INSTI-NEWS SPRING 2024

IN THIS ISSUE

03

STAY CONNECTED

04

PRESIDENT’S REPORT

Janice HunterDesjarlais, M.I.M.A.

09

AN UNDERSTANDING OF REASONABLY PROBABLE THAT IS PROBABLY REASONABLE

Charles Johnstone, M.I.M.A., Haydn C. Johnstone, AACI, P.App

16

POWER OF SALE: A SIGN OF THE TIMES

Melissa VanBerkum

23 DISTRICT NEWS

Lee Tomkins, M.I.M.A., Jessica Martini, M.I.M.A., Debbie Simone, M.I.M.A., Pete Fortin, M.I.M.A., Emily Hopkins, M.I.M.A.

12

2024 IMA SCHOLARSHIP AWARD WINNERS

20

TAKE 5 WITH THE IMA

Charlene MacNeil, AACI, P.App., M.I.M.A., Sheryl Walt, M.I.M.A.

26

COLLABORATING FOR GROWTH: UNLOCKING THE POWER OF SHARED KNOWLEDGE

Dan Rossman, Affiliate, Krista O’Brien, Affiliate, Dan Devellis, M.I.M.A.,

05

THE IMPORTANCE OF QUALITY DATA FOR QUALITY ASSESSMENTS: INSIGHTS FROM THE CANADIAN ASSESSORS SUMMIT

Travis Lantz, A.I.M.A. Janice Hunter-Desjarlais, M.I.M.A.

15

DISPUTE RESOLUTION

Scott Powell, M.I.M.A., AMAA

22

MEMBER ELEVATIONS

SPRING 2024 ISSUE

Insti-News is published by the Institute of Municipal Assessors with assistance from the Communications Services Committee. Chaired by: Lori-Ann Seethaler, M.I.M.A.

Any opinions or recommendations expressed in this issue are those of the contributors and do not necessarily reflect the views of the IMA.

SUBMISSIONS

Interested in submitting an article? Have a great idea for a hot topic? Make your submission to communications@theima.ca. Be sure to put “Insti-News Submission” in the subject line or contact the IMA office by phone to discuss.

REPRINTS

Written permission must be obtained before reproduction or use of any contents.

CONTACT

Institute of Municipal Assessors 16 Industrial Parkway South Aurora, Ontario, L4G 0R4

905-884-1959

1-877-877-8703

info@theima.ca

STAY CONNECTED

https://theima.ca/

@theima.ca @the_ima1957

Institute of Municipal Assessors

PRESIDENT’S REPORT

Dear members, as this is my last official President’s report in Insti-News, I wanted to take the opportunity to share the successes of this past year, on behalf of the Institute of Municipal Assessors.

“With over 1,270 members, the IMA is Canada’s largest association of property assessment and taxation professionals. Our diverse membership includes individuals from the private and public sectors practicing in the field of assessment, consultancy, appraisal, taxation and law. Incorporated in 1957, the IMA is dedicated to advancing the interests, education and professional competencies of our Members.”

I had the pleasure of leading the organization this past year, with a recommitment to the professional growth of our members and the future of our profession. We kicked off another Strategic Plan 3 year cycle with projects focused on all our strategic pillars of Educate, Grow, Lead and Govern.

We continued our work to ensure that our members, regardless of their geographical location, have access to the current best practices and training relevant to our industry. We saw 755 attendees across Canada attend our IPTI/IMA webinar series, with almost 400 attendees attending the First Canadian Virtual Assessment Symposium. Our in-person conference had nearly 240 participants reconnecting with colleagues from across the country. We continued our offering of our Fast Track Designation Program (FTDP) with over 80 members who successfully completed their accreditation journey this past year. We also offered 3 complimentary webinars in partnership with WHSC. These ongoing investments in professional development and education, continue to support our members while positioning them as recognized experts in the field of property assessment and related function.

We have continued to grow our IMA community of members across Canada, with new members joining us from Nova Scotia, New Brunswick and Alberta. We built on our partnership with the Alberta Assessors Association (AAA) by offering the First Canadian Virtual Assessment Symposium and we joined colleagues in NB and MB to build on our collaborations.

The IMA finished the 2023-2024 Fiscal Year with a healthy profit that will be reinvested in our educational review project and supporting members across the country. The Board of Directors continues to stay focused on ensuring the IMA’s Investment fund is set up for long-term financial growth in response to changing financial markets.

As we move through this next Strategic Planning Cycle we will continue to stay focused on strengthening our position as the leading Canadian educational and professional body for property assessment and taxation professionals.

For those of you looking for further details, you can find our Annual Report here. I trust you will be equally pleased with the success and direction of the Institute, including the commitment to fulfilling our vision to be the industry leader in education, ethical standards, and professional accreditation in the field of property assessment.

I would like to leave you with an encouragement to volunteer in your association. It is only by sharing our passion for the profession and expertise that we can make an impact.

Yours truly,

Janice Hunter-Desjarlais, M.I.M.A. IMA President

Janice Hunter-Desjarlais, M.I.M.A. IMA President

THE IMPORTANCE OF QUALITY

DATA FOR QUALITY ASSESSMENTS: INSIGHTS FROM THE CANADIAN ASSESSORS SUMMIT

Travis Lantz, A.I.M.A.

Janice Hunter-Desjarlais, M.I.M.A.

Talk to an assessor anywhere in Canada and they will all say the same thing “it’s pretty much impossible to produce quality assessments without quality data.”

During the second day of the 1st Canadian Assessors’ Summit, hosted jointly by IMA and AAA, I was lucky enough to moderate a panel on the topic of Data Gathering and Transmission with my colleague Janice Hunter-Desjarlais, M.I.M.A. The panel presented to nearly 400 audience members from across Canada. Our audience was truly coast to coast, with attendees from British Columbia, Alberta, Saskatchewan, Manitoba, Ontario, New Brunswick, Nova Scotia and Newfoundland!

