TUESDAY,

Blake Road storage reclaimed over $1.166m unpaid tax fears

By NEIL HARTNELL Tribune Business Editor

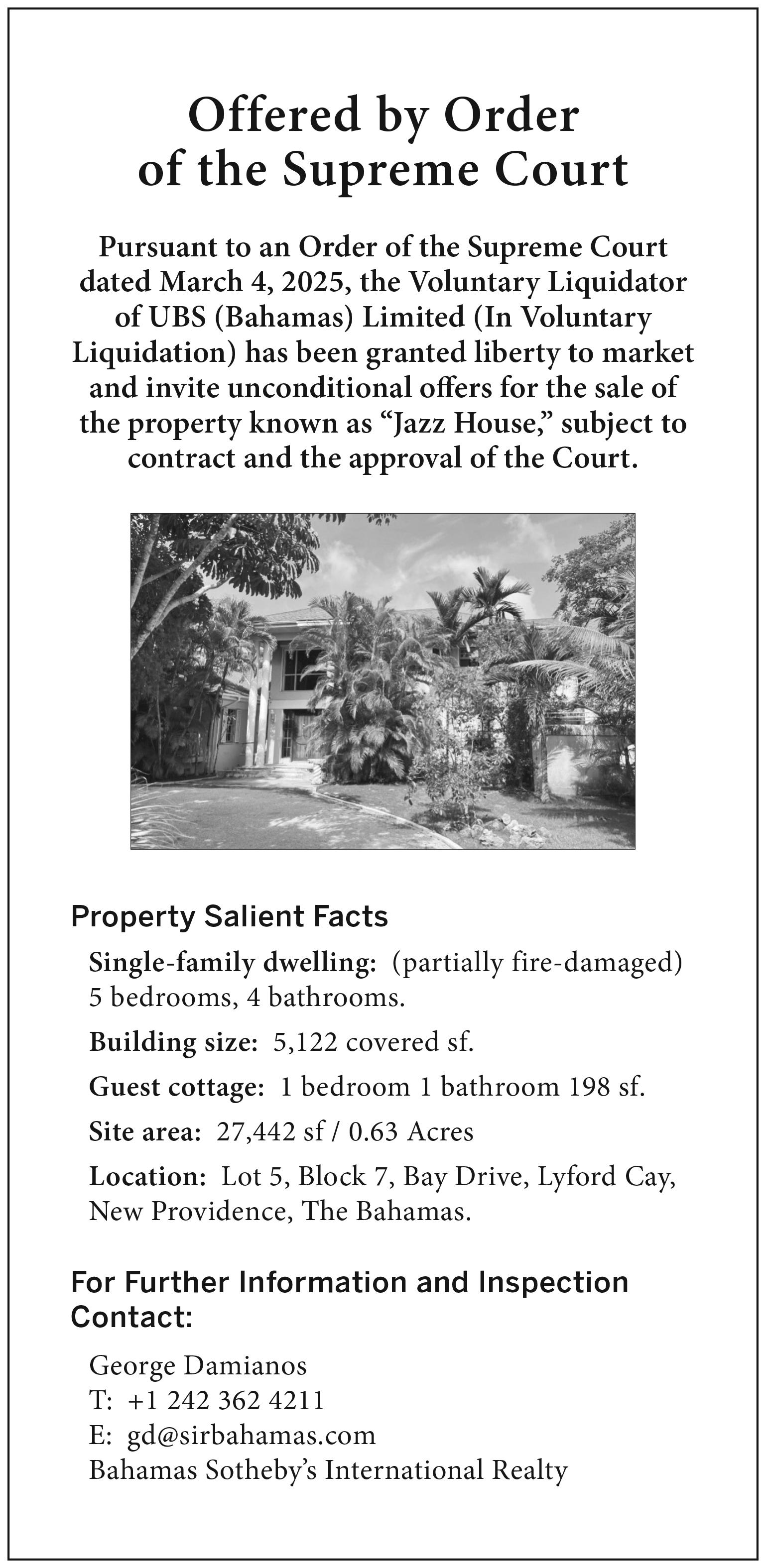

A 765-unit Blake Road storage facility has been reclaimed by its owner over fears it was about to be seized and auctioned-off to recover $1.165m in unpaid real property taxes.

Justice Camille DarvilleGomez, in a July 16, 2025, verdict ordered that Mogul Trading Ltd, whose principals include Lyford Cay philanthropist and investor, Philippe Bonnefoy, receive

By NEIL HARTNELL

Business Editor

THE entrepreneur behind the popular Bahamian-made drink, Switcha, yesterday asserted he is “100 percent” confident the brand will escape voluntary liquidation and emerge even stronger.

Mervin Sweeting, who founded the company in 2007, told Tribune Business that the issues which resulted in newspaper notices last week advertising that Switcha Bahamas has been placed into a “voluntary” winding-up are “being resolved” and there is “no real material effect” on its operations and production.

The brand’s creditors were given 14 days to submit their claims, including details of the debts owed to them, after the Baker Tilly Gomez accounting firm was named as voluntary liquidators with effect from May 7, 2025. But Mr Sweeting, while giving few precise details on what has caused this situation other than

Realtor renews plea for tax consistency

By NEIL HARTNELL Tribune Business Editor

nhartnell@tribunemedia.net

A BAHAMIAN realtor has renewed plea for tax consistency and continuity in the sector amid concerns that constantly changing rates represent an increased investment risk for overseas buyers.

David Morley, Morley Realty’s broker/owner, told Tribune Business in a recent interview that the Bahamas Real Estate Association (BREA) has been trying to impress upon the Government the need to maintain a relatively seamless VAT transfer tax and real property tax policy that avoids continual rate changes in the annual Budget.

While it is unknown whether the message has got through, he added that “at one point in time” it was understood that the Government was considering raising the annual property tax cap from $150,000 to $175,000 in a bid to generate more revenue. However, it ultimately decided to leave the cap at $150,000.

“The big thing the real estate association (BREA) is trying to remind the Government of is, on the issue of taxation of property, they’ve got to have a period of consistency,” Mr

“immediate possession” of the 3.543-acre site amid accusations of “sabotage, delay and deception”.

She also ruled that Store Away Ltd, which had been operating the storage facility for more than 27 years as Mogul Trading’s tenant, had been in “unlawful occupation” of the 3.543-acre site since May 6, 2025 - the date when the deal was terminated via a second demand letter.

Legal documents obtained by Tribune Business detail a variety of concerns raised by Mogul Trading over Store Away’s management of the storage facility,

alluding to the COVID pandemic’s impact, voiced optimism he can regain ownership control.

“I’m 100 percent. We will be covered. No issues,” the Switcha principal told this newspaper.

“There’s no issues. That’s why I put no material issues [in the statement]. It’s being resolved as we

which operated under the latter’s name. A February 10, 2023, letter issued by Adrian White, the St Anne’s MP who was Mogul Trading’s then-attorney, alleged that Store Away Ltd owed his client $520,000 in unpaid rent arrears dating from January 1, 2022.

Other frustrations emerged over the alleged failure by Store Away’s principals, Larry Ferguson and his wife, Brenda, to close the sale of the Blake Road property with various potential buyers between 2017 and 2021. Mogul Trading Ltd and its directors claim the failed sales efforts were

speak. There’s no question. No question.”

Explaining that what he confronts is no different to someone who loses their home because they fail to keep up with mortgage payments, Mr Sweeting added that “everybody has their own challenges” as he reiterated confidence in his own ability to retrieve the situation.

“I’m 100 percent, and that’s why I can smile with you,” he said. “It may be

Gov’t demolishes 13th property in downtown

By FAY SIMMONS Tribune Business Reporter jsimmons@tribunemedia.net

THE Davis administration was yesterday said to have completed its 13th downtown Nassau property demolition in two years by levelling the Levy building in its drive to revive the city as a commercial hub.

The demolished property had previously housed the Bahamas Agricultural and Marine Science Institute (BAMSI) on Bay Street and Chester Cooper, deputy prime minister and minister of tourism, investments and aviation, said the Government is making “steady progress” with its Downtown revitalisation project.

