Licence issue set to reignite Old Bahama Bay takeover battle

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE takeover battle at Old Bahama Bay is poised to reignite after the necessary government licence was issued on Friday to the corporate vehicle seeking to assume the resort’s management.

Daniel Baker, a representative for Lubert Adler-Old Bahama Bay (LRA-OBB), which owns the resort, told Tribune Business that the long-awaited permit has now been received and it is “co-ordinating with our team to implement the remaining transition” elements that

will see an affiliate take back responsibility for operating amenities such as the marina and restaurants. Any such move, though, threatens to trigger a new fight - and likely legal battle - with Island Ventures Resort and Club (IVRC), the entity formed by the 73 condo owners to keep the hotel open following Ginn’s 2011 default.

John MacDonald, IVRC’s president, told this newspaper its position remains that it will resist LRA-OBB’s efforts to reclaim Old Bahama Bay’s management absent an eviction notice from the Bahamian courts. And he challenged whether

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

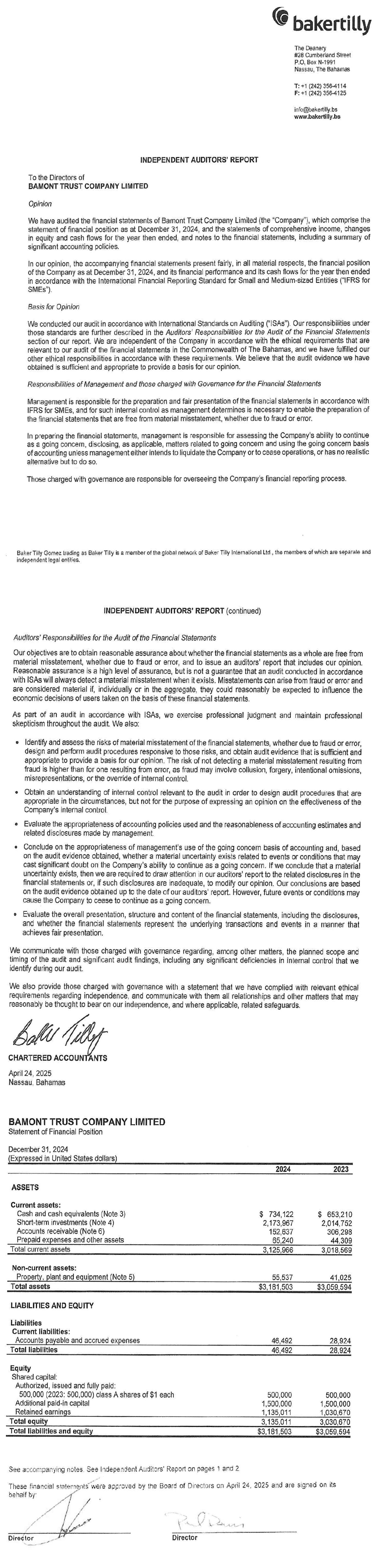

COMMONWEALTH

Bank’s shareholders are set to enjoy a near $35m total dividend payout during the 2025 first half after setting a new annual profits record last year via a 29 percent bottom line improvement.

Tangela Albury, the BISX-listed lender’s chief financial officer, in a series of written replies to Tribune Business questions confirmed the $19.27m increase in total comprehensive income to a new all-time high of $85.9m for 2024 “exceeded” the bank’s expectations and “will be challenging” to repeat this year.

The profitability leap from $66.338m in 2023 was entirely driven by an almost 11-fold increase in reversals of provisions

for non-performing credit and loans. These reversals, or write-backs of impairment charges previously taken, surged massively from just $2.339m in 2023 to $25.578m last year, and Ms Albury acknowledged this was “unlikely to be repeated at the same scale” during 2025. However, she voiced confidence to this newspaper that “underlying growth in core banking operations” will still drive “strong results” for the current financial year, after $41m gross loan book growth

for 2024 represented the first time Commonwealth Bank’s credit portfolio has expanded in successive years since 2016. And, while the BISXlisted institution is closely watching the global economic turmoil and potential fall-out from Donald Trump’s tariff policy, Ms Albury asserted that it is well-positioned “to withstand external shocks” through a liquidity ratio and capital adequacy ratio that stand at 65 percent and more than 40 percent, respectively.

Commonwealth Bank’s impairment/loan loss provision reversals, while adding to the boost provided by net interest income and fee revenue increases in 2024, also more than offset the over $10m year-over-year increase in the bank’s general and administrative costs that acted as “a drag on profitability”.

