Entrepreneur hopes cruise giant’s PI ‘invasion’ ending

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

A BAHAMIAN entrepreneur has voiced renewed optimism that Royal Caribbean may be halting its “invasion” of his leased Crown Land after it purportedly submitted a revised proposal for its $110m Paradise Island project.

Toby Smith, the principal behind the $3m Paradise Island Lighthouse & Beach Club project, told Tribune Business it would represent “a win” not only for himself but “all Bahamians” if the cruise giant retreated from his development’s boundaries and scaled down its plans.

Multiple sources, speaking on condition of anonymity, also told this newspaper they understood Royal Caribbean had supplied the Davis administration with a revised project proposal that reduced the seven acres of Crown Land it had secured from its Minnis predecessor via an effective 150-year lease.

However, the Government neither confirmed nor denied that Royal Caribbean had submitted such revisions although it said talks over the latter’s Royal Beach Club destination were continuing. Chester Cooper, deputy prime minister and minister of tourism, investments and aviation, told this newspaper in a statement:

Marinas: Online portal closure is ‘step back’

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE Association of Bahamas Marinas (ABM) president says the industry has “taken a step back” through the closure of its online clearance portal with charter demand for this nation down 30 percent compared to the Caribbean.

Marques Williams told Tribune Business that it was unclear why the Ministry of Finance had required the industry to “pull back” its SeaZ Pass app, which had operated as “a one-stop shop” to allow incoming vessels and their owners/ captains to register online, clear Customs and pay for/ obtain cruising permits and charter fees.

Confirming that the return to manual-based processes, and having to visit the likes of Customs and the Port Department to make the necessary applications and payments, was “definitely frustrating” for visiting boats and yachts, as well as their hosts, he added that the issue was among several discussion points between the Association and the Government.

“The ease of business has become more difficult with the recent removal of the SeaZ Pass app. The ABMsupported app provided an online solution to allow foreign yachters and boaters to clear Customs and register

for charters in the country,” Mr Williams said, confirming that Customs and the Ministry of Finance have now “pulled it back”.

“They took it off, made it not available to the public,” he confirmed. ‘However, the full potential of it has not yet been realised. The aspects it provided have not yet been replaced. The idea behind it was to create a single point for persons to apply for charters, get their clearance, come in and eventually provide the likes of fishing permits.

“It was to provide a onestop shop. That was the concept, but for reasons that still remain unclear to me it was pulled and has not been replaced as yet. It’s definitely frustrating on the yachting side, definitely frustrating, as this was a step forward it seemed to them.

“It made it simple as a one-stop shop, and now they’ve been set back to operate how they previously did it. Multiple steps in the process and physical locations they need to visit. The whole gamut. It’s kind of a step back, and has increased the level of paperwork and effort by captains, which is never good.”

The halt to SeaZ Pass, and online registrations and fee payments, comes just as the Government is seeking

“Government is in ongoing dialogue with Royal Caribbean in relation to its proposed development on Paradise Island.

“This does not include any discussion in relation to land that is in dispute. The matter with Toby Smith remains before the court and we are not at liberty to speak to it.” That refers to the Supreme Court action Mr Smith launched

Insurer warnings over 15-20% premium hike

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

BAHAMIAN households and businesses were yesterday warned insurance premiums could increase “across the board” by 15-20 percent this year as underwriters pull back from covering waterfront and Family Island risks.

Brokers spoken to by Tribune Business confirmed that The Bahamas faces “a hard market” for hurricane insurance and other property and casualty-related coverage as global reinsurers adjust to the multi-billion dollar losses inflicted by Hurricane Dorian and similar storms throughout Florida and the Caribbean in recent years.

The increases, which the Bahamian insurance industry has little control over, will add another element to the cost of living crisis sparked by multiple price rises across virtually all economic sectors. And they will make it increasingly difficult for homeowners and businesses to afford to fully insure their properties - likely among their most valuable assets - despite the

growing threat posed by more frequent and severe storms.

The Bahamas Insurance Association (BIA), in a statement confirming the premium increases that were forecast by multiple Tribune Business reports last year, said local underwriters such as Bahamas First, RoyalStar Assurance and Security & General have “seen a dramatic increase in their reinsurance costs of 20 percent to 30 percent for 2023”.

It explained that this cost increase will have to at least partially be passed on to Bahamian homeowners and businesses via higher insurance premiums for 2023, and warned that “some persons may find that they may have difficulty obtaining catastrophe insurance protection due to the shortage in capacity”.

The BIA asserted that the local industry has no control over reinsurance prices that local property and casualty underwriters must pay. These increases have been driven by the greater risk associated with insuring Caribbean

business@tribunemedia.net MONDAY, JANUARY 23, 2023

SEE PAGE B6

SEE PAGE B8

• Says

•

•

SEE PAGE B4

Royal Caribbean ‘scaling back’ Crown Land

Move would be ‘win for me and all Bahamians’

Gov’t talking to cruise line; no word on reduction

$5.25 $5.29 $5.46 $5.16

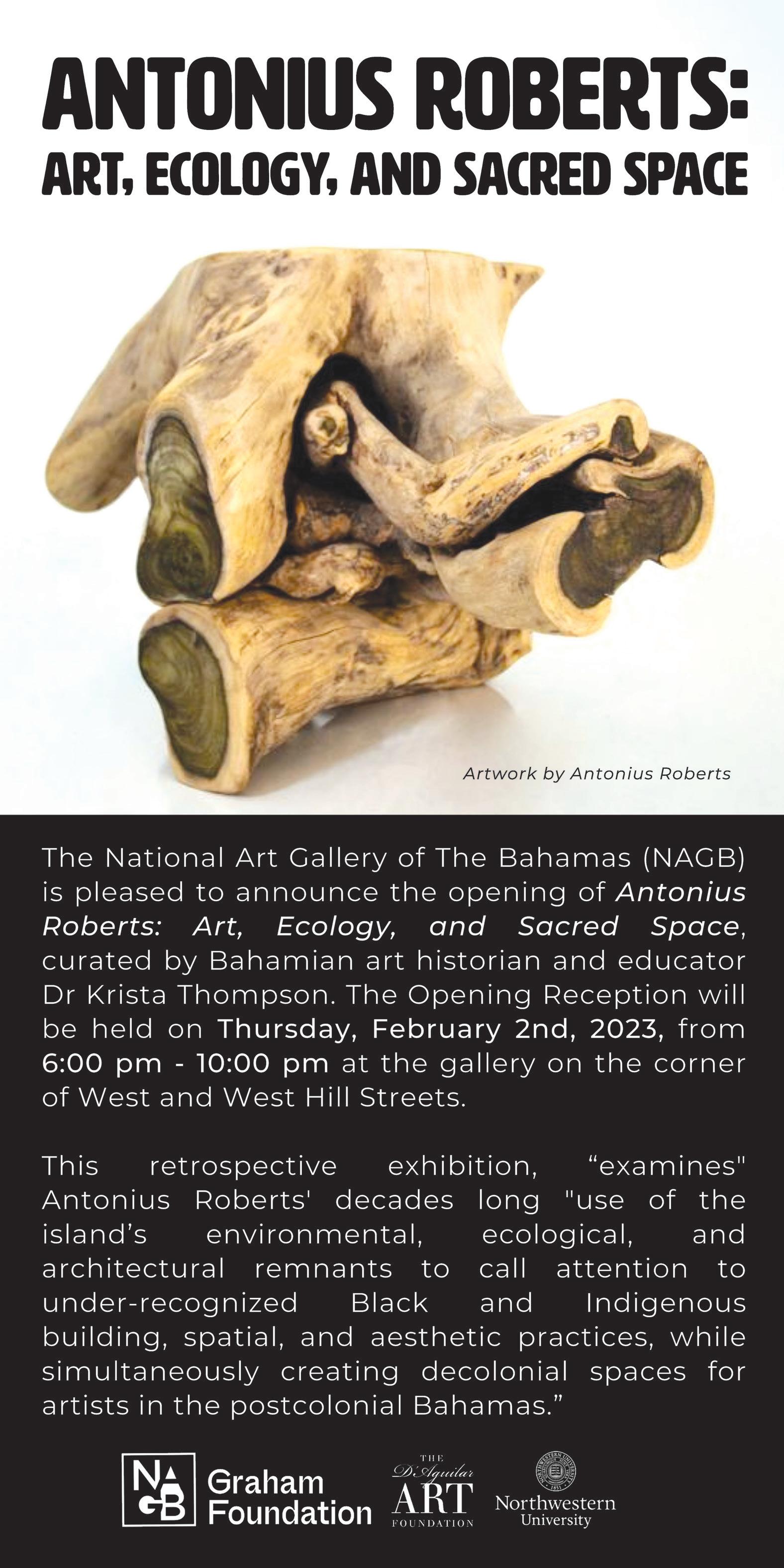

ROYAL beach club water taxi route.

A firm’s greatest assets can also be major risk

By Derek Smith

People can be a company’s most valuable asset if well-managed, but also represent a significant risk. Defending, equipping and motivating this critical asset requires human resources (HR) and risk management to break down silos and collaborate. To address the inherent risk posed by human capital, a human resources/ employee risk assessment must be considered.

A human resources risk assessment aims to identify the potential risks that employees pose to a company. It involves assessing the risks associated with employee behaviour, and adhering to applicable employment laws regarding hiring and dismissing employees, workplace behaviour and working conditions. Furthermore, your company should conduct a human resources risk assessment to determine whether your practices and procedures align with recommended best practices. Moreover, it would be best if you put in place a plan for preventing and minimising risks in the event they are identified.

