Low energy: Bahamas worst in Caribbean for renewables

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

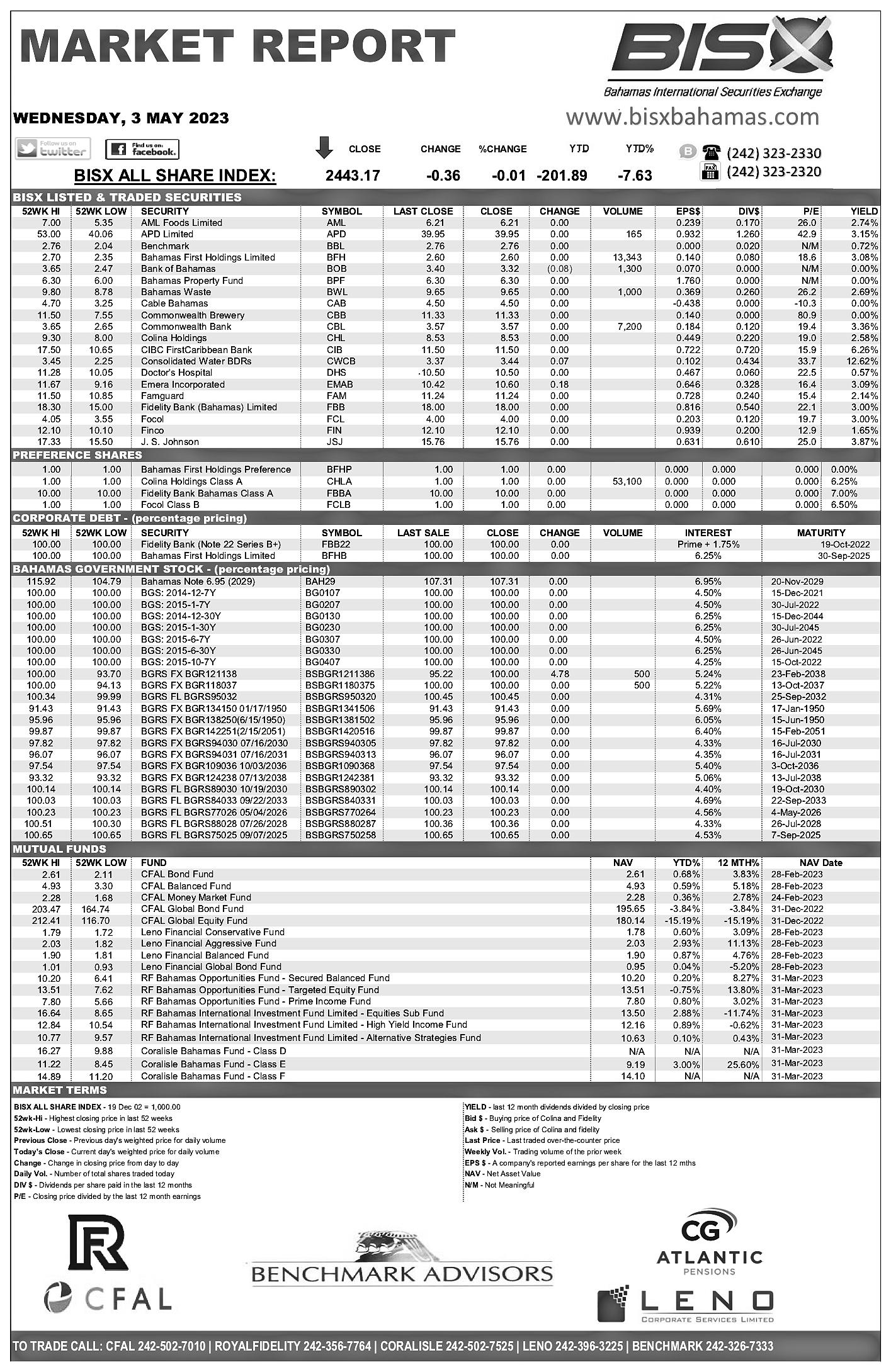

RENEWABLE energy providers yesterday voiced significant “doubts” that The Bahamas will meet its 2030 goals after this nation was found to have the lowest penetration in the Caribbean at just 2 percent.

Guilden Gilbert, vice-president of Alternative Power Sources (Bahamas), told Tribune Business that the “availability of financing for the average consumer” is the main “sticking point” preventing a faster, wider rollout of solar photovoltaic (PV) and other systems that would enable this nation to meet the National Energy Policy target of 30 percent of energy from renewable sources within sixand-a-half years.

The size of the chasm that The Bahamas has to bridge to hit that number is exposed in an InterAmerican Development Bank (IDB) report on the next phase of a $170m project aiming to infuse renewables into the country’s energy mix during the post-Dorian infrastructure rebuild.

The document, which notes The Bahamas still remains close to 100 percent reliant on fossil fuels despite efforts to introduce renewable systems at locations such as government buildings and schools, said the next stage is “to strengthen the energy sector institutional and regulatory framework for the transition” to sustainable power sources.

“Despite the potential for solar and wind power generation, and the steady cost decline of such technologies, The Bahamas ranks lowest in the region for renewable energy penetration [at] around 2 percent,” the

FTX chief blasts Bahamas over ‘closed legal system’

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

IDB report said. “Accelerating the transition to clean energy represents a unique opportunity for the country to enhance its energy security, meet its climate change action goals, and contribute to economic development and employment opportunities.

“To address these objectives, the Bahamian National Energy Policy 2013-2033 set in 2014 the target of reaching approximately 30 percent of renewable energy in the mix by 2030. In 2015, the Electricity Act of 1956 was repealed to allow renewable

Recipients of welfare may face gaming ban

By FAY SIMMONS Tribune Business Reporter jsimmons@tribunemedia.net

GAMING regulators are mulling measures to ban persons receiving welfare benefits as part of a package of reforms that would also eliminate discrimination against Bahamians playing in hotel casinos if approved.

Officials from the Gaming Board, speaking yesterday at the Caribbean Gaming Conference, said they are also studying the possible removal of restrictions that presently disqualify Cabinet ministers and their relatives from working in the sector or

holding a gaming licence provided the regulator is satisfied there is no conflict of interest.

Ian Tynes, the Gaming Board’s secretary, confirmed that banning recipients of welfare and social security benefits from gaming is “a consideration” to protect vulnerable families and prevent irresponsible members from driving them further into poverty. He revealed that the regulator already has software that can block persons receiving welfare benefits from gaming.

“There is a component of [the tool] which has all compliance checks, everything. It is so sophisticated