He added that the demolition creates an opportunity for the “continued transformation of Bay Street” as the site can now be used to attract investors. “This is our 13th demolition here today. This building is owned by the Government of The Bahamas, and we are demonstrating by our deeds that we are committed to the clean-up and the restoration of Bay Street,” said Mr Cooper.

“We have embarked on this project over the last two-and-a-half years, making steady progress. Today, the Levy building is about to be demolished, and we hope

that this site will become something that’s renewed, whether it’s a hotel or shopping or entertainment. We are creating opportunity for a continued transformation of Bay Street.”

The historic Levy building was previously used as a distribution centre and was connected to the Levy plantation in Eleuthera. Acknowledging the site’s historical significance, Mr Cooper said the only requirement for its development is that it must ensure the legacy of Mr Levy is preserved.

“Our mission, really, is to get public engagement, stakeholder engagement. We want to ensure that we are not just talking the talk, we’re walking the walk,” said Mr Cooper.

“This is significant for us. The Levy building held some agricultural and humanitarian significance of Mr Levy, and we’re going to ensure that that is preserved in the future, so that whatever comes here, the name Levy will live on. That will be our one requirement for this development.”

really a strategy for Mr Ferguson, his wife and Store Away “to prolong control” and ensure they retained the rent and profits.

The Supreme Court filings also contained previous Tribune Business reports detailing how Mr Ferguson suffered two recent legal defeats in his battle with Royal Bank of Canada (RBC) after it refused to clear a $22.11m investment in his aragonite export venture by a Slovakian citizen he had never met. He was also contractor for the Gladstone Road wastewater plant that suffered major cost overruns.

This newspaper’s contacts, meanwhile, revealed that Mr Bonnefoy and Mogul Trading Ltd have wasted no time in reclaiming control at Blake Road and changing both staff and management.

One of the 700 existing tenants, speaking on condition of anonymity, told this newspaper that the storage facility’s name has also

GB Power ‘confident it can hold fort’ on further outages

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

GRAND Bahama Power Company “seems pretty confident they are going to be able to hold the fort” with no further major outages for summer 2025, private sector representatives have disclosed. Dillon Knowles, the Grand Bahama Chamber of Commerce president, told Tribune Business that the plans unveiled by the island’s monopoly energy provider last week “seem to be sound” but it now has to execute - especially on generation unit maintenance - to restore both business community and household confidence in the reliability of its supply. He added that GB Power has a 22 mega watt (MW) generation capacity surplus, with 74 MW if all units are available to handle the island’s 55 MW peak load demand, but this depends on all necessary and scheduled maintenance being completed. The utility informed Chamber representatives that it intends to finish this by month’s end. Dave McGregor, GB Power’s president and the senior Caribbean executive for its 100 percent

DIGITAL IMMIGRATION CARD TO BOOST TOURISM DATA CAPTURE

By FAY SIMMONS Tribune Business

THE Deputy Prime Minister yesterday said the new digital Immigration card will improve visitor tracking, digitise the entry process and help collect better statistical data on the tourism industry.

Chester Cooper, also minister of tourism, investments and aviation, responding to a recent International Monetary Fund (IMF) report that found there would be $930m worth of net errors and omissions (NEOs) in the 2023 total tourist spending data if the $4.574bn reflected in the balance of payments did not match the preliminary $5.567bn, said he is “satisfied” the sector’s impact is properly tracked. However, acknowledging that “there is always room for improvement”,

he asserted that the new digital Immigration cards will track guest landings in real time and send out a departure survey that can be enhanced to meet international data capture and tracking standards.

“Well, I would need to have a greater dialogue with the IMF about what they perceive. We are confident in the work that we are doing. I believe the IMF had some question or concern about the questionnaires being used. There is room for enhancing those questions,” said Mr Cooper.

“The beauty of the work we’re doing is that it’s an evolution. We are launching very shortly the digital Immigration card. What this is going to do is to really process the landing of our guests real time, and on departure, it’s going to send them a survey. So there’s this survey with new questions, which will cause there to be a more automated approach. It’s an

opportunity for enhancement, and we’re not sitting on our hands.

“We’re working steadily. The IMF had applauded the growth of tourism and the growth of our economy as remarkable. So we are happy that they have cited the great work that we’re doing, the remarkable growth in the economy and in tourism,” the Deputy Prime Minister continued.

“Do we want more spending? Absolutely, yes. We are satisfied that we are adequately tracking the activity of our guests, and there’s always room for improvement. So if they believe there is an issue, we will certainly be looking at it in the new landing card process.”

The IMF report flagged the country’s tourism estimates as potentially inflated and warned that outdated data collection is making it harder to track where money is really coming from or going. It said

Beverage producer forced into ‘pivot’ from COVID-19

EMERGE - from page B1

you,” he said. “It may be something that looks like a defeat, but a defeated person would not speak like this. It’ll be fine. The brand and drink are going to move forward. There’s so much more to come. Entrepreneurship is like a chess board; that’s what it is. You have your strategies, you have your pawns, and sometimes you have to give them up in order to win.”

Craig A. ‘Tony’ Gomez, the Baker Tilly Gomez accountant and partner, said he did not discuss client business publicly when contacted by Tribune Business and declined to comment other than to confirm the advertisement’s details and the firm’s appointment as voluntary liquidators. He is joined in that capacity

by fellow accountant Terez Simmons. Tribune Business understands that Switcha’s voluntary liquidation has resulted from Royal Bank of Canada’s (RBC) bid to realise its collateral, or loan security, under a debenture it holds over the company’s assets. It is thought that around $1m is owed to the Canadian-owned lender on a loan that the company has presently defaulted on. Baker Tilly Gomez, in its capacity as voluntary liquidator, will be empowered to take control of Switcha’s operations, plant and other assets including its bank accounts. However, it is thought likely that it will continue existing beverage production operations and may even rely heavily on Mr Sweeting to still run day-to-day management

Constant chances raise buyer investment risks

RATES - from page B1

Morley told this newspaper.

“An international buyer doesn’t want to find out that, five years ago, it was this percentage and then last year it increased by two percentage points.

“They want to know that whatever taxation they’re buying into will be there for a longer period of time, so that getting money out might not be subject to the risk of increased taxation and, therefore, running a risk on their investment.”

Mr Morley added that his firm’s analysis of Multiple

Listing System (MLS) data for the 2025 second quarter further affirmed that The Bahamas has five distinct, separate property markets - each with their own characteristics - in the shape of New Providence, Grand Bahama, Abaco, Exuma and Eleuthera. “There’s no if’s, and’s and but’s about it,” he said. “There’s no doubt about it. There’s some similarities. If you look at the five different island markets throughout this report, some of the islands have similarities - it might be contracted sales or new listings - but when you look at

given his expertise and knowledge.

One well-placed source, speaking on condition of anonymity, told Tribune Business that Mr Gomez and his team are likely to focus on “preserving the brand and the existing operation” at least in the short-term as they work to determine the best options for recovering and realising the sums owed to RBC and other creditors.

They added that, given Switcha’s relative popularity and recognition among Bahamian consumers, it made sense to keep drinks production going especially as there is likely to be value in the brand’s name and intellectual property.

“This is an established brand that is quite popular, and it’s quite popular in a broad arena of our society,” the source said. “It’s

other islands they might be somewhat different... You have to look at them as individual island markets.”

Mr Morley said the MLS data as a whole was “encouraging”. While new listings fell on Exuma and Eleuthera, they had increased on Abaco and New Providence. “We’re still seeing increases quarter-on-quarter on new listings coming on to the market,” he added, noting that the supply of available properties continues to exceed demand.

“The question was whether the volume of inventory coming on to the market would be sustainable for a long period of time or level out, but there’s still a significant amount of inventory out there,” Mr

current estimates for how much tourists spend, known as “travel credits”, appear too high and are propping up the country’s balance of payments.

The concern is that those numbers may not match what is actually happening in the Bahamian economy, especially as newer data from the Ministry of Tourism suggests lower revenue than what’s reported in official statistics. If those numbers are adjusted downward, the result could be a nearly $1bn hole in the national accounts.

Most data used to estimate visitor spending is based on old surveys and assumptions. The IMF is urging the Government to modernise how it collects that information through updated visitor surveys, better collaboration with the Ministry of Tourism, and more accurate tracking of what visitors actually do and spend when they’re here.

widely accepted and the name rings a bell with every Bahamian. That’s the type of product the liquidators will be dealing with.

