business@tribunemedia.net THURSDAY, SEPTEMBER 29, 2022 EU blacklist threat to insurance costs

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE Bahamas’ immi nent ‘blacklisting’ by the European Union (EU) has sparked fears that increased local insurance rates, and a drastic reduc tion in the availability of coverage, will be among the repercussions for this nation.

Bahamian property and casualty insurers spoken to

by Tribune Business yester day were guarded in their comments as they are still scrambling to assess the full impact of the black listing fall-out for their treaties with European reinsurance companiesespecially those based in Germany.

German reinsurers have a “substantial” share of the reinsurance market in The Bahamas and wider Caribbean, but that nation last year enacted a law

designed to deter its com panies and individuals from conducting business with entities in so-called “tax havens”. Inclusion on the EU blacklist, with The Bahamas likely to be added as early as next week, is one of the cri teria for identifying “tax havens”.

Three German reinsur ers - Munich Re, Hanover Re and R & V Re - are among the biggest part ners for Bahamian and

Caribbean underwrit ers. Anything preventing the renewal of their rein surance treaties with Bahamian carriers, as such agreements are typically negotiated at this time of year, or even paying out their share of hurricane, vehicle accident or other claims, would have sig nificant consequences for local insurers, households and businesses.

‘Free’ Sand Dollars to give currency lift

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

“FREE” Sand Dollars will be issued to incentivise early adoption of a Cen tral Bank-backed digital currency that remains “on the runway”, its governor said yesterday, despite a

305 percent circulation increase during 2021.

John Rolle, address ing a seminar organised by Royal Bank of Canada (RBC), said the pay ments regulator plans to drive increased usage by targeting what he described as a “subset” of consumers with no-cost Sand Dollars to encourage

Bahamas ‘leads pack’ over digital adoption

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

A SENIOR Royal Bank of Canada (RBC) execu tive yesterday hailed The Bahamas as “a bit of a bellwether” for the Carib bean on digital payments adoption with more than 50

percent of its local clients now using such channels.

David Hewick, RBC’s senior director of payments for digital and automation enablement, told a webi nar organised by the bank to discuss The Bahamas’

them to conduct digital transactions via their cell phones.

“We’re basically still on the runway in terms of the level of use and circula tion,” he explained of the Sand Dollar. “What we do around adoption becomes critically important. We do have a programme to pull the commercial banks into

that space. We’re working in this space.

“From the Central Bank’s point of view, there’s going to be a delib erate marketing effort to invest in early use by con sumers. There will be a sub-set of early adopters the Central Bank will give

Seven-fold jump in Benchmark’s debt to clients no alarm

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

A BISX-listed firm has reassured investors that the seven-fold increase in monies owed to clients at year-end 2021 is no cause for alarm since it stems from $150m in securities trading activity.

Julian Brown, Bench mark (Bahamas) president and chief executive, speak ing to Tribune Business ahead of tonight’s annual general meeting (AGM) said the $18.44m shown on the company’s balance sheet represents monies that belonged to customers rather than funds owed to them by the company itself from its own account.

Explaining that, as a broker/dealer, it holds client monies in a fiduciary capacity, he added that this sum represented proceeds from securities trading that customers were now collec tively seeking to “cash out” and retain. And it was these activities that drove Bench mark’s return to profitability in 2021 via a $3.38m bottom line, which was propelled

by a near-$5.5m increase in commissions paid by clients for conducting their stock market transactions.

“That’s just the level of activity we were doing last year. Last year we traded over $150m of securities over our desk on behalf of clients,” Mr Brown told this newspaper, when asked why sums due to clients had jumped from $2.519m to $18.44m year-over-year. “That’s the result of us being able to see a substan tial increase in amounts due to clients that cash out with us at the end of the year.”

He explained that broker/ dealers such as Benchmark

JULIAN BROWN

SEE PAGE B6SEE PAGE B10

SEE PAGE B7 SEE PAGE B11 $5.85 $5.88 $5.71 $5.96

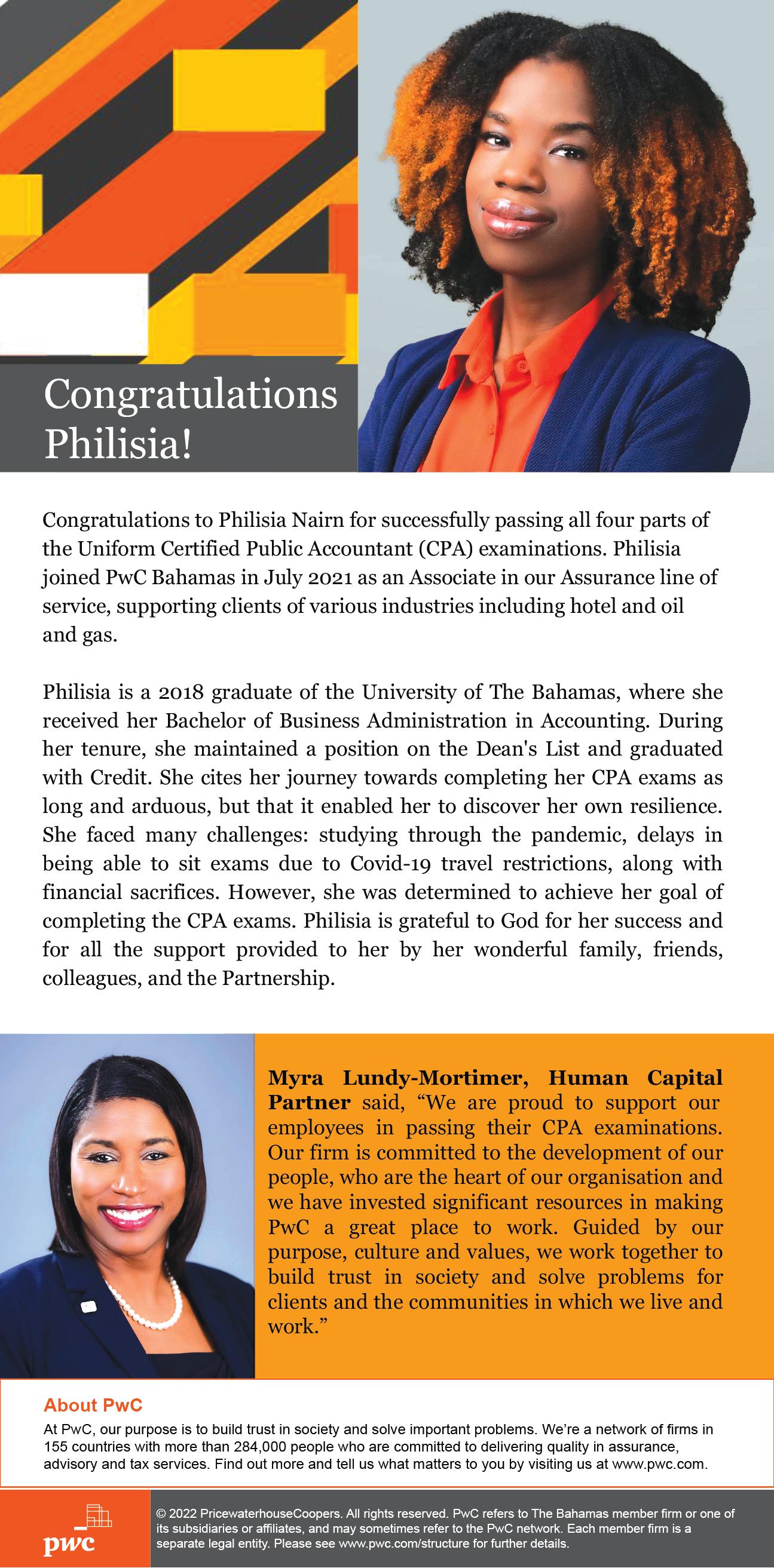

GAINING AN EDGE

VIA STAFF UPGRADES

Training and devel opment in the workplace presents a prime opportunity to expand the knowledge base of all employees. However, many employers find this expensive, and view it as staff missing out on work time while attending training sessions, which may delay the completion of projects.

Despite the potential drawbacks, staff training and development provides both the company and individual employees with benefits that make the cost and time a worthwhile investment.

Assessment Employee development trainers need to be able to assess where workers stand in relation to their ability to complete their tasks cor rectly. This provides the trainer with a baseline from which to judge the employ ee’s future performance, and determines whether or not that worker is meeting the company’s expectations.

Skill Development

Employees who lack some of the skills necessary to complete their jobs require additional training, as their abilities should match the tasks for which they are hired.

Employee development trainers should be able to provide consistent and useful feedback so employ ees can see the areas in which they have improved, and those in which they are still weak. Feedback should be tactful and encouraging but professional rather than tearing down the employee. Deficiencies should be noted, but only in rela tion to the recognition of positive as well as negative performance.

