‘Everything is on table’ over VAT health claims

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

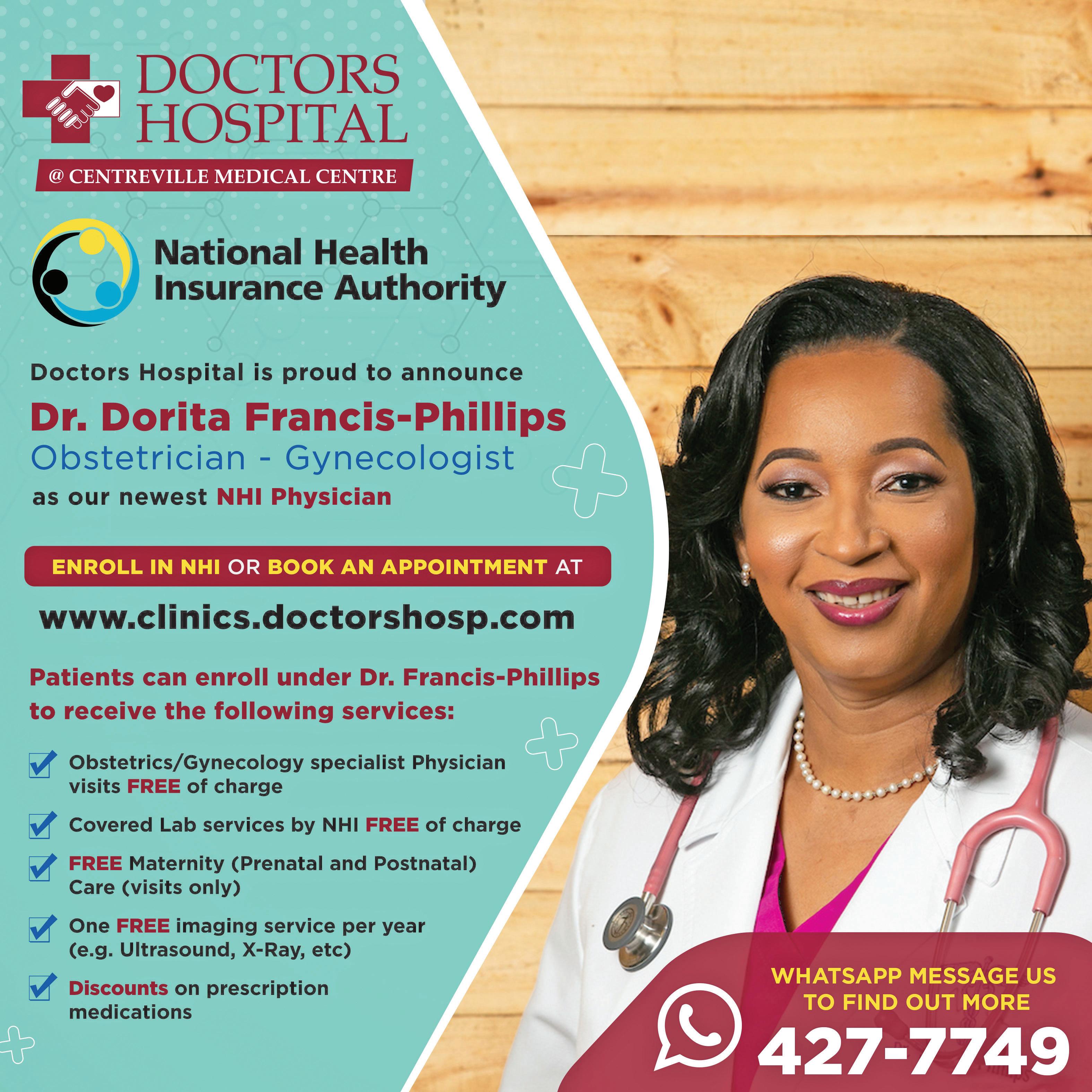

THE Ministry of Finance’s top official says “everything is on the table” with VAT-related reforms, which could have raised medical costs for thousands of insured Bahamians, now not proceeding prior to the Budget at end-May.

Simon Wilson, the financial secretary, told Tribune Business that the Davis administration was keen to ensure the proposalwhich would effectively switched the liability for paying VAT on health insurance claims payouts from the insurance companies to patients - “works for everybody”.

As a result, it had deferred the planned April 1 implementation, which

would have prevented insurers such as Colina, Family Guardian and CG Atlantic Medical from treating the VAT on claims payments as an ‘input’ expense and netting it off - or recovering this sumagainst the 10 percent levy

paid by patients on their healthcare

The delay will allow the Government to engage in further consultation with impacted industries, including the Medical Association of The Bahamas (MAB) as well as the Bahamas Insurance Association (BIA), and conduct further research on the issue in a bid to develop a revised position

Oban’s investors hit by $5m ‘fraud’

acceptable to all parties in time for when the 20232024 Budget is unveiled in Parliament on May 31.

Mr Wilson, speaking after he chaired a meeting with MAB representatives as well as insurers and their regulator, the Insurance Commission of The Bahamas (ICB), on the matter last Wednesday, confirmed that this newspaper’s understanding of the situation was “accurate”.

“We said we have to consult with all the parties,” he said of the current position. “What we said to them is everything is on the table. We have to take a good look at it and then move forward. We’ve got to deal with it. It’s something we’ve just got to deal with, and make the best of the situation. We have just

SEE PAGE B3

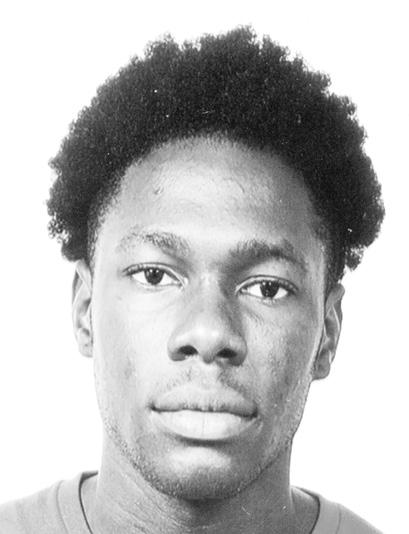

SBF’s trading arm gave Pointe owner $3.4m ‘gift’

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE CHINA Construction America (CCA) owned entity that developed The Pointe in downtown Nassau purportedly received $3.362m in “gifts or charitable contributions” from Sam Bankman-Fried’s private trading arm.

Court filings by John Ray, the FTX US executive overseeing 134 entities presently in Chapter 11 bankruptcy protection, have revealed that Newworld One Bay Street received a series of payments between January 14, 2022, and July 29,

2022, ranging from a low of $197,101 to as much as $879,375.

Some six payments, all for six-figure sums, were made during that six-anda-half month period by

‘Up the ante’ on cruise line deals

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

A FORMER Bahamas National Trust (BNT) chief yesterday said this nation must “up the ante” and leverage its “natural capital” to obtain better deals from the cruise industry, adding: “We give up too easily.”

Eric Carey, the Trust’s former executive director, told Tribune Business that The Bahamas needs to emphasise the value it brings and adds to the cruise passenger experience when negotiating with the likes of Royal Caribbean, Carnival and Mediterranean Shipping Company (MSC).

Speaking after he wrote a letter to the editor, in which he reiterated his “serious misgivings” over Royal Caribbean’s planned $100m Paradise Island beach break destination, he said of the cruise lines:

“Obviously they are a very powerful economic group.

From my experience, what

I’ve heard, they’ve been very tough negotiators and, in the past, when certain Caribbean countries have said we’d like a bit more, the cruise companies have pushed back to the point of threatening to pull out.

“It’s going to take sensible negotiations. I think we have to get them to

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

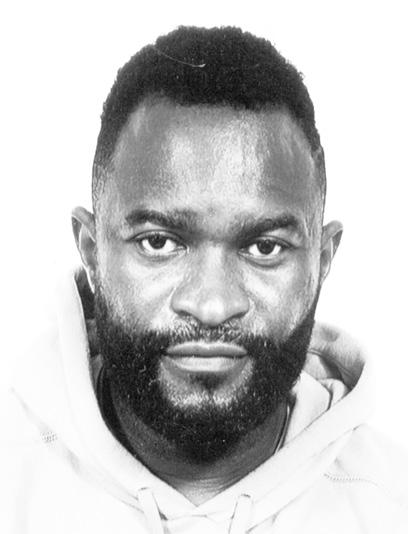

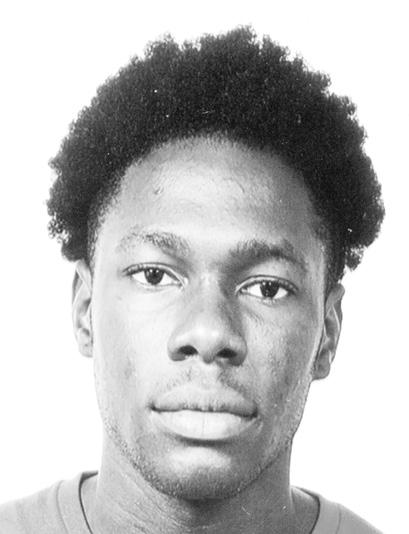

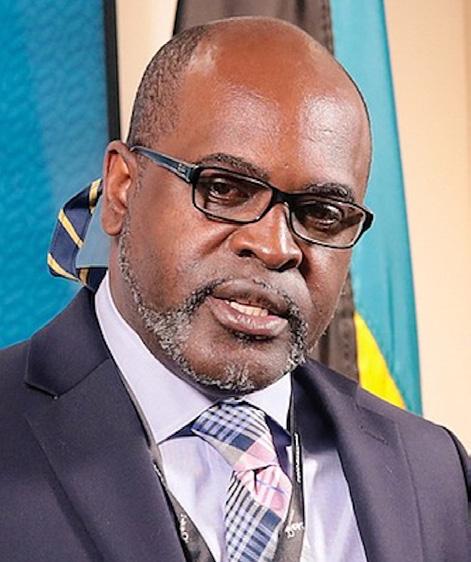

THE PRINCIPAL behind the controversial $5.5bn Oban Energies oil refinery deal has agreed to be sanctioned and pay fines after being accused of defrauding investors in the project of some $5.2m.

