INSTI-NEWS SUMMER 2023

Insti-News is published by the Institute of Municipal Assessors with assistance from the Communications Services Committee. Chaired by: Cathy Ranieri Sweenie, Affiliate.

Any opinions or recommendations expressed in this issue are those of the contributors and do not necessarily reflect the views of the IMA.

Interested in submitting an article? Have a great idea for a hot topic? Make your submission to communications@theima.ca. Be sure to put “Insti-News Submission” in the subject line or contact the IMA office by phone to discuss.

Written permission must be obtained before reproduction or use of any contents.

16 Industrial Parkway South, Suite 205 Aurora, Ontario, L4G 0R4

905-884-1959

1-877-877-8703

info@theima.ca

First of all, I would like to take this opportunity to thank all our members for the privilege to serve as President of the IMA for the 2023-2024 year. For those of you that know me, you will know that I have been a member and advocate for the IMA at both the district and national level throughout my career, so I am thrilled to have the opportunity to continue to give back in this new role.

I am fortunate to have a passionate and hard-working team of professionals joining me in leading the IMA this year. Our IMA Executive Committee members – Carlos Resendes M.I.M.A., 1st VP, Drew Samuels, M.I.M.A., 2nd VP, Erin Johnston, M.I.M.A., 3rd VP, Greg Martino, M.I.M.A., Past President, bring decades of a wealth of experience across the assessment and taxation industry to guide our decision making. We are joined by our dedicated District Directors; Jane Sokol- Kennedy, A.I.M.A., Lee Tomkins, M.I.M.A., Jessica Martini, M.I.M.A., Debbie Simone, M.I.M.A., Bill O’ Connor, M.I.M.A., Mark Lindquist, M.I.M.A., Andrew Loney, M.I.M.A., Pete Fortin, M.I.M.A., Emily Hopkins, M.I.M.A., and Janice Sooley, A.I.M.A. Our District Directors are a crucial part of our governance model, ensuring that we always connect our strategy to our members’ needs at a national and local level.

You will be happy to know that in my presidency year, we will continue to focus on our four key strategic pillars - Educate, Grow, Lead and Govern. These four pillars are crucial to the wellbeing of an educational, membership-based organization like ours. To that end, the Board of Directors recently met to update our strategic activities with an eye on developing measurable KPIs that we can link directly to continuously creating value for our members. We will share more on our updated Strategic Plan in our next Insti-News.

Our Vision of being “the industry leader in education, ethical standards, and professional accreditation in the field of property assessment”, is ever evolving. We will continue to focus on ensuring our educational offerings are best in class, while ensuring our members have the support they need to uphold the highest ethical standards, and we will always advocate for the value of your A.I.M.A. Designation and M.I.M.A. Accreditation.

Lastly, let me leave you with one idea – the IMA is your association. We are here to create and deliver value for you, our members, so that your professional path can be best supported. Please reach out to me to share your thoughts and ideas. There is always room at the IMA for the voices of all our members.

Janice Hunter-Desjarlais, M.I.M.A. IMA President

Well, that was a quick summer! I hope everyone had a chance to relax and spend some time with family and friends. Welcome to back-to-school season, a full calendar of meetings and many deliverables due.

Even with a slower summer pace, things have been busy at the IMA office since our last Insti-News. We had an incredibly successful in-person Conference in Kingston, ON. Attended by almost 270 participants, from across Canada, this year’s conference included a wide range of topics related to industry challenges and successes, current rulings, artificial intelligence, Bill 23, ethics and much more. We were able to connect in person with old colleagues and meet new ones. Personally, it was such a pleasure to meet with members and stakeholders from across the country and industry. I left the conference feeling inspired and thankful to be part of the IMA community and the extraordinary professionals in it. The team has been busy reviewing the conference feedback, diving into lessons’ learned and planning for the 2024 conference in Niagara-on-the-Lake.

We are continuing our partnership with IPTI to offer 12 new online webinars, that you can access from the comfort of your home or office. The topics continue to be best in class and insights can be immediately applied to your work. If you have not had a chance to do so yet, take a look at all the new topics (and our comprehensive library of On-Demand offerings) at theima.ca/page/2023_24webinar

Our Districts are hard at work planning for upcoming District Meetings. We are also collaborating on a special project with the Alberta Assessors’ Association, working to elevate and bring more recognition to the identity of the Canadian Assessor and the IMA designations. Stay tuned for updates shortly.

As we work to support you, our members at every stage of your career, we are exploring the value of a mentorship program, specialized educational offerings and new CPD.

Our Fast Track Designation Program is continuing with over 30 participants in this current co-hort. Contact us if you are interested in participating in future cohorts.

I was honoured to present on the IMA, our educational offerings and the strength of our A.I.M.A. Designation and M.I.M.A. Accreditation at the recent meeting of the Canadian Directors of Assessment, in Toronto. I have also had the pleasure to meet with employers and colleagues from across Canada and leveraged each opportunity to highlight the professionalism that the letters behind your names speak to. I am committed to continuing these efforts to advocate on behalf of our members.

Finally, the team took on an analysis of our operations with an eye toward streamlining. I am proud to say that we have been able to realize robust savings out of this activity that will be reinvested in product development and value generation for our members.

I am looking forward to sharing our new Strategic Plan with you all shortly and all the successes that I know await us. As usual, we are here to create value for you, our members. Reach out and connect with us and let’s work together to advance the interests, education and professional competence for all our members.

