OPINION ⬛ The latest across residential, buy-to-let, specialist finance and more

INTERVIEW ⬛ Dan Wass reflects back over a year at the helm of The Bucks

BROKER

Marketing, Meet the Broker, and tips for tricky cases

OPINION ⬛ The latest across residential, buy-to-let, specialist finance and more

INTERVIEW ⬛ Dan Wass reflects back over a year at the helm of The Bucks

BROKER

Marketing, Meet the Broker, and tips for tricky cases

Many of my conversations in this industry centre around the work being done to create, raise and maintain high standards, whether in terms of product development, how lenders deal with brokers, how brokers handle client needs, or any of the other myriad moving parts at play. This has come even more to the fore over the past year or so, with the approach, implementation, and now initial stages of the new Consumer Duty. I won’t spend too many words on that, as I’ve already dedicated a previous comment – and many editorial pages beyond – to the subject.

However, this context made it particularly disheartening to report the news that the Financial Conduct Authority’s (FCA) year-long review of the later life mortgage market found “many cases” where advice “did not meet the standards expected,” as well as issues with almost 400 promotions. This is not to say that the later life mortgage market hasn’t come a long way, that the key players aren’t conducting themselves with customers’ best interests at heart, or that it should be singled out as the only sector with a long path ahead of it. However, the fact remains that later life lending has – rightly and wrongly – always been plagued with a negative image, and therefore has more of an uphill struggle than other parts of the market.

This negativity is something that many in the industry have worked tirelessly to counter, but the idea of doting grannies being turfed from

Jessica Bird Managing Editor

Jessica O’Connor Reporter

editorial@theintermediary.co.uk

Claudio Pisciotta BDM claudio@theintermediary.co.uk

Ryan Fowler Publisher

Felix Blakeston Associate Publisher

Maggie Green Accounts nance@theintermediary.co.uk

Barbara Prada Designer

Bryan Hay Associate Editor Subscriptions

subscriptions@theintermediary.co.uk

their homes is an emotive one, and hard to shi . It would be easy to blame this on the need for more mythbusting, but the fact that the regulator looked at major firms, responsible for around half of all lifetime mortgage sales, and found them wanting, suggests that there is still very real work to be done.

This comes at a time when the dialogue around property finance in all its forms is incredibly fraught. While those of us with an eye on the internal workings of the market have, for example, seen lenders in their droves lower rates recently, my suspicion is this narrative only reaches so far. The average borrower is still facing an affordability cliff-edge, and the image of young families struggling to juggle childcare costs with rising mortgage payments, for example, is stirring up consternation.

Speaking of emotive subjects, last month I waxed lyrical about the need to eschew party politics when it comes to housing, no ma er how tempting an election ba leground it might be. This month, from interviews to comment pieces, the topic is clearly weighing even heavier on commentators’ minds across all the sectors we cover. In fact, take a look at our feature on Page 34 for a particularly in-depth look at the idea of taking a fresh approach to policy. Perhaps our experts have the insight needed to address the property powder-keg before it’s too late. ●

Jessica Bird @jess_jbird

Aaron Conlon | Alison Pallett | Alpa Bhakta

Aimie-Jo Shutt | Andrea Glasgow

Brian West | Chris Pearson | Dave Magee

David Binney | David G Jones | David Morris

Donna Wells | Elise Coole | Ellen Fell

Grant Hendry | Jacqueline Dewey | Jade Keval

Jason Berry | Jatin Ondhia | Jay Shah

Jeremy Duncombe | Jonathan Newman

Jonathan Stinton | Leon Diamond

Lukasz Grochowski | Lucy Waters

Marie Grundy | Mark Gregory | Martese Carton

Matthew Dilks | Natalie omas

Neal Jannels | Nicholas Mendes | Paresh Raja

Paul Brett | Paul Goodman | Paul Glynn

Paul omas | Phil Deacon | Ranjit Narwal

Richard Rowntree | Rob May | Robin Johnson

Steve Goodall | Tony Ward | Vic Jannels

Will Hale | William Reeve

WE KNOW YOUR CLIENTS WON’T ALWAYS FIT THE MOULD.

—

— We’ll consider pension pots, as well as fixed pensions, investment and rental income. Other income can be considered on a case-by-case basis.

— We lend in retirement with higher maximum ages than most lenders.

— We have a common sense approach to lending and use human beings, not robots, to underwrite each case. This means we can tailor our solutions to each of your client’s needs.

Feature 34

Natalie Thomas asks what’s on the wishlist for future housing policy

A look at the practical realities of being a broker, from marketing tips and interviews to the monthly case clinic

This month The Intermediary takes a look at the housing market in Coventry

An eye on the revolving doors of the mortgage market: the latest industry job moves

The Interview 20

BUCKINGHAMSHIRE BUILDING SOCIETY

Dan Wass looks back at his rst year at the helm, and ahead to the society’s future

KEYSTONE 32

Elise Coole talks sustaining service levels in turbulent times

PARAGON 50

Louisa Sedgwick looks at how lenders can step up to support landlords

PURE RETIREMENT 64

Andrew Clare discusses the evolution of the later life sector

Q&A

CSS/CORELOGIC 76

Matthew Cumber and Mark Blackwell discuss their recent partnership

PAYMENTSHIELD 86

Louise Pengelly dissects the latest Adviser Survey results

MAGNET CAPITAL

Will Calito tells us about the challenges and opportunities facing business development managers

Iwas pleased to see HSBC UK launch into the 40-year term space at the end of August, which is another way we are helping customers with the increased cost of living.

‘So what’s new?’ I hear you say, and you may have a valid point. HSBC UK was not the first of the high street lenders to let borrowers take out 40year mortgages.

So, what is behind this latest evolution towards longer-term mortgages? Is it good for customers? Will we see the trend continue?

We know that homeownership is a key life ambition for many people, but affordability can be an issue. This move underscores our commitment to supporting aspiring homeowners in their journey onto the housing ladder.

In very simple terms, it reduces monthly payments, making lending more affordable and ge ing onto the property ladder more possible.

Taking out a 40-year term versus a 35-year term reduces monthly repayments from £1,239 to £1,202 on a £200,000 mortgage at the average 2-year fixed rate of 6.72%, as per the example quoted in The Times on 30th August.

Where absolutely every penny counts in the monthly household budget –and ever-increasing proportions of those budgets are being consumed by mortgage costs in the current interest rate environment – it’s easy to see the argument in favour of stretching that mortgage term out a li le further for some borrowers.

When I refer to ‘some borrowers’, we must be alive to the fact that extending the term out as far as 35 to

40 years comes with the caveat that the borrower has the propensity in terms of their current age profile, or is well provisioned in terms of income up to and into retirement, to ensure such a lengthy term is a viable option.

Pu ing in a larger deposit, such as from ‘the Bank of Mum and Dad’ – a whole debate for another article, perhaps – as well as interest-only, part and part, etcetera, are also viable options to reduce monthly repayments depending upon the customer profile and lender’s policies, as well as the a itude to risk the customer may have in respect of all these options.

No one is extolling the virtue of stretching the term for as long as we can and worrying about tomorrow another day. A longer term is not a magic wand approach to reducing monthly repayments, there’s a cost to doing it. Delving back into The Times article referred to earlier, it says if you take out a longer-term mortgage you will pay more interest over the lifetime.

PEARSON

Assuming an interest rate of around 4% over the entire term, someone who took out a 25-year £200,000 mortgage would pay £316,800 overall, whereas someone who took out the same loan over 40 years would pay £401,280. A significant difference.

As customers’ circumstances evolve over the years, so too should the advice that brokers provide to them. While a 40-year term may be right today, that advice can o en evolve to reducing the term later, if and when the customer is earning more money and can afford to do so.

This is one very important upside – among many – to always having a great adviser on your side, consistently checking to make sure your mortgage is tailor-made to always meet your precise needs.

The question around how many of these longer-term mortgages mature to run their full term remains to be seen. Some will no doubt reduce their term as circumstances allow. However, at the outset we must assume that they will run to term and therefore ensure that each customer has the propensity to cover off that level of commitment into older age.

