‘Do not hit rock bottom’ on public sector reform

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE BAHAMAS “cannot squeeze out” civil service reform if it wishes to tackle “the vexing problem” of perceived corruption in accessing public services, governance reformers warned yesterday.

Matt Aubry, the Organisation for Responsible Governance’s (ORG) executive director, told Tribune Business that The Bahamas does not have to follow Jamaica and Barbados’ in “hitting rock bottom” before it enacts meaningful reforms to the public service, fiscal management and other key aspects of government.

He spoke as ORG released a report, produced for it by Dr Yvette Pintard-Newry, that sets out a potential road

map for improving the efficiency and effectiveness of The Bahamas’ public sector and its role in advancing the ease of doing business and quality of life for all citizens and residents.

The report, recommending that The Bahamas start by reviewing the Public Service Bill 2010 and using it as the foundation for a new Public Service Act, said it was vital that The Bahamas address real

and perceived corruption within the sector if Bahamians were to regain “trust” in the Government. Dr Pintard-Newry also suggested that The Bahamas’ present fiscal crisis, and the drive for austerity, had created something of a paradox for public service reform. While the Government was directing increasing resources to front-line public services, such as national security, health, education and

Investors in $18m boost as bank beats target 10%

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

COMMONWEALTH

Bank yesterday said it beat 2022 profit targets by 10 percent as it used its record net income to return $18m to shareholders via two extraordinary dividend payments.

social services, it was also allocating less to develop the public service even though its employees are vital to arresting and turning around The Bahamas’ fiscal decline.

“Dedicated resources (human, technical and financial) are also essential to public sector reform,” she wrote. “The importance of improved fiscal management and debt reduction so that the

BTC chief in promise on service ‘black hole’

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE BAHAMAS Telecommunications Company’s (BTC) top executive last night pledged to deliver “a best-in-class experience” for all users after complaints that clients were left “in the lurch” by poor customer service.

Sameer Bhatti, BTC’s chief executive, acknowledged to Tribune Business there will be “occasions” when technology fails to function after several wellknown customers recently complained they were being billed for communications

services they were not receiving, with no information on the problem’s cause or when it would be rectified being provided. One, frustrated after four weeks

SEE PAGE B6 SEE

Gov’t gives $115m tax relief in fiscal first half

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE GOVERNMENT granted almost $115m of Excise tax and Customs duty relief during the first half of the 2022-2023 fiscal year, the mid-year Budget documents have revealed.

The section on “tax relief, remissions and other waivers” discloses that tax breaks worth a collective $14.869m were granted on eligible goods imports worth a total $415.632m during the six months to end-December 2022, with the concessions granted under a variety of investment incentives laws and other legislation.

The biggest share, some 36.7 percent or $42.104m, was granted to the Bahamian resort and hotel sector - the largest industry in the country - under the Hotels Encouragement Act. This sum, more than one-third

Tangela Albury, the BISX-listed lender’s vice-president and chief financial officer, told Tribune Business that 2022’s “unusual” $60m profitability was unlikely to be repeated this year with the performance largely driven by the reversal of COVIDrelated loan loss provisions and recovery of charged-off loans.

However, she added that Commonwealth Bank was aiming to match or beat its pre-COVID and Hurricane Dorian performance in 2019 as it aims to drive loan delinquency rates below historical levels. And, with deposits growing by 4 percent year-over-year, the personal loan specialist is

aiming to convert those clients into borrowers.

In written replies to this newspaper’s questions, Ms Albury said Commonwealth Bank had paid a total six cents per share in extraordinary dividends as a result of 2022’s performance. This was split into two payments, with the first four cents per share payout taking place last November and the two cent balance occurring in February 2023.

“The total extraordinary dividend payment is approximately $18m to shareholders,” she

business@tribunemedia.net MONDAY, MARCH 6, 2023

SEE PAGE B9

PAGE B12

PAGE B7

SEE

SAMEER BHATTI SIMON WILSON • Bahamas can ‘control own destiny’ with change • But ‘can’t squeeze out’ reform in corruption fight • Report: Ending graft vital to ‘trust’ in Government

MATT AUBRY

$5.76

TANGELA ALBURY

$5.76 $5.72 $5.92

GOOD CORPORATE GOVERNANCE CRITICAL TO SUSTAINABLE GROWTH

CORPORATE governance incorporates the principles and practices that guide how a company is directed, managed and controlled. It is critical for building long-term value for all stakeholders, including shareholders, employees, customers, suppliers and the broader community. Effective corporate governance is essential in The Bahamas, where the country’s economic success depends on attracting foreign investment and building strong, resilient businesses that can weather economic and environmental challenges. Based on the overwhelming feedback regarding this writer’s most recent article

Derek Smith By

on the need for Board of Directors diversity, we will today highlight four additional aspects of corporate governance.

Transparency and accountability

A critical element of corporate governance in The Bahamas is transparency and accountability. Companies in The Bahamas should be transparent about their financial performance and disclose all material information to their stakeholders, including shareholders, employees and regulators. This transparency helps build trust with stakeholders and ensures that companies are held accountable for their actions. For example, the Securities Commission of The Bahamas, Central Bank of The Bahamas and the Insurance Commission

of The Bahamas require their registrants to file annual financial statements and disclosures about any material events that may impact the company’s performance or value. This reporting requirement helps ensure that investors have access to accurate and timely information about the companies in which they invest.

Corporate Social Responsibility

Sustainability and social responsibility are also important aspects of corporate governance in The Bahamas. Companies should prioritise environmentally-sustainable practices, promote diversity and inclusion, and

engage with stakeholders to understand their needs and concerns. Companies should also establish mechanisms for reporting and investigating potential breaches of corporate social responsibility policies and take appropriate action to address any violations.

Ethical behaviour and integrity

Effective corporate governance requires a culture of ethical behaviour and integrity. Accordingly, companies in The Bahamas should establish a code of conduct that sets out clear expectations for ethical behaviour and conduct regular training and awareness programmes for employees to ensure they

Construction corruption ‘big elephant in room’

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

CONSTRUCTIONrelated corruption has been branded as a “big elephant in the room” with the potential to compromise building safety, a Bahamian Contractors Association (BCA) trustee is warning.

Debbie Deal told an Organisation for Responsible Governance (ORG) panel discussion that illicit practices relating to permits and approvals is “one of the biggest problems” she has with the construction industry.

She said: “My biggest problem in the construction industry is that when I was building, I know that I could go in those days to the…... and say: ‘I’m having

an issue with this building. What can you do? How can you help me?’ That, to me, is a conflict of interest. How can I possibly expect and really guarantee that the persons that will occupy the building are going to be safe?”

Urging government official to ensure that “everything is above board”, Ms Deal also called for the Construction Contractors Board to finally be

activated to crack down on operators who are not fit to practice.

She said: “I went to the first Contractors Association meeting back in 1985, when we were talking about passing the Construction Act, but at the time nobody wanted to do it because they wanted to include lien laws, but we passed that now.

“We really need government to do whatever it can do to enforce these

laws and we, as contractors, can build safe, reliable homes and businesses and buildings for the general public…. But the elephant in the room is we have created this monster. We now have to disassemble that monster by enacting the laws that are actually in place.”

Causing contractors to prepare bids for projects they will not get is a challenge when bidding on government contracts, Ms

understand and adhere to these standards.

Internal Audit

Internal audit plays a crucial role in corporate governance by providing an independent and objective assessment of a company’s internal controls, risk management processes and governance practices. An effective internal audit function can help companies identify and mitigate risks, improve operational efficiencies, and ensure compliance with laws and regulations. In addition, by providing management and the Board with regular reports on the effectiveness of internal controls and

Deal said. She added that it takes “often times months” to prepare a bid for a government contract, only for it to be awarded to someone with inside knowledge or the right connections who can put in a lower bid. In such cases, the selected contractor is often unable to complete the job and leaves it unfinished, resulting in the Government having to recall one of the rejected bidders to finish the work.

$100m Cable Beach project is 70% sold

AN 11-storey Cable Beach development is two months ahead of its construction schedule with 70 percent of available units pre-sold, its developer has revealed.

Jason Kinsale, Aristo Development’s president, says the Aqualina project’s topping-off ceremony occurred just 18 months after underground and infrastructure construction began on the company’s latest high-end development.

Speaking as 141 workers gathered to throw hard hats in the area to mark the last structural element’s completion before the building is closed in with doors, windows, electrical, plumbing and interior work, Mr Kinsale said: “We have a great, highly motivated team, excellent supervision and project management, plus we have been fortunate with the weather.

“The topping off ceremony was scheduled for early April and we had it in late February, so we could not be more pleased with how everything is going.” Aqualina features 30 residences, all three and four-bedroom ocean

view condominiums, with private elevators, floor to ceiling storm-rated glass, an infinity pool, fitness centre, padel court, covered parking, 24/7 security, boat club membership and Baha Mar’s amenities a five-minute walk away.

The full project is valued at $100m, and Matthew Marco, Aristo’s sales and marketing director, said: “The appeal of The Bahamas, I am very pleased to say, is stronger than ever in the world of the high net worth individual and, when you combine what the country has to offer with what Aqualina has to offer, you have a winning combination.

“We know that a luxury tower must contain more than just efficient floor plans and an innovative design. It must have a soul, and provide a lifestyle and a level of service that is incomparable. During the pandemic when there was a rush to work in the sunshine so long as you had to work from home, we saw droves of people finding their way to The Bahamas - not just Nassau, but throughout the islands, including places like Exuma and Eleuthera.

“They just wanted reliable Internet and warmth. Now, our market is much more targeted, largely from the eastern seaboard of the US, Canada, the UK and Europe, and they are not looking for a temporary solution or escape. They are looking for an incomparable lifestyle they cannot find anywhere else. Throw in the attractive permanent residency programme, and the benefits are unmatched.”