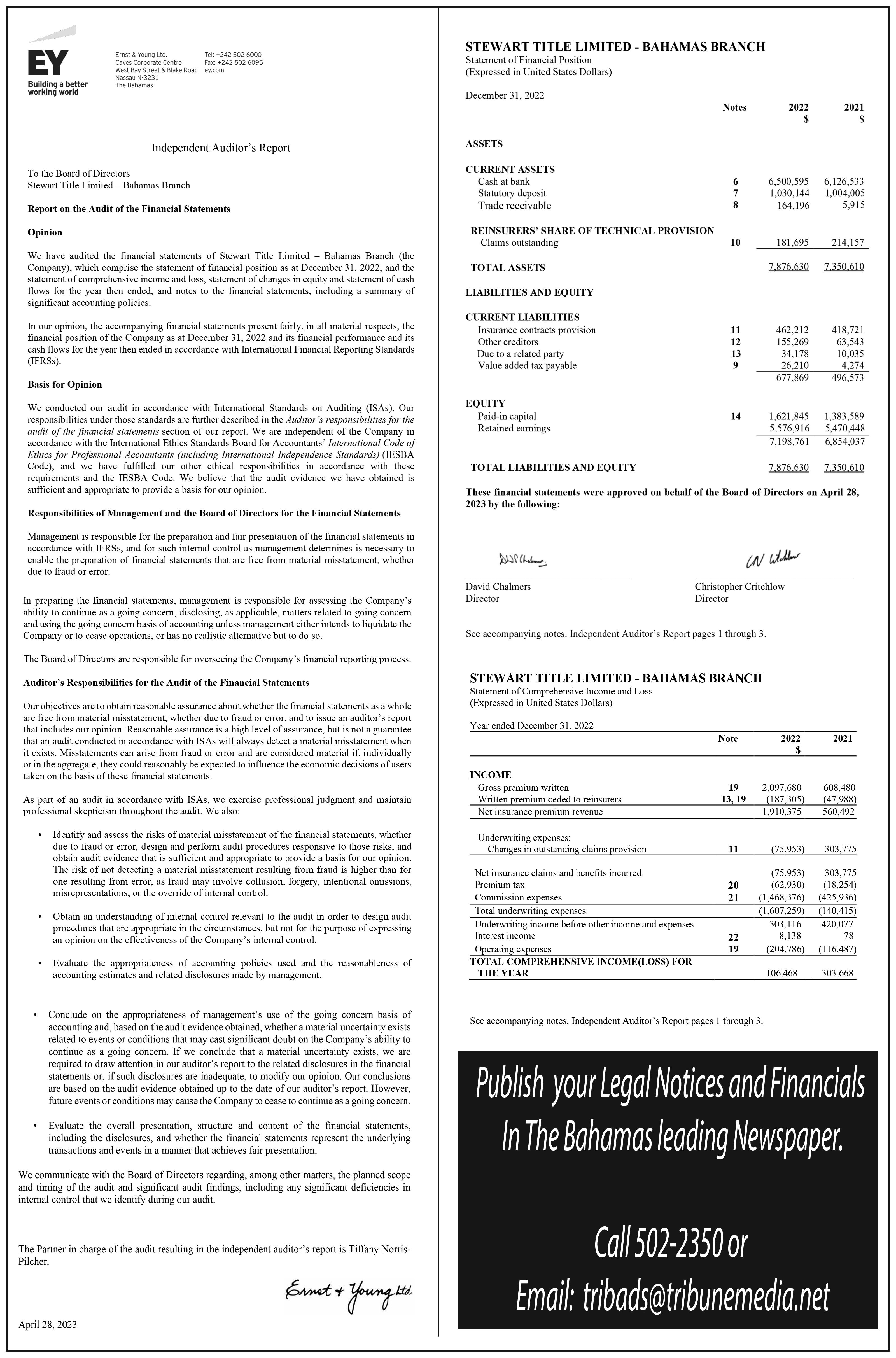

Insurer doing ‘everything to remedy’ Cayman breaches

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

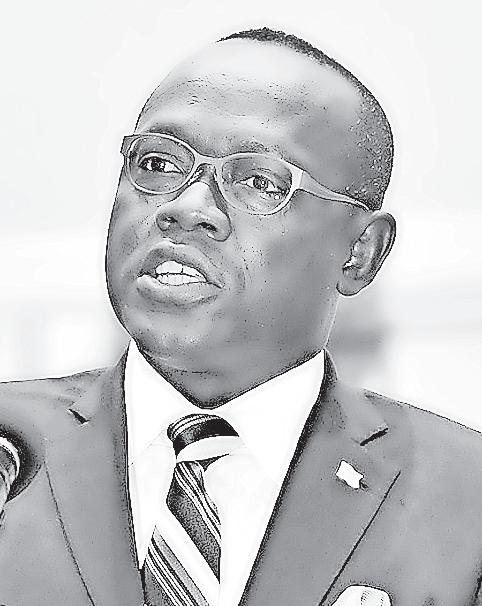

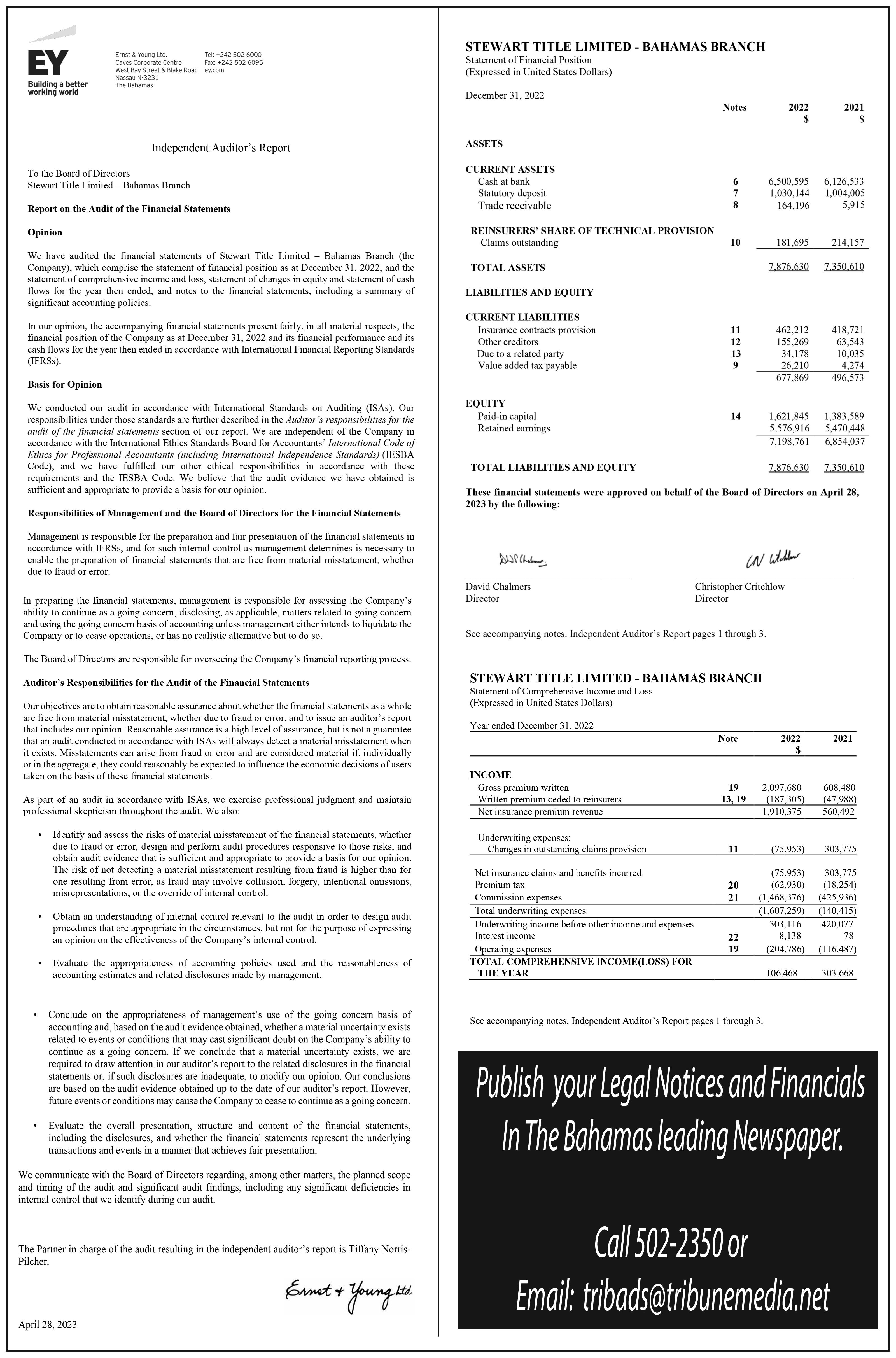

BAHAMAS First’s top executive yesterday pledged it is doing “everything possible to remedy” its Cayman Islands’ subsidiary’s non-compliance with that territory’s health insurance regulations due to a claims processing “backlog”.

Patrick Ward, the BISXlisted insurer’s president and chief executive, told Tribune Business that its Cayman First subsidiary has already submitted a plan to address the shortcomings to the territory’s regulator and is confident

they will be resolved “for sure” in 2023.

He added that there was

“no reason” for Bahamas

First to believe that its Cayman subsidiary faces

FTX’s US chief yesterday blasted The Bahamas’ “closed legal system” and argued his team will “find it difficult to protect our rights” due to challenges in gaining approval for their chosen UK KC to act before this nation’s courts.

John Ray, who oversees 134 FTX entities currently in Chapter 11 protection in Delaware, asserted that “meaningful participation” in Bahamas-based litigation involving the collapsed crypto currency exchange “may not even be possible” as the Bahamas Bar Council was presently “not minded” to permit David William Allison KC to act as lead counsel in representing his team’s interests.

The move to sully the Bahamian legal system

came as the battle for jurisdictional control of FTX’s liquidation, which has been raging ever since its early November collapse apart from a temporary two-month truce, heats up yet again as Mr Ray and his team move to prevent the local joint provisional liquidators gaining any relief from the worldwide Chapter 11 freeze imposed

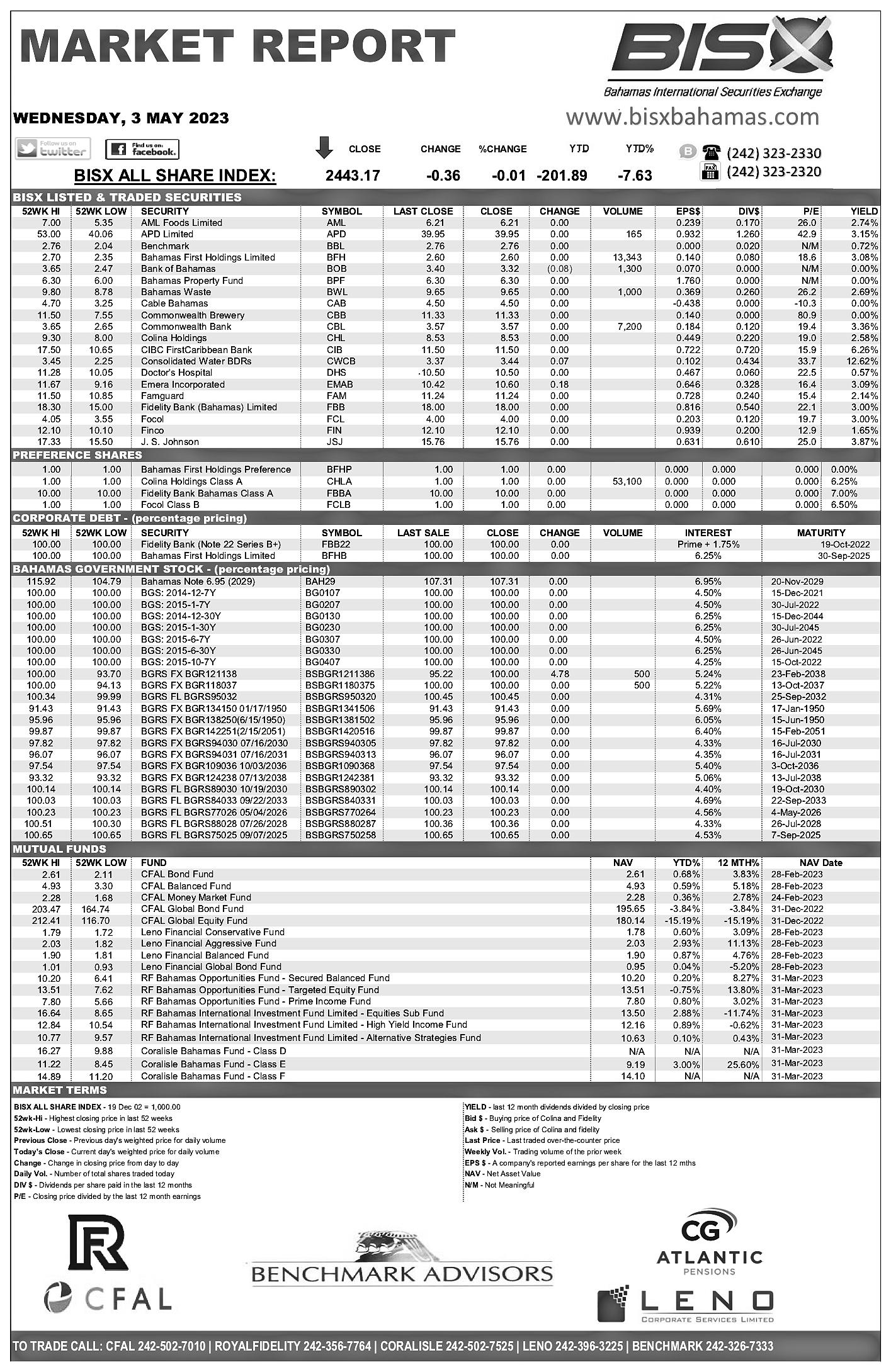

business@tribunemedia.net THURSDAY, MAY 4, 2023

SEE PAGE B8

• IDB: Just 2% penetration for sustainable sources

• Provider has major ‘doubts’ 2030 goals will be hit

• Says ‘sticking point’ is consumer access to finance

SEE PAGE B7 SEE PAGE B9

• Claims can’t ‘protect our rights’ here

SEE PAGE B6 PATRICK WARD

JOHN RAY $5.74 $5.74 $5.78 $5.71

Marketing is no longer about making endless calls, or shaking hands while exchanging business cards. While those aspects are still essential, a significant component must

revolve around a digital marketing strategy. In this fast-paced digital age, an online presence is crucial and, in many cases, vital to a company’s overall success. With consumers increasingly searching for the

products and services they need online, it is more critical than ever to meet them where they live their lives - on the Internet and social media.

