MONDAY,

Central

By NEIL HARTNELL Tribune Business Editor

nhartnell@tribunemedia.net

THE Central Bank’s governor has slammed as “flawed” concerns raised by a noted Caribbean economist that The Bahamas’ external reserves are “more than 100 percent borrowed” because they are lower than this nation’s foreign currency debt.

John Rolle, in a written response to Tribune Business inquiries, pushed back at an analysis by Marla Dukharan, the former head Caribbean economist for Royal Bank of Canada (RBC), who in her September 2025 monthly economic report implied that external debts which exceed a

country’s foreign currency reserves are unsustainable.

“The Bahamas, Barbados, Suriname and Trinidad & Tobago all have external debt levels that surpass the level of foreign exchange reserves, meaning that

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

BAHAMIAN hotels are hoping “we can roll out the red carpet rather than red tape” for the industry over the new liquor certification process that operators fear may impede the licensing of their resorts.

Robert Sands, the Bahamas Hotel and Tourism Association’s (BHTA) immediate past president, told Tribune Business that the sector is concerned about the burden imposed by the “onerous” new registration process despite assurances that resorts “won’t have to jump through all the hoops” to

register their restaurants, bars, nightclubs and stores selling liquor.

Shunda Strachan, the Department of Inland Revenue’s (DIR) controller, told the BHTA’s quarterly directors meeting last Thursday that the agency had “come up with a very shortened process for the hotels” compared to standalone venues that sell liquor separate and apart from the resort industry.

Mr Sands, also Baha Mar’s senior vice-president of government and external affairs, told this newspaper, though, that the resort industry would still have to register all its liquor-selling properties through the new

more than100 percent of their reserves are borrowed,” Ms Dukharan, who now runs her own consultancy business, wrote.

Referring specifically to The Bahamas, she added:

“Total and usable reserves were both down 1.5 percent year-on-year in July 2025 to $3bn and $1.4 bn, or around 2.4 months of imports, and

these reserves are more than 100 percent borrowed!

“The Central Bank flipped from a net foreign exchange purchase of $53.5m in July 2024 to a net foreign exchange sale of $16.2m in July 2025.” Mr Rolle, though, denied that this was any cause for concern or that there was any

Bahamas warned: ‘Don’t get carried away by S&P move’

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE Bahamas is being urged not to let its upgraded credit rating from Standard & Poor’s “go to your head” even as a prominent businessman hailed the move as “a game changer” and signal the economy has “turned the corner”.

Gowon Bowe, Fidelity Bank (Bahamas) chief executive, speaking after Standard & Poor’s (S&P) raised the country’s sovereign credit rating by one notch from ‘B+’ to ‘BB-‘ on the basis of it strengthened economy,

told Tribune Business that this was far from the end game but “merely a step towards the achievement we are targeting” – a return to investment grade status with all the rating agencies. The Bahamas still remains three notches away from escaping socalled ‘junk’ status with S&P, and Mr Bowe said this nation must remain disciplined, “continue those actions” that sparked this upgrade and “accelerate” the improvements if it is to achieve Prime Minister Philip Davis KC’s ambitions

UPGRADE - See Page B8

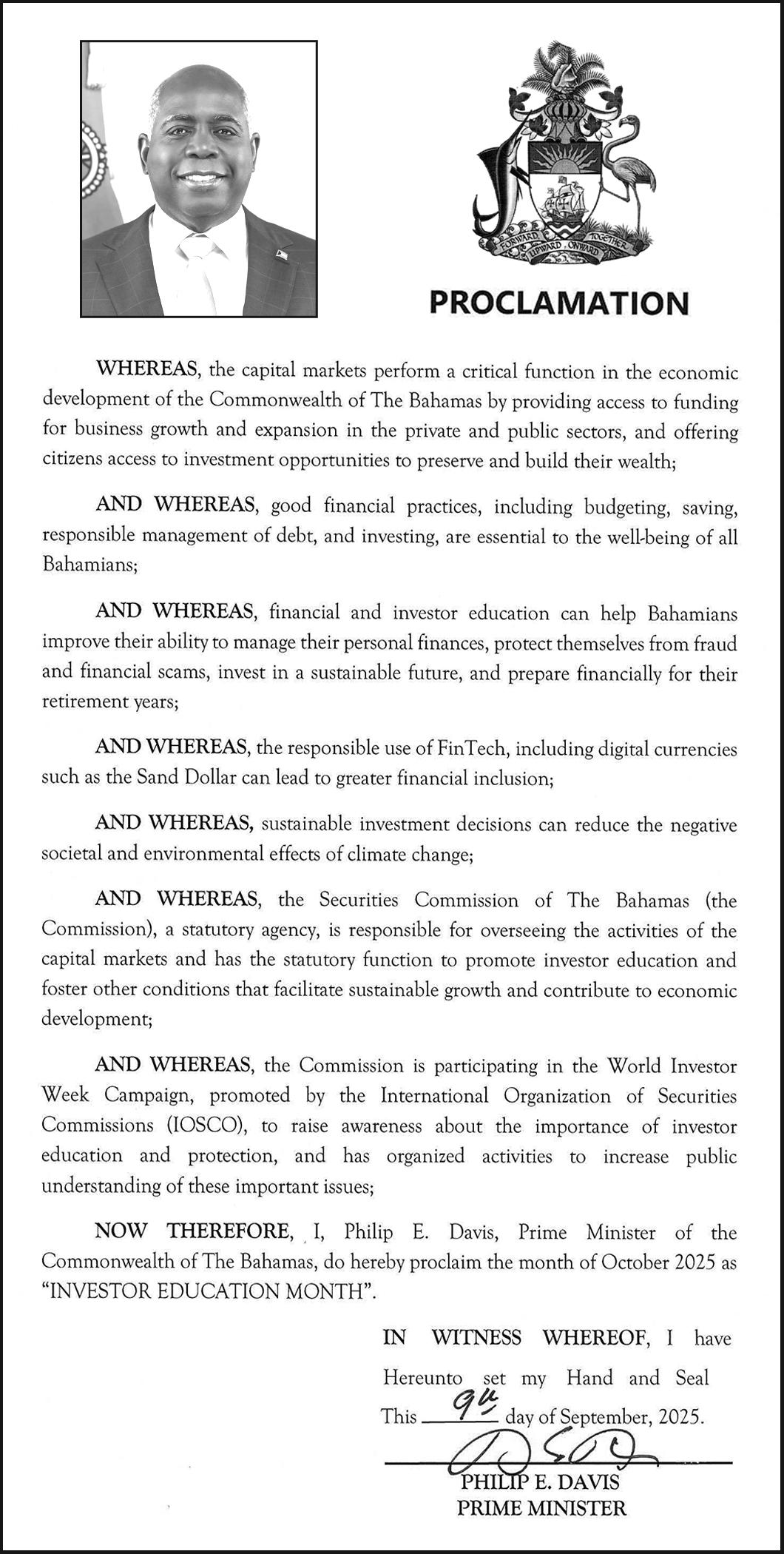

BAHAMAS MUST IMPROVE PAYMENT PROTECTION REGULATION FOR MINORS

AT the 2025 ACAMS Assembly in Las Vegas, which brings together anti-financial crime and anti-money laundering specialists, speakers delivered the warning that fintech (financial technology) payment services are not designed with minors in mind, yet children are among their fastest-growing users. Digital wallets, pre-paid cards and peerto-peer apps now handle pocket money, wages and purchases. While convenient, they expose minors to privacy gaps, fraud and exploitation. The challenge is that neither parents nor regulators have fully addressed these risks.

This article examines how minors’ growing use of fintech payment services exposes them to privacy risks, fraud and sextortion, drawing on insights from the ACAMS Assembly in Las Vegas and comparing regulatory approaches in the US and The Bahamas.

Privacy and exposure

A panellist noted how easily a child’s account can become visible. In some

cases, attempting to send a payment through services such as Zelle may reveal whether an e-mail or phone number is enrolled. For minors, that visibility invites scams and unwanted contact. To children, these apps are just another icon on their phones, but unlike games or social platforms, they carry money and personal data. Parental controls are uneven. Some platforms, such as Apple Cash Family and Venmo Teen Accounts, offer transaction visibility and limits. Others provide only monthly summaries or fewer controls. Not all services allow parents to disable high-risk features such as instant transfers, leaving gaps in oversight. Sextortion and small transactions

The Assembly highlighted the growing link between fintech and sextortion. Payment note fields, which should be used for notes such as ‘lunch’ or ‘haircut’, are misused under coercion for threats and blackmail. These lowvalue transfers may look harmless, but for teenagers

a $100 payment is as significant as a $1,000 adult transfer. Compliance teams often dismiss small dollar activity, but experts stressed that these payments are red flags. Money mules use them to launder sextortion proceeds, consolidating funds from multiple victims. Ignoring ‘pocket change’ means missing early signs of wider exploitation.

