By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE MINISTRY

transaction given that it occurred in this jurisdiction and involved Bahamian-domiciled entities.

Some $12.8m would be owing on the sale, based on the 10 percent rate, making this one of the single-largest VAT generating transactions seen in The Bahamas’ to-date. However, the vessels’ secured financier, DNB Bank, is fighting the application of VAT in a legal battle currently playing out before the Supreme Court as any payment would reduce its loan recovery.

Insurers: ‘Everyone will pay’ if storm cover unaffordable

Pilots join demand for sanctions push against Bahamas airlines

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

US PILOTS are now urging federal authorities to impose sanctions on the ability of Bahamian airlines to access their market unless this nation “immediately ends the collection of these egregious” air navigation fees.

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

BAHAMIAN insurers yesterday warned that “everyone will have to pay” if hurricane coverage becomes increasingly unaffordable with the issue representing a growing public policy “dilemma” for the Government.

Property and casualty underwriters told Tribune Business that an ever-escalating burden will be imposed on the Public Treasury in the aftermath of major storms if growing numbers of homeowners and businesses are unable to afford skyrocketing premium prices for all-perils catastrophe coverage.

This was exposed in Hurricane Dorian’s aftermath, with millions of taxpayer dollars still being spend to effect repairs to thousands of uninsured homes, and senior executives said the industry and government now need to “sit at the table” and explore how they can increase

coverage penetration at a time when the Bahamas Insurance Association (BIA) has warned global reinsurers may demand “substantially increased rates” in this nation and wider Caribbean.

Anton Saunders, RoyalStar Assurance’s managing director, told this newspaper that the underwriter had sought to mitigate the 20-30 percent hike in reinsurance rates by absorbing 5-7 percent of the increase itself.

However, despite this the company had no choice but to increase its catastrophe insurance rates for property by around 15 percent in 2023.

“We did not pass all of our costs on to our clients,” he explained. “We decided to absorb about 5-7 percent that we are going to eat internally. Our margins are reduced to absorb some of the cost. We encourage all our clients to review their portfolio to see where they can take on more risk themselves if they can afford to

The Airline Pilots Association thus added its weight to calls by US airlines for Bahamian carriers to be barred, or “curtailed”, from flying to the US as a “regrettable” next step given that this nation’s government is unlikely to be persuaded to adjust

charges they allege are “unjust, discriminatory and anti-competitive”.

Captain Jason Ambrosi, the Association’s president, in a January 20, 2023, letter to the US Department of Transportation, gave Airlines4America’s full-scale pressure campaign against The Bahamas’ air navigation services fees his complete backing.

“Air Line Pilots Association International (ALPA) strongly supports the complaint of the members of the Air Transport Association of America (doing business as Airlines4America) against The Bahamas for ‘astronomical’ air navigation service charges under the International Air

SIMON WILSON

Transport Fair Competition Act,” he wrote.

“The Department should take the steps that Airlines4America requests because they would advance key public interest factors in the aviation statutes. As the National Air Carrier Association points out in its answer, which ALPA also supports, the Bahamian service charges are unjustified because the US Federal Aviation Administration provides 75 percent of The Bahamas’ air traffic services; Cuba provides the rest.

“In Airlines4America’s estimation, the charges that The Bahamas expects US airlines to pay are likely five times in excess of the actual costs. As a result, US carriers pay twice: Once to the Federal Aviation Administration (FAA) trust fund for these services, and again to The Bahamas for the same services.

Village Rd ‘can see finish’ following up to 70% losses

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

VILLAGE Road businesses yesterday said they can “see the finish line” on year-long roadworks that have caused sales revenue to plummet by up to 70 percent.

Michael Fields, president of Four Walls Squash and Social Club, told Tribune Business the project’s contractor had disclosed that paving work should start at the road’s northern end this week as business owners wait to receive the Government’s formal response to their proposal for tax relief and

other incentives to help commerce in the area rebound.

Revealing that the Davis administration has asked for seven working days to reply when the two sides met last Monday, he added that the Government “had a listening ear” to the private sector’s plight and appeared to be “very open” to providing some form of assistance to Village Road businesses.

The details remain to be worked out, and Mr Fields said he wanted to give the Government the time it had requested to respond before commenting in greater detail.

Nevertheless, he told this newspaper: “The

Agent ‘unsuccessful’ again on FamGuard conspiracy claims

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

A FORMER Family Guardian sales agent has been “largely unsuccessful” in her bid to obtain greater damages from the BISXlisted insurer which was again cleared on “conspiracy” to injure by unlawful means”.

Jennifer Bain had sought to appeal a Supreme Court verdict which found that Family Guardian worked

with Alana Major, its senior manager of group sales, “to injure” her financially by trying to prevent several major Bahamian corporate clients going with her after the two sides parted ways in late 2015.

Justice Indra Charles, in her March 8, 2022, ruling awarded Ms Bain $20,000 in damages for this “conspiracy” to injure her via “lawful means” and another $25,000 over a defamatory letter written on her to the Insurance Commission.

The BISX-listed life and health insurer also had to pay $60,000 towards her legal costs, and $10,675 in disbursements, taking these combined costs and damages to more than $110,000.

And Family Guardian was also ordered to pay Ms Bain “damages for breach of contract” equivalent to a year’s notice pay. However, Justice Charles rejected her claim of “conspiracy to injure by unlawful means”.

The Court of Appeal, in a unanimous January 19,

2023, verdict noted that Ms Bain was still “dissatisfied” with the Supreme Court ruling - particularly the rejection of her “unlawful conspiracy” claim and failure to award exemplary damages - and took the matter before the higher court.

Sir Michael Barnett, the Appeal Court’s president, recalled how Family Guardian terminated Ms Bain’s services on September 29,

Government actually expressed their sympathy and had a listening ear. They were certainly very open to the possibility of some sort of compensation to the businesses. It was very positive and they were very open to it.

“They promised a response to us within a week. It’s been four days and I want to give them an opportunity. They have to review our proposal in detail. They have to look at the historical things that were done and then really come to us in writing.” Based on the outcome of the meeting with Michael Halkitis, minister of economic affairs, and other government officials, Mr Fields said he is “very confident” that some relief will

business@tribunemedia.net TUESDAY, JANUARY 24, 2023

of Finance’s top official yesterday asserted “there’s no dispute” that the Government should receive a near-$13m VAT windfall from the sale of two cruise ships despite a legal challenge by their secured lender.

