• ‘Free for all’ threat to public space is slammed

• ‘Greedy business community’ hit on billboards

• Ad signage leaves Nassau ‘like garbage can’

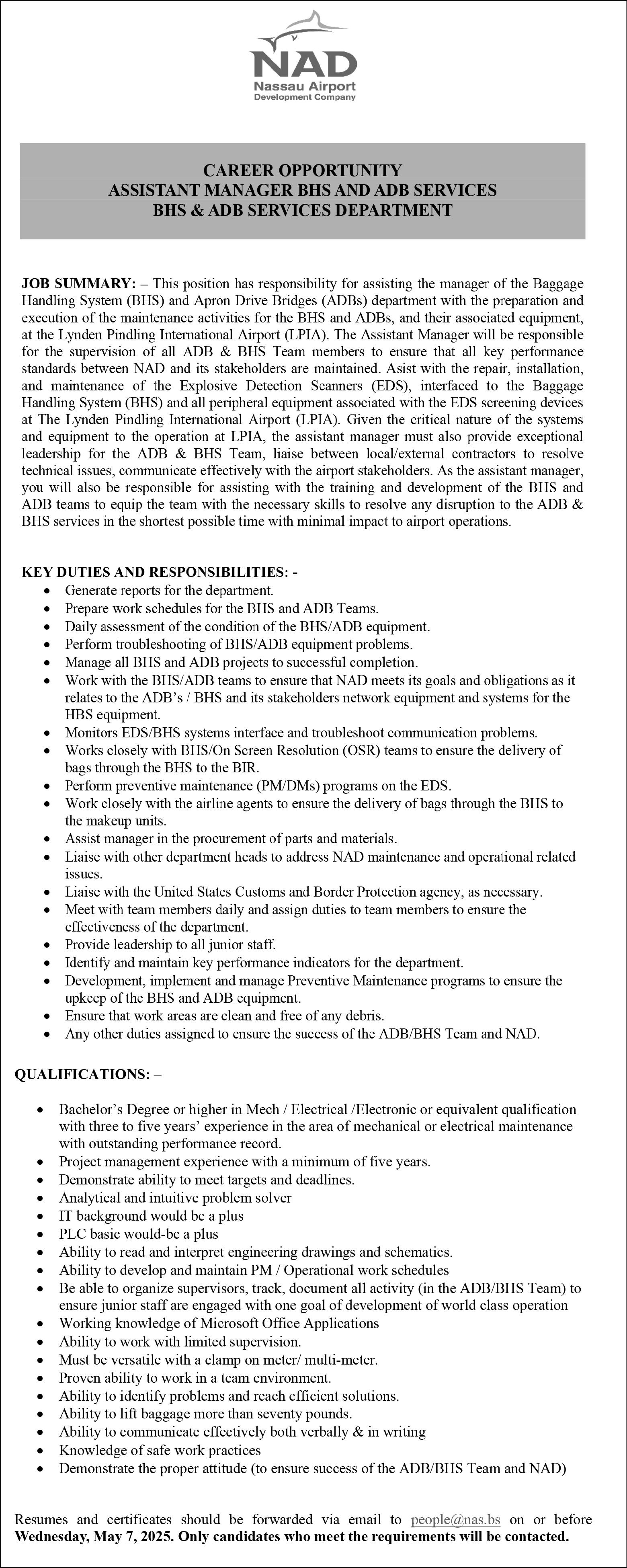

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

RESIDENTS and politicians alike are slamming as “absolutely crazy” the excessive commercial exploitation at one of the few waterfront New Providence sites dedicated for Bahamians and their families to enjoy.

Loretta Butler-Turner, who helped drive Fort Montagu Park’s

restoration and clean-up when she was the area’s MP between 2007 and 2012, told Tribune Business the location has now become “a free for all” for multiple commercial uses which is threatening “to defeat the purpose of all the work done” with persons “abusing it and doing whatever they want”.

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

SARKIS Izmirlian is alleging that the US unit of Baha Mar’s contractor booked $96m in debt owed to subsidiaries and affiliates “under a line item for country club memberships”.

The multi-billion dollar Cable Beach resort complex’s original developer, in legal filings with the US federal bankruptcy court in New Jersey, asserted that this and other recent discoveries underscore why the probe into CCA Construction Inc - one of three entities found liable to pay his $1.7bn fraud and breach

of contract award - by an “independent examiner” is so urgently needed. That “examiner”, whose appointment has already been approved by the New

By NEIL HARTNELL Tribune Business Editor

HOTEL workers are being urged “don’t panic” amid fears that Donald Trump’s tariff policies will still spark a major tourism and economic slowdown despite the ‘90-day pause’ imposed by the US president.

Darrin Woods, the Bahamas Hotel, Catering and Allied Workers Union’s (BHCAWU) president, told Tribune Business that members are being advised to exercise prudence in their spending habits so that they have some savings to fall back on should any negative fall-out be felt during the 2025 second half. With some workers said to have enjoyed “notable increases in their take home pay”, after the gratuity increases contained in the union’s latest industrial agreement started to take effect during the recent peak winter tourism season,

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

A CABINET minister has blasted a governmentowned bank for cutting branch hours in his constituency and further pushing Family Island communities “down this path of neglect”.

Leon Lundy, hitting out in his capacity as South and Central Andros MP, said Bank of The Bahamas’ decision to slash operating hours at its Kemp’s Bay branch to just one day per week - while leaving its Mangrove Cay location open four days per week - makes no obvious sense given that the former serves the larger population.

And Mr Lundy, who is minister of state in the Prime Minister’s Office, in urging Bank of The Bahamas’ Board and management to “rethink” the move also called for this nation to adopt a new banking “model” based on greater competition. This would involve permitting more Bahamians with the capability to do so to obtain a commercial banking licence.

Neil Strachan, Bank of The Bahamas’ managing director, in a messaged reply to Tribune Business

Describing the move by Bank of The Bahamas, which is 84 percent majority-owned by the Government via a combination of the Public Treasury and National Insurance Board (NIB), as a “disservice” to Bahamians still reliant on branch banking, he added that it was another example of how Family Islands and their communities are “treated as an afterthought” by the commercial banking sector and others.

hen build-

Wing your company’s cyber security or risk management programme, the debate between NIST and ISO frameworks quickly becomes unavoidable. Both offer valuable guidance but differ sharply in design, application and business outcomes. This article examines both frameworks, clearly outlines their differences, and provides a guide to decision-making.

Understanding NIST

The National Institute of Standards and Technology (NIST) frameworks are US-developed standards that guide companies in managing cyber security risks. Chief among them is the NIST Cyber security Framework (CSF), built around five core functions: Identify, Protect, Detect, Respond and Recover. NIST’s strength lies in its flexibility. It does not prescribe a rigid model. Instead, it enables you

to tailor practices to your specific size, sector and maturity level. The framework delves deeply into cyber security controls, providing detailed and actionable guidance. Although NIST was originally developed for US federal agencies and critical infrastructure sectors, its practical approach has driven widespread global adoption. While its primary focus remains on cyber security, it can also support broader enterprise risk

management when applied strategically.

If you need a framework that you can shape around your specific needs without formal certification, NIST provides a strong foundation.

Understanding ISO

In contrast, the International Organisation for Standardisation (ISO) offers globally-recognised management standards across industries, with ISO/ IEC 27001 leading the field for information security management systems (ISMS).

ISO 27001 is designed for formal adoption and implementation. Organisations implement it not just to improve security but to achieve third-party certification. Certification signals to clients, partners and regulators that your business adheres to a structured, internationally recognised approach to protecting information. ISO demands clear governance. Management commitment, structured risk assessments, continual improvement and documented policies are all mandatory.

If your business operates internationally or seeks to compete globally, ISO 27001 certification can be a significant differentiator.

NIST versus ISO: The core differences

Several key differences stand out when comparing the NIST and ISO frameworks. NIST serves as a flexible guide. It provides a detailed road map for managing cyber security risks, while leaving implementation decisions to your discretion.

It suits companies seeking adaptable tools without the overhead of formal certification.

ISO, however, demands discipline. It requires structured processes, formal governance and documented proof of security practices. Certification under ISO 27001 signals a higher level of maturity, especially valued by multinational clients and regulators.

Where NIST excels in operational cyber security, ISO aligns more closely with corporate governance and continuous improvement.

Making the right choice

Choosing between NIST and ISO is not just a technical decision; it is a strategic one. If your goal is to build a cyber security programme that fits your risk profile, operational realities and regulatory requirements without certification, NIST offers a strong, flexible starting point.