Mr Marco said pricing was not an issue. “Clients who had bought at One Cable Beach, and knew the quality of construction and attention to detail in the finishes, have turned around and bought multiple residences in Aqualina,” Mr Marco added. “That kind of confidence and cult following says a lot about a developer.”

Aqualina is the latest in a series of developments by the company. Among various Aristo projects are Hampton Ridge, Balmoral, Thirty-Six (Paradise Island), One Cable Beach and now Aqualina. The latter’s completion date is estimated as being the 2024 first quarter.

PAGE 2, Monday, March 6, 2023 THE TRIBUNE

MORE than 140 construction workers gathered at Aqualina to celebrate a roof-topping off ceremony two months ahead of schedule.

SEE PAGE B8

A NEW Bay Street tourist attraction will later this month seek to recruit 100 Bahamians to staff its operations, the Government’s labour director, said yesterday, after this weekend’s job fair produced “a significant number of hirings”.

Robert Farquharson told Tribune Business that the Department of Labour is teaming with the new business, I Dream of Sugar, to hold a March 25 job fair at its premises specifically to hire workers for that operation. And further Labour on the Blocks-style job fairs are planned for the Freetown and Fox Hill communities on April 1 and June 17, respectively.

Disclosing that Saturday’s ‘Labour on the Blocks 2.0’ event has likely resulted in several hundred persons finding fresh employment, he also disclosed that Disney Cruise Line has asked the Department to help with finding Nassau-based construction workers willing to help build its Lighthouse Point project after running into labour shortages on Eleuthera. Abaco, too, is seeking more workers in the construction field.

Mr Farquharson also told this newspaper that his agency plans to hold a workshop in the upcoming weeks to help ready job seekers to be interviewed, disclosing that employers have voiced concern that a number of potential recruits are “not prepared to enter the labour market”.

“On March 25 this month, in a couple of weeks, we have a specific

The Tribune wants to hear from people who are making news in their neighbourhoods. Perhaps you are raising funds for a good cause, campaigning for improvements in the area or have won an award. If so, call us on 322-1986 and share your story.

job fair from 9am to 5pm,” he revealed. “A company, called I Dream of Sugar, a new tourist attraction based on Bay Street, they’ve asked if we can find 100 people for them.

“Then, on April 1, we will be partnering with the Freetown community and having a job fair at the Pilgrim Baptist Church from 9am to 2pm. All the major employers have agreed to come. Then, on June 17, we will be in Fox Hill.”

Again asserting that there is “plenty of work” available for Bahamians seeking employment opportunities, Mr Farquharson said the strategy of bringing prospective employers to communities where they can meet multiple potential recruits and interview them en masse at one time appeared to have paid off again.

He asserted that this weekend’s ‘Labour on the Blocks 2.0’ in Carmichael had gone “extremely well” and was “a very, very

event”. Mr Farquharson said: “We estimate we had about 450 persons attend the job fair, and we had about 40 employers. Persons were lined up from 6.30pm. We opened at 9am and closed at 3pm.

“We have a number of employers who would have identified persons and hired on the day. We know a significant number of persons were hired. Blue Lagoon came there looking specifically to hire about 100 persons. They got a good number. We know Wemco Security hired 40 persons. Sysco Bahamas, Fidelity and Sands Brewery, all of them would have identified and hired some persons. They’re waiting for background checks on others.”

However, finding sufficient labour to meet employer needs in the Family Islands - especially those with major foreign direct investment (FDI) projects in the build-out stage - remains a challenge. As does luring workers in Nassau to work in the Out Islands, with the result that developers and companies are often left with little choice but to import expatriate labour on work permits.

“We’re still busy looking for people interested in working in the construction industry and looking for job opportunities in Abaco and south Eleuthera,” Mr Farquharson said. “They’re looking for young men and women to come down and do construction in those areas, and also Norman’s Cay in the Exumas.

“We want to focus on people coming to the island.

We have significant construction going on in those islands. The Disney project in south Eleuthera is having challenges finding people in Eleuthera to work, so they’ve asked us to look in New Providence.” PostDorian reconstruction work in Marsh Harbour and Baker’s Bay is also driving labour demand that Abaco’s workforce cannot meet.

“After they hire, these companies gave accommodation and food included in

the package,” Mr Farquharson said of Family Island construction employers. “If you go, these companies are offering accommodation and three meals a day.”

Reiterating that the ‘Labour on the Blocks 2.0’ series has resulted in more than 3,000 Bahamians finding work, the Government’s labour chief added: “One of our biggest concerns is that many of these persons are not prepared to enter the

labour market. They don’t have the interviewing skills.

“In the next couple of weeks, the Department of Labour will be holding a workshop for job seekers so they can be properly prepared for interview. That’s some of the things we’ve been getting from employers; people entering the job market do not know how to interview properly, so we are looking to assist them in that area.”

THE TRIBUNE Monday, March 6, 2023, PAGE 3

NEW BAY

ENTITY

SEEK

RECRUITS By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

STREET

TO

100

ROBERT FARQUHARSON

Share your news Condo For Sale PALM CAY ANCHORAGE 1 GATED COMMUNITY Spacious 2 bed, 2 1/2 bath Den, Large Balcony 1,324 sq. ft. Resort Style Amenities Beach Marina (242) 535-7149 Phone Bay Investment serious inquiries only Price $575,000

MORTON SALT STAFF TO ENJOY UP TO 25% WAGE INCREASE

By

LINE staff at Morton Salt are set to enjoy wage increases of up to 25 percent after their trade union signed an “historic” fiveyear industrial agreement with the Inagua-based salt harvester.

The Bahamas Industrial Manufacturers & Allied Workers Union (BIMAWU), in a statement, said: “We have continued to build on our agreement which was first signed in Nassau, under president Wilfred Seymour, in 2002. Our union was formed with the assistance of Robert Farquharson, the now-director [of labour],

and Shane Gibson (of Bahamas Communications and Public Officers Union at the time).”

Jennifer Brown, the union’s current president, said: “This is an historic event for the workers in Inagua as they will be able to witness the first-hand signing of an agreement.

“We have gained in our contract… wage increases

on the contract up to 25 percent for the five-year term of the contract. Shift premium, Christmas bonus, increased sick days, increased compassionate leave, paternity leave with pay, increased life insurance. A five year contract with a 5 percent each year guaranteed, a production bonus that can increase up to 9 percent, and the signing

bonus of $1,500 for each bargaining unit member.

“It was such a struggle over the years but we are beginning to see a light at the end of the tunnel. To our workers we say come to work, do your work and the executive officers will do our best to represent you.”

Jesus Rodriguez, Morton Salt Bahamas general manager, said at the signing of

the agreement: “We need to keep on communicating to make the most of our operation. The company has invested in us and we need to keep on delivering. We are hiring and we are completing our workforce. Again, I’m sure that if we keep on delivering we will keep on bringing the people we know we need. That’s important.”

Bahamas company among climate award’s contenders

A BAHAMIAN company co-founded by an ex-NBA basketball player is among 13 regional initiatives that have been nominated for the Earthshot Prize.

Partanna Bahamas, the carbon-negative concrete innovator created by former LA Laker, Rick Fox, has been put forward as a contender for the £1m award given to companies and individuals working to effect positive environmental and climate-related change.

Founded in 2020 by the Royal Foundation, the Earthshot Prize has one

winner for each of the five categories: protect and restore nature; clean our air; revive our oceans; build a waste-free world; and fix our climate. Bahamasbased Coral Vita earned top honours in the ‘revive our oceans’ category last time.

As well as Partanna, the 13 regional projects nominated by the Caribbean Climate-Smart Accelerator (CCSA) also hail from Aruba, Barbados, Costa Rica, Grenada, Haiti, Jamaica, Panama, Saint Lucia and Trinidad & Tobago. The CCSA has also nominated another

13 projects based outside the Caribbean but focused on implementation in the region.

Racquel Moses, chief executive of the Caribbean Climate-Smart Accelerator, said: “The Caribbean has a long distinguished history as global innovators, and we are proud to highlight this at the world stage by nominating locally-led and regionally-focused projects.

“These initiatives are improving the sustainability of our communities and providing opportunities for new pathways in socioeconomic development. Their importance cannot

be understated, and neither can their innovation. We wish our nominated projects good luck in earning the Earthshot Prize, and look forward to their continued work in making the Caribbean the world’s first climate-smart zone.”

Partanna has already signed a Memorandum of Understanding (MoU) with the Caribbean ClimateSmart Accelerator (CCSA), which will help to promote the impact of its work to a global market. And, under the (MoU) signed with the Davis administration at last year’s COP27 climate conference, it pledged to

build 30 affordable homes using its carbon-negative concrete in Hurricane Dorian-ravaged Abaco this year.

Partanna’s concrete employs recycled steel slag and brine. Its binding components are designed to absorb carbon dioxide as they cure in production, and continue to do so throughout their lifecycle. The company says a 1,250 square foot home constructed by itself, and employing its concrete product, removes 22.5 tons of carbon dioxide from the Earth’s atmosphere while a

standard home of the same size actually emits 70.2 tons.

Mr Fox formed Partanna in partnership with architect Sam Marshall. Both have witnessed the devastating impacts of climate change, the former with the aftermath of Hurricane Dorian in Abaco, and the latter via the wildfires that have frequently ravaged the US state of California. The two thus developed a shared interest in climate resilient, sustainable building materials, with Mr Marshall having worked on the concrete solution for seven years, and Mr Fox some three-and-a-half.

TOP OFFICIAL HEADS BAHAMAS TEAM TO MAJOR TOURISM EVENT

THE BAHAMAS’ tourism director-general is leading the country’s delegation to a major international industry conference that begins tomorrow in Berlin.