Our legislative environments of the US and The Bahamas

In the US, minors generally cannot contract directly with financial institutions, so youth accounts require a parent or guardian sponsor. This creates dual responsibility: Parents must supervise, and institutions must adapt monitoring scenarios to youth-specific risks. The Bank Secrecy Act and anti-money laundering regulations apply, and the Children’s Online Privacy Protection Rule (COPPA) restricts how providers collect data from children aged under 13. Yet many fintech products still treat youth accounts as scaled-down adult versions rather than

DEREK SMITH BY

distinct categories requiring tailored safeguards.

In The Bahamas, the Central Bank regulates payment systems under the Payment Systems Act, while the Financial Transactions Reporting Act (FTRA) imposes customer due diligence and anti-money laundering obligations. However, no explicit parental control requirements appear in publicly available legislation or guidance. Providers therefore retain wide

discretion, leaving uneven protection for minors.

Safety by design

Speakers during the ACAMS Assembly Las Vegas emphasised that child protection cannot be retrofitted. Safety must be part of the product design.

Key steps include:

* Tiered thresholds: Treat $100 in a teen account with the same scrutiny as $1,000 for an adult.

* Parental approvals: Require approval for new contacts or unusual transfers, especially late at night.

* Adaptive alerts: Notify parents of suspicious activity without flooding them with minor updates.

* Exploitation detection: Monitor note fields for signs of coercion.

* Education: Provide targeted awareness for parents and minors in a language each can understand.

In short, the message from the ACAMS Assembly Las Vegas was clear: Minors are active fintech users, and ignoring their risks is unacceptable.

Although US and Bahamian frameworks exist,

they do not mandate sufficient safeguards for minors. If you are a financial institution or a payment systems provider, re-examine youth account controls and monitoring. If you are a regulator, consider setting minimum standards for parental oversight and red flag detection. And if you are a parent, audit the fintech apps on your child’s phone today. Financial independence is valuable, but it should not come at the expense of safety. A shared responsibility must be taken to protect minors in fintech.

Smith Jr and compliance professional for more than 20 years with a leadership, innovation and mentorship record. He is the author of ‘The Compliance Blueprint’. Mr Smith is a certified anti-money launand holds multiple governance credentials. He can be contacted at hello@ pineapplebusinessconsultancy.com

Minister: Economic growth benefits must be felt by all

A CABINET minister

has acknowledged that investment and economic development on Grand Bahama must be felt by, and directly benefit, its residents.

Pia Glover-Rolle, minister of labour and the public service, speaking on the theme, ‘The state of labour and the public service on Grand Bahama: Reforms, opportunities and challenges ahead', outlined to the Grand Bahama Chamber of Commerce the strategic efforts being undertaken to transform the island’s workforce and economy.

She said: “Grand Bahama’s economy is finally approaching pre-pandemic figures for the first time in 2024, and that’s a great thing. We often hear about progress from Nassau, but I know you feel it differently here. The numbers and charts may reflect one thing, but your reality is just as important."

She acknowledged that Grand Bahama is at a pivotal moment in its economic recovery and described the island as a “crown jewel” of The Bahamas. She added that recent data places Grand

Bahama’s unemployment rate just below 10 percent, and emphasised that inclusive growth remains a priority.

“It would be pointless to host amazing developments without seeing tangible benefits for the people who matter most,” Mrs GloverRolle said.

The Minister highlighted a recent Department of Labour job fair, which successfully connected around 700 Grand Bahama residents - both existing and returning residents -with employment opportunities.

Mrs Glover-Rolle said the Government is taking bold steps to build a more productive, protected and prepared workforce, adding: “If we are paying more, we must also expect more in terms of productivity.

“While we understand the pressures of the cost of living and the need for fair wages, productivity must remain a priority.”

A major focus is the modernisation of key labour laws, including the Employment Act, the Industrial Relations Act and the Public Service Act. These reforms aim to align

workplace standards with 21st century realities.

Among the proposed changes are stronger protections for casual workers, particularly at companies such as the Grand Bahama Shipyard; expanded maternity leave; the introduction of mental health leave; and support for paternity involvement in early child development.

“We support the extension of maternity leave, but we also believe fathers should play an active role in shaping the children they help bring into the world,” Mrs Glover-Rolle said.

On productivity, training and the future workforce, the minister unveiled plans for the establishment of a National Productivity Council and announced new apprenticeship pathways aimed at equipping young Bahamians with practical skills for today’s evolving job market.

Mrs Glover-Rolle reiterated the administration’s commitment to balanced wage reform, ensuring that increases in pay are sustainable for both workers and businesses.

S&P: BUDGET SURPLUS MISS IF NO FURTHER FISCAL REFORMS

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

STANDARD & Poor’s (S&P) has voiced scepticism that the Government will hit its forecast $75.5m Budget surplus for the current fiscal year without enacting further “meaningful fiscal reform”.

The rating agency, in the analysis that accompanied the first sovereign credit rating upgrade The Bahamas has ever enjoyed, predicted that the Government will do no better than “maintain low fiscal deficits” ranging from 1.2-1.3 percent of gross domestic product (GDP) for the next three fiscal years through 2027-2028.

While not identifying what it means by “meaningful fiscal reform”, S&P’s language effectively implies austerity measures such as new and/or increased taxes, spending cuts or a combination of both. The International Monetary Fund (IMF) has suggested similar, but the Davis administration has repeatedly rejected calls for greater austerity and instead focused on generating more rapid economic

growth, enhanced revenue compliance and enforcement and attempting to hold public spending at current levels.

“The growing economy has supported reduced fiscal deficits to levels more consistent with those seen before the pandemic, with the reported fiscal deficit for the fiscal year ended June 30, 2024, at 1.3 percent of GDP,” S&P said in its Bahamas assessment, released on Friday.

“This outcome partly owed to improved tax collection - through a dedicated Revenue Enhancement Unit, among other initiatives - and greater compliance with property taxes. We expect the Government will be able to maintain low fiscal deficits, although in our view it will be more challenging to achieve fiscal surpluses, as the Government is forecasting, absent meaningful fiscal reform.”

Based on The Bahamas’ current GDP economic output, S&P is predicting that this nation will consistently run relatively moderate fiscal deficits of around $181.2m to $196.3m for the next several years through 2027-2028. This

LIQUOR STORE: DRIVE-THROUGH BAN TO HARM 50% OF SALES

By ANNELIA NIXON Tribune Business Reporter

anixon@tribunemedia.net

THE co-owner of a Bahamian liquor store says banning drive-through alcohol sales will damage its competitive advantage and eliminate a segment that accounts for 50 percent of its sales.

The co-owner, speaking out on condition of anonymity after it was revealed that window or “cage” alcohol sales, will be banned from January 1, 2026, as part of the Government’s new liquor licensing regime along with sales by so-called “drive throughs”, take-away restaurants, convenience stores and supermarkets, and mobile bars, said their store’s drivethrough “is a big part of our operation.

“I don't feel as if it's going to affect our establishment as much, seeing as we don't have a cage. But we do have a drivethrough,” the co-owner said. “So that there can be a little bit complicated, because the drive-through is actually a big part of our operation, seeing that it's so convenient.

“A lot of people, they are under-dressed, or they're too tired, or they're prideful and they don't want anybody to see them, or they have kids in the car. And so with us having a drivethrough window, that's like a bonus.”

The co-owner added that the convenience provided by the drive-through has been a huge “selling point” for their store, and said it has given them an edge over nearby competitors.

“So what I've noticed is there's a lot of liquor stores

in this area but, if I'm not mistaken, I think we're the only drive-through,” they said. “And so that helps with us, as far as customers are concerned, because this is pretty much the only place on this long stretch that people can actually come and just drive right up and get served and go without having to leave their car.

“So as far as that is concerned, I feel like that would hurt the business, in a sense, because that gives us a bit of an advantage amongst our competitors because of the convenience that we're able to offer with our drive-through service.

“The drive-through is a very important part of what we actually do. It's what makes us, us, in a sense, because of the convenience and all the other stuff that it actually provides. Bahamians are generally lazy. It's the truth. And one of our selling points has always been convenience making things easy,” the co-owner continued.

“Even as far as our popular items, we put them in easy-to-reach areas, or right at the front door or whatever, because we want to make it as convenient for our customers as possible. And having that drive-through, that does that. So, I feel like it would definitely hurt us, and we won't agree with it.”

Acknowledging that they were not aware of the rationale driving the Government’s new liquor licensing regime, the coowner called for a meeting between the industry and relevant government agencies in a bid to find “common ground”.

CURBS - See Page B8

is in sharp contrast to the $291.4m and $299.6m surpluses that the Davis administration itself is forecasting for 2026-2027 and 2027-2028.

However, Gowon Bowe, Fidelity Bank (Bahamas) chief executive, argued that achieving the Government’s forecast surplus is more a “bonus” rather than a target that must be hit.

