Legal action threat in Old Fort Bay row

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE DEEPENING divide at one of western New Providence’s most upscale gated communi ties is set to trigger legal action as early as today amid concerns over new construction and earlier alleged “rogue actions”.

Old Fort Bay residents, speaking on condition of anonymity, yesterday told Tribune Business that an injunction will likely be sought to halt plans by its homeowners associa tion’s Board of Directors to construct “a multi-use pathway” that will pro vide bicycle and golf cart access to Lyford Cay - and other nearby communities - starting from the West Gate on its northern boundary.

Homeowners, espe cially in the Islands of Old Fort Bay and Bay Creek subdivisions, are questioning whether the necessary government per mits have been obtained for the construction and if Environmental Impact Assessments (EIAs) and other studies are required. They also told this news paper they were “caught off-guard” by the project, which was announced last week, and for which con struction work is due to start on October 31, and want more time for public consultation.

Senior Ministry of Works officials confirmed to Tribune Business that the Old Fort Bay Property Owners Association and its contractor, Bahamas Hot Mix (BHM Construction), have all the necessary approvals to begin and carry out the work after

the project was “vetted” by its technical team. This was after Keenan Johnson, the Town Planning Com mittee’s chairman, said his department had received no submissions or applica tions on the matter.

The imminent legal action over a seemingly benign project designed to improve the quality of life for homeowners and their families further exposes the growing rift between the various communities and subdivisions that make up Old Fort Bay itself.

Tribune Business revealed last week how a dis pute triggered by demands that homeowners finance a 50 percent increase in security costs had esca lated into the closure of a gate that divides the com munity into two.

The gate was closed after homeowners in the Islands of Old Fort and Bay Creek

subdivisions declined to pay their share of the increased security fees on the basis that the 50 per cent hike had not been justified. They believe the “multi-use pathway” is a solution to the loss of “free” golf cart and bike access that residents in Old Fort proper have suf fered as a result of the gate closure, which has denied them access to West Bay Street via Islands and Bay Creek.

As a result, residents in Islands of Old Fort and Bay Creek are interpret ing the project as a tacit acknowledgement by the Old Fort Property Owners Association that it is quite content to keep the gate closed, thereby prevent ing their easy access to the Old Fort Bay Club and associated amenities, thus

Dorian blocks $300,000 unpaid water bill cut-off

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

A FREEPORT con dominium complex has successfully prevented its water and sewerage services from being cut-off over an unpaid $300,000 bill due to concerns over post-Hurri cane Dorian supply quality.

Justice Loren Klein, in an October 21, 2022, ruling extended Grand Bahama Utility Company’s (GBUC) frustration over its near four-year battle to discon nect the Lucayan Towers South Condominium Association by granting

JUSTICE LOREN KLEIN

a further injunction block ing any such move.

However, the injunc tion is only for a six-month period and is conditional on the Association bringing

Bahamasair’s staff pension flies into trustee turbulence

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

BAHAMASAIR’S employee pension fund has flown into turbulence due to a dispute that has equally divided the trustees respon sible for its management and administration.

Justice Loren Klein, in an October 21, 2022, ruling disclosed that the trustees representing the national flag carrier itself and those acting for the Bahamas Airline Pilots Association are at odds with their coun terparts from the Airport, Airline and Allied Work ers Union (AAAWU) and the Public Managers Union (PMU) “over the general administration and

management of the fund” that contains millions of dollars for retirees.

Gladstone Adderley, Susan Palmer and Hugh Morally, the three AAAWU trustees, have initiated legal action against their counterparts representing Bahamasair’s and the pilots’ interests in the Bahamasair Employees Provident Fund over what they allege is the “improper” amendment of the trust deed and rules governing the pension plan. They claim to have the sup port of their fellow union trustees from the PMU, representing the airline’s middle management staff.

The changes, Justice Klein noted, were said to

Smaller stores ‘lead way’ on price control response

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

SMALL, inner-city and Family Island food stores were yesterday said to be “leading the way” as the industry works “feverishly” to supply the Govern ment with an alternative to the massive price control expansion by this Friday.

John Bostwick, the Retail Grocers Association’s attor ney and legal adviser, told Tribune Business that larger operators such as Super Value and AML Foods had “magnanimously” taken a supporting role over the sector’s response knowing that smaller operators and their staff will be “hurt the most” if price controls are expanded to 38 product categories.

As a result, smaller-scale grocery merchants are taking the lead in craft ing a viable alternative to the Davis administration’s initial proposal because they know “what they can survive on”. Although Mr Bostwick provided no

details on the Association’s likely solution, he indicated it will likely involved a dras tically slimmed-down price control list compared to the Government’s version that potentially covers up to 5,000 different line items.

Speaking after the Gov ernment confirmed on Friday that it has granted food retailers and wholesal ers a one-week extension, until October 28, to come up with a viable alternative that satisfies both sides as well as consumers, Mr Bost wick told this newspaper:

business@tribunemedia.net MONDAY, OCTOBER 24, 2022

SEE PAGE B7

SEE PAGE B8 SEE PAGE B9 SEE PAGE B6

JOHN BOSTWICK

$5.85 $5.88 $5.76 $5.79

COUNTERING THE SECURITY RISK FROM MOBILE PHONES

The mobile phone has become a necessity in today’s workplace. It has become common practice for com panies to allow employees access to company e-mails, read, review and respond to critical company files, and even attend video confer ences via their personal devices.

However, do you and your company truly understand the security challenges posed by mobile devices? In the first of this two-part series, this writer gave an overview of the significant cyber security threats to smart phones and other mobile devices. These were included, but not limited to, mobile mal ware, android rooting, fake access points, unsecured wi-fi, SSL certificates and packet sniffing. Now, in the second this two-part series,

Derek Smith By

we move to discuss coun ter-measures for the major threats facing smart phones and other mobile devices.

Bring your own device (BYOD) policy

Your company will ben efit from this written policy

in two ways. First, it will clarify your IT strategy and provide a framework for employees to learn about cyber security on their devices. Furthermore, the company will be able to focus its efforts and budget on critical mobile protec tions with a good BYOD policy, and be able to set an enforceable standard of conduct for the use of employee devices that will ensure their safety. Essen tially, a company should work to balance the free dom of employees to use their phones for personal use with the tools they need to access their work assets safely whenever they need them.

Prohibit non-approved cloud storage Employees need to work on a document at home over the weekend, or a vendor requires papers that

need to be reviewed. There are always tempting sce narios that may arise from time to time that prompt you to “send a document to a personal e-mail” or into a “Google Docs Dropbox environment”, which would seemingly ease the burden associated with this process. In many cases, this kind of behaviour is benign. How ever, a company is at risk whenever employees take work files outside your encrypted network. Cloudbased backup systems are recommended for most companies. Keep all docu ments in a central location that is protected by the company so employees can access them easily. Once that is achieved, they will be able to address this mobile security challenge.

Containerisation Companies should create “containerised”

Kalik and other beer prices to jump today

COMMONWEALTH Brewery has warned all liquor stores and retail ers that sell its products of increases in the price of Kalik and other locallyproduced beers with effect from today.

Wenrick Clarke, the BISX-listed brewer, whole saler and retailer’s sales

director, in an October 19, 2022, letter to trade cus tomers said: “Although things are getting better, challenges with global supply chain disruptions are causing ongoing cost increases for logistics and raw materials used in our locally-manufactured products.

“This is leading to increased pricing on all locally-produced beers as of Monday, October 24.... Please know that we remain committed to managing our prices and ensuring they remain in line with industry best practices.”

Commonwealth Brew ery later confirmed the

increase in a statement, saying: “As a good business practice, Commonwealth Brewery always informs trade customers before any price changes to afford them the opportunity to adjust their operations where needed and pro vide them access to our

communication channels on an employee’s personal phone to mitigate mobile security challenges. This simply separates your com pany’s applications and data from the employees’ per sonal activities. It depends on your network, and needs, how you create this “walled garden” type approach. You can accomplish this by installing zero trust enable applications, requiring a minimum of two-factor authentication to enter the company’s network through a mobile device or installing a Virtual Private Network (VPN).

Conclusion In short, a company can improve the security posture of its employees’ mobile devices with sev eral defensive tools. These tools, which should be deployed based on the smart phone and mobile

support teams to ease any transitions.

“The announcement comes as the world, includ ing Commonwealth Brewery, is experiencing rising costs associated with raw and packing materials, energy and logistics closely linked to global supply chain shortages.