“It’s a good brand and good product that is known by many. The smaller retailers seem to think that it’s a very hot item. It’s still very much a popular product in the beverage industry.” The Switcha founder, though, will likely have to raise sufficient new capital and financing to largely repay RBC if he is to regain full ownership control.

Mr Sweeting, in a statement responding to Tribune Business inquiries, said Switcha had been forced to “pivot” due to COVID-19, which resulted in lockdowns, health restrictions and other measures that severely limited commerce and business earnings for much of 2020 and 2021. However, he promised there is “more to come” once the drinks manufacturer emerges from voluntary liquidation.

“The matter is being resolved as we speak; no

Morley continued. “The demand is obviously not greater than the supply coming in.

“It’s not depleting, and it’s not at the break even where demand meets supply. We’re not seeing that. We’re seeing a net increase in inventory.... I think it’s still a very strong market. If you look at the number of contracted sales, to me everything is up quarter-on-quarter, year-on-year, pretty much across the board except for Eleuthera homes where contracted sales are down 6-7 percent.

“Demand is still there, which is great. If the demand is still there it means financing is there with the banks. It’s really a situation where I think it’s a very good market. Is it a seller’s market? A buyer’s market? I think it’s still very much a seller’s market. If you look at the sales to listing price ratio most of them are north of 90 percent; some of them are close to 95 percent.”

Morley Realty, in its assessment of 2025 second

Mr Cooper said the Government has assessed the economic benefit of cruise tourism and introduced regulations to correct”leakages” in the industry and ensure its benefits are felt by Bahamians. He added that the reports will be released to the public, who “will be pleased” with the economic growth The Bahamas is seeing as a result of the cruise industry.

“I will tell you, though, that the Government embarked upon an exercise to assess economic benefit and economic value of private destination cruising. That examination was extensive. We visited all of the cruise ports all across the islands of The Bahamas,” Mr Cooper added.

“We were able to find some leakages, and as a result of those leakages, we were able to put in place some just adjustments in regulations during the last Budget cycle. We

real material effects,” Mr Sweeting added. “However, due to the COVID-19 fall-out we had to pivot. Although it was challenging for a myriad of reasons, the new path turned out to be even greater than we anticipated.

“We forged alliances with production and distribution giants. The growth of the brand has been an amazing experience with more to come. Entrepreneurship is a chess board. You need strategy and pawns in order to survive and win.”

Mr Sweeting, in a 2014 interview with Tribune Business, recalled how the Bahamas Development Bank (BDB) turned him down for financing in 2009, branding his project ‘non-viable’.

“I still have my letter from the Development Bank in 2009, when they told me my project wasn’t viable,” he revealed. “In the beginning it was discouraging, but I took that discouragement and made it work. Now I sit on the same technical panels as the

quarter market trends, said: “Contracted and completed sales presented mixed results. New Providence stood out with a 47.2 percent increase in contracted home sales and a 32.1 percent gain for land. Abaco also performed well, with completed home sales up 46.7 percent.

“Eleuthera land remained active, with a 35 percent increase in contracts and 35.7 percent more closings. Exuma experienced some changes, with a 33.3 percent decline in contracted homes and a 14.3 percent decline in completed home sales, though land sales rebounded, increasing 350 percent quarter-on-quarter. Grand Bahama showed modest home sales growth and a 50 percent rise in land closings, though overall volume remained lighter.”

Elsewhere, Morley Realty added: “Sales prices were uneven, reflecting both seasonal variation and market recalibration. New Providence homes recorded a 56 percent drop in average price quarter-on-quarter,

will continue to review the activity of cruising across The Bahamas. “We will continue to make adjustments where necessary, but we are really looking positively at improving economic benefits. Economic benefit goes beyond the actual tourist spend, but it trickles through taxes, departure taxes, through VAT, Ministry of Finance doing a more effective job at collecting VAT and private destinations, work permit fees. There’s really a comprehensive overall improvement of how we calculate economic benefit,” he continued.

“So this is a work we’ve started already over the past year, and I believe once these reports are released, I think the public will be pleased with the overall economic growth that we are seeing as a result of the cruise business in The Bahamas.”

BDB that told me the project was not viable and we can’t help you.

“The company started in 2007. I started it in my kitchen, and went on to the East-West Highway where I stayed for two years, selling product on the side of the road.” Switcha’s name is a play on what older generations used to call limeade or lemonade.

“What our company decided to do was bring back that culture and also mass produce this beverage, which is loved by all and by far the best tasting and freshest limeade/lemonade on the market, as we only use real citrus,” Switcha said in its promotion on the Government’s online trade portal.

RBC appears to have embarked on a drive to clean up relatively small delinquent commercial loans in recent months, having also placed Geneva Brass Seafood into receivership over a debt believed similar to that owed by Switcha.

and Exuma homes followed with a 30.5 percent decline, though Exuma still led with an average price of $1.84m.

“Eleuthera saw modest improvement, with average home prices rising 1.5 percent over the quarter. Land prices showed a mixed pattern: Grand Bahama fell 57 percent, while Exuma land rose 1401.7 percent quarteron-quarter. Median land prices climbed in Abaco, Eleuthera and Exuma, pointing to demand for mid-range land parcels.

“Days on market (DOM) saw sharp quarterly increases in several segments. Exuma and Abaco land both exceeded 225 days, suggesting slower closings. New Providence homes rose to 118 days, while land remained somewhat stead,” the realtor’s report added.

“Conversely, homes in Eleuthera and Exuma moved faster, with DOM dropping nearly 50 percent in both, signalling increased urgency. Grand Bahama homes were steady, while land took significantly shorter to sell.”

WHAT TO KNOW ABOUT A VULNERABILITY BEING EXPLOITED ON MICROSOFT SHAREPOINT SERVERS

By SHAWN CHEN Associated Press Writer

MICROSOFT has issued an emergency fix to close off a vulnerability in Microsoft's widely-used SharePoint software that hackers have exploited to carry out widespread attacks on businesses and at least some U.S. government agencies. The company issued an alert to customers Saturday saying it was aware of the zero-day exploit being used to conduct attacks and that it was working to patch the issue. Microsoft updated its guidance Sunday with instructions to fix the problem for SharePoint Server 2019 and SharePoint Server Subscription Edition. Engineers were still working on a fix for the older SharePoint Server 2016 software.

"Anybody who's got a hosted SharePoint server has got a problem," said Adam Meyers, senior vice president with CrowdStrike, a cybersecurity firm. "It's a significant vulnerability." Companies and government agencies around the world use SharePoint for internal document management, data organization and collaboration. A zero-day exploit is a cyberattack that takes advantage of a previously unknown security vulnerability. "Zero-day" refers to the fact that the security engineers have had zero days to develop a fix for the vulnerability. According to the U.S. Cybersecurity and Infrastructure Security Agency (CISA), the exploit affecting SharePoint is "a variant

of the existing vulnerability CVE-2025-49706 and poses a risk to organizations with on-premise SharePoint servers." Security researchers warn that the exploit, reportedly known as "ToolShell," is a serious one and can allow actors to fully access SharePoint file systems, including services connected to SharePoint, such as Teams and OneDrive.

Google's Threat Intelligence Group warned that the vulnerability may allow bad actors to "bypass future patching."

Eye Security said in its blog post that it scanned over 8,000 SharePoint servers worldwide and discovered that at least dozens of systems were compromised.

‘MOST’ FREED AFTER NORMAN’S CAY IMMIGRATION OPERATION

By ANNELIA NIXON Tribune Business

MULTIPLE government agencies raided Norman’s Cay yesterday following allegations of Immigration law violations but “most” foreign workers were subsequently released as their papers were in order.

The Department of Immigration teamed with the Royal Bahamas Defence Force to lead the operation early yesterday morning on the Exuma cay. The raid followed a a mass termination of around

30 employees on Friday, including both Bahamians and foreign workers, and claims that expatriate workers were being hired without proper documentation including valid work permits.

“The Department of Immigration confirms that, acting on intelligence received, it executed a multi-agency operation on Norman’s Cay in the early hours of Monday morning July 21, 2025,” it said in a statement. “The operation was conducted in co-ordination with the Royal Bahamas Defence Force.