Do you know where your audience is?

You know your audience, but do you know where to locate them and connect?

If you do, then it is time to create devices to rope them in. Be sure to use an effective branding strategy to ascertain a full understanding of who your audience is and why they would want your product or service. With this knowledge, you can then figure out which digital marketing platform is best employed as well as how to interact with them.

One concern to note is that online digital products generate specific challenges. And one in particular - competition with free online content. Consumers can easily find free alternatives to what you are selling. So what do you do? Compete. A business that has no fighting power will not last very long in the game. Think carefully about the niche targeted, types of products sold and packaged product descriptions, simply because you wish to propose valuable products built to compete.

If you employ the right tools when designing your digital product business, then most of the anticipated challenges can be overcome. Start by thinking about what type of assets your online audience would want, and which are

in demand (and thus easier to sell). While it is easy to get stuck waiting for a ‘eureka’ moment, be sure to protect your digital goods and services with watermarks and other security measures. In addition, whether you are a brand new business owner or adding online digital products to your existing store, keep these tips for a more effective digital online presence in mind.

Meet customers where they live DEIDRE BastiaN By

* Use keyword research to see how many people are searching for your online product or service, as this will give you an idea of the demand and which assets are generating a growing interest.

* Since you are competing with free content on the Internet, invest in building a product that is rare to find.

* Promote a lead magnet. Regardless of how much your product costs, create a light version of it for free. Gratis builds trust between your business and potential customers.

* Start an affiliate programme. Find online influencers who are established and trusted in your industry, and offer them a commission for each sale they make to promote your products.

As a final point, there are countless benefits to incorporating a digital presence

into your business, some of which are cost-effectiveness, direct access to your customers, quick results, measurable transparency and analysed data in real time. Until we meet again, fill your life with memories rather than regrets. Enjoy life and stay on top of your game.

• NB: Columnist welcomes feedback at deedee21bastian@gmail.com

About Columnist: Deidre M. Bastian is a professionally-trained graphic designer/brand marketing analyst, author and certified life coach.

RBC moves on Sand Dollar top-up ease

ROYAL Bank of Canada (Bahamas) has announced that clients can now add funds to their Sand Dollar wallets via its digital banking platform. The Canadian-owned commercial bank, in a statement, said the top-up feature will help consumers embrace the Central Bankbacked digital currency, which is a digital version of the fiat Bahamian dollar.

“We are extremely proud to support the Central Bank’s Sand Dollar digital currency by providing Sand Dollar top up through our digital banking platform,” said LaSonya Missick,

RBC’s managing director for The Bahamas & Turks and Caicos Islands.

“This means we offer our clients the ability to transfer funds from their RBC accounts to any Sand Dollar wallets. We believe digital currencies represent the future of banking, and RBC is committed to making it easier for our clients and staying ahead of the curve.”

RBC said clients can use the ‘Send to Local Bank’ feature in online banking and the mobile app, which is available round-theclock, to top up their Sand Dollar accounts.

It added that digital currencies such as the Sand Dollar can offer businesses and consumers more convenience, opportunities and flexibility. RBC said the Sand Dollar will be a vital tool in bringing more Bahamians into the formal financial system, boosting financial inclusion and stimulating the Bahamian economy.

“As a responsible corporate citizen, RBC is committed to supporting initiatives that enhance financial inclusion, drive growth and create opportunities for our clients,” Ms Missick added.

while praising staff for delivering on solid customer service deliverables.

SCOTIABANK (Bahamas) says it has again been named as the country’s ‘best bank’ for 2023 by Global Finance magazine after earnings improved by almost 50 percent yearover-year for 2022.

The award also came after the Canadian-owned bank implemented several initiatives to improve customer access to digital financial services products. These included a new e-commerce platform, a branch refresh and upgrades, a new dedicated sales centre and expanded small and medium-sized enterprise (SME) credit facilities and loan funds.

Roger Archer, Scotiabank (Bahamas) managing director, said its 2022 earnings exceeded pre-COVID levels and were almost 50 percent above 2021. “Our pandemic recovery and future-proofing strategy has been exceptionally executed by our staff, and they are the drivers of our continued transformation programme,” he added,

“This award is very exciting and important to us”, Mr Archer said. “It confirms and validates the sound strategic decisions we’ve made over the past three years as we emerged from the COVID-19 pandemic. The business is strong and well-positioned to continue this growth trajectory.”

Scotiabank (Bahamas) ‘Best Bank’ 2023 award is just one of several that the bank has captured this year, winning similar accolades in the Cayman Islands and the Turks and Caicos Islands.

Global Finance editors, with input from industry analysts, corporate executives and technology experts, select the winners for the ‘Best Bank’ awards using entries provided by banks and other providers, as well as independent researchers. Judging incorporates criteria that includes knowledge of local conditions and customer needs, financial strength and safety, strategic relationships and governance, competitive pricing, capital investment and innovation in products and services.

PAGE 2, Thursday, May 4, 2023 THE TRIBUNE

Scotiabank earnings up almost 50% in ‘22

SCOTIABANK team members assist customers who attended the bank’s Digital Saturday opening earlier this month to get assistance with their online banking needs.

GOV’T BLASTED OVER ‘FEEBLE’ GB WATER RATE HIKE REPLY

THE Opposition’s finance spokesman yesterday blasted the Government for a “weak and feeble response” to the hike in water rates that will be imposed on Grand Bahama residents and businesses from next month.

Kwasi Thompson, also the east Grand Bahama MP, yesterday demanded an “immediate intervention” by the Davis administration that would delay the increases until the situation was reviewed by a “third party” to determine if they were justified and what the extent of the hikes should be. However, any intervention by the Government is complicated by the fact that neither itself, nor a national regulator, has authority to oversee utilities in Freeport.

He suggested that this assessment be performed by the likes of the Utilities Regulation and Competition Authority (URCA), Water & Sewerage Corporation or an international organisation with water industry experience after the Ministry for Grand Bahama again reiterated the Government’s opposition to the Grand Bahama Utility Company’s rate increases. The tariff hikes were approved earlier this week by the Grand Bahama Port Authority (GBPA), its regulator, but the ministry’s statement alluded to the glaring conflict of interest this poses. This is because the GBPA is effectively regulating itself since GB Utility is directly owned by its affiliate, Port Group Ltd. Both the GBPA and Port Group Ltd have common shareholders, namely the Hayward and St George families.

The Ministry for Grand Bahama also reiterated that a consultation period of

• Opposition urges delay, ‘third party review’

• Chamber chief urges Hawksbill Creek study

• Port must be more transparent to get support

just over two weeks, given that the GB Utility rate increases were announced on April 13, was insufficient time for consumers and the wider community to study the move and the impact it will have on them.

“We are of the view that a reasonable consultative period could not have realistically occurred within the notice period,” the ministry said. “As many residents continue to piece their lives back together in the aftermath of Hurricane Dorian, we do not support this rate increase, as approved by the GBPA. A satisfactory case for the proposed increase has not been made.

“It is also noted that Intercontinental Diversified Corporation (IDC) holds common shareholding in both GBPA (the regulator) and GB Utility (the water provider). The issue of regulatory independence is currently before the court, and we eagerly await the outcome. Again, the Government is dedicated to tackling the long-standing obstacles that have hindered progress on Grand Bahama.”

Intercontinental Diversified Corporation (IDC) is the company that sits at the top of the GBPA and Port Group Ltd ownership structure, and is the parent entity through which the Haywards and St Georges own and control Freeport’s quasi-governmental authority. It is unclear which court

GAMING DISCRIMINATION END WILL ‘GO IN BOTH DIRECTIONS’

By FAY SIMMONS Tribune Business Reporter jsimmons@tribunemedia.net

THE GAMING Board’s executive chairman yesterday indicated that casinos are open to Bahamians gaming at their resorts as the deputy prime minister conceded the separation from web shops is growing “thin”.

Dr Daniel Johnson, referring to discussions on ending the discrimination that bars Bahamians from gaming in hotel casinos, said: “It’s a proposal and we’re sending this around to our industry partners now. These industry partners, I think, the initial response has been excellent. The large fixed-base casinos are indicating that they want Bahamians and permanent residents to be able to come in and wager.”

He added that if the proposed changes are made, tourists will also be able to gamble in web shops. “The proposed regulations go in both directions. So, it is the removal of discrimination against anyone in The Bahamas,” Dr Johnson said.

“And that means that if someone is at Sandals on Cable Beach, they can go across the street and go to a local gaming house. Everybody Wins, Island Luck, Chances, AsureWin, whatever and vice versa... Bahamians will be able to go to other places if they wish to game and sit down and game.”

Chester Cooper, deputy prime minister, said both components of the Bahamian gaming sector are performing well and the separation between the two is growing thin.

He said: “In The Bahamas there are two sectors of gaming - casino gaming and what we refer to as gaming houses. Both sectors attract different clientele. But casino players are often looking for more

action the ministry was referring to, but it appears to be Grand Bahama Power Company’s battle with URCA over whether the latter has the ability to regulate utilities in the Port area.

Mr Thompson, though, yesterday queried why the Ministry for Grand Bahama and wider Davis administration would be waiting on the outcome of that legal dispute given that it has no relation to, or bearing on, GB Utility’s water increases. While he has yet to fully consult his constituents on the matter, he added that they were likely to be “extremely disappointed but unfortunately not surprised” by the GBPA’s approval.

“This involves the conflict of interest between the Port Authority and GB Utility,” the MP told Tribune Business. Referring to the regulatory framework agreement between the two entities, he added:

“My particular view is that the entire agreement is an inherently unfair position because they are owned by the same shareholders.

“Even if what they are saying is true, and they have

taken these steps, the very fact it is the Port Authority that made this decision taints the entire process.”

The GBPA, in announcing the approval of the rate rises, said its regulatory committee had accounted for “the concerns expressed by residents and stakeholders” as it sought to balance their needs with maintaining a financially viable water supplier for the island.