Innovation will certainly reach into the market to offer further solutions I’m sure. For now, extending the term as a tool to reduce monthly repayments remains a good option as long as customers, brokers and lenders are all clear on the logic both now and in 40 years’ time. ●

One aspect of the Bank of England’s interest rate hiking cycle that has perhaps been overlooked is the impact it has had on high-net-worth individuals’ (HNW) mortgages. In the current economic climate, the fate of the affluent borrower is understandably not front and centre of the media’s a ention. But we should not discount the challenges higher rates pose to HNWs, particularly when coupled with the difficulties many already face when seeking a mortgage.

One would think that, by definition, having a high net worth would mean that applying for and securing credit would be a relatively straightforward task. However, the reality is quite different; many HNWs are turned away by mainstream lenders because of the unique nature of their income, investments, and liquidity.

With interest rates set to remain at these new, elevated levels –and potentially rising further as inflationary pressures continue in the UK – what does the new era of higher rates mean for HNWs seeking mortgages? And what does this, in turn, mean for lenders and intermediaries?

Before the start of 2022, the UK mortgage market had grown accustomed to a period of historically low interest rates, with some borrowers acquiring mortgages with interest rates as low as 1%. The Bank of England’s 14 consecutive hikes to the base rate have changed all that.

Despite their wealth, HNWs are not immune to the impact of such rapid hikes. They frequently invest in highvalue properties, and typically carry

larger mortgage debts than the average borrower. Moreover, those mortgages are o en on 5-year or 10-year terms, rather than the 15-year or 30-year terms many homebuyers obtain on the high street.

Simply put, larger mortgages on shorter terms mean a change in interest rates will be more pronounced for these individuals, with less flexibility to spread the costs.

Clearly, lenders and brokers are required to help HNWs navigate this economic climate to find the right product. A er all, high street banks are o en ill-suited to catering for HNW borrowers, whose complex financial profiles and irregular incomes do not satisfy more rigid application criteria.

The greater an individual’s wealth, the more complex their financial situation tends to be. They may not receive a regular paycheck or have a credit history, for example. Their wealth might be locked into other investments and assets, or they might be non-UK residents.

Commonly, the mortgages sought by HNWs are not intended for the purchase of a primary residence. They may not even plan to live in the property at all. A er all, prime property is still one of the most popular investment asset classes among HNWs – particularly in the upper echelons of the market.

All these factors present challenges if high street lenders want to engage with HNWs. The rise in interest rates and greater scrutiny borrowers are now under will only exacerbate the problem.

HNWs need lenders and brokers that can assess a more inclusive, holistic picture of their financial situation, as

BHAKTAwell as their investment motives. This includes those with mortgages and those applying for them.

Working with specialists in the HNW mortgage sector is important. It is a particular skill and experience, with the ability to cater for each client on a more bespoke, case-by-case basis, which is especially valuable in the current climate.

As they are typically more flexible, specialised lenders are not only be er suited to assessing complex applications from HNWs, but also to work with such clients once the loan has been delivered.

A recent Bu erfield Mortgages survey of UK mortgage customers revealed that just 44% feel they have received adequate support and communication from their mortgage provider over the past 18 months.

It is clearly a pertinent issue – a reminder that lenders must proactively engage with brokers and borrowers to identify any concerns and, wherever possible, present solutions to them.

It is evident that HNWs need support. They are not immune to the effects of the rapid rise in interest rates, either when applying for mortgages or repaying existing ones.

It is vital, therefore, that lenders with expertise in working with HNW clients are able to guide them through the changing economic environment and, with the help of brokers, deliver the right products to ensure they can still invest in property with confidence. ●

ALPA is CEO at Butter eld Mortgagesellbeing is a subject that can engender, from some, an eyeroll and a lung emptying sigh. However, with a large number of rate changes over the past few months, I want to take a moment to consider the impact on broker wellbeing.

I once asked “Alexa, what is wellbeing?” and she de ly replied: “Wellbeing is a quality of life that is intrinsically valuable to an individual.” She also referred to it as a “state of contentment.” That sounds nice.

It’s been a busy time for all of us working across the mortgage industry with the recent complexities of a more changeable market. I appreciate the challenges that rapidly changing rates can have on mortgage brokers.

From having to get clients to act quickly to take advantage of the best rates, to revisiting certain deals when rates reduce, this can all have a real impact on work-life balance, as brokers work around the clock to get the best deals for their clients.

WIt’s also good to reflect on why we are here. I refer not to the mystery of our existence, but rather the ‘why’ of our roles. Our customers are our why – lender and broker alike. We want the best possible outcomes for our customers. It is their financial wellbeing that is our raison d’être

As lenders, we don’t want brokers working all hours, and we don’t want that for our own colleagues, either. We understand that, as intermediaries, reputation and financial stability can hang on your recommendations. We genuinely want you to have confidence in those recommendations – with eyes fixed on the customer’s financial contentment.

Market fluctuations are outside of our control, and they require lenders to adapt swi ly and adjust strategy, in much the same way as a broker, to ensure customers receive the best possible outcomes. This can lead to increased stress and pressure to stay up to date with the latest market trends.

Managing clients’ expectations and concerns requires effective

communication from us all. How and when we communicate with you as a broker is key. We want to be able to give you as much time as possible to ensure you can deliver the right advice to your customers and maintain a good work-life balance.

We have recently launched our Santander for Intermediaries LinkedIn page, which enables us to cascade additional messages in another format. We appreciate there is more that can be done, and we continue to look for more effective ways to communicate with our broker community.

We continue to take broker feedback on board, and I hope that the improvements we have already made to the range of communication channels available, and the speed we can cascade information, will help support the wellbeing of our teams and the wider broker community. Wellbeing could be described as an outfit that looks different on everyone, and as such, the remedies are different too. Personal lives aside, I believe there are aspects, such as communication, that all lenders can consider as an element which could improve wellbeing in our professional lives.

Sir Winston Churchill famously said: “To improve is to change, to be perfect is to change o en.”

We as lenders would do well to ingrain this ethos, taking the opportunity to try and improve with every change. This will ensure that even in a rapidly changing market, we can all have time to think about our wellbeing. ●

This October, we’re launching ‘Bring it Home’ - an entire month dedicated to making the most of general insurance.

We believe it’s your duty of care to make sure your clients are fully protected, so we’ve made it our mission to provide you with all the tools you’ll need to start those all-important home insurance conversations and grow your business.

We believe it’s your duty of care to make sure your clients are fully protected, so we’ve made it our mission to provide you with all the tools you’ll need to start those all-important home insurance conversations and grow your business.

Sign up today to take part

We’re asking advisers to pledge to talk general insurance with every mortgage and remortgage conversation in October.

We’re asking advisers to pledge to talk general insurance with every mortgage and remortgage conversation in October.

If you take part in ‘Bring it Home’ month, we’ll donate £5* to Family Action for every completed Gold or Platinum Home insurance sale you make in ‘October 2023.’

If you take part in ‘Bring it Home’ month, we’ll donate £5* to Family Action for every completed Gold or Platinum Home insurance sale you make in ‘October 2023.’

Once you’ve signed up, you’ll receive an email with all the details you need to make sure your sales count.

Once you’ve signed up, you’ll receive an email with all the details you need to make sure your sales count.

With our collective voice, we’ll reduce the stigma associated with asking for help, especially focussing on those less likely to reach out, so it becomes the norm. We’re ready to help, are you ready to sign up? Scan the QR code to nd out more or sign up. * LV= General Insurance will donate up to a maximum of

With our collective voice, we’ll reduce the stigma associated with asking for help, especially focussing on those less likely to reach out, so it becomes the norm. We’re ready to help, are you ready to sign up? Scan the QR code to nd out more or sign up. * LV= General Insurance will donate up to a maximum of £10,000.

For Financial Advisers only

Posting thoughts and speculation based on limited published information always fills you with a sense of hesitation and dread.

In a market which continually faces challenges, any shi in dynamics can make you want to write about the past, taking comfort that it’s at least something you can control.