“If we achieve a surplus that’s a bonus. It isn’t one that we must achieve a surplus, but if we get closer to that in the eight to ten months that will bode well and support the upgrade that has taken place,” he told Tribune Business.

Still, S&P is forecasting that The Bahamas will beat both earlier predictions and its long-run average with 2025’s full year economic growth set to be 2.1 percent thank to “booming cruise tourism” and foreign direct investment (FDI) related construction projects across the Family Islands. The rating agency, though, projected that from 2026 onwards economic growth will taper-off to a consistent 1.7 percent through 2026.

“Growth will temper in 2026, although over time the successful implementation

of comprehensive energy reforms may address some bottlenecks for growth,” S&P added. “We expect the Government will continue to carefully manage its expenditure and focus on tax compliance measures to sustain revenue and maintain small fiscal deficits….

“However, the country remains highly dependent on tourism, and labour constraints weigh on longterm growth. The Bahamas also has a sizable financial sector, and while opportunities exist to foster local fintech (financial technology) and position the country for opportunities in digital assets, we view this as a longer-term goal.”

Shrugging off the potential impact of the upcoming Bahamian general election, S&P added: “We expect policy predictability across administrations with the upcoming 2026 electoral cycle. The sovereign recently faced two large shocks, Hurricane Dorian in 2019 and the COVID-19 pandemic in 2020, which significantly raised government debt and tested the Government's resolve to sustain the nation's finances.

“While the Government has been able to reduce the deficit on the back of the country's economic recovery, it has not introduced material new revenue or significant cost-cutting measures. The country is exposed to environmental risks and has limited fiscal buffers.

“While the Government has demonstrated its commitment to fiscal consolidation since the pandemic and reduced the deficit, we expect that absent meaningful reforms to build buffers, it will remain vulnerable to external shocks like hurricanes.”

Noting that The Bahamas has no personal income tax, and only a 15 percent corporate tax for those entities that are part of multinational groups with an annual turnover above 750m euros, S&P said it does “not expect further changes to its [The Bahamas] fiscal and tax model.

“Added revenue from the Domestic Minimum Top-Up tax, expected to go into effect in fiscal year 2025-2026, may be offset by the announced reduction of the VAT rate to 5 percent from 10 percent on select unprocessed and essential

food items to address cost of living pressures,” S&P said.

“Controlling expenditure will be crucial to maintaining low deficits. The Government has limited fiscal space, given a higher share of recurrent expenditure, including around 15 percent of total expenditure on subventions to public entities. Moreover, the Government has had to make payments on the guaranteed debt of stateowned enterprises (SOEs). SOE reform has been historically limited.”

S&P, though, said that the Government’s refinancing risks have “abated” despite needing to rollover 43.6 percent of its total debt that is due to mature in one year or less. It added: “We expect small fiscal deficits and a growing economy will lead to a slow decline in The Bahamas' financing needs as a share of GDP, with the increase in general government net debt averaging 1.3 percent of GDP during 2025-2028.

“The Bahamas has significant short-term debt, with almost 43.6 percent of debt maturing in the next

TAXI CABS STRUCK BY CELEBRATION KEY DROP

By ANNELIA NIXON Tribune Business Reporter

anixon@tribunemedia.net

GRAND Bahama taxi drivers are looking to the Government to help remedy a significant loss of business caused by the opening of Carnival Cruise Lines’ $600m Celebration Key project.

Speaking after drivers met with the JoBeth Coleby-Davis, minister of energy and transport last Monday, Grand Bahama Taxi Union president, Harold Curry, said further talks are scheduled with her as well as with Carnival.

Disclosing that the union has also met with Chester Cooper, deputy prime minister and minister of tourism, investments and aviation, on the issue, Mr Curry said the next meeting is set for October 16.

“She’s [Mrs ColebyDavis] working on it,” Mr Curry said. “She’s working on it hard. She’s doing a tremendous job with us. As a matter of fact, Monday gone, we met with her. She met with the union about Celebration Key. She’s now aware, and she is having a meeting with Celebration Key, seeing if they can get some more jobs for us as well. She’s working with us.”

Mr Curry said tourists seemingly stay within Celebration Key’s confines and no longer venture off-property on taxi rides, tours and excursions. He added that Celebration Key likely does not promote these activities to their guests either, wanting them to stay on property so Carnival and its vendors can retain all their spending.

Mr Curry said he has written a letter to Celebration

Key requesting a taxi information booth be provided. He added that the private cruise port’s set-up does not allow for taxi drivers to attract sales.

“We recognised Celebration Key, the way they have it situated, you can’t get in there to mingle with the guests, to sell the island, because Celebration Key, that’s a private key,” he added.

Since Celebration Key’s opening, Mr Curry said taxi drivers have gone from transporting around 300

people a day to under 150 people a day.

“Since they came, we’re just not getting the business like we was expecting,” Mr Curry said. “It looks like most of the people stay on the key. And because of that, it affects the harbour. The harbour doesn’t have much traffic coming through there.

“One time ago, from the [Freeport] harbour we could move at least 300 people a day from the cruise ship port from the harbour. But now we can’t move 150 from Celebration Key a day.

“We get more people coming in, but get a lot less traffic out of there. There’s like sometimes 12,000 people, two boats a day in there, 12,000, 8,000 people a day, and taxi drivers can’t get 200 out of that. They can’t get 150,” Mr Curry added.

“We used to move at least - and our cars were loaded - we could have moved at least 30, sometimes 40 cars a day. And now you can’t move seven cars hardly.

“That’s where everybody used to get a piece of the pie. And now the tour operators crying as well, because they used to come up with bus loads. The tours dropped. Like they’d get 15 people, sometimes 18 a day

from there. So everything dropped for everybody.”

John Fox, owner of Seashore Treasures said sales at the cruise port are “fabulous.” However, as an owner of a downtown Freeport business, he added there has been a “a significant drop off in sales”.

“Since the opening of Celebration Key, which is Carnival’s port, in general in the city, it seems to be a slowdown in business,” MrFox said. “And I can attest to that as well, because my wife and I also own a shop in the downtown area, and it’s been a significant drop-off in sales.

“I know that this is the time of year when everybody expended a lot of funds, getting their kids back in school. So you do see a downturn in September, but it just seems to be exaggerated this year. And even traffic wise, on a Saturday morning you go downtown, it’s not the same amount of traffic.

“Maybe a lot of people working at Carnival. They’re open seven days a week, so maybe a lot of people don’t have time to shop. I don’t know. It’s strange. It’s hard to explain. But as a business owner in the downtown area, we’ve seen a significant drop off in sales.”

BONEFISH TRUST SALUTES

THE Bonefish and Tarpon Trust (BTT) says it has recognised flats fishing tourism as one of this nation’s most high-value and sustainable experiences in celebration of Saturday’s World Tourism Day.

The Trust, in a statement, said its partnership with the Ministry of Tourism, Investments & Aviation and Bahama Out Islands Promotion Board (BOIPB) underscores the country’s position as the premier destination for flats fishing - from Andros to Abaco, Grand Bahama to Inagua and beyond - while advancing best practices that

protect marine ecosystems and the livelihoods they support.

It added that anglers travel to The Bahamas for fishing experiences that simply do not exist elsewhere in the world at this scale and quality.

“Flats tourism is a winwin: It brings visitors who value pristine nature and authentic Bahamian service, and it rewards communities for keeping ecosystems healthy. On World Tourism Day, we celebrate partnerships that translate conservation into opportunity," said Rashema Ingraham, the BTT's

BAHAMAS SEES 24 TOURISM STAKEHOLDERS GAIN

TWENTY-four Bahamian tourism stakeholders have been recognized by the Bahamas Travel and Sustainability Awards, hosted by Caribbean Journal.

Voted upon by nearly 50,000 visitors, industry professionals and local Bahamians, the winners of Caribbean Journal’s 2025 Bahamas Travel and Sustainability Awards are:

– Nassau, Paradise Island

Bahamas – Pink Sand Beach, Harbour Island

The Bahamas – The Cove at Atlantis, Paradise Island

The Bahamas – Graycliff Hotel

The Bahamas – Graycliff Restaurant

in The Bahamas – Sandals

Royal Bahamian

HONOURS

year – Atlantis Paradise Island of the Year – Exuma

Bahamas – Bahamasair

Bahamas – Valentines, Harbour Island

Bahamas – Royal Caribbean Cruise Line

host/hostess – Katherina and Victor Cooper - Exumamas – Dilly Club, Paradise Island

attraction in The Bahamas – Boating in Exuma

ism award – Nassau Straw Market

vation award – Coral Vita, Grand Bahama

Bahamas – Cheryl Cambridge, Nassau

Caribbean programme director.

The Trust said guided bonefishing is more than a sport, but a culture, a craft, and a reliable engine for Out Island economies. The sector supports Bahamian guides, small lodges, marinas, restaurants, water taxis and family businesses that anchor local communities.