Ejona Balashi B.A., CMP, SFC IMA Executive Director

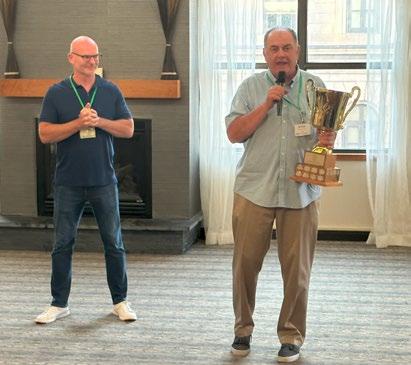

The Institute of Municipal Assessors (IMA) held its first in-person conference in over three years, from June 25-27 in Kingston, ON! The event commenced with the Annual Golf Tournament, a friendly competition that helped raise funds for the Scholarship Trust Fund. Over the course of the two and a half days, thanks to the generous donations from our speakers and attendees we raised over $2000 for the Scholarship Fund. Additionally, donations were made on behalf of some speakers to the following charities:

• Kingston Youth Shelter

• Distress Centre - Ottawa

• Kids Eat Smart Foundation: Newfoundland and Labrador

• Hearth Place Cancer Support Centre in Oshawa

• Ottawa Centre Refugee Action

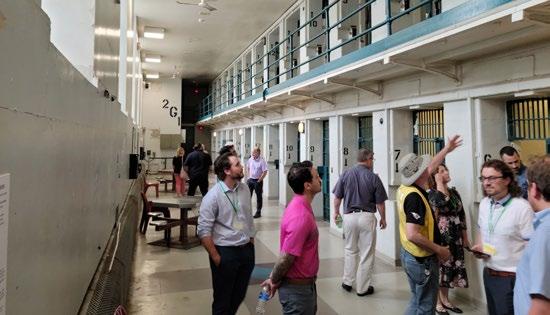

The 64th Annual Conference provided attendees some much-needed time to learn, network and rejuvenate. Along with insightful sessions and presentations, the event also offered ample opportunities for attendees to reconnect with their peers and have a great time. We are pleased to share some moments from the conference, captured by the talented volunteer’s Drew Samuels, M.I.M.A. and Lee Tomkins, M.I.M.A., which we hope will bring back fond memories of the event.

What fun we had at the IMA Conference in Kingston learning how to make the most out of the dreaded ARB settlement conference! While I cannot possibly provide you with all the tips and insights that were shared at the session, I can share highlights from a truly memorable event.

I want to begin by thanking everyone who participated on the panel: Michelle Cicchino (Gowling WLG), Drew Samuels (DuCharme, McMillen & Associates), Scott McAnsh (NextGenLaw LLP), Greg Martino (MPAC), Tristan Bock (Altus Group), Amboka Wameyo (City of Kitchener), Dan DeVellis (MPAC), John Watling (IPTI), Debbie Brennan (City of Kingston), and Jeff Walker (City of Kingston). Talk about a Dream Team!

The ‘script’ for the mock settlement conference, acted out with Academy Award winning panache by our panelists, included both excellent performances and intentional mistakes that the audience were asked to recognize by using thumbs up and thumbs down.

Before we began our mock settlement conference, however, the panelists were asked to explain how they prepare for a settlement conference. Their tips included one central theme: the importance of properly preparing.

For advocates, preparing includes understanding the strengths and weaknesses of their client’s case, and appreciating the strengths and weaknesses of the other parties’ cases. Advocates rely on their independent and impartial experts to assist them with this analysis.

Advocates use their professional judgment to critically analyze the case to determine what they think the ARB likely will decide if the appeals go to hearing. This does not mean that the advocate disagrees with their expert or their client. It is a

recognition by the advocate that the ARB almost never accepts one party’s position completely.

Before the settlement conference, advocates must have realistic conversations with their clients about the client’s expectations: it serves no purpose to convince a client that their case is ironclad when it is not. Advocates should arrive at the settlement conference understanding their client’s view of an acceptable settlement outcome. For most assessment appeals, this usually is in the form of a range of acceptable values.

The experts were all very much aware of their duties of impartiality and independence, which limits their role in settlement discussions both with their clients and in the settlement conference. Experts should be able to point out any areas of weakness in their own opinions and in the other experts’ opinions. They can provide information on where it might be reasonable to adjust a component of value, but experts must do this based on their expertise as valuators and not because this will ‘get us a settlement’.

Clients have a role to play in a settlement conference, particularly if the client has knowledge of property assessment or property values. Clients indicated that they try to approach the issues with an open mind and a willingness to consider the other parties’ positions. Clients also consider the costs of proceeding to a hearing and the consequences of a decision on other files. MPAC and municipal clients consider issues of fairness and transparency.

When we moved on to the settlement conference position of the session, we began with a roll call. Oops! It turns out that the municipality did not send its instructing client to our session! Failing to bring clients to settlement conferences is contrary to the ARB’s Rules, undermines the process, and makes reaching a settlement more difficult. Fortunately for us, however, Debbie was able to ‘call’ Jeff who then had to do the walk of shame from the audience to join us on the panel.

Moving on to the opening comments, the ARB Member asked one of our experts (Tristan) to provide the opening comments for his client. Drew correctly objected because an expert should not be putting forward a client’s position: experts have opinions of value; they do not advocate for their client’s position.

As our settlement conference progressed, we had an interesting interplay between the Member and the advocates. The Member volunteered to provide her opinion of what the likely decision would be if the appeals went to a hearing. Scott politely and clearly objected because he did not think it would be helpful to the settlement discussions. Scott’s objection was accepted by the Member because the process is within the parties’ control. Interestingly, however, when we caucused1 with Michelle’s client, she asked for the Member’s opinion. This is a very good strategy to use if your client is reluctant to move from a position because it allows you to get an opinion from the Member that is not necessarily shared with the other parties.

Speaking of caucusing, we had a very good interaction in caucus with Drew and his team concerning confidentiality. Drew demonstrated how important it is to make it clear to the Member what information, if any, disclosed during the caucus can be shared with the other parties. Usually, a party will request that everything said in caucus be treated as confidential unless expressly agreed.

