REINFORCING THE SAFETY NET

How Consumer Duty rules will shape the future of the protection market

How Consumer Duty rules will shape the future of the protection market

Skipton Building Society stole the headlines this month with its 100% mortgages launch. This led many commentators to ask if they are a good thing. In my humble opinion, they are, and pardon the laziness here: 100% so.

To be clear, what I am about to say here is in no way aimed at The Skipton; I believe it is sincerely trying to help a truly underserved sector, and I hope more lenders follow. The issue is that there is a middle ground between reckless lending – see 125% mortgages from Northern Rock – and these 100% products that we will certainly see others offer in the coming months.

If you don’t have access to the ‘Bank of Mum and Dad’ and have no deposit, you rent, paying more than a mortgage costs. People get trapped in a cycle, and the issue comes down to paying rent or other bills. You pay rent because, above all else, keeping a roof over your head – and in some cases, your kids’ – is the priority.

My dearly departed grandfather always told me: “Keep a roof over your head and then deal with the rest.” But based on that logic, a credit card payment may be late, or perhaps you miss a month on a loan to pay for a school trip, or make a payment slightly late to catch up on that missed loan. As if by magic, your credit is impaired.

100% mortgages, I’m happy to be proved

Ryan Fowler Publisher

Felix Blakeston Associate Publisher

Jessica Bird Managing Editor

Jessica O’ Connor Reporter editorial@theintermediary.co.uk

Claudio Pisciotta BDM

claudio@theintermediary.co.uk

Maggie Green Accounts

finance@theintermediary.co.uk

Barbara Prada Designer

Bryan Hay Associate Editor

Lorraine Moore Subscriptions

subscriptions@theintermediary.co.uk

wrong, will require proof of rent payments alongside proof of affordability and a good credit record.

These things are rarely so clear-cut. Indeed, FCA data shows that the number of adults struggling to pay their bills and debts has soared to nearly 11 million. That’s some 3.1 million more people facing difficulties in January than they did in May last year.

Kudos to The Skipton – it has made a bold move and hopefully started the journey towards helping the underserved. Does this mean a return to sub-prime? Not even remotely.

Is negative equity also a risk? Of course, it is. But surely this is something that lenders will factor in and find a solution to.

Find solutions, be innovative and don’t create undue risk. Lending at 125% is madness. Supporting people who can prove that, while not conforming to a standard credit profile, they can pay their potential mortgage, is a noble cause.

I’d like to add that Leeds Building Society, though drowned out by the Skipton news, is also looking at innovative ways to help those who pay their bills but may not be seen as prime.

In this issue, we look at another area of the market that isn’t given the a ention it deserves – protection. Alongside the plight of the renters that Skipton is trying to help, the complete lack of protection in some areas is a serious issue. ●

Alexander Manas | Alison Pallett | Allan Smith | Andrea Glasgow | Ben Bailey | Brian West

Bruce McDonald | Charles Morley | Charlotte

Grimshaw | Chris Needham | Chris Pearson

Colin Sanders | David Jones | Hannah Smith |

Heidi Deaton | Helen Scorer | Ian Russell

Jacqui Gillies | Jason James | Jonathan Sealey | Jon Sturgess | Maeve Ward | Mags James

Mark Davies | Mark Roberts | Martese Carton

| Mike Illingworth | Neal Jannels | Neil Dyke |

Nick Mendes | Nick Russell | Paul Brett

Piragash Sivanesan | Ranjit Narwal | Reece

Bedall | Robin Johnson | Shelley Read | Steve

Goodall | Susan Baldwin | Tom Denman-Molloy

| Tony Ward | Victoria Wilson | Will Hale

INTERVIEWS & PROFILES

The Interview 58

FEATURES & REGULARS

Feature 26

Hannah Smith looks at effects of the upcoming Consumer Duty regulations

This month The Intermediary takes a look at the housing market in Leeds

An eye on the revolving doors of the mortgage market: the latest industry job moves

SECTORS AT-A-GLANCE

Residential 6

Buy-to-let 30

Later Life 34

Specialist Finance 38

Technology 48

Second Charge 57

Protection 62

CENTRAL TRUST AND MERCANTILE TRUST

Commercial director, Maeve Ward, discusses product innovation, second charges, and helping underserved markets

STRIDE UP

Jon Sturgess discusses the lender’s commitment to helping first-time buyers onto the property ladder

Q&A 24

JOHN CHARCOL

Nicholas Mendes talks about John Charcol’s legacy, current innovations, broker support and more

In Profile 44

LDS

Mark Roberts shares how LDS’ unique proposition is reinvigorating the development market

SANTANDER

Bruce McDonald tells us about the challenges and opportunities he faces as a business development manager

For us, working closely with the brokers who have access to our mortgages is more than just providing them with the products and the means to submit applications, or answering their case questions in a timely manner. Having a lasting, meaningful and beneficial relationship with brokers is extremely important to us, and providing regular and ongoing opportunities for continuing professional development (CPD) plays a big part of that.

We want to support brokers in developing their skills to become more rounded operators.

One recent example was our second Emerging Talent event, which took place on 27th April at HSBC’s global HQ in Canary Wharf. A room full of ambitious young women and men gathered to invest in their personal development, build knowledge and network with fellow professionals.

It was a real privilege to spend some quality time with the next generation of mortgage professionals coming up

through the industry. The room was buzzing with energy throughout the day, and it’s just amazing how much of that energy you personally capture by being part of it.

It’s one of my favourite events on the calendar, and as with the inaugural cohort last year, it le me in no doubt we are blessed with a healthy pipeline of talented people across the industry.

As an established mortgage lender and part of a major global bank, HSBC UK is in a position of strength to have ready access to insights, data, thought leadership and experience across a multitude of topics.

I’ve always seen this as something to be shared and nurtured, as opposed to just leaving the books on the shelf, so to speak. I think it is extremely important to equip our partners in the industry with knowledgeable insights, especially if that knowledge helps build be er businesses, drives innovation, and ultimately delivers even be er customer experiences. We all benefit from that, don’t we?

So the only question was: how do we go about sharing those insights? Thus HSBC UK’s Emerging Talent Event for Mortgage Brokers was born!

We fully intend make these events a mainstay of our calendar, and we’ll be taking the show on the road next time around, with our next stop being our UK HQ in Birmingham. We’ll be reaching out across the market for candidates for cohort three in the not too distant future.

April’s event provided insights into the economy, the mortgage market, how to be ‘a li le bit more Disney’, how lenders fund mortgages and set rates, being a brilliant broker – by the fantastic David Baker from LIFT Mortgages, the retrofit outlook, and ‘Dreams to reality and personal branding’ – delivered by the amazing Bianca Miller-Cole.

So, whilst we’re always going to mix it up a bit, a endees can expect an action packed agenda on similar lines to this. I personally can’t wait!

Before we host another set of up-and-coming brokers, we have the HSBC UK Intermediary Risk Networking Event, where 50 risk and compliance leads from some of our networks come together to hear and discuss topics that are, or should be, front of mind.

They will receive sessions providing economic and mortgage market updates, an insight into financial inclusion and vulnerability, and a deep dive into cyber threat. I’m expecting another lively session, which will provide important food for thought for those a ending. ●

To be positive or not to be positive that is the question…

As we left 2022, there was an air of trepidation across the market. Not only following the impact of September’s mini Budget, but also the Bank of England had raised interest rates to 3.50%, CPI was at 10.5% and mortgage rates were rising rapidly. Not to mention consumer confidence which had also been severely compromised. In addition early declared forecasts of gross mortgage originations for 2023 of £265bn£275bn were looking extremely over optimistic.