We were fortunate to be joined by assessment subject matter expert panelists from a variety of jurisdictions across the country- Daniel Lidgren, AACI, P.App from the City of Calgary, Andrew Loney, M.I.M.A. from MPAC, Bryce Trew, MAAS, CAE from the City of Saskatoon, Marc Colatruglio, AAM from the City of Winnipeg, and Alana Hempel, AMAA from the City of Edmonton. It was an informative and insightful conversation, diving into how data is leveraged and managed in each represented jurisdiction.

We found the conversation so insightful that we wanted to ensure members of the IMA and AAA, could still benefit from it, even if you were unable to attend the Summit. Below, for a few highlights from each jurisdiction, as presented by our panelists.

Andrew Loney started the panel off with an overview of MPAC and its use of vast amounts of data. (MPAC stays very busy with its inventory of 5.6m properties.) MPAC has established a data governance department to improve the quality, knowledge and security of the data. Andrew took the audience through MPACs Assessment Information request program. The biggest program, the property income and expense return (PIER) program which covers over 35,000 properties! While the response rate is strong at 50-60% MPAC is striving to increase compliance and increase the quality of the responses. Andrew also stressed MPACs commitment to transparency through methodology guides, market value reports and property specific information. He took the audience through the wide variety of information available on the self-serve AboutMyProperty portal.

Marc Colatruglio from the City of Winnipeg was next. Marc focused on four pillars; data collection, data management, data transparency and data quality. He discussed the types of requests for information (RFIs) used in the City of Winnipeg and the methods available for ratepayers to respond. Response rates in Winnipeg tend to be around 50%. Marc highlighted how the CAMA system, ADVIS, stores property data while linking with document management, appeal tracking and the permit system. The City of Winnipeg has adopted the international Open Data Charter and, through its open data portal, ranks 9th of Cities in North America in openness and transparency! Marc stressed the importance of data quality to the City of Winnipeg.

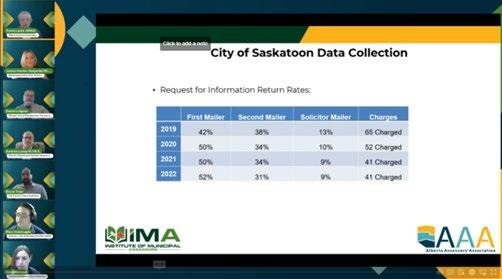

Next up, Bryce Trew highlighted Saskatchewan’s unique legislation that states that assessments must be defended using mass appraisal not single property appraisal. This adds to the importance of having good data. Saskatchewan legislation has powerful tools to enforce compliance with requests for information including charges and fines of up to $10,000! These tools enable the City of Saskatoon to achieve compliance in the 90%-95% range (much to the envy of the other panelists). Bryce stated that property owners have grown to understand the process and the need for charges has been minimal. Bryce discussed how the balance between privacy and transparency is one of the biggest issues in Saskatchewan. Bryce illustrated how the City of Saskatoon has been striving for continuous improvement on its transparency and the publics access to data.

Finally, Daniel Lidgren and Alana Hempel from the Cities of Calgary and Edmonton provided a joint presentation on Alberta and their cities. Daniel stressed that with an annual assessment cycle in Alberta, quality data is of the utmost importance. Alana provided a perspective of Edmonton and its 450,000 parcels! The City of Edmonton sends 5,000 RFIs a year with a return rate in the 60-65% range. Shopping centers lead the way with an 85% response rate. It takes the assessment team 4,000 hours annually to work with the data. Alana also discussed the advantages Edmonton has found from moving to a Google Workspace to work with their massive amounts of data. Furthermore, Alana provided an overview of Edmonton’s data portals. Daniel, then presented from a City of Calgary perspective including the ability for residential owners to provide data on their property on an annual basis through an online tool. He spent time demonstrating the tools for non-residential property owners. The audience was able to benefit by a demonstration of all the portals available

Following each presentation, the panelists engaged in an outstanding Q&A with the moderators and audience members. It was an excellent opportunity for them to share even more of their knowledge.

I want to take a moment to thank again our panelists for joining us during the 1st ever Canadian Assessors’ Summit, and the organizing committee for making this inaugural event, engaging and filled with deep learning for all our members. I know, I am looking forward to the next one.

AN UNDERSTANDING OF REASONABLY PROBABLE THAT IS PROBABLY REASONABLE

Charles Johnstone, M.I.M.A., Principal, Expert Witness Services, Property Tax Complex, Ryan Haydn C. Johnstone, AACI, P.App, Director, Property Tax, Ryan

We know that market value is most often defined as the most probable selling price. We also know that Highest and Best Use is the reasonably probable use of the real property that is, physically possible, legally permissible, financially feasible, and maximally productive, and that results in the highest value. How do these concepts fit together? Is it reasonable that the most probable selling price would be the highest value? Hot off the press is the latest update to the Appraisal of Real Estate - the 4th Canadian Edition for those keeping count - which provides the definition for Highest and Best Use at 17.1 as described above. Nothing startling there; however, flip the page and you find: the Most Probable Use is defined as “[t] he use to which a property will most likely be put to based upon market analysis and the highest and best use conclusion. The most probable use is the basis for the most probable selling price of a property (17.2).” You also find that the Most Profitable Use is “[h]ighest and best use in the context of investment value” not market value. Let us explore these concepts a bit further.

The latest edition of the Appraisal of Real Estate references reasonably probable; however, no definition is provided. This is likely because reasonably probable can mean many things depending on the scope of the assignment. That said, we have found that by providing a base level or foundation of our understanding of the term, that we have gained a better appreciation for it. Going to the root of the two words:

Reasonable is defined as, “being in accordance with reason; having the faculty of reason; or, possessing sound judgment.”

Whereas, probable is defined as, “supported by evidence strong enough to establish presumption but not proof; or, likely to be or become true or real.”

