advertising deal comes under scrutiny

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

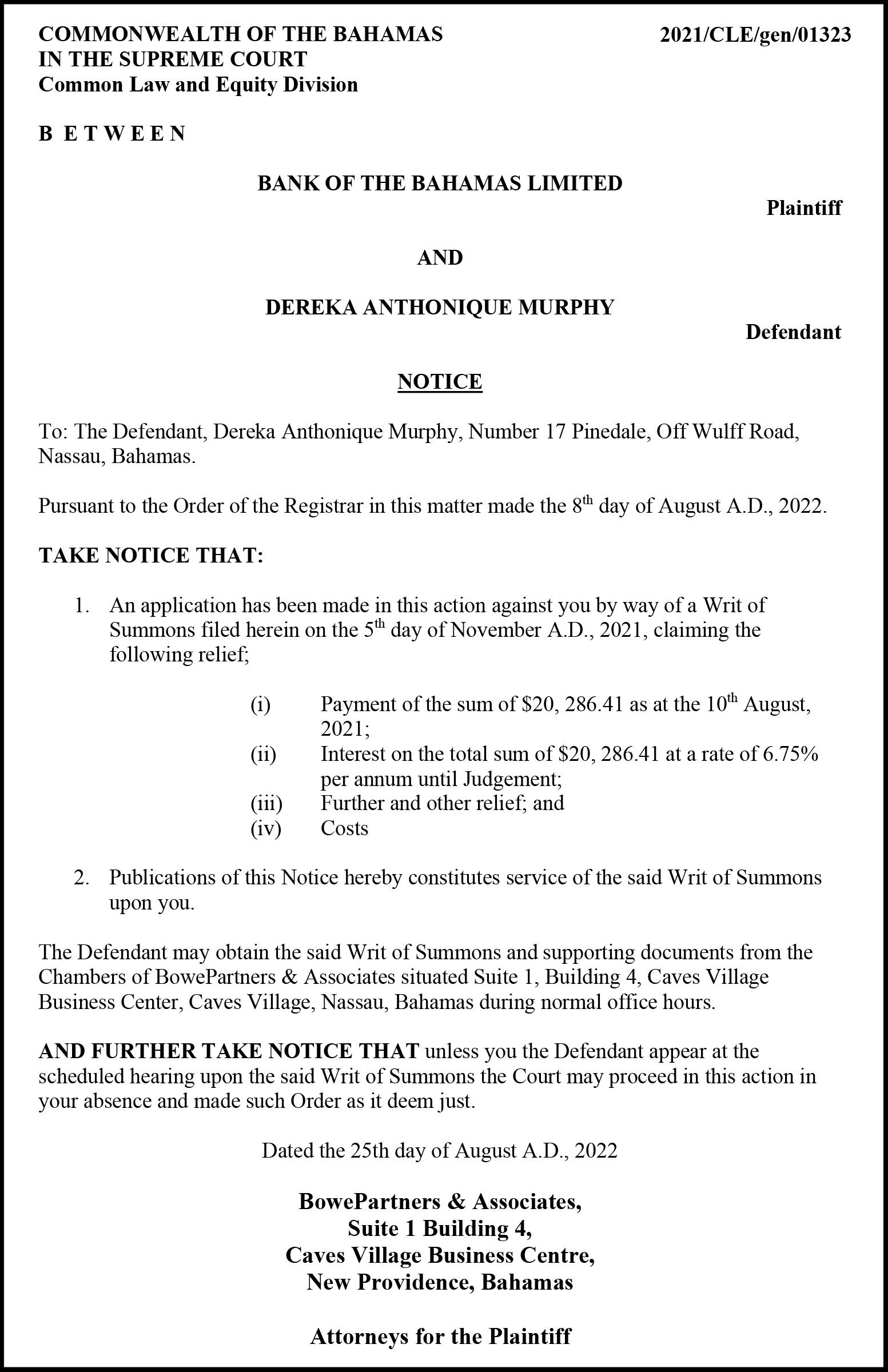

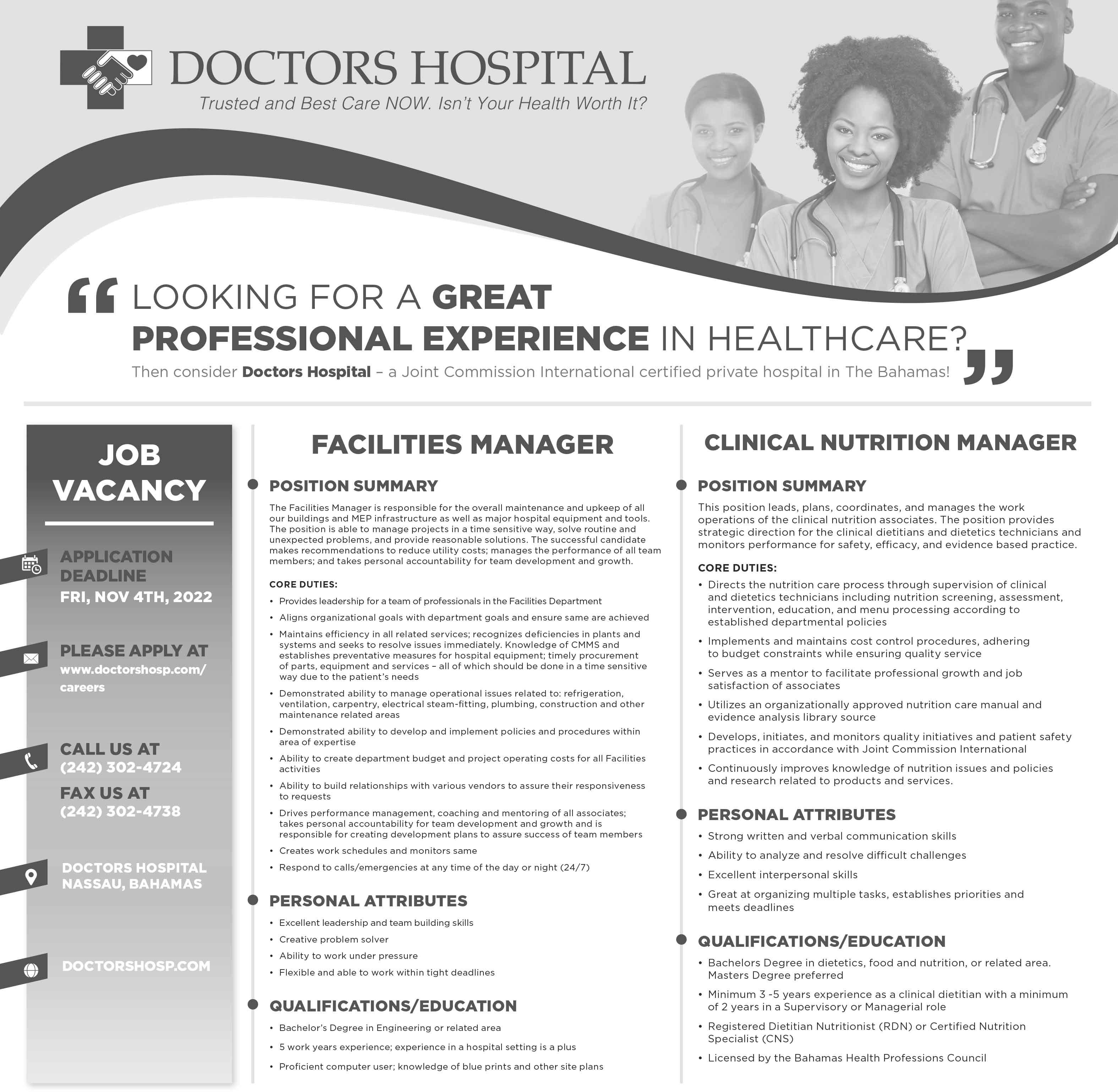

NASSAU airport’s top executive yesterday rejected concerns that the selection of its new advertising partner could run afoul of both the multi-million dollar contract’s bid requirements and the National Investment Policy.

Vernice Walkine, Nassau Airport Development Compa ny’s (NAD) president and chief executive, in written replies to Tribune Business questions said it had conducted “extensive due diligence” before select ing RG Media (Bahamas) as Lynden Pindling International Airport’s (LPIA) new advertis ing concession operator with effect from January 1, 2023.

She added that the move was “in the best interests of the airport”, affirming it was NAD’s “preference to work with Bahamians first” and that it adheres to a National Invest ment Policy that stipulates all

advertising, marketing and public relations (PR) activity is supposed to be exclusively reserved for companies 100 percent owned by locals.

Ms Walkine responded after Tribune Business received concerns, backed by docu ments and other evidence, which raised concerns over RG Media (Bahamas) selection. A search of The Bahamas’ com panies registry revealed that the firm was only incorpo rated on May 30, 2022 - just five months ago, and only two

months after the LPIA adver tising concession tender was launched to potential bidders on March 24 this year.

RG Media (Bahamas) 100 percent owner and presi dent, as confirmed by Ms Walkine, is Shane Garner, John Bull’s financial controller. All this raised questions over whether the company qualified to bid, as the original Request for Proposal (RFP) stipulated that the “minimum qualifica tions” to participate were “five to ten years’ experience in the

operation of an advertising programme that includes gen erating high volume display advertising sales and revenue at airports”.

The winning bidder also appears to be affiliated with RG Media, a UK-headquartered company bearing the same name, and which is a subsidiary of Roadgrip - a firm that has previously performed runway surfacing and paving at LPIA and other airports throughout The Bahamas.