Fast forward several months and we haven’t exited the proverbial woods just yet as CPI remains a real concern to both homeowners and savers. At the time of writing we are waiting for May’s meeting of the MPC and there is an air of uncertainty over the direction of travel of the base rate, with some experts predicting a level of five per cent in the very near future, the highest we will have seen since Q2 2008.

It is still impossible to ignore the major ripple effect caused by last year’s mini Budget. Rates are now starting to gradually fall from the heights which saw two-year fixed rate mortgages increase by 50 per cent in a matter of weeks to 6.4 per cent. However they still remain well above where they were a year ago.

With all of this backdrop, it’s fair to say that neither the UK mortgage market nor the housing market have collapsed. Any reductions in house prices have been far more modest than predicted, even only a single digit correction, which have all helped to return an element of calmness and stability to our sector.

The intermediary community also appears far more positive than it was 8 months ago. If as expected, we see a UK mortgage market of circa £220 - £250bn in gross new originations this year - it will still rank as a strong year, when compared to the market performance over the last 15 years and in effect a return to an element of normality after the distorted years of 2021 and 2022.

In addition, mortgage maturities are expected to rise by up to 6% this year to a high of £347bn providing very strong remortgage and product transfer opportunities, especially as we approach the middle of the year – with the latter expected to be up 8% to £212bn, according to UK Finance. In addition, on the property side, recently published data suggests “Agreed Sales” may be 18% down on last year, however they have returned

CHARLES MORLEY is director of mortgage distribution at Metro Bank

to levels seen just before the pandemic, with just a 1% differential between March 2023 and March 2019. March has also been the first month where “Agreed Sales” volumes surpassed activity seen in September last year, marking a recovery from the 21% decline recorded right after the mini Budget.

The cost of living crisis is also changing the needs of many customers which in turn is changing the market. Customers now have more complex needs and requirements, requiring lenders and mortgage intermediaries to develop solutions that support the needs of today’s borrowers. An evolution which we are already starting to see more of as lenders deliver wider criteria choice and look at ways to support those looking to get on the housing ladder – who could have foreseen the return of the 100% mortgage in 2023?

So yes, the market is not 2021 or 2022 and the backdrop and influence of many external factors is making it tougher, however the combination of the pandemic and the cost of living crisis has made our industry far more resilient and resourceful than it has ever been. It is not all doom and gloom and green shoots of positivity and greater stability can be seen in abundance everywhere you look. Ultimately significant opportunity exists in all areas of the market for those that are ready and want to take it.

Quite simply, we have “to be positive.”

It’s no secret that mortgage lenders and servicers today are under greater scrutiny from regulators, investors and funders than ever before. Much of this scrutiny results in systems and processes, o en built reactively, to deliver the confidence to markets and law-makers that no undue risk is happening. However, as we have all seen recently, Silicon Valley Bank, Credit Suisse and First Republic, have all encountered problems from systemic risk.

How is this possible, when so much time, intellect and energy is devoted to rooting out risk? Many will be mu ering ‘here we go again’, but history does not repeat itself – it merely rhymes. That’s why things happen again, but differently. I’m not going to comment on the individual cases here, except to say what is evident is that risks evolve. Risk management is an organic business.

To demonstrate my point, consider the world of IT in banking and financial services. From the 1970s onwards, the development of financial services has been largely enabled and sustained by the exponential growth of systems and processing power available to financiers. The result is that, today, most financial services boards preside over a plethora of different tech platforms.

Built in different eras with varying degrees of interoperability, these platforms, once the launchpads of transformation, are o en now legacy headaches. Worse still, in reality few in these boardrooms really understand the spaghe i of systems and infrastructure over which they preside. How many executives or nonexecutives can write code? They rely on experts and partners.

Risk requires a robust approach as much as accountability to ensure it is managed properly and the interaction

of a business’ moving parts and policy decisions works effectively.

The Mortgage Control Framework is something we have developed to help boardrooms and non-executive directors maintain confidence that what they believe is happening is actually occurring on the ground.

It, too, is designed to evolve as the nature of risks in a business evolve. The risks facing a startup, for example, are very different to those facing an established business. Therefore, the approach should flex too.

What is essential is that decisions taken in good faith at the top of a company are being executed properly at the coalface. This is not to say people are deliberately mismanaging the risks on the ground, but it is an acknowledgement that companies can and do create their own silos that prevent effective risk management. There is a risk chain linking the top to bo om, but also running through different business functions.

Our Mortgage Control Framework is the first in the industry to focus on identifying and mitigating substantive risks across the entire mortgage supply chain. It is an essential reinforcement to a lender’s regular first line of defence, which – if recent events are anything to go by – may be more in need than anyone previously thought.

Our framework updates as legislation evolves, so no stone is le unturned in the pursuit of be er business practice. This kind of approach identifies the risk gaps and risk points in policies, procedures, documents and processes. For every risk point, we can then assess the severity of the risk, how it should be monitored, and how o en.

In his book ‘Outliers’, Malcolm Gladwell writes that “the typical plane crash involves seven consecutive human errors.” Plane crashes, it

TONY WARD is non-executive chairman of Fortrum

appears, are much more likely to be the result of an accumulation of minor errors.

Too o en, risk managers at every level have become accustomed to looking at big pictures or small details, but rarely understanding how these things join up. This is important because, as Gladwell observes, the devil is in the detail. It’s why something like the Mortgage Control Framework is so important. If we are always looking for big red flags, then it is likely we will miss the myriad small details that can combine to create a real risk.

Business is by definition full of risks, and one man’s risk is another’s opportunity, but where there is collective acceptance that business risk is not acceptable, either through regulators or customer or investor appetite, we have to be more vigilant.

The recent failures of financial institutions should remind us that every area of business needs to be understood, and that how it interacts with other parts of the business is as important. Heads of risk are important, but for everything else there is the Mortgage Control Framework. ●

If we are always looking for big red flags, then it is likely we will miss the myriad small details that can combine to create a real risk”

Aer a quiet start to the year, it appears that activity in the Northern Ireland mortgage market has picked up again in the second quarter of the year.

A er dropping off a cliff in 2020, pent up demand led to a market bounce back in 2021, and transaction levels remained at healthy levels well into the first half of 2022.

Then, like every other part of the UK, the local market was undoubtedly affected in the second half of the year by the economic turbulence caused by the war in Ukraine, the fallout from the September mini-Budget, and the worsening cost-of-living crisis.

January and February were quieter than expected, but we have returned to a more positive outlook through March and April, with house sales and mortgage approvals increasing across Northern Ireland as economic forecasts stabilised.

By those measures, Q1 2023 is still behind where the market was at the same point in 2022; however, local data produced by the likes of PropertyPal and Royal Institution of Chartered Surveyors (RICS) suggest that it is now returning to some sort of normality.

Feedback we’re ge ing from brokers is that many of those first-time buyers who were starting conversations in September have now come back to the table as rates reduce.

In 2022, 97% of our mortgage customers opted for a fixed rate mortgage product, with 70% of them choosing a 5-year fix. This preference has continued into 2023, with 94% of approvals in the first quarter being for fixed rate deals.

This isn’t surprising in a year when the Bank of England raised the base rate several times, it shows the benefit of ge ing mortgage advice, and also that some of the media commentary on the impact of rate rises on mortgage affordability has perhaps been overdone, with only a smaller percentage of people hit with large repayment hikes.

Affordability does, however, remain a concern. While inflation is expected to ease from record levels, prices are still expected to keep going up this year, so as a bank, we are keeping a watching brief on customers who may run into challenges.