“This action was taken following reports of Immigration breaches, including allegations of individuals residing and working on the island without valid documentation. The Department wishes to emphasise in the strongest terms that The Bahamas is a country governed by the rule of law.

“We will not tolerate the mistreatment or displacement of Bahamian workers in their own country, nor will we turn a blind eye to the violation of the Immigration laws. We encourage members of the public to report any suspected

breaches of Immigration laws to the Department. Our officers remain committed to enforcing the law fairly and ensuring that our borders and labour standards are respected.”

While it was not disclosed whether any persons were found on Norman’s Cay without valid work permits or other documents, video footage circulating via WhatsApp shows what appears to be Immigration officers among a large group of persons at a dock. Tribune Business was unable to identify the nationality or race of the gathered persons, and nor

was it able to confirm if persons without proper documentation were found.

A former employee, terminated from Norman’s Cay yesterday morning, and speaking on the basis of anonymity, said of the foreign workers: “They still here.”

“They just apprehend them. They carry them by the marina. They just process them and just was waiting on their papers to come. But they let most of them go. After lunchtime I saw most of them.”

The Department of Labour and the Department of Immigration conducted

Roker: Feed Ya Self to be every Saturday event

By ANNELIA NIXON Tribune Business Reporter anixon@tribunemedia.net

ROKER’S Gas Station is partnering with Nu Gaia Farms through its Feed Ya Self initiative in a bid to highlight what is produced by Bahamian farmers and other small businesses.

Noting that the initiative is now in its third week, Peter Roker, the station’s principal, confirmed it will be held indefinitely every Saturday from 8am through 4 pm in the open area of his new location on Faith Avenue. While targeted mainly at farmers and food processors, he said other small businesses are invited to take part in the Feed Ya Self Initiative.

“When we came down here to do the service station and the lumber company, what we wanted to do is to make the area more accommodating for entrepreneurs... and also to bring to light the people who are doing farming, backyard farming, citrus, herbs and also, there’s a tremendous amount of people doing different types of programmes for sauces, spices, juices - all very indigenous, organic and very, very natural,” Mr Roker said.

“There are a lot of Bahamian small farmers out there. And so what we’re trying to do as a business is highlight that, and give them a forum where they can come there every Saturday and it’ll rotate. In other words, it won’t always be the same people. Just to give you an example, this

Maintenance execution targets end-July finish

RELIABILITY - from page B1

owner, Canadian energy giant Emera, could not be reached for comment before press time. However, Mr Knowles confirmed that the outages and load shedding that occurred around Independence Day resulted from a lightning strike knocking out the key generating unit then in operation.

With other turbines offline for maintenance, this led to a generation capacity shortfall where electricity supply could not match demand. GB Power is now seeking to complete maintenance by July’s end. “I had an interesting meeting with them [GB Power],” Mr Knowles disclosed of last Thursday’s encounter.

“They gave some background on the situation, but it appears they have it back to normal.

“They are working on more reliability, but are managing to keep the power on. They have maintenance work going on, but nothing to stop them from supplying. They seem to be pretty confident that they are going to be able to hold the fort. They had some units offline for service when the unit that was hit by lightning, or affected by lightning, went down.

“So they are continuing to work that cycle to get them back up and running and into service. Their plan seems to be sound. Obviously, they still have to execute it, but assuming they are able to execute what they plan to do they should be in OK shape,” the GB Chamber president added.

“They have 74 MW of capacity, and peak load is usually around 55 MW. They have the capacity to handle the load. The question is can they get reliability up by completing maintenance activities? They’re looking at the end of the month.”

Asked how GB Power can now restore the confidence of its customers, Mr Knowles added: “I don’t know how they do that other than through demonstrating. I don’t know that any of these conversations are going to restore that confidence easily. I think time will tell you how they respond with what they’re doing.”

GB Power, on Friday, July 11, gave “two days” as its restoration timeline

while warning that residential and business customers may still “experience temporary outages... as a result of the current shortfall”. It had previously blamed its woes on a surge caused by a lightning strike that impacted the Peel Street plant on July 9, which resulted in “the loss of one of our primary generating units”. The utility added that Unit 33 had to be taken offline the following day due to what it described as “the absence of critical auxiliary support” from unit 31.

“This has resulted in a generation shortfall, directly affecting our ability to supply power reliably to all customers,” GB Power added. It said a generation specialist had already arrived on Grand Bahama, with a turbocharger specialist also set to arrive shortly.

last week we had a company down there that does dog training.

“[It is] especially [for] farmers and persons who are producing homemade juices, jams, spices, your edible crafts, edible crops and to spotlight them. Even if they don’t attend. In other words, they can bring the brochures. There’s no charge for the brochures. They can go and interact with our customers on the pumps, and give them samples,” Mr Roker said.

“So it’s all about exposing what a lot of Bahamians are doing. You take, for instance, I bought a dozen eggs, totally organic eggs for $8- totally organic fresh eggs. And the other thing, too, is the eggs were all different colours by different hens. You have really specialised types of products

Both are to stay for summer to support repairs and “help strengthen systems against risk”.

“Our teams are working around the clock to troubleshoot and repair the affected units, with a restoration timeline estimated within the coming days.... As a result of the current shortfall, customers may continue to experience temporary outages until the affected units are fully restored,” GB Power said.

The latest generation shortfall, and inability to keep Grand Bahama fully supplied with electricity, comes at an especially sensitive time for the Power Company and the island’s wider energy regulatory regime.

Mr McGregor, speaking to this newspaper in November 2024 following a series of power outages and load shedding that disrupted last summer, asserted then that the company had “shored up

The Tribune wants to hear from people who are making news in their neighbourhoods. Perhaps you are raising funds for a good cause, campaigning for improvements in the area or have won an award. If so, call us on 322-1986 and share your story.

that you really can’t buy in the food store.”

Mr Roker said his hope is that restaurants and hotels will take notice of Bahamian farmers and support such enterprises by purchasing their products, noting that they are freshly grown while organic provides a healthier alternative.

“We don’t have a problem with people coming in and helping farmers and Bahamians,” Mr Roker added.

“But what we would like to see happen is some of the hotels and restaurants connect with these people and buy their product, because it’s a real high quality product and would be a very important addition to any good restaurant.

“And we want to connect people to people. So someone’s using eggs, and they want the organic eggs. We

reliability with temporary generation” and had “a very robust maintenance plan going forward” to prevent any repeat. However, just such an event has now occurred.

GB Power is still seeking approval of its proposed 6.3 percent base rate increase,

want to be the ones to connect them, or we want to help them to be connected to other people. Like I said before, there’s no charge at all whatsoever. So it’s not a commercial thing. This is more for Roker’s Gas Station and Nu Gaia farms farms to make our contributions.

“I think that the public must be sensitised to how many people are out there growing and producing very, very good food. There’s no question at all about the need for the best food possible for people, because there is, as you know, so many types of sickness going around and eating natural is probably one of the safest things.”

Mr Roker said when he first thought of the Feed Ya Self initiative, he reached out to farmers and Nu Gaia

for which it had sought regulatory approval last year and had hoped would take effect from New Year’s Day 2025.

And, adding further pressure to the generation woes is the Utilities Regulation and Competition Authority’s (URCA) Supreme

an investigation and inspection on Norman’s Cay a few months ago. The unannounced visit on May 16 led to interaction between the government agencies, Bahamian employees and expatriate workers. The investigation and inspection led to three senior expatriate executives’ work permits being cancelled. While Norman’s Cay’s representatives have attributed the mass terminations to their need to downsize, they have advised the Department of Labour that there will be future employment opportunities for Bahamians.

Farms provided “the more positive” response.

“I met the people from Nu Gaia Farms about a month ago, through the farmers WhatsApp chat group. I had sent something out to the farmers, and they were the ones who responded. And that’s when we met each other. They’re a very young couple that is extremely knowledgeable,” Mr Roker said.

“I had planned the event. As a matter of fact, I had put the the idea across to all the farmers on the chat group. And they’re the ones who responded, I guess, the more positive way. They do have a programme for kids to be interested in that as well. We encourage children to come by and see what we’re doing, and be a part of the learning process.”