This has sparked concerns that a foreign company is taking over LPIA’s lucrative advertising contract when the National Investment Policy stipulates that the sector is reserved for Bahamianowned businesses only, along with questions over whether a quasi-government agency such as NAD is adhering to the Davis administration’s pledge to put Bahamians first. Fears have also been voiced that foreign salesmen will be

Fuel hedge to save $55m, BPL chief informed minister

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

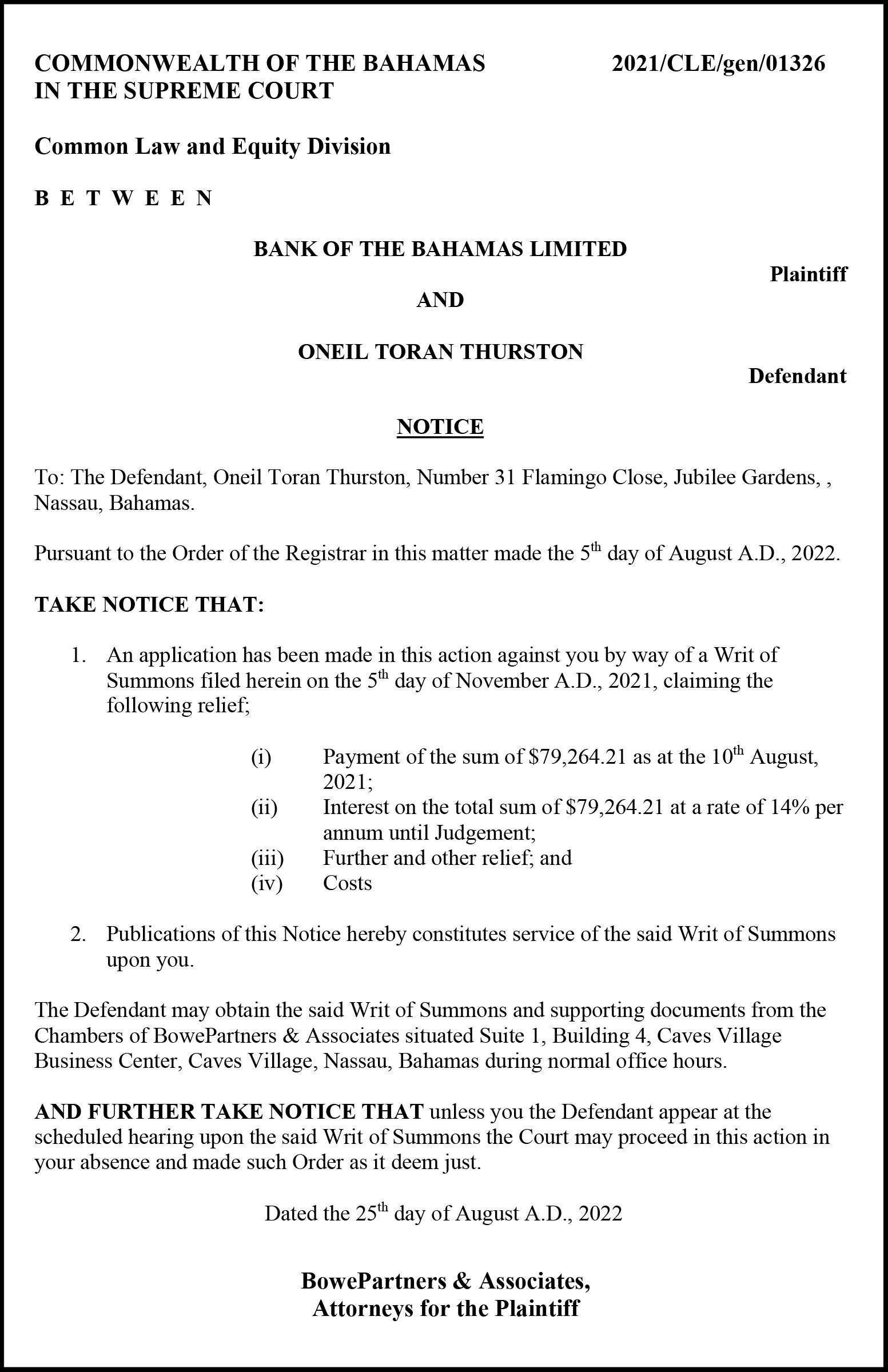

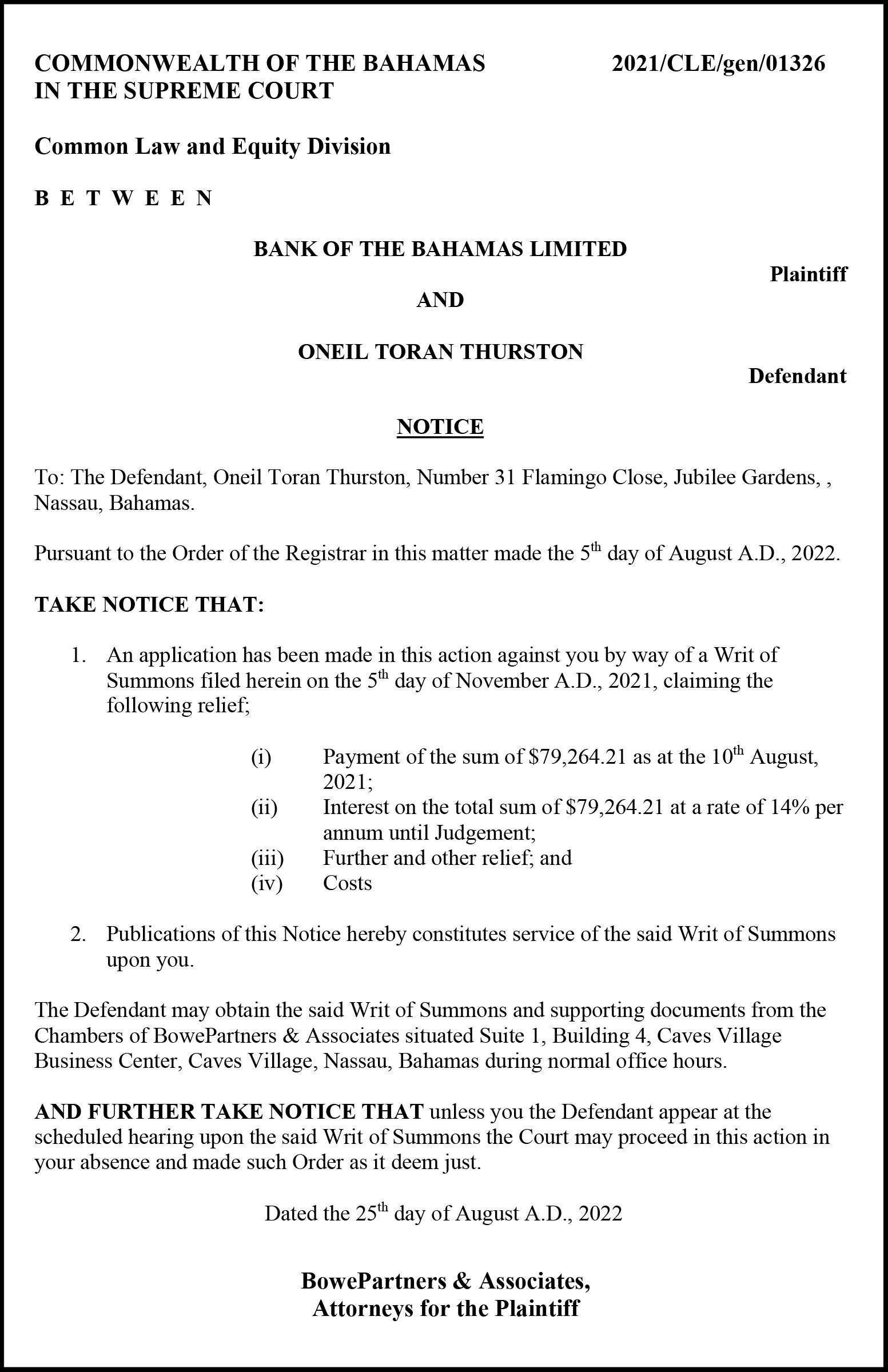

BAHAMAS Power & Light (BPL) was on track to save its customers more than $54m over the 18 months to Janu ary 2022 if its controversial fuel hedging initiative was fol lowed, a Cabinet minister was informed.

Michael Pintard, the Oppo sition’s leader, last night tabled a letter from former BPL chief executive, Whitney Heastie, to Alfred Sears KC, minister of works and utilities, in the House of Assembly following a day of heated exchanges over whether the up to 163 percent hike in the utility’s fuel charge - which all Bahamians will have to endure next summerwas “inevitable”.

The document was tabled by Mr Pintard in a bid to show the Davis administration had been fully briefed on BPL’s fuel hedging strategy and the need to maintain it, after both the Prime Minister and Mr Sears, the latter of whom has ministerial responsibility for the electricity monopoly, both repeatedly denied they had received advice and Cabinet

‘Devil in the detail’ over NHI reforms

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

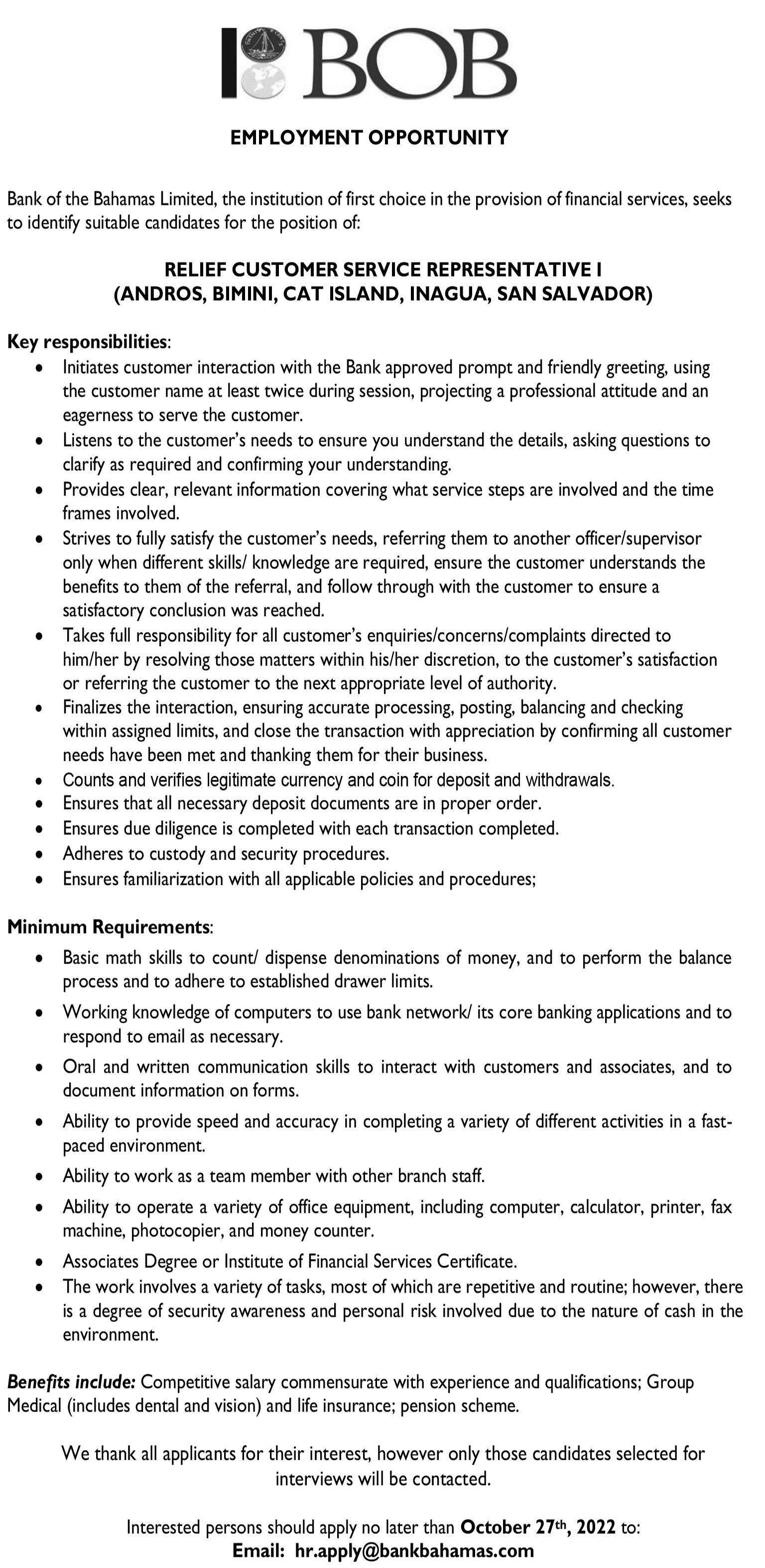

DOCTORS and private health insurers yesterday appeared to be caught offguard by the Government’s tabling of National Health Insurance (NHI) reforms in the House of Assembly, with one saying: “The dev il’s in the details.”