The labour market remains strong, and at present we are not seeing any notable increase in customer distress regarding mortgage repayments. Nevertheless, levels of distress may change, and we are well prepared to support customers when they need us. We would certainly encourage people to talk to their bank as early as possible if they are struggling.

Demand for housing is expected to stay relatively strong, sustained in part by the somewhat limited supply of housing in Northern Ireland. This market has an issue around the speed and volume at which new housing stock is being built, which is likely to keep both demand and prices up.

There is also healthy competition, and Danske Bank continues to focus on innovation, particularly around sustainability.

More than half of the new mortgage lending we approved across the UK last year was through our carbon neutral mortgage product.

The first mortgage certified as carbon neutral by the Carbon Trust, it offers favourable rates to properties

with an energy efficiency rating of Band A to Band C.

This move to reward the owners of more sustainable housing is a positive step, but there are questions the industry will need to address about how it will treat lower rated properties that don’t meet the criteria for carbon neutral mortgages in the long term.

While the region waits for the rate of housebuilding to catch up with demand, there is a big opportunity in the retrofi ing and upgrading of existing housing that isn’t well rated, to bring it up to standard, so we have launched a personal loan product for this specific use.

In the short term, we anticipate the market will be relatively steady in Northern Ireland this year, with consumer demand continuing across all segments. It will be interesting to see if the current uptick in activity can be sustained, and whether any further economic headwinds are on the horizon. ●

Demand for housing is expected to stay relatively strong, sustained in part by the somewhat limited supply of housing in Northern Ireland”

Self-build mortgages are one of the more complex types of mortgage lending. On the face of it, this is simply a loan that is released in stages, but behind every successful application is a great deal of effort on behalf of the broker and the lender.

Brokers just dipping their toes may feel like this effort-reward ratio is not in their favour. With some investment, though, this type of business is not only very profitable, but also incredibly rewarding.

Here I will touch on five elements that will help brokers provide even be er support for their clients.

All self-build mortgage applications have some common elements, but there are a considerable number of factors that are unique. No lender will release funds without a thorough grasp of the project, so it’s important that brokers are prepared to put in the legwork.

If brokers are new to self-builds, or just not confident in this area, they should lean on their lender relationships. Most niche lenders in this area are more than happy to hold the broker’s hand from start to finish, and in turn, the broker can do the same for their client.

In fact, most lenders would prefer to hear from brokers before they start, as they will be be er able to spot any potential hurdles and address anomalies early in the process.

Self-build mortgages are not only required for greenfield sites where a brand new property is being developed, but also in other

circumstances, such as for major renovation works.

Whether or not a self-build mortgage is required usually hangs on a number of factors. These include if the property is uninhabitable, whether it is le without kitchen or bathroom facilities for an extended period, whether work alters structural elements, including foundations and beams, and whether work will make the property non-watertight or nonsecure at any point.

Clients may be surprised when they hear a major renovation project actually requires a self-build mortgage, but it will reduce stress further down the road if all parties are on the same page from the outset.

It’s important for brokers to get to grips with the various types of construction methods available for self-build. Over and above the basic acceptance criteria, each construction method will have implications for the timing and the cost of the build.

Lenders usually want to know that construction will begin quickly a er the application has been accepted. Usually, once the foundations are started, the planning permission is locked in. This type of knowledge will grow over time, but gaining awareness of construction types and methods would be time well spent.

It’s rare for a self-build project to progress without obstacles, from weather delays to complications with the ground. One issue o en leads to another, as third-parties will need to delay access to the site and store the components already commissioned.

Demonstrating that the project will not struggle with cashflow is essential.

Brokers must familiarise themselves with the workflow by scrutinising schedules and asking difficult questions of the client.

Clients are likely to have heard that funds are released in stages, but few understand much beyond this, so brokers can support them in deciding which type of stages is best.

A stage payment mortgage is where the funds are released in tranches, as the build progresses, and a borrower only pays or accrues interest on the monies received, and not the total amount from the outset. This helps the lender ensure that the money is being spent as planned, while the borrower has a reduced risk of running out halfway through.

The most common method is in arrears, where funds are released a er each stage is completed and the client must have adequate funds upfront. Advance stage payments are the opposite. This is a li le riskier for the lender, as the security for the loan doesn’t exist yet.

Stages usually include certain benchmarks of the build. Some lenders will offer more flexibility than others, but it’s worth noting that lenders will want a certified valuer to report on progress before funds are released, so there will be a cost to get this approval each time.

Brokers shouldn’t overlook selfbuild because of its complexities. All mortgage applications are about helping clients realise their property dreams, but there is an even greater level of satisfaction in being involved with a self-build project. ●

hen the Coronation of Her Majesty Queen Elizabeth II took place in June 1953, the average house cost just £1,692 and the average salary was £333. Now, at the time of His Majesty King Charles III’s Coronation seven decades later, it’s a very different picture. The average house price currently stands at £294,329 and the average salary is £31,928, meaning that houses are now at their most unaffordable level for 150 years.

Perhaps the only common factor between now and post-war Britain is the severe lack of housing the country faces – it’s this chronic shortage of new-build homes that has been a major contributor to the current housing crisis.

So, the Coronation is a great opportunity to look back 70 years to the ‘golden age’ of UK housebuilding, when well over a quarter of a million new homes were built each year –something which can only be dreamed about today.

There was a huge shortage of housing after World War II – with no new housing being built during the sixyear war period. More than a fifth of all homes in Britain had been destroyed during the war, with many people having to live in army camps or shared accommodation.

It was estimated that around three million new homes were needed immediately, and as a result, the Government aimed to build more than 300,000 new homes each year. However, in a post-war environment there were many shortages, including builders, materials, and money.

In May 1946, the Government announced plans to build several ‘new towns’ to relocate people in poor or bombed out areas following the Second World War.

WCommenting at the time about the Government’s vision and its post-war housing policy, Lewis Silkin, Labour’s Minister of Town and Country Planning, said: “Basildon will become a place which people from all over the world will want to visit.”

The new towns were built in three waves, and the intention was to build housing ‘fit for all income groups, not just the working class’.

The first wave of new towns were built between 1947 and 1955. Stevenage was the first, followed quickly by towns such as Crawley, Hemel Hempstead, Harlow, Welwyn Garden City, Hatfield, Basildon, Bracknell and Corby.

The second wave were built in the early 1960s, and included towns away from the South of England such as Skelmersdale, Telford, Livingston, Redditch, Runcorn and Washington. The third wave were created or expanded in the late 1960s and included Milton Keynes, Peterborough, Irvine, Northampton, Ipswich and Warrington.

A growing economy in the 1950s meant that around 250,000 new local authority homes were built each year. In addition to the growth of the new towns, around 750,000 brick homes were also built between 1945 and 1953, as well as thousands of prefabricated houses, which were factory made and assembled on site.

Many ‘non-traditional’ homes were built using various prefabrication approaches, and as a result of these new building approaches, total annual new housing completions soared, peaking in 1968 at around 400,000.

The 1960s was also the decade of tower blocks – which allowed many people for the first time to have a new property with modern facilities.

Quantity rather than quality became a priority for the Government – in some cases, good homes were demolished to make way for big estates.

Some new towns were successful, whilst others suffered high

unemployment and high levels of poverty.

The scale of the current housing supply shortage in England can be highlighted by comparing the actual number of houses built in the past 30 years to the number built in the 30 years prior to that.

Between 1959 and 1988, approximately 7.5 million new homes were built, whereas only 3.3 million new homes were built in the past 30 years. This suggests a total shortfall of around 4.2 million homes.

