cents to $96.28 a barrel.

| Go to AccuWeather.com

N S

N S

W E 8 16 knots

N S

W E 7 14 knots

N S

N S

W E 7 14 knots

W E 8 16 knots N S

0.9 12:03 a.m. 2.1 5:59 a.m. 1.0 12:26 p.m. 2.6 7:05 p.m. 0.9 1:00 a.m. 2.1 6:58 a.m. 1.1

1:19 p.m. 2.6 7:57 p.m. 0.9 1:58 a.m. 2.2 7:59 a.m. 1.1 2:13 p.m. 2.5 8:46 p.m. 0.8

2:53 a.m. 2.3 9:00 a.m. 1.0 3:06 p.m. 2.5 9:31 p.m. 0.6 3:44 a.m. 2.6 9:56 a.m. 0.8 3:55 p.m. 2.6 10:15 p.m. 0.4 4:31 a.m. 2.8 10:49 a.m. 0.5 4:43 p.m. 2.6 10:57 p.m. 0.1 uV inDex toDay The higher the AccuWeather UV Index number, the greater the need for eye and skin protection. Forecasts and graphics provided by AccuWeather, Inc. ©2022 tracking map Shown is today’s weather. Temperatures are today’s highs and tonight’s lows.

W E 6 12 knots N S

N S

W E 8 16 knots

W E 6 12 knots

W E 8 16 knots

PAGE 14, Monday, November 14, 2022 THE TRIBUNE

Shown is today’s weather. Temperatures are today’s highs and tonight’s lows. ORLANDO Low: 65° F/18° C High: 80° F/27° C TAMPA Low: 67° F/19° C High: 78° F/26° C WEST PALM BEACH Low: 72° F/22° C High: 82° F/28° C FT. LAUDERDALE Low: 73° F/23° C High: 83° F/28° C KEY WEST Low: 76° F/24° C High: 83° F/28° C Low: 76° F/24° C High: 85° F/29° C ABACO Low: 72° F/22° C High: 82° F/28° C ELEUTHERA Low: 74° F/23° C High: 84° F/29° C RAGGED ISLAND Low: 76° F/24° C High: 85° F/29° C GREAT EXUMA Low: 78° F/26° C High: 84° F/29° C CAT ISLAND Low: 74° F/23° C High: 84° F/29° C SAN SALVADOR Low: 75° F/24° C High: 84° F/29° C CROOKED ISLAND / ACKLINS Low: 76° F/24° C High: 85° F/29° C LONG ISLAND Low: 76° F/24° C High: 85° F/29° C MAYAGUANA Low: 76° F/24° C High: 85° F/29° C GREAT INAGUA Low: 77° F/25° C High: 86° F/30° C ANDROS Low: 75° F/24° C High: 84° F/29° C Low: 73° F/23° C High: 82° F/28° C FREEPORT NASSAU Low: 73° F/23° C High: 85° F/29° C MIAMI THE WEATHER REPORT 5-Day Forecast Partly sunny with a passing shower High: 85° AccuWeather RealFeel 88° F The exclusive AccuWeather RealFeel Temperature is an index that combines the effects of temperature, wind, humidity, sunshine intensity, cloudiness, precipitation, pressure and elevation on the human body—everything that affects how warm or cold a person feels. Temperatures reflect the high and the low for the day. Mainly clear and warm Low: 76° AccuWeather RealFeel 77° F Partly sunny High: 85° AccuWeather RealFeel Low: 74° 92°-77° F Mostly sunny and nice High: 86° AccuWeather RealFeel Low: 74° 91°-75° F Mostly sunny High: 85° AccuWeather RealFeel Low: 75° 92°-78° F A stray t‑storm; showers at night High: 84° AccuWeather RealFeel 88°-75° F Low: 76° TODAY TONIGHT TUESDAY WEDNESDAY THURSDAY FRIDAY almanac High 86° F/30° C Low 71° F/22° C Normal high 81° F/27° C Normal low 70° F/21° C Last year’s high 89° F/32° C Last year’s low 67° F/19° C As of 1 p.m. yesterday trace Year to date 52.27” Normal year to date 37.03” Statistics are for Nassau through 1 p.m. yesterday Temperature Precipitation sun anD moon tiDes For nassau Last Nov. 16 New Nov. 23 First Nov. 30 Full Dec. 7 Sunrise 6:26 a.m. Sunset 5:23 p.m. Moonrise 10:30 p.m. Moonset 11:46 a.m.

Tuesday

High Ht.(ft.) Low Ht.(ft.)

‑‑‑‑‑ ‑‑‑‑‑

Photo:Eugene Hoshiko/AP

Today

Wednesday Thursday

11:35 a.m. 2.7 5:07 a.m. 0.8

6:13 p.m.