Supervised financial institutions (SFIs) are required to perform robust risk assessments. Risk assessments should include human capital risk if these are to be considered thorough and well-designed assessments. Earlier articles by this author have explained how risk assessments should be structured, as they aim to

identify any hazards in the workplace, assess the risks and subsequently control them. But this article will only focus on several human resources hazards that companies should consider. These hazards can be grouped into health and safety, talent practice, environment and social, and governance and finance.

Health and Safety Mental Health - A high level of anxiety, stress, depression and/or addiction can affect well-being, productivity, benefits spending and the employer’s brand.

Dissatisfaction – An employee’s work-life balance issues, change fatigue and ever-changing company priorities tend to cause tiredness, high staff turnover and decreased productivity. Wellington Hepburn, the past president of the Bahamas Society of Human Resources Management (BSHRM), noted this state as “employee dissatisfaction” during his presentation entitled ‘Help! I’m stuck on my job’, at the SHYFT into FOKUS conference held this past weekend.

Talent practices Talent attraction, retention and engagement - The absence of talent pipelines, employment value propositions and growth opportunities necessary to keep and motivate the workforce could be detrimental to a company’s goals.

Workplace evolution - In innovation and workforce management, flexible working, technology adoption and a growth mindset pose new challenges.

Environment and Social

DEVELOPMENT BANK TEAMS FOR AGRICULTURE’S EXPANSION

THE BAHAMAS Development Bank (BDB) has partnered with a multilateral institution to help drive sustainable development in this nation’s agriculture industry.

The Government-owned institution, in a statement, said it has signed a Memorandum of Understanding (MoU) with the Inter-American Institute for Cooperation on Agriculture (IICA) that will see the latter provide technical co-operation, innovation and specialised knowledge to help Bahamian agriculture become competitive.

The BDB added that its recent meetings with the IICA to discuss opportunities for financing agri-tourism, climate resilience and Family Island development resulted in the MoU. Both parties have a long history of collaboration, having worked together on initiatives including the apiary project in Grand Bahama, which trained and provided financing for young beekeepers.

“Family Island development is integral to the bank’s mission, especially as it relates to agriculture,” said Quinton Lightbourne, the BDB’s chairman. “Currently, the bank has a slate of projects targeted toward sustainable development in the chain of Family Islands, and this MoU is an integral step toward that development.

“This partnership with IICA will increase the technical capacity of farmers throughout The Bahamas, and allow them to increase their output, leading toward a decrease in food importation, which is a big goal for the current administration.”

“Family Island development is also fundamental to IICA’s core mission,” said its representative, Mari Dunleavy.

“At IICA, we firmly believe in and support our Family Island farmers and rural development, which are bedrocks of economic growth and food security. IICA’s partnership with BDB is a natural alliance and I’m excited for the potential our

Labour and employee relations - The grievances of employees, and perceptions that the company is uncaring, all contribute to increased operational costs, poor customer experiences and social responsibility problems.

Diversity, equity and inclusion - Employees, customers and others risk reputational damage without a truly inclusive work environment.

Governance and finance Due to a lack of controls or expertise, inadequate benefit plan design, financing, vendor selection and management, poor decisions can be made. This results in high costs, liabilities and commitments.

Conclusion

In short, your company may find the above useful to understand the forces and risks. HR and risk management teams can use this information to discuss the implications of not acting now in board meetings and with business leaders.

• NB: About Derek Smith Jr Derek Smith Jr. has been a governance, risk and compliance professional for more than 20 years. He has held positions at a TerraLex member law firm, a Wolfsburg Group member bank and a ‘big four’ accounting firm. Mr Smith is a certified anti-money laundering specialist (CAMS), and the compliance officer and money laundering reporting officer (MLRO) for CG Atlantic’s family of companies (member of Coralisle Group) for The Bahamas and Turks & Caicos.

relationship holds for the Family Islands.”

As part of the MOU, the BDB and IICA have agreed to co-operate and work together for the expansion and enhancement of agriculture and rural development throughout The Bahamas. They will also share resources on programmes and projects intended to achieve this objective.

The MoU contains several areas of co-operation, including joint programmes, the sourcing of funding for agricultural projects in the Family Islands, and other forms of co-operation as agreed on by both parties who will meet on a regular basis. The BDB has previously co-operated with the IICA to support the development of the recentlylaunched ‘Integrated landscape management for addressing land degradation, food security and climate resilience challenges in The Bahamas’ project. This initiative is sponsored by the Government (led by the Department of Environmental Planning & Protection) in collaboration with the United Nations Environment Program (UNEP) and IICA, with funding from the Global Environmental Facility (GEF). The project is a $20m initiative that is designed to improve livelihoods, well-being and global environmental benefits through enhancements in the sustainability, productivity, health and resilience of productive ecosystems across seven islands. The BDB will continue to support this project throughout its upcoming phases as a member of the project’s steering committee.

The BDB said it is mandated by its 1974 governing Act to promote industrial, agricultural and commercial development through financing and investing in approved enterprises. The IICA is a specialised agricultural agency that provides support to its 34 member states, promoting and encouraging agricultural development and economic growth.

PAGE 2, Monday, January 23, 2023 THE TRIBUNE

Water Corp’s $84m taxpayer subsidy three times’ budget

By NEIL HARTNELL and YOURI KEMP Tribune Business Reporters

TAXPAYER subsidies to the Water & Sewerage Corporation in 2022 hit $84m, more than three times the sum budgeted, as the state-owned utility seeks to develop a plan that makes it financially viable.

The state-owned enterprise (SOE), in a statement, said government subsidies had increased more than eight-fold over the past two decades with the Ministry of Finance now seeking to minimise the burden this imposes on the Public Treasury.

It wants the Water & Sewerage Corporation to obtain financing for capital works projects from multilateral lenders, such as the Inter-American Development Bank (IDB) or Caribbean Development Bank (CDB), to reduce taxpayer support it views as unsustainable given the fiscal crisis facing the cash-strapped government. However, to access such funding, the Corporation must first develop a sound corporate business plan.

A strategy meeting to develop such a plan was held pre-Christmas on December 15, 2022, at Baha Mar’s convention centre.

Alfred Sears KC, minister of public works and utilities, who has responsibility for the Water & Sewerage Corporation, told the meeting that this strategy would define reforms such as tariff adjustments, structural adjustments, and changes to the water sector’s legislative and regulatory framework.

The tariff/prices charged to consumers has not increased since 1999 despite multiple cost and inflationdriven increases, which has left the Water & Sewerage Corporation selling water below cost. Its statement

said it is “paramount that we move to adjust the tariffs to reflect the major changes that the Water & Sewerage Corporation has undergone in recent years.

“The Water & Sewerage Corporation has steadily increased its supply of high quality desalinated water over the last two decades with desalinated water now accounting for over 97 percent of the Water & Sewerage Corporation’s New Providence water supply and over 60 percent of the Water & Sewerage Corporation’s Family Island water supply.”

The Water & Sewerage Corporation added that desalinated water, purchased from privately-owned reverse osmosis operators, had replaced groundwater sources that had become “increasingly brackish” yet was more expensive.

Prices charged to consumers have not been adjusted to reflect increased costs, and any increase will have to be approved by both Cabinet and Parliament as water is not yet regulated by the Utilities Regulation and Competition Authority (URCA).

And the state-owned water supplier also called for legislation to regulate the installation and use of private wells, and abstraction of private water. “The

use of groundwater by residents and businesses utilising unregulated private wells remains a serious risk to the health and welfare of our citizens, and is a direct competition to Water & Sewerage Corporation in areas where extensive investments were made to provide piped potable water,” it added.

“Extensive capital investments were made to provide piped potable water, but the residents have decided, with no authorisation from any licensing authority or government agency, to extract and utilise groundwater, which is a natural resource, for their private personal purposes with no payment of any fees to anyone, and which poses serious issues for the growth and development of the Corporation as a viable and fiscally sustainable entity.”

The Water and Sewerage Corporation (WSC) added that it received $84m in taxpayer subsidies in 2022, a more than eight-fold increase from the $10m extended some 20 years ago. The former figure is also more than three times’ higher than the $26m allocated for capital projects in the 2021-2022 Budget.

Robert Deal, the Water & Sewerage Corporation’s general manager, told Tribune Business in reply to e-mailed that almost 50

percent or half of the “particularly high” $84m in subsidies represents “many past due payments to various Water & Sewerage Corporation suppliers dating back to 2021 and before last year”.

He continued: “The Corporation has commenced work on a corporate business plan, and we anticipate that it will be substantially complete by the end of May 2023. This corporate business plan, once approved by our Board and Cabinet, is expected to guide the strategic direction of the Corporation inclusive of the necessary reforms required to drive transformational changes within the Corporation and the water and sanitation sector in The Bahamas.”

Mr Deal said the $84m is divided between $40.2m to cover current and past due bills to Consolidated Water for water supplied to New Providence; $9.8m for Family Island water purchases; $5.2m for debt service; $8m for continued post-Hurricane Dorian restoration work in the Abacos; $3.3m for new potable water storage tanks for North and Central Eleuthera; and $17.5m for Mira for work on New Providence’s non-revenue water reduction project.

Mr Sears said a corporate business plan must be developed if the Water & Sewerage Corporation is to access IDB and Caribbean Development Bank financing. It also has to be shared with the Ministry of Finance. K&M Advisors has been selected as the consultants to help develop the plan as its managing director, Nils Janson, was previously involved with the company that came up with the 2016 version, Castalia Strategic Advisors.