Yet, even as the growth in housing stock has been declining, demand for homes has been increasing, as the population continues to grow and more ‘singletons’ want to buy homes on their own.

In the Government’s manifesto document published in 2019, it set a target of building 300,000 new homes a year by the mid-2020s. This doesn’t now look achievable. Indeed, the last time 300,000 new homes were built by any Government in a year was in 1977.

In January, the Centre for Policy Studies published an excellent report called ‘The Case for Housebuilding’.

The report stated that the arguments that housebuilding is roughly keeping pace with new household formation are flawed, as are claims that that enough homes can be delivered

simply by building on brownfield land or building out existing planning permissions. As an example, London could only build 24% of the homes it needs over the next 15 years on currently existing brownfield sites.

Commenting in the report, the Right Hon Kit Malthouse MP, former Housing Minister, said: “We should all be concerned about where and how our children are going to live, but more than this, we also have a duty to give them the same or a better chance at home ownership as their parents and grandparents.

“We simply cannot do this without building millions of new homes.”

This view is supported by several individuals, charities and thinktanks. The Centre for Cities said that it will take at least 50 years to catch up with housing demand, even if the Government target of 300,000 new homes a year is met.

As recently as last month, Michael Gove, Secretary of State for Levelling Up, Housing and Communities, said the UK housing market was “broken” and “desperately” needs a greater supply of new homes and higher building standards.

In the same report, the chief executive of Shelter, Polly Neate, said the UK’s housing policy was “a mess.”

There is no doubt that achieving the national 300,000 housebuilding target will be difficult, and it will take all parts of the market to deliver this level of housebuilding – from private developers to housing associations and local Government.

The recent Government announcement, therefore, that councils will keep 100% of their Right to Buy receipts to build thousands of new council homes is to be welcomed.

However, for private housebuilders facing economic headwinds, and housing associations balancing the costs of important remediation work

with providing new homes, what is needed from Government is stability and certainty. This is, however, quite the opposite of what is being proposed in the planning reforms.

The watering down of housebuilding targets, alongside a range of other reforms, is already having a dramatic impact.

New planning applications are at their lowest level on record, and councils up and down the country are ripping up their local plans.

At the same time, changes to the way developers contribute to the number of new affordable homes has raised the concern that even fewer will be delivered. The important work being done to design the new Infrastructure Levy this year must safeguard funds for more affordable options to rent and buy.

With enough political will, and by listening to experts in the field, many of these challenges can be resolved. In the long-term, we can surely start to deliver on the homeownership aspirations of millions of people.

The issues facing homeownership are deep-rooted and wide-ranging, but building enough homes to meet demand is the right place to start.

Homeownership was once a rite of passage for young people as they grew up, but over the last decade house prices have become increasingly out of reach for millions of people.

We need a national conversation about why we’re not building enough homes, and we need all the political parties to address the real housing issues this country faces.

As ‘The Case for Housebuilding’ report succinctly concludes: “The fundamental case for housebuilding is that without it, Britain will become a less productive, less equal, less fair, and less happy country.

“If we want to rebuild our economy after the pandemic and create a better society, we need to get building.”

Wouldn’t it be good if we could look back in future years and agree that the Coronation of King Charles marked the start of a new golden age of UK housebuilding! ●

Building enough homes to meet demand is the right place to start”Jubilee street party, Wordsworth Rd, Lockleaze, Bristol in 1953

There has been a lot of talk in the industry about green mortgages over the past couple of years, and rightly so. With the country’s long-term objective of achieving net zero and the ever-increasing energy costs, sustainability and energy efficiency are at the forefront of people’s minds.

Whilst much of the conversation has focused on proposed Energy Performance Certificate (EPC) requirements for rental properties, together with the potential application to residential homes and the increasingly stringent requirements for new-builds, another area which represents a prime opportunity to support the green agenda is self-build.

Self-build properties are not only an increasingly critical part of our new housing stock, they’re a fantastic way to build sustainable and energy efficient new homes, and o en, selfbuilders are only too keen to take up the challenge.

At Mansfield Building Society, we take a permissive approach to lending criteria, and we’re open-minded when it comes to non-standard construction types – the majority of which are much more energy efficient once a property has been built, but also o en offer a more sustainable option when it comes to choosing materials and building the property.

It’s not all that long ago that anything not built of brick or block was seen as unmortgageable, but this certainly isn’t the case today. We have agreed an increasing number of mortgages to fund projects using timber frame and structured insulated panel (SIP) systems, which can be

manufactured off-site to exacting quality standards.

This means less wastage and time to construct on site – avoiding the carbon emissions produced when manufacturing masonry building materials – and the opportunity to easily design in carbon saving features to reduce the emissions, and costs, produced when running the home.

We can also consider alternative cladding materials – including timber, which again can reduce the carbon produced during manufacture and incorporate high levels of insulation. Different considerations

Advising on self-build is different to standard lending. There’s more to think about, and chances are most brokers don’t do a large volume of self-build deals. Considerations include additional insurances, costs and budgets, how the client will fund the build, and at what stage to advance funds. Does the client need payments in arrears or in advance?

As a lender, there are also additional risks. What if the client runs out of money during the build? What if they run into problems and the cost increases significantly? What if the build doesn’t get finished? I think we’ve all seen episodes of ‘Grand Designs’ where the build hasn’t gone to plan. In fact, I don’t think I have seen an episode where it does!

Clearly, self-build is not your standard type of lending. That’s why, at Mansfield Building Society, we recognise the benefits of specialist expertise, so we choose to partner with BuildLoan. BuildLoan is the UK’s leading distributor of specialist homebuilding finance for intermediaries, and it provides guidance throughout the process, with a proposition that includes a costings service, handheld guidance to help your clients right through from finding land to laying the final brick, and guidance on the types of insurances needed.

The challenges of the housing sector’s environmental impact are large, let alone the continued challenges of providing new housing stock. Nevertheless, with the right expertise and support, self-build can bring sustainable new-builds to life.

The team at BuildLoan are experts in their field, and self-build is an area where we believe that expertise is a necessity, not just a nice to have.

Together, we take great care to empower self-builders to not simply create their dream home, but also a sustainable future. ●

It’s not all that long ago that anything not built of brick or block was seen as unmortgageable, but this certainly isn’t the case today. We have agreed an increasing number of mortgages to fund projects using timber frame and SIP systems”

The UK mortgage sector has faced a growing affordability crisis for years, and it’s not showing any signs of slowing down. With house prices rising, real wage rises stagnant, and the cost-of-living crisis not going away any time soon, people at every stage of homeownership are being affected.

Housing in the UK is at its least affordable for nearly 25 years. The average house is 9.1 times the average local wage, and we know that some of the highest levels of inflation we’ve seen in decades are eroding purchasing power for millions. This includes the rising cost of food, petrol and energy – the la er exacerbated by the end of the Government’s Energy Bills Support Scheme.

Right now is, arguably, as difficult a time as it’s ever been to be a first-time buyer. Intermediaries are likely to be seeing first-hand the struggles that their clients are facing. The average asking prices for homes which are popular first-time purchases hit their highest levels of £224,963 this month.

This jump in asking prices means first-time buyers need to save even more for a deposit, and then face higher mortgage repayments – it’s no surprise we’ve seen that the number taking out 40-year fixed rate mortgages has doubled.

In such difficult times, we must look for solutions that can help ease the struggles of aspiring homeowners. The affordability crisis in the UK is a complex and multidimensional issue, but a key issue for me is that of supply.