Peter Krieger, Oban Energies’ non-executive chairman, who was its public face and chief promoter, “without admitting or denying” the Securities & Exchange Commission’s (SEC) allegations against him last week consented to the imposition of civil penalties as well as “disgorgement” and associated interest payment sanctions after he misused investor monies to fund his lavish lifestyle.

The US federal securities regulator, in a March 13, 2023, lawsuit that raises fresh questions about the level of scrutiny applied by the Bahamian government to Oban and its principals, alleged that Mr Krieger

raised $15m to finance the proposed Grand Bahamabased oil refinery and storage terminal from 23 investors.

However, it claimed that more than one-third - some $5.2m - was subsequently “misappropriated” by Mr Krieger for his own personal use, including the purchases of “luxury cars, jewellery and vacations”.

The SEC action reveals that, while Mr Krieger seemingly stepped away from the project after Tribune Business and others raised questions about his

business@tribunemedia.net MONDAY, MARCH 20, 2023

SEE PAGE B4

SEE PAGE B8 SEE PAGE B10 SAM BANKMAN-FRIED

• Gov’t aims to make it ‘work for everybody’ • No tax treatment change before Budget • Doctors: ‘Disservice’ if patients go abroad

SIMON WILSON

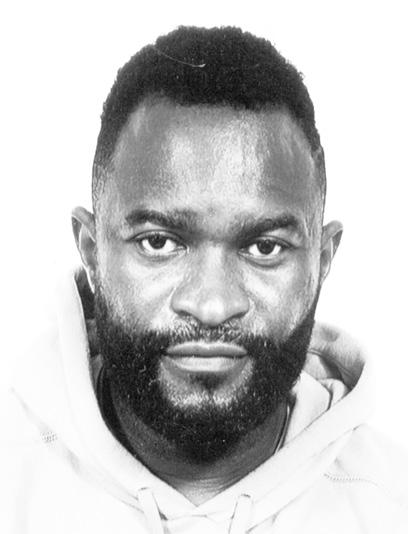

• Used by controversial GB project chair to fund lavish lifestyle PETER KRIEGER

$5.70 $5.76 $5.72 $5.92

Bahamian small businesses told: Embrace e-commerce

By FAY SIMMONS jsimmons@tribunemedia.net

BAHAMIAN small and medium-sized businesses must embrace digital payments and transactions if they are to properly participate in the tourism industry and wider global economy, a provider says.

Jeffrey Beckles, Island Pay’s managing director, told the Grand Bahama Business Outlook: “The global digital payment market size was valued at about $81bn in 2022. It is expected to expand at a compound growth rate of 20.8 percent between 2023 and 2030.

“Anything that you have that will grow at an annual rate of 20 percent is worth having, which tells you that most of the people that we will engage with from here on in are going to be referred to as digital citizens. If we intend to be successful as small and medium-sized enterprises (SMEs), then it means that we must take the initiative now to position ourselves to be able to engage those individuals. That’s our

reality: The world has gone to a global platform.”

Mr Beckles said the majority of tourists that visit the Bahamas come from digitised economies - the US, UK and Canada. As a result, small and mediumsized businesses must begin to accept digital payments so as not to potentially cut themselves off from conducting transactions with this market.

He added: “When we consider the top 10 digitised economies in the world, three of them - Canada, the United States and the UKprovide almost 100 percent of our tourists. We must remember, then, that the tourists that are coming to the Bahamas are digitised citizens, and if small businesses are unable to accept digital payments, it means that the separation between the customer, your revenue and your progress is going to remain.

“That gap is going to remain, and it’ll get probably larger and larger. The reality of it today is that more and more consumers are conducting transactions in a digital format than they

ever have. Yes, cash will be around, but the reality of it is the access and the usability of cash will continue to diminish as the global digital space evolves.

“The takeaway, then, for us as we evolve in our business environments is to what degree are you facilitating or accepting or enabling your business to be able to accept a digital payment?”

Mr Beckles said the emergence of digital transactions and currencies have shifted consumers away from traditional methods of purchasing and engagement. He said: “The emergence of CBDCs [Central Bank Digital Currencies] and other forms of digital currencies, new online shopping methods and, of course, the metaverse offer

businesses a new landscape of possibilities.

“Many of these emerging opportunities are tied to the increasingly digital world in which we live; a trend that is going to move quickly and will continue to accelerate in the coming years. As our personal and professional lives continue to move online, so does more and more of our economic activity.

“We understand more than ever before that the brick-and-mortar model that we used to have, where we told customers ‘come to us’, that’s dying very quickly. Consumers have moved away to being online. Not only do they have access to online products, but the expectation is that if you want me to look at your product, want me to buy your product, then you must be able to facilitate the payment online. Many companies are still struggling with that fact.”

Mr Beckles asserted:

“Digital tools transact at a fraction of what traditional institutions will charge you. There are more than 52,000 Bahamians using our

digital apps, and not just for domestic use. But because of our global partnership with MasterCard they have access to global markets.

“When you think about a taxi driver who no longer has to be concerned about whether the consumer has cash or not, but he can tap and pay and be done..... When you think about SMEs on the beach, straw vendors, bakery workers and bellmen today are receiving gratuities via tap and pay technology. When we think about a country where your websites have integrated, where people from around the world can conduct and close a transaction in a matter of moments rather than having to come and see you to close those....

“We are enabling them to participate in an ecosystem. We’re enabling them to be able to develop state of the art websites where there is an e-commerce platform that is integrated into their platform so that customers have an opportunity to make a buying decision. We have SMEs who are able now to provide digital payroll for their staff.”

PAGE 2, Monday, March 20, 2023 THE TRIBUNE

JEFFREY BECKLES

‘Everything is on table’ over VAT health claims

got to make sure that it works for everybody.”

Mr Wilson added that the deferred implementation does not mean the Government is “abandoning” its plans to change the VAT treatment of health insurance claims payouts.

However, the delay will give the MAB, which represents the private physicians and doctors, an opportunity to provide feedback on an initiative whichdespite having potentially major consequences for their patients and business models - has not sought their views to-date.

Dr Cindy Dorsett, the MAB’s president, told Tribune Business that the Association was not taking a position on who was right - the Government, or the BIA and its life and health insurance members - over how VAT should be applied to health insurance claims payments and the potential consequences for patients.

She added, though, that it was critical that The Bahamas do nothing to increase treatment and medicine costs for thousands of middle class Bahamians with private health insurance.

And she warned it would be “a gross disservice” to local medical professionals if such increased VAT and healthcare costs drove their patients to seek treatment abroad and bypass the local industry.

“Some of our main concerns were the clients themselves, the insureds themselves,” Dr Dorsett told this newspaper. “We don’t want more of a burden in terms of them having to pay a greater cost for any type of healthcare service, whether it’s with the medical doctors, dentists, physiotherapists or pharmacies - anyone who accepts insurance.

“We don’t want them to have to carry a greater burden, paying the full burden or more VAT. We want them to be able to come to the dentist, the physiotherapist with a lighter burden not a heavier burden.” Increased costs could prompt some persons to delay seeking

critical treatment, or not access it all, and Dr Dorsett also voiced fears that any increase in the patient’s burden could drive Bahamians overseas - especially for more expensive surgeries and tertiary forms of care.

“We don’t want the insureds to look for a fair price that may mean they go to the US and other countries for service,” she added. “That would be a gross disservice to physicians. At the end of the day, you would be moving money out of the country and VAT would not be collected for the benefit of the country.

“We also have to look at administrative costs in all the scenarios. It’s going to change the way we collect VAT, and make it much more tedious at the point of service. These are things we need to sit down and look at and balance, so no major stakeholder, as much as we could, is negatively impacted. We’re not running from the fact that VAT needs to be collected. We’re saying: Let’s sit down at the table and look at everyone’s point of view.

“It’s normally the middle class that have private health insurance. They’ve gone out of their way to make sure they are covered by private insurance. It takes some of the burden off of the Government. We cannot go back, at the end of the day, and put a greater burden on this class. It’s been working this way. We want to keep our valued clients, and ease the burden of healthcare delivery straight across the board.”

Dr Dorsett confirmed that “everything remains status quo” on the VAT treatment of health claims payouts with the planned change on April 1 no longer proceeding - for now. She made clear that concerns raised by doctors and MAB representatives at a previous meeting with Michael Halkitis, minister of economic affairs, had influenced the Government’s approach.

“Mr Wilson openly stated that certain things were brought to light, and we pointed out certain thing that put us at a disadvantage,” she said. “He agreed

that was not what they had hoped for, and that they would defer it and do further research.

“I thought that was an extremely good stance for him to take. It’s definitely a step in the right direction. They’re going to go back and look at it. When they finish, they will go and send the information to the Insurance Commission of The Bahamas, and the Insurance Commission of The Bahamas will further consult with the BIA and the MAB.” Dr Dorsett said it was vital that the Government understand any impact the proposed VAT reform will have at “the point of service”.

Insurers have previously warned that the VAT treatment change, by making patients liable for the full tax on their cost of treatment rather than just the 20 percent co-pay, would have to find thousands of dollars that they presently do not have to pay to cover hospital and tertiary care costs.