Dr Michael Darville, min ister of health and wellness, in tabling the NHI Bill 2022 for its first reading indi cated that it “will lay the foundation for the launch of catastrophic care cover age” by providing the legal framework for the roll-out of its Standard Health Ben efit package.

Private health insur ers will be mandated by the legislation, if passed by Parliament, to offer this product as their “mini mum standard of coverage”

Gov’t in near-$40m deficit for August

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE GOVERNMENT

incurred a near-$40m defi cit during August 2022 as it reclassified almost $35m of revenues earned in July as VAT, Ministry of Finance data released yesterday revealed.

The report on August’s fiscal performance showed that the prior month’s VAT intake, shown as $105.5m when the July equivalent was released barely weeks ago, has now been increased to $140.1m - a 32.8 percent increase. This corresponded with a revision in revenue

from “other taxes on goods and services”, which fell from $49.1m in the July report to just $15.7m in the latest publication.

No explanation was pro vided for the switches, with the Ministry of Finance in a statement confirm ing that the Government incurred a $39.7m fiscal deficit for August with the country’s debt rising by a more modest $8m. Still, the $41.3m surplus recorded for July is sufficient to keep the Government in a $1.6m surplus position - mean ing revenue income has exceeded total spending

‘Herculean effort’: Food stores submit price controls counter

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

BAHAMIAN food retailers were last night hoping the Government “embraces their Her culean effort” to craft an alternative to the major price control regime expansion that sat isfies the needs of all parties.

John Bostwick, attorney and legal adviser to the Retail Grocers Association (RGA), told Tribune Business the group had yesterday submitted its counter to the Davis adminis tration’s initial proposal of expanding price controls by 38 product categories although he declined to give details on its contents.

This newspaper understands the Associa tion, which has 120 members ranging in size from ‘Mom and Pop’ stores to the likes of AML Foods and Super Value, is likely to have presented a solution that drastically shrinks the number of additional items subjected to price-controlled margins and mark-ups with the Government refusing to budge from the November 1 implementation deadline.

Mr Bostwick, while agreeing that there will be new in-store prices on that date, voiced optimism that they will not be “dictated” by the Government and that a compromise can be reached which helps to ease the cost of living crisis for middle and lower income Bahamians - the Government’s key objective in this exercise.

“We did actually manage to get the Asso ciation’s position in to the Government today, and that position has just been shared in full with all of our members,” he disclosed to this newspaper. “It’s now up to 120 members;

business@tribunemedia.net THURSDAY, OCTOBER 27, 2022

SEE PAGE B5

SEE PAGE B7 SEE PAGE B10

LPIA

SEE PAGE B4

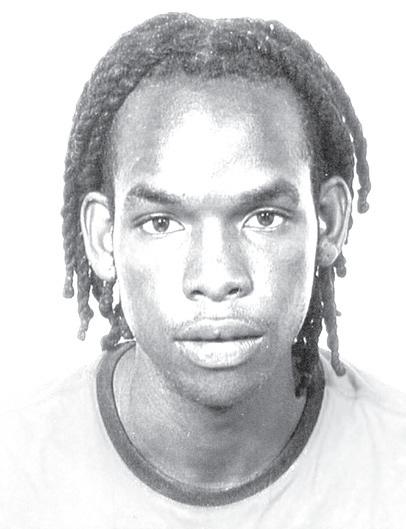

MICHAEL PINTARD

DR

MICHAEL DARVILLE

SEE PAGE B6 • NAD: RG Media award ‘in best interests of airport’ • Concerns raised if winner met tender qualifications • This, and Bahamian ownership query, fully rebutted • Optimistic November 1 pricing not ‘dictated’ • Association eyeing ‘plausible compromise’ • Attorney brands offer ‘fair and considerate’ $5.85 $5.88 $5.76 $5.79

How you can survive a looming recession

Can businesses be successful during a recession? It may depend on what industry a company is in as, unde niably, there are some

sectors which are more likely to make it out rela tively unscathed. With a possible recession on our doorstep, is this a good time to panic, sell all our

stock investments and start hoarding cash? Recessions are a normal part of the economic cycle, and there is no need to panic just because an economic

contraction might be on the horizon. While the prospects of such an event occurring have certainly increased, it is more difficult to justify cling ing on to what does not work

and yet more reason to rein vent something new.

In basic terms, a recession is when the economy’s per formance deteriorates for an extended period of time, at least two quarters, and is marked by a GDP contrac tion, higher unemployment rates and lower consumer spending. It is wise to assume that few businesses are safe when it comes to a recession but, if strategic planning occurs ahead of time, more companies can survive and grow stronger as a result.

So we must ask: Can businesses remain sustain able during a recession? Here is a guide as to how companies can prepare to withstand the downturn.

During periods of eco nomic contraction, investors may wish to prioritise port folio diversification and avoid panic selling. Consider which products you can add to the line-up at minimal cost. This is an obvious one, but it is by no means a silver bullet solution, and nor is it sustainable. Research less expensive vendors or utili ties, and cut non-essential technology costs. If possible, delay payables and collect receivables sooner. Ensure that you always have a steady and reliable cash flow.

Strengthen and prepare customer relationships

During a recession, a loyal customer can be among a company’s biggest assets. Building customer commu nication via social media, and a survey encouraging them to provide feedback on products and services, is essential. This will not only help to sustain relation ships but also ascertain their needs.

Furthermore, during a recession consumers become more selective on spend ing. As an added incentive, develop a unique selling proposition by launching a loyalty programme that rewards long-serving cus tomers or offers flexible payment options.

Pay attention to competitors

During a recession, it is wise to pay attention to your competitors. If they are cut ting back on their marketing strategies, this presents an opportunity for your busi ness to get ahead. The goal is to nurture the existing customer base and reach out to existing clients or custom ers. If they are nurtured in a difficult time, they are more likely to remain loyal.

Remain consistent Do not use a recession as an opportunity to rebrand or make any significant changes to your company name or business model, as it will likely complicate

matters, which may result in a decline in sales. Stay consistent.

Support the employees you are retaining A recession naturally provokes anxiety and fear, especially if employees are being furloughed or laid off. Letting go of your worstperforming employees may be unavoidable nonetheless, but build morale with your staff despite what is happen ing within the business. Try to involve them in the deci sion-making process so they can feel included as part of the solution.

Assess the health of your business. Readjust your products and services, and the resources required, as necessary as every business has a product, service or area in which they shine. A reces sion is usually the time to refocus and reinvent those core competencies that have been tried and tested.

Be ready for opportunities

It is not all doom and gloom. Market disruption can birth opportunities that may be able to rescue a bad situation. Always keep the lines of communication open, network and build relationships. Keep your ears open, your eyes peeled and think outside the box to identify opportunities.

To this end, recessions do not last forever. Your main goal should be to tighten your belt and remain focused until it passes. However, it is important to continue marketing your businessso as not to jeopard ise a long-term investment. Until we meet again, fill your life with memories rather than regrets. Enjoy life and stay on top of your game.

NOTICE is hereby given that WILFRID ESTIME JR of P.O Box SB-51250 Wild Guava Avenue, Pinewood Gardens, Nassau, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 27th day of October, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

PAGE 2, Thursday, October 27, 2022 THE TRIBUNE

`NB: Columnist welcomes feedback at deedee21bas tian@gmail.com

ABOUT COLUMNIST: Deidre M. Bastian is a pro fessionally-trained Graphic Designer/Brand Marketing Analyst, Author and Certi fied Life Coach

DEIDRE

BastiaN

By

NOTICE

SOVEREIGN WEALTH FUND REPLACE TO PUT BAHAMAS ‘AMONG TOP TIER’

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

THE Prime Minister yes terday said the proposed Sovereign Wealth Fund replacement will place The Bahamas “among the top tier” by helping to mobilise private capital and direct investment towards critical infrastructure projects.

Philip Davis KC, unveil ing the National Funds Investments Bill in the House of Assembly for its first reading, said the proposed fund structure will enable The Bahamas to better target monies to key economic develop ment priorities, maximise the value of public assets for the taxpayer and better manage the country’s natu ral resources.

Besides facilitat ing public-private partnerships (PPPs) with private capital and inves tors, he added that the

National Investment Fund - and its various underly ing sub-funds - will focus on areas such as Family Island infrastructure upgrades; the blue (ocean), green (envi ronmental) and orange (cultural) economies; revenues obtained from carbon credits; the Gov ernment’s shareholdings in private companies; and the country’s traditional and biological resources.

“The legislation we are tabling today, the National Investment Funds Bill, will allow The Bahamas to max imise the nation’s assets, investing and deploying our own capital to expand access to additional capi tal and opportunities,” the Prime Minister said.

“Consider public-private partnerships (PPPs): If we only finance projects with government revenues or borrowing, fiscal con straints will significantly limit how much and how ambitiously we can build.

Partnering with the pri vate sector greatly expands

CROWDFUNDING FOOTCARE PROVIDER OPENS ITS ‘HUB’

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

A BAHAMIAN footcare provider, which has raised more than double its mini mum crowdfunding target, yesterday used the proceeds to open the “hub” for its Bahamas and Caribbean expansion

Dr Daniel Johnson, former minister for youth, sports and culture, said the new office for his Foot Care RX business will provide the platform for further growth. “We’ve been up and running for a year, and we went to ArawakX to really to finance an expan sion. We’re not raising money to do what we do. We already do it,” he said of the

fund-raising conducted via the crowdfunding platform.

The “necessary” expan sion will allow Foot Care RX to send teams to the Family Islands until it even tually sets up individual clinics in these locations. It presently provides a once-amonth service to Abaco, but will expand into the south ern Bahamas next because of demand for its services.

Immalasha ThompsonJohnson, director at Foot Care RX, added: “That’s a pocket that we often don’t give enough attention to, and so we want to capital ise on those individuals that are lacking and needing our assistance. Whatever we raise we are taking it one clinic at a time. It all depends on what we raise, and whatever we have we

the number and scope of infrastructure projects we can take on, allowing us to move forward on more projects on more islands simultaneously.