“Commonwealth Brew ery continues to explore options to further mitigate

device’s data taxonomy, can reduce threats/vulnerabili ties in data, application and network connectivity.

• NB: About Derek Smith Jr Derek Smith Jr. has been a governance, risk and com pliance professional for more than 20 years. He has held positions at a TerraLex member law firm, a Wolfs burg Group member bank and a ‘big four’ accounting firm. Mr Smith is a certi fied anti-money laundering specialist (CAMS), and the compliance officer and money laundering report ing officer (MLRO) for CG Atlantic’s family of compa nies (member of Coralisle Group) for The Bahamas and Turks & Caicos.

the impact on our custom ers and consumers despite the ever-changing market conditions. At the same time, Commonwealth Brewery is actively studying market trends and explor ing opportunities to expand our portfolio by introducing innovations into the local market.”

PAGE 2, Monday, October 24, 2022 THE TRIBUNE

PETROLEUM DEALER SAYS PRICE CONTROLS ‘A THING OF THE PAST’

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

A PROMINENT petro leum dealer has called on The Bahamas to eliminate price controls, describ ing them as “a thing of the past”.

Vasco Bastian, the Baha mas Petroleum Dealers Association’s (BPDA) vice-president, told Tribune Business that the Govern ment’s proposal to expand

the list of price-controlled food items by 38 product categories will impact gas stations through what they sell in their convenience stores.

“Price controls are a thing of the past. We have to do away with them. We have to come into the times. It is an outdated system,” he said. Petroleum retailers, meanwhile, are supporting calls by wholesale fuel sup pliers for their own margin increase because they now “understand” the plight of

dealers, a prominent opera tor says.

Mr Bastian said he sympathises with the indus try’s wholesaler suppliers - Rubis, Esso (Sol Petro leum), and Shell - pushing for an increase in their own 33 cents per gallon of gaso line margin.

“We are all Bahamians, and we are all vested in this country and we deserve a return on our investment,” he explained. “People deserve a return on their investment. They not only report to themselves but

they report to their board and their shareholders.”

Raymond Samuels, Rubis’ managing director for The Bahamas and Turks and Caicos, told report ers last week month that the price-controlled, fixed margin for wholesal ers has not been changed in two years while the cost of doing business has risen significantly over the same period.

Wholesale petroleum margins are 33 cents per gallon on gasoline, and 18 cents on diesel. Retailers,

meanwhile, have their mar gins fixed at 54 cents per gallon on gasoline and 34 cents for diesel.

Increasing margins for retailers is something Mr Bastian is still pursuing with the Government. He said: “The current government has been very accommodat ing. They have put some offers on the table and it’s just up to us to decide what the offer might be. But I’m happy with the nego tiations. They were long but worthwhile.”

Mr Bastian did not con firm if a margin increase is among these options, but said that there was “more on the table” for petro leum retailers than just that. He confirmed: “We need the margin increase, espe cially since minimum wage is going up and, once that goes up, National Insurance contributions will go up. Then our overall costs will go up, our purchases for our store will go up from the grocers, and that will impact our prices, so we will have to offset that.”

Water Corp supplier in ‘tremendous’ costs rise

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

THE Water & Sewerage Corporation’s main supplier says the cost of operating its two New Providence reverse osmosis plants has increased “tremendously” over the past year due to the rise in global oil prices.

Henderson Cash, Con solidated Water (Bahamas) general

manager, said during a tour of its Windsor desalination plant that energy and other fossil fuel-related costs have been impacted by price vol atility on global markets. It is understood the com pany is able to recover at least some of this through an energy “pass through” charge to the Corporation, for which it supplies all the water consumed by its New Providence customers from the Windsor and Blue Hills plants.

“We do employ some forms of renewable energy,” said Mr Cash. “We use a bit of solar for some of our systems and we exploit any input of energy. For instance, when we extract water from water wells, that’s the sea water, which is on our feet technically. We take that water and we purify some of it before we dispose of that. That is used for cooling requirements, and so we try to maximise that. We are always pushing that envelope.”

The Windsor Plant’s contract with the Water & Sewerage Corporation was renewed in 2018. Consoli dated Water, which is listed on the Bahamas Interna tional Securities Exchange (BISX), has a 20-year agreement to supply the Water and Sewerage Corporation.

The Windsor plant pro duces more than 16m imperial gallons of water per week. Its wells go 300 feet deep to bring salt water from below ground to the

plant, where it goes through the reverse osmosis process.

Windsor itself employs 19 people working a 24-hour day, seven days per week, schedule in shifts.

Mr Henderson added: “If we take 100 gallons of sea water from the well, we get around 40 gallons of fresh water from the process.

Sixty percent is brine, and it’s kind of the cutting edge technology just now.

“We take that water and we send it across the second RO (reverse osmosis)

ORG partnering over digital message push

THE Organisation for Responsible Governance (ORG) has partnered with a start-up to push its message out on digi tal marketing platforms in more than 60 Bahamian businesses.

ORG, in a statement, said it has teamed with Modinet Global Software Ltd, which operates a digital adver tising system to promote companies via a nationwide network of remote-con trolled digital monitors.

Modinet’s digital ad monitor placement, an electronic billboard, allows businesses to display

animated commercials and announcements on a flat screen placed at their premises. It is this plat form through which ORG’s messages of responsible governance are being trans mitted in New Providence, Andros, Bimini, Eleuthera, Grand Bahama and Great Exuma.

Modinet has also donated its technical expertise, and is working with ORG to adjust public education materials to fit the plat form. Through Modinet’s support, ORG said its public education adver tisements are now being

featured nationwide every six minutes.

Modinet, which has executed successful part nerships with Aliv and

system to go up to 850 psi. This (Windsor Plant) goes up to maybe 200 psi. And so we further purify that water such that we’re making ultra-pure water, or what we call bottled water locally. That water is taken and blended by the Water & Sewerage Corporation to World Health Organisation (WHO) standards, and they send that to your home or my home for consumption.”

over Bahamian firms, approached ORG about the partnership after

with product brand for

start-up provided.

necessary for

THE TRIBUNE Monday, October 24, 2022, PAGE 3

L-R: CANDICE THOMPSON, Senior Communications Officer, Organisation for Responsible Governance; Matthew Aubry, ex ecutive director, Organisation for Responsible Governance; Marc Hohnstein, president, Modinet Global; and Arthur Thompson, managing partner, Modinet Global.

SEE PAGE B5

Manufacturing

business

sale. All machinery/equipment

immediate

Also included are raw materials and packaging. For information contact (242) 727-7668 MANUFACTURING BUSINESS FOR SALE

Tourism keeping ‘island hopping in top of mind’

THE MINISTRY of Tourism is urging visitors travelling through the key North Carolina gateway to “keep island-hopping in The Bahamas top of mind” as it continues its promo tional push.

The US state was the latest stop on the Ministry of Tourism, Investments and Aviation’s global sales and marketing missions, as it seeks to re-engage tourism partners postCOVID-19 and boost visitor arrivals and invest ment from the area.

Chester Cooper, deputy prime minister and minis ter of tourism, investments and aviation, led a del egation including Ginger Moxey, minister for Grand Bahama; Latia Duncombe,

acting tourism directorgeneral; and senior tourism officials in a series of events and meetings.

These included discus sions with key stakeholders and media from across the tourism industry, as well as Bahamian-themed cul tural events at The Marriott Charlotte South Park in Charlotte, North Carolina, and The Raleigh Marriott City Centre in Raleigh, North Carolina, on October 20

Mr Cooper and Mrs Duncombe, together with Ministry of Tour ism, Investments and Aviation executives, des tination representatives and hotel partners hosted more than 200 guests at the evening events, with industry officials, sales and trade representatives, stakeholders and media in attendance.

A live “question and answer” panel highlighted The Bahamas’ steadily growing tourism numbers; plans for future growth and innovation; its 16 islands and the many reasons why The Bahamas is a soughtafter destination.

“There is infinite poten tial in the south-east – we consider the region an extremely important gateway market,” said Mr Cooper.

“With new direct flights from Raleigh to Grand Bahama coming this November, and frequent flights from Charlotte to Grand Bahama, Eleuthera, Abaco, Exuma and Nassau, visiting our beautiful islands is easier than ever. Southern travellers should

keep island-hopping in The Bahamas top of mind for their next vacation.”