Tribune Business was previously shown two examples of how the changed VAT treatment will impact medical bills of varying sizes. The first involved a patient requiring $2,000 worth of treatment, with their ‘outof-pocket’ costs pegged at $250. Under the present tax treatment, they only have to pay VAT worth $25 (10 percent) on that $250 share, leaving their share of the medical care expense at $275.

Yet, when insurers are unable to reclaim the VAT on their share, the patient will now also be liable for paying the 10 percent levy on the $1,750 claims payout. This will add a further $175 to their bill, taking the total amount they must fund to $450 - a 63.6 percent increase in their financial burden.

The sums and percentage increases become greater the higher the cost of care.

The final example involved a patient who requires a five-night hospital stay that incurs $12,500 in medical bills. The ‘out-of-pocket’ expense is $500 and, under the current structure, the patient will only pay 10 percent VAT on that latter sum,

incurring $50 in tax and taking the total payment to $550.

However, under present plans to change the VAT treatment, the patient will also have to pay the VAT levied on the insurer’s $12,000 claims payout. That will amount to $1,200, taking the patient’s own payment to $1,750 - a more than three-fold increase from what his/her financial exposure would be currently.

One insurance source, speaking on condition of anonymity, said of the Government’s revised approach: “The penny seems to gave dropped. If you were going to have open heart surgery, you’d have to come up with $50,000 [to cover the VAT] before anything happens. If people have insurance, they will go abroad rather than put up $50,000.”

Marcus Bosland, the BIA’s health insurance committee chair, told Tribune Business the Government had given no commitment that the issue will be dealt with or included as part of the upcoming May Budget. “It was stated in the meeting by Mr Wilson that the previously planned change to VAT that was planned for April 1, it will not happen on that date and has been deferred. He did not specifically say there will be a change around the Budget,” he added.

Besides promising to put it in writing to the BIA that there will be a deferral, Mr Bosland said: “The other thing he committed to do was have some discussion around VAT on insurance. We have no idea what the contours will be for that discussion. They did say they would look to make a decision as part of the Budget process, but exactly what that looks like at this point we don’t know. They do intend to consult with us prior to making whatever announcement will be made.”

Asserting that the VAT health claims deferral is “in the country’s best interests”, he added: “We

definitely don’t know if they’ve changed their mind completely, so we’re still guardedly optimistic that the discussion will lead to something that makes sense for our clients. The VAT doesn’t affect us directly; it will be paid by our clients..... In that regard, we don’t think increasing taxes on our clients makes sense...

“That’s our concern. It increases costs for our clients that seek medical care here, and we don’t think that’s fair given that clients already pay VAT on the premium. We don’t believe they should pay VAT on all underlying claims as well. We think the 10 percent they’re paying on the premium is a fair VAT bill, and they shouldn’t have any additional burden on their insurance.

“Our view is that the Government feels it’s not getting enough VAT receipts. The reality is health insurance is a very low margin product. It’s very expensive because the underlying medical care is very expensive. The value add on health insurance is not that great because of the small margins,” Mr Bosland continued.

“Maybe from the Government’s perspective they believe the margins should be higher, and thus the VAT receipts they get directly from us will be higher as well. It’s always been low margins. The value add

is not that much. A lot of that medical care is care people would not be able to afford if they didn’t have insurance. The amount the Government gets directly from us as opposed to medical providers is small because the margins are small. That’s simply a feature of the business.”

The Insurance Commission of The Bahamas’ annual report for 2021, containing the last set of available data, shows that almost $206m worth of health claims were paid by Bahamian insurers that year. That was split into $175.202m on behalf of group clients, usually businesses providing coverage for their employees, and $30.716m for individual policyholders. Most of that $206m would have been spent at home due to the COVID restrictions that were in place at the time.

The Ministry of Finance’s position is it is “clearly against the VAT Act” for insurers to claim back the 10 percent levy on medical claims payouts by netting it off against the VAT paid on the premium - a practice allegedly costing the Public Treasury millions of dollars. Its position is that VAT is payable on medical insurance claims payouts because these are being made on behalf of the end-user - the consuming patient - and thus should attract the tax.

THE TRIBUNE Monday, March 20, 2023, PAGE 3

FROM PAGE B1 Condo For Sale PALM CAY ANCHORAGE 1 GATED COMMUNITY Spacious 2 bed, 2 1/2 bath Den, Large Balcony 1,324 sq. ft. Resort Style Amenities Beach Marina (242) 535-7149 Phone Bay Investment Price $575,000

OBAN’S INVESTORS HIT BY $5M ‘FRAUD’

background and that of other project principals, he remained its “spearhead” and driving force.

It was only in late 2020, the SEC alleged, that he was finally removed after Oban Energies’ other Board members discovered the theft of investor funds. “From May 2016 through August 2020, Oban Energies, a Floridabased entity managed by Peter D. Krieger, raised approximately $15m from 23 investors,” the US regulator said. “Investors, some of whom were elderly, were told that their funds would be used to develop an oil refinery and storage facility in The Bahamas.

“In reality, from January 2017 through August 2020, defendant misappropriated approximately $5.2m of investor funds to pay for personal expenses, such as luxury cars, jewellery and vacations.” The SEC added that Krieger, 49, served

as “Oban’s manager, ran its day-to-day operations from 2017 through 2018, and maintained exclusive control over Oban’s bank account from January 2017 through August 2020”.

Effectively revealing that Krieger was the mastermind behind Oban Energies, the lawsuit alleged he began negotiations with the Government for the oil refinery project as far back as 2009 when the last Ingraham administration was in office. However, it was only in mid-2016, when the final Christie administration was in its last year, that Oban was incorporated and sought to raise the necessary financing from investors.

“Most investors in Oban are friends with [Krieger] and each other, live at least part-time in the same community, and were solicited by word-of-mouth,” the SEC said. In return for their investment, they received a ‘member interest’ in Oban, which brought the company

under the regulator’s oversight as the investment agreement is deemed to be a security.

“Defendant ran Oban’s day-to-day operations and led its efforts to develop the project. In February 2018, Oban and the Bahamian government signed a Heads of Agreement awarding Oban the rights to develop the project. Shortly thereafter, however, the Bahamian government sought to renegotiate the terms of the agreement,” the SEC noted.

The Minnis administration’s renegotiation was sparked by this newspaper’s revelations on Mr Krieger’s questionable past, plus questions about the background and qualifications of other Oban principals.

“Oban formalised a Board of managers in March 2018.

The Board consisted of four investors who were to provide oversight over the project, and status updates to members, while renegotiation discussions with

JOB OPPORTUNITY

Overview

A property management company is looking for a maintenance professional. To do well in this role, you should have previous experience in maintenance, be highly skilled in the use of power tools, and be able to read blueprints and repair manuals. The successful candidate will be responsible for the routine preventative maintenance of mechanical equipment, buildings and machines. Your assigned tasks include (but are not limited to) plumbing work, painting, floor repair and upkeep, electrical repairs, and air conditioning system maintenance.

Responsibilities

Conducting routine inspections of premises and equipment

• Performing preventative maintenance

Handling basic repairs and maintenance

• Overseeing contractors when professional repairs are necessary

• Diagnosing mechanical issues and correcting them

• Repairing machines, equipment, or structures as necessary.

Requirements

Proven maintenance experience – 5+ years working experience in a similar role.

Related degree from a technical college

• Skilled in the use of hand and power tools

• Ability to take apart machines, equipment, or devices to remove and replace defective parts.

Ability to check blueprints, repair manuals, or parts catalogs as necessary.

Ability to use common tools such as hammers, hoists, saws, drills, and wrenches.

• Experience with precision measuring instruments or electronic testing devices.

• Experience performing routine maintenance.

• Strong organizational and follow up skills.

• Eye for detail.

Professional presentation and attitude.

• Ability to maintain focus while working individually.

Strong time management skills.

All interested candidates must send their CVs and resumes to bahamasluxuryhr@gmail.com no later than March 31, 2023.

the Bahamian government ensued,” the SEC alleged.

“The Board had exclusive authority to manage and control all aspects of Oban’s business and operations, including but not limited to,overseeing Oban’s day-to day operations, making expenditures to conduct Oban’s business, and investing Oban’s assets.

“Despite stepping back as the face of Oban in early 2018 shortly after the [Heads of] Agreement was executed, Krieger continued to spearhead the project on behalf of Oban and maintain exclusive control over its bank account.

In late 2020, Oban’s Board discovered that defendant was misappropriating investor funds for personal use and immediately took steps to remove him from Oban.”

The Minnis administration had sought to renegotiate key economic, environmental and legal provisions of Oban Energies’ Heads of Agreement following its signing and the subsequent media disclosures. Oban’s team was purportedly headed by Alexander Grikitis, but the talks never appeared to make much progress and the oil refinery/storage terminal project disappeared from public view and was seemingly discontinued.

However, the timelines detailed in the SEC lawsuit suggest that Mr Krieger, despite taking a background role, remained Oban’s mastermind and driving force from just after the Heads of Agreement until his late 2020 removal - meaning he was still in place during the subsequent talks with the Minnis administration.

Detailing Mr Krieger’s purported deceit, the SEC alleged: “From January 2017 through August 2020, defendant was the sole signatory on Oban’s bank account and exercised exclusive control over it. During that time, defendant misappropriated at least $5.2m of investor funds to pay for personal expenses, such as luxury cars, jewellery, designer clothing, vacations to Aspen and Hawaii, and day-to-day living expenses.