Latia Duncombe will head the team participating in the International Tourism Exchange (ITB), the world’s largest tourism

trade forum, scheduled to take place from March 7-9. The delegation includes officials from the Ministry of Tourism, Investments and Aviation, plus representatives from the three major promotion boards, hotels and local tour operators.

Over the three-day event, executives from both the

private and public sectors will hold one-on-one-meetings with some of the largest global tour operators and other industry professionals to expand and negotiate new travel business to The Bahamas.

“Our destination has been participating in ITB for many years,” said Mrs Duncombe. “This year,

all the major players of our tourism industry will be in Berlin on a mission to showcase in the international travel trade that The Bahamas is the top destination for memorable vacations.

“In 2022, we made huge strides in tourism recovery, coming in close to rival our pre-pandemic numbers of 2019. At ITB, we will be making the strategic connections to drive new business and to increase business from our present

partners in Europe and from around the world.”

ITB is the world’s largest tourism trade show and features more than 10,000 exhibitors, representing all sectors of the international travel trade. These include countries, destinations, tour operators, booking systems, transport providers and hotels. After a three-year break due to the pandemic, ITB returns this year as an in-person event under the slogan, Open for Change

Sterling partners over trust service provision

BAHAMAS-headquartered Sterling Global Financial has entered a strategic partnership with JTC, a provider of private client, corporate and fund services, that will see the latter offer select services to its customers.

The two companies, in a statement, said JTC will now provide trust and corporate administration services to Sterling clients. Sterling will continue to provide alternative asset management, real estate development and banking services.

“The partnership with JTC is an endorsement of Sterling Financial Group’s people, strategy and the future,” said David Kosoy, Sterling’s chairman and founder. “For our clients and our team, this is excellent news as we can all benefit from our global relationship with JTC.”

Iain Johns, JTC’s group head of private client services, added: “We are delighted to have entered into this partnership. At JTC we have a strong track record of helping financial organisations to deliver strategic transformation, and with its excellent client book and strong service ethos,

IAIN JOHNS

Sterling Group Financial is a natural long-term partner for us.”

JTC has more than 35 years’ experience in providing trust, fund and corporate administration. It is a FTSE 250 company, listed on the London Stock Exchange, and has a collaborative and entrepreneurial culture driven by its shared ownership model.

Sterling Global Financial Group is a global asset manager focused on real estate investment, development, lending, infrastructure and bank and trust services. Built over more than 50 years, Sterling focuses on strategies that align with its partners’ goals to preserve and grow investments.

SEMI-SKILLED AC TECHNICIAN HELPER

We are a property management company that services commercial and residential sites. The right candidate for this job opening will possess the following skills:

• 2-3 years job experience

• Be able to trouble-shoot central air conditioning and ductless units

• Have some common knowledge on Air Conditioning installation practices and procedures

• Good organizational skills

• Excellent people and communication skills

• Must be reliable

• Must have your own tools

• Must have own transportation.

If you meet the above criteria, please email your resume to actechjob2023@gmail.com

Please note that only qualified applicants will be contacted.

PAGE 4, Monday, March 6, 2023 THE TRIBUNE

Reporter

YOURI KEMP Tribune Business

ykemp@tribunemedia.net

LATIA DUNCOMBE

THE DEBT CEILING ISSUE

For years the US national debt limit has been a persistent political issue, pitting Democrats against Republicans. As the latest deadline for the approval of a new limit approaches, with a cutoff date of March 2023, the question is whether the two parties can find common ground and agree to raise the size of the US sovereign debt.

In essence, this ceiling is a limit on the amount of debt the US government can issue, which is set by Congress. When the limit is reached, the state becomes barred from further borrowing. As the US government relies on borrowing to fund its operations, reaching this limit can have dire consequences. Without the ability to borrow, the US government would have to cut spending, and even default on its obligations.

In the past, both parties have used the debt ceiling as a bargaining chip, leading to tense negotiations and last-minute approvals. The most recent stand-off in

2019 resulted in a temporary agreement that suspended the limit until July 2021. The deadline was then extended to March 2023, due to the COVID pandemic and related economic concerns.

Currently, the political climate in the US is very polarised, with the Democrats holding a slim majority in the Senate but a minority in the House of Representatives. This means that any rise in the debt ceiling will require support from law makers belonging to both parties. However, the Republicans have indicated they are not willing to support an increase without significant concessions from the Democrats, including cuts on the Inflation Reduction Act (IRA), a federal law recently signed by President

Biden that involves large state-sponsored spending.

The IRA entails spending in the order of $738bn, including funding for social programmes, climate initiatives and infrastructure projects. The Republicans have criticised the package as excessive and argue it will increase the deficit and debt. The Democrats argue that the spending is necessary to address long-standing social and environmental issues and stimulate economic growth. As the deadline for the approval of the debt ceiling approaches, there are two possible scenarios for how the stand-off could play out in 2023. The first and most desirable outcome is that the Democrats and Republicans will come together and approve an increase before

the March deadline, avoiding any disruption to the US economy and government operations.

The worst-case scenario is that the two parties will be unable to come to an agreement, and the US government will default on its obligations. This would have catastrophic consequences for the American people and the global economy.

To mention just a couple of major points of disruption:

SEBAS ACQUIRES FORMER CITIBANK SITE NEAR UOB

By FAY SIMMONS jsimmons@ tribunemedia.net

THE FORMER Citibank property on University Drive has been renamed in honour of the father of its new owner - Island Luck chief, Sebas Bastian.

The building, which houses a Scotiabank branch, was formally branded the Edwin “Smiley” Bastian Corporate Centre during a rededication ceremony that attracted Prime Minister Philip Davis KC; former PLP leader, Perry Christie, and numerous other persons with political connections including Seabreeze MP, Leslia Miller-Brice, and exattorney general, Allyson Maynard-Gibson KC. Mr Bastian, too, was present. “Citibank had owned that for years,” one source, speaking on condition of anonymity, said of a commercial property that sits opposite the University of The Bahamas (UoB) campus. “It was on the market for a while. There were several groups trying to buy it. Some were looking to buy it and fix it up for the Government of The Bahamas. The last thing I heard was that whoever was going to buy it was going to convert it into [UoB student] dormitories.”

All rivals, though, appear to have been beaten out by Mr Bastian who continues to expand his real estate interests and investments. The gaming chief’s Brickell Management Group recently unveiled plans to construct a condo hotel as part of its $200m Venetian Village project for western New Providence, which is now seeking to obtain the necessary government approvals. Citibank relocated to western New Providence some time ago. “I have said on any number of occasions, and I say so today, that it is important for us, as private citizens and as a nation, to memorialise the life and work of significant personalities in our lives, and the life of our family, and in the life of our nation,” Mr Davis said. “In so doing, we protect their legacy, defend their good name and pay the ultimate tribute to them.”

He added that the property’s renaming was an “example of a grateful son memorialising his father in tribute to all of the intangible attributes transferred to him that have collectively shaped his character and his value system”.

Describing Mr Bastian as the “personification of the Bahamian dream” for his

philanthropy and business grant funding initiatives, Mr Davis added: “Sebastian Bastian has distinguished himself as a successful businessman, investor and mentor to fledgling entrepreneurs, giving back to a country that has given so much to him.

“I applaud him for his philanthropy, and his business grant programme that has expanded ownership opportunities in our national economy for scores of young Bahamian entrepreneurs. This model is worthy of praise and emulation. His body of work in business augurs well, not only for the reputation of The Bahamas abroad, but his business acumen will allow him to identify business opportunities that can complement and diversify our economy.”

Referring to Mr Bastian’s role as The Bahamas’ top diplomat for central America, the Prime Minister said: “By any standard, His Excellency is an exceptional Bahamian, a fine role model; the personification of the Bahamian dream and I thank him for his public service and his invaluable contributions to both the business community and the national economy.”

Mr Davis, encouraging Bahamians to

continue honouring the legacies of those that have contributed to the country’s development, said: “In our 50th anniversary of sovereign nationhood, let us all in our own unique ways commit ourselves to celebrating and memorialising the significant contributions and legacies of our brothers, sisters and loved ones.

“The institutional memory this national practice creates will only serve to deepen our cultural roots and strengthen our national identity as Bahamians.” Mr Bastian, meanwhile, credited his entrepreneurial spirit to his parents and declared it a privilege to name the building in honour of his late father.

He said: “I have both of my parents to thank for exposing me, at such a young age, to their hustle, their entrepreneurial spirit, and it was my father that taught me the importance of saving. It was my mother that brought me here to open up my first savings account at Citibank in the 1980s. Never in my wildest imagination, at seven years old, did I think I would own such a building, and have the honour and the privilege to name it after one of my greatest heroes, my father.”

THE CAPITOL IN WASHINGTON

Those in the military would go unpaid, and beneficiaries of social security payments, which include tens of millions of pensioners and families on child tax credits, would no longer receive financial support.

As the US dollar is the world’s reserve currency, a default would shatter confidence in the US government’s ability to meet its financial obligations, leading

to a steep decline in the value of the greenback. In addition, a US default would impact the global economy, leading to a ripple effect in international markets, which rely on the stability of the dollar. Let us hope that partisan politics can be put aside, at least momentarily, and common sense prevails. The alternative is a scenario where everyone loses.

THE TRIBUNE Monday, March 6, 2023, PAGE 5

‘Do not hit rock bottom’ on public sector reform

Government can invest in and support public sector reform is critical as the pressing priorities of the Government in health, education, national security, infrastructure and the economy overshadow the need for reform.

“Funding from revenue is channelled into addressing those obvious national needs. Interestingly, public sector reform is vital to the acquisition and management of all resources, so without it meaningful fiscal management is unlikely and some level of national borrowing will continue.”