While the wording may seem arbitrary, it is much more nuanced. What is possible may not be probable. Really, it could be simplified down to “could” versus “likely.” When you buy a lottery ticket, it is possible that you will win but it’s not probable. This adds some complexity to HBU, where the use with the highest value could be possible, but not probable (unlikely). The key is, we are not trying to determine what the highest value could be without constraints, we are trying to determine the highest value the market would likely achieve and how it might go about doing this. We are attempting to replicate market behaviour, and therefore, we must understand the constraints the market itself faces. As valuers, if we are not replicating reality, we are fabricating fantasy.

With that in mind, when combined we can synthesize our understanding of reasonably probable to:

A conclusion of the property’s use supported by sound appraisal judgment and market evidence, which is strong enough to establish the likelihood of becoming true or real.

There is still room for professional judgment. Take for example, the complex world of assessing or valuing redevelopment lands. If we are to replicate market behaviour, does the market behave through the lens of the most probable use1 or the most profitable use2? How is this perceived in assessment? Perhaps a summary from the recent IMA/AAA “Canadian Assessors Summit” will provide some insight on this topic.

The stage was set by asking the participants to imagine they were on an assessment appeal tribunal and tasked with determining the correct market value of an estate home of historical significance close to the downtown core. The 3,500 square foot home is situated on 1.5 acres of land. The subject property is zoned residential, but the community plan shows the local area has been designated mixed-use high-density and nearby properties have been developed as such. However, there is also an historical society that strongly opposes redevelopment for potential heritage-designated properties including the subject property.

Assessor focuses on HBU: As my evidence has been presented, based upon the nearby sales, it is at least 51% probable that this site can be redeveloped to a new mixed high-density use based upon the designated land use. I interviewed nearby purchasers, looked at development cost and sales potential, and estimated that it is in fact profitable to redevelop the subject. While I do acknowledge the possible heritage constraints, it is still reasonable to value the future redevelopment potential of this property. I have provided four similar redevelopment potential lands in the vicinity and have shown them to be selling for $2,000,000 per acre. Further to this, the Act requires market value and that is based upon the highest and best use as of the valuation date. My sale comparables are properties of similar size and land use designation as the true value is in the land’s development potential and not in the current use. The correct assessment for the property based on its HBU is $3,000,000, calculated as 1.5 acres at $2mil an acre. I requested that the Tribunal not speculate on the possibility of a heritage designation for this property when I have provided sound evidence that redevelopment is reasonably probable as the value of the land exceeds the value of the current use and any developer would not see the value in the estate.

Owner focuses on MPU: I have no intention to sell or redevelop the property, it is an historical estate, and it is well-maintained to the original specifications as drafted by a famous architect. The market would appreciate the true value of historical significance. I have provided articles and documents showing there are strong political pressures to designate this property as heritage, with an active local lobbying group. It is not speculation that a heritage designation is imminent, it is self-evident and plastered all over the news. The greatest value can be achieved through preservation. I have also presented evidence challenging the absorption targets, impact of tightening lending policy and rising interest rates, and increasing construction costs, which have softened the real estate market making any redevelopment in the current market speculative. The current use requires no speculation, as the property is going to remain a house for the indefinite future and should be assessed as such. I agree with the assessor that without constraints and without the change in the market, there may have been a possibility of redevelopment at some future date; however, as of the valuation date there was no probability of it. I have provided the board with sales similar estates in the vicinity to capture only the value of the current use. I have also provided the board with

court decisions stating that assessors should not speculate on future changes to the property. The sales and assessments indicate that the value of the subject property in its MPU should be set at $1.5mil to achieve a fair and equitable assessment.

It is unlikely that both could have a 51% chance or greater of occurring, so we asked the participants – the newly assigned Board members – to provide their thoughts on which was more correct for assessment purposes. The results were about 50/50, with a slight edge to the most probable use. Our surprise(d) guest of honour, whom we sprung the challenge of rendering a decision on-the-spot as the case study’s arbitrator, provide sound guidance (as they are a respected Member in this realm) suggesting in this instance, the value would be somewhere between the two (purposely curated) polar opposite HBU and MPU stances. The decision rendered was the market would appreciate the existing use while inherently understanding that there is some additional value in the future development potential or location, being more proximate to downtown and higher-density uses.

All of this to say that even when our understanding of reasonably probable is probably reasonable, the greatest minds in valuation and assessment – yes you, the participants – were almost evenly split. Each assignment comes down to judgment, expertise, and a proper highest and best use analysis. The most probable use will define the most probable user which identifies what is comparable. To select sales before determining the most probable use, is to put the cart before the horse. Alongside this, the analysis should provide the timeframe of the redevelopment or maintenance of the current use. While this in no way is profound, the conclusion is “be transparent and use your discretion.”

2024 IMA SCHOLARSHIP AWARD WINNERS

Each year, thanks to the generous donations from our members and sponsors via the IMA Scholarship Fund, we can support the growth and advancement of the next generation of property assessment and taxation professionals.

Visit our website if you are interested in learning more about how you can contribute to the Scholarship Fund.

Congratulations to this year’s winners on their tremendous personal and professional accomplishments! We are proud to be a part of your professional journeys.

CHRISTIAN G. SCHULZE AWARD, 2024 RECIPIENT:

Available to students in the full time Real Property Administration diploma program at Seneca College. This award is given to the student who achieves the highest mark in IMA-321: Fundamentals of Canadian Assessment Law. Students must also demonstrate good attendance and class participation. The winner will receive $500 awarded in the second yearof study.

Stephanie Engel

“It is an honour to be the recipient of this year’s Christian G. Schulze Award of Excellence.

I entered the Real Property Administration Program (RPA) at Seneca, a mature student looking for a career change within the real estate industry. The RPA program has opened my eyes to the different pathways within the appraisal, assessment, property taxation and real estate fields. My passion for research and analysis, paired with an in-depth knowledge of property valuation techniques, and a thorough understanding of the assessment appeal process and relative legislation has me looking forward to a rewarding and successful career within the industry.

Receiving this scholarship is confirmation of my hard work and determination. I am committed to excelling in my studies and utilizing the knowledge and skills gained from the RPA program to make a positive impact within the industry. Ongoing education and training in real estate and valuation methods, as well as a commitment to staying current with industry trends and regulations, is imperative to achieving excellence in this profession.