Also in caucus, we discussed who should make an offer: the advocate or the Member on the parties’ behalf. In our case, MPAC had decided to seek an increase, and the appellant was very upset. It was decided that having the Member convey the offer to the other parties might make them more receptive.

Unfortunately for us, our parties were not able to resolve the appeals. Therefore, we moved on to discuss what should be included in the Member’s Case Management Report and Order (CMRO).

The Member wanted to use the Board’s ‘standard’ hearing management plan (HMP). Drew objected and asked that the advocates be able to consult and provide an HMP after the settlement conference. This is an appropriate position to take if the parties believe that the standard HMP is not appropriate for the appeals.

The advocates also discussed the importance of dealing with evidentiary issues at the settlement conference to avoid surprises at the hearing. Some issues to consider:

• Are there any objections to the experts’ qualifications? If not, ask the Member to note the lack of objection in the CMRO.

• Are there any issues with the evidence, such as a party filing a document not previously disclosed? If so, the CMRO should provide directions on how the issue is to be resolved with prior to the hearing.

• Are there any new documents that a party wants to file before the hearing? Sometimes, parties discover additional documents during settlement discussions. However, unless the documents are in the party’s filing package, they cannot be relied on at the hearing even if they are used and discussed at the settlement conference.

Hearing time is strictly limited: you do not get extra hearing time if you spend some of your allotted time on ‘housekeeping’ issues. Therefore, it is very important that everyone arrives at the hearing ready to go with a minimum of organizational or procedural concerns.

The session provided a lot of practical information that all of us can put to good use as we prepare for and attend future settlement conferences.

NAME COMPANY

Joseph Anderlich

Greg Anger

Robin Bradley

Janet Briscoe

Cindy Chiasson

Sandra Conrad

Alana Danard

Linda Erickson

Sean Fewer

Karen Folk

Rodrigo Fresnedi

Marco Frias

Allison Haffner

Nathan Haley

Alexandru Hariton

Myke Harrison

Bria Harvey

Samantha Hollingsworth

Tania Jafary

Hardeep Kaur

JungWoo Kim

Gregg Mandeville

Ashley Mills

Hong Min

Scott Patterson

Sam Reyes

Eirin Rhodes

Tyler Scott

Dwayne Vey

Adelso Vivas

Weihua Wang

Raymond Williams

Yizhuo Yin

Ho sang Yoon

Di Zhao

NAME COMPANY

MPAC Peterborough

MPAC Windsor

MPAC Kitchener

MPAC Pembroke

PVSC

PVSC

MPAC Kitchener

City of London

PVSC

MPAC Toronto

MPAC Toronto

MPAC Richmond Hill

MPAC Kitchener

PVSC

MPAC Toronto

Equitable Value Inc.

PVSC

City of Ottawa

New graduate

MPAC Mississauga

New graduate

MPAC Mississauga

MPAC London

Recently graduated

PVSC

PVSC

PVSC

MPAC Barrie

MAA St. John’s

Service New Brunswick

Construction

Altus Group

PVSC

Choice Properties REIT

City of Mississauga

Jeffrey Allen

Derrick Chan

Lena Dantzer

Katherine Flagler

Cory Leclerc

Dorota McKeen

Kyle Petterson

Jeffrey Pine

Shelby Roper

Natalia Weidner

Kent Wong

Sandra Wood

MPAC Mississauga

MPAC Toronto

MPAC London

MPAC Peterborough

MPAC Cornwall

MPAC Kitchener

MPAC Hamilton

MPAC Toronto

MPAC Barrie

Parry Sound Muskoka Appraisals

MPAC Mississauga

MPAC Pickering

NAME COMPANY

Jeffrey Batcher

Michel Benoit

Jon Blahut

Krysta Chapman

Anthony DiFonzo

Lacey Harrison

Olga Nastich

Olivia Phillips

Linda Russell

Drew Samuels

Kevin Wong

Grace Xian

MPAC Toronto

MPAC Ottawa

MPAC North Bay

MPAC Barrie

MPAC Toronto

MPAC Owen Sound

MPAC Toronto

MPAC Mississauga

MPAC Pickering

DMA

MPAC Richmond Hill

MPAC Richmond Hill

Professional associations with a mandate to provide accreditation, education and regulation, expect their members to adhere to a code of ethical conduct. Successful completion of a mandatory annual refresher course on ethics is a requirement in the continuing professional development (CPD) curriculum of many global organizations such as The World Bank. The Royal Institute of Chartered Surveyors places a similar emphasis on incorporating ethical content in their annual requirement for continuing professional development.

The IMA requires its members to make a career-long commitment to ethical conduct. The IMA’s Ethical Guide for the Assessor is a compulsory course for accreditation and designation as a practicing (A.I.M.A., M.I.M.A.) professional, while CPD requirements include reflection on the IMA’s Code of Ethics and Professional Standards

A common theme shared by these organizations, including the IMA, is that ethics is an active skill rather than a passive outlook. Along the spectrum of skills applied by property assessors and appraisers, ethics is a judgmental skill that has tangible expression in quantitative work, similar to judgments used to make adjustments to recognize a property’s “inferiority”, “superiority” or “marketability”.

Classifying ethics as a judgmental skill leads to the question of what circumstances might present an ethical dilemma or compel an ethical choice? How do we know when we are obliged to make a decision that should be shaped by our ethical values, or does ethics impinge on every aspect of professional conduct? In order to examine those questions and review our relationship to ethics as a core component of the IMA’s mission, a real-world case study can offer guidance.