2022 mixed for Out Island resort targets

By YOURI KEMP Tribune Business Reporter ykemp@tribunemedia.net

FAMILY Island resorts experienced a mixed 2022 in terms of hitting their collective targets as they closed in on a return to pre-COVID business volumes, a top tourism official has confirmed.

Kerry Fountain, the Bahamas Out Island Promotion Board’s (BOIPB) executive director, told Tribune Business that while member properties did not quite reach their room nights sold goal they did manage to exceed room revenue ambitions.

“Last year, our goal was to realise 95 percent of room nights sold compared to the benchmark year of 2019, and the goal was to realise 86 percent of the room revenue compared to 2019,” he explained. “We did not make the room nights sold. The goal was 95 percent and we ended up at 84 percent.”

“In terms of room revenue, our goal was 86 percent but we ended up at 97 percent. So we’re almost on par in terms of room revenue compared to 2019.”

The latter year, besides being the last full year free of COVID-19, was also a record for Bahamian tourism in terms of tourist arrivals with 7.249m foreign air and sea visitors.

While Grand Bahama, Abaco and Andros were the top three islands for visitor arrivals in 2019, outside of New Providence, in 2022 these places were taken by Abaco, Harbour Island and Andros. “Those islands performed surprisingly well and are on par, not only in terms of room revenue but room nights sold, compared to 2019,” Mr Fountain said.

“Islands like Abaco, islands like Harbour Island, even Andros and Exuma, that have direct lift from either the US and or Canada and ideal, same day to and from connections from Nassau, those islands are faring better than the islands like San Salvador, Acklins and Long Island, where we need better connectivity.

“So if we don’t have the service at this time from South Florida, then what we would we need to do is ensure that if tourists are flying into Nassau on any given day, and they want to go to Acklins or Long Island, or Cat Island or wherever it is, they can get there without overnighting in Nassau. And if I’m flying back home, I can get back home on a 6pm flight from Nassau as opposed to overnight in Nassau and wait to fly on the day after. This means sitting down with Bahamasair, in particular, and making these things happen.”

We are seeking to employ the following positions here at February Point Resort Estates in beautiful Great Exuma. We are hoping to find candidates with a minimum of 2-3 years’ experience.

F&B Manager Bartender Landscape Manager

We offer a competitive salary and excellent benefits; housing will also be considered.

Interested persons should send their resume to: teneeshia@februarypoint.com

THE TRIBUNE Monday, January 23, 2023, PAGE 3

&

HEADQUARTERS Here we grow again! We are looking for an ambitious Accountant to provide support to the Finance Department by managing the daily accounting tasks. Responsibilities • Post and process journal entries to ensure all business transactions are recorded • Support accounts receivable and issue invoices • Support accounts payable, perform reconciliations and ensure timely payment of invoices, • Assist with financial statement analysis, preparation of balance sheet, income statement and other financial statements. • Assist with reviewing of expenses, payroll records etc. as assigned • Update financial data in databases to ensure that information is accurate and immediately available when needed • Prepare and submit weekly/monthly reports • Assist

WATER

SEWERAGE CORPORATION

senior accountant in the preparation of monthly/year end closing • Assist with other accounting and company projects

Requirements • BSc/BA in Accounting • Proven experience as an accountant • Excellent organizational skills • Meticulous attention to detail • Analytical mind with strong proficiency in math • Sound understanding of accounting and financial reporting principles and practices • Ability to work independently and as part of a team • Excellent knowledge of MS Office • Advanced MS Excel skills including Vlookups and Pivot Tables • Excellent Knowledge of Quick Books • CPA Qualifications is a plus but not required

Interested persons should submit a résumé to info@slendingbahamas.com

Entrepreneur hopes cruise giant’s PI ‘invasion’ ending

against the Government, in which he is arguing that his two Crown Land leases on Paradise Island are legally binding and should be enforced.

However, the Bahamian entrepreneur revealed that despite the ongoing litigation he remains in discussions with the Davis administration to move his project forward. Taking encouragement from recent reports, he told Tribune Business: “I understand through reliable sources that Royal Caribbean have presented a proposal to the Government on a reduced footprint of land that possibly does not continue their invasion of my land boundaries.

“That, in essence, would be a win for Paradise Island Lighthouse & Beach Club, and a win for all Bahamians that I am fighting for.” However, efforts to obtain

confirmation of such a scaling down from Russell Benford, Royal Caribbean’s vice-president of government relations for the Americas, and other spokespersons for the cruise giant have proven fruitless despite multiple attempts being made.

“They were supposed to have a more toned down version of their plans that they were going to submit to the Government,” another source, speaking on condition of anonymity, said of Royal Caribbean’s Paradise Island ambitions. “They had approached the Government with a plan where they were going to decrease their footprint and ask for less Crown Land to do their development. The problem they’re having is that I understand the Government is not minded to do that.”

The source said the difficulty arose because Prime Minister Philip Davis KC, while in Opposition, had

pledged that he would cancel any Crown Land lease in favour of Royal Caribbean. This promise came when Mr Smith asserted that he secured his deal before the cruise giant, and that the former Minnis administration sought to ditch his project to make way for Royal Caribbean after realising its mistake.

Some of the seven-acre tract leased to Royal Caribbean is included among one of the two Crown Land parcels that Mr Smith says he holds a valid lease for, thus meaning the Government allegedly dealt the same land assets near Colonial Beach on Paradise Island’s western end to two separate investors within the space of a year.

Meanwhile, Mr Smith, backing Mr Cooper’s call for greater Bahamian participation in major investment projects, said he was continuing to speak with the Davis administration about

his own plans. “I continue a healthy dialogue with the Government, and it’s a matter we’re discussing politely as professionals,” he told Tribune Business

“I’m very grateful to the Bahamian public for their support, which suggests that in the court of public opinion that my project is way ahead of the game over Royal Caribbean. Even Minnis didn’t like the lease he gave to Royal Caribbean because he already wants to reduce the terms from a 150-year minimum.”

Warning the cruise giant it could be in “contempt of court” if it is negotiating for Crown Land tied-up in his legal battle with the Government, Mr Smith added: “You’d better believe that if Royal Caribbean are negotiating land that is in litigation before the Supreme Court of The Bahamas, it’s a snub to The Bahamas, the Bahamian people and the Supreme Court, and potentially could put them in contempt of court.”

The entrepreneur again called for a detailed breakdown of cruise passenger spending, and the industry’s economic benefits to The Bahamas, once payments by local retailers and tour/ excursion providers for marketing their businesses, and directing visitors to them, are subtracted.

“I read with interest the comments by Michael Maura, the chief executive of Nassau Cruise Port,

Share

that the offerings of excursions in The Bahamas are dismal,” Mr Smith said. “I agree with Mike, and I also endorse any entity, including Nassau Cruise Port, that supports Bahamian-owned and operated excursions.

“While the number of cruise passengers is hitting new records, I would like to see a detailed breakdown of the spending of those cruise passengers so that Bahamians can see that, after the cruise lines have taken their commissions from local excursions and Bay Street retailers - after all these subtractions are made - net net what ends up in the pockets of Bahamians.”

Royal Caribbean’s Paradise Island plans attracted renewed attention over the weekend after several Internet blog posts surfaced talking about the Royal Beach Club and showcasing artists impressions of what it will look like once constructed. One of these appeared on www.royalcaribbeanblog.com, although it includes a disclaimer that it is not directly affiliated with the cruise giant.

However, the appearance of these articles has reignited concern among Bahamian industries that rely on the cruise industry - Bay Street merchants, restaurants, tour and excursion providers, straw vendors, taxi drivers and others - that thousands of potential tourist customers will be sucked away to Royal Caribbean’s private Paradise Island destination to the detriment of their earnings. They will cross the harbour via water ferry without touching Bay Street.

The cruise line, though, has repeatedly said that the Royal Beach Club does not have space to accommodate all its Nassau visitors and it has no intention of keeping them there for the day. It added that they will be able to circulate freely in Nassau and Mr Maura, the cruise port chief, last week made the point that with 20,0000plus passengers arriving in Nassau daily his facility

and its attractions can only accommodate between 5,000-7,000 at any one time.

The Royal Beach Club is forecast to generate $26m in extra annual visitor spending, a figure that rises to $650m when extended over the initial 25-year lease term. Royal Caribbean previously said its $110m Paradise Island investment will boost overall visitor spending by $1bn over a ten-year period, although it is uncertain where this impact falls.

The blog postings suggested that the Royal Beach Club and other investments remain on the table, although Royal Caribbean has yet to determine a timeline for when they will start as it waits to put in place the necessary financing as it recovers from the COVID19 pandemic’s fall-out.’ Royal Caribbean has amassed around 13.5 acres on Paradise Island’s western end by buying out private landowners in the area, or taking options on their properties, but its efforts to lease the extra seven Crown Land acres have brought it into conflict with Mr Smith.

He is seeking himself to lease two Crown Land parcels at Paradise Island’s western end, one of which involves two acres around the lighthouse and another three acres for the “beach break” element of his own project. Two of the acres sought by Mr Smith are included in Royal Caribbean’s Crown Land lease.

Mr Smith’s court action is alleging that he was granted a valid Crown Land lease over both parcels, including the lighthouse and the area at Colonial Beach for his “beach break” destination, which is now legally binding. The case is based on a January 7, 2020, letter from Richard Hardy, acting director of Lands and Surveys, that was headlined “approval for crown land lease” over the two tracts he wanted. This lease was agreed over a year before Royal Caribbean’s deal.

