Old Fort Bay ‘torn’ by escalating fight

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

ONE of western New Providence’s most upscale communities is being “torn” apart through an escalating dispute triggered by demands that homeowners finance a 50 percent increase in security costs.

Multiple homeowners in the subdivisions that comprise Old Fort Bay, in interviews with Tribune Business, said they and their neighbours have steadily become more “soured and depressed” during a year which has literally seen the high-end community split in two.

They revealed that the disa greement over security fees has morphed into the closure of a gate that now prevents residents from roaming freely throughout their community, with one 30-year western New Providence homeowner and

Old Fort Bay dweller saying: “In all my years I have never seen anything like this ever. It’s really sad. Sad. Just sad.”

Old Fort Bay is effectively a collection of several subdivi sions. Besides Old Fort Bay itself, there is also the Islands of Old Fort that was devel oped by Orjan Lindroth, plus Lester Smith’s Bay Creek sec tion. After the Islands and Bay Creek homeowners declined to pay their share of the increased

security fees, on the basis that the 50 percent hike had not been justified, the Old Fort Bay Property Owners Associa tion’s Board ultimately reacted by closing the middle access gate.

This means that, for several months, Old Fort Bay residents have been unable to cross over into the Islands and Bay Creek sections and vice versa.

Homeowners in Islands and Bay Creek now have to jump

in their vehicles and drive to Old Fort Bay’s main entrance to visit the development’s club, for example, while their Old Fort Bay counterparts must do likewise to visit their sections via the access gate on Western Road.

Edward Chemaly, a Bay Creek homeowner, told Trib une Business the growing divisions “exploded” in early September after an Associa tion Board member threatened to block the boating access he and other residents enjoy to the community’s canal and waterway on the basis that they had not contributed to dredging and security costs.

While the Association sub sequently clarified it was not seeking to cut-off boat ing access, the episode has added to the growing ten sions and deepened Old Fort Bay’s divide. Mr Chemaly, and others, have alleged that the Association’s Board has

Bahamas cannot be blacklisting ‘pariah’

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE Bahamas will not risk becoming a global “pariah” by rejecting the countries and organisations that continue to ‘blacklist’ its financial services industry, a Cabinet minister asserted yesterday.

Jomo Campbell, minister of state for legal affairs, told

the House of Assembly that the Government will not heed the calls of those demand ing The Bahamas cut all ties with the likes of the European Union (EU) and Organisation for Economic Co-Operation and Development (OECD) because of how unfairly they treat this nation.

Speaking as MPs passed the first legal reforms aimed at addressing The Bahamas’ tax

co-operation deficiencies, he asserted: “It is incumbent on this government to safeguard our economy, and a large part of our economy is the financial services sector.

“There are some who think we should remove ourselves from the purview of interna tional organisations because of blacklistings and non-coop erative ratings. However, The

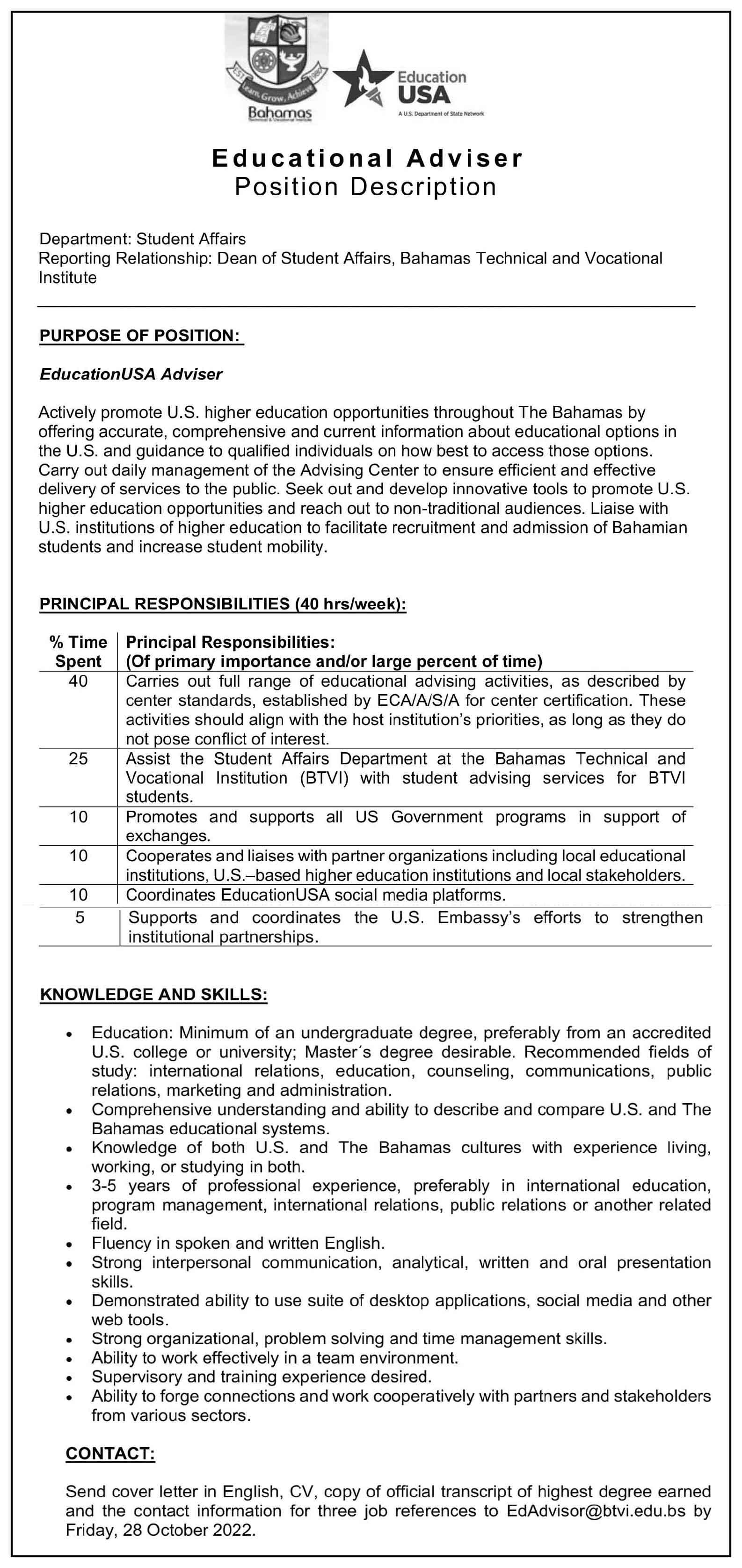

BTVI overpaid staff by nearly $100,000

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE Bahamas Techni cal and Vocational Institute (BTVI) potentially over paid its 135 staff by almost $100,000 over the ten months to end-July 2020, it was revealed yesterday.

The Auditor Gen eral’s Office, in a probe covering the three years to end-June 2021, called on the education facility to explain discrepancies that revealed a collective $95,596 more was paid out to staff over that period than was shown on the pay roll spreadsheet.

While BTVI’s bank statements disclosed that

$1.271m was paid in total employee salaries for seven months during that timespan, namely October, November and December 2019 and January, March, June and July 2020, its pay roll spreadsheet said only a collective $1.176m was due.

“We examined payroll totals for the period of October 15, 2019, through July 30, 2020,” the Audi tor General’s Office found.

“We observed a difference of $95,597. It is recom mended that the Institute provide an explanation for the difference of $95,597.”

No such explanation was forthcoming from BTVI management in response to

EU blacklist: ‘Square peg in round holes’

By NEIL HARTNELL and YOURI KEMP Tribune Business Reporters

THE Government and Opposition yesterday con tinued to trade blows over who was responsible for The Bahamas’ blacklisting by the European Union (EU) amid accusations a key reporting system “did not cut the mustard”.

Wayde Watson, the Min istry of Economic Affairs parliamentary secretary, told the House of Assembly that the Minnis adminis tration had sought to “put a square peg in a round hole” in trying to expand the Government’s existing

Revenue Management System (RMS) to handle the EU’s economic sub stance reporting demands.

However, Michael Pin tard, the Free National Movement (FNM) leader, said The Bahamas’ list ing for allegedly being non-cooperative on interna tional tax matters resulted from the Davis administra tion being “late again” and failing to follow through on the strategy left behind by the former administration to address the reporting deficiencies identified by the EU.

Food retailers ‘trying like hell’ for Friday solutions

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

BAHAMIAN food retailers were yesterday “trying like hell” to meet Friday’s deadline to produce an acceptable alternative to the Government’s “catastrophic” price control expansion.

Philip Beneby, the Retail Grocers Associa tion’s president, told Tribune Business that the industry was “working as hard as we can” to meet the tight timeline provided to come up with a solution agreeable to both sides as well as ease the cost of living crisis for Bahamian consumers.

Declining to provide details on any propos als for fear it will prejudice the outcome of negotiations with the Government, he indi cated that coming up with a workable plan by Friday will be challenging given the need to consult both Family Island food merchants as well as wholesalers to gain their input.

“All I can say is that we’re working as hard as we can to see if we can come up with a suit able solution and one that the Government could accept,” Mr Beneby told this newspaper.

“It’s not easy because we have to communicate with those in the Family Islands as well, and so we are trying as best we can to have it ready for Friday. It is a work in motion. It’s tight

“All I can say is we’re trying like hell to do so. We hope we do. Everybody is on board trying to work it out. It is a group effort, and we have to take consultation with the whole salers as well. Dozens, dozens of people are involved. We’ll have to see how it goes. I can’t say too much. We don’t want to aggravate it. We want everything to be done in good faith, and don’t want to pre-empt our efforts. We’re working, we’re working. Give us a chance; let us see what we can come up with.”