At the time of writing, UK Finance and the Bank of England have published the latest Household Finance Review for Q2 2023, and Money and Credit Report for July 2023, respectively.

Lending for house purchases and external remortgaging remained weak in Q2 2023 according to UK Finance, impacted by affordability constraints and a reduction in house buying and selling activity. Meanwhile, the Bank of England says net mortgage approvals decreased from 54,600 in June to 49,400 in July, while approvals for remortgaging slightly increased from 39,100 to 39,300 during the same period.

The highlights in both reports aren’t exactly revolutionary for brokers, given the past few months and a quieter summer period than normal. This potential break may have even been welcomed by some, considering the past year we’ve had.

With a wet summer coming to an end, Q3 certainly seems to be warming up. Mortgage holders approaching the end of their fixed rates are open to reviewing remortgage options versus product transfers, with product transfers having been the most common recommendation recently, and sometimes the only option because of affordability constraints.

Interestingly, purchase activity seems to have taken an upward shi in confidence, with an increased desire to move despite growing mortgage costs.

First-time buyer (FTB) activity has also taken a positive turn, with FTBs taking a higher share of the smaller purchase market. Shaking off any anecdotal thoughts, we could see this taper off until 2024, when they may benefit from a property price dip.

Regardless of how my predictions hold up, at least we can take some comfort as brokers, knowing we can assist more clients moving forward.

Mortgage rates understandably continue to be a topic of discussion. While no one can be certain of what the best buys will look like at the end of the year, we can relax slightly in the knowledge that most lenders have started to slowly reduce rates.

Core inflation was 6.9% in July, unchanged from June, which saw the highest level since 1992.

With inflation remaining as stubborn as my seven and four-yearolds in Hamleys during the festive period, markets are forecasting further base rate rises as the Bank of England continues with the main tool in its toolbox to bring down inflation.

As Robert Sinclair from the Association of Mortgage Intermediaries (AMI), speaking with Foundation Home Loans on a recent webinar, eloquently put it: “[It is a] tool created back in the ‘80s, when 80% of people had variable mortgages and 70% of ownership had mortgages, so if they move interest rates up, it had a very quick impact on the economy.

“We’re now in a position where 80% are on a fixed rate and only 50% of ownership have got a mortgage. Therefore, the population impact is much smaller, and it’s going to take a lot longer for that to feed through and deal with the issue.”

While swap rates at the end of August broadly mirrored the end of July, there’s still a margin for lenders to reprice fixed rates downwards, but at a slower pace than initially hoped.

NICHOLAS MENDES is mortgage technical manager at John Charcol

Now that markets are se ling and lenders are no longer playing weekend rate change poker and ‘catch me if you can’ with brokers, we can spend more time doing what we do best: delivering a high level of service to our customers – unless you’re an estate agent that relies on blackmail to secure clients. While there is an expectation that fixed rates will continue to fall slowly through the rest of 2023 and into 2024,

certainty and stability remains key for mortgage holders; as a brokerage, we’re seeing mortgage applicants overwhelmingly opt for fixed rates versus trackers or discount products.

For the remainder of the year, I expect to see lenders continue to reprice downwards, albeit sporadically, with a mixture of criteria changes. Recent changes – from HSBC extending the term to 40 years, or No ingham BS accepting sale of mortgage property for interest-only – aren’t revolutionary. However, in the current climate, lenders will be tweaking their criteria to align with competitors and win over more business.

These tweaks are certainly welcomed, and I encourage more lenders to review their policies, as this helps maximise the opportunities for brokers to place cases. ●

I expect to see lenders continue to reprice downwards, albeit sporadically”

Perspective is a tricky thing to get a handle on – especially when it comes to the economy. Everything is measured by the rate of change, the absolute value, the rise, the fall, the stay the same. There may be no be er way to describe our economic health, but it does lend itself to painting a picture with a dramatic lack of perspective.

There are few examples of this conundrum which be er illustrate the damage that thinking about the economy within the limitations of percentage change does, than with house prices.

First of all, averages are almost meaningless, especially in the housing market. What’s an average house? In Pimlico it might be a Victorian converted terrace. Next door to Kensington Palace, it’s a vast multi-million-pound mansion with electric gates and security guards. In Carshalton Beeches, it’s a 1930s semi. Inner city docklands, you’re probably talking glass and steel skyscrapers with a balcony and ‘partial river view’. Mansion blocks in Maida Vale, high rise estates in Tower Hamlets, mews in Mayfair.

To claim that house prices are rising or falling anywhere is o en to completely miss the point. It isn’t about price at all, but demand, and that comes down to the very antithesis of average.

Ironically, what the stats don’t emphasise – but should – is that it’s more important to think about the property itself. Average prices may be falling, but it’s most probably because the price of average – read ubiquitous – properties is falling.

If something is in oversupply, demand is spread across a wider base, so prices come down.

In Britain, we are lucky that our housing market is so diverse –especially in London. It’s hard to imagine a flood of identikit houses listed on estate agents’ books, all concentrated in one area.

This is exactly why the blanket numbers churned out in national price indices are unable to paint a picture that makes sense in practice. If a rare home goes on the market and a buyer is there, falling house prices be damned, that buyer will pay.

There’s another consideration when it comes to perspective on how healthy a housing market is. What are we comparing today to? The answer is at worst four weeks ago, and at best a year ago.

Do you know anyone who moves house once a year? The very fact that 2-year and 5-year mortgages are the norm illustrates that the average person stays put.

In the heady housing market days that preceded the Global Financial Crisis in 2008, received wisdom had it that most people moved home every seven years or so. Now it’s almost double that amount of time – largely because prices have risen so much in relation to incomes over the intervening years.

There are silver linings in this tale of housing market clouds gathering above the capital. There are a few things it’s worth remembering when considering falling house prices. Lower prices are irrelevant unless you have to sell or remortgage to a different lender. Indeed, lower prices are irrelevant if you don’t have a mortgage. Lower prices are good if

ROBIN JOHNSON is MD of KFH professional services

you want to move to a bigger home. A house worth £100,000 would sell for £90,000 a year later if prices fell 10%, but a house worth £500,000 would sell for £450,000 a year later on the same basis. You’re losing £10,000 on the home you sell, and saving £50,000 on the one you buy. Every time there is a downturn, we see this writ large.

Zoopla’s trend analysis showed in May that London’s housing market saw modest annual price falls of around 0.2%. At the same time, the number of agreed property sales in London is among the highest in the country. Why? Because of perspective.

Below-average house price growth in London over recent years, coupled with a so ening in prices, makes housing in the capital more affordable than five to seven years ago. It’s driving demand inwards, with properties in Inner and West London a racting more buyers than many of the suburbs. These details o en go missing when we generalise at regional and national levels. This is what really defines the health of the housing market – and in London, we’re in good shape.

Whatever else ails our industry in terms of affordability challenges, property itself as an asset is remains resilient. How many other asset classes can you name that can undergo the challenges that face housing, and still perform as well as it does.

We mustn’t forget to take a step back at times when things seem gloomy. The picture isn’t perfect for all, but dour headlines are just that. ●

Perspective is key to understand what’s really

Over the past two decades, even though the percentage of new house purchase loans taken out by firsttime buyers (FTBs) has continued to increase, high prices and affordability issues have meant a big reduction in the proportion of mortgages taken out by single FTBs.

With housing at its most unaffordable level for 150 years, firsttimers are particularly impacted. Rates of ownership among 25 to 34-year-olds are round 41%, having collapsed from 59% in 2003.

According to data from UK Finance, the number of loans to FTBs fell to 370,200 in 2022, by around 9% compared with 2021 – a year which saw the highest level of FTBs since 2006. Although the actual number of loans to FTBs fell in 2022, the proportion of their loans as a percentage of all house purchase loans increased, and now stands at 54% –its highest ever level. The continued number of FTBs entering the market reflects the overwhelming desire to become owner-occupiers.

However, the proportion of FTB loans taken out by single applicants fell in 2022 to 45%, reversing the increase in 2021 under the temporary Stamp Duty holiday. In 2006, singletons accounted for 53% of all FTB loans, but this has fallen steadily as affordability issues hit. During the first five months of 2023, the proportion of FTB loans taken out by single people stood at 46%.