Owner to ‘escalate’ rebuild of fire-ravaged properties

By FAY SIMMONS Tribune Business Reporter jsimmons@tribunemedia.net

THE owner of two buildings devastated by Thursday night’s downtown Nassau blaze says the devastation has “escalated” his ambitions to renovate both properties.

He said about $3m was invested into his first Bay Street location, and he intends to begin work in the “near future” on the other properties hit by the fire. “Before this happened, we already had a plan in place, so it just escalated it to move even faster. We’ll work with the team that’s there to help clean it up and, in the near future, you have upcoming events,” said Mr Ferguson.

“Right now, we already have something on Bay Street and we invested

Delvon Ferguson, who also owns I Dream of Sugar, a candy store located across from the Straw Market on Bay Street, told Tribune Business he is committed to bringing more retail and entertainment attractions to the area east of East Street that has largely been abandoned by commercial activity.

‘Urgent’ mediation over cruise island labour

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE Government’s labour chief last night voiced optimism that elements of a private cruise island dispute could be resolved “within seven days” with all sides set to attend an “urgent” mediation meeting this week.

Howard Thompson, the Department of Labour director, in a statement to Tribune Business said his visit and investigation at Norwegian Cruise Line’s (NCL) Great Stirrup Cay had revealed there are “two sides to the story” following complaints from staff - including members of the island’s former management - about alleged

non-compliance with Bahamian labour laws, along with unfair treatment. In particular, he hinted that questions had been raised by NCL over whether managerial staff are entitled to overtime

TANGELA ALBURY

OLD BAHAMA BAY

HOWARD THOMPSON

BAHAMAS MUST ‘OWN MESSAGING’ OVER FINANCIAL SERVICES INDUSTRY

By ANNELIA NIXON

THE Bahamas must “own our messaging” to ensure it sheds the ‘tax haven’ label and better explains what products its financial services industry offers, a senior executive has asserted.

Niekia Horton, the Bahamas Financial Services Board’s (BFSB) chief executive and executive director, speaking at the inaugural Bahamas Global Wealth summit, also stressed the need for The Bahamas to maintain high compliance standards despite the “uneven playing field” created by larger, developed economies.

She added that the summit’s goal was to “understand how we can navigate the future” and dispel incorrect perceptions of The Bahamas and its financial services industry. Ms Horton said: “We have to own our messaging. It’s all in the context of the global economy; always the conversation about offshore, onshore, tax haven, not tax haven. All of these labels that actually don’t really reflect who we are actually.

“And, on the panel earlier, we were talking about this dialogue around taxation. The Bahamas is a ‘tax haven’. And I said:, ‘Well, I don’t know what Bahamas they’re in, because I pay plenty taxes’. Now, we don’t

have the personal income tax. This is true. But we do have a tax regime here, and it’s now about: How do we participate in the dialogue of taxation for country development?

“Because this is how countries develop; through taxation. And it’s here, and it’s going to be here. And so for me, it’s about engaging with that now and telling the world that, listen, we are tax friendly. We have a low-tax environment. And there’s nothing wrong with that. There are many jurisdictions that operate in that way. They leverage it for competitiveness.

“Now, take the example of the Trump administration with the ‘golden visa’. He is constantly beating up on Caribbean nations that are using these visa programmes to drive economic development, but he announces, as a developed nation, we’re going to do the ‘golden visa’ programme, and it’s okay, but it’s not okay for the rest of us,” Ms Horton said. “And I think that is where we need to pivot in the dialogue. We need to stop taking on those stories and we’re saying, no. It’s a double standard, because you’re allowed to do it, but you’re telling us that we can’t. It’s not fair.”

Ms Horton suggested that the global financial services playing field will never be even, or fair, for The Bahamas and other international financial centres but she voiced optimism that it can overcome those challenges.

“I raised the fact in a very provocative way that The Bahamas is 40 out of 40, FATF compliant, one of maybe seven countries in the world, when we talk about our level of compliance, the standards that we bring to the table,” she added. “Fully compliant jurisdiction, fully transparent jurisdiction, here in The Bahamas.

“And I was a bit provocative and I said: ‘Well, Governor Rolle is it a twoedged sword, because we’re lifting the standard that the others are not being held to. So it brings the compliance burden to us to ensure that we are doing it right. And his response was absolutely the perfect one. We’re here to lead. It’s about being compliant, and we don’t want to be in a catch-up position.

“And we always have the conversation about it’s unfair. The reality is the playing field will never be levelled. And I think we have to come to grips with that, as a country, as a nation, there will never be a level playing field for us. And this is my perception,” Ms Horton said.