Mr Beneby spoke out after the Association warned, in a statement, that expanding price control by 38 product categories would poten tially cover up to 5,000 different line items due to the varieties involved. This would mark a major increase in products sold at a loss, or socalled loss leaders, with between 40-60 percent of a food store’s inventory covered by price control.

business@tribunemedia.net THURSDAY, OCTOBER 20, 2022

“While the Retail Grocers Association affirms its commitment to working with the

SEE PAGE B6

SEE PAGE B10 SEE PAGE B7

SEE PAGE B5 SEE PAGE B4

JOMO CAMPBELL

• Community ‘soured’ by 50% security fee hike row • And now sliced in two by access gate’s closure • Fears access and waterway rights trampled on $5.85 $5.88 $5.76 $5.79

IS PM’S

In the first article of this series, I raised the question as to whether “economic dignity” is an emerging philosophy with potential for spillover into the wider Caribbean. Here I raise another question as to whether there are leaders who have the conviction to act in this direction. Both, I believe, are important ques tions to contemplate.

As we look to the future and anticipate individual Caribbean countries, and the region as a whole, having greater economic influence and geo-political relevance, we must look at the extent to which people will expe rience sustained economic and social advances. This possibility, without question, will turn on the efficacy of leadership and the path such leaders pursue.

So when Prime Minister Philip Davis KC speaks to a particular approach or philosophy, it should not be ignored. The question that needs to be answered is the extent to which there is a full commitment and conviction to these ideas, and on what basis can such commitment be reasonably assessed.

Convicted by Experience

The Prime Minister, like others in the region, comes from reasonably humble beginnings. He currently enjoys the repu tation of being a great personality with the ability

Hubert edwards by

to connect to the ‘ordi nary man’s’ circumstances. How committed, therefore, should one anticipate he will be in marshalling the trans formation that will lead to a better day for such persons?

In leadership and public speaking, you learn that personal stories are the most effective means of connecting with an audi ence, developing credibility and authenticity. The Prime Minister, in common with others across the Caribbean, tells his personal stories often.

One such occasion was upon being sworn into office. He shared then: “As a young boy growing up in Cat Island, I faced many hardships and obstacles… As a young man trying to

DIGNITY’ FOCUS THE CLUE TO REFORM?

find his first job, I faced doors that seemed always slammed shut.. As a lawyer trying to build a practice, I missed out on many oppor tunities because I didn’t have the right connections. I know what it is like to be on the outside looking in...I am determined to take the wisdom gained from these experiences and use it to help others...”

Without question, this is a powerful overview of humble beginnings and life’s challenges. Given such life experiences one would reasonably anticipate there will be significant policies targeted at championing the cause of the people and, objectively, charting initia tives and programmes that help create a new environ ment, which will tackle the obstacles Mr Davis himself had to overcome.

The Connection

The pillars of “economic dignity” loom large when one considers the life expe riences that the Prime Minister shared. These are experiences that lesserresourced and less capable individuals are often unable to overcome. It is there fore not very difficult to understand why there is an attraction to the concept, and why it has seemingly become a central element of the Prime Minister’s eco nomic discourse.

The Prime Minister has outlined what I believe to be the desired outcome for his leadership. This is a desire to create circumstances in which there is greater eco nomic equity, a greater focus on human dignity, and a set of outcomes where, as he often states, “the many” benefit.

Seemingly, this is a desire to create circumstances built on the principle of govern ment being facilitative, with the individual responsible for their own heavy lifting, all heading towards greater economic equity. “Eco nomic dignity” appears to be the philosophy of choice to guide this effort.

If “economic dignity” as a concept is to become a real ity, it is my view that it will serve The Bahamas well to have a broad framework against which development can be forged, managed and measured to thus ensure a more balanced social and economic advancement.

While we must remain mindful that “economic dig nity” is largely an American concept, and is premised on a fundamentally different social and taxation frame work, there is no doubt it strikes at the core of a number of critical factors present in The Bahamas from pre-1967, which are still actively at play and are debilitating to national development.

In his University of The Bahamas lecture, the Prime Minister recog nised that elements such as the Government’s failure to fully support the private sector and an entrenched status quo have existed for more than 50 years. This honest acknowledgement should feature prominently in considering how to chart the way forward. It will be important, therefore, that the values driving future performance are effective in countering the obstacles to more persons benefiting from The Bahamas’ contin ued development.

It is critical that the coun try realise greater equity in opportunities for persons across all socio-economic groupings to pursue their individual dreams and thrive. It is only when the broadest swathe of citizens and residents have oppor tunities to reach their full potential that The Bahamas’ growth and development will be optimised.

This clues us in on the fact that the Prime Minis ter might have a view that reform is necessary, and this is to facilitate wealth creation among Bahami ans who have previously been locked out of such opportunities.

Conclusion

Would it be reason able to conclude that the Prime Minister’s intent is to

change, or at least influence, the trajectory and output of governance in The Baha mas? Gene Sperling, when challenged on the idea that Obama’s focus on health care was a distraction from focusing on the economy, asked whether “the fear felt by millions of Americans of being one serious illness away from financial ruin was not considered an economic issue”.

Sperling often speaks to the fact that we measure economic success by met rics such as GDP, instead of determining whether the economy is succeeding in lifting up the sense of mean ing, purpose, fulfillment and security of people. No doubt The Bahamas and wider Caribbean could easily align with this ideal.

By invoking the idea of “economic dignity”, is this a clear signal of how the trajectory will change? Have the Prime Minis ter’s personal experiences rendered him sufficiently convinced to follow through on these ideas and thinking? Are there clues to be gleaned from his clos ing statement, when he said: “National develop ment needs us all to pull together for the betterment of everyone. By working in partnership, we can spend the next 50 years building

PAGE 2, Thursday, October 20, 2022 THE TRIBUNE

‘ECONOMIC

SEE PAGE B12

LIVEABLE WAGE NOT POSSIBLE WITHOUT PRODUCTIVITY BOOST

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

A CABINET minis ter yesterday warned that achieving a “liveable wage” will not be possible unless there is an improvement in Bahamian worker productiv ity and business efficiency.

Keith Bell, minister for labour and immigration, told the House of Assem bly that the 24 percent minimum wage increase to $260 per week was viewed by the Davis administra tion as merely another step towards the ultimate goal of

introducing a so-called live able wage that will enable all workers and their families to cover their living costs.

He conceded, however, that the “transition” from a minimum to a liveable wage will take time and gave no indication for how long this may take. Referring to the University of the Baha mas (UoB) study on what would be a “liveable wage” for New Providence and Grand Bahama respectively, Mr Bell said: “The report was viewed by some as unreasonable.

“However, in my view it is hard to challenge the num bers, hard to challenge the

methodology, and hard to dismiss the conclusions, and nor should we. Whilst it is not possible to move to a liveable wage immediately, it is the view of this Davisled Progressive Liberal Party (PLP) government that it is a goal we should seek to tran sition to a liveable wage over time......

“I especially emphasise that the transition to a live able wage over time can only be implemented if there’s an increase in efficiency and productivity.” The UoB study, published in 2021, pegged a “liveable wage” at which a worker can sus tain a family of four at $2,625

per month for New Provi dence and $3,550 for Grand Bahama.

This translated to a net monthly liveable wage of $2,500 per month for New Providence, and $3,400 on Grand Bahama. Mr Bell said: “It is notable that the report’s estimates are almost 200 percent higher than the minimum wage and nearly 130 percent higher than the poverty line for New Provi dence. For Grand Bahama, it is almost 300 percent higher than the minimum wage and 160 percent higher than the poverty line.”

The minister added that worker productivity

“must increase”, advocat ing increased education and training, as well as the need to “work smarter and use more efficient technology to assist us to be more pro ductive in the workplace.

Employees must be com mitted to carrying out their duties to a high standard in the businesses in which they are employed.”

Mr Bell argued that the Government had managed to strike “a balancing act between various competing interests” with the private sector minimum wage rise, which will increase by $50 per week from the current $210 come January 1, 2023,

Digital assets summit seeks to attract 3,000

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE SECURITIES Commission yesterday con firmed it has teamed with the Government to host a three-day digital assets summit at Atlantis in Janu ary that aims to attract some 3,000 industry leaders.

The regulator, in a statement, said the FinTech (financial technology) and Web3 Fes tival will be branded as D3 Bahamas. This stands for Decentralised; Digital; Dis ruptive. The conference has been designed to shape global, regional and indus try agendas in areas such as Web3, digital/crypto assets, decentralised finance (DeFi), Central Bank digital currencies (CBDC), green finance and more.

Senator Michael Halki tis, minister of economic affairs, said: “The Gov ernment is aiming to substantially grow the digital assets sector in The Bahamas and, through this festival, bring FinTech thought lead ers, entrepreneurs,

enthusiasts and people with a deep interest in this space to our shores.”

Christina Rolle, the Securities Commission’s executive director, added: “The Commission is pleased to collaborate with the Government in hosting D3 Bahamas. The festival represents a proactive ini tiative by the Commission to lead the regulatory discus sion about FinTech, and to address solutions that will inform the future of FinTech and Web3 in The Bahamas and globally.”

D3 Bahamas will have five different elements. The first will involve a regu latory showcase, where global supervisors con vene to share information, knowledge and experiences related to FinTech and to collaborate on regulating digital assets issues, trends and risks.

There will also be a ven ture capital forum, where active investors set the agenda for 2023 and tackle issues limiting the growth and adoption of FinTech and Web3. 3. Technology com panies in the Web3 space

will also compete for up to $1m in funding, while a focus will also be placed on opportunities for Bahamian professionals in sectors such as law, accounting, real estate, tourism, sports and the arts. The conference will also feature 50 networking events.

D3 Bahamas is being organised by Finnoverse, a firm that has been organis ing the Hong Kong FinTech Week since 2015. Anthony

Sar, its chief executive and founder, said: “We are pleased to collaborate with the Government of The Bahamas and the Com mission to expand our international FinTech exper tise with D3 Bahamas.

“The event will focus on three global trends reshap ing financial services today: Digitalisation, decentrali sation and disruption. As more global computing

OFFICE SPACES FOR RENT

SPACES

the

power has driven down computing costs, all-things digital are more possible than ever and decentrali sation will help ‘solve for trust’ the challenges that blockchain overcomes.

as the Davis administration moves on multiple fronts to ease the cost of living crisis faced by thousands of middle and low income Bahamians.