Should we be concerned about this reduction? Yes. FTBs are crucial to the health of the housing market. Without them, the market would grind to a halt. We also know that the dream of owning your own home remains as strong as ever.

However, over the past 50 years, due to a combination of an ageing population, an increase in the number of divorces, and more people choosing to live alone, there has been a change in household composition – singleperson households have doubled. This has increased the demand for properties from singletons, who have suffered as the lack of housing supply has pushed up prices to levels never seen before.

There is some light at the end of the housing tunnel, particularly through the Shared Ownership scheme, which allows borrowers to buy a share in the overall value of a home and pay a rent on the rest of it. The scheme is specifically aimed at helping FTBs get on the housing ladder.

Shared Ownership has quickly become the tenure of choice for many FTBs. In 2021-22, more than threequarters of private registered provider Shared Ownership sales were to first-timers. The scheme can also help younger people become homeowners earlier, with the average age being 31, compared with 34 for FTBs in general.

Shared Ownership is especially important for singletons, as it provides a much be er chance to get on the housing ladder. In 2021-22, around 56% of these purchases were made by one-adult households, versus just 29% for FTB households in general.

Leeds Building Society is the largest Shared Ownership lender in the UK, and we know that the deposit requirements are typically lower, so it can also shorten the period someone needs to save up for their deposit. The average deposit required for a Shared Ownership mortgage in 2021-22 was £20,800, compared with £43,693 on average for FTBs.

As we approach National Shared Ownership Week in September, singletons still face huge pressures in ge ing on the housing ladder due to insufficient new-builds.

Across England there were 210,070 properties built in 2021-22, of which only around 28% were classed as affordable homes. There were 19,386 new Shared Ownership properties delivered in 2021-22, of which 92% were new-builds, meaning Shared Ownership properties accounted for just 30% of the new-build total. That figure is way too low.

It’s estimated that over the next 15 years the UK will require five million new homes – an average of 340,000 each year. This is greater than the Government’s current 300,000 target, which has not been achieved since 1971. The average number of homes delivered each year over the past decade has been under half this figure.

Achieving these targets will be difficult and will take all parts of the market to deliver this level of housebuilding, from private developers to housing associations and local government.

But the longer-term aim for the next Government, whatever that might be, should be to address the drastic shortage in housing.

The issues facing homeownership are deep-rooted and wide-ranging, but building enough homes to meet demand is the right place to start and would be the first step in delivering on the homeownership aspirations of millions of people. ●

The cost-of-living crisis, inflation, high rents and rising base rates, along with property prices far outstripping average incomes – there’s no denying that today’s first-time buyer has a sea of economic challenges to overcome on their journey to owning a home.

It’s no wonder, therefore, that generational support is becoming more heavily relied upon. More firsttime homes are being bought with support from parents, grandparents and siblings than ever before.

The ‘Bank of Mum and Dad’ –having financial help from parents in order to purchase a home – is a common concept in the UK, yet a stigma remains.

The phrase conjures up images of the privileged minority with plenty of extra cash reserves comfortably gi ing large sums of money to their children. While this is, of course, a stereotype like any other, not all who support their children in buying a home are extremely wealthy.

The fact remains that is not easy or straightforward for everyone to support their family members in ge ing a foot on the property ladder.

Traditionally, lenders have only easily supported familial support in the form of a gi ed deposit: that is, cash given to the homebuyer for a deposit with no expectation of having any of it returned.

There are strict rules that this cannot be a loan – it must be stated in writing that this is a gi with no intention of repayment. This clearly restricts who can support their family and how they can help get their foot on the ladder: in essence, only those who have enough additional cash to give away and not expect a penny back.

Family support for buying a home is becoming increasingly common, so we as an industry need to think about how we can make familial support accessible to more people.

At The No ingham, we are proud to have partnered with innovative fintech disruptor Gen H which is doing just this. As its only building society partner, we have provided a forward flow of funds to help Gen H roll out its innovative lending products to more people.

ALISONWe need to be able to allow more people to support loved ones in the journey to ownership – not just those who can gi cash reserves with no need to have it paid back.

It is partnerships like these –between historic lenders and industry innovators with a shared vision of making the dream of homeownership a reality for all – that will help make family support more accessible to a wider range of borrowers.

We must work together and support each other in this industry, to create a be er ecosystem that meets the needs of today’s borrowers.

We’re delighted to be able to provide not only funding but expertise and knowledge, as a lender with a 170-year history. As part of our partnership, Gen H will broaden who can support their families in home buying, and how such support can be offered.

Its innovations mean that people can easily help their children, grandchildren, nieces and nephews, brothers and sisters, and even friends without having to gi money that they don’t need paying back.

Whether it is by making a loaned deposit contribution as simple and straightforward as a gi ed one, or allowing a simple way to commit to supporting monthly repayments, a flexible and forward-thinking approach to family support is refreshing and necessary.

A need for innovative thinking and support is even more prudent when we consider that today’s modern borrower is not only facing external hurdles such as high house prices, but that the very nature of who they are and how they work is changing.

The concept of a full-time ‘job for life’ is simply no longer the norm. Today, ever more people are working on contracts, are freelance or selfemployed, or have multiple income streams. It is these borrowers who face additional challenges in the mortgage market, and who need as many options as possible to help them get on the ladder – including different ways for family and friends to support them.

The mortgage sector must adapt to the needs of borrowers and offer solutions which reflect the economic environment, and I look forward to seeing how traditional lenders and financial disruptors can continue work together to make familial support an option for everyone. ●

Traditionally, lenders have only easily supported familial support in the form of a gifted deposit”

e’ve seen a rollercoaster of ups and downs in mortgage rate trends since the Bank of England (BoE) began increasing its base rate in December 2021. Average market rates currently stand at 6.16% for a 5-year fix and 6.67% for a 2-year equivalent. A far cry from the circa 1% offerings which had been commonplace since 2008. Questions like ‘what will interest rates do next?’ and ‘which mortgage should I choose and when?’ are now perhaps the most common ones being fielded by brokers every day. So, when this happens, what should they say?

Well, a er months of uncertainty during which the swap rates lenders reference in pricing products have bounced around all over the place, there are now tangible signs that the central rate which influences them –in addition to other factors – may be close to reaching its peak.

BoE governor Andrew Bailey addressed the Commons Select Commi ee on 6th September, telling MPs he believed that “we are much nearer now to the top of the

cycle,” a ributing his new-found optimism to falling energy prices and a weakening labour market.

He also predicted that high inflation, which successive rate increases have been intended to curb, will “fall quite markedly” before the end of 2023. This, if it happens, will reduce the need for further tightening, and the likelihood of the BoE’s Monetary Policy Commi ee feeling the need to increase the base rate again in future months.

This, of course, means there may at last be hope on the horizon for borrowers struggling with mortgages and other cost-of-living pressures; however, brokers are still likely to hear the question ‘how quickly and how far might rates fall once the trend does reverse?’

While no one can offer a definitive answer on that, it does help to be able to explain to them all the elements at play, and what they might mean.

The governor’s change of tack follows a range of economic factors showing tentative signs of se ling down.

Threadneedle Street’s chief economist Huw Pill had already indicated that the rate rises were working, although policymakers were still having to respond as the economy and data evolved. This was due to the components fuelling the need for rate rises being volatile from month to month, as borrowers wrestle with a range of issues affecting the ability to afford both daily essentials like food, fuel and energy, and their mortgages.

The main ‘enemy’ the Government and Bank of England have been trying to beat into submission via higher interest rates is, of course, inflation.

They have faced a difficult balancing act in trying to bring this cost driver down from its recent heady heights – Consumer Price Index (CPI) inflation topped out at 11.1% in October 2022 – to their target expectation of 5% by the end of 2023, without imposing such curbs on people’s pockets that it pushes the country into recession, defined as two quarters of negative economic growth.