Despite The Bahamas faring relatively well in the World Bank’s Perception of Corruption Index between 2018 and 2021, Dr PintardNewry also warned that the country needs to make further progress in weeding out graft. “It is most important for public sector reform to address this vexing problem in order to increase transparency, accountability and trust in Government,” she added. Calling for the role of civil servants to be better defined, the report suggested that public sector reform be anchored in an overall strategy such as the National Development Plan to ensure that it aligns with

Share your news

The Tribune wants to hear from people who are making news in their neighbourhoods. Perhaps you are raising funds for a good cause, campaigning for improvements in the area or have won an award. If so, call us on 322-1986 and share your story.

national objectives with progress measured against performance indicators and benchmarks.

Dr Pintard-Newry gave two options for managing reform - the creation of an agency or ministry headed by a permanent secretary, such as Barbados’ Office of Public Reform, or an initiative that is run out of the Prime Minister’s Office by the Prime Minister’s Delivery Unit and is accountable to the Cabinet secretary.

To hold senior civil servants accountable for their actions under the first model, she also advocated the creation of a committee of permanent secretaries. “Each permanent secretary would be mandated to have a strategy for his ministry and an annual implementation plan,” Dr Pintard-Newry suggested.

“The Public Service Bill 2010, sections seven, eight, and nine, provide for the establishment of a Permanent Secretaries Committee. If the functions of the committee are expanded, permanent secretaries would have to

defend their performance on an annual basis. Progress could, therefore, be effectively monitored and evaluated. Of course, there would have to be incentives and consequences for progress or the lack thereof.”

Suggesting that The Bahamas undertake a wideranging review of how government business is conducted and implemented, the report added: “While significant progress has been made... in The Bahamas via the digitisation of government services project, there is a long way to go with the services for ease of doing business, cyber security and the adoption/ passage of legislation.

“Additionally, ministries and departments must modernise and adopt effective information management processes within the agency itself.” While both major Bahamian political parties have frequently advocated for public service reform, and pledged to deliver it in their respective manifestos, neither has implemented a comprehensive plan for achieving this.

Mr Aubry yesterday said the report’s release links well with ORG’s anticorruption symposium last Friday because the “review and reform of the public sector to be more efficient and effective” was directly tied to efforts to fight graft. He described the road map and goals set out by Dr Pintard-Newry as “very actionable; they’re not aspirational”, and said public sector reform is a “moving target” rather than one with a clearly-defined end goal and timeline.

“Particularly in The Bahamas, we see the public sector as one of the most significant employer groups,” the ORG chief told Tribune Business. “We’re putting a lot of money into a system that serves our interests, so we need a system in place to make sure we’re getting the best return for our investment. There are some key opportunities that, if we can take advantage and move in a meritorious way, we can benefit.

“If we can take the opportunity to invest and appropriately organise our public service, it gives us a great opportunity to address climate change, ensure the level of taxation and revenue management is sufficient, access to government services becomes more smooth and responsive, and we reduce the

potential for cheating. It’s an opportunity to reduce corruption and wastage from people trying to get around the system.

“There are great opportunities if we deploy this to a whole government approach with best practices. There’s potential for even further reforms in an environment that looks to support it.” Mr Aubry, though, argued that public sector reform will not work in The Bahamas if the effort is starved of resources.

“The effectiveness of the public service is not something we can squeeze out,” he said. “It’s going to require time, attention and resource allocation at a time of fiscal austerity..... Everything that ORG advocates for is on The Bahamas being able to create more positive and sustainable long-term outcomes.

“Unfortunately we have other countries in the region that had to hit bottom before they made reforms. Jamaica and Barbados have to go a very hard road to come back from that. We have a real opportunity with the talent we have in our current scenario to control our own destiny and level the playing field. I don’t think it’s required for us to hit bottom before we invest in it.”

LEGAL NOTICE

N O T I C E

EXXONMOBIL EXPLORATION AND PRODUCTION RUSSIA (SEA OF OKHOTSK) LIMITED

Creditors having debts or claims against the above-named Company are required to send particulars thereof to the undersigned c/o P.O. Box N-624, Nassau, Bahamas on or before 29th day of March, A.D., 2020. In default thereof they will be excluded from the benefit of any distribution made by the Liquidator.

Dated the 6th day of March, A.D., 2023.

Daniel A. Bates Liquidator 22777 Springwoods Village Parkway Spring, Texas 77389 U.S.A.

LEGAL NOTICE

N O T I C E

EXXONMOBIL EXPLORATION AND PRODUCTION RUSSIA (SEA OF OKHOTSK) LIMITED

N O T I C E IS HEREBY GIVEN as follows:

(a) EXXONMOBIL EXPLORATION AND PRODUCTION RUSSIA (SEA OF OKHOTSK) LIMITED is in dissolution under the provisions of the International Business Companies Act 2000.

(b) The dissolution of the said Company commenced on the 2nd day of March 2023 when its Articles of Dissolution were submitted to and registered by the Registrar General.

(c) The Liquidator of the said Company is Daniel A. Bates, of 22777 Springwoods Village Parkway, Spring, Texas 77389, U.S.A.

Dated the 6th day of March, 2023

HARRY B. SANDS, LOBOSKY MANAGEMENT CO. LTD.

Registered Agent for the above-named Company

NOTICE

IN THE ESTATE OF PEGGY JOYCE PINDER, late of Russell Island near the Settlement of Spanish Wells, St. George’s Cay in the Commonwealth of The Bahamas, Deceased

IT IS HEREBY NOTIFIED, for the information of those it may concern, that all persons having any claim or demand against the said Estate are required to send the same to the undersigned on or before the 20th day of March, A.D. 2023 and if so required by notice in writing from the undersigned to come in and prove such demand or claim or in default thereof be excluded from the bene t of any distribution made before such debts are proved;

AND NOTICE is hereby given that all persons indebted to the said Estate are requested to settle their respective debts at the Chambers of the undersigned on or before the date hereinbefore mentioned.

Dated the 20th day of February, A.D. 2023

CALLENDERS & CO. Chambers, One Millars Court, P.O. Box N-7117, Nassau, The Bahamas

Attorneys for the Personal Representatives

PAGE 6, Monday, March 6, 2023 THE TRIBUNE

FROM PAGE B1

Gov’t gives $115m tax relief in fiscal first half

of the value of all Excise and duty tax breaks granted during the fiscal year’s first half, applied to some $161.53m worth of goods imported into the country.

No other industry or sector came close to matching the tax relief bestowed on the hotel industry. The Special Economic Recovery Zones (SERZs), set up in Grand Bahama and Abaco to aid economic recovery and reconstruction in Hurricane Dorian’s wake, attracted tax relief worth $942,678 on some $11.859m in imports.

Elsewhere, exemptions for clothing, footwear and accessories provided some $7.027m in Excise and duty relief on $34.571m worth of imports. Cottage and light industries received tax breaks worth $7.581m on $26.294m in goods, while the relief provided under the Industries Encouragement Act and Family Island Development Encouragement Act stood at $6.313m and $6.58m respectively.

The figures give an insight into the value, extent and range of the investment incentives and tax relief that The Bahamas grants to key industries and economic sectors. While this is seen as helping to stimulate growth, investment and job creation in the target areas, it also represents revenues foregone by the Public Treasury, while the figures may not capture the true amount of concessions because they do not include VAT.

Elsewhere, the mid-year Budget data shows that the Davis administration reallocated or repurposed some $18.257m during the fiscal year’s first half. This represents funding that

was already approved in the original Budget in May 2022, but which ministries have subsequently switched between line items to cover new priorities or increased and unplanned costs as they arose.

Included in this sum is a collective $729,000 that has been moved from the advertising, marketing and promotions, and consultancy budget in the Prime Minister’s Office to cover the travel costs and subsistence (living expenses) associated with Philip Davis KC and his delegation attending the COP27 climate change conference in Egypt last year. Over $200,000 was moved for “subsistence”, and the $325,000-plus balance covered air travel.’

Simon Wilson, the Ministry of Finance’s financial secretary, last night told Tribune Business that the repurposing of the $729,000 should not be interpreted as a sign of excessive travel, or that Cabinet ministers and their delegations were travelling more frequently and in larger numbers.

“When you look at the travel amount, it doesn’t represent more people travelling,” he said. “It represents the inflation in travel costs. The amount of seats leaving New Providence has decreased by 20 percent. People act as if we’re back to normal on air travel; we’re not. Most of the airlines have cut drastically the amount of seats coming into the country. That has increased the cost.

“All these things mean higher travel costs. That’s probably the biggest driver of the increase in travel costs; not the amount of people or no of trips, but the cost to travel is so much higher.” The Government’s

total travel budget in the 2022-2023 fiscal year was increased by $1.319m in the mid-year Budget, taking the total spend to $16.172m compared to the $14.854m originally forecast.

The greatest increase in the travel budget for the Prime Minister’s Office, which has more than quadrupled from the original $398,546 to $19.33m - a $1.534m increase compared to the May 2022 estimates.

The Government previously faced criticism for taking a 70-person delegation to COP27 in Sharm El-Sheikh, Egypt. However, it was stated that some on the trip funded by the private sector.

Justifying that trip, Mr Davis added that he met with the IMF’s top executive at COP 27. “As you may have seen previously reported, the conversation led to a ground-breaking agreement in principle for the IMF to partner with The Bahamas to develop our blue carbon market sector, and to explore swapping debt for carbon credits,” the Prime Minister said.

“You would’ve heard comments about our meetings. This has never happened before, and The Bahamas is set to be in the forefront of this innovation. This is the difference between our approach and what went before. We didn’t go to the IMF begging for a loan - they came to us, you know, to discuss a partnership.”