“In the past week, vari ous arguments have been made from various sectors about the sum of $260,” Mr Bell added. “I wish to make it clear to employees who work incredibly hard and cannot survive off $210 per week: The Government is not saying that you should only earn $260 or that sum is adequate. The Govern ment recognises that, in time, the minimum wage will

“This space is poised for continued disruption, as the technology and teams that power tomorrow’s solutions with investment, competi tion and innovation come together at D3 to discuss what’s possible through out the digital economy ecosystem.”

Help Wanted

Established technology company based in Nassau is seeking candidates for the position of Network Administrator

Minimum of five years experience with ability to deploy, configure, maintain and monitor all active network equipment in order to ensure smooth network operation.

2-5 years of working with Windows Server 2008 and up, supporting Exchange Server 2013 and up and O365/Hosted Exchange, strong Windows 7 & 10 desktop support.

Knowledge of VMware ESXi and Cisco routing and switching a plus.

of

Must have your own transportation.

Please send responses to resourcesit2@gmail.com

THE TRIBUNE Thursday, October 20, 2022, PAGE 3

SEE PAGE B13

10” X 10” OFFICE

available at

Harbour Bay Plaza in

Peachy Flamingo Ltd. unit as

December 2022. Rent is set at $950.00 excluding VAT, per month All interested persons should contact Jason Pinder @ Jpinder@stargeneralnp.com

Old Fort Bay ‘torn’ by escalating fight

been “hijacked” - all used this word - by a minority of directors who have adopted a “take or leave it attitude” to the changes being forced through and imposed on residents.

There are fears that the dispute is now starting to undermine real estate values in Old Fort Bay, with poten tial buyers looking to Albany and rival western New Provi dence high-end communities as details of the community’s divisions start to leak out into the market.

One Bahamian realtor who regularly handles Old Fort Bay property sales, speaking on condition of anonymity, told this newspa per: “This is not good in any way, shape or form for values of the entire community.

I’ve had Swiss bankers say they’ve gone over to Albany because of the discord and fractious nature of this com munity. Word is getting out. It’s having a really negative effect.”

Tribune Business sent a detailed list of written ques tions to both Sean Andrews, the Old Fort Bay Prop erty Owners Association’s chairman, and Bert Krista, another Board member, earlier this week in a bid to give the Association an opportunity to respond to the concerns, allegations and criticism levied against it.

However, no reply was received from the Board or either man before press time

last night. Phone calls and e-mails to Vanessa Carlino, of Carlino & Company, an attorney who represents the Association’s Board, were also not answered prior to deadline.

Several homeowners, though, have voiced suspi cion that the Association’s actions may be rooted in its ongoing nine-year legal battle with Old Fort Bay’s developer, New Providence Development Company, which has now reached the Court of Appeal.

They say the Association began asking Islands and Bay Creek to close their access gate to Lyford Cay residents early in the New Year, which coincided with when Justice Indra Charles ruled that New Providence Development Companyand not the Association - is the true and lawful owner of the Old Fort Bay Club and the development’s marina.

Many Lyford Cay resi dents are also members of the Old Fort Bay Club, and the homeowners believe the closure request - and now the middle access gate clo sure - are designed to get back at New Providence Development Company and its principal, Terry White.

They also feel that, rather than finance security, the fees increase was instead designed to fund the Asso ciation’s legal costs and the addition of new amenities at Old Fort Bay.

While neither assertion can be confirmed, Tribune

Business sources have veri fied that the Old Fort Bay Club, and New Providence Development Company, have initiated another legal action against the Asso ciation to prevent access by club members from being blocked or restricted.

One, speaking on condi tion of anonymity, said the closure of Old Fort Bay’s “middle gate” is trampling across “rights of way” and access that all homeowners have by virtue of being com munity residents. “The Old Fort Bay Property Owners Association have closed one of the gates that run across a road that joins the two com munities, there are people that have rights of way over that road that the Associa tion is not respecting,” they said.

“For example, the Old Fort Bay Club. Its members have a right to go to and fro across that road from their properties to the Old Fort Bay Club. It’s a way for them to get to the Club without driving on the main road. The Association have taken it upon themselves to deter mine who can cross that road, and they don’t have the right to do that.

“The legal title to that road is not vested in them. When that road was built, people were given rights of way over that road. Each property owner has a right of way over that road. The Association doesn’t have the right to block anybody.”

Islands and Bay Creek homeowners have informed this newspaper that the middle access gate has been closed for between one-anda-half to four months. They argue that if the Associa tion has security concerns, it

MUSIC PRIMARY TEACHING JOB OPPORTUNITIES

MUSIC teacher needed.

A pre-eminent, well-established, independent, international school in Nassau is seeking a full-time qualified MUSIC TEACHER. Candidates should have sound classroom experience; a passion for innovative education; a professional attitude towards work; a friendly and cooperative disposition; a willingness to work in a team environment; a determination to grow professionally; and strong communication & organisational skills.

Successful candidates will be required to:

● Prepare and deliver well-planned learning experiences and curricula

● Differentiate curriculum objectives to support a diverse range of learners

Show

classroom management skills

reports

could simply issue tran sponders to all 265 home and lot owners within the entire development to facilitate remote-controlled access.

And they suggested that the closure is potentially “dangerous” to the Asso ciation’s own members in Old Fort Bay proper. Now unable to access Western Road via the Islands/Bay Creek gate to take their chil dren to Lyford Cay school by golf cart, those parents now face having to exit via the congested main gate and roundabout, and deal with heavy traffic - something that will almost certainly force them to travel by car.

The Islands’ own property owners association detailed its concerns in a May 5, 2022, letter to their fellow home owners in Old Fort Bay proper. In particular, they noted how - despite repeated requests - the Association’s Board had failed to provide the supporting documenta tion to justify the surge in security costs from $1.587m per year to $2.375m, espe cially when a contract at the former figure had been signed just over one year previously.

“We find it extremely unsettling that your Board seems determined to physi cally divide our community, and want to share what we know about the situation so that each of you can be fully informed and perhaps question the wisdom of [the Association’s] actions,” Old Fort Bay property owners were told.

“As you know, this issue emerged out of the blue (without any prior discus sion) in late March when the Association threatened to close the ‘middle gate’, blocking access for Islands residents into Old Fort Bay and vice versa. Several rea sons surfaced for this action. One was because Islands had not paid for security, which was a false claim that

was quickly discredited and disappeared from the discussion.

“Other reasons included blocking access to Old Fort Bay property owners associ ation amenities or simply an attempt to extract a higher than the recently-agreed fee for security services.

Increasing security fees now appears to be the primary motive, and we have recently been presented with a 50 percent price increase and a reduction in services without supporting details.”

The increase would have resulted in all homeowners, including in Islands and Bay Creek, paying an average of $9,000 per homeowner per year for security based on 265 total lots. Islands and Bay Creek together account for 80 lots, and the letter pointed out that this repre sented a 50 percent increase to the price that was agreed with the Old Fort Bay Asso ciation’s Board as recently as January 2021.

“Given that this rate is a huge increase compared to the agreed amount one year ago, we would like to see the justification for the increase and guess that you would like to see the same,” the Islands homeowners wrote.

“This massive increase comes with a reduction in services in the form of no access to the service gate. This adds additional cost to Islands and Gruntsfield (Bay Creek) from having to build and staff a new service gate.

“We are shocked that such an increase with reduced ser vices is warranted, despite current inflation rates. We guess that you may be sur prised too. Many of you are successful businesspeo ple, so we think you would agree that it is unreasonable for a supplier to present a customer or a joint venture partner to present another partner with a 50 percent cost increase in a year and a

reduction in services without explanation......

“Islands and Gruntsfield/ Bay Creek would very much like for the status quo to remain in our community. We are sure most of you will agree that it is a great ben efit to all to be able to move freely through the entire community to commute safely to school and work by golf cart, to visit friends and exercise without going on to the main Western Road. We are prepared to take reasonable steps and have reasonable discussions to achieve this.”

Mr Chemaly told Trib une Business that the gate closure has “severed ties” that bound Old Fort Bay together as one community. Islands and Bay Creek are presently paying for their own security, in the absence of an agreement with the Association, and he added: “The atmosphere is terrible. A lot of people are bitter. A lot of people have said how sad it is, putting up walls and barriers.... It’s a take it or leave it attitude. It’s just not right the way it is.”

Another homeowner, speaking on condition of anonymity, added: “Hon estly I think it’s really soured and depressed the entire environment in here. My children used to ride their bikes throughout the community. Now it’s not a community. It’s two com munities the way they have it set up. They have really killed what was a family community. It feels like a torn community in my opin ion. Our side is completely in agreement with opening that gate.”

And an Islands resident, also speaking on condition of anonymity, said: “Old Fort Bay, Islands and Bay Creek were designed to have a symbiotic relationship, not to have this separation.... It’s such a shame for the whole western community. Some of our members are mem bers at Lyford Cay, and vice versa.

“This is ruining the club, ruining the community, dividing the community. It’s just plain sad for families in Old Fort Bay, Islands and Bay Creek. It’s just sad for everybody. It’s very upset ting, it’s not neighbourly and not what you would expect of a Property Owners Asso ciation Board today. It’s not community-minded.”

PAGE 4, Thursday, October 20, 2022 THE TRIBUNE

FROM PAGE B1

●

consistent, compassionate,

● Assess student learning and produce detailed

● Use learning data to inform and adapt instruction ● Contribute to the co-curricular programme and whole-school activities in a committed and enthusiastic manner ● Maintain high standards of professionalism ● Communicate positively with parents, staff, and administration Please Forward your resume and introduction letter by email to teachingbahamas@gmail.com Used like new Office Furniture in good condition, wooden desks, metal desks, leather chairs, cubicle sets, metal file cabinets, wooden file cabinets and conference tables for sale. Only serious enquiries Call 424-8270 FOR SALE Manufacturing business with product brand for sale. All machinery/equipment necessary for immediate start-up provided. Also included are raw materials and packaging. For information contact (242) 727-7668 MANUFACTURING BUSINESS FOR SALE

BAHAMAS CANNOT BE BLACKLISTING ‘PARIAH’

Bahamas has no intention of taking on pariah status when it comes to interna tional best practice and compliance. It is necessary for this administration to ensure we maintain proper monitoring, compliance and reporting to remain in good standing.”