To become a vendor, interested parties should WhatsApp 805-4242 or Mr Roker at 424-0749.

Court challenge to determine whether itself or the Grand Bahama Port Authority (GBPA) is the true regulator for GB Power and, by extension, the wider energy industry in Freeport.

‘Irreparable damage’ fears on tenant’s sudden ousting

been changed from Store Away to Blake Road Storage.

“They’ve fired all the staff and changed the name,” they disclosed. “What they were telling me was Bonnefoy had stepped in, and the real owner had stepped back in to take possession of his property. Instead of it being called Store Away they’ve now called it Blake Road storage.

“They’ve issued me a new contract and I’ve started paying rent to them. I went in there before the weekend and they said ‘new management, new system’, this, that and the other. I have to pay my money into an account with this real estate company run by a German woman.”

Justice Darville-Gomez, in her capacity as the duty judge over the Independence holiday weekend, recalled that Store Away Ltd was initially granted a ten-year lease over the Blake Road property on March 1, 1998. It expired on February 28, 2008, and was not renewed or extended.

Store Away Ltd, though, “remained in occupation with the claimant’s tolerance, and the parties operated under a de facto arrangement” that Mogul Trading Ltd argued amounted to a tenancy-at-will. It terminated the arrangement via two demand letters, issued on April 22, 2025, and May 6, 2025, and sought a speedy Supreme Court hearing on its application for “immediate possession”.

The “urgency” for this was that “the Department of Inland Revenue (DIR) has issued a notice indicating that the subject property may be subjected to public auction due to unpaid taxes. The continued occupation by the defendant obstructs the claimant’s ability to resolve tax arrears and jeopardises the claimant’s proprietary interest in the subject property.

“The threatened auction by DIR constitutes an immediate and irreparable risk of loss to the claimant if possession is not obtained forthwith.” A February 11, 2025, tax certificate issued by the Bahamian tax authority showed unpaid real property taxes dating back 11 years to 2014, with annual arrears ranging from $58,077 to $130,445, for a total $1.166m due to the Public Treasury. Mogul Trading Ltd, in its statement of claim, asserted that Store Away Ltd had been allowed to occupy the

premises but without a fixed term “or legal entitlement to remain” - meaning its tenancy could be revoked at any time. It alleged that it was “in material breach of its obligations” due to the failure to pay both taxes and rent - the latter calculated at 90 percent of gross turnover. Operational and financial data, necessary to determine the accuracy of the gross turnover, was also purportedly not provided to the landlord. “The claimant has issued multiple demands requesting compliance, financial disclosure and payment. These have been ignored or refused by the defendant,” Mogul Trading Ltd alleged.

Store Away Ltd, in its defence, asserted that Mr Ferguson only became its beneficial owner after the original lease expired in 2008. It added that he “entered into a verbal agreement with the claimant” to pay a monthly rent of $10,000 thereafter, but suffered a stroke in 2017 and “his health deteriorated drastically late last year” to the extent he has been “in and out of hospital” and inactive with Store Away Ltd.

Don Johnson, Store Away Ltd’s accountant, conceded in an affidavit that Store Away Ltd “has a right to vacant possession” but urged the Supreme Court to “permit a reasonable period” to notify clients and find an alternative location for store their possessions.

“There currently exists no property that is outfitted with storage units that can meet the requirements of the defendant to operate its business efficiently,” he alleged. “Therefore, in order for the defendant to continue operating a large tract of land would have to be purchased or leased and a storage facility would have to be designed and constructed.

“This process involves a number of steps, including but not limited to engaging an architect to draw plans, obtaining the necessary permits and approvals, securing adequate financing and obtaining the requisite insurances.

“Vacating the premises without the defendant having the opportunity or a reasonable time to source an alternative arrangement would, in essence, close the business down,” Mr Johnson added. “We would be liable to customers who have already pre-paid for the space, we have no ability to secure their belongings and

we would have to terminate all the employees.

“The impact on the defendant is draconian, and thus we are asking the court to be considerate of the technical nature of our business and proceed cautiously so as to minimise the irreparable damages that can result from a sudden departure.”

Mr Johnson added that 700 of the 765 units are currently leased, with some tenants having paid for a year or six months in advance, and others on a month-to-month. He argued that the storage facility’s layout, with just one entrance that is also used for an exit, meant it restricted visitors to three vehicles at a time to prevent “a blockage of traffic on Blake Road”.

“Therefore, it is impossible to have 700 tenants evicted simultaneously as those would create chaos,” Mr Johnson asserted. “The process of evicting each tenant would have to be done on a staggered basis perhaps by sections to avoid congestion within the property and on the main Blake Road...

“While we accept that the claimant has a right to vacant possession we are appealing to the court to provide a reasonable period to provide the contractual notice to terminate each lease, provide an opportunity for the tenants to retrieve their possessions and seek an alternative and suitable location to operate its business.”

However, Madeliene Todd, a Mogul Trading Ltd director, countered by alleging that the Fergusons’ actions “show a pattern of sabotage, delay and deception amongst other accusations”. Her June 26, 2025, affidavit alleged that the owner/landlord had been “exposed” by the “amassing of over $1.165m in unpaid real property taxes”.

“From 2019 onward, Mr Ferguson assured us that a buyer for the property existed and was ready to

close. On multiple occasions, including on the very day a sale contract was to be executed, Mr Ferguson personally intervened to halt closings, stating that he had a superior buyer who would complete within weeks. No such buyer ever materialised,” Ms Todd claimed.

“A demand for outstanding rent in the sum of $520,000 was issued by White Law Chambers on February 10, 2023. The license (sic, lease) was formally revoked on 22 April 2025, by service of a Notice to Quit..... Instead of vacating and being cooperative, the Fergusons have entrenched themselves, refused to disclose financial records and continued their operations with impunity.

“While Store Away operated profitably from the premises, the tax obligations fell upon Mogul, the registered owner. This dereliction has not only placed Mogul at risk but also deprived the Treasury of The Bahamas of substantial revenue.”

The demand for the alleged unpaid rent was sent to Store Away’s then-attorney, Andrew Edwards, at Davis & Co.

Other documents filed with the Supreme Court reveal that a $6m offer was made to acquire Store Away on November 11, 2017, by James Allan “or his assigns”. That was purportedly from a Canadian investment firm that specialised in the purchase of storage facilities, and which was represented by Gregory Graham of Graham Real Estate.

Ms Todd alleged that funds for the purchase had been lodged in escrow with the Graham, Thompson & Company law firm, adding: “Three principals of the buyer group flew to Nassau for signing. At the last moment, Mr Ferguson refused to sign, claiming he had a better deal with Hemingway Properties, which would supposedly close in a matter of days.

“Hemingway Properties never closed. No funds or contracts ever materialised. This was part of a pattern. Each time a legitimate buyer emerged, Mr Ferguson would tout a ‘better deal’ with his own preferred group, which would conveniently evaporate once

Legal Notice NOTICE

N O T I C E IS HEREBY GIVEN as follows:

(a) PONTEK LTD. is in dissolution under the provisions of the International Business Companies Act 2000.

(b) Te Dissolution of said Company commenced on July 22, 2025 when its Articles of Dissolution were submitted and registered by the Registrar General.

(c) Te Liquidator of the said company is Helvetic Management Services Ltd. of 2nd Terrace West, Centreville, Nassau, Bahamas.

(d) All persons having Claims against the above-named Company are required on or before August 22, 2025 to send their names and addresses and particulars of their debts or claims to the Liquidator of the company or, in default thereof, they may be excluded from the beneft of any distribution made before such debts are proved.

July 22, 2025

HELVETIC MANAGEMENT SERVICES LTD.

LIQUIDATOR OF THE ABOVE-NAMED COMPANY

Legal Notice

Protection Income Investments Fund Ltd.