Simon Wilson, the financial secretary, told Tribune Business “the law is clear” that the combined $128m sale of the Crystal Serenity and Crystal Symphony was a VAT-able

SEE PAGE B3 SEE PAGE B6

SEE

PAGE B5

SEE PAGE B4 Gov’t battling for $13m VAT on cruise ship sale

• Finance chief: ‘No dispute’ $128m sale taxable • Crystal Cruises lender fighting taxation swoop • Nassau Cruise Port, creditors contest priority CRYSTAL CRUISE SHIP • Greater taxpayer burden if more uninsured • Hikes ‘very concerning’, public policy ‘dilemma’ • RoyalStar absorbs 5-7% of rise in own margins SEE PAGE B2 $5.25 $5.29 $5.46 $5.16

IDB visits renewable energy installations

By FAY SIMMONS jsimmons@tribunemedia.net

AN Inter-American Development Bank (IDB) delegation has toured solar installations in New Providence and Abaco as part of an $89m project to revamp this nation’s energy sector.

The IDB officials, part of the multilateral lender’s energy mission, are working on the renewables initiative with members of the Ministry of Finance’s Project Execution Unit (PEU).

The initiative, called ‘Reconstruction with Resilience’, seeks to advance The Bahamas’ renewable penetration given the country’s target of generating 30 percent of its energy needs from renewable sources by 2030. This, in turn, is designed to increase energy resilience and lower costs.

Burlington Strachan, Bahamas Power and Light’s (BPL) chief technical officer, led a tour of the 25 Mega Watt (MW) battery energy storage system that is under construction at the Blue Hill Road plant. He explained the infrastructure being installed to accommodate the stand-by solar batteries, and gave an overview of how they operate.

Mr Strachan said the batteries represent a transition from

fossil fuel to green energy, and will minimise the current wastage of fuel - especially after a power outage, when more fuel is required to power the grid.

He added that the batteries will reduce electrical trips of BPL’s feeds, as the new system will provide a more stable voltage frequency. The battery energy storage system is expected to be in operation by the end of March once the batteries, which are expected to arrive this month, are installed.

The group also visited solar panel sites at C.V. Bethel High School and T.G. Glover Primary School. C.V. Bethel has solar panels installed in three areas, which are able to power the school during the day, significantly reducing energy costs. The 430 panels at T.G. Glover are still being installed.

The IDB team then travelled to Abaco to assess the reconstruction of BPL’s transmission and distribution systems following Hurricane Dorian’s devastation. While in Abaco, the group visited the Wilson City Power Station, the Marsh Harbour generation plant, the proposed site for the new Red Bays sub-station and the proposed site for the solar park in Seven Hills.

PILOTS JOIN DEMAND FOR SANCTIONS PUSH AGAINST BAHAMAS AIRLINES

FROM PAGE B1

Neither Bahamian airlines nor any other country’s air carriers pay twice.”

The Government, in its response to the airlines’ initial complaint, denied that US carriers pay twice as alleged while asserting that the payments into the FAA trust fund relate only to services for US domestic flights. However, Captain Ambrosi continued: “These excessive and discriminatory charges would seem to violate Article 10 of the US-Bahamas Air Transport Agreement.

“According to Airlines4America, informal attempts to persuade The Bahamas to rectify its behaviour have failed.

Formal governmental consultations over this dispute under Articles 13 and 14 of that agreement likely would fall on the same rocky ground. Therefore, Airlines4America’s complaint under the Act is the next necessary yet regrettable step.”

He added that suspending the air traffic rights of Bahamian carriers, and their ability to access the US market, was justified because of the alleged “harm” that The Bahamas’ “egregious” charges were inflicting on US airlines and their employees.

“ALPA supports Airlines4America’s request that the Department issue a show cause order providing

that, unless The Bahamas immediately ends the collection of these egregious user charges, Bahamian air carrier authority to operate in the US should be ‘curtailed or suspended, or be subject to other countervailing measures as the Department finds to be in the public interest’,” Mr Ambrosi concluded.

The Bahamas, in 2021, signed a 10-year deal that outsourced management of 75 percent of its air space above 6,000 feet to the FAA, with the US agency agreeing to waive the air navigation fees it previously levied for using this country’s air space.

The Bahamas subsequently imposed its own air

navigation services charges in a bid to generate revenue sufficient to fund the development of civil aviation safety and oversight in The Bahamas, and associated regulatory functions. This will thus eliminate the need for Bahamian taxpayers to fund this, saving the Public Treasury millions of dollars per annum at a time when it is coming under increasing fiscal stress.

However, arguing that these fees should only cover the cost of providing the service, the US airlines are alleging there is no justification for “the tens of millions of dollars” that The Bahamas is collecting given that it is just paying, at most, $80,000-$100,000

to the FAA. They claim this “runs afoul” of global best practice and agreements, plus the US International Air Transport Fair Competitive Practices Act 1974.

The Bahamas has established a sliding scale for its air navigation services fees that ranges from $8.50 to $51.60 per 100 nautical miles based on the aircraft’s weight. Several observers have privately suggested to Tribune Business that the US airlines are seeking to bully The Bahamas by placing no value on the worth of this country’s sovereign air space.

They believe the sector is longing for a return to the days when The Bahamas earned not a single cent

in revenue from the aviation industry’s use of its air space, which sits on key Atlantic and other routes between Europe and the western hemisphere and North and South America. The FAA used to waive air navigation services fees for planes that took off and/or landed in the US after passing through Bahamian air space, thus giving them free use of this country.

The Government, in its answer to the US airlines’ complaint, asserted that The Bahamas’ air navigation services regime was compliant with the Chicago Convention - the agreement that established the main principles of global air transport - as well as International Civil Aviation Organisation (ICAO) guidelines.

PAGE 2, Tuesday, January 24, 2023 THE TRIBUNE

A DELEGATION representing the IDB energy mission and the Ministry of Finance’s project execution unit joined technical officers, and visited various sites, on New Providence to view installations of solar energy technology. On Abaco, they toured reconstruction of BPL’s transmission and distribution systems.

Photos:Patrick Hanna/BIS

Grocers chief: Food prices to remain high

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

FOOD prices will remain high in the short to medium-term, the Retail Grocers Association’s (RGA) president warned yesterday, amid little sign that inflationary pressures are easing.

Philip Beneby told Tribune Business he “has not seen any indication or proof” that food prices start

to decline in the immediate months ahead. “Maybe the larger stores that do a lot of importing, and those who have a lot of communication with the other foreign suppliers, and have access to monthly letters giving forecasts or predictions as to what may take place [might have seen declines], but it doesn’t reach The Bahamas in a timely fashion,” he added.