Several prominent fig ures, including Branville McCartney, the former Democratic National Alli ance (DNA) leader, have suggested that The Baha mas should tell the EU to “go to hell” over the per ceived injustice associated with its continued blacklist ing assault on The Bahamas for alleged non-coopera tion on international tax matters.

Yet the reality, as Mr Campbell suggested, is that The Bahamas likely has little choice but to comply with their demands given that it depends on access to the financial services markets of the EU’s 27 members to attract clients, business and investments.

The minister added that the Government is exploring “every avenue” to minimise the EU

blacklisting’s impact on the Bahamian financial services industry while it works to resolve the bloc’s concerns and escape such status. Individual EU coun tries are being “engaged” on the matter, although he declined to name the nations involved.

Bahamian insurers, as reported by Tribune Busi ness, have already voiced fears that the EU blacklist ing threatens to increase local insurance rates and reduce the availability of hurricane coverage locally.

This is because Germany has enacted a law designed to deter business with socalled “tax havens”, yet three German reinsur ers - Munich Re, Hanover Re and R & V Re - are among the biggest partners for Bahamian insurers in underwriting local risks.

Mr Campbell, mean while, affirmed that the EU blacklisted The Baha mas because it was unable to correct deficiencies in its economic substance reporting regime prior to the April 2022 deadline. This relates to the Com mercial Entities (Substance Requirements) Act 2018, which requires companies

conducting “relevant activi ties” to confirm they are carrying out real business in The Bahamas via annual electronic filings.

These companies must show they are doing real, legitimate business in a jurisdiction and are not merely brass plate, letter box fronting entities acting to shield taxable assets and wealth from their home country authorities. The minister said that “shortly after the election” on September 15, 2021, the Davis administration was “informed of deficiencies” in The Bahamas’ imple mentation, monitoring and reporting requirements for 2019 and 2020.

“This administration worked diligently to ensure our country was not black listed or placed on the list of non-cooperative juris dictions,” Mr Campbell said. “This [blacklisting] occurred because we were unable to address all deficiencies before the determination of our review in April this year. The Gov ernment of The Bahamas is committed to resolving all issues as soon as practi cally possible, and seeking

a re-determination of our status.”

The House, though, yes terday debated changes to the Automatic Exchange of Financial Account Information Act so as to address weaknesses identi fied by the OECD over a separate tax related matter. The amendments will pro vide greater regulatory flexibility and oversight by enabling the Ministry of Finance to delegate its supervisory powers to the Central Bank, Securities Commission, Insurance Commission and Compli ance Commission.

These regulators will then become responsi ble for ensuring their respective licensees and registrants comply with the requirements for automatic tax information exchange, thereby expanding their obligations but also helping to address a “noncompliance” rating from the OECD.

“With the amendment and enactment of new leg islation, the regulators will be vested with the authority to act on behalf of the Min istry of Finance to monitor compliance of registrants and/or licensees for the

purpose of this Act,” Mr Campbell said.

The OECD’s concerns relate The Bahamas’ imple mentation of the Common Reporting Standard (CRS).

The Government was notified shortly after the September 2021 general election about the results of the OECD’s Global Forum peer review of The Baha mas, which gave the country a clean bill of health when it came to “exchanging infor mation in an effective and timely manner” with other jurisdictions at the state level.

However, the Bahamas fared less well - and failed to meet the OECD’s require ments - when it came to its financial institutions and providers “correctly con ducting the due diligence and reporting procedures”. While this nation met the standard required in one of the two areas reviewed, the overall rating for the “technical effectiveness” of automatic tax informa tion exchange has been deemed non-compliant.

This was despite Michael Halkitis, minister of eco nomic affairs, and Ryan Pinder KC, the attorney general, meeting with the

OECD in Paris to argue for a “revision” to this finding. While the OECD refused to budge, a strategy for fixing the deficiencies was agreed and The Bahamas will be re-examined and rated in 2023.

Mr Campbell, mean while, said the Government was “optimistic” that The Bahamas will be rated “compliant” or “largely compliant” with the Finan cial Action Task Force’s (FATF) 40 anti-money laundering and counter terror financing recommen dations when its regional affiliate meets next month.

The Bahamas has attained such designations on 38 of the recommen dations already, and has further enhanced regulation in the remaining areas - dig ital assets and non-profits.

TO ADVERTISE TODAY IN THE TRIBUNE CALL

PRIMARY TEACHING JOB OPPORTUNITIES

FIFTH GRADE teacher needed.

A pre-eminent, well-established, independent, international school in Nassau is seeking a full-time qualified FIFTH GRADE TEACHER. Candidates should have sound classroom experience; a passion for innovative education; a professional attitude towards work; a friendly and cooperative disposition; a willingness to work in a team environment; a determination to grow professionally; and strong communication & organisational skills.

Successful candidates will be required to:

Prepare and deliver well-planned learning experiences and curricula

curriculum objectives to support a diverse range of

compassionate, classroom management

student learning

produce

to inform and adapt instruction

to the co-curricular programme and whole-school activities in a committed and enthusiastic manner

high standards of professionalism

positively with parents, staff, and administration

by

THE TRIBUNE Thursday, October 20, 2022, PAGE 5

FROM PAGE B1

@ 502-2394

●

● Differentiate

learners ● Show consistent,

skills ● Assess

and

detailed reports ● Use learning data

● Contribute

● Maintain

● Communicate

Please Forward your resume and introduction letter

email to teachingbahamas@gmail.com

FOOD RETAILERS ‘TRYING LIKE HELL’ FOR FRIDAY SOLUTIONS

FROM

Government of The Baha mas towards ensuring that food is affordable for Baha mians in these challenging economic times, the Asso ciation maintains that the impact of the recent expan sion of the price control

basket (PCB) will undoubt edly prove catastrophic to the local wholesale and retail industry,” the state ment said.

“The Association wishes to again clarify that while the Government announced that 38 items would be added to the

basket, it is in actuality 38 categories of foodstuffs, which would affect more than 5,000 items to which inventory and price adjust ments would have to be made. To facilitate such changes would be a very expensive undertaking, and would mean that 40 to 60 percent percent of total revenues for local wholesal ers and retailers would be controlled.

“Additionally, such a decision was made without prior industry consultation and at a time when busi nesses are faced with already slim profit mar gins, increasing electricity costs, increased operating expenses and theft. The sector employs some 4,000 persons, and the expansion of the PCB will undoubt edly have a ripple effect which would prove det rimental, with mass store closures, particularly among the smaller food stores and the real potential for food shortage in the country.”

The statement contin ued: “The Association is keenly aware of the effects of global inflation and the hardships being faced across the country by many Bahamians. Our collective objective is to provide the best prices possible to our customers. It is also worth noting that customers have been able to benefit from the pass-through reductions in Customs duties for some items.

“Our members have, and continue to contribute unselfishly, to all manner of charitable organisations

and efforts throughout the country. The Association suggests the Government provide a more targeted approach to relief to those most in need of assistance. It is our hope to part ner with the Government towards presenting some form of food assistance for the most vulnerable at this time.”

The Prime Minister, in unveiling the expanded price control regime, said it was for a six-month trial for food items and three months for pharmaceuti cal drugs, although there is every possibility it may be extended further.

Food wholesale margins, or mark-ups, are capped at 15 percent for all 38 product line items listed, while those for retailers are set at 25 percent across-the-board. Those goods impacted, some of which are already price controlled, are baby cereal, food and formula; broths, canned fish; con densed milk; powdered detergent; mustard; soap; soup; fresh milk; sugar; canned spaghetti; canned pigeon peas (cooked); peanut butter; ketchup; cream of wheat; oatmeal and corn flakes.

The remainder are macaroni and cheese mix; pampers; feminine nap kins; eggs; bread; chicken; turkey; pork; sandwich meat; oranges; apples; bananas; limes; tomatoes; iceberg lettuce; broccoli; carrots; potatoes; yellow onions; and green bell peppers.

CALL 502-2394 TO ADVERTISE TODAY!

LEGAL NOTICE

INTERNATIONAL BUSINESS COMPANIES ACT, 2000

DOMO VENTURES FOREIGN INVESTMENTS LTD.

NOTICE IS HEREBY GIVEN in accordance with Section 138 (4) of the International Business Companies Act, 2000, as follows:

a) DOMO VENTURES FOREIGN INVESTMENTS LTD., is in dissolution under the provisions of the International Business Companies Act, 2000

b) The dissolution of the said Company commenced on the 13th October 2022.

c) The Liquidator of the said Company is Amicorp Bahamas Management Limited whose address is: Bahamas Financial Centre, 3rd Floor, Shirley & Charlotte Street, P.O. Box N-4865, Nassau, Bahamas.

NOTICE

Pursuant to the provisions of The Companies Act, 1992 NOTICE is hereby given that Gens Holdings Company Limited has been dissolved and struck from the Register as of the 7th day of March, A.D., 2022.

Barbara J. Barmes LIQUIDATOR

c/o Clement T. Maynard and Company, G. K. Symonette Building, Shirley Street, P. O. Box N-7525, Nassau, The Bahamas

PUBLIC NOTICE OF APPLICATION IN THE PROBATE DIVISION OF THE SUPREME COURT IN THE SUPREME COURT 2022/PRO/npr/00 PROBATE DIVISION

In the Estate of KEVIN ROBERT BARRETT, late of 1032 Long Point Road in the Town of Grasonville, in the State of Maryland, one of the United States of America, deceased.