“Mobilising private capi tal in partnership with the Government is the most effective way to see sig nificant advancement in expensive projects. Instead of the public having to con tribute or borrow every penny for roads, schools, hospitals, airports and homes, we will invite the private sector to part ner with us,” Mr Davis continued.

“Instead of the public having to contribute or borrow every penny to expand renewable energy, or improve our defences against hurricanes, we will invite others to partner with us to strengthen our resilience.”

Mr Davis said the National Investments Funds Bill would provide the regulatory framework to govern these activities,

are going to work to see how we can spread our wings into all of those locations.”

Foot Care RX has to-date raised $336,690 from around 223 investors via ArawakX, with the closing date set for October 31. While this represents only 16.8 per cent of the $2m maximum it was seeking, it is some 131 percent more than the $15,000 minimum threshold for a successful offering.

The minimum was exceeded just four days after the offering was launched in August. While there has been no request for an extension to the raise, Foot Care RX can return to ArawakX for more funding six months after the present offering closes.

Ms Thompson-John son said of the new office: “This hub is extremely important because this is where our parent company hub is. It provides the proper training ground needed for all of those persons who will be working under our

establishing how assets ultimately owned by the Bahamian people will be governed and managed.

“This is an essential first step in taking a comprehen sive approach to national investment,” he added. “The new framework brings together a number of different strands of gov ernment fiscal operations relating to investments, and puts them into prop erly structured entities that enable partnerships with the private sector. Thus such partnerships can be effectively, efficiently and transparently managed in the national interest.”

Explaining how the National Investment Fund would be structured, Mr Davis said that immediately following the Bill’s pas sage the Government will proceed with the creation of The Bahamas Resilient Infrastructure Fund to help mobilise capital for the financing of Family Island infrastructure projects.

franchise. So this here is really a training ground. This is our head office, and we have immediate access to our chief executive and our chief surgeon, Dr Johnson.”

Underneath this fund will be a series of sub-funds aimed at promoting Family Island growth, food security and renewable energy. “We will also create national funds to leverage and max imise value in underutilised national assets,” Mr Davis said.

“We will co-invest these underutilised assets with private investment and capital in order, for the first time, as a matter of national policy to participate in pro jects that maximise value, appreciate in value, and utilise the value created to

reinvest in national infra structure priorities.

Pledging that the National Investment Fund will be structured in line with international best practice on governance, transparency and account ability, Mr Davis added: “This will put The Bahamas among the top tier of world class national funds, and demonstrate to Bahamians and to investment partners alike that they can be con fident in the integrity of this fund and have confidence in doing business in The Bahamas and with the Gov ernment of The Bahamas.”

THE TRIBUNE Thursday, October 27, 2022, PAGE 3

BPL CHIEF INFORMED MINISTER

papers recommending they execute the necessary roll ing trades to achieve this.

Mr Sears subsequently described Mr Heastie’s letter as a technical, theo retical document rather than a recommendation to conduct the purchases nec essary to maintain BPL’s fuel charge at 10.5 cents per kilowatt hour (kWh) or at a level close to that.

And Philip Davis KC last night indicated that while “recommendations were made to execute the trades”, these were still being addressed by the Government’s “techni cal people” who wanted to examine “the circum stances” in which they would be executed given rising global oil prices and volatility.

Mr Pintard made his move after asserting it was “not inevitable” that Bahamian households and businesses would have to bear a 163 percent increase in BPL’s fuel charge

between June 1, 2023, and end-August next year, had the Davis administration pulled the trigger on fuel purchase options left in place by its predecessor.

Accusing the Govern ment of “failing to act”, charges that were disputed by the latter’s representa tives, Mr Pintard said that during peak summer 2023 consumption - when BPL’s fuel charge is predicted to hit 27.6 cents per kWh“the most vulnerable” will see their light bills increase by between 35 percent and 46 percent while middle income Bahamians and business owners will suffer “an almost 100 percent” rise.

Mr Heastie’s letter, sent to Mr Sears on October 18, 2021, just over a month after the Davis adminis tration’s general election victory, appears to be an effort to both justify and explain the rationale for BPL to employ a fuel hedging initiative. The document, which appears to have been a reply to

an e-mail from the minis ter, asserted that BPL had seen “huge benefits” from locking in much of its fuel needs at lower prices with oil costs trending up to $85 per barrel.

“To prevent large move ments in the fuel charge, timely fuel hedges are executed. These periodic purchases provide ‘lay ering’ of the hedges that will result in a smoothing effect to the fuel charge to customers over time,” Mr Heastie wrote.

“The execution of con tracts is based on quotes obtained from the market by the IDB (Inter-Amer ican Development Bank) and passed on to BPL. The options have a strike price and with each strike price is a corresponding premium that is paid, along with the transaction fee to the IDB.....

“Through September 2021, BPL and its custom ers have benefited by a reduced $30m fuel cost over the past 13 months. It is estimated that by January

2022 the savings amount will be $55m. This reduc tion in fuel oil price through hedging has also reduced the demand for US dollars from the foreign reserves of the country.”

Mr Sears, during the morning’s proceedings in the House of Assem bly, denied that he had been briefed on BPL’s fuel hedging strategy - and the need to execute the roll ing trades - upon coming to office. Instead, he argued that he was pressured to sign-off and approve BPL’s proposed $535m rate reduction bond (RRB) refi nancing even though the former Cabinet - of which Mr Pintard was a member - failed to give the goahead prior to the general election.

“What was on the table was the Rate Reduction Bond (RRB) to borrow $500m (sic $535m). Five hundred million, Mr deputy,” Mr Sears said. “The first briefing I received, this was urgent. This was the solution. This would solve the problems of energy in Commonwealth of The Bahamas. They said it had to be signed right away.

“Mr deputy speaker, I’m a new minister. I haven’t been fully briefed. The first question was for me

CALL

to sign this and take it to Cabinet.” Noting that there was no provision for renew able energy attached to the bond documents, Mr Sears argued that Mr Pintard had failed to disclose the Minnis administration’s fail ure to approve the $535m financing despite being “fully briefed” and having “months to prepare”.

The minister added that BPL’s existing fuel hedging structure, put in place in 2020 via the IDB, continues to exist and will not expire until 2024. “The hedge is still in place, and BPL is working right now through a committee internal to BPL on how to extend it,” Mr Sears told the House of Assembly.

The Government and BPL have repeatedly said the initial fuel hedg ing structure, put in place by the Inter-American Development Bank (IDB), remains in place. That is correct, as the December 2020 hedge executed by the IDB covered a total 3.565m barrels of oil for BPL that were priced at $40 each and split into three tranches.

This transaction hedged 75 percent of BPL’s fuel needs for 2022, 50 percent of its requirements for 2023, and 25 percent of 2024’s needs via the IDB’s upfront hedge. These were were not

hedged 100 percent because BPL needed to monitor global oil price movements so that it did not end up hedging at a price above market costs and thus end up losing money.

The Government, though, is not giving the full story. BPL was supposed to “backfill” the original IDB hedge by purchasing the extra fuel volumes to fully address its needs. This was to be done via a series of trades, known as call options, that would have enabled BPL to obtain fuel - covering the 20 percent balance for 2022, 50 percent for 2023 and 75 percent for 2024 - at prices below thenprevailing oil market rates had they been executed.

It was these trades, sched uled to have been executed in tight windows in Septem ber 2021 and December 2021 just after the Davis administration took office, that were not carried out. As a result, BPL has increasingly been buying fuel at higher market rates with the fuel charge artifi cially held at 10.5 cents per kWh via the combination of government subsidies and $90m Shell non-payment. This can no longer be sus tained, and consumers must pay up as a result.

ADVERTISE

PAGE 4, Thursday, October 27, 2022 THE TRIBUNE

FUEL HEDGE TO SAVE $55M,

FROM PAGE B1

502-2394 TO

effort’: Food stores submit price controls counter

from the large to the small and everyone in between, and they are digesting it. We had to create a subcommittee, a tight working group, to develop it.

“We’ve been able to move forward now, and come back with a posi tion that I think is a very good position. We are now in a wait and see position to see what they do with it, and what the Govern ment thinks of it.” Food merchants and wholesalers have warned that the origi nal 38 product category proposal would threaten jobs and store closures, as it would result in between 40 percent to 60 percent of retail inventories becoming price-controlled.

This would result in these products becoming loss leaders, with retailers losing money in stocking and sell ing them. As a result, some may elect not to carry such products any more, result ing in potential shortages of certain food items while, to compensate for price-con trolled losses, merchants would likely hike the prices of non-controlled goods further fuelling alreadyhigh inflation.

“We did meet our target deadline of having a posi tion in writing back to the Government today,” Mr Bostwick affirmed. “We are hopeful the sugges tions will be received by the Government in the spirit in which they were produced, which is to find a solution that mainly works for the public at large, the Bahamian people, while meeting the objectives of the Government and pro tecting the livelihoods and incomes of members of the Association.

“I think the Association is confident it has produced a more than plausible

compromise and a more than acceptable compro mise. With that, we can only be hopeful that the Govern ment sees it as worthy and embraces it - that Hercu lean effort it took to be fair, inclusive and considerate to all persons affected - the merchants, customers and administration.”

Michael Halkitis, minis ter of economic affairs, on Tuesday warned that the new prices will be enforced from November 1 and that the Government will not be shifted from that deadline.

“There will be new prices hopefully by November 1, but those prices will be agreed between the Associ ation and the Government of The Bahamas, not as dic tated by the Government of The Bahamas,” Mr Bost wick replied.

“The Association remains grateful for the consultation process that is ongoing.” The Govern ment previously said the expanded price control regime for both industries is a temporary measure. For food retailers and wholesal ers it will last six months until May 1, 2023, while for their pharmaceutical counterparts it will remain in effect for three months until February 1, 2023. Both deadlines can be extended.

The Retail Grocers Asso ciation, in a statement last week, said the price con trol expansion will “affect more than 5,000 items to which inventory and price adjustments would have to be made. To facilitate such changes would be a very expensive undertaking, and would mean that 40 to 60 percent percent of total revenues for local wholesal ers and retailers would be controlled.

“Additionally, such a decision was made without prior industry consultation

and at a time when busi nesses are faced with already slim profit mar gins, increasing electricity costs, increased operating expenses and theft. The sector employs some 4,000 persons, and the expansion of the price control basket will undoubtedly have a ripple effect which would prove detrimental, with mass store closures, par ticularly among the smaller food stores and the real potential for food shortage in the country.”

Food wholesale margins, or mark-ups, are capped at 15 percent for all 38 product line items listed, while those for retailers are set at 25 percent across-the-board. Those goods impacted, some of which are already price controlled, are baby cereal, food and formula; broths, canned fish; con densed milk; powdered detergent; mustard; soap; soup; fresh milk; sugar; canned spaghetti; canned pigeon peas (cooked); peanut butter; ketchup; cream of wheat; oatmeal and corn flakes.