Addressing Employee Weaknesses

Most employees possess weaknesses in their work place skills, so development programmes bring all to a higher level. This helps elim inate any weak links within the company who rely heav ily on others to complete basic work tasks.

Improved Employee Performance

Improved confidence may push workers to perform even better, and think of new ideas that help them selves and the company to excel. Against this backdrop, continuous training keeps employees on the cutting edge of industry develop ments. Employees who are

DEIDRE BastiaN By

competent, and on top of changing industry standards, help a company maintain its position as a leader and strong competitor .

Employees who feel both appreciated and challenged through training opportuni ties may feel more satisfied with their jobs. And, of the utmost importance, work place training improves employee retention and growth. It indicates that the company is committed to providing them with the resources needed to ensure they are doing a good job.

Employees with access to training and develop ment programmes have an advantage over their coun terparts in other companies who are left to seek out training opportunities on their own. The investment in training makes the employ ees feel valued, and creates a supportive workplace.

Training and development programmes provide a host of benefits, as they boost employee performance and productivity, reduce turnover and improve the corporate culture. It gives employees a foundation for how their jobs, duties and tasks should be completed and, most importantly, what their managers are looking for. Until we meet again, fill your life with memories rather than regrets. Enjoy life and stay on top of your game.

BAMSI GREENHOUSES ARRIVE IN TRAINING BOOST

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

A Cabinet minister yes terday said the Bahamas Agricultural and Marine Science Institute (BAMSI) has received long-awaited greenhouses that will enhance training opportu nities for students.

Clay Sweeting, minis ter for agriculture, marine resources and Family Island affairs, told the House of Assembly: “BAMSI has embarked on a greenhouse project that will engage Family Island farmers to provide training oppor tunities in greenhouse technology.

“We will expand the opportunities to grow specific varieties of crops year-round. The first phase of this project will impact the islands of Abaco, Andros, Cat Island, Exuma and, of course, Eleuthera. I’m happy to announce that these massive greenhouses are not just an announce ment, but they are in country as of this week.”

The greenhouse project is something BAMSI had tar geted as far back as April.

Senator Tyrell Young, its executive chairman, described them as a “game changer” for agriculture in The Bahamas. These green houses will allow BAMSI to grow crops year-round and enable farmers on the selected islands to stagger their crop harvests.

Mr Sweeting added: “The evidence shows that since the chairman has taken office… BAIC (Bahamas Agricultural and Industrial Corporation) has reviewed, approved and presented more leases to our partners in one year than under fourand-a-half years under the prior administration.”

“This speaks to the holis tic approach, and the level of commitment and drive, that this team has to meet ing the mandate of this government by tackling food security issues. Speak ing of land, BAIC has been spared in two major initiatives. One is the ongoing commitment to partner with the Bahamas National Trust to preserve our unique pond case sys tems and surrounding land, called Sweetings Pond.

“It is said that Sweet ings Pond has the largest population of seahorses worldwide. This will now become the national Sea horse National Park at Sweetings Pond in the great constituency of central and south Eleuthera.”

The Seahorse National Park is expected to become a “cultural and heritage site” for both locals and visitors. “Bahamians can provide opportunities for themselves in an educa tional or research facility there where we can have students come and do the tour, so this is holistic in its approach at Sweetings Pond in itself,” Mr Sweet ing added.

• NB: Columnist welcomes feedback at dee dee21bastian@gmail.com ABOUT COLUMNIST: Deidre M. Bastian is a pro fessionally-trained Graphic Designer/Brand Marketing Analyst, Author and Certi fied Life Coach

PAGE 2, Thursday, September 29, 2022 THE TRIBUNE

BROKERS IN CONCERNS OVER CUSTOMS SOFTWARE MOVE

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

THE MINISTRY of Finance’s top official yes terday said Customs is merely seeking to ensure its systems are used prop erly amid concerns from small brokers about being forced to hire third-party software providers.

Simon Wilson, the finan cial secretary, told Tribune Business that while Cus toms had issued “no mandate” to the industry it wanted all brokers to use the Electronic Single Window (ESW) or Click 2Clear in accordance with how it is designed based on electronic data indices.

However, David Humes, owner/operator of Integral Logistics, said this means that Customs brokers must now buy third-party entry forms and programs to facilitate the uploading of import declarations and other entry forms to the Cick2Clear portal.

Customs and Ministry of Finance officials met with the broker community over the issue on Monday. The encounter has left Mr Humes and other smaller

Customs brokers anxious because they fear they must now acquire - and install - a file upload program.

They previously uploaded Customs dec larations to Click2Clear themselves. Brokers said they were given a choice between two software providers, Information Specialists Ltd (ISL) and its SWIM technology, or the Goods Acquisition And Control Solutions (GAACS) system.

Patrick Wilson, owner/ operator of CBD Import/ Export, said: “We were highly concerned in ref erence to government implementing these sec ondary companies to supplement the Elec tronic Single Window that is already in place, and which we have been using without having to go through the secondary company to access the Elec tronic Single Window.

“That will cost a large expense on us as brokers. If the Electronic Single Window is working as it is, why is there a need to bring in a secondary company for us to access the Electronic Single Window?”

Mr Wilson, though, said the Government is impos ing “no mandate” that

SIMON WILSON

Customs brokers must use specific firms and prod ucts. He added: “That’s not a mandate. That is false. But what Customs said to them is that the system is designed for electronic indi ces of data. That’s the way the system is designed.

“The way it is being utilised now is not in keep ing with the design of the system, and we want them to use the system the way it is designed. We can’t say which system they should go and select. They can build their own system or they can use what’s commercially available offthe-shelf, or they can use what is available in The Bahamas.”

Mr Humes, though, asserted: “They want us to use independent software to upload files into the system because I guess it’s more efficient for them. Larger Customs brokers already use the Bahamas-based SWIM programme to enter their invoices, and some use their own software, as in the case of Pinder’s Customs Brokerage, which inputs using a Microsoft XAML interface, while others have opted for the GAACS.

“They have the SWIM programme created by ISL and they have the GAACS,” Mr Humes added. “The thing about it is they are telling us that we have to use one of these

come January 2023. The question is why do we have to use it when the Gov ernment system has been accepting our declarations for the past few years? The thing is we have to pay for this and it isn’t cheap.”

The cost of a Customs declaration software pro gram ranges between $2,500 to $5,000 a year depend ing on the sophistication. This is not a one-time fee in many cases, either, as there are renewals on an annual basis or continual upgrade patches provided. There is also the option of using a generic interface such as XAML, which would cost less.

Mr Humes said: “So the Government spent millions of dollars on the Click 2Clear system and it isn’t sufficient, and we have to use a third party? This doesn’t make sense. The other part to this, too, is whether or not this is law as opposed to policy.

“We don’t have any idea as to what this is all about, and we were told that we should contact the financial secretary on whether or not this is a recommendation or a mandate. The meeting on Monday was poorly organ ised, I can tell you that. To mandate something like

this it has to be law. That’s how I see it. Other than that it is a policy, and they may as well had gone to ISL from the get-go.

“Buying a third-party system is a hit to your bottom line, and you have to pass the expense on to your consumer. Large com panies like Pinder’s could afford a system that costs thousands of dollars, but most of us are independent small businesses.”

Kenneth Gibson, chief executive of Five Star Bro kers, added: “I agree with everything Mr Humes said. Monday’s meeting was supposed to be about concessions, and it turned into a third-party mandate on Click2Clear. They want us to pay for this now when the Government’s system was free.

“The GAACS and SWIM is more for big customs bro kerage houses, and that’s why large companies use them because they have the capability of being able to eliminate the redundancies associated with putting in an entry. For them to force the smaller brokerage firms like myself is totally oner ous because we don’t need that.”

‘Increased criminality’ drove 6% suspect reporting growth

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE FINANCIAL Intel ligence Unit (FIU) says the 5.7 percent increase in suspicious transaction (STR) and other reports received in 2021 was driven by “increased criminality” experienced during the COVID-19 pandemic.

The unit, which is responsible for analysing questionable financial deal ings to determine whether a criminal offence is involved, said it received a new record high of 707 STRs last year representing a 6.63 percent year-over-year increase compared to 2020.

Its annual report, tabled in the House of Assembly yesterday, said the increase in its workload mirrored that faced by the Royal Bahamas Police Force and other law enforcement agencies worldwide. “The Financial Crimes Investiga tion Branch of the Royal Bahamas Police Force reported that in 2020 the unit investigated 519 finan cial crime-related matters,” the document said.

“These consisted of offences of fraud, stealing by reason of employment, stealing by reason of ser vice, forged documents, failing to declare and pro ceeds of crime matters. For the year 2021, the Financial Crimes Investiga tion Branch received and investigated 571 matters, an increase of 10.02 per cent. The Central Bank of The Bahamas reported in December 2021 that there was a four-fold increase in the number of frauds attempted during 2020.”