“I am not in communication with their suppliers overseas, and only if I have sight of a forecast letter

then I would know. But, on the local scene, prices will either increase or they will remain the same.” Lettuce prices have doubled in the past few weeks, while the cost of eggs has been steadily increasing to the point where they are also almost double the price seen in 2019.

“The lettuce has declined somewhat, and I don’t know if they will continue, but eggs have been increasing. A case of eggs now is $230 a case for large and extra large eggs, and $195

for medium A,” Mr Beneby said. “I won’t say there won’t be a decrease in food prices, but I don’t think there is going to be one in the near future. I don’t have communication with a lot of the overseas suppliers to get that kind of feeling, but not at this time.

“Things are high, and also the availability of some items has still not changed. There are a lot of items that are just out of stock, and all of that was due to the pandemic. Factories and manufacturers are trying

to pull back together with the materials, and some of them have just gone out of business.”

Despite the unavailability of some brand names familiar to Bahamian consumers, Mr Beneby encouraged shoppers to make use if “generic brands”. He added: “I would encourage customers to be more conscious of their shopping and maybe not go for the regular brands that may cost a bit more,” he added.

The Retail Grocers chief, meanwhile, said the price

Agent ‘unsuccessful’ again on FamGuard conspiracy claims

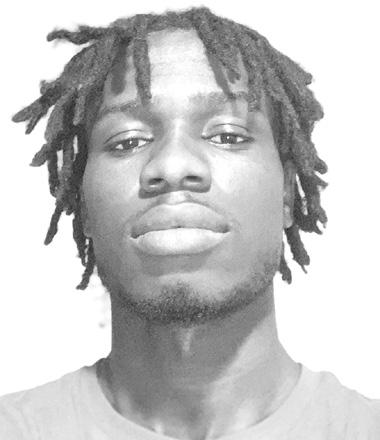

FROM PAGE B1 JOB

2015, for alleged breach of contract after she elected to pursue tertiary education in the US for some 16 months.

Family Guardian then moved swiftly to prevent Ms Bain’s group health insurance clients from moving with her, and potentially becoming insured with a rival underwriter, after she joined Hope Insurance Agents and Brokers. It sought to induce luxury goods retailer, John Bull, and auto dealer, Bahamas Bus & Truck, to renew their group health policies directly with itselfand abandon Ms Bain - by offering reduced premium and commission rates.

“Mrs Major advised some of the appellant’s [Ms Bain’s] former clients that if they purchased insurance directly from the

respondent, that they would be offered a more favourable insurance rate,” Sir Michael recalled. “Further, in a letter dated October 9, 2015, Mrs Major wrote to the appellant and complained that the appellant had improperly provided clients’ information to Hope Insurance.

“The letter was copied to Michele Fields and Patrice Rolle, the superintendent and the manager of the intermediary and market conduct unit of the Insurance Commission of The Bahamas, respectively. The letter alleged that the recent appointment of Hope Insurance as broker of record for several policies arose as a result of the appellant disclosing client information.

“Mrs Major demanded that the appellant ‘cease and desist’. She referenced

the Data Protection (Privacy of Personal Information) Act, which prohibits persons from using information obtained without authority.” This triggered Ms Bain’s largely successful Supreme Court action, but she argued that Family Guardian’s actions over the John Bull and Bahamas Bus & Truck policies should have been ruled an “unlawful conspiracy” to injure her.

Sir Michael, though, found that the alleged Insurance Act violations cited by Ms Bain to support her claim of “unlawful conspiracy” were not included in her pleadings or raised before the Supreme Court during the first trial.

“Clearly the respondent [Family Guardian] felt it had a lawful right to offer an insured a lower premium

control battle with the Government has been “sorted out” and the industry has “nothing else to report” at this time. The sector reached a stand-off with the Davis administration last year over the latter’s bid to expand the price control regime and lower its margins - a move it argued could have resulted in widespread job losses and business closures.

to ensure that it kept its business,” he ruled.

“I see no basis for setting aside the judge’s finding. Even if the respondent could conspire with its employee, the appellant has not adduced any evidence tending to show that there was a breach of section 137 of the Act.” And Sir Michael also rejected Ms Bain’s claim that Family Guardian breached the Data Protection Act by disclosing client billings.

He and his fellow appeal judges similarly dismissed the claim for compensatory damages, which Ms Bain’s attorney, Camille Cleare, alleged should have been $500,000 and not $20,000, plus the bid for exemplary damages. The only areas where was successful were in persuading the Court of Appeal to award prejudgment interest at 2.4 percent between February 17, 2016, and March 8, 2022, and in having her legal costs to be remitted back to the Supreme Court for determination by the registrar.

THE TRIBUNE Tuesday, January 24, 2023, PAGE 3

Assists with various maintenance responsibilities as part of the training required to develop job knowledge essential for full time employment as a mechanic in one of the company functional maintenance departments. JOB SCOPENo supervisory or budgetary responsibilities PRINCIPAL DUTIES AND RESPONSIBILITIES Performs basic preventative maintenance on all equipment. Assists with checking and ensuring that all machines are serviceable. Assists Maintenance Supervisor when required. Makes quality fabrications as needed, Performs fueling duties when required. Makes service calls to warehouse. Keeps work area and tools/equipment clean. Reports all recurring problems to Maintenance Supervisor. Participates in training sessions and technical oriented workshops. Continually supports the Quality Improvement efforts in the company. Performs all other duties as assigned. MINIMUM EDUCATION Certification, Experience and Physical Requirements EDUCATION: High School Diploma or equivalent EXPERIENCE Six(6) months experience preferred. License: Valid local driver’s license Travel N/a Job Title - Mechanic Helper Reference - 9769 Department - Nassau Equipment Ops Bahamas - Nassau Supervisor - Mario Butler | Phone: 424-1194 Recruiter - Daniela Ayala Pay Grade - BAH Grade 004 Close Dat JOB OPPORTUNITY Please send resume to MButler@tropical.com Tel: (242) 397-7235

SUMMARY

Gov’t battling for $13m VAT on cruise ship sale

This newspaper can reveal that legal arguments were made last week on both the Government and DNB Bank’s behalf before Justice Andrew Forbes, who is now considering his verdict. Mr Wilson yesterday voiced confidence that the Ministry of Finance and Department of Inland Revenue will prevail, arguing that all the elements to make it a taxable transaction are in play.