Increasing housing supply must be addressed if we are ever to see a fairer, more stable housing market. One of

the aims of the Government’s recently announced new infrastructure levy on housebuilders is to give powers to local leaders to make decisions about the level of affordable housing being built.

Whilst this thinking is a step in the right direction, I fear that its rate of implementation – only to be introduced in a small number of councils in a ‘test and learn’ system over the next decade – will risk today’s aspiring homeowners missing out in the current economic climate.

time position at the same company for decades until retirement – is no longer considered the norm.

At the start of the year, there were 4.39 million self-employed workers in the UK – an increase of 1.19 million since 2020; and 1.21 million people working more than one job. The number of people on zero hours contracts has reached its highest level on record, at more than 1.13 million.

From designers to nurses to tech entrepreneurs, Britain is brimming with people who fall outside of the ‘traditional’ employment model. It is this group of people who will struggle to get on the housing ladder the most as the affordability crisis tightens its hold.

We know all savers looking to purchase their first home are struggling with rising costs – and the lack of supply isn’t helping. However, there is a group of first-time buyers who – despite having saved for a deposit and being able to afford mortgage repayments – still cannot get on the housing ladder at all.

Those with more complex income streams can find that the goal of homeownership feels like a dream which is out of their reach. Yet today, the concept of a ‘job for life’ – a full-

First-time buyers with different financial histories can also find themselves struggling to get on the ladder. Increasingly common financial situations, such as complicated credit history in the past or simply a lack of credit history, can make the process of purchasing a first home more difficult, even though they are not sub-prime.

Lenders and intermediaries will be doing all they can to help today’s aspiring homeowners. At The No ingham, we have recently increased our loan-to-income (LTI) ratio to help ease affordability issues.

However, in order to truly help first-time buyers, the industry as a whole needs to adapt to this shi in the way people live and work, to ensure it offers products and services which are suitable for the modern borrower. ●

A er graduating from Anglia Ruskin University Cambridge, I gained my CeMAP qualifications and gave mortgage advice via a national estate agency chain. rough this role, I was approached by a BDM who felt that I had the skills and temperament to be successful in a BDM role, he put my name forward and I have not looked back since.

What brought you to Santander?

ere were two main reasons that I was attracted to join Santander. First, the role of specialist new-build business development manager was a new one, giving me the opportunity to build and develop my own strategy to support key newbuild firms across the whole of the country. Second, this role gives me the opportunity to be more involved with policy discussions, through a close working relationship with the head of new-build.

What makes Santander stand out from the crowd?

Santander offers the intermediary marketplace multiple levels of support. ere are teams of field and telephone-based BDMs, a specialist new-build desk, and a dedicated product transfer team. Santander underwriters are encouraged to call or email brokers and BDMs when they require a document or

The Intermediary speaks with Bruce McDonald, specialist new-build business development manager at Santander

a confirmation from the broker, delivering a four working hour offering, which results in a smoother journey for the customer.

Post-completion the support continues, with customers able to port both simultaneously and non-simultaneously, and when a customer has less than six months on their current mortgage, they can take all of their borrowing onto a new rate and Santander will waive the early repayment charge (ERC).

One of the main challenges is the changing working patterns postCovid. Pre-Covid, most brokers were office-based, whereas now a lot of brokers have a flexible approach to working from home or in the office, which can make it more difficult to book appointments sometimes to ensure that you connect with everyone within a firm. In an everchanging marketplace, it is key to adapt to keep everyone updated with criteria and process changes.

e challenge of flexible working practices also opens up an opportunity for BDMs. Systems like Teams and Zoom allow BDMs to reach a wider audience. Balancing face-to-face appointments with Teams meetings gives BDMs the ability to support businesses with market knowledge, economic updates and policy changes, helping brokers educate their customers, signpost potential market changes and ensure the best possible outcome for their clients.

It is key to ensure that a BDM understands the full customer situation when answering criteria questions. For example, in the new-build sector, the end of the Help to Buy scheme has resulted in builders increasingly offering sales incentives. At Santander, we can accept a range of cash and non-cash incentives.

Not only do we need to ensure that these incentives are within policy, but also whether these incentives –alongside our flexible deposit criteria – could help the customer to move loan-to-value (LTV) brackets, which can open up lower rates.

We find that proactive dialogue with a broker will always result in the best outcome for the customer.

We support customers with a range of fixed and tracker rates, with differing fee options, including zero fees. We also support them with free valuation and cashback options as part of the rate structure.

Do not be seduced by the lowest rates. Advice from a mortgage professional is worth its weight in gold. We have seen our marketplace change rapidly over the past 12 months, and brokers will ensure that customers are placed with a lender that suits their circumstances and future plans. ●

There are few bigger discussion topics within the property market than the value of our homes. The past few years have seen house price growth hit astonishing levels; the most recent data from the Land Registry shows that the average house price is now at £287,500. While that is down from the peak seen in November last year, it nonetheless represents a jump of more than £60,000 in cash terms on just three years ago.

However, it is indisputable that the drop in demand since the miniBudget has had a knock-on effect on what properties are worth today, with further falls seeming likely in the months ahead.

As a result, ge ing a clear idea of what a property is likely to be worth is absolutely crucial for buyers of all kinds, from first-timers hoping to take that initial step onto the housing ladder, to investors keen to add to their portfolios in a budget-friendly way.

That is where the role of a valuer is so crucial.

We believe that at the heart of any good valuation business is the desire to help cases actually cross the line and complete; li le good can come from carrying out a full valuation on a proposed purchase that is unlikely to actually proceed.

That was at the heart of our decision to launch a pre-valuation check service more than a decade ago. We felt that we would rather not get a valuation instruction than produce a report which was not going to really assist with a case progressing.

The pre-valuation check service involves collecting the details of

the property and running it against Rightmove, adding in data around the sales figures of similar properties of a comparable condition in the area.

The idea is to provide the client with a range of what we would expect a full valuation to come in at, helping them make a more informed decision around whether to continue with the purchase process.

Obviously, as brokers know only too well, the mortgage market can shi quickly, so that valuation range is not a guarantee of what the property would be valued at. A proper valuation can only be produced through a true, full assessment of the property.

HELEN SCORER is operations director at Pure Panel Management

whether they will then be able to access the funds needed to go through with the deal.

What’s more, we know that this service makes a real, tangible difference to the firms we work with and their clients.

For example, Dave White, operations director at Fluent Money, says: “The pre-valuation check service that Pure provides is extremely valuable to our process. It allows us to have a preliminary assessment on the valuation of the subject property, which helps the speed and smoothness of the customer journey and the high service that we deliver to our customers.”

However, this service provides the client with more information up front, allowing them to determine whether they really want to go ahead. This is something clients value, no ma er what shape the housing market is in more generally.

A er all, few buyers are overly concerned about market averages when they are going through the purchase process – they don’t want to know about the average value of a home in the UK, but rather what that specific property is likely to be valued at by a mortgage lender, and

Most importantly, the pre-valuation check service does not cost the client anything. There are enough additional costs that come with purchasing a home that buyers have to account for, from stamp duty to removal fees; the last thing we want to do is add yet more costs to the process, which can obstruct the chances of a sale going through.

All of us working within the property industry want to deliver the best possible experience to our customers. We all know only too well that moving home is rarely a stressfree and straightforward process. By working with the right partners, brokers can ensure that their clients avoid some of those hiccups which can be both emotionally and financially painful, and ensure that ge ing the keys to their new home is as pain-free as possible. ●

There are enough additional costs that come with purchasing a home, from stamp duty to removal fees; the last thing we want to do is add yet more”

It is just possible that both sides of this debate are valid, but the reality is that there is li le discussion about how the new rules could be implemented, which has three major implications.