The remainder are macaroni and cheese mix; pampers; feminine nap kins; eggs; bread; chicken; turkey; pork; sandwich meat; oranges; apples; bananas; limes; tomatoes; iceberg lettuce; broccoli; carrots; potatoes; yellow onions; and green bell peppers.

Price-controlled markups range from 15 percent to 18 percent for pharma ceutical wholesalers. For retailers, the range is from 35 percent to 40 percent. The medicines covered include vaccines, anti-dia betic drugs, decongestants, laxatives, contraceptives, antacids, anti-hypertension medicines, cough prepara tions, cardiovascular agents and serums.

THE TRIBUNE Thursday, October 27, 2022, PAGE 5

‘Herculean

FROM PAGE B1

LPIA advertising deal comes under scrutiny

replacing Bahamians in jobs locals can perform, but all these allegations have been shot down by both NAD and the winning bidder. Ms Walkine said it was “not unusual” for bidders to form corporate entities to bid

on a specific contract, and said RG Media (Bahamas) is “readying” to hire more Bahamians than the previous advertising contract holder.

Tribune Business under stands that at least one rival bidder is mulling a Judicial Review challenge to the advertising contract award.

But Mr Garner, when con tacted by Tribune Business vehemently denied that RG Media (Bahamas) was a sub sidiary or affiliate of the UK company bearing the same name. And he also rejected allegations that he was “fronting” for the UK firm, saying: “I own the company RG Media (Bahamas).

“We’re just going through everything right now, trying to assess everything. We’re trying to develop a new advertising platform to offer better opportunities for vendors.... You don’t get eve rything in place until you get the contract, and then you do what you need to do.”

Mr Garner also denied there were any plans to bring in a foreign salesforce at the expense of Bahamian jobs, adding of RG Media (Bahamas) plans to build a workforce: “That’s all being worked out right now. We’re talking to people. That’s where we are. We’ve got a couple of people we’re inter viewing at the moment. I can’t name them.”

Tribune Business sources, speaking on condition of anonymity, said advertis ing provides a lucrative multi-million dollar annual revenue stream for NAD estimated at between $3.6m to $4.2m per year. It sup plements the income that LPIA’s operator receives from its core aeronautical revenue streams, including the passenger facility charge

plus the likes of airport land ing fees and gate fees.

With more than 3.9m pas sengers passing through LPIA per year prior to the COVID pandemic, advertis ers effectively have a captive audience to whom they can promote their products and services. This makes elec tronic, billboard and other spots at The Bahamas’ main aviation gateway extremely valuable, with the adver tising concession operator responsible for production and installation of marketing materials, and revenues split between itself and NAD.

Ms Walkine described the relationship between Mr Garner and RG Media (Bahamas), and RG Media LLC, as a “consulting agree ment” whereby the latter will be providing its exper tise to assist with building out the Bahamian company’s operation and training its staff. Tribune Business has seen screenshots from social media showing that Mr Garner and Roadgrip’s managing director, Nick Morley, both graduated from Berkhamsted College in the UK in 1995.

The consulting agreement was confirmed by Gilbert Aguiles, the US-based exec utive leading RG Media LLC’s Bahamian support efforts. He told Tribune Business that the winning bidder will make “a sig nificant capital investment” of $1.5m in setting up and enhancing LPIA’s advertising

offering, with the effort pos sibly impacting up to “two dozen” jobs depending on sales performance.

“Mr Shane Garner owns it,” Mr Aguiles said. “I’m just brought in as a consult ant to assist in building out the programme, and helping establish a presence for Mr Garner in The Bahamas. I was brought in as a consult ant to help Mr Garner win the tender, and we are assist ing in hiring a local sales presence, co-ordinating with local contractors and assist ing with the establishment of the graphic houses that will help in a production capacity.”

Mr Aguiles, who gave the impression he is very much the managing and organis ing mind behind RG Media (Bahamas), branded sugges tions that foreign advertising salesmen will replace Baha mians as “completely false” and said he was fully aware of the National Investment Policy’s stipulations reserv ing the sector for Bahamian ownership only.

“We are coming in to assist in hiring of a sales force,” he added. “We’ll be consulting on that, and showing them how to sell. We will provide them with some outside agencies. If there are agen cies interested in being in The Bahamas we will facili tate that relationship and phone calls. As far as bring ing in a foreign force, no.

“That would be illegal. We know Bahamian law strictly states advertising, PR and marketing efforts have to be 100 percent fully-owned by a Bahamian firm. We are just there to assist, we are just there to consult and help them build the company.... We are just there to provide guidance for Mr Garner. We were contracted to help win the bid and to help with the build-out.”

Mr Aguiles has worked for Clear Channel’s airport advertising divisions and affiliates, and it is likely his experience helped RG Media (Bahamas) meet the LPIA bid requirements. He described RG Media (Baha mas) creation as a four-phase build-out, with the first two completed in 2023 and the

final spread over 2024 and 2025.

“There’s going to be a sig nificant capital investment of approximately $1.5m that’s going to be rolled out within three years,” Mr Aguiles told Tribune Business. “What our company is going to be doing is assisting in the design of that, and local contractors will be installing the assets. All we’re doing is provid ing the expertise we have and helping out Mr Garner. That’s really our role. It’s to get them up and running on their own, and then we could extend on an as needed basis.”

Ms Walkine, in her response to Tribune Business questions, said NAD was more than justified in select ing RG Media (Bahamas) to replace Bahamas Airport Advertising, headed by John Bethel, who have held the LPIA tender for ten years.

Disclosing that five bids were ultimately received from “all Bahamian part nerships”, she said: “Prior to COVID-19, NAD deter mined to place the airport advertising contract out to tender at expiration as we wanted to explore options to improve the airport’s adver tising services.

“We were not happy with the standard of advertis ing presentation within key areas of the airport among other concerns, and sought a world class presentation for advertisers in keeping with LPIA and other similar air ports. We duly advised our advertising partner in this regard.

“Notwithstanding, Bahamas Airport Adver tising requested a ten-year extension to their contract and, given the advent of the pandemic, we determined to offer a two-year exten sion only which allowed time for businesses to recover from the pandemic prior to NAD going out to RFP,” Ms Walkine continued.

“Bahamas Airport Adver tisin determined that they did not wish to have a twoyear extension, and their preference was to take a chance and participate in the

PAGE 6, Thursday, October 27, 2022 THE TRIBUNE

FROM PAGE B1 SEE PAGE B16 10” X 10” OFFICE SPACES available at OFFICE SPACES FOR RENT Harbour Bay Plaza in the Peachy Flamingo Ltd. unit as of December 2022. Rent is set at $950.00 excluding VAT, per month All interested persons should contact Jason Pinder @ Jpinder@stargeneralnp.com

in the detail’ over NHI reforms

have an initial presentation and meeting with them.

in terms of the medical ser vices that are covered. The Bill stipulates that these must include primary health care services; health educa tion and promotion; early detection and preventative care; diagnostic imaging; paediatric and maternity care; and screening initia tives for cancer and other “specified conditions’.

Dr Duane Sands, former minister of health and cur rent FNM chairman, who was still trying to obtain a copy of the Bill when con tacted by Tribune Business, said that the question of who pays for the expanded coverage - and how much - were likely to resurface again as they have been a recurring theme during NHI’s existence.

Confirming that the Standard Health Benefit has been “a concept that has been floating around” ever since the consultants, Sanigest Internacional, pro duced their NHI report for the Christie administration almost one decade ago, Dr Sands said: “The devil is in the detail. On the face of it, let’s see how this advances us on the path to primary care.

“Second, how are they going to pay for it? There have been discussions about co-opting some of those premium dollars from pri vate health insurance to pay for that particular area, the Government will pay some and so forth.” While the Standard Health Ben efit already exists, Dr Sands added: “The Government is now going to define what that is, and ultimately this is going to be a case where everybody has the Standard Health Benefit.”

Insurers and doctors appeared to be blindsided by the Government’s tabling of the NHI Bill in the House of Assembly, although Dr Darville made clear further consultation will take place with all stakeholders. Trib une Business was told that members of the Medical Association of the Bahamas

(MAB) had been due to meet last night to discuss the Bill unaware that it was to be publicly unveiled.

One doctor, speaking on condition of anonymity, said: “I know it was up for discussion. The insurance industry has been in discus sions with the Government for over 12 months on this legislation, I understand, and the Government just reached out to the MAB to

“That was about Octo ber 6. In that meeting there were lots of questions and concerns raised after the presentation, and we have another meeting tonight [last night] with the Asso ciation to discuss further what our recommendations and suggestions will be with the legislation. What it appears as if the Govern ment is doing is forcing the hand of insurers to provide a national health benefit package to all Bahamians.”

Dr Darville, in his House of Assembly presentation, confirmed: “All private insurers that offer health insurance plans in the coun try will be required to offer the newly-purposed Stand ard Health Benefit package as a minimum standard of coverage.

“In this sense, the NHI Authority will assume the role of the insurer of last

resort and will protect our poorest and most underserved communities. The impacts of country-wide healthcare coverage cannot be understated and our administration made a com mitment to the Bahamian people and we continue the journey we started in 2016.’

In a bid to “reduce dupli cation and unnecessary spending in our healthcare sector, individuals with

private insurance coverage will receive the Standard Health Benefit through their private insurance plans and therefore be ineligible for coverage under the NHI programme”, Dr Darville added.

“I want to be clear that those eligible for coverage from the NHI Authority must not be a recipient of private health insurance coverage. But make no

mistake. If, for whatever reason, an individual loses their private insurance coverage, NHI Authority will step in as their pri mary insurer and ensure they have continued access to primary care services under the Standard Health Benefit.”

Promising consultation with healthcare providers, insurers and the business community, Dr Darville said some 135,000 persons have enrolled in NHI with patient satisfaction ratings said to be “well over 90 percent”.

THE TRIBUNE Thursday, October 27, 2022, PAGE 7

‘Devil

FROM PAGE B1 DR

DUANE

SANDS Manufacturing business with product brand for sale. All machinery/equipment necessary for immediate start-up provided. Also included are raw materials and packaging. For information contact (242) 727-7668 MANUFACTURING BUSINESS FOR SALE

Gov’t in near-$40m deficit for August

- for the first two months of the 2022-2023 fiscal year.

“During the month, revenues increased by 9.4 percent ($17m) to $197.8m compared to the prior year,” the Minis try of Finance said. “The improved performance is largely attributed to an increase in revenue col lection from international trade and transaction taxes ($12.4m), other taxes on goods and services ($5.2m), sale of goods and services ($5.9m) and VAT receipts ($3.9m).

“However, monthover-month, revenues decreased by 24 percent ($62.6m) largely due to

seasonal trends of lower VAT receipts ($50.6m) for August relative to July as domestic consumption eases with more sum mertime travelling.” The release, though, ignored the fact that July’s VAT filings include quarterly as well as monthly registrants, while August only involves the latter.