Suggesting that these trends drove the increase on STRs, inter-agency reports and foreign agency requests that it received in 2021 to 885, compared to 837 the year before, the FIU said increased awareness by all agencies involved in com bating money laundering and terror financing would also have helped fuel the rise.

“There was also a substantial increase in sub missions from one financial institution in reporting cases related to a trend peculiar to them, and this undoubtedly affected the

numbers,” the FIU annual report said. “This risk was identified and mitigated after management of the FIU had meaningful dia logue with the regulator and the financial institution concerned.” The institution in question was not named.

STRs filed with the FIU breached the 700 mark for the first time in 2021 fol lowing a “steady increase” over the previous five years. This number compared to 663 in 2020, and was more than double or greater than a 100 percent increase when matched against the 306 filed in 2016.

“Of the 707 STRs filed, 86 percent were filed by banks, with 2 percent from casinos and 4 percent from trust companies, insurance companies and non-bank entities,” the FIU annual report said. “In 2021, the figures showed that the COVID-19 pandemic did not have a noticeable impact on the number of STRs that were filed by banks.

“Notwithstanding the increase in submissions by a particular institution, there was still a marked

increase in submissions by others. STRs received from banks in 2021 represented a 5.6 percent increase over STRs received from banks in 2020.

“There was a slight decline in casino submis sions from 18 in 2020 to 16 in 2021. Statistics also show a decrease in STRs from trust companies from 25 in 2020 to 11 in 2021, and an increase in submissions from insurance companies from one in 2020 to 11 in 2021.”

The FIU annual report added that there was a 166.7 percent jump in STRs

submitted on the basis that cash transactions were involved, with the number increasing from 141 in 2020 to 376 last year. Yet there was also a 71.7 percent decrease in the number of STRs made because account activity was incon sistent with Know Your Customer requirements. These fell from 254 in 2020 to just 72 last year.

Fraud was the suspected criminal offence underlying most STRs. Such reports rose by 25.6 percent in 2021, growing from 325 to 411.

“Criminality documented as corruption increased by

75 percent,” the FIU annual report added. “Tax matters, drugs, insider trading, brib ery and regulatory matters were the next major crimi nality suspected identified.

“While most of the subjects of STRs were Bahamian nationals, the data shows that subjects were also from 32 other countries. There were 61 subjects for whom their country of citizenship was not provided.” Hai tian nationals were second behind Bahamians as the subject of 25 STRs, while Americans accounted for 14 and Brazilians ten.

THE TRIBUNE Thursday, September 29, 2022, PAGE 3

COTTON BAY’S DEVELOPER LEADS TEAM ON SITE VISIT

THE Colombian billionaire behind the longpromised $100m Cotton Bay Holdings project has accompanied architects, resort operators and con struction personnel on a tour of the Eleuthera pro ject site.

Dr Luis Carlos Sarm iento (pictured centre) was joined by representatives from ABAX Architects, the newly-selected design firm for the resort project, as well as executives from Marriott International, Construcciones Planificadas S.A. and Cotton Bay Hold ings in touring the 400-acre location.

“After an intense and comprehensive search of the world’s best design and architectural firms, we have selected ABAX Archi tects, an award-winning design firm, headquartered in Mexico City, as the lead designers for our project,” said Daniel Zuleta, com pany manager for Cotton Bay Holdings.

“Over the last few months, we undertook a

rigorous process with Mar riott International and our partners to identify and secure a team of world-class designers to craft the vision for this highly immersive luxury resort and residen tial development. This announcement marks a sig nificant milestone for this project, and we are excited to be working alongside ABAX to move this ven ture forward.”

Cotton Bay Holdings unveiled its agreement with Marriott International to bring the latter’s Ritz-Carl ton Reserve brand to The Bahamas in early Decem ber 2021. Planned as an open air project, the pro posed resort and residential development will feature 90 guest rooms and 60 RitzCarlton Reserve-branded residences, designed to include a mixture of two to five-bedroom villas.

Emilio Perez, senior con tinent leader in Marriott’s global design team, said: “We are thrilled to kick-off the design process for this highly-anticipated project

with Cotton Bay Holdings and ABAX. The iconic Ritz-Carlton Reserve brand will undoubtedly add a new level of luxury to Eleuthera and The Bahamas.”

Mr Zuleta added “We are committed to designing a world-class development that will capture the beauty and magic of South Eleuthera. We were taken by ABAX’s promise to design with a sense of place and full of integration into the context, culture and history of a location. This is especially important to us; the essence of Cotton Bay will be embodied in the architecture of the resort.”

ABAX Architects, which has a 40-year background in design, were said to have been selected because of their proposal’s sensitiv ity. The company has also previously worked with Marriott International to create Zadún, a Ritz-Carl ton Reserve in Los Cabos, Mexico, and is said to be “very familiar with the brand’s standards and what

is expected from a Reserve property”.

The recent site visit was intended to kickoff the planning and design phase for the $100m project. ABAX Architects was joined by executives from Cotton Bay Holdings Ltd., Construc ciones Planificadas S.A. and its in-house design manage ment team, and Marriott International.

Fernando de Haro, ABAX’s managing director, said: “For ABAX, starting a new project is always a great challenge and a very stimulating experience. We are excited to have the opportunity to visit the property and get to know the island and its amaz ing people, its customs and culture, and to discover the magic that surrounds Cotton Bay. This in-depth understanding will position

us to create a beautiful Reserve.

“We are grateful that Cotton Bay Holdings has placed their trust in ABAX to be the lead architects for the design of this Ritz-Carl ton Reserve. We commit to our clients complete pro fessionalism and the vast expertise acquired from our extensive experiences, which include being the architects for Zadún, a RitzCarlton Reserve in Los Cabos, Mexico. I believe that working together we will create a successful pro ject which our client will feel deeply proud of.”

During their time on the island, Ritz-Carlton design team met with other Eleuthera resort properties, including Carlton Russell, general manager at The Cove, and Tom Marazza, owner of La Bougainvillea.

Mr Zuleta concluded: “Now that we have selected our lead design partners, we are well on our way to moving forward with our plans to bring this pro ject to fruition. We remain on schedule, and are now positioned to finalise agree ments with a number of highly-skilled local service providers and consultants. We will also be engaging Bahamian architectural and engineering firms to work alongside ABAX, and will be announcing details in the coming weeks.”

Dr Sarmiento’s Cotton Bay project has been on the drawing board for 25 years, having first appeared as far back as 1997. Several Heads of Agreement sign ings have taken place prior to the December 2021 deal with the Davis adminis tration, including one for a Four Seasons-branded property that the last Chris tie administration signed in 2015.

A Heads of Agreement was also signed in the 1990s with the then-Ingraham administration, but all prior efforts to advance the development seem ingly stalled with little to no progress visible. Many Eleuthera residents are likely to be sceptical of the latest prospects for success as a result, but Dr Sarm iento’s presence is likely designed to foster percep tions that the project now has momentum.

BAHAMAS THE ‘PRE-EMINENT DIGITAL ASSETS’ SECTOR MODEL

THE ATTORNEY General has hailed The Bahamas as “a model” for what it takes to become a “pre-eminent player in the digital assets industry”.

Addressing the Society of Trust and Estate Prac titioners (STEP) Latin America conference in Panama, Ryan Pinder KC again highlighted the key role that The Bahamas sees the fast-evolving sector playing in the revival of its broader financial services industry.

“In order for a jurisdic tion to be a pre-eminent player in the digital assets industry there must be confidence [in] a nimble regulator, a regulatory regime that is respected worldwide and incorporates real time best practices, and a commitment of gov ernment policy to advance the growth of the industry, assuring the jurisdiction is a safe place to do busi ness that will do what is

necessary to keep the bad actors out,” he said.

“I am proud to say The Bahamas is an exam ple of the success of the model.” STEP LATAM, which is a professional net working body for financial services professionals, has more than 21,000 members

worldwide spread across 95 jurisdictions.

“I wish to mention three more items intrinsically linked to any successes we will enjoy in the future from our commitment to be in the vanguard of global

PICTURED during the recent site tour are representatives of ABAX Architects, Marriott International, Construcciones Planifi cadas S.A. and Cotton Bay Holdings, including principal Dr Luis Carlos Sarmiento (centre).