GENERAL DUTIES AND RESPONSIBILITIES INCLUDE:

• Identifying new business opportunities, including new markets, new clients, new partnerships, or new products and services

• Creating strategies to successfully capture and capitalized in on new business opportunities

• Building relationships with new clients, gauging their needs, and developing proposals to address these needs

• Maintaining and developing relationships with current clients

• Negotiating with Local and International companies and organizations

• Negotiating with Government and Private Sector

•

•

•

•

•

•

•

•

•

•

•

•

Suite, particularly Excel

• Customer service orientation and negotiation skills

• High degree of accuracy and attention to detail

• BS degree in Accounting, Finance, or Business Administration Interested persons should submit a résumé to info@slendingbahamas.com

• Possessing a strong understanding of the company’s products, the competition in the industry, and positioning

• Responsible for new business development via prospecting, social selling, qualifying, and consultative selling

• Achieve growth targets for new business acquisition

• Building a strong professional network

• Identifying new business opportunities in order to generate revenue, improve profitability and help the business grow.

CORE COMPETENCIES, SPECIAL REQUIREMENTS & ATTRIBUTES:

• Excellent time management skills and the

•

•

•

•

EXPERIENCE DESIRED

PAGE 4, Monday, January 23, 2023 THE TRIBUNE

FROM PAGE B1

The Tribune wants to hear from people who are making news in their neighbourhoods. Perhaps you are raising funds for a good cause, campaigning for improvements in the area or have won an award. If so, call us on 322-1986 and share your story.

Here we grow again! We are looking for a skilled Bookkeeper to maintain our financial records, including purchases, receipts and payments. Responsibilities

your news

Record day to day financial transactions and complete the posting process

Verify that transactions are recorded in the general ledger

Bring the books to the trial balance stage

Perform partial checks of the posting process

Enter data, maintain records and create reports

Process accounts receivable/payable and payroll in a timely manner

Requirements

Proven bookkeeping experience

Solid understanding of basic bookkeeping and accounts payable/receivable principles

Proven ability to calculate, post and manage accounting data and financial records

Data entry skills along with a knack for numbers

Hands-on experience with Quick Books

Proficiency in English and in MS Office

ability to multitask

A strategic and creative mind • Specializations or a clear understanding of financial management

Strong leadership qualities to lead a team

Result-oriented

Excellent customer service skills

Technical skills to understand and propose products or solutions by focusing on the client’s requirements

•

•

•

•

•

Solid IT skills and knowledge of necessary software applications including Microsoft Word, Excel, PowerPoint, and other statistical analysis software.

A solid understanding of business and marketing principles

EDUCATION/

Bachelor’s

in Business

similar equivalent)

Degree

Management, Marketing, Finance (or

4-6 years

working experience in Marketing, Finance or related field • Negotiation skills: Knows how to prepare, how to make offers, how to respond to offers, how to respond to typical tactics, how to close, and how to ensure the agreement lasts. Communication skills: Operate at the most senior level with confidence, can make formal persuasive presentations, can communicate 1-1 with confidence, and discuss the company products/services and added value potential effectively PLEASE SEND RESUMES AND DOCUMENTS TO: PBROWN@BAHAMASSTRIPING.COM BUSINESS DEVELOPMENT MANAGER A Bahamian-owned company is seeking a Business Development Manager with a strong financial background to expand the company’s current markets by researching markets, identifying new business opportunities, generating new revenue, and creating strategies. JOB OPPORTUNITY JOB OPPORTUNITY GOLDEN EMPLOYMENT OPPORTUNITY FOR AN EXPERIENCED ULTRASOUND TECHNOLOGIST IN BEAUTIFUL BERMUDA ANNUAL SALARY: $100,000 Interested applicants should contact Dr. Brown at efbrownmd@aol.com no later than February 10,2023

of

IS TESLA A CAR MAKER OR A TECH COMPANY?

By RICARDO EVANGELISTA

Being the world’s richest man is not for everybody. It takes a blend of determination, hard work and talent. Being born to an already wealthy and wellconnected family also helps, as does attending the best schools and universities. But more than anything else it takes luck, and being in the right place at the right time. In the case of Elon Musk, it took all the above, but mainly it took founding and successfully running an electric vehicle manufacturer with perfect timing. So much so that this car maker/ tech company became the greatest beneficiary of the pandemic-era abundance of cheap money that inflated the value of technology stocks.

In November 2021, the price of Tesla stock touched an all-time high of $414 per share, with the market capitalisation of the firm exceeding $1.2trn. This was more than the market cap of almost all other car manufacturers put together, making Elon Musk the richest person in the world at that time with a net worth of $340bn. Since then, Tesla lost three quarters of its value. Just last month, it lost 40 percent, shrinking Mr Musk’s fortune by $200bn.

At the peak of its value, in November 2021, Tesla was

Cloud provider gains top security standard

A BAHAMAS-BASED cloud services provider says it has attained the Cloud Security Alliance security, trust, assurance and risk (CSA STAR) level two designation to further show its compliance with security best practices.

Cloud Carib, in a statement, said this latest standard demonstrates its commitment to meeting stringent regulations executed by Fortune 500 companies as one of only six CSA trusted Cloud companies worldwide to obtain Level Two status. It gained CSA STAR Level One certification in 2021.

The qualification comes with customers becoming increasingly concerned about the security of their personal and financial information in an online environment. Cloud Carib said the CSA STAR Level

Two recognition is awarded to companies that meet the CSA’s high security standards. It requires firms to have a formal risk assessment process in place,

and to meet the CSA’s requirements for training, documentation and policy development.

It added that the CSA STAR programme is designed to help customers assess and select a cloud service provider through a three-step programme that includes a self-assessment, third-party audit and continuous monitoring. By achieving Level Two status within the programme, Cloud Carib said it has assured clients of its commitment to providing secure cloud computing through tested security practices.

Deno Cartwright, Cloud Carib’s internal audit and compliance manager, said: “Today, we take our commitment to security one step further with our STAR Level Two attestation. These certifications demonstrate our dedication to maintaining industry-recognised security standards and protecting our customers’ services and infrastructure.

“Many customers frequently worry that regional

seen by investors as a technology company promising visions of a futuristic world full of electric self-driving vehicles. Since then, with the tightening of monetary policies, money became more expensive and investors more careful. The result is a sharp contraction in the technology sector, with the Nasdaq index losing more than 32 percent in 2022.

The change of mood means that investors now look at Tesla differently - as a car manufacturer rather than a technology company. And this is one of the reasons why Elon Musk is no longer

the richest man in the world. Investors stopped dreaming about a Tesla driven future, focusing instead on a present riddled by supply chains issues, expensive overheads and increasing competition from other manufacturers.

Against this background, Mr Musk’s decision to purchase Twitter and appoint himself as chief executive may have been ill-advised. Saying the whole episode has been bad for the share price of Tesla is an understatement. Investors fear that the distractions of Twitter will stop Mr Musk

from giving management of the car manufacturer his full attention, damaging the firm’s prospects. There is also the risk of brand damage. Tesla buyers tend to be environmentally conscious, left leaning progressives, who may not enjoy the recent libertarian stance of Elon Musk.

Looking ahead, what are the prospects for Tesla? If you think of it as a technology company which, at the time of writing, is worth 75 percent less than it was 12 months ago, then the prospects are not that great. The firm is unlikely to get

anywhere near the previous market cap in the foreseeable future. However, if you think of Tesla as a car company, then it is fair to say it is not doing too badly. Output grew by 40 percent in 2022, with the delivery of 1.3m vehicles. A smaller and cheaper model is currently in development, and 2023 will also see the release of the much-awaited Cyber Truck. Tesla is still worth $340bn, almost as much the next three most valuable car manufacturers put together. Not doing too badly for a vehicle maker.

businesses won’t be able to adhere to the highest regulatory standards. However, this certification is proof that Cloud Carib and the Caribbean are not only competing but excelling internationally.”

Cloud Carib, established more than a decade ago, says security compliance will be among the primary concerns as develops its solutions, processes and teams. It last year became SOC 2 compliant, providing customers with more transparency regarding its security posture.

THE TRIBUNE Monday, January 23, 2023, PAGE 5

DENO CARTWRIGHT, Cloud Carib’s manager of internal audit and compliance.

If you are interested in the solicitation, you must be technically qualified and financially responsible to perform the work. At a minimum, each Offeror must meet the following requirements when submitting their proposal:

Complete NDAA Compliance Forms (in the solicitation documents)

• Be able to understand written and spoken English;

• Have an established business with a permanent address and telephone listing;

• Have the necessary personnel, equipment and financial resources available to perform the work;

• Have all licenses and permits required by local law;

• Meet all local insurance requirements;

• Have no adverse criminal record;

• Be willing to register in SAM (System for Award Management) see attachments

• Have no political or business affiliation which could be considered contrary to the interests of the United States;

• Have good experience and past performance records; and

• Identify specialized experience and technical competence required to complete the work in accordance with this solicitation

A Bahamian licensed and certified Water System Contractor is required to complete this project.

If you are interested in receiving a copy of the solicitation documents, please send an email to nelsonda@state.gov no later than 3pm on January 27, 2023.

Insurer warnings

assets, and the desire of global reinsurers to recover multi-billion dollar losses, sustained from recent hurricanes that have struck The Bahamas, Florida and the wider Caribbean in recent years.

Some reinsurers have also decided to exit this region as a result, cutting the supply of reinsurance and further driving up prices. Bahamian property and casualty underwriters must acquire huge amounts of reinsurance annually because their relatively thin capital bases mean they cannot cover the multi-billion dollar assets at risk in this nation, thus making the local industry a price taker.

