$5.76 $5.76 $5.46 $5.92

Bahamas beats airlines; US has ‘strong concerns’

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.netBAHAMIAN airlines yesterday escaped the threat of US sanctions after federal authorities rejected the aviation industry’s accusations that this nation’s air navigation fees regime is “discriminatory”.

Anthony Hamilton, Southern Air’s director of administration, and president of the Bahamas Association of Air Transport Operators, told Tribune Business it was “a major relief” that local carriers no longer face the possibility of being restricted or barred completely from the US market after the Biden government’s Department of Transportation ruled in this nation’s favour.

Dismissing the complaint by the Airlines4America

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.netTHE Opposition yesterday demanded the Government “come clean” over its $232.3m IMF special drawing rights (SDRs) borrowing after reforms were tabled in Parliament to retroactively make the transaction lawful.

Kwasi Thompson, the FNM’s finance spokesman, questioned “what was the urgent need” for the Government to obtain the advance prior to changing the Central Bank of The Bahamas Act. The Bill tabled yesterday contains

consortium, whose members include American Airlines, Jet Blue, FedEx, Delta, Southwest Airlines, United Airlines, and the United Parcel Service, it found that the charges could not stand as the fees imposed by The Bahamas were the same as those levied on this nation’s carriers and those from other foreign countries.

The Department of Transportation found that the same air navigation service fees applied regardless of whether aircraft were landing in, or taking off, from The Bahamas or simply passing through this country’s air space headed towards another destination.

As a result, it ruled: “We cannot conclude in those circumstances that the fee structure constitutes unjustifiable or unreasonable discrimination.”

Chester Cooper, deputy prime minister, and minister of tourism, investments and aviation, in a statement yesterday hailed the Department of Transportation’s verdict as upholding Bahamian sovereignty and the country’s right to determine the fee structure it wishes to impose on the aviation industry for use of its air space.

Noting that the US regulator has rejected the airline industry’s allegations of “unfair practices”, he said: “The Department of Transportation recognised the sovereignty of The Bahamas to charge these fees and collect them.

“The Department of Transportation raised questions about the methodology used to assess the fees and is seeking to have a clearer understanding of the matter through bilateral

water down’ fiscal transparency

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.netGOVERNANCE reformers yesterday urged that fiscal accountability and transparency are “not lost and watered down” through a comprehensive reform package unveiled by the Prime Minister.

language stating it “shall

come

force on December 1, 2022”, thus making its implementation and legal effect retroactive to when

SEE PAGE B7

Matt Aubry, the Organisation for Responsible Governance’s executive director, voiced concern that key elements in the existing Fiscal Responsibility Act and Public Financial Management Act be retained in the 108-page

over deficit rise, $76m spend increase

• Mid-Year Budget projects $11.4m deficit widening

• And ‘conservative’ $53m rise in full-year revenue

• Capital budget cut $12m; SIE subsidies up $35m

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

BAHAMIANS

SEE PAGE B6

Public Finance Management Bill 2023 that was tabled in the House of Assembly yesterday. The Bill, which had its first reading, was introduced by Philip Davis KC as he slammed the existing fiscal regulatory regime for “severely hampering the legitimate operations of the Government” through not being aligned with the practical realities that exist in The Bahamas. Accusing the former Minnis administration of being on “autopilot” by its enactment of the Public Procurement Act, Public Finance Management Act, Public Debt Management Act and the Fiscal Responsibility Act package in their current forms, the Prime Minister charged: “None of the legislation reflects the situation which actually exists within The Bahamas, and their provisions severely hampered the legitimate operations of the Government.....

SEE PAGE B12

should be “wary” but not alarmed after the Government yesterday revealed a modest $11.4m increase to its forecast 2022-2023 fiscal deficit along with a similar-sized capital spending cut-back.

Fiscal observers said the revised $575.4m deficit, up from the originally planned $564m, was “not material in the grand scheme of things” as the Davis administration unveiled a $76.5m increase in its recurrent or ‘fixed cost’ spending above the estimates produced in last May’s Budget. Gowon Bowe, Fidelity Bank (Bahamas) chief executive, said he and other private sector chiefs who attended Monday’s Business Round Table meeting with the Prime Minister and key Cabinet members were informed that both revenue and public spending “in certain cases” were outpacing the 2022-2023 Budget projections. Asserting that the $11.4m deficit increase is “nothing to write home about”, he told Tribune Business that yesterday’s mid-year Budget appeared consistent with the message delivered to the private sector. “They indicated at the briefing that they should be able to come in at the deficit projected,” Mr Bowe said. “They had indicated some of the revenue elements

SEE PAGE B10

‘Wary’

‘Come clean’: $232m loan made lawful retroactively

‘Don’tCHESTER COOPER KWASI THOMPSON HUBERT EDWARDS

DEPOSITOR PROTECTION FUND $87M BELOW IMF’S TARGET

By NEIL HARTNELL and YOURI KEMP Tribune Business Reporters

THE FUND to protect Bahamian bank depositors had reached just 45.8 percent of the minimum $160.775m target recommended by the International Monetary Fund (IMF) at year-end 2021.

The Deposit Insurance Corporation’s 2021 annual report, tabled in the House of Assembly yesterday, revealed that the protection fund was worth some $73.644m at that year’s end. This was equivalent to 0.9 percent of insurable deposits within the Bahamian banking and credit union system, as compared to the minimum 2 percent

threshold suggested by the Fund in its 2019 Financial Sector Assessment Programme (FSAP) report on The Bahamas.

“As at December 31, 2021, the Deposit Insurance Fund (DIF) stood at $73.6m, consisting of premiums paid by member institutions and income from investments in government bonds,” the report

said. “Since 2017, the DIF has grown at an average rate of 10 percent per annum. Based on the $8bn in insurable deposits held by member institutions at end-2021, the DIF represents the equivalent of approximately 0.9 percent of insurable deposits and 2.8 percent of insured deposits.

“In 2019, following the IMF’s FSAP mission to The Bahamas, a recommendation was made for the Deposit Insurance Corporation to achieve a medium-term target fund size with a coverage of at least 2 percent of insurable deposits, increasing closer to 4 percent over the longer-term.”

The DIF fund was at year-end 2021 some $87m below the IMF’s recommended 2 percent minimum threshold, and some 77 percent or almost $248m under the 4 percent target. “Further, the IMF’s technical assistance mission

in October 2021 recommended strengthening the funding arrangements by establishing a higher target fund size, appropriate premiums rates of levies to meet that target, and a back-up credit facility from the Ministry of Finance or Central Bank,” the report said.

“Thus, a focal point of the DIC’s strategy in 2022 will be to finalise a review of the adequacy of the DIC fund target ratio and to determine the necessary premium levels to achieve the appropriate funding target ratio.” John Rolle, the Central Bank’s governor, who chairs the DIC, said the regulator was also working to “develop a recovery and resolution framework for The Bahamas”.

The DIF covers Bahamian dollar deposits up to a value of $50,000. It was created after the collapse of Gulf Union Bank (Bahamas) in the late

1990s. Payouts are made to insured depositors only when a member institution has been closed as a result of action taken by the Central Bank.

The DIC was established under the Protection of Depositors Act 1999, as amended by the Protection of Depositors (Amendment) Act 2020. It has the power to put levies on member institutions upon the advice of the Central Bank and provide capital for a bridge institution and financing in the amount of insured deposits to an entity that acquires the business or all or part of the assets and liabilities of a member institution which has been placed under statutory administration by the Central Bank.

The premiums paid by member banks and credit unions are equivalent to 0.05 percent of the average sum of deposits insured.

PM HITS BACK OVER PRICE CONTROL CRITICS

THE PRIME Minister yesterday hit back at critics of the Government’s efforts to expand price controls by accusing them of participating in “anti-competitive practices” that hurt Bahamian consumers.

Philip Davis KC, unveiling the mid-year Budget in the House of Assembly, did not identify by name who he was talking about when he asserted that the most vociferous price control critics are involved in “monopolies, duopolies and oligopolies” that benefit their interests rather than that of the Bahamian public.