The latest figures released by the Office for National Statistics (ONS) for June pegged CPI inflation at 7.9%, so it seems they are on track to achieve

this crucial stabilisation; however, it’s important to remember that there are broader factors at play, and even an eventual reduction to 5% would be higher than the usual target of 2%.

Growth is another vital component of the country’s economic health.

According to the International Monetary Fund (IMF), the UK is set for the slowest growth out of the richest economies, predicted to fall to 0.5%, 0.7% below its forecast earlier in the year. Indeed, while gross domestic product (GDP) was up 0.2% quarter-on-quarter, overall economic output is still only about 1% higher than it was in 2019, pre-pandemic. We have hovered around this point since Q2 2022.

Meanwhile, in August, the National Institute of Economic and Social Research noted that we could be entering a period of stagflation – a toxic combination of higher inflation and li le growth, fuelled by the unique structural issues the UK faces, also highlighted by Pill recently, like productivity and our trading relationship with the EU.

While the potential stabilisation of rates is good news, the real challenge for the powers-that-be, going forward, will be how to drive growth without

sending inflation spiralling again. We will all now be watching September’s base rate decision in earnest.

Most sectors will have felt the impact of the past year’s economic volatility, with financial services providers like ourselves front and centre when it comes to reacting fast to cushion the impacts for our customer base.

However, it will be interesting to see how discussion evolves in the months ahead around wider factors impacting the UK’s financial health, like trade barriers, productivity and fiscal policy.

For example, Brexit continues to weigh heavy, with a recent Department for Business and Trade annual survey of 3,000 companies revealing many have concerns around red tape and supply chain issues, as well as falling demand for UK goods and services.

At the same time, the Office for Budget Responsibility (OBR) forecasts that we’re heading into the highest tax burden in post-war Britain. Both reports serve as a reminder of the UK’s ongoing challenges. The fact that, despite these, economic news remains dominated by inflationary linked ma ers more typical of boom times, further highlights the complexity.

Nevertheless, the UK is also showing signs of resilience. The collapses in growth and house prices many pundits predicted haven’t materialised, and it looks hopeful that we could avoid recession.

While this is good news on the one hand, the fact remains that any dramatic recovery still looks unlikely.

As issues surrounding inflation hopefully start to recede, the more farreaching structural challenges may become more obvious issues – lack of growth in particular.

One irrevocable truth, however, is the vital role brokers play in helping their clients – our borrowers – navigate a safe path through the minefield that is the current mortgage market, helped by innovation from lenders. ●

Just when lenders find themselves dealing with distressed borrowers – selfdiagnosed or otherwise – Consumer Duty has added more complexity to mortgage lending. This does as much, I think, to increase lenders’ regulatory risk as it does to address the economic risk to borrowers.

Consumer Duty is the first step on a path that moves away from a focus on pure product regulation, and the behaviour and processes around that, to embrace a notion of borrower outcomes. We will all discover in due course how broad that word really is, but it is seismic in its implications for everything around advice and borrower management.

Key to the idea of good outcomes is the idea that a lender understands its borrowers, and how vulnerable they might be.

money is arguably vulnerable. A er all, they are in someone’s debt. But the real point here, on a practical risk basis, is around how firms decide what action to take with which individuals.

For now, at least, we should assume that borrowers are not vulnerable until circumstances, either of their own others’ making, have made them so.

Interestingly, in addition to the Consumer Duty requirements, some lenders have signed up to the Mortgage Charter and pledged to offer certain remedies which, while not new, defer economic judgements to political decision-making rather than prudent lending.

Clearly, the right option for any borrower in distress will depend on the customer’s circumstances. But in those very moments, that might not be so obvious. It is unlikely that everyone will simply unanimously agree which measure best delivers the right outcome.

TONY WARD is non-executive chairman at Fortrum

We go back to outcomes. “Our rules require firms to consider the needs, characteristics and objectives of their customers – including those with characteristics of vulnerability –and how they behave, at every stage of the customer journey,” states the FCA.

“As well as acting to deliver good customer outcomes, firms will need to understand and evidence whether those outcomes are being met.”

The intention of this regulation is to offer greater protection to consumers, and with good reason. The majority of lenders are readying themselves for 2024, and recent senior appointments among lenders in collections departments tell their own story.

To recap, the Financial Conduct Authority (FCA) is crystal clear. It states: “Our view of vulnerability is as a spectrum of risk. All customers are at risk of becoming vulnerable, but this risk is increased by having characteristics of vulnerability.

“These could be poor health, such as cognitive impairment, life events such as new caring responsibilities, low resilience to cope with financial or emotional shocks and low capability, such as poor literacy or numeracy skills.”

Vulnerability as a concept in financial services, it appears, is expanding. I’d be tempted to suggest that anyone who needs to borrow

We will in some instances, I am sure, have the prospect of doing the very best to keep people in their own homes even when the circumstances this action create more problems at the end of a period of payment relief. Borrowers may actually owe more than if they had handed in the keys. There will be exceptions where walking away will be the best option for a borrower.

The line is unclear, and boardrooms need to understand that the guidance they give at a high level will have to work at a granular level operationally, and be evidenced as such.

When does forbearance start to act to the customer’s detriment, who is the judge of this, and can it be decided before the fact?

When interest rate movements happen, who becomes vulnerable, and should all responses really be the same?

It’s a division of most lenders’ operations that has lain relatively untested since 2007. Most expect arrears to grow and initial signs of distress are already visible. Lenders are under no illusion that the regulator expects forbearance and leniency where consumers are under duress through li le fault of their own.

Consumer Duty has changed the focus of what constitutes good behaviour, and it is more important than ever that lenders understand the risks to their loans from this change. From distribution to servicing and funding, many of the logical actions implied as a result of these rules will impact how loans are wri en and managed for years to come.

As we move into a new era of consumer care, the entire value chain from broker to funder will need to understand where their responsibilities lie, where the handoff points begin and end, and how the interplay between the parties involved in lending has to evolve to afford not just be er outcomes for one party, but for everyone. ●

The entire value chain from broker to funder will need to understand where their responsibilities lie”

complete, at a time when speed is o en of the essence.

The second component is the role of title insurance for relatively straightforward remortgages.

days. It’s not a long period of time. It’s less than your two-week summer holiday, for example.

But following the launch of our fasttrack remortgage service last October, this is the average time it takes for our remortgages to complete once the offer has been issued for borrowers using this service. The time taken by the broader industry is higher – much higher – but more on that in a moment.

It seems reasonable to assume that the velocity of remortgage approvals could be the story of the industry for the rest of the year.

A vast number of fixed-rate deals need to be remortgaged. Some 81% of outstanding residential mortgages are fixed agreements and – according to Government data from January – most of those coming to an end this year were set at interest rates below 2%.

As if anyone needs reminding, the Bank of England’s base rate currently sits at 5.25%, a er a rapid ascent.

Approximately 800,000 fixed-rate borrowers will have gone through this process in the second half of this year. How many of them will experience high levels of anxiety about ge ing their deal over the line before it expires, while also worrying about being exposed to higher rates?

Increasing the velocity of approval, improving borrowers’ chances of achieving the rate they want, and reducing these likely levels of anxiety are all possible.

This is why we believe that it is important to put borrowers back in control of the remortgage process, enabling them to complete quickly once the mortgage offer has been issued.

One material contributor to these shorter remortgage approval times is efficient conveyancing. In our view, there are two components to speedy and effective legals.

The first is an in-house legal team. This means a team of solicitors who sit within the mortgage business, rather than an agreement with a single law firm or panel of solicitors.

External legal advice can, of course, bring many benefits. These depend on the specific lender-lawyer service level agreement and the type of transaction taking place. Not all cases have straightforward legal requirements, and in those instances it would be prudent to obtain separate legal representation.

However, when lenders start to bundle such services into their products, marketing them as free legals, the cost benefit can easily be wiped out if it takes weeks or even months for the remortgage to

Post-transaction title claims – from a property’s previous owners, its builders, or others – are not common. Nevertheless, they can pose a significant threat to the remortgaging process, especially in terms of time. Just when your client believes they have a done deal, they are thrown off balance by this wagging tail risk.