A well-known company was named in a civil lawsuit in U.S. Federal District Court filed under provisions of the HelmsBurton Act of 1996. The defendant was alleged to be conducting business on property that was confiscated from a U.S. person, which was considered trafficking in stolen property under provisions of the Act. If the allegation was proven in court, damages could be assessed at 3-times “…the fair market value of that property calculated as being either the current value of the property or the value of the property when confiscated plus interest, whichever is greater ”

The first ethical issue was whether an assessor retained by the defendant would incur reputational risk accepting a retainer to provide services to an organization that had been accused of trafficking in confiscated property. While it is not uncommon for property valuations to be performed in politicized and publicized cases, these circumstances required the application of professional skills as a footnote to historical events that violated international law.

The ethical issue was addressed by structuring a contract that limited the scope of services on behalf of the defendant to include: (1) a critique of the professional services offered by the plaintiff’s valuation experts; (2) a peer review of the ways in which the plaintiff’s experts applied their valuation methodology including the sources and uses of data; and (3)

an assessment of the relevance of their calculations, findings and conclusions to estimate the fair market value of the subject property in the time periods prescribed in the Act. In other words, an ethical lens was applied to define the scope of work as a peer reviewer in relation to professional practice generally and valuation of the class of property and type of market specifically.

The second ethical issue arose when considering how to critique the plaintiff’s valuation methodology in unprecedented circumstances. The subject property in the lawsuit was confiscated in the same period as other actions by the Cuban government to abolish the country’s property market, seize properties nationwide without due process or compensation, nationalize financial and regulatory institutions, and repudiate foreign debt.

Recognizing that the plaintiff’s valuation experts were required to conduct a valuation under unprecedented circumstances, was there an ethical duty to “soften” the critique of their valuation methodology and its application to recognize that conventional notions of a working property market, metrics regarding activity in that market, and other conventional guidelines of professional practice were not available or did not apply in Cuba?

Using an ethical lens to address those unique circumstances meant abandoning a “textbook” valuation approach and allowing for a narrative that conformed to the qualitative and quantitative limitations in that market including: (i) motivations of buyers and sellers in the valuation years; (ii) conditions facing buyers and sellers in the valuation years; and (iii) factors that would be relevant in valuing the specific trade-related property at the heart of the litigation. In combination with those context-sensitive judgments, an ethical perspective also helped outline related issues for consideration including the rationale for: (i) use of the market, cost, or income approach when valuing a commercial airport; (ii) assumptions used in a discounted cash flow or income capitalization applied to a trade-related property; and (iii) adjustments to property revenues and expenses to account for market distortions caused by the Cuban government’s actions in and between the valuation years.

The third ethical issue was presented during questioning from the plaintiff’s attorney during the deposition phase. The issue was whether to acknowledge that a recorded transaction between a buyer and seller a few

years prior to the confiscation represented “fair market value” and could serve as a benchmark for an estimate of value in one or both valuation years.

The convenient answer would not, however, have been the ethically responsible answer. Reported transactions in any market must be vetted against several factors before accepting that they represent “fair market value” including such things as: (i) did the purchase price account for tangible or intangible assets that were associated with the business operating the property as distinct from the property itself; and (ii) were the buyer and seller motivated by factors that would not have been present in the actions of “typical” buyers and sellers.

Drawing on the ethical responsibility to uphold professional standards at every stage of a valuation assignment resulted in a principled resistance to pressure to acknowledge that the only measure of the property’s fair market value prior to its confiscation was the last recorded sale, absent any objective review of the circumstances surrounding that transaction.

The IMA’s curriculum acknowledges that professional ethics is a tangible skill that is expressed in valuation practice. It has the unique attribute of being a qualitative skill that can directly influence the quantitative outcomes of valuation work and the conduct of valuation practice.

Therefore, the IMA’s code of ethics should continue to be applied as a lens through which its members interpret instructions received from clients and employers, and as a guardrail when giving directions to others, making it an essential component of entry to the profession and ongoing career development.

Each year, thanks to the generous donations from our members and sponsors via the IMA Scholarship Fund, we can support the growth and advancement of the next generation of property assessment and taxation professionals.

Visit our website if you are interested in learning more about how you can contribute to the Scholarship Fund.

Congratulations to this year’s winners on their tremendous personal and professional accomplishments! We are proud to be a part of your professional journeys.

Christian G. Schulze Award, 2023 Recipient: Chun Hau Chan (Leon)

Available to students in the full time Real Property Administration diploma program at Seneca College. This award is given to the student who achieves the highest mark in IMA321: Fundamentals of Canadian Assessment Law. Students must also demonstrate good attendance and class participation. The winner will receive $500 awarded in the second year of study.

“I am writing to express my sincere gratitude for the scholarship that you have awarded me as a student enrolled in the Real Property Assessment and Administration (RPAA) program at Seneca College. Your generous support is invaluable and will help me achieve my academic and professional goals.

As a student in the RPAA program, I am passionate about real property assessment and the role it plays in the administration of municipalities. The program at Seneca College has been instrumental in equipping me with the knowledge and skills necessary to excel in this field.

I believe that Seneca College is the best choice for studying RPAA. The program offers a wellrounded curriculum that covers all aspects of real property assessment, including valuation techniques, property assessment legislation, and market analysis. The courses are taught by experienced and knowledgeable faculty members who bring real-world examples and scenarios to the classroom.

Once again, I would like to express my sincere thanks for your support. Your contribution has made a significant impact on my academic and professional journey, and I am truly grateful.”

Hardeep Kaur

Available to the student who achieves the highest overall grade in the full-time Real Property Administration diploma program at Seneca College. The winner will receive $1,000 for obtaining the highest mark in the RPA Program, awarded in the second year of study.

“Being awarded the Mario Vittiglio Achievement Scholarship by the Institute of Municipal Assessors at Seneca College holds great significance to me. It is a recognition of my diligent efforts and commitment to my studies, and it motivates me to persist in my pursuit of professional and academic excellence.