“What I would like to see happen is the Government fight for the people of Grand Bahama,” Mr Thompson said. “I would like to see the Government take some action against the decision that was made. The Government could ask for a third party to look at the entire matter. They could ask for representatives from URCA, they could ask for representatives from Water & Sewerage, to come in and look at the entire situation.

“They could also ask for a delay, and could have met with the Port Authority and demanded a delay, but none of that - through their statement - would appear to have been done. It has been

a complete failure on behalf of the Government. It is a situation where it requires a separate person to review the entire matter, and the Government unfortunately has not taken any action to prevent it from happening.”

The Ministry of Grand Bahama’s statement did not detail what specific steps it may have taken to intervene with the GBPA and GB Utility, having learnt of the water tariff increases at the same time as the public, since they were unveiled on April 12. Nor was there any mention of any further action planned by the Government.

This led Mr Thompson to blast its reaction as a “weak and feeble response”, arguing that it had failed to act “despite the big talk and heavy promises”. He also accused the Davis administration of being “long on talk and photo ops but short on action and effective governance”.

However, any government intervention in the GB Utility water rate increases is complicated by Freeport’s founding treaty, the Hawksbill Creek Agreement. This gives regulatory authority

for all utilities in the Port area to the GBPA, including for water, electricity and communications. This has caused numerous difficulties and legal battles over the years, and it lies at the heart of GB Power’s current battle with URCA.

James Carey, the Grand Bahama Chamber of Commerce’s president, told Tribune Business in a recent interview it was possibly time for the Hawksbill Creek Agreement to be reviewed and ensure it remains fit for purpose given that the world has changed markedly over the past 70 years.

“The Hawksbill Creek Agreement is 70 yearsold this year,” he said. “It should be reviewed, and reaffirmed or changed as the case may be. It was good 70 years ago but the world has changed drastically. Maybe it’s time to look at that and see if it’s still relevant for the world today.”

Speaking to the water rate increases, Mr Carey yesterday said the GBPA needed to become more transparent with residents and business licensees if it is to continue to enjoy their support. Speaking specifically to the GB Utility hikes, he added: “As stated in a previous exchange, the process perhaps needs to be revisited.....not perhaps; the process ought to be revisited in terms of approval, the participation of communities, and hearings or something would certainly be in order.

“But while they [the GBPA and GB Utility] say it’s necessary, there’s been

high-end bets with greater stakes, and more modest players being able to turn comparatively small bets into exponentially higher wins, but both niches of the gaming sector serve their clientele well.

“However, there is a need to ensure that both sectors are performing at their peak. Number house gaming was born of innovation, and great buy-in was given by the leaders in that industry to ensure a revolutionary Bill was passed by the Government. But the barriers between these two sectors are growing thinner and may one day fall away.”

Dr Johnson also mentioned the development of standalone casinos on the Family Islands, and indicated that this makes allowances for Freeport, Abaco and Exuma.

He said: “We also have a very unique opportunity coming, which is our Family Island experience that we’re not wanting it to be as it always was. So, you may see Family Island casinos that will now request that they have a boutique setup, where they would like anyone to be able to game in those areas.”

“The proposal speaks to Freeport, Abaco and Exuma. They may wish to have a casino where anyone above the proper age, and of the right financial status, would be able to attend and participate in that entertainment experience.”

THE TRIBUNE Thursday, May 4, 2023, PAGE 3

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

KWASI THOMPSON GINGER MOXEY

SEE PAGE B4

DR DANNY JOHNSON

DPM: GAMING REFORMS KEY TO INDUSTRY GROWTH

THE Deputy Prime Minister yesterday said recommendations to upgrade The Bahamas’ gaming laws will be assessed and consulted on over the “next several months” in a bid to enhance the sector’s competitiveness. Chester Cooper, also minister of tourism, investments and aviation, told the Caribbean Gaming Show and Regulator’s Forum during his keynote address that the reforms are critical to providing better protection for gaming patrons, enhancing growth prospects for web shops and hotel casinos, and ensuring The Bahamas remains compliant with international best practices.

“In recent years, our Gaming Board has been tasked with reviewing and modernising our current gaming laws to ensure that they remain relevant and effective. And, over the

course of the next several weeks and months, we will continue to review the recommendations from the Board, and feedback from the stakeholders in the industry, to determine what future adjustments and amendments we will make in our current legislative framework,” he said. “This process is crucial for providing patron protection, adhering to international best practice, and giving both land-based and domestic gaming operators the legislative framework they need to support growth and sustainability.”

Mr Cooper maintained that with the rise in popularity of online and digital games, the regulatory regime for both casinos and domestic gaming houses must be overhauled - and continuously evolve - to stay abreast of ever-changing trends.

He said: “In the digital sphere, innovations such as the rapid adoption of i-gaming and online sports books have dramatically altered

CHESTER COOPER

the landscape. According to the American Gaming Association, US gaming in 2022 tallied a record $60bn in revenues, with sports betting generating $7.5bn and online betting adding another $5bn.

“While traditional slot machines and gaming tables experienced a bump in revenues in 2022, industry experts predict that the popularity of these types of games may wane in the long-term, particularly as the demographic trends for this type of gaming are

geared towards an older population.

“Younger demographics will still be drawn to the casino experience, but significant numbers will drift towards online gaming and sports books. Therefore, key challenges in our current regime will have to be addressed. Digitally, both areas of gaming in The Bahamas can see development that will grow the overall industry.”

Mr Cooper said the benefits of incorporating artificial intelligence (AI) into the gaming model could help attract gaming tourists and ensure fair play. “Offerings such as virtual reality gaming allow us to utilize AI and emerging technologies to add to players’ experiences,” he added. “AI, in fact, has the potential to revolutionise gaming by offering personalised experiences, optimising game design and enhancing security measures. “AI can analyse player behaviour and preferences to tailor gaming

experiences, ensuring higher levels of engagement and satisfaction. Additionally, AI can be used to detect and prevent fraud, ensuring fair play and protecting both operators and patrons. And, most importantly, AI can be that tool that will cause us to attract the type of patrons to our jurisdictions that we need and want.”

While acknowledging that physical gaming will always have a market, Mr Cooper asserted that the industry must be innovative in order to maintain its competitiveness.

He said: “Visceral brick and mortar casino games remain incredibly popular, providing players with an authentic gaming casino experience [and] luxury destination accommodations. The interaction with a live dealer and other players still is a thrill to be branded and marketed.

“However, we foreshadow that these experiences can be enhanced, and we must work smartly to develop a regulatory framework that is

Gov’t blasted over ‘feeble’ GB water rate hike reply

FROM PAGE B3

no sharing of data in terms of the financial standing of GB Utility and what has

been spent etc, etc. They speak about the hurricane and the damage that it did to the wellfields and all that sort of stuff, but there’s

been no specifics about what they may have recovered in terms of insurance claims if any.

“Again, transparency is a good thing, and it’s something that’s not forthcoming,” the GB Chamber chief added. “I may have said on previous occasions elsewhere that governments make decisions and do things, and the public responds by changing them if they’re dissatisfied, but the same opportunity is not there with the GBPA. It’s a private company.”

Mr Carey said there was “a prescription for dealing with the GBPA”, which appeared to be a reference to the clause in the Hawksbill Creek Agreement that allows for its quasi-governmental powers to be devolved to a local government authority if 75 percent of licensees vote in favour of this. However, as he acknowledged, this mechanism has never been acted on.

“So some more information needs to be shared,” Mr Carey said of the rate increase. “I think it’s something we need in this town if we are to continue supporting what the Port Authority does. They do do a lot of good things but it can certainly be a more viable proposition if they have more public support, and that will come through transparency, I’m sure.”

GB Utility, seeking to justify the recovery of at least some of its $15m Hurricane Dorian restoration costs from its customers, said that while the $5m investment in a reverse osmosis system will provide extra supply

resilience and sustainability in the future this has come at a significant increase in operating costs and “a financial loss”.

“Reverse osmosis systems are extremely expensive to operate in comparison to well water plants, adding an additional $2.5m to the utility’s annual operating costs from 2021 at a financial loss to the utility. This additional operating cost, to date, will not be recouped in rates retroactively,” GB Utility said in a presentation.

“GB Utility also experienced $3m in Hurricane Dorian-related infrastructure storm damage. In addition, there was approximately $2m in uninsurable losses associated with Hurricane Dorian including over $500,000 in costs to operate the free water depots for residents and 25 percent discounts given to residents for water usage.

“These costs were at a financial loss to the utility and will not be recouped in rates..... GB Utility deferred the rate case for two years, at a significant financial burden and cost to the utility. To defer any longer will result in higher cost accumulation and consequently rates, and jeopardises the utility’s ability to maintain and produce potable water and remain functional.”

GB Utility, in its rate increase application, pledged that 40 percent of its customer base - those who use 2,000 gallons or

cutting edge and safeguard all stakeholders. We must be more innovative today than we have ever been if we are going to sustain our growth. And we want to continue the phenomenal growth, and the vibrancy of gaming, that we have come to know in the Bahamas, in the region and around the world.

“The industry has contributed significantly to the overall tourism product in The Bahamas. It has created jobs, spurred economic growth and attracted visitors from around the world. It has further solidified The Bahamas as premier destination for both leisure and for entertainment,” Mr Cooper said.

“We are well-positioned to remain competitive in the global market. And by staying informed, and adapting our regulations to the pace of innovation, including the integration of AI, we can ensure the long-term success and sustainability of this vital sector of our economy.”

less per month, and are likely to be lower income residential users - will not see any price hikes from the adjusted tariff structure that is due to take effect in June. Average consumption among this group is 600 gallons per month, and the average bill is forecast to remain at $12.83. The water provider, in a statement, said a further 47 percent of clients - who consume between 2,001 and 10,000 gallons monthly - will only see an $8.16 per month tariff increase that will take their average bill from $28.13 to $36.29. This equates to an annual water cost increase of $97.72 - less than $100.

GB Utility is clearly expecting large volume users, namely higher income residents and the business community, to bear the brunt of the increases. Those consuming between 10,001 and 20,000 gallons per month, and representing 8 percent of the customer base, will see their bills rise by around $20.73 per month - representing a jump from an average $71.42 to $92.14. This is equivalent to a $248.76 annual increase in water costs.

