Say hello to ModaMortgages, a new buy to let lender.

We’re here to speed things up, not slow things down. Our 100% online application is stripped back to the essentials, offering speed of service, saving time for everyone.

Smarter

£ for £ remortgages assessed at pay rate helping with affordability, even on short-term fixed rates.

Faster

Quick, consistent decisions with instant DIPs and desktop valuations for remortgages on standard properties that meet eligibility.

Simpler

All underpinned by clear criteria so you know where you stand with simple processes for portfolio landlords, no extra forms just a few additional questions to fully understand your application.

01978 80 33 33

From the editor...

Alot of the conversations we have at The Intermediary are about trust, fairness, ge ing the best outcomes for customers – and we’re all o en on the same page about the importance of these things, albeit not always on the methods to achieve them. This is not just about increased and ongoing regulatory scrutiny – although it would be naïve to say that isn’t a driving force –but genuinely a motivation behind good business for many of the key players in the property market, whatever their particular sub-sector.

It’s a stark wake-up, then, when we are reminded that this is not the prevailing thought process in every part of the market. I am talking, of course, about Panorama’s recent investigation, which uncovered alleged conditional selling at two major estate agents. I hardly think I’m being overly pessimistic when I express my deep doubt that this is an isolated issue.

It is sometimes easy to forget, working as we do in a heavily regulated and scrutinised part of the market, that estate agencies are something of a Wild West in comparison. They don’t need to be licensed or qualified, and while the Estate Agents Act 1979 and Consumer Protection from Unfair Trading Regulations 2008 go some way to providing structure, there is no overarching statutory regulation of private sector le ing or managing agents in England.

Having had my own negative experiences, ranging from incompetent to outright malicious, it shows. Mentioning no company names, of

course, but my bet is almost everyone has their own to contribute.

While the regulator is casting its all-seeing eye across the property buying process, perhaps the time has come to overhaul a key part of the market that has so far been allowed to run free.

I don’t doubt that some of the people involved in the alleged poor behaviour discovered by Panorama’s Lucy Vallance were unaware that they were doing anything wrong, and were simply doing as they were told by their superiors. But as we know, ignorance is no defence. For people in a position of such importance for customers making the biggest purchase of their lives, education, awareness and qualifications should be paramount.

This is true, of course, across the property finance market, and is particularly important when discussing the topic of this month’s Special Focus: later life lending. This month, we deep dive into this market – from product innovation to changing client demographics.

The real takeaway, overall, is that later life products are no longer a last resort, and nor are they a niche product that can be ignored. Retirement planning, the use of assets and managing of debt, and the dynamics of intergenerational wealth, are all factors that should be front of mind for any broker wishing to provide clients – age regardless – with a fair, trustworthy and beneficial service. ●

Jessica Bird

@jess_jbird

www.theintermediary.co.uk www.uk.linkedin.com/company/the-intermediary @IntermediaryUK www.facebook.com/IntermediaryUK

The Team

Jessica Bird Managing Editor

Jessica O’Connor Deputy Editor

Marvin Onumonu Reporter

Brian West Sales Director (Interim) brian@theintermediary.co.uk

Ryan Fowler Publisher

Felix Blakeston Associate Publisher

Helen Thorne Accounts nance@theintermediary.co.uk

Orson McAleer Designer

Bryan Hay ......................... Associate Editor Subscriptions subscriptions@theintermediary.co.uk

Contributors

Alex Upton | Amanda Wilson | Andrew Blundell

Andrew Teeman | Andy Shaw | Averil Leimon

Ben Allkins | Brendan Crowshaw

Christopher Davies | Craig Hall | Darrell Walker

Darren Deacon | Dave Castling | Dave Harris

David Binney | David Wylie | Dipinder Surey

Emma Graham | Gavin Hancock

Hamza Behzad | Harpal Singh | Jake Sandford

James Staunton | Jerry Mulle | Jim Boyd

Jonathan Fowler | Laura omas | Lee Chiswell

Lisa Kelly | Louise Pengelly | Mark Blackwell

Mark Jones | Martin Dodd | Martin Sims

Michael Craig | Mike Says | Paresh Raja

Paula Higgins | Richard Pike | Rob Cli ord

Rob McCoy | Rob Stanton | Shaun Sturgess

Sonya Matharu | Stephanie Dunkley

Stephen Harrison | Steve Goodall

Tanya Elmaz | Wes Regis | Will Hale Copyright © 2025 The Intermediary Cartoon by Fergus Boylan Cover illustration by Ed Wishewsky

by Pensord Press

Contents

LATER LIFE LENDING

SPECIAL FOCUS ISSUE

Feature 6

ROOTED IN GROWTH

Jessica O’Conner looks at how the later life lending market is changing with the times

Opinion 12

The latest on later life lending from Mortgage Advice Bureau, Hodge, more2life, Phoebus and many more…

REGULARS

Broker business 60

A look at the practical realities of being a broker, from choosing a network to the monthly case clinic

Local focus 78

This month The Intermediary takes a look at the housing market in Swansea

On the Move 82

An eye on the revolving doors of the mortgage market: the latest industry job moves

INTERVIEWS & PROFILES

The Interview 26

PURE RETIREMENT

Gavin Hancock discusses the rise of fringe later life cases

In Pro le 18

EQUITY RELEASE COUNCIL

Jim Boyd talks holistic nancial planning in the face of changing lifestyles

Meet the Broker

THE MORTGAGE ATELIER

Q&As 50, 56

TOGETHER

Sonya Matharu gives her view on running a brokerage in the current market

Tanya Elmaz outlines the next stage in the lender’s evolution

LIFESEARCH

Lisa Kelly re ects on one of her most challenging cases

Meet the

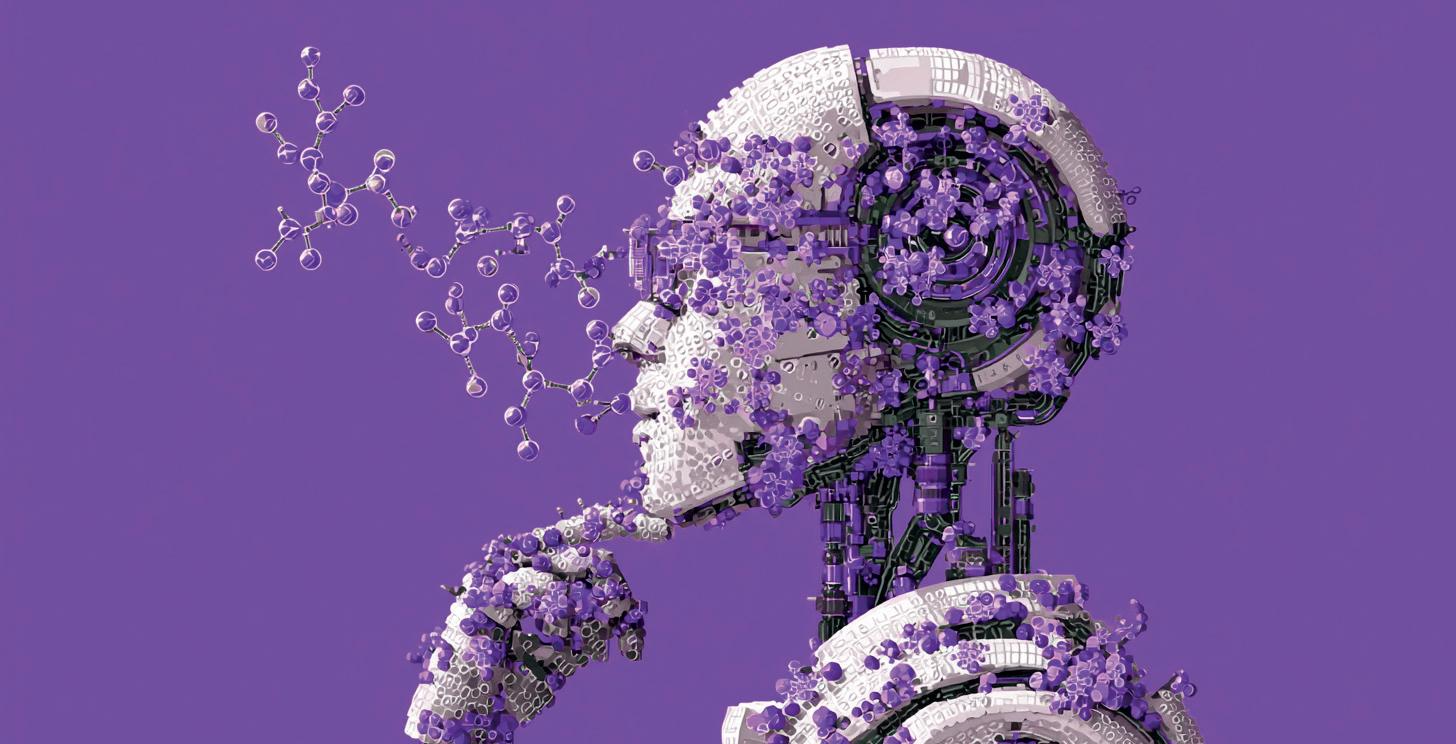

ROOTED IN CHANGE

HOW LATER LIFE LENDING IS GROWING INTO THE MORTGAGE MAINSTREAM

by Jessica O'Connor

Once considered the final chapter in a homeowner’s financial story, later life lending is quietly redefining its place in the financial lifecycle. No longer a niche solution for the few, it is an essential consideration for a growing proportion of the population – both earlier and later than expected.

Homeowners are increasingly engaging with mortgage products well into their retirement years, while others are entering the later life lending market in their early fifties, decades before the ‘traditional’ retirement age.

In Q1 of this year, more than 38,510 new loans were advanced to older borrowers alone, marking an annual increase of 33.5%, according to UK Finance. This uptick has been driven by a number of factors, including longer life expectancy, rising living costs, complex family structures, and the growing use of property wealth as a planning tool, rather than a last resort.

It clear that this shift is not just an emerging product trend but a generational transition in how wealth is accessed, transferred and managed.

As the market deepens its roots in early financial planning, it provides a broader reach across varied borrower profiles, thus providing a structure that reflects the diverse needs of modern later life.

For intermediaries, navigating this terrain requires both a strategic view and a nuanced

understanding of how lending needs are evolving with age.

Retirement redefined

The traditional image of retirement – an end to work at 65, a gold watch, and a final payslip – has largely faded into obscurity.

In its place is a more fluid, phased transition where individuals in their fifties and sixties remain economically active, often working parttime or scaling back work hours gradually.

According to Mark Gregory, founder and CEO of Equity Release Group: “Retirement is increasingly seen as a gradual transition, with many people working part-time or in consultancy roles beyond state pension age.”

This shift is not just cultural, but financial. In the UK alone, there are now more than 22 million people aged 50 and over, representing 38% of the population, according to the Centre for Ageing Better. In addition, life expectancy continues to rise, reaching 79.0 years for males and 82.9 years for females in 2022, according to the Office for National Statistics (ONS).

Gregory notes that this increased longevity, along with evolving lifestyle expectations, is prompting more people to seek “flexible, longterm financial planning solutions that can adapt over time,” often with housing wealth playing a key role in supplementing pension income.

This redefinition of retirement began in earnest with the abolition of the default retirement age.

Jim Boyd, CEO of the Equity Release Council, explains: “In 2011, the Government changed legislation to bring an end to the default retirement age which meant that people were no longer forced to retire at a specific age. This has changed how retirement is viewed and gives people the freedom to decide how and when they want to retire.”

Nevertheless, while working longer may offer financial benefits, such as paying down mortgages or growing pension pots, it also comes with challenges, including health, caring responsibilities, and dwindling employment opportunities in later life.

According to Les Pick, sales director at LiveMore, retirement was once viewed as “a distinct line in the sand […] marked by complete withdrawal from the workforce and a reliance on pension savings.”

However, today’s homeowners – many of whom have benefited from house price growth in recent decades – are navigating a more complex environment marked by the end of defined benefit (DB) pensions, inflationary pressures, and social factors like divorce. As a result, Pick says, many are “looking at phased retirement, and often leverage against property wealth to enhance their lifestyle and retire in a timely fashion.”

Paul Carter, CEO at Pure Retirement, sees this shift as part of a broader social evolution.

He says: “Modern retirees are seeking to make the most of their later years, and are probably the most active generation in that regard – the passive ‘slippers and rocking chair’ retirement is definitely a thing of the past.”

As attitudes toward later life evolve, so too has the role of borrowing. Once stigmatised as a failure of planning, Carter says, borrowing in later life is now “a viable and accepted tool, making use of existing assets, to live the retirement that people want or aspire to.”

Younger borrowers

Once the ‘twilight end’ of the mortgage market, later life lending now often begins far earlier than expected. Increasingly, borrowers in their early fifties are engaging with products traditionally reserved for retirees – a trend fuelled by rising property prices, longer mortgage terms, and evolving life circumstances.

Boyd explains: “According to the FCA, the average first-time buyer is 34, which means that even if they take out a 30-year mortgage, then they will be 64 years old when they repay it.” That is assuming no further borrowing or remortgaging along the way.

Karina Hutchins, principal of mortgage policy at UK Finance, adds that increasing numbers of people now “access later life lending at younger ages, with some providers reporting a reduction in average customer age from 70 to 67 this year.”

As a result of this shift, and increased need for work in order to pay off mortgage debt later into life, the market has adjusted accordingly.

Boyd notes a steady stream of changes from lenders, which are now introducing new products to “allow for people working longer.”

He says: “For some, their plans to work into what was traditional retirement fall apart, and they need to consider how they repay the capital.”

This reality is particularly acute for those impacted by divorce, redundancy, or historical interest-only mortgages with no repayment vehicle – scenarios that are becoming more common among borrowers in their fifties and early sixties.

Mike Batty, product and proposition director at Legal & General, observes that “the cost of entry to the UK property market has significantly increased, pushing many to consider homeownership later in life.” He points to recent Legal & General data, which shows an 80% rise in mortgage adviser searches for first-time buyers aged 56 to 65 in Q1 2025, with a further 23% increase among those over 65.

Batty continues: “For many who are getting on the property ladder later in life, carrying a mortgage or unsecured debt into retirement will be a reality.”

With many facing stretched budgets, longer financial commitments, and later starts on the property ladder, it is clear that the 50 to 65 age group has become a growing and increasingly diverse presence in the lending pipeline.

Pick says: “Homeowners over the age of 50 have benefitted from house price inflation, but the complexities of modern-day life have often taken their toll financially.”

The new normal

A growing number of homeowners are carrying debt – both mortgage and unsecured – well beyond the traditional retirement threshold. This trend is driven by a combination of structural and generational shifts, including rising living costs and a broader cultural comfort with debt among emerging retirees.

Boyd says: “There are a variety of different reasons driving this trend, but arguably affordability is at the heart of it. People are struggling to get on the housing ladder, and when they do may need a longer term in order to afford the repayments.”

Beyond individual circumstances, broader demographic trends are at play. Pick notes that

"I still think equity release would have been easier, Captain"

“long gone are the years of ‘save to buy’,” as people want more from life than previous generations.

Many consumers have grown up in an era of easier access to credit, and are more accustomed to managing debt as a means to maintain lifestyle. This shift, compounded by rising inflation and reduced DB pension provision, means that many retirees now bear far more responsibility for managing their own long-term financial wellbeing.

Pick adds: “Many clients experience a shortfall between pension income and day-to-day living costs, especially after inflation or a partner's death.” This leads more people to look to property as a viable source of later life funding.

Around 15% of Pure Retirement’s new lifetime mortgages in Q2 listed paying off a mortgage as the primary reason for releasing funds, and Carter notes that many borrowers are entering retirement still repaying capital – or using lifetime or retirement interest-only (RIO) mortgages to manage legacy interest-only arrangements.

However, he is careful not to reduce this to financial distress alone. He says: “There will doubtless be a cohort able to continue making the payments, but who just want the peace of not having to think about it any more. If they take out a lifetime mortgage to clear the balance, and choose to repurpose their previous monthly

repayment amount as disposable income, is that not actually lifestyle improvements by proxy?”

Not just necessity

This marks a growing trend of older homeowners using borrowing to enhance quality of life – not merely to sustain it. Indeed, later life finance is increasingly being used for comfort, and convenience – primarily for reasons such as home renovations or discretionary expenses.

Hutchins notes:” The motivations behind borrowing are changing. While previously it was often about paying off interest-only mortgages, today’s borrowers are using these products to supplement retirement income, manage financial transitions like divorce, improve their homes, or consolidate debt.

"These shifts highlight the growing flexibility and relevance of later life lending in helping customers navigate complex personal and financial needs.”

Batty reports that “half of [L&G] customers use their mortgage products for home improvements, while a fifth (20%) opt to use their mortgage for living expenses, and a further fifth (19%) use it to finance holidays in later life.”

He adds that these improvements are often intended to enhance the experience of retirement at home – making it more enjoyable or simply more suited to changing needs.

This supports a broader trend identified by Pick, who sees borrowing split between “necessity-driven and aspiration-driven” motivations. Among the latter, intergenerational gifting is becoming a more visible feature of later life lending, even if it still accounts for a smaller proportion of cases. In many cases, older borrowers choose to release equity to help the next generation climb the property ladder, thus helping them gain a degree of financial freedom earlier in life.

Pick explains: “The ‘Bank of Mum and Dad’ sits comfortably in the top 10 lending sources in the UK”, while Batty notes that 10% of all mortgage applications are for gifting purposes.

Gregory adds that gifting to children or grandchildren for house deposits or debt reduction “has grown significantly in recent years,” and is expected to rise further as wealth is increasingly passed down during people's lifetimes, not after death.

Diversifying demographics

As reasons for later life lending continue to evolve, the market is actively adapting to suit the needs of a diverse range of borrower profiles. Despite historical stereotypes, older homeowners are far from a monolith – now boasting varying borrower types experiencing different personal circumstances. Among the most prominent emerging sub-demographics are divorced individuals navigating asset separation, and older single women or widows managing retirement independently.

Gregory notes the growing number of single women borrowers over 60 who are “often looking for long-term aspirational capital, or stability and autonomy,” particularly as many outlive their spouses and face increased financial pressures in later life.

Equity release, he explains, enables them “to unlock housing wealth to fund retirement, cover care costs, or to help family members.”

Pick highlights the disproportionate impact of bereavement on women in later life. “The average life expectancy for women in the UK is four years longer than that of men,” meaning many widows “find themselves living alone post-bereavement,” often relying on reduced or discontinued spouse pensions.

He adds: “This income drop drives demand for releasing capital from their homes to maintain their standard of living. Post-bereavement, many widows wish to remain in their family homes or stay close to social networks, and later life lending can support this need.”

Gregory observes that homeowners who are divorced – or planning for divorce – often turn to equity release “to retain the family

p

UK FINANCE UPDATE In Numbers

◆ 38,510 new loans were advanced to older borrowers in Q1 2025, up 33.5% year-on-year.

◆ The value of this lending was £6.1bn, which was up 42.6% compared with the same quarter a year previously.

◆ There were 5,620 new lifetime mortgages advanced in Q1, up 11.1% year-on-year.

◆ The value of this lending was £530m, which was up 39.5% compared with the same quarter a year previously.

◆ There were 339 retirement interest only mortgages advanced in Q1, up 19.4% year-on-year.

◆ The value of this lending was £33m, which was up 17.9% compared with the same quarter a year previously.

◆ Residential later life loans in Q1 represented 7.6% of all residential loans.

◆ Buy-to-let later life loans in Q1 represented 21.5% of all buy-tolet loans.

home and help to split the assets,” with funds sometimes used “to fund lifestyle changes or maintain their standard of living post-divorce.”

These life events, particularly when emotionally charged or sudden, can place individuals in vulnerable positions, prompting advisers to ensure extra care and due diligence throughout the advice process.

Regulation and responsibility

The importance of tailored, responsible advice has only grown more critical. While Boyd notes that “older borrowers are not necessarily vulnerable,” they are statistically more likely to be in vulnerable circumstances, highlighting that “advisers who operate in this sector are acutely aware of not only the challenges, but also of the practical support needed.”

The Financial Conduct Authority’s (FCA’s) Consumer Duty regulation has helped formalise what many advisers in the sector were already doing: prioritising good outcomes through fairness, transparency, and empathy.

In light of this, firms across the industry are adopting increasingly sophisticated strategies to identify and respond to risk. According to Boyd, the Equity Release Council’s recent 2025 update to its standards – including a new product standard for customers in long-term care and a revised Customer Charter – reinforces an industry-wide model where “tailored, transparent, trusted and thorough support” is not optional, but foundational.

Gregory further highlights the role of bespoke processes throughout the later life sector, noting that Equity Release Group’s “advice model is aimed at the right target market, and constantly monitored to ensure it is tailored, empathetic and bespoke to each customer.” In support of this, he points to internal analysis that shows that “half of [their] customers may potentially be vulnerable,” and that integrated tools, from digital questionnaires to adviser prompts, help flag risks early in the process –prompting a ‘continue with caution’ approach when appropriate.

While many of these practices predate regulation, leaders in the space agree that Consumer Duty has elevated the overall standard and sharpened the industry’s focus since its implementation in 2023. The direction of travel is clear: responsible advice is no longer just about compliance, but about anticipating complexity and ensuring every customer receives the thoughtful guidance, regardless of circumstance.

Carter, who outlines Pure Retirement’s own investment in being “empathic and

understanding” – including regular consumer testing of literature through to mandatory vulnerability and Dementia Friends training for all customer-facing staff – says the advent of Consumer Duty has undoubtedly “helped keep that focus front and centre of industry thinking.”

Product flexibility

The sector has moved decisively away from the rigid, one-size-fits-all roll-up models of the past toward a much more adaptable product landscape. Batty notes: “The later life lending sector has been a highly innovative space in recent years,” with advisers now able to choose from more than 1,200 products and plans – up from just 300 in 2019, according to Q1 2025 data from the Equity Release Council.

This rapid diversification reflects a clear shift toward modular, flexible mortgage solutions that can accommodate increasingly diverse borrower needs. Batty highlights L&G’s Optional Payment Lifetime Mortgage (OPLM), which allows customers to pay some, or all, of their interest, but also to stop payments if needed.

New products are also helping address affordability challenges and complex life situations. Boyd points to the arrival of mandatory payment lifetime mortgages, which allow borrowers to access higher loan-to-values (LTVs) in exchange for committing to monthly repayments that later convert to a standard roll-up. Other innovations, such as discounted interest rates for making ongoing payments – as seen from more2life – give borrowers additional levers to manage their borrowing proactively.

Boyd highlights progress in underwriting practices, with lenders like Suffolk Building Society removing maximum age limits and using manual assessments to better reflect older borrowers’ varied financial realities.

Crucially, this innovation is not just about greater choice, but it is also about smarter, more personalised solutions. Gregory notes that “voluntary payment features, inheritance protection, and downsizing protection are now widely available,” while interest reward products from providers like Standard Life Home Finance (SLHF) and Just allow customers to reduce their interest rates based on how much interest they choose to repay. “The more interest that’s paid, the lower the rate becomes,” he explains, which offers later life borrowers greater control and long-term cost savings.

An integrated approach

As the mortgage market adapts to an ageing population and increasingly complex financial

lifecycles, later life lending is no longer a specialist corner of the industry, but a central thread in the broader mortgage narrative.

Borrowing beyond the age of 55 has been treated as a siloed sub-sector, segmented off from traditional advice pathways and engaged only as a reactive solution. But the evolving needs of customers – who are now just as likely to hold mortgage debt into retirement as they are to enter the market in their fifties – demand a more integrated approach.

Boyd observes: “Later life lending is increasingly becoming mainstream, and the recent discussion paper from the FCA on the future of the mortgage market has the potential to make it even more so.”

He points to a growing appetite among residential advisers to support clients throughout their lives, noting that “they are keen to continue the relationship with individual customers” rather than hand them off at a certain age or life stage.

Batty agrees that both lenders and advisers must begin “breaking down barriers between standard residential mortgages and later life lending,” particularly as more clients carry debt past retirement.

With 68% of first-time buyers in 2024 borrowing for terms of 30 years or more, a significant proportion of future retirees will still be making repayments well into their sixties and seventies. The result, as Batty and others make clear, is a new kind of borrower – one who expects holistic, long-term support, not fragmented advice at the margins of retirement.

Carter notes that property wealth will undoubtedly play a larger role in retirement planning in years to come, but stresses the need to build awareness early, well before a borrower reaches their fifties or sixties.

The opportunity lies not just in selling more products, but in shaping a coherent journey for customers that reflects the full arc of their financial lives: from first mortgage to family support, and from midlife planning to late retirement stability.

For advisers and lenders alike, the challenge is to move beyond segmented thinking and embed later life borrowing into the broader financial journey – treating it not as an end-stage solution, but as a strategic tool that evolves with the customer.

The market is reframing the conversation, not around shortfall and necessity, but around planning and informed choice.

As Gregory puts it, this means “repositioning equity release and later life funding as a financial planning product, not just a safety net.” ●

Transforming Later Life

DAVE HARRIS, CEO, MORE2LIFE

We’re living longer and carrying more debt into retirement than ever before. Property wealth has soared, with older homeowners sitting on more substantial levels of equity. It’s turning later life lending from what has historically been a niche product into a more accessible and required financial tool.

There’s a misconception that owning property equals financial security. Rising living costs and interest-only mortgages maturing without a repayment vehicle, for example, have been drivers of this longer-lasting debt. As has the ‘Bank of Mum and Dad’ effect, where parents or grandparents want to help children onto the housing ladder. Inflationary pressures mean pensions sometimes fall short of maintaining the lifestyle people expected. The result is more older borrowers who would benefit from unlocking their property wealth in order to support their retirement.

Housing policy still lags. Many older homeowners feel trapped because there’s not enough suitable housing or incentives to downsize. We must look closely at reforms around Stamp Duty and housing supply to give people real choices.

The industry is very good at understanding motivations for these forms of borrowing. While some want to do things like support family or improve their home, for others it’s about tackling existing debt or covering essential expenses. It’s crucial for advisers to really sharpen their focus and ensure the conversations they have with their clients allow them to truly understand their goals, while lenders must keep innovating to make sure our products line up with those wants and needs.

Brokers should proactively start these conversations, even if clients don’t ask. Education, both for advisers and consumers, is crucial. For lenders, it’s about innovation, but also supporting advisers with training, tools, and clear communication.

The market is moving in the right direction, but we are only scratching the surface of what later life lending could be. Let’s not forget that the regulator also has a major role to play – the FCA Discussion Paper suggests it is willing to look at addressing regulatory barriers in the Handbook that are preventing firms delivering good outcomes, including the current advice qualification split, facilitating the review of all options for all older borrowers. That would be a big step forward.

The big opportunity is to embed later life lending into wider holistic financial planning. Housing wealth can transform retirement outcomes for millions. It is the missing link in many retirement plans, and as more clients understand how it can support them, demand will grow.

It’s imperative we handle this growth responsibly, with robust advice, transparent products, and genuine focus on customer outcomes. The industry has made huge strides in improving standards, but we can’t afford complacency. Done right, later life lending could transform financial security for millions of people.

The crest for later life lending – or just the beginning?

Last month, The Intermediary reported a 33% year-on-year increase in later life lending in the first quarter of 2025. It’s a significant number – and for those of us working in this space, it mirrors what we are seeing in real time.

The once-niche specialist lending market has evolved into a diverse, fastmoving sector. At Hodge, we’re proud to play a part in that evolution. But as anyone in the industry knows, it’s not just about numbers, it’s understanding what’s behind them.

The surge is being fuelled by the needs of a growing, changing demographic. From pension shortfalls to the rising cost of living, from inheritance planning to property wealth being used to support family –the financial pressures and priorities of later life borrowers are changing fast. Lending must change with them.

New kind of borrowing

What defines a ‘later life borrower’ today is not age, but the complexity of their situation. Some are still working, others are self-employed into their seventies. Many are looking to help younger generations onto the ladder, diversify their income streams through buy-to-let (BTL), or improve the energy efficiency of their homes. What they share is a need for lending that adapts to their reality, not the other way round.

This has changed the shape of the market. The days of a one-sizefits-all later life product are long gone. We now see a spectrum of options: flexible lifetime mortgages, retirement interest-only (RIO), and hybrid solutions that allow borrowers to switch repayment options or make ad-hoc repayments.

Many of these products come with features that allow for partial repayments, flexible terms or inheritance guarantees – giving borrowers more control over how they meet their financial priorities, such as reducing their balance over time to leave more for loved ones.

Downsizing protection is another feature which gives borrowers the confidence to move later in life without facing punitive charges, acknowledging that lifestyle needs o en change as people age.

Responsible lending

As an industry, there is a growing recognition of the importance of responsible lending. Vulnerability can impact anyone, and later life lenders must ensure that every decision is made with empathy, clarity, and the right support in place for the future of the borrower.

Technology is also playing a crucial role in transforming the customer journey. From online affordability calculators tailored to later life criteria, to more streamlined digital application processes, technology is helping make these products more accessible and transparent.

At Hodge, we see these innovations as a way to enhance, not replace, the human touch. Especially when dealing with customers making complex, emotional decisions about their homes, face-to-face advice and personalised service remain essential.

We’ve done a li le more than scratch the surface of what later life lending can offer. We expect later life lending products to become even more flexible and responsive to individual borrower needs. We see more modular products, where features like drawdown facilities, repayment options or inheritance protection can

EMMA GRAHAM is business development director at Hodge Bank

be customised based on a borrower’s specific circumstances. This could further reduce the risk of unsuitable borrowing. We anticipate further growth in sustainable and energyefficient lending.

As the UK housing stock continues to face pressure to meet energy performance standards, there’s scope for later life products that incentivise or reward borrowers for making green improvements.

Affordability criteria are also evolving. Historically, income in retirement was one of the biggest hurdles for many borrowers, but lenders now recognise a wider range of income sources, including pensions, investment income, and even rental income from BTL properties. This has made it possible for more people to access borrowing, even if their income looks very different from when they were working.

Ultimately, later life lending is about more than just releasing equity. It’s about helping people make the most of their retirement, stay in control of their finances, and live with dignity and peace of mind. As a lender, we see it as our duty to deliver products that offer flexibility and choice, underpinned by responsible lending practices that put customers first.

We’re not just watching the wave, we’re riding it. But whether we’re nearing the crest or only building momentum, the future of later life lending is bright, and we’re excited to continue playing a role in helping customers use the value of their homes to achieve their retirement goals. ●

Why RIO mortgages are on the rise

The later life lending market is undergoing a significant transformation, and the data is hard to ignore. According to recent findings from UK Finance, retirement interest-only (RIO) mortgage lending increased by 19.4% year-on-year across the UK in Q1 2025. At Vernon Building Society, we’ve seen a 158% increase in RIO mortgage applications between January and May 2025 compared to the same period last year.

This is not a seasonal fluctuation or a short-term spike. It’s a clear indication that borrower behaviour is shi ing, and the implications for brokers are substantial.

The drivers behind this growth are well understood: longer life expectancy, rising living costs, and a growing cohort of older homeowners who are asset-rich but income-constrained.

But what’s becoming increasingly evident is that RIO is moving into the mainstream of later life financial planning, and brokers are at the forefront of this evolution.

Shift in client mindset

Older borrowers have long recognised the value of using their homes to unlock capital in later life. Equity release products have been a wellestablished part of the market for years, offering a way to access property wealth without monthly repayments. But today, the conversation is shi ing. It’s not about a new openness to using housing equity, but rather a growing awareness of alternative options.

This shi in mindset is creating new opportunities for brokers. Clients are looking for advice that goes beyond traditional mortgage solutions. They want to understand how later life lending fits into their broader financial goals, whether that’s supplementing income, funding home improvements, or helping

children onto the property ladder. RIO mortgages offer a compelling solution for many of these scenarios. For clients with sufficient income to cover interest payments, they offer a flexible and cost-effective way to access property wealth without the long-term commitments or costs o en associated with equity release.

Retirement strategy

The surge in RIO demand reflects a broader trend: property is becoming central to retirement strategy. This is particularly relevant in the context of intergenerational wealth transfer. Many clients are looking to gi equity to children or grandchildren during their lifetime, rather than waiting until a er death.

RIO mortgages can facilitate this, allowing clients to provide meaningful support at a time when it’s most needed.

There is also a growing awareness of the potential Inheritance Tax benefits of gi ing equity early. By reducing the value of their estate, clients may be able to mitigate future tax liabilities while also seeing the impact of their support in real time.

These are complex, sensitive conversations, and brokers are uniquely positioned to guide clients through them with care and expertise.

Complexity

As demand for later life lending grows, so does the complexity of client circumstances. Many older borrowers have multiple income sources, including defined benefit (DB) pensions, drawdown arrangements, and investment income. Others may have lasting power of a orney in place or require more flexible underwriting due to health or lifestyle factors.

This complexity requires a lender that can take a holistic view of the client’s financial position, working closely with intermediaries to assess each case on its own merits.

BRENDAN CROWSHAW is head of mortgage and savings distribution at Vernon Building Society

Later life lending is not one-size-fitsall, so we should remain commi ed to providing solutions that are both responsible and adaptable.

We also recognise the importance of supporting brokers with clear criteria, responsive service, and access to underwriters who understand the nuances of later life cases.

It’s important to make it easier for brokers to deliver great outcomes for their clients, even in the most complex scenarios.

Growing opportunity

The growth in RIO demand is not a passing trend. It’s part of a broader transformation in how people approach later life finance. As the population ages and retirement becomes more fluid, the need for flexible, sustainable lending solutions will only increase.

For brokers, this represents a significant opportunity. Later life lending is no longer a specialist corner of the market – it’s becoming a core part of the advice landscape. Brokers who are prepared to engage with this space, build their knowledge, and partner with lenders that understand the market, will be well placed to deliver real value to their clients.

The surge in RIO interest is a clear signal that the later life lending market is maturing. Clients are more informed, more open to new solutions, and more reliant on expert advice. Brokers have a vital role to play in helping them navigate this evolving landscape.

Later life lending is not just about borrowing. It’s about enabling clients to live the life they want, as well as helping brokers build lasting relationships based on trust, insight, and shared success. ●

Later life considerations

The later life lending market has been saying for years that it’s important to consider the use of housing equity as part of normal financial planning, but how mortgage debt is managed post the age of 50 is also crucial in ensuring that customers can fulfil their wants and needs as they move towards – and through – retirement.

Basic facts from the mortgage and retirement planning market make the case. The average age of first-time buyers is 36, and one in five of them is over 40. A 36-year-old first-time buyer opting for a 35-year term will be paying a mortgage until age 71 – way past traditional retirement ages.

Borrowing past traditional retirement ages is already a reality. Around one in four 55 to 64-yearolds are still paying off mortgages. People are borrowing until later in life, and the numbers doing so will only increase. They need support with managing their debt while maximising retirement income.

National Statistics (ONS), which is just over £5,000 above the £12,800 threshold to achieve a ‘basic’ retirement, as calculated by the Resolution Foundation.

Against that background – and particularly in light of innovation around lifetime mortgages that allow customers to serve some or all of the interest – it does not make sense for equity release to be seen as a last resort. People need to maximise every asset, including property, if they are to achieve a comfortable and fulfilling retirement, and they need to start thinking about it much earlier, with the support of advisers.

Advisers need support from the later life lending market to help them ensure clients are aware of all the options available to them, and they need support from regulators, too. There are strong signs that regulators are well aware of the need.

Positive on later life

WILL HALE is CEO of Air

the options and choices in retirement – on lifestyle, housing, care, and tax, to name a few – are wider and more complex than ever.

“So, learning from the past, and with the right product design and consumer protections in place, could later life lending benefit more people, as part of an individual’s financial plan, rather than a last resort?”

Financial Conduct Authority (FCA) chief executive Nikhil Rathi certainly appears to recognise the potential of the later life lending market.

more difficult for many customers.

Paying off a mortgage while saving for retirement is already challenging, and will become even more difficult for many customers. The average retirement income is £18,148, according to the Office for

£18,148, according to the Office for

At the recent JP Morgan Symposium Pensions and Savings, he said: “Those who do own a home in later life also face an evolving picture. For many, their home is their biggest asset, and

His colleague Emad Aladhal, director of retail banking, told the BSA Annual Conference that later life lending is “increasingly the norm. We all need to face up to the complexities and opportunities of increased consumer need to continue borrowing into later life.”

The mortgage market discussion paper from the FCA published on 25th June included a significant section on later life lending, but while this reiterated the scale of the opportunity and importance from a societal perspective, it also highlighted significant structural issues which need to be addressed. The question is whether the industry is capable of stepping-up?

Outlining the opportunity

Products have evolved to meet the needs of older customers, with the development of more retirement interest-only (RIO) mortgages, term interest-only mortgages and longterm fixed rated products. Lifetime mortgage lenders are offering higher

must start earlier

Mainstream

mortgage brokers [...] should be seizing the opportunity to break down siloes and work collaboratively in order to deliver better outcomes for customers”

loan-to-values (LTVs), shorter and fixed early redemption charges, and increased flexibility around regular payment options.

These lifetime mortgages, which allow some or all of the interest to be served, are designed to help mitigate the impact of compound interest and evolve with borrowers as they move into retirement.

These products offer the option to eventually transition into a full rollup product with a fixed interest rate for life, and certainty of tenure, once any mandatory payment terms have been met.

There are products available which incentivise customers to manage their cost of borrowing by reducing the interest rate while making regular repayments.The worry is that awareness of these products among potential customers is poor, and even more worryingly, awareness among many intermediaries is not much be er.

These products are suitable for a significant cohort of over-50s customers, and should be viewed as very much part of the mainstream – and at least considered alongside other options for every customer in this demographic.

Seizing the opportunity

Mainstream mortgage brokers, generalist independent financial advisers (IFAs), wealth managers and equity release specialists – and the trade bodies that represent them – should be seizing the opportunity to break down siloes and work collaboratively in order to deliver be er outcomes for customers.

Air is looking to do our bit and engage with stakeholders across the ecosystem to ensure a be er functioning market that works in the interests of older customers.

We believe that a thriving advice sector is crucial to meeting the challenge, and we are focused on equipping advisers with the tools they need to deliver great advice cost effectively.

That means working with mainstream sourcing platforms and customer relationship management (CRM) providers to create efficient and integrated journeys. We are also making changes to our Academy proposition, and with support from our lender partners, we want to make this accessible to all intermediaries, free of charge, to help them upskill and maintain competency in the market.

Our fact-find learning programme –which is London Institute of Banking & Finance (LIBF) accredited learning, and wri en and endorsed by the Equity Release Council – is a great starting point.

Alongside our WriteRoute journey that includes fact-find and suitability report functionality, we can support advisers in ensuring all options are properly represented through the research process so that ultimately the right recommendations can be made.

Later life lending should be firmly established as part of mainstream mortgage advice and broader retirement planning.

As a sector, we must seize this opportunity. Let’s make our voices heard in feeding back on the FCA’s discussion paper – but also, here and now, embrace the support available to allow us to deliver be er outcomes for older customers. ●

Later life lending is evolving to meet modern needs

RICHARD PIKE is chief sales and marketing o cer at Phoebus

UK Finance’s Q1 2025 update shows a 33.5% year-on-year increase in activity from Q1 2024. This signals that older borrowers are continuing to take a more proactive approach to managing their finances – whether through traditional mortgages, retirement interest-only (RIO) products, or equity release.

While the cost of living remains high and retirement income is increasingly under pressure, this is not simply a story of necessity. It’s a maturing market where borrowers are exercising more control over their finances in later life. The other great news is that complaints around advice remain very low.

Advisers should be discussing future property wealth very early in people’s financial advice cycle, as it should be considered alongside other provisions for retirement wealth.

Diversi cation

In the past, equity release dominated the conversation. Today, the market has grown to include a broader suite. RIO mortgages have emerged as a valuable option for those with ongoing income who want to retain ownership and keep monthly payments manageable. Meanwhile, term mortgages with maximum age limits extending well into later life have also helped broaden accessibility.

This shi is supported by greater innovation from lenders, many of which are developing products specifically designed for older borrowers, recognising that this group is far from one-size-fits-all.

The market is taking this sector seriously, with volume originators such as tier one lenders offering products to over-65s, and of course,

the very important building society sector assisting members with some innovative products.

As the market grows in complexity, advisers play a critical role in helping clients navigate the options, assess the implications for inheritance, tax, and long-term affordability, and ensure the solutions align with their wider financial plans.

But advice alone isn’t enough –the way products are underwri en and serviced is equally important. Traditional affordability metrics don’t always fit borrowers relying on pensions, investments or rental income. Specialist lenders are responding with more holistic approaches to income and risk.

This is particularly vital for interest-only maturities. Thousands of borrowers are reaching the end of their original terms with no repayment vehicle. When the originating lender can’t offer an alternative, access to a broad and flexible later life lending market, underpinned by agile servicing platforms, becomes crucial.

Strategic technology

Technology is now a central enabler of growth and resilience in later life lending. Beyond digital fact-finds and affordability tools that support the advice process, the infrastructure behind the scenes is just as important, especially as lenders scale and prepare for regulatory scrutiny.

Automated servicing and flexible application programming interface (API) ecosystems allow lenders to efficiently integrate with third-party suppliers that give a competitive edge, streamline processes, adapt to regulatory change, and deliver high service standards at scale. This ma ers not just for operational efficiency, but

strategically – enabling more lenders to grow with confidence.

Migrations are a case in point. As loan books change hands more frequently and funders increase liquidity in the market, being able to migrate accounts quickly and securely is essential. Platforms like Phoebus offer automated migrations which have been delivered in six to nine weeks. This reduces transformation risk and is a key consideration in successful securitisations and investor confidence.

Tech is also enabling lenders to take greater ownership of their operations. By reducing reliance on manual processes and external support through automation of basic tasks, allowing users to deal with cases by exception, they can control costs and improve resilience.

Sustainable market

The continued growth of later life lending depends on ensuring it remains both responsible and sustainable. That means products that truly serve borrower needs, improving adviser training and resources, and continuing to raise awareness.

With so much wealth tied up in property, enabling older homeowners to unlock equity in a safe and structured way could help address intergenerational wealth gaps, support younger generations, and improve quality of life for retirees.

Collaboration across lenders, advisers, regulators and tech providers is essential. This market can become a cornerstone of financial wellbeing for millions in the years to come. ●

When we speak to new brokers, one of the most common things we hear is ‘Wow! I didn’t know you did that!’

With our manual underwriting approach, award-winning team of local Business Development Managers, generous lending criteria and innovative products - we strive to find a way to lend to your clients.

How can we help?

— We take into account earned income up to the age of 70, or even 75 if the client is in a non-manual role

— We’ll consider pension pots, as well as fixed pensions, investment and rental income. Other income can be considered on a case-by-case basis

— We lend in retirement with higher maximum ages than most lenders

— We have a common sense approach to lending and use human beings, not robots, to underwrite each case. This means we can tailor our solutions to each of your client’s needs.

In Profile.

The Intermediary speaks with Jim Boyd, CEO of the Equity Release Council, about how holistic advice is critical

According to Scottish Widows, 39% of people are currently on course to miss the minimum retirement standards, up from 35% in 2023. Against this backdrop, housing wealth is primed to take centre stage. With an estimated £23bn in housing equity available per year by 2040 if tackled properly, according to Fairer Finance, The Intermediary sat down with Jim Boyd, CEO of the Equity Release Council, to understand the scale of the opportunity, and what must be done to bring equity release further into the conversation.

Growth of the market

At a time of heightened scrutiny for the entire finance and advice market, Boyd says: “[The regulator] has a dedicated focus on later life lending. That demonstrates the importance of this market. We’ve got a rapidly ageing population, and people within that space have inadequate retirement savings.”

This is not only being exacerbated by economic turbulence and the ongoing cost-of-living crisis, but by a fundamental shift in how we fund retirement – namely, the decline of defined benefit (DB) or final salary pensions. Meanwhile, if the Government wants to stimulate growth in the economy, that £23bn figure is significant.

“By 2040, 50% of people are likely to draw on some kind of housing equity,” says Boyd.

“This isn’t just a small, or even a significant market, this is already a mainstream market.”

The Financial Conduct Authority (FCA) is keenly focused on the barriers and opportunities around growth in this market, with chief executive Nikhil Rathi reinforcing that the home is often a person’s biggest asset. Meanwhile, lending to those aged over 55 made up 7.6% of all mortgages in Q1 2025.

The next step is to make sure that the market is prepared for growth and the inevitable increase in demand. Boyd says: “We need flexibility to promote consumer understanding and innovation in the market. This is a dynamic intervention from Government.”

He adds: “There’s a real risk that property wealth might be overlooked if the Government doesn’t develop a vision for it. In the same way that without Pension Wise, pension wealth might have been overlooked following Pensions Freedom.”

To “make sense of the shortfall” facing so many approaching retirement, even from a great distance, Boyd calls for a “multi-asset approach,” that shifts the narrative away from just pensions, and towards an individual’s whole economic picture.

This, he adds, must be reflected in regulation and policy. For example, downsizing provides individuals the opportunity to move into a home that suits their needs, while freeing up funds that could support care, lifestyle or loved ones, as well as creating movement in the property market.

Boyd says: “Downsizing makes a huge amount of sense, providing you’ve got a coherent strategy based on looking at the last-time buyer.”

He notes that treating pensions, mortgages and savings as separate silos is not going to get consumers the best outcomes in retirement, and confirms that the regulator’s approach is to work towards an interconnected network.

He adds: “It’s not just a consultation on separate points, it’s a significant undertaking welcoming insights from experts on a multi-sector basis. [This] stands out as one of the more significant engagements by the regulator in recent years.”

While a truly cross-collaborative approach might seem hard to reach, Boyd points to the Council’s own work with major trade bodies across the mortgage market, implementing conversations with representatives from Government, consumer groups and various trade bodies, to find commonality and understand the barriers to and opportunities for growth.

“Everyone agrees that someone approaching retirement should be able to draw down from all their assets in a way that is well guided or advised,” Boyd says. “A mortgage adviser, meanwhile, is sitting on the biggest asset that people in Britain have. A property adviser is going to need to be the first point of call for many people – not just those taking out residential mortgages.”

Vibrant and evolving

To get consumers to see the bigger picture, this conversation should be happening earlier in the process. With changes to pension schemes and the economic environment, people are “more responsible for their individual wealth accumulation and decumulation” than ever before. A young first-time buyer might seem far off from

retirement, but it is important to raise their awareness of how their property wealth will come into play later. A ‘mid-life MOT’, such as in Sweden, could also take account of assets across the board.

This means a much broader consideration of financial health, such as factoring in how renting can affect a person’s financial trajectory.

Younger generations are already showing a different attitude to debt, according to the Council’s ‘Home Advantage’ research, and intend to use property wealth to fund their retirement lifestyles. Advisers must be ready with a full toolkit to keep up.

“People are living longer lives, making the transfer of equity to support their children’s financial objectives through traditional inheritance harder,” Boyd says. “So actually, having a vibrant later life market is becoming more important.

“On a macro-level, if you don’t encourage people in later life to release funds to top up their retirement needs – such as funding their needs for care and health, easing the strain on the NHS – and give them more ways to engage in efficient markets or transfer wealth to younger generations, then public spending will become squeezed.”

making sure there’s coherence and clarity as this market evolves.”

In the meantime, he says: “We are updating our website, and I’d love for it to increasingly become a destination point for those all those advisers trying to make sense of later life lending products. The expectation is for consumers to also be able to understand where to go to get advice, from mainstream mortgages to care.”

Building on strong foundations

While borrowing in retirement is becoming more widely accepted, there are still misconceptions around equity release as a product of last resort.

Nevertheless, it is currently “a total lottery” from one adviser to the next. A wealth manager might not factor in property assets, while a mortgage adviser might not be aware of the full range of later life products available. Part of the problem is a “fractured market” that enforces a different regulatory structure across different areas. This is also where trade bodies and industry representatives must come in.

The Council is at the heart of this question. By continually refreshing and updating its standards, it aims to create a market that is “completely committed to great customer outcomes [and] peace of mind for consumers.”

Boyd highlights the work of Michelle Highman, chair of the Standards Committee, to strip out ambiguities and duplications, and refreshing the Council’s standards overall.

Its Later Life Lending Summit, taking place in November, aims to further this education, including practical case studies and ‘newbie streams’ for those looking to understand more.

In order to address the “lottery” element of choosing an adviser, Boyd points to an increasing focus on qualifications, which shows that the Government understands the need for better awareness and education.

“We support various ad hoc training initiatives, such as webinars, but we also work closely with Government and the regulators,” Boyd explains. “It’s about driving a change in expectation and

The effort to build out education, create more resources, and prime the market for growth must also normalise housing wealth as part of the cultural understanding of financial stability.

This not only requires the ‘next gen’ products signalled as expected by the FCA to fit evolving consumer needs, as well as space for further innovation, but a fundamental behavioural and mindset change.

Boyd suggests that the UK draw on examples from around the world – markets with a more welcoming approach to deploying housing equity, such as Australia, which has Government backed equity release schemes.

Meanwhile, broadening the terms of the Pensions Dashboard, Money and Pensions Service (MAPS) and Department for Work and Pensions (DWP) could help crack open public consciousness.

Furthermore, Boyd suggests that there should be a “commissioner for retirement,” a Government role unaffiliated with any political party, a “core navigator” able to see where issues overlap – such as the integral importance of the care industry to this conversation – and change the narrative.

For now, the Council will continue building on its own work, as well as with other trade bodies, facilitating public discussion and using its summit and other events to share vital information.

Boyd concludes: “Public discussion and close collaboration are both a huge focus – looking at commonalities and sharing best practice.

“The market is still facing incredibly tough headwinds, due to consumer uncertainty and high gilt yields. But we are seeing growth, and this market demonstrates significant resilience and extraordinary opportunities to innovate.

“We will see greater stability returning. This is going to be a vibrant, coherent later life lending market. It’s hugely exciting, provided the basis for growth is underpinned by great standards.” ●

JIM BOYD

Vulnerable customers are a growing concern

More and more of the UK population are classed as vulnerable –which should both worry and motivate financial services intermediaries in equal measure.

In fact, our recent white paper, ‘Vulnerability in 2025’, revealed that more than half of financial services customers in the UK now qualify as being vulnerable.

As a consulting and customer solutions company, we can see the challenge this poses as well as the opportunity.

The rise is largely due to a neardoubling in cases of mental health conditions, from 10.2% to 19.5% in 2024. Additionally, 16.7% said they felt financially stressed in 2024, up from 14.1% in 2023. We identified a jump in the number of customers reporting an addiction and experiencing financial distress because of it – 3.5% today compared to 0.8% in 2023.

Our survey found that a worrying number of individuals are still unaware that they would be classified as vulnerable, at 53%, although this has fallen from 67% in 2023.

Driving the rise

Part of the reason for the increase in detected vulnerability is thanks to financial services firms themselves actively asking customers about their needs. However, far too many just rely on individuals self-reporting, which doesn’t show the full picture when so many are unaware they may require extra help.

At Huntswood, we have seen examples of firms not joining up their teams and information holistically, meaning customers must say they are vulnerable multiple times to get

proper assistance. Treating vulnerable customers fairly is crucial for intermediaries, and not just because it’s the right thing to do.

The Financial Conduct Authority (FCA) takes a dim view of firms that do not properly take vulnerability into account when handling clients.

The regulator has made it clear that all customers are at risk of becoming vulnerable, and that firms should consider vulnerability on a spectrum, related to four key drivers – health, life events, resilience and capability.

The right culture and technology, used properly, can be a major help for firms seeking to improve how they treat their vulnerable customers.

A matter of duty

Not spotting customers that need extra help can have serious consequences, even when clients know they need this assistance. We found that just 29% of vulnerable customers said organisations they deal with knew of their vulnerable circumstances, while 42% said their firm was unaware of their need for support. A further 29% said they were unsure if the firm was aware or not of their situation.

The research found that vulnerable customers whose provider was aware of their vulnerability, but whose needs went unacknowledged, resulted in 82% saying they were left feeling unsatisfied. This contrasts with just 18% of dissatisfied customers whose firm knew about their vulnerability and had acknowledged it when dealing with a client.

The lack of empathy felt by customers whose firm did not acknowledge and support their vulnerability resulted in those clients reporting negative emotions such as anger, sadness and disgust towards their provider.

MARTIN DODD is chief executive of Hunstwood

Conversely, those at-risk clients who felt their circumstances were acknowledged and supported were more likely to express positive emotions such as trust, joy, and even surprise.

Helping hand

So the big question is – what can intermediaries do to help? We would recommend several strategies to help mitigate the risk of failing to support vulnerable customers.

These include ensuring clear documentation is provided that highlights important information, such as insurance policy exclusions, in accessible formats. We would also suggest protection intermediaries improve identification of vulnerable customers to maximise opportunities to prioritise claims handling activity. Most intermediaries already do this, but we recommend ensuring that proper provisions are made for more elderly clients, who may feel excluded from online channels and may make unsuitable decisions due to impaired judgement.

Intermediaries would also do well to contact known vulnerable customers in advance of potentially impactful events for home and travel insurance, and take steps to minimise risk and provide additional support.

Intermediaries are the first line of defence in financial services when it comes to identifying and helping the vulnerable.

It is clear that, now more than ever, intermediaries must have excellent resources in place to identify those that may need a little extra help – this is set to be a growing proportion of the population. ●

Lending over 60 and beyond

Although we have just celebrated our 11th anniversary as Family Building Society, we’ve been around a lot longer – since 1896 in fact! Our mission has always remained the same: we lend to all members of the family, regardless of age or situation.

We had a record year in 2024, and our continued success is very much dependent on the relationships we’ve built with brokers and intermediaries across the country.

There is no longer a taboo on having a mortgage in retirement. Being mortgage-free used to be a champagne moment in one’s life, but with the growing need for intergenerational lending and increased use of property equity for Inheritance Tax and retirement planning, meeting the rising demand for borrowing into retirement requires an innovative approach and increasingly flexible criteria.

Later life is one of our main lending areas at Family Building Society. Many of the clients that come to us are in their mid-to-late sixties or early seventies, having reached the end of their mortgage term with their high street lender who will not extend it into retirement.

We know this, not just because of the enquires we see, but from our own research into how the high street lenders view the older borrower – in a word, badly!

Often their income has reduced, possibly due to retirement, bereavement or a ‘grey divorce’. There are also older borrowers who are unencumbered but looking to gift money to family members, invest in a second home, or carry out home improvements on their current property. High street lenders see these cases as just too much trouble!

Lending to borrowers in later life with complicated income streams isn’t

always straightforward. However, manual underwriters are able to look at each application on a case-bycase basis.

Innovative criteria

With more flexible criteria and a broader product range available to older borrowers, traditional mortgages can be a more attractive option than equity release. UK Finance data confirms this.

Brokers not familiar with our approach are often very pleasantly surprised when we tell them about our flexible and innovative lending criteria. In fact, one of the most common things we hear is, “Wow! I didn’t know you did that!”

The way we treat investments and pension pots is perhaps the most surprising. We can consider up to 90% of the value in a pension pot divided by the full term of the mortgage, and use that as an affordability measure. This is the case whether the pension is in drawdown or not. It’s a great way of monetising an asset.

Another timely and innovative product is Joint Borrower Sole Proprietor (JBSP). We’re seeing an increasing trend of older borrowers wanting, or needing, to help family members financially.

As we know, with tougher affordability, high interest rates and increasing property prices, getting onto the property ladder is harder than ever for younger borrowers.

Our own JBSP products allow up to four incomes to be used for affordability – one or two borrowers who will own and occupy the property, supported by up to two other family members.

A great benefit of this is that supporting family members will not be liable for Stamp Duty on a second home. Last year, we broadened the family members eligible to support a JBSP to grandparents, aunt, uncles and siblings.

DARREN DEACON is head of intermediary sales at Family Building

Meeting the rising demand for borrowing into retirement requires an innovative approach

We also offer JBSP in reverse –enabling adult children to help their parents to meet affordability if they no longer have the income to support their repayments in cases of divorce or bereavement – allowing parents to stay in a much-loved family home for longer.

Lending trends

Recent UK Finance data showed a resilient and strengthening market for later life lending, with consistent quarterly increases throughout 2024. Lending to the over-55s in Q1 2025 rose to £6.1bn, up 42.6% compared to the same quarter a year previously.

Demand is there, but education remains key. Brokers and clients alike are often not aware that standard repayment and interest-only mortgages are available to those in or approaching retirement.

These can often be more costeffective than equity release and an alternative to retirement interest-only (RIO) mortgages where death-stress rates prove prohibitive.

We continue to work with other lenders, mortgage clubs, networks and trade bodies to ensure brokers are aware of the options available in the later life sector. ●

Society

To quote Billie Burke, “Age is something that doesn’t matter... unless you are a cheese!” Or trying to navigate the financial planning and lending journey that seems to get more complicated as we all get older.

The lending market for individuals aged 55 and above, extending to mortality, has evolved into an exceptionally intricate domain, presenting considerable challenges for both mortgage advisers and financial planners. This complexity stems from a confluence of demographic shifts, regulatory demands, and the increasing diversity of financial products, creating an environment where a single adviser can no longer realistically maintain expert proficiency across all relevant areas.

First, the demographic landscape itself is a primary driver of this complexity. People are living longer, often carrying mortgage debt further into retirement, and facing varied financial circumstances that defy simple categorisation.

Unlike previous generations, who might have paid off their mortgages by retirement, a significant proportion of those aged 55 to 64 still have outstanding mortgage balances. This necessitates a broader spectrum of lending solutions beyond traditional residential mortgages, including retirement interest-only (RIO) mortgages and various forms of equity release, such as lifetime mortgages. Each of these products comes with its

own unique set of criteria, risks, and implications for income, inheritance, and long-term financial security.

Regulatory scrutiny

The regulatory environment adds another layer of intricacy. The Financial Conduct Authority (FCA) places a high onus on advisers to demonstrate that advice is suitable and personalised, especially for vulnerable clients – a category that often includes older individuals. This requires comprehensive due diligence, meticulous record-keeping, and a deep understanding of how different products interact with an individual’s entire financial picture.

Recent FCA reviews have highlighted concerns about poor advice and misleading promotions in the later life mortgage market, underscoring the need for advisers to move beyond a siloed approach and consider all available options, not just those within their immediate specialism.

The Consumer Duty, introduced by the FCA, further reinforces this, requiring firms to act to deliver good outcomes for retail customers, which in later life lending means exploring a wider range of solutions beyond just equity release.

Constant evolution

The ‘myriad of options’ is not merely a figure of speech. It’s a stark reality. For individuals over 55, financing needs can range from remortgaging an existing property to fund home

ANDREW TEEMAN is business principal and later life mortgage specialist at Mortgage Advice Bureau

improvements, consolidating debt, providing financial assistance to family members, or supplementing retirement income.

This diverse set of objectives calls for an equally diverse range of solutions. Traditional residential mortgages may still be an option for those with sufficient demonstrable income, but often with stricter age caps.

RIO mortgages allow homeowners to pay interest-only, with the capital repaid from the sale of the property upon death or entry into long-term care. Lifetime mortgages offer a way to release equity without monthly payments, with interest rolling up, but can significantly erode the value of the estate.

Beyond these, there are also specialist products from smaller building societies and niche lenders, each with specific criteria regarding income sources – for example, pension, rental income, investments

– property types, and even credit history. Navigating this labyrinth of product variations and lender appetites is a full-time endeavour in itself.

Big picture

The interconnectedness of later life financial planning makes it impossible to view lending in isolation.

A mortgage adviser focused solely on securing a loan might overlook the broader implications for a client’s retirement income strategy, their potential need for long-term care, or their inheritance tax liabilities. For example, releasing equity from a property can significantly impact the value of an estate, affecting the inheritance left to beneficiaries.

Similarly, the availability of certain state benefits can be means-tested, meaning that a lump sum from equity release could inadvertently disqualify a client from crucial support. Estate planning, including the drafting of wills and consideration of trusts, becomes paramount to ensure a client’s wishes are respected and their assets are managed efficiently upon their passing.

The fundamental issue is that no single professional can realistically be an expert in conventional mortgage borrowing for younger clients, the intricacies of later life lending, comprehensive retirement planning, the complexities of long-term care funding, the nuances of Inheritance Tax planning, the labyrinth of state

benefits, and meticulous estate planning. Each of these fields requires dedicated study, ongoing professional development, and practical experience to truly master.

Expecting a single adviser to possess deep knowledge across all these specialisms places an unrealistic burden upon them, and more critically, risks suboptimal outcomes for clients, who deserve holistic and truly informed guidance.

Therefore, the sector urgently needs to define a clearer strategy for serving clients in these increasingly complicated but profoundly necessary areas.

This could involve several approaches. First, fostering greater collaboration between specialist advisers. Instead of attempting to be a ‘jack of all trades’, mortgage advisers could specialise in later life lending, working in tandem with financial planners who focus on retirement and estate planning, and perhaps even legal professionals specialising in wills and trusts. This collaborative model would ensure clients receive expert advice across all relevant domains.

Second, developing enhanced accreditation and educational pathways specifically for later life financial advice.

While some accreditations exist – for example, from the Society of Later Life Advisers – a more widely recognised and rigorous standard that encompasses the breadth of financial considerations for older clients is essential.

This would provide advisers with the necessary knowledge, and clients with the confidence that they are receiving truly comprehensive advice.

Finally, embracing technological solutions could streamline the initial information gathering and product matching process, freeing up advisers to focus on the nuanced, humancentric aspects of advice.

Intelligent platforms could help identify suitable lending options based on a comprehensive assessment of a client’s financial position and objectives, flag potential conflicts with other areas of their financial plan, and prompt advisers to consider all relevant aspects.

In conclusion, the lending market for those over 55 has become exceptionally complex due to evolving demographics, stringent regulation, and a proliferation of specialised financial products.