THE TRIBUNE Monday, March 6, 2023, PAGE 7

FROM PAGE B1 ADVERTISE TODAY! CALL THE TRIBUNE TODAY @ 502-2394

GOOD CORPORATE GOVERNANCE CRITICAL TO SUSTAINABLE GROWTH

FROM PAGE B2

risk management, an internal audit helps ensure the company operates transparently, ethically and in ways where it can be held accountable. This, in turn, helps protect the interests of shareholders and other stakeholders, enhances the company’s reputation, and ultimately contributes to its long-term success.

In conclusion, effective corporate governance is critical for building sustainable businesses in The Bahamas. Companies prioritising corporate governance are more likely to operate ethically, manage risk effectively, and make decisions aligning with their goals and values. To establish effective corporate governance, companies in The Bahamas should focus on establishing transparent and accountable policies and procedures, prioritising corporate social

responsibility, fostering a culture of ethical behaviour and integrity, and ensuring an active internal audit function. By doing so, they can create long-term value for all stakeholders and help drive economic growth in The Bahamas.

NB: About Derek Smith Jr Derek Smith Jr. has been a governance, risk and compliance professional for more than 20 years. He has held positions at a TerraLex member law firm, a Wolfsburg Group member bank and a ‘big four’ accounting firm. Mr Smith is a certified anti-money laundering specialist (CAMS), and the assistant vicepresident, compliance and money laundering reporting officer (MLRO) for CG Atlantic’s family of companies (member of Coralisle Group) for The Bahamas and Turks & Caicos.

ACCURAD IMAGING CONSULTANTS SEEKING RADIOLOGIST

AccuRad Imaging Consultants is a diagnostic imaging reporting/teleradiology company operating in the Bahamas. AccuRad provides diagnostic imaging reporting services to facilities and doctor’s offices throughout the Bahamas. The imaging modalities reported include, but are not limited to, x-ray, mammography, CT, ultrasound and MRI. AccuRad is seeking a fellowship trained radiologist to join the practice. Fellowship training in oncology imaging and neuroradiology is preferred. On-site work is not required. The candidate is expected to be able to provide coverage on weekends and/or stat holidays. Occasionally, there may be overnight coverage requirements. Competency in reporting all above mentioned modalities is a must. Only candidates who have completed a full radiology residency program and attained board certification by examination will be considered. Fellowship/subspecialty training must have been acquired at an accredited institution in the US, Canada or UK. All applicants must be eligible for specialist licensure in the Bahamas.

PAGE 8, Monday, March 6, 2023 THE TRIBUNE

JOB OPPORTUNITY Interested applicants can submit their CV and statement of interest via email to admin@accurad.live

INVESTORS IN $18M BOOST AS BANK BEATS TARGET 10%

confirmed. “The 2022 unaudited financial results will be the highest level of yearly profit in the history of the bank. Our 2022 unaudited financial results have exceeded our budgeted expectations by approximately 10 percent, as the strong rebound of the economy has facilitated the reduction of the bank’s non-performing loan book, as well as allowed for improvement in overall loan delinquency.

“We have seen the reversal of loan impairment expense in the first quarter largely hold, and this resulted in the bank meeting its full-year profitability goal at the end of the third quarter. The main drivers of the profit return were reversals of allowances for loan losses, along with recovery of previously charged-off loans.

“While the economic rebound is the underlying driver of this experience, our management team was focused on delinquency management and credit risk governance to improve the asset quality condition of the bank’s loan portfolio. These efforts of our team translated the improvements in

the economy into improvements in our 2022 unaudited financial results.”

Commonwealth Bank produced a $72m reversal in the first nine months of 2022 from the near-$24m loss it suffered in 2021. However, Ms Albury acknowledged that this was driven by the recovery of loan loss provisions rather than credit portfolio or organic growth.

“We continued to focus on the organic components of our business,” she added of 2022. “That is, controlling interest expense, controlling charge-off loans, controlling our operating expenses, and identifying opportunities for growth of our non-interest income. Interest expenses, charged-off loans, and operating expenses were in line with budgetary expectations, and our non-interest income exceeded our budgetary expectations by approximately 13 percent.”

Ms Albury said Commonwealth Bank is “cautiously optimistic about improvements in the level of qualified borrowers” in 2023 as employment, wages and incomes continue to recover from COVID-19.

“As the economy continues to normalise and the rate of profitability trends towards historic averages,

PUBLIC NOTICE

INTENT TO CHANGE NAME BY DEED POLL

The Public is hereby advised that I, ROBERT MILTON HUMES, ROBERT SYMONETTE and MILTON ROBERT SYMONETTE Gladiator Road, Stapledon Gardens, New Providence, The Bahamas, intend to change my name to ROBERT MILTON SYMONETTE If there are any objections to this change of name by Deed Poll, you may write such objections to the Chief Passport Officer, P.O.Box N-742, Nassau, Bahamas no later than thirty (30) days after the date of publication of this notice.

we plan to focus on the organic growth of our loan book and yields, delinquency management and improvements in the way we service our customers, which we expect to sustain the bank’s normal level of profitability,” she told this newspaper.

“Growth of interest income will come at a steady rate as we attract both new depositors and borrowers to the bank. Our customer deposit base has grown by approximately 4 percent year-over-year, and these new depositors are also potential customers for our loan products, so our plans are around harnessing this opportunity for loan growth.

“We are also focusing on our existing loan clients and their needs for expanded credit, as well as niche opportunities within the

mix of our personal lending products of mortgages, consumer loans and credit card facilities. We also expect that our continued efforts to reduce our non-performing loan book will translate into increased interest income, and so delinquency management, inclusive of aggressive recovery of charge-off loans, will be key to growing topline interest income.”

Commonwealth Bank’s loan delinquency rate dropped more than eight percentage points year-overyear at end-2022, Ms Albury said. She added: “Overall delinquency was at 11.25 percent as of December 31, 2022, compared with 19.43 percent on the same date in 2021, and our non-performing loan ratio has followed a similar trend. As the business moves into postpandemic normalization,

NOTICE

NOTICE is hereby given that ALTUDA ANESTOR of Harbour Island, Eleuthera, The Bahamas, is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 27th day of February, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE

NOTICE is hereby given that ALEXANDRIA ARTHURNIQUA CAREY of Jack Fish Drive, Carmichael Road, New Providence, The Bahamas, is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 6th day of March, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

we expect the delinquency to trend toward historic averages.

“However, we believe that by continuing to focus on delinquency management, and where necessary adjusting our strategy and deployment of team resources more efficiently, we will be able to see delinquency rates trend lower than historic averages. This will not necessarily occur in 2023, but we expect it to occur over the bank’s current strategic horizon, subject to the economic headwinds that exist for The Bahamas.”

As for 2023’s profit expectations, Ms Albury said:

“2022 was an unusual year for both The Bahamas and the bank, similar to how the years 2020 and 2021 were unusual. As we normalise our economy and

the bank’s operations, there is no expectation that 2022 against 2023 will be comparable. What is the basis of comparison will be our pre-Dorian and pre-COVID normalised financial performance, and we expect to match or exceed that in 2023.

“We recognise that the bumper level of profitability that the bank is experiencing in 2022 is driven by the strong rebound of the economy of The Bahamas. To match or exceed 2022’s profitability would require a recurrence of the level of economic rebound we experienced in 2022.

“However, we are awake to opportunities around increasing our products and services, increasing our feegenerating opportunities, and, where possible, affecting our cost structure to be within budgetary expectations for those cost items not specifically targeted for growth in 2023.”

NOTICE is hereby given that MONA MARIA BURROWS of Florida, United States of America is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 27th day of February, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE

NOTICE is hereby given that LUCNISE ARIUS of Kenilworth Street, New Providence, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 6th day of March, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

AGI Snowstorm Holdings Limited

In Voluntary Liquidation

Notice is hereby given that in accordance with Section 138(4) of the International Business Companies Act. 2000, AGI Snowstorm Holdings Limited is in dissolution as of February 23rd, 2023 RAMON ORTIZ DE TARANCO office situated at Ruta 8, km 17.500 of 120 A-002, 91600, Zonamerica, Montevideo, Uruguay is the Liquidator.

L I Q U I D A T O R

Legal Notice

NOTICE

PEACOCK STAR HOLDING CORPORATION

NOTICE IS HEREBY GIVEN as follows:

(a) Peacock Star Holding Corporation is in voluntary dissolution under the provisions of Section 138 (4) of the International Business Companies Act 2000.

(b) The dissolution of the said Company commenced on the 3rd day of March 2023.

(c) The Liquidator of the said Company is Delco Investments Limited of Deltec House, Lyford Cay, P.O.Box N-3229, Nassau, Bahamas.