While acknowledging that price controls are unnecessary in “a perfect market”, he argued that The Bahamas was far from achieving such status and pledged that the Government “will not flinch or shirk our responsibilities” to protect consumers.

“This government came under sustained and unwarranted criticism for our efforts to assist and protect

consumers through the expansion of items under price control. We acknowledge that, in a perfect market, price controls are unnecessary,” Mr Davis told the House of Assembly. “But The Bahamas is not a perfect market. Many of those who shout loudly about the virtues of the free market themselves participate in monopolies, duopolies, oligopolies and other non-competitive practices. In all areas, the Government has a critical role to play in protecting consumers from market abuse. We will not flinch or shirk our responsibilities.”

It was unclear who the Prime Minister was targeting with his comments, but they appeared directed in particular at the food distribution industry - retailers and wholesalers - given the concerns and push back voiced over the Davis administration’s plans to implement a major price control regime expansion last October without any prior consultation with the sector. Given The Bahamas’ relatively small consumer market, estimated around 400,000 persons, some

GOV’T’S $286M DEFICIT OVER 50% AT HALF-WAY

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.netTHE GOVERNMENT yesterday revealed that its $285.7m fiscal deficit at the 2022-2023 half-way point was more than 50 percent of that projected for the full-year despite revenue collections increasing by $111.5m year-over-year.

The Prime Minister, unveiling the mid-year Budget in the House of Assembly, credited the economy’s strong post-COVID rebound driven by surging tourist arrivals for having driven the increase in the Public Treasury’s income during the six months to end-December 2022.

“During the first six months of fiscal year 20222023, despite fluctuations in global markets, the local economy sustained steady activity. Inflation in the US had little-to-no impact on demand for travel within the region, with stopover arrivals for the first six months of the fiscal year outpacing those of the same period of the prior year by 135.8 percent,” Mr Davis said, with the prior year comparisons impacted still by COVIDrelated restrictions.

“In total, there were 2.3m additional visitors during the period, largely supported by a 2.1m increase in cruise ship arrivals, which totalled 3.3m. Strong activity within the tourism sector had an important impact throughout the domestic economy, and led to record-breaking revenue in both the hotel sector, as well as the short- term home rental market.

“Falling just short of prepandemic levels, arrivals in 2022 totalled approximately seven million, an undeniable indicator of economic rebound over the year. Likewise, hotel revenue during the first six months of fiscal year 2022-2023 exceeded pre-pandemic levels owing to steady occupancy and higher nightly rates.”

As for the Bahamian economy’s monetary side, Mr Davis admitted that “poor access to credit by businesses remains a significant constraint on economic growth” despite the significant reduction in loan arrears since the COVID pandemic. “The uptick in domestic market conditions helped to support a $138.3m (17.8 percent) contraction in private sector loan arrears, compared to the position in September 2021,” he added.

“Banks weighted average loan rate firmed to 11.02 percent and, at the end of September 2022, the weighted average deposit rate was 0.52 percent.” Noting that the difference between the two rates was “quite a disparity”, Mr Davis said: “The seasonal increase in demand for foreign currency contributed to a $36.2m decline in external reserves to $3.2bn at the end of December 2022.

industries can only sustain a small number of operators. The food distribution business, especially on the retail side, does not appear to fall into the “monopolies, duopolies, oligopolies” category given that there are numerous small players which compete with larger operators such as Super Value and AML Foods. Competition also exists on the wholesale side.

And the nature of the Prime Minister’s comments also indicate that The Bahamas needs a competition regulator rather than a price control watchdog. Food merchants and their wholesale suppliers last year warned that the 38 selected categories for expanded price controls included more than 5,000 product line items, and would lead to between 40-60 percent of a retailer’s inventory becoming price controlled with mark-ups below their cost of sales.

This would result in a large portion, or the majority, of their inventory being sold at a loss. Besides threatening hundreds of industry jobs, and the very survival of many operators, the Retail Grocers Association and its members also warned that the original proposal could result in food shortages as retailers/wholesalers decline to stock loss-making items while also increasing prices on non-controlled items,

“All told, madam speaker, while uncertainty can never be completely eliminated, all signs point to the economy and country finally moving in the right direction. Businesses continue to grow, underdeveloped sectors are nourished, tourists are flocking to our shores, and the economy continues to rebound.” Tourist arrivals, the Prime Minister added, are expected to exceed 2022’s seven million by some 20 percent, with economic growth for the remainder of the fiscal year over 3 percent.

As to what this means for fiscal performance, Mr Davis said: “For the first six months of the year, total revenue collections are estimated at $1.2bn, which represents a $111.5m increase over the same period of the prior year.... Tax revenue collections improved by $123.8m and stood at $1.1bn for the first six months of the fiscal year. This represents 44 percent of the budget target.

“VAT, which accounts for 54.8 percent of tax revenues, totalled $600.2m and grew by $23.7m relative to the same period in the previous year. This equates to 42.5 percent of the annual budget target. With the sustained improvement in the tourism sector, departure tax collections totalled $715m and improved by $45m relative to the previous year. At the half-year mark, departure tax accounts for 73.7 percent of the Budget target.

“Likewise, Excise duties during the period improved to $120m, a $38.3m increase compared to the previous year. At the half-year mark, excise duties are at 74.3 percent of the Budget target. Stamp tax collection increased to $57.8m, an improvement of $41.4m when compared to the previous year. This makes up 72.6 percent of the total budget target at the half-year mark.”

When it came to unpaid bills, Mr Davis said they totalled $90.7m or 2.7 percent of budgeted spending.

“These bills include $44.3m in unpaid bills and other obligations for state-owned enterprises, of which $30.7m in unpaid bills were to the Water and Sewerage Corporation for water purchased; $13.8m in unpaid bills to the Ministry of Tourism, Investments and Aviation, mainly for consultancy services, quality assurance and global communications.”

A further $9.9m related to unpaid bills for catastrophic healthcare services and the upkeep of community clinics via the Ministry of Health and Wellness, with some $8m due at Department of Transformation and Digitisation for unfunded contractual obligations.

Of the balance, some $5.9m was due to the Ministry of National Security for various security enhancement projects, and $5.5m to the Bahamas Agricultural and Industrial Corporation (BAIC) for insurance services and utility services.

thereby further fuelling the cost of living crisis. Price controls have always been a controversial instrument among the private sector - especially those companies and businesses impacted by them. They were imposed by the Government decades ago to prevent what it viewed as an unscrupulous merchant class from exploiting lower income Bahamians by unreasonably hiking the price of food staples and other essential products, thus placing them out of reach while undermining living standards.

However, opponents argue they are an anachronism that have no place in a modern 21st century economy. The private sector views price controls as an inefficient, distortionary mechanism that creates more unintended consequences than the supposed problems they solve. They can result in product shortages, while retailers and wholesalers have to increase prices and margins on non-price controlled items to compensate for selling these goods as effective “loss leaders”.

Mr Davis, meanwhile, yesterday touted his administration’s increased investments in consumer protection. “We have added more staff, we have upgraded the office accommodation of the price inspectorate and consumer

protection staff and, more importantly, we have invested in technology.

“This means that, for the first time, price inspectors will be able to do digital inspections, and merchants will be able to make digital requests for adjustment in prices. This will not only improve price transparency, but also result in lower costs for merchants by reducing the time between ‘importation’ and ‘approval-to-sell’ a price-controlled product.”

Elsewhere, the Prime Minister pledged to make it easier for Bahamian taxpayers to fulfill their obligations to the Public Treasury. “I would prefer my actions to speak for themselves,” he said. “We believe it is important to make it easier for taxpayers to comply with their obligations. Unlike a previous minister of finance, I am not going to brag about my power to take criminal action against those who cheat the exchequer.....

“We have to offer a better service to taxpayers. In this regard, we are launching initiatives for all types of taxpayers: Large, medium, small and micro. While it makes sense to allocate resources to initiatives which yield the highest return, all taxpayers deserve to be treated in an equitable way, and within defined timelines.

“Our overriding philosophy is that taxpayers

respond better to positive reinforcement, rather than negative harassment. The Bahamian people fully understand that if we are to continue to build and improve our infrastructure, and provide the many services that citizens expect in the 21st century, then the running of the country needs to be funded through taxation. And while nobody enjoys paying tax, most accept the need to do so. We think that our job is to make that as simple, and as easy, and as affordable as possible.”