RYAN PINDER KC

PAGE 4, Thursday, September 29, 2022 THE TRIBUNE

SEE PAGE B11

•• * • * • * * * * * •• • • * • * * * * * * • * • * • * * * * * * • * * * • * * * * * * * * * * * Embassy of the United States Vacancy Announcement The American Embassy in Nassau is accepting applications for the following position: Open to: All Interested Applicants/ All Sources Duties: Public Engagement Assistant The Public Engagement Assistant works wider the direct supervision of the Public Affairs Officer. The position has no supervisory responsibilities. Monitors press and digital media coverage of issues of importance to the U.S. Identifies and advises the Public Affairs Officer on strategies for promoting accurate, balanced press and digital media coverage of U.S. foreign policy and American interests; correcting misinformation; and countering disinfonnation. Maintains Mission flagship digital properties (social media, website content). Researches and analyzes audiences for Mission digital properties; customizes online engagement to promote Mission objectives. Builds productive relationships with working-level press and media professionals in person and online. Interested candidates are required to possess the following skills and qualifications: • Education: A University degree in Journalism Communications, International Relations Political Science, or Economics is required • Experience: A minimum of four years of progressively responsible experience in a media outlet, think tank, university, NGO, international organization, foreign embassy, government office or corporation is required, with responsibility for public relations, public affairs, journalism, communications, marketing, outreach events, press conferences, and other media interactions as significant parts of the job Must have experience managing digital properties, and content creation in multimedia and traditional formats, including photography and videography. • Skills & Abilities: Thorough, detailed knowledge of Microsoft Word and Excel. This may be tested. Must be available to travel throughout The Bahamas to develop professional contacts, support Mission press and online media engagement activities, and create content (photo/video of ambassador's travel, PD programs, etc.) • Language: Fluent Speaking/Reading and written English ability is required. This may be tested. The complete Vacancy Announcement and Application forms are available online on the Electronic Recruitment Application (ERA) located on the following website: https://bs usembassy gov/embassy/jobs Applications will not be accepted at the Security Gate of the Embassy, by Mail, E-mail or other means of delivery. Opening Period: Monday September 19, 2022 Friday September 30, 2022. Due to the high volume of applications, unsuccessful candidates will not be contacted.

NEW BTC CHIEF HIRES 25 STAFF IN FIRST MOVE

THE BAHAMAS

Telecommunications Company’s (BTC) newlyappointed chief executive has moved to boost cus tomer service by hiring 25 extra employees for the company’s contact centre just a week after taking office.

Sameer Bhatti said: “One of the first things I noticed during my first week in office was that we needed to bolster operations in our contact centre. Our cus tomers come first, and as a team, as one BTC, we are focused on understanding their needs and delivering a seamless experience for them.

“We want to be able to give our customers the confidence that we will deliver for them. As this is our first point of contact, we have to ensure that

when our customers reach out through any medium, they’re able to reach us. The way that our customers talk to us has changed, and many prefer social media channels including What sApp. In talking with both staff members and custom ers, this was an area that

needed to be addressed with urgency.”

The all-Bahamian con tact centre comprises the company’s call centre, social media support and customer retention. The 25 new positions will be filled by Bahamians that responded to the company’s recent job fair.

Darron Turnquest, BTC’s human resources and people director, said: “We will immediately onboard these new hires as we’ve already gone through a job fair earlier this year. We are happy to see a number of young, qualified individuals taking up these new posts and taking the opportunity to be a part of the big gest telecoms brand in The Bahamas.

“We have a new chief executive who has truly taken a people-focused

approach to how we do business. Not only that, but he has been able to hear the cries of our cus tomers - both internal and external. He has begun the process of starting with our contact centre so that we can make some progressive improvements to improve our customer experience in a more positive direction.”

Along with the staff ing increase, BTC’s contact centre team has also returned to the office

after working in a fully remote environment for more than two years. The move, according to Mr Turnquest, allows the com pany to improve its overall customer experience by retooling, re-equipping and retraining agents to ensure they deliver the experience customers expect.

“Having our team together is critical and cru cial to our operations, and this is yet another milestone in our journey. I am both

listening keenly to our staff members and our custom ers, and this is just the first of a number of areas that we will seek to buoy and strengthen in the coming months. As we continue to invest in next generation technology, we also have to continue to invest in build ing a formidable team,” said Mr Bhatti.

BTC’s top executive meets nation’s chief

THE BAHAMAS

Telecommunications Company’s (BTC) newlyinstalled chief executive has met the Prime Minister while accompanied by sev eral of the carrier’s Board members.

Sameer Bhatti’s meet ing with Philip Davis KC was among his first actions since being formally named chief executive on September 20. He was joined by Inge Smidts, BTC’s chair, who also heads controlling shareholder, Cable & Wireless Com munications (CWC), and attorney Valentine Grimes, BTC’s deputy chairman and the lead government repre sentative on the Board.

“I look forward to the direction that Bhatti takes in BTC towards improving telecommunications in The Bahamas,” said Mr Davis. “Under his leadership, the Government of The Baha mas will remain a strong supporter and partner to BTC.”

Mr Bhatti, a Baha mian national, joined the company from Comcast, where he spent the past ten years as an executive in commercial and chan nel development roles.

Prior to that, he held senior positions at Juniper Networks and Verizon in the US. In his new role at BTC, Mr Bhatti will have overall responsibility for the company’s commer cial operations across The Bahamas.

“BTC has always held strong ties with the Gov ernment, which is one of its major shareholders. It was very important for me as the new chief executive to pay this courtesy call on the Prime Minister to find out how best we can sup port each other to improve the telecoms sector in The Bahamas,” Mr Bhatti said. “Our talks were very meaningful and fruit ful, and I look forward to strengthening the existing

relationship that BTC has with the Government.”

Ms Smidts said Mr Bhatti has enjoyed a stellar career in the communica tions industry, and will bring a wealth of experience to BTC. “It was important for us to pay this courtesy call on the Prime Minister with Sameer because we wanted him to learn first-hand of some of the new plans to take BTC to the next level, and we were also open to receiving feedback from the Government and how best we can lend our support,” she added.

During his first week in office, Mr Bhatti met with the two trade unions rep resenting BTC’s middle management and line staff. He also held an all-staff meeting with in-person attendance in New Provi dence, and virtually for Family Island employees. He will visit those islands in the coming weeks.

SAMEER BHATTI

BTC CEO PAYS COURTESY CALL ON PRIME MINISTER DAVIS

THE TRIBUNE Thursday, September 29, 2022, PAGE 5

Seven-fold jump in Benchmark’s debt to clients no alarm

and its Alliance Investment Management subsidiary typ ically hold client assets for trading “off balance sheet” since they do not belong to the company. They are instead held in escrow, or trust, on behalf of the client who then directs their secu rities trading activity and then pays a commission to the broker/dealer for con ducting the trade.

Securities trading profits can be reinvested and used to finance further buying and selling “depending on the appetite”, or clients can elect to “liquidate their positions” and convert their holdings to cash. Mr Brown said that when customers opt for the latter, the sums due to them come back on Benchmark’s balance sheet and are shown as owing to clients.

Benchmark Bahamas’ financial statements show assets under administration, representing client assets, increased by 84 percent or almost $20m year-over-year, jumping from $22.36m at end-2020 to $41.4m some 12 months later.

Describing 2021 as a banner year for Bench mark (Bahamas), due to the strong stock market perfor mance stimulating increased client trading activity, he

conceded that 2022’s fullyear performance - while likely still profitable - will probably not match the prior year.

“We had a signifi cant increase in our trading volumes coming out of COVID, and a lot of our clients picked up their trad ing activity in 2021,” Mr Brown told Tribune Busi ness. “That’s what drove the bottom line. With the mar kets the way they are this year, we can see the trading volumes going back down because there is a lot more volatility and a lot more uncertainty.

“Our business ebbs and flows with the movement of the markets, and how that impacts the clients who trade through us. We had a very good year last year. At the start of this one we were on a good pace, then we had the war in Ukraine that put a damper on the mar kets, and then the Federal Reserve has raised interest rates multiple times.

This year the markets have become volatile and that’s affecting how people feel about trading activity and cooled it down. That’s what we’ve seen in the third quarter, a slowdown in trad ing, but business is still good. Our business is one that ebbs and flows based on

that trading activity. We’re a broker/dealer.”

Mr Brown acknowledged that Benchmark (Bahamas) “won’t produce as much” in profits for the 2022 fullyear as it did in 2021, given that “it’s already been slow” and such conditions were likely to last for another six months at least. “We will be profitable, but not as much as last year,” he added. “I think we’ll be alright.

“The good part about the story is even though clients are not trading as much, assets in the trading book are building. Our book has actually grown from last year because of the increase in assets, but clients are not trading as much because of the market volatility. It’s like reserves in your tank. When things turn around it will be good news for us. When things cool off, and they will come back, I’m excited about 2023.”

Tribune Business revealed last week that Benchmark (Bahamas) external audi tors, PKF Bahamas, gave a “qualified” opinion on the group’s 2021 year-end accounts which were only signed-off on July 31, 2022, before being published via BISX’s website on August 15. BISX-listed companies usually have 120 days from year-end to disclose their annual financials, meaning

that Benchmark must have obtained an extension.

While Benchmark did not obtain a clean bill of health, the accounting firm said all other aspects of the finan cial statements reflected the company’s true position at year-end 2021. However, other items likely to inter est shareholders include the fact the group has made provision for 87 percent, or $10.267m, of the $11.807m it advanced to customers for activities such as margin trading. This means they are “doubtful debts” that may not be collected.