“Specifically, defendant diverted approximately $3.7m of investor funds through various means to the bank account of

an unrelated entity he controlled, Mid-Atlantic Group.. For instance, defendant deposited approximately $795,000 of investor funds directly into Mid-Atlantic Group’s bank account. Defendant also diverted through hundreds of electronic funds transfers approximately $1.37m of investor funds from Oban’s bank account to Mid-Atlantic’s bank account.

“Furthermore, in an effort to conceal his misappropriation, defendant transferred $1.5m of investor funds from Oban’s bank account to an account for another entity he controlled, S&P Projects. From there, defendant transferred the $1.5m to the trust accounts of Oban’s outside attorney, who then routed the money back to MidAtlantic Group,” the SEC continued.

“Additionally, defendant transferred another $1.5m in investor funds from Oban’s bank account to pay credit card charges for S&P. Defendant’s transfers of approximately $5.2m of investor funds for his personal use were not disclosed to or authorised by Oban’s Board.”

Oban was ultimately dissolved in March 2021, and its assets and liabilities - presumably including the rights conferred to the company by the 2018 Heads of Agreement - sold to Lucayan Trans Fuels. The latter is an entity formed by other former Oban investors.

Krieger, in court filings on March 14, 2023, has agreed to be barred from serving as an officer or director of any company that issues/ offers securities. He has also agreed to be prohibited from issuing securities and further violations of US federal securities laws.

The Government’s normal practice is for the Bahamas Investment Authority (BIA) and National Economic Council to use Interpol and other established sources to conduct background checks on the principals involved in foreign direct investment (FDI) projects, ensuring they have clean records and no criminal past.

However, under questioning from The Tribune, Krieger confirmed at the time when the Oban

Energies’ Heads of Agreement was signed that he had been involved in two earlier lawsuits where he was convicted of misusing investor monies. No stranger to the SEC, he was one of three defendants who it accused of misappropriating more than $3.7m of investor monies back in 2005.

That was settled without going to trial some three years later. Mr Krieger, who challenged the allegations against him, paid a $110,000 civil penalty “without admitting or denying” the claims, and agreed to be bound from committing future securities law violations.

And, following further research by The Tribune, Mr Krieger confirmed he was also named as a defendant in a legal action filed in 2013 by the Bahamas-based judicial manager for a sister company of the insolvent insurer, CLICO (Bahamas).

John Lopez, the KPMG (Bahamas) accountant who took over British American Insurance Company (BAICO) in the wake of its collapse, and that of its CL Financial parent, alleged that Mr Krieger misappropriated $8.7m of the company’s funds for his own personal use. The case against Mr Krieger, though, was dismissed on a technicality, as it was “time barred” according to the “statute of limitations” that applies in the US.

The Oban Energies principal said then that the claim against him had subsequently been defeated in the appeals courts, and added: “They really have no grounds to stand on.” Mr Krieger argued that he was the injured party, given that BAICO had failed to fully pay him the purchase price for 14,000 acres of land he sold to the insurer prior to its failure.

He alleged that he had obtained a $70m judgment against the company, and that the judge had “scolded them for perjury and making these outrageous claims against me, and dragging my wife into it”. However, The Tribune could find no record of the case or judgment, which Mr Krieger said he had filed in the middle district Florida court, despite an extensive search of that court’s case database.

PAGE 4, Monday, March 20, 2023 THE TRIBUNE

FROM PAGE B1

Flashbacks of 2008

The past two weeks have produced flashbacks to the 2008 financial crisis following the collapse of Silicon Valley Bank (SVB). The failure of this once-thriving bank sent shockwaves throughout the world, and raised concerns about the health of the global financial system. The failure of SVB is rooted in poor risk management practices, primarily due to the bank’s heavy investment of client funds in long-term US Treasury bonds. The problem was that the bank failed to anticipate the bonds’ loss of nominal value after the Federal Reserve began hiking interest rates.

The collapse of SVB has had a significant impact on investor confidence, triggering worries about the stability of other financial institutions, especially after Credit Suisse’s woes emerged only a couple of days later. Material deficiencies were detected in the Swiss bank’s reporting over the past two years, stoking fears of a domino

effect that could lead to more widespread damage in the banking ecosystem. This sequence of events created a dilemma for the Federal Reserve and European Central Bank, as both institutions may have to choose between bringing down inflation or guaranteeing the stability of the financial system. The troubles of SVB and Credit Suisse showed that the fastest rate hiking cycle in living memory creates the type of conditions that make it more likely for such accidents to happen.

The failure of SVB and the ongoing issues with Credit Suisse have also highlighted the importance of effective risk management practices in financial institutions, with regulatory bodies also carrying this burden. Regulators should strive to apply an appropriate level of prudential supervision that will detect

Share your news

The Tribune wants to hear from people who are making news in their neighbourhoods. Perhaps you are raising funds for a good cause, campaigning for improvements in the area or have won an award. If so, call us on 322-1986 and share your story.

malpractices at an early stage. Banks must ensure they have a diversified portfolio of assets, reducing their exposure to any particular asset class. They must also invest in instruments with high levels of liquidity, so that any unexpectedly high levels of client withdrawals can be honoured.

Regulators must ensure that financial institutions adhere to strict risk management practices, that they are adequately capitalised and have sufficient liquidity to meet client demands. They must be vigilant and take appropriate action to address any issues found.

In conclusion, the collapse of SVB has caused significant volatility in the financial markets, highlighting the importance of effective risk management practices and regulation in the financial sector. The ongoing issues with Credit

Suisse have added to the concerns about the stability of the global financial system. The dilemma facing the Federal Reserve and European Central Bank is

significant, and they must strike a balance between managing inflation and ensuring the stability of the financial system. It is essential that systemically

important institutions learn from the recent events and take steps to ensure effective best practices to prevent similar incidents in the future.

THE TRIBUNE Monday, March 20, 2023, PAGE 5

By RICARDO EVANGELISTA

EMEA Headquarters for Credit Suisse in London’s Canary Wharf.

Applications must be submitted to yachts.recruitment@thlmarine.com

Realtor’s four agents join brand’s top 15%

A BAHAMIAN real estate company and its executives have been recognised during its brand franchisor’s 2022 Annual Global Performance Awards.

Out of more than 13,000 agents worldwide, Better Homes and Gardens MCR Bahamas saw four of its top performers receiving awards and recognition. Partner Timothy Smith received the highest performance honour, the Emerald Elite- Founder’s Club Award, reserved only for the top 1 percent of all affiliated sales associates and teams in the brand’s network, and the highest distinction in the awards categories.

Mario Carey, Better Homes and Gardens MCR Bahamas founder, and managing partner and broker, Tim Rodland, both received the Emerald Elite Award, reserved only for the top 3 percent of the brand’s independent agents worldwide. The final winner, Livingston Brown, received the Silver Award, a ranking awarded to only the top 15 percent of agents.

“The awards acknowledge the achievement of top performers within the franchise network based

on stringent criteria in the categories of total closed units or sales volume,” said Better Homes and Gardens. The purpose of the annual event is to recognise and spotlight the successes of Better Homes and Gardens’ top agents across more than 400 offices globally.

Better Homes and Gardens MCR Bahamas says it enjoyed a strong 2022.

“Our revenue grew by 60 percent year-over-year, and we broke many new price records,” said Mr Rodland. “I couldn’t be more proud of our staff and agents, and the way they rallied and supported each other. Seeing our culture thrive through the volatility of the past year has motivated us even more as a company.”

“These awards are such an honour,” said Timothy Smith. “But when you look at what we’ve been able to accomplish here, compared to other regions of the world - The Bahamas is a fairly small country - this is a huge deal.”

PAGE 6, Monday, March 20, 2023 THE TRIBUNE

PICTURED at the STEP Bahamas Conference are (l-r): Senator the Hon. Michael B. Halkitis, Minister of Economic Affairs; Theo Burrows, STEP Bahamas Branch Chair; Wendy Warren, Founder and Managing Director of Caystone Solutions Ltd.; John Lawrence, CEO of The Windermere Group, and Bruno Roberts, AIBT Chairman. Ms. Warren was presented with the first-ever John Lawrence Trailblazer Award at the event.

BAY STREET MERCHANTS ‘OVERCHARGING’ TOURISTS

BAY Street merchants have been accused by The Bahamas’ consumer protection watchdog of overcharging cruise ship passengers and other tourists on their credit card purchases Lavade Darling, the Consumer Protection Commission’s senior supervisor for education, research and training, told a media briefing at the Prime Minister’s Office: “There are certain stores on Bay Street that are targeting our tourists, particularly cruise ship passengers.

“They would purchase an item for ‘x’ amount of dollars. Then they would give you some free items, and when these tourists get back to their home, they find that the credit card has been charged $10,000 or $15,000 for an item that really should have cost only what they agreed to purchase.”

Mr Darling did not identify the culprits, but made clear the issue is something the Commission is “not addressing” by itself and is “working with the other relevant agencies” within the Government to combat the problem. “It’s not something that we can address totally on our own,” he added. “(The Ministry) of Tourism is aware, and we’re working with them to resolve the cyber issues.”

Such practices, if they are occurring, would threaten to harm The Bahamas’ integrity and reputation as a world-class tourism destination - the very image that the Government, various industry promotion Boards and individual resorts and operators are seeking to promote.

Mr Darling, meanwhile, said another focus for the Consumer Protection Commission is that businesses are still requiring consumers to purchase a minimum amount, and also levying a fee, for credit and debit card purchases. This, he added, violates the merchant services agreement that these businesses have signed with card issuing companies and financial services providers.

“Another area of concern for us is credit and debit card fees,” Mr Darling said. “That’s something that comes up quite regularly because the merchant services agreement for using a credit card stipulates that you’re not supposed to have a minimum purchase and you’re not supposed to be charging a convenience fee to use a credit or debit card.