Mrs Moxey touted the new direct airlift to Grand Bahama, via Bahamasair, as another clear indication of the island’s rebound and that it is open for business. “I am elated to see up-close and personal all the possi bilities available for Grand Bahama in just this southeastern market, and look forward to how tourism at large will benefit from the invaluable connections and opportunities advanced from these global mis sions,” she added.

“I invite all of you to come to Grand Bahama and experience our diverse product offerings. Indeed, Grand Bahama is on a direct trajectory to being grand again.”

The global sales and mar keting missions began in September in Fort Laud erdale and Orlando, and continued in the tri-state area with stops in New Jersey and New York last month. Upcoming destina tions in the US and Canada include Los Angeles and Toronto, Calgary and Montreal. The Ministry of Tourism, Investments and Aviation will also be head ing to Atlanta and Houston in the future.

Once the missions to the major travel hubs across the US and Canada have finished, the Ministry of Tourism, Investments and Aviation delegation will visit Latin America and Europe as part of efforts to directly target key interna tional markets.

Help Wanted

&

of VMware

a plus.

and

send responses to

PAGE 4, Monday, October 24, 2022 THE TRIBUNE

10” X 10” OFFICE SPACES available at OFFICE SPACES FOR RENT Harbour Bay Plaza in the Peachy Flamingo Ltd. unit as of December 2022. Rent is set at $950.00 excluding VAT, per month All interested persons should contact Jason Pinder @ Jpinder@stargeneralnp.com Established technology company based in Nassau is seeking candidates for the position of Network Administrator Minimum of five years experience with ability to deploy, configure, maintain and monitor all active network equipment in order to ensure smooth network operation. 2-5 years of working with Windows Server 2008 and up, supporting Exchange Server 2013 and up and O365/Hosted Exchange, strong Windows 7

10 desktop support. Knowledge

ESXi

Cisco routing and switching

Must have your own transportation. Please

resourcesit2@gmail.com

Rise and fall

By CHRIS ILLING Business developer ActivTrades Corp

It has been a few busy weeks in the Forex (foreign exchange) markets. On Thursday, the reaction of the markets was unequivocal, and we saw a certain ruthlessness when UK prime minister, Liz Truss, had barely announced her resignation before the pound sterling was appre ciating again. The 30-year UK government bond yield fell nine basis points, which means investors are now viewing those securities as less risky once again.

Across the Atlantic, US president Joe Biden has dis missed warnings of a strong dollar, and instead blamed poor economic policies and weak growth in other parts of the world for the weaken ing of the global economy. He was not worried about

the strong dollar but about the rest of the world. The US economy is strong. With this sharp rhetoric, Biden is reacting to international crit icism that was bundled at the annual meeting of the Inter national Monetary Fund (IMF) and World Bank the previous week.

Rarely in the past 20 years has the US dollar been as valuable as it is now. Since January this year, it has gained 22 percent against the Japanese yen, 13 percent against the euro and around 6 percent against emerg ing market currencies. A strong dollar puts a strain on countries and their econo mies that have taken on large debts in US currency, or depend on raw material imports because these usu ally must be paid in dollars.

The strength of the dollar can be explained by the US Federal Reserve’s tight mon etary policy. It has acted

more resolutely than other central banks in raising interest rates, which in turn has made the dollar more attractive.

The war in the Ukraine is the second factor. It has pushed up commodity prices, especially food and energy. This development weighs particularly heavily on the euro area, has a mixed impact on emerging markets and is even positive overall for the US. At least part of the shift in currency rela tions can be explained by the

fact that economic strength has changed. Europe is suf fering more than the US.

Emerging countries have been doing surpris ingly well so far. On the one hand, the central banks of many emerging countries have reacted particularly rigorously to inflationary tendencies, and thus also shielded the value of their currencies. Some central banks have also intervened in currency markets to sup port their currencies. On the other hand, some countries

benefit from the develop ment of raw material prices.

These include Brazil, whose currency has appreciated against the dollar since the beginning of the year. Brazil is a major exporter of soy beans, iron ore and crude oil.

Mexico’s currency is also still robust thanks to the devel opment of crude oil prices.

But the strong dollar weighs heavily on emerging and developing countries because of higher import dependency, and because

ORG partnering over digital message push

FROM PAGE B3

observing the not-for-prof it’s local and international events promoting accounta bility and democracy. Marc Hohnstein, its president, is a member in the Atlan tic Treaty Association, an international group com mitted to freedom, liberty,

peace, security and the rule of law.

“We need organisations like ORG to fill the gap, and to share knowledge of how the Government system works. We must do our part to share every day people’s influence on these systems,” Mr Hohn stein said. He has a master’s degree in finance and has

held key positions in the German and US financial services sector.

He has worked with Bank One, now Chase Bank, and Wells Fargo, and led an international consulting company, LCA Global Consulting. Mr Hohnstein served as a member of the economic council to the Christian

Democratic Union (CDU) party of former German chancellor Angela Merkel, representing the interests of thousands of small and medium-sized firms.

Besides digital adver tising, Modinet will be promoting ORG’s corpo rate circle programme and mobilising other private sector leaders to become

involved with good govern ance. “It’s all about making their brands and businesses stand out from the crowd,” said Modinet Global’s man aging partner, Arthur ‘Ray’ Thompson.

Matthew Aubry, ORG’s executive director, added: “The ORG team is excep tionally grateful for Modinet’s belief in our

many bills must be paid in US dollars. They have also accumulated large debts due to the pandemic, many of which are also in dollars. There are now correlations with the early 1980s when Fed chairman, Paul Vol cker, managed to curb inflation in the US. Mon etary policy, together with President Ronald Reagan’s fiscal policy, had boosted the dollar to unprecedented heights. However, that was linked to a severe debt crisis in developing countries. Countries such as Egypt, Tunisia and Lebanon are very fragile.

The voices warning about a looming global reces sion are getting louder, and include now signals from bil lionaires Elon Musk and Jeff Bezos that tough times are ahead. Interesting times for the avid forex investor.

work. Their partnership and expertise are signifi cantly expanding ORG’s capacity to reach and help Bahamians to “get informed and get involved’ on issues of governance and civic participation. Modinet’s dedication to corporate social respon sibility sets a high bar for cross-sector partnerships in The Bahamas.”

The partnership between ORG and Modinet is antici pated to run for 12 months.

THE TRIBUNE Monday, October 24, 2022, PAGE 5

Bahamasair’s staff pension flies into trustee turbulence

enable the Bahamasair and pilot trustees to manage the trust and exclude those from both unions. “This, it is said, had the effect of altering the quorum requirements of the committee to the prejudice of the plaintiffs (AAAWU trustees), and cleared the

way for the defendants to administer the affairs of the trust - including the power to amend the trust instru ments to the exclusion of the plaintiffs and the PMU trustee,” he wrote.

“They also allege other management breaches, which include excluding them from management

functions and meetings by failing to give notice; with holding their honoraria; failing to share reports and other records which the plaintiffs say are necessary for the performance of their duties; and the irregular appointment of the chair man of the committee (Dion Bethell).”

The trust deed sets out how the pension fund is to be administered and managed on behalf of Baha masair employees, both existing and retired. Delv ing more deeply into the dispute, Justice Klein added: “Significantly, the plaintiffs claim that the effect of the amendments was to oust their participation in the management of the fund, as it allowed the defendants to form a quorum and transact all necessary business with out them, contrary to the requirements of the rules.

“They also claim that the conduct of the defend ants has resulted in the loss of their monthly hono raria from November 2021, ostensibly based on their failure to attend meetings of which they say they were not made aware and even though they continue to carry out other duties towards the fund.

“Further, they question the legality of the election of the first defendant as chairman of the committee. They also allege that the defendants have denied the PMU a second trustee seat, even though the same was voted on and approved,” he added.

“Finally, they say that the defendants had an audit

prepared without their knowledge and approval, and are presenting it for approval at the pend ing AGM (annual general meeting), notwithstanding that it has not been seen or approved by the plaintiffs and the PMU trustee.”

The concern with dis putes of this nature is that they prove a major distrac tion for those charged with properly administering and managing millions of dol lars on behalf of existing and future retirees, although there is no indication from Justice Klein’s ruling that this is happening here. The Supreme Court was not required here to rule on the substantive merits of the AAAWU trustees’ case, just their application for an injunction. The three AAAWU trustees had sought an injunction to block the stag ing of the AGM, which had originally been set for August 10, 2022, and had publication of the pension plan’s audit until the main dispute was resolved and the auditor’s work reviewed and queried. The scheme provides for plan members to contribute between 5-6 percent of their salaries, with matching contributions

made by Bahamasair and the participating unions.