Several related party transactions are also iden tified in the financials although their purpose is not fully explained. “A subsidiary of the company [Benchmark] has advanced loans amounting to $1.511m to an entity affili ated to the group by virtue of common management,” the audited statements add. “The loans have no fixed terms of repayment.

“Under the terms of a management and con sultancy agreement, the subsidiary has the option to convert a portion of the loans to common shares in the entity. This option, once exercised, will permit the subsidiary to convert its loans into a controlling interest in the entity of up to

51 percent. This convertible option is at the discretion of the subsidiary and has no expiration date. A provision amounting to $500,000 was recognised on these loans at year-end.”

The same unnamed sub sidiary was also said to have advanced some $36,137 to other entities, again with the option to convert them into majority equity ownership. Meanwhile, Benchmark Ventures, another affiliate, was said to have “entered into an agreement with PureWater Systems to pur chase the administrative software developed by the latter for monitoring and optimisation of its day-today operations at a cost of $250,000.

“PureWater is a related party by common owner ship and key management,” the financials added. Bench mark also continues to provide a guarantee that it will offer sufficient fund ing to keep its Alliance subsidiary solvent due to the accumulated histori cal losses on the latter’s books, while the parent’s $5m preference share capi tal remains caught up the fraud-related collapse of its former client, BC Capital Group.

Mr Brown, though, exuded optimism about Benchmark’s prospects and

pointed to the benefits of diversifying into real estate investments via its Proper ties subsidiary. This now includes a condo in the GoldWynn condo complex at Goodman’s Bay, as well as the commercial complex at the junction of Carmi chael and Fire Trail Roads.

“Properties has become a very strong performer with revenue and income for us,” he added. “We are invested in one of the units at Gold Wynn, and that will come on stream when the hotel opens next year. Properties has been a very good invest ment for us. We started at $2m-$3m, and now it’s on the books as $6m, so we can’t complain about that.

“I think we’re in good shape. We’re going to be doing a number of new things. I’m very excited about our business and our future. I think it’s going to be an exciting not just 2023, but ten years coming up. We started at $4.5911m and are at $16.034m (net equity) today. I think we’ve done a very decent job in grow ing the book. In the next 25 years we can become a $50m company. I’m smiling. I’m smiling. I’m smiling.”

PAGE 6, Thursday, September 29, 2022 THE TRIBUNE

FROM PAGE B1

EU blacklist threat to insurance costs

Already-expensive insur ance coverage, especially that which protects prop erties and other assets against hurricanes, would only increase further due to the cutback in rein surance supply. In turn, this would push premium prices beyond the reach of more Bahamian businesses and households, making insurance increasingly unaf fordable in a climate where the threat posed by Dorianstyle storms is growing.

Bahamian property and casualty underwriters must acquire huge amounts of reinsurance annually because their relatively thin capital bases mean they cannot cover the multibillion dollar assets at risk in this nation. The global reinsurance market has been recently been pulling back from the Caribbean due to hurricane-related losses, and the EU ‘black listing’ could lead to a further scaling back of

coverage availability as well as demands for more oner ous terms and conditions.

Patrick Ward, Bahamas First’s president and chief executive, told Tribune Business: “It’s definitely going to be a material issue as it now stands. Definitely. At this point it seems like it will at least create a problem.

“We’re actually still in conversation among the carriers that might be impacted. It’s going to be more specific to the Ger man-based reinsurance market. Their share of the market is substantial. We’re probably going to have a statement coming out of the Bahamas Insurance Association.”

Germany passed its Act to Combat Tax Avoid ance and Unfair Tax Competition in December 2021, and Bahamian insur ers were yesterday trying to determine whether it would apply to German

reinsurers’ dealings with them and to what extent.

Asked whether the end result could be a substan tial increase in Bahamian insurance premium costs, and a reduction in capacity that might result in carriers electing not to insure clients or assets perceived as more risky, Mr Ward replied: “You don’t have to be an economist to figure that out.”

As to what he would say to consumers, the Bahamas First chief added: “I think the industry will do its best to make sure we mitigate any fall-out from this. At this point, we don’t have any certainty around the outcome.”

Timothy Ingraham, Summit Insurance Com pany’s managing director, echoed Mr Ward in telling this newspaper: “It’s some thing we’re looking at and what the implications are. We’ve seen it but haven’t quite had a chance to analyse what the full impli cations would be.

“We’ve started a conver sation about it. One or two members [of the industry] are not available at the moment. It’s something we’re trying to gather infor mation on and determine

what the impact will be. We have to get to the bottom of it and see as much as pos sible what the implications are and likely to be. We’re just looking into it at this point.”

Another Bahamian insurance industry source, speaking on condition of anonymity, said of the EU’s potential blacklisting fallout: “If we end up on these lists, sometimes reinsurers cannot deal with the ter ritory, and that becomes a complication for rein surers. I don’t think we’re there yet, but we have to be careful.”

The insurance impact highlights the potentially adverse consequences for The Bahamas, its economy and society, as a result of ending up on such adverse listings regardless of their arbitrary, unfair and dis criminatory nature.

The implications for The Bahamas were also spelled out in a Jamaica Observer article yesterday that highlighted concerns among that nation’s insur ance industry about the repercussions of the EU’s initiative, and the need for it to escape the 27-nation bloc’s so-called ‘grey list’.

This newspaper was told that the remarks by Peter Levy, British Caribbean Insurance Company’s (BCIC) managing direc tor, detail the scenario that would also play out in The Bahamas. “There are three major reinsurance compa nies that are German, and they provide a significant amount of the capacity for us to write business, espe cially catastrophe exposed business like property insurance,” Mr Levy was quoted as saying.

“Those three companies would be in a situation where they would either not do business with us or, well, they could do business with us but couldn’t pay us. Obviously, you can’t do business with an insurance company that can’t pay you or you have to take 15 per cent of whatever they’re going to pay you and pay it over to the government.

“It could potentially have a devastating effect on the ability of property owners to get insurance. This would be significantly damaging to the economy because all these properties that are the subject of loans would be struggling to get insur ance and the lenders would be exposed.”

Asked about the impact on Trinidad and Tobago’s (T&T) insurance industry, given that state is already on the EU’s blacklist, Mr Levy said: “They had withdraw als of reinsurance capacity from that market. There are companies that will not do business with Trinidadbased insurance companies.

“They haven’t had a catastrophe, and this wouldn’t necessarily show up unless you have a sig nificant loss event. The thing about Trinidad is that they’re not as catastrophe -exposed as we are. So, it will be easier for them to attract replacement reinsur ance into that market.”

Bahamian property and casualty premium costs are already under pressure due to reinsurance losses on Hurricane Dorian and other recent Caribbean storms. And Hurricane Ian’s likely multi-billion damages bill in Florida will only cause this pressure to further rise, with one insur ance industry source saying yesterday: “Florida and The Bahamas tend to be rolled in together as far as rein surers are concerned. What happens to rates and capac ity in 2023?”

THE TRIBUNE Thursday, September 29, 2022, PAGE 7

FROM PAGE B1 NOTICE Bahamas Electrical Utilities Managerial Union (BEUMU) (The Senior Staff Union of The Bahamas Electricity Corporation) Will Hold a Special Call Meeting On Wednesday 5 October 2022 at 5:30 p.m. In Classrooms 1 & 2 of the E. Cobourne Sands Building Bahamas Power and Light Company Limited Big Pond Complex on Blue Hill Road and Huyler Street, New Providence Agenda: Call to Order Prayer Vote to Amend the Constitution Prize Giving Important Updates on the Industrial Agreement General Update Adjournment All Officers and Financial Members are asked to attend and to be on time. Refreshments will be served

‘Free’ Sand Dollars to give currency lift

FROM PAGE B1

give free Sand Dollars to so they get experience with using their mobile phones and conducting electronic transactions.”

The Central Bank’s 2021 annual report, released earlier this year, admit ted that Sand Dollar adoption efforts had “still moderated” with some $300,000 worth of the Baha mian digital currency in circulation at year-end com pared to around $80,000 some 12 months prior.

Harry van Schaick, Amer icas managing editor for the Oxford Business Group, the economic research consultancy, told the same webinar that the amount of Sand Dollar digital

currency in circulation had increased by 305 percent during 2021. This compared to a 56 percent surge in the COVID-hit prior year and a 5 percent expansion in the 2022 first quarter.

Mr Rolle, meanwhile, while acknowledging that cash will never be fully eliminated as a means of payment, added that The Bahamas has some way to go in reducing continued consumer reliance on this particular mechanism.

Drawing on the results from recent Central Bank surveys, he said between “20 percent and 30 percent of consumers in The Baha mas are still using cash for all their transactions..... Our estimate is that 30-40

percent of all transactions in our economic space are likely being conducted in cash”.