However, if you need a globally recognised certification - something that strengthens relationships with international partners and satisfies rigorous client demands - then ISO 27001 is the path forward.

In practice, many companies blend both. They use NIST as an operational guide and pursue ISO 27001 certification as a strategic objective. In The Bahamas, the Central Bank of the Bahamas noted in a 2021 communication to its regulated entities: “There are no mandated cyber security frameworks in place.”

Derek Smith By

Ultimately, there is no universal answer to the question of whether to use the NIST or ISO framework. Your choice depends on your objectives, the regulatory environment and the level of assurance required by stakeholders. Both frameworks offer strong, structured approaches to managing security risks. You need to decide which one aligns with your company’s ambitions.

• NB: About Derek Smith Jr Derek Smith Jr has been a governance, risk and compliance professional for more than 20 years with a leadership, innovation and mentorship record. He is the author of ‘The Compliance Blueprint’. Mr Smith is a certified antimoney laundering specialist (CAMS) and holds multiple governance credentials. He can be contacted at hello@ pineapplebusinessconsultancy.com

The Central Bank added: “However, the bank references the following frameworks - NIST, CIS, OWASP and ISO 27001- in establishing its security baseline.”

The Tribune wants to hear from people who are making news in their neighbourhoods. Perhaps you are raising funds for a good cause, campaigning for improvements in the area or have won an award. If so, call us on 322-1986 and share your story.

By FAY SIMMONS Tribune

THE Bahamas Taxi Cab Union’s president is asserting that his members and the wider industry are “under siege” by individuals operating illegal rideshare services.

Tyrone Butler told Tribune Business that while the concerns surrounding unauthorised drivers, or hackers, are not new, the issue has grown in recent years and reports have been filed about rogue drivers attempting to attract passengers in tourist zones such as Lynden Pindling International Airport (LPIA) and the Nassau Cruise Port.

He added that only authorized agents are allowed to charge

passengers fares, and they must have the appropriate liability insurance in case of an accident. “The taxi industry is under siege right now with so many people encroaching on the landscape,” Mr Butler charged.

“In The Bahamas, the only persons that are authorised to take persons for a fare is a public service vehicle. Whether that be a private schedule or taxi or livery, or one of the authorised private franchises because their insurances carry a different liability than a private citizen, and so the liability on these public service vehicles is totally different.

“Here in The Bahamas, if somebody’s taking you in their own private car, they are totally responsible. So, it’s wrong for persons to put the motoring public at risk

like that, and the motoring public should know that they’re taking a chance by riding and paying somebody for a ride and they’re not covered by liability insurance.”

Mr Butler noted that unauthorised rideshares can also pose a risk to The Bahamas’ tourism industry as they are providing services to visitors but have no oversight. “Servicing the local market is one thing, but when you’re taking passengers from places like the cruise port, the airport, especially persons who are just visiting the country, that could be a very dangerous thing,” he added.

“Since our country’s economy turns on tourism, I am very concerned about persons booking those online transportations and not understanding that they

AML Foods says it has redeployed all 129 employees impacted by the blaze that destroyed its Cost Right Nassau and Solomon’s Old Trail stores at its other New Providence outlets.

The BISX-listed food retail and franchise group, in a statement, reaffirmed that two weeks after the fire there has been “no loss of jobs” as a result while it makes progress on restoring Cost Right’s e-commerce operations and product selection for Nassau-based members.

Renea Bastian, AML Foods’ vice-president of marketing and communications, said in a statement: “We’re proud to report that there has been no loss of jobs, and every team member affected has been welcomed into new roles within the company.

“We are incredibly grateful to our employees for their resilience, and to our community for their ongoing support. From day one, our top priority was to take care of our people, and we’re proud to have delivered on that commitment.”

Acknowledging the impact on customers who have long depended on the Solomon’s Old Trail and Cost Right locations, Ms Bastian added: “We know this loss has affected many in our community, and we want to reassure our customers that we’re still here for them.

“We invite everyone to shop at Solomon’s Yamacraw, where you’ll find the same great value, wide assortment and friendly service you’ve come to expect from Solomon’s Old Trail.” To further support Cost Right members, AML

Foods said it has begun integrating the most popular Club items into the product mix at Solomon’s Yamacraw. Select meat club packs are already available, with additional products to be introduced in the coming weeks.

Efforts are also underway to restore Cost Right’s e-commerce operations.

“We are actively exploring several warehouse space options that would support online order fulfillment - and potentially in-store purchases - in the near future,” Ms Bastian said. She added that AML Foods is also close to enabling online orders to Nassau through Cost Right Freeport.

don’t have reliability when they get into these private vehicles.”

The new union president said the transportation market has become “lucrative” for many of the new taxi drivers, and the union is working on its website so passengers can book and pay for their rides in advance.

“With the introduction of an additional 700 new taxis, some drivers are now finding the local market a bit more lucrative than the traditional hotels and airport. Our new administration has been looking at this, and we’re exploring some new possibilities once we’re able to get our house in order, perhaps going to

an online system once we get our website set up so you can buy transportation in advance,” said Mr Butler.

“We recognise that the local market is a big market, and we’re not closing our minds to it, because we believe we have the vehicles and we have the personnel.

We’re all the new drivers to service that market, and it’s something that we will be going after. We are public service drivers, and as we have a responsibility to the public, and we will honour that commitment.”

Mr Butler added that taxi fares are set by the Government, and a “review and revamp” of the pricing system is also required to change the public’s

perception that taxis have high rates.

“Taxi drivers have fares that are fixed by the Government. I think the pricing system needs a total review and a revamp. As the new president, I would like to have a look at the pricing system and see if we can go to a more simple pricing system, but the general public has this perception that taxi drivers are outrageous with their pricing,” he said.

Mr Butler added that the union is prepared to work with the Government to “clean up” the taxi cab industry, which he feels has been neglected for quite

This newspaper can confirm that last week’s advisory and video by the Beaches and Parks Authority, warning that “unauthorised and excessive” billboard signage will be removed to reduce “visual pollution” across New Providence, came around two weeks after Mrs Butler-Turner met with McKell Bonaby, its executive chairman, to detail the concerns she and multiple residents have over Montagu Park’s deterioration.

The situation sparked a Change.org petition, which has already obtained more than 400 signatures, and was launched by Bruce Raine, founder of International Private Banking Systems (IPBS), the Bahamas-based financial services software developer, in a bid to pressure the businesses who have erected multiple billboards at Montagu Beach to “smarten up.... and take the damned things down”.

“The Bahamas has been blessed by God with one of the most beautiful seascapes in the world, yet our greedy business community would prefer the island’s commuting public not to look at the seascape with all

of its beauty and soul-setting tranquility, and instead gaze into their mismash of disparate signs promoting an equal mishmash of product offerings,” the Change. org petition blasted.

“But the public can fight back, and this petition is to ask that you take note of the business establishments that jam these gaudy signs right in your face and determine to boycott them by not buying any of their products. They will smarten up, one can hope, and take the damned things down.”

Besides the excessive billboard advertising, preventing motorists and their passengers enjoying views out over Montagu Bay, other concerns relating to the area’s increased use and commercial exploitation at the expense of the public’s interest and enjoyment have also been voiced. They include:

* The presence of multiple restaurant, food and drink, and souvenir vendors at a location supposed to have been set aside for the quiet enjoyment of Bahamians, their families and visitors. When Tribune Business visited yesterday, the generator supplying one of the restaurants located at the western end near Fort Montagu was humming

away supplying it with electricity

At least three different vendors, selling what appeared to be a range of souveniurs, were starting to pack up and remove their tents and coverings. Mrs Butler-Turner, Mr Raine and others have questioned whether they have permission from the Parks and Beaches Authority to be there, or any other government agency, and if they possess the necessary permits such as Business Licences and food handling.

* Other issues involve the use of the public dock by tour and excursion boats and other commercial operators. Mr Raine and Adrian White, the St Anne’s MP, told Tribune Business that commercial vessels are frequently pulling up to the dock to embark and disembark visitors, who are taken on harbour tours or to nearby cays such as Athol Island and Rose Island.

Besides gaining what is effectively a free ride at Bahamian taxpayer expense, given there is no indication they are paying to use the dock, Mr Raine said it is also interfering with the public’s enjoyment of Fort Montagu Park. This newspaper has seen photos of traffic congestion, with

the park’s eastern entrance almost completely blocked, by multiple buses dropping off visitors to the boats.