Registration No. 205309 B

INTERNATIONAL BUSINESS COMPANIES ACT (No.45 of 2000)

In Voluntary Liquidation

Notice is hereby given that in accordance with Section 138 (8) of the International Business Companies Act, No.45 of 2000, the dissolution of Protection Income Investments Fund Ltd. has been completed, a Certifcate of Dissolution has been issued and the Company has therefore been struck of the Register. Te date of completion of the Dissolution was the 26th June, 2025

Crowe Bahamas Liquidator

the threat of a real closing passed.” Hemingway Properties’ director was named in the documents as Taran Mackey. Ms Todd added that Store Away Ltd’s audited financial statements for 2021 and 2023 showed that, despite generating annual gross income of between $1.48m-$1.55m, it was suffering from “declining or negative net income” despite no rent or property tax being paid. Profits fell from $283,312 in 2020 to $56,202 in 2021, then to just $5,244 for 2022 and a $30,603 loss in 2023. She noted, though, that over the same period the compensation paid to directors - including Mr Ferguson - had jumped from $463,406 in 2020 to $664,812 in 2021, and then to $837,874 and $855,043 for 2022 and 2023.

And, while Mr Johnson had called for more time to vacate, Ms Todd noted that its financials showed it had invested $1.875m in 2008 to acquire a ten-acre Freeport site for a storage facility.

“This land has been held for over a decade. To now claim hardship in my opinion is disingenuous and deceptive,” she alleged. Justice Darville-Gomez noted this contradiction, as well as Mogul Trading Ltd’s argument that Store Away Ltd had admitted in its own evidence that it was merely a tenant-at-will and the landlord had lawfully terminated its occupation.

The judge, in her verdict, noted that Store Away Ltd did not deny there were rental or tax arrears, while also failing to challenge that the Mogul Trading Ltd’s ownership or that the lease had expired. And she found that Store Away Ltd’s request for time “to wind down its operations” and construct an alternative storage facility is “unrealistic and unfeasible”.

“The defendant ought to have given its sub-tenants notice either in April 2025 or May 2025 after receipt of

the demand letters from the claimant,” Justice DarvilleGomez ruled. “However, the defendant chose to continue in occupation without giving the 30-day notice which Mr Johnson explained is the period required in the agreement, or without complying with the requests for the production of the requested documentation.

“The defendant has failed to demonstrate to this court any attempt to comply with the production requests so that the claimant could ameliorate its position with the Department of Inland Revenue. Consequently, the claimant is now faced with possible penalties from the Department of Inland Revenue including the sale of the property by auction as a result of unpaid taxes.

“The defendant’s operational concerns cannot override the claimant’s proprietary rights, especially where the defendant continued to collect payments from licensees while failing to remit rent to the claimant. The defendant has benefited from extended possession and failed to discharge financial obligations or produce requested documentation. No further delay is justifiable.”

Besides ordering that Mogul Trading Ltd be given “immediate possession”, Justice Darville-Gomez also ordered that Store Away Ltd provide profit and loss statements for 2023 and 2024; VAT returns for 2023, 2024 and the 2025 first quarter; the most recent rent roll; utility bills for the past year; and the most recent real property tax bill and notices of unpaid taxes; plus copies of current storage rental deals.

Ashley Williams represented Mogul Trading Ltd, while Donovan Gibson of Munroe & Associates acted for Store Away Ltd.

NOTICE

Pursuant to the provisions of Section 138 (8) of the International Business Companies Act (as amended), NOTICE is hereby given that Shemara Investment Holdings Limited has been dissolved and has been struck from the Register with effect from 16 June 2025.

John Jephson LIQUIDATOR c/o Corvalier Trust Company (Bahamas) Limited Pineapple House #4 Lyford Cay P.O. Box SP-64284 Nassau, Bahamas

Levy property may be redeveloped by PPP

Mr Cooper said the Government has been “resolute” on improving downtown Nassau and, as there were no medium or long-term plans to renovate the site, Cabinet decided to demolish the Levy building to make way for future development.

“We have been resolute in the work that we’re putting in here in Bay Street, and we hope that within the years to come we will see renewal and revitalisation right here on on Bay Street. The Government of the Bahamas had no medium or long-term aspiration for the restoration of this

building, and therefore the Cabinet of The Bahamas determined that we ought to take this course of action, and I am delighted that we are being able to do so today,” said Mr Cooper. He added that two buildings were demolished due to the recent fire on Bay Street, and the Government recognises continued infrastructure work is needed but the initiative will “kick start” development. “As a result of the recent fire, there were two demolitions. And, of course, before that, we’ve had a steady path. We are preserving the historical sites. We are in recognition that there is some work to be

done, by way of the infrastructure here on Bay Street. This is still phase one of the work we’re doing here, and we continue to press forward steadily,” said Mr Cooper.

“We know that this is a long-term job. The deterioration that we’re seeing here on Bay Street didn’t just start. This has been going on for 30-40, years, but I believe the work we’ve done over the last three years is important to kick start what I hope would be a great vision for Bay Street.”

Mr Cooper foreshadowed that the buildings being demolished will one day host “vibrant businesses”,

5 years after Ohio’s $60M bribery scandal, critics say more could be done to prevent a repeat

By JULIE CARR SMYTH

Associated Press

FIVE years after a $60 million bribery scheme funded by FirstEnergy Corp. came to light in Ohio, expert observers say the resulting prosecutions, lawsuits, penalties and legislation haven't led to enough change and accountability to prevent politicians and corporate executives from cutting similar deals in the future.

The scheme — whose prospective $2 billionplus pricetag to consumers makes it the largest infrastructure scandal in U.S. history — surfaced with the stunning arrests of a powerful Republican state lawmaker and four associates on July 21, 2020.

That lawmaker, former House Speaker Larry Householder, is serving 20 years in federal prison for masterminding the racketeering operation at the center of the scandal.

Jurors agreed with prosecutors that money that changed hands wasn't everyday political giving, but an elaborate secret scheme orchestrated by Householder to elect political allies, become the House speaker, pass a $1 billion nuclear bailout law in House Bill 6 and crush a repeal effort. One of the dark money groups Householder used also pleaded guilty to racketeering.

Householder and a former lobbyist have unsuccessfully challenged their convictions. Two of the arrested associates pleaded guilty, and the other died by suicide.

Dark money keeps flowing

Any hope that the convictions would have clarified federal law around 501(c)4 nonprofit "dark money" groups or prompted new restrictions on those hasn't materialized, said former U.S. Attorney David DeVillers, who led the initial investigation.

"I think it's actually worse than it was before," he said. "Nationally, you have both Democrats and Republicans using these, so there's no political will to do anything about it."

Indeed, a study released in May by the Brennan Center for Justice found that dark money unleashed by the 2010 Citizens United decision hit a record high of $1.9 billion in 2024 federal races, nearly double the $1 billion spent in 2020. The vast majority of money from undisclosed donors raised into dark money accounts now goes to super PACs, providing them a way to skirt a requirement that they make their donors public, the study found.

DeVillers said one positive result of the scandal is that Ohio lawmakers appear genuinely concerned about avoiding quid pro quos, real or perceived, between them and their political contributors.

Anti-corruption legislation perennially introduced by Ohio Democrats since the scandal broke has gone nowhere in the GOPdominated Legislature.

Republican legislative leaders have said it is outside their authority to amend

federal campaign finance law. The U.S. Attorney's office declined to discuss the investigation because prosecutions remain ongoing. Two fired FirstEnergy executives have pleaded not guilty on related state and federal charges and await trial.

Former Public Utilities Commission of Ohio Chairman Samuel Randazzo, to whom FirstEnergy admitted giving a $4.3 million bribe in exchange for regulatory favors, had faced both federal and state charges. He died by suicide after pleading not guilty.

State regulator hasn't penalized FirstEnergy

Akron-based FirstEnergy — a $23 billion Fortune 500 company with 6 million customers in five states — admitted using dark money groups to bankroll Householder's ascendance in exchange for passage of the bailout bill. It agreed to pay $230 million and meet other conditions to avoid prosecution, and faced other sanctions, including a $100 million civil penalty by the U.S. Securities and Exchange Commission.

But FirstEnergy hasn't yet faced consequences from the state regulator.

"They never actually got penalized by regulators at the PUCO level," said Ohio Consumers' Counsel Maureen Willis, the lawyer for Ohio utility customers.

Testimony in four PUCO proceedings stemming from the scandal finally began last month after the cases were delayed for nearly two years, in part at the request of the Justice Department. They're intended to determine whether FirstEnergy used money for bribes that was meant for grid modernization and whether it improperly comingled money from its different corporate entities.