Mr Davis argued that the Government’s decision to better engage with lenders, bondholders and creditors, and to better explain its economic and fiscal plans, was paying dividends as The Bahamas’ sovereign bonds were rated among the best performers in the Latin American and Caribbean region in 2022.

“This accomplishment required not just a sound fiscal plan but a willingness to meet, and engage, in active dialogue with banks, investors, and ratings agencies,” he added. “The minister of economic affairs (Michael Halkitis) has met virtually, or in-person, with hundreds of investors, talking in detail about our plans, and providing an unprecedented level of access to the Government.”

ISLAND BAY PHASE III CONDOMINIUM ASSOCIATION

P.O. BOX F-42040, FREEPORT, GRAND BAHAMA

CONTACT PHONE 242-646-7888 maureen.hamill01@gmail.com

Island Bay Phase III Condominium Association, the body corporate for and on behalf of Island Bay Phase III Condominiums, does hereby offer for sale by virtue of its charge held over the hereinafter described Apartment Unit, made between the said body corporate of the one part and the owner of the other part, and now lodged for record in the Registry of Records in the Commonwealth of the Bahamas:

ALL THAT ONE BEDROOM CONDO BEING APARTMENT UNIT 113A ISLAND BAY PHASE III CONDOMINIUM SITUATED IN THE CITY OF FREEPORT IN THE ISLAND OF GRAND BAHAMA.

Such condo is sold “AS IS” and may be viewed by appointment made with the manager of the said Island Bay Phase III Association, contact details listed above.

All offers should be sealed bids in writing and should be tendered on or before March 15, 2023 to Cafferata & Co., at P.O. Box F-42614, or drop off at Cafferata & Co. offices Poinciana and West Mall Drive, Freeport, Grand Bahama, Bahamas.

Appointment as Principal of Akhepran International Academy

Oscar Shorn Dames was appointed Principal of Akhepran International Academy effective 19 February 2023, and is historically the first male principal since Akhepran’s establishment in 2011.

Mr. Dames graduated in 1988 from R.M. Bailey Senior High School with the Most Outstanding Music Award. He is an author and Certified teacher with an Associate of Arts Degree in Music, a Bachelor of Education Degree from the College of The Bahamas, and a Master of Arts Degree in Music Education from VanderCook College of Music in Chicago.

Oscar Dames was employed by the Ministry of Education and served two years as Senior Master at C. I. Gibson Senior High School and was awarded Teacher of the Year 2010-2012 for C.R. Walker Senior High School. He was the school’s band director and coordinator for the School’s Junior Junkanoo program and also served as Senior Master. He is a parttime music lecturer at the University of the Bahamas in the School of Communication and Creative Arts.

Mr. Dames was also employed as a law enforcement officer with Royal Bahamas Defence Force for 14 years and is currently with the Royal Bahamas Police Force as a Reserve Officer. He performs with the Royal Bahamas Police Force Band and serves as an education instructor for the Police Reserve Band section.

Mr. Dames is a cultural enthusiast and community builder who formed several community bands. He served as Assistant Director of the Royal Ambassadors Band, Director for the Urban Renewal Band, and leader and founder of the Fiesta Fun Junkanoo Group. He was a member of the Saxons Superstars Junkanoo Group and plays solo clarinet and bassoon with the Bahamas Symphony Orchestra.

He is also a Journeyman plumber registered with the Ministry of Works, Nassau, Bahamas, a second-degree black belt holder in Judo, and enjoys teaching, swimming, and playing music in various ensembles. He is a member of Pentecostal Baptist Church where he serves as Youth Leader, and is married to the former Rachelle Bastian and is the proud father of three sons: Oscar Jr., Ontario, and Othello.

ARBITRATION REFORMS HAILED AS ‘FUTURISTIC’

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.netTHE TWO Arbitration

Bills tabled yesterday in Parliament were hailed as “futuristic” concepts that open up alternatives to the Supreme Court as a forum for resolving commercial and other disputes.

Rengin Johnson, immediate past president of the Chartered Institute of Arbitrators(CAirb) Bahamas chapter, told Tribune Business she was thrilled that the Arbitration Amendment Bill 2023

and International Commercial Arbitration Bill 2023 were laid by Prime Minister Philip Davis KC.

Describing them as a “futuristic and valuable concept”, she said: “The thing is, I am hoping that it will become one of our income-earning industries, both from domestic as well as internationally, because at the end of the day it is popular globally.

“Rather than go to the judicial department, the parties are able to select their own arbitrator or arbitrators, or the mediator or the negotiators, and they select the time and the

venue. They also negotiate an established price of an arbitrator in order to do the arbitration proceedings, or the mediator, negotiator or adjudicator.

“So everything is preagreed. The parties select the procedure. The parties actually have to give authority to prepare the proceedings, or actually the parties have an input as to the selected procedure, whether it’s going to be face-to-face in an office or virtually through a Zoom meeting or Skype.”

The Bahamas has talked for decades about establishing itself as a major

Canadian trade mission eyes Bahamas ventures

A NINE-STRONG

Canadian delegation will visit The Bahamas next week to seek out trade opportunities and business partnerships with firms in New Providence and Grand Bahama.

The inaugural Atlantic Canada Trade Mission’s participants plan to engage in one-on-one business meetings during their February 27-March 1 visit, a statement said yesterday. The trip is being coordinated by an Atlantic Canadian industry association, econext, and is sponsored by the Canadian government’s Atlantic Canada Opportunities Agency, the government of Newfoundland and Labrador’s department of innovation, energy and technology.

The delegation includes organisations specialising in information technology, education and consulting engineering. The four Atlantic Canadian provinces consist of Newfoundland and Labrador, New Brunswick, Nova

Scotia and Prince Edward Island. econext supports its members in both exploring new trade opportunities and expanding existing relationships, whether that be through exports; joint ventures or other partnerships; licensing technologies; and accessing capital.

The statement said the Caribbean is a priority market for econext, when has led ten trade missions into the region since 2014.

A key objective for this first mission to The Bahamas will be the creation of mutually beneficial partnerships. All participating companies are focused on identifying potential partners with whom to collaborate on future business development, both in The Bahamas and in other markets. Some 70 meetings are scheduled during the threeday mission.

arbitration hub in the Latin American and Caribbean region, offering a forum for alternative dispute resolution (ADR) for commercial as well as other matters to both foreigners and locals. The two Bills tabled yesterday represent an effort to reinvigorate this push.

“We have legislation that is being drafted,” Ms Johnson said. “We have an Arbitration Act, and then we are also going to have a Domestic and International Mediation Act. The Arbitration Act is going to need some amendments because of the new concepts coming

in like virtual meetings and so on.

“I think our government should be very, very happy with this new concept in any working together with the judicial system, and when I say working together with the judicial system, the new Supreme Court rules have adopted the use of mediation proceedings during trial in certain matters.

“It can actually cut the costs down as well as the time spent in court, where you come to an agreement and then an Order is drafted. Then it becomes a part of the court’s Order, where it is used in domestic

matters, civil proceedings,” she added. “So therefore we already adopting ADR proceedings, one of which is the mediation in the Supreme Court.

“We will be helping the Supreme Court to condense the amount of time spent in the court system. So, therefore, I see it as a very futuristic and very valuable concept. We’re not taking anything away from the court. In fact, we are going to help the courts so that they can proceed with the court hearings in a more swift manner without adjournments or without the length of time that is spent.”

THE BAHAMAS has not properly leveraged the strength of recent anticorruption reforms, a governance reformer argued yesterday.

Matt Aubry, the Organisation for Responsible Governance’s (ORG) executive director, told Tribune Business:

“Our general take is that we have done some things, and we have passed some laws and we have pushed forward with opportunities like the Public Procurement

YET TO LEVERAGE ANTI-CORRUPTION REFORMS

Act and the digitisation of our government services. “We’ve had some greater levels of transparency in different instances, but we haven’t leveraged the strength of those advantages. We haven’t done what we need to make sure that not only do people locally see the difference, they believe that there can be a difference.”