Ahead of its 31st July launch date, Consumer Duty is moving full steam ahead, so it is worth considering its likely broader market impact.

A big question is how exactly the rules will be implemented across a non-homogenous web of manufacturers, distributors, and administrators. In a recent communication, the Financial Conduct Authority (FCA) emphasised the progression milestones and what still needed to be achieved. Its tone and language made it clear that there would not be a so launch. Sheldon Mills, FCA executive for competition and the consumer, confirmed: “The deadline of [31st] July will not be moved…and we are here to help’’.

This was arguably a response to recent survey data which suggests 50% of firms are still inadequately prepared for the launch. The message and evidence should be a ma er of concern for everyone.

Furthermore, low levels of customer awareness about the rules suggests that there is an education piece required to manage public expectations. As it stands, the regulator is pushing ahead

even if the industry and public are, at best, only partially onboard.

At Westminster, the new financial glasnost has had a mixed reception. MPs and Peers continue to argue the pros and cons of the new rules.

Former Pensions Minister Baroness Altmann is a supporter, saying: “It would be wrong, in my view, to abandon these sensible plans for tightening consumer protection in financial services.”

So is Nick Smith MP, who adds: “Without confidence in a robust regulatory framework, consumers will be worried about engaging with financial services.”

However, City Minister Andrew Griffiths was reported as being concerned that the duty would “impose more regulatory constraints on the sector at a time when the Treasury is seeking to relax EU rules following Brexit.”

A possible inference is that the new rules will make the City uncompetitive versus other international financial centres.

Lord Sharkey, meanwhile, called the Duty “deeply flawed” and unlikely to “drive a change in culture.”

First, the biggest firms will have the resources to establish a new division within their compliance departments and will invest in data management capability. For smaller operators, implementation might be more of an existential threat, as they will have to interpret the rules to suit their budget and be far more pragmatic. How the rules are enforced may determine the degree to which these firms can afford to implement them.

Second, a core requirement is end-to-end responsibility for a customer’s journey, from scoping and defining the product, through to sales, support and solving major problems, including managing a customer through financial or personal difficulties. Companies are exposing themselves to greater liability.

Third, in an economically challenging climate, it will be difficult for the financial sector to pass the extra costs through to the customer. To be compliant, firms will have to fund the change in other ways – perhaps by increasing interest margins or reducing product ranges – without compromising service delivery.

A er 31st July, a possible outcome may be a poorer first level of customer service, relying on technology and chatbots to deliver basic communication and signposting and frontline remediation – but followed therea er by a far more expensive people-centric operating model for issue escalation. ●

For those looking to get onto the property ladder for the first time, the barriers to homeownership may seem higher than ever before. As purse strings tighten in the face of the rising cost-of-living and higher mortgage rates in a post mini-Budget world, issues surrounding affordability are rife.

However, StrideUp hopes to level the playing field for prospective homeowners.

Championing property purchase through its Home Purchase Plan, StrideUp not only helps customers get onto the ladder, but also focuses on buying bigger and better.

Since John Sturgess joined StrideUp last October, the mortgage market has been turbulent, to say the least.

Nevertheless, despite the market’s reaction to the Truss Government’s ill-fated mini-Budget casting a dark shadow over much of the industry, according to Sturgess it has been an extremely busy few months.

“Prior to me joining, StrideUp hadn’t entered into the broker space with the networks, clubs, and packages,” he explains.

“So, we were looking for a route into market, and how to design a proposition so that we could get it to brokers and make it something that they would use. We’ve delved into that now, and we’ve had some great successes with many introducers, as well as networks and clubs.”

He adds: “We do see that the proposition is moving more along the lines of [directly authorised (DAs)] and clubs, who are obviously looking for our type of product.

“We have taken that out to the market and we’re having great success with key partners already.”

Speaking on the chaos surrounding the autumn mini-Budget, even though he does not expect rates to return to where they were previously,

Sturgess says he has seen some improvement: “We are now seeing some decline in pricing which is great to see.

“I think that it has introduced more certainty with people who are looking to purchase as well as remortgage, and they’re getting a more balanced view of what the funding is likely to be now.”

He adds: “What I do think, though, is that it has shown that there is a challenge in the market around affordability, where obviously rates have gone up and people’s ability to borrow because of increased rates has reduced – this is where our proposition is really helpful.”

StrideUp’s unique selling point centres on affordability. Utilising an innovative Shared Ownership model that aims to make life easier for both brokers and customers alike, StrideUp aims to break down the barriers to homeownership by lending up to six and a half times income.

The Intermediary catches up with Jon Sturgess, StrideUp’s head of intermediary sales, to talk about its recent emergence into the broker space, and its commitment to helping firsttime buyers enter the market

“One benefit of our product is that, as a lender, we can put a 20% equity share into the equation for the customer, and then they only require a 15% deposit,” Sturgess explains.

“And we have a lot of flexibility when it comes to the deposit – like many lenders, we can utilise parents and family, but also friends. We’re quite unique in that we allow that to happen.”

He adds: “We’re helping a lot of people who can’t get on the ladder due to affordability – that’s one of the main areas we operate in.

“Our income stretch will allow them the flexibility to increase what they’re looking to purchase and get the home of their dreams, and not just accept a smaller property.”

There are key differences when compared with standard Shared Ownership or equity loan schemes.

Sturgess explains: “I think the biggest unique piece for us is that – unlike a lot of the other lenders and Shared Ownership schemes – if there is any equity produced in the property, the client usually has to share that with the housing association or the other lenders.

“But with us, the full equity increase goes to the customer. We don’t look to gain any value out of the property increases.

“So, it really is a win-win for the customer. We help them get on the market with a 20% equity share, we do their mortgage, and we give them an affordability stretch, granting them the benefit of the equity.”

Having recently launched a brand new broker portal, StrideUp is not only committed to supporting potential homebuyers, but investing in its relationship with brokers, too.

“With most lenders, the ability to do business for brokers and make it as seamless and as smooth as possible is paramount,” Sturgess says.

“Because our proposition is slightly different in that we do the advice, brokers need to have confidence in us and fully understand where they are throughout the process.”

He continues: “We have a referral route so brokers can become basically a formalised packager, they place business with us through our [decisions in principle (DIPs)], and we take that over and then they package it.”

However, even in light of this invaluable broker support, there is still education needed surrounding StrideUp’s unique product offering.

StrideUp’s product is offered as a Home Purchase Plan, which traditionally has been used for Islamic finance mortgages.

“I do think there is an unawareness out there of what the product can do, and that – because it

is obviously linked with Shariah compliance and Islamic finance – people could potentially not realise how it can also help other types of clients,” Sturgess says.

“So, it’s about giving brokers the awareness that really, despite slight differences in the process, the outcome for their client will simply be an accessible way to buy their home.”

He concludes: “We do the advice, but apart from that, with everything else we want the broker to have complete control over the process.”

Sturgess believes that more innovation is required in order to get first-time buyers into the market.

“The majority of our customers are first-time buyers, which obviously shows that we must be doing something right, because they are coming to us,” he says.

“But I do think that the industry and the market need first-time buyers to be assisted, and that could come more from the Government side of things.”

He adds: “There’s got to be a smarter way for lenders to be able to assist first-time buyers.

“Some of that comes down to affordability, some of it comes down to regionality.

“But I think the market is there. It seems to be the biggest area at the moment, but we, as lenders, do need assistance with it.”

After a year of both positive growth and market turbulence, StrideUp is only just getting started. With a focus on diversification and streamlined technology on the horizon, it is clear that there are bright things ahead.