“The Bahamas’ flats are a national treasure. Our Out Island lodges and guides are the backbone of this sector. Flats tourism brings repeat visitors who support local businesses year after year," added Kerry Fountain, executive director,

ing also complements

‘blue economy’ experiences ranging from scuba diving on vibrant reefs and blue holes to snorkelling, kayaking and eco-tours, extending stays and spreading benefits across islands and seasons.

“The flats of The Bahamas offer more than world class fishing; they offer a model for sustainable tourism rooted in culture, conservation and community. As we celebrate World Tourism Day, we honour bonefishing not only for its economic value, but for the way it preserves our ecosystems, empowers local livelihoods, and showcases the spirit of The Bahamas to the world," said Jermaine Johnson, co-ordinator, sustainable development department, Ministry of Tourism, Investments and Aviation

mas – Jamal Smalltive of the year – Audrey Oswell, Atlantis Paradise Island

leadership award – Lakeshia Anderson Rolle

The Bahamas – Bimini Big Game Club

The Bahamas – Marv Cunningham

Bahamas – Goldie’s Conch House, Nassau

Bahamas – Bahama Mama Chester Cooper, deputy prime minister and minister of tourism, investments and aviation, said, “The continual growth of tourism in The Bahamas is a testament not only to the beauty of islands and the warmth of our people, but also our commitment to building a responsible and resilient sector.

“Prioritising sustainability is vital to preserving the

destination we wish to share with the world, and we are proud to honour those who lead by example, ensuring that The Bahamas remains as extraordinary tomorrow as it is today.”

“We applaud the vision and dedication of those recognised for driving sustainable tourism across our islands,” said Latia Duncombe, director-general at the Bahamas Ministry of Tourism, Investments and Aviation.

“Their innovation and passion preserve our natural environment, uplift our

communities, and enrich the experiences we share with millions of visitors each year.”

“The Bahamas continues to set the standard for sustainable tourism in the region,” said Alexander Britell, editor and publisher of Caribbean Journal.

“Through these awards we’re proud to shine a spotlight on the people and places whose innovation and commitment are shaping the future of Bahamian tourism, and to celebrate the destination’s leadership on the global stage.”

DPM is main speaker for Exuma Business Outlook

THE Deputy prime minister will deliver the keynote address at the 19th annual Exuma Business Outlook conference that is scheduled to be held at the Grand Isle Resort & Residences on Thursday, October 16.

Clay Sweeting, minister of works and Family Island affairs, will introduce Chester Cooper, also minister of tourism, investments and aviation, and Exuma’s MP, at an event that will be held under the theme ‘Prioritising inclusive sustainable growth’.

Hosted by The Counsellors, it will bring together government officials,

business leaders, entrepreneurs and community stakeholders to examine Exuma’s economic landscape and explore opportunities for future growth. With a focus on sustainable development, tourism, infrastructure and entrepreneurship, the Business Outlook series seeks to foster collaboration and deliver practical strategies for long-term progress. The programme will feature a wide range of presentations and discussions designed to provide insight into Exuma’s growth potential. Tourism will be featured in the panel

discussion, ‘Tourism is everybody’s business’, moderated by Kerry Fountain, executive director at the Bahamas Out Island Promotion Board.

Panellists include Emmett Saunders of the Exuma Chamber of Commerce; Tracy Cooper of Bahamasair; Sarah Swainson of Hocher Holdings; Candice Moncur of L.N. Coakley School; Superintendent Deanza Cash of the Royal Bahamas Police Force; and Shona Perry of the Grand Isle Resort.

Senator Randy Rolle, executive chairman of the Consumer Protection Commission, will address

consumer protection issues, while Dr Lincoln Marshall, adjunct professor at Bowling Green University, will present on maximising the benefits of regattas and festivals.

Shakera Johnson, director of information security at Cable Bahamas, will focus on cyber security, while Keith Roye, founder and chief operating officer of TriblockHR, will examine the role of artificial intelligence in the workplace.

The challenges of delivering sustainable infrastructure will be explored in a session led by Ayla Isaacs of the Water & Sewerage Corporation and Anthony Christie, chief operating officer at Bahamas Power & Light (BPL). Ian Ferguson, chief executive of the Tourism Development Corporation, will also

share insights on opportunities for tourism growth.

The day will close with an entrepreneurial panel featuring Alvin Clarke, a farmer; Keiron Sears, a fisherman; and Shenifer Rolle of Exuma Home Rentals, highlighting the grassroots innovation driving the island’s economy.

Ehren Hanna, president of the Exuma Chamber of Commerce, said of The Counsellors: “Their dedication to fostering meaningful dialogue and supporting the business community has been invaluable, and the Chamber expresses its gratitude for their continued partnership in making events such as this a success.

“The Exuma Chamber of Commerce believes that this event will serve as a critical platform for collaboration and networking, helping to connect local businesses

Development Bank teams on climate change efforts

THE Bahamas Development Bank (BDB) and The Nature Conservancy (TNC) have signed an agreement to collaborate on initiatives that promote climate adaptation and mitigation.

The two parties, in a statement, said the Memorandum of Understanding (MOU) also involves conservation finance and the development of a sustainable ‘blue economy’ in The Bahamas.

They added that the agreement establishes a framework for co-operation between the two institutions and reflects a shared commitment to supporting the goals of The Bahamas’ National Development Plan (NDP), sustainable development goals (SDGs) and other national priorities related to environmental sustainability and inclusive economic growth.

The BDB and TNC said they will work together to promote and support projects that contribute to the conservation and restoration of coral reefs, sustainable marine resource management, and the

creation of resilient, naturebased livelihoods. The partnership is also centred on the advancing blended finance models that support the Impact Funding for BahamaReefs programme, supported by the Global Fund for Coral Reefs, and other innovative conservation finance efforts.

Dave Munroe, the Bahamas Development Bank’s acting managing director, said: “This MOU underscores the bank’s strategic vision to support sustainable development through climate-resilient financing and impactful partnerships.

“By combining our financial tools with TNC’s environmental expertise, we are creating pathways for more inclusive, equitable growth while safeguarding our invaluable marine ecosystems.”

Sumayyah Cargill, the BDB’s acting deputy managing director, added: “We are proud to be working with The Nature Conservancy to expand access to sustainable financing in The Bahamas.

“This partnership supports the empowerment of local communities and entrepreneurs to take part in protecting our natural environment while building climate-resilient livelihoods.”

Through the MOU, the BDB will also serve as a member of the BahamaReefs Steering Committee and provide technical assistance, financial services and business development support to strengthen TNC’s conservation finance initiatives, including the Impact Funding for BahamaReefs blended finance initiative.

Marcia D. Musgrove, Northern Caribbean programme director of The Nature Conservancy, said: “For more than 20 years, TNC has collaborated with national and communitybased organisations to conserve the lands and waters on which all life depends. Today, we are excited about this new partnership with the Bahamas Development Bank to help finance a more resilient Bahamas where both nature and people thrive.”

Frederick Arnett, BahamaReefs programme manager of The Nature Conservancy, added:

“Through the BahamaReefs programme, TNC and The Global Fund for Coral Reefs (GFCR) are seeking to provide innovative financing to develop and scale reef positive

businesses in the Blue and Green Economy.

“BDB is the right local partner to deliver the financial expertise necessary to make this programme a success. It is our hope that through this partnership we will be able to provide Bahamian businesses and projects with the support

with the resources and knowledge needed to thrive in an ever-evolving global market. This is a unique opportunity to gain valuable insights, discuss pressing issuesand be part of shaping the future of business in Exuma.”

Dr Lincoln Marshall added: “I’ve attended many regattas and festivals, and I want to provoke thought about their broader value. Too often, people see these events as just opportunities to enjoy themselves.

“But there’s more to it. We need to consider how the community benefitshow it develops pride, how economic activity is generated, and how cultural and social aspects can be enhanced. I want to challenge those in attendance to think about how we can maximise the impact of our festivals and regattas.”

they need to finance innovative solutions designed to restore and protect Bahamian Coral Reefs while increasing the resilience of local communities.”

The MOU is effective for five years and is structured to allow both parties to maintain their independence while aligning their activities for greater national and community impact.

year. We expect this debt will be largely rolled over in the domestic market. Refinancing risks have abated, given the Government’s commitment to fiscal discipline, combined with limited private sector lending opportunities.

“Foreign currencydenominated debt accounts for 47.2 percent of total debt. We expect the Government will continue to use commercial and multilateral bank funding, and may issue in external bond markets,” S&P continued.

“Net general government debt is likely to fall to 66.3 percent of GDP by the end of 2025 from 77.8 percent

in 2020, while interest payments will remain above 15 percent of revenue for the next three or more years. We net some of the assets held by the country’s social security system from our measure of net debt.