Justice Klein, in granting the injunction sought by the AAAWU trustees, limited it to blocking the Bahamasair and pilot representatives from acting on any of the disputed trust deed amend ments said to have been agreed at the November 10, 2021, AGM. They are also forbidden from doing any work on the pension plan’s behalf without the knowl edge of the three AAAWU representatives.

The audited financials were already posted on the pension plan’s web site on August 4 this year, and Justice Klein added: “I discharge the interim injunc tion granted on August 10, 2022, preventing the hold ing of the AGM. This means that the committee, acting pursuant to the quorum requirements existing pre2021 amendments, is free to give the requisite notice for the holding of the AGM.

“To facilitate the AGM, I also direct that the plaintiffs be provided with the neces sary documents relating to the audit and an opportunity to discuss the said audit with the auditors in a meeting organised for that purpose. I further direct that they attend such meeting when it is organised.

BAHAMASAIR

“It should also be clear that the issue of the amend ments does not arise for the consideration of the AGM. The trust instruments are very clear as to the location of the power to amend; it is reposed in the company and participating unions along with the trustees, although the formulations for the exercise of the power differ depending on the nature of the amendments proposed.”

PAGE 6, Monday, October 24, 2022 THE TRIBUNE

FROM PAGE B1

Smaller stores ‘lead way’ on price control response

“When we first met with the Government last Monday, they gave us until Friday to come back.

“Last Wednesday, we would have written to them requesting an extension to this Friday’s date - from October 21 to October 28. They agreed to that. They allowed us to have that extension. In between times, we are working feverishly. The reason we asked for the extension is there was no way we could canvass every food store in every constituency in three days - Tuesday, Wednesday, Thursday. Impossible. We couldn’t canvass everybody in Nassau to be honest.”

Mr Bostwick said the Association was deter mined that its solution would not be “Nassau cen tric” or dominated by the larger food merchants. “It’s incredibly important even in New Providence to get a cross-section because this initiative covers every level of income. You have your small ‘Mom and Pops’, a 500 square foot retailer in Governor’s Harbour, Eleuthera,” he added.

With the impact from the proposed price con trol expansion differing island by island, and from merchant to merchant, the Association’s legal adviser said it was critical that the consultation net be cast as widely as possible so that all views are taken into account. Logistics and transportation costs vary between Family Islands, depending how far they are from Nassau, and have to be factored into its govern ment response.

“We can’t sit here with this Nassau centric way of operating,” Mr Bostwick told Tribune Business “This Association is not Nassau centric. It’s countrywide, every constituency in The Bahamas, so we need their input. We also need the input of the small guys as opposed to the big guys.

“The big guys magnani mously said that the effect of this resolution will impact the smaller opera tors and the Family Island operators the most. They’re the least flexible to with stand that change, and also they have the tightest mar gins and lowest volumes, so any change affects them the most.

“It was said to them that they come up with the first list. The larger opera tors said they will leave it with them. They said: ‘You know what you can survive on, and we will sup port you leading the way

with suggestions as to what you can survive with. The understanding is that you guys will be hurt the most; tell us what you can survive on’,” he explained of the industry’s position.

“It makes no sense the larger guys writing the list. It might destroy them. They make the list; they know what they need to survive, and the larger ones will support them. The answer is true indicative democ racy.” Food retailers have previously warned that the Government’s price control expansion, as it stands now, could lead to store closures and staff terminations as more products will now be sold at a loss.

The price control regime’s expansion effec tively means merchants and wholesalers will be selling more of their inven tory as ‘loss leaders’ where they are unable to recover their cost of sales. The consequences will likely involve merchants further raising prices on non-price controlled goods to com pensate, thereby further feeding already-high infla tion. And it also provides a disincentive for retailers to stock price-controlled items, which could result in product shortages.

The Davis administra tion unveiled the move as a bid to further ease the cost of living crisis for thou sands of middle class and low income Bahamians, who are being continuously squeezed by soaring food prices and are seeing living standards/quality of living eroded as they increasingly struggle to afford basic commodities such as food and medicines. However, retailers have pointed to the unintended consequences, and say there are better ways to meet this goal.

Mr Bostwick yesterday said “every piece” of the current controversy could have been avoided if the Government had con sulted with food retailers and wholesalers before making its announcement.

“In my personal opinion, consultation is a fundamen tally important thing in a progressive, mature civil society,” he added.

“I think it’s important that the public understand that the grocers are not their enemy, and are work ing among themselves to be extremely democratic. You cannot turn around and the big guys in Nassau are making the decisions and don’t consult the membership.”

The Ministry of Eco nomic Affairs, in a statement issued on Friday,

confirmed that food retail

ers and wholesalers, plus their pharmaceutical coun terparts, have until October 31, 2022, to complete the transition to the new pricecontrolled margins and mark-ups - effectively granting them the week’s extension. Price control inspectors will not begin enforcement of these changes, whatever they ultimately may be, until November 1, 2022.

“The minister of eco nomic affairs [Senator Michael Halkitis] and offi cials met separately with a group of pharmaceutical wholesalers and retailers on Friday, October 21. The meetings were fruitful and, in both instances, both sides committed to continuing the dialogue,” the state ment added.

The Retail Grocers Asso ciation, in a statement last week, said the price con trol expansion will “affect more than 5,000 items to which inventory and price adjustments would have to be made. To facilitate such changes would be a very expensive undertaking, and would mean that 40 to 60 percent percent of total revenues for local wholesal ers and retailers would be controlled.

“Additionally, such a decision was made without prior industry consultation and at a time when busi nesses are faced with already slim profit mar gins, increasing electricity

costs, increased operating expenses and theft. The sector employs some 4,000 persons, and the expan sion of the price control basket will undoubtedly have a ripple effect which

would prove detrimental, with mass store closures, particularly among the smaller food stores and the real potential for food shortage in the country.”

THE TRIBUNE Monday, October 24, 2022, PAGE 7

FROM PAGE B1

LEGAL ACTION THREAT IN OLD FORT BAY ROW

splitting the community in two and keeping it physically divided.

Sean Andrews, the Old Fort Bay Property Owners Association’s chairman, declined to comment on the situation when contacted by Tribune Business yesterday and said he would have to consult other Board mem bers. “I would need time to consider it,” he responded. “I’d have to speak to me Board before I could com ment on anything.”

Tribune Business last week sent e-mails contain ing multiple questions on the situation at Old Fort Bay to both Mr Andrews and fellow Board member, Bert Krista, but neither responded despite being given several days to do so. Following this newspaper’s call to Mr Andrews, it was yesterday contacted by an attorney for the Association, Vanessa Carlino, of Carlino & Co, asking about the nature of the inquiry and time her client had to respond.

Despite being given the requested details, no reply was received from the Association before press deadline last night. The “pathway” concerns follow swiftly behind allegations that Islands and Bay Creek residents were recently threatened with the loss of boating access to Old Fort Bay’s canals and waterways something which contra dicted the official position of Mr Andrews and his Board set out just weeks earlier.

Fred Smith QC, attorney and partner at Callenders & Co, in an October 6, 2022, letter, said: “Our client was recently made aware of an e-mail sent by Mr Bert Krista, one of the directors of the Old Fort Bay Prop erty Owners Association, wherein Mr Krista threat ened to instruct the security stationed at the entrance of the canal passage not to lower the chain to permit them access through the canal as a result of his and others’ alleged ‘refusal to pay the agreed share for the last dredging operation”.

This, Mr Smith argued, was inconsistent with the notice sent to homeown ers on September 23, 2022, which said “there has been no such discussion or

contemplation within the Board of Directors on the closure or restriction of access to the canal entrance relative to Old Fort Bay residents or neighbouring communities that utilise that entrance”.

Mr Smith, asserting that his client and their guests “have an unobstructed right” to freely use the canals and waterways, warned that legal action for damages and costs would follow if this was denied or there was any damage to their boats.

Ms Carlino replied for the Association, stating: “In order to remove any doubt, the Property Owners Association does not have any intention to block access through the canal entrance. We trust that this unequivocal statement will bring closure to any sugges tion otherwise.” Mr Smith, though, urged the Associa tion to protect his client from “such threats” and what he termed “rogue actions” in the future.

Among the Association directors copied in on the exchange were Mr Andrews, Mr Krista, Arantxa Klon aris and Nadim Nsouli.