Receiving this award is a significant encouragement to me, and it will help alleviate some of the financial burden that comes with pursuing higher education. I am deeply grateful for this support, and I promise to use it to continue my academic pursuits of A.I.M.A./M.I.M.A. and contribute to the field of Real Property Administration. I would also like to express my appreciation to the Institute of Municipal Assessors for their generosity and commitment to promoting education in the field of real estate.

Thank you once again for this incredible honor and for supporting me in my academic journey. I am determined to make the most of this opportunity and to uphold the standards of excellence that the Institute of Municipal Assessors represents.”

This award is given to students demonstrating potential in the field of property assessment and taxation as deemed deserving, by the faculty of the RPA program at Seneca College, based on enthusiasm and interest shown in the subject matter and notable in-class participation and performance. The winner will receive complimentary registration for IMA-435: Cost Depreciation Analysis.

Benjamin Ra: “It is with great honour and excitement that I am writing to express my appreciation for being nominated for the IMA Assessors Recognition Award as a Real Property Administration student at Seneca College. It is a privilege to be considered for such a prestigious recognition. I am honoured to have been chosen by the faculty of the RPA program at Seneca College, and I am humbled by this recognition.

As a Real Property Administration student, I have learned to value the importance of fairness, accuracy, and attention to detail when assessing properties. I believe that every assessment should be conducted ethically and professionally, and I have always strived to uphold these values.

I am proud to say that I have received numerous positive feedback and recognition from my professors, colleagues, and industry professionals. This feedback has reinforced my commitment to excellence and has motivated me to push myself further.

For me, receiving the IMA Assessors Recognition Award would be a great accomplishment and mark a crucial turning point in my academic career. This acknowledgement would not only validate my efforts and commitment to Seneca College’s Real Property Administration program, but it would also motivate me to strive more and accomplish more in the future.”

Gemma Zhou: “I am deeply honoured to receive the IMA Assessors Recognition Award, which is a testament to my passion and dedication towards the field of property assessment and taxation.

The IMA Assessors Recognition Award has reaffirmed my commitment to pursuing a career in property assessment and taxation, and I’m confident that with the knowledge and skills gained through the RPA program, I can make significant contributions to the industry. I’m excited about the future possibilities, and I’m determined to work hard to achieve my career goals.”

Available to all members. This award is given to the student who achieves the highest mark in IMA-321: Fundamentals of Canadian Assessment Law. The winner will receive $500, awarded annually in April.

“I am honoured to be this year’s recipient of the Carl B. Davis award. The education that I received from the Fundamentals of Canadian Assessment Law course was comprehensive and has been highly relevant as a property assessment professional. I look forward to continue using the knowledge attained from this course in my everyday work. Thank you again, I am so thankful for this opportunity.”

Larry K. Hummel Award, 2023 Recipients:

David Bressi, A.I.M.A., & Dong-hyuk (Don) Kang, M.I.M.A.

Given to candidates from the Fast Track Designation Program (FTDP) who achieve the highest overall mark in their final exam. The winners from the M.I.M.A. program and A.I.M.A. program will each receive $500.

David Bressi, A.I.M.A.: “I truly believe everyone should do the FTDP. It’s a great program initiated by the IMA that gives the student ample time to study the materials and prepare for the exam. It is a great resource for those who want to obtain a designation quickly. I will be also doing the FTDP for the M.I.M.A as well.”

Dong-hyuk (Don) Kang, M.I.M.A.: “I am truly honoured to receive the Larry K. Hummel Award. I want to express my sincere gratitude to the IMA for their support in recognizing my hard work and dedication. This award is a testament to my commitment to lifelong learning and professional development. It inspires me to continue expanding my knowledge and skills in the field of property assessment and valuation and to use my expertise to make a positive impact on the property assessment industry. This award will serve as a constant reminder to always strive for excellence in everything I do. Thank you once again for this incredible honour. “

Andrew Posteraro, M.I.M.A., Ashley Alladin, A.I.M.A. & Mark Hotte, M.I.M.A.

The IMA’s Scholarship Trust Fund Committee and Board of Directors amended the criteria for the prestigious W.J. Lettner Memorial Award.

M.I.M.A. Category ($1,500): Awarded to the M.I.M.A. Accredited member with the highest composite mark on the M.I.M.A. Written Exam and Oral Interview (weighted equally).

A.I.M.A. Category ($500): Awarded to the A.I.M.A. Designated member with the highest composite mark for all seven IMA-300s courses (weighted equally).

Dividing this prestigious award into two categories (one for A.I.M.A. designated members and the other for M.I.M.A. accredited members) grants the Institute an opportunity to recognize two exemplary and deserving candidates each year.

With the goals and objectives outlined in the 202023 Strategic Plan guiding the revision process, these amendments were approved to ensure fair and equal access to members regardless of geography. As one of the IMA’s most celebrated awards, we are delighted to continue honouring the values and memory of award founder W.J. Lettner.

Congratulations to the 2023 recipients!

“It is truly an honour to receive the W.J. Lettner Memorial Award and I would like to sincerely thank all those involved in the IMA’s Education Program. Coming from a nonassessment educational background, the Institute’s AIMA and MIMA designation programs provided me with top class training, support, and resources that I am able to apply to my everyday work responsibilities. Again, I truly appreciate the recognition for this award.”

Ashley Alladin, A.I.M.A.

“I am honored to have been selected for the W.J. Lettner Memorial Award. It is a very rewarding feeling to be recognized after many long days and late nights working hard to achieve my A.I.M.A designation. This recognition encourages me to continue on this path and begin working towards my M.I.M.A designation so that I can continue to learn and grow in my career.

I would like to thank both the instructors and the staff at the IMA for their assistance throughout the process of obtaining my designation, and for their continued support.”

Mark Hotte, M.I.M.A.“I am very grateful to be one of the recipients of this year’s W.J. Lettner Memorial Award.

The knowledge that I have gained on my journey to become an accredited Member has given me the ability to undertake the valuation challenges that I encounter as a property assessor with confidence.”