Users of more than 20,000 gallons per month, chiefly hotels and Freeport’s large industrial companies who comprise 5 percent of customers, will see their tariffs jump by $125.74 per month to an average $558.67 compared to the present $432.93. This is equivalent to a $1,508.88 annual increase.

PAGE 4, Thursday, May 4, 2023 THE TRIBUNE

By FAY SIMMONS Tribune Business Reporter jsimmons@tribunemedia.net

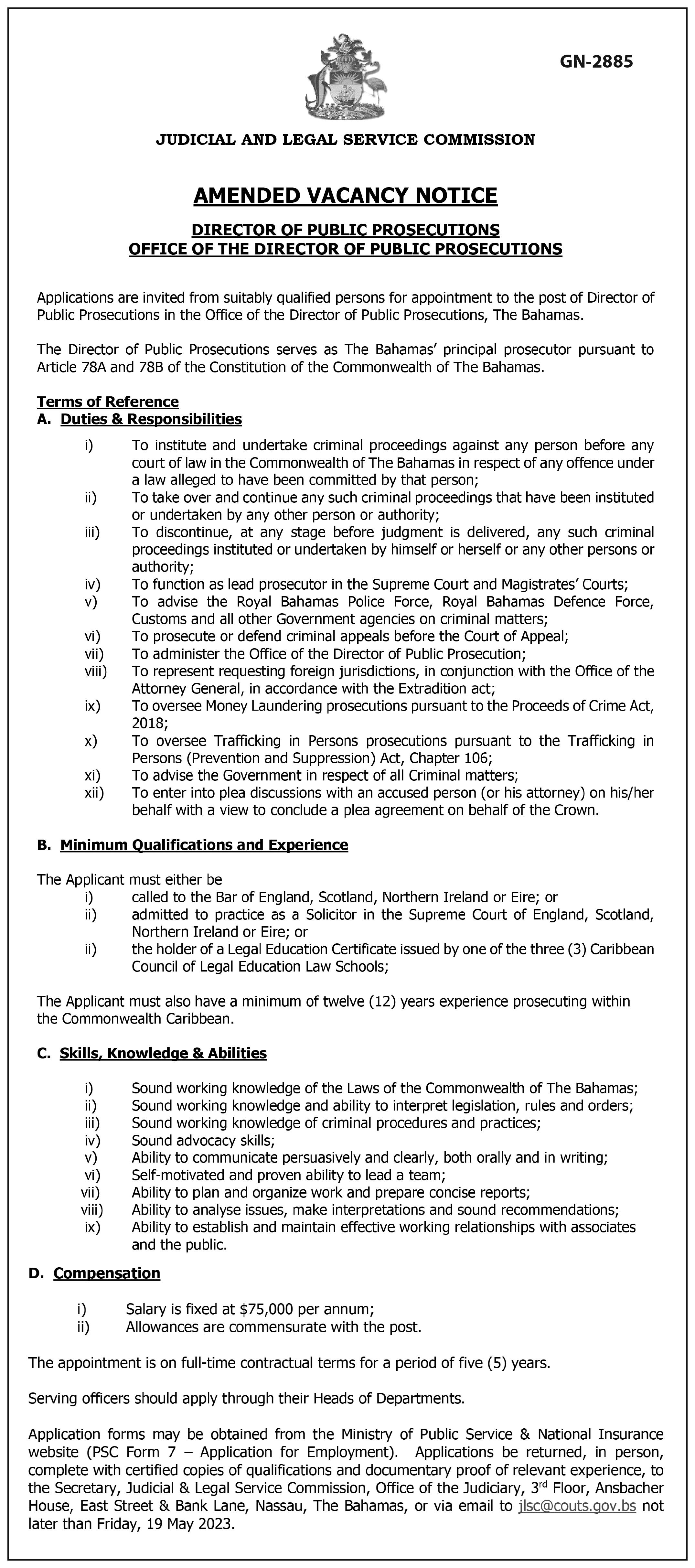

GAMING BOARD AGREES TURKS REGULATORY COOPERATION DEAL

nation [in compliance with the Financial Action Task Force’s (FATF) recommendations].

framework. Getting them up to speed on it has been fantastic.”

THE Gaming Board yesterday signed an agreement with the Turks and Caicos Islands over the exchange of gaming information and services between the two.

Dr Daniel Johnson, the Bahamian regulator’s executive chairman, said the Memorandum of Understanding (MOU) provides an opportunity for The Bahamas to export its regulatory knowledge and frameworks acquired over the past 100 years.

“This is a big thing for us in The Bahamas,” he added. “We’ve got 100 years of experience. We are highly regulated out of the 193 countries in the world.

There are only six countries that enjoy the regulatory status we have as a 40/40

“And in the Caribbean there are only two of us, and the other countries are asking us for consulting services. One of the weaknesses of our industries is we’re importers. We are consumers, we’re not exporters. And so the Gaming Board is taking the position now that we’re going to export some of our expertise.

“In the first instance we were asked to do something with Turks and Caicos, which is our nearest neighbour has a great history, of course, with The Bahamas. That was a consulting service about their gaming industry. Phase one is complete, and we now have signed a Memorandum of Understanding to proceed with phase two to assist them in their regulatory

While the MOU does not specify a timeline, providing these consultancy services should take 12 to 18 months to complete. Dr Johnson said: “That MOU doesn’t have a timeline on it, but we’ll try to be as efficient as we can. These services tend to take a year or 18 months to complete.

“And that is setting up regulatory frameworks that are tailor made to other countries who have seen what we’ve done in The Bahamas in gaming - online gaming, our infrastructure and systems - and assisting them to see how they can progress in their own jurisdictions”

Stuart Taylor, deputy permanent secretary for the Turks and Caicos Islands Gaming Control Commission, said the territory chose to collaborate with

DPM: ROYAL CARIBBEAN BEING HELD TO SAME STANDARD AS ATLANTIS, BAHA MAR

By FAY SIMMONS Tribune Business Reporter jsimmons@tribunemedia.net

The DEPUTY Prime Minister yesterday reiterated that Royal Caribbean’s proposed $110m Paradise Island project must meet the same environmental standards as those imposed on Atlantis and Baha Mar.

Chester Cooper, also minister of tourism, investments and aviation, addressing the ongoing environmental concerns over the cruise giant’s Royal Beach Club, said: “I’ll just make the point once more for good measure. The same protocols that must be followed by Royal Caribbean are the same protocols that were followed, and have to be followed, by Atlantis and by Baha Mar. So if it was good enough for them, then it’s good enough for Royal Caribbean.

“The conversation is continuing in relation to Royal Caribbean’s development on Paradise Island. This is a standard process for consultation as a part of DEPPs (Department of Environmental Planning and Protection) programme for environmental assessments, and that public consultation is continuing. I have encouraged anyone who has concerns or feedback to make those concerns known

to the DEPP and they will be considered.”

Mr Cooper voiced confidence in the DEPP’s ability to properly vet Royal Caribbean’s submissions, and said: “I am confident that the professionals at DEPP will do their work appropriately. And I encourage everyone who has a contribution to make - a concern or question, or some feedback - to present it to DEPP. Every comment, every question will be addressed appropriately by the developer. That’s our undertaking.”

Environmental activists earlier this week took Mr Cooper at his word and submitted multiple questions and concerns to the DEPP.

Joe Darville, Save the Bays executive chairman, wrote a letter to the DEPP’s director, Rhianna Neely-Murphy, highlighting 12 separate concerns over the proposed Royal Caribbean project that he and others want addressed.

He again voiced fears that the Royal Beach Club will lead to the “complete decimation” of western Paradise Island, and voiced concerns about the sustainability of accommodating a projected 2,750 to 3,000 average daily visitor volume.

“How did Royal Caribbean determine that its estimated daily use of the site by 2,750 to 3,000 visitors is acceptable?” Mr

Darville asked. “Was it based at all on an analysis of the capacity of this narrow, fragile strip of land to hold up under such density and intensity of use? On 17 acres, that’s 176 people per acre.

“Given the requirement to dedicate land for the site’s power plant, waste treatment facilities, buildings, restaurant areas, performance stages and other structures, the density of people-per-acre will be even greater. Does this comport with DEPP best practices and established standards?”

And Eric Carey, former Bahamas National Trust executive director, who will review Royal Caribbean’s environmental submissions on behalf of Atlantis, previously raised questions about the project’s socio-economic impact as he asserted it will mean hundreds of cruise passengers bypass downtown Nassau businesses.

The Bahamas to improve its gaming regulations after a dismal mutual evaluation by the FATF in 2020.

He said: “In the Turks and Caicos Islands, the mutual evaluation report that was done in 2020 by the Caribbean Financial Action Task Force, one of the key recommendations that the report recommends was that agencies should work together to combat anti-money laundering and counter terror financing issues regionally.

“And, in order to do that, the Turks and Caicos Islands first reached out to Bermuda. We would have executed an MoU with Bermuda, I think, in May 2021. And after executing that memorandum, we reached out to our colleagues in The Bahamas, and we would have had

intimate discussions with the Gaming Board for the Bahamas. And, finally, we have now signed a Memorandum of Understanding with The Bahamas.”

Mr Taylor said the MOU’s purpose is to understand how large casinos are operated in accordance with international anti-money laundering and counter terror financing standards, and he hopes to have Turks & Caicos officers either seconded or embedded with the Gaming Board.

He added: “What the Turks and Caicos Islands is trying to do with the memorandum of understanding is we are trying to get a better, intimate understanding of the way [in which] large casinos are regulated in accordance with antimoney laundering and

counter terror financing conditions.

“We want to pull on The Bahamas’ 100 years of gaming experience so we can implement what The Bahamas would have learned over 100 years in the Turks and Caicos Islands. And also we want to help use the memorandum to foster and build capacity between our organisations.

“So we would like, hopefully, to have our officers either seconded or embedded for short periods with the Gaming Board to understand exactly how their methods of operandi is basically similar or different from u, because as a regulator we want to ensure that we have international standards across the board in the regulation process.”

THE TRIBUNE Thursday, May 4, 2023, PAGE 5

By

SIMMONS Tribune Business Reporter jsimmons@tribunemedia.net

FAY

TO ADVERTISE TODAY IN THE TRIBUNE CALL @ 502-2394

Low energy: Bahamas worst in Caribbean for renewables

FROM PAGE B1

energy utility-scale power generation as well as self-generation.

“In recent years, there has been increasing interest from commercial entities to pursue renewable energy self-generation projects selling surplus energy to BPL. However, the current market governance and regulatory framework pose barriers to such developments in renewable energy and private sector participation.”