“So, as that may be, that is fine. We are strong people. We are able, and we’ve always had to do more than. That’s just who we are. That’s us as a country. And our strength is we can do as we’ve been doing it, and we will continue to do more, and we’ll continue to lift that standard.”

Ryan Pinder KC, the attorney general, said The

Bahamas is looking to position itself as a near-shore jurisdiction. Speaking at the inaugural InsurTech Compliance, Innovation and Regulatory Practices (ICRP) course graduation that occurred a few nights ago, he said the “initiative aligns with our broader national agenda for The Bahamas to remain a respected, progressive and competitive international financial centre.”

“Well, I think it’s important that when you look at The Bahamas, you look at it as a service provider, or a jurisdiction of service providers that really is attractive to wealth management and attractive to the high net worth individual,” Mr Pinder said.

“One thing that we’ve really worked hard at repositioning ourselves with respect to global wealth is that we look to become a near shore jurisdiction, meaning that we just don’t only want to manage your wealth, but we want you to come to The Bahamas. We want you to have a physical presence, to have some economic substance in The Bahamas, to use The Bahamas as kind of an international platform for your global operations, for your US-based operations.

“One thing I spoke about with respect to the digital assets framework is, as you look at the United States and this administration, the United States moving to regularise and be a bit more regulatory friendly to the digital asset industry,

they’re going to need both an onshore and an offshore operation,” he added.

“They’re going to need a US-based operation, certainly for US clients, and a non-US based operation for international clients. Well, we’re perfectly positioned. We have a long-standing positive reputation in financial services. When it comes to digital assets, we’re a global leader in that. We have the capacity, the human capacity, as a jurisdiction that many financial centres, frankly, don’t have.

“I spoke last night at the Insurance Commission event, and I told them, I said, we may lead the world, when you look at our relative size in compliance professionals, and certainly we lead the region. We have the ability to support whatever type of business comes to The Bahamas. And so I think that’s a true asset of The Bahamas that you might not see in other financial centres; our human capacity and our ability to serve those clients who want to come and be within The Bahamas.”

Mr Pinder added that the recent ‘positive’ outlook placed on the Bahamian economy by Moody’s is a “a foreshadowing of a positive adjustment in your credit rating”.

“You always want, when it comes to your sovereign credit rating, a positive momentum. And usually when you see this move by Moody’s, that’s a foreshadowing of a positive adjustment in your credit

AG: US anti-financial crime attacks ‘don’t match’ reality

By ANNELIA NIXON Tribune Business Reporter

THE Attorney Gen-

eral has reiterated that US criticisms of The Bahamas’ anti-financial crime regulatory regime and its enforcement do not “match up” to reality. Ryan Pinder KC, speaking ahead of planned discussions with US officials in Washington DC, asserted that The Bahamas has a world-class regime and the US had not done the necessary research before publishing the criticisms in its international narcotics control strategy report (INCSR).

Explaining that the focus of the meetings is to educate, he reassured that The Bahamas “strives for

full compliance” and this nation’s regulators will be present for the discussions.

“We’ve reached out to the United States informally, and we will do so diplomatically to request such a meeting, and we hope to meet with the Treasury Secretary on these matters, as well as the SEC (Securities & Exchange Commission) and their digital asset czars that they’ve appointed to help clarify this,” Mr Pinder said.

“I mean, when you look at the report versus you look at the reality, you could see that they don’t match up. We are 40 for 40 in anti-money laundering (the Financial Action Task Force recommendations). We’re one of seven countries now in the world that has accomplished that. We did that during our

administration. We have a framework that is world class.

“When you look at the United States, they don’t even collect beneficial ownership on their companies, which is a hallmark of preventing money laundering. So when you look at their report versus the reality, they just don’t match up,” Mr Pinder added.

“And that’s really the messaging that we want to take to Washington to demonstrate that when they issue these reports - and they’re not political reports - we think they’re very technical, bureaucratic reports, and the bureaucrats that are issuing these reports, frankly, have not done their homework on The Bahamas and take the easy way out by republishing a

historical report. That’s our belief.

“So we don’t think it’s a political attack on The Bahamas or anything like that, but we just want the bureaucrats and those in power to be educated and understand where The Bahamas is, and we are a country of excellence,” Mr Pinder continued.

“We are a country that strives for full compliance in everything we do, and we recognise that with financial services being our second largest contributor to GDP that we need to be recognised and accepted as fully compliant with international best practices, and that hasn’t wavered.