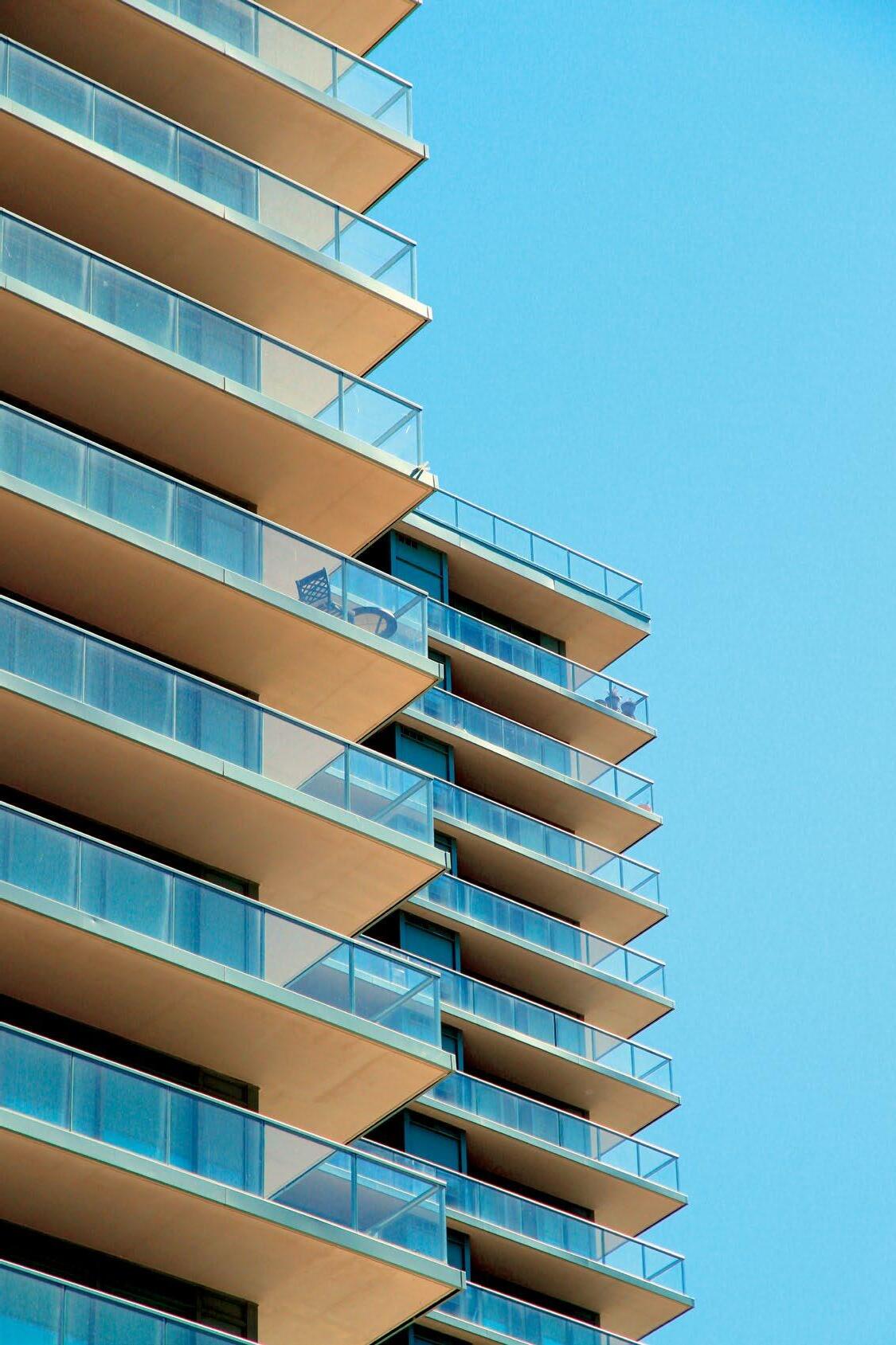

An update from BC Assessment

BC Assessment produces annual property assessments that are released each January.

For 2023, BC Assessment produced property assessments for 2,160,828 properties, up about one per cent from the total number of properties in 2022. The total value of real estate on the 2023 Roll is over $2.72 trillion, an increase of nearly 12 percent compared to 2022. The amount of ‘non-market change’, including new construction and rezoning/ subdivisions of properties is approximately $33.52 billion, a decrease of almost one percent from the 2022 Roll of $33.85 billion.

British Columbia has a highly dynamic and complex real estate market. As an example, the 2023 highest assessed value of a residential single detached home in B.C. is over $74 million, a property in Vancouver’s Kitsilano neighbourhood.

Our property assessments are used by 161 municipalities, 27 regional districts as well as the provincial government to determine property tax distributions for funding the needs of local communities, schools, hospitals, and public transit.

Over 98% of property owners typically accept their property assessment without proceeding to a formal, independent review of their assessment. For example, only 1.4% of all properties in British Columbia were appealed for 2023.

2023 assessments are the estimate of a property’s market value as of July 1, 2022, and physical condition as of October 31, 2022. This common valuation date ensures there is an equitable property assessment base for property taxation.

The Government of Ontario has announced a further deferral of the province-wide property assessment. On August 16, 2023, the government filed Ontario Regulation 261/23 which, among other things, officially extends the January 1, 2016, current value assessment base year to apply to the 2024 taxation year.

Ontario’s Minister of Finance, Peter Bethlenfalvy, has noted that the “government will conduct a review of the property assessment and taxation system that will focus on fairness, affordability and business competitiveness.”. The Minister has also noted that the government is “exploring modernized administration tools to provide support to municipalities with ongoing assessment base management and increased access to data, to enhance the transparency and equity of future assessments.

The IMA will continue to monitor the property assessment and taxation landscape in Ontario and provide members with relevant updates.