Friday Saturday Sunday marine Forecast WINDS WAVES VISIBILITY WATER TEMPS. ABACO Today: NE at 7 14 Knots 3 5 Feet 10 Miles 82° F Tuesday: ESE at 4 8 Knots 3 6 Feet 10 Miles 82° F ANDROS Today: NE at 7 14 Knots 0 1 Feet 10 Miles 81° F Tuesday: NE at 6 12 Knots 0 1 Feet 10 Miles 81° F CAT ISLAND Today: ENE at 6 12 Knots 2 4 Feet 10 Miles 83° F Tuesday: ENE at 7 14 Knots 2 4 Feet 10 Miles 83° F CROOKED ISLAND Today: ENE at 8 16 Knots 1 3 Feet 8 Miles 84° F Tuesday: E at 8 16 Knots 2 4 Feet 10 Miles 84° F ELEUTHERA Today: ENE at 6 12 Knots 2 4 Feet 7 Miles 83° F Tuesday: E at 7 14 Knots 3 5 Feet 10 Miles 82° F FREEPORT Today: ENE at 7 14 Knots 1 3 Feet 10 Miles 81° F Tuesday: ESE at 3 6 Knots 1 3 Feet 10 Miles 79° F GREAT EXUMA Today: NE at 6 12 Knots 0 1 Feet 8 Miles 83° F Tuesday: ENE at 7 14 Knots 1 2 Feet 10 Miles 83° F GREAT INAGUA Today: NE at 8 16 Knots 1 3 Feet 7 Miles 84° F Tuesday: ENE at 8 16 Knots 1 3 Feet 10 Miles 84° F LONG ISLAND Today: ENE at 7 14 Knots 1 3 Feet 8 Miles 84° F Tuesday: E at 8 16 Knots 1 3 Feet 10 Miles 84° F MAYAGUANA Today: ENE at 7 14 Knots 2 4 Feet 7 Miles 83° F Tuesday: E at 8 16 Knots 3 5 Feet 8 Miles 83° F NASSAU Today: ENE at 6 12 Knots 0 1 Feet 8 Miles 83° F Tuesday: ENE at 6 12 Knots 1 2 Feet 10 Miles 83° F RAGGED ISLAND Today: NE at 8 16 Knots 1 3 Feet 10 Miles 84° F Tuesday: E at 8 16 Knots 1 3 Feet 10 Miles 84° F SAN SALVADOR Today: NE at 6 12 Knots 1 2 Feet 8 Miles 83° F Tuesday: ENE at 7 14 Knots 1 2 Feet 10 Miles 83° F

Antitrust battle over iPhone app store goes to appeals court

By MICHAEL LIEDTKE AP Technology Writer

APPLE is heading into a courtroom faceoff against the company behind the popular Fortnite video game, reviving a high-stakes antitrust battle over whether the digital fortress shielding the iPhone’s app store ille gally enriches the world’s most valuable company while stifling competition.

Oral arguments Monday before three judges on the Ninth Circuit Court of Appeals are the latest volley in legal battle revolv ing around an app store that provides a wide range of products to more than 1 bil lion iPhones and serves as a pillar in Apple’s $2.4 trillion empire.

It’s a dispute likely to remain unresolved for a long time. After hearing Monday’s arguments in San Francisco, the appeals court isn’t expected to rule for another six months to a year. The issue is so impor tant to both companies that the losing side is likely to take the fight to the U.S. Supreme Court, a process that could extend into 2024 or 2025.

The tussle dates back to August 2020 when Epic Games, the maker of Fortnite, filed an anti trust lawsuit in an attempt to obliterate the walls that have given Apple exclusive control over the iPhone app store since its inception 14 year ago.

That ironclad control over the app store has enabled Apple to impose commis sions that give it a 15% to 30% cut of purchases made for digital services sold by other companies. By some estimates, those commis sions pay Apple $15 billion to $20 billion annually — revenue that the Cupertino, California, company says helps cover the cost of the technology for the iPhone and a store that now

contains nearly 2 million mostly free apps.

U.S. District Judge Bar bara Gonzalez Rogers sided almost entirely with Apple in a 185-page ruling issued 13 months ago. That fol lowed a closely watched trial that included testi mony from Apple CEO Tim Cook and Epic CEO Tim Sweeney, as well as other top executives.

Although she declared Apple’s exclusive control over iPhone apps wasn’t a monopoly, Gonzalez Rogers opened one loophole that Apple wants to close. The judge ordered Apple to allow apps to provide links to payment alternatives outside the app store, a requirement that has been put off until the appeals court rules.

Monday’s arguments are expected to open with Epic lawyer Thomas Gold stein trying to persuade the trio of judges — Sidney R. Thomas, Milan D. Smith Jr. and Michael J. McShane — why Gonzalez Rogers should have looked at the iPhone app store and the payment system as distinctly separate markets instead of bundling them together.

A lawyer for the Justice Department will also get a chance to explain why the agency believes Gonza lez Rogers interpreted the federal antitrust law too nar rowly, jeopardizing future enforcement actions against potentially anti-competitive behavior in the technol ogy industry. Although the department technically isn’t taking sides, its argu ments are expected to help Epic make its case that the appeals court should overturn the lower court decision.

Another lawyer for the California Attorney Gen eral’s office will present arguments defending the law that Gonzalez Rogers cited in ordering Apple to provide links to alternative

ways to pay outside its app store. Apple lawyer Mark Perry will get the chance to make the final arguments,

giving him an opportunity to tailor a presentation aimed at answering some of the questions that the judges

may ask the lawyers preced ing him.

Much of what Perry says is likely to echo the successful

case that Apple presented in the lower court.

During his testimony in lower court, Cook argued that forcing Apple to allow alternative payment sys tems would weaken the security and privacy con trols prized by consumers who buy iPhones instead of devices running on Google’s Android software. That sce nario would create “a toxic kind of mess,” Cook warned on the witness stand.

THE TRIBUNE Monday, November 14, 2022, PAGE 15