“And so that’s the purpose of the trip. That’s what we’ll be doing. We’re co-ordinating that with the appropriate regulators as

well. So we want to take the regulators with us so they can talk about how they regulate and what they do with their licensees, so they’re not just hearing from politicians and senior government officials, but they’re hearing from the regulators, their counterparts, and so we think it’s a very important trip that we’re working on.”

Mr Pinder’s comments follow the US report’s claim that The Bahamas lacks prosecution and convictions for money laundering and other financial-related crimes, and there is no strong political will involved to crack down on this.

rating. So I think Bahamians can forecast that coming down the pipe in the near future is an adjustment in a positive way. It demonstrates fiscal stability,” he said.

“When you look at the debt-to-GDP ratio when we came to office, it was 100.3 percent. When you look at it now, it’s about 81 percent - a measurable decrease in debt-to-GDP. When you look at the deficit, when we came to office, versus the deficit now, it has shrunk dramatically. All financial and monetary indications in the country show a dramatic improvement, show stabilisation from a financial point of view.

“Nobody wants to do business in an unstable country, in a country that is on the border of sovereign default. And then, clearly, we’ve demonstrated that we’ve improved the financial situation of the country, and not only that, we’ve done it in a very creative way,” Mr Pinder said.

“If you look at the IDB bond offering that we just won an award for, the climate debt swap bond offering, that’s a novel bond offering. It’s the largest, I think, in this hemisphere, if not the world, and certainly it’s something that that both balances fiscal stability with our investment in our environment, and it’s something that is, like I said, won awards is something we should be very proud.”

“The lack of convictions and asset forfeiture make The Bahamas a lowrisk base of operations for many sophisticated fraudsters, including corrupt actors,” the report read. “Despite extensive training and improved investigative and prosecutorial abilities, Bahamian law enforcement and prosecutors are hesitant to investigate and prosecute complex financial crimes and seize real property and assets derived from illicit activities.”

Speaking at the inaugural Bahamas Global Wealth summit, Mr Pinder said

RYAN PINDER KC

Downtown fire reinforces derelict building tear-down

FROM PAGE B3

Maura added, “and it’s a challenge for us to ensure we have the ability to fight these fires when they happen. This causes us to pause and think about what we should be doing to prevent similar occurrences happening in the future.

“We’re very fortunate there was no loss of life. We were very fortunate that we were spared that level of disaster and type of catastrophe. To your point, let’s pause, think about this. Could we, should we, respond differently in the future. This is not casting blame on anyone; the emergency services addressed it very quickly.

“We recognise the close proximity of our buildings to one another and their area. Do we need to provide more support to our Fire Department should we have a downtown fire in the future, so that they have the resources to combat a

fire and it doesn’t spread easily from one location to another because of their proximity.”

Asked whether Thursday night’s blaze justifies renewed urgency, and acceleration of the demolition of abandoned, derelict Nassau properties, Mr Maura replied: “Yes, I would agree. I definitely would say it does....

“Derelict, abandoned buildings, by their very nature, there isn’t reinvestment occurring in them, and as they disintegrate and fall apart, in their wake they become potentially hazards,” he added. “Having this type of property in your downtown area literally increases the risk for those properties that are in business, where owners and tenants continue to do the right thing and invest in the necessary equipment and support to keep their properties safe.

“To have derelict and abandoned buildings in

such close proximity places all downtown properties at risk. It’s an opportunity to think further, and obviously the Government has taken steps in the last couple of years and has begun the demolition of abandoned buildings and I think the initiative needs to continue.

“Some of those buildings were also the ones which may not have been responsible for starting the fire, but they were the ones that fuelled the fire.” Mr Maura added that, with cleanup efforts having already begun, he does not foresee the fire site being unsightly for long.

“Fortunately for us, it was not in the heart of the tourism area, notwithstanding it was devastating for people who live in that area, have residences there, have businesses there. My heart goes out to them and their families. From the standpoint of tourism, fortunately we were spared,” Mr Maura said.

WARREN BUFFETT’S BEST AND WORST INVESTMENTS IN HIS 60 YEARS LEADING BERKSHIRE HATHAWAY

By JOSH FUNK AP Business Writer

BILLIONAIRE investor

Warren Buffett said Saturday that he wants to step down as chief executive of Berkshire Hathaway at the end of the year. The revelation came as a surprise because the 94-year-old had previously said he did not plan to retire.

Buffett, one of the world's richest people and most accomplished investors, took control of Berkshire Hathaway in 1965 when it was a textiles manufacturer. He turned the company into a conglomerate by finding other businesses and stocks to buy that were selling for less than they were worth.