IMA’s membership actively supports and advances our shared profession through our ten districts across Canada. This new regular feature will highlight the important work of our districts across the country.

For this issue, we asked District 2 Director Lee Tomkins, M.I.M.A., to share an update on their activities. District 2 represent the major centres in Ontario of Niagara, Hamilton-Wentworth, Haldimand-Norfolk, Waterloo, and the Counties of Brant, Dufferin and Wellington

We are currently in the planning stages for our next meeting which will take place in early spring of 2024. We are building on the successes of our last district meeting held in Hamilton on May 31st, our first in-person meeting since the Pandemic. Topics of the meeting included an Appraiser discussing local trends of various property types, an informative session on current and relevant ARB Cases and a very interesting session on vertical farming and the valuation complexities that come along with those property types. The sessions were very well received and generated a great deal of discussion from our participants. We plan to continue with another in-person program for our upcoming spring meeting which will be held at one of the City of Hamilton historic sites. We hope you can join us!

I believe it is essential that we stay connected. Planning in-person events with our District Executive on upcoming programs which focus on new appraisal tools and other technological innovations is valued by our members, especially for those who may not be able to attend the annual Conference. Working with the IMA Executive and District Directors is vital, and I am able to collaborate and bring exciting new presenters to our district with a focus on local market trends incorporating the latest industry standards. Whether you work for the assessment authority, private sector, or local government, the presentations are informative and stimulate in-depth discussions.

In 2024, I am looking to re-connect with our members and develop new relationships. I also encourage members from other districts to join us at our Spring meeting. Post-pandemic, we must engage with the next generation of assessment and appraisal professionals and assist with their professional development through meaningful experiences. While it remains important for our existing members to fulfill their CPD requirements, we must also assist our new colleagues on their accreditation journey. Our industry is complex and constantly evolving, our District will keep members current and professionally recognized.

Visit the IMA website to learn more about district membership.

It is with deep sorrow that the IMA acknowledges the passing of a cherished member of our community, Sonya Bye.

As a vital member of the IMA District 1 Executive, Sonya devoted significant time and energy to supporting fellow members and advocating for the IMA as a whole. Her unwavering commitment to the profession was highly regarded and deeply appreciated by all who knew her.

May she rest in peace.

Tributes can be shared here

September 27, 2023 – 11:30

September 27, 2023 – 11:30 AM – 1:00 PM EST

*NEW DATE Webinar part of 2022-23 series

October 24, 2023 – 11:30

AM to 1:00 PM EST

October 24, 2023 – 11:30 AM to 1:00 PM EST

Appeals - Expert Witness Challenges: Preparations, Working with Lawyers, & Virtual Hearings

Appeals - Expert Witness Challenges: Preparations, Working with Lawyers, & Virtual Hearings

This webinar is designed to familiarize the attendee with the ‘ins and outs ‘of preparing for an Assessment Appeal hearing. It will cover the role of the parties, preparation, information exchange, procedures, and practice. The role and challenges facing an expert witness will be discussed. Prehearing preparations including interaction and working with lawyers will be covered.

This webinar is designed to familiarize the attendee with the ‘ins and outs ‘of preparing for an Assessment Appeal hearing. It will cover the role of the parties, preparation, information exchange, procedures, and practice. The role and challenges facing an expert witness will be discussed. Prehearing preparations including interaction and working with lawyers will be covered.

The first step in utilizing the cost approach to value is determining the cost to construct property improvements. This webinar will discuss the two possible starting points - reproduction cost and replacement cost new and discuss which method is preferred for property assessment. The audience will also gain an understanding of cost data sources and the importance of updated cost estimates. The panelists will also examine the various methods of developing costing estimates using one of the three traditional approaches.

The first step in utilizing the cost approach to value is determining the cost to construct property improvements. This webinar will discuss the two possible starting points - reproduction cost and replacement cost new and discuss which method is preferred for property assessment. The audience will also gain an understanding of cost data sources and the importance of updated cost estimates. The panelists will also examine the various methods of developing costing estimates using one of the three traditional approaches.

Session Flyer: Available here

Session Flyer: Available here

CPD: 1.5 Learning Credits

CPD: 1.5 Learning Credits

Register Now: Member | NonMember

Register Now: Member | NonMember

Session Flyer: Coming Soon!

Session Flyer: Coming Soon!

CPD: 1.5 Learning Credits

CPD: 1.5 Learning Credits

Register Now: Member | NonMember

Register Now: Member | NonMember

November 21, 2023 – 11:30 AM – 1:00 PM EST

November 21, 2023 – 11:30 AM – 1:00 PM EST

*NEW DATE Webinar part of 2022-23 series

*NEW DATE Webinar part of 2022-23 series

December 13, 2023 – 11:30 AM to 1:00 PM EST

December 13, 2023 – 11:30

AM to 1:00 PM EST

Market data collection is one of the important steps in the mass appraisal process however, this step is not always one that is completely understood. This webinar will look at various aspects of the data collection process, the importance of having accurate and reflective market data and the impact inaccurate data can have on the analytical process. It will also look at how to properly categorize and stratify your data to help form better analytics and application of models to the population. The webinar will also outline the importance of ensuring proper data checks and process controls are implemented throughout the process.

Market data collection is one of the important steps in the mass appraisal process however, this step is not always one that is completely understood. This webinar will look at various aspects of the data collection process, the importance of having accurate and reflective market data and the impact inaccurate data can have on the analytical process. It will also look at how to properly categorize and stratify your data to help form better analytics and application of models to the population. The webinar will also outline the importance of ensuring proper data checks and process controls are implemented throughout the process.