IT IS HEREBY NOTIFIED, for the information of those it may concern, that SALENA LEIGH VALDES, of 1032 Long Point Road in the Town of Grasonville, in the State of Maryland, one of the United States of America has made application at the PROBATE DIVISION of the Supreme Court, for a GRANT OF PROBATE in respect of the real and personal estate of KEVIN ROBERT BARRETT, late of 1032 Long Point Road in the Town of Grasonville, in the State of Maryland, one of the United States of America, deceased.

This advertisement is published from the 20th day of October, 2022 to the day of 21st day of October, 2022 and NOTICE IS HEREBY GIVEN that the application will be heard by the court at the expiration of 21 days from the last date hereof.

Dated this 20th day of October, 2022

MILLER-FRAZER & CO.

Chambers Suite No. 4 No. 27 Chesapeake Road Nassau, Bahamas Attorney for the Applicant

PAGE 6, Thursday, October 20, 2022 THE TRIBUNE

PAGE B1

EU blacklist: ‘Square peg in round holes’

Accusing the Government of “a dereliction of duty”, he blasted: “They failed to grasp the state of play when they arrived, and devise a proactive solution to head off this blacklisting.” How ever, Mr Watson, the Bain and Grant’s Town MP, who is now leading the adminis tration’s digitisation drive, said it had been informed of “a software issue that was completely inadequate and did not meet funda mental business or reporting requirements”.

The Commercial Entities (Substance Requirements) Act 2018 requires companies conducting “relevant activi ties” to confirm they are carrying out real business in The Bahamas via annual electronic filings. These companies must show they are doing real, legitimate business in a jurisdiction and are not merely brass plate, letterbox fronting enti ties acting to shield taxable assets and wealth from their home country authorities.

Mr Watson said the former administration expanded the existing RMS portal to receive these annual sub stance reporting filings, as demanded by the EU, but it was simply unable to handle the volume of work gener ated.

“The senior officers in the ministry [of finance] expressed their concerns about the portal, expressed their concerns about the software to their then senior superiors in the Ministry of Finance,” he added.

The economic substance portal was unable to run the level of analysis and in-depth reporting sought by the EU, Mr Watson said. “It must be noted that the software did not have the features and analytical tools that provide the necessary statistics to the [OECD] Forum on Harmful Tax Practices and the EU.....

“Simply put, the RMS did not cut the mustard as required with these report ing requirements, and it was more like putting a square peg in a round hole. It’s my understanding there was no consultation informing the requirements about the

software solution. Only the senior expert and a former senior official sat down in Starbucks and came up with a design and flawed solution.”

Mr Watson did not call names or explain what he meant, but added that the Government “could not leave the state of affairs as is and we are more concerned about the solution” that will enable The Bahamas to ful fill its substance reporting obligations to the EU as well as automatic tax information exchange.

He added that the search for new software had been narrowed down to two providers via “pro posals considered more appropriate for The Baha mas’ needs”. While data will

be stored in the cloud, it will be held via a Bahamas-based provider so as not to infringe data protection laws.

However, Kwasi Thomp son, who was minister of state for finance in the former Minnis adminis tration, argued that the Government made a “criti cal mistake” in December 2021 by releasing Stephen Coakley-Wells, who was its key adviser on tax-related matters and knew of the EU deadlines, demands and what was needed to address the substance reporting deficiencies.

And he pointed to recent comments by Simon Wilson, the Ministry of Finance’s financial secretary, who said the Government needs to invest $4m-$5m in a new

software system to address

these woes as a sign that the Government failed to follow through on the strategy its predecessor left in place to avoid the EU blacklist. He queried why only now, after the event has happened, is the Government talking about new software.

Tribune Business also previously revealed that the Prime Minister signed three letters promising the EU that The Bahamas would address - within the required deadline - the very concerns that have resulted in the country’s blacklist ing. Philip Davis KC signed three separate letters over a six-week period between December 15, 2021, and Jan uary 26, 2022, pledging that The Bahamas will resolve

the 27-nation bloc’s issues over “economic substance” and tax reporting.

This suggests that either someone underestimated the work required or failed to follow through. Mr Thompson charged: “The question now, and we have to ask, is that in September of 2021, right after the elec tion… the technical advisors advised the Government, here is a proposal, or here is what is being proposed for us to change in order for us to become compliant. Sep tember of 2021.

“You had a deadline of March/April 2022 to become compliant. So, if you had acted in September, October, November, December, if you had acted you would have been able to amend, change,

upgrade, overhaul the com puter system in order to ensure that you were ready for the March or April dead line. I’m also advised that in February 2022 there was an expectation that March/ April we were not going to meet the deadline. So there was an extension to Septem ber 2022.”

The former minister of state for finance added: “We have to ask the ques tion: Had the Government acted in September, had they acted in October, had they acted in November, would we still have been black listed? What we must press or ask for is if you knew in September 2021, if you knew, you were advised that this needed to happen, why is it that we are only now in October 2022 purchasing the new application?”

THE TRIBUNE Thursday, October 20, 2022, PAGE 7

FROM PAGE B1

KEY RESPONSIBILITIES:

• Approve and sign income and expense accounts vouchers.

• Monitor and review staff expenses and accounts payable.

• Monthly preparation of management accounts and supplementary schedules.

• Monthly/quarterly compilation of magnitude data and preparing reports.

• Prepare weekly/monthly/quarterly financial statements and reports of the Group and submit same to Executive Management.

• Prepare and submit all financial reports to The Central Bank of The Bahamas, the Securities Commission and Department of Inland Revenue.

• Prepare variance analysis.

• Oversee and supervise the daily operations of the Finance department.

• Maintain effective cash flow management, time billing, client invoicing, accounts receivable and accounts payable systems.

• Prepare Budget Reports.

• Assist in designated project reports.

• Drafting Management Commentary.

• Assist in preparation of Board reports.

• Preparation of annual Financial Statements.

• Liaise with external auditors and manage the overall audit process.

• Maintain Lease Agreement files and coordinate tenant issues.

REQUIRED SKILLS REQUIRED:

• Accounting Designations (CPA/CA/ACCA)

• Master's Degree preferred in Finance/Accounts

• Minimum of 10 years' experience in a managerial Finance position

• Advanced knowledge of MS suite

• Superior numeric, writing and communication skills

• Understanding of investment and private banking processes

• Proven ability to work with others in a multi-faceted financial services institution

and

will

with

and experience. Suitable

should submit their Curriculum Vitae (CV) electronically to:

BTVI overpaid staff by nearly $100,000

the findings, with the Audi tor General’s Office also raising queries about how donations were handled. It focused on one anonymous $200,000 donation that was received to finance “tech nical trades training” on Grand Bahama after Hur ricane Dorian, which it said was seemingly approved by neither the Ministry of Edu cation or BTVI’s Board.

The educational institute added that the monies were intended to help provide National Centre for Con struction Education and Research (NCCER) certi fied training via a mobile laboratory, and even offered to refund the money of necessary.

BTVI’s response, which appears to have been writ ten by ex-president, Dr Robert Robertson, as the audit was conducted on his watch, admitted it had been “very difficult” to keep the agency’s financial affairs in order due to the high turno ver of staff.

“As discussed with the audit team, BTVI has had three chief financial offic ers in the past six years,” BTVI management wrote. “In fact, for 50 percent of the past six years, that post has been vacant. This fact is material as context to the draft report. Based on this fact, it has been very difficult to maintain the effective functioning of the financial affairs of BTVI.

“My suggestion is that this area (finance) be prop erly funded and staffed with individuals holding the appropriate credentials and training. Also, as a practical matter, BTVI has increased enrollments substantially with very limited added Budget support (personnel) to support this increased workload. A comprehensive

human resources and com pensation review has just been completed and it needs to be implemented as quickly as possible.”

The constant churn, and absence, in the chief financial officer post likely played a significant role in BTVI’s non-compliance with legal requirements that its audited financial state ments be presented to the minister of education within three months of its financial year-end.

BTVI received $8.103m in taxpayer monies in the 2018-2019 fiscal year. While this was cut to $6.103m in the following two Budget periods, it still receives sig nificant funding from the Public Treasury on which it relies to make ends meet.

The Auditor General’s Office found no audited financial statements have been provided since at least 2016.

“The financial statements of BTVI for the year ended 2016 were presented in draft form,” the report said.

“In addition, statements for the years 2017, 2018, 2019 and 2020 are unaudited. It is recommended that BTVI management engage the services of an accounting firm to have the financial statements audited, brought up to date and presented to Parliament.”

BTVI’s management, meanwhile, said operations were also handicapped for at least six months because no Board was in place. Yet the BTVI Act that provides the legal basis on which it functions requires a Board be installed. “In some instances, actions pursuant to the suggestions and direc tions in the report are now underway under the direc tion of the newly-appointed Board,” management added.

“For example, the report mentions any anonymous donation of $200,000. The Board has directed added information on this donation be secured. For information, the donation was received via a reputable Bahamian law firm. If it is required, the donation can be returned.”

Elsewhere, the Auditor General’s Office found that BTVI paid a company “a one-time fee to initiate a Student Success Collabo rative programme” worth $22,500. However, pay ment was made without the Board’s approval. And discrepancies also emerged over its financial dealings with major investors.

Referring to a Decem ber 13, 2017, agreement between BTVI and Free port Container Port over an engineering apprentice ship initiative, the Auditor General’s Office called for the different figures in vari ous financial reports to be explained. “The detail gen eral ledger and the balance sheet as at June 2019 indi cated an amount of $28,000 was received from the com pany,” the report found.

“However, a copy of the BTVI liabilities report doc ument reflected an amount of $21,000. Additionally, we observed that the profit and loss statement showed an amount of $22,750 spent on the programme at the time of our review.”

PAGE 10, Thursday, October 20, 2022 THE TRIBUNE

FROM PAGE B1 TO ADVERTISE TODAY IN THE TRIBUNE CALL @ 502-2394 SENIOR VICE PRESIDENT OF FINANCE A boutique Offshore Bank is seeking a candidate for the position of Senior Vice President of Finance whose functions include but not limited to the following:

Salary

benefits

commensurate

qualifications

candidates

Recruitinghr2oo9@gma il.com SUBJECT: Human Resources Senior Vice President, Finance

BTC unveils annual innovation summit

THE Bahamas Telecom munications Company (BTC) will hold its annual InKnowVation conference on Friday, October 28, as it celebrates the small busi nesses that make up 80 percent of its corporate clients.