“Total expenditure increased by 6.9 percent ($15.3m) to $237.4m com pared to the prior year, owing to increased outlays on the use of goods and services ($10.2m) and subsi dies ($12.9m),” the Ministry of Finance added.

“As economic activity further trend to pre-COVID levels, COVID-19 specific

social assistance payments were lower ($9.7m) yearover-year. Compared to the prior month, August 2022 expenditure increased by 8.4 percent ($18.4m) mostly due to additional disbursements for the acquisition of non-financial assets ($21.3m).”

August’s deficit was said to be a 4 percent or $1.7m decline compared to the prior year. “Central govern ment’s net debt increased during the period by $8m, and accounted for a 92.2 percent ($95.4m) decrease from the prior year, as a net result of $82.8m in borrowings and $74.8m in repayments,” the Ministry of Finance added.

“Proceeds of borrowings during the period totaled $82.8m, sourced by $12.7m in Bahamas Registered Stock, $50m in Central Bank advances and $20.1m in Treasury Bill place ments. Repayments totalled $74.8m, primarily driven by repayments of $50m for Central Bank advances and $20.5m for foreign currency bank loans.

“Revenue receipts totalled $197.8m, a 9.4 percent ($17m) increase year-over-year. Aggre gate expenditure equated $237.4m, a 6.9 percent ($15.3m) increase com pared to the same period of the prior year. Recurrent expenditures increased 7.9 percent ($15.6m) compared to the prior year and totaled $212.7m,” it continued.

“Capital expenditures declined 1 percent ($0.2m) to $24.7m and included $23.1m to acquire nonfinancial assets and $1.6m in capital transfers.”

PAGE 10, Thursday, October 27, 2022 THE TRIBUNE

FROM PAGE B1 TO ADVERTISE TODAY IN THE TRIBUNE CALL @ 502-2394

BTC CONNECTS 30 PARKS USING WI-FI

THE BAHAMAS Tel ecommunications Company (BTC) yesterday said it has connected 30 parks to Wi-Fi as part of the Gov ernment’s drive to provide free Internet access in at least one park in every constituency.

The carrier, in a state ment, said the latest launch of a BTC-connected park took place earlier this month in Matthew Town, Inagua, giving island resi dents the ability to easily access Internet-related ser vices simply by connecting their devices.

Since ‘Park Connect’s’ launch on August 13, BTC has partnered with the Government and others to connect parks on New Prov idence, Cat Island, Andros,

Eleuthera, Exuma, Bimini, Long Island and Inagua. Phase two began earlier this week, with the connection of an additional 18 parks throughout The Bahamas that are all slated for com pletion before year-end.

“Members of our tech nology and B2B team have played a major role to ensure that all systems were in place for a smooth launch of these parks in New Providence and the Family Islands,” said Andre Knowles, BTC’s head of B2B (business to business).

“When BTC was initially approached by the Govern ment to begin this initiative, I was indeed excited as I knew that it was an oppor tunity for us to support the Government’s push for

digital transformation and the further development of the information and com munications technology sector.”

Mr Knowles said the park wi-fi will benefit many residents, and added: “As we move into phase two of this project, I’d like to thank the Government for choos ing BTC as its trusted ally, and we are indeed grate ful for the opportunity to be a part of history in the making. We are looking forward to future partner ships with the Government, with the aim of bridging the digital divide and promoting a culture of technology and innovation throughout the Bahamas.”

ParkConnect is a col laboration between the

Prime Minister’s Office and the Ministry of Economic Affairs, in partnership with the Bahamas Public Parks and Beaches Author ity, Cable Bahamas, BTC, Bahamas Power and Light (BPL) and the Grand Bahama Power Company. The initiative was offi cially launched on August 13 by Prime Minister Philip Davis KC in his Cat Island constituency. At the time, he announced that the launch was part of a larger digital transformation strat egy for The Bahamas and represented an important step towards closing the dig ital divide.

THE TRIBUNE Thursday, October 27, 2022, PAGE 11

THE PRIME MINISTER, along with BTC’s Trevor Styles, the car rier’s B2B (business to business) manager, is seen using the free Wi-Fi at Regatta Site Park in New Bight, Cat Island. The launch of the ParkConnect initiative was held in the Prime Minister’s Cat Island constituency on August 13.

Bahamas ramps up boating promotion

THE BAHAMAS once again has a strong pres ence at the 63rd annual Fort Lauderdale International Boat Show (FLIBS) as it bids to promote the country to the yachting sector.

John Pinder, parliamen tary secretary in the Ministry of Tourism, Investments & Aviation, together with Dr Kenneth Romer, the minis try’s deputy director-general, are expected to attend the five-day show, which began yesterday, and meet with

various manufacturers, influencers, members of the international media, inves tors and leading boating industry partners.

“Boating is a sector that is very important to The Bahamas, especially as we continue to see significant arrivals to our islands by boat. To date we are more than 80 percent back to pre-pandemic levels”, said Chester Cooper, deputy prime minister and minister

of tourism, investments and aviation.

“Fort Lauderdale Inter national Boat Show is an incredible opportunity for us to showcase the expan sive offerings we have available in this space, while networking with key industry partners, media and more. We look forward to another successful year of promoting our partners and experiences to boat ing enthusiasts in Fort Lauderdale”.

Owned by the Marine Industries Association of South Florida (MIASF), and produced by Informa Markets, the Fort Lauderd ale International Boat Show (FLIBS) is recognised as the largest in-water boat show in the world. It exhibits a vast array of the industry’s latest boats and yachts of all sizes, plus multiple marine products and accessories. The show is expected to attract thousands of boating

enthusiasts from the US and around the world.

The Ministry of Tour ism team, headed by executive director, Bridg ette King, and senior director, Greg Rolle, are aiming to generate a sig nificant volume of inquiries ahead of the winter boating season and 2023 start. The Bahamas will host two semi nars during the show.

The first, on October 28, will be hosted by Grant Johnson, Bahamas boating ambassador, and Jonathan Lord, Ministry of Tourism, Investments & Aviation tourism ambassador. The seminar will take place at 4pm in the Broward County Convention Centre

The second, staged on October 29, will be hosted by Robert Brousseau, Baha mas boating ambassador, and Jonathan Lord, Minis try of Tourism, Investments & Aviation. It will again be held at 4 pm at the Broward County Convention Centre. The Bahamas will be featured at an evening

event experience hosted by Worth Avenue Yachts at the yacht docks, where attendees can experience Junkanoo and Graycliff’s cigar rolling and sampling. Participating Bahamas partners and exhibitors will include: Romora Bay Hotel & Marina; Odyssey Avia tion Bahamas; Makers Air; Staniel Cay Yacht Club; San dals Emerald Bay; Atlantis Paradise Island; Bay Street Marina; Valentines Resort; Grand Bahama Yacht Club; Grand Bahama Island Tourism Board; Kalik; 3N’s Exuma Vacations; Bahamas National Trust; Bahamasair; Bluff House Resort & Marina; Nassau Yacht Haven; Neal Watson Bimini Scuba Centre; Tropic Ocean Airways; Silver Air ways; Buzz Air; Bradford Marine; Bimini Big Game Club; Abaco Beach Resort; Graycliff Hotel; Sterling Financial Group; Hurricane Hole Superyacht Marina; and Montage Cay.

Share your news

The Tribune wants to hear from people who are making news in their neighbourhoods. Perhaps you are raising funds for a good cause, campaigning for improvements in the area or have won an award. If so, call us on 322-1986 and share your story.

PAGE 12, Thursday, October 27, 2022 THE TRIBUNE

A dividend of CAD $0.1725 per Emera depositary receipt (CAD $0.69 per common share of Emera) will be payable on and after November 15, 2022 to depositary receipt holders of record as at November 1, 2022. Dividends will be subject to applicable withholding tax. EMERA INCORPORATED (“Emera”) Notice to Holders of Depositary Receipts DIVIDEND NOTICE Duties will include but are not limited to: • Management of Client matters • Assisting attorneys with trial preparation, • Composing routine letters and general communications • Preparing reports and various legal documents • Responding efficiently to internal and external inquiries. • Tracking the progress of multiple transactions • Preparation of fee billings The Candidate must be: a. Customer service oriented b. A team player c. Computer proficient d. Conscientious, thorough, organized and extremely detailed oriented. JOB OPPORTUNITY A well-established Law Firm seeks a Legal Assistant. The Legal Assistant will perform complex legal assignments with a high degree of independence, experience, skills, and knowledge. Interested persons should submit resumes via email not later than October 31st, 2022 to: employment@bahamaslaw.com CALL 502-2394 TO ADVERTISE

Share your news

The Tribune wants to hear from people who are making news in their neighbourhoods. Perhaps you are raising funds for a good cause, campaigning for improvements in the area or have won an award. If so, call us on 322-1986 and share your story.

PUBLIC NOTICE

INTENT

NAME BY DEED POLL

The Public is hereby advised that I, ANIQUA SHERILYN ALLEN of Lincoln Boulevard Nassau, The Bahamas, Mother of JOYANN ANGEL TRECO a minor intend to change my child’s name to JOYANN ANGEL CURTIS If there are any objections to this change of name by Deed Poll, you may write such objections to the Deputy Chief Passport Officer, P.O. Box N-742, Nassau, Bahamas no later than thirty (30) days after the date of publication of

NOTICE is hereby given that JONEY JOSEPH of Butler’s Way off Carmichael Road, Nassau, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 27th day of October, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE

NOTICE is hereby given that CHRISTIANE CHARLES of Farrington Road, Nassau, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 27th day of October, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE

NOTICE is hereby given that GEORGE RONALD BUTLER of Seabreeze Lane, New Providence, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 20th day of October, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE is hereby given that ANDREW SINCLAIR of P. O. Box N-8895, #58 Poinciana Drive, New Providence, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 20th day of October, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE is hereby given that JEANETTE JISLANE BLANC of Central Pines, Abaco, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 20th day of October, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

send a

signed statement of the facts within twenty-eight

from the 20th day of October, 2022 to the Minister

for nationality and

P.O.