After the determination of replacement or reproduction cost new of the property improvements all forms of depreciation and obsolescence are deducted. One of the more difficult forms to account for is external/economic obsolescence. In this webinar the panelist will highlight the differences between various types of depreciation with detailed focus on external/economic obsolescence. The audience will gain an understanding of the factors causing external/economic obsolescence and the primary methods used to quantify obsolescence. The panelist will also

After the determination of replacement or reproduction cost new of the property improvements all forms of depreciation and obsolescence are deducted. One of the more difficult forms to account for is external/economic obsolescence. In this webinar the panelist will highlight the differences between various types of depreciation with detailed focus on external/economic obsolescence. The audience will gain an understanding of the factors causing external/economic obsolescence and the primary methods used to quantify obsolescence. The panelist will also

Session Flyer: Available here

Session Flyer: Available here

CPD: 1.5 Learning Credits

CPD: 1.5 Learning Credits

Register Now: Member | NonMember

Register Now: Member | NonMember

Session Flyer: Coming Soon!

Session Flyer: Coming Soon!

CPD: 1.5 Learning Credits

CPD: 1.5 Learning Credits

Registration: Coming Soon!

Registration: Coming Soon!

January 10, 2024 – 11:30

AM to 1:00 PM EST

look at the feasibility of determining functional obsolescence in a mass appraisal environment.

Functional obsolescence results when flaws or deficiencies form in the structure, materials or design of the improvements over time. This webinar will focus on types of functional obsolescence, key factors causing functional obsolescence and discuss processes to help assessors quantify functional obsolescence. The panelist will also look at the feasibility of determining functional obsolescence in a mass appraisal environment.

January 25, 2024 – 11:30

AM to 1:00 PM EST

Office buildings are currently seeing a surge in vacancy rates as tenants continue to review and reduce current space requirements. This webinar will focus on the challenges both owners and tenants are facing such as reduction of space, flight to quality space and continued offering of tenant inducements. The panelist will also discuss how return to work policies, carbon tax initiatives and higher carrying costs are impacting office valuations. The audience will gain insight into the state of the office industry and look to potential solutions moving forward.

February 15, 2024 – 11:30

AM to 1:00 PM EST

This webinar will discuss the difficult challenges assessors face when valuing development land for property assessment purposes. The panelist will discuss the concepts of highest and best use and the importance of conducting a proper analysis. They will also discuss the role different levels of government play in land use designation, planning policies and zoning bylaws and the affect those have on property valuation.

February 22, 2024 – 11:30

AM to 1:00 PM EST

Many assessing jurisdictions are required to determine a market or current value for property assessment purposes. In addition to determining market value many jurisdictions are also challenged with ensuring the market value is fair and equitable with the treatment of similar property. This webinar will look at the role equity has in property assessment valuations, current case law and how courts are interpreting the definition of equity. The panelists will also discuss the role a valuer plays when an equity argument is raised.

March 21, 2024

– 11:30 AM to 1:00 PM EST

This webinar will focus on the current trends and factors affecting multiresidential properties today. Participants will obtain a better understanding of the fundamentals and principles in valuing multi-residential properties. The panelist will discuss the effects of rent control on valuation for property tax purposes. Participants will gain an understanding of the various valuation techniques looking at the direct capitalization and the gross rent multiplier valuation approaches as well as the determination of rents and expense allowances.

April 17, 2024

– 11:30 AM to 1:00 PM EST

Any interest in real estate that is capable of generating income can be valued using the direct capitalization approach. This requires an appropriate derivation of the capitalization rate. Depending on the quantity and quality of available data, there are various techniques used. This webinar will cover the challenges assessors and valuators face in deriving capitalization rates in the application of the direct capitalization methodology. Emphasis will be given to derivation of the rates from comparable sales. As well, data requirements and practical application of the methodology will be discussed.

Session Flyer: Coming Soon!

CPD: 1.5 Learning Credits

Registration: Coming Soon!

Session Flyer: Coming Soon!

CPD: 1.5 Learning Credits

Registration: Coming Soon!

Session Flyer: Coming Soon!

CPD: 1.5 Learning Credits

Registration: Coming Soon!

Session Flyer: Coming Soon!

CPD: 1.5 Learning

Credits

Registration: Coming Soon!

Session Flyer: Coming Soon!

CPD: 1.5 Learning Credits

Registration: Coming Soon!

Session Flyer: Coming Soon!

CPD: 1.5 Learning Credits

Registration: Coming Soon!

May 15, 2024 –11:30 AM to 1:00 PM EST

Care homes cover a wide range of property types. This webinar will provide participants with an overview of the different types of care homes, evolving trends in care home design and how each are valued for property assessment purposes. Participants will gain an understanding of industry specific terminology, legislative differences, and subsidies provided by governments. The webinar will look at developing a proforma valuations for various care home types including funding formulas, expense ratios and developing capitalization rates.

June 20, 2024

– 11:30 AM to 1:00 PM EST

This webinar will identify and clarify the differences between excess and surplus land. The panelist will discuss the effect these differences have on calculating value using the income approach to value. The audience will gain an understanding of how to identify surplus or excess land and how to accurately estimate the value of each considering local zoning bylaws and the shape and placement of the structures on the land.

To learn more, visit: https://theima.ca/page/2023_24webinar

Session Flyer: Coming Soon!

CPD: 1.5 Learning

Credits

Registration: Coming Soon!

Session Flyer: Coming Soon!

CPD: 1.5 Learning

Credits

Registration: Coming Soon!

THANK YOU TO THE FOLLOWING SPONSORS, WHOSE GENEROUS DONATIONS SUPPORTED THE IMA SCHOLARSHIP FUND

SUPPORT THE NEXT GENERATION OF PROPERTY ASSESSMENT PROFESSIONALS WITH A TAXDEDUCTIBLE DONATION TO THE IMA SCHOLARSHIP FUND. LEARN MORE ABOUT THE AWARDS AND VIEW PAST RECIPIENTS HERE