The Bahamas held its position in Transparency International’s Corruption Index for 2022, achieving an unchanged score of 64 percent and ranking 29th out 180 countries rated.

Mr Aubry, though, added: “The difference between a top shelf business coming

here to relocate their headquarters might really be a past reputation that doesn’t reflect who The Bahamas is.

“We know that we’re on the verge of things like the enactment of Freedom of Information. We know that there’s been discussions about a revamp of the Public Disclosures Act. We know that in the [Progressive Liberal Party’s] Blueprint for change, and the agenda for the last administration, was an Integrity Commission and the nature not only locally, but internationally, is changing related to that.”

Minimizing corruption can save The Bahamas “hundreds of millions” of

dollars while, at the same time, “building trust” between citizens and public officials. “And when you have better trust, you have better compliance. We’re spending a lot of money to go out and try and get real property tax, and try and get people to pay fees and things that they already owe, and reduce the people trying to get around Customs and duty and all of those things,” Mr Aubry said.

Improved checks and balances can ensure people “believe” in the system and that money is not being wasted or lost. Mr Aubry also pointed to ORG’s upcoming

Economic Roundtable this Thursday evening, where there will be a panel discussing ways to move the Bahamian economy forward. “This is really giving a chance for us to recognise that the 50th is a critical moment, but beyond the 50th independence is really the point of this forum,” he said.

“It’s an opportunity for the public to hear from different perspectives, both from government and from the Opposition, and then from the governor of the Central Bank about what we see as the potential future and what are some of the challenges. Also, what are some of the

opportunities, and what should people be thinking about as they hear plans being put forward and made on their behalf?

“The hope and goal is that folks will listen to this, and be able to get their own ideas and thoughts, and then be better prepared to understand and sift through things that are presented with the policies, then advocate for the portions that they think are beneficial to them and also be able to speak to areas that need to be adjusted or changed because it doesn’t address their particular area or their industry or not.”

New BAMSI lettuce type exceeding expectations

THE BAHAMAS Agriculture and Marine Science Institute (BAMSI) yesterday said a new lettuce variety it has just introduced is exceeding performance expectations.

Avrett Lightbourne, BAMSI’s farm manager, hailed the flavour and growth of the Dov Romaine lettuce that was planted about nine weeks ago. He said: “We are yielding even more than we expected and the flavour is excellent by international standards. And, even though it’s getting warm, the lettuce is still thriving so we will see how long it will flourish under these conditions.

BAMSI said it is slowly rolling out the lettuce, which takes six to seven weeks to mature, planting about a third of an acre each week. The quick maturation cycle of the lettuce enables farmers to earn a significant revenues in a relatively short period of time.

Mr Lightbourne said: “We plant tomatoes and

JOB OPPORTUNITY

Harbourside Marine is seeking: Facility Engineer

• Must have strong knowledge in electrical and Plumbing • Able to work unsupervised

Please email resume to: ian@hbsmarine.com

THE AUDLEY C. KEMP SR. ESTATE BENEFICIARIES

In the Estate of AUDLEY C. KEMP SENIOR late of Waterloo Road in the Eastern District of the Island of New Providence one of the Islands of The Commonwealth of the Bahamas, deceased.

NOTICE is hereby given that the Judicial Trustee Report as of December 2022 is available for review. All Beneficiaries are asked to contact Ms. Sydnease Rolle for arrangements to be made to obtain a copy of the report. Identification must be provided.

Legal Administrator

Email: srolle.ake@gmail.com

Telephone: 603-1022/805-3976

THE COMPANIES ACT (2023 REVISION) OF THE CAYMAN ISLANDS NOTICE OF MEETING OF CREDITORS ROCINANTE FUND (IN OFFICIAL LIQUIDATION) (The “Company”) Grand Court Cause No FSD 243 of 2022 (DDJ)

TAKE NOTICE that the first meeting of creditors of the Company registration number 355773 whose registered office is situated at Mourant

other produce, but I grew romaine lettuce on my personal farm before joining BAMSI, and I wanted to try this variety on a larger scale. Early on we went through different management practices to be able to introduce this crop to the market. Another factor also is that this is a multi-million dollar crop, and I wanted to be able to encourage

Bahamian farmers to grow this as well.”

Lettuce currently sells for about $70 per case on the wholesale market, but BAMSI is selling its produce at a much lower cost. It is forecast that Bahamian consumers can purchase produce less than five days from harvest through BAMSI’s Dov project and private farmers that opt to grow the crop,

maximising freshness and adding more nutrient-rich food to their diets.

Mr Lightbourne attributed a large part of the crop’s success to staff training. He said: “A lot of [the staff] are not used to growing this particular crop, so we had to identify certain things, such as at what stage to cut the lettuce, where to cut the leaves. We had to teach them how to package it and take off the outer leaves, and leave the pretty inner leaves intact.

“The lettuce can’t be left out in the field. They must go into the cooler within an hour-and-a-half of being harvested; a cooler set at 42 degrees to keep them nice and crisp while being shipped. Every person must be reliable and dependable so the lettuce arrives in the best condition possible. We had to emphasise that this a more precise crop, and they have to stay on top of the management and care of it.”

once they have done the following: (1) advised the Joint Official Liquidators in writing by way of proxy form of their intention to attend and vote at the Meeting (“Proxy Form”); and (2) sent the Joint Official Liquidators a completed proof of debt form together with all supporting documentation ( Proof of Debt ), if not done so already The Proof o f Debt (unless previously submitted) and the Proxy Form are to be submitted to the Joint Official Liquidators by sending them to the address for service detailed below or by emailing them to the email address listed below prior to 11:00am Cayman Islands time (EST) on Friday, 24 March 2023

Please note that any creditor who fails to notify one of the Joint Official Liquidators of their intention to participate in the Meeting prior to 11:00am Cayman Islands time (EST) on Friday 24 March 2023 may not be granted access to the Meeting

Dated this 9th day of February 2023 James Parkinson, Joint Official Liquidator

BAHAMAS BEATS AIRLINES; US HAS ‘STRONG CONCERNS’

“We are pleased by the recognition of The Bahamas’ sovereignty in this matter, and we are happy to enter into consultations with the US government as we continue to strengthen our partnership. We will continue to work with our airline partners to make doing business with The Bahamas a mutually rewarding experience.” Mr Cooper’s statement, though, did not address the extent of the Department

of Transportation’s ruling - especially its “serious concerns” about the fees’ costs and whether they are excessive when compared to the actual expenses The Bahamas incurs for providing air navigation services. It raised concern whether the level of charges is compliant with the Air Transport Agreement treaty agreed between The Bahamas and US, to which Mr Cooper referred. While The Bahamas will benefit from the airline industry effectively being taken out of the dispute,

with the matter now set to be resolved at the government or diplomatic level, the Department of Transportation warned that it has “ample statutory and regulatory ability to take actions required by the public interest” if it determines this nation’s fees are excessive.

“Representatives of the US and the Commonwealth of The Bahamas have exchanged letters regarding this matter, and on January 18 and February 13, 2023, held virtual meetings in which both sides expressed

a desire to reach a resolution,” the ruling revealed.

“The Department believes the preliminary discussions have been productive. However, we have serious concerns and a number of questions outstanding, particularly with regard to The Bahamas’ cost-basis analysis for its [air navigation services] fees.

Concurrent with the action we are taking by this order, we have taken steps to initiate formal consultations under Article 13 of the agreement.. We fully expect to reach satisfactory closure of the issue through diplomatic efforts.”

Detailing its position, the US Department of Transportation said: “After analysing the entire record of this proceeding, we have serious concerns that the air navigation service charges imposed by BANSA may not fall within a reasonable level vis-à-vis The Bahamas’ cost for the provision of air navigation services, and we question whether the charges are fully consistent with Article 10 of the Air Transport Agreement, which entered into force on January 27, 2020.”

BANSA is the Bahamas Air Navigation Services Authority, but the Department of Transportation said the airlines’ complaint against this nation fails because they have produced no evidence that the air navigation services fees are discriminatory.