His success made him a Wall Street icon. It also earned him the nickname "Oracle of Omaha," a reference to the Nebraska city where Buffett was born and chose to live and work.

Here are some of his best and worst investments over the years:

Buffett's Best

— National Indemnity and National Fire & Marine: Purchased in 1967, the company was one of Buffett's first insurance investments. Insurance float — the

premium money insurers can invest between the time when policies are bought and when claims are made — provided the capital for many of Berkshire's investments over the years and helped fuel the company's growth. Berkshire's insurance division has grown to include Geico, General Reinsurance and several other insurers. The float totaled $173 billion at the end of the first quarter. — Buying blocks of stock in American Express, Coca-Cola Co. and Bank of America at times when the companies were out of favor because of scandals or market conditions. Collectively, the shares are worth over $100 billion more than what Buffett paid for them, and that doesn't count all the dividends he has collected over the years. — Apple: Buffett long said that he didn't understand tech companies well enough to value them and pick the long-term winners, but he started buying Apple shares in 2016. He later explained that he bought more than $31 billion worth because he understood the iPhone maker as a consumer products company with extremely loyal customers.

The value of his investment grew to more than $174 billion before Buffett started selling Berkshire Hathaway's shares.

— BYD: On the advice of his late investing partner Charlie Munger, Buffett bet big on the genius of BYD founder Wang Chanfu in 2008 with a $232 million investment in the Chinese electric vehicle maker. The value of that stake soared to more than $9 billion before Buffett began selling it off. Berkshire's remaining stake is still worth about $1.8 billion.

— See's Candy: Buffett repeatedly pointed to his 1972 purchase as a turning point in his career. Buffett said Munger persuaded him that it made sense to buy great businesses at good prices as long as they had enduring competitive advantages. Previously, Buffett had primarily invested in companies of any quality as long as they were selling for less than he thought they were worth. Berkshire paid $25 million for See's and recorded pretax earnings of $1.65 billion from the candy company through 2011. The amount continued to grow but Buffett didn't routinely highlight it.

$35m investor windfall as bank’s profits up 29%

general and administrative costs that acted as “a drag on profitability”.

These rose by 11.7 percent year-over-year, rising from $86.357m in 2023 to $96.453m, with Ms Albury attributing the increase to “core non-controllable costs” such as a doubling of deposit insurance premiums and a 35 percent jump in National Insurance Board (NIB) contributions as a result of the rate increases implemented last July 1 to ensure the social security system remains viable.

But, while warning that continued inflation and global economic events could produce further general and administrative expenses increases, the Commonwealth Bank finance chief said renewed focus on “cost containment” will seek to minimise the rate of future expense growth.

Commonwealth Bank, in its just-released audited financial statements for the 12 months to end-December 2024, confirmed that its shareholders have already received dividends totalling $14.8m during 2025 to-date with further payouts to come. That figure comprises both a quarterly and extraordinary dividend, worth three cents and two cents per share respectively, and totalling $8.9m and $5.9m.

They were paid at endMarch and end-April 2025, respectively, and the audited financial statements disclose that another extraordinary dividend, this time worth four cents per share and a collective $11.7m, is due to be paid out to investors on May 30. Ms Albury said that, when these payouts are combined with the dividends distributed in 2024, the bank has generated a 74 percent effective dividend payout rate.

“These payments, totalling six cents per share or approximately $17.1m, demonstrate our commitment to delivering value to our shareholders,” she added. “Furthermore, the

Board has sanctioned a regular dividend of three cents per share, a notable increase from the previous rate of two cents per share following the pandemic.

“In effect, shareholders received cash dividends of around $14.3m in March and April of 2025, with an additional $19.95m in dividends slated for distribution in May and June of this year. This underscores our dedication to fostering shareholder wealth and reflects our robust financial health.”

Based on the figures contained in the financial statements, the $14.3m payout in March and April totals $14.8m. This places the total 2025 firsthalf dividend return to Commonwealth Bank shareholders at close to $34.8m as investors receive some of the fruits from 2024’s record performance.

“2024 marked the most profitable period in the bank’s history, with total profits reaching $85.9m, surpassing the $66.338m recorded in 2023 and $75.5m in 2022. We are proud to have delivered a return on equity of 26.22 percent, significantly above the 21.24 percent achieved in the prior year,” Ms Albury told Tribune Business

“Our expectations were exceeded because, over the past three years, we focused on improving credit quality, delinquency management and targeted credit sales growth. We saw the benefits of the post-COVID-19 years reflected in improvements to the reassessment of the Bank’s loss given default (LGD).