The latter, the founder of Inspired Education Group, which boasts of a global network of 80 schools in 23 countries, attended by more than 65,000 students, has shaken up private educa tion in The Bahamas with his development of King’s College School on Western Road in south-west New Providence.

Meanwhile, although the attorneys’ exchange may have eased canal access ten sions, the rift at Old Fort Bay has again been laid bare by plans for the new pathway. “The residents are seeking to get an injunc tion. They’re talking to the lawyers as we speak,” one source told this newspaper.

“They’re not sure if they need an EIA and other sorts of approvals.

“We’re trying to get an injunction as we speak. There needs to be some consultation and discussion.

They [Old Fort Bay proper] will have to move their ser vice entrance further east, so this is part of a much large project. We’ve already spoken to the lawyers, and as of tomorrow [today] they’re going to seek an injunction and file the paperwork. We want consultation on this. It’s dangerous, and we don’t see the need to push this through so fast.”

The multi-use pathway was unveiled by Mr Andrews in a letter to homeowners dated October 17, 2022. He wrote: “We are pleased to announce a great develop ment that will benefit our property owners. In order to enhance access, the Gov ernment of the Bahamas has approved a multi-use paved pathway from the West Gate that ties directly into the existing pathways which lead ultimately to Lyford Cay, providing access to all the commercial entities in between.

“This pathway will be able to readily accommodate bicycles, foot traffic and golf carts in a safe and sustaina ble way.” The Islands of Old Fort Bay residents, though, immediately raised their

concerns and objections in an October 20 letter sent by their association’s chairman, Gregory Graham.

“The property owners represented by the Islands property owners’ asso ciation would be directly affected by this project, and several of our members have expressed serious concerns about the safety implications of locating a pathway for pedestrians, cyclists and golf cart users directly alongside an extremely busy public road frequented by cargo trucks and heavy machinery transports,” he wrote.

“As directly interested parties, our members are also very concerned that, to their knowledge, no record of the relevant government approvals has been circu lated, published or otherwise made public. They are also unaware of any oppor tunity to take part in any public consultation exercises regarding this project, as set out in the law.” Work is set to begin on October 31 and be completed by November 18. Luther Smith, permanent secretary at the Ministry of Works, confirmed that all necessary approvals have been granted. “It’s a project which has been designed and developed by the developers, who are private developers. The proposals were submit ted to the ministry’s civil design section, who vetted it carefully as they would any other civil design project,” he told Tribune Business.

“They made a few suggested changes, like wid ening a few little pieces of the proposed sidewalk, and then they set out a routine approval, which is done all the time when people are asking for road designs or any other such designs for private subdivisions.”

The Ministry of Works is “by no means” spear heading this project at all, which Mr Smith said was being financed and driven by the Old Fort Bay Prop erty Owners Association. “It is a project by the private developers whose engineer is a gentleman by the name of Mr Garraway, who fully complied with all of the Min istry of Works and Utilities requirement for that kind of situation,” he added.

“The developer will pay for it and will do what they have to do, and it meets the ministry’s full specifica tion. It’s not a matter for the Ministry of Works and we certainly are not building the footpath.” One homeowner, speaking on condition of anonymity, said the Associa tion was spending thousands of dollars on a pathway it would have no need for if it opened up the middle access gate to make all of Old Fort Bay one again.

“It has the illusion that they’re doing something and are spending a lot of money when they already had a free road that cost them no money other than mainte nance,” they added. “They already had safe passage [to West Bay Street] through Islands and it didn’t cost them anything. We main tained security, the roads and verges at no cost to Old Fort Bay. It’s a hell of an effort to cut out Islands and Bay Creek when they had access for free. It’s insane.”

NOTICE is hereby given that BENIAN BRINAE BEAUCHAMP of Keywest Street P.O Box SS19324, New Providence, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 24th day of October, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE is hereby given that ALECSSANE MARC-LEORAND of P. O. Box CR-54802, Carmichael Road, New Providence, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 17th day of October, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