“We forecast the external debt of the public and financial sectors, net of usable reserves and financial sector external assets, will be about 42.3 percent of current account receipts in 2025. These figures include the Government’s $2.64 bn in external bonds.”

S&P forecast that The Bahamas’ current account deficit may widen in the short-term due to increased imports associated with the ongoing energy reforms. “Based on the large

external liabilities of the country’s banking sector, the gross external financing needs of the public and financial sectors will average 193.6 percent of current account receipts in 20252028, down from about 519 percent in 2020,” the rating agency said.

“The current account deficit may widen in the short-term due to higher imports associated with investments undertaken because of the energy reform, offsetting some gains in tourism receipts, and as the financial sector’s rollover needs remain high. Over the long-term, the reforms could contribute to smaller current account deficits by reducing fuel imports.”

Bahamas external debt profile is ‘manageable and improving’

FIXED - from page B1

threat posed to The Bahamas’ external reserves or debt sustainability.

The Bahamas’ external reserves, which were

down year-over-year by a modest $12.1m at $2.963bn for the seven months to end-July, are the most critical element in this nation’s monetary policy because they underwrite the fixed exchange rate regime and

this nation’s one:one peg with the US dollar. They received a recent boost from the Government’s recent $1.067bn foreign currency bond placement.

S&P, in upgrading The Bahamas’ sovereign credit rating from ‘B+’ to ‘BB-‘, also assigned a ‘stable’ outlook to this nation to indicate that no reversal of this decision is likely within the next 12-18 months.

“The stable outlook reflects our expectation that GDP growth prospects will remain solid and that long-term growth will align with that of peers at the same level of development. We also assume the Government will remain committed to prudent fiscal management and contain the debt burden,” S&P said.

“We could lower the ratings over the next 12-18 months if the Bahamas’ growth trajectory faces unexpected and significant setbacks or if the Government reverses the progress it has made on fiscal adjustment, leading to large fiscal deficits. We could also lower the ratings

As at end-June 2025, The Bahamas’ foreign currency debt stood at 47.2 percent of the total $11.769bn, pegging it at $5.555bn. This exceeds the external reserves by more than $2.555bn, and Ms Dukharan herself noted that external debt is 44.7 percent of the total with 50 percent of the latter held by private creditors.

But Mr Rolle argued that The Bahamas is earning sufficient returns from the activities funded by its foreign currency borrowing to repay these debts.

As for the concerns over debt sustainability, the Central Bank governor argued that the maturities – or timing of foreign currency bond principal and other borrowing repayments – is spread out over a decade with prospects for any refinancings improving due to The Bahamas’ recent sovereign credit upgrade by Standard & Poor’s (S&P).

And, noting that foreign currency inflows from private sector investments have helped boost The Bahamas’ foreign currency reserves, Mr Rolle said the latter’s “more than net doubling” over the past decade was due to this rather than Government or public sector borrowing.

“The analysis is flawed,” the Governor said of Ms Dukharan’s concerns. “There are many reliable and consistent measures of the debt burden and reserves adequacy that can be used.

“Debt sustainability is grounded in assessments of an economy’s ability to earn sufficient returns from the investments funded by the borrowings to repay the debt. It is also a function of the maturity profile

if the sovereign’s access to external liquidity were to deteriorate unexpectedly.

“We could raise the ratings in the next 12-18 months if The Bahamas continues to demonstrate solid growth and sustained near-balanced fiscal outcomes. This could result from stronger revenue supported by, among other things, the successful implementation of a new corporate income tax and policies and initiatives that accelerate state-owned enterprise (SOE) reform.”

The Government, responding to S&P’s action, said: “This ratings upgrade from S&P reflects the ongoing recovery of credit perception and marks a significant milestone in The Bahamas’ re-rating trajectory, building upon positive ratings actions from Moody’s (outlook revision to ‘positive’ from ‘stable’) and Fitch (‘BB-’

of the debt, which is manageable for The Bahamas, as the repayment for The Bahamas, at least, is spread over more than a decade with continued favourable prospects for refinancing maturing portions of the debt if needed.

“Ability to refinance when needed is improving, and grounded in strengthening access to international capital markets,” he added.

“Moreover the accumulated net inflows which impact the external reserves have resulted for The Bahamas from both public and private sector activities, including private sector investments.

“It is valid to consider both the public and private sectors’ profile of assets and liabilities when looking at the adequacy or vulnerability implied from the stock of external reserves. That is a profile in which liabilities have largely funded investments, with returns that will pay interest on the debt and eventually repay principal.

“Beyond debt, the investment inflows are also substantially in private ownership, which when required are also being sustainably satisfied from dividend payments,” Mr Rolle asserted.

“A final point, which we must stress is that as a residual, the accumulation in the stock of external reserves over the last decade - when it has more than doubledwas on net due to a greater net retention of private sector inflows than net public sector borrowing.”

Ms Dukharan, meanwhile, noted that it is forecast that The Bahamas’ annual gross domestic product (GDP) or economic growth is converging to its long-run average. “The IMF expects 1.7 percent growth in 2025, falling below 1.6 percent through 2029, with an estimated long run growth potential of 1.5 percent. Central Bank also

/ ‘stable’ inaugural credit rating), both of which were published in April, and the country’s successful return to international capital markets in June. It further demonstrates the authorities’ commitment to improved market disclosure and financial transparency.”

One financial source, speaking on condition of anonymity, said: “This is an accomplishment. You can’t knock that. This helps us from a financing standpoint. That’s critical. It’s now for the Government to make use of their fortune.

“They have to decide if they will continue with fiscal consolidation because it will help to lessen the burden of refinancing debt. We’re still non-investment grade. The consolidation has to continue to get back to investment grade. It’s still not where we need to get to. We only got knocked down because of the pandemic.”

anticipates growth below 2 percent in 2025,” she wrote. S&P, in its just-published annual country analysis of The Bahamas, added: “We forecast the external debt of the public and financial sectors, net of usable reserves and financial sector external assets, will be about 42.3 percent of current account receipts in 2025. These figures include the Government’s $2.64bn in external bonds.

“Based on the large external liabilities of the country’s banking sector, the gross external financing needs of the public and financial sectors will average 193.6 percent of current account receipts in 2025- 2028, down from about 519 percent in 2020. The current account deficit may widen in the short term due to higher imports associated with investments undertaken because of the energy reform, offsetting some gains in tourism receipts, and as the financial sector’s rollover needs remain high. Over the long term, the reforms could contribute to smaller current account deficits by reducing fuel imports.

“However, we consider the financial sector’s external assets to be highly liquid, diminishing liquidity risk,” S&P said. “Errors and omissions have historically been high and tend to fluctuate, contributing to the weak external profile.

“The Bahamas has limited monetary and exchange rate flexibility. The Bahamian dollar is fixed at par with the US dollar. Lower demand for foreign exchange and the Government’s external borrowing have bolstered foreign exchange reserves, which remain slightly under $3bn. We expect the Central Bank will continue to rely on interest rates, moral suasion and macroprudential tools to influence domestic credit growth.”

FINANCIAL ACCOUNTANT

The candidate will be required to provide assistance to the Accounting Department by managing daily accounting task. The person is expected to be well versed in accounting policies and maintain high level attention to details.

Responsibilities:

Maintain Accounts payable and post necessary entries to GL, wire transfers and prepare checks Review, analyze and investigate variances along with maintaining the general ledger Complete Credit card reconciliation

Manage the company’s time clock system & Process bi-weekly and monthly payroll Process all staff NIB contributions

deposits Contribute to the end of month process including journals, accruals and Bank reconciliations. Assist with Ad hoc reports and other management reports.

SKILLS

Bachelor’s Degree in Accounting/ Finance/ Economics services

Word

Excellent organizational and communication skills

Proven analytical and problem-solving skills Strong understanding of basic accounting and bookkeeping procedures.

If you meet the above Requirements and

Resorts ‘won’t have to jump through all hoops’

online portal set to launch on October 1 despite making the case that it already provides a list of them to the Hotel Licensing Board.

With the BHTA now moving rapidly to present a position paper identifying “four to five fundamental issues that would be concerning issues to the industry”, Mr Sands said: “I asked a question, because this is so onerous, would they give consideration for a two-three year licence, especially for the hotel industry?

“We’re going to sit and have our meeting, and do our recommendations. I don‘t want to pre-empt that discussion, but there is obviously a burden around the onerous arrangement and registration to the extent that it doesn’t hold up hotel licensing which can be delayed for hotel purposes.

“We want to meet collaboratively and have a discussion and put a position that’s unified. We understand why they are doing it, and we understand it has

to be one framework, but maybe there can be ways in which we can roll out the red carpet rather than red tape for this sector.”

Ms Strachan, in her BHTA presentation, conceded that the changes to the Business Licence Act’s section nine – which require all businesses to apply for registration and certification by December 31 – will “be a big change because right now some hotels just have a hotel licence.