“Essentially, LGD is the amount of money the bank expects to lose if a borrower fails to repay a loan, after accounting for any recoveries such as payments collected or assets like collateral that can be sold. We have worked to minimise these potential losses over the past three years, the results of which are a key measurement factor in determining the provision for expected credit losses.”

Besides the near-$26m loan impairment charges reversal, Commonwealth Bank also benefited from more modest growth in its core lending and other banking activities. Interest income rose by more than $5M year-over-year, improving to $143.185m in 2024 compared to $137.961m in the prior year, representing a 3.8 percent increase.

With interest expense slightly down, net interest income increased by a similar sum, rising almost $6m to $126.669m in 2024 compared to $120.766m in the prior year. This was a 4.9 percent year-over-year increase, while Commonwealth Bank’s fee revenue improved by almost $4m from $30.515m to $34.401m last year.

Ms Albury revealed that Commonwealth Bank’s entry into the merchantacquiring services market generated some $2.2m in fee income for 2024, while the lender’s overall credit portfolio expanded by $41m. “In addition to the $25.6m reversal of impairment losses, the bank’s 2024 performance was fuelled by robust loan book growth, disciplined delinquency management and a sustained increase in transaction-based fee income,” she said.

“The introduction of merchant-acquiring services created a new revenue stream, while increased usage of the bank’s debit and credit card products enhanced non-interest income. Furthermore, improved credit quality and lower chargeoffs supported profitability.

“These factors, along with favourable economic conditions, provided a strong foundation for performance. While the impairment reversal is unlikely to be repeated at the same scale in 2025, the underlying growth in core banking operations is expected to continue supporting strong results.”

Noting that loan delinquency rates fell from 9 percent to 7 percent in 2024, the Commonwealth finance

chief told Tribune Business: “Our current focus is on increasing transactionbased fee income. This approach aims to enhance the usage of our services, and introduce new services that can generate additional transaction-based fees.

“For example, our entry into merchant-acquiring services contributed $2.2m in new fee income. Additionally, income from our credit life insurance product improved significantly, as it correlates closely with the growth of our loan book. Our current focus is on increasing transactionbased fee income.

“This approach aims to enhance the usage of our services, and introduce new services that can generate additional transaction-based fees. For example, our entry into merchant-acquiring services contributed $2.2m in new fee income. Additionally, income from our credit life insurance product improved significantly, as it correlates closely with the growth of our loan book,” Ms Albury said.

“Opportunities to grow include continued servicing of the demand for all types of personal loans, increased uptake of new credit card offerings, and enhancing the bank’s digital and merchant services footprint. The forward-looking strategy is oriented toward sustaining or exceeding current growth levels, while maintaining the credit quality and soundness of the loan book.”

Disclosing that high electricity and insurance costs also helped drive the ramp-up in general and administrative expenses, Ms Albury added: “Deposit Insurance premiums doubled year-over-year, National Insurance premiums rose by approximately 35 percent, and utility costs increased for most of 2024, resulting in a drag on the bank’s profitability.

“Additionally, insurance costs were impacted by the repricing of climate-related risks by global reinsurers operating in the region. In response, the bank’s

focus has been on strategic investments in technology infrastructure to enhance efficiency, which will continue in 2025.

“Our investment in technology infrastructure resilience has seen a shift in our IT spend from a capital expenditure to an operational expenditure nature. However, we believe this investment will be most fruitful in the coming years,” she said.

“While some increase in general and administrative costs may continue due to inflation and the impacts of geopolitical events, the bank’s emphasis on cost containment and operational resilience should help manage the rate of growth going forward.”

With Commonwealth Bank starting to “prepare” for a reduced rate of economic growth amid the Trump tariffs fall-out, Ms Albury said: “The bank is closely monitoring the effects of economic uncertainty on both credit demand and borrower repayment capacity. As of the end of 2024, no significant signs of a slowdown had been detected; loan delinquency rates had declined, and credit performance remained strong.

“Nonetheless, the bank is taking a prudent approach by reinforcing its credit

risk management practices, maintaining robust liquidity and capital buffers, and enhancing its portfolio diversification. It is wellpositioned to withstand external shocks, owing to its high capital adequacy ratio of over 40 percent and liquidity ratio of 65 percent.”

Ms Albury said this will enable Commonwealth Bank to “pursue lending opportunities” while managing any negative impact, and added: “We aim to sustain profitability through organic loan growth, continued focus on credit quality and delinquency control.