“So that is a matter of major concern for us… We had a meeting recently with the Central Bank to speak about that, and one of the things that came out of that meeting is that we’re going to be looking at introducing legislation to actually enforce the merchant services agreement because moral suasion is obviously not working. These merchants are aware of the terms of their merchant services agreement.”

The switch to digital transactions and cashless payment systems further accelerated due to the COVID-19 pandemic. Many merchants were not prepared to handle the sudden shift to electronic payment forms during lockdowns and other associated restrictions.

The Consumer Protection Commission officials acknowledged that making it more difficult, and expensive, for consumers to pay using debit and credit cards not only violates these companies’ merchant services agreements but also works against the Government and Central Bank’s drive to move the economy away from reliance on cash to digital transactions.

Mr Darling said: “The Government of the Bahamas has stated that they want us to go cashless. So using your credit or debit card should not be more expensive than using cash. But it goes against the stated policy objective of the Government of The Bahamas.

“As a statutory agency, those type of matters are a concern for us, and we are addressing them. So what we’re going to do is develop a financial literacy campaign that we expect to launch in a few months, where we’re going to be speaking to particularly small businesses, SMEs, about how you can lower your costs with digital transactions.”

Mr Darling said other frequent consumer complaints received by the watchdog related to the timeshare industry. “Persons basically purchase a timeshare,” he said. “They want out of it, right, and the Act provides the conditions under which you can get out of your timeshare. The problem is that the timeshare operators are not giving them the opportunity to get out of their timeshare. So that’s a major concern for us.”

The Commission also wants to strengthen its governing legislation so that it is better placed to deal with complaints against funeral homes and cemeteries, both of which are sectors that are largely unregulated.

CALL 502-2394 TO ADVERTISE TODAY!

JOB OPPORTUNITY

ACCURAD IMAGING CONSULTANTS SEEKING RADIOLOGIST

AccuRad Imaging Consultants is a diagnostic imaging reporting/teleradiology company operating in the Bahamas. AccuRad provides diagnostic imaging reporting services to facilities and doctor’s offices throughout the Bahamas. The imaging modalities reported include, but are not limited to, x-ray, mammography, CT, ultrasound and MRI. AccuRad is seeking a fellowship trained radiologist to join the practice. Fellowship training in oncology imaging and neuroradiology is preferred. On-site work is not required. The candidate is expected to be able to provide coverage on weekends and/or stat holidays. Occasionally, there may be overnight coverage requirements. Competency in reporting all above mentioned modalities is a must. Only candidates who have completed a full radiology residency program and attained board certification by examination will be considered. Fellowship/subspecialty training must have been acquired at an accredited institution in the US, Canada or UK. All applicants must be eligible for specialist licensure in the Bahamas.

THE TRIBUNE Monday, March 20, 2023, PAGE 7

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

Interested applicants can submit their CV and statement of interest via email to admin@accurad.live

Alameda Research, the hedge fund/trading vehicle created by Mr BankmanFried. Its activities were heavily financed by FTX

investors, whose monies and assets were used to finance Alameda’s risky and speculative bets without their permission. It is unclear why the payments, between two

privately-owned entities, have been classified by Mr Ray and his team in their Delaware Bankruptcy Court filings as “gifts and charitable contributions”. They could potentially represent

payment for accommodation that was provided to FTX and Alameda Research staff during the crypto exchange’s 14-month stay in The Bahamas prior to its early November 2022 collapse.

For the Margaritaville Beach Resort, which is also part of The Pointe complex in downtown Nassau, and was initially revealed to be Alameda Research’s fourth largest creditor with a sum of $55,319 due to it, has subsequently seen its claim increase ten-fold to almost $600,000.

Alameda Research workers were reported previously to have stayed for weeks - even monthsin about 20 suites at One Particular Harbour, whose prices range from $365,000 to more than $6m. They were said to have been transported to and from the resort in a shuttle bus every day.

However, given that the payments to Newworld One Bay Street were made so close to FTX’s Chapter 11 bankruptcy filing, it is possible that Mr Ray and his team may seek to claw them back on the basis that they are “voidable preferences”.

The Alameda Research filings also allege that it transferred funds to FTX Digital Markets, the Bahamian-incorporated entity in provisional liquidation before the Supreme Court, to finance property purchases in this nation on behalf of Mr BankmanFried, his inner circle and other senior executives.

These transactions were described as an “intercompany payable from Alameda Research to FTX Digital Markets. Among the deals these financed were the $2.34m acquisition of a Sandyport property for Can Sun, FTXs general counsel; an $8.217m Albany property deal for Constance Wang; property purchases of $2.2m, $1.502m and $1.405m for Mr Bankman-Fried, Gary Wang and Nishad Singh at One Cable Beach; and an $8.87m Albany acquisition for Ryan Salame, FTX Digital Markets’ chief executive.

Several of these properties, part of a Bahamian

real estate portfolio valued at over $241m in Mr Ray’s legal filings, were put in personal names rather than those of FTX Property Holdings, FTX Digital Markets or Alameda Research. Whether these transactions represent assets/monies belonging to the Bahamian liquidation or the Chapter 11 process are likely to be one of many legal battles between the local provisional liquidators and Mr Ray.

Meanwhile, the documents filed by the latter also reveal that Alameda Research had some $13.091m in its account with Lyford Cay-based Deltec Bank & Trust. The $50m loan it made to Deltec’s parent, Deltec International Group, which was arranged by Mr Salame, is also documented. Those funds were received in October 2021 from Norton Hall Ltd, an entity alleged to be controlled by Mr Salame, but the inference is that these monies came from Alameda Research. “In the ordinary course of business, the parent company of Deltec Bank, Deltec International Group, received a short-term loan to fund strategic growth initiatives from Norton Hall Ltd, an entity affiliated with FTX,” Deltec said in a previous statement.

“While the terms of the loan extend until March 2023, Deltec International Group has been attempting to repay the loan in full since December 2022. Deltec International Group is currently awaiting information as to the proper instructions on how to repay the loan.” The “strategic growth initiatives” and loan terms were not disclosed.

Deltec then reiterated that it has “no credit or asset exposure” to FTX, while touting its year-end 2021 financial statements for showing that it is wellcapitalised and has no debt. It also hailed its “unparalleled risk management”, along with “good corporate governance practices” and “regulatory compliance”, reassuring investors “there is no threat to the bank’s sustainability, safety and soundness”.

PAGE 8, Monday, March 20, 2023 THE TRIBUNE

FROM PAGE B1

SBF’s trading arm gave Pointe owner $3.4m ‘gift’

GB to Abaco power cable ‘doable’ but more needed

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

THE Grand Bahama Chamber of Commerce president says supplying power from the island to Abaco via an undersea electricity cable is “doable” but more details are required on the initiative.

James Carey told Tribune Business he was unsure how far advanced Grand Bahama Power Company (GBPC) and the Grand Bahama Port Authority (GBPA) were on the initiative given there were signs that the announcement at last week’s Business Outlook conference may have been premature.

“I really didn’t know this was on the cards for GB Power and GBPA,” he said. “I think Mr Rolle was speaking a little bit out of turn when he mentioned it at the Grand Bahama Business Outlook because it is something GB Power is looking at is the implication that he gave.”

Ian Rolle, the GBPA’s president, told the Grand Bahama Business Outlook last week that running an electricity cable between the island and Abaco was a way to potentially stabilise electricity costs and bring rates down. He also suggested that such a venture would potentially expand GB Power’s customer base and provide additional redundancy for Abaco consumers who presently rely on Bahamas Power & Light (BPL).

“We feel if we are able to stabilise the cost of electricity.... we envision a cable possibly running from Grand Bahama to Abaco that would help to spread the cost over a larger population and add redundancy for our brothers and sisters next door to us,” he explained. “We hope that with the spreading out of cost, the rate, it will have a positive effect for all of us.”

Mr Carey noted that east Grand Bahama’s proximity to Abaco meant there had even been previous discussions about “building a bridge” between the

two. Mr Carey said running a power cable between the two islands would present logistical and infrastructure challenges at the very least. “I was a little bit confused there for a moment, so I guess it’s one of those things that we’ll have to wait and see, and when the opportunity comes by then I can go a little deeper if I get the opportunity,” Mr Carey added. “Mr Rolle also made mention of the fact that they’re looking at micro grid to service East Grand Bahama, which is not very populated and, you know, it’s a long run and, of course, the longer the run then the more electricity that’s lost in the power lines.

“But if you’re looking at a micro-grid to service East Grand Bahama, they can’t really be, in my view, looking at a cable connecting Abaco, because if you connect Abaco then the line must go through east Grand Bahama, so why micro grid if you’re going to be doing this massive infrastructure line to Abaco? So I don’t know if Mr Rolle and the GB Power are on the same page.”

GB Power, though, is making more concrete moves in the area of solar energy. It was joined by the GBPA in signing a four-party agreement, also involving the Inter-American Development Bank (IDB), for construction of a $15m utility-scale solar project at two sites that will supply a combined 9.5 Mega Watts (MW) to the island’s electricity grid.

The deal will see Lucayas Solar Power begin construction on the Devon and Fairfield plants this month. The build-out of the two sites, which will provide 4.5 MW and 5 MW, respectively, is set to create some 80 construction jobs and be completed by the 2024 first quarter.

Lucayas Solar Power will operate as an independent power producer (IPP) that sells the electricity it produces to GB Power, which will then distribute it to its customer base via Grand

SEE PAGE B13

THE TRIBUNE Monday, March 20, 2023, PAGE 9

the ante’ on cruise line deals

acknowledge the value of our natural capital with what we bring to the table.