The Central Bank gover nor also pointed out that “at least 90 percent” of Baha mians and residents are still employing cash to conduct some payment transactions, while some businesses are still meeting payroll via this mechanism or using a mix with cheques.

The transition to digital payment methods is also designed to enhance finan cial inclusion and access, especially among remote Family Island communities where commercial banks have long withdrawn from having a physical presence via a branch network.

Mr Rolle said it was vital that there be investment in The Bahamas’ telecom munications networks for financial inclusion to succeed by ensuring all citizens can conduct trans actions via their mobile phone wherever they are in the country.

While more than nine out of every ten Bahami ans possesses their own cell phone, he added: “We have to address access to data. Data has to be looked at in somewhat the same way we look at breadbasket items, food and other commodities in The Bahamas.”

Recalling Hurricane Dorian’s catastrophic impact on Abaco’s bank ing and financial services

sector, the governor noted: “It took our financial insti tutions in many cases more than 12 months to get their physical infrastructure back up. In the digital space, the condition is how quickly the telecommunications infra structure is restored.”

Mr Rolle also called for banks and other institutions to provide “digital kiosks” so that customers who cannot access the Internet and technology at home are not excluded from access to electronic transactions and payment methods.

The Central Bank’s latest annual report has detailed the increased adoption of digital payments among Bahamians, which was aided by COVID-19 lock downs and other restrictions that forced many persons to work and remain at home.

When it came to large transactions processed by the commercial banking sector’s Real Time Gross Settlement System (RTGS), the report said: “In 2021, the number of transac tions cleared through the RTGS system increased by 28.2 percent to 273,115, albeit the corresponding value declined by 20.8 per cent to $36bn. In contrast, the previous year recorded

a 41.4 percent expansion valued at $45.5bn.”

As for the Automated Clearing House (ACH), which handles smaller transactions, it added: “The volume of these transac tions grew by 7.6 percent to 3.4m, while the corre sponding value expanded by 39.2 percent to $5.8bn. This extended the prior year’s 13.6 percent growth in value.

Over the review period, cheque usage remained subdued, with the exception of largevalue transactions. More specifically, the number of processed cheques declined by 7.6 percent to 1.2m, while the attendant value fell by 6.8 percent to $4.2 bn year-on-year.”

Turning to debit and credit cards, the Central Bank added: “Cemented by changes in consumer behaviour and commercial bank policies as a result of the pandemic, during 2021 the volume and value of debit card activities expanded by 41.5 percent to 17.6m transactions and by 14.3 percent to $2bn, respectively.

“Although the total number of ATMs deployed grew modestly by 1.8 per cent to 388 terminals, and usage firmed by 1.8 per cent to 8.1m transactions, the corresponding value decreased by 7 percent to $1.9bn year-on-year.”

PAGE 10, Thursday, September 29, 2022 THE TRIBUNE

Bahamas ‘leads pack’ over digital adoption

FROM PAGE B1

electronic transition that this nation was “certainly leading the pack” in this process.

“Usage has grown rap idly and steadily across the region, but I would high light the growth in adoption has certainly been stronger in The Bahamas,” he said. “We see more than half of our customers in The Baha mas use digital banking regularly.

“I would say that from 2017 to today, for example, we see a significant migra tion of our transactions and payments where they are done digitally or with a card... The number of noncash payments has more than doubled in The Baha mas in particular.

“We certainly see The Bahamas leading the pack in the region. A lot of the

trends we’re getting into, The Bahamas is a bit of a bellwether for the region. That’s something to be proud of.”

John Rolle, the Cen tral Bank’s governor, told the same webinar that reduced transaction costs and greater efficiency are the main advantages of switching to a digital pay ments structure. And, from a consumer perspective, the goal was greater finan cial inclusion and access, with Bahamians living in remote Family Island com munities able to conduct bill payments and other transactions with the same convenience and cost as New Providence residents.

“The most important reason why we need to move more to the digi tal transformation is cost and efficiency. It’s cost

and efficiency,” he added. “That’s what we have to be focused on. For The Baha mas, that means we need to be able to have it such that if you’re living in Acklins or Crooked Island versus New Providence, the cost or currency aspect of the transaction undertaken, whichever one of the finan cial institutions provides that service, it should be no more costly - and as conven ient as - New Providence.”

While a 2019 Central Bank survey had revealed more than 90 percent of Bahamians have access to bank accounts, with 88 per cent able to obtain savings facilities and 23 percent the chequing variety, Mr Rolle voiced scepticism that this provided a true picture of financial inclusion given the number of “undocu mented” persons in society.

BAHAMAS THE ‘PRE-EMINENT DIGITAL ASSETS’ SECTOR MODEL

FROM PAGE B4

digital assets regulation,” Mr Pinder added.

“The first is the under standing that there needs to be greater general and advanced knowledge and competence with regard to financial technology in The Bahamas, to support the talent base necessary to be industry leaders, innovators and entrepreneurs, coders, analysts, regulators, sup port staff, [and] to write news and technical stories about developments in the space.

“To further this endeav our, the [Securities] Commission intends to collaborate with the Uni versity of The Bahamas on three eight-week courses focused on the digital assets sector. Attendees will earn a certificate upon suc cessful completion of the course, which can be used to demonstrate to the Com mission that the individual possesses the requisite education and knowledge to engage in digital assets business registrable activi ties in The Bahamas,” he continued.

“In conjunction with this, the Digital Advi sory Panel is working with the Bahamas Institute of Financial Services to build a sustainable curriculum for our domestic financial services talent to be knowl edgeable, qualified and excel in the digital asset

Fintech (financial technol ogy) space.”

A second collaboration with the Securities Com mission involves its Fintech hub, SCB FITLink, which launched in 2019. “The hub is a central point for the Commission and the public to engage on digital assets business, crowdfunding, distributed ledger tech nology and initial token offerings,” Mr Pinder said./

“In addition to engage ment with the public, FITLink facilitates regu latory consultation by helping Fintech innovators and incumbents navigate the digital assets regulatory landscape, among other things, making the regulatory process under standable and efficient.”

Mr Pinder invited STEP members to visit The Bahamas in 2023 for the FinTech festival, which will be held at Atlantis in Janu ary. “We are not being shy about telling the world what an amazing and wonderful legislative framework we

have for digital assets busi ness,” he added.

“On that note, I take this opportunity to invite you all to D3 Bahamas, which will undoubtedly be the annual FinTech festival in the region. The date has been tentatively set for January 2023 at the Atlantis resort and conference centre.”

“We have to temper our understanding of what is a very high, in the mid-90 percent range, access to banking facilities with the undocumented pop ulation,” he added. A Central Bank research paper, released earlier this week, estimated that around 18 percent of The Bahamas’ total population may be unbanked or lack access to financial services.

“Financial inclusion is closer to the low 80

percent range,” the gover nor agreed. “That reflects what’s happening particu larly in the undocumented part of the economy.... Depending on where you are in The Bahamas, some transactions are only com plete when you fly to New Providence. That’s not the same level of inclusion that the numbers tell.”

And he also urged Baha mians to understand that there was a cost involved when it came to using and

moving cash around the country. “I always make the comment in any forum that Bahamians need to under stand when cash moves through The Bahamas it does not fly commercial,” Mr Rolle said.

“You’re getting dollar for dollar, but whether it’s the Government or a finan cial institution they have to charter a plane and security personnel to get the cash” to where it needs to go.

Notice is hereby given that, in accordance with Section 138 (4) of the International Business Companies Act, (No.45 of 2000), Ltd. is in dissolution. The date of commencement of the dissolution is 26th September, 2022. Nicholas Gabriel Arons with address at 605 Third Avenue, 17th Floor, New York, New York 10158, United States is the Liquidator and can be contacted at all persons having claims against the above-named company are required to send their names, addresses and particulars of their debts or claims to the Liquidator before the 26th day of October, 2022.

THE TRIBUNE Thursday, September 29, 2022, PAGE 11

TO ADVERTISE TODAY IN THE TRIBUNE CALL @ 502-2394

LEGAL NOTICE

RAIL UNIONS EMPHASIZE POSITIVES OF THEIR TENTATIVE DEALS

By JOSH FUNK AP Business Writer

THE two biggest U.S. railroad unions were work ing Wednesday ahead of key ratification votes to dispel rumors about the contract deals that averted a potentially devastating nationwide strike .

The unions have been fighting rumors on social media that they would

impose the deals on work ers if they vote to reject them. The rumors were sparked by a railroad trade publication suggesting that was possible in an article earlier this month.

And some newly formed worker groups that helped organize protests at rail yards across the country last week have been urging workers, some harboring deep resentment over how

they’ve been treated by the railroads in recent years, to reject the proposed contracts.

“The challenge is to first get past how angry they are,” said Dennis Pierce, president of the Broth erhood of Locomotive Engineers and Trainmen. “The education process we’re working through now is to try to get concentrat ing on the facts of the deal

instead of the emotions of what they’ve been through. And that’s a heavy lift.”