PAGE 8, Monday, October 24, 2022 THE TRIBUNE

FROM PAGE B1

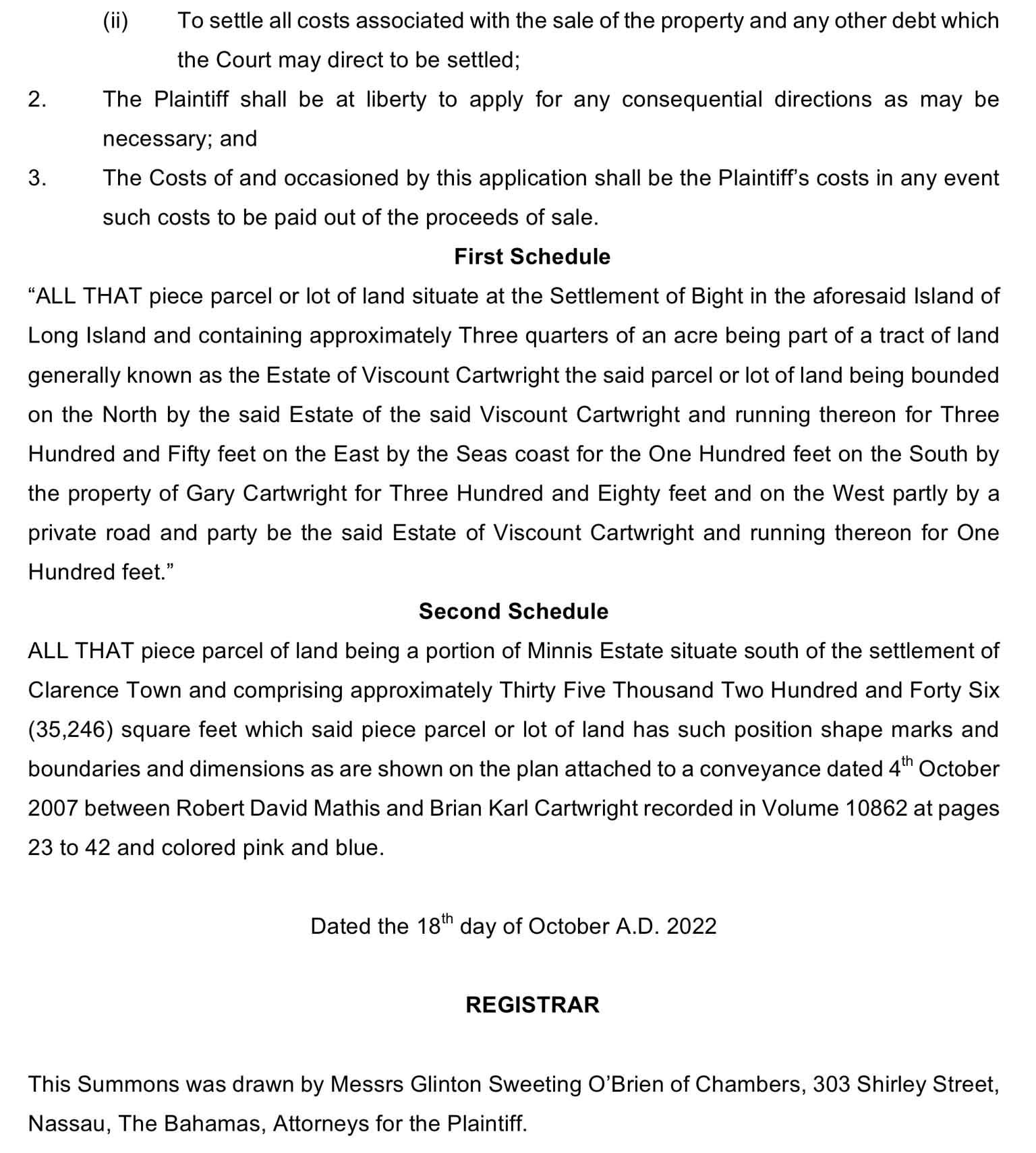

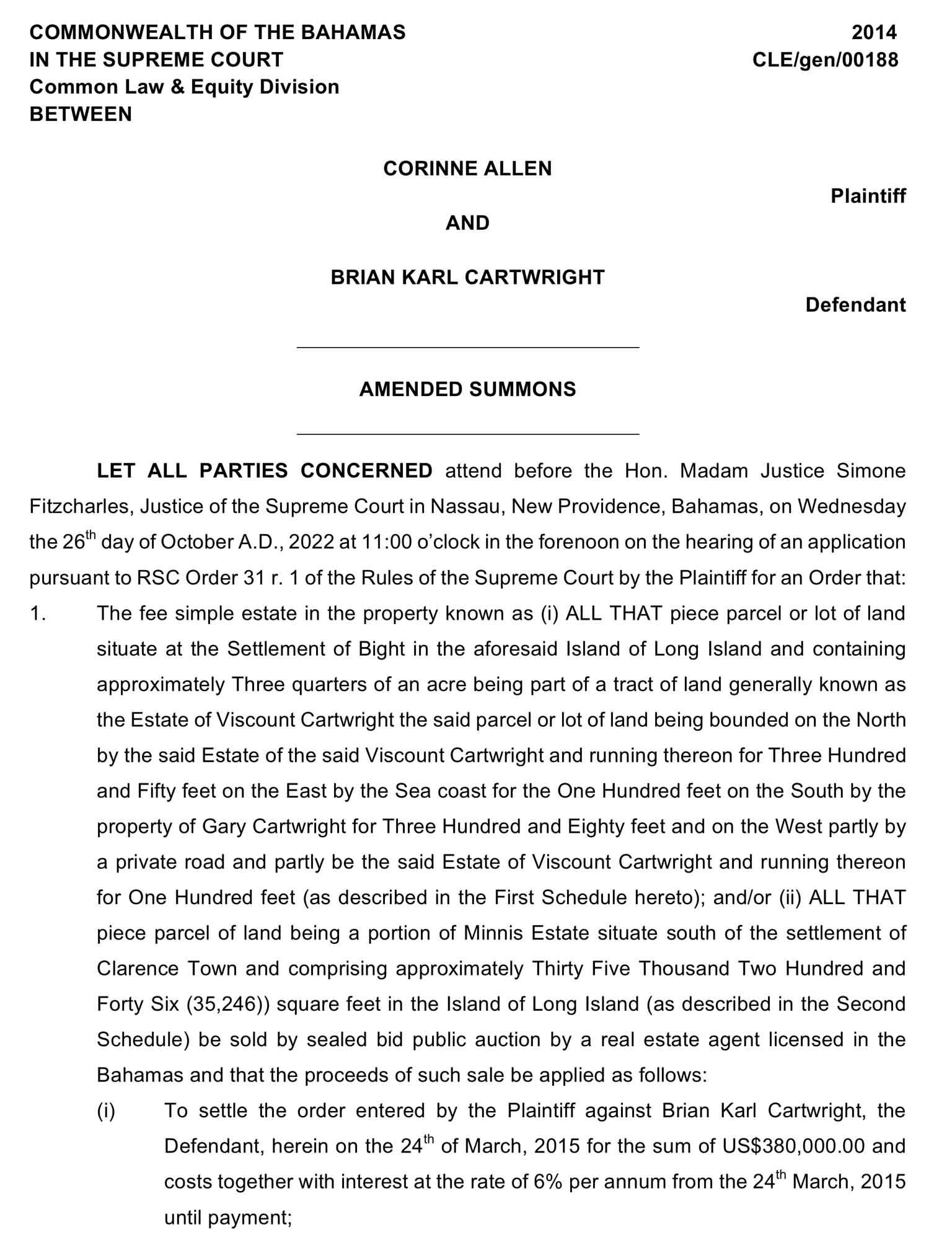

NOTICE FRIDAY, 21 OCTOBER 2022 CLOSECHANGE%CHANGEYTDYTD% BISX ALL SHARE INDEX: 2631.634.820.18403.3918.10 BISX LISTED & TRADED SECURITIES 52WK HI52WK LOWSECURITY SYMBOLLAST CLOSECLOSECHANGE VOLUMEEPS$DIV$P/E YIELD 7.005.30 AML Foods Limited AML 6.95 6.950.00 0.2390.17029.12.45% 53.0039.95 APD Limited APD 39.95 39.950.00 0.9321.26042.93.15% 2.761.60Benchmark BBL 2.76 2.760.00 0.0000.020N/M0.72% 2.462.20Bahamas First Holdings Limited BFH 2.46 2.460.00 0.1400.08017.63.25% 2.852.15Bank of Bahamas BOB 2.85 2.850.00 4000.0700.000N/M0.00% 6.205.75Bahamas Property Fund BPF 6.20 6.200.00 1.7600.000N/M0.00% 10.058.78Bahamas Waste BWL 8.78 8.780.00 0.3690.26023.82.96% 4.342.82Cable Bahamas CAB 4.34 4.340.00 -0.4380.000-9.9 0.00% 10.657.25Commonwealth Brewery CBB 10.25 10.250.00 0.1400.00073.20.00% 3.652.27Commonwealth Bank CBL 3.50 3.500.00 0.1840.12019.03.43% 8.516.01Colina Holdings CHL 8.23 8.230.00 0.4490.22018.32.67% 17.5010.25CIBC FirstCaribbean Bank CIB 16.00 16.000.00 0.7220.72022.24.50% 3.251.99Consolidated Water BDRs CWCB 3.23 3.320.09 0.1020.43432.513.07% 11.289.25Doctor's Hospital DHS 10.50 10.500.00 0.4670.06022.50.57% 11.6711.25Emera Incorporated EMAB 8.88 9.160.28 0.6460.32814.23.58% 11.5010.00Famguard FAM 10.85 10.850.00 0.7280.24014.92.21% 18.3014.05Fidelity Bank (Bahamas) Limited FBB 18.10 18.100.00 0.8160.54022.22.98% 4.003.50Focol FCL 4.00 4.000.00 0.2030.12019.73.00% 11.509.01Finco FIN 11.00 11.380.38 1,0000.9390.20012.11.76% 16.5015.50J. S. Johnson JSJ 15.50 15.500.00 0.6310.61024.63.94% PREFERENCE SHARES 1.001.00Bahamas First Holdings PreferenceBFHP 1.00 1.000.00 0.0000.0000.0000.00% 1000.001000.00 Cable Bahamas Series 6 CAB6 1000.001000.000.00 0.0000.0000.0000.00% 1000.001000.00 Cable Bahamas Series 9 CAB9 1000.001000.000.00 0.0000.0000.0000.00% 1.001.00Colina Holdings Class A CHLA 1.00 1.000.00 0.0000.0000.0006.25% 10.0010.00Fidelity Bank Bahamas Class A FBBA 10.0010.000.00 0.0000.0000.0007.00% 1.001.00Focol Class B FCLB 1.00 1.000.00 0.0000.0000.0006.50% CORPORATE DEBT - (percentage pricing) 52WK HI52WK LOWSECURITY SYMBOLLAST SALECLOSECHANGEVOLUME 100.00100.00Fidelity Bank (Note 22 Series B+)FBB22 100.00100.000.00 100.00100.00Bahamas First Holdings LimitedBFHB 100.00100.000.00 BAHAMAS GOVERNMENT STOCK - (percentage pricing) 115.92104.79Bahamas Note 6.95 (2029) BAH29 107.31107.310.00 100.00100.00BGS: 2014-12-7Y BG0107 100.00100.000.00 100.00100.00BGS: 2015-1-7Y BG0207 100.00100.000.00 100.00100.00BGS: 2014-12-30Y BG0130 100.00100.000.00 100.00100.00BGS: 2015-1-30Y BG0230 100.00100.000.00 100.00100.00BGS: 2015-6-7Y BG0307 100.00100.000.00 100.00100.00BGS: 2015-6-30Y BG0330 100.00100.000.00 100.00100.00BGS: 2015-10-7Y BG0407 100.00100.000.00 103.49103.49BGRS FX BGR118027 BSBGR1180276102.70102.700.00 100.66100.60BGRS FX BGR142241 BSBGR1420417100.66100.660.00 99.9599.30BGRS FX BGR142251 BSBGR142051699.9599.950.00 99.9599.95BGRS FL BGRS91032 BSBGRS91032499.9599.950.00 100.57100.11BGRS FL BGRS95032 BSBGRS950320100.45100.450.00 100.5299.96BGRS FL BGRS97033 BSBGRS970336100.19100.190.00 100.0089.62BGRS FX BGR129249 BSBGR129249389.6289.620.00 100.0089.00BGRS FX BGR131249 BSBGR1312499100.00100.000.00 100.9890.24BGRS FX BGR132249 BSBGR1322498100.00100.000.00 100.0090.73BGRS FX BGR136150 BSBGR1361504100.00100.000.00 MUTUAL FUNDS 52WK HI52WK LOW NAV YTD%12 MTH% 2.552.11 2.552.24%4.01% 4.833.30 4.833.42%7.26% 2.241.68 2.241.70%2.82% 207.86164.74 197.44-2.97%-2.35% 212.41116.70 202.39-4.72%6.04% 1.751.70 1.751.96%2.84% 1.911.76 1.914.83%7.23% 1.871.77 1.873.48%4.44% 1.050.96 0.96-6.57%-8.29% 9.376.41 9.37-0.02%10.36% 11.837.62 11.79-0.33%18.23% 7.545.66 7.540.22%3.05% 16.648.65 15.94-3.89%14.76% 12.8410.54 12.47-1.04%-2.57% 10.779.57 10.740.81%4.20% 10.009.88 N/AN/AN/A 10.438.45 10.433.00%25.60% 14.8911.20 14.897.90%48.70% MARKET TERMS BISX ALL SHARE INDEX - 19 Dec 02 = 1,000.00 YIELD - last 12 month dividends divided by closing price - Highest closing price in last 52 weeks Bid $ - Buying price of Colina and Fidelity 52wk-Low - Lowest closing price in last 52 weeks Ask $ - Selling price of Colina and fidelity Previous Close - Previous day's weighted price for daily volume Last Price - Last traded over-the-counter price Today's Close - Current day's weighted price for daily volume Weekly Vol. - Trading volume of the prior week Change - Change in closing price from day to day EPS $ - A company's reported earnings per share for the last 12 mths Daily Vol. - Number of total shares traded today NAV - Net Asset Value DIV $ - Dividends per share paid in the last 12 months N/M - Not Meaningful P/E - Closing price divided by the last 12 month earnings TO TRADE CALL: CFAL 242-502-7010 | ROYALFIDELITY 242-356-7764 | CORALISLE 242-502-7525 | LENO 242-396-3225 | BENCHMARK 242-326-7333 5.95% 6.40% 4.31% 5.55% 15-Feb-2041 15-Feb-2051 17-Apr-2033 15-Apr-2049 4.37% 4.31% 15-Aug-2032 25-Sep-2032 6.25% 30-Sep-2025 31-Mar-2022 FUND CFAL Bond Fund CFAL Balanced Fund CFAL Money Market Fund CFAL Global Bond Fund 6.25% 4.50% 6.25% 4.25% NAV Date 5.65% 5.69% 4.82% 15-Dec-2021 30-Jul-2022 15-Dec-2044 30-Jul-2045 26-Jun-2022 26-Jun-2045 15-Oct-2022 29-Jul-2022 21-Apr-2050 13-Oct-2027 15-Oct-2049 31-Mar-2021 31-Jan-2022 31-Jan-2022 31-Aug-2022 31-Jan-2022 31-Jan-2022 31-Jan-2022 31-Jan-2022 31-Aug-2022 31-Aug-2022 INTEREST Prime + 1.75% MARKET REPORT 31-Mar-2021 31-Mar-2021 MATURITY 19-Oct-2022 20-Nov-2029 31-Jul-2022 31-Jul-2022 6.95% 4.50% 31-Mar-2022 31-Aug-2022 4.50% 6.25% 5.60% 15-Jul-2049 Colonial Bahamas Fund Class D Colonial Bahamas Fund Class E Colonial Bahamas Fund Class F CFAL Global Equity Fund Leno Financial Conservative Fund Leno Financial Aggressive Fund Leno Financial Balanced Fund Leno Financial Global Bond Fund RF Bahamas Opportunities Fund - Secured Balanced Fund RF Bahamas Opportunities Fund - Targeted Equity Fund RF Bahamas Opportunities Fund - Prime Income Fund RF Bahamas International Investment Fund Limited - Equities Sub Fund RF Bahamas International Investment Fund Limited - High Yield Income Fund RF Bahamas International Investment Fund Limited - Alternative Strategies Fund (242)323-2330 (242) 323-2320 www.bisxbahamas.com