“We really don’t know how many restaurants and bars and lounges and liquor stores, or even stores that may sell souveniurs and liquor, you have,” she added. The Business Licence Act changes, introduced alongside the 2025-2026 Budget, now mandate that all entities selling liquor – including those based in the hotels – must apply to, and obtain from the tax authority, certification before they can obtain their full Business Licence.

Liquor retailers and wholesalers, as well as bars, restaurants and nightclubs, plus hotels must submit

their applications 90 days in advance if it is a new business or by December 31, 2025, if it is a licence renewal. All applications will now be subjected to a public consultation process to obtain the views of nearby residents and others on whether a licence should be granted for a particular location or operation.

“Right now renewals happen almost automatically for Business Licences and there’s no public consultation process,” Ms Strachan

conceded. She added that the new licensing regime, in effect, replaces the Liquor Licensing Board that was eliminated in 2010 and never replaced.

Responding to Mr Sands’ concerns that hotels are being asked to duplicate what they provide to the Hotel Licensing Board, Ms Strachan said: “We know you have a hotel licence that kind of gives you carte blanche to open and operate the establishments you need to open in that hotel….

“What we have done at the Department of Inland Revenue is we already came up with a very shortened process for the hotels, especially the big hotels, so we won’t require you to jump

through all the hoops of get-

ting all the certification.

“What we will require you to do is go on the Liquor Registration Portal and at least sign on to the portal and indicate to us the number of restaurants you have, the number of liquor stores or souveniur stores that sell liquor, and attach copies of your hotel licence. That will suffice for liquor registration for the hotels because we realise that the Hotel Licensing Board does a really thorough inspection of the hotels.”

Responding to Mr Sands’ concerns that the liquor registration process may “not tie-in” with the hotel licensing timeline, and that resorts should be given concessions if this is missed through no

fault of their own, Ms Strachan said the tax authorities were in touch with all other relevant government agencies and recognized there will “be challenges trying to meet the deadline”.

Hotels will have to pay a fee for each liquor-selling entity that operates from within their property, and Ms Strachan said she was unable to speak on suggestions that the industry be given a reduction on its hotel licensing fee or any other form of levy.

She also added that it was “too soon to speak” to Mr Sands’ suggestion that hotels be given two or threeyear certifications to ease the “very onerous” liquor licensing regulatory burden.

Liquor store owners backs crackdown on take-aways

CURBS - from page B3

“I don’t think it’s right to make changes without knowing and fully understanding the entire concept of what it is or what it takes to operate that business,” they said. “So it’s basically like, you’re on the outside looking in, but yet here you are making all of the decisions.

“I don’t feel like you can make a decision about something that you don’t understand. That’s like me going to NASA and I telling them, ‘Hey, I don’t think y’all should fly the spaceship today.’ I don’t know anything about spaceships, so like, I have no right to actually go there and say some stuff like that.

”And I feel like it’s the same thing here. More due diligence needs to be done,

and they need to meet with the owners and the operators to see if some sort of common ground can actually be met.”

There was, however, support for the Government’s move to prohibit take-away restaurants that double as liquor stores. Many liquor retailers and wholesalers owners have voiced displeasure with such businesses selling liquor either

Sir Franklyn: Minnis grew fiscal deficit ‘too rapidly’

UPGRADE - from page B1

of restoring ‘investment grade’ status by 2028-2029.

However, Sir Franklyn Wilson, the Arawak Homes and Sunshine Holdings chairman, described S&P’s assessment of The Bahamas’ improved creditworthiness as “a game changer” and signal that this nation is “bouncing back” from the $1.335bn fiscal deficit it incurred for 20202021 during the COVID-19 pandemic’s peak.

Asserting that he was “not being partisan”, he argued that the then-Minnis administration had expanded the fiscal deficit at “too rapid” a pace even though significant public spending was necessary after the Bahamian economy was forced to shutdown almost overnight by the pandemic.

Sir Franklyn said the S&P upgrade is a sign of improved investor and international capital markets confidence that The Bahamas is emerging from those struggles, and agreed that the country’s enhanced creditworthiness will improve the Government’s access to financing and ability to borrow at lower costs (reduced interest rates) and better terms.

Credit rating upgrades typically give investors greater confidence that countries are managing their fiscal affairs prudently, which can help attract greater levels of foreign direct investment, while lower borrowing costs help ease the debt servicing burden for Bahamian taxpayers.

S&P, explaining what drove The Bahamas’ credit rating upgrade, cited the upward revision to The

Bahamas’ gross domestic product (GDP) growth for 2024 by the Bahamas National Statistical Institute (BNSI) to 3.4 percent as well as its strong tourism arrivals performance – especially in the cruise industry.

Providing a further boost by forecasting that Bahamian economic output or GDP growth for 2025 will beat both earlier predictions and its long-run average by coming in at 2.1 percent, S&P said the Government’s energy reforms will be critical to lowering costs for households and companies, improving the ease of doing business and introducing more reliable power supply.

“The Bahamas’ GDP grew at a stronger pace of 3.4 percent in 2024, following revised GDP data collection methods from the Bahamas National Statistical Institute, including wider geographic coverage across the Family Islands,” S&P said.

“Further, The Bahamas’ tourism sector continued to perform very well, particularly within the cruise segment. Total arrivals in 2024 were 11.2m, compared with 9.6 m the year before and up about 153 percent from 2019. The economy also had support from sustained investments across the Family Islands.

“We expect growth in 2025 will remain above potential at 2.1 percent, accounting for continued buoyancy in tourism despite challenges in key source markets. GDP per capita is estimated at $39,590,” S&P added. “The number of inbound arrivals reached 6.3m in the first half of 2025, compared with 5.7m during the same period in 2024.

NOTICE

MVV Assertive Corp.

Incorporated under the International Business Companies Act, 2000 of the Commonwealth of e Bahamas registered in the Register of Companies under the Registration Number 205420 B

“The Bahamas is advancing on its comprehensive energy reforms announced in June 2024, with key partnerships and contracts signed set to support improvements to the country’s transmission and distribution infrastructure, as well as diversifying energy sources in favour of solar power and natural gas. These shifts could create important savings and ease the high costs of doing business in the Bahamas over the long-term.”

Mr Bowe told Tribune Business that S&P’s action was “absolutely positive news”. He added: “It’s one of moving us up one notch closer to ‘investment grade’. As with all rating assessments, it’s more important to read through the basis for which they made their decision.

“Ultimately, there’s a significant amount of reliance based on the fiscal projections; maybe not a surplus but a reduction in the fiscal deficit and curtailment of expenditure. If we achieve a surplus that’s a bonus. It isn’t one that we must achieve a surplus, but if we get closer to that in the eight to ten months that will bode well and support the upgrade that has taken place.”

Mr Bowe acknowledged that energy reform is “high on the agenda” for S&P “from the perspective they are looking to see this isn’t lip service; we are going to see the investments you [the

inside or through a caged walk-up window.

The co-owner said they “agree wholeheartedly” on that element of the crackdown, adding: “I’ve never supported that, and I don’t support it today.”

“I feel like the playing field should definitely be levelled, especially for us as Bahamians, and I don’t feel like we should be at a disadvantage in our own country,” they said.

“So them using a restaurant licence in order to sell liquor earlier and later than the average Bahamian [who owns a liquor establishment], that’s definitely a ‘no’. I’ve never supported

Government] are speaking about and see a reduction in energy costs and improved reliability. That’s a high priority”.

The Fidelity Bank (Bahamas) chief added that another key focus for S&P, as well as its fellow rating agencies, Moody’s and Fitch, is whether the Government will hit its much-touted 25 percent revenue-to-GDP target as well as wider tax reforms.

Examining the overall impact from S&P’s rating upgrade, which is the first that The Bahamas has enjoyed for almost two decades, Mr Bowe added: “To me, I say let us not get too high on the highs or too low on the lows.

“This one is certainly a positive move. It puts us in non-investment grade with lower risk, and places us in a positive light.” The Bahamas also appears to be tracking Jamaica, albeit one notch behind, with S&P having also raised its fellow Caribbean nation’s credit rating last week.

Mr Bowe said Jamaica was more advanced than The Bahamas from the standpoint of having already achieved a Budget surplus and lowered its debt-to-GDP ratio to under 60 percent. This nation’s debt-to-GDP ratio remains in the 70-80 percent range.

“The reason why it’s important to get debt-toGDP down is because it gives us headroom for hurricanes, it gives us headroom to look at capital development and advancement, it gives us some headroom for future borrowing and asset utilization,” Mr Bowe added.

that, and I don’t support it today.” They also noted the disadvantage of alcohol distribution through a caged walk-up window and drive-throughs, including difficulty detecting underage drinkers.