Bundling title insurance into the legal process from the start can reduce the time it takes to remortgage. This is what can take a borrower down to that 11-day average.

Essentially, what we have here is the second charge legal process placed into the first charge market. This is all designed to put the borrower in control of their remortgage process.

We understand the siren call of free legals can appear a ractive. The cost-of-living crisis continues, with household disposable income down 0.6% year-on-year, and more than 1.4 households facing the prospect of higher interest rates.

Free legals do not necessarily mean be er legals. They can, in fact, o en mean a longer process. This is the ‘two to six weeks’ o en quoted by the industry. Plus, a longer process can mean missing the target date of a deal’s expiry. At a time when anxiety levels will be high, this is needless additional pressure on the borrower.

Instead, pu ing the borrower in control of time and costs, giving them piece of mind about their chances of meeting their target, is surely the bigger and more valuable prize. ●

Apre-nuptial agreement – or ‘pre-nup’ – is a legal document drawn up between a couple before their marriage to outline how each of their assets will be divided in the event of a divorce. A post-nuptial agreement does exactly the same thing, only it is created during the marriage.

To many, the idea of signing a prenup may seem unromantic, or even pessimistic. However, this is far from true. Even se ing aside the high rate of divorce in the UK, pre-nups are a very sensible way to enter into a marriage with a shared sense of openness and honesty, and should be kept in mind by all financial advisers when exploring wealth protection and estate planning options for clients.

Unlike many jurisdictions around the world, pre-nups are still not legally binding in the UK. There has, however, been a growing recognition within the English courts that pre-nups that have been entered into properly should be upheld, provided they meet the needs of the parties concerned.

If dra ed properly and with all the necessary criteria satisfied, pre-nups can be an invaluable tool to protect wealth and provide both parties with a degree of certainty for the future. They help avoid lengthy and distressing litigation when a relationship breaks down, saving time and money, and are increasingly viewed as a way to foster trust and open communication between parties about finances.

At Hall Brown Family Law, we have seen an increased number of instructions over the years from

couples wishing to enter into a prenup. Generally speaking, they are more likely to be put in place when one partner entering a relationship already has, or is likely to receive, more assets than the other. For example, the most common scenarios tend to be: those who enter a relationship with generated wealth or established business interests; those who have, or are likely to receive inheritances; and landowners, business owners or couples who are marrying later in life and wish to ensure that the wealth they have built up can be passed on to their children.

It’s important that clients understand the benefits of a prenup, and how it can significantly support people when it comes to amicably dealing with a relationship breakdown.

Asset protection: Once married, parties have various financial claims against one another’s assets, which can include those brought into a relationship. A pre-nup helps protect assets such as inherited wealth or anticipated inheritance, business and trust assets, gi s, properties, and children’s financial interests, as well as other valuable assets.

Clarity: This type of agreement allows for a degree of certainty and transparency which can avoid arguments later down the line on visceral issues. It is also an opportunity to view things in a fair and objective manner, as opposed to a position of potential hurt or conflict, where emotions can cloud judgement. Cost benefits: It is far less expensive to negotiate and dra a nuptial agreement than embark upon expensive financial proceedings upon divorce.

ELLEN FELL is a senior associate solicitor at Hall Brown Family Law

Less stress, more freedom: Not only does it minimise acrimony upon separation, but it also allows for greater freedom of choice as to what to include in the contract, as opposed to having the terms imposed. Control: Clients can choose a specific process. This might include collaboration, mediation, or roundtable meetings, whereby the dialogue can be far more valuable than wri en communication.

We understand that advisers o en find themselves dealing with clients who require family law advice, and there are many unanswered questions clients may have. Financially, it is always in the best interest of the client to seek legal advice at the earliest possible time to safeguard their finances, understand all the options available to them and allow for future plans to exist.

At Hall Brown Family Law, we thrive on working with clients to help them enter or exit commi ed relationships in a financially secure way. ●

Pre-nups and

There has been a growing recognition within the English courts that pre-nups that have been entered into properly should be upheld, provided they meet the needs of the parties concerned”

value of what he refers to as the ‘mutual mindset’, which he rst found when he joined e Woolwich.

He says: “Re ecting on my career, the mutual sector is one I feel quite strongly about.

“ is is the notion of, yes, being a business that strives to generate a pro t, but one that sustains its position to continue to provide its services well into the future, and distribute the value that it generates through its membership and into the community it serves.

“It’s a relatively simple model, but one that I found a very strong connection with.”

Wass describes this mutual ethos as being focused on pro ts as a source of sustainability and a cushion for the future – whether that is in the context of steady growth, or a bu er to provide protection for both the society and its members against the shocks and vagaries of a cyclical market.

He also sees this mindset as being inherently linked with listening to members, and using those pro ts to develop the business in ways that are important to them.

From the point he started out at e Woolwich in the ‘90s, through to two decades spent at major institutions – including Barclays and Nationwide – Dan Wass’ career has given him a strong foundation and broad base of expertise in nancial services.

All of this came to a head when he took over as CEO of the Buckinghamshire Building Society in September 2022, with a view to focusing on the mutual’s everyday relationships, reinvigorating its membership, and moving it from a product to a propositional mindset.

At the anniversary of his taking over this role, e Intermediary spoke with Wass about his achievements so far, how the Buckinghamshire Building Society has fared during a turbulent year, and what lessons he has learned for the months ahead.

Looking back over his experience so far, Wass notes that he has always been aware of the

“Once we’ve made sure that we’ve got su cient protection and cushion for the future, we can then start to invest in our products and services,” Wass explains. is is one of the things that drew Wass to Buckinghamshire Building Society.

He says: “I could see from the beginning that Bucks has a very clear mutual ethos.

“It’s very proud of its heritage and its roots, and has been around for a long time – founded in 1907. You won’t be surprised, then, to hear that there is also a strong set of values and a strong culture.

“It was a combination of those reasons that meant that, when the chance arose to lead [the society], it was a real opportunity and privilege to join an organisation with that heritage, purpose and mutuality, and a team of people that have such strong values.

“It was a big opportunity to lead and shape that for the future.”

Part of this mutual ethos, put simply, is that the building society is very much rooted in Buckinghamshire. It has worked hard to maintain deep connections to its community, while also, of course, distributing mortgages at a national level.

Jessica Bird sits down with Dan Wass, CEO of Buckinghamshire Building Society, to look back over his rst year at the helm, and ahead to the society’s futureBuckinghamshire Building Society

Overall, Wass explains, this mutual mindset – whether it is investing in local relationships, creating a cushion for an uncertain future, or listening to what members want – is increasingly important in the modern world.

Mortgage borrowers across the board are facing rising costs, tightening in ationary pressures, and an ever-moving carousel when it comes to products and prices. For many, the value of working with an organisation that focuses on sustainability and accountability, both for its clients and in its impact on the world around it, is only going to rise.

Wass says: “ ere is a strong resonance with those sorts of business models, given the pressures that the planet is facing at the moment – fairness, sustainability and the distribution of value is as relevant today as it ever has been.

“As the world moves on at pace, even more people will take notice of this model.”

While the idea of having a clear culture and set of values, as well as pride in its heritage, history and local community, are all well and good, Wass is clear that this foundation is not just high-level messaging and good PR.

It also shows in the day-to-day dealings brokers and members have with Buckinghamshire Building Society. To put it simply, this is not just talk.

One element that makes Bucks stand out, for Wass, is its clear mortgage and lending proposition. At its core, this is founded on the simple purpose of supporting people into homeownership.

Beyond this, however, the building society has carved out certain niches, such as tailored products for those with credit blips, family assist options to allow parents to help their children onto the housing ladder, joint borrower sole proprietor (JBSP) mortgages, self-build deals for those looking to build their own dream home, and on into buy-to-let (BTL), holiday let, and specialist expat o erings.

One of the factors underpinning this proposition, Wass says, is the commitment to provide brokers and borrowers with “access to human beings.”

is includes human underwriting for every deal it handles.

“ at sits right at the centre of our proposition, and is one of the things that is uniquely di erent about our approach,” he adds.