The communications pro vider, in a statement, said it is again using October to honour small businesses under the theme, ‘Work Smarter, Not Harder’. K. Teneile Simmons, BTC’s executive senior manager for small and medium busi nesses, said: “We’ve been hosting several smaller events all summer long, leading up to our big InKnowVation Conference later this month.

“At InKnowVation, small business customers will learn how to make money moves from our keynote speakers, gain digital ‘know how’ from our expert workshops, and have the opportunity to pitch their business to win cash, free business connectivity and so much more.

“We are providing our small business customers with the tools to work smart and not hard, as we pro vide them with even more

value. Customers will soon experience upgraded bun dled plans providing even faster broadband speeds, and unlimited mobile plans. We’ve recently increased our handset credits, making it more affordable for our customers to purchase mobile devices.”

BTC presently provides Bahamian small businesses with access to products and services that include a free customised website and online store; business e-mail pro that provides ten e-mail addresses using the client’s .com domain with built-in anti-spam fil ters; and e-marketing pro. The latter allows customer to attract more clients with custom-made digital mar keting campaigns, together with SEO and Google Busi ness tools.

This InKnowVation con ference will be held live at Baha Mar, and via an inter active live stream for the entire Caribbean. Speakers include Donatello Antonio, also known as ‘The King of Content’, and Mimi BrownDavis, also known as ‘Coach Mimi’. The former will speak on ‘Captivating content, supercharged sales, while Ms Brown-Davis will

give insight on ‘Showcas ing your business at its best with Canva’.

BTC held its Small Business Master Class in September to help entre preneurs position their companies for success. More than 200 small busi nesses attended an event that featured personalities such as Kenny St Mark, brand architect; Ianthia Ferguson, media coach and content creator; Kevin McKinney from the Baha mas Development Bank; and Heather Bowles from Bahaprintz.

Keron Rose, Flow & BTC social media ambas sador, and also a marketer and e-commerce specialist, and Lisa Etsy, smart solu tions specialist, also took part. Small businesses were able to learn about funding opportunities, how to max imise media opportunities and how to market their business.

Small business custom ers wishing to attend the InkKnowVation Master Class and or participate as vendors should contact the BTC Small Business team at 47-SMALL/477-6255 or through www.btcbahamas. com.

MAINTENANCE JOB OPPORTUNITIES

A pre-eminent, well-established, independent,International school in Nassau Bahamas seeking a skilled Maintenance worker to perform upkeep tasks such as repairs and cleaning. You will be responsible for applying basic fixes to equipment and ensuring facilities are tidy and functional.

Responsibilities

● Perform cleaning activities such as dusting, mopping etc.

● Check control panels and electrical wiring to identify issues

● Install appliances and equipment

● Do garden/yard upkeep by collecting trash

● Conduct maintenance tasks such as replacing light bulbs

Inspect and troubleshoot equipment and systems (e.g. projector screens)

Collaborate with workers and other professionals during renovations

Report to a facilities or maintenance manager for issues

THE TRIBUNE Thursday, October 20, 2022, PAGE 11

BTC SMB TEAM

You must possess manual dexterity and physical stamina.

●

●

●

Please forward your resume and introduction letter by email to teachingbahamas@gmail.com

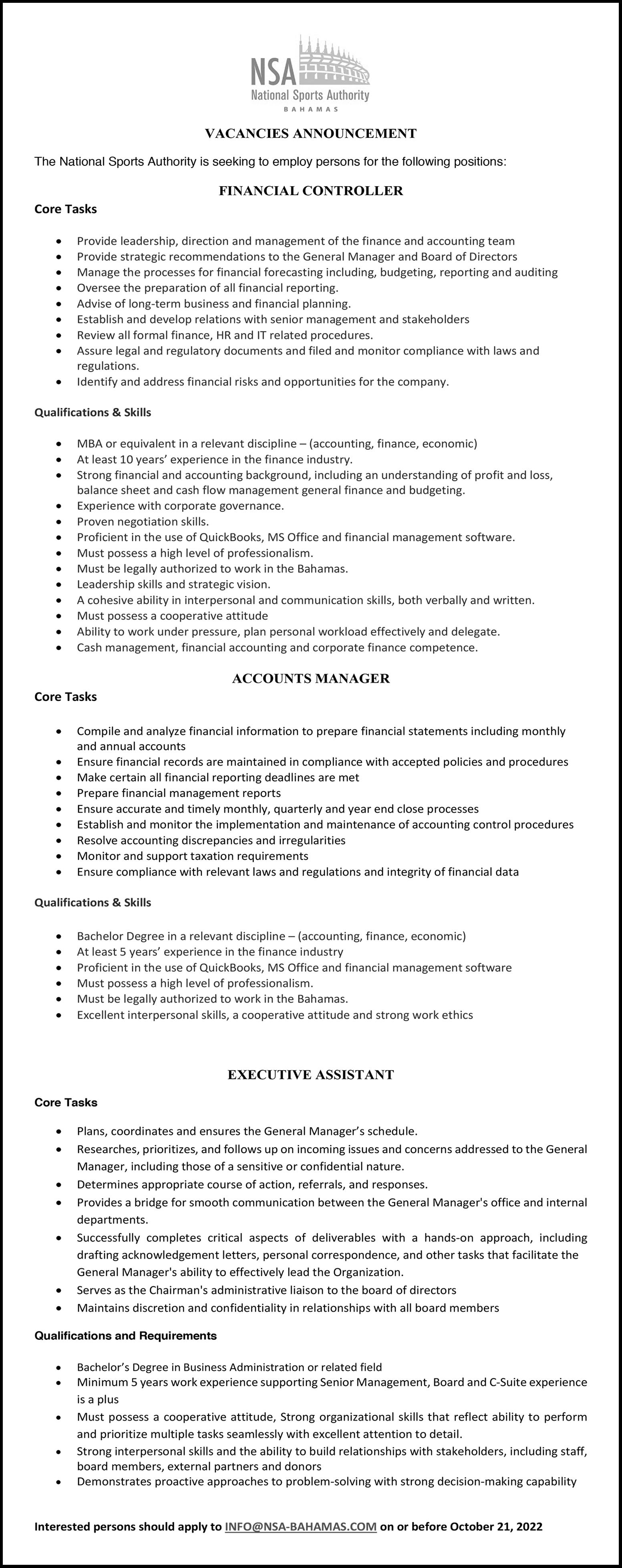

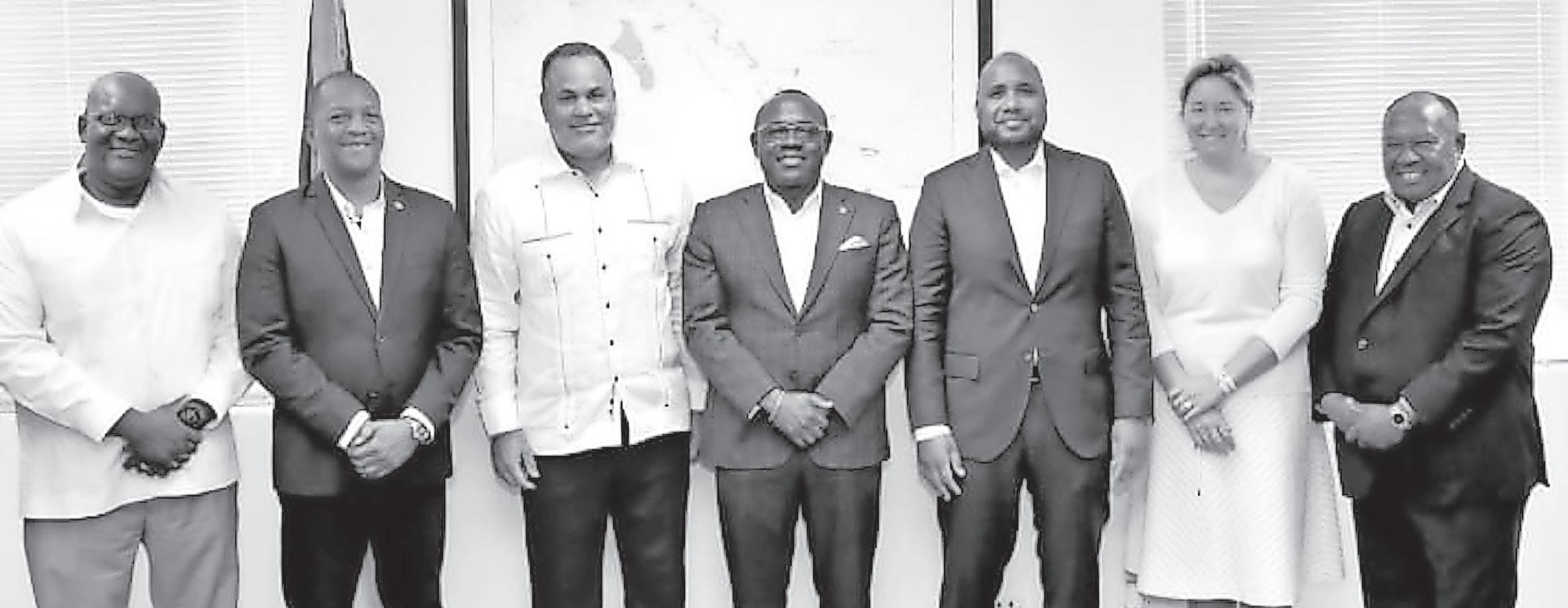

NEW BTC CHIEF MEETS WITH DPM

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE Bahamas Telecom munications Company’s (BTC) newly-appointed chief executive, Sameer Bhatti, has met with the deputy prime minister and other senior Cabinet minis ters and officials.