“I agree to some extent that, with the takeaway windows, it’s easier for them to go in and purchase alcohol, because what ends up happening is you don’t exactly have a clear view of who’s in front of you in order to say, ‘I can clearly see that this is a child’, or this person isn’t old enough, or I’m not certain that this person is old enough so let

“It’s important to remain disciplined. There shouldn’t be exaggeration of the upgrade. It’s not taking us from non-investment grade to investment grade. There’s still three notches to go to investment grade.

“It means read the tea leaves for the basis of why they’ve given this assessment, so we manage and ensure these things are carried out and executed so that we can look forward to further upgrades in the ensuing years.”

Mr Bowe continued: “In the Bahamian vernacular, the best way to put it is:

‘Don’t let it go your head’. This is not the achievement we want. It’s merely a step to achievement of your target. Don’t get enamoured by a one-notch improvement from non-investment grade to non-investment grade.

“We must continue these positive actions and make sure where possible to accelerate them.” He added that the information upon which S&P based its decision will be available to all other rating agencies as well as multilateral institutions such as the International Monetary Fund (IMF), which should aid consistency in their assessment of The Bahamas and, potentially, further creditworthiness upgrades.

Sir Franklyn, meanwhile, said of S&P’s actions: “It’s a game changer, it’s a game changer. I have just got back from Washington DC, and what is becoming clearer and clearer to me.. I was speaking to some people and what happened to The Bahamas was, and

me check for some ID,’” they said.

“With the takeaway windows, everything is a lot more fast-paced. So we have lines outside, people in the hot sun. So I feel like, like them as operators, like they just want to get the people in and out. So as far as the licence and checking for IDs and ‘whatnot’, they’re not going to be too focused on that. So, I don’t know if there’s a way to implement, whether you have a take-out or not, that you have to check for ID, but maybe that actually needs to happen.”

I’m not being partisan here, but what happened here is that the pace at which the Minnis administration increased the national deficit was the problem.

“It happened too quickly. COVID happened, and we have to understand the effects, but the pace of it was too rapid. It was too rapid. I was speaking to a finance man who knows The Bahamas extremely well, and his point was that confidence is building that we are bouncing back from that; that particular period.

“When Minnis ran the deficit up at the pace he did it was too fast. That was too fast. It was too fast. That was the problem. I think it takes time for people to see that we are over that. That’s what I think international agencies are now gaining confidence in. We are over that,” Sir Franklyn added.

“I think this [the S&P upgrade] is really a comment on the fact we have turned the corner from that rapid pace of escalation under Minnis.” Tribune Business calculations show that some $2.896bn was added to The Bahamas’ national debt over the three-year period between 2019-2020 and 2021-2022. The Government incurred annual fiscal deficits ranging from $839m during the first of those three fiscal years to $1.335bn in the second and $722m in the latter. However, all were in response to unexpected events –first, the loss, damage and rebuilding caused by Hurricane Dorian and, second, the COVID-19 pandemic.

Notice is hereby given that the liquidation and winding-up of the Company is complete and the Company has been struck o the Register of Companies maintained by the Registrar General.

Dated this 8th day of September, 2025.

NOTICE

MLLV World Holdings Ltd.

Incorporated under the International Business Companies Act, 2000 of the Commonwealth of e Bahamas registered in the Register of Companies under the Registration Number 205106 B

(In Voluntary Liquidation)

The Public is hereby advised that I, JONATHAN CAMPBELL of P.O. Box CR56119 Sunset Park, Ava Way, intend to change my name to JONATHAN SMITH If there are any objections to this change of name by Deed Poll, you may write such objections to the Bahamas no later than thirty (30) days after the date of publication of this notice.

Notice is hereby given that the liquidation and winding-up of the Company is complete and the Company has been struck o the Register of Companies maintained by the Registrar General.

Dated this 8th day of September, 2025.

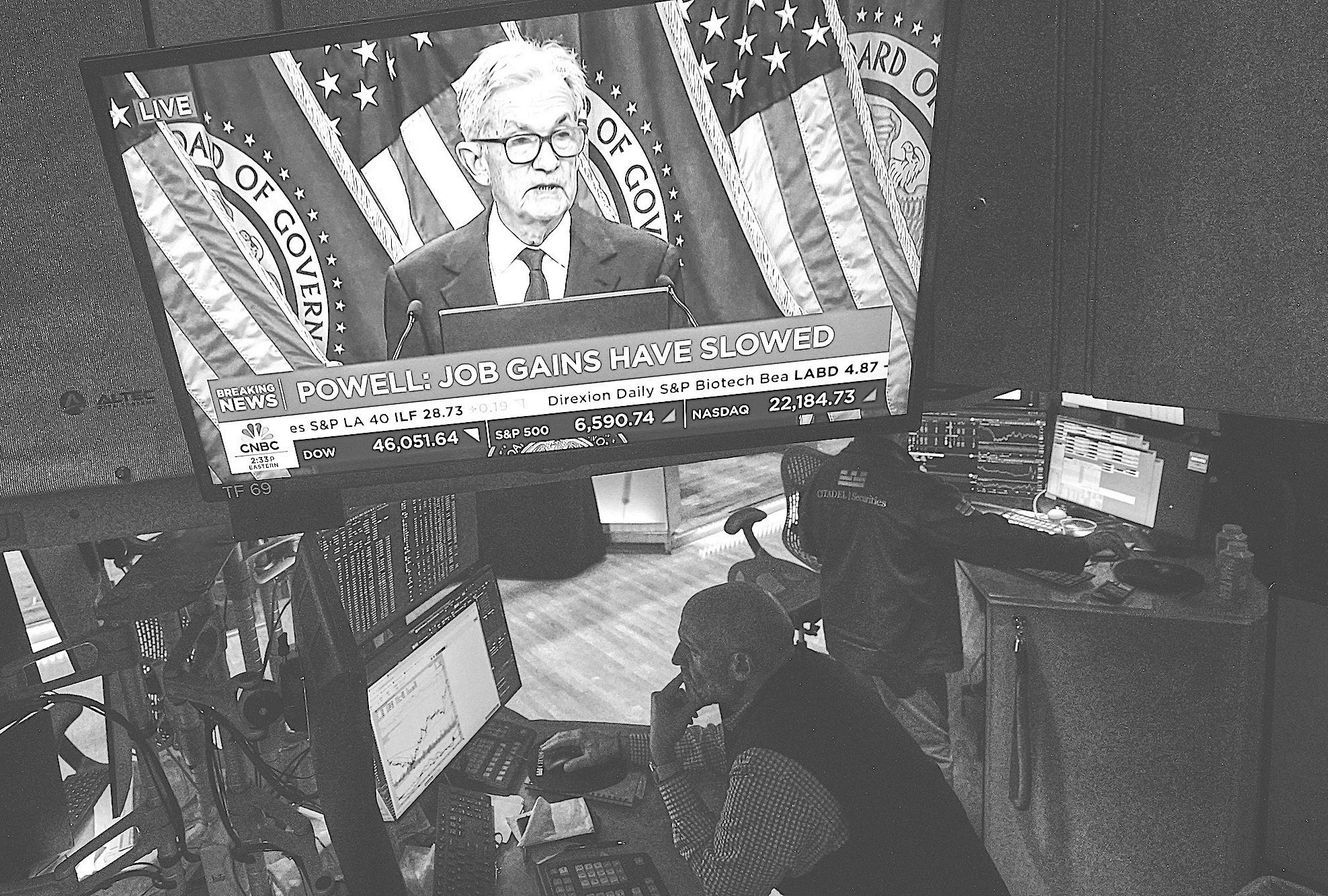

WALL STREET RISES AND SNAPS OUT OF ITS 3-DAY LOSING STREAK

By STAN CHOE AP Business Writer

U.S. stocks climbed Friday and trimmed their losses for the week after a report showed that inflation is behaving roughly as economists expected, even if it’s still high.

The S&P 500 rose 0.6% and broke its three-day losing streak. The Dow Jones Industrial Average gained 299 points, or 0.7%, and the Nasdaq composite added 0.4%. All three indexes pulled closer to the all-time highs they set at the start of the week.

Stocks got some help from a report showing that inflation in the United States accelerated to 2.7% last month from 2.6% in July, according to the measure of prices that the Federal Reserve likes to use. While that’s above the Fed’s 2% target, and it’s more painful than any household would like, it

was precisely what economists had forecast.

That offered some hope that the Fed could continue cutting interest rates in order to give the economy a boost. That’s critical for Wall Street because it’s already sent U.S. stocks on a blistering run to records from a low in April in large part because of expectations for a string of rate cuts. Without such cuts, growing criticism that stock prices have become too expensive by rising too quickly would become even more powerful. The Fed just delivered its first rate cut of the year last week but is not promising more because they could worsen inflation.

One factor threatening to push inflation higher is President Donald Trump’s tariffs, and he announced a set of more late Thursday. They include taxes on imports of some

Share your news

The Tribune wants to hear from people who are making news in their neighbourhoods. Perhaps you are raising funds for a good cause, campaigning for improvements in the area or have won an award. If so, call us on 322-1986 and share your story.