Dated

THE TRIBUNE Monday, March 6, 2023, PAGE 9

FROM PAGE B1

Delco

this 6th day of March A.D., 2023

Investments Limited Liquidator

NOTICE

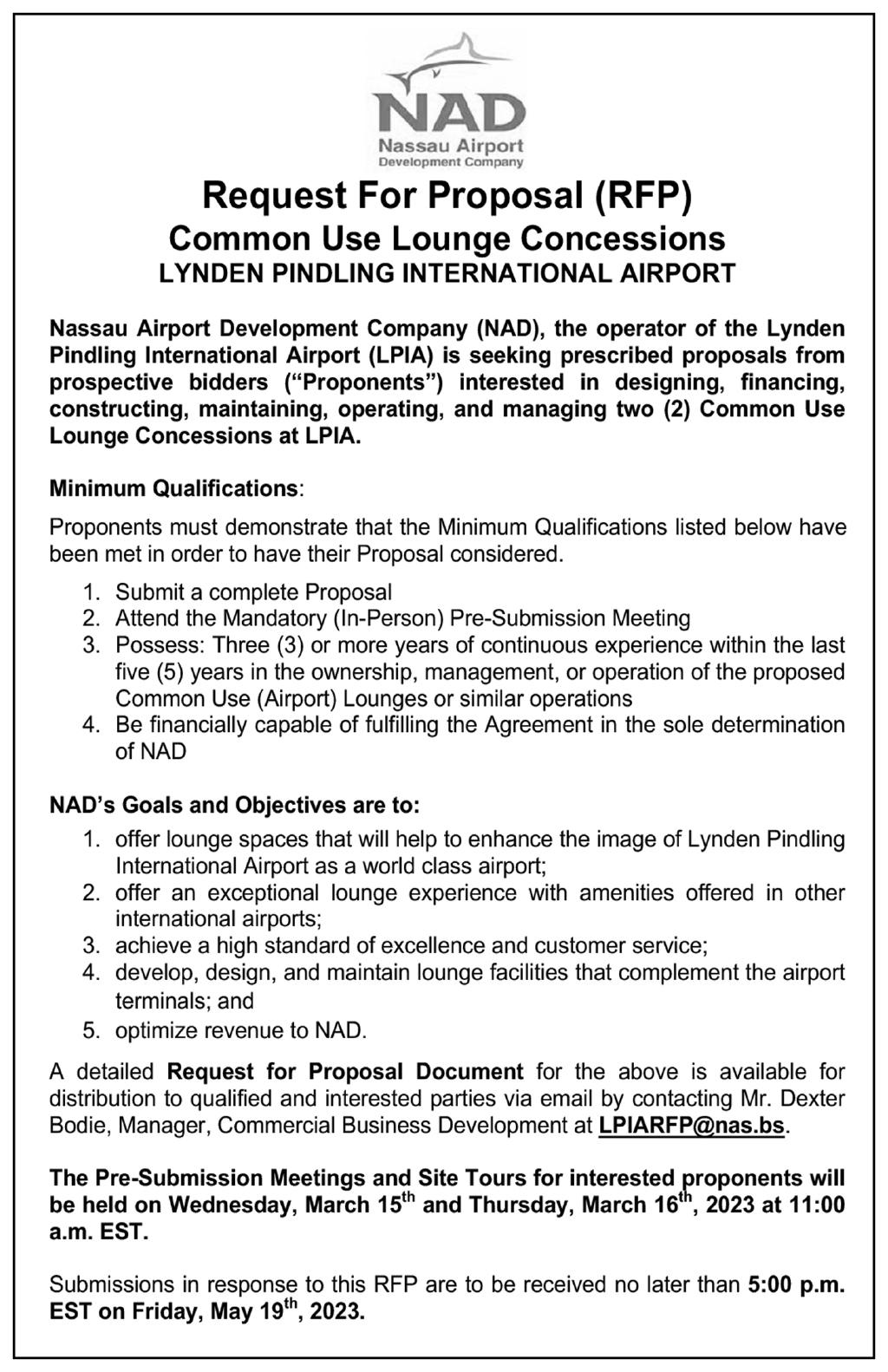

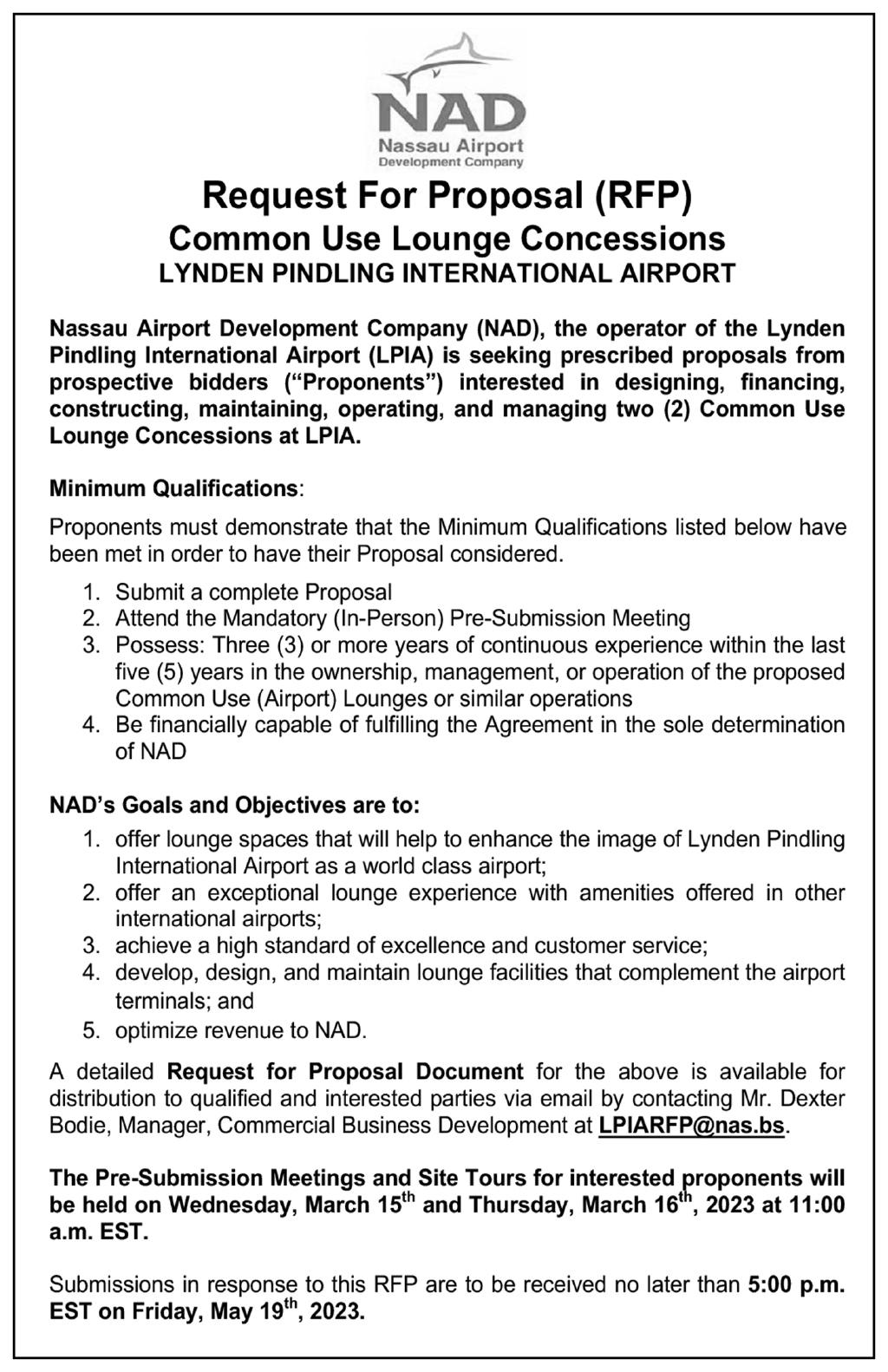

FRIDAY, 3 MARCH 2023 CLOSECHANGE%CHANGEYTDYTD% BISX ALL SHARE INDEX: 2598.75-1.01-0.04-46.31-1.75 BISX LISTED & TRADED SECURITIES 52WK HI52WK LOWSECURITY SYMBOLLAST CLOSECLOSECHANGE VOLUMEEPS$DIV$P/E YIELD 7.005.30 AML Foods Limited AML 6.95 6.950.00 0.2390.17029.12.45% 53.0040.06 APD Limited APD 39.95 39.950.00 0.9321.26042.93.15% 2.762.04Benchmark BBL 2.76 2.760.00 0.0000.020N/M0.72% 2.652.31Bahamas First Holdings Limited BFH 2.46 2.460.00 0.1400.08017.63.25% 3.652.25Bank of Bahamas BOB 3.10 3.100.00 0.0700.000N/M0.00% 6.306.00Bahamas Property Fund BPF 6.30 6.300.00 1.7600.000N/M0.00% 9.808.78Bahamas Waste BWL 9.65 9.650.00 0.3690.26026.22.69% 4.503.25Cable Bahamas CAB 4.49 4.500.01 1,000-0.4380.000-10.3 0.00% 11.507.50Commonwealth Brewery CBB 11.33 11.330.00 0.1400.00080.90.00% 3.652.54Commonwealth Bank CBL 3.56 3.55 (0.01) 22,4000.1840.12019.33.38% 9.307.01Colina Holdings CHL 8.50 8.500.00 0.4490.22018.92.59% 17.5013.00CIBC FirstCaribbean Bank CIB 14.40 14.400.00 0.7220.72019.95.00% 3.252.05Consolidated Water BDRs CWCB 3.08 3.080.00 0.1020.43430.214.09% 11.2810.05Doctor's Hospital DHS 10.50 10.500.00 0.4670.06022.50.57% 11.679.16Emera Incorporated EMAB 9.48 9.670.19 0.6460.32815.03.39% 11.5010.75Famguard FAM 11.20 11.200.00 0.7280.24015.42.14% 18.3014.50Fidelity Bank (Bahamas) Limited FBB 18.10 18.100.00 0.8160.54022.22.98% 4.003.55Focol FCL 3.99 3.990.00 0.2030.12019.73.01% 12.1010.00Finco FIN 12.10 12.100.00 0.9390.20012.91.65% 16.2515.50J. S. Johnson JSJ 15.76 15.760.00 0.6310.61025.03.87% PREFERENCE SHARES 1.001.00Bahamas First Holdings PreferenceBFHP 1.00 1.000.00 0.0000.000 0.0000.00% 1.001.00Colina Holdings Class A CHLA 1.00 1.000.00 0.0000.000 0.0006.25% 10.0010.00Fidelity Bank Bahamas Class A FBBA 10.0010.000.00 0.0000.000 0.0007.00% 1.001.00Focol Class B FCLB 1.00 1.000.00 0.0000.000 0.0006.50% CORPORATE DEBT - (percentage pricing) 52WK HI52WK LOWSECURITY SYMBOLLAST SALECLOSECHANGEVOLUME 100.00100.00Fidelity Bank (Note 22 Series B+)FBB22 100.00100.000.00 100.00100.00Bahamas First Holdings LimitedBFHB 100.00100.000.00 BAHAMAS GOVERNMENT STOCK - (percentage pricing) 115.92104.79Bahamas Note 6.95 (2029) BAH29 107.31107.310.00 100.00100.00BGS: 2014-12-7Y BG0107 100.00100.000.00 100.00100.00BGS: 2015-1-7Y BG0207 100.00100.000.00 100.00100.00BGS: 2014-12-30Y BG0130 100.00100.000.00 100.00100.00BGS: 2015-1-30Y BG0230 100.00100.000.00 100.00100.00BGS: 2015-6-7Y BG0307 100.00100.000.00 100.00100.00BGS: 2015-6-30Y BG0330 100.00100.000.00 100.00100.00BGS: 2015-10-7Y BG0407 100.00100.000.00 97.4897.48BGRS FX BGR112036 10/13/2036BSBGR1120363 97.1597.150.00 101.50101.50BGRS FX BGR121025 02/23/2025BSBGR1210255 101.30101.300.00 91.3791.37BGRS FX BGR134150 01/17/1950BSBGR1341506 91.3791.370.00 100.63100.63BGRS FL BGRS76026 01/18/2026BSBGRS760265 100.63100.630.00 100.14100.14BGRS FL BGRS79027 03/28/2027BSBGRS790270 100.14100.140.00 100.33100.33BGRS FL BGRS80027 05/09/2027BSBGRS800277 100.82100.820.00 100.66100.66BGRS FL BGRS81027 07/26/2027BSBGRS810276 100.52100.520.00 100.79100.79BGRS FL BGRS81036 07/26/2036BSBGRS810367 100.79100.790.00 100.41100.41BGRS FL BGRS83027 11/28/2027BSBGRS830274 100.41100.410.00 100.12100.12BGRS FL BGRS84032 09/22/2032BSBGRS840323 100.12100.120.00 100.12100.12BGRS FL BGRS84033 09/22/2033BSBGRS840331 100.12100.120.00 100.00100.00BGRS FL BGRS86036 08/27/2036BSBGRS860362 100.32100.320.00 99.6999.69BGRS FX BGRS94029 07/16/2029BSBGRS940297 99.6999.690.00 100.77100.77BGRS FL BGRS81035 07/26/2035BSBGRS810359 100.77100.770.00 92.0592.00BGRS FX BGR125238 10/15/2038BSBGR1252380 100.00100.000.00 MUTUAL FUNDS 52WK HI52WK LOW NAV YTD%12 MTH% 2.602.11 2.600.36%3.89% 4.903.30 4.900.11%5.06% 2.271.68 2.270.18%2.94% 203.47164.74 195.65-3.84%-3.84% 212.41116.70 180.14-15.19%-15.19% 1.771.71 1.773.07%3.07% 1.981.81 1.988.44%8.44% 1.881.80 1.884.42%4.42% 1.030.93 0.95-7.23%-7.23% 9.376.41 10.188.63%8.63% 11.837.62 13.6115.01%15.01% 7.545.66 7.732.87%2.87% 16.648.65 13.13-20.87%-20.87% 12.8410.54 12.06-4.33%-4.33% 10.779.57 10.62-0.31%-0.31% 16.279.88 16.27N/AN/A 11.228.45 11.223.00%25.60% 14.8911.20 N/A N/A N/A MARKET TERMS BISX ALL SHARE INDEX - 19 Dec 02 = 1,000.00 YIELD - last 12 month dividends divided by closing price 52wk-Hi - Highest closing price in last 52 weeks Bid $ - Buying price of Colina and Fidelity - Lowest closing price in last 52 weeks Ask $ - Selling price of Colina and fidelity Previous Close - Previous day's weighted price for daily volume Last Price - Last traded over-the-counter price Today's Close Current day's weighted price for daily volume Weekly Vol. - Trading volume of the prior week Change Change in closing price from day to day EPS $ A company's reported earnings per share for the last 12 mths Daily Vol. - Number of total shares traded today NAV - Net Asset Value DIV $ - Dividends per share paid in the last 12 months - Not Meaningful P/E - Closing price divided by the last 12 month earnings TO TRADE CALL: CFAL 242-502-7010 | ROYALFIDELITY 242-356-7764 | CORALISLE 242-502-7525 | LENO 242-396-3225 | BENCHMARK 242-326-7333 Colonial Bahamas Fund Class D Colonial Bahamas Fund Class E Colonial Bahamas Fund Class F CFAL Global Equity Fund Leno Financial Conservative Fund Leno Financial Aggressive Fund Leno Financial Balanced Fund Leno Financial Global Bond Fund RF Bahamas Opportunities Fund - Secured Balanced Fund RF Bahamas Opportunities Fund - Targeted Equity Fund RF Bahamas Opportunities Fund - Prime Income Fund RF Bahamas International Investment Fund Limited - Equities Sub Fund RF Bahamas International Investment Fund Limited - High Yield Income Fund RF Bahamas International Investment Fund Limited - Alternative Strategies Fund INTEREST Prime + 1.75% MARKET REPORT 31-Dec-2021 31-Dec-2021 MATURITY 19-Oct-2022 20-Nov-2029 31-Jan-2023 31-Jan-2023 6.95% 4.50% 31-Dec-2022 31-Dec-2022 4.50% 6.25% 31-Dec-2021 31-Dec-2022 31-Dec-2022 31-Dec-2022 31-Dec-2022 31-Dec-2022 31-Dec-2022 31-Dec-2022 31-Dec-2022 31-Dec-2022 CFAL Global Bond Fund 15-Dec-2021 30-Jul-2022 15-Dec-2044 30-Jul-2045 26-Jun-2022 26-Jun-2045 15-Oct-2022 27-Jan-2023 15-Oct-2038 13-Oct-2036 26-Jul-2035 16-Jul-2029 23-Feb-2025 FUND CFAL Bond Fund CFAL Balanced Fund CFAL Money Market Fund 17-Jan-1950 4.56% 6.25% 30-Sep-2025 31-Dec-2022 6.25% 4.50% 6.25% 4.25% NAV Date 4.81% 5.00% 5.40% 4.30% 5.69% 4.56% 4.50% 4.65% 4.13% 9-May-2027 27-Aug-2036 4.56% 4.56% 18-Jan-2026 28-Mar-2027 26-Jul-2027 26-Jul-2036 22-Sep-2033 4.56% 4.84% 4.68% 28-Nov-2027 22-Sep-2032 (242)323-2330 (242) 323-2320 www.bisxbahamas.com

NOTICE

Aliv hails its latest speed recognition

ALIV says that for the third consecutive year the Ookla Speedtest Awards have recognised the speed and performance of its Internet connection.

“For our customers nationwide, receiving the Speedtest award for our mobile network proves that they’ve trusted the best,” said Aliv chief executive, John Gomez. “Since our inception, we’ve focused on being the best for our customers, both in speed and

quality. We are thrilled to be recognised once again by Ookla.”

Cable Bahamas, which is Aliv’s 48.25 percent shareholder, and has Board and management control, said in a statement that it continues to develop its networks. It added that Aliv has given critical importance to enhancing its Family Island networks following the impact of Hurricane Dorian. It recently launched ALIV

Fibr, which provides faster speeds on an updated fibre network.

“Recognition from Ookla as the Speedtest Fastest Mobile Network in The Bahamas for the third year in a row is the highest honour as the country’s newest mobile network, because it highlights our exponential growth in a short amount of time,” said Aliv’s vice-president of engineering, Tracy Boucher.

SOLOMON’S LAUNCHES NEW DELI MEATS LABEL

AML Foods’ Solomon’s Fresh Market brand says it has launched Kretschmar, a premium deli meats and cheeses label, in its stores.

Kretschmar’s partnership with Solomon’s Fresh Market is part of a brand expansion into The Bahamas and Caribbean market. “We are thrilled to partner with Solomon’s Fresh Market to bring Kretschmar products to New Providence,” said Americans Foods chief executive, Eoghan O’Byrne.

“Our products are made with only the highest-quality ingredients, and we are confident that they will be well-received by customers who value a premium quality and taste.” The Kretschmar brand is known for its wide range of premium deli meats, including ham, turkey, roast beef and chicken, as well as a variety of cheeses and are free from artificial preservatives and flavours.

“Solomon’s Fresh Market is excited to offer our customers the opportunity

to experience this great brand,” said Vanessa Eneas, the Solomon’s Fresh Market deli category manager. “We believe that Kretschmar’s commitment to quality and fresh aligns with our own values, and we are confident that our customers will appreciate the premium taste, flavour and quality of these products.” Kretschmar products are now available at both Solomon’s Fresh Market Harbour Bay and Old Fort Bay locations.