Mr Bhatti was accom panied by BTC chair, Inge Schmidt, and BTC deputy chair, Valentine Grimes, in his meeting with Chester Cooper, who

has responsibility for tour ism, investments and aviation. Also present were Michael Halkitis, minister of economic affairs; Wayde Watson, parliamentary secretary in the Ministry of Economic Affairs; and Reginald Saunders, per manent secretary in the Ministry of Tourism, Invest ments and Aviation.

Pictured from L to R are: Mr Saunders; Mr Watson; Mr Halkitis; Mr Cooper; Mr Bhatti; Ms Schmidt; and Mr Grimes.

IS PM’S ‘ECONOMIC DIGNITY’ FOCUS THE CLUE TO REFORM?

the kind of Bahamas that each of us knows in our hearts, is ‘Better’”?

Certainly a Bahamas where the wider masses can readily declare that they enjoy, commensurate with their efforts and commit ment, equitable chances of success. Social and eco nomic advancement must be at least a part of the foundational prerequisites for future growth. Growth that truly uplift the masses. Moreover, certainly such an outcome would be a clear example that the wider region would be attracted to.

NB: Hubert Edwards is the principal of Next Level

Solutions (NLS), a manage ment consultancy firm. He can be reached at info@ nlsolustionsbahamas.com. He specialises in govern ance, risk and compliance (GRC), accounting and finance.

NLS provides services in the areas of enterprise risk manage ment, internal audit and policy and procedures development, regulatory consulting, anti-money laundering, accounting and strategic planning. Hubert also chairs the Organisation for Responsible Govern ance’s (ORG) Economic Development Committee. This and other articles are available at www.nlsolu tionsbahamas.com.

NOTICE

NOTICE is hereby given that ANDREW SINCLAIR of P. O. Box N-8895, #58 Poinciana Drive, New Providence, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 20th day of October, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE

NOTICE is hereby given that ROLMINE VALSAINT of Marsh Harbour, Abaco, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 20th day of October, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE

NOTICE is hereby given that JEANETTE JISLANE BLANC of Central Pines, Abaco, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 20th day of October, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE is hereby given that GEORGE RONALD BUTLER of Seabreeze Lane, New Providence, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 20th day of October, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

PAGE 12, Thursday, October 20, 2022 THE TRIBUNE

FROM PAGE B2

NOTICE

LIVEABLE WAGE NOT POSSIBLE WITHOUT PRODUCTIVITY BOOST

be transitioned into a wage appropriate for today’s cost of living...

“The labour force for the Commonwealth of the Bahamas stands at 214,600 persons, although data is not current. I am advised that as much as 60,000 workers may be impacted by this increase, almost 25 percent of our workforce.”

Mr Bell added that last weekend’s ‘Labour on the Blocks 2.0’ job fair, targeted at the South Beach and Southern Shores constitu encies, had resulted in the actual or likely recruitment of several hundred Baha mians to actual jobs. He recalled how one hotel hired “on the spot” a woman that

it interviewed and, by 2pm, she was reporting for work.

While not naming any companies, Mr Bell cited another hospitality busi ness where 42 new recruits began work on Monday. Two restaurants also reported success, he added, as 44 per sons who attended the job fair began work at one estab lishment on Monday, while the other believed it had found 40 staff from the 60 it interviewed.

The minister said “a luxury upscale retailer” had identified 55 potential hires, from the 75 it had interviewed, “pending back ground checks”, while a hardware store had spoken to 44 persons and made two hires “on the spot”.

NOTICE

NOTICE is hereby given that DEANIKA PIERRE of Dignity Gardens, Nassau, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 13th day of October, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE is hereby given that WIDNEL SAINTIL of Fort Fincastle, North Street, New Providence, Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 13th day of October, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

100.00100.00BGS:

100.00100.000.00 100.00100.00BGS: 2015-6-30Y BG0330 100.00100.000.00 100.00100.00BGS: 2015-10-7Y BG0407 100.00100.000.00 103.49103.49BGRS FX BGR118027

BSBGR1180276102.70102.700.00 400 100.66100.60BGRS FX BGR142241

BSBGR1420417100.66100.660.00 99.9599.30BGRS

BGR142251

BSBGR142051699.9599.950.00 99.9599.95BGRS

BGRS91032

BSBGRS91032499.9599.950.00 100.57100.11BGRS

BGRS95032

BSBGRS950320100.45100.450.00 100.5299.96BGRS

BGRS97033

BSBGRS970336100.19100.190.00 100.0089.62BGRS

BGR129249

BSBGR129249389.6289.620.00

-0.4380.000-9.9

0.1400.00073.20.00%

0.1840.12019.03.43%

0.4490.22018.32.67%

0.1020.43432.313.19%

0.4670.06022.50.57%

0.6460.32814.23.57%

0.7280.24014.92.21%

0.8160.54022.22.98%

0.2030.12019.73.00%

2.552.24%4.01%

1.873.48%4.44%

NOTICE0.96-6.57%-8.29% 9.376.41 9.37-0.02%10.36% 11.837.62 11.79-0.33%18.23% 7.545.66 7.540.22%3.05% 16.648.65 15.94-3.89%14.76% 12.8410.54 12.47-1.04%-2.57% 10.779.57 10.740.81%4.20% 10.009.88 N/AN/AN/A 10.438.45 10.433.00%25.60% 14.8911.20 14.897.90%48.70%

THE TRIBUNE Thursday, October 20, 2022, PAGE 13

FROM PAGE B3

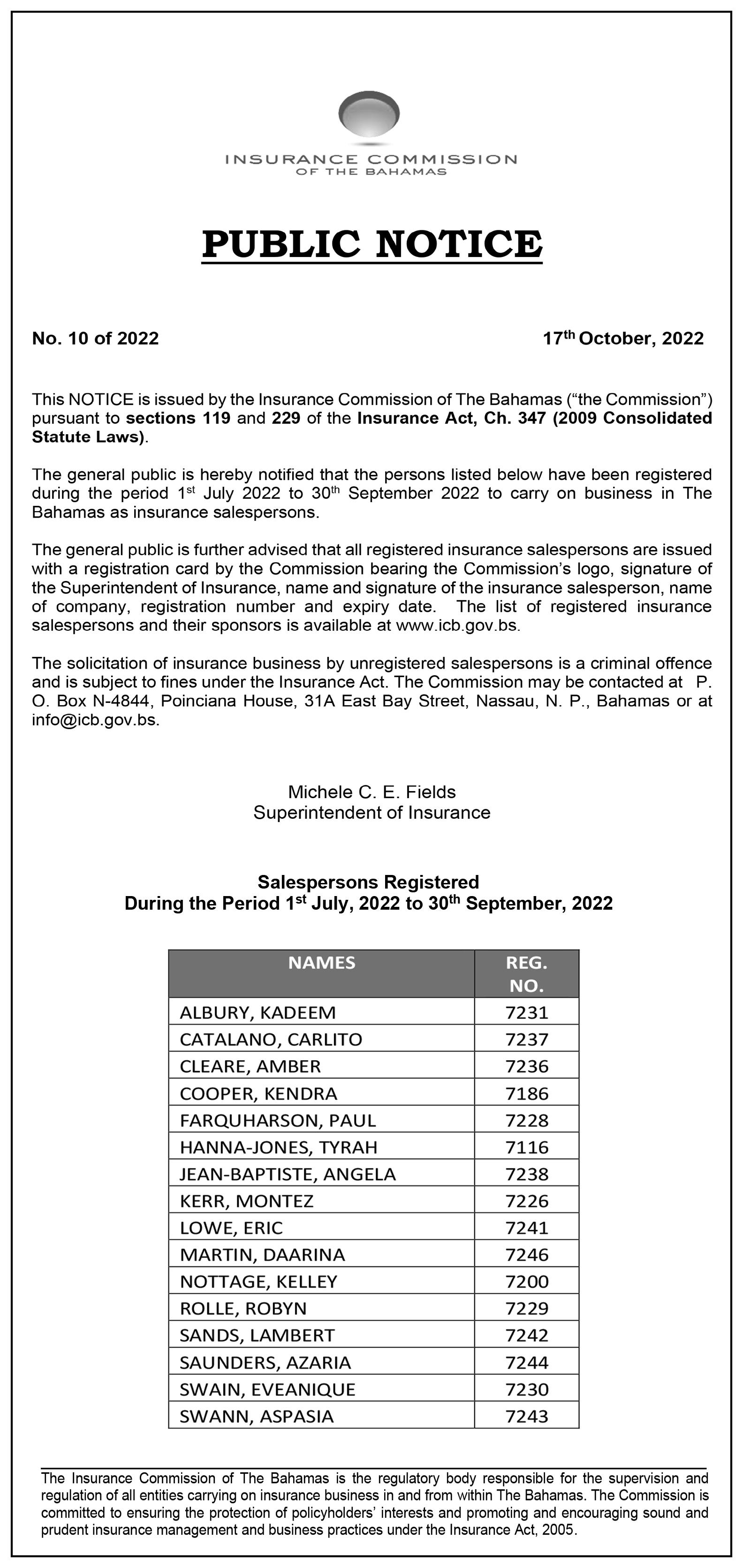

WEDNESDAY, 19 OCTOBER 2022 CLOSECHANGE%CHANGEYTDYTD% BISX ALL SHARE INDEX: 2627.10-0.40-0.02398.8617.90 BISX LISTED & TRADED SECURITIES 52WK HI52WK LOWSECURITY SYMBOLLAST CLOSECLOSECHANGE VOLUMEEPS$DIV$P/E YIELD 7.005.30 AML Foods Limited AML 6.95 6.950.00 0.2390.17029.12.45% 53.0039.95 APD Limited APD 39.95 39.950.00 0.9321.26042.93.15% 2.761.60Benchmark BBL 2.76 2.760.00 0.0000.020N/M0.72% 2.462.20Bahamas First Holdings Limited BFH 2.46 2.460.00 0.1400.08017.63.25% 2.851.69Bank of Bahamas BOB 2.85 2.850.00 0.0700.000N/M0.00% 6.205.75Bahamas Property Fund BPF 6.20 6.200.00 1.7600.000N/M0.00% 10.058.78Bahamas Waste BWL 8.78 8.780.00 1,0000.3690.26023.82.96% 4.342.82Cable Bahamas CAB 4.34 4.340.00