“In accordance with that, we’re able to think about how we nd solutions to needs that can be identi ed in the market, whether they’ve

The team has worked incredibly hard to build these strong, open relationships with the broker community. And we can see through the feedback that this really has resonated – we hear back about the openness, friendliness and supportive nature of the teams that work here”

been raised through our broker relationships or through our own members directly.

“We have this unique position where we can start to see those opportunities.”

is consistent approach to seeking both new opportunities and solutions to the real issues faced by members and brokers is also supported by the society’s strong local partnerships. ese help it understand the market realities, and work with partners and members to focus on their needs.

“ e ‘Bucks way’ is to deliver a service that matches the product line,” Wass says.

Brokers are a particularly important element of this. To this end, Wass explains, the society’s approach centres on accessibility, openness and transparency.

“ e team has worked incredibly hard to build these strong, open relationships with the broker community,” he says.

“And we can see through the feedback that this really has resonated – we hear back about the openness, friendliness and supportive nature of the teams that work here.

“Given the challenges the market is facing at the moment, those elements are particularly strong.”

While Wass settled quickly into his new role, it was certainly not against a market backdrop anyone would wish for.

Whether the seemingly endless interest rate hikes, the e ects of the cost-of-living crisis on large swathes of the borrower community, or broader geopolitical turbulence on the world stage, this has been a dramatic year, to say the least. is has taken an inevitable toll on the mortgage market, and the lenders that make it up.

“ e market has changed dramatically just in the year I’ve been here,” Wass says.

“It feels completely di erent to where it was 12 months ago.

“What would have been the relatively simple task for lenders of pricing mortgages then is now a very challenging thing to do, driven by a lot of uncertainty.

“It has made for challenges in pricing funding and mortgages at a level that is sustainable.

“ ere is a global geopolitical set of challenges, combined with the national circumstances that have stimulated a lot of change.”

Nevertheless, Wass points out, Bucks itself has shown some solid results, even reporting 12.7% asset growth and a £1.5m pre-tax pro t when it released its nancial results in March 2023.

In addition to this, the society hit all its key metrics, including member satisfaction, which remained strong in spite of the challenges facing lenders.

“As I re ect, the year has passed very quickly, but it’s a year in which we’ve taken some big strides,” Wass says.

“We had a clear strategy when I arrived, and that hasn’t changed.

“As a small society with a distinct proposition, the strategy was to achieve a level of measured growth.

“What we did a year ago, which I was particularly pleased about, was to put a simple shorthand around that strategy, which we refer to as: sustainably strong, member centred and community rooted.

“What that has done is allow us to both internally and – to an extent – externally build better communications and marketing, and to distil our priorities down and create more clarity as to how our proposition is put out to the market.

“It has allowed us to sharply prioritise internally, and to channel our e orts in ways that we know matter to our members and the brokers that we work with.”

Wass also re ects on the community aspect of the mutual model, with the society having made key investments into local organisations such as the South Bucks Hospice over the past year.

Looking back at those nancial results, Wass has a positive outlook for the society in the year ahead.

“I was really pleased with the solidity of those results in the context of a market that,

for everyone, was particularly challenging,” Wass says.

“Going back to that mutual model, that enables us to think about how we’re going to invest further in the proposition.”

As well as taking a closer look at aspects like technology, this is about investing further in local relationships, particularly with brokers.

He says: “ e broker relationship is key for us, and how we develop those relationships is important, too.

“At the moment, we’re starting the extension of our Platinum broker proposition, extending those services to brokers based locally, in order to o er them fast-tracked [decisions in principle (DIPs)] and applications, right the way through to exclusive products.

“We’re looking at ways we can particularly drive up the local proposition, whether for mortgage brokers or directly to members.”

For the second year of his tenure, and following a strong performance in the rst, Wass says the focus will be on “moving with the times but recognising feedback.” is includes boosting members’ online access on the savings side, and looking to extend its community investment and partnership programme into 2024.

For the wider market, Wass says that casting an eye back over the dramatic challenges faced over the past year does show evidence of a silver lining, in that it has demonstrated the resilience of the both the economy and, more speci cally, the housing market. is makes him hopeful about staving o recession, and could allay concerns about a the potential for a signi cant house price drop.

Wass says: “ ere are signs of resilience there, though I don’t think we’re through the woods yet.

“ e mortgage market has clearly been subdued, and will continue to be, but has shown signs of resilience too.

“ ese conditions will continue, certainly in the short-term.

“ ere will be increased competition for funds over the short-term as lenders look to secure funding at the right price, and until the base rate stabilises it will continue to be a challenging environment.”

Rather than a bleak outlook, however, Wass explains that it is times like these when lenders such as Buckinghamshire Building Society, with foundations focused on steady growth, sustainable pro ts and supportive service, are able to come into their own.

“We – and other lenders with a similar ethos –should be there for our respective members and brokers,” he says.

“ ese are the times when we should be listening to the market and our partners, to what their needs are, working through where it’s prudent for us to participate.

“ ese times are designed for lenders like us, as long as we are clear about where people’s needs are, and where we can and cannot provide solutions.

“We shouldn’t feel pessimistic, we should look for those points of opportunity and optimism.”

When looking ahead to the future, for both the market and the building society itself, Wass further stresses the importance of remaining optimistic.

Indeed, this is all the more important as he predicts that 2024 will see more of the same when it comes to market turmoil and uncertainty. Even when the market does move beyond this turbulence, it is unlikely that it will ever quite see a full return to the conditions that were considered normal prior to the Covid-19 pandemic.

However, he notes that even in the face of these challenges, it is clear that the housing market is stronger than it was during the 200708 Global Financial Crisis, and while advising caution, he does not anticipate a substantial house price drop, despite some of the more pessimistic predictions plaguing the headlines.

For Bucks, the future means continuing its steady, sustainable growth strategy, guided by brokers, members and its local partnerships. is includes enhancing the journeys of both brokers and members, as well as considering what areas of the market are currently underserved, and where the society would be best equipped to make a di erence.

“ ere are some important things we want to do to enhance our local partnerships with brokers, so expect to see more of that in the coming months,” Wass says.

Finally, he concludes: “Ultimately, we will be growing sustainably, being membercentred – which brokers are integral to – and community rooted.

“ at agenda remains, and we will just be looking to refresh it, re ne it, and keep it relevant.” ●

These conditions will continue, certainly in the short-term. There will be increased competition for funds over the short-term as lenders look to secure funding at the right price, and until the base rate stabilises it will continue to be a challenging environment”