Assessing the current Bahamian energy market, the IDB report added: “Final energy consumption in the country is dominated by gasoline (40 percent), followed by diesel with 28 percent and electricity with 24 percent. Transportation represents the largest energy consumption sector (around 40 percent of the total). Gasoline accounts for 76 percent of the total consumption in this sector followed by kerosene/jet fuel (12 percent) and diesel (11 percent).

“Together with an old power generation infrastructure, The Bahamas suffers from a high fuel import bill [equal to] 7 percent of Gross Domestic Product (GDP) and high electricity prices. Electricity prices are around $0.25 per kilowatt hour (kWh) compared to $0.142

per kWh in the Caribbean region.” BPL was branded as “financially challenged”, and experiencing frequent power outages and high electricity losses from its system. “Volatile oil prices have contributed to making electricity tariffs among the highest in the Caribbean,” the IDB continued. “With a tourism and services-oriented economy, electricity is consumed by large commercial users 42.6 percent (mostly hotels); residential 34.8 percent; small commercial 8.3 percent; street lighting 1.9 percent; and other users, 2.7 percent, and is concentrated in New Providence (about 75 percent).”

Mr Gilbert, in response, told Tribune Business that the “very, very conservative” approach to financing renewable energy projects by Bahamian commercial banks was the greatest obstacle to increased penetration. Noting that few have “$20,000 and $30,000 lying around”, he added that The Bahamas would “be very close” to its 2030 goals and on track to hit them if lenders were more proactive and reduce their collateral demands.

“I think the difficulty is project financing,” he said. “It’s difficult to find project financing. Locally, the banks

don’t issue loans against solar installations unless there is some collateral to be held. Most people don’t have $20,000 or $30,000 lying around. In other markets the financing is relatively easy to secure. In this market it’s not.

“The banks here are very, very conservative, and want lots of collateral. I think that’s probably the biggest obstacle; banks. I think the demand is there if the financing is there. I think you would see a lot more penetration. I think we’ll be very close to the 30 percent by 2030 if the financing is there.”

Mr Gilbert said both residential and commercial renewable installations were being impacted by lack of accessibility to financing, but the latter to a slightly lesser extent because companies typically have more assets to pledge as potential security. He added that The Bahamas now needs to develop utilityscale solar plants, capable of supplying multiple Mega Watts (MW) of power, to hit the National Energy Policy targets.

“I have my doubts we’ll get to 30 percent by 2030,” Mr Gilbert told this newspaper. “We’re half-way through 2023. Let’s say we now have 5 percent penetration. That gives us six-and-a-half years to get the remaining 25

Career Opportunity CAD TECHNICIAN

• Must have - 5 years experience using CAD

• Ideally - 2 years experience working for an architecture firm

• Be able to produce full architectural drawings (internal floor plans,

elevations, site plans)

• Create high-quality detailed technical drawings and plans based on designs

supplied by architects and designers and make modifications to existing

drawings

• Use a variety of CAD software programmes to create designs in 2D and

3D models

• Liaise with architects, engineers and designers to understand their design

requirements and provide technical advice to manufacturing and

construction technicians

• Provide accurate, detailed and to scale drawings

• Ensure drawings are compliant with industry and health and safety standards

and protocols

• Calculate costs and apply knowledge of materials and engineering principles

to check feasibility of manufacture and construction of the product

• Conduct site visits and surveys when required

• Present working drawings for use in all stages of the project, tender,

manufacture/construction and installation

• Produce installation and manufacturing documentation

• Maintain accurate records.

Should submit examples of previous work/ projects completed

percent. I stand to be proven wrong, but I have my doubts it will happen. “I think it comes down to the availability of financing for the average consumer. That’s the sticking point right there. I don’t think it’s anything related to the Government. The Government has removed import duties on solar components. I don’t think there’s necessarily any concessions the Government can give at this point.”

The Alternative Power Sources (Bahamas) vicepresident said the company is currently working with a financier, who he declined to name, on a funding proposal for a client and was waiting to hear its response. “We have submitted something to an entity we’re working with,” he added. “We’re waiting to hear back from them now whether they are prepared to finance 100 percent.

“We’ve submitted something on behalf of the client and are just waiting to hear what the feedback is from the financing entity we’ve been having discussions with for some time. We’ve had a number of conversations with a number of entities. We do have some ideas, but I think we may still be a ways off before we have that secured.”

Mr Gilbert said the payback period for residential

renewable energy investments was now typically “under five years”. He added: “One of the things we don’t do as a company is we don’t market renewables as a cost savings. It’s really energy independence.”

As a result, the systems that Alternative Power Sources (Bahamas) installs are frequently not tied into BPL’s grid and feeding excess energy back into that system. “We’ve had some clients who have registered [with URCA], but typically we don’t set the system up to send power back to the grid because it doesn’t make sense,” Mr Gilbert said.

“We’ve done one or two grid-tied systems, but what we typically offer the client is energy independence. I think that’s the way to go if we want to cut down. If we keep talking about cutting down the use of fossil fuels, getting clients off grid and using the utility as a back-up is the way to go.”

Mr Gilbert said Alternative Power Sources (Bahamas) has performed “well over 100” residential and small commercial renewable installations in this nation. Regulators have also acknowledged The Bahamas remains a long way from generating 30 percent of its energy mix from renewable sources by 2030 even though last year saw a 26 percent

increase in installed capacity from such systems.

The Utilities Regulation and Competition Authority (URCA), in its 2022 annual report and 2023 action plan, revealed that at end2022 there were some 305 installed renewable energy systems in The Bahamas representing a combined 6,242 kilowatts (kW). These were split into 244 residential, and 61 commercial, systems with the former responsible for 1,859 kW of capacity and the latter some 4,383 kW. The vast majority, some 291, were based on New Providence with a combined installed capacity of 4,931 kW. Of the 14 others, ten were located on Eleuthera. “The vast majority of renewable energy systems installed in the country are solar (photovoltaic),”URCA said. “ Since 2021, there was a 22 percent increase in the number of systems online and a 26 percent increase in the installed capacity. Most of this occurred on New Providence.

“Gekabi Chub Cay Utilities has commissioned a 4 MW (Mega Watt) solar plant with 10 MWh (mega watt hours) battery back up allowing them to become almost entirely independent of fossil fuels. In 2022, BPL commissioned a 0.4 MW solar plant with battery storage in Ragged Island. In 2022, BPL also commenced work on solar and energy storage projects on Abaco.”

PAGE 6, Thursday, May 4, 2023 THE TRIBUNE

email: hr@palmcay.com

Recipients of welfare may face gaming ban

that if you’re receiving benefits from the Government in terms of social services, it blocks your name. You will not be able to gamble. However, that’s just a consideration for now. It’s up the policymakers,” he added.

Crystal Knowles, the Gaming Board’s chief counsel, added that it is also mulling removing the condition that gaming licence holders and their relatives cannot be a member of Cabinet in its entirety, or editing it to allow for the inclusion of such persons once the Board is satisfied there is no conflict of interest.

She said: “It is envisioned that section 25 1C of the Act, which currently provides that a person may not hold an employment licence if that person is a member of the Board, a member of the Cabinet or was a family member of such person... it is proposed that that will be deleted. “Or it will be amended to either remove a member of the Cabinet from the list of persons who are currently disqualified from holding an employment licence, or it will include language from section 25 1D to the effect that the Board may condone such disqualification if it is satisfied that no material conflict of interest will arise by reason of such employment.” Ryan Brown, a Gaming Board official, also told the conference: “We must

eradicate discrimination in all facets Bahamian. Gaming is no different. Therefore, we propose removing in its entirety section 69 of the Gaming Act. This provision, informed by section two of the Act, defines who a domestic player is. Currently, residents, including citizens and permanent residents, cannot sit at a slot machine at Atlantis, Baha Mar or Resorts World. “This should not be in a modern country. Likewise, casinos are limited to two islands in our country, but tourists go throughout. So conversely, because tourists cannot take part in our gaming and number house activity, we believe that that section should be eradicated to allow all persons to take part in gaming. We believe that will benefit the industry as a whole by increasing revenue to the licensees; all of them. It will increase taxes to the Bahamian people as well.”

Ms Knowles confirmed this thinking, saying: “Consideration is being given to removing the restriction that

precludes tourists or domestic players from gambling and commercial casinos.

In turn, it is proposed the restriction that prevents tourists from gambling in gaming house premises will also be removed, especially on the islands where no commercial casinos are present. It is intended that gaming will be accessible to all.”

Mr Brown recommended a national lottery, and noted that the Gaming Act already makes an allowance for its formation upon approval by the Chester Cooper, the minister presently responsible for the industry.

“Another recommendation is the concept of a national lottery. Currently, section 58 of the Act allows the minister to simply approve a lottery. We believe that we can do it in an innovative way if we were to take that step,” he said.

Ms Knowles added:

“Possible amendments may also involve including a provision whereby the Government or the Board

can incorporate a corporate soul that it would own for the purpose of operating the National Lottery. In order to determine the best approach, the Board is considering having a feasibility study conducted to examine the structure of a national lottery in the context of our existing gaming sector.”

A fee structure change is also being considered by the Board, which will charge gaming houses based on the number of locations or size of premises. Ms Knowles said: “The Board is also currently considering amendments that may involve the incorporation of a tiered approach to the fee structure that is attributable to gaming house premises in the domestic sector. The amendments therefore may be based upon the size of the gaming house premises or the number of locations.”

Ms Knowles added that the Board is also considering permitting standalone casinos for Family Islands only. She said: “Proposed amendments may involve adding a new section, under

which a gaming license authorises the operation of a standalone casino without reference to a designated area of a casino resort.

“Consideration has also been given to establishing a maximum number of standalone casinos, and restricting the construction and operation of such casinos to the Family Islands only to prevent any further saturation of the gaming market in New Providence.”

Ms Knowles said the Gaming Board is currently reviewing allowing digital verification technology that would permit domestic

players to open accounts without face-to-face verification. She added that the regulator is considering accepting crypto currency for gaming transactions.

“The proposed amendments seek to support the use of digital online verification technology provided that stringent KYC requirements are met. This proposed amendment is specific to the domestic sector,” Ms Knowles said.

“The Board is currently considering amendments that could potentially facilitate the acceptance of crypto currency as a method of payment for gaming transactions.”