“While we are concerned that the charges potentially exceed a reasonable cost basis as contemplated in the agreement, the record shows that air navigation fees are imposed on US carriers at equal rates with the charges imposed on Bahamian and third-country carriers,” the ruling found. “In those circumstances, we are unable to conclude that the charges constitute discriminatory activity.” Without proof of discrimination, the industry’s case has no basis for success.

“We have also considered the complainants’ assertions that discriminatory activity is construed from the difference between the fees charged for transit flights compared to the fees for flights originating or departing The Bahamas,” the Department of Transportation said.

“The complainants argue that it is unreasonable and discriminatory for The

Bahamas to use charges imposed on transiting operators to bankroll The Bahamas’ entire air navigation services system, including for services not used by such transiting operators.

“The complainants themselves acknowledge, however, that operators in the same category of operations are charged the same amount. We cannot conclude in those circumstances that the fee structure constitutes unjustifiable or unreasonable discrimination,” the federal regulator continued.

“Nor do we find a basis to regard payments made to the US Airport and Airway Trust Fund as a discriminatory action on the part of The Bahamas..... In the circumstances presented, we believe that the public interest is better served by pursuing our cost-basis questions and seeking to resolve the underlying matter through the terms established in the Air Transport Agreement.”

The dispute had potentially serious ramifications given that the US Department of Transportation, if it found in the US airlines’ favour, could go to the extent of totally barring Bahamian airlines such as Bahamasair and Western Air from flying to the US or reducing such access. Mr Hamilton yesterday said it was critical that The Bahamas won because of the negative for both domestic aviation and tourism if their US counterparts had succeeded.

“That is excellent news,” he told Tribune Business of the US verdict. “Certainly given that the domestic operators were interested in that matter it’s a major relief not having to be concerned about that. Its a high priority matter given that our tourism industry depends heavily on it, domestic operators and airline industry partners.

“We are in the flying business, and if you can’t fly, you’re out of business. The US is a major market, and not being able to participate in that arena would be a major thing. The Government had indicated they felt this matter was better dealt with at the government-togovernment level and we were conscious they were making that effort.”

The Bahamas, in 2021, signed a 10-year deal that

outsourced management of

75 percent of its air space above 6,000 feet to the Federal Aviation Administration (FAA), with the US agency agreeing to waive the air navigation fees it previously levied for using this country’s air space. The Bahamas subsequently imposed its own air navigation services charges in a bid to generate revenue sufficient to fund the development of civil aviation safety and oversight in The Bahamas, and associated regulatory functions. This will thus eliminate the need for Bahamian taxpayers to fund this, saving the Public Treasury millions of dollars per annum at a time when it is coming under increasing fiscal stress.

However, arguing that these fees should only cover the cost of providing the service, the US airlines alleged there was no justification for “the tens of millions of dollars” that The Bahamas is collecting given that it is just paying, at most, $80,000$100,000 to the FAA - sum equivalent to 1 percent of the charges. They claim this “runs afoul” of global best practice and agreements, plus the US International Air Transport Fair Competitive Practices Act 1974.

The Bahamas has established a sliding scale for its air navigation services fees that ranges from $8.50 to $51.60 per 100 nautical miles based on the aircraft’s weight. Several observers have privately suggested to Tribune Business that the US airlines are seeking to bully The Bahamas by placing no value on the worth of this country’s sovereign air space.

They believe the sector is longing for a return to the days when The Bahamas earned not a single cent in revenue from the aviation industry’s use of its air space, which sits on key Atlantic and other routes between Europe and the western hemisphere and North and South America. The FAA used to waive air navigation services fees for planes that took off and/or landed in the US after passing through Bahamian air space, thus giving them free use of this country.

The Government, in its answer to the US airlines’ complaint, asserted that The Bahamas’ air navigation services regime was compliant with the Chicago Convention - the agreement that established the main principles of global air transport - as well as International Civil Aviation Organisation (ICAO) guidelines.

the $232.3m was advanced to the Government.

The east Grand Bahama MP argued that the Bill’s emergence following the mid-year Budget presentation was “proof” the Opposition had been correct to accuse the Government of “breaking the law” as there was previously no provision in the Central Bank Act allowing it to borrow, or access, the SDRs allocated to The Bahamas by the International Monetary Fund (IMF).

That will now be permitted by the new legislation, which states in its ‘objects and reasons’ section: “The Central Bank of The Bahamas (Amendment) Bill 2023 seeks to make provision.... of a new section 17A to empower the minister to access, utilise or convert special drawing rights allocated by the IMF for the purpose of reducing its foreign currency debt obligations and to manage its foreign currency debt operations.”

Significantly, the Bill says section 21 in the existing Central Bank Act will not apply to the Government’s “use or conversion” of SDRs or the proceeds.

Section 21 sets limits on how much the monetary policy regulator can lend or advance to the Government. It currently can only make temporary loans that mature within 91 days and have “market-based” interest rates attached, while the amount involved is also capped.

Combined with total issued Treasury Bills, and securities issued or guaranteed by the Government and its corporations, total outstanding loans to the former by the Central Bank cannot exceed 30 percent of the Government’s “average” or “estimated” revenue - a sum around $800m-$900m.

Mr Thompson, meanwhile, queried why the Government had been in such a hurry to gain access to the SDRs without “first coming to Parliament” to make the necessary legal changes. He effectively

accused the Davis administration of a backwards process, where it borrowed first and then obtained the necessary legal authority after the event.

“It is no surprise that the Government has tabled the amendment to the Central Bank Act,” he told this newspaper. “It is proof that the Opposition was in the right in pointing out that the Government was in breach of the law. They are now seeking to change the law to correct the breach that was made previously.

“We now see through their reports, and we now see through the tabling of this legislation, that the Government did in fact breach the Central Bank Act, and they did in fact have a loan or advance from the Central Bank that was contrary to the law. They are now seeking to remedy that law.

“We are calling for someone to be held accountable for the breach of the law. It cannot be right that any government can simply break the law and come to Parliament and seek to correct their mistake. The Government also owes the public an explanation as to what was the urgent circumstances that took place that caused them to take the advance without coming to Parliament,” Mr Thompson continued.

“They have failed to come clean with the Bahamian public. Even in today’s presentation the Prime Minister made it appear we are heading in the right direction, and that everything is going well, but the evidence is to the contrary. What was the urgent need for you to break the law without first coming to Parliament? That means there was a serious situation that the Government found itself in which caused them to disregard the law.”

John Rolle, the Central Bank’s governor, revealed to Tribune Business in early January that the Memorandum of Understanding (MoU) between the monetary policy regulator and Ministry of Finance stipulated the Davis administration must change the Central Bank Act to facilitate the SDR transaction.

The Opposition has seized on the $232.3m advance since it was first disclosed at year-end 2022 in the Central Bank’s November economic update, but the Davis administration will likely argue that its rivals are making much ado about nothing since the transaction gave it access to low-cost foreign currency borrowing that will save Bahamian taxpayers millions in interest (debt servicing) costs.

Simon Wilson, the Ministry of Finance’s financial secretary, previously said the MoU would provide the

We are seeking to employ the position of Landscape Manager here at February Point Resort Estates in beautiful Great Exuma. We are hoping to find candidates with a minimum of 2-3 years’ experience. We offer a competitive salary and excellent benefits; housing will also be considered. Interested persons should send their resume to: teneeshia@februarypoint.

Government with access to financing that was an estimated 700 basis points below prevailing market rates. He argued that this seven percentage point differential could generate close to $20m in annual interest savings for hardpressed Bahamian taxpayers compared to the likely rates if the Government had to borrow in the international capital markets. Mr Wilson also argued that the Government’s SDR borrowing was aligned with the IMF’s stated reason for issuing them, which was their use for “fiscal purposes”. It emerged in the Government’s December

2022 fiscal report that the full $232.3m had been drawn down by the Davis administration that month, classifying this as “bank loans” or part of some $250m in “foreign currency loans”.

The Ministry of Finance’s financial secretary confirmed that the $232.3m was used to repay $180m in foreign currency borrowings, leaving $52.3m unused. He also indicated that the SDRs were encashed and monetised.

However, Michael Pintard, the Opposition’s leader, argued that the Bill tabled yesterday - and its contents - were “proof

positive” that the FNM’s concerns were on target.