“There’s no dispute. The law is clear. That transaction is VAT-able,” the financial secretary told this newspaper. “I don’t think there’s any contest. There’s no basis to contest it. That transaction is VAT-able. That transaction was structured as a transaction by a Bahamian entity to a next Bahamian entity. That is clearly a VAT-able transaction, and it happened in this jurisdiction.

“It’s clearly VAT-able. There’s no reason for dispute. That’s clearly a VAT-able transaction. It was a transaction involving a sale.” Mr Wilson said he did not know the combined purchase price fetched by the two Crystal Cruises vessels, or the precise amount of VAT that

could be generated, but added: “I heard it was a lot. It’s definitely a VAT-able transaction.”

A Bahamian legal source, speaking on condition of anonymity, confirmed that there was an “issue arising from the sale of the ships” that was heard by Justice Forbes in Freeport last week. “There’s a big VAT claim that the Government is asserting for VAT on the sale of the ships by the bank,” they added. “That’s a big VAT claim. The bank are disputing it; that obviously takes down, and reduces, their take home pay. The judge reserved his decision.”

Tribune Business last year reported that the Crystal Serenity and Crystal Symphony’s were sold by DNB Bank, acting as their secured financier and mortgage holder, for $103m and $25m respectively. These valuations have both been confirmed by a subsequent Supreme Court judgment.

The Crystal Serenity was bought by a company called CSE Ltd, and the Crystal Symphony by an entity named CSY Ltd. Both CSE Ltd and CSY Ltd were likely special purpose vehicles (SPVs) or entities specifically created to acquire, and hold, the two now-former

Crystal Cruises vessels, with CSE standing for “Crystal Serenity” and CSY for “Crystal Symphony”.

One maritime industry professional, speaking on condition of anonymity, while agreeing that the Government may be entitled to VAT also voiced alarm that levying the tax on a vessel’s sale could harm The Bahamas’ ambitions to develop itself into a true maritime hub.

They pointed out that transactions involving the sale of high-end yachts and other vessels were frequently conducted in The Bahamas because of its perceived friendly taxation regime - an image that could be impacted if VAT is levied at the full rate on the Crystal Cruises sale.

“If they start doing this, this idea of creating a maritime hub, they’re going to drive all ship sales away,” the source said. “People come here, fly in from around the world, to do yacht and vessel closings in The Bahamas because The Bahamas has a favourable tax regime for the sale of yachts and vessels.

“They’re going to drive that away if they make that a policy. It will crush maritime sales. I get why they’re doing what they’re doing.

PUBLIC NOTICE OF INTENDED APPLICATION FOR A GRANT OF LETTERS OF ADMINISTRATION

IN THE SUPREME COURT PROBATE DIVISION

In the Estate of ROBIN LAWRENCE SWEETING, late of Oxford & Yorkshire Streets, in the Western District of the Island of New Providence one of the Islands of the Commonwealth of the Bahamas, deceased.

NOTICE is hereby given that WINSTON SWEETING of West Dennis Court, Yellow Elder Gardens, in the Western District of New Providence one of the Islands of the Commonwealth of the Bahamas will make application to the Supreme Court of the Bahamas after the expiration of fourteen days from the date hereof, for a grant of Letters of Administration of the real and personal Estate of ROBIN LAWRENCE SWEETING in the Western District of the Island of New Providence, one of the Islands of the Commonwealth of the Bahamas, deceased.

WINSTON SWEETING Intended Applicant

WINSTON SWEETING Intended Applicant

The country needs money, but there’s got to be a better way of doing it than driving off everything the country has left.”

The Prime Minister is currently attending the seventh Summit of Heads of State and Government of the Community of Latin American and Caribbean states (CELAC), and has taken Jobeth Coleby-Davis, minister of transport and housing, plus Bahamas Maritime Authority (BMA) officials with him in a bid to push this nation’s credentials as a maritime centre. However, as the industry source acknowledged, the Government needs every cent it can get in taxes.

Meanwhile, aside from the VAT dispute, another legal battle has embroiled the Crystal Cruise vessels’ $128m sale - this time involving their other creditors, who are fighting over whose claims should gain priority and how much they should be entitled to.

The creditors include the Nassau Cruise Port, said to be owed just over $300,000 for dockage and other services provided to the former Genting-owned cruise line when it launched the cruise industry’s post-COVID rebound by home porting in, and cruising around, The Bahamas in summer 2021.

Others fighting for their share of the $128m sales proceeds are GPH (Global Ports Holding) Antigua, an entity owned by Nassau Cruise Port’s controlling shareholder, which is understood to be claiming around $30,000, plus the crew of bit vessels. The competing parties are rounded out by Peninsula Petroleum Far East, the two ships’

foreign fuel supplier, and SMS International Shore Operations US, their export agent.

The details are revealed in a December 19, 2022, judgment by acting Supreme Court justice, Ntshonda Tynes, who confirmed the two former Crystal Cruises vessels were sold for a combined $128m in June 2022 after being arrested under warrants obtained by DNB Bank some four months prior. The proceeds were deposited into an escrow bank account where they were held while creditors came forward to submit claims for monies allegedly owed to them.

DNB Bank then applied for a Supreme Court ruling setting out the order in which the various creditors are to be paid. “As usually happens when there are insufficient funds to fully satisfy the respective claims of all claimants, a dispute has arisen between the claimants concerning their respective rights to be paid out of the proceeds of sale of the vessels Crystal Symphony and Crystal Serenity,” the judge noted.

Acting Justice Tynes said the two vessels’ former crews, Nassau Cruise Port, GPH Antigua and SMS had all taken the position that, as maritime creditors, their claims took priority over DNB Bank’s even though the latter held mortgage security over the ships. Yet they had obtained no judgments to support their case.

The Bahamas’ Merchant Shipping Act gives priority to maritime creditors, such as ship’s crew, over registered mortgage holders so as to ensure they are not left unpaid. As a

result, the other creditors were all arguing that DNB Bank must wait until they are paid out before it can recover what it was owed even though it had obtained a default judgment in its favour.

Acting justice Tynes rejected their argument, finding that if correct “it would mean that an interested party can forgo normal court procedures whereby judgments are obtained (be it by default or otherwise) and forgo obtaining the consent of all claimants (whose interests would be affected by disbursement) yet expect to receive a payment out”.

She added: “Not only is this argument not supported by clear legal authority, it does not seem reasonable or in the interest of justice. Neither does it seem reasonable or in the interest of justice that a judgment creditor should be kept out of the fruits of its judgment because it ranks lower in priority than other claimants who are slow or reluctant to prosecute their claims.