The IPBS founder, and petition organiser, also asserted that the Bahamian public is being left with little to no parking spaces at Fort Montagu Park because these are all being taken up by the crew and destination staff who serve these boats, with many vehicles parked there from 7am and their owners not returning to reclaim them until 7pm.

Mr Bonaby, when contacted by Tribune Business yesterday, asked this newspaper to send him a list of detailed questions on the Authority’s billboard signage removal and clean-up campaign at Fort Montagu Park and elsewhere throughout New Providence.

This newspaper complied, but no response was received before press time last night, so it could not be determined which billboards had been erected legally and are either paying rent or a fee to the Authority for their presence. However, even if all were legitimately there, their number appears excessive as they almost completely obstruct views of the water from the road.

When Tribune Business visited the site yesterday, billboards present ranged from those advertising consumer goods such as Heineken beer to promotions for the likes of Aliv, real estate companies and realtors, RF Bank & Trust, and the Windsor Lakes residential development being constructed on the other side of the island in southwestern New Providence. Mrs Butler-Turner, though, in an interview with Tribune Business confirmed she had brought Fort Montagu Park’s condition and the concerns of residents to Mr Bonaby’s attention when they met two to three weeks ago. “He said to me at the time that he was just finishing up some other stuff, and I should give him about a month,” she recalled.

“I haven’t seen anything removed yet, so I’m hoping they proceed with that matter quickly. It’s crazy. It’s absolutely crazy. This is not the purpose of that space.” Remembering how the area “was in really poor condition” during the last

Ingraham administration’s

term in office, when she was both a Cabinet minister and MP, Mrs Butler-Turner said she helped assemble a group of “like-minded persons” to transform it. They included thenAtlantis owner Kerzner International plus the Higgs & Johnson law firm and other major Bahamian corporate names. Mrs Butler-Turner said the late Sir Sol Kerzner, the Atlantis founder and visionary, personally donated $2.5m to fund the Montagu Beach restoration.

“It was an amazing job and so beautiful,” she said. “But it’s just a free for all now. It’s really an eyesore, and you have tour boats using the dock. Let me tell you: We are going to defeat the purpose of all that work we had done in 2011 and 2012. It’s become neglected. People are throwing up all types [of construction]. I counted about three restaurants, food vendors....

“I compiled everything. I have the photos of the boats, the vessels, everything, and when I met with Mr Bonaby I gave him the whole package. I said to him the signage has definitely got to go. I don’t know about those businesses; who has licensed them, who has given them authority to be there. We have Potter’s Cay, we have the official fish market [at Montagu]. I don’t know anyone else who should have a licence to be there.

“It looks like everything is out of control,” Mrs Butler-Turner said. “It’s not supposed to be a marketplace. It’s supposed to be a green space. Could you imagine us going to Central Park in New York and having all that stuff over the place?

“I must commend Mr Bonaby. He does seem to be on it. I don’t know how far it’s going to go. I believe that we need to have a voice from higher up to say this is not acceptable and not just mine.” Mrs ButlerTurner also challenged why businesses were continuing to erect billboard signs to advertise their products and services when they could instead make easier - and better - use of social media.

Mr Raine, too, argued that the proliferation of billboards similar to those presently at Fort Montagu Park is damaging New Providence’s appearance. “It’s the whole of the island,” he told Tribune Business. “The island, it

looks like a garbage can and it is a garbage can. I hope they do a clean sweep of the island and it never comes back up.”

Mr White, the Opposition MP for St Anne’s, told this newspaper that Fort Montagu Park looks more like Junkanoo Beach than the green space enjoyed by Bahamian families and visitors alike that it was intended to be. “Montagu Park is one of the few true open spaces on the waterfront with public access for Bahamians to enjoy,” he said.

“The primary concern is the over-commercialisation of Montagu Park, one, through the excessive display blocking the scenic view over East Bay Street by advertising from every type of commercial entity - even from real estate entities encouraging people to move west for better living, which is a complete insult for people who live in the east and have made it a pleasant community,” he argued.

“We need to think of Bahamians more than we think of the books sometimes and definitely, in a limited and congested island like New Providence, preserve, protect and revere the very few green spaces along the waterfront for Bahamians to enjoy peacefully with their families.”

The Beaches and Parks Authority, in its statement, said: “We’ve entered phase one of removing unauthorised and excessive billboard signage across New Providence, a key step in our fight against visual pollution. This effort was implemented by our executive chairman, McKell Bonaby, to bring structure to billboard advertising, reduce clutter in high traffic areas and revamp our beautiful island.”

The removal efforts began at Montagu Beach Park. Business owners were advised that unauthorised signs will be removed and stored at the Authority’s head office, where they will be made available for collection.

“We are about to start our phase one removal of billboards process. This will combat visual pollution in New Providence. Business owners are advised to take note of these upcoming changes. All removed signs will be stored and available for collection at our head office on Fire Trail Road west,” said the Beaches and Park Authority.

A BAHAMIAN security firm and its Caribbean affiliate last week hosted a transport security training course at the Soldier Road campus of CyberTech Career College.

Preventative Measures, and the Caribbean Safe and Secure Academy, trained 15 drivers from some of The Bahamas’ top executive transportation providers during a one-day workshop that focused on safety, client protection and executivelevel service delivery.

The training was designed to help drivers better protect high-profile clients, such as government officials, corporate executives and celebrity guests, while maintaining the highest standards of professionalism and discretion.

The five key topics covered were security awareness and threat recognition; vehicle and road safety for executive transport; professionalism and confidentiality; emergency readiness and response; and law enforce-

ment and security team co-ordination. “This course reinforces that the job of a professional driver is not simply transportation; it’s protection,” said Gamal Newry, president of Preventative Measures. “Through training like this, we’re raising the standard of safety, service and preparedness across the Caribbean.”

Participating professionals included Geoffrey Deveaux, Plus One Luxury Services; Kurt Major, Kurt’s Limo Services; Geré Stubbs, Plus One Luxury Services; Steven Bain, Steven H. Bain Transportation Services; Ken Henfield, Ken’s Limo Services; Shandy Higgs, S&C Transportation; Eleanor Maycock, Top Tier Luxury; Chavan Robinson, Robinson’s VIP Service; Patrice Robinson, Robinson’s VIP Service; Maxwell McNeil, M & M Concierge Services; Jackson Russell, Prestige VIP Limousine Services; Eric Smith, Dream Limo Concierge; Vincent Smith, Dream Limo Concierge; and Lamont

Feast, BAS executive transportation. Geoffrey Deveaux, of Plus One Luxury Services, said: “Our group is constantly working to improve the delivery of professional service. When transporting high-end individuals, security and safety are always key considerations. This training helps improve our awareness and sensitivity to those needs.”

Jersey federal bankruptcy court, is effectively an arm of the US Justice Department and will begin work tomorrow to investigate the business affairs of Baha Mar’s main contractor. Mr Izmirlian and his BML Properties vehicle, in their latest submissions, suggested there is much to probe including a “senior executive” using corporate funds for personal purchases.

“The need for a thorough independent investigation is underscored by facts uncovered since the commencement of this case, which strongly suggest that CCA’s misconduct remains ongoing even after the events that led to the New York judgment,” they argued.

“That trial court found that the self-serving assertions of CCA’s witnesses were not credible and were contradicted by the contemporaneous documents that BML Properties fought CCA to obtain in discovery, all of which led to extensive findings of fraud, diversion of corporate assets, misuse of corporate assets for personal purposes and repeated fraudulent statements.

“The limited discovery that BML Properties has taken or attempted to take to date, and the limited responses received, are sufficient to reveal that.. CCA experienced deepening insolvency for the better part of the last decade while, at the same time, continuing to incur hundreds of millions in purported ‘loans’ from CSCEC Holding that

are undocumented and have rarely been repaid”.

CSCEC stands for China State Construction and Engineering Corporation, which is CCA’s ultimate parent and partially listed on the Shanghai Stock Exchange. CSCEC Holding is one of the parent entities upstream from CCA Construction, the US entity currently in Chapter 11 bankruptcy protection in the US.

“At least one highranking CCA executive potentially used corporate funds to make tens of thousands in personal purchases during the litigation and leading up to the [Chapter 11] petition date, as revealed in recent thirdparty productions,” Mr Izmirlian and BML Properties alleged. The Chapter 11 petition date was during

the 2024 Christmas holiday period.

“What’s more, CCA’s own disclosures further raise numerous questions that need to be investigated, including why CCA has incurred more than $96m of apparent outstanding inter-company debt to its subsidiaries and affiliateswhich it scheduled under a line item for country club memberships - while it was most likely insolvent,” they added.