FirstEnergy spokeperson Jennifer Young said it invested $4 billion in grid upgrades in 2024 and plans to spend a total of $28 billion through 2029.

Young said FirstEnergy has redesigned its organizational structure, established a dedicated ethics and compliance office, overhauled the company's political activity and lobbying practices and strengthened other corporate governance and oversight practices.

"FirstEnergy is a far different company today than it was five years ago," she said.

The PUCO also made changes in response to the scandal. Chair Jenifer French told state lawmakers that ethics training has been enhanced, staff lawyers and the administrative law judges who hear cases now report to different directors to ensure legal independence, and she never takes a meeting alone.

Some tainted money hasn't been returned to customers

Ashley Brown, a retired executive director of the Harvard Electricity Policy Group who previously served as a PUCO commissioner, said the commission is the only state entity with the power to order FirstEnergy to return tainted cash — including the bribe money — to customers. That largely hasn't happened.

He said the Ohio commission had vast power to hold FirstEnergy accountable for its misdeeds but hasn't conducted its own management audit of the energy giant, demanded an overhaul of FirstEnergy's corporate board or pressed for public release of FirstEnergy's own internal investigation of the scandal, whose findings remain a mystery. Shareholders won some accountability measures as part of a $180 million settlement in 2022, but they continue to fight in court for release of the investigation. Willis does, too.

"How do you allow a utility to operate a vast criminal conspiracy within the utility (with) consumer dollars, and you don't even look at what went wrong?" Brown said.

and called for Bahamian

investors to participate in Bay Street’s revival.

“One day, these same places that we demolish will be converted to vibrant businesses. I foreshadow that we will have active roof-top bars, hotels, residences, new entertainment opportunities, entrepreneurs. Bahamians will converge on Bay Street, seizing the opportunities,” Mr Cooper added.

“We will attract more of the guests outside of the Nassau Cruise Port on to Bay Street proper, and we will see the same robust level of activity that we’re seeing inside the Nassau Cruise Port outside,where Bahamian businesses can thrive. That excites me.

“We’re inviting Bahamians to participate in this process. We cannot do this alone. We need the full support of stakeholders. Many

building owners have come forward. They have offered to demo their buildings directly covering the cost of doing so, and many of them are already committed to rebuilding and helping us in this in this process,” the Deputy Prime Minister added.

“The Government is the facilitator of this work.

But make no mistake, we cannot do it all on our own.

So whilst there may be some who would like to see this work go faster, we acknowledge that enthusiasm for revitalisation encourages the Bahamian public to step forward and participate, and the stakeholders themselves to engage even more actively.”

Mr Cooper said once the 45-day demolition is completed the site will be transformed into a green space, but as it is “prime property for revitalisation”

and owned by the Government it may be developed through a private-public partnership (PPP).

“We anticipate that, in the first instance, this is going to become a beautified space. We anticipate seeing palm trees, or whatever the experts recommend that’s ideally suited for for this space,” said Mr Cooper “But ultimately, we hope that this will be prime property for revitalisation. It’s owned by the Government, so I foreshadow some public-private partnership for its redevelopment and that, of course, will be a decision of Cabinet.

“But, ultimately, we want to see the redevelopment of this space in the medium term, and we will be pressing forward creating this environment, that environment and opportunities for Bahamians to do this redevelopment.”

Beef prices have soared in the US — and not just during grilling season

By JOSH FUNK AP Business Writer

ANYONE firing up the grill this summer already knows hamburger patties and steaks are expensive, but the latest numbers show prices have climbed to record highs.

And experts say consumers shouldn't expect much relief soon either.

The average price of a pound of ground beef rose to $6.12 in June, up nearly 12% from a year ago, according to U.S. government data. The average price of all uncooked beef steaks rose 8% to $11.49 per pound.

But this is not a recent phenomenon. Beef prices have been steadily rising over the past 20 years because the supply of cattle remains tight while beef remains popular.

In fact, the U.S. cattle herd has been steadily shrinking for decades. As of Jan. 1, the U.S. had 86.7 million cattle and calves, down 8% from the most recent peak in 2019. That is the lowest number of cattle since 1951, according to the U.S. Department of Agriculture.

Many factors including drought and cattle prices

The risks

have contributed to that decline. And now the emergence of a pesky parasite in Mexico and the prospect of widespread tariffs may further reduce supply and raise prices. Here's a look at what's causing the price of beef to rise.

Smaller herd

The American beef industry has gotten better at breeding larger animals, so ranchers can provide the same amount of beef with fewer cattle, said David Anderson, a livestock economist at Texas A&M. Then in 2020, a threeyear drought began that dried out pastures and raised the cost of feed for cattle, according to the American Farm Bureau.

Drought has continued to be a problem across the West since then, and the price of feed has put more pressure on ranchers who already operate on slim profit margins. In response, many farmers slaughtered more female cattle than usual, which helped beef supplies in the short term but lowered the size of future herds. Lower cattle supplies has raised prices. In recent years cattle prices have soared, so that

now animals are selling for thousands of dollars apiece. Recent prices show cattle selling for more than $230 per hundredweight, or hundred pounds.

Those higher prices give ranchers more incentive to sell cows now to capture profits instead of hanging onto them for breeding given that prices in the years ahead may decrease, Anderson said.

"For them, the balance is, 'Do I sell that animal now and take this record high check?' Or 'do I keep her to realize her returns over her productive life when she's having calves?'" Anderson said. "And so it's this balancing act and so far the side that's been winning is to sell her and get the check."

Disease dilemma

The emergence of a flesheating pest in cattle herds in Mexico has put extra pressure on supply because officials cut off all imports of cattle from south of the border last year. Some 4% of the cattle the U.S. feeds to slaughter for beef comes from Mexico.

The pest is the New World screwworm fly, and female flies lay eggs in wounds on warm-blooded

and rewards of tokenization as crypto heavyweights push for it

By ALAN SUDERMAN AP Business Writer

AS cryptocurrencies become more intertwined with the traditional financial system, industry heavyweights are racing for a long-sought goal of turning real-world assets into digital tokens.

"Tokenization is going to open the door to a massive trading revolution," said Vlad Tenev, the CEO of the trading platform Robinhood at a recent James Bond-themed tokenization launch event in the south of France.

Advocates say tokenization is the next leap forward in crypto and can help break

down walls that have advantaged the wealthy and make trading cheaper, more transparent and more accessible for everyday investors. But critics say tokenization threatens to undermine a century's worth of securities law and investor protections that have made the U.S. financial system the envy of the world. And Robinhood's push into tokenizing shares of private companies quickly faced pushback from one of the world's most popular startups. What is tokenization?

The basic idea behind tokenization: Use blockchain technology that

powers cryptocurrencies to create digital tokens as stand-ins for things like bonds, real estate or even fractional ownership of a piece of art and that can be traded like crypto by virtually anyone, anywhere at any time.

The massive growth of stablecoins, which are a type of cryptocurrency typically bought and sold for $1, has helped fuel the appetite to tokenize other financial assets, crypto venture capitalist Katie Haun said on a recent podcast.

She said tokenization will upend investing in ways similar to how streamers radically changed how people watch television.

animals. The larvae that hatch are unusual among flies for feeding on live flesh and fluids instead of dead material. American officials worry that if the fly reaches Texas, its flesh-eating maggots could cause large economic losses as they did decades ago before the U.S. eradicated the pest.

Agricultural economist Bernt Nelson with the Farm Bureau said the loss of that many cattle is putting additional pressure on supply that is helping drive prices higher.

Tariff trouble

President Donald Trump's tariffs have yet to have a major impact on beef prices but they could be another factor that drives prices higher because the U.S. imports more than 4 billion pounds of beef every year.

Much of what is imported is lean beef trimmings that meatpackers mix with fattier beef produced in the U.S. to produce the varieties of ground beef that domestic consumers want. Much of that lean beef comes from Australia and New Zealand that have only seen a 10% tariff, but some of it comes from Brazil where Trump has

threatened tariffs as high as 50%. If the tariffs remain in place long-term, meat processors will have to pay higher prices on imported lean beef. It wouldn't be easy for U.S. producers to replace because the country's system is geared toward producing fattier beef known for marbled steaks.