He added that there are some “out there from the outside and inside with their own agendas that are trying to keep everyone agitated.”

The BLET and the Transportation Division of the International Asso ciation of Sheet Metal, Air, Rail and Transportation

Workers unions are instead emphasizing to their mem bers the potential benefits of the five-year deals, which include 24% raises and $5,000 in bonuses. Union leaders are stressing that the only way a contract will be imposed on members is if Congress steps in to block a strike because so many businesses rely on railroads to deliver their raw materi als and finished products.

Workers were ready to strike until the Biden administration helped broker a last-minute deal that prevented a mid-Sep tember walkout at Union Pacific, BNSF, Norfolk Southern, CSX, Kansas City Southern and other railroads. But now all the unions, which represent a total of 115,000 workers, must ratify their deals over the next six weeks to ensure there won’t be a strike. The International Brotherhood of Electrical Workers voted Wednesday to join two smaller rail unions as the only ones to approve their deals so far.

The financial terms of these deals closely follow the recommendations a special board of arbitra tors Biden appointed made this summer, but that board didn’t resolve all of the worker concerns about schedules and workloads after the major railroads eliminated nearly one third of their workforces over the past six years.

Conductors and engi neers have been especially upset about quality-of-life issues because they say the strict attendance policies railroads imposed to make sure they have enough

crews make it hard to take any time off and keep them on call 24-7.

The president of the SMART-TD union, Jeremy Ferguson, acknowledged in a video he sent out to his members that this deal “did not abolish the whole attendance policy like we asked” but he said it does include some key gains.

The concessions the unions got include three unpaid leave days a year for medical appointments, although those must be scheduled 30 days ahead of time on Tuesdays, Wednes days or Thursdays. The railroads also promised not to dock workers when they are hospitalized and said they would negotiate at each railroad about ensur ing workers have regularly scheduled days off.

Pierce said the unions focused on time off for medical needs because that seemed to be where the greatest harm was being done. In one case high lighted by the Washington Post, a BNSF engineer who skipped a doctor’s appointment earlier this year because he was wor ried about being penalized under that railroad’s attend ance policy died on a train a few weeks later after suffer ing a heart attack.

Ferguson also empha sized that the unions were able to protect two-per son crews by preventing the railroads from forcing them into arbitration over their proposals to cut train crews down to one person. Unions have vehemently opposed that idea for years because of concerns about safety and protecting jobs.

NOTICE

NOTICE is hereby given that HONECA JANE DOWNERBROWN of Blue Wave Estates. P.O. BOX N-8582, Nassau, Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 29th day of September, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE

NOTICE is hereby given that ALILIA PIERRE of P. O. Box N-7060, Garden Hills #1, New Providence, Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 22nd day of September, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE

NOTICE is hereby given that DIENORD BIEN-AIME of P. O. Box CR-55415, Malcolm Road, New Providence, Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 22nd day of September, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE

NOTICE is hereby given that APPOLONIA ADAKU NGOBIDI of P. O. Box SS-19068, 3rd Terrace Centreville, New Providence, Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 22nd day of September, 2022 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

PAGE 12, Thursday, September 29, 2022 THE TRIBUNE

BIDEN ON ENDING HUNGER IN US: ‘I KNOW WE CAN DO THIS’

By ASHRAF KHALIL AND DARLENE SUPERVILLE Associated Press

PRESIDENT Joe Biden said Wednesday his admin istration’s goal of ending hunger in the U.S. by the end of the decade was ambi tious but doable, if only the nation would work together toward achieving it.

“I know we can do this,” Biden told an auditorium full of public health offi cials, private companies and Americans who have experienced hunger. They were gathered for the first White House conference on hunger, nutrition and health since 1969.

It was the president at his most optimistic, sketch ing out a future where no child in the U.S. would go hungry, and diet-related diseases would diminish because of better, healthier food alternatives and access to vast outdoor spaces.

“That’s why we’re here today, to harness our great est resource: our fellow Americans,” Biden said. “Everyone, everyone has an important role to play.”

He’s counting on a variety of private-sector partnerships to help fund and implement his ambi tious goal of ending hunger in America by 2030.

The 1969 hunger con ference, hosted President Richard Nixon, was a pivotal moment that influ enced the U.S. food policy agenda for 50 years. It led to a major expansion of the Supplemental Nutri tion Assistance Program, commonly known as food stamps, and gave rise to the Women, Infants and

Children program, which serves half the babies born in the U.S. by providing their mothers with parent ing advice, breastfeeding support and food assistance.

And yet, 10% of U.S. households in 2021 suf fered food insecurity, meaning they were uncer tain they could get enough food to feed themselves or their families because they lacked money or resources for food, accord ing to the Food and Drug Administration.

Scientific advances have helped Americans better understand how the foods they eat contrib ute to disease. One of the administration’s goals is to decrease obesity and dietrelated disease like diabetes and hypertension through better promotion of healthy eating, good nutrition and physical activity.

Sen. Cory Booker, D.-N.J., one of the con gressional sponsors of the conference, said the key is to address food insecurity while also steering away from the “massively pro cessed foods” that are often a dietary staple of lowincome Americans.

“Eighty percent of our health care problems are preventable,” he said.

Referring to the Food and Drug Administration, Booker said, “We need to put the F back in FDA.”

Some of the conference attendees have known hunger. Jimmieka Mills, co-founder of Equitable Spaces, a nonprofit that connects those working on hunger solutions with people who have experi enced hunger, said it was “an historic opportunity

NOTICE

IN THE ESTATE OF MYRTLYN JUDITH DELANCY ALSO KNOWN AS MYRTLYN JUDITH WILLIAMS ALSO KNOWN AS JUDITH M. WILLIAMS late of 8 Rose Close situate Bel-Air Estates Subdivision in the South Western District of the Island of New Providence one of the Islands of the Commonwealth of The Bahamas, deceased.

NOTICE is hereby given that all persons having any claims or demands against the above Estate are required to send the same duly certified in writing to the undersigned on or before the 13th day of October, A.D. 2022, after which date the Administrator will proceed to distribute the assets of the deceased having regard only to the claims of which he shall then have had notice.

AND NOTICE is hereby given that all persons indebted to the said Estate are requested to make full settlement on or before the date hereinbefore mentioned.

HARRY B. SANDS, LOBOSKY AND COMPANY CHAMBERS

Attorneys for the Administrator

Magna Carta Court

Shirley and Parliament Streets North New Providence, The Bahamas

NOTICE

IN THE ESTATE OF WILLIAM ALFRED DELANCY also known as WILLIAM DELANCY also known as WILLIE ALFRED DELANCEY late of #8 Rose Close situate in Bel-Air Estates Subdivision in the South Western District of the Island of New Providence one of the Islands of the Commonwealth of The Bahamas deceased.

NOTICE is hereby given that all persons having any claims or demands against the above Estate are required to send the same duly certified in writing to the undersigned on or before the 13th day of October, A.D. 2022, after which date the Executor will proceed to distribute the assets of the deceased having regard only to the claims of which he shall then have had notice.

AND NOTICE is hereby given that all persons indebted to the said Estate are requested to make full settlement on or before the date hereinbefore mentioned.

HARRY B. SANDS, LOBOSKY AND COMPANY CHAMBERS

Attorneys for the Executor

Magna Carta Court

Shirley and Parliament Streets North New Providence, The Bahamas

for us to learn directly from those impacted.”

She spoke of growing up and experiencing firsthand the impact of poverty, hunger and homelessness.

“I know what it’s like to not know where your next meal will come from,” she said, adding she wanted solutions so that no one in the “country with the most abundant food system in

the world ever goes hungry again.”

Rep. James McGovern, D-Mass., a driving organi zational force behind the summit, sounded a simi lar note. He said the goal was nothing short of “transforming America ... into a country where hunger is illegal.” But McGovern also warned against complacency and

self-congratulation, saying that merely organizing a successful summit wasn’t much of an accomplishment.

“We need to leave here with an assignment for tomorrow, for next week, for the week after,” he said.

Before the kickoff, the administration released a list of more than $8 billion in commitments to the cause from private companies,

charitable foundations and industry groups. They range from outright donations to in-kind contributions of ser vices and include:

— A $20 million com mitment from the Novo Nordisk pharmaceuti cal company to improve access to healthy foods and safe spaces for physi cal activity in marginalized communities.