“Nor is it necessary for a judgment creditor to await indefinitely payment to higher-ranking claimants when the court has at its disposal the ability to insure the protection of priority claimants by ordering that sufficient funds be reserved to satisfy future favourable judgments and any costs to be incurred in pursuit thereof.”

As a result, Acting justice Tynes “urged” that the crews, Nassau Cruise Port, GPH Antigua and SMS all “prosecute their respective claims with despatch should they so choose” as they needed to either obtain a judgment or consent of other creditors to claim against the $128m proceeds. She also ordered that sufficient funds be set aside to ensure such creditor payouts can be met. Some $2m has been retained as “security for the potential future costs” that may be incurred in prosecuting claims by the crews, Nassau Cruise Port, GPH Antigua and SMS, as well as the Department of Inland Revenue. GPH Antigua was also to “rank in priority” as a maritime creditor and some $30,000 to be set aside to cover its potential claim.

Financial strife at its immediate parent caused Crystal Cruises, which pioneered home porting in The Bahamas alongside Royal Caribbean, to initially suspend operations early last year with the hope they could be restarted in April. This was to allow management to assess the company’s business, and determine its future options, as the parent was set to run out of cash by end-January 2022, but all rescue efforts proved futile and the cruise line was wound up.

PAGE 4, Tuesday, January 24, 2023 THE TRIBUNE

PAGE B1

FROM

Insurers: ‘Everyone will pay’ if storm cover unaffordable

FROM

do so. They can take on some risk themselves where possible.”

That would come through higher deductibles. Mr Saunders said the magnitude of the 2023 premium increases in The Bahamas was less than for all the other Caribbean territories in which it operates, including the Cayman Islands, British Virgin Islands, US Virgin Islands and Anguilla, as this nation was more appropriately priced for the hurricane risks it faces in the eyes of global reinsurers.

However, Mr Saunders said the extent of premium increases facing Bahamian clients was still “very concerning” as it may affect insurance’s affordability for some. “From the RoyalStar standpoint we are talking about north of 15 percent,” he added of the average rise. “We are very concerned, and we hope that the reinsurers don’t put additional increases on which will then make our policies unaffordable.”

The BIA asserted that the local industry has no control over reinsurance prices that local property and casualty underwriters must pay. These increases have been driven by the greater risk associated with insuring Caribbean assets, and the desire of global reinsurers to recover multi-billion dollar losses, sustained from recent hurricanes that have struck The Bahamas, Florida and the wider Caribbean in recent years.

Some reinsurers have also decided to exit this region as a result, cutting the supply of reinsurance and further driving up prices. Bahamian property and casualty underwriters must acquire huge amounts of reinsurance annually because their relatively thin capital bases mean they cannot cover the multi-billion dollar assets at risk in this nation, thus making the local industry a price taker.

Mr Saunders yesterday said it would be impossible for RoyalStar to remain in business without reinsurance support. “We are not going to put any risks on our books if we do not have reinsurance support. Therein lies he dilemma,” he told this newspaper.

He added that The Bahamas, Florida and Caribbean catastrophe insurance market was unlikely to attract new reinsurance capacity for at least the next two years thus ensuring that this year’s high premium costs will persist in the

near-term. And, if Bahamian underwriters had failed to deliver higher premiums for 2023, they would have “an even higher hurdle to overcome next year” when the increased demanded will be even greater.

Patrick Ward, Bahamas First’s president and chief executive, told Tribune Business that a premium increase in 2023 was “almost unavoidable given the current market scenario”. He added: “All of us who have coverage against catastrophe perils are going to see some level of increase.... I don’t see a scenario where clients don’t have an increase at all. That’s just not going to be possible.”

The Bahamas First chief, though, said the magnitude of the increase would vary.

Homeowners and businesses with well-maintained properties not near the waterfront, and who have invested in the latest roofs and hurricane-resistant windows, were likely to be viewed as “prime properties” where the rises are smaller.

Agreeing that reinsurance cost pressures will not ease soon, Mr Ward said Bahamas First was confining the rate increases to property coverage. “We realise most clients buy more than one product,” he added. “To the extent we can reduce the bill they pay on an annual basis we’ll try to do so.

“I think it’s [the hike] a major issue but I have to hasten to say at the level they are going up now it’s not going to be the highest level of rate increases we’ve seen in The Bahamas. We’ve seen rates rise by more in the past and, unfortunately, this is part of the business cycle. When reinsurance rates go up we’re obliged to pay pay our share and, if at some point in the future they moderate, we’ll pass the benefits to all.”

Agreeing that catastrophe insurance affordability is becoming a significant policy challenge for the Government, Mr Ward said: “I think it is getting to that point. This is not something that has just emerged as a public policy issue, but it’s developed into a fairly substantial one over a number of years.

“The reason is that when persons, unfortunately, don’t have insurance to recover from a hurricane inevitably they’re going to look to the Government for assistance to get back on their feet. That effectively means everybody will have to pay because the Government gets its income from taxes. To the extent we have less and less people buying insurance, it becomes a bigger and bigger public policy issue.

“There are ways to mitigate the impact on the state, but it’s going to take political will and looking at

the options available and making some choices about the way forward. Some of the options available a few years ago have changed because of climate change and the severity of storms, but there are options that can be pursued.”

Mr Ward declined to detail what those “options” are, but added: “The sooner we come up with solutions the better we are going forward. The more we kick the can down the road, the more acute the problem is likely to be.”

RoyalStar’s Mr Saunders agreed, suggesting that the Government and Bahamian insurance industry need to “sit down and see what strategies” the two sides can come up with through a frank exchange of views. He warned that reinsurance market conditions are “not going to change tomorrow”, implying that homeowners and businesses must brace for elevated premiums for some years to come.

IN THE ESTATE of MURIEL LOUISE EDWARDS late of the Western District of the Island of New Providence, one of the Islands of The Commonwealth of The Bahamas, deceased.

Notice is hereby given that all persons having any claim or demands against the above named Estate are required to send their names, addresses and particulars of the same duly certified in writing to the undersigned on or before the 13th day of February A.D., 2023, and if required, prove such debts or claims, or in default be excluded from any distribution; after the above date the assets will be distributed having regard only to the proved debts or claims of which the Executor shall then have had Notice.

And Notice is hereby given that all persons indebted to the said Estate are requested to make full settlement on or before the aforementioned date.