I’m not certain that’s properly acknowledged by the cruise lines, and I’m not sure it’s properly leveraged by our negotiators.

“I’ve never really heard us advance a position where they come to The Bahamas for our pristine waters,

our natural environment is what enhances their clients’ experience, and really put that on the table as much as we should have. We need to up the ante on that, and not just promote based on investment in cruise ports, such as the $300m Nassau port or private islands,” Mr Carey added. “We need to go to the table and place more on it, leverage the incredible

natural environment and the experience that brings to the cruise passengers.”

The former National Trust chief, who has been hired by Atlantis to review Royal Caribbean’s Environmental Impact Assessment (EIA) for its revised Royal Beach Club project whenever it is released, said The Bahamas also needs to leverage the “certain competitive

advantages” provided by its geography and proximity. Besides being able to offer multiple island experiences within just one nation, the country’s position as the nearest stop to the major Florida cruise ports of Miami, Port Everglades and Canaveral means that - with Cuba still largely off-limits - The Bahamas remains the only option on the three, four and five night cruises.

And the Jones Act, which refers to section 27 of the US Merchant Marine Act 1920, requires that foreignflagged cruise ships (many of which are flagged by the Bahamas) have to call on a foreign port before they can return to their home base in the US. This further strengthens and cements

The Bahamas’ position as the only viable option on short-term cruises.

Many observers have long questioned why The Bahamas has not sought to leverage this, and the country’s value as a private island destination, to negotiate better economic terms with the cruise lines.

Mr Carey said yesterday that The Bahamas’ strategic location means the cruise lines “do not have to burn the fuel” they would in sailing to the Caribbean, thus lowering their business costs as well as reducing ‘wear and tear’ and vessel maintenance costs.

“We definitely give up too easily,” Mr Carey told Tribune Business. “When we allow for these private island destinations, every cruise line owns them, and if we haven’t thrown in Crown Land we are allowing them to add incredible value to their product by setting up private island destinations because they can sell another product to their passengers.

“I’ve run into tourists who have gone to a private island experience and not realised they were still in the same country. That points there to their incredible advantage, and we should leverage that to our benefit.” Mr Carey, who now heads ONE Consultants, in a letter published in The Tribune, acknowledges that cruise tourism remains important to The Bahamas.

“I want to make it clear that I am not opposed to all aspects of the cruise industry, and that despite its large carbon footprint, the industry is an important part of our tourism landscape. Many Bahamians depend on the industry to make a living,” he wrote.

“Notwithstanding this, I believe that as a country we need to do a better job of negotiating more favourable terms of engagement with the cruise industry. We need to better leverage the natural capital that is provided by the Bahamian environment. Cruise lines use our environment to make billions of dollars. Therefore we should strive for a more equitable,

sustainable business arrangement.”

Turning specifically to Royal Caribbean’s proposed Paradise Island project, Mr Carey said: “I want to be very clear in stating that I do not support the project and have serious misgivings about its value to The Bahamas. Ever since the project was introduced years ago, I felt this was not a project that should get government approval because of significant environmental risks and considerations.

“I have since reviewed the initial Environmental Impact Assessment (EIA) for this proposed project, which has in no way lessened my concerns. Firstly, the site contains the last remnant pockets of native coastal forests on Paradise Island. And as this is Crown Land, we should be looking to protect this last vestige of native plants on Paradise Island rather than replace it with non-native vegetation.

“I also have concerns about the proposed development’s carrying capacity to service thousands of cruise passengers at the site every day. The quantity of solid waste to be added to the landfill will be significant. Who will bear the environmental cost of these impacts? The Bahamian consumer whose taxes fund the management of the landfill?”

Mr Carey reiterated Atlantis’ concerns about how waste water and solid waste will be treated and/or disposed of. And any move to modify or change the coastline could impact other beaches on Paradise Island and New Providence’s northern coastline.

“There are numerous examples around The Bahamas of how beaches have been destroyed by altering the coastline. One need not look any further than Cable Beach to see where interference with the beach profile has resulted in significant and nearly irreparable damage to the natural beach profile there,” he said.

The Prime Minister, though, has voiced confidence that his administration has negotiated a better deal with Royal Caribbean that allows for greater participation by Bahamian entrepreneurs and investors, as well as securing a collective 49 percent equity ownership in the project for locals. The full details, though, have yet to be revealed, while the project’s further progress depends on environmental evaluations.

PUBLIC NOTICE

INTENT TO CHANGE NAME BY DEED POLL

The Public is hereby advised that I, GARNELL JOHNSON of Freeport, Grand Bahama, Parent of ZARIAH TAMETRA JOHNSON A minor intend to change my child’s name to ZARIAH TAMETRA PARKER If there are any objections to this change of name by Deed Poll, you may write such objections to the Deputy Chief Passport Officer, P.O. Box N-742, Nassau, Bahamas no later than thirty (30) days after the date of publication of this notice.

NOTICE

NOTICE is hereby given that WILLIAM DORSAINT of Marsh Harbour, Abaco The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 13th day of March, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE

NOTICE is hereby given that ANDREA STEWART of P. O. Box AP-59223, Eastbrook Road, Highland Park, New Providence, The Bahamas, is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 13th day of March, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

PAGE 10, Monday, March 20, 2023 THE TRIBUNE

‘Up

FROM PAGE B1

International Business Companies Act No.45 of 2000

RBMH Investment Fund Ltd. (the “Company”)

Notice is hereby given that, in accordance with Section 138 (8) of the International Business Companies Act, No.45 of 2000, the Dissolution of RBMH Investment Fund Ltd., has been completed, a Certificate of Dissolution has been issued and the Company has therefore been struck off the Register. The date of completion of the dissolution was the 30th Day of December, 2022.

Rafael Baldi De Moraes Horta Liquidator

NOTICE

given that ERIC OSAGIE OKHAROBO of #4 Mahogany Street, Pinewood Gardens, New Providence, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 20th day of March, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE LEGAL NOTICE