NOTICE CALL 502-2394 TO ADVERTISE

the case to trial “expedi tiously” following a legal fight that has been raging since December 2018.

And Justice Klein issued the injunction on the basis that contamination of Grand Bahama Utility Company’s wellfields with salt water from Dorian’s storm surge meant it was unable to supply customers with a “wholesome water quality” for several years post-storm.

The Supreme Court, which was only required to find the Association had an arguable case, and did not rule on the merits of the action, said assertions of an “inferior water supply” could impact the amount of outstanding arrears owed to the Grand Bahama Utility Company, create a potential claim for damages and, pos sibly, provide the basis to resist disconnection.

Describing this as “a seri ous issue to be tried” by hearing the Association’s substantive case, Justice Klein said the injunction should also be granted given that the condo complex would “suffer far greater harm” than Grand Bahama Utility Company, a member of the Grand Bahama Port Authority (GBPA) Group of Companies, if it were refused.

“The injunction is sought to restrain the first

defendant, the Grand Bahama Utility Company (GB Utility), from discon necting water and sewerage services to the condominium property managed by the plaintiff pending trial of the claims for declaratory and other relief,” Justice Klein’s verdict said. “GB Utility claims to be entitled to dis connect the supply over an outstanding bill of nearly $300,000.”

The Association first sought an injunction to pre vent Grand Bahama Utility Company from disconnect ing its water and sewerage supplies via legal action that was initiated on Decem ber 17, 2018. Then-Justice Keith Thompson ultimately granted that relief at an April 9, 2019, hearing where only the condo complex’s attorneys were present and no reasons for the decision were provided.

Justice Klein, in his verdict, noted that the out standing bill owed to Grand Bahama Utility Company had accumulated during a ferocious legal battle within the Association itself over which one of two separate Boards of residents was to head the complex. Besides splitting the residents into duelling factions, this also resulted “in near paralysis” of the Association and “crip pled” its finances.

Pointing to this back ground, Justice Klein wrote:

“The claim for injunctive relief arises in somewhat unusual circumstances. Firstly, it concerns the pro vision of utilities in the unique constitutional con text of the Hawksbill Creek Agreement.....

“Secondly, this is a renewed application for an injunction by the plaintiff following the discharge of an earlier injunction that had been granted to restrain GB Utility from disconnect ing the supply. Curiously, the first injunction was imposed pending the dis position of outstanding litigation between members of the Association and was not based on any claim then articulated against the first defendant. Subsequently, the Association pleaded dis crete claims against the GB Utility.”

GB Utility, “concerned that the Association’s account was falling fur ther into arrears”, sought to have the initial injunc tion imposed by Justice Thompson discharged via legal papers filed on Octo ber 30, 2019. However, the COVID-19 pandemic inter vened before the case could be heard by the Supreme Court, and GB Utility sus pended disconnection of customer accounts in any event.

Having granted the Asso ciation extra time to file the substantive merits of

its claim against GB Util ity, due to the delays caused by COVID-19 and Dorian, Justice Klein then turned his attention to whether it had raised “a serious issue” worthy of determination at a full trial.

He turned first to its claims of “nonfeasance and ultra vires” conduct against GB Utility relating to the “duties and obligations” it was alleged to owe custom ers by virtue of Freeport’s founding treaty, the Hawks bill Creek Agreement. “The gravamen of the complaint is that the GBPA failed to pro mote bye-laws to authorise the provision of the utili ties. This, the plaintiff says, is mandated by the Hawks bill Creek Agreement,” the judge wrote.

“The main claim is that the supply of water and sew erage services by GB Utility, and the imposition of fees and penalties in relation to such supply, is unlaw ful in the absence of any law authorising the same.”

Meryl Glinton, the Associa tion’s attorney, alleged that the Hawksbill Creek Agree ment and related Acts “were only enabling” and did not give the GBPA and GB Util ity statutory authority to provide water and other util ity services in the Port Area.

As a result, the Asso ciation alleged that disconnection and the impo sition of other penalties was

unlawful in the absence of bye-laws permitting the same. But Edward Marshall III, GB Utility’s attorney, denied that there was any issue worthy of trial, arguing that his client was empow ered by the Hawksbill Creek Agreement which itself has statutory force.

Justice Klein, finding in GB Utility’s favour on this point, said GB Utility’s right to disconnect for nonpayment does not depend on legal authority. “In other words, the outcome of this case could never be that the first defendant could be enjoined from disconnecting supply because of the want of bye-laws,” he added.

The Supreme Court also dismissed concerns over whether GB Utility could charge 10 percent VAT on its bills or if it could increase rates by only seeking per mission from the GBPA.

The Association, though, enjoyed more success over its assertions that GB Utility’s supply was “substandard and non-potable” for several years due to “contamination from hurri cane damage”.