NOTICE

NOTICE is hereby given that ULRICK JEAN BAPTISTE Charles Vincent Street, Nassau, The Bahamas, is applying to the Minister responsible for Nationality and Citizenship, for Registration/ Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twentyeight days from the 29th day of September 2025 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

NOTICE

NOTICE is hereby given that DEAVON CHARISME of Pinewood Gardens, Buttonwood Avenue, The Bahamas, is applying to the Minister responsible for Nationality and Citizenship, for Registration/ Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twentyeight days from the 22th day of September 2025 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

NOTICE

NOTICE is hereby given that SAMMUEL EDWIGE of Nassau, The Bahamas, is applying to the Minister responsible for Nationality and Citizenship, for Registration/ Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 22th day of September 2025 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

NOTICE

NOTICE is hereby given that REVNEAR LOUIS-JEAN of Cox Street, Fox Hill Nassau, The Bahamas, is applying to the Minister responsible for Nationality and Citizenship, for Registration/ Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twentyeight days from the 22th day of September 2025 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

pharmaceutical drugs, kitchen cabinets and bathroom vanities, upholstered furniture and heavy trucks starting on Oct. 1.

Details were sparse about the coming tariffs, as is often the case with Trump’s pronouncements on his social media network. That left analysts unsure of their ultimate effects, and the announcement created ripples in the U.S. stock market instead of huge waves.

Paccar, the company based in Bellevue, Washington, that’s behind the Peterbilt and Kenworth truck brands, revved 5.2% higher, for example.

Big U.S. pharmaceutical companies nudged higher. Eli Lilly rose 1.4%, and Pfizer added 0.7%.

Several companies that sell home furnishings, which could be hurt by higher prices for imports, swung between gains and losses. Williams-Sonoma went from an initial loss of 2.5% to a modest gain and back to a loss before rising 0.1%. RH dropped 4.2% following its own back and forth.

On the losing end of Wall Street was Costco Wholesale, which fell 2.9% even though it reported a stronger profit for the latest quarter than analysts expected. Renewal rates for its membership slowed a touch, while an important measure of underlying revenue growth at its stores fell short of analysts’ expectations.

All told, the S&P 500 rose 38.98 points to 6,643.70.

The Dow Jones Industrial Average added 299.97 to 46,247.29, and the Nasdaq composite gained 99.37 to 22,484.07.

In stock markets abroad, indexes rose in Europe after slumping in Asia.

NOTICE

NOTICE is hereby given that ADELINE BAZILE of Pyfrom Road, Nassau, The Bahamas, is applying to the Minister responsible for Nationality and Citizenship, for Registration/ Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 29th day of September 2025 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

France’s CAC 40 climbed 1%, while South Korea’s Kospi tumbled 2.5% for two of the world’s bigger moves.

Japan’s Nikkei 225 fell 0.9% as Sumitomo Pharma Co.’s shares lost 3.5% and Chugai Pharmaceutical sank 4.8%.

In the bond market, the yield on the 10-year Treasury held steady at 4.18%, where it was late Thursday.

One notable exception was among Americans who own plenty of stocks, who have benefited from Wall Street’s run to records even as the job market slows. Sentiment for them held steady in September, while falling for households with smaller or no stock investments.

The next big event for Wall Street could be a looming shutdown of the U.S. government, with a deadline set for next week. But investors have experience with such political impasses, and they have had limited impact on the market before.

A report said sentiment among U.S. consumers was weaker than economists expected. The survey from the University of Michigan said consumers are frustrated with high prices, but their expectations for inflation over the coming 12 months also ticked down to 4.7% from 4.8%.

NOTICE

NOTICE is hereby given that KENSON JULES of Pinewood Gardens, Nassau, The Bahamas, is applying to the Minister responsible for Nationality and Citizenship, for Registration/ Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 29th day of September 2025 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

Moldova awaits election results in vote plagued by Russian interference claims

By STEPHEN McGRATH Associated Press

MOLDOVANS are awaiting the results of their closely-watched parliamentary election Sunday, a race fraught with claims of Russian interference. Many viewed the ballot as a geopolitical choice between a path to the European Union or a drift back into Moscow's fold.

The tense race was marked by a string of incidents, ranging from bomb threats at multiple polling stations abroad to cyberattacks on electoral and government infrastructure, voters photographing their ballots and some being illegally transported to polling stations. Police also detained three people suspected of plotting to cause unrest after the vote.

When polls closed locally at 9 p.m. (1800 GMT) on Sunday, the Central Electoral Commission reported that more than 1.59 million, or about 51.9% of eligible voters had cast ballots, including 264,000 Moldovans in polling stations set up abroad, which will remain open until 7 p.m. in their respective countries. In the 2021 parliamentary election, turnout was just over 48%.

The race pitted the governing pro-Western Party of Action and Solidarity, which has held a strong parliamentary majority since 2021, against several Russia-friendly opponents but no viable pro-European partners, leaving a lot of uncertainty over potential outcomes even as the results data rolls in.

The pivotal vote will elect a new 101-seat parliament, after which Moldova's president nominates a prime minister, generally from the leading party or bloc, which can then try to form a new government. A proposed

government needs parliamentary approval.

Claims Russia attempted to 'hijack' the vote

Igor Grosu, the leader of Party of Action and Solidarity, said after polls closed that "Russia's attempts to hijack the electoral process have been huge" and that state institutions made efforts to ensure the security and integrity of the voting.

"The consequences of this intervention are hard to estimate at this hour," he said. "We are waiting for the election results. We pray for patience and calm."

Moldova is landlocked between Ukraine and EU member Romania. The country of about 2.5 million people has spent recent years on a westward path and gained candidate status to the EU in 2022, shortly after Russia launched a full-scale invasion of Ukraine. Tensions between Russia and Moldova, a Soviet republic until 1991, skyrocketed.

After casting her ballot on Sunday, Moldova's proWestern President Maia Sandu reiterated long-held claims that Russia "massively interfered" in the election, saying she voted "to keep the peace" and that her country's future lies within the EU.

Long-alleged Russian interference fears

Days before Sunday's vote, Moldovan Prime Minister Dorin Recean warned that Russia was spending "hundreds of millions" of euros as part of an alleged hybrid war to try to seize power, which he described as "the final battle for our country's future."

The alleged Russian strategies include a large-scale vote-buying operation, cyberattacks, a plan to

incite mass riots around the election and a sprawling disinformation campaign online to diminish support for the pro-European ruling party and sway voters toward Moscow-friendly ones.

Just before the vote, police carried out hundreds of raids, detaining scores of people allegedly trained in Serbia to cause "mass riots" and destabilize the country around the critical election.

Russia has repeatedly denied meddling in Moldova and dismissed the allegations last week as "anti-Russian" and "unsubstantiated."

But on Sunday, Moldovan police said they have information about "groups of people" planning to cause unrest from around midnight and on Monday during a protest in Chisinau, to create "disorder and destabilization."

Igor Dodon, a former president and a member of the pro-Russian Patriotic Electoral Bloc, called for a protest in front of the Parliament building on Monday, and later alleged after polls closed that the pro-Western ruling party "is now in panic and is considering various pretexts, excuses and scenarios that go beyond the law and democratic norms."

Shortly before polls closed, police detained three people suspected of being from the security services in Moldova's proRussian breakaway region of Transnistria, who were allegedly planning to cause "mass destabilizations and disorder" after the election.

"They are alleged leaders responsible for coordinating, monitoring and logistically supplying the groups," police said, adding that they found pyrotechnics and flammable materials the suspects

intended on using to cause panic and chaos.

Multiple incidents on election day

But there were many more allegations of irregularities as Moldovans cast their ballots.

Moldova's Ministry of Foreign Affairs said that bomb threats had targeted polling stations set up in several cities abroad, which stopped people from voting for up to two hours in some cases, authorities said. Sandu said in a Facebook address that the authorities also had multiple reports of voters being illegally transported to polling stations abroad, "obviously in exchange for money," and cases of blank ballots being removed from polling stations so they could later "be reintroduced already stamped."

Moldova's Information Technology and Cyber Security Service said that cyberattacks had targeted electoral infrastructure and

government cloud services, but were swiftly dealt with.

Promo-Lex, a nongovernmental organization monitoring the vote, said in a report a few hours before polls closed that it had confirmed more than 300 incidents, ranging from unauthorized persons at polling stations to scores of people photographing or filming their ballots.

The importance of diaspora voters

Moldova's large diaspora is expected to play a decisive role in Sunday's outcome. In last year's presidential runoff — which was also viewed as a choice between East and West — a record number of 327,000 voters cast ballots abroad, more than 82% of whom favored Sandu, and ultimately secured her reelection.

A key opponent of PAS in Sunday's election is the pro-Russian Patriotic Electoral Bloc, a group of political parties that wants "friendship with Russia"