THE TRIBUNE Thursday, October 27, 2022, PAGE 13

NOTICE

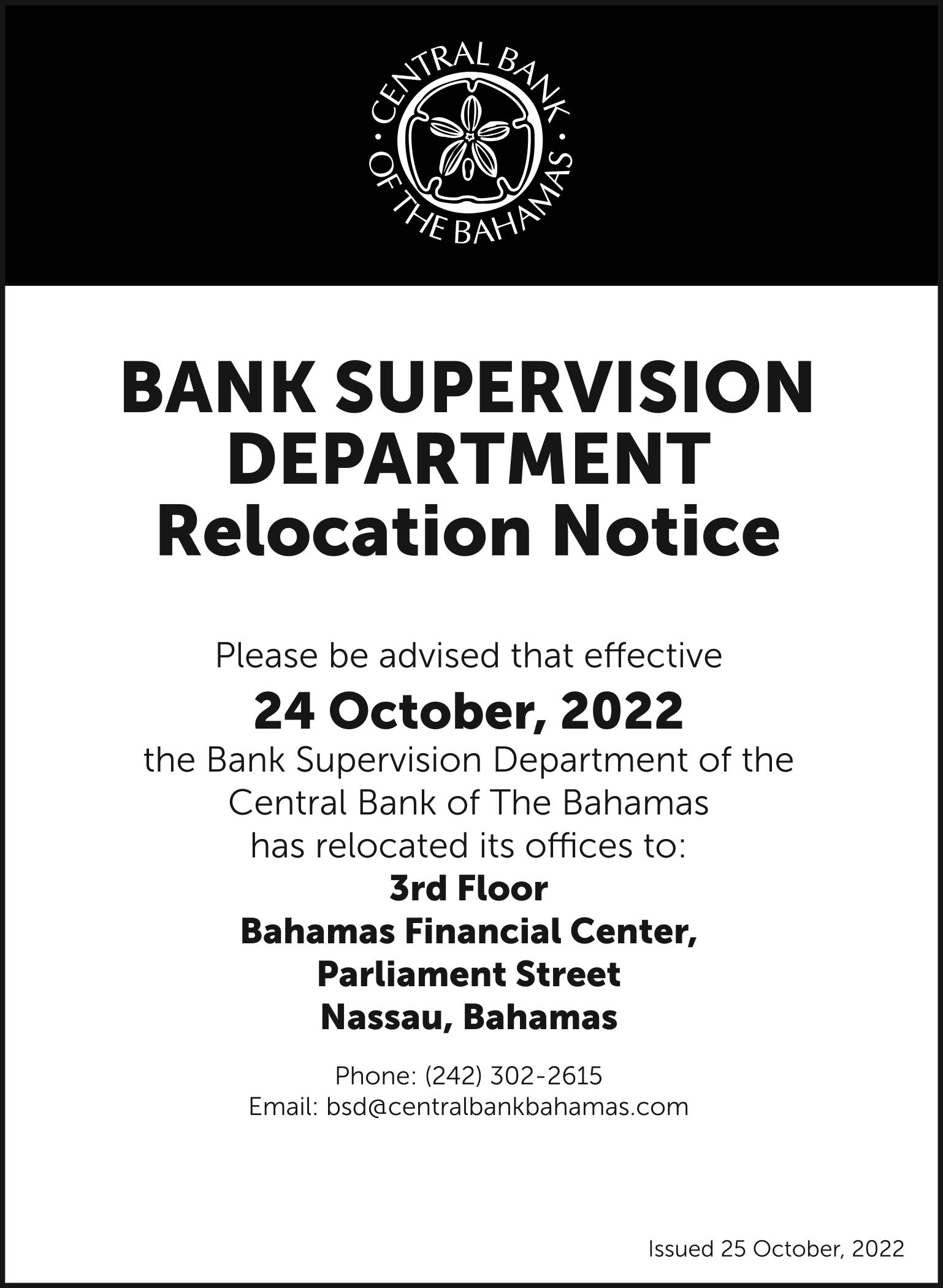

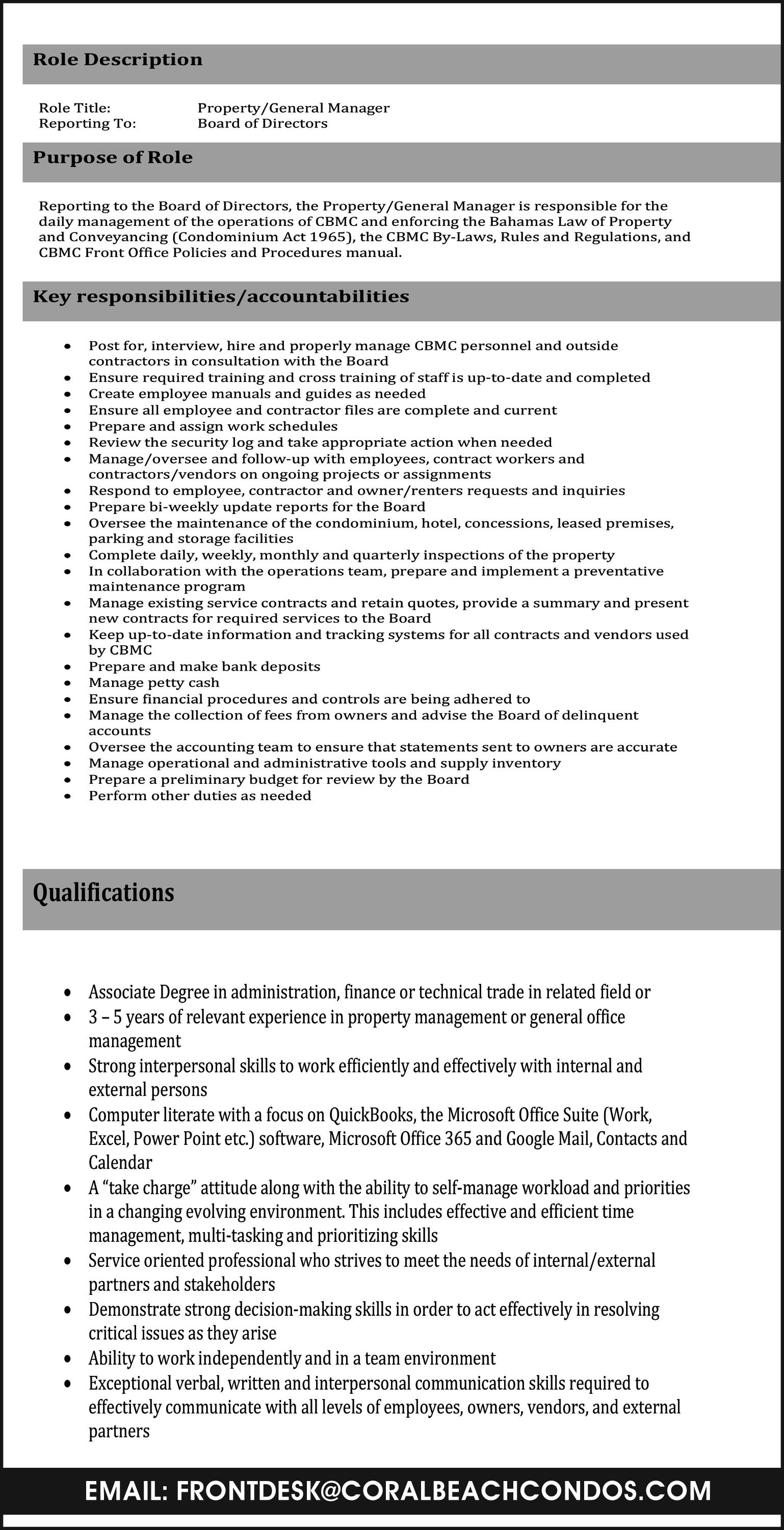

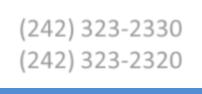

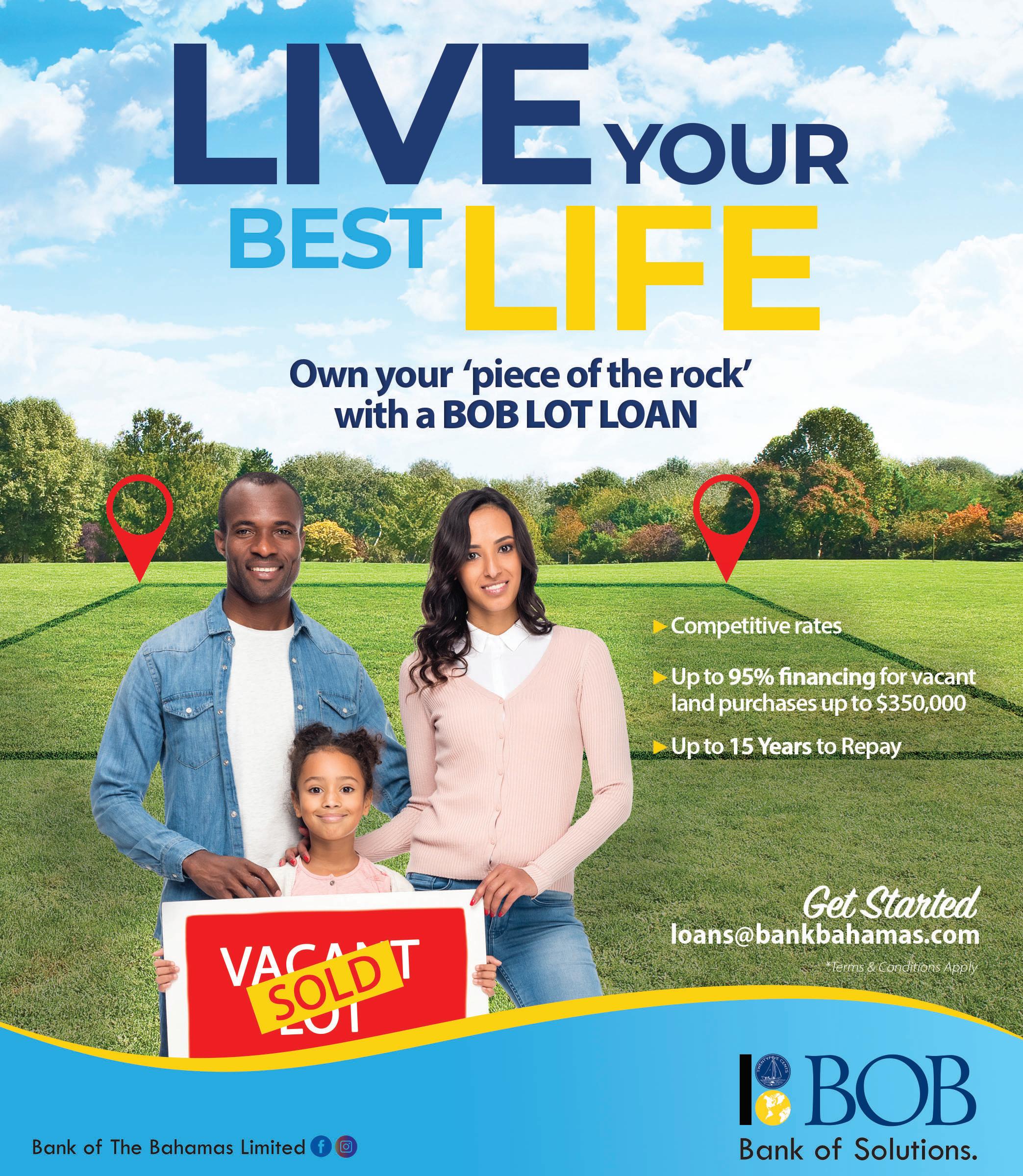

NOTICE WEDNESDAY, 26 OCTOBER 2022 CLOSECHANGE%CHANGEYTDYTD% BISX ALL SHARE INDEX: 2624.810.060.00396.5717.80 BISX LISTED & TRADED SECURITIES 52WK HI52WK LOWSECURITY SYMBOLLAST CLOSECLOSECHANGE VOLUMEEPS$DIV$P/E YIELD 7.005.30 AML Foods Limited AML 6.95 6.950.00 0.2390.17029.12.45% 53.0039.95 APD Limited APD 39.95 39.950.00 0.9321.26042.93.15% 2.761.60Benchmark BBL 2.76 2.760.00 0.0000.020N/M0.72% 2.462.20Bahamas First Holdings Limited BFH 2.46 2.460.00 0.1400.08017.63.25% 2.852.15Bank of Bahamas BOB 2.85 2.850.00 0.0700.000N/M0.00% 6.205.75Bahamas Property Fund BPF 6.20 6.200.00 1.7600.000N/M0.00% 10.058.78Bahamas Waste BWL 8.78 8.780.00 0.3690.26023.82.96% 4.342.82Cable Bahamas CAB 3.95 3.950.00 -0.4380.000-9.0 0.00% 10.657.50Commonwealth Brewery CBB 10.25 10.250.00 3000.1400.00073.20.00% 3.652.27Commonwealth Bank CBL 3.50 3.500.00 0.1840.12019.03.43% 8.516.01Colina Holdings CHL 8.23 8.230.00 0.4490.22018.32.67% 17.5010.25CIBC FirstCaribbean Bank CIB 16.00 16.000.00 0.7220.72022.24.50% 3.251.99Consolidated Water BDRs CWCB 3.47 3.530.06 0.1020.43434.612.29% 11.289.25Doctor's Hospital DHS 10.50 10.500.00 0.4670.06022.50.57% 11.679.16Emera Incorporated EMAB 9.24 9.240.00 0.6460.32814.33.55% 11.5010.00Famguard FAM 10.85 10.850.00 0.7280.24014.92.21% 18.3014.05Fidelity Bank (Bahamas) Limited FBB 18.10 18.100.00 0.8160.54022.22.98% 4.003.50Focol FCL 4.00 4.000.00 0.2030.12019.73.00% 11.509.25Finco FIN 11.38 11.380.00 0.9390.20012.11.76% 16.5015.50J. S. Johnson JSJ 15.50 15.500.00 0.6310.61024.63.94% PREFERENCE SHARES 1.001.00Bahamas First Holdings PreferenceBFHP 1.00 1.000.00 0.0000.0000.0000.00% 1000.001000.00 Cable Bahamas Series 6 CAB6 1000.001000.000.00 0.0000.0000.0000.00% 1000.001000.00 Cable Bahamas Series 9 CAB9 1000.001000.000.00 0.0000.0000.0000.00% 1.001.00Colina Holdings Class A CHLA 1.00 1.000.00 0.0000.0000.0006.25% 10.0010.00Fidelity Bank Bahamas Class A FBBA 10.0010.000.00 0.0000.0000.0007.00% 1.001.00Focol Class B FCLB 1.00 1.000.00 0.0000.0000.0006.50% CORPORATE DEBT - (percentage pricing) 52WK HI52WK LOWSECURITY SYMBOLLAST SALECLOSECHANGEVOLUME 100.00100.00Fidelity Bank (Note 22 Series B+)FBB22 100.00100.000.00 100.00100.00Bahamas First Holdings LimitedBFHB 100.00100.000.00 BAHAMAS GOVERNMENT STOCK - (percentage pricing) 115.92104.79Bahamas Note 6.95 (2029) BAH29 107.31107.310.00 100.00100.00BGS: 2014-12-7Y BG0107 100.00100.000.00 100.00100.00BGS: 2015-1-7Y BG0207 100.00100.000.00 100.00100.00BGS: 2014-12-30Y BG0130 100.00100.000.00 100.00100.00BGS: 2015-1-30Y BG0230 100.00100.000.00 100.00100.00BGS: 2015-6-7Y BG0307 100.00100.000.00 100.00100.00BGS: 2015-6-30Y BG0330 100.00100.000.00 100.00100.00BGS: 2015-10-7Y BG0407 100.00100.000.00 100.24100.24BGRS FL BGRS76024 BSBGRS760240100.24100.240.00 1,200 100.03100.03BGRS FL BGRS99031 BSBGRS990318100.03100.030.00 3,551 99.9599.30BGRS FX BGR142251 BSBGR142051699.9599.950.00 99.9599.95BGRS FL BGRS91032 BSBGRS91032499.9599.950.00 100.57100.11BGRS FL BGRS95032 BSBGRS950320100.45100.450.00 100.5299.96BGRS FL BGRS97033 BSBGRS970336100.19100.190.00 100.0089.62BGRS FX BGR129249 BSBGR129249389.6289.620.00 100.0089.00BGRS FX BGR131249 BSBGR1312499100.00100.000.00 100.9890.24BGRS FX BGR132249 BSBGR1322498100.00100.000.00 100.0090.73BGRS FX BGR136150 BSBGR1361504100.00100.000.00 MUTUAL FUNDS 52WK HI52WK LOW NAV YTD%12 MTH% 2.552.11 2.552.24%4.01% 4.833.30 4.833.42%7.26% 2.241.68 2.241.70%2.82% 207.86164.74 197.44-2.97%-2.35% 212.41116.70 202.39-4.72%6.04% 1.751.70 1.751.96%2.84% 1.911.76 1.914.83%7.23% 1.871.77 1.873.48%4.44% 1.050.96 0.96-6.57%-8.29% 9.376.41 9.37-0.02%10.36% 11.837.62 11.79-0.33%18.23% 7.545.66 7.540.22%3.05% 16.648.65 15.94-3.89%14.76% 12.8410.54 12.47-1.04%-2.57% 10.779.57 10.740.81%4.20% 10.009.88 N/AN/AN/A 10.438.45 10.433.00%25.60% 14.8911.20 14.897.90%48.70% MARKET TERMS BISX ALL SHARE INDEX - 19 Dec 02 = 1,000.00 YIELD - last 12 month dividends divided by closing price - Highest closing price in last 52 weeks Bid $ - Buying price of Colina and Fidelity 52wk-Low - Lowest closing price in last 52 weeks Ask $ - Selling price of Colina and fidelity Previous Close - Previous day's weighted price for daily volume Last Price - Last traded over-the-counter price Today's Close - Current day's