Sturgess concludes: “For us, it’s about having our website and our portal completely utilised, and to continue expanding the proposition with our introducers.

“We’re looking to diversify in terms of the different ways in which we think the market can work.

“We have introduced a new product range – Iman – that’s for Shariah-compliant Islamic finance, and IncomeMax, which will be more attuned to a traditional specialist mortgage lender with the opportunity to lend up to 6.5-times income. So there’s two opportunities for brokers to look at us.

“As we’re new and believe in innovation to support aspiring homeowners, we’re understanding ways to work better with our brokers, whether that be automated valuation models (AVMs), adverse credit or loan-to-values (LTVs).

“So, there’s lots of activity ahead.” ●

hile the papers might claim catastrophe, a er having the privilege of a front seat in the housing market for some time now, I’m skeptical whenever I see click-bait headlines foretelling an impending housing crash.

We are not on the brink of a house price crash. To be frank, that summation couldn’t be further from the truth. However, that’s not to say there aren’t serious challenges facing the housing market at the moment.

Far more important, and worrying, than any assumed crash in values is the lack of stock available –particularly when it comes to the most in-demand types of property.

Agents say the market is fragmented, with discounts available for some types of housing, such as flats, but very li le supply of indemand properties like family homes.

According to the Financial Times, the latest Royal Institution of Chartered Surveyors (RICS) report revealed that the stock of residential properties for sale is close to its lowest level since records began in 1978.

It’s not entirely clear why, but higher interest rates, high inflation and the risk of being made redundant are all contributing to a collective reluctance among homeowners to sell and crystallise what they consider losses, albeit paper, based on lower selling prices. It’s a trend that can be seen across the UK, and honestly, it’s expected. When the economy takes a turn for the worse, the urge to move to a new house usually abates.

There are some mitigating factors when it comes to the capital, however.

WThere is strong evidence that lockdown leavers are returning to London and the commuter belt. While 73% of workers said they would look for a new job if told to work five days a week in-person, according to Bloomberg Intelligence, This is Money reported that Tony Danker, head of the Confederation of British Industry (CBI), recently said bosses ‘secretly’ want staff back.

Andrew Monk at City broker VSA Capital said too many are looking to have their cake and eat it, with young people shooting themselves in the foot as a result.

I don’t take such a hard line on this: what’s right for one person isn’t always right for another. However, the comments do highlight the broader move by businesses to get staff back into the office. Indeed, Rightmove’s most recent market review showed that London has bucked the trend of residents abandoning the city in favour of the countryside.

According to the property portal, the number of agreed sales of flats is now 23% higher than in March 2019. There is a noticeable shi in the makeup, however. Market analyst Propcast found that the 10 ho est property markets across the capital last month were outside Zone 2, with buyers willing to accept longer commutes in return for countryside access.

Given that apparent willingness to stomach longer journeys into work, there appear to be serious bargains to be had in some areas of London which particularly suffered in the wake of the pandemic.

Research by Savills shows that prices paid by first-time buyers in Barking, a Zone 4 stop in East London, are around 24% lower than a year ago,

ROBIN JOHNSON is managing director of KFH Professional Services

presenting an opportunity to get a lot more bang for your buck.

Just down the road in Dagenham Heathway, the average house price is up more than 8%.

Disparities such as these, however, underline the need to employ the aid of an experienced agent. Average price movements never tell the whole story, and it’s important that buyers understand the nuances affecting the value of a property they wish to buy.

As has always been the case, the health of the property market – for those in the industry at least – has much more to do with transactions than property prices.

On that front there seems cause for optimism. The Greater London Authority is forecasting that London’s population – already in excess of 9.6 million people – will expand by another 700,000 by 2031.

There is no way that the current housing supply can possibly support that expansion. It will necessitate considerable housebuilding, along with the provision of more public services including medical centres, schools, and basic amenities.

We must hope that those who need to move to a new house are not so spooked by headlines designed to use fear to induce clicks that they stall their plans.

The truth is that Britain’s housing market is so constrained by supply that a collapse is almost unthinkable. The real threat is a loss of confidence, and we should not indulge in that kind of talk. ●

As we plough through another sticky period for UK housing, policymakers might be forgiven for not seeing the wood for the trees. However, there are some significant micro-pressures building up in the market which impact other parts significantly.

As a start, we have a situation where private landlords are seemingly looking to leave the sector in their droves as more regulation and higher financing costs make it less profitable. It’s pu ing a huge strain on the private rented sector (PRS).

Reducing the supply of rented housing, to my mind, makes things considerably worse for first-time buyers, who are having to dole out more and more of their income on rising rents. Saving for a deposit on top of that, and dealing with inflation over 10%? It’s just not realistic for most would-be homeowners.

Then there’s the pressure a contracting PRS has on the social housing sector. How many landlords are already taking yet another hit on their dwindling profits by buffering tenants from rents rising in line with higher mortgage costs? For registered social landlords, the situation is much worse.

Housing benefit has been frozen for the past three years, and even before this, margins on le ing to local authorities were tight. Now, landlords are virtually paying local authorities to house social tenants. Where are those on housing benefits supposed to live? How are these policies protecting tenants? They’re doing the reverse –simply removing available housing from the market.

Combined with inflation and interest rate rises, the situation is becoming untenable. And yet, in Jeremy Hunt’s first formal Budget in March, housing was conspicuously absent.

Help for those struggling to pay energy bills and cope with the rapidly rising costs of basic items, including food, is needed. Nevertheless, a policy of cash pay-outs to abate the cost-of-living crisis ignores the wider problems facing our economy. Any help is quickly eaten up with rising mortgage costs.

The cost of living is rising, in large part because of housing. The retail price index (RPI), which includes housing costs, was 13.5% in March. Consumer price index (CPI) being over 10% is bad enough, but it’s masking the considerable pressure that keeping a roof over one’s head is also having on families across the country.

For far too long, successive Governments have tinkered with housing policy, bankrolled firsttime buyers whose parents have the money to gi their deposits, and made promises to build more houses which haven’t materialised.

We need a proper plan for housing in this country, not a succession of tactical schemes designed as much to win votes as to address affordability bumps in the market. This plan must address tenure, quality and the type of builds needed to meet the needs of a changing population.

We currently have a shortage of the right kind of homes. For example, retirees who want to downsize are stuck in big family homes, while there’s a shortage of family homes on the market. Our latest Property Watch showed e.surv surveyors report that semi-detached and detached remain the key under-represented property types in demand. In the past year, the number of our surveyors reporting this has risen from 35%, to 41%.

There is also Net Zero to take into consideration. UK homes remain the least energy efficient in Europe, with heating residential properties accounting for 14% of our total carbon

emissions. UK Finance estimates it will cost UK homeowners around £300bn to reach the Government’s required Energy Performance Certificate (EPC) ratings alone.

Our carbon footprint is just one side of the climate change challenge. Last summer, temperatures in the UK went above 40°C for the first time on record. This summer is set to be even ho er. Winters are ge ing we er, and anyone who drives will know only too well the damage that combination is wreaking on our roads. Coping with potholes aside, the changing weather is also affecting the condition of homes across the country, which were never designed to cope with these extremes in temperature and precipitation. New risks are emerging as a result, with potential increases in subsidence as the ground swells and contracts to a higher degree.

There’s also a global shortage of the type of sand needed for construction, and last year the UN warned it’s rapidly turning into a crisis. It’s all very well to agree we need to build more houses, but how we do that and what materials we use must be part of that equation too. As sand becomes scarcer, the cost of using concrete, rendering and bricks to build new homes is going to keep going up.