“We certainly acknowledge that matching or surpassing the recordbreaking 2024 results will be challenging, particularly given the expected normalisation of economic growth and the non-repeatable nature of large impairment reversals.

“However, the bank is positioning itself to maintain strong financial outcomes through disciplined cost control, improved IT infrastructure to create operational efficiencies and remaining agile, because next to profitability we prioritise resilience, especially in the face of major 2025 external uncertainties.”

MANCHESTER FORTUNE INTERNATIONAL LTD. (In Voluntary Liquidation)

Notice is hereby given that in accordance with Section 138(4) of the International Business Companies Act 2000, the above-named Company is in dissolution, which commenced on the 1st day of May, 2025. The Liquidator is Windermere Corporate Management Limited, 200 Sterling Commons East, Paradise Island, Bahamas.

NOTICE is hereby given that ALTANYS YOUTE of Deveaux Street, New Providence, Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 5th day of May, 2025 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE is hereby given that RICHARD JOHN BEEK of 15 Club Lane, Old Fort Bay, Nassau, Bahamasapplying to the Minister responsible for Nationality and Citizenship, for Registration Naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 5th day of May 2025 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, New Providence, The Bahamas.

Trump, in a new interview, says he doesn’t know if he backs due process rights

By AAMER MADHANI Associated Press

PRESIDENT Donald Trump is circumspect about his duties to uphold due

process rights laid out in the Constitution, saying in a new interview that he does not know whether U.S. citizens and noncitizens alike deserve that guarantee.

He also said he does not think military force will be needed to make Canada the "51st state" and played down the possibility he would look to run for a

third term in the White House. The comments in a wideranging, and at moments combative, interview with NBC's "Meet the Press"

came as the Republican president's efforts to quickly enact his agenda face sharper headwinds with Americans just as his second administration crossed the 100-day mark, according to a recent poll by The Associated PressNORC Center for Public Affairs Research.

Trump, however, made clear that he is not backing away from a to-do list that he insists the American electorate broadly supported when they elected him in November.

Here are some of the highlights from the interview with NBC's Kristen Welker that was taped Friday at his Mar-a-Lago property in Florida and aired Sunday.

Trump doesn't commit to due process

Critics on the left have tried to make the case that Trump is chipping away at due process in the United States. Most notably, they cite the case of Kilmar Abrego Garcia, a Salvadoran man who was living in Maryland when he was mistakenly deported to El Salvador and imprisoned without communication.

Trump says Abrego Garcia is part of a violent transnational gang. The

Republican president has sought to turn deportation into a test case for his campaign against illegal immigration despite a Supreme Court order saying the administration must work to return Abrego Garcia to the U.S. Asked in the interview whether U.S. citizens and noncitizens both deserve due process as laid out in the Fifth Amendment of the Constitution, Trump was noncommittal.

"I don't know. I'm not, I'm not a lawyer. I don't know," Trump said when pressed by Welker.

The Fifth Amendment provides "due process of law," meaning a person has certain rights when it comes to being prosecuted for a crime. Also, the 14th Amendment says no state can "deny to any person within its jurisdiction the equal protection of the laws."

Trump said he has "brilliant lawyers ... and they are going to obviously follow what the Supreme Court said."

He said he was pushing to deport "some of the worst, most dangerous people on Earth," but that courts are getting in his way.

PRESIDENT Donald Trump holds a document with notes about Kilmar Abrego Garcia as he speaks with reporters in the Oval Office of the White House, April 18, 2025, in Washington. Photo:Alex Brandon/AP

Licence issue set to reignite Old Bahama Bay takeover battle

the Government would approve a licence for an entity it has previously told to “cease and desist” while also rejecting its bid to purchase the Grand Bahama resort.

That was a reference to a March 21, 2025, letter by Phylicia Woods-Hanna, the Government’s director of investments, who asserted that Kingwood International Resorts and its affiliates will “violate” Bahamian law if they assume management of both Old Bahama Bay and the former Ginn sur mer project given that the Davis administration has twice rejected the company’s application to conduct business in this nation.

Mr Baker previously denied allegations that Kingwood was involved in the management takeover bid, although there are concerns it is hiding behind LRA-OBB’s corporate identity. He told this newspaper on Friday that the licence is being issued to the former OBB Hospitality, which is in the process of being renamed Sur Mer Club.