Asserting that the Government had placed the Central Bank “in a horrible position” over the SDRs, Mr Pintard said: “They have refused to lay the MoU on the table as we asked for, and have not explained what the interest rate is. They have done everything possible to hide this transaction, and this piece of legislation confirms it.

“Had the Central Bank governor not done his fiduciary duty of publishing the liability of the Government, and insisting on the MoU, I don’t think any of this would have seen the light of day. The Prime Minister has to give an accounting for breaking the law.”

‘Wary’ over deficit rise, $76m spend increase

were outpacing projections, but expenditure in certain cases was also outpacing forecasts.”

The Prime Minister, in announcing the supplementary Budget and spending appropriations, said the revisions “would not be possible” without government revenues for the six months to end-December 2022 exceeding forecast targets by $79.4m to come in at $1.257bn. Despite outperforming

projections, he added that the Government is now only predicting that revenues will exceed Budget estimates by some $53m. And, of that $53m increase, some $8m is being generated by the return of “unused” Department of Social Services monies to the Consolidated Fund. “The Department of Social Services identified $8m of unused balances on its accounts at Bank of The Bahamas and Kanoo. These amounts were for previous

years, so they had to be transferred to the Consolidated Fund and accounted for as revenue,” Mr Davis explained. “In keeping with our conservative approach to managing our fiscal affairs we have only increased our revenue projections for the entire fiscal year by $53m, which includes the $8m returned by Bank of The Bahamas and Kanoo. The net increase is $45m, which is only 56 percent of the excess revenue received by the Government.” That 56 percent is a percentage of the $79.4m increase during the first six months of the fiscal year. However, the Opposition yesterday voiced concern

over the widening deficit, and recurrent spending outpacing the growth in revenues. Michael Pintard, its leader, told Tribune Business: “They are confirming what we know already - that the deficit is widening. He [the Prime Minister] should have at least acknowledged the fact that has happened. I didn’t hear any plausible explanation from him as to why that occurred.”

And, speaking to this newspaper before the midyear Budget, the FNM leader said the Government’s frequent attempts to secure increased revenue suggested all was far from well on the fiscal front. Besides the changed VAT treatment on health insurance claims payouts, and fee increased at agencies such as the Road Traffic Department, he pointed to the administration’s accessing of $232.3m in IMF special drawing rights (SDRs).

“We know the Government is experiencing a cash crunch,” Mr Pintard argued. “It’s clear given the frequency with which they have introduced new fees. That is one clear indication. The fact they have drawn down on the SDRs held by the Central Bank. All of these are red flags absent an explanation as to what motivated these fee increases, the draw down on SDRs, the way they’re putting an additional burden on consumers by VAT treatment of medical claims.

“All this suggests that the Government is under tremendous financial pressure, and rather than have a candid conversation with the public about the fiscal position they find themselves in they continue to put pressure on the pockets of Bahamians.”

However, Mr Davis, who spent much of the mid-year Budget blasting the former Minnis administration for causing the national debt to increase by more than $3bn during COVID-19 and Hurricane Dorian, asserted: “I have a simple message for the Bahamian people. Our policies are working.”

While the increased $76.5m recurrent spending is not material in the context of a $3bn Budget, a deeper dive into the data released by the Ministry of Finance yesterday shows the Government is largely moving around and reallocating funds as needed to address new priorities and challenges as they emerge. This has resulted in a $12.1m cut to capital spending forecasts, with this sum dropping from May’s $371.1m to a new $359m.

The supplementary Budget also reveals that taxpayer subsidies to loss-making state-owned

Head of Facilities and Maintenance

This is a rare and exciting opportunity to join an outstanding and ambitious team at Inspired who recently opened premium school on the island of New Providence in The Bahamas. The school has already proven to be incredibly successful and is now moving into its second year.

We are looking for an exceptional Head of Facilities and Maintenance, who brings outstanding experience, high standards and a solution focused approach. You will be able to demonstrate the ability to assist in the key decision making related to systems, their commissioning and critical infrastructure required for our new, state of the art school campus in Western New Providence. Working with the site delivery team, consultants and others, as Head of FM you will be central to ensuring a smooth transition of the project from live construction to practical completion and handover. Amongst other responsibilities you will: deliver monthly and annual strategic reporting and planning; produce a multi-year campus maintenance plan; coordinate all maintenance related works to the campus and its facilities; support the site team throughout the current construction process, whilst always ensuring regulatory compliance and adherence to global best practice.

King’s College School offers the highest quality modern facilities in a purpose-built state-of-the-art facility on an expansive 10-acre campus, ensuring that students benefit from a learning environment that has been designed for how students learn in the modern day.

Facilities include football pitches, tennis and padel courts, as well as dance, drama, and art studios. There will also be state-of-the-art science labs, a multi-purpose hall, a 25m swimming pool, an adventure park playground, and plenty of green spaces and shaded areas for students to enjoy.

When joining King’s College School, The Bahamas, you will join the family of the award-winning Inspired Education Group, the leading global group of premium schools, with over 80 schools operating in 23 countries. We offer a competitive salary and benefits and access to best practice and career pathways with some of the very best schools worldwide.

To apply please send a CV and letter of motivation to admin@kingscollegeschool.bs

enterprises (SOEs) are set to increase by $35m, or 7.7

percent, compared to the May Budget estimate, reaching just shy of $500m or half a billion dollars at a total $492.24m.

The majority of that increase is an extra $20m allocated to the Water & Sewerage Corporation to help pay bills due to its reverse osmosis suppliers.

Another $3m is being provided to the Bahamas Public Parks and Beaches Authority, taking its total subsidy for 2022-2023 to $27m, while the University of The Bahamas is to receive a further $5.2m in taxpayer subventions.

The Airport Authority, too, is to receive an additional $4m to help cover its “operating expenses”, which will bring its subsidy to $12.542m. The increases unveiled in the supplementary Budget represent a reversal of the Minnis administration’s plan to cut SOR subsidies by a collective $100m over three years, and are heading in a different direction from that unveiled by the Government’s recently-published Fiscal Strategy Report.

To enable a $38.278m increase in the Ministry of Education’s capital budget, so as to facilitate school repairs and new construction, cuts have been made elsewhere. The Ministry of Works and Utilities’ capital budget has been slashed by some $20m to $101.399m, with cut backs in areas such as building maintenance, bridge repairs, road repairs, ports and docks, water and airport infrastructure. The $20m cut matches the increased Water & Sewerage subsidy.

The Ministry of Finance’s capital works budget, too, has been lowered by some $18.069m. Small and medium-sized business support has been cut by 50 percent, from $8m to $4m, although financing to aid this sector is contained elsewhere in the Budget. And funds earmarked for Family Island capital development have been reduced by $10m - from $12m to $2m.

Successive administrations have cut capital spending to a minimum as a means to keep annual fiscal deficits in check, but this has left key public infrastructure - roads, docks, bridges, hospitals and schools - that provide a critical platform for economic growth starved of financing for development and upkeep.

Hubert Edwards, the Organisation for Responsible Governance’s (ORG) economic development committee head, told Tribune Business that while the reduction in capital spending

compared to the May Budget did not appear “significant” it required monitoring.

“I don’t know that the number you mentioned would be of any great significance to worry about in terms of paring back, but I concur with your suggestion that over the years governments have used capital spending as a means to manage the the deficit,” he agreed.

“The overall concern would be that, in totality, is your capital Budget sufficient to drive things in the economy and be beneficial to long-term growth. Any type of cut backs, you want to be a bit wary. The question of cut backs in this instance doesn’t seem to be significant in the grand scheme of things, but you want to see your capital spending increasing rather than decreasing.”

Another source, familiar with Budget processes, was more alarmed. “The criticism of the Government is that it has always underspent on capital works,” they said. “These are the things we need to ramp up. Governments have been consistently starving capital expenditure to fund recurrent spending. That’s a road to nowhere. You cannot have economic development if the infrastructure is not up to standard.”

Similarly, Fidelity’s Mr Bowe said of the reduced capital budget: “It should definitely be an area that causes the antennae to go up for the Bahamian people. When you look at current infrastructure, would you consider it to be the most modern? Absolutely not. What we don’t want is a situation of delayed repairs, maintenance and development that costs me in the future.”