Mortgage lenders remain cautious of lending on properties built with modern methods of construction, as this industry is still establishing itself.

We’re now on our sixth Housing Minister in a year, so I’m not holding out much hope that we’ll see a proper plan any time soon.

Sticking plasters on specific troublesome areas will work to an extent, but without a vision for UK housing we will be making do and mending for many years to come. ●

I’ve been with John Charcol since 2019. I joined as a broker initially, but my background prior to John Charcol was always around the commercial markets. So after a while, I moved into the commercial, second charge and bridging side of things. About two years ago, due to a number of factors, an opportunity for me to step into my current role came about and everything kind of fell into place.

For me, one of the key things was trying to make mortgages and property ownership more accessible – to try and not make it such a scary process. Those were my motivations coming into it, and since then it’s been great, meeting loads of people and sharing new ideas – there’s loads of stuff you can get involved in out there now.

Yes, we are definitely whole of market. So naturally, we do the things like residential, buy-tolet (BTL), bridging, second charges, all that stuff.

The only area we don’t do at the moment is equity release. It’s an area which we looked at operating in in the past, and one we might potentially move into in the future.

We recently decided to partner up with Propp to help deal with our commercial side of things.

Propp’s systems are great in terms of sourcing, and we felt that in order for our clients to get the best support, this was the perfect relationship for both ourselves and the clients.

As a broker, we still do one or two bits in-house with regards to commercial, but we are referring most of our business to Propp.

This is where we’re seeing packagers come into their own. Naturally, with the second charge market really expanding, as well as the commercial

and specialist markets, it’s great from a client perspective, in that products which a couple of years ago were seen as ‘dirty words’, as the market had a bit of stigma to it, are now becoming more commonplace.

When people talk about first charges, they are thinking about seconds potentially at the same time.

I guess in a lot of respects, people that have dealt in the residential and buy-to-let markets probably would have come across bridging scenarios quite often. Whether it’s to do with a property that is uninhabitable, a property doesn’t meet a first charge lender’s requirements, or a buy-to-let purchase at auction, we’re increasingly seeing different lenders come into the market.

Take buy-to-let, for example. We’ve got refurbishment BTLs with lenders like Precise and Castle Trust, and then we’ve also got new lenders coming up like Octane Capital, which does great products where it can basically offer a purchase within 28 days. So, a lot of brokers will probably already have dealt within certain lenders that can also do bridging within their products.

Moving forward, getting into that more specialist mindset, we try to educate the client around the risks we take into account when we talk about bridging. The key thing we talk about with bridging is the exit. Whether that’s going to be the refinance or sale of the property, it’s important to give the client a plan A, plan B and maybe even a plan C.

In having those conversations, you’ll be able to find the right product. Most brokers who have dealt in the industry for a period of time will have

Nicholas Mendes, mortgage technical manager at John Charcol, explores how the business has grown and changed in recent years, and how it ensures that no borrower gets left behind

come across situations where a bridging product is needed. For those who have not previously delved into bridging or second charges, there are great opportunities to have those extra conversations.

One of the things we’re trying to encourage within John Charcol, in terms of the network, is that if advisers come to us without that background, we try and support them, helping them upskill and educating them to be able to give the right advice.

If you think about the past few months, in terms of the mergers and acquisitions that we’ve had in the marketplace, we’re in an interesting place.

When you look at some high street lenders, their systems are pretty archaic in terms of criteria, background finance and everything else.

But we’ve also got these smaller, more niche lenders which are nimble and able to lend on adverse credit and things along those lines.

Going forward, we’re going to see the more of these niche lenders swallowing up traditional lenders and trying to adapt; yes, they may try to offer better rates, but I think it’s their IT systems which will fundamentally play a key part.

We’ve seen the start of it with Starling Bank and Fleet Mortgages. Here, we had a fintech bank doing the opposite of what we’re accustomed to – usually the more established building society or bank would take over a fintech, whereas this time it was the other way around, which was really interesting. This poses a bigger question for later down the line, when we look ahead to the next 20 years: will we start to see big players like Amazon and Apple delve into lending? That could be the next step when we talk about financial products.

It’ll be interesting to see how non-financial companies step into the market and disrupt it.

There’s a few things that we try and do when it comes to support, especially as we deal with the whole of market.

We work closely with lenders. Lenders often come to us to provide updates on their products and criteria. We also work hard in the background

when it comes to different types of matrixes. In the expat market, for example, we keep a real-time sheet of all the lenders, criteria and rates available to our advisers.

Anything that we see as a gap in the market, or if we’ve had a number of enquiries about a certain topic, we try to use data to emphasise its popularity so that we can spread the word to all our advisers. This means no one gets left behind. Whether employed or self-employed, we make sure that advisers have all the support they need.

We have taken a bit of a shift. Pre-pandemic, we were more focused on employed and selfemployed, but in the past two years we’ve focused on trying to grow the network.

We’ve seen it before, where certain advisers have been with other networks, or were employed previously by estate agents or other brokerages, and are unhappy, looking to make a move.

We’ve seen more and more people looking to join John Charcol, which is great.

We offer our advisers plenty of benefits, including remote working, uncapped lead support with competitive commission, the ability to write their own protection or refer it to an inhouse team. We have a fantastic administration team, we don’t have any network fees, and we offer marketing support, whether that’s helping advisers grow their own introducers group, or support with brochures or social media.

One thing we’re really proud of is that we get a lot of people who come into the John Charcol network and after a month or so say that they weren’t expecting to have so many diverse leads. They might feel overwhelmed to a certain extent, but we support them in a range of different ways.

We give them the support they need, and then months later, they end up feeling it’s the best decision they’ve ever made. ●

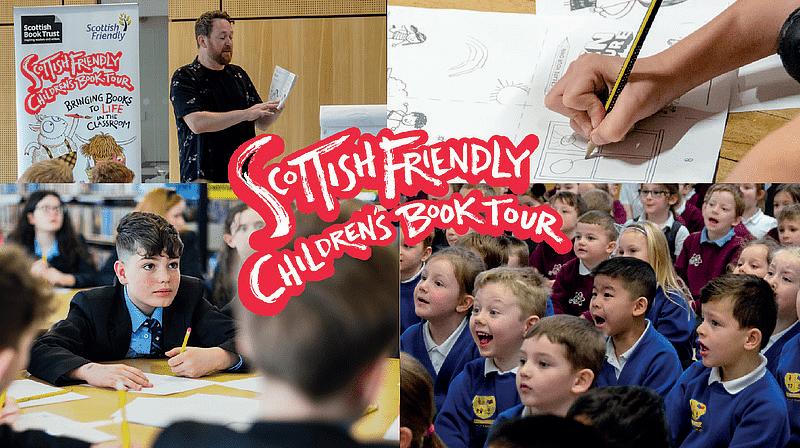

The Financial Conduct Authority’s (FCA) Consumer Duty rules come into effect for new and existing financial products and services on 31st July, and closed products and services a year later. The rules are designed to improve outcomes for customers across the financial services space, but what does a good consumer outcome look like for protection firms, and how will regulations change the way they do business?

In February, the FCA wrote to firms in the general insurance and pure protection sectors to set out its expectations ahead of the Consumer Duty deadline, reminding CEOs: “We want good outcomes for customers to be at the heart of firms’ strategies and business objectives.”

Many in this market will no doubt feel –correctly in countless cases – that they already put good customer outcomes at the heart of their business practices. However, the FCA has made it clear that some firms are over-confident that the policies and processes they already have in place are enough to comply with the Consumer Duty.