Then there was “CCA’s relationship to its sureties and the fact that the approximately $700m surety bond obligations could be partially or wholly cross-collateralised and back-stopped by CSCEC Holding and CCA’s ultimate parent in China through their indemnity agreements with the sureties, which was glossed over in CCA’s initial filings but elicited through discovery”.

Mr Izmirlian and BML Properties also challenged how “CCA claims to be a holding company that does not know the value of its equity interests in subsidiaries and generates no cash flow” in legal filings challenging the hiring of a US law firm to assist CCA Construction’s bankruptcy committee.

Noting that the appointment was made the very next day after the New York appeals court upheld his $1.7bn damages award, Mr Izmirlian said this appeared to be an effort to “duplicate” the independent

examiner’s probe and amounted to a waste of CCA’s remaining resources.

“The court has already granted BML Properties’ motion for an examiner, and now that the New York appellate division has affirmed BML Properties’ judgment against CCA, the US Trustee’s Office has commenced the process of selecting and appointing one,” he added.

“BML Properties agrees that an investigation is necessary. Indeed, BML Properties is the estate’s largest creditor by orders of magnitude and would be the primary beneficiary of that investigation. But BML Properties objects to the retention of Duane Morris for that purpose in light of the forthcoming examiner.

“The important work of an independent examiner cannot be substituted by, and estate resources should not be diverted to, a separate and duplicative investigation organised behind closed doors by CCA and its sole shareholder CSCEC Holding Company. BML Properties understands that the US Trustee has been diligently interviewing several wellqualified candidates and will appoint an examiner by the April 29 deadline.”

Mr Izmirlian described the Chapter 11 case as “predominantly a two-party dispute between BML Properties and CCA, and BML Properties has both a significant interest in any investigation and a proven

‘under siege’, asserts union president

some time, and individuals have taken advantage of the “chaos” to operate unauthorised rideshares.

track record of ferreting out misconduct by CCA, as shown by the New York judgment for liability that CCA apparently still refuses to accept”.

The only involvement that CCA and its parent will have in the independent examiner process is “to determine the scope and budget for the examiner’s investigation”. Mr Izmirlian had urged that an examiner be appointed to probe CCA Construction’s pre-Chapter 11 bankruptcy protection dealings with other CCA affiliates for alleged “fraud, dishonesty, incompetence, misconduct, mismanagement” or other irregularities.

He and his BML Properties vehicle, in filings with the New Jersey federal bankruptcy court, argued that the examiner’s appointment was justified because CCA Construction Inc has shown “clear bias” against themselves even though the damages awarded against the Chinese stateowned contractor makes Mr Izmirlian its largest creditor by far. With no official creditors committee likely to be appointed, and China Construction Inc purportedly “stonewalling” Mr Izmirlian’s information requests following its December 22, 2024, filing for Chapter 11 bankruptcy protection, Baha Mar’s original developer argued that appointing an independent examiner would be the best way to protect all creditors given the contractor’s “history of serious - and already proven - fraud claims”.

“The Road Traffic Department is a department that the Government needs to place more emphasis on because they have dropped the ball over many years and allowed this taxi industry to just run on its own. They’re partly responsible for the mess and the chaos that you see with these rideshares because this is not a new phenomenon. This has been around for years now, but it just continued to grow because nobody was paying attention to it,” said Mr Butler.

“The industry is a mess, and it is no fault of the drivers. It’s really a fault in the

authorities allowing any number of persons to access the system through false pretences, whether it’s persons who may have some court matters, some violations of law, drugs, persons who may not have legal standing in the country.

“Any number of things you can find. Persons who are not entitled to be in the business may be in the taxi business, and that’s a challenge, not only for us in the Bahamas Taxi Cab Union, but also for the Government.”

The Ministry of Energy and Transport issued a statement on Friday advising the public that it is illegal to offer rideshare services.

“The Road Traffic Department is the only legal agency that can issue grants for the purpose of transportation for hire or reward. Members of the public are advised that it is illegal to offer uber or rideshare services to the public using private vehicles. Further, the Department is strongly warning the public that this practice is unsafe and dangerous,” said the statement. Taxi drivers

he said the BHCAWU and its members are hoping The Bahamas will fare relatively well from a “double edged sword” effect if the worstcase Trump tariff scenario materialises.

Given that persons tend to stay closer to home during times of economic upheaval and uncertainty, Mr Woods told this newspaper healong with the rest of the tourism industry - is hoping that The Bahamas’ proximity to its largest visitor source market in the US will help to minimise any negative impacts associated with a decline in demand for this country’s largest industry.

Mr Trump has temporarily halted the biggest tariff hikes, with the notable exception of China, on all other countries’ imports to the US until early July to see if they will seek free trade deals with his administration. This has delayed, but not yet eliminated, the negative consequences of the tariffs that have been predicted by many economists, and the uncertainty together

with the impact on business and consumer confidence lingers.

Mr Woods, though, said union members and all hotel workers “for the most part fared very well” in terms of take-home pay and gratuities during the peak winter tourism season that ended with the recent holiday weekend. They, as well as their employers, benefited from an extended winter season that ended in late April this year as opposed to the earlier 2024 close when Easter fell at end-March.

“For the hospitality workers, the hotel workers, they enjoyed pretty much full weeks and enjoyed the fruits of some of the new gratuity structure. They fared pretty well,” the union president told Tribune Business. Mr Woods added that not all workers would have felt the new gratuity structure’s benefits, either in full or at all, because of how it was introduced under the new industrial agreement’s terms.

The old gratuity rate, formula and structure still applies to visitors who

booked their Bahamas vacation prior to the new industrial agreement’s signing and member resorts, such as Atlantis, adjusting their guest pricing accordingly. This prevented already-booked guests from being hit with an unexpected increase in their vacation costs.

“It [the new gratuity structure] officially kicked-in in its totality on April 1 this year,” Mr Woods explained. “It was in specific spots. Persons who booked prior to the agreement were locked in at the earlier rate. The impact is really difficult to say. Right now, we have not actually done comparisons at this point in time.

“It’s something we want to do as a result of the new industrial agreement, and being able to say this is the value of it. But, based on what the workers are saying, they would have seen an increase in their take home pay on a week-on-week basis but we have to do the actual comparisons. We got some reports saying they were seeing a notable

increase in their take home pay.

“I can’t say the exact percentage by what the gratuity was increased. For some areas, like the restaurants, we actually put in a sliding scale similar to when they travel abroad. We have varying scales. We were able to get this in and into other areas.”

Mr Woods, though, conceded that the ongoing global trade, economic and stock market turmoil is “a major concern” for the union, its members and all hotel workers because of the potentially damaging ramifications for global travel and tourism.

“There was also a good bump in Spring Break activity,” he added, “but we’re also heading into the summer and are saying to our people: ‘Be cautious, because after summer you have September, October and November, and a little lull.

“And, where there are tariff wars or any type of war, there’s always going to be a reciprocal or domino

effect in that persons are not sure what’s happening so they tend to stay at home. What we’re hoping for is that, as opposed to the travelling public travelling far, they will come closer based on our proximity.

“We’re hoping it’s a double-edged sword. It cuts one way, and also cuts the other way, and then we become the beneficiaries of them coming this way as opposed to going somewhere else.”

Mr Woods, though, said the union is warning its members to take nothing for granted in uncertain times.

He added that the BHCAWU has already received reports from one island outside New Providence that “some people have cancelled their flights” to the detriment of “a major property”. Although he did not identify the resort, it appeared to be Club Med on San Salvador, as a number of those flights were said to be from Europe and that property caters to the European market.

“For us, one is a concern. That’s one too many,” Mr Woods told Tribune Business. “We are saying to our people don’t panic, but be cautiously careful as to how you dispose of your income.

Try to make cautious purchases. It’s pretty much a wait and see.

“We don’t know what’s happening, and don’t want to alarm anyone or push any panic buttons, but we want to prepare for the worst. If anything happens, you have some income that is already stored up.” Mr Woods, meanwhile, said he and the union plan to also “jump” on plans to develop affordable housing for members with “some government approvals already being worked on. He added that the BHCAWU was targeting between 10-15 home sites, featuring a mixture of single and multi-family properties. “We’re trying to do a two-pronged approach,” Mr Woods disclosed. “We had some land left over from an earlier project. We ran into some challenges so we’re trying to do some other stuff to get sorted out in western New Providence; south-western New Providence.” The increase in takehome pay has made it “a bit easier” for hotel workers to qualify for mortgages, he added, but many need to clean-up and address the multiple existing consumer loans they have outstanding.

inquiries, sent a noteseemingly sent by the bank’s management to its staff - where it asserted it “remains committed” to serving clients in both the Family Islands and New Providence.