MICHAEL A. DEAN & CO.,

Attorneys for the Executor

MICHAEL A. DEAN & CO.,

Attorneys for the Executor

Alvernia Court, 49A Dowdeswell Street P.O. Box N-3114 Nassau, The Bahamas

THE TRIBUNE Tuesday, January 24, 2023, PAGE 5

PAGE B1

NOTICE

Village Rd ‘can see finish’ following up to 70% losses

be forthcoming for businesses and residents.

Some 15 companies had signed their names to a letter authored by Mr Fields where it was suggested the Government provide “refurbishment grants” for residents and business owners to repair damaged premises, vehicles and other facilities impacted by the project. It also called for Bahamas Power & Light (BPL) bill discounts, and “full sponsorship” of a collaborative marketing campaign to entice consumers back to the Village Road area.

VAT credits, plus Business Licence and real property tax waivers, were also suggested as mechanisms to compensate for the damage inflicted

by roadworks that have caused consumers to avoid the area “like the plague” and resulted in up to a 46 percent income losses for businesses.

It is not unheard of, though, for the Government to provide tax breaks and other concessions for businesses impacted by long-running roadworks projects. The last Christie administration did so for the New Providence Road Improvement Project that impacted multiple businesses in numerous areas of the island more than one decade ago.

Mr Fields yesterday reiterated that the latest roadworks completion date of January 31, 2023, is unlikely to be met based on current progress. However, he added that several businesses have been informed

by the project’s contractor that paving work will start this week at Village Road’s northern intersection with Shirley Street.

“It remains to be seen,” he said, “but it appears that they’ll start that paving exercise this week. There’s not many open trenches compared to where it was three weeks ago. It’s obviously coming to an end. We’re starting to see the finish line and, of course, we’re excited about it.

“We have some scepticism because there have been so many delays in the past. At least for my business I don’t think we’ll meet January 31, but certainly we can see the finish line.” Once the roadworks have finished, Mr Fields said all Village Road business owners will have to invest in repairing and upgrading

their properties after the impact to premises and driveways.

“We did a survey of all the businesses, and it was between 30 percent and one business was as much as 70 percent. The average was somewhere in the 40 percents; the drop in revenue,” he told Tribune Business, “as well as damage to buildings, all the dust, use of premises and driveways on Village Road with heavy equipment, loss of business.

“Everyone is going to have to invest in their properties and bring them back to a level where they’re ready to have the public back.” The completion date for the Village Road roadworks was initially scheduled for September last year, but the deadline was then shifted to December before moving again to

January. It now appears as if work may drag on into February 2023.

Mr Fields, in his letter to the Government, wrote that “an economic stimulus package” will be a vital tool in helping the area’s businesses to rebound in 2023.

“The sprawling construction and protracted delays have placed a crippling strain on local businesses, which employ hundreds of Bahamians,” he wrote.

“The Government has recognised the importance of business relief in the past, and the risks of unwieldy roadworks literally putting Bahamians out of business completely. The current losses come at a time when the ordinary cost of doing business continues to rise, on top of the fact that we have all just barely emerged

from the full impact of the pandemic.

“Small businesses have recently faced increases in electricity costs, property taxes, wages and inflation. When the work is complete, businesses will also incur high costs to clean up our properties, repair damages, and re-engage customers.”

Mr Fields continued: “Between the open trenches, unpaved roads, detours, strained traffic management and dust, customers are avoiding Village Road like a plague. The original target for completion, which was September 2022, and even the revised date of November, would have allowed local businesses to benefit from the holiday bump that most rely upon.

NOTICE is hereby given that ASHLEY CHERY of Sutton Street, New Providence, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 24th day of January, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE

NOTICE is hereby given that JUMELLE WALLACE of Cox Street off Bernard Road, Nassau, The Bahamas, is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 24th day of January, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE is hereby given that CELISSA PHILIPPE of Fowler Street off East Street, New Providence, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 24th day of January, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE

NOTICE is hereby given that RICARDO JEAN of Israel Street, Adelaide Village, Nassau, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 16th day of January, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

“Each missed deadline has serious implications for businesses, and there is little belief that the latest end-of-month forecast for completion will be met given the lack of clear communication and the conditions on the ground. With no clear end in sight, our reserves are depleted, our business planning efforts have become futile, and we continue to experience tremendous losses.”

PUBLIC NOTICE

NOTICENOTICE is hereby given that RICARDO TOUSSAINT of P.O. Box N-9426, Carmichael Road, Nassau, The Bahamas, is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 24th day of January, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE

NOTICE is hereby given

and Citizenship, for registration/naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/ naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 24th day of January, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

PAGE 6, Tuesday, January 24, 2023 THE TRIBUNE

PAGE B1 TO ADVERTISE TODAY IN THE TRIBUNE CALL @ 502-2394

FROM

is

given that

NOTICE

NOTICE

hereby

JULIE JACQUES of Joans Height, New Providence, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 24th day of January, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE is hereby given that DJANESLY FANFAN of P.O. Box FH-14406 Kool Acres, Fox Hill, New Providence, The Bahamas is applying to the Minister responsible for Nationality and Citizenship, for registration/ naturalization as a citizen of The Bahamas, and that any person who knows any reason why registration/naturalization should not be granted, should send a written and signed statement of the facts within twenty-eight days from the 24th day of January, 2023 to the Minister responsible for nationality and Citizenship, P.O. Box N-7147, Nassau, Bahamas.

NOTICE

that SHANTE IEASHA JOHNSON of Mason’s Addition, Nassau, The Bahamas, is applying to the Minister responsible for Nationality

NOTICE

NOTICE

The Public is hereby advised that I, CHRISTON PIERRE of Claire Road, Mackey Street, New Providence, Bahamas, intend to change my name to CHRISTON MCKENZIE If there are any objections to this change of name by Deed Poll, you may write such objections to the Chief Passport Officer, P.O.Box N-742, Nassau, Bahamas no later than thirty (30) days after the date of publication of this notice.