Reassuring that the ‘Old Bahama Bay’ name and brand will be used in all marketing and promotional efforts moving forward,

given the ‘Sur Mer’ link to the former failed Ginn development of the same name, he added that a final effort will be made to yet again “extend an olive branch to IVRC” in a bid to achieve a harmonious management transition rather than a battle - whether protracted or short-lived.

“We went over to Nassau this [last] week and had some meetings. One of the results was that we received our licence this morning, so we are co-ordinating with our team to implement the transition,” Mr Baker told Tribune Business. “We’ve made progress. We’re waiting and hopeful. They just needed some clarity on some items, and we were able to achieve that through discussion.

“It’s all very good. We’re excited. We’ve been watching the clock.” LRA-OBB’s management takeover had been stalled for over a month until the licence, understood to have been issued by the Department of Inland Revenue, was issued on Friday. It had originally given IVRC notice to vacate by March 28, 2025. However, the first delay occurred while it waited for the Department of Labour to confirm in writing that IVRC - and not itself or its

affiliates - would be responsible for paying the former’s staff due termination pay and other benefits up to the day of the takeover.

That confirmation is understood to have never been provided. Then a further delay occurred after the Government required both OBB Hospitality/Sur Mer Club and the entity operated by Don Churchill, who LRA-OBB wanted to takeover and lead Old Bahama Bay’s management, to obtain licences from itself.

Mr Churchill’s company is understood to be licensed by the Grand Bahama Port Authority (GBPA), but the Government insisted that it obtain a licence from itself because Old Bahama Bay is outside the Port area. Now, with licences in hand, Mr Baker told Tribune Business that one final attempt will be made to achieve a harmonious transition with IVRC.

“It’s been disappointing that we extended an olive branch to IVRC previously for a harmonious transition, and it was not met with greetings; it was met with silence and non-cooperation,” he added. “We’ll make one final approach.... It doesn’t have to be dictating; it can be respectful and we’re hoping that happens.

“We believed that we had the necessary documentation to take over on March 28, but given the Department of Labour and request for us to delay things while they looked into the matter, we feel having our own licence in hand reinforces and confirms the correctness and integrity of what we are doing.

“A month of waiting for this process, and now this has happened there should be little if any question about” the takeover proceeding. Mr MacDonald, though, signalled that IVRC is in no mood to compromise and plans to stand its ground.

“We haven’t heard anything yet,” he told Tribune Business. “That ‘cease and desist’ was pretty clear. We don’t know what’s going on behind the scenes. I certainly don’t believe the Government will change their minds on someone who was not approved to operate in The Bahamas. They can call themselves whatever they want, but it’s still the same people.”

The ‘LRA’ in LRA-OBB stands for Lubert Adler, the investment bank that was Ginn’s former financing partner, and which took over the West End development’s core property and Old Bahama Bay after the

developer defaulted some 14 years ago. It has been seeking a buyer, and exit route, for some time, and Tribune Business previously reported it had done an offshore deal with Kingwood where the latter’s principals took control of LRA-OBB and other affiliates. This newspaper saw documents showing Lubert Adler executives resigned en masse from their positions as officers and directors with a variety of Ginn-related companies on August 3, 2022. They were purportedly replaced by Kingwood executives, but a package circulated to Old Bahama Bay condo owners purporting to include LRA-OBB’s latest corporate filings dated March 10, 2025, showed the Bahamian-domiciled entity’s Board as still being comprised of Lubert Adler executives.

However, recentlypublished promotional material named Kingwood as the entity that will be taking over Old Bahama Bay’s management and operations on LRA-OBB’s behalf. Mr Baker, meanwhile, confirmed that various inspections had been conducted at Old Bahama Bay by government agencies, such as the

Ministry of Works and Min-

istry of Health, as part of the licensing procedure.

“There have been inspections,” he said. “We were a little bit surprised by those inspections, given that it was an existing operating resort and that we’re not yet running things. It turned out that there was some miscommunication about our licence. People at the ministry thought it was a brand new licence. There was some miscommunication that happened.

“We certainly want to know if anything is amiss or not right, and that persons up to this point responsible have taken care of the property and that things are correct from day one when we assume operations. We didn’t object to the inspections; we didn’t think they should be a condition for issuing the licence. We were happy for them to look at the property and see if things were not right.”

Mr MacDonald, though, said of the inspections: “I know somebody came and then they left. I don’t know what transpired there. Why would they even come out to do an inspection when a current licensed company is there and not going to give up their licence to anyone. Our manager said we’re operating here; what’s going on? They [LRA-OBB] didn’t start a court action [eviction] yet so we’ll see what’s going on.”

MARINE FORECAST