However, Bank of The Bahamas conceded that “service and delivery channels may be impacted due to operational matters”, citing South Andros in particular. “The bank

continues to explore ways to meet customer needs while prioritising both efficiency and sustainability,” the BISX-listed institution said.

Yet Mr Lundy, in his capacity as South Andros and Mangrove Cay MP, voiced “deep frustration and disappointment” over changes that Bank of The Bahamas said will take effect from May 5, 2025.

The Kemp’s Bay branch will now only offer “limited services” between 10am and

2pm on Wednesdays to deal with in-branch deposits and withdrawals that exceed the $2,000 automated teller machine (ATM) limit. Mangrove Cay, by contrast, will be open four days per week apart from Wednesday, with Bank of The Bahamas clearly joining its rivals in seeking to drive clients to online banking. “Customers are required to use our convenient and secure digital platforms,” the bank said in unveiling the changes.

Mr Lundy, though, questioned the rationale for the changes given that Kemp’s Bay, whose branch will only be open one day per week, “serves the larger and more populous area of South Andros”. He added: “This disparity highlights a serious disconnect between decision-makers and the realities on the ground.

“This is not just an inconvenience; it is a disservice to the hard-working people of South Andros. Time and time again, we see financial institutions making decisions purely from a business perspective with little to no regard for the real human impact on our island communities.

“Banking is not a luxury; it is an essential service that underpins every day life - from running small businesses to simply being able to access one’s own funds,” Mr Lundy continued. “For too long Family Island communities have been treated as an after-thought.

“This latest move is yet another stark reminder that much of our banking system is Nassau-centric without enough consideration for those who live and work beyond New Providence. I firmly believe the time has come for us to rethink the model.

“We must encourage and open the way for Bahamian individuals and corporations - especially those who truly understand and value life in the Family Islands - to establish financial institutions that genuinely serve and support those communities. Our people deserve better.”

Obtaining a commercial banking licence, though, is no easy task given the

capital and regulatory hurdles that must be overcome to obtain one from the Central Bank of The Bahamas. Such a task has been made much harder in recent decades by the onslaught of global financial services regulations impacting The Bahamas and other international financial centres (IFCs). Still, Mr Lundy urged: “I call upon regulators and private sector leaders to treat this matter with the urgency and seriousness it deserves. South Andros and Mangrove Cay are vibrant, growing communities whose residents deserve the same access to essential services as anyone living in the capital. “We cannot, and we must not, continue down this path of neglect. I ask the decision-makers at the Bank of The Bahamas to rethink this decision.” However, the decline in Family Island physical bank branch locations and service provision is far from a new trend as institutions seek to slash costs, eliminate unprofitable locations and drive their clients to increasingly use digital and electronic banking channels.

John Rolle, the Central Bank’s governor, revealed previously that the number of bank branches in Grand Bahama and the Family Islands shrank by almost 40 percent in the seven years to 2021. Data showed the scale of the commercial banking industry’s retreat from physical presence operations, with branch numbers declining from 86 in 2014 (and 88 in 2008) to just 61 then - a reduction of some 25 locations.

The decline was more pronounced in Grand Bahama and the Family Islands, where there was analmost 40 percent fall-off in bank branch locations from 38 in 2014 to 23 at that time. As for New Providence, bank locations dropped by just over 20 percent or ten over the same period to reach 38.

The branch network shrinkage has largely been driven by the commercial banks - especially those that are Canadian-ownedseeking to exit unprofitable, costly island markets that they deem too small and expensive to maintain amid the push for Bahamians to increasingly use digital banking channels.

Some institutions left Automated Teller Machines (ATMs) as a substitute for physical branch presence, while many residents have also relied on the web shops to transfer monies. Electronic payments providers such as Sun Cash, Omni Financial Services and Island Pay have been eyed as the replacement for physical bank branches, as well as the Bahamian digital dollar, the Sand Dollar, and agency banking. Bank of The Bahamas’ Mr Strachan, meanwhile, told this newspaper yesterday that the temporary closure of Bank of The Bahamas’ Inagua branch with effect from last Friday had been caused by staff shortages. While “several employees are out due to vacation, during their absence several others became ill”, he explained.

The Tribune wants to hear from people who are making news in their neighbourhoods. Perhaps you are raising funds for a good cause, campaigning for improvements in the area or have won an award. If so, call us on 322-1986 and share your story.

By LAURA UNGAR AP Science Writer

EMILY KramerGolinkoff can't get enough oxygen with each breath. Advanced cystic fibrosis makes even simple things like walking or showering arduous and exhausting.

She has the most common fatal genetic disease in the U.S., which afflicts 40,000 Americans. But her case is caused by a rare genetic mutation, so medications that work for 90% of people with cystic fibrosis won't help her.

The same dynamic plays out in other genetic conditions. Stunning advances in genetic science have revealed the subtle, insidious culprits behind these brutal diseases and have started paving the way for treatments. But patients with these exceedingly rare mutations have fewer options and poorer prospects than those with more typical forms of these diseases — and many are now pinning hopes on experimental gene therapies.

"We feel such pure joy for our friends who have been lifted from this sinking ship," said KramerGolinkoff, 40. "But we just feel so eager and desperate to join them. It's really hard to be in this minority of people left behind."

It's not just science that is working against these patients, it's market forces. Drug companies are naturally going to look for medications that target the most common mutations.

"You need a sufficiently large number of patients in a major market in order for a company to be interested in going forward," said Dr. Kiran Musunuru, a University of Pennsylvania gene editing expert. What it amounts to, he says, is "mutational discrimination."

Charities – including a nonprofit Kramer-Golinkoff cofounded called Emily's Entourage – are trying to overcome this barrier. Fundraising efforts have helped jump-start gene therapy that could help patients regardless of mutation. While it likely won't be available for years, "just to have these therapies in trials provides so much hope," Kramer-Golinkoff said.

Current treatments for genetic diseases don't help everyone Kramer-Golinkoff was just six weeks old when she was diagnosed with cystic fibrosis, which causes thick,

sticky mucus to build up in the body.

It occurs when the socalled CFTR protein is not made or not made correctly, allowing chloride to become trapped in cells, meaning water can't keep the cell's surface hydrated. Mucus buildup can lead to damage, blockages and infections in the lungs and other affected organs.

"As I've gotten older … my CF has gotten worse, despite all my best efforts to delay it," Kramer-Golinkoff said.

Before her illness got so bad, she was able to earn a master's degree in bioethics at the University of Pennsylvania, work, travel and spend time with friends. But she eventually developed CF-related diabetes and other problems. She's prone to infections, and since the pandemic has lived with her parents in isolation in Greater Philadelphia. "CF is a real monster of a disease," she said.

Meanwhile, others with the condition have seen vast improvements in their health with "CFTR modulator" therapies that work for people with the most common mutation, correcting the malfunctioning protein. Research shows they dramatically improve lung function, respiratory symptoms and patients' overall quality of life.

Besides not working for people with rare mutations, these treatments are unavailable to patients whose disease-causing mutations aren't known or fully understood. Mutations may be unknown because of a lack of genetic testing in places such as developing nations, or understudied because they are uncommon or difficult to detect.

Genetic testing companies such as GeneDx have made some headway in

screening more people of diverse backgrounds, but inequities remain.

For example, comprehensive data about cystic fibrosis is scarce among African populations –affecting people who live on the continent as well as those who trace their ancestry there. Research shows Black cystic fibrosis patients are more likely than their white counterparts to be among the 10% who don't benefit from modulator therapies.

Can a gene therapy work no matter the mutation?

While there's little chance of changing market dynamics, researchers said, one solution is to develop "mutation agnostic" gene therapies targeting all patients with a disease. This approach is being tried in diseases of the retina as well as cystic fibrosis.

"There's a huge push to develop these therapies," said Dr. Garry Cutting of the Johns Hopkins Cystic Fibrosis Center.

Most of the 14 experimental gene therapies in the pipeline for the disease aim to help patients with any mutation, the Cystic Fibrosis Foundation says, delivering a new, correct version of the CFTR gene to cells. Getting correct copies of the CFTR gene would enable cells to make normal proteins no matter what mutation causes a patient to have no, or not enough, functional CFTR proteins.