THE WEATHER REPORT

THE TRIBUNE Monday, March 6, 2023, PAGE 11

Shown is today’s weather. Temperatures are today’s highs and tonight’s lows. ORLANDO Low: 65° F/18° C High: 85° F/29° C TAMPA Low: 69° F/21° C High: 85° F/29° C WEST PALM BEACH Low: 68° F/20° C High: 87° F/31° C FT. LAUDERDALE Low: 70° F/21° C High: 85° F/29° C KEY WEST Low: 72° F/22° C High: 83° F/28° C Low: 68° F/20° C High: 85° F/29° C ABACO Low: 73° F/23° C High: 78° F/26° C ELEUTHERA Low: 72° F/22° C High: 80° F/27° C RAGGED ISLAND Low: 74° F/23° C High: 80° F/27° C GREAT EXUMA Low: 74° F/23° C High: 80° F/27° C CAT ISLAND Low: 71° F/22° C High: 82° F/28° C SAN SALVADOR Low: 71° F/22° C High: 82° F/28° C CROOKED ISLAND / ACKLINS Low: 74° F/23° C High: 80° F/27° C LONG ISLAND Low: 73° F/23° C High: 80° F/27° C MAYAGUANA Low: 72° F/22° C High: 81° F/27° C GREAT INAGUA Low: 73° F/23° C High: 83° F/28° C ANDROS Low: 70° F/21° C High: 82° F/28° C Low: 70° F/21° C High: 83° F/28° C FREEPORT NASSAU Low: 71° F/22° C High: 87° F/31° C MIAMI

5-Day Forecast Mostly cloudy High: 85° AccuWeather RealFeel 90° F The exclusive AccuWeather RealFeel Temperature® is an index that combines the effects of temperature, wind, humidity, sunshine intensity, cloudiness, precipitation, pressure and elevation on the human body—everything that affects how warm or cold a person feels. Temperatures reflect the high and the low for the day. A moonlit sky Low: 68° AccuWeather RealFeel 69° F Mostly sunny and beautiful High: 83° AccuWeather RealFeel Low: 69° 92°-69° F Mostly sunny; breezy in the p.m. High: 83° AccuWeather RealFeel Low: 68° 87°-64° F Mostly sunny, breezy and pleasant High: 80° AccuWeather RealFeel Low: 66° 82°-63° F Breezy; a little afternoon rain High: 80° AccuWeather RealFeel 81°-62° F Low: 67° TODAY TONIGHT TUESDAY WEDNESDAY THURSDAY FRIDAY almanac High 82° F/28° C Low 70° F/21° C Normal high 78° F/26° C Normal low 65° F/18° C Last year’s high 82° F/28° C Last year’s low 63° F/17° C As of 1 p.m. yesterday 0.00” Year to date 1.22” Normal year to date 3.15” Statistics are for Nassau through 1 p.m. yesterday Temperature Precipitation sun anD moon tiDes For nassau Full Mar. 7 Last Mar. 14 New Mar. 21 First Mar. 28 Sunrise 6:28 a.m. Sunset 6:14 p.m. Moonrise 5:42 p.m. Moonset 6:11 a.m. Today Tuesday Wednesday Thursday High Ht.(ft.) Low Ht.(ft.) 7:07 a.m. 2.7 12:52 a.m. 0.0 7:24 p.m. 2.4 1:29 p.m. 0.0 7:43 a.m. 2.7 1:32 a.m. 0.0 8:00 p.m. 2.5 2:02 p.m. 0.0 8:17 a.m. 2.7 2:10 a.m. -0.1 8:36 p.m. 2.6 2:33 p.m. -0.1 8:51 a.m. 2.6 2:48 a.m. -0.1 9:12 p.m. 2.7 3:05 p.m. -0.1 Friday Saturday Sunday 9:26 a.m. 2.5 3:27 a.m. 0.0 9:50 p.m. 2.7 3:38 p.m. -0.1 10:03 a.m. 2.4 4:08 a.m. 0.0 10:31 p.m. 2.7 4:13 p.m. -0.1 11:43 a.m. 2.2 5:53 a.m. 0.1 5:54 p.m. -0.1 marine Forecast WINDS WAVES VISIBILITY WATER TEMPS. ABACO Today: E at 8-16 Knots 3-5 Feet 8 Miles 78° F Tuesday: WSW at 4-8 Knots 2-4 Feet 10 Miles 77° F ANDROS Today: E at 6-12 Knots 0-1 Feet 10 Miles 77° F Tuesday: SE at 3-6 Knots 0-1 Feet 10 Miles 77° F CAT ISLAND Today: ESE at 6-12 Knots 1-3 Feet 10 Miles 75° F Tuesday: S at 3-6 Knots 3-5 Feet 10 Miles 75° F CROOKED ISLAND Today: E at 8-16 Knots 1-3 Feet 10 Miles 79° F Tuesday: E at 6-12 Knots 1-3 Feet 10 Miles 79° F ELEUTHERA Today: E at 7-14 Knots 1-3 Feet 10 Miles 80° F Tuesday: SW at 3-6 Knots 3-5 Feet 10 Miles 80° F FREEPORT Today: ESE at 6-12 Knots 1-3 Feet 9 Miles 80° F Tuesday: W at 6-12 Knots 1-3 Feet 10 Miles 80° F GREAT EXUMA Today: E at 7-14 Knots 1-2 Feet 9 Miles 80° F Tuesday: SE at 3-6 Knots 0-1 Feet 10 Miles 80° F GREAT INAGUA Today: NE at 10-20 Knots 2-4 Feet 10 Miles 79° F Tuesday: ENE at 7-14 Knots 1-3 Feet 10 Miles 79° F LONG ISLAND Today: ESE at 8-16 Knots 1-3 Feet 10 Miles 80° F Tuesday: E at 6-12 Knots 1-2 Feet 10 Miles 79° F MAYAGUANA Today: E at 7-14 Knots 2-4 Feet 10 Miles 78° F Tuesday: ESE at 3-6 Knots 3-5 Feet 10 Miles 78° F NASSAU Today: E at 7-14 Knots 1-2 Feet 10 Miles 81° F Tuesday: S at 2-4 Knots 0-1 Feet 10 Miles 82° F RAGGED ISLAND Today: E at 10-20 Knots 2-4 Feet 10 Miles 79° F Tuesday: E at 7-14 Knots 1-3 Feet 10 Miles 79° F SAN SALVADOR Today: E at 7-14 Knots 1-2 Feet 10 Miles 80° F Tuesday: S at 3-6 Knots 1-2 Feet 10 Miles 80° F uV inDex toDay The higher the AccuWeather UV IndexTM number, the greater the need for eye and skin protection. Forecasts and graphics provided by AccuWeather, Inc. ©2023 H H tracking map Shown is today’s weather. Temperatures are today’s highs and tonight’s lows. N S E W 3-6 knots N S W E 8-16 knots N S E W 6-12 knots N S W E 7-14 knots N S W E 7-14 knots N S W E 10-20 knots N S W E 10-20 knots N S W E 6-12 knots

BTC chief in promise on service ‘black hole’

without home phone and Internet service, said he had given up and switched to Aliv.

Of the trio who spoke at length to Tribune Business about their experience, Mr Bhatti said BTC had been in contact with all three and “resolved” the issues impacting two of them. “We are working with the final customer to ensure those issues are also rectified,” he added.

“Our customers are at the heart of everything that we do, and as a business we are focused on improving our reliability and delivering a best-in-class experience for them. We acknowledge that there will be occasions where man-made technology will falter, as in any industry. However, we strive to keep these instances as minimal as possible.”

Attorney Leandra Esfakis told Tribune Business it was only after she sent a complaining February 20, 2023, e-mail to Inge Smidts, BTC’s chair and head of its immediate parent, Cable & Wireless Communications (CWC), that two phone lines at her Market Street premises for which she paid a deposit in November 2022 were switched on.

In the meantime, she said BTC had been calling to demand payment of around $218 for use of the lines, but had provided no bill so she could understand on what basis the charges had accrued. “They really need to pay more attention to the service end of things rather than the advertising and marketing,” Ms Esfakis told this newspaper.

“It’s all very well to have high-powered marketing people all over the place, but can you provide what you are marketing?” Meanwhile, David Morley, Morley Realty’s president, told Tribune Business he was “left with no alternative” to switch his home phone and Internet business from BTC to Cable Bahamas/ Alive after being a customer of the former since 1995.

After losing both services to his eastern New

Providence residence over the last weekend in January 2023, he told this newspaper that he endured a frustrating four weeks trying in vain to obtain an explanation from BTC as to the cause of the problem or a likely timeline for when it would be fixed.

With no alternative solution offered by BTC, Mr Morley added that he ended up porting to its competitor and said: “It’s unfortunately not the BTC we all remember.” Fast, reliable Internet and communications services are vital for Bahamians and businesses to compete in today’s increasingly digital economy, especially given this nation’s position as an international business and financial centre that requires constant connectivity to global clients.

Mr Bhatti yesterday sought to reassure that BTC is addressing the challenges: “We are continuing with our mandate to upgrade our networks and completely ‘fiberise’ our entire network with unmatched speeds and value. More than 70 percent of New Providence has been upgraded to fibre, and during the course of this year, the entire New Providence footprint will be fully fibre.

“Where services have been upgraded, we encourage our customers to also upgrade to fibre for better reliability. Eventually, BTC will only maintain its fibre network, and we will shut down our legacy copper technology. We encourage our customers to reach out to us directly through CALLBTC (225-5282) or any of our social media platforms. In instances where customers are unable to reach us through these platforms, I invite them to send a note directly to me at btcceo@ btcbahamas.com.”

Ms Esfakis, though, in her February 20, 2023, e-mail to Ms Smidts said: “I am a customer of BTC. Unfortunately, my experience is not satisfactory. You may not be aware of the poor service and resulting dissatisfaction with services of BTC on this island. I paid a deposit for phone service on November 22, 2022. Phone lines were

connected about second week of January 2023. I do not have an account number.”

She told BTC’s chair that one of the phone lines she was given proved unusable because the number had already been ported to Aliv. Upon visiting BTC’s offices on February 11, 2023, she was given an alternative number but also told that she owed a $307 bill on the two phones.

“I queried how I would have a phone bill of that amount in four weeks, particularly when I did not have the use of one phone during the four weeks,” Ms Esfakis told Ms Smidts. “And I had received no phone bill indicating what was being charged or why. I had not been presented with any packages, nor agreed to any package of charges. The staff member promised to investigate it......