JOB OPPORTUNITY

Full time Caregiver For Two Young Children

This position would suit a responsible mature minded person who has a genuine interest in children. A native spanish speaker is preferred. We are seeking a longterm placement. Caregiver MUST LOVE TODDLERS and have at least 2 years’ experience in a caring role where they were in sole charge of more than one child throughout the day. You must be patient, show empathy, care, and appreciate the challenges that these formative years have on a child.

The suitable applicant must meet the following criteria:

• First Aid Certification

• Driver’s License

• Police Check Day to day duties include:

• Meal preparation

• Playing with children

• Reading and counting with children

• Taking children to clubs, after school activities, weekend activities etc.

• Outings to the park, ensuring they arealways safe

• Some light housework duties are required; general tidy up after meals, laundry and folding for the child.

Please forward your resume and introduction letter by email to hrbahamas2014@gmail.com.

THE TRIBUNE Thursday, May 4, 2023, PAGE 7

FROM PAGE B1

FTX CHIEF BLASTS BAHAMAS OVER ‘CLOSED LEGAL SYSTEM’

on the crypto exchange’s assets.

Brian Simms KC, the Lennox Paton senior partner and attorney, and the PricewaterhouseCoopers (PwC) accounting duo of Kevin Cambridge and Peter Greaves, who have responsibility for winding-up FTX Digital Markets, the Bahamian subsidiary, are seeking the Delaware Bankruptcy Court’s confirmation that they will not violate the Chapter 11 stay if they seek to progress their own liquidation proceedings.

However, Mr Ray and his team further highlighted the territorial contest by alleging that the provisional liquidators and Bahamian court proceedings are only causing “confusion” for millions of FTX creditors

and investors at a “critical juncture” in proceedings. Their message is that The Bahamas should stand back, and let the Delaware Bankruptcy Court proceedings take the lead, especially since some $7.3bn in recovered assets are already in their possession compared to just $30m held by FTX Digital Markets’ provisional liquidators. Seeking to strengthen their case for determining all key legal issues in the Chapter 11 process, and avoiding the Bahamian judicial process almost entirely, Mr Ray and his team alleged in documents filed with the Delaware Bankruptcy Court: “Only if this court determines there is property held by the debtors that belongs to FTX Digital Markets, and the transaction providing

that property is not voidable, would the Bahamas court need to become involved with respect to these issues.

“As a practical matter, meaningful participation in The Bahamas to determine ownership issues may not even be possible for the debtors, never mind their millions of stakeholders. The Bahamas has a closed legal system that makes it difficult to secure appropriate representation.

“On March 23, 2023, the debtors filed an application to have a King’s Counsel (KC) specially admitted for the purpose of being available to the debtors for any proceedings in The Bahamas. After more than a month’s delay, on April 27, 2023, the debtors received a letter from the Bahamas Bar Association indicating

it is ‘not minded’ to approve the application and requiring further proceedings.”

However, that letter, which was included in yesterday’s legal filings, does not represent an outright rejection of their KC application. Tara Knowles, the Bar Association’s honorary secretary, merely informed Jason Maynard, an attorney with Mr Ray’s Bahamian lawyers, Peter D. Maynard & Company, that the correct process needs to be followed before the application for Mr Allison would be considered.

Referring to her April 21, 2023, conversation with Mr Maynard “about your firm’s request for David William Allison to be specially admitted to the Bahamas Bar to act” in FTX-related litigation, Ms Knowles said: “At that juncture, I advised

that a usual requirement for ‘special calls’ is canvassing all other local King’s Counsel to ascertain their expertise and availability to be retained for the necessary application.

“To that end, I also advised you that Ianthia Forbes, office administrator at the Bahamas Bar Association, could provide you with the necessary document to fulfill the canvassing requirement as early as Monday, April 24. Additionally, we also discussed that Council is not minded at this juncture to approve your firm’s application for a special call for Mr Allison but we invite you to provide dates of availability to appear to make oral representations as to why he should be admitted.”

Thus the door has not been completely closed on admitting Mr Allison. Bahamian legal sources, speaking on condition of anonymity, yesterday said it appeared as if Mr Ray and Peter Maynard & Company had failed to comply with what is the routine process of consulting all other KCs on the application process - especially given the large number of Bahamian KCs capable of acting in liquidation and insolvency-related matters such as FTX’s.

However, Edgar Mosley, managing director at Alvarez & Marsal, a restructuring advisory services firm working as part of Mr Ray’s team, alleged yesterday in an affidavit that the delay in obtaining approval for Mr Allison means they will be unable to safeguard the interests of FTX creditors in Bahamian court proceedings.

“The debtors will also have a difficult time fully and adequately protecting their rights in The Bahamas,” he claimed. “On March 23, 2023, the debtors submitted an application for the special admission of David William Allison KC to the Bahamas Bar Council, which I understand to be similar to a pro hac vice motion in the US, and allows a foreign citizen to represent a client in particular proceedings in The Bahamas, which to date has not been granted.”

Mr Mosley also alleged that the Bahamian joint provisional liquidators’ efforts to secure assets on behalf of FTX Digital Markets creditors are disrupting the work of Mr Ray and his team. “In my opinion, the debtors will be prejudiced by the confusion created from proceedings in the Bahamas court concerning customer entitlements and the debtors’ assets at this critical juncture in the Chapter 11 cases,” he claimed.

“The debtors’ reorganisation efforts have already

been impacted by the joint provisional liquidators’ actions. For example, the joint provisional liquidators have attempted to cloud title to assets that have been marshalled by the debtors and are available to be distributed to customers and other creditors in a plan of reorganisation.”

To back his allegation, Mr Mosley cited the joint provisional liquidators’ first interim report to the Supreme Court that detailed $7.7bn in transfers “from FTX Digital Markets” to FTX Trading, Alameda or other entities in the Chapter 11 proceedings. He also claimed the trio have “interfered with the debtors’ efforts to negotiate settlements with targets of avoidance actions by filing a position statement in response to a stipulation entered into between Alameda and Voyager Digital, asserting FTX Digital Markets may hold the claims and seeking a veto over settlements”.

And Mr Mosley also objected to the Bahamian provisional liquidators announcing “publicly a claims ‘portal’, and claims resolution procedure, that gets ahead of the forthcoming claims bar date and resolution process of the debtors, creating confusion among stakeholders”.

However, the trio’s position is that they cannot progress the FTX Digital Markets liquidation without an understanding of who its customers and creditors are, and the scope of the Bahamian subsidiary’s rights to its and its customers’ assets.

These are among the key questions that the chief justice, Sir Ian Winder, will be asked to determine. This will involve analysing multiple “terms of service”, which governed the relationship between FTX’s international platform and its customers, and determining which one applies and on what date.

This is critical to working out when, and if, clients were migrated to FTX Digital Markets and became its customers prior to the crypto exchange’s early November 2022 collapse, or if they are clients of FTX Trading and any of the other entities in Chapter 11 protection in the US.

Another vital issue that Sir Ian will be asked to decide is whether FTX Digital Markets was holding assets, either digital, fiat or both, on trust for investors/clients in a fiduciary or escrow capacity. If it was, then assets treated in such a manner will belong to the client, but if they were not then such properties belong to the liquidation estate.

Stock market today: Asian markets mixed after US rate hike

By JOE MCDONALD AP Business Writer

ASIAN stock markets were mixed Thursday after the Federal Reserve raised its benchmark lending rate again to cool inflation and said it wasn't sure what may come next.

Shanghai and Hong Kong advanced while Seoul and Sydney declined. Japanese markets were closed for a holiday.

Wall Street's benchmark S&P 500 index fell 0.7% on Wednesday after the Fed announced a 0.25 percentage point increase in its lending rate. The Fed's statement dropped a reference to "additional policy firming" but stopped short of declaring an end to rate hikes.

"The key takeaway, in my view, is that we are likely at or very near the end of the rate hike cycle," said Kristina Hooper of Invesco in a report.

The Shanghai Composite Index rose 0.5% to 3,340.28 and the Hang Seng in Hong Kong surged 1.1% to 19,924.15.

The Kospi in Seoul lost 0.3% to 2,494.80 and Sydney's S&P-ASX 200 fell 0.2% to 7,183.20. New Zealand and Southeast Asian markets also declined.

On Wall Street, the S&P 500 fell to 4,090.75. The Dow Jones Industrial Average lost 0.8% to 33,414.24 and the Nasdaq composite slipped 0.5% to 12,025.33.

Traders expect a U.S. recession this year as the Fed and other central banks in Europe and Asia try to extinguish inflation that was near multi-decade highs. Jitters have increased following three high-profile bank failures in the United States and one in Switzerland blamed on strain from higher interest rates. Central banks have tried to reassure investors by pledging steps including additional lending if needed.

Traders expect the Fed to start cutting rates as early as this year to prop up weakening economic growth.

On Thursday, Fed Chair Jerome Powell said he doesn't expect rate cuts that soon.

Traders worry industry turmoil might prompt banks to reduce lending, worsening downward pressure on economic activity. Powell mentioned a survey that is yet to be released and will show how much loan officers at banks say they are tightening lending standards.

PAGE 8, Thursday, May 4, 2023 THE TRIBUNE

FROM PAGE B1

INSURER DOING ‘EVERYTHING TO REMEDY’ CAYMAN BREACHES

any further regulatory action over the regulations breach, which stems from issues encountered with a new health claims processing system implemented during the 2022 third quarter, and the situation was “not a material issue” for the wider group.

Mr Ward was also quick to point out that there is no issue with Cayman First’s ability to pay claims on behalf of its insured clients, with the matter instead focused on delays in processing such payments and later-than-normal payouts.

He spoke after the situation was flagged in Bahamas First’s audited financial statements for 2022 by the group’s external auditors, Deloitte & Touche. Under the heading “contingencies”, the financials said: “As at December 31, 2022, the group was not in compliance with the prescribed reporting timelines outlined in subsections three, nine and 20 of the Cayman Islands’ Health Insurance Regulations (2017 Revision).

“The delay in reporting resulted from the group’s implementation of a new policy and claim processing system during the year. The group has subsequently established a remediation plan to improve reporting timelines to ensure it is in compliance with the regulations for future reporting periods.”

Mr Ward told this newspaper: “That basically was something that related to the period in 2022, and so we have a plan in place to address the issue with the claims backlog which has been communicated to the regulator in Cayman, the Health Insurance Commission.