One treatment, partially funded by the foundation, is sponsored by Spirovant Sciences, a company Emily's Entourage provided seed money to launch. The first patient received the therapy in November in a 53-week clinical trial at Columbia University that aims to determine if it's safe and how long it stays in the lung.

Associated Press

IOWA'S governor on Friday sued the Des Moines Register over the newspaper's open records request, asking the court to validate her office's withholding of certain emails she claims are protected. A Register reporter submitted a records request in February to Gov. Kim Reynolds' office, according to the complaint. In response, the Republican governor's office provided 825 pages of relevant documents and withheld four emails, asserting they were protected because they were "intended to be confidential, and disclosure would inhibit the governor's ability to receive candid, fulsome, and robust information in the future," according to the office's response included in filings.

An attorney followed up on the Register's behalf last week, according to court

filings, arguing that socalled executive privilege is not an exemption in Iowa's open records law and, even if it was, there was no indication the governor sent or received the emails. The attorney, Susan P. Elgin, called the withholding "legally indefensible" and asked the records be produced in a week's time.

Instead, Iowa Attorney General Brenna Bird sued Friday to ask the court to intervene, as Iowa law allows, and force the Register to halt its pursuit of the records. The Associated Press emailed Elgin Friday requesting comment. The Register's parent company, Gannett Co., said in an email it does not comment on pending litigation.

In a statement, the governor's office said it was unfortunate that public resources would be used to defend the governor's withholding of the records.

"It is in the public's interest that governors can receive candid advice from their closest advisors," said spokesperson Mason Mauro.

In 2023, the Iowa Supreme Court rejected

Reynolds' request that the court throw out a recordsrelated lawsuit filed against her by the liberal-leaning Bleeding Heartland blog, Iowa Capital Dispatch and Iowa Freedom of Information Council, a nonprofit that focuses on open government issues. The organizations and some of their reporters sued accusing Reynolds of violating the state's open records law by ignoring records requests and not producing records in a timely manner. The Register, along with the newspaper's parent company and their former pollster, also is named in a suit filed by President Donald Trump, Rep. Mariannette Miller-Meeks and former Iowa state Sen. Brad Zaun. Accused of misleading voters with an inaccurate poll in the final days of the 2024 campaign, the Des Moines Register has called that lawsuit an affront to constitutional free speech principles.

By MATT SEDENSKY AP National Writer

MICHAEL Montgomery

used to check the balance on his retirement account once a week and smile. But lately, not wanting to get upset and question if he could retire in a few years, there was only one solution.

"I'm not looking," says the 66-year-old professor from Huntington Woods, Michigan.

As the White House simultaneously injects turmoil into financial markets with its trade war and dismisses fears of a downturn, retired and near-retired Americans are anxiously looking on, worried about outliving their savings or having to put off entries on their bucket lists.

Keeping logged off his account has made Montgomery's days less worrisome. He and his wife adjusted their portfolio after Election Day, including moving more money into bonds. But he's not sure what more he can do if the entire world economy can be affected by Washington's decisions.

"I hope like hell I don't lose all my retirement savings," he says. "But where else could you put the money that these people could not disorder? They can't get into your mattress but that's about it."

Many experts warned U.S. stocks were overpriced and due for a correction even before President Donald Trump reclaimed the Oval Office. But a historic blanket of tariffs have injected new uncertainty into the market.

Though stocks rallied this week, the S&P 500 is down 10% from an all-time high reached in February. Losses in the Nasdaq and among small-cap stocks are steeper. Even bonds and the U.S. dollar have been volatile. Many economists are warning of a possible recession.

It has 71-year-old Jeanne Oats Estridge feeling so "paranoid" she called her financial planner with an idea.

"How about we put it all in cash?" Oats Estridge asked.

"I just don't advise it," she heard back.

Oats Estridge, who lives in Dayton, Ohio, retired from a job in software engineering and now writes books, including her latest, on four octogenarian women kidnapped by sex-trafficking aliens. Her account is down more than $40,000 and she gets angry thinking about how some in Washington have reacted to the market volatility, including Trump's recent market assessment that it was "a great time to buy."

"Where am I supposed to come up with the money to buy? My underwear drawer?" Oats Estridge asks.

Earlier this month, the Cboe Volatility Index, considered a "fear gauge" of investor pessimism, reached

its highest level in five years. The index, known as VIX, has since retreated but is still in territory reflecting fearful investors. Another measure of market sentiment, the Cboe S&P 500 Left Tail Volatility Index, which tracks investor worry about so-called "black swan" events such as the 2008 housing crash that spurred the Great Recession, likewise has backed off from highs but remains elevated.

Trump has urged people to "be cool" in assessing the impact of tariffs on their investments. Asked about his own savings earlier this month, he chuckled and replied: "I haven't checked my 401(k)."

Treasury Secretary Scott Bessent, meantime, brushed off the possibility that some might need to delay retiring, saying people "don't look at the day-to-day fluctuations of what's happening."

That seeming nonchalance isn't sitting well with some older investors.

Peter Rost, 72, retired from his software development job last year and planned to start tapping his retirement savings to supplement Social Security. But he doesn't want to bake in his losses.

"I'm looking to take $2,000 and meanwhile the account drops by $30,000," he says.

He's been through serious downturns before, but those were different.

"I had the time to be patient and let it work its way back," says Rost, who lives in New Hartford, Connecticut, "but now I'm retired and I need money from that account."

At his age, he says, there's one goal: "Make sure I don't run out of money before I die."

Americans' retirement savings totaled about $44 trillion at the end of 2024, according to the Investment Company Institute.

The composition of those savings has shifted increasingly toward stocks in the last couple decades as the 401(k) has become employers' typical offering.

Among fund giant Vanguard's nearly 5 million accounts, for example, the average investor puts threequarters of their savings in stocks. Even older investors are still heavily steeped in equities: People 55 to 64 have 64% in stocks at Vanguard; those 65 and older have 49% in stocks.

With that exposure, financial advisers are getting an influx of calls amid the recent market uncertainty.

Tj Binkowski, who runs Narrow Road Financial Planning in Clarksville, Tennessee, says some clients find themselves obsessively checking their accounts and feel the emotional strain of worrying about their money. A downturn, he says, hits an older investor much differently.

"When you're retired, paper losses aren't just on paper anymore," says Binkowski. "You're locking them in every month that you take money out."

Paul Duesterhaus, a 68-year-old retiree from Quincy, Illinois, is passing up an IRA withdrawal this year to avoid selling at a low. Instead, the retired manager at an air compressor manufacturing company will put off buying a new

car as planned and cut back on things like eating out. Still, he can't help but feel bigger impacts of a trade war are ahead.

"I think there's going to be longer lasting effects that are going to affect every American," he says. That angst is more common among older adults than younger people.

An April poll by The Associated Press-NORC Center for Public Affairs Research found just under half of U.S. adults ages 45 and older said their retirement

savings are a "major" source of stress for them right now, compared to about one-third of younger people. Older Americans were also more likely to say they're stressed about the stock market.

For now, many older investors are taking the advice of many experts, to fine-tune investments if necessary but avoid dramatic moves. But it can be hard advice to swallow.

"The more things go up and down, the more nervous you get," says Steve

BEIJING Associated Press

CHINA announced a lower threshold for tax refunds for foreign tourists among a series of policies on Sunday to boost consumption as its economy comes under pressure during a trade war between Beijing and Washington. Travelers can apply for a tax refund if they spend 200 yuan (about $27) at the same store on the same day and meet other requirements starting Saturday, according to a joint statement by the Ministry

of Commerce and other authorities. Previously, the minimum amount was 500 yuan (about $69).

The upper limit for their tax rebate in cash also has been doubled to 20,000 yuan ($2,745).

The government will expand the coverage of tax refund shops and streamline the procedures. Officials encourage some regions to set up refund points for travelers to get rebates immediately after their purchases in areas highly concentrated with tourists, the statement said.

China's Vice Minister of Commerce Sheng Qiuping told reporters in a news conference that inbound tourist consumption accounted for about 0.5% of China's gross domestic product in 2024, while figures in other major countries ranged between 1% and 3%. That indicated a great potential for growth, Sheng said. Last year, inbound tourists' spending hit $94.2 billion, up 77.8%, he added. China's economy expanded at a 5.4% annual pace in January-March, the government said earlier this month, supported by strong

Turner, a 74-year-old from Chesterfield, Missouri, who runs a small public relations business. He now finds himself anxious when he goes to log on to his retirement account, wondering, "Gee, do I want to press the button?"