Spelling out the consequences for Bahamian consumers, Guilden Gilbert, a principal with Chandler Gilbert Insurance Associates, told Tribune

Business: “We knew it was coming. We’ve seen fairly significant rate increases across the board; property, professional liability, yacht and marine coverage. It’s an overall hardening of the market with the storms that hit south Florida.

“Pretty much what happens in Florida affects The Bahamas. Because we’re so close to Florida the reinsurers look at it as as one book of business.” Asked how much premiums for Bahamian homeowners and businesses are likely to increase in 2023, Mr Gilbert replied: “It’s probably going to be between 15-20 percent. That’s where we are. We’re in a hardening market. In a hard market you get rate increases.”

Bruce Ferguson, the Bahamas Insurance Brokers Association’s (BIBA) newly-elected president, said pricing pressures and capacity shortages had

first shown themselves in The Bahamas towards the end of 2022. “This has been going on for a few months now,” he told this newspaper.

“Last year, a couple of insurers said in October that they couldn’t write any new catastrophe cover for the rest of 2022. One said they couldn’t write anything in the Family Islands, and the other said they couldn’t write anything full stop. One company [underwriter] we deal with raised their rates in November by 10 percent as a temporary measure. They’ve been edging up. They didn’t exactly tell us by how much, but looking at it it’s around 10 percent on catastrophe cover.

“Another one went up pretty much across the board from January 1 to 15 percent, and probably there’s another company where reinsurance arrangements are different from everyone else. From the end of January/February 1 they are pretty much expected to follow suit.”

JOB SUMMARY Assists with various maintenance responsibilities as part of the training required to develop job knowledge essential for full time employment as a mechanic in one of the company functional maintenance departments. JOB SCOPENo supervisory or budgetary responsibilities PRINCIPAL DUTIES AND RESPONSIBILITIES Performs basic preventative maintenance on all equipment. Assists with checking and ensuring that all machines are serviceable. Assists Maintenance Supervisor when required. Makes quality fabrications as needed, Performs fueling duties when required. Makes service calls to warehouse. Keeps work area and tools/equipment clean. Reports all recurring problems to Maintenance Supervisor. Participates in training sessions and technical oriented workshops. Continually supports the Quality Improvement efforts in the company. Performs all other duties as assigned. MINIMUM EDUCATION, Certification, Experience and Physical Requirements EDUCATION: High School Diploma or equivalent EXPERIENCE Six(6) months experience preferred. License: Valid local driver’s license Travel N/a

Hurricane Ian, which struck south-west Florida last year, is estimated to have been the second most expensive storm in history with costs pegged at between $50bn to $60bn, making it second only to 2005’s Hurricane Katrina. Mr Ferguson agreed with Mr Gilbert that reinsurers tend to “lump” The Bahamas in with south Florida, and treat the two as one market, but disagreed that all lines of insurance coverage have been impacted.

He said the likes of motor insurance, and contractors’ all-risk coverage, have either held their premium costs or increased by 1-2 percent at most. “It’s not all doom and gloom. It’s not over the whole spectrum by any means,” Mr Ferguson added.

However, he warned that properties “within 200 feet” of the sea and those located in the Family Islands, where building codes are

PAGE 6, Monday, January 23, 2023 THE TRIBUNE

PAGE B1

FROM

The American Embassy in Nassau, The Bahamas has a requirement for the review and inspection of the water installation process at the New Embassy compound in Nassau, The Bahamas.

Job Title - Mechanic Helper Reference - 9769 Department - Nassau Equipment Ops Bahamas - Nassau Supervisor - Mario Butler | Phone: 424-1194 Recruiter - Daniela Ayala Pay Grade - BAH Grade 004 Close Dat JOB OPPORTUNITY Please send resume to MButler@tropical.com Tel: (242) 397-7235

over 15-20% premium hike

less strictly enforced, could struggle to obtain the necessary coverage amid the tougher market conditions. “Insurers are looking very carefully, particularly this year, and it started last year, at properties near the sea,” the BIBA president warned.

“We had the first brokers’ meeting of the year last Thursday and we discussed the lack of capacity and difficulty in placing certain risks. Anything within a few hundred feet of the sea, it’s very difficult to place that. That’s a premium premium, and a higher deductible. They’re not only increasing rates, reinsurers and insurers, they’re also imposing stricter terms of coverage. It’s a double edged-sword.

“At my company, we deal with three main insurers. One was adamant that it will not insure anything within 200 feet of the sea; it’s a ‘no no’. Another company we deal with has a huge problem with the Family Islands.”

Mr Ferguson said a 20-30 percent increase in reinsurance costs “sounds drastic’, but paled in comparison to Florida where homeowners had seen premiums increase by between 40-60 percent and even double in Ian’s aftermath. He agreed that the premium hikes were “out of our control”, due to The Bahamas’ dependence on global reinsurers, but said local brokers will be hoping to keep any increase for their clients below 15-20 percent depending

on property location and claims history.

Acknowledging concerns that all-perils hurricane and catastrophe insurance is becoming increasingly unaffordable for a growing percentage of the Bahamian market, Mr Ferguson said he nevertheless does not anticipate a “drastic” increase in persons electing to go without insurance or under-insure. Homeowners and businesses who have mortgages secured on their properties are mandated to fully insure by the loan’s terms, and cannot drop coverage.

“I don’t think it will drop-off drastically,” Mr Ferguson said. “I think that over the years a lot of people dropped hurricane cover because of the economy, because of rate increases, and I think a lot of people thinking about dropping it will have probably done it.

“No doubt it has become an issue. But I think Hurricane Dorian emphasised to

many people that you can get the big one. No matter how remote a hurricane may seem, it’s worth having the conversation for peace of mind every year and biting the bullet.”

The BIA, in its statement, said global reinsurers suffered $120bn in losses during 2022 - a sum almost 50 percent higher than the historical ten-year average of $81 billion. Without reinsurance support, Bahamian underwriters would have been unable to pay the more than $2bn in 2019 to settle losses arising from Hurricane Dorian.

“These increased losses, and the potential of increased catastrophe losses in the future, have resulted in many reinsurers who provide protection to insurance companies withdrawing from the region, therefore leading to a shortage in available reinsurance capacity. Those reinsurers who have remained in the region have applied significant rate increases for the

protection they provide to cover the risk of catastrophes,” the BIA added.

“Insurance companies in The Bahamas cannot operate without substantial amounts of reinsurance and, therefore, are highly sensitive to the movement in the price of reinsurance. Given the recent catastrophe losses and withdrawal of reinsurance capacity from The Bahamas, it is no surprise that Bahamian property and casualty insurers have seen a dramatic increase in their reinsurance costs of 20 percent to 30 percent for 2023.

“In view of this, buyers of property and casualty insurance in The Bahamas will see increases in their premiums during 2023, and some persons may find that they may have difficulty obtaining catastrophe insurance protection, due to the shortage in capacity.”

The BIA pledged “that every effort has been made to minimise these increases”. It added: “Unfortunately, the increase in premiums is due to the current reinsurance market conditions, of which local insurance companies have minimal control.

“In fact, some international observers warn that unless regional companies can substantially increase rates, the reinsurance cover needed to protect companies from natural catastrophes will become increasingly difficult to obtain. Local companies must now balance the demand for higher prices by their reinsurance partners in order to continue to support this market with the objective of providing their policyholders with the best available insurance protection.”

Vacancy

All

•

•

Th

•

Applications

Opening Period: Mondav Januan 23 - Fridav February 3, 2023.

Due to the high volume of applications, unsuccessful candidates will not be contacted.

Position Overview

The Legal Counsel will provide a wide range of legal services connected to the operations and administration of the Bahamas Air Navigation Services Authority (“the BANSA”). Among the primary functions are providing legal advice and counsel to management, the Director, and the Board of Directors; conducting legal research; drafting legal documents; reviewing authority action for legal sufficiency; and representing BANSA in civil litigation and administrative hearings.

services.

6. Collaborates with management in respect of labor relations matters, including assisting with industrial agreement negotiations.

7. Supports the HR function by managing high-risk, complex employee matters, including overseeing judicial and administrative proceedings.

8. Drafts new and amended legislation, regulations, notices, etc., as required by BANSA.

9. Maintains currency on all relevant laws and contributes to the enhancement of the knowledge base of the BANSA management through training programmes.

10. Coordinates with outside counsel on outsourced matters.

11. Serves as Board Secretary.

12. Performs other job-related duties, as assigned.

Qualification Requirements:

• Degree from an accredited law school.

• At least 3 years of responsible experience in the practice of law—preferable in a government or aeronautical setting.

• In good standing with the Bahamas Bar Association

Knowledge Requirements:

Sound knowledge of national laws and regulations covering civil aviation, the provision of air navigation services and labour laws.

• Sound knowledge of the ICAO Convention and Standards and Recommended Practices.

In-depth knowledge of administrative law and procedures

Ability to:

• Assimilate complex problems and identify solutions.

• Provide effective representation in negotiations and dealings with industrial agreements, governmental agreements, and international agreements.

• Develop and communicate proposals and recommendations clearly, logically, and persuasively in public, internal and international settings.

• Prepare clear, concise, and comprehensive correspondence, reports, studies, and other legal written materials.

• Exercise sound, expert independent judgment within policy and legal guidelines.

• Exercise tact and diplomacy in dealing with sensitive, complex, and confidential issues and situations.

Competence Requirements:

• Capable of maintaining quality while working under pressure and adhering to deadlines.

• Demonstrate ability to work independently and largely unsupervised.