NOTICE is hereby given that

THE TRIBUNE Monday, March 20, 2023, PAGE 11

FRIDAY, 17 MARCH 2023 CLOSECHANGE%CHANGEYTDYTD% BISX ALL SHARE INDEX: 2527.4827.181.09-117.58-4.45 BISX LISTED & TRADED SECURITIES 52WK HI52WK LOWSECURITY SYMBOLLAST CLOSECLOSECHANGE VOLUMEEPS$DIV$P/E YIELD 7.005.35 AML Foods Limited AML 6.90 6.900.00 0.2390.17028.92.46% 53.0040.06 APD Limited APD 39.95 39.950.00 0.9321.26042.93.15% 2.762.04Benchmark BBL 2.76 2.760.00 0.0000.020N/M0.72% 2.652.35Bahamas First Holdings Limited BFH 2.46 2.460.00 0.1400.08017.63.25% 3.652.25Bank of Bahamas BOB 3.40 3.400.00 0.0700.000N/M0.00% 6.306.00Bahamas Property Fund BPF 6.30 6.300.00 1.7600.000N/M0.00% 9.808.78Bahamas Waste BWL 9.65 9.650.00 0.3690.26026.22.69% 4.503.25Cable Bahamas CAB 4.50 4.500.00 -0.4380.000-10.3 0.00% 11.507.50Commonwealth Brewery CBB 11.33 11.330.00 0.1400.00080.90.00% 3.652.54Commonwealth Bank CBL 3.40 3.600.2013,5000.1840.12019.63.33% 9.307.01Colina Holdings CHL 8.50 8.500.00 0.4490.22018.92.59% 17.5012.96CIBC FirstCaribbean Bank CIB 12.96 12.960.00 0.7220.72018.05.56% 3.252.05Consolidated Water BDRs CWCB 2.96 2.91 (0.05) 0.1020.43428.514.91% 11.2810.05Doctor's Hospital DHS 10.50 10.500.00 0.4670.06022.50.57% 11.679.16Emera Incorporated EMAB 9.89 9.960.07 0.6460.32815.43.29% 11.5010.75Famguard FAM 11.20 11.200.00 0.7280.24015.42.14% 18.3014.50Fidelity Bank (Bahamas) Limited FBB 18.00 18.000.00 4500.8160.54022.13.00% 4.003.55Focol FCL 4.00 4.000.00 0.2030.12019.73.00% 12.1010.00Finco FIN 12.10 12.100.00 0.9390.20012.91.65% 16.2515.50J. S. Johnson JSJ 15.76 15.760.00 0.6310.61025.03.87% PREFERENCE SHARES 1.001.00Bahamas First Holdings PreferenceBFHP 1.00 1.000.00 0.0000.000 0.0000.00% 1.001.00Colina Holdings Class A CHLA 1.00 1.000.00 0.0000.000 0.0006.25% 10.0010.00Fidelity Bank Bahamas Class A FBBA 10.0010.000.00 0.0000.000 0.0007.00% 1.001.00Focol Class B FCLB 1.00 1.000.00 0.0000.000 0.0006.50% CORPORATE DEBT - (percentage pricing) 52WK HI52WK LOWSECURITY SYMBOLLAST SALECLOSECHANGEVOLUME 100.00100.00Fidelity Bank (Note 22 Series B+)FBB22 100.00100.000.00 100.00100.00Bahamas First Holdings LimitedBFHB 100.00100.000.00 BAHAMAS GOVERNMENT STOCK - (percentage pricing) 115.92104.79Bahamas Note 6.95 (2029) BAH29 107.31107.310.00 100.00100.00BGS: 2014-12-7Y BG0107 100.00100.000.00 100.00100.00BGS: 2015-1-7Y BG0207 100.00100.000.00 100.00100.00BGS: 2014-12-30Y BG0130 100.00100.000.00 100.00100.00BGS: 2015-1-30Y BG0230 100.00100.000.00 100.00100.00BGS: 2015-6-7Y BG0307 100.00100.000.00 100.00100.00BGS: 2015-6-30Y BG0330 100.00100.000.00 100.00100.00BGS: 2015-10-7Y BG0407 100.00100.000.00 90.8890.34BGRS FX BGR131249 BSBGR1312499 90.8890.880.00 90.9890.89BGRS FX BGR132249 BSBGR1322498 90.8990.890.00 100.2499.95BGRS FL BGRS91026 BSBGRS910266 100.24100.240.00 100.09100.03BGRS FL BGRS99031 BSBGRS990318 100.03100.030.00 100.14100.14BGRS FL BGRS79027 03/28/2027BSBGRS790270 100.14100.140.00 100.33100.33BGRS FL BGRS80027 05/09/2027BSBGRS800277 100.82100.820.00 100.66100.66BGRS FL BGRS81027 07/26/2027BSBGRS810276 100.52100.520.00 100.79100.79BGRS FL BGRS81036 07/26/2036BSBGRS810367 100.79100.790.00 100.41100.41BGRS FL BGRS83027 11/28/2027BSBGRS830274 100.41100.410.00 100.12100.12BGRS FL BGRS84032 09/22/2032BSBGRS840323 100.12100.120.00 100.12100.12BGRS FL BGRS84033 09/22/2033BSBGRS840331 100.12100.120.00 100.00100.00BGRS FL BGRS86036 08/27/2036BSBGRS860362 100.32100.320.00 99.6999.69BGRS FX BGRS94029 07/16/2029BSBGRS940297 99.6999.690.00 100.77100.77BGRS FL BGRS81035 07/26/2035BSBGRS810359 100.77100.770.00 92.0592.00BGRS FX BGR125238 10/15/2038BSBGR1252380 100.00100.000.00 MUTUAL FUNDS 52WK HI52WK LOW NAV YTD%12 MTH% 2.602.11 2.600.36%3.89% 4.903.30 4.900.11%5.06% 2.271.68 2.270.18%2.94% 203.47164.74 195.65-3.84%-3.84% 212.41116.70 180.14-15.19%-15.19% 1.791.72 1.780.60%3.09% 2.031.82 2.032.93%11.13% 1.901.81 1.900.87%4.76% 1.010.93 0.950.04%-5.20% 9.376.41 10.188.63%8.63% 11.837.62 13.6115.01%15.01% 7.545.66 7.732.87%2.87% 16.648.65 13.13-20.87%-20.87% 12.8410.54 12.06-4.33%-4.33% 10.779.57 10.62-0.31%-0.31% 16.279.88 16.27N/AN/A 11.228.45 11.223.00%25.60% 14.8911.20 N/A N/A N/A MARKET TERMS BISX ALL SHARE INDEX - 19 Dec 02 = 1,000.00 - last 12 month dividends divided by closing price 52wk-Hi - Highest closing price in last 52 weeks Bid $ - Buying price of Colina and Fidelity 52wk-Low - Lowest closing price in last 52 weeks Ask $ - Selling price of Colina and fidelity Previous Close - Previous day's weighted price for daily volume - Last traded over-the-counter price Today's Close Current day's weighted price for daily volume Weekly Vol. - Trading volume of the prior week Change Change in closing price from day to day EPS $ A company's reported earnings per share for the last 12 mths Daily Vol. - Number of total shares traded today DIV $ - Dividends per share paid in the last 12 months N/M - Not Meaningful P/E - Closing price divided by the last 12 month earnings TO TRADE CALL: CFAL 242-502-7010 | ROYALFIDELITY 242-356-7764 | CORALISLE 242-502-7525 | LENO 242-396-3225 | BENCHMARK 242-326-7333 22-Sep-2033 4.56% 4.84% 4.68% 28-Nov-2027 22-Sep-2032 6.25% 30-Sep-2025 31-Dec-2022 6.25% 4.50% 6.25% 4.25% NAV Date 4.81% 5.00% 5.60% 4.30% 4.32% 4.56% 4.50% 4.65% 15-Oct-2049 FUND CFAL Bond Fund CFAL Balanced Fund CFAL Money Market Fund 15-Aug-2026 4.56% 5.65% 9-May-2027 27-Aug-2036 4.30% 4.56% 23-Sep-2031 28-Mar-2027 26-Jul-2027 26-Jul-2036 CFAL Global Bond Fund 15-Dec-2021 30-Jul-2022 15-Dec-2044 30-Jul-2045 26-Jun-2022 26-Jun-2045 15-Oct-2022 27-Jan-2023 15-Oct-2038 15-Jul-2049 26-Jul-2035 16-Jul-2029 31-Dec-2021 31-Dec-2022 31-Dec-2022 28-Feb-2023 31-Dec-2022 31-Dec-2022 31-Dec-2022 31-Dec-2022 28-Feb-2023 28-Feb-2023 INTEREST Prime + 1.75% MARKET REPORT 31-Dec-2021 31-Dec-2021 MATURITY 19-Oct-2022 20-Nov-2029 31-Jan-2023 31-Jan-2023 6.95% 4.50% 31-Dec-2022 28-Feb-2023 4.50% 6.25% Colonial Bahamas Fund Class D Colonial Bahamas Fund Class E Colonial Bahamas Fund Class F CFAL Global Equity Fund Leno Financial Conservative Fund Leno Financial Aggressive Fund Leno Financial Balanced Fund Leno Financial Global Bond Fund RF Bahamas Opportunities Fund - Secured Balanced Fund RF Bahamas Opportunities Fund - Targeted Equity Fund RF Bahamas Opportunities Fund - Prime Income Fund RF Bahamas International Investment Fund Limited - Equities Sub Fund RF Bahamas International Investment Fund Limited - High Yield Income Fund RF Bahamas International Investment Fund Limited - Alternative Strategies Fund (242)323-2330 (242) 323-2320 www.bisxbahamas.com NOTICE is hereby

MAURICE EMMANUEL BRIAN DOLCE of Flamingo Gardens New Providence, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twentyeight days from the 20th day of March, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas. NOTICE

NOTICE is hereby given that CHRISTOPHER STEWART of P. O. Box AP-59223, Eastbrook Road, Highland Park, New Providence, The Bahamas, is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 13th day of March, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

FINCO CHIEF: 95% OF LOCAL TRANSACTIONS DONE DIGITALLY

RBC FINCO’s top executive says Bahamians are beginning to embrace a digital future with 95 percent now conducting their financial transactions electronically.

Deverson Warner, the BISX-listed mortgage lender’s managing director, told the Grand Bahama Business Outlook that financial institutions such as his own are focused on accelerating e-commerce and the increased use of card payments at the expense of cash, plus the introduction of robust legal and regulatory frameworks to facilitate this new business environment.

He said: “The acceleration of e-commerce and card payments at the

DEVERSON WARNER

expense of cash has become a focus of many economies, and specifically, financial institutions. The future will require an e-commerce ecosystem that facilitates the digital payments and establishes appropriate legal and regulatory framework for online transactions. Financial institutions like RBC

play a vital role in helping clients thrive in a fast-paced digital environment.”

Mr Warner added that financial institutions must, at a minimum, understand client needs, how technology influences consumer behaviour and how to use that same technology to derive a competitive edge.

“It has now become table stakes for financial institutions to understand three things. One, how our clients’ needs are changing, how technology has and continues to transform consumer behaviour, and leveraging technology and digital solutions to give businesses a competitive edge,” he said.

“Clients have said that they want fast and convenient payments solutions. Governments and regulators are seeking to

accelerate financial inclusion and reduce cash usage to cashless initiatives. Businesses need digital solutions that give them a competitive advantage; being able to pay payments processing within one to three seconds by a merchant and e-commerce solutions. “This is the minimum expectation of a client’s access to solutions that allow payment gateway integration with major social media platforms like Facebook, Instagram, Twitter or What’s App.” Mr Warner said the COVID-19 highlighted the need for a transition to digital banking, and that providing safe banking platforms should be a priority for financial institutions. He said: “The COVID19 pandemic highlighted the necessity for adopting

GB TO ABACO POWER CABLE ‘DOABLE’ BUT MORE NEEDED

Bahama’s electricity grid.

GB Power will purchase the solar energy produced by the plants at a locked-in price of $0.09 cents per kilowatt hour (KWh) over the duration of a 25-year power

purchase agreement (PPA) with Lucayas Solar Power.

Mr Carey said of the move: “Environmentally, it’s good. It looks good.

From what was said the company [Lucayas] is majority Bahamian-owned. The power company here

will be buying power from that plant. Of course, the dynamics in terms of what mark-up they will put on their cost, we don’t know. But I think it’s a good start and there was a suggestion that other companies were

looking at solar plants in Grand Bahama Grand Bahama uses up to 100 Mega Watts (MW) of energy, so the Lucayas Solar Power facilities will “take care of less than 10 percent, but it’s a step in the right direction”.

e-commerce and technological solutions for all levels of business. Propelled by the pandemic, bankers, consumers and retailers have been moving away from manual processes and cash payments towards using technology and digital forms of payment.

“The digital future for The Bahamas means our people need a safe, secure and easy way to navigate a digital platform for their financial transactions. This has to be a top priority for financial institutions.”

Mr Warner said more than 95 percent of financial transactions are performed digitally in the Bahamas. He added: “In recent years across the globe, the popularity of cash has dwindled as digital payments have become faster, cheaper and more convenient. Today,

economic and financial environments like The Bahamas promote e-commerce and local businesses to serve domestic and international consumer markets.