"You worry that things may work themselves out in the long run, but you don't have as long," says Turner.

"You're not 30, you're not 40, you're not 50, you're not even 60."

exports ahead of U.S. President Donald Trump's rapid increases in tariffs on Chinese products.

But analysts expected the world's second largest economy would slow significantly in the coming months as tariffs as high as 145% on U.S. imports from China take effect. Beijing has hit back at the U.S. with 125% tariffs on American exports, while also stressing its determination to keep its own markets open to trade and investment.

China has stepped up efforts to spur more consumer spending and private sector investment over the past months, doubling down on subsidies for auto and appliance trade-ins and channeling more funding for housing and other cashstrapped industries.

By HYUNG-JIN KIM Associated Press

LEE Jae-myung, a liberal who wants greater economic parity in South Korea and warmer ties with North Korea, became the main opposition party's presidential candidate Sunday, solidifying his position as front-runner to succeed recently ousted conservative President Yoon Suk Yeol. The former Democratic Party chief had led the opposition-controlled parliament's impeachment of Yoon over the imposition of martial law in December. The country's Constitutional Court formally dismissed Yoon earlier this month, prompting an early presidential election on June 3 to find a new president.

In a nationally televised announcement, the Democratic Party announced that Lee won its presidential nomination with nearly 90% of the votes cast during the primary that ended Sunday, defeating two competitors.

"Now, the people and our party colleagues gave me an opportunity to win back the presidency and build a new, real Republic of Korea. Thank you! I'll humbly uphold that ardent, serious task," Lee said in a victory speech. Lee, 60, who served as the governor of South Korea's most populous Gyeonggi province and a mayor of Seongnam city, is the clear favorite to win the election.

In a Gallup Korea poll released on Friday, 38% of respondents chose Lee as their preferred choice, while all other aspirants obtained single-digit ratings. The main conservative People Power Party will nominate its candidate next weekend. Its four presidential hopefuls competing to win the party ticket won a combined 23% of support ratings in the Gallup survey. It will be Lee's third bid to run for president. He lost the 2022 election to Yoon in the narrowest margin in the country's presidential elections. In 2017, Lee ranked third in a Democratic Party primary.

Anti-corruption crusader or populist?

Lee has long established an image as an anti-establishment figure who can eliminate deep-rooted inequality and corruption in South Korea. But his critics view him as a populist who relies on stoking divisions and demonizing opponents and worry his rule would likely further polarize the country.

Lee currently faces five trials for corruption and other criminal charges. If he becomes president, those trials will likely stop as he will enjoy special presidential immunity from most criminal charges. Lee's rise comes as conservatives are struggling to win back public confidence in the wake of Yoon's martial law decree that plunged the country into turmoil. The People Power Party is grappling with internal feuding between senior members defending Yoon's action and reformist members who voted for his impeachment.

"This election is a venue where the people hand down their judgment on Yoon's martial law imposition after the Constitutional Court issued a judicial judgment on it," said Choi Jin, director of the Seoul-based Institute of Presidential Leadership.

"It's subsequently difficult for the People Power Party to win the election if they slide over the martial law issue and fail to apologize."

When Yoon declared martial law and sent troops to the National Assembly, Lee livestreamed as he went to the assembly and urged people to gather there to protect lawmakers from possible arrests. Lee and others managed to enter an assembly hall to vote down Yoon's decree, forcing him to lift it.

Focus on the economy

Lee has recently made few comments that could be portrayed as too radical and has focused on ways to revive the economy, ease economic polarization and overcome a national divide.

"Restoring democracy is the path to national unity. Reviving economic growth is the path to national unity. Narrowing the gaps between us is the path to national unity," Lee said during Sunday's speech.

On foreign policy, Lee has underscored the importance of a trilateral South Korea-U.S.-Japan security partnership. But he's also called for healing badly frayed ties with North Korea, saying peace can drive South Korea's economic growth.

In a recent online talk show, Lee said that he thinks the U.S. would pursue better ties with North Korea as a way to contain China and that such a stance would provide South Korea with diplomatic room to restore ties with the North.

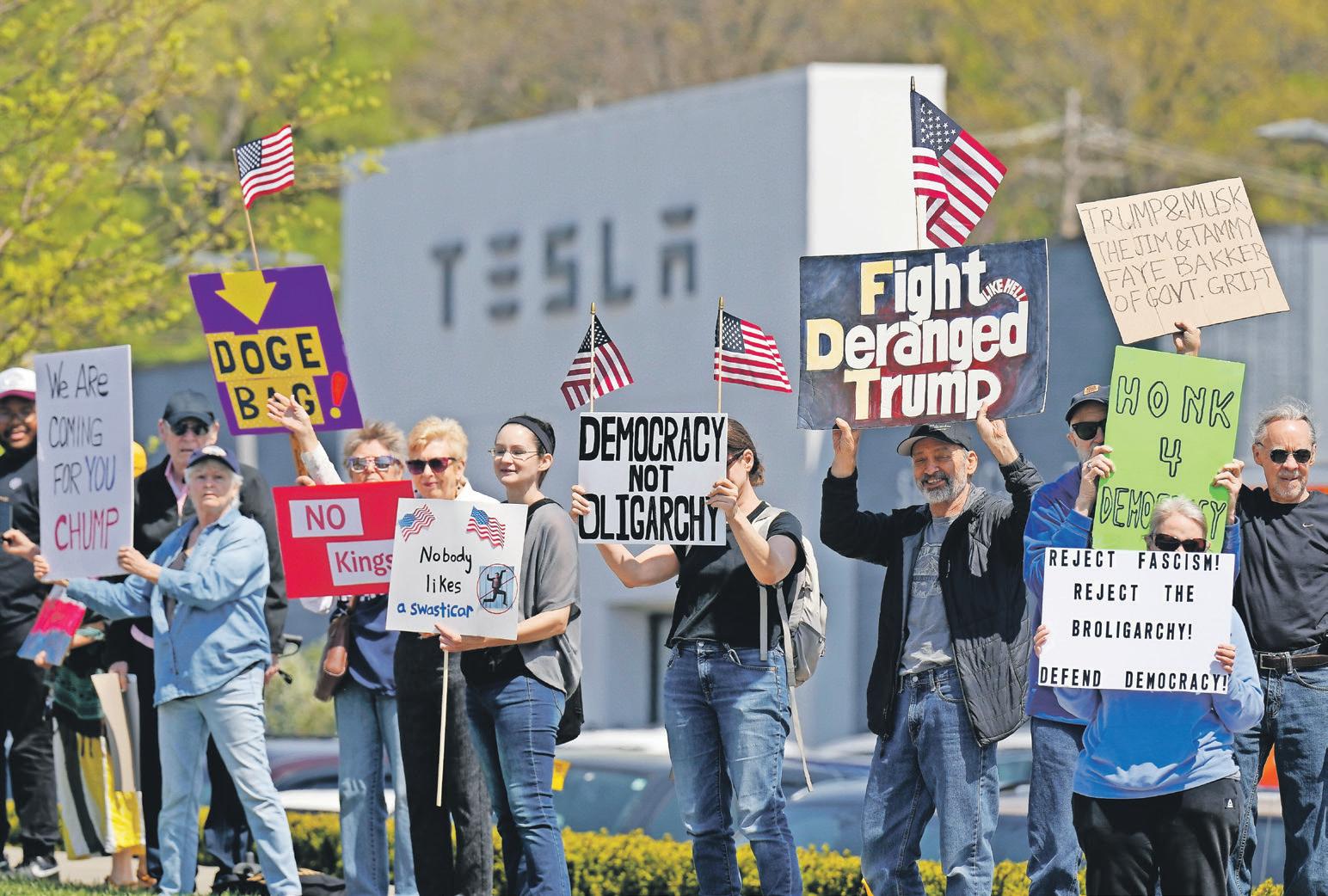

By BERNARD CONDON AP Business Writer

RULE changes announced by the Trump administration this week could allow automakers to report fewer crashes involving self-driving cars, with Tesla potentially emerging as the main beneficiary.

The Transportation Department announced Thursday that it will no longer require automakers to report certain kinds of non-fatal crashes — but the exception will apply only to partial self-driving vehicles using so-called Level 2 systems, the kind Tesla deploys. Tesla CEO Elon Musk had complained the old reporting rules cast his company in a bad light.

If Tesla and other automakers are required to report fewer crashes into a national database, that could make it more difficult for regulators to catch equipment defects and for the public to access information about a company's overall safety, auto industry analysts say. It will also allow Tesla to trumpet a cleaner record to sell more cars.