The generous support provided by your organization enables me to develop and expand expertise while giving me the confidence and motivation to strive for excellence in my future endeavours. I am grateful to be this year’s recipient and look forward to becoming an IMA Member.”

MARIO VITTIGLIO AWARD, 2024 RECIPIENT:

Available to the student who achieves the highest overall grade in the full-time Real Property Administration diploma program at Seneca College. The winner will receive $1,000 for obtaining the highest mark in the RPA Program, awarded in the second year of study.

Cathy Cheng

“I am honoured to receive the Mario Vittiglio Achievement Award. I would like to extend my heartfelt gratitude to the Institute of Municipal Assessors for recognizing my efforts and presenting me with this esteemed award.

The Real Property Administration Program at Seneca has provided me with practical insights and industry-relevant training, effectively preparing me for the challenges of the real estate sector. My time at Seneca has been incredibly rewarding. The dedicated professors and the collaborative learning environment have greatly contributed to my personal and professional growth.

Receiving the Mario Vittiglio Achievement Award is a tremendous honour. It inspires me to strive for excellence both academically and professionally. Your generous support not only aids me in pursuing further education towards obtaining the I.M.A. designation but also alleviates my financial burden, allowing me to fully concentrate on my studies and career aspirations. I am sincerely grateful to the Institute of Municipal Assessors for this invaluable support.”

IMA ASSESSOR’S RECOGNITION AWARD, 2024 RECIPIENTS:

This award is given to students demonstrating potential in the field of property assessment and taxation as deemed deserving, by the faculty of the RPA program at Seneca College, based on enthusiasm and interest shown in the subject matter and notable in-classparticipation and performance. The winner will receive complimentary registration for IMA-435: Cost Depreciation Analysis.

Eun Kyung (Aimee) Lee

“I am honoured to be the recipient of the 2024 IMA Assessors Recognition Award, chosen by the faculty of the Real Property Administration program at Seneca Polytechnic.

The IMA Assessors Recognition Award is an important accomplishment in my academic career. It is an acknowledgement to my passion and dedication towards the field of property assessment and taxation. Not only that, but this award also represents the support from the industry which motivates me to work even harder to achieve my goals.

Once again, I want to thank the faculty members of Seneca Polytechnic who saw the potential in me, and to the Institute of Municipal Assessors for their generosity.”

Sara Doherty

“I am honoured to be the recipient of the IMA Assessors Recognition Award. I would like to thank the Institute of Municipal Assessors and the RPA faculty for selecting me for this award. This award will allow me the opportunity to further my education by taking one of the required courses for the M.I.M.A designation, which I am looking forward to starting. Thank you again. I truly appreciate this recognition.”

CARL B. DAVIS AWARD, 2024 RECIPIENT: Steven Koutsovitis, A.I.M.A.

Available to all members. This award is given to the student who achieves the highest mark in IMA-321: Fundamentals of Canadian Assessment Law. The winner will receive $500, awarded annually in April.

“I am honoured to receive the Carl B. Davis Award this year. I want to thank the IMA, my instructors and colleagues for their support since my professional journey began. The education I gained from the Fundamentals of Canadian Assessment Law course has been essential to my professional development. I will carry forward the critical lessons learned and knowledge throughout my career and strive to achieve the highest standards. I again would like to thank the IMA for this incredible recognition and honour.”

LARRY K. HUMMEL AWARD, 2024 RECIPIENTS: M.I.M.A. Award: Oliver Linwood

Given to candidates from the Fast Track Designation Program (FTDP) who achieve the highest overall mark in their final exam. The winners from the M.I.M.A. program and A.I.M.A. program will each receive $500.

“Thank you so much for this incredible recognition. Taking the IMA Fast Track Designation Program was a great experience, where I gained considerable knowledge in a short period of time. The course content was very well organized and was easy to pick up in my free time during the study period. The program has been essential in my professional growth and I would recommend it to anyone interested in professional development for their property assessment career. This award will serve as a life lesson to always try my best and if you are willing to put in the work anything is possible.”

A.I.M.A. Award: Salma Sedigh

“Receiving this year’s Larry K. Hummel Award fills me with profound gratitude. It stands not only as a testament to my dedication but also as a reflection of the invaluable opportunities provided by IMA. I am grateful for the doors opened and the pathways paved, propelling me toward success, and I carry this recognition as a reminder to pay it forward and uplift others in their pursuits. ”

W.J. LETTNER MEMORIAL AWARD

The IMA’s Scholarship Trust Fund Committee and Board of Directors amended the criteria for the prestigious W.J. Lettner Memorial Award.

M.I.M.A. Category ($1,500): Awarded to the M.I.M.A. Accredited member with the highest composite mark on the M.I.M.A. Written Exam and Oral Interview (weighted equally).

A.I.M.A. Category ($500): Awarded to the A.I.M.A. Designated member with the highest composite mark for all seven IMA-300s courses (weighted equally).

Dividing this prestigious award into two categories (one for A.I.M.A. designated members and the other for M.I.M.A. accredited members) grants the Institute an opportunity to recognize two exemplary and deserving candidates each year

With the goals and objectives outlined in the 2020-23 Strategic Plan guiding the revision process, these amendments were approved to ensure fair and equal access to members regardless of geography. As one of the IMA’s most celebrated awards, we are delighted to continue honouring the values and memory of award founder W.J. Lettner.

Congratulations to the 2024 recipients!

Andrew Doble, M.I.M.A.

“I would like to thank the Institute of Municipal Assessors (IMA) – I am truly honored to receive the W.J. Lettner Memorial Award in the Category of M.I.M.A. I would also acknowledge the support and encouragement of my family, peers, and other assessment professionals that I have met, and who through their interactions have helped make this profession so rewarding for me. I have found the IMA’s educational programs for both A.I.M.A. & M.I.M.A. to be very applicable and relevant to my career as a professional in property assessment, valuation and taxation. As a “lifelong learner” I plan to continue my professional development through future course work and education with the IMA. In memory of my late childhood friend Attila Csanyi, I will be donating a portion of this scholarship to the Canadian Centre for Addictions and Mental Health (CAMH).”