• Methodical and organized with a high level of attention to details.

• Professionalism and adherence to good work ethics.

• Results and performance driven.

• Team player.

THE TRIBUNE Monday, January 23, 2023, PAGE 7

TO ADVERTISE TODAY IN THE TRIBUNE CALL @ 502-2394 Duties may include but are not limited to: 1. Provides sound and timely advice and direction to the Director, management and the

on any legal matter related to BANSA, its functions and operations. 2.

3.

4.

Board

Undertakes legal sufficiency reviews of BANSA’s programs, policies, procedures, and practices to ensure compliance with institutional priorities and statutory obligations—including legislative initiatives of the Civil Aviation Authority Bahamas (CAA-B) and the International Civil Aviation Organization (ICAO) Standards and Recommended Practices (SARPs).

Performs or supports due diligence, negotiations, requests for proposals and contract development for proposed commercial transactions and manages associated documents.

Implements, tracks, and monitors legal aspects of strategic organizational initiatives. 5. Defines budget and other resources necessary for the optimal provision of legal

Who are We Bahamas Air Navigation Services Authority is the premier Air Navigation Service provider in the Bahamas. We provide reliable and quality air navigation services through a proficient workforce, servicing the global community. We are dedicated to being the regional leader in air navigation services.

Open to: •• *•• * •** •• •• *•• * * ** ** •** •** ** ** * * ** ** * * ** ** ** ** * *

of the United

Interested, qualified candidates should submit their Curriculum Vitae and all relevant supporting documents to the attention of the Human Resources Department at Hrd@bansabahamas.com , on or before Friday, January 27th, 2023.

Embassy

States

Announcement The American Embassy in Nassau is accepting applications for the following position: Supply Clerk (Expendables)

inventory

supplies. The position is in the General

GSO

Interested Applicants/ All Sources Duties: Manages the delivery, issuance, storage, disposal, and

control of expendable

Services Section and under the supervision of the

Property Supervisor or Designee Interested candidates are required to possess the following skills and qua lifications:

Education: Completion of high school education is required.

Experience: A minimum of two (2) years of experience in supply/warehousi nwexpendable s or property/supply management is required.

Language: English level Ill (good working knowledge) Written/Speaking/Reading. This may be tested.

• Skills & Abilities: Computer competencies including basic skills in Microsoft Office applications. This may be tested. Must have had a valid, current driver's license for a minimum of five (5) years. Must be able to lift a maximum of 51 lbs. (23kg) under OSHA standards.

e complete Vacancy Announcement and Application forms are available online on the Electronic Recruitment Application (ERA) located on the following website: https://bs.usembassy.gov/embassy/jobs

will not be accepted at the Security Gate o f the Embassy, by Mail, E-mail or other means of delivery.

to generate increased revenues from the imposition of 10 percent VAT on yacht charter fees in addition to the Port Department’s existing 4 percent levy. The implication is that the Government has made it more difficult for boaters to pay, and comply, just when it wants a greater tax take from the sector.

Peter Maury, the former ABM president, under whose watch the SeaZ Pass online portal was installed, yesterday explained that the Association was given permission to launch it and collect the relevant fees that were then paid directly to the Public Treasury. He added that local payments provider, Omni Financial Services, was hired to act

as the facilitator or gateway for these transactions which generated around $4m in revenue.

Confirming that it had been operational for around a year-and-a-half, Mr Maury said: “It went directly to the Treasury. We paid to make it digital. It was a convenience for our customers. They were complaining about it. Nobody

could pay it because they had to physically go there. If you were in Abaco doing your charter, how do you pay your fee?

“It was an easy way to pay. Now all the boaters and captains are complaining because it’s so difficult. Once again we’re encouraging people to go in and pay in cash. It’s very confusing

to us. We just want to move ahead.”

Mr Maury, meanwhile, told Tribune Business that charter inquiries for The Bahamas were down 30 percent compared to the Caribbean according to information provided by the International Yacht Brokers Association (IBYA). He last week reiterated to this newspaper that the imposition of VAT on the charter fee, in addition to the 4 percent Port Department fee, had made The Bahamas uncompetitive from a taxation perspective with vessels electing to head elsewhere.

- depending on location and how much they rely on charter business - not faring so well

“There are some marinas, particularly in the northern Bahamas, that are reporting a good start to the winter yachting and boating season. One of these marinas is reporting near pre-COVID levels of business,” the ABM chief disclosed.

www.bisxbahamas.com

0.9321.26042.93.15%

6.30 6.300.00 1.7600.000N/M0.00% 9.808.78Bahamas

4.26 4.260.00 -0.4380.000-9.7 0.00% 10.657.50Commonwealth

10.25 10.250.00 0.1400.00073.20.00% 3.652.54Commonwealth Bank CBL 3.37 3.370.00 0.1840.12018.33.56% 8.547.01Colina Holdings CHL 8.54 8.540.00 0.4490.22019.02.58% 17.5012.00CIBC FirstCaribbean Bank CIB 15.99 15.990.00 0.7220.72022.14.50% 3.251.99Consolidated Water BDRs CWCB 2.83 2.830.00 0.1020.43427.715.34% 11.2810.05Doctor's Hospital DHS 10.50 10.500.00 0.4670.06022.50.57% 11.679.16Emera Incorporated EMAB 9.83 9.910.08 0.6460.32815.33.31% 11.5010.06Famguard

0.7280.24015.42.14%

Mr Williams, the current ABM president, confirmed to this newspaper that the Association is also talking to the Government about the increased tax burden’s impact. “Marinas that cater to charter yachts had hoped to retain the new charter business that was developed from the COVID pandemic and the hurricanes that ravaged the southern Caribbean,” he acknowledged.

“However, the difficulties of conducting charters and the recent introduction of VAT to charter fees have put a strain on the industry. The latter is a subject that is currently being discussed with the Government of The Bahamas.”

“Unfortunately, a combination of bad weather and distance in accessing supplies have contributed to less than desired outcomes in the southern Bahamas thus far. Nonetheless, these marinas are still optimistic about January business.” Mr Williams explained that fuel availability, more so than cost now, was weighing more heavily on the performance of marinas in the south.

100.00100.000.00 100.00100.00BGS: 2014-12-30Y

100.00100.000.00 100.00100.00BGS: 2015-1-30Y BG0230 100.00100.000.00 100.00100.00BGS: 2015-6-7Y BG0307 100.00100.000.00 100.00100.00BGS: 2015-6-30Y BG0330 100.00100.000.00 100.00100.00BGS: 2015-10-7Y BG0407 100.00100.000.00 100.11100.11BGRS

BGRS98034 BSBGRS980343 100.11100.110.00 100.12100.12BGRS FL BGRS88037 BSBGRS880378 100.03100.030.00 94.1594.09BGRS FX BGR132139 BSBGR1321391 93.3693.360.00 101.55101.42BGRS FX BGR124228 BSBGR1242282 101.45101.450.00 103.49103.38BGRS FX BGR118027 BSBGR1180276 102.70102.700.00 92.6792.67BGRS FX BGR131239 BSBGR1312390 92.5592.550.00 90.9890.98BGRS FX BGR132249 BSBGR1322498 90.9590.950.00 94.8094.80BGRS FX BGR134140 BSBGR1341407 93.9493.940.00 100.39100.39BGRS FX BGR138230 BSBGR1380306 100.39100.390.00 96.8496.84BGRS FX BGR138240 BSBGR1380405 96.1096.100.00 100.32100.32BGRS

6.25% 30-Sep-2025

MATURITY 19-Oct-2022 20-Nov-2029

26-Jul-2034

26-Jul-2037 4.42%

4.66% 4.82%

5.65%

5.35% 5.00%

2.582.11 2.583.48%3.87% 4.883.30 4.884.49%5.32% 2.261.68 2.262.74%3.02% 205.22164.74 190.45-6.40%-6.95% 212.41116.70 169.68-20.12%-15.15% 1.761.71 1.762.49%2.79% 1.941.78 1.935.71%7.96% 1.881.79 1.863.39%3.91% 1.030.93 0.93-8.94%-9.55% 9.376.41 10.107.82%9.00% 11.837.62 13.4413.58%15.81% 7.545.66 7.712.57%2.83% 16.648.65 13.25-20.10%-19.25% 12.8410.54 12.03-4.50%-4.64% 10.779.57 10.59-0.55%-1.61% 16.279.88 16.27N/AN/A 11.228.45 11.223.00%25.60% 14.8911.20 N/A

15-Oct-2039

Asked about the progress of these talks, he added: ‘It’s still being discussed. We don’t want to speak on that before time. We’re still in active discussions with them to find possible solutions. It’s still on the table. We’re still talking.

“It’s not clear cut,” he added. “Some marinas are saying: ‘Yeah, we’re doing great’, and other marinas are saying, ‘hey, not so’, but it’s for various reasons. What we’ve been working with the Government on is to see what changes can be made legislation wise, what changes can be made policy wise, what changes can be made marketing wise to drive business. We have to work with the Government to get it all sorted out and create a policy framework.

22-Sep-2033

30-Nov-2022 30-Nov-2022

15-Dec-2021 30-Jul-2022 15-Dec-2044 30-Jul-2045 26-Jun-2022 26-Jun-2045 15-Oct-2022 25-Nov-2022

30-Sep-2022 31-Oct-2022

31-Oct-2022 31-Oct-2022

31-Oct-2022 30-Nov-2022 30-Nov-2022 30-Nov-2022 30-Nov-2022

30-Nov-2022 30-Nov-2022

31-Dec-2021 31-Dec-2021

31-Dec-2021

“All these talks are pretty much in tandem as we look at it holistically. I think the Government understands there needs to be more simpler process [SeaZ Pass] and I’m sure they have ideas on how that can work as well. We want to support that as well, but we need a solution; some kind of solution.”