“The first defendant [GB Utility] did not address any arguments as to whether the issue of water quality raised a serious issue to be tried between the parties. Signifi cantly, it did not deny that the water was non-potable for certain periods, although

it contends that quality had been restored before the date of the first hearing of the injunction application [on] 23 November, 2021,” Justice Klein wrote. “Thus, although the alle gations in the pleadings are not specific, it is possible to perceive a cause of action in the draft [claim] sounding either in breach of contract or breach of statutory duty, or otherwise at common law, for failure to provide whole some water of the quality indicated.

“Moreover,the plaintiff has indicated that it intends to argue whether GB Util ity is entitled to charge for non-potable water, and/or whether such charges and fees ought to be adjusted and/or are reasonable in such circumstances. As indicated, the claim does contemplate potential dam ages payable for inferior water supply. I am, there fore, prepared to resolve this issue in favour of the plain tiff and conclude that there is a serious issue to be tried here.

“If the plaintiff is right and the court has no impressions of the merits of the claim at this point it could affect the amount of the arrears owed based on any possible adjustments and, as indicated, might possibly ground a claim for damages. This state of affairs conceivably creates an equitable right to pre vent disconnection pending the determination of those issues.” Hence the injunc tion was granted.

marine Forecast

tiDes For nassau

Today

Wednesday Thursday

Friday Saturday Sunday

7:32 a.m.

1:20 a.m. 0.3 7:48 p.m. 3.0 1:52 p.m. 0.3 8:14 a.m. 3.5 1:58 a.m. 0.1 8:30 p.m. 3.0 2:36 p.m. 0.2 8:56 a.m. 3.6 2:38 a.m. 0.0 9:13 p.m. 2.9 3:22 p.m. 0.1 9:41 a.m. 3.6 3:19 a.m. 0.0 9:58 p.m. 2.8 4:09 p.m. 0.1

10:29 a.m. 3.6 4:04 a.m. 0.0 10:48 p.m. 2.7 4:59 p.m. 0.2 11:21 a.m. 3.5 4:53 a.m. 0.1 11:42 p.m. 2.6 5:54 p.m. 0.4 12:18 p.m. 3.4 5:48 a.m. 0.2 6:54 p.m. 0.5

sun anD moon

THE TRIBUNE Monday, October 24, 2022, PAGE 9

DORIAN BLOCKS $300,000 UNPAID WATER BILL CUT-OFF FROM PAGE B1 Shown is today’s weather. Temperatures are today’s highs and tonight’s lows. ORLANDO Low: 63° F/17° C High: 85° F/29° C TAMPA Low: 66° F/19° C High: 85° F/29° C WEST PALM BEACH Low: 69° F/21° C High: 85° F/29° C FT. LAUDERDALE Low: 71° F/22° C High: 84° F/29° C KEY WEST Low: 75° F/24° C High: 83° F/28° C Low: 73° F/23° C High: 85° F/30° C ABACO Low: 72° F/22° C High: 83° F/28° C ELEUTHERA Low: 72° F/22° C High: 85° F/29° C RAGGED ISLAND Low: 76° F/24° C High: 84° F/29° C GREAT EXUMA Low: 75° F/24° C High: 85° F/29° C CAT ISLAND Low: 74° F/23° C High: 84° F/29° C SAN SALVADOR Low: 75° F/24° C High: 83° F/28° C CROOKED ISLAND / ACKLINS Low: 76° F/24° C High: 84° F/29° C LONG ISLAND Low: 75° F/24° C High: 84° F/29° C MAYAGUANA Low: 76° F/24° C High: 83° F/28° C GREAT INAGUA Low: 76° F/24° C High: 84° F/29° C ANDROS Low: 73° F/23° C High: 85° F/29° C Low: 73° F/23° C High: 83° F/28° C FREEPORT NASSAULow: 71° F/22° C High: 84° F/29° C MIAMI THE WEATHER REPORT 5-Day Forecast Partly sunny and pleasant High: 85° AccuWeather RealFeel 89° F The exclusive AccuWeather RealFeel Temperature® is an index that combines the effects of temperature, wind, humidity, sunshine intensity, cloudiness, precipitation, pressure and elevation on the human body—everything that affects how warm or cold a person feels. Temperatures reflect the high and the low for the day. Clear Low: 73° AccuWeather RealFeel 74° F Partly sunny and nice High: 85° AccuWeather RealFeel Low: 72° 92°-73° F Sunny and pleasant High: 84° AccuWeather RealFeel Low: 74° 89°-78° F Sunshine and patchy clouds High: 85° AccuWeather RealFeel Low: 73° 90°-76° F Sunshine with a stray thunderstorm High: 86° AccuWeather RealFeel 89°-76° F Low: 76° TODAY TONIGHT TUESDAY WEDNESDAY THURSDAY FRIDAY almanac High 84° F/29° C Low 74° F/23° C Normal high 84° F/29° C Normal low 72° F/22° C Last year’s high 88° F/31° C Last year’s low 70° F/21° C As of 2 p.m. yesterday 0.00” Year to date 49.58” Normal year to date 33.80” Statistics are for Nassau through 2 p.m. yesterday Temperature

Precipitation

New Oct. 25 First Nov. 1 Full Nov. 8 Last Nov. 16 Sunrise 7:13 a.m. Sunset 6:35 p.m. Moonrise 6:18 a.m. Moonset 6:15 p.m.

Tuesday

High Ht.(ft.) Low Ht.(ft.)

3.3

WINDS WAVES VISIBILITY WATER TEMPS. ABACO Today: NE at 8-16 Knots 3-6 Feet 10 Miles 82° F Tuesday: N at 4-8 Knots 3-5 Feet 10 Miles 82° F ANDROS Today: NE at 8-16 Knots 1-2 Feet 10 Miles 82° F Tuesday: NNE at 3-6 Knots 0-1 Feet 10 Miles 81° F CAT ISLAND Today: NNE at 6-12 Knots 3-5 Feet 8 Miles 85° F Tuesday: E at 3-6 Knots 3-5 Feet 10 Miles 85° F CROOKED ISLAND Today: NE at 7-14 Knots 2-4 Feet 8 Miles 85° F Tuesday: ENE at 4-8 Knots 2-4 Feet 10 Miles 85° F ELEUTHERA Today: NE at 8-16 Knots 3-6 Feet 10 Miles 84° F Tuesday: ENE at 2-4 Knots 3-5 Feet 8 Miles 84° F FREEPORT Today: NE at 10-20 Knots 2-4 Feet 10 Miles 82° F Tuesday: NNE at 6-12 Knots 1-3 Feet 10 Miles 81° F GREAT EXUMA Today: NE at 7-14 Knots 0-1 Feet 5 Miles 85° F Tuesday: E at 2-4 Knots 0-1 Feet 8 Miles 84° F GREAT INAGUA Today: NE at 6-12 Knots 1-3 Feet 6 Miles 85° F Tuesday: NE at 3-6 Knots 1-3 Feet 8 Miles 85° F LONG ISLAND Today: NE at 7-14 Knots 1-3 Feet 8 Miles 85° F Tuesday: E at 3-6 Knots 1-3 Feet 8 Miles 85° F MAYAGUANA Today: ENE at 7-14 Knots 3-5 Feet 6 Miles 84° F Tuesday: NNE at 3-6 Knots 3-5 Feet 6 Miles 84° F NASSAU Today: NE at 8-16 Knots 1-2 Feet 10 Miles 84° F Tuesday: NNE at 3-6 Knots 0-1 Feet 10 Miles 84° F RAGGED ISLAND Today: NE at 8-16 Knots 1-3 Feet 6 Miles 85° F Tuesday: NE at 3-6 Knots 1-2 Feet 8 Miles 85° F SAN SALVADOR Today: NE at 7-14 Knots 1-2 Feet 8 Miles 85° F Tuesday: ESE at 3-6 Knots 1-2 Feet 7 Miles 85° F uV inDex toDay The higher the AccuWeather UV Index number, the greater the need for eye and skin protection. Forecasts and graphics provided by AccuWeather, Inc. ©2022 H tracking map Shown is today’s weather. Temperatures are today’s highs and tonight’s lows. N S W E 8-16 knots N S W E 8-16 knots N S W E 10-20 knots N S W E 7-14 knots N S W E 7-14 knots N S W E 6-12 knots N S W E 8-16 knots N S W E 8-16 knots | Go to AccuWeather.com

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net