He pointed to World Bank and IMF research suggesting that capital spending on infrastructure works in the Latin American and Caribbean region needs to be equivalent to 5 percent of annual gross domestic product (GDP) to drive growth and development. The Bahamas, for 2022-2023, has dropped from 2.8 percent to 2.7 percent, further explaining why the Government is seeking to source private capital and management via public-private partnerships (PPPs).

As for the rise in SOE subsidies, Mr Edwards said: “We don’t want to see that increasing given that SOEs have been at the forefront on the table for reform for a number of years. If we are moving closer to $500m, that’s not a good thing.”

“There is no shame in borrowing ideas, concepts and even language in the drafting process. However, those in leadership have the responsibility to ensure that what is being adopted reflects the Bahamian

reality. That was not done, and so it was that in September 2021, the Ministry of Finance was not equipped to comply with the new legislation.

“The required information systems were outdated or completely lacking, but the reality has changed and

the Ministry of Finance is now well on its way to achieve full compliance,” he added. “The Government has acquired, and is now using, a best-in-class software to provide the many reports required under the Public Procurement Act.

“The Government is also acquiring a best-in-class financial information system to replace two legacy systems. For the first time, we are introducing true automation to our human resource systems. This is a significant achievement, and we are proud to have led the way in making government finances more transparent and accountable.”

The Public Finance Management Bill’s “objects and reasons” section pledges that it includes the “material provisions” from the laws it is designed to replace. “This Act repeals and replaces the Public Financial Management Act 2021, repeals the Fiscal Responsibility Act 2018 and sections of the Financial Administration and Audit Act,” the Bill said.

“Finally, this Act incorporates material provisions of the foregoing repealed enactments into a consolidated public finance and fiscal responsibility framework.” Mr Aubry acknowledged that government has a duty to make existing laws more “cohesive” and function better in their actual execution/ implementation, as well as align them with practical realities, but urged that the new Bill not depart from the existing Acts’ core principles and provisions.

Noting that the Davis administration had previously served notice of its intent to reform both the Fiscal Responsibility Act and Public Financial Management Act, the ORG chief told this newspaper: “I don’t think we understood it would be put in a larger, more comprehensive piece of legislation...

“ORG, and a lot of other entities, contributed some pretty detailed feedback on the Fiscal Responsibility Act, Public Financial Management Act and Public Procurement Act. It’s important these pieces of legislation are cohesive, but there are key components

of transparency and accountability put in those Bills and a level of adherence that raised certain standards and expectations of decision-making and reporting to the public.

“In looking at the new legislation, it will be important to pay attention to the fact these things are not lost.” Pointing to the revised Public Procurement Bill, Mr Aubry said ORG’s benchmarking review of the new legislation identified a mixed bag, with some provisions new and enhanced, others retained from the present Act, and a few where it appeared that standards may have eased.

Acknowledging that laws must be “user friendly” as well as achieving any enforcement objectives, he also warned against revamping critical legislation every five years when administrations change because this could rob the initiative of momentum and impact.

“The mechanism was built out five years ago,” Mr Aubry said of the Fiscal Responsibility Act, “and, if we’re going to rebuild it, it inhibits momentum sometimes. The hope is that doesn’t continue. We want the right legislation, we want it to be functional and enacted, but don’t want it to be someone looking at it five years later, saying it’s not our legislation, and redoing it. The success and outcomes of this need to be paramount.

“We also hope there is available time and resources for consultation; not just with the technocrats, not just those looking at actuarial tables and accrual reporting, but with dayto-day citizens so that this information is made tangible and meaningful.”

Michael Pintard, the Opposition’s leader, yesterday questioned whether the Public Finance Management Bill had been “peer reviewed” and been subject to consultation. “The thing that occurred to us right away is: Was it peer reviewed,” he added of the Bill. “Was this shared internally prior to them making the final decision?

“When we had introduced the package of Bills they went through a series of peer reviews. One of the questions is: Was that Bill put out for consultation? Our Bill was circulated, and we received technical assistance from CARTEC (the IMF’s regional facility). It would be really interesting to find out to what extent the Public Finance Management Bill went out for consultation and who they consulted with in that regard. I don’t think it was. Certainly no one I spoke to.”

Mr Pintard said he had spoken to a former finance minister, who he did not name, and who had yet to see the Bill tabled by the Prime Minister yesterday.

UNESCO CHIEF URGES TOUGHER REGULATION OF SOCIAL MEDIA

By IAN PHILLIPSAssociated Press

THE UNITED Nations' educational, scientific and cultural agency chief on Wednesday called for a global dialogue to find ways to regulate social media companies and limit their role in the spreading of misinformation around the world.

Audrey Azoulay, the director general of UNESCO, addressed a gathering of lawmakers, journalists and civil societies

from around the world to discuss ways to regulate social media platforms such as Twitter and others to help make the internet a safer, fact-based space.

The two-day conference in Paris aims to formulate guidelines that would help regulators, governments and businesses manage content that undermines democracy and human rights, while supporting freedom of expression and promoting access to accurate and reliable information.