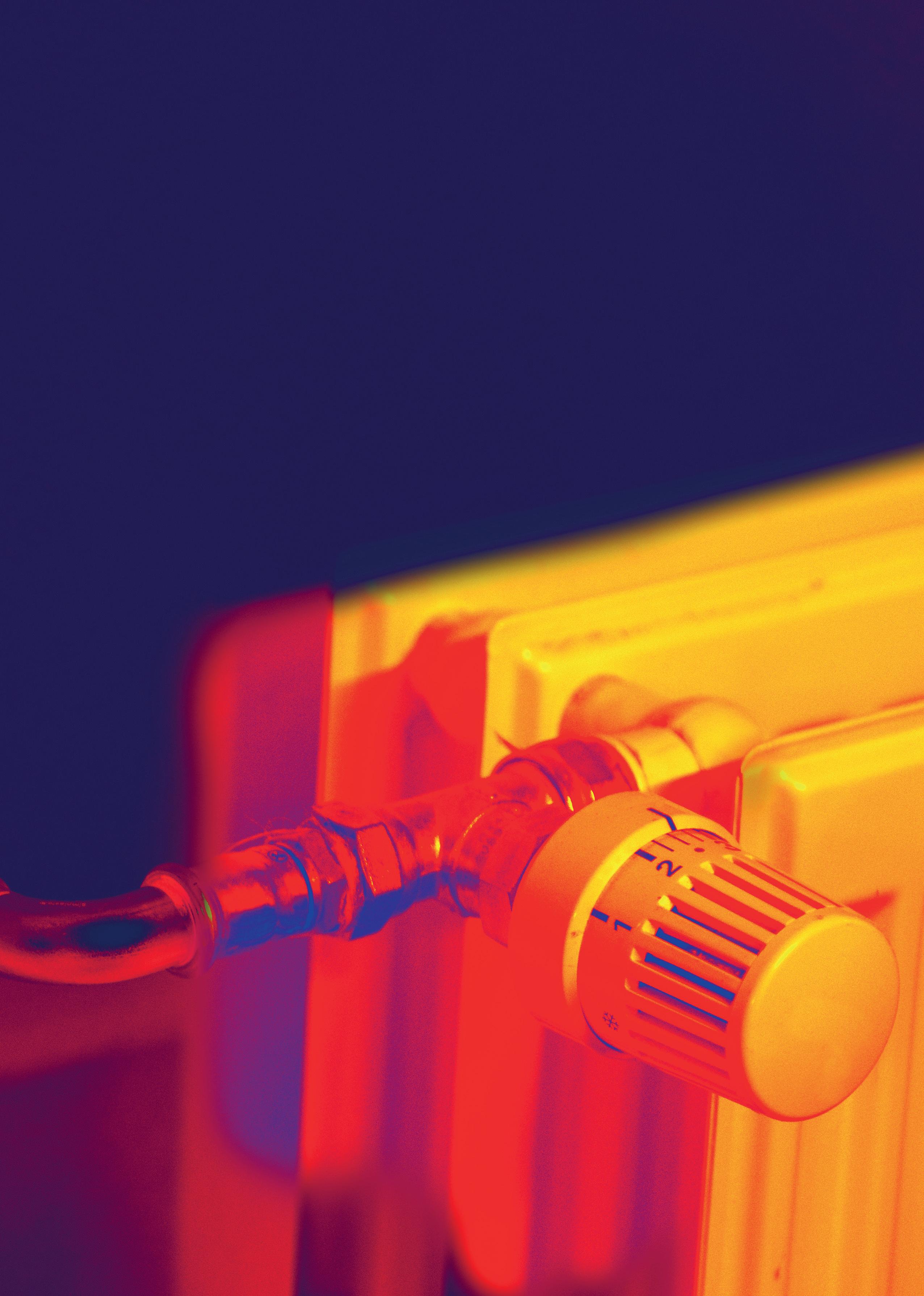

For more than two years now, landlords have been living under a cloud of uncertainty.

Potentially, they face a bill in the tens of thousands of pounds to ensure their properties have an Energy Performance Certificate (EPC) rating of at least Band C by either 2025 for new tenancies, or 2028 otherwise.

I say potentially, because the bill proposing that has fallen into some sort of political purgatory, yet continues to evolve in the background, such that a new single deadline of 2028 has recently appeared.

The snappily titled Minimum Energy Performance of Buildings (No.2) Bill, introduced in 2021 by the late Sir David Amiss MP, reached the second reading stage in May 2022 and has stayed there ever since.

Going by current timescales, that means landlords have less than 15 months to find the money to make the required upgrades. That is simply unfair, and is nowhere near enough time.

Given that the bill must go through 10 more steps in the legislative process before it receives Royal Assent, there is no way the current timetable is workable. That’s assuming it becomes law at all, seeing as so few Private Members’ Bills do.

As a result, calls for the implementation of the bill to be delayed have grown louder. The most recent of those came from none other than Michael Gove.

However, in my eyes, the bill not only needs to be delayed – it needs to be rethought entirely.

As one of the first lenders to introduce a green mortgage range in

2021, we wholeheartedly support the drive to make the UK’s housing stock more energy efficient.

While I have no doubt that this bill was proposed with the best intentions, it is the wrong document, in the wrong place, at the wrong time.

There are so many holes and potential pitfalls in the legislation that there is a serious risk of unintended consequences, were it to go through in its current format.

Firstly, basing the legislation on the flawed EPC system is unwise at best. EPCs are not fit for purpose, as they are based on energy costs, rather than emissions, meaning they do not always incentivise property owners to lower their carbon footprint.

Architects have also argued that these simplistic certificates unfairly punish owners of older buildings, and are based on outdated data assumptions.

While the EPC system is clearly flawed, I am conscious of the fact that it is the best we have currently got. However, a commitment to reforming it should form part of this legislative bill.

Another major cause for concern is the proposed exemption clause. As things stand, landlords can apply for an exemption if the cost of the works exceeds £20,000, or the work is unfeasible.

But how will that be policed? What’s to stop a canny property owner obtaining a grossly inflated quote from a friendly-yet-unscrupulous builder?

Moreover, it is far more likely that energy efficiency upgrades on a £2m house in Surrey will breach the threshold than a £200,000 house in Bradford. This clause punishes those landlords who can least afford it.

Incentives and tax breaks are sometimes controversial, but I cannot

COOLEsee how this policy could be workable without them.

The expression of a ‘carrot and stick’ approach stands the test of time across all areas of endeavour – where is the incentive that always precedes the penalty?

Suggestions that lenders will simply further ‘incentivise’ those who can get to the required level stops short of considering the real costs and disadvantages to those who cannot ever reach that level.

At the moment, the legislation will require lenders to ensure that the average energy performance of their portfolios is at least EPC Band C by 31st December 2030.

Lenders could decline to lend on new transactions from an effective date, but those with current mortgages would rightly challenge the terms and conditions that do not cover this requirement, and turn lenders into the Government’s police.

As an industry, we have spent over 15 years agonising about mortgage prisoners, yet now run the risk of creating a far larger cohort of ‘property prisoners’.

Unfortunately, everything is up in the air, and as far as anyone can tell, we are no closer to getting a clear position from politicians.

We need MPs to agree on a position and a timetable, but most importantly, they need to address all of the weaknesses I have identified above.

If they don’t do that – and soon –then I worry the implementation of this piece of legislation could be a catastrophe. ●

In light of the economic turbulence experienced in recent times, a large number of landlords across the UK have taken stock of their financial position and the performance of their portfolios, and in some cases, re-evaluated their short, medium and longer-term buy-to-let (BTL) aspirations.

Inevitably, this has led to some landlords selling up and exiting the market altogether, although it’s fair to say that this trend has been far more prominent among landlords with one or two properties, rather than at the more professional end of the spectrum. In fact, from discussions with our intermediary partners who service the needs of larger portfolio clients, confidence remains largely unwavering among this latter type.

This assurance helps underline just how remarkably resilient the BTL market continues to be.

One of the main factors behind this sustained confidence is the number of competitive options still available for landlords who benefit from the tax efficient nature of trading through a limited company vehicle, and from the lower levels of stress testing by many lenders for this product type.

The sustained rise in limited company lending has been ably supported by the quality of advice on offer across the intermediary market, not to mention an even more professional approach on show across the whole sector. This trend is only likely to continue.

In fact, according to the Q2 2023 Landlord Panel research from BVA BDRC – in conjunction with Foundation Home Loans – almost three-quarters (74%) of respondents

are now intending to buy their next property within a limited company structure, a figure which represents a new high, up 12% compared with Q1.

The report outlined that only 17% plan to purchase as an individual, a fall of 7% on the previous quarter and a whopping drop of 12% compared to Q4 2022.

Those with larger portfolios remain significantly more likely to purchase in a limited company structure – 63% of six-plus property landlords, versus 37% of those in possession of one to five properties.

The strength of tenant demand is also playing a key role in the positive outlook for portfolio landlords, and with a growing number of potential buyers being priced out of the housing market – a combination of significant house price growth, higher mortgage rates, rising living costs and the impact on affordability – there continues to be a supply and demand imbalance.

This combination is forcing more people to rent for longer, which – in a classic ‘Catch-22’ situation – is fuelling further demand, pushing up rental costs and therefore denting financial capabilities to build deposit pots for a future purchase.

These factors were reflected further in Q2 BVA BDRC data, which showed that tenant demand remained high and stable, with two-thirds of respondents reporting increased demand over the last quarter.

The research outlined that just 2% of landlords have seen a fall in demand over the past three months, and there’s no sign of any let-up, with demand currently sitting at a historic high.