Mr Williams described the Bahamian marina industry’s performance over late 2022, the Christmas/ New Year period and 2023 to-date, as well as the outlook for the remainder of the year, as “not so clear cut” and “a mixed bag” where some were enjoying a good period and others

“There is tremendous potential. Our proximity, our physical make-up, we have to now capitalise on those things. These are literally customers that can go anywhere. We need to make sure it’s a no brainer to come to The Bahamas. That requires some work on everyone’s part. We have to be of the same accord, and make sure we get these yachts to come back or entice more persons to come,” the ABM chief said.

“The ABM is working closely and diligently with its members, the Ministry of Tourism and Aviation, and the Ministry of Transport and Local Government to the development of much-needed legislative revisions and policies for the advancement of the industry.”

PAGE 8, Monday, January 23, 2023 THE TRIBUNE

Marinas: Online portal closure is ‘step back’ FROM PAGE B1 CALL 502-2394 TO ADVERTISE TODAY! FRIDAY, 20 JANUARY 2023 CLOSECHANGE%CHANGEYTDYTD% BISX ALL SHARE INDEX: 2624.736.470.25-20.33-0.77 BISX LISTED & TRADED SECURITIES 52WK HI52WK LOWSECURITY SYMBOLLAST CLOSECLOSECHANGE VOLUMEEPS$DIV$P/E YIELD 7.005.30 AML Foods Limited AML 6.95 6.950.00

53.0040.03 APD Limited APD 39.95 39.950.00

2.761.60Benchmark BBL 2.76

2.462.31Bahamas First Holdings Limited BFH 2.46

2.852.25Bank of Bahamas BOB 2.61

Property Fund BPF

Waste BWL

CAB

CBB

FCL

FIN

S. Johnson JSJ

PREFERENCE SHARES 1.001.00Bahamas First Holdings PreferenceBFHP 1.00 1.000.00

1000.001000.00 Cable Bahamas Series 6 CAB6 1000.001000.000.00

1000.001000.00 Cable Bahamas Series 9 CAB9 1000.001000.000.00

1.001.00Colina Holdings Class A CHLA 1.00 1.000.00 0.0000.0000.0006.25% 10.0010.00Fidelity Bank Bahamas Class A FBBA 10.0010.000.00

1.001.00Focol Class B FCLB 1.00 1.000.00

CORPORATE DEBT - (percentage pricing) 52WK HI52WK LOWSECURITY SYMBOLLAST SALECLOSECHANGEVOLUME 100.00100.00Fidelity Bank (Note 22 Series B+)FBB22 100.00100.000.00 100.00100.00Bahamas First Holdings LimitedBFHB 100.00100.000.00 BAHAMAS GOVERNMENT STOCK - (percentage pricing)

Note 6.95 (2029) BAH29

BG0107

BG0207

BG0130

FL BGRS81035 BSBGRS810359

FL BGRS81037 BSBGRS810375

FL BGRS84033 BSBGRS840331

MUTUAL FUNDS 52WK HI52WK LOW NAV YTD%12 MTH%

N/A N/A MARKET TERMS BISX ALL SHARE INDEX - 19 Dec 02 = 1,000.00 YIELD - last 12 month dividends divided by closing price 52wk-Hi - Highest closing price in last 52 weeks Bid $ - Buying price of Colina and Fidelity - Lowest closing price in last 52 weeks Ask $ - Selling price of Colina and fidelity Previous Close - Previous day's weighted price for daily volume Last Price - Last traded over-the-counter price Today's Close - Current day's weighted price for daily volume Weekly Vol. - Trading volume of the prior week Change - Change in closing price from day to day EPS $ A company's reported earnings per share for the last 12 mths Daily Vol. - Number of total shares traded today NAV - Net Asset Value DIV $ - Dividends per share paid in the last 12 months - Not Meaningful P/E - Closing price divided by the last 12 month earnings TO TRADE CALL: CFAL 242-502-7010 | ROYALFIDELITY 242-356-7764 | CORALISLE 242-502-7525 | LENO 242-396-3225 | BENCHMARK 242-326-7333 Colonial Bahamas Fund Class D Colonial Bahamas Fund Class E Colonial Bahamas Fund Class F CFAL Global Equity Fund Leno Financial Conservative Fund Leno Financial Aggressive Fund Leno Financial Balanced Fund Leno Financial Global Bond Fund RF Bahamas Opportunities Fund - Secured Balanced Fund RF Bahamas Opportunities Fund - Targeted Equity Fund RF Bahamas Opportunities Fund - Prime Income Fund RF Bahamas International Investment Fund Limited - Equities Sub Fund RF Bahamas International Investment Fund Limited - High Yield Income Fund RF Bahamas International Investment Fund Limited - Alternative Strategies Fund INTEREST Prime + 1.75% MARKET REPORT

0.2390.17029.12.45%

2.760.00 0.0000.020N/M0.72%

2.460.00 0.1400.08017.63.25%

2.610.00 0.0700.000N/M0.00% 6.306.00Bahamas

9.75 9.750.00 0.3690.26026.42.67% 4.502.90Cable Bahamas

Brewery

FAM 11.22 11.220.00

18.3014.50Fidelity Bank (Bahamas) Limited FBB 18.10 18.100.00 0.8160.54022.22.98% 4.003.55Focol

3.98 3.980.00 0.2030.12019.63.02% 12.109.85Finco

11.40 11.940.54 1,8300.9390.20012.71.68% 16.2515.50J.

15.76 15.760.00 0.6310.61025.03.87%

0.0000.0000.0000.00%

0.0000.0000.0000.00%

0.0000.0000.0000.00%

0.0000.0000.0007.00%

0.0000.0000.0006.50%

115.92104.79Bahamas

107.31107.310.00 100.00100.00BGS: 2014-12-7Y

100.00100.000.00 100.00100.00BGS: 2015-1-7Y

FL

100.66100.660.00 100.34100.34BGRS

100.17100.170.00 100.57100.57BGRS

100.15100.150.00

4.50%

6.95%

4.50% 6.25%

26-Jul-2037 26-Jul-2035 FUND CFAL Bond Fund CFAL Balanced Fund CFAL Money Market Fund CFAL Global Bond Fund

6.25% 4.50% 6.25% 4.25% NAV Date 4.87% 4.68% 4.32% 4.81% 5.29% 5.14% 5.60%

30-Sep-2022

15-Jul-2039 15-Jun-2040

13-Jul-2028 13-Oct-2027 15-Oct-2049 17-Jan-2040 15-Jun-2030

(242)323-2330 (242) 323-2320

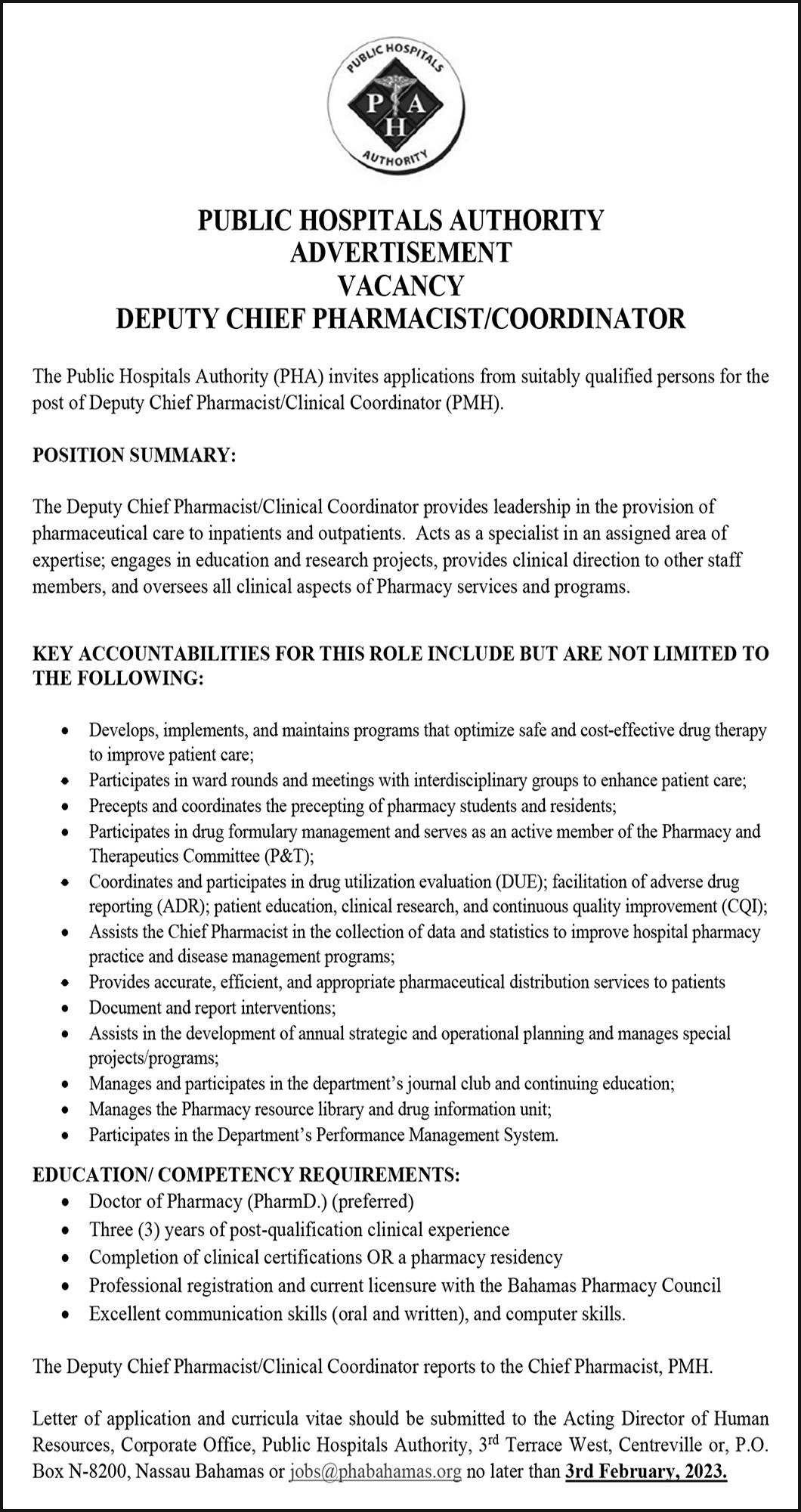

THE deputy prime minister has confirmed Latia Duncombe as the Ministry of Tourism’s director-general.