100.00100.00BGS:

15-Jul-2049

20-Nov-2029 31-Jul-2022 31-Jul-2022

31-Mar-2022 31-Aug-2022

31-Aug-2022

31-Jan-2022 31-Jan-2022 31-Jan-2022 31-Jan-2022

31-Jan-2022

31-Mar-2021 31-Mar-2021

THE TRIBUNE Thursday, September 29, 2022, PAGE 13

WEDNESDAY, 28 SEPTEMBER 2022 CLOSECHANGE%CHANGEYTDYTD% BISX ALL SHARE INDEX: 2634.142.840.11405.9018.22 BISX LISTED & TRADED SECURITIES 52WK HI52WK LOWSECURITY SYMBOLLAST CLOSECLOSECHANGE VOLUMEEPS$DIV$P/E YIELD 7.005.30 AML Foods Limited AML 6.95 6.950.00 0.2390.17029.12.45% 53.0039.95 APD Limited APD 39.95 39.950.00 1150.9321.26042.93.15% 2.761.60Benchmark BBL 2.76 2.760.00 0.0000.020N/M0.72% 2.462.20Bahamas First Holdings Limited BFH 2.46 2.460.00 0.1400.08017.63.25% 2.851.30Bank of Bahamas BOB 2.85 2.850.00 0.0700.000N/M0.00% 6.205.75Bahamas Property Fund BPF 6.20 6.200.00 1.7600.000N/M0.00% 10.058.78Bahamas Waste BWL 9.75 9.750.00 1,6500.3690.26026.42.67% 4.152.82Cable Bahamas CAB 3.80 3.950.1513,500-0.4380.000-9.0 0.00% 10.656.75Commonwealth Brewery CBB 10.35 10.350.00 0.1400.00073.90.00% 3.652.27Commonwealth Bank CBL 3.58 3.580.00 0.1840.12019.53.35% 8.255.29Colina Holdings CHL 8.23 8.230.00 0.4490.22018.32.67% 17.5010.25CIBC FirstCaribbean Bank CIB 16.00 16.000.00 0.7220.72022.24.50% 3.251.99Consolidated Water BDRs CWCB 3.24 3.280.04 0.1020.43432.213.23% 11.288.51Doctor's Hospital DHS 10.50 10.500.00 0.4670.06022.50.57% 11.6711.25Emera Incorporated EMAB 10.20 10.310.11 0.6460.32816.03.18% 11.5010.00Famguard FAM 10.85 10.850.00 0.7280.24014.92.21% 18.3014.05Fidelity Bank (Bahamas) Limited FBB 18.10 18.100.00 0.8160.54022.22.98% 4.003.50Focol FCL 3.99 3.990.00 0.2030.12019.73.01% 11.009.01Finco FIN 11.00 11.000.00 5,5000.9390.20011.71.82% 16.5015.50J. S. Johnson JSJ 15.50 15.500.00 0.6310.61024.63.94% PREFERENCE SHARES 1.001.00Bahamas First Holdings PreferenceBFHP 1.00 1.000.00 0.0000.0000.0000.00% 1000.001000.00 Cable Bahamas Series 6 CAB6 1000.001000.000.00 0.0000.0000.0000.00% 1000.001000.00 Cable Bahamas Series 9 CAB9 1000.001000.000.00 0.0000.0000.0000.00% 1.001.00Colina Holdings Class A CHLA 1.00 1.000.00 0.0000.0000.0006.25% 10.0010.00Fidelity Bank Bahamas Class A FBBA 10.0010.000.00 0.0000.0000.0007.00% 1.001.00Focol Class B FCLB 1.00 1.000.00 0.0000.0000.0006.50% CORPORATE DEBT - (percentage pricing) 52WK HI52WK LOWSECURITY SYMBOLLAST SALECLOSECHANGEVOLUME 100.00100.00Fidelity Bank (Note 22 Series B+)FBB22 100.00100.000.00 100.00100.00Bahamas First Holdings LimitedBFHB 100.00100.000.00 BAHAMAS GOVERNMENT STOCK - (percentage pricing) 115.92104.79Bahamas Note 6.95 (2029) BAH29 107.31107.310.00 100.00100.00BGS: 2014-12-7Y BG0107 100.00100.000.00 100.00100.00BGS: 2015-1-7Y BG0207 100.00100.000.00 100.00100.00BGS: 2014-12-30Y BG0130 100.00100.000.00 100.00100.00BGS: 2015-1-30Y BG0230 100.00100.000.00 100.00100.00BGS: 2015-6-7Y BG0307 100.00100.000.00

2015-6-30Y BG0330 100.00100.000.00 100.00100.00BGS: 2015-10-7Y BG0407 100.00100.000.00 100.0097.49BGRS FX BGR106036 BSBGR106036197.4997.490.00 100.03100.03BGRS FL BGRS99031 BSBGRS990318100.03100.030.00 101.5599.72BGRS FX BRS124228 BSBGR1242282101.42101.420.00 99.9599.95BGRS FL BGRS91032 BSBGRS91032499.9599.950.00 100.57100.11BGRS FL BGRS95032 BSBGRS950320100.45100.450.00 100.5299.96BGRS FL BGRS97033 BSBGRS970336100.19100.190.00 100.0089.62BGRS FX BGR129249 BSBGR129249389.6289.620.00 100.0089.00BGRS FX BGR131249 BSBGR1312499100.00100.000.00 100.9890.24BGRS FX BGR132249 BSBGR1322498100.00100.000.00 100.0090.73BGRS FX BGR136150 BSBGR1361504100.00100.000.00 MUTUAL FUNDS 52WK HI52WK LOW NAV YTD%12 MTH% 2.552.11 2.552.24%4.01% 4.833.30 4.833.42%7.26% 2.241.68 2.241.70%2.82% 207.86164.74 197.44-2.97%-2.35% 212.41116.70 202.39-4.72%6.04% 1.751.70 1.751.96%2.84% 1.911.76 1.914.83%7.23% 1.871.77 1.873.48%4.44% 1.050.96 0.96-6.57%-8.29% 9.376.41 9.37-0.02%10.36% 11.837.62 11.79-0.33%18.23% 7.545.66 7.540.22%3.05% 16.648.65 15.94-3.89%14.76% 12.8410.54 12.47-1.04%-2.57% 10.779.57 10.740.81%4.20% 10.009.88 N/AN/AN/A 10.438.45 10.433.00%25.60% 14.8911.20 14.897.90%48.70% MARKET TERMS BISX ALL SHARE INDEX - 19 Dec 02 = 1,000.00 YIELD - last 12 month dividends divided by closing price - Highest closing price in last 52 weeks Bid $ - Buying price of Colina and Fidelity 52wk-Low - Lowest closing price in last 52 weeks Ask $ - Selling price of Colina and fidelity Previous Close - Previous day's weighted price for daily volume Last Price - Last traded over-the-counter price Today's Close - Current day's weighted price for daily volume Weekly Vol. - Trading volume of the prior week Change - Change in closing price from day to day EPS $ - A company's reported earnings per share for the last 12 mths Daily Vol. - Number of total shares traded today NAV - Net Asset Value DIV $ - Dividends per share paid in the last 12 months N/M - Not Meaningful P/E - Closing price divided by the last 12 month earnings TO TRADE CALL: CFAL 242-502-7010 | ROYALFIDELITY 242-356-7764 | CORALISLE 242-502-7525 | LENO 242-396-3225 | BENCHMARK 242-326-7333 4.30% 4.66% 4.31% 5.55% 23-Sep-2031 13-Jul-2028 17-Apr-2033 15-Apr-2049 4.37% 4.31% 15-Aug-2032 25-Sep-2032 6.25% 30-Sep-2025 31-Mar-2022 FUND CFAL Bond Fund CFAL Balanced Fund CFAL Money Market Fund CFAL Global Bond Fund 6.25% 4.50% 6.25% 4.25% NAV Date 5.65% 5.69% 5.40% 15-Dec-2021 30-Jul-2022 15-Dec-2044 30-Jul-2045 26-Jun-2022 26-Jun-2045 15-Oct-2022 29-Jul-2022 21-Apr-2050 4-Aug-2036 15-Oct-2049 31-Mar-2021 31-Jan-2022

31-Aug-2022

31-Aug-2022

INTEREST Prime + 1.75% MARKET REPORT

MATURITY 19-Oct-2022

6.95% 4.50%

4.50% 6.25% 5.60%

Colonial Bahamas Fund Class D Colonial Bahamas Fund Class E Colonial Bahamas Fund Class F CFAL Global Equity Fund Leno Financial Conservative Fund Leno Financial Aggressive Fund Leno Financial Balanced Fund Leno Financial Global Bond Fund RF Bahamas Opportunities Fund - Secured Balanced Fund RF Bahamas Opportunities Fund - Targeted Equity Fund RF Bahamas Opportunities Fund - Prime Income Fund RF Bahamas International Investment Fund Limited - Equities Sub Fund RF Bahamas International Investment Fund Limited - High Yield Income Fund RF Bahamas International Investment Fund Limited - Alternative Strategies Fund (242)323 2330 (242) 323 2320 www.bisxbahamas.com

ALZHEIMER’S DRUG SHOWS PROMISE IN EARLY RESULTS OF STUDY

By TOM MURPHY AP Health Writer