Shelby Roper, A.I.M.A.

“It is an honour to be recognized as one of the recipients of the W.J. Lettner Memorial Award this year. The education provided through the IMA courses have given me the ability to further my knowledge of assessment and valuation challenges that I encounter each day as a property assessor. I appreciate the recognition of this award and look forward to continuing to expand my knowledge with the MIMA educational program.”

DISPUTE RESOLUTION

Scott Powell, M.I.M.A., AMAA, Team Lead, Property Tax Complex, RyanOn March 7, 2024, it was my pleasure to chair the Dispute Resolution panel discussion during the Virtual Canadian Assessors Summit. I was fortunate to be joined by three fantastic members of the assessment and property taxation community; Erin Johnston MIMA, Robert Andrews BA, LLB, and Nelson Karpa AACI, P.App. This group of professionals reflected the diverse backgrounds and viewpoints found in our industry, and yet espoused universal support for the value of dispute resolution. Here are some of the key takeaways for members to consider and take back to their respective businesses.

What is Dispute Resolution?

The right of taxpayers to understand, audit and appeal their assessments is fundamental to the assessment and property tax industry. These build and support the confidence that taxpayers have in the system; that if inaccuracies are identified then remedies exist. It can be argued that because these taxpayer rights exist the system is inherently adversarial. However, simply because the system embraces conflict, does not mean it must be acrimonious. Dispute resolution refers to a variety of actions and processes leveraged as a means of dealing with conflict beyond the costly and demanding requirements of a formal hearing.

Takeaways from Our Panel Discussion

1) Celebrate the Small Wins

Just because you have adopted a dispute resolution mindset doesn’t mean you’re going to hit a home run every time. It is important to see and celebrate the little wins too such as:

a. Better working relationships with colleagues, making it easier to pick up the phone in the future when situations arise.

b. Encourages a more open exchange of information. Better data equals better assessments.

c. More concise appeals reducing the time/effort required.

2) Impact to Employee Satisfaction

Organizations which incorporate dispute resolution into their business process have experienced increased employee satisfaction, more manageable stress levels, and better staff retention. Efforts taken to reduce the acrimonious aspects of the adversarial process of assessment appeals is good for employees, which is in turn good for employers.

3) Impact to Financial Stability

The incorporation Pre-Roll and/or case management processes into reassessment cycles allows taxpayers and assessment authorities to gain value and tax certainty which in turn supports revenue stability.

4) If at first you don’t succeed.

Championing a dispute resolution mindset means adopting a positive mindset despite setbacks. Have confidence in the process, and in the reasons why engaging in dispute resolution is better than not. Being an agent for change means that you will encounter those who are not comfortable or bought-in to your way of doing things. Don’t let that dissuade you.

POWER OF SALE: A SIGN OF THE TIMES

Melissa VanBerkum¹

On May 10, 2024, The Globe and Mail reported that the Bank of Canada, in its 2024 Financial Stability Report²,warns of a steep jump in mortgage payments (the majority occurring in 2026), with the median monthly payment increasing by more than 60% for those with a variable rate mortgage.³ Mortgage Professionals Canada reported in its Housing and Mortgage Market Review (Ontario, January Q1, 2024),that high mortgage rates and a softening economy exerted upward pression on mortgage delinquencies in the last quarter of 2023.⁴ While Ontario remains below the national average, defaults are on the rise, with no expectation that these numbers will decrease through 2024.⁵

If mortgage repayment obligations cannot be met, mortgagors will default on their mortgages, leaving mortgagees to explore their remedies. I consider below the mortgagee’s power of sale option.

What is a mortgage?

Mortgages, in one form or another, have been recognized for hundreds of years. The earliest mortgages under English law were pledges of land, where a pledge (or gage) was obtained by the lender (gagee) acquiring possession of some object.⁶ A practice then developed whereby the fee simple estate in land was granted to the mortgagee that gave the mortgagor a right of re-entry upon full payment of the debt.⁷

Over time, there was some modification with the introduction of a charge, with rights that encumbered the borrower in favour of the lender, but without a transfer of the legal estate to the lender.⁸ Currently, in Ontario, mortgages and charges are treated equally. Legislation provides that parties to a charge are entitled to all of the legal rights and remedies in the same way as if the borrower has transferred the land by way of a mortgage.⁹

Most often, it is the fee simple estate in land that is mortgaged but other legal interests, such as leasehold interests, easements and even a mortgagee’s rights can be mortgaged. In this paper, I assume that the interest is the fee simple.

Equity of Redemption

Historically, if the mortgagor failed to make the repayment in the full amount owed or by the due date, the mortgagor’s “right to redeem” (the right to recover the mortgaged interest) was lost forever, regardless of how little remained owing or the length of the delay.¹⁰ The courts of equity determined that this was an unfair result; they realized that the rights of a mortgagee to prompt and full payment of the debt needed to be balanced against the mortgagor’s investment in the property. In response, the courts developed the legal notion of a mortgagor’s “equity of redemption” or the net value of a property after deducting the mortgage loan amount.

Default Remedies

When a mortgagor fails to make payment by the prescribed deadline, default occurs. There are five remedies available to a mortgagee upon default:

(i) an action against the mortgagor on its personal covenant;

(ii) possession;

(iii) appointment of a receiver;

(iv) foreclosure; or

(v) a sale of the property via power of sale.

The best remedies in terms of cost and speed are power of sale and foreclosure.

Power of Sale Process

Individual mortgages spell out the mortgagee’s remedies. In Ontario, power of sale is also expressly permitted by statute.¹¹ Power of Sale gives the mortgagee the right to sell the mortgaged interest and is the most common remedy used in Ontario. Generally, in the power of sale process, the mortgagor continues to hold the ownership interest until the property is sold. This

means that the mortgagor has an opportunity to redeem the mortgage by either bringing the mortgage up to date or by paying it off entirely.

The Mortgages Act, RSO 1990, c. M.40 sets out the obligations regarding the power of sale process in Ontario. In summary, the steps that must be followed are as follows:

1. Once the mortgagor fails to make the required payments, the mortagee may issue and serve a Notice of Sale 15 days after the default has occurred.

2. The Notice of Sale must state the amount owing for principal, interest, taxes, insurance premiums, costs and other expenses.

3. The Notice of Sale must be served on the mortgagor, their spouse, anyone who appears on the parcel register and, if applicable, the Crown and any person who has provided written notice of the mortgagee that it has an interest in the property.

4.The property may not be listed for sale for 35 days following the Notice of Sale. During this “redemption period”, the homeowner can bring the mortgage up to date or pay it off.

5. If the mortgage debt remains, the mortgagee may sell the property upon the issuance of a court judgment and after obtaining a Writ of Possession that gives the mortgagee the right to evict the occupants, with the assistance of the Sherriff.

6. The sale proceeds are then used to pay all of the costs of the mortgagee.

Fair Market Value

Typically, where there is equity in a property, the mortgagor refinances the mortgage to make it current and prevent a forced sale. This protects the mortgagor’s equity in the property. However, where there is little equity because the outstanding principle is significant or the property’s value has declined well below its purchase price, and the mortgagor cannot make the mortgage current, the property will be sold via power of sale.

In a power of sale, the mortgagee has a fiduciary duty to sell the property at fair market value. If the property is sold for more than the total debt, the surplus must be paid to the mortgagor. This means that, if the lender makes a quick sale at a discount, the mortgagor can sue the lender for any loss in equity. If the property sale proceeds do not cover the debt owed, the lender may sue the mortgagor for the outstanding balance.

To satisfy its fiduciary duty, a lender will typically use the services of a real estate agent/broker to list the property to ensure that it is marketed widely. It will also obtain appraisals to demonstrate the fair market value of the property prior to sale.

Both of these actions will help the mortgagee defend itself against claims that it breached its duty and sold below the property’s fair market value.

In practice, properties sold under power of sale are often listed on an “as is” basis and/or do not allow inspections prior to purchase. Both of these red flags would be expected to have an impact on the purchase price. In a declining market where property values are receding rapidly, the number of properties for sale under power of sale proceedings will likely increase. If supply outstrips demand, property values will slip even further. In this scenario, an appraisal will have to account for market forces at time of sale that may be quite different from those that were in play years, or even months, earlier.

Since the mortgagee does not take title to the property under power of sale, properties sold via power of sale are considered sales under duress (i.e. no “willing seller”) and are not classic “good indication of value sales.” However, power of sale proceedings still tell the appraiser/valuator something about the market, particularly where the number of forced sales are increasing due, in part, to overall changes in the economy such as higher interest rates, unemployment, rising debt-toincome ratios, etc.

Even with a reduction in current interest rates later this year, the Bank of Canada is not expected to lower rates to prepandemic levels. It will be interesting to see how mortgagors and mortgagees respond when the next tranche of mortgages come up for renewal in 2025-2027.

1. This article does not constitute legal advice. Parties should rely retain their own independent legal counsel.

2. https://www.bankofcanada.ca/2024/05/financial-stability-report-2024/

3. Mark Rendell and Rachelle Younglai, Bank of Canada warns of steep jump in mortgage payments, The Globe and Mail, May 10, 2024

4. Mortgage Professionals Canada, Housing and Mortgage Market Review: Quarterly Report – January 20; https:// mortgageproscan.ca/news-publications/publications/housing-and-mortgage-market-review

5. Ibid.

6. Bruce Ziff, Principles of Property Law, 5th Ed. (Toronto: Thomson Reuters Canada Limited, 2010), p. 431

7. Ibid, p. 432

8. Ibid.

9. Land Registration Reform Act, RSO 1990, c. L.4, subs. 6(3)

10. Bruce Ziff, Principles of Property Law, 5th Ed. (Toronto: Thomson Reuters Canada Limited, 2010), p. 433

11. Mortgages Act, RSO 1990, c. M.40, s. 24

TAKE 5 WITH THE IMA

Charlene MacNeil, AACI, P.App., M.I.M.A.1

Where do you work and what is your current role?

I am the Assistant Director of Commercial Valuation and Defence for Property Valuation Services Corporation (PVSC). We provide assessment services for the municipalities in the province of Nova Scotia.

2

What prompted you to get involved with the IMA?

I have been a member of the IMA since 1996 when I was working for the Ministry of Revenue (now MPAC). I joined the institute to obtain a designation that would provide me with credentials to support me in court settings and also assist me with career advancement. Membership was also a great way to meet more assessors and appraisers and to participate in educational events and courses.

3

How has being a member positively impacted your career?

The IMA designations are respected throughout the assessment industry. Having my AIMA helped me obtain a Senior Assessor position in the Scarborough Assessment office, and also later an Acting Area Analyst position at Head Office. When I moved to Nova Scotia in 2003, the IMA was not well known in this province at the time, but my designation provided me with the credentials required to obtain a position as a commercial assessor. My MIMA enabled me to be designated as an Expert Witness at the Nova Scotia Utility and Review Board (second highest court in the province). Since then, the IMA has become the chosen association for our new assessors at PVSC to affiliate with.

4

What would you tell your younger self just starting in the industry?

If I had the opportunity to talk to my younger self I would have told her to join the IMA as soon as I was hired and to take advantage of all the opportunities it provides to gain more knowledge and connect with others in the industry. Over the years I have learned so much through other members and also through the various seminars offered by the IMA.

5

What are your goals for the future?

Having spent 35 years in the assessment industry, I am preparing for my retirement in a few years. A major part of this preparation involves the mentoring and training of those on my team so that they will be prepared for their futures. Supporting them in getting their designations is part of that preparation.

1

Where do you work and what is your current role?

I work for the Municipal Property Assessment Corporation, where I am a Property Valuation Specialist.

2

What prompted you to get involved with the IMA?

I chose to become involved with the IMA as it is the organization that best allows for me to enhance my skills and knowledge in the field of property assessment. The IMA offers valuable training and resources that align with my professional goals. Understanding the complexities of property valuation is a neverending challenge, as new and unique circumstances arise frequently. For this reason, I chose to become part of the Institute of Municipal Assessors as they offer opportunities for continuous learning to keep up to date on current trends.

3

How has being a member positively impacted your career?

Being part of the IMA provides networking opportunities that allow me to connect with professionals who share similar interests and challenges in the field of property assessment. The IMA allows me to stay updated on industry trends, regulations, best practices and ensuring that my skills stay current and relevant. The networking opportunities within the Institute are invaluable, as this allows members to connect with peers, share experiences, and stay abreast of the industry. Being involved in the IMA contributes to a sense of community and shared purpose.

4

What would you tell your younger self just starting in the industry?

Looking back, I would tell my younger self to embrace a mindset of continuous learning. The world of property assessment is dynamic, so staying updated in industry changes and refining skills is crucial. I would also advise myself to seek mentorship from experienced assessors, as learning from others’ experiences can be incredibly valuable. More importantly, I would remind myself to stay patient and persistent, as it is a journey with a lot of growth along the way.

5

What are your goals for the future?

As I approach the latter years of my career, I plan to continue expanding my knowledge in the field of property assessment. I plan to continue being a leader and mentor for others in the field who may be new to the discipline. I have realized the importance of imparting knowledge to others in an effort to maintain expertise and continued success for MPAC. I would also like to become more involved in the IMA and I have a desire to become a marker for courses in order to help others reach their destination.

MEMBER ELEVATIONS

THE IMA WOULD LIKE TO CONGRATULATE THE RECENTLY ELEVATED AND NEWLY APPOINTED MEMBERS!

AFFILIATE MEMBERS

NAME COMPANY

Pierre Boudreau

Katelyn Crow

Zach Egan

Myriam Lefebvre

Rui Min

Chelsea Mullen

Earl Petten

Tori Rollins

Jill Bender

Nicholas Collins

Goeun Kim

Shelly LeBlanc

Yee wei Lo

Guoping Chen

Suzanne Hammond

Matison Montgomery

Jenny Mui

Kiernan Wolters

Eason Yau

Kevin Young

Nan Ye

Rachel Lethbridge

Yuri Chae

Max Wark

Andrea Chomitsch

Daniel Paluch

Robert Eakins

Gbamila Adejumo

Stefanie Engel

Aynur Mustafayeva

Service New Brunswick

Property Valuation Services Corporation

Property Valuation Services Corporation

MPAC Barrie

City of London

Property Valuation Services Corporation

Municipal Assessment Agency

St. Leonards Residential Services

Navitax

MPAC

MPAC

Service New Brunswick

MPAC

Student

Student

MPAC London

Beijing

Magna Autosystems

Beijing

Service New Brunswick

New Seneca RPA Grad

MPAC London

New Seneca RPA Grad

MPAC Kitchener

MPAC Sudbury

MPAC Hamilton

PwC Canada Property Tax Services

MPAC Pickering

New Seneca RPA Grad

New Seneca RPA Grad

A.I.M.A. MEMBERS

NAME COMPANY

Vala Khani

Steven Koutsovitis

Martins Aina

Adelso Vivas

Jennifer Anderson

Nicholas Collins

Sebastien Cyr

Jeanie Hynes

Chudi Ngwuluka

Mary Zubert

Gage Evoy

MPAC Toronto

MPAC Toronto

Service New Brunswick

Service New Brunswick

City of Brampton

MPAC Kitchener

MPAC North Bay

PVSC

PVSC

City of Waterloo

MPAC Sault Ste Marie

M.I.M.A. MEMBERS

NAME COMPANY

Xi (Cynthia) Shen MPAC Toronto

NAME COMPANY

Curtis Chafer

Ron Etchen

Nicholas Gowing

Andrew Heipel

Andrea Kilpatrick

Frank Lee

Oliver Linwood

Catherine McDonald

Shawn O’Connor

Vidura Rathnayake

Rebecca Rochford

Amy Van Wyngaarden

Patrick Laroche

Allison Haffner

Taylor Parker

MPAC Pembroke

MPAC Mississauga

MPAC Kitchener

MPAC Kitchener

Service New Brunswick

MPAC Toronto

MPAC Brockville

MPAC Ottawa

MPAC Peterborough

MPAC Brockville

MPAC Kitchener

MPAC Sudbury

MPAC Ottawa

MPAC Kitchener

MPAC London

DISTRICT NEWS

It was a busy few months in our Districts. Districts 2, 3, 4, 8 and 9 all hosted virtual, in-person and hybrid meetings. We caught up with each of the District Chairs to find about more about each of their events.

DISTRICT 2

What are the three take aways you got from attending the session?

Our take aways included: the Hybrid Meeting format does work and was well received for those who couldn’t attend in person, a historic site in Hamilton is a good central meeting site off the highway for members to travel to and from, and we found there was interest in recording future meetings for sale afterwards for those who could not attend.

What is your District focusing on for the upcoming year?

I believe the focus of our district will continue to be planning our next meeting, likely next spring as there are quite a few meeting already planned for the fall.

What new information do you think attendees found most interesting?

I believe all three of our presentations provide a wealth of new information, I personally enjoyed the Landfills presentation the most having the least exposure to such an asset throughout my career.

Why do you think volunteering with your District Executive is important?

From my perspective, I think volunteering keeps me connected with colleagues from various organizations across our industry. I am always looking to develop new relationships with our municipal partners and tax agents. Being part of the industry for 27 years, I also use my roll in the executive to engage with the next generation of assessment professionals, provide mentorship and guidance as they navigate their career opportunities. This engagement helps with success planning by opening the door, starting the dialogue, and sets up future discussions with our younger professionals. Earlier in my career, I accepted the Vice-Chair and Chair roles to practice my public speaking in front of other assessment professionals to develop confidence and composure when appearing in court. In the end, it’s my way of giving back to the IMA for years of educational content and helping organize future content.