“Clients are choosing digital options to conduct more and more of their transactions. Today, 95 percent of financial transactions are being performed digitally by our clients in The Bahamas. This is what it means to embrace the digital future, making it easier for Bahamians to access a vital online platform and access to first world solutions to effectively compete with the rest of the world.

“Access is no longer limited to physical availability. This is technology. This is what embracing the digital future of financial institutions look like.”

today’s weather. Temperatures are today’s highs and tonight’s lows.

Shown is today’s weather. Temperatures are today’s highs and tonight’s lows.

THE TRIBUNE Monday, March 20, 2023, PAGE 13

SIMMONS jsimmons@tribunemedia.net

By FAY

PAGE B9 Shown is

ORLANDO Low: 48° F/9° C High: 70° F/21° C TAMPA Low: 49° F/9° C High: 68° F/20° C WEST PALM BEACH Low: 63° F/17° C High: 73° F/23° C FT. LAUDERDALE Low: 64° F/18° C High: 73° F/23° C KEY WEST Low: 67° F/19° C High: 70° F/21° C Low: 71° F/22° C High: 78° F/26° C ABACO Low: 70° F/21° C High: 74° F/23° C ELEUTHERA Low: 73° F/23° C High: 78° F/26° C RAGGED ISLAND Low: 75° F/24° C High: 80° F/27° C GREAT EXUMA Low: 75° F/24° C High: 80° F/27° C CAT ISLAND Low: 74° F/23° C High: 82° F/28° C SAN SALVADOR Low: 74° F/23° C High: 83° F/28° C CROOKED ISLAND / ACKLINS Low: 75° F/24° C High: 81° F/27° C LONG ISLAND Low: 74° F/23° C High: 81° F/27° C MAYAGUANA Low: 73° F/23° C High: 84° F/29° C GREAT INAGUA Low: 74° F/23° C High: 83° F/28° C ANDROS Low: 72° F/22° C High: 79° F/26° C Low: 65° F/18° C High: 74° F/23° C FREEPORT NASSAU Low: 64° F/18° C High: 72° F/22° C MIAMI

5-Day Forecast Variable clouds with showers around High: 78° AccuWeather RealFeel 83° F The exclusive AccuWeather RealFeel Temperature is an index that combines the effects of temperature, wind, humidity, sunshine intensity, cloudiness, precipitation, pressure and elevation on the human body—everything that affects how warm or cold a person feels. Temperatures reflect the high and the low for the day. Patchy clouds with a few showers Low: 71° AccuWeather RealFeel 67° F Breezy in the morning; partly sunny High: 81° AccuWeather RealFeel Low: 70° 84°-67° F Sunny to partly cloudy and windy High: 82° AccuWeather RealFeel Low: 69° 83°-66° F Partly sunny and windy High: 83° AccuWeather RealFeel Low: 69° 84°-67° F Mostly sunny, breezy and pleasant High: 83° AccuWeather RealFeel 87°-67° F Low: 70° TODAY TONIGHT TUESDAY WEDNESDAY THURSDAY FRIDAY almanac High 81° F/27° C Low 70° F/21° C Normal high 79° F/26° C Normal low 66° F/19° C Last year’s high 86° F/30° C Last year’s low 76° F/24° C As of 2 p.m. yesterday 0.31” Year to date 2.45” Normal year to date 3.89” Statistics are for Nassau through 2 p.m. yesterday Temperature Precipitation sun anD moon tiDes For nassau New Mar. 21 First Mar. 28 Full Apr. 6 Last Apr. 13 Sunrise 7:14 a.m. Sunset 7:21 p.m. Moonrise 6:41 a.m. Moonset 6:30 p.m. Today Tuesday Wednesday Thursday High Ht.(ft.) Low Ht.(ft.) 7:26 a.m. 3.2 1:12 a.m. -0.5 7:52 p.m. 3.0 1:48 p.m. -0.6 8:16 a.m. 3.2 2:07 a.m. -0.7 8:41 p.m. 3.2 2:34 p.m. -0.7 9:03 a.m. 3.1 2:59 a.m. -0.7 9:29 p.m. 3.2 3:19 p.m. -0.8 9:49 a.m. 2.9 3:49 a.m. -0.7 10:16 p.m. 3.2 4:02 p.m. -0.7 Friday Saturday Sunday 10:35 a.m. 2.7 4:38 a.m. -0.5 11:03 p.m. 3.1 4:45 p.m. -0.6 11:20 a.m. 2.5 5:27 a.m. -0.3 11:50 p.m. 2.9 5:29 p.m. -0.3 12:08 p.m. 2.2 6:17 a.m. 0.0 6:15 p.m. 0.0 marine Forecast WINDS WAVES VISIBILITY WATER TEMPS. ABACO Today: NE at 8-16 Knots 3-5 Feet 6 Miles 76° F Tuesday: ENE at 12-25 Knots 5-9 Feet 8 Miles 75° F ANDROS Today: NE at 6-12 Knots 0-1 Feet 7 Miles 80° F Tuesday: NE at 10-20 Knots 1-2 Feet 10 Miles 79° F CAT ISLAND Today: SSW at 8-16 Knots 2-4 Feet 7 Miles 78° F Tuesday: NNE at 10-20 Knots 3-5 Feet 10 Miles 78° F CROOKED ISLAND Today: SSE at 4-8 Knots 2-4 Feet 10 Miles 78° F Tuesday: NNE at 6-12 Knots 1-3 Feet 10 Miles 80° F ELEUTHERA Today: N at 6-12 Knots 2-4 Feet 5 Miles 77° F Tuesday: NNE at 10-20 Knots 3-6 Feet 10 Miles 77° F FREEPORT Today: N at 10-20 Knots 2-4 Feet 7 Miles 78° F Tuesday: ENE at 8-16 Knots 2-4 Feet 10 Miles 76° F GREAT EXUMA Today: NW at 4-8 Knots 0-1 Feet 7 Miles 78° F Tuesday: NE at 10-20 Knots 1-2 Feet 10 Miles 79° F GREAT INAGUA Today: SW at 3-6 Knots 1-3 Feet 10 Miles 78° F Tuesday: NNE at 6-12 Knots 1-2 Feet 10 Miles 80° F LONG ISLAND Today: S at 7-14 Knots 1-3 Feet 10 Miles 78° F Tuesday: NE at 7-14 Knots 1-2 Feet 8 Miles 79° F MAYAGUANA Today: SSE at 8-16 Knots 3-6 Feet 7 Miles 78° F Tuesday: NNE at 4-8 Knots 3-5 Feet 10 Miles 78° F NASSAU Today: NE at 6-12 Knots 1-2 Feet 7 Miles 77° F Tuesday: NE at 10-20 Knots 1-3 Feet 10 Miles 77° F RAGGED ISLAND Today: S at 6-12 Knots 1-3 Feet 7 Miles 78° F Tuesday: NE at 7-14 Knots 1-2 Feet 8 Miles 79° F SAN SALVADOR Today: W at 6-12 Knots 1-3 Feet 6 Miles 78° F Tuesday: NNE at 10-20 Knots 1-3 Feet 10 Miles 78° F uV inDex toDay The higher the AccuWeather UV Index number, the greater the need for eye and skin protection. Forecasts and graphics provided by AccuWeather, Inc. ©2023 H L tracking map

FROM

THE WEATHER REPORT

N S E W 15-25 knots N S W E 8-16 knots N S E W 15-25 knots N S W E 6-12 knots N S E W 4-8 knots N S E W 3-6 knots N S E W 6-12 knots N S W E 6-12 knots

The Management of UBS Trustees (Bahamas) Ltd. is pleased to announce its

2023 Promotions

‘Mom and Pop’ merchants worst price control violators

SMALL ‘Mom and Pop’ retailers are the most frequent price control violators, government inspectors have revealed, with their larger food retail competitors typically compliant with the regulations.

Theodore Curry, senior price control inspector, told the Prime Minister’s Office’s media briefing: “Unfortunately, at the moment it’s the Mom and Pop stores, or the stores we call ‘Over The Hill’. We find that most of the biggest stores, and I don’t want to call any names, but the bigger ones, they are in compliance because of the cost of doing business. For the most part, they have been compliant.

“But some people, their complaint is it’s difficult doing business in the country, so anywhere where they can try and get around the system they try to do that. But we try to admonish, and try to tell them that, hey, the law is the law (and) you have to find other creative, innovative means to make extra money.

“If it’s on the items that we control, you may have to unfortunately pass that cost on to something else to make up the difference. We don’t like to do that. But the reality is that’s what it is. Over the past few months, there have been some complaints about the margins with regard to pharmaceuticals. But those have since gone back to the original 50 percent markup. So everything’s back to where it used to be.”

While there may have been isolated incidents of price gouging by merchants in New Providence and the Family Islands, Mr Curry said it was “nothing of a major concern”.

He added: “There’s no particular area in which people are complaining. One, I guess, is the

instability of eggs, the volatility of the egg imports because of the supply chain, bird flu and other mitigating circumstances that cause the volatility to go up and down.”

The Consumer Protection Commission is also planning to increase its manpower and add more inspectors throughout the Family Islands.

Rex Adderley, head of the price control unit, said: “The department has acquired nine additional inspectors in New Providence. We are seeking now to look at a full picture of the whole Bahamas, and look at the islands that require inspectors. Those that don’t have inspectors, we want to hire inspectors in those areas.” There are some islands that presently have no price control inspectors, but the larger ones will get an additional staff member, particularly Eluethera, Andros and Abaco. Mr Adderley said a proposed budget for funding the recruitment of extra price control inspectors has been sent to the Ministry of Finance.