INTENT TO CHANGE NAME BY DEED POLL

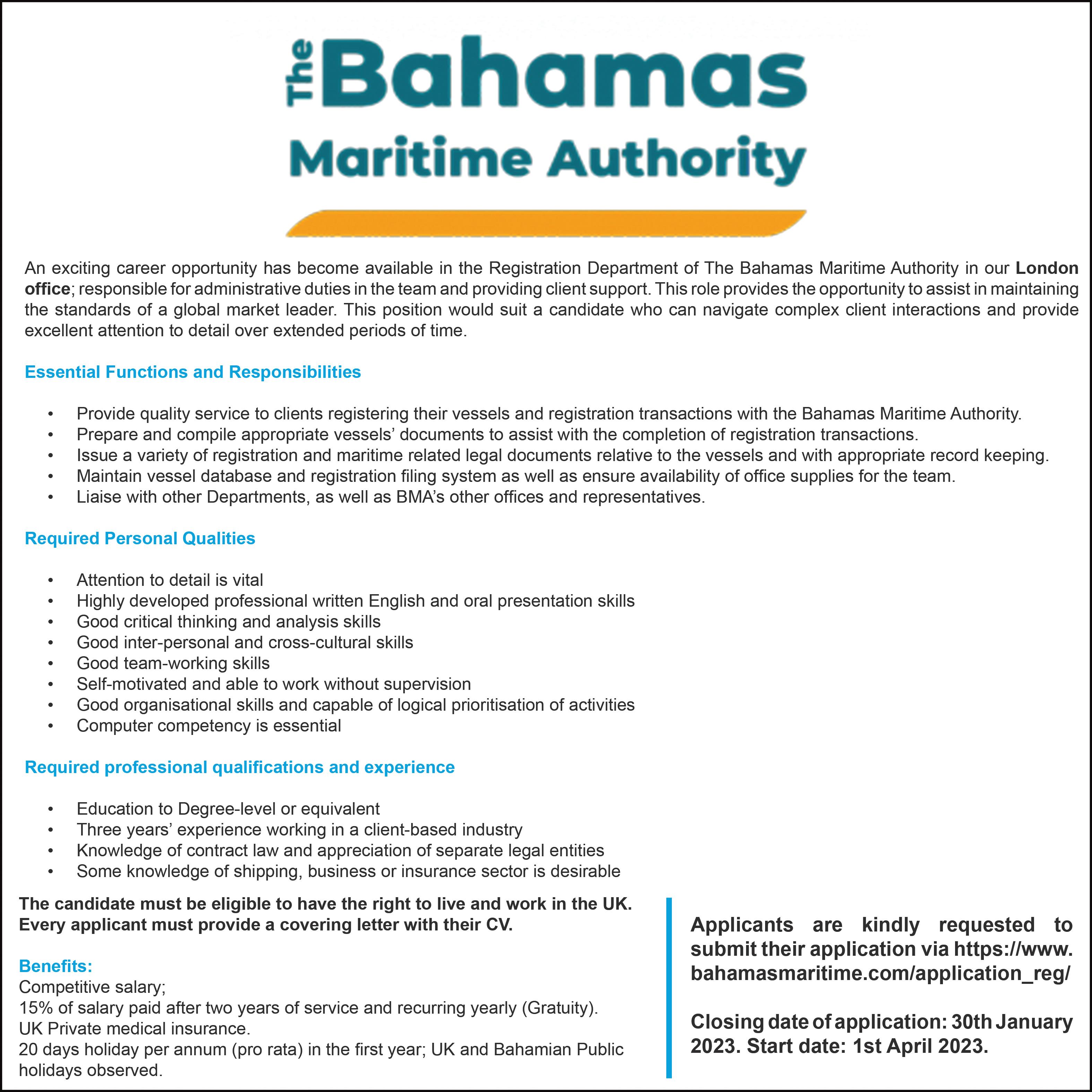

MONDAY, 23 JANUARY 2023 CLOSECHANGE%CHANGEYTDYTD% BISX ALL SHARE INDEX: 2652.5527.821.067.490.28 BISX LISTED & TRADED SECURITIES 52WK HI52WK LOWSECURITY SYMBOLLAST CLOSECLOSECHANGE VOLUMEEPS$DIV$P/E YIELD 7.005.30 AML Foods Limited AML 6.95 6.950.00 2500.2390.17029.12.45% 53.0040.05 APD Limited APD 39.95 39.950.00 550.9321.26042.93.15% 2.761.60Benchmark BBL 2.76 2.760.00 0.0000.020N/M0.72% 2.462.31Bahamas First Holdings Limited BFH 2.46 2.460.00 0.1400.08017.63.25% 2.852.25Bank of Bahamas BOB 2.61

6.306.00Bahamas Property Fund BPF 6.30

9.808.78Bahamas Waste BWL 9.75

4.502.90Cable Bahamas CAB 4.26

10.657.50Commonwealth Brewery CBB

3.652.54Commonwealth Bank CBL

8.547.01Colina Holdings CHL

17.5012.00CIBC FirstCaribbean Bank CIB

3.251.99Consolidated Water BDRs CWCB 2.83

(0.03)

11.2810.05Doctor's Hospital DHS 10.50 10.500.00

11.679.16Emera Incorporated EMAB 9.91 9.89 (0.02)