Chester Cooper, also minister of tourism, investments and aviation, said in a statement: “During the past year, Mrs Duncombe has brought energetic leadership to our senior executive management team at the Ministry of Tourism, Investments & Aviation.

“She has made a seamless transition from the corporate sector to public service, parlaying her wealth of knowledge and experience into outstanding leadership of ‘Team Tourism’. She came aboard at a critical juncture as we undertook the task of tourism recovery and has worked tirelessly toward the goal of getting our industry back on track.”

Mrs Duncombe is the seventh executive to be named as the Ministry of Tourism’s director-general in its 54th year, and the third woman to be appointed as its technical head. She said: “It’s an honour and privilege to be given the opportunity to lead The Bahamas’ chief economic engine. Tourism is a fascinating industry, and one that touches the lives of the entire population and guarantees the socio-economic stability of The Bahamas.

“Our robust performance last year is a testament that growth and expansion are realisable, considering our country’s assets and the resilience of our people. We have excelled not just in the numbers, but also in revenues. I want to express my sincere gratitude to former leaders and ‘Team Tourism’, all of whom have played

an integral role in leading, undergirding and facilitating The Bahamas’ mainstay. It has been an honour to be able to serve my country.”

Mrs Duncombe’s appointment to the director-general post took effect on January 16, 2023, and came after she had acted in the post for around one year.

Tuesday: ENE at 12-25 Knots 1-2

2.8

9:36 a.m. 3.3 3:19 a.m. -0.8 10:04 p.m. 2.8 4:02 p.m. -0.8 10:26 a.m. 3.1 4:15 a.m. -0.6 10:59 p.m. 2.8 4:51 p.m. -0.7 11:18 a.m. 2.8 5:12 a.m. -0.4 11:56 p.m. 2.7 5:41 p.m. -0.6

12:11 p.m. 2.5 6:11 a.m. -0.1 6:32 p.m. -0.4 12:54 a.m. 2.7 7:14 a.m. 0.1 1:06 p.m. 2.2 7:25 p.m. -0.2 1:53 a.m. 2.6 8:19 a.m. 0.3 2:05 p.m. 2.0 8:20 p.m. -0.1

THE TRIBUNE Monday, January 23, 2023, PAGE 11

Tourism confirms director general

Shown is today’s weather. Temperatures are today’s highs and tonight’s lows. ORLANDO Low: 49° F/9° C High: 70° F/21° C TAMPA Low: 50° F/10° C High: 68° F/20° C WEST PALM BEACH Low: 64° F/18° C High: 80° F/27° C FT. LAUDERDALE Low: 67° F/19° C High: 82° F/28° C KEY WEST Low: 68° F/20° C High: 79° F/26° C Low: 69° F/21° C High: 84° F/29° C ABACO Low: 67° F/19° C High: 77° F/25° C ELEUTHERA Low: 73° F/23° C High: 80° F/27° C RAGGED ISLAND Low: 76° F/24° C High: 80° F/27° C GREAT EXUMA Low: 75° F/24° C High: 80° F/27° C CAT ISLAND Low: 72° F/22° C High: 83° F/28° C SAN SALVADOR Low: 73° F/23° C High: 83° F/28° C CROOKED ISLAND / ACKLINS Low: 75° F/24° C High: 80° F/27° C LONG ISLAND Low: 74° F/23° C High: 81° F/27° C MAYAGUANA Low: 75° F/24° C High: 81° F/27° C GREAT INAGUA Low: 74° F/23° C High: 82° F/28° C ANDROS Low: 72° F/22° C High: 81° F/27° C Low: 63° F/17° C High: 80° F/27° C FREEPORT NASSAU Low: 69° F/21° C High: 83° F/28° C MIAMI THE WEATHER REPORT 5-Day Forecast Mostly sunny High: 84° AccuWeather RealFeel 88° F The exclusive AccuWeather RealFeel Temperature® is an index that combines the effects of temperature, wind, humidity, sunshine intensity, cloudiness, precipitation, pressure and elevation on the human body—everything that affects how warm or cold a person feels. Temperatures reflect the high and the low for the day. A shower early; partly cloudy Low: 69° AccuWeather RealFeel 68° F Breezy with sun and some clouds High: 82° AccuWeather RealFeel Low: 72° 83°-71° F Breezy in the morning; mostly sunny High: 85° AccuWeather RealFeel Low: 70° 86°-69° F Mostly sunny High: 84° AccuWeather RealFeel Low: 70° 88°-64° F Mostly sunny and breezy High: 80° AccuWeather RealFeel 78°-65° F Low: 69° TODAY TONIGHT TUESDAY WEDNESDAY THURSDAY FRIDAY almanac High 81° F/27° C Low 68° F/20° C Normal high 77° F/25° C Normal low 65° F/18° C Last year’s high 86° F/30° C Last year’s low 66° F/19° C As of 1 p.m. yesterday 0.00” Year to date 0.03” Normal year to date 0.93” Statistics are for Nassau through 1 p.m. yesterday Temperature Precipitation sun anD moon tiDes For nassau First Jan. 28 Full Feb. 5 Last Feb. 13 New Feb. 20 Sunrise 6:56 a.m. Sunset 5:48 p.m. Moonrise 8:38 a.m. Moonset 8:03 p.m.

High Ht.(ft.) Low Ht.(ft.) 8:45

3.4

LATIA DUNCOMBE

Today Tuesday Wednesday Thursday

a.m.

2:24 a.m. -1.0 9:10 p.m.

3:13 p.m. -0.8

marine Forecast WINDS WAVES VISIBILITY WATER TEMPS. ABACO Today: SW at 8-16 Knots 2-4 Feet 8 Miles 76° F Tuesday: ENE at 10-20 Knots 4-7 Feet 10 Miles 76° F ANDROS Today: S at 3-6 Knots 0-1 Feet 10 Miles 76° F Tuesday: ENE at 10-20 Knots 1-2 Feet 10 Miles 78° F CAT ISLAND Today: S at 7-14 Knots 2-4 Feet 8 Miles 79° F Tuesday: ENE at 12-25 Knots 3-6 Feet 10 Miles 79° F CROOKED ISLAND Today: SE at 8-16 Knots 3-5 Feet 10 Miles 80° F Tuesday: E at 10-20 Knots 2-4 Feet 10 Miles 80° F ELEUTHERA Today: SSW at 6-12 Knots 2-4 Feet 10 Miles 77° F Tuesday: ENE at 12-25 Knots 3-6 Feet 10 Miles 78° F FREEPORT Today: W at 10-20 Knots 1-3 Feet 7 Miles 79° F Tuesday: E at 10-20 Knots 2-4 Feet 10 Miles 81° F GREAT EXUMA Today: S at 4-8 Knots 0-1 Feet 10 Miles 79° F

Feet 8 Miles 79° F

Feet 10 Miles 80° F

Friday Saturday Sunday Feet 10 Miles 80° F

GREAT INAGUA Today: SE at 8-16 Knots 2-4

Tuesday: E at 10-20 Knots 2-4

Feet 10 Miles 80° F

Feet 10 Miles 80° F

LONG ISLAND Today: SSE at 7-14 Knots 2-4

Tuesday: E at 8-16 Knots 1-3

Feet 8 Miles 79° F

ESE at 8-16 Knots 3-5 Feet 8 Miles 79° F NASSAU

S at 4-8 Knots 1-2 Feet 10 Miles 77° F Tuesday: ENE at 12-25 Knots 1-3 Feet 10 Miles 78° F RAGGED ISLAND Today: SE at 7-14 Knots 2-4 Feet 10 Miles 79° F Tuesday: E at 10-20 Knots 2-4 Feet 10 Miles 79° F SAN SALVADOR Today: SW at 6-12 Knots 1-2 Feet 10 Miles 78° F Tuesday: ENE at 12-25 Knots 2-4 Feet 10 Miles 79° F uV inDex toDay The higher the AccuWeather UV Index number, the greater the need for eye and skin protection. Forecasts and graphics provided by AccuWeather, Inc. ©2023 tracking map Shown is today’s weather. Temperatures are today’s highs and tonight’s lows. N S E W 7-14 knots N S E W 8-16 knots N S E W 8-16 knots N S E W 6-12 knots N S E W 4-8 knots N S E W 8-16 knots N S E W 7-14 knots N S E W 3-6 knots

MAYAGUANA Today: SE at 10-20 Knots 3-6

Tuesday:

Today: