OPINION ⬛ The latest across residential, buy-to-let, specialist finance and more

INTERVIEW ⬛ Nathan Blissett on making the move from football to finance

Q&A ⬛ Lendco and Finanze give us the lowdown on their businesses and the market

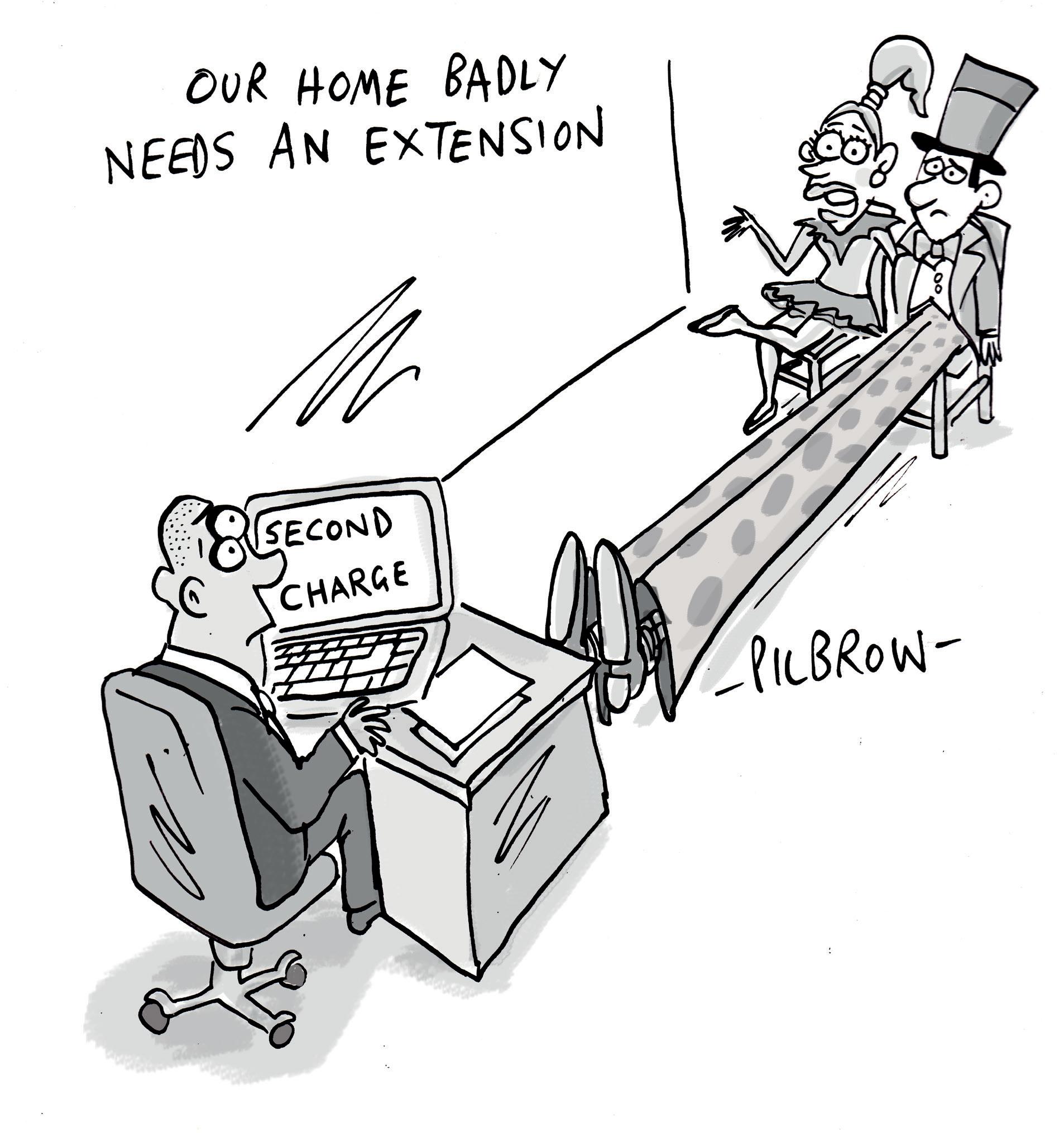

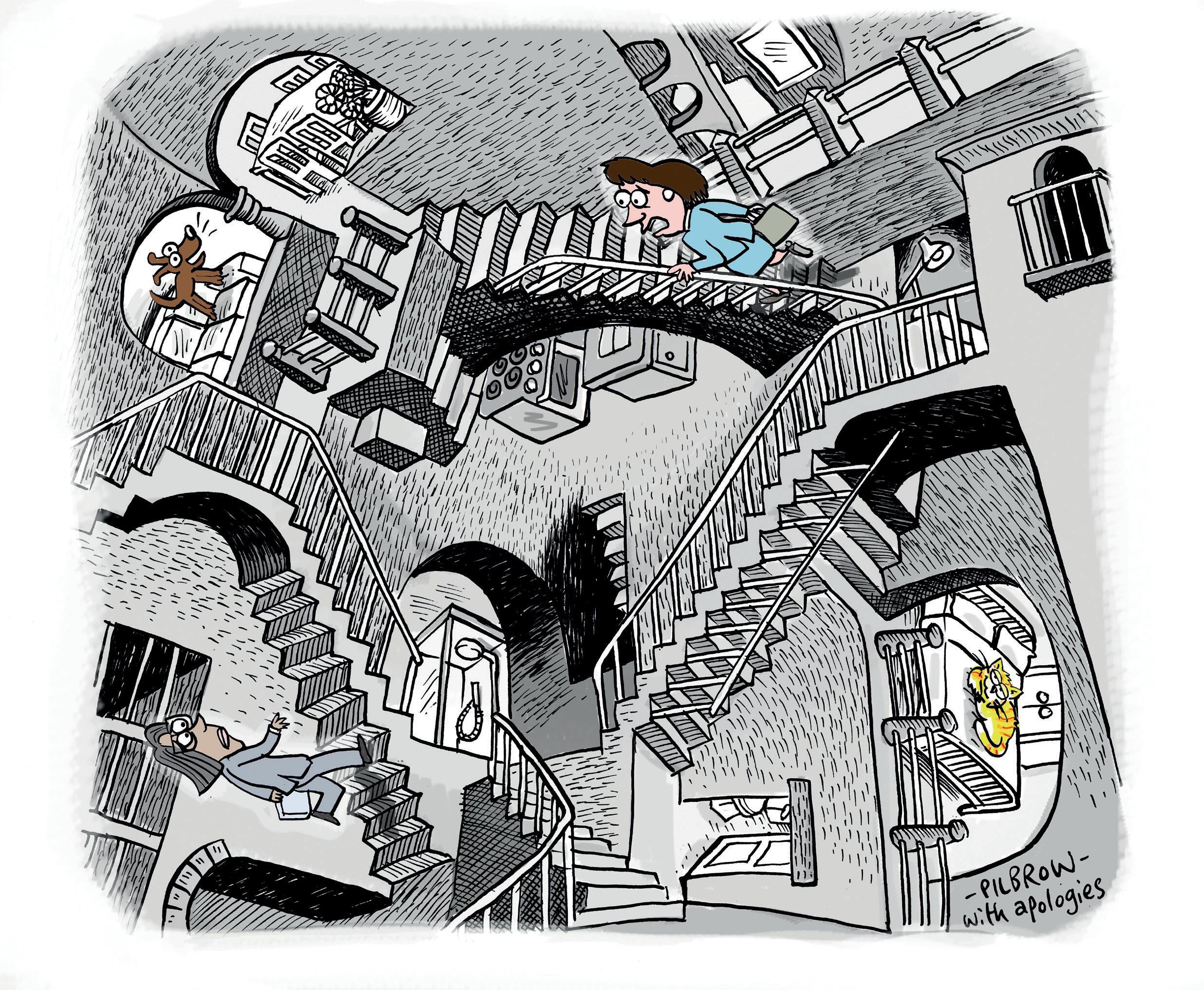

“Are you coming or going?”

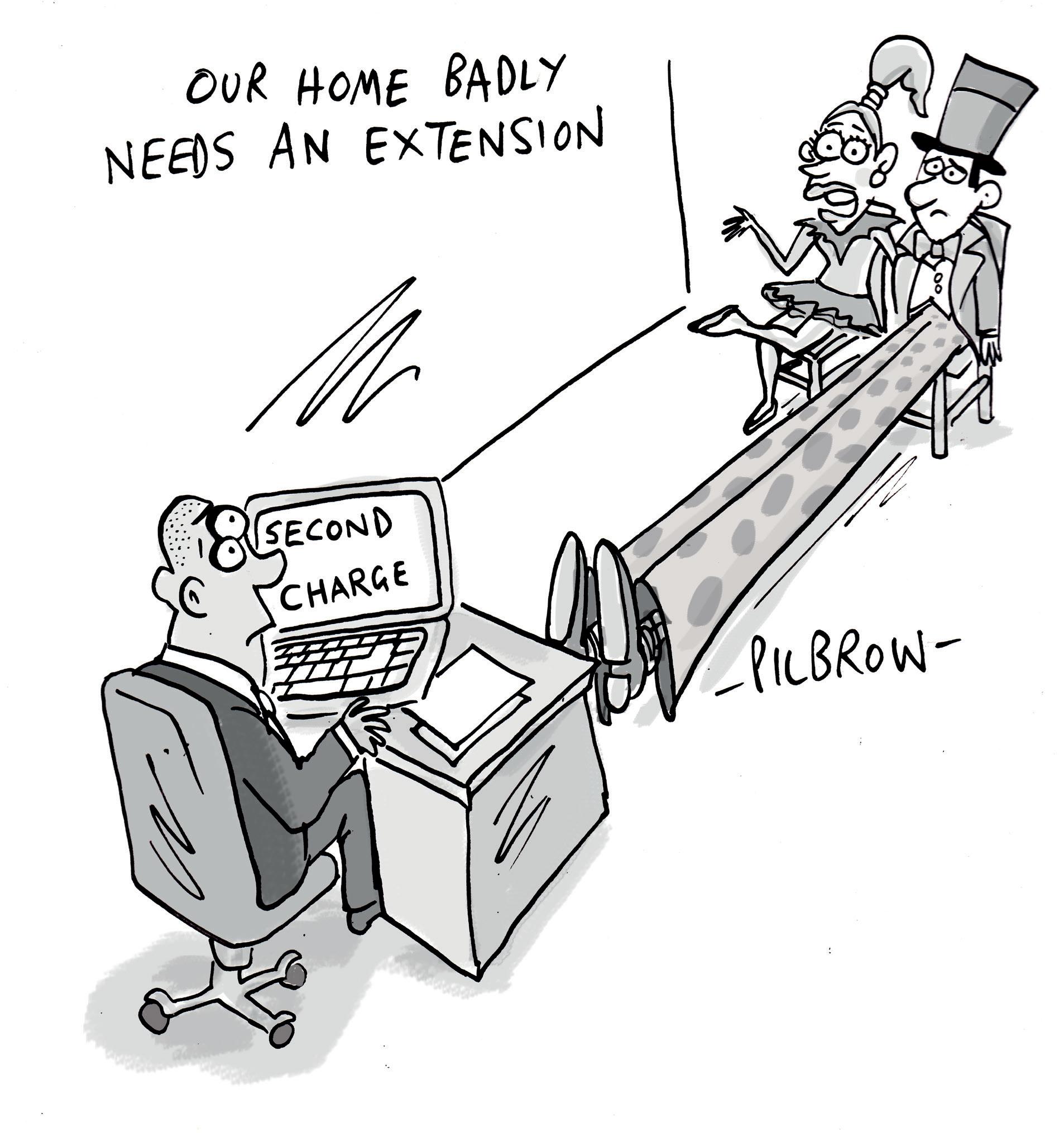

SECOND CHARGE

the future of a market in flux Intermediary. The www.theintermediary.co.uk | Issue 6 | July 2023 | £6 DIGITAL EDITION

Considering

WE HELP YOUR CLIENTS TO SPREAD THEIR WINGS Let’s talk. 0344 225 3939 borrow@ccbank.co.uk ccbank.co.uk For intermediary use only. Cambridge & Counties Bank Limited. Registered office: Charnwood Court, 5B New Walk, Leicester LE1 6TE United Kingdom. Registered number 07972522. Registered in England and Wales. We are authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. Financial Services Register No: 579415 Whether it’s commercial investment or owner occupier, our knowledgeable relationship managers are here to help your clients continue building a portfolio through straightforward and simple solutions. We’re always here for you. Our flexible finance solutions are perfect for property professionals looking to expand their portfolio

From the editor...

This issue, there is really one thing playing on everyone’s mind, from the residential market right through to specialist lending: the Consumer Duty deadline. This is our final issue to land ahead of what has come to be seen as a Rubicon-like moment for the property market.

To hear some talk about it, you might think the 31st of July deadline was set to see us pass magically into an entirely new era of mortgage lending – a brave new world in which the consumer is elevated to a status surpassing profits, while lenders, brokers and other market players join hands and work together in harmony for a be er world. An upli ing, if somewhat naïve picture.

In truth, much like Huxley’s utopia, there is something not quite right about all this. Perhaps it is the pessimist in me, but with news constantly flooding in of brokers either feeling unprepared or unsupported, or even taking a ‘not my problem’ approach to the whole thing, I don’t see us suddenly passing into a new era come the dawn of August 2023.

There is a general consensus that the Financial Conduct Authority (FCA) will go easy on people in the first instance. The way I see it, there are two possibilities here: either this is true, and the July deadline is therefore li le more than an encouragement to start shuffling off the

The Team

Jessica Bird Managing Editor

Jessica O’ Connor Reporter

editorial@theintermediary.co.uk

Claudio Pisciotta BDM

claudio@theintermediary.co.uk

Ryan Fowler Publisher

Felix Blakeston Associate Publisher

Maggie Green Accounts

nance@theintermediary.co.uk

Barbara Prada Designer

Bryan Hay Associate Editor Subscriptions

subscriptions@theintermediary.co.uk

starting line, or people will get a nasty shock when the regulator takes a hard line to what, by many, has been seen as a so launch. Neither is a particularly encouraging image.

More positively, the important thing is that those who are taking it seriously – and there are many, despite the headlines – are doing a lot to make the launch a success, from the regulator itself, through to firms such as SimplyBiz, LiveMore and Paradigm taking the time to push out content aimed at making the process smoother. Perhaps their hard work will prove this pessimist wrong, and we will all be happily popping the Soma come Christmas.

However the next few months pan out, the fact is that increased regulation will undoubtedly have an interesting effect on the market. There are some negatives, such as lenders withdrawing from the regulated space in order to avoid being affected. However, in this issue our feature takes a look at the changing second charge sector, which is set for an influx of new business as brokers ensure they are offering all potential options to borrowers. It might well be worth keeping an eye on this market, as savvy lenders look to take advantage during the dawn of, perhaps not utopia, but certainly change. ● Jessica Bird

Contributors

Alan Waddington | Alison Pallett | Andrew Gilbert

Andy Tilsley | Ashley Pearson | Bob Hunt

Claire Askham | Colin Sanders | Debbie Kennedy

Daniel Stacey | Donna Wells | Hiten Ganatra

Je Davidson | Je Knight | Jerry Mulle

Jessica Brome | Jessica Smith | Jo Breeden

Jonathan Newman | Jonathan Stinton | Kat Atkin

Leon Diamond | Lorenzo Satchell

Louisa Sedgwick | Louise Pengelly | Louis Mason |

Lucy Waters | Maeve Ward | Marie Grundy

Mark Blackwell | Mark Bogard | Martese Carton

Michael Conville | Natalie omas | Neal Jannels |

Nick Allen | Nick Lovell | Paul Brett

Paul Goodman | Ranjit Narwal | Richard Sharp

Robin Johnson | Simon Jackson | Sophie MitchellCharman | Steve Carruthers | Steve Cox

Steve Goodall | Steve Smith | Steve Taylor

Stuart Wilson | Susan Baldwin | Tanya Toumadj

Tim Hague | Tom Denman-Molloy | Tony Ward

@jess_jbird

www.theintermediary.co.uk www.uk.linkedin.com/company/the-intermediary @IntermediaryUK www.facebook.com/IntermediaryUK

Copyright © 2023 The Intermediary Cover and feature cartoons by Giles Pilbrow Printed by Pensord Press CBP006075 SECOND CHARGE “Are you coming or going?” Considering the future of a market in flux Intermediary. The July 2023 | The Intermediary 3

Contents

Feature 46

Natalie Thomas explores the comings and goings of a second charge market in ux

Local Focus 82

This month The Intermediary takes a look at the housing market in Lincoln

On the Move 90

An eye on the revolving doors of the mortgage market: the latest industry job moves

AT-A-GLANCE Residential 6 Buy-to-let 36 Second Charge 52 Specialist Finance 56 Later Life 70 Technology 76 Protection 86

82

DWELLO

Nathan Blissett talks trust, transparency, and taking the leap to set up his own business

In Pro le 34

SMART MONEY PEOPLE

Jacqueline Dewey tells us how tech can enable better choices, and why price is only part of the equation

Q&A 42

LENDCO

Alex King discusses the evolution of the business, and keeping steady on troubled market waters

Q&A 60

FINANZE

Alastair Hoyne talks about the ight to quality in specialist property investment, and making the most of customer loyalty

Meet the BDM 72

PURE RETIREMENT

The Intermediary | February 2023 3

INTERVIEWS & PROFILES The Interview 18

Karen Banks tells us about the challenges and opportunities facing business development managers Local Focus

FEATURES & REGULARS

SECTORS

The importance of Open Banking for intermediaries

It’s a busy time for brokers. With the mortgage market in a very different place to a couple of years back, intermediaries are spending a fair chunk of their day reassuring clients as they go through the steps to get a mortgage. Is there enough time in the day for all these spinning plates?

One of the longstanding difficulties surrounding the work of intermediaries is the sheer scale of the admin needed to check the finances of clients, making sure every detail is accurate to give the best advice and provide the best possible deal for people looking for a new home.

Meanwhile on the consumer side, it’s well known that moving house is one of the most stressful experiences for someone.

With interest rates rising in quick succession and the cost-of-living crisis present in everyone’s minds, who could blame homebuyers for dreading the thought of preparing and triple checking the necessary details their broker needs to complete the deal?

These, of course, are essential steps to get a mortgage. But it takes time –prolonging the stress and anxiety for consumers and eating into valuable time for brokers which could be be er spent seeing more clients or having more time for existing customers.

The solution to both of these challenges comes from a source which would probably be unfamiliar to those outside the financial sector: Open Banking.

This is the process by which banks now share data, with customer consent, to fintech firms and help smooth out processes which used to be done by hand.

We can look at the benefits of Open Banking across three areas: simplification of processes, be er

customer outcomes, and the future application of technology.

One of the key reasons why the implementation of Open Banking is so important for brokers is simplification. At Nationwide, we’ve implemented Smartr365’s application programming interface (API) to share data our customers have agreed to give on their finances.

This helps both mortgage applicants and intermediaries by accessing customers’ bank statements digitally with their consent. Brokers can then access these statements as normal and select the appropriate time window from the past 12 months of transactions.

Our data shows that this process saves brokers around half an hour of printing, checking and scanning for each application – time that can now be freed up for brokers to focus on the advice they give to their clients on the best mortgage deal for them.

Better customer outcomes

The implementation of Open Banking is also important for helping deal with inaccuracies and fraud.

Using Open Banking to collapse the information gap between brokers and their clients helps cut down on the amount of duplication and errors that otherwise might get introduced.

Needing to re-key data, double check documents, ensure bank statements cover the correct date range and consult printed copies to make decisions can be both time consuming and energy sapping for brokers.

Open Banking technology helps offer greater levels of certainty and keeps the process clear and simple for everyone involved.

Open Banking is vital not just to freeing up brokers’ time, but also reducing the amount of friction for

homebuyers wanting to know what their options are.

Intermediaries can use Experian’s Affordability Passport to gain a single, comprehensive view of all the factors that might influence a potential customer’s affordability – such as income, expenditure, and financial behaviour.

The future

Open Banking was first introduced five years ago in the UK, but the technology is still only just beginning to achieve its potential.

Nationwide’s implementation of Open Banking tech has been rolled out to selected brokers, and in the near future we hope to make this proposition accessible to a wider audience, and in the longer-term launch to the entire industry.

It’s our hope that by cu ing away manual processes in favour of automated solutions, we can help free intermediaries to focus on giving deeper advice to a wider range of clients.

There is still room to grow across the industry, however, and partnerships for specific use cases – like the relationship between intermediaries and their customers – will represent a growth area for Open Banking in the future.

Ultimately, the free movement of information between financial providers, customers, and fintechs will help usher in a new age of smoother transactions and be er outcomes – not just for intermediaries and their customers, but across the industry, in a new digital revolution for banking. ●

Opinion RESIDENTIAL The Intermediary | July 2023 6

ANDY TILSLEY is intermediary digital relationships lead at Nationwide Building Society

Introducing our two-year fixed rate and tracker products featuring a reduced stress test and flexible fee structure for clients looking to remortgage with no capital raise. Buy-to-let. Better. Call 020 7096 2700 or visit Landbay.co.uk Maximise affordability with our like-for-like remortgages

Evidencing standards with lender support

As the Financial Conduct Authority’s (FCA) Consumer Duty deadline fast approaches, brokers will be working hard to finalise their implementation plans and looking to experts for advice on how to ensure they meet new standards by 31st July 2023.

According to the FCA, the Consumer Duty will set “higher and clearer standards of consumer protection across financial services and require firms to act to deliver good outcomes for customers.”

Understandably, there is some nervousness surrounding the upcoming deadline, but the new regulations are really just reinforcing good practice which is already widespread in the intermediary mortgage market.

With the right support, this should be a relatively straightforward task for brokers. But for anyone who is unsure, there are some steps they can take to demonstrate they are meeting the new standards.

Collaborate with lenders

The Consumer Duty requires brokers and lenders to work together to make sure they are offering products and services that provide fair value, with a reasonable relationship between the price consumers pay and the benefit they receive.

Just as brokers work together with lenders and their business development management (BDM) teams day-to-day, they should also communicate with them when preparing for the upcoming Consumer Duty deadline.

Working with lenders to be er understand their products and intended target market will be

essential going forward. Ge ing to grips with the benefits, prices and fees of each product or service will allow brokers to give clients comprehensive and tailored advice to suit each customer’s individual circumstances.

Providing clients with a balanced picture of the market and helping them identify which products are right for them – something most brokers are already actively doing –will go a long way to demonstrating how they are complying with the duty.

In the current market, with products being withdrawn or changed at pace, brokers should maintain regular contact with lenders and their support teams.

Keeping track of product and rate changes is a more challenging task, so making the most of telephone BDMs, monitoring for lenders’ email and social media updates, and using live chat tools are great ways for brokers to access information and updates quickly and easily.

Draw on lender resources

Lenders also need to comply with the Consumer Duty and show how they are working in the best interests of the customer, so they have produced their own guides and templates on

how best to evidence meeting the new regulatory guidelines.

Lenders, including Coventry for intermediaries, have created Fair Value Templates specifically designed to help brokers check they are fulfilling their Consumer Duty obligations.

These documents can cut out much of the work required, so that preparing for the deadline will be significantly less time-consuming. Additionally, some lenders have produced guides to help brokers support different types of customers through the mortgage journey. For example, if brokers are looking for guidance on how to support customers with vulnerabilities, Coventry for intermediaries has a full guide with practical steps on how best to communicate and make sure information is clear and accessible ahead of any financial decisions.

Using guides like this can complement brokers’ existing strategies by showing their commitment to helping clients through the mortgage journey.

While many brokers may feel that they still have steps to take to meet the Consumer Duty requirements by the end of July, they may be pleasantly surprised to find out they could be meeting some of the requirements already.

The important thing for brokers will be to demonstrate good practices which provide clients with comprehensive, tailored guidance to pursue their financial objectives.

Brokers should capitalise on wide-ranging support from lenders, engaging with support teams where possible, to effectively evidence the great work they are doing. ●

Opinion RESIDENTIAL The Intermediary | July 2023 8

JONATHAN STINTON is head of intermediary relationships at Coventry for intermediaries

Providing tailored advice will go a long way

Defaults and missed payments should not close the door

Recent years have been particularly challenging for many of us when it comes to our finances.

The pandemic had a big impact on the household incomes of millions of people who were placed on furlough, or even laid off.

Those who work for themselves may also have felt the effects, being unable to work their usual hours, and so seeing their incomes tumble.

Given the difficulties of the situation, we know many turned to credit as a way of keeping afloat.

Research by the charity Turn2Us found that one in three people had to utilise some form of debt, from credit cards and overdra s to loans, in the first six months of the pandemic.

In fact, more than one in 10 had to make use of multiple forms of debt during that period.

Back on an even keel

Now that we are a couple of years removed from this, there are plenty of households looking to get their finances back into smoother shape.

New figures from the likes of Legal & General show that there has been a spike in searches from brokers around the issue of debt consolidation, as they look to tap into their equity and reduce their repayments whilst clearing those debts.

It’s an entirely sensible a itude. Unfortunately, we know that some borrowers who want to borrow for such purposes are being held back because of historical payment issues.

It’s not exactly a huge shock if borrowers have had the odd missed payment or default in recent years, given the financial upheaval caused by the pandemic, and yet we know that there are lenders for which the mere

presence of a black mark is enough to kill a borrower’s chances from the outset.

As a result, would-be borrowers are being denied the finance needed to get their finances entirely back on track.

Missed payments

At Mansfield Building Society we have recognised the growing number of would-be borrowers who are perfectly good prospects, but who may have some history of defaults.

On both our Versatility and Versatility Plus ranges, any defaults over two years old on things like credit cards, loans and hire purchase can be ignored, whether they have been satisfied or not. The client simply needs to have no new defaults within the past 24 months.

Our Versatility range also provides understanding to those who have missed a payment on their existing mortgage. Where our underwriters can be satisfied that adverse credit is linked to a single life event, and there are no missed payments in the past three to six months, we can allow up to a status two within the past 24 months.

Understanding borrowers

If lenders adopt a rigid, automated approach to their lending, then it is inevitable that prospective borrowers with defaults and historical payment issues will be let down.

These borrowers are going to be underserved by such lenders, leading only to frustration and upset for them and their brokers.

That applies whether they are looking to consolidate outstanding debts as they justifiably manage their progress from the stresses of the pandemic through to our current inflationary environment, or even

TOM DENMAN-MOLLOY is intermediary sales manager

Society

Society

if they are looking to borrow for some other purpose, such as home improvements or in order to purchase a new property.

Those aspirations can come to a grinding halt because of some lenders’ a itudes to the odd historical payment issue.

That’s why it is important for advisers to broaden their search and consider lenders which take a more details-based, understanding approach to applications.

A recent study by Mortgage Broker Tools noted that brokers are more commonly turning to affordability systems in order to help source deals for their more complex clients, and that is leading to them working with a wider range of lenders.

By recognising lenders like Mansfield Building Society, which will consider a case on its true merits, we can work together to support even clients with adverse credit on their mortgage journey.

Being a responsible lender does not mean ruling out adverse credit borrowers without taking the time to get a true understanding of their situation. ●

Opinion RESIDENTIAL The Intermediary | July 2023 10

at Mans eld Building

If lenders adopt a rigid, automated approach to their lending then it’s inevitable that prospective borrowers with defaults and historical payment issues will be let down”

Seeing Consumer Duty as a journey

In news that will, quite frankly, shock no one working in financial services, many firms are going to be preoccupied with all things Consumer Duty in the coming weeks and days.

Indeed, by the time you read this, we will be just days away from the implementation of the new rules on the 31st July.

No one is expecting the regulator to launch any sort of cut and thrust against firms it judges not to be complying in the early days of August, as time passes we can expect there to be a growing focus in this area.

Understandably, in these July days, advisory firms are continuing to focus on the requirements of the Consumer Duty, and quite handily, the Financial Conduct Authority (FCA) recently published 10 questions it expects all regulated firms to be asking themselves when it comes to their compliance.

Having talked to a lot of firms over the past year or so about Consumer Duty, these 10 questions do provide a further opportunity to ascertain whether what you have done is enough, and where you might be able to see some loose ends or – though hopefully not – some gaping holes in your services, product offering or process.

Again, the closer we get to 31st July, the more likelihood of firms become a li le more nervous about whether they are on the track the FCA wants them to be on.

Perhaps this is why, in a recent survey conducted by Hodge, 61% of advisers said they wanted more information about Consumer Duty from financial providers to help with the changes they needed to implement. However, nearly threequarters also said they were ‘fully prepared’ for the upcoming changes.

What appears to be clear here is that, even as we pass the deadline,

the Consumer Duty journey just gets going, rather than moving off into the sidings as a trip already completed.

Therefore, firms are right to want to keep learning about the requirements, to want to see further information that can support them on the ongoing journey, and to look to providers, but also distributors like ourselves, to keep helping them motor along.

A er all, there’s a very good point we can make about Consumer Duty, and it involves how the FCA goes about looking at firm’s compliance, what it deems to be non-compliance, how it communicates this, and the time and support it gives firms to get their houses in order.

In that sense, we’ll of course be looking for early precedents being set, and as per usual, the FCA will expect firms to take these on board and work them into their businesses if they feel they also have this gap.

Consumer Duty on lm

Looking at Consumer Duty as a journey has been instructive for us as a business seeking to provide support and resources to authorised advisory firms, and I think it’s valuable for firms to do the same.

We’ve certainly adopted this approach over the past 12 months in particular, using our ‘Consumer Duty on Film’ series to start at the very beginning, working through what we see as the main components of compliance, and then regularly reviewing the various missives and communications coming out of the FCA to adapt our own viewpoint, and to feed that into the support we provide.

The latest video moves that journey on again, especially given that manufacturers of regulated products, including most lenders and providers, were required to produce their Fair Value Assessments by 30th April.

This film looks at how firms can review their own charging structures

BOB HUNT is chief executive at Paradigm Mortgage Services

for the services the provide, and how they can conduct a Fair Value Assessment on their own services.

At the same time, they can utilise the manufacturers’ published assessments on products to assess whether they agree with the target market that has been outlined and whether it does truly provide fair value to their clients.

Then, it’s about marrying these both together so that when all the charges and services are combined, the firm’s overall proposition adds fair value to the client.

We would probably say there’s been a li le confusion about Fair Value Assessments, and whether they just apply to the product manufacturers. It’s important to understand that advisory firms are also considered ‘manufacturers’ of the services they provide to clients, and therefore they do need to have conducted their own Fair Value Assessment of those client services.

It’s another very important aspect of the Consumer Duty, and will go a long way toward firms being able to prove they are offering that fair value and delivering the positive consumer outcomes at the heart of the new rules.

Again, firms should always know they are not on their own, they have access to the resources and support they need through firms like Paradigm, and they can run their activity and Consumer Duty strategy past experienced professionals to secure feedback on the route they have taken and the changes they have made.

As mentioned, 31st July is a deadline, but it’s one that pushes open the Consumer Duty starting gates for all firms, rather than closing them for good. ●

Opinion RESIDENTIAL July 2023 | The Intermediary 11

Championing building society innovation

Tackling the challenges facing first-time buyers (FTBs) trying to get a foot on the property ladder is a topic I am extremely passionate about. I have wri en extensively over the past 12 to 18 months about why helping aspirational FTBs buy their own home is crucial to both the mortgage and housing markets, as well as the wider UK economy.

Homeownership gives people a greater stake in society. It provides a stepping stone to future wealth creation, and helps the economy to thrive.

More importantly, an active pool of FTBs keeps the housing market fluid and enables those in the second-time buyer market to move further up the chain.

When it comes to addressing the challenges facing FTBs, I have always believed that it is the responsibility of the mortgage industry to lead the charge by finding ways to break down these barriers, through the creation of new and innovative products that tap into the existing wealth held in the homes of older generations.

According to estate agent Savills, the total value of homes in the UK was £8.7trn at the end of 2022, of which, almost half (£3.34trn), was held by mortgage-free homeowners. Given the fact that the average house price in March 2023 in the UK was £285,000 – or £523,000 in London – according to official Government figures, the potential to utilise the existing wealth in the nation’s homes seems a no-brainer.

Building societies such as Mansfield and Loughborough are already leading the way in terms of product innovation, with a range of family assist mortgages that tap into the

equity held in the homes of parents and grandparents by enabling them to support their children or grandchildren to buy a home.

Borrowers can take out a mortgage for 100% of the property’s value, provided a family member acts as a guarantor, by either taking out a collateral security of 20% of the property value against their home, or depositing the equivalent in cash into a security deposit account. The cash or charge is then released a er seven years.

Other intergenerational lending products, such as joint borrower sole proprietor (JBSP) mortgages are also available, enabling buyers to join forces with family members to boost borrowing power and get onto the property ladder.

Product innovation

More recently, the launch of a 100% mortgage that uses previous rental conduct for affordability purposes from Skipton is another example of how building societies are innovating to encourage homeownership among FTBs.

The launch has sparked muchneeded debate in the mortgage market, and while I do have some concerns around a full return to 100% mortgages across the market, the use of rental conduct for affordability purposes is something I strongly believe in.

Saving for a deposit has long been cited as one of the biggest hurdles facing many FTBs, o en because a large proportion of their income is spent on rent. Any mortgage product that seeks to address this issue by taking previous rental conduct into account must therefore be welcomed.

A er all, if someone can afford to pay £1,000 or more each month

in rent for one or two years without falling into arrears, then surely they can afford to pay the equivalent in mortgage repayments on their own home?

According to Statista, private renters pay a considerably higher proportion of their income on rent compared with those who have their own mortgage – 21.7% of disposable income for those with mortgages, versus 33.1% of disposable income on rent.

For far too long, the mortgage market has been crying out for innovative products that go beyond the status quo and seek to truly address the challenges faced by those trying to buy their first home.

The UK’s building societies are rising to this challenge by developing products that use different ways to assess affordability while also drawing on the wealth held in many of the homes of older generations.

As an industry, we need to encourage more of this type of lending by proactively looking at ways to innovate. Instead of shying away, we need more mortgage providers to jump on board and embrace the potential to bring about change. Only then can we help the FTB market to truly flourish. ●

Opinion RESIDENTIAL The Intermediary | July 2023 12

HITEN GANATRA is managing director at Visionary Finance

The use of rental conduct for a ordability purposes is something I strongly believe in”

New-build sector sweeteners only go so far

As increased mortgage rates threaten the homeowning hopes of first-time buyers (FTBs), we are seeing new-build developers pull out all the stops in a bid to tempt them into signing on the do ed line.

Developers once offered an upgraded kitchen or bathroom to seal the deal, but more recent incentive disclosure forms offer a glimpse into some of the challenges buyers and builders currently face.

In some instances, prospective new-build buyers can now take their pick between having their deposit paid in full or living mortgage-free for the first 12 months; in some cases, help with moving costs and new flooring have been thrown in as well.

It is difficult – if not unheard of – for house builders to reduce the prices on a development once they have already sold a portion. Ideally, in a buoyant market they would like to see prices go up by the time those in the last stage of the development come to market. However, the reality in today’s se ing is that some new-builds are worth less than they are on the market for – they are just incentivising the difference.

Cautious approach

Housebuilding firm Bellway is the latest developer to sound the alarm over the impact rising rates and the cost-of-living crisis are having on its pipeline. Its June trading update revealed that between 1st February and 4th June, its overall reservation rate was down 24.9% on the equivalent period in 2022.

Its forward order book consists of 6,172 homes – down from last year’s 8,152. It is, however, on track to deliver around 11,000 homes this year, a fall of only 198 on last year, with the average

selling price expected to be around £300,000 – only slightly below last year’s £314,399.

The housebuilder said its overall headline pricing had remained robust across its regions, but it was continuing to use targeted incentives in some instances to secure reservations.

Perhaps the most telling figure is the number of plots it has acquired since 1st August 2022. At 4,342, this figure is in stark contrast to the 13,496 it bought during the same period the previous year. Bellway cited the strength of its land bank and its ongoing cautious approach towards land investment in the current uncertain market for the reduction.

It also revealed its decision to not proceed with the purchase of 886 plots across four previously approved sites.

Harder for developers

Unsurprisingly, Bellway said that while customers were adapting to higher mortgage costs, the recent expiry of Help to Buy in England led to lower year-on-year demand from FTBs. In addition, there remains a relative lack of affordable higher loanto-value (LTV) mortgage products.

We also continue to see stories about Michael Gove, the Secretary of State for Levelling Up, Housing and Communities, making life harder for developers and blocking schemes on design grounds.

He hit the headlines in April when he made the controversial decision to block a 165-home Berkeley Homes scheme in an area of outstanding natural beauty, a er he reportedly found the scheme to be “too generic” in nature.

If reports are to be believed, Gove also plans on wielding his power and potentially blocking other

developments on similar grounds. The recent media coverage about the potential destruction of some new-builds due to inadequate foundations may also not have helped developers’ cause.

Housebuilders are feeling the strain from all corners, and it surely will not be long before we see them retreat further, building fewer houses and holding onto the land until conditions improve.

While we have seen demand for second-hand stock hold steady in recent months, the new-build sector has always been a market in its own right, and without a steady influx of FTBs, we will most likely see it wind down further.

Look to the longer-term

None of this will be good for FTBs, who have just started to see some targeted help from lenders in the absence of Help to Buy – such as Skipton’s 100% LTV mortgage.

The phrase ‘housing crisis’ has become so embedded in our vocabulary that in some ways it has created less urgency in trying to solve it. While much of the media focus remains on the short-term issues surrounding the market, we must also look to the longer-term.

Much of what is happening in the new-build market today will not be felt for a number of years, as the houses not being built today will be missing from stock further down the line – this, I’m afraid, is only storing up additional problems for the future.

As always, the best time to act is normally yesterday. ●

Opinion RESIDENTIAL July 2023 | The Intermediary 13

SIMON JACKSON is managing director at SDL Surveying

Housing:

Elections are usually fought and won in three key policy areas: healthcare, education and housing. The housing market o en steals the limelight, promising access to homeownership for more people, while the complex politics of education and healthcare can lead to controversy rather than a clear campaign slogan.

It’s perhaps no surprise that both the Conservative and Labour parties look set to ba le it out over housing.

Real and present issues

For the past 20 years, economists and housing market specialists have been warning that the country’s inability to build enough homes would lead to soaring house prices, intergenerational financial inequality, and ultimately a rise in homelessness.

These issues are present and real in every part of the country.

This year marks two decades since Kate Barker’s review of housing supply was published. In 2003, she argued that to keep pace with population growth and housing demand, around 300,000 new homes would have to be built every year. That target has been missed by a long way, and Dame Barker’s bleak predictions of a housing market creaking at the edges are

increasingly accurate. While neither party has made firm policy commitments, rumours are already beginning to swirl.

Will Prime Minister Rishi Sunak revive the Help to Buy equity loan scheme, as has been suggested? Will opposition leader Sir Keir Starmer force through legislation allowing for more homes to be built on the green belt?

Politics can be unpredictable and policy promises can be knocked off course as legislation is debated and amended. It was only six months ago that Sunak was compelled to drop compulsory housebuilding targets a er around 50 backbench MPs rebelled. Starmer’s recent pledge to deliver 150,000 new council and social homes each year if Labour should win the 2025 General Election is a nice headline, but can it be delivered?

Kick-start the process

No one is suggesting any of this is easy. Complex value chains and economic environments, not to mention concerns about sustainability, will weigh on any Government’s ability to kick-start the process – but a kick-start is what must happen.

It’s difficult to put a precise number on the amount of new housing needed in England. According to one estimate commissioned by the National Housing Federation (NHF) and Crisis from Heriot-Wa University, around 340,000 new homes are necessary in

Opinion RESIDENTIAL

Politics can be unpredictable, and policy promises can be knocked o course as legislation is debated and amended”

A key election battleground, but politicians alone won’t x it

England each year, of which 145,000 should be affordable.

All of this underlines just how vital our role in supporting homeowners is, because ultimately, politicians don’t build houses, developers do.

Those developers don’t build houses unless people are willing and able to buy them.

Housing is a long-term market, with new homes taking around three years from start to completion. Add six months for mortgage offer to purchase completion, and developers are planning ahead to 2027.

That planning must take account of the economic outlook over the next few years, with all the implications of persistently high inflation and rising interest rates factored in.

Ownership dreams

At Newcastle, our purpose is to help those who want to buy become homeowners, whether interest rates are rising, inflation is high, or otherwise. It’s why we have commi ed to finding ways to innovate so that we can continue supporting our customers’ homeownership dreams.

As lenders, we must remember that not all solutions will fit all borrowers. Loan-to-value (LTV) and loan-toincome (LTI) are not the only tools we have to open or close the lending tap.

We are not the only lender to innovate in this market and embrace schemes such as Deposit Unlock and First Homes, but we have also made a huge effort to offer other alternatives to borrowers in various situations.

Indeed, it was recognised at the recent Legal & General Mortgage Club Awards, where we were awarded Best Medium Lender.

We continue to lend up to 95% LTV on properties worth up to £500,000, and to accept gi ed deposits from family members where borrowers have found it hard to save a big enough

deposit for any number of reasons –usually high rents.

Where family don’t have access to ready cash, or would prefer to support children or other relatives by boosting their LTI affordability, we offer joint mortgage sole proprietor (JMSP) mortgages, allowing borrowers to use the income of a family member to increase their borrowing capacity. These initiatives – and many others in the market – are not going to solve the housing shortage by themselves, but by finding flexible ways to say ‘yes’ to buyers, we are doing our bit to keep the wheels turning. In turn, we can expect others in policymaking to do theirs.

We need more of the right kind of homes that will deliver for younger buyers, and we will be there to support them. A er all, the whole is greater than the sum of the parts when it comes to building homes. ●

Opinion RESIDENTIAL

MICHAEL CONVILLE is chief customer o cer at Newcastle Building Society

New-build remote valuations

It’s been a rocky year in Whitehall, with big swings in polling ahead of the next General Election.

The electorate is pre y fed up. 10 years of austerity under George Osborne’s rule at the Treasury, then two years of pandemic misery. Now, serious cost-of-living shocks to household finances, inflation over 10% for six of the past 10 months, and 13 consecutive base rate rises.

The mood is low, and both parties know it. It is a timely moment for some aspirational housing market policy promises.

It’s a political approach that hasn’t just worked in the past, it’s responsible for at least two huge property market booms. The first came in the 1980s under Margaret Thatcher’s Right to Buy Scheme, and the consequent bust in the early 1990s when the Conservative Government was forced to raise interest rates fast to stop the pound collapsing. The second came in as the New Labour Government under Tony Blair and Gordon Brown won the 1997 election in a landslide. Their manifesto underlined support for the private rented sector (PRS) and just a year a er the first buy-to-let (BTL) mortgage product went on the market, house prices rocketed.

Lender expectation

The point is that new housing market support scheme rumours are circulating around both Labour leader Sir Kier Starmer and Conservative Prime Minister Rishi Sunak.

It’s highly likely that any new scheme will be targeted at building more houses and helping first-time buyers. Whether another is needed is debateable – we already have several, including First Homes, Deposit Unlock and some 100% loan-tovalue (LTV) products still available. Whatever route is taken, though, lenders will be expected to provide mortgage finance.

This raises the issue of affordability. It’s a complex environment at the moment, and one likely to become more so over the coming years. The double whammy of painfully high inflation and rising interest rates is only just beginning to hit the housing market as fixed rate deals expire. Lenders are already gearing up to manage a rise in arrears, and it’s unlikely we’ll see a repeat of the repossession and fire sale scenario in the 1990s that so damaged house prices and household finances.

Balancing risk

Nevertheless, there are downside risks to be managed on both the borrower and security. New-build has always been viewed as more of a valuation risk than existing stock, simply because homes are seen as having a price premium.

Exposures, as well as new-build premiums, have long been an issue for lenders gauging the value of a new-build property. Lower maximum LTVs can provide a cushion, but while house price inflation is still strong, it’s prudent to be prepared for that to shi , however unlikely.

With each new housing policy scheme comes new risk, simply due to the unknown and untested.

Those risks do not lie just with new lending on new housing. All lenders have an eye on their loan book when it comes to product offerings and price. Given how much change the economy has been through over the past three years, the real-time risk is likely to vary against the risk booked at the time mortgages were made. Yet real-time risk is key to understanding exposure.

Many a mistake is made in haste, and at a time when there is still a good deal of uncertainty circling the housing market, lenders want to keep costs low – along with risk. When it comes to quantifying security risk, that means a balance between an in-

person valuation and an automated valuation model (AVM).

e.surv’s Remote Valuations for New Build service delivers both. We tailor the service to every lender’s individual risk appetite to find a balance that keeps costs low, and higher risk security accurately valued.

On first instruction to a new development, our surveyor will visit the site and assess its suitability for remote valuation. Once approved by our specialist new-build team, an automated triage process will then be put in place for subsequent inspections. If approved, we digitally collect information, such as the UK Finance Disclosure Form as well as site and floor plans from developers.

A local surveyor will carry out the remote valuation on receipt of the requested documents. The output is then automatically forma ed into the lender’s mortgage valuation report.

We use a data-led methodology to make the process slicker, taking an average of four days less than a physical valuation. The efficiencies speak for themselves, and by valuing remotely where appropriate, the service also cuts carbon emissions from reduced site visits.

Life and the market’s outlook may be uncertain, but there are some risks you can control. ●

Opinion RESIDENTIAL The Intermediary | July 2023 16

STEVE GOODALL is managing director at e.surv

With each new housing policy scheme comes new risk, simply due to the unknown and untested ”

Interest rates are a blunt tool to crack the in ation nut

The UK’s housing market has been very much in the spotlight in recent weeks. For many people, the prospect of the end of their fixed rate deal is causing real fear. How households, lenders and the Government respond will be central to the UK’s economy in the coming years.

However, having been in this market through several ups and downs, I do also have context. My observation would be that statistics, data, and averages make news, but they do not tell a nuanced story. And that nuance ma ers a lot.

For the past five years or so, London’s house price growth has lagged behind the rest of the UK’s. But is this all bad? No. On the contrary, London leads the rest of the UK when it comes to investment – and particularly foreign investment into Britain.

That investment is not tailing off, because the fundamentals of the capital’s economy and property market are not dependent on the same domestic stresses and strains as elsewhere in the country.

Right, wrong, fair, or unfair aside, London is a global city – it has been for hundreds of years.

It may be oversimplified, but there is a bleak irony in the Bank of England’s predicament. Monetary policy tools that have worked for centuries – since 1694, in fact – have worked because the British economy was domestic. We made and consumed largely within our own borders.

Globalisation has changed that dynamic, and it’s why the central bank has found raising the base rate less effective at curbing inflation than it has been in the past. It is a very blunt sledgehammer to crack the inflation

nut. It is also the reason that London remains a steady ship. The city’s economy is global, and thus is far less exposed to domestic supply and demand dynamics.

There’s no denying that higher mortgage rates will affect London’s housing market, but I think the effects will be felt at an individual level. Those who are highly geared, those whose circumstances have altered in recent years, and those who are simply unlucky.

It is truly dreadful for those who will find their lives changed –sometimes swi ly and painfully.

Nevertheless, London as a market will weather this storm, as it has weathered storms for centuries.

Litmus test for the market

I was heartened to read the views of London’s agents in the latest report from the Royal Institution of Chartered Surveyors (RICS). The people on the ground, the people talking to buyers, sellers and investors, are a much more accurate litmus test for where the market really is. They are realistic, but not panicked. Agencies across the board are united in their view that things are by no means as bad as they could be.

Vendors need to be realistic, but not despondent. The demand is there – the mortgage finance is slightly trickier. However, supporting the market is an uptick in investor activity, as they look to acquire whole blocks, and international investors search for opportunities in London and the South East.

One agent observed that there is more negotiation on smaller properties, while those over £1m are obtaining their asking prices.

The latest Prime London Sales Market Report also shows that

ROBIN JOHNSON is managing director at KFH Professional Services

demand is robust. Excluding 2020, the number of new prospective buyers was 35% above the five-year average in the first four months of this year.

Supply is also picking up, and the number of sales instructions was 16% higher over the same period, which helped push the number of exchanges up by 8%.

The report’s author Tom Bill said: “London has benefi ed as demand gravitates back towards the capital following the pandemic. Prime markets have also been buoyed the return of international travel, a relatively weak pound, and the fact average prices in prime central London are still 15% below their last peak in mid-2015.

“Lower-value markets are performing more strongly than most anticipated despite the fact mortgage rates are more than double the level of two years ago.

“The bo om line is that the market is experiencing a robust period of activity as confidence returns following a chaotic end to 2022. The number of offers made and viewings are also picking up.”

Pre y robust stuff, which illustrates that even within the many markets of London, there are more than a few reasons to be optimistic.

In the end, whether it is right or wrong, it is a fact that the medicine of higher interest rates is not working for everyone everywhere. London may continue to perform, but other parts of the country are being crucified.

Interest rate policy is a brutal tool to address an inflationary problem that is not felt the same way by everyone everywhere. Perhaps that needs a rethink. ●

Opinion RESIDENTIAL July 2023 | The Intermediary 17

The Inter view.

When Nathan Blissett bought his own house at the age of 25, his career as a professional footballer had not necessarily equipped him with an in-depth understanding of property finance. However, working with an experienced broker, Blissett unlocked an unexpected love of the industry that opened up some entirely new prospects for life after football.

“My wife and I didn’t really know anything about buying a property, but the mortgage broker was amazing,” Blissett says.

“He really took the time to really help us understand the process, and we felt really looked after and cared for, and the process was really smooth.

“I knew at some point I would be finishing football, and that this was something I could get real job satisfaction and enjoyment from –helping people.”

Fast-forward five or six years, and Covid-19 hit, leaving the UK facing a much more challenging environment, both in terms of the mortgage market and the wider economy.

Rather than deterring Blissett, this only made the need for compassionate, transparent mortgage advice more pressing.

“When Covid-19 hit it was the perfect storm, it was a time for myself to reset and just go for it,” he explains.

A crash course and six weeks submerged in the literature saw Blissett achieve his qualifications, after which it was simply a matter of reaching out to as many people as possible who might be able to help him learn and gain real-life experience.

The Intermediary | July 2023 18

Jessica Bird speaks with Nathan Blissett about making the move from football to nance, and why today’s market is all about trust and transparency

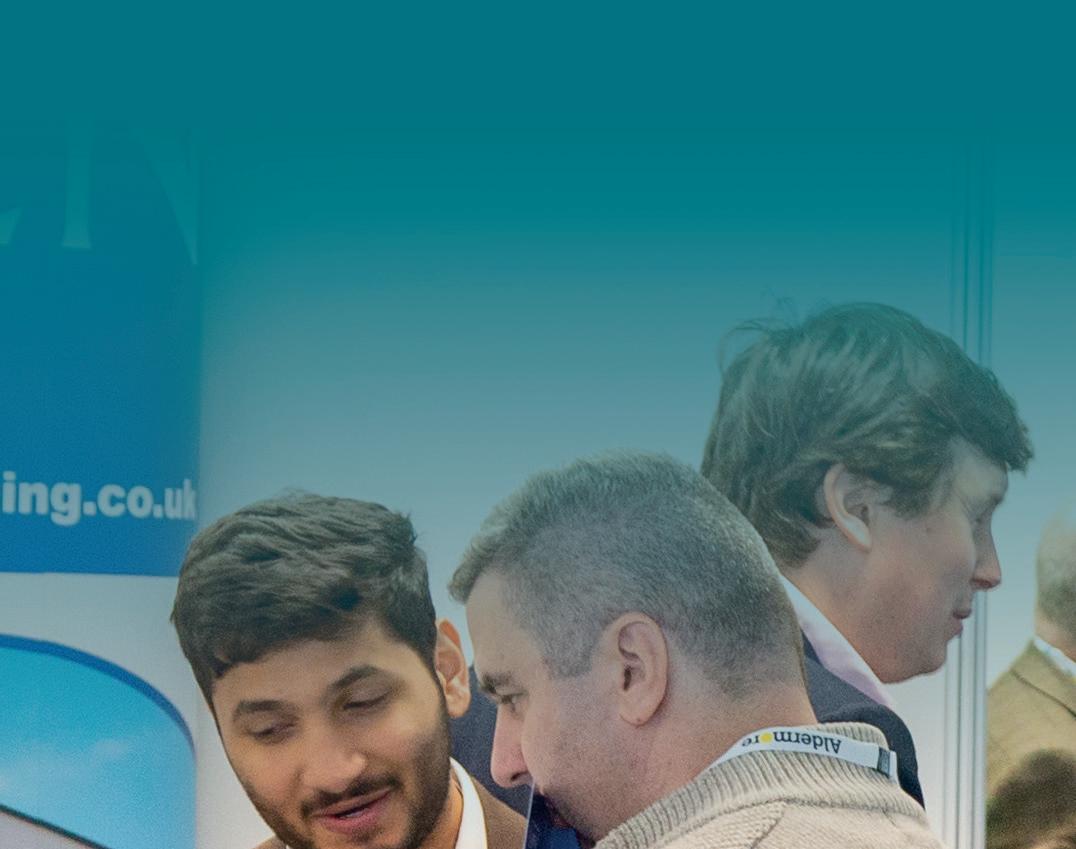

Nathan Blissett, principal mortgage adviser at Dwello Mortgages

He says: “Experience counts for so much more nowadays than just qualifications, so I was looking for someone who could give me roles in which I could learn everything from how to deal with clients, speaking on the phone, to how to process an application.”

Two and a half years later, with experience and understanding under his belt, the time was right for Blissett to form his own consultancy, Dwello , which launched in May 2023, focusing initially on business in Telford, but already with ambitious plans to expand.

Transferrable skills

While there are many in this market who would be confident – rightly or wrongly – showing off their skills on the pitch, it might be hard to see what direct transferrable skills there are between these two markets.

Blissett, however, says that much of what he learned in his previous career can be seen in how he handles business now.

“Teamwork and hard work are two points that are massive, and another one would be communication,” he explains.

“Obviously on the football pitch you have to communicate with teammates to get the best out of the team, and it’s also about communicating with individuals from all walks of life. I’ve also lived in various locations in the UK, and it’s enabled me to converse and get my point across to come to an ideal situation, and to help people.”

Speaking of teammates, it was important for Blissett to build Dwello with the right people. Having built relationships with several of his now shareholders over a long period, during which Blissett helped them secure their own mortgages, it became clear that this was the perfect opportunity to create a business that handled challenging cases, in an up-and-coming area of the UK.

The journey to yes

Even before forming Dwello, Blissett’s ethos was to create a relationship of trust and communication with clients, and this is something he has worked to weave into the new business.

“It’s also about the tenacity to get the deal,” he adds. “I’m here to knock down doors for my clients. A ‘no’, isn’t a no for me, it’s a chance to reconvene at another time.

“It’s really about trying to get the best out of a bad situation at times.

“Obviously, all clients are different. You have some that are straightforward, or others that are quite large scale, and others that are

complex. My job is to go to battle for every single one of them, to try and find the best deal. We want to treat all customers the same – as you should – but a lot of firms don’t do that in practice.”

While Blissett is determined to get the best for his clients, he adds that this is sometimes a case of managing expectations.

This kind of open communication means borrowers know their broker has fought for the best deal, even in those circumstances where it looks different to what they might have hoped for.

In practice, this means total transparency with clients, even if it means admitting that something is not doable.

Blissett says: “We want to be champions for our clients – sherpas along the journey to

the top of the mountain, the ‘yes’ moment. That integrity and transparency comes back to us in terms of long-term relationships and referrals.”

Although it takes on a diverse range of clients, Dwello has a particular sweet spot specialising in self-employed borrowers, where incomes can have complex structures.

The firm aims to help these clients maximise affordability, where some lenders might struggle to fit them in a traditional algorithm.

Market movement

This ability to deal with complex cases is only becoming more important as market turbulence persists, and as various forces come together to make incomes and affordability something of a minefield.

For Blissett, there are some headlinegrabbing developments that, if not implemented correctly and with the customer front of mind, could be just that.

“For instance, the 100% mortgage is a big trend, but that’s not really doing what people maybe thought it would,” he explains.

“It had all the headlines, but it hasn’t really come to fruition for the consumer, the end user.”

July 2023 | The Intermediary 19 →

INTERVIEW

I knew at some point I would be nishing football, and that this was something I could get real job satisfaction and enjoyment from – helping people”

Rather than making a big splash with eye-catching gimmicks, lenders should be addressing the realities for those struggling to secure a deal in an unpredictable market.

“What we’re seeing now is a steady incline in rates, along with a lot of products being taken off the market,” Blissett continues.

“The Bank of England has continued to increase its rates – I thought we would have hit the pinnacle at about 4%, but that’s just the optimist in me. Where do we see it going to? No one knows – no one’s got a crystal ball.”

For Dwello, which offers mortgage, remortgage and protection advice across the residential and buy-to-let (BTL) markets, straddling both sectors is important to understanding opportunities and staying ahead of market trends.

For example, where buy-to-let business might dip due to certain market trends affecting landlords – such as increased regulation and tightening yield margins – the firm can look ahead to how this might tip the scale in favour of owner-occupiers and firsttime buyers.

Indeed, it is not all bad news for home buyers, as Blissett points to a potential movement among portfolio landlords to get rid of properties, which should lead to a slight ease in stock constraints for first-time buyers, in turn helping to bring property prices down.

Blissett notes that there are other practical ways to help buyers in the current market, highlighting in particular the idea of salary sacrifice mortgage payments, helping individuals save on tax and National Insurance (NI) payments, as with their pensions.

Although the Government has been clear that it currently has no concrete plans to introduce this, Blissett says: “We just want to be on the cutting edge of whatever’s happening – to understand it and try to implement it when possible.”

Plans for the future

While Dwello focuses on the market in Telford for now, the plan is to build out a nationwide presence and scale the business accordingly.

Blissett says: “When we started, that was the main question: where do we want to see the business? We thought, if we’re going to build something, let’s build something we can grow into, rather than getting off the ground running.

“We’ve really put a lot into our research and development, marketing, and the brand itself. You can see with the kind of traction we’ve got already that it’s paying dividends.”

Looking ahead to Q4 2023, Dwello plans to expand its number of employees, and is working towards its first acquisition, with a view to scaling the business. Otherwise, Blissett says, it is all about introducers’ referrals and building relationships.

“We’re trying to work with as many likeminded businesses, estate agents, accountants and solicitors as possible,” he says.

Even with its ambitious growth and expansion plans, Dwello aims to keep the values of trust, transparency and communication at its core.

Blissett concludes: “We really want to be people’s go-to, where you can send a client knowing we’re going to treat them exactly how you would. We’re just here to do business really well with the right people.” ●

The Intermediary | July 2023 20

INTERVIEW

The Dwello team

Advertise with The Intermediary and reach 10,000 current and next-generation property nance business leaders. With commercial opportunities spanning print, digital and events, e Intermediary has a multitude of creative channels that can deliver your marketing message to the people that matter. Contact Claudio Pisciotta on CLAUDIO @ THEINTERMEDIARY.CO.UK to discuss how e Intermediary can help your business achieve its goals. Want to share your message

the industry? theintermediary.co.uk

with

From order-taker to educator: The broker’s role

Financial literacy is the cornerstone to building wealth. It gives people the confidence and ability to make smart decisions when faced with financial choices, by providing them with greater insight into how to budget, save money and avoid ge ing into debt.

Having these skills has never been more important than in the current economic climate, where fast-changing interest rates and rising living costs are forcing many people to reassess their household budgets as they learn to prioritise financial demands and make some sacrifices along the way.

Recently, I was invited into a local pre-school to talk to 17 three-year-olds about how to save money, and I started by giving the children a Loughborough Building Society piggy bank and four pence each. I also had some sweets for sale at a rate of two pence per sweet.

The children were given free rein on how to spend their money, and could either save the four pence with opportunity to gain another four pence, buy one sweet, save two pence and gain another two pence, or buy two sweets and spend the lot.

Unsurprisingly, 10 children spent all their money, but seven chose to hold back, leaving them with the option of purchasing some bigger sweets at four pence each. At this stage, six of the remaining children decided to spend all their money on the larger treats, leaving them with nothing. At the end of the game, only one child had money le and had managed to turn four pence into 16 pence by saving her money.

The experiment taught the children an extremely valuable lesson about basic money management skills, and

though it had to be simplistic given the age group, the underlying message about the importance of saving money was clear.

Conducting this experiment made me think about the importance of financial education in schools, and why basic money management skills such as savings, debt, tax and mortgages should be taught in the classroom.

It also made me acknowledge the current changing financial landscape, and its impact on the role of the broker, from order-taker to educator.

Harder than ever before

Over the past 15 years, historically low interest rates meant mortgage deals were plentiful, and finding a suitable product for the majority of clients was a relatively simple task. However, in the current climate this is no longer the case, and brokers are having to work harder than ever before to secure a good rate for their clients in a rapidly changing and frustratingly volatile mortgage market.

Brokers are also having to manage and reset the expectations of many of their clients about why operating in this new normal means their money may not go as far as it once did, and how this may impact their homeownership aspirations.

Conversations like this can be very difficult, particularly if a basic understanding of the fundamentals of finance is lacking. As the initial point of contact for borrowers looking for a mortgage, brokers have involuntarily become the educator, which means they’re under more pressure to help borrowers understand every single aspect of their finances and how it relates to their mortgage application.

As lenders, we have a duty to step up and support brokers in this new role

ASHLEY PEARSON is national BDM at e Loughborough for Intermediaries

by seeking out ways to help customers understand the basic principles of financial literacy and mortgage borrowing.

Brokers come to us to discuss the best solution for their clients, so working with brokers to identify the challenges they’re facing and any gaps in consumer knowledge is imperative.

Like many other building societies, Loughborough plays an active role in the community, and was established with the aim of helping people in the heartlands to save money and buy a home.

While this ethos still rings true today, my recent visit to the local preschool reminded me of the importance of giving back to the community, and highlighted the ongoing responsibility of the industry to ensure that we educate consumers on all aspects of finance.

While instilling these values early can help lay the foundations for more financially savvy consumers in the future, for those borrowers currently facing an immediate increase in their monthly mortgage payments, the industry needs to find ways to educate consumers on changing mortgage dynamics and the impact of this on their finances going forward.

The intermediary market remains at the forefront of this. ●

Opinion RESIDENTIAL The Intermediary | July 2023 22

Brokers are having to work harder than ever before to secure a good rate for their clients”

Consumer Duty will help us support clients for life

So, what even is ‘a er sales service’ where mortgage advice is concerned? Is it just remembering to send the client a bunch of flowers when they pick up the keys to the new home you’ve arranged the mortgage for, or is it more than that?

With interest rates escalating by the week and Consumer Duty likely to be in force by the time you read this, long-term support for customers has never been more important.

US President Benjamin Franklin once said: “Nobody cares how much you know until they know how much you care.”

New opportunities

There is a lot of fine rhetoric about the need for mortgage brokers to work their back book and keep in touch with clients. But despite the platitudes, do brokers really think of a customer as being for life, or just for the duration of the mortgage process? Especially when business is going well and there is a stream of new opportunities walking through the door.

The reality is that many think of mortgage advice as starting and finishing with a mortgage or remortgage. But that needs to change – not just because of the introduction of Consumer Duty, but also because, in a tougher market, it makes good business sense. The rise in interest rates and a waning appetite by homeowners to take on further debt mean many brokers are finding it harder to match the income they generated last year.

The ticking timebomb of 1.5 million people coming to the end of their fixed rates this year means clients need us now more than ever, with many facing a trebling of interest

rates. How many of those borrowers, if not contacted by their broker, will just take the lender’s product transfer option? How many, while panicking about the rise in interest rates, will have cancelled their protection policy? The policy that may be their saviour around the corner.

Client services

It’s not always easy to give clients the ongoing care they need. It takes planning and a proactivity which is not always possible when you’re busy.

At Just Mortgages, with this in mind, we’ve made it much easier for brokers to look a er a client for life by se ing up an entire team to contact clients regularly on their behalf. Our client services team checks in, sees if anything has changed, and sets up further appointments with our brokers to provide a financial review and ongoing advice – o en helping to keep that valuable protection policy in place, or even claim on it if required.

Our customer care has always included reviews every couple of years and contact six months before the end of their tied-in period.

Consumer Duty, however, means this process needs to include many more regular touchpoints to see if a client’s circumstances have changed, help establish ongoing vulnerability, and update advice.

Life changes

For those about to come off a 5-year fixed rate, for example, life might have changed significantly. If a couple were first-time buyers five years ago, they will have been through Covid-19, one of them may have become ill – perhaps even long-term. They could have been made redundant, or forced to change their jobs. They may have had a child, with one person now working

JESSICA BROME is head of central operations at Just Mortgages

fewer hours. In other words, this couple could well be in a dramatically different financial place to the one they were in five years ago, and they are likely to be very worried at the prospect of an interest rate hike.

Financial review

Consumer Duty is an opportunity for us to think more broadly about clients’ needs. While a broker may advise only on mortgages and protection, clients should now undergo a full financial review every year.

If that review highlights needs beyond mortgages or protection, then it is in the client’s best interest to refer them for more specialist advice, perhaps for wealth or pensions advice, or for equity release or later life lending.

This is about more than customer retention. It’s about what’s right for the customer. Regular reviews and touchpoints mean that we are here for the client when they need us, rather than when we – or they – think they need us.

Consumer Duty is an opportunity to make sure that we genuinely meet our clients’ needs. It’s also an opportunity for us to stress-test our own service.

By showing our clients that we care, and by keeping in contact with them – at least once a year – we will be a consistent part of their financial journeys, supporting them throughout the duration of their mortgage, from first-time buyer to potential equity release customer and beyond.

Only then will we truly have clients for life. ●

Opinion RESIDENTIAL July 2023 | The Intermediary 23

The case for a product lies in the consumer

Every so o en, the UK mortgage market is compared to European and American markets. Countries including France, Germany, Denmark, and the US tend towards fixed rates that match the mortgage term – 25-year and 30-year fixed rate loans, in other words.

In contrast, the UK market is dominated by 2-year and 5-year fixed rates, with all manner of explanations as to why that might be. Not all, it should be said, are terribly fair.

Regardless of why the UK mortgage market evolved this way, there is no doubt that short-term fixed rate products force borrowers to remortgage multiple times during the term of their loan.

Long-term fixed rates have the advantage of providing certainty for borrowers for the full duration of that loan. It also means borrowers are less exposed to short and medium-term economic volatility, reactive monetary policy, and payment shocks.

In the current market, certainty offers obvious comfort, particularly to those borrowers coming off very low fixed rates and facing a sharp rise in their monthly outgoings. It’s worth remembering that exposure to market rates works both ways.

Bank rates around the world fell in the wake of the US sub-prime mortgage crash, and borrowers paying a perfectly competitive fixed rate of around 7% in 2007 found they could remortgage at 3% when their deal ended, and then two years later they were being offered a fix below 1%.

One does wonder whether someone taking a 30-year fixed rate in 2007 when the base rate was 5.75% would have been delighted for the next 15 years. On the other hand, that same

homeowner would probably be feeling a li le less short-changed today.

Were someone to have taken a 30year fix in 2017, their rate could quite plausibly be lower than today’s base rate at 5%.

The prospect of another 24 years locked into what today’s remortgagers would probably give their eye teeth for might leave them feeling vindicated.

The grass is always greener. Every model has pros and cons, and there is room for both. Understanding borrowers is key to knowing what is appropriate for their outcome.

Time in the market

There is a time-honoured adage rolled out by the investment industry regularly and with alacrity: it’s not timing the market, it’s time in the market.

Let’s rewind to 1993, when the base rate was 5.88%. In 1998, the Bank of England raised it to 7.5%. In March 2020, Covid-19 hit and lockdown stopped the economy overnight.

In the most drastic monetary policy cut in history, the Bank of England slashed the base rate to 0.1%. Shortterm fixed rates, priced on markets’ short to medium-term interest rate expectations, rise and fall in line with that.

The borrower carries the risk in exchange for the reward that is very cheap mortgages when they’re available. However, risk plays both ways, and a er more than a decade of the base rate below 1%, an entire generation of borrowers became homeowners without any concept of that trade-off.

Add to that mix the Government bailouts that staved off global financial collapse in 2009, and the emergency support payments precipitated by the pandemic.

TIM HAGUE is managing director at Sagis

The result for millions of homeowners who first took a mortgage in the past 10 years is a misconstrued assumption that the Government and Bank of England will take the pain away when the going gets tough.

Returning to the point about risk, the base rate high in the past 30 years may have been 7.5% and the low just 0.1%, but the rolling average was 4.35%. Many of those stressed at 3% over standard variable rate (SVR) will probably be able to afford current prices, but some who took longer fixes may be in for a nasty shock.

Considering all the factors

Any broker worth their salt will remind you that rate is just one of many considerations when choosing a mortgage. Early repayment charges (ERCs), portability, the availability and access to further advances, earning potential over a full career and the consequent affordability constraints – these are just a few factors borrowers must consider.

The length of any fixed rate term should now be part of those considerations. That which anyone in the regulated advice business knows to be true: every circumstance is different. What is right for one borrower is wrong for another, and the other way around.

The Consumer Duty rules go live soon, and the question advisers must ask now is: how will short and long-term fixed rates affect consumer outcomes? The answer will, as ever, depend. The important thing is that the question is asked. ●

The Intermediary | July 2023 24 Opinion RESIDENTIAL

Sound investment or expensive mistake?

LOUIS MASON is content and communications manager at Oportfolio

Rising rates

Every day we are asked the same question by first-time buyers: “Is now a good time to buy, or should I wait?”

Let’s face it, from an outsider’s perspective the mortgage market – and the property market as a whole – looks quite unappealing.

Mortgage rates are rising daily, property values are either remaining high or in a lot of cases starting to drop only as interest in purchasing faulters, and other household bills associated with homeownership have spiralled out of control.

Despite all this, though, is it a good time to purchase, or should new buyers hang fire?

Of course, this debate doesn’t apply to people who are not currently in a position financially to purchase, but if someone is considering purchasing a property now or in the near future, whether a first-time buyer or looking to sell and move, it is important to always look towards the future and consider the power of investment.

Big investment assets

When clients purchase a property, no ma er how high the mortgage rate or the value of the property, they are investing in their future. Yes, the property market is going through a tough period, but historically it has always bounced back. As one of the biggest investment assets most

of us will ever own, a property will appreciate over time, and the sooner someone can buy, the be er their future returns will look.

More than 60% of homeowners in the UK consider their property to be their most valuable asset, and I am surprised that the percentage isn’t even higher.

Freedom to move

One of the main rebu als to this argument that we see frequently comes from private rental tenants and people still living with family at home, who can perhaps afford to buy their first home, but are unsure if they should.

If you can live at home and save money then why not, right? It means avoiding paying out hundreds or thousands a month, which you could keep adding to a nest egg. What about renting a property that you can freely move from when you like, and avoid being tied into investing in a property with an expensive mortgage?

The main issue with these two arguments is that while waiting, clients aren’t gaining anything financially. They aren’t creating equity or investing in anything.

In fact, the longer someone waits, the more they are investing in their landlord’s property, without any returns. If they are living at home, the longer they wait, the more potential asset appreciation they are losing.

We are in a period where mortgage interest rates are higher than they have been for a number of years. Unfortunately, that is a reality that we are going to have to get used to. Mortgage rates will come down, but long gone are the days of rates at 1% or below.

For landlords in particular, these rate rises will hit hard and will narrow their profit margins. Are landlords going to cover these extra costs themselves? Absolutely not. It will be renters who will be worse off per month.

So, investing in your own property and paying your own mortgage will always be more beneficial if you can afford to purchase.

But what if property prices drop significantly? This is perhaps one of the biggest worries that every property owner has at some point or another.

The simple answer is that if the client is not planning on selling any time soon, then they don’t need to worry about it! As long as they aren’t hoping for a quick ‘buy and flip’ job, then it doesn’t ma er too much if a property goes down in value due to market conditions, because it will come up again. A property is a longterm investment and there will be ups and downs. But property value has always bounced back, and demand is always going to be high.

We as buyers, sellers, brokers and lenders have a real storm to weather right now, but things will get be er.

Property is a great asset to have, and even if the market struggles, the right property and mortgage market advisers will be able ensure clients’ money is invested in the most beneficial way possible. ●

Opinion RESIDENTIAL July 2023 | The Intermediary 25

Property value has always bounced back and demand will always be high

Could variable rates grow in popularity?

Isaw something interesting within some recent data tables, published by the Financial Conduct Authority (FCA). It showed that in the first quarter of 2023, the proportion of all new residential loans – gross lending – that were on a fixed rate had dropped. While 83% of all loans were on a fixed rate, that proportion was previously 94.5%, and it had remained in the 90% range since 2017.