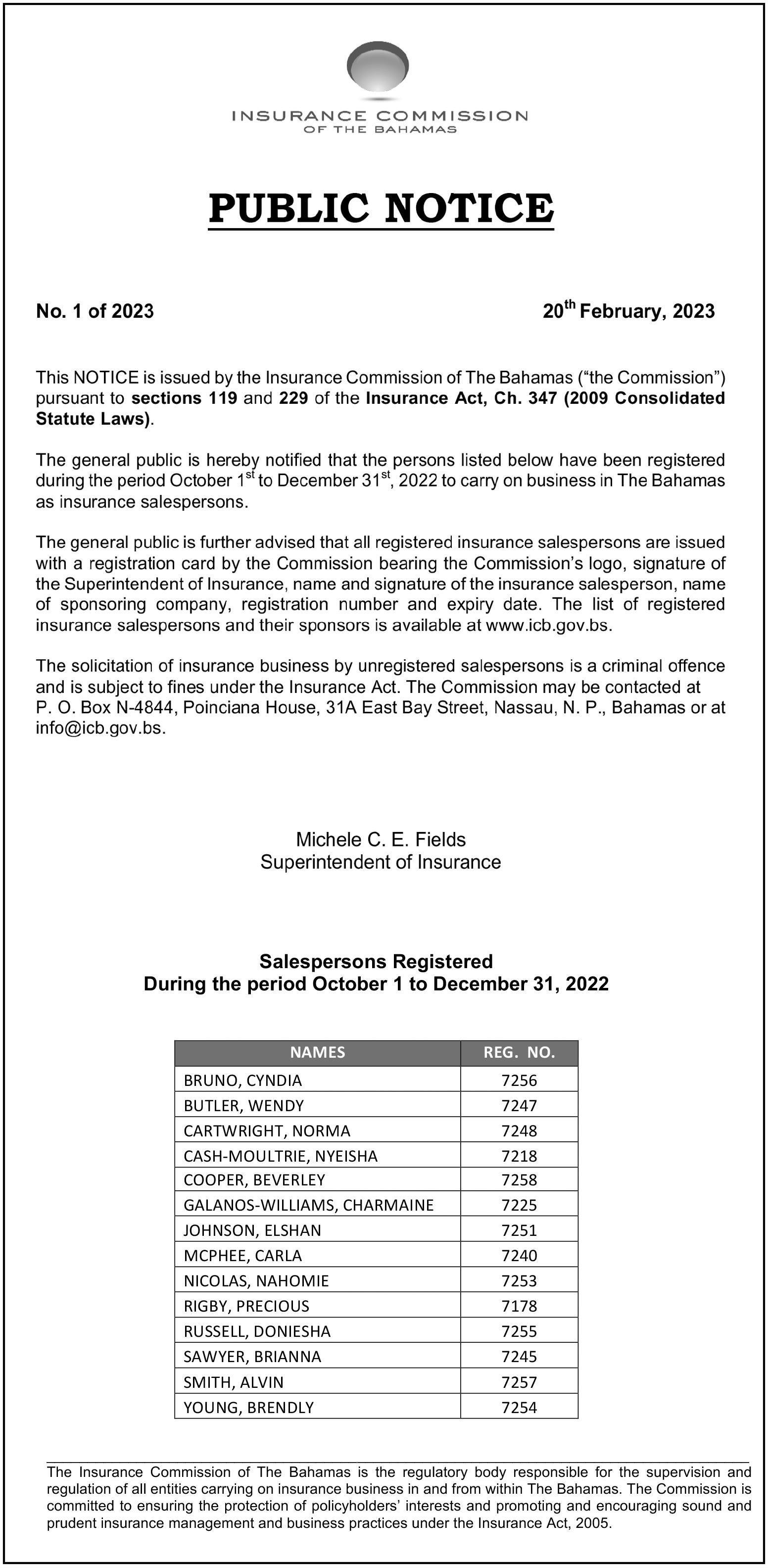

PUBLIC NOTICE

INTENT TO CHANGE NAME BY DEED POLL

The Public is hereby advised that I, DELLIANA DIANA BURROWS of #39 Jackfish Drive, Carmichael Road P.O Box N3408 Nassau, Bahamas, intend to change my name to DELLIANA DIANA HARDY If there are any objections to this change of name by Deed Poll, you may write such objections to the Chief Passport Officer, P.O.Box N-742, Nassau, Bahamas no later than thirty (30) days after the date of publication of this notice.

LEGAL NOTICE

INTERNATIONAL BUSINESS COMPANIES ACT, 2000

Safra Lemuria

Investment Fund Ltd.

Voluntary Liquidation

NOTICE IS HEREBY GIVEN in accordance with Section 138 (4) of the International Business Companies Act, 2000 as follows:-

a) Safra Lemuria Investment Fund Ltd. is in dissolution under the provisions of the International Business Companies Act, 2000.

b) The dissolution of the said Company commenced on 9th February 2023 when its Articles of Dissolution were submitted to and registered by the Registrar General.

c) The Liquidator of the said Company is Israel Borba whose address is Lyford Financial Centre, Building 2, Western Road, P.O. Box CB-10988, Lyford Cay, New Providence, Nassau, Bahamas.

Israel Borba Liquidator

The global dialogue should provide the legal tools and principles of accountability and responsibility for social media companies to contribute to the "public good," Azoulay said in an interview with The Associated Press on the sidelines of the conference. She added: "It would limit the risks that we see today, that we live today, disinformation (and) conspiracy theories spreading faster than the truth."

The European Union last year passed landmark legislation that will compel big tech companies like Google and Facebook parent Meta to police their platforms more strictly to protect European users from hate

speech, disinformation and harmful content.

The Digital Services Act is one of the EU's three significant laws targeting the tech industry.

In the United States, the Justice Department and Federal Trade Commission have filed major antitrust actions against Google and Facebook, although Congress remains politically divided on efforts to address online disinformation, competition, privacy and more.

Filipino journalist and Nobel laureate Maria Ressa told participants in the Paris conference that putting laws into place that would prevent social media companies from "proliferating

NOTICE

NOTICE is hereby given that GLORDY REVOLTE of #22 Albemarle Road, Ridgeland Park West, New Providence, The Bahamas, is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 15th day of February, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE

NOTICE is hereby given that VERRILUS SYLVERRAIN of Betsy Village, Governor’s Harbour, Eleuthera, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 16th day of January, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

2021 Nobel Peace Prize Maria Ressa delivers her speech during a conference on guidelines for regulating digital platforms, Wednesday, Feb. 22, 2023 in Paris.

Photo:Aurelien Morissard/AP misinformation on their platforms" is long overdue.

Ressa is a longtime critic of social media platforms that she said have put "democracy at risk" and distracted societies from solving problems such climate change and the rise of

authoritarianism around the world.

By "insidiously manipulating people at the scale that's happening now, ... (they have) changed our values and it has rippled to cascading failure," Ressa told the AP in an interview on Wednesday.

PUBLIC NOTICE

The Public is hereby advised that I, OCTAVIA VANDETTE BENSON of Southern Shores Subdivision, New Providence, The Bahamas, Mother of MELANIE JASMINE CENEMAT BENSON A minor intend to change my child’s name to LILLY OLIVIA BENSON If there are any objections to this change of name by Deed Poll, you may write such objections to the Deputy Chief Passport Officer, P.O. Box N-742, Nassau, Bahamas no later than thirty (30) days after the date of publication of this notice.

NOTICE

NOTICE is hereby given that ANASKACIA MOREAU of General Delivery, Marsh Harbour Abaco, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 23rd day of February, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

STOCKS STALL IN MIXED TRADING DAY AFTER WORST DROP IN MONTHS

By STAN CHOE AP Business Writer

STOCKS stalled in mixed trading on Wednesday, a day after falling to their worst loss since December, as Wall Street prepares for interest rates to stay higher for longer.

The S&P 500 dipped 0.2% after drifting between small gains and losses through the day. The Dow Jones Industrial Average slipped 84 points, or 0.3%, while the Nasdaq composite edged up by 0.1%.

After leaping at the start of the year, stocks have hit a wall in February on worries that inflation may not be cooling as quickly or as smoothly as hoped. That has Wall Street upping its forecasts for how high the Federal Reserve will take interest rates, as well as for how long it will keep them at that level.

High rates can help drive down inflation, but they raise the risk of a recession because they slow the economy. They also hurt investment prices.

That recalibration by Wall Street, which earlier was betting that easing inflation would soon get the Fed to take it easier on interest rates, has caused yields in the Treasury market to shoot higher this month.

The yield on the 10-year Treasury is near its highest level since November. It pulled back a bit from its surge on Tuesday, dipping to 3.92% from 3.95%. That helped take some pressure off stocks on Wednesday.

The two-year yield, which moves more on expectations for the Fed, fell to 4.69% from 4.73%. It’s also been near its highest level since November. If it tops that level, it would be at its highest since 2007.

Traders have in recent weeks called off bets that the Fed could cut rates later this year. Now they’re in closer alignment with what Fed officials have been telling the market for months, if not preparing for even more.

Investors are penciling in at least two more rate hikes of 0.25 percentage points. They’re even talking about the possibility that the Fed may consider going back to increases of 0.50 points.

The Fed has brought its main overnight rate up to a range of 4.50% to 4.75%, up from virtually zero at the start of last year, in its drive to stamp out high inflation. It’s also said it envisions no cuts to rates this year.

Minutes from the central bank’s last meeting showed policy makers still think inflation is too high and that interest rates need to rise further. “A few” officials even said they preferred raising rates by 0.50 percentage points at its last meeting, which was double the size of what the Fed actually did.

And that discussion came before a slew of strongerthan-expected reports arrived on the economy that could raise the pressure further on inflation. They included resilient readings on the job market, retail sales and inflation itself.

The disappearing hopes for a rate cut this year on Wall Street, along with rising expectations for how high rates will ultimately go, have dragged down the S&P 500’s gain for the year to 3.9%. Earlier this year, it was up as much as 8.9%.

“February is known as a hangover month,” said Ryan Detrick, chief market strategist at Carson Group. “After one of the best months we’ve seen, to have some indigestion shouldn’t surprise any investors. Now we’re starting to get some of that volatility and weakness.”

The Fed’s next move on rates will be next month. Traders see a roughly threein-four chance that the Fed will raise rates by 0.25 points, according to CME Group. They see a 27% chance of a hike of 0.50 points. A month ago, traders were seeing a roughly one-in-five chance that the Fed wouldn’t raise rates at all in March.

A relatively lackluster earnings reporting season for big U.S. companies is winding down, and some of Wednesday’s biggest losers dropped despite reporting better results for the latest quarter than expected. That’s because investors have been putting more emphasis on what companies say about their upcoming results, with worries high about rising costs and inflation eating into profits.

Charles River Laboratories dropped 10.1% despite topping forecasts for the latest quarter. It said it received a U.S. Justice Department subpoena related to shipments of nonhuman primates that the company received from its supplier in Cambodia. The company said it voluntarily suspended such shipments, which pushed it to cut its forecast for revenue this upcoming year.