“The plan basically introduces oversight by both Board and management of a remediation plan that tackles the issue of claims payments past the due date, which has arisen because of the system implementation issues we’ve had. While I cannot go into the details of the plan, we are confident we will take every measure possible to to ensure we’re within the timelines set by the Health Insurance Commission.

“This is nothing to do, or an issue with, resources to pay claims or our ability to pay claims. It’s just a processing issue,” Mr Ward added. “We’re highly confident [this will be addressed] because we’ve given an undertaking to the regulator. While I cannot give any specific details, everything possible to remedy the situation will be done within the timeframe indicated.”

Asked whether the Cayman woes will be resolved this year, Mr Ward replied: ‘“During the course

of 2023 for sure. That’s our view at this stage. All our efforts have been focused on making sure the claims backlog is addressed.” And, as to the prospect of further regulatory measures being taken against Cayman First, he said: “There’s no reason for us to believe any further action will be taken at this stage.

“As you can tell from what the auditors have said, it’s a matter that’s been noted in the accounts but is not a material issue from a group standpoint.” Asked when Cayman First would be compliant once again with the regulations, and the claims backlog eliminated, Mr Ward said: “It’s a moving target. Every day as we speak it goes down.

“It’s something we see progress being made on, but don’t want to go into any specifics at this point. I’m confident the efforts we are putting in place now will put us in a much better position than we are presently.” Cayman First’s implementation of the new claims processing system was one of the issues identified as a “key audit matter” by Deloitte.

With gross written health insurance premiums of $45.498m for 2022, the audit firm wrote: “During the year, the group implemented a new policy administration system for its health line of business. The implementation of the policy administration system introduced risks related to system access, change management and data integrity.

“The new policy administration system became operational during the third quarter of the [2022] fiscal year. The implementation of the new policy administration system resulted in management having to make manual adjustments to address the completeness and accuracy of the amount reported as gross premiums written for health.”

Deloitte added: “In evaluating the new system implementation, we involved our information technology specialists to understand the controls over access and change management. We also assessed whether policyholder information related to billing transferred to the new policy administration system was complete and accurate.

“We evaluated the design and implementation of controls related to revenue recognition impacted by the new policy administration system, and reviewed management’s process to reconcile revenue omitted from the new policy administration system. We performed analytical procedures and tested a sample of individual policies included in the manual adjustments,

and vouched them to supporting documentation.”

Mr Ward, in a previous report to Bahamas First shareholders, conceded that Cayman First’s health business had performed “below our expectations”. He added: “The roll-out of new technology and connected systems, together with a change in key personnel within the health segment, has caused a number of operational challenges for our Cayman subsidiary, leading to negative market perceptions about the company’s ability to fulfill its obligations to policyholders.

“The Board and management are focused on the remedial actions that are required to resolve these issues, and to ensure that the benefits of the new systems are experienced by our clients in that market in the shortest possible timeframe.”

THE TRIBUNE Thursday, May 4, 2023, PAGE 9

FROM PAGE B1

By CORA LEWIS AND ADRIANA MORGA

Associated Press Writers

THE Federal Reserve has raised its key interest rate yet again in its drive to cool inflation, a move that will directly affect most Americans.

On Wednesday, the central bank boosted its benchmark rate by a quarter-point to 5.1%. Rates on credit cards, mortgages and auto loans,

which have been surging since the Fed began raising rates last year, all stand to rise even more. The result will be more burdensome loan costs for both consumers and businesses.

On the other hand, many banks are now offering higher rates on savings accounts, giving savers the opportunity to earn more interest.

Economists worry, though, that the Fed’s streak of 10 rate hikes since March 2022 could eventually cause the economy to slow too much and cause a recession.

Here’s what to know:

WHAT’S PROMPTING

THE RATE INCREASES?

The short answer: inflation. Inflation has been slowing in recent months, but it’s still high. Measured

over a year earlier, consumer prices were up 5% in March, down sharply from February’s 6% year-over-year increase. The Fed’s goal is to slow consumer spending, thereby reducing demand for homes, cars and other goods and services, eventually cooling the economy and lowering prices. Fed Chair Jerome Powell has acknowledged in the past that aggressively

raising rates would bring “some pain” for households but said that doing so is necessary to crush high inflation.

WHO IS MOST AFFECTED?

Anyone borrowing money to make a large purchase, such as a home, car or large appliance, will likely take a hit. The new rate will also increase monthly payments and costs for any consumer who is already paying interest on credit card debt.

“Consumers should focus on building up emergency savings and paying down debt,” said Greg McBride, Bankrate.com’s chief financial analyst. “Even if this proves to be the final Fed rate hike, interest rates are still high and will remain that way.”

WHAT’S HAPPENING WITH CREDIT CARDS?

Even before the Fed’s latest move, credit card borrowing had reached the highest level since 1996, according to Bankrate.com.

The most recent data available showed that 46% of people were carrying debt from month to month, up from 39% a year ago. Total credit card balances were $986 billion in the fourth quarter of 2022, according to the Fed, a record high, though that amount isn’t adjusted for inflation.

For those who don’t qualify for low-rate credit cards because of weak credit scores, the higher interest rates are already affecting their balances.

HOW WILL AN INCREASE AFFECT CREDIT CARD RATES?

The Fed doesn’t directly dictate how much interest you pay on your credit card debt. But the Fed’s rate is the basis for your bank’s prime rate. In combination with other factors, such as your credit score, the prime rate helps determine the Annual Percentage Rate, or APR, on your credit card.

The latest increase will likely raise the APR on your credit card 0.25%. So, if you have a 20.9% rate, which is the average according to the Fed’s data, it might increase to 21.15%. If you don’t carry a balance from month to month, the APR is less important. But suppose you have a $4,000 credit balance and your interest rate is 20%. If you made only a fixed payment of $110 per month, it would take you a bit under five years to pay off your credit card debt, and you would pay about $2,200 in interest.

If your APR increased by a percentage point, paying off your balance would take two months longer and cost an additional $215.

WHAT IF I HAVE MONEY TO SAVE?

After years of paying low rates for savers, some banks are finally offering better interest on deposits. Though

the increases may seem small, compounding interest adds up over the years. Interest on savings accounts doesn’t always track what the Fed does. But as rates have continued to rise, some banks have improved their terms for savers as well. Even if you’re only keeping modest savings in your bank account, you could make more significant gains over the long term by finding an account with a better rate.

While the biggest national banks have yet to dramatically change the rates on their savings accounts (clocking in at an average of just 0.23%, according to Bankrate), some mid-size and smaller banks have made changes more in line with the Fed’s moves.

Online banks in particular — which save money by not having brick-and-mortar branches and associated expenses — are now offering savings accounts with annual percentage yields of between 3% and 4%, or even higher, as well as 4% or higher on one-year Certificates of Deposit (CDs). Some promotional rates can reach as high as 5%.

WILL THIS AFFECT HOME OWNERSHIP?

Last week, mortgage buyer Freddie Mac reported that the average rate on the benchmark 30-year mortgage edged up to 6.43% from 6.39% the week prior. A year ago, the average rate was lower: 5.10%. Higher rates can add hundreds of dollars a month to mortgage payments.

Rates for 30-year mortgages usually track the moves in the 10-year Treasury yield. Rates can also be influenced by investors’ expectations for future inflation, global demand for U.S. Treasuries and what the Fed does.

Most mortgages last for decades, so if you already have a mortgage, you won’t be impacted. But if you’re looking to buy and already paying more for food, gas and other necessities, a higher mortgage rate could put home ownership out of reach.

WHAT IF I WANT TO BUY A CAR?

With shortages of computer chips and other parts easing, automakers are producing more vehicles. Many are even reducing prices or offering limited discounts. But rising loan rates and lower used-vehicle tradein values have erased much of the savings on monthly payments. Since the Fed began raising rates in March 2022, the average new-vehicle loan rate has jumped from 4.5% to 7%, according to Edmunds data. Used vehicle loans dropped slightly to 11.1%. Loan durations average around 70 months — nearly six years — for new and used vehicles.

PUBLIC NOTICE

INTENT TO CHANGE NAME BY DEED POLL

The Public is hereby advised that I, BRICE THOMAS HINSEY of Highbury Park, Nassau, Bahamas, intend to change my name to KIRKWOOD SAMUEL BRICE THOMAS HINSEY If there are any objections to this change of name by Deed Poll, you may write such objections to the Chief Passport Officer, P.O.Box N-742, Nassau, Bahamas no later than thirty (30) days after the date of publication of this notice.

PAGE 12, Thursday, May 4, 2023 THE TRIBUNE

HOW A FED INCREASE COULD AFFECT CREDIT CARD DEBT, AUTO

LOANS

COLOMBIA’S PETRO URGES SPAIN TO LEAD EU ON CLIMATE CHANGE

By RAQUEL REDONDO AND JOSEPH WILSON

Associated Press

COLOMBIAN President

Gustavo Petro began a state visit to Spain on Wednesday to seek support for his peace plan for the South American country while urging for greater action against climate change from Europe.

King Felipe VI and Queen Letizia greeted Petro and his wife in Madrid, where they will later attend a state dinner hosted by the Spanish royals.

Prime Minister Pedro Sánchez, Spain's Socialist leader, is a backer of Petro, an ex-rebel who became Colombia's first leftist president last year.

One of the main topics on his agenda is his peace process with the National Liberation Army (ELN), a communist-inspired guerrilla organization still active after the dissolution of FARC, a group which spent decades pursuing rebellion.

Colombia's government and the ELN started talks in November, shortly after Petro was elected president. Petro has called the talks a cornerstone of his effort to resolve a conflict that dates back to the 1960s.

Last week, ELN militants killed nine Colombian soldiers in an attack, complicating efforts by Petro to negotiate a lasting peace.

The Colombian leader seeks Spain's full support for his plan, which he will likely explicitly obtain from Sánchez, according to reports from high-ranked officials in the European country.

Starting in July, Spain is set to hold the European Union's rotating presidency, a six-month period in which Madrid aims to revitalize Europe's relations with Latin America. That includes plans by Spain to hold a summit between Latin America and the EU in the early days of its presidency.

Petro, 63, started his speech before the joint session of parliament by recalling the importance of his early reading of Don Quijote and the role of Spain in Colombia's cultural imagination, but he quickly moved on to warning of what he called the existential threat to humanity posed by global climate change.

The environmental message was timely for Spain's lawmakers, who are managing a prolonged drought after a record-hot 2022.