"This will significantly reduce the number of

crashes reported by Tesla," said auto analyst Sam Abuelsamid at Telemetry Insight. Added Dan Ives of Wedbush Securities, noting that Tesla rival Waymo won't get an exception, "This is a win for Tesla, a loss for Waymo." Tesla stock soared nearly 10% Friday on the rule changes. Wall Street analysts, and Musk critics, have said that Musk's role as an adviser to President Donald Trump could put Tesla in position to benefit from any changes to regulations involving self-driving cars. Other car makers such as Hyundai, Nissan, Subaru and BMW make vehicles with Level 2 systems that help keep cars in lanes, change speed or brake automatically, but Tesla accounts for the vast majority on the road. Vehicles used by Waymo and others with systems that completely take over for the driver, called Automated Driving Systems, will not benefit from the change.

The National Highway Traffic Safety Administration, which enforces vehicle safety standards, said the new rules don't favor one type of self-driving system

over another, and that raft of changes it announced will help all self-driving automakers.

"No ADS company is hurt by these changes," the agency said in statement to The Associated Press, using the acronym for Automatic Driving System. It added that the changes also make sense because "with ADS, no driver is present meaning stronger safety protocols are needed."

Waymo declined to comment for this story. The AP

reached out to Tesla but did not receive a reply. Under the change, any Level 2 crash that is so bad it needs a tow truck to come will no longer be required to be reported if it doesn't result in death or injury or air-bag deployment. But if a tow truck is called for crashes of vehicles using ADS, it has to be reported.

The vast majority of partial self-driving vehicle crashes reported under the old NHTSA rules involved Teslas — more than 800 of a total 1,040 crashes in the

past 12 months, according to an AP review of the data.

It's unclear how many of those Tesla crashes required the vehicles to be towed, because a column requesting that information in the database is mostly blank. The NHTSA said after the story was published that only 8% of total reported crashes under the old criteria were cases in which partial selfdriving vehicles had to be towed away and there was no other qualifying crashreporting factor involved. It is not clear about cases where tow-away information wasn't provided. The relaxed crash rule was part of several changes described by the Transportation Department as a way to "streamline" paperwork and allow U.S. companies to better compete with the China in the race to make self-driving vehicles. The department said it would also move toward national self-driving regulations to replace a confusing patchwork of state rules.

"We're in a race with China to out-innovate, and the stakes couldn't be higher," said Transportation Secretary Sean Duffy on Thursday. "Our new

framework will slash red tape and move us closer to a single national standard."

Traffic safety watchdogs had feared that the Trump administration would eliminate the NHTSA reporting requirement completely.

The package of changes came days after Musk confirmed on a conference call with Tesla investors that the electric vehicle maker will begin a rollout of selfdriving Tesla taxis in Austin, Texas, in June. Waymo, which is owned by Google parent Alphabet, already has cybercabs available in that city and several others. Musk has argued that the previous reporting requirements were unfair since Tesla vehicles all use its partial self-driving systems and therefore log more miles than any other automaker with such technology. He says that his cars are far safer than most and save lives.

Tesla sales have plunged in recent month amid a backlash against Musk's backing of far-right politicians in Europe and his work in the U.S. as head of Trump's government costcutting group.

By CHRIS MEGERIAN and AMELIA THOMSONDEVEAUX Associated Press

ELON Musk spent years building cachet as a business titan and tech visionary, brushing aside critics and skeptics to become the richest person on the planet.

But as Musk gained power in Washington in recent months, his popularity has waned, according to a poll from The Associated Press-NORC Center for Public Affairs Research.

Just 33% of U.S. adults have a favorable view of Musk, the chain-saw-wielding, late-night-posting, campaign-hat-wearing public face of President Donald Trump's efforts to downsize and overhaul the federal government. That share is down from 41% in December.

"It was a shame that he crashed and burned his reputation," said Ernest Pereira, 27, a Democrat who works as a lab technician in North Carolina. "He bought into his own hype."

The poll found that about two-thirds of adults believe Musk has held too much influence over the federal government during the past few months — although that influence may be coming to an end. The billionaire entrepreneur is expected to leave his administration job in the coming weeks.

Musk is noticeably less popular than the overall effort to pare back the government workforce, which Trump has described as bloated and corrupt. About half of U.S. adults believe the Republican president has gone too far on reducing the size of the federal workforce, while roughly 3 in 10 think he is on target and 14% want him to go even further.

Retiree Susan Wolf, 75, of Pennsylvania, believes the

federal government is too big but Musk has "made a mess of everything."

"I don't trust him," she said. "I don't think he knows what he's doing."

Wolf, who is not registered with a political party, said Musk's private sector success does not translate to Washington.

Musk, in his work for the administration, has continued a political evolution toward the right. Although the South African-born entrepreneur was never easy to categorize ideologically, he championed the fight against climate change and often supported Democratic candidates.

“He thinks you run a government like you run a business. And you don’t do that. One is for the benefit of the people, and the other is for the benefit of the corporation.”

"He thinks you run a government like you run a business. And you don't do that," she said. "One is for the benefit of the people, and the other is for the benefit of the corporation."

Much of the downsizing has been done through socalled the Department of Government Efficiency, or DOGE, which was Musk's brainchild during last year's campaign. Thousands of federal employees have been fired or pushed to quit, contracts have been canceled and entire agencies have been brought to a standstill.

Musk has succeeded in providing a dose of shock therapy to the federal government, but he has fallen short of other goals. After talking about cutting spending by $1 trillion, he has set a much lower target of $150 billion. Even reaching that amount could prove challenging, and DOGE has regularly overstated its progress. He is expected to start dedicating more time to Tesla, his electric automaker that has suffered plummeting revenue while he was working for Trump.

Musk told investors on a recent conference call that "now that the major work of establishing the Department of Government Efficiency is done," he expects to spend just "a day or two per week on government matters."

Now he criticizes "the woke mind virus" and warns of the collapse of Western civilization from the threats of illegal migration and excess government spending.

Susan Wolf

Musk's increasingly conservative politics are reflected in the polling. Only about 2 in 10 independents and about 1 in 10 Democrats view Musk favorably, compared with about 7 in 10 Republicans.

In addition, while about 7 in 10 independents and about 9 in 10 Democrats believe Musk has too much influence, only about 4 in 10 Republicans feel that way.

Mark Collins, 67, a warehouse manager from Michigan who has leaned Republican in recent years, said Musk "runs a nice, tight ship" at his companies, "and the government definitely needs tightening up."

"He's cleaning up all the trash," he said. "I love what he's doing."

Republicans are much less likely than Democrats to be worried about being affected by recent cuts to federal government agencies, services or grants. Just 11% said they are "extremely" or "very" concerned that they or someone they know will be affected, while about two-thirds of Democrats and 44% of independents have those fears.

By JAMES BROOKS Associated Press

NEW Greenlandic Prime

Minister Jens-Frederik

Nielsen said Sunday that U.S. statements about the mineral-rich Arctic island have been disrespectful and that Greenland "will never, ever be a piece of property that can be bought by just anyone."

Nielsen made the remarks in defiance of U.S. President Donald Trump's interest in taking control of the strategic territory as Nielsen stood side by side with Danish Prime Minister Mette Frederiksen on the second day of a three-day official visit. Greenland is a semi-autonomous territory of Denmark.

"The talks from the United States have not been respectful,"

Nielsen said at a news conference at the prime minister's Marienborg official residence in Lyngby, 12 kilometers (8 miles) north of Copenhagen.

"The words used have not been respectful. That's why we need in this situation, we need to stand together," he added.

Political parties in Greenland, which has been leaning toward eventual independence from Denmark for years, recently

agreed to form a broadbased new coalition government in the face of Trump's designs on the territory.

Greenland's government said that Nielsen's three-day visit, which began Saturday, was aimed at future cooperation between the two countries.

"Denmark has the will to invest in the Greenlandic society, and we don't just have that for historical reasons. We also have that because we are part of (the Danish) commonwealth with each other," said Frederiksen.

"We of course have a will to also continue investing in the Greenlandic society," she added. Nielsen is set to meet King Frederik X on Monday, before returning to Greenland with Frederik for a royal visit to the island.

Frederiksen and Nielsen were asked whether a meeting between them and Trump was being planned.

"We always want to meet with the American president," Frederiksen said.

"Of course we want to. But I think we have been very, very clear in what is the (Danish commonwealth's) approach to all parts of the Kingdom of Denmark."