weighted price for daily volume Weekly Vol. - Trading volume of the prior week Change - Change in closing price from day to day EPS $ - A company's reported earnings per share for the last 12 mths Daily Vol. - Number of total shares traded today NAV - Net Asset Value DIV $ - Dividends per share paid in the last 12 months N/M - Not Meaningful P/E - Closing price divided by the last 12 month earnings TO TRADE CALL: CFAL 242-502-7010 | ROYALFIDELITY 242-356-7764 | CORALISLE 242-502-7525 | LENO 242-396-3225 | BENCHMARK 242-326-7333 5.60% 15-Jul-2049 Colonial Bahamas Fund Class D Colonial Bahamas Fund Class E Colonial Bahamas Fund Class F CFAL Global Equity Fund Leno Financial Conservative Fund Leno Financial Aggressive Fund Leno Financial Balanced Fund Leno Financial Global Bond Fund RF Bahamas Opportunities Fund - Secured Balanced Fund RF Bahamas Opportunities Fund - Targeted Equity Fund RF Bahamas Opportunities Fund - Prime Income Fund RF Bahamas International Investment Fund Limited - Equities Sub Fund RF Bahamas International Investment Fund Limited - High Yield Income Fund RF Bahamas International Investment Fund Limited - Alternative Strategies Fund INTEREST Prime + 1.75% MARKET REPORT 31-Mar-2021 31-Mar-2021 MATURITY 19-Oct-2022 20-Nov-2029 31-Jul-2022 31-Jul-2022 6.95% 4.50% 31-Mar-2022 31-Aug-2022 4.50% 6.25% 31-Mar-2021 31-Jan-2022 31-Jan-2022 31-Aug-2022 31-Jan-2022 31-Jan-2022 31-Jan-2022 31-Jan-2022 31-Aug-2022 31-Aug-2022 15-Dec-2021 30-Jul-2022 15-Dec-2044 30-Jul-2045 26-Jun-2022 26-Jun-2045 15-Oct-2022 29-Jul-2022 21-Apr-2050 18-Jan-2024 15-Oct-2049 6.25% 30-Sep-2025 31-Mar-2022 FUND CFAL Bond Fund CFAL Balanced Fund CFAL Money Market Fund CFAL Global Bond Fund 6.25% 4.50% 6.25% 4.25% NAV Date 5.65% 5.69% 4.50% 4.30% 6.40% 4.31% 5.55% 23-Sep-2031 15-Feb-2051 17-Apr-2033 15-Apr-2049 4.37% 4.31% 15-Aug-2032 25-Sep-2032 (242)323-2330 (242) 323-2320 www.bisxbahamas.com NOTICE is hereby given that ROLMINE VALSAINT of Marsh Harbour, Abaco, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should

written and

days

responsible

Citizenship,

Box N-7147, Nassau, Bahamas. NOTICE

TO CHANGE

NOTICE

LPIA ADVERTISING DEAL COMES UNDER SCRUTINY

“At this time, RG Media (Bahamas) is readying to commence the hiring pro cess and is preparing to work with businesses to provide the production and installa tion of advertising at home. This was important to NAD as our current contractor has just a very small team of three or four persons in Nassau who worked with us. We are extremely pleased with what RG Media will be able to extend to us over the course of their agreement with NAD.”

This included their financial offer; plans to improve the airport advertising experi ence and their clear ability to do so; their alignment with RG Media via a consult ing agreement that brought considerable expertise to the company; their proposed capital investment in the air port to provide a full upgrade of all advertising assets and financial guarantees.

“In this regard, they are a 100 percent Baha mian-owned company well-positioned to deliver the level of advertising expertise and revenue NAD sought for the airport. Further, the company was selected given their determination and experience in developing strong employee teams and business partnerships to sup port the programme.

Summing up, Ms Walkine said: “As with all contracts, not only does NAD follow the National Investment Policy but our preference is to work with Bahami ans first. Further, we have completed extensive due diligence to ensure that RG Media (Bahamas) is able to meet and guarantee every obligation it has made to NAD given the impor tance of advertising to the airport....

“We recognise that it is sometimes difficult for pro ponents to accept a decision made. This is most unfor tunate, but we have clearly moved forward in the best interests of the airport having done the consider able work required to select the best proponent.”

PAGE 16, Thursday, October 27, 2022 THE TRIBUNE

RFP with the hopes of gain ing a new ten-year contract for the airport. As such, the RFP commenced on March 24, 2022, and we received wide interest that culminated into five proposals being made to NAD on June 30, 2022, the closing date of the RFP.”

Explaining why NAD decided to go with RG Media, Ms Walkine added: “A number of factors decided the award in favor of RG Media (Bahamas).

FROM PAGE B6

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net