11.5010.75Famguard FAM 11.22 11.220.00

18.3014.50Fidelity Bank (Bahamas) Limited FBB 18.10 18.100.00

4.003.55Focol FCL 3.98 3.980.00

12.109.85Finco FIN 11.94 11.940.00

16.2515.50J. S. Johnson JSJ 15.76 15.760.00

PREFERENCE SHARES 1.001.00Bahamas First Holdings PreferenceBFHP 1.00 1.000.00 0.0000.0000.0000.00% 1000.001000.00 Cable Bahamas Series 6 CAB6 1000.001000.000.00 0.0000.0000.0000.00% 1000.001000.00 Cable Bahamas Series 9 CAB9 1000.001000.000.00 0.0000.0000.0000.00% 1.001.00Colina Holdings Class A CHLA 1.00 1.000.00 0.0000.0000.0006.25% 10.0010.00Fidelity Bank Bahamas Class A FBBA 10.0010.000.00 0.0000.0000.0007.00% 1.001.00Focol Class B FCLB 1.00 1.000.00 0.0000.0000.0006.50% CORPORATE DEBT - (percentage pricing) 52WK HI52WK LOWSECURITY SYMBOLLAST SALECLOSECHANGEVOLUME 100.00100.00Fidelity Bank (Note 22 Series B+)FBB22 100.00100.000.00 100.00100.00Bahamas First Holdings LimitedBFHB 100.00100.000.00 BAHAMAS GOVERNMENT STOCK - (percentage pricing) 115.92104.79Bahamas Note 6.95 (2029) BAH29 107.31107.310.00 100.00100.00BGS: 2014-12-7Y BG0107 100.00100.000.00 100.00100.00BGS: 2015-1-7Y BG0207 100.00100.000.00 100.00100.00BGS: 2014-12-30Y BG0130 100.00100.000.00 100.00100.00BGS: 2015-1-30Y BG0230 100.00100.000.00 100.00100.00BGS: 2015-6-7Y BG0307 100.00100.000.00 100.00100.00BGS: 2015-6-30Y BG0330 100.00100.000.00 100.00100.00BGS: 2015-10-7Y BG0407 100.00100.000.00 100.11100.11BGRS FL BGRS98034 BSBGRS980343 100.11100.110.00 100.12100.12BGRS FL BGRS88037 BSBGRS880378 100.03100.030.00 94.1594.09BGRS FX BGR132139 BSBGR1321391 93.3693.360.00 101.55101.42BGRS FX BGR124228 BSBGR1242282 101.45101.450.00 103.49103.38BGRS FX BGR118027 BSBGR1180276 102.70102.700.00 92.6792.67BGRS FX BGR131239 BSBGR1312390 92.5592.550.00 90.9890.98BGRS FX BGR132249 BSBGR1322498 90.9590.950.00 94.8094.80BGRS FX BGR134140 BSBGR1341407 93.9493.940.00 100.39100.39BGRS FX BGR138230 BSBGR1380306 100.39100.390.00 96.8496.84BGRS FX BGR138240 BSBGR1380405 96.1096.100.00 100.32100.32BGRS FL BGRS81035 BSBGRS810359 100.66100.660.00 100.34100.34BGRS FL BGRS81037 BSBGRS810375 100.17100.170.00 100.57100.57BGRS FL BGRS84033 BSBGRS840331 100.15100.150.00 MUTUAL FUNDS 52WK HI52WK LOW NAV YTD%12 MTH% 2.582.11 2.583.48%3.87% 4.883.30 4.884.49%5.32% 2.261.68 2.262.74%3.02% 205.22164.74 190.45-6.40%-6.95% 212.41116.70 169.68-20.12%-15.15% 1.761.71 1.762.49%2.79% 1.941.78 1.935.71%7.96% 1.881.79 1.863.39%3.91% 1.030.93 0.93-8.94%-9.55% 9.376.41 10.107.82%9.00% 11.837.62 13.4413.58%15.81% 7.545.66 7.712.57%2.83% 16.648.65 13.25-20.10%-19.25% 12.8410.54 12.03-4.50%-4.64% 10.779.57 10.59-0.55%-1.61% 16.279.88 16.27N/AN/A 11.228.45 11.223.00%25.60% 14.8911.20 N/A N/A N/A MARKET TERMS BISX ALL SHARE INDEX - 19 Dec 02 = 1,000.00 YIELD - last 12 month dividends divided by closing price 52wk-Hi - Highest closing price in last 52 weeks Bid $ - Buying price of Colina and Fidelity - Lowest closing price in last 52 weeks Ask $ - Selling price of Colina and fidelity Previous Close - Previous day's weighted price for daily volume Last Price - Last traded over-the-counter price Today's Close - Current day's weighted price for daily volume Weekly Vol. - Trading volume of the prior week Change - Change in closing price from day to day EPS $ A company's reported earnings per share for the last 12 mths Daily Vol. - Number of total shares traded today NAV - Net Asset Value DIV $ - Dividends per share paid in the last 12 months - Not Meaningful P/E - Closing price divided by the last 12 month earnings TO TRADE CALL: CFAL 242-502-7010 | ROYALFIDELITY 242-356-7764 | CORALISLE 242-502-7525 | LENO 242-396-3225 | BENCHMARK 242-326-7333 4.42% 15-Jul-2039 15-Jun-2040 4.66% 4.82% 13-Jul-2028 13-Oct-2027 15-Oct-2049 17-Jan-2040 15-Jun-2030 5.65% 5.35% 5.00% 6.25% 30-Sep-2025 30-Sep-2022 6.25% 4.50% 6.25% 4.25% NAV Date 4.87% 4.68% 4.32% 4.81% 5.29% 5.14% 5.60% 26-Jul-2037 FUND CFAL Bond Fund CFAL Balanced Fund CFAL Money Market Fund CFAL Global Bond Fund 15-Dec-2021 30-Jul-2022 15-Dec-2044 30-Jul-2045 26-Jun-2022 26-Jun-2045 15-Oct-2022 25-Nov-2022 22-Sep-2033 26-Jul-2034 26-Jul-2037 26-Jul-2035 15-Oct-2039 31-Dec-2021 30-Nov-2022 30-Nov-2022 31-Oct-2022 30-Nov-2022 30-Nov-2022 30-Nov-2022 30-Nov-2022 31-Oct-2022 31-Oct-2022 INTEREST Prime + 1.75% MARKET REPORT 31-Dec-2021 31-Dec-2021 MATURITY 19-Oct-2022 20-Nov-2029 30-Nov-2022 30-Nov-2022 6.95% 4.50% 30-Sep-2022 31-Oct-2022 4.50% 6.25% Colonial Bahamas Fund Class D Colonial Bahamas Fund Class E Colonial Bahamas Fund Class F CFAL Global Equity Fund Leno Financial Conservative Fund Leno Financial Aggressive Fund Leno Financial Balanced Fund Leno Financial Global Bond Fund RF Bahamas Opportunities Fund - Secured Balanced Fund RF Bahamas Opportunities Fund - Targeted Equity Fund RF Bahamas Opportunities Fund - Prime Income Fund RF Bahamas International Investment Fund Limited - Equities Sub Fund RF Bahamas International Investment Fund Limited - High Yield Income Fund RF Bahamas International Investment Fund Limited - Alternative Strategies Fund (242)323-2330 (242) 323-2320 www.bisxbahamas.com

2.840.23 1,0000.0700.000N/M0.00%

6.300.00 1.7600.000N/M0.00%

9.750.00 0.3690.26026.42.67%

4.260.00 -0.4380.000-9.7 0.00%

10.25 10.250.00 0.1400.00073.20.00%

3.37 3.370.0015,0000.1840.12018.33.56%

8.54 8.540.00 0.4490.22019.02.58%

15.99 15.990.00 0.7220.72022.14.50%

2.80

0.1020.43427.515.50%

0.4670.06022.50.57%

0.6460.32815.33.32%

2,7500.7280.24015.42.14%

0.8160.54022.22.98%

0.2030.12019.63.02%

0.9390.20012.71.68%

0.6310.61025.03.87%

WINSTON SWEETING Intended Applicant

WINSTON SWEETING Intended Applicant

MICHAEL A. DEAN & CO.,

Attorneys for the Executor

MICHAEL A. DEAN & CO.,

Attorneys for the Executor