0.00% 10.656.80Commonwealth Brewery CBB 10.25 10.250.00

3.652.27Commonwealth Bank CBL 3.50 3.500.00

8.516.01Colina Holdings CHL 8.23 8.230.00

17.5010.25CIBC FirstCaribbean Bank CIB 16.00 16.000.00 1,6000.7220.72022.24.50% 3.251.99Consolidated Water BDRs CWCB 3.31 3.29 (0.02)

11.289.25Doctor's Hospital DHS 10.50 10.500.00

11.6711.25Emera Incorporated EMAB 9.65 9.18 (0.47)

11.5010.00Famguard FAM 10.85 10.850.00

18.3014.05Fidelity Bank (Bahamas) Limited FBB 18.10 18.100.00

4.003.50Focol FCL 4.00 4.000.00

11.009.01Finco FIN 11.00 11.000.00 0.9390.20011.71.82% 16.5015.50J. S. Johnson JSJ 15.50 15.500.00 0.6310.61024.63.94% PREFERENCE SHARES 1.001.00Bahamas First Holdings PreferenceBFHP 1.00 1.000.00 0.0000.0000.0000.00% 1000.001000.00 Cable Bahamas Series 6 CAB6 1000.001000.000.00 0.0000.0000.0000.00% 1000.001000.00 Cable Bahamas Series 9 CAB9 1000.001000.000.00 0.0000.0000.0000.00% 1.001.00Colina Holdings Class A CHLA 1.00 1.000.00 0.0000.0000.0006.25% 10.0010.00Fidelity Bank Bahamas Class A FBBA 10.0010.000.00 0.0000.0000.0007.00% 1.001.00Focol Class B FCLB 1.00 1.000.00 0.0000.0000.0006.50% CORPORATE DEBT - (percentage pricing) 52WK HI52WK LOWSECURITY SYMBOLLAST SALECLOSECHANGEVOLUME 100.00100.00Fidelity Bank (Note 22 Series B+)FBB22 100.00100.000.00 100.00100.00Bahamas First Holdings LimitedBFHB 100.00100.000.00 BAHAMAS GOVERNMENT STOCK - (percentage pricing) 115.92104.79Bahamas Note 6.95 (2029) BAH29 107.31107.310.00 100.00100.00BGS: 2014-12-7Y BG0107 100.00100.000.00 100.00100.00BGS: 2015-1-7Y BG0207 100.00100.000.00 100.00100.00BGS: 2014-12-30Y BG0130 100.00100.000.00 100.00100.00BGS: 2015-1-30Y BG0230 100.00100.000.00

2015-6-7Y BG0307

FX

FL

FL

FL

FX

100.0089.00BGRS FX BGR131249 BSBGR1312499100.00100.000.00 100.9890.24BGRS FX BGR132249 BSBGR1322498100.00100.000.00 100.0090.73BGRS FX BGR136150 BSBGR1361504100.00100.000.00 MUTUAL FUNDS 52WK HI52WK LOW NAV YTD%12 MTH% 2.552.11

4.833.30 4.833.42%7.26% 2.241.68 2.241.70%2.82% 207.86164.74 197.44-2.97%-2.35% 212.41116.70 202.39-4.72%6.04% 1.751.70 1.751.96%2.84% 1.911.76 1.914.83%7.23% 1.871.77

1.050.96

MARKET TERMS BISX ALL SHARE INDEX - 19 Dec 02 = 1,000.00 YIELD - last 12 month dividends divided by closing price 52wk-Hi - Highest closing price in last 52 weeks Bid $ - Buying price of Colina and Fidelity 52wk-Low - Lowest closing price in last 52 weeks Ask $ - Selling price of Colina and fidelity Previous Close - Previous day's weighted price for daily volume Last Price - Last traded over-the-counter price Today's Close - Current day's weighted price for daily volume Weekly Vol. - Trading volume of the prior week Change - Change in closing price from day to day EPS $ - A company's reported earnings per share for the last 12 mths Daily Vol. - Number of total shares traded today NAV - Net Asset Value DIV $ - Dividends per share paid in the last 12 months N/M - Not Meaningful P/E - Closing price divided by the last 12 month earnings TO TRADE CALL: CFAL 242-502-7010 | ROYALFIDELITY 242-356-7764 | CORALISLE 242-502-7525 | LENO 242-396-3225 | BENCHMARK 242-326-7333 5.95% 6.40% 4.31% 5.55% 15-Feb-2041 15-Feb-2051 17-Apr-2033 15-Apr-2049 4.37% 4.31% 15-Aug-2032 25-Sep-2032 6.25% 30-Sep-2025 31-Mar-2022 FUND CFAL Bond Fund CFAL Balanced Fund CFAL Money Market Fund CFAL Global Bond Fund 6.25% 4.50% 6.25% 4.25% NAV Date 5.65% 5.69% 4.82% 15-Dec-2021 30-Jul-2022 15-Dec-2044 30-Jul-2045 26-Jun-2022 26-Jun-2045 15-Oct-2022 29-Jul-2022 21-Apr-2050 13-Oct-2027 15-Oct-2049 31-Mar-2021 31-Jan-2022 31-Jan-2022 31-Aug-2022 31-Jan-2022 31-Jan-2022 31-Jan-2022 31-Jan-2022 31-Aug-2022 31-Aug-2022 INTEREST Prime + 1.75% MARKET REPORT 31-Mar-2021 31-Mar-2021 MATURITY 19-Oct-2022 20-Nov-2029 31-Jul-2022 31-Jul-2022 6.95% 4.50% 31-Mar-2022 31-Aug-2022 4.50% 6.25% 5.60% 15-Jul-2049 Colonial Bahamas Fund Class D Colonial Bahamas Fund Class E Colonial Bahamas Fund Class F CFAL Global Equity Fund Leno Financial Conservative Fund Leno Financial Aggressive Fund Leno Financial Balanced Fund Leno Financial Global Bond Fund RF Bahamas Opportunities Fund - Secured Balanced Fund RF Bahamas Opportunities Fund - Targeted Equity Fund RF Bahamas Opportunities Fund - Prime Income Fund RF Bahamas International Investment Fund Limited - Equities Sub Fund RF Bahamas International Investment Fund Limited - High Yield Income Fund RF Bahamas International Investment Fund Limited - Alternative Strategies Fund (242)323-2330 (242) 323-2320 www.bisxbahamas.com

STOCKS LOSE GROUND AS MORE EARNINGS ROLL IN; YIELDS RISE

By DAMIAN J. TROISE AND ALEX VEIGA AP BUSINESS WRITERS

A BROAD slide on Wall Street reversed two days of gains for stocks Wednesday, as Treasury yields climbed to multiyear highs, tempt ing traders with higher returns on relatively lowrisk investments.

The pullback came as investors reviewed a mix of quarterly reports from several companies. Netflix and United Airlines rose sharply after releasing their quarterly results, while others, including Abbott Laboratories and M&T Bank, sank. Major indexes rose in the early going, but their gains faded fast. The S&P 500 fell 0.7%, the Dow Jones Industrial Aver age slipped 0.3% and the Nasdaq composite ended 0.9% lower. Small compa nies fell more than the rest of the market, sending the Russell 2000 index 1.7% lower. Stocks were coming off of two days of gains, but trading has been unsteady throughout.

“Today was interest ing in that it was almost a back-to-reality check for the market,” said Quincy Krosby, chief equity strate gist for LPL Financial. “Not only were the yields higher, you also had the dollar much stronger today, and that’s a recipe for difficul ties for the market.”

The yield on the 10-year Treasury, which influences mortgage rates, climbed to 4.13%, its highest level since June 2008. It was at 4.02% late Tuesday. The yield on the two-year Treas ury, which tends to track expectations for future Fed eral Reserve action, rose to 4.54% from 4.43%.

A sharp move in the three-month Treasury may have helped put traders in a selling mood. The yield briefly hit 4.01% before inching back to 3.98%. Should the three-month Treasury yield rise above that of the 10-year Treas ury, what’s known as an

inversion, that would be a strong warning that the economy could be headed for a recession.

“It takes a while for the three-month (Treasury) to invert, but it’s getting ever so closer to the 10-year,” Krosby said.

The S&P 500 fell 24.82 points to 3,695.16. The Dow lost 99.99 points to close at 30,423.81. The Nasdaq dropped 91.89 points to 10,680.51. The Russell 2000 gave up 30.20 points to 1,725.76.

Homebuilders and other housing industry-related companies fell Wednesday following a report show ing that construction on new homes declined more than expected in Septem ber.

Homebuilder Lennar fell 6% and home-improve ment retailer Lowe’s slid 4.8%. U.S. crude oil prices rose 3.3%, giving a boost to energy stocks. Exxon Mobil rose 3%. The White House plans to announce another release of oil from the U.S. strategic reserve.

Investors have been focusing on the latest round of corporate earnings this week. The latest results are being closely watched for clues about how com panies are dealing with the hottest inflation in four dec ades and how they intend to operate through the rest of the year and into 2023.

Netflix soared 13.1% after the company said it picked up 2.4 million subscribers during the July-September period, a comeback from a loss of 1.2 million customers during the first half of the year.

United Airlines rose 5% after reporting strong third-quarter financial results. American Airlines will report its results on Thursday.

Household goods giant Procter & Gamble rose 0.9% after also reporting strong financial results. It joined a growing list of companies, including Hasbro and Johnson & Johnson, warning investors about a strong U.S. dollar

cutting into revenue. A strong dollar decreases the value of overseas sales after converting the currency. The U.S. currency is now worth more than a euro for the first time in 20 years.

The dollar has gained strength versus currencies worldwide as inflation and recession concerns prompt investors to look for rela tively stable investments. Central governments and banks worldwide are deal ing with stubbornly hot inflation.