Prices will likely stay high

It's the height of grilling season and demand in the U.S. for beef remains strong, which Kansas State agricultural economist Glynn Tonsor said will help keep prices higher. If prices remain this high, shoppers will likely start to buy more hamburger meat and fewer steaks, but that doesn't appear to be happening broadly yet — and people also don't seem to be buying chicken or pork instead of beef.

"You used to have to sit there on a Thursday night and watch Seinfeld," Haun said. "You tune in at a specific time, you don't get to choose your program, you couldn't be watching a program like Squid Games from Korea. Netflix was market-expanding. In the same way, I think the tokenization of realworld assets will be market expanding."

Growing momentum

Robinhood began offering tokenized stock trading of major U.S. public companies for its European customers earlier this month and gave away tokens to some customers meant to represent shares in OpenAI and SpaceX, two highly valued private companies.

Several other firms are diving in. Crypto exchange Kraken also allows customers outside the U.S. to trade tokenized stocks while Coinbase has petitioned regulators to open

the market to its U.S. customers. Wall Street giants BlackRock and Franklin Templeton currently offer tokenized money market funds. McKinsey projects that tokenized assets could reach $2 trillion by 2030.

Crypto's golden age

The push for tokenization comes at a heady time in crypto, an industry that's seen enormous growth from the creation and early development of bitcoin more than 15 years ago by libertarian-leaning computer enthusiasts to a growing acceptance in mainstream finance.

The world's most popular cryptocurrency is now regularly setting all-time highs — more than $123,000 on Monday — while other forms of crypto like stablecoins are exploding in use and the Trump administration has pledged to usher in what's been called the "golden age" for digital assets.

Even if ranchers decided to raise more cattle to help replace those imports, it would take at least two years to breed and raise them. And it wouldn't be clear if that is happening until later this fall when ranchers typically make those decisions.

"We've still got a lot of barriers in the way to grow this herd," Nelson said. Just consider that a young farmer who wants to add 25 bred heifers to his herd has to be prepared to spend more than $100,000 at auction at a time when borrowing costs remain high. There is typically a seasonal decline in beef prices as grilling season slows down into the fall, but those price declines are likely to be modest.

Nelson said that recently the drought has eased — allowing pasture conditions to improve — and grain prices are down thanks to the drop in export demand for corn because of the tariffs. Those factors, combined with the high cattle prices might persuade more ranchers to keep their cows and breed them to expand the size of their herds.

Lee Reiners, a lecturing fellow at Duke University, said the biggest winners in the push for tokenization could be a small handful of exchanges like Robinhood that see their trading volumes and influence spike.

"Which is kind of ironic given the origins of crypto, which was to bypass intermediaries," Reiners said.

Trump bump Interest in tokenization has also gotten a boost thanks to the election of President Donald Trump, who has made enacting more crypto-friendly regulations a top priority of his administration and signed a new law regulating stablecoins on Friday.

"Tokenization is an innovation and we at the SEC should be focused on how do we advance innovation at the marketplace," said Securities and Exchange Commission Chairman Paul Atkins.

Is it legal?

Securities law can be complex and even defining what is a security can be a hotly debated question, particularly in crypto. The crypto exchange Binance pulled back offerings of tokenized securities in 2021 after German regulators raised questions about potential violations of that country's securities law.

Under Trump, the SEC has taken a much less expansive view than the previous administration and dropped or paused litigation against crypto companies that the agency had previously accused of violating securities law.

Looming over two cases threatening Musk’s car company is a

By BERNARD CONDON and DAVID FISCHER Associated Press

ELON Musk fought court cases on opposite coasts Monday, raising a question about the billionaire that could either speed his plan to put self-driving Teslas on U.S. roads or throw up a major roadblock: Can this wildly successful man who tends to exaggerate really be trusted?

In Miami, a Tesla driver who has admitted he was wrong to reach for a dropped cell phone moments before a deadly accident, spoke of the danger of putting too much faith in Musk's technology — in this case his Autopilot program.

"I trusted the technology too much," said a visibly shaken George McGee, who slammed into a woman out stargazing, sending her 75 feet through the air. "I believed that if the car saw something in front of it, it would provide a warning and apply the brakes."

In unusual coincidence, regulators arguing an Oakland, California, case tried to pin exaggerated talk about the same Tesla technology at the center of a request to suspend the carmaker from being able to sell vehicles in the state.

Musk's tendency to talk big — whether its his cars, his rockets or his government costing-cutting efforts — have landed him in trouble with investors, regulators and courts before,

single question: Can he be trusted?

but rarely at such a delicate moment.

After his social media spat with President Donald Trump, Musk can no longer count on a light regulatory touch from Washington. Meanwhile, sales of his electric cars have plunged and so a hit to his safety reputation could threaten his next big project: rolling out driverless robotaxis — hundreds of thousands of them — in several U.S. cities by the end of next year.

The Miami case holds other dangers, too. Lawyers for the family of the dead woman, Naibel Benavides Leon, recently convinced the judge overseeing the jury trial to allow them to argue for punitive damages. A car crash lawyer not involved in the case, but closely following it, said that could cost Tesla tens of millions of dollars, or possibly more.

"I've seen punitive damages go to the hundreds of millions, so that is the floor," said Miguel Custodio of Los Angeles-based Custodio & Dubey. "It is also a signal to other plaintiffs that they can also ask for punitive damages, and then the payments could start compounding."

Tesla did not reply for a request for comment.

That Tesla has allowed the Miami case to proceed to trial is surprising. It has settled at least four deadly accidents involving Autopilot, including payments

NOTICE

NOTICE is hereby given that BENDREY JEANITH of Claridge Road, New Providence, Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 22nd day of July, 2025 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE

NOTICE is hereby given that JEAN JOHNSON of Garden Hills, New Providence, Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 22nd day of July, 2025 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE

NOTICE is hereby given that ROLAND CADET of P. O. Box EL-29921, Dry Hill Road, Palmetto Point, Eleuthera, Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 22nd day of July, 2025 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

just last week to a Florida family of a Tesla driver. That said, Tesla was victorious in two other jury cases, both in California, that also sought to lay blame on its technology for crashes.

Lawyers for the plaintiffs in the Miami case argue that Tesla's driver-assistance feature, called Autopilot, should have warned the driver and braked when his Model S sedan blew through flashing lights, a stop sign and a T-intersection at 62 miles-an-hour in an April 2019 crash. Tesla said that drivers are warned not to rely on Autopilot,

or its more advanced Full Self-Driving system. It say the fault entirely lies with the "distracted driver" just like so many other "accidents since cellphones were invented."

Driver McGee settled a separate suit brought by the family of Benavides and her severely injured boyfriend, Dillon Angulo.

Shown dashcam video Monday of his car jumping the road a split second before killing Benavides, McGee was clearly shaken.

Asked if he had seen those images before, McGee pinched his lips, shook his

NOTICE

NOTICE is hereby given that HERMEZY RENE of Marsh Harbour, Abaco, The Bahamas, is applying to the Minister responsible for Nationality and Citizenship, for Registration/ Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 22nd day of July 2025 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

NOTICE

NOTICE is hereby given that MATTHEW RASHARD PETIT-CHARLES of Carmichael Road, New Providence, Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 22nd day of July, 2025 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE

NOTICE is hereby given that KIM FRANCIS ROLLE of Ringstrasse 25A, 91187 Roettenbach, Germany is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 22nd day of July, 2025 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE is

that LAVERN ISAACS of #24 Knowles Drive, Harrold Road, P.O. Box N-832, is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 15th day of July, 2025 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

But lawyers for the Benavides family had another chance to parry that line of argument and asked McGee if he would have taken his eyes off the road and reached for his phone had he been driving any car other than a Tesla on Autopilot.

McGee responded, "I don't believe so."

The case is expected to continue for two more weeks.

head, then squeaked out a response, "No."

Tesla's attorney sought to show that McGee was fully to blame, asking if he had ever contacted Tesla for additional instructions about how Autopilot or any other safety features worked. McGee said he had not, though he was heavy user of the features. He said he had driven the same road home from work 30 or 40 times. Under questioning he also acknowledged he alone was responsible for watching the road and hitting the brakes.