DISTRICTS 3 & 4

Why did Districts 3 & 4 collaborate to bring together this District Meeting?

Districts 3 and 4 have similar market areas and interests. Historically we have always done these meetings together. A lot of people live and work in either district so there is a lot of overlap.

What are the three take aways you got from attending the session?

People enjoyed the in-person meeting. It’s been 5 years since our last in-person meeting and our districts enjoyed the opportunity to network with members.

Logistics are crucial when planning an in-person meeting. Given that the assessment update has been paused for several years it was challenging to find new and innovative speakers to discuss assessment.

Having a wide variety of topics- assessment and otherwise makes for a more informative and interesting day.

What new information do you think attendees found most interesting?

AI is a big topic that is on everyone’s mind- What can it do? How will it affect our industry? Future applications?

In relation to their scope of work, attendees were interested in the speakers for various reasons. The LRT discussion spoke to the impact between the LRT and surrounding properties positively and negatively. Many of our members were interested in this aspect of discussion as it relates to value.

Changes to legislation in regards to heritage properties and how they will affect the population of heritage structures across the province.

What is your District focusing on for the upcoming year?

We are currently in the process of closing out the meeting. This means getting feedback from the districts (a survey will be going out), establishing lessons learned and best practices. The rest of the year will be focused on continuing professional development. We are encouraging our districts to attend some of the other great CPD offerings.

Why do you think volunteering with your District Executive is important?

The role of the District Executive is to liaise between the members and the executive. Volunteering is so important as it makes you a well-rounded individual in your industry. It forces you to keep up to date with current events within the industry. To host a successful meeting you must present speakers that are relevant to your attendees and the issues that arise in their district. It provides you the opportunity to collaborate with individuals in your industry outside of your day to day work contacts.

DISTRICTS 8 & 9

Why did Districts 8 & 9 collaborate to bring together this District Meeting?

Since District 8 had a whole new executive, and it was their first time organizing a meeting together, and District 8/9 have so many similarities with respect to their markets, we thought it would be great to collaborate on a virtual meeting this year.

There was a lot of work put into the Mock Settlement Conference, what are the three take aways you got from attending the session?

It’s one thing to read about how to do a Settlement Conference; it’s another thing to see one in action! We felt that the mock settlement conference was a good way to show people the good, the bad and the ugly of how a settlement conference could go. We added some humour to make it more interesting—including some examples of what NOT to do—and some ‘hard to believe but true’ examples—which we think resonated well with the audience. Some of the performances will likely be remembered for a long time!

Three key takeaways would be:

1) Be prepared and know both your side as well as the others’ side thoroughly;

2) Be ready for the unexpected;

3) Have a good idea of where you are willing to settle, and where you are not, going into the Settlement Conference.

In terms of the Secondary Dwelling Unit session - what new information do you think attendees found most interesting?

While this presentation was primarily geared to the Sudbury market, many of the issues resulting in a housing shortage here are applicable in many markets. Most of the housing growth in the Sudbury market has involved single detached homes however encouraging a broader supply of ownership typologies are required to meet the current and future housing demand. Interestingly, the newest and most expensive rental stock has the tightest vacancy which indicate that people are willing to pay a premium to live in newer buildings. Simultaneously, the supply of low-end and rent-geared-to-income units fall way short of demand, meaning there is potential for growth at all levels of the market. To promote the creation of more housing, the City of Greater Sudbury has introduced policies regarding secondary dwelling units, parking reductions and zoning amendments that allow for multi-unit buildings to be built in more commercial zones. It also reduced or exempted development charges for certain projects. The Secondary Dwelling Unit program encourages a gentle intensification of existing neighbourhoods by permitting secondary units in basements, additions or ancillary structures thereby taking advantage of existing infrastructure making home ownership more affordable for an owner renting out a secondary unit. In the end, the City of Greater Sudbury is hoping to create an additional 10,300 to 11,600 households within the next 30 years when Sudbury’s population is expected to reach 200,000 people.

What is your District focusing on for the upcoming year?

District 9 is going to be having an election this summer and afterwards we will begin planning an in-person meeting for 2025.

District 8 will continue to build momentum with the return of the District Meeting that hasn’t happened for 4-5 years. The executive will promote new membership into the IMA by encouraging current and new members to enroll in some of the courses offered by the IMA. Budget permitting, we are also looking to have an in-person meeting for 2025 and to that end have been considering some exciting and timely topics and speakers for our next session.

Why do you think volunteering with your District Executive is important?

Volunteering for the District Executive is very important to help grow and shape our membership, education, and future within our local executive, as well as within the IMA as a whole. It helps give a local perspective, and flavour as well as an opportunity for networking, when we plan and execute our District meetings, which is a very important part to have within the broader umbrella of the IMA.

COLLABORATING FOR GROWTH: UNLOCKING THE POWER OF SHARED KNOWLEDGE

IMA Conference Co-Chairs:

Dan Rossman, Affiliate, Civil Litigation & Property Tax/Assessment Lawyer

Krista O’Brien, Affiliate Program Manager, Property Assessment and PILTs, City of Ottawa & Director of Legislation, OMTRA

Dan Devellis, M.I.M.A.,

Acting Vice-President, Valuation & Customer Relations, MPACUnlock the power of shared knowledge at the 65th Annual IMA Conference from June 9-11, 2024, at White Oaks Conference Resort & Spa in Niagara-on-the-Lake.

Collaborating across the property assessment industry is crucial for several reasons. It fosters the sharing of best practices, ensuring that all members benefit from the latest innovations and methodologies. By working together, professionals in our industry can address shared challenges, and learn new perspectives while working to achieve similar goals. That is why we have focused this year’s conference on creating conversations across the industry. Whether you work on the service provider, municipal, legal, or private sides of the industry, you will find content that resonates and insights you can bring to your work.

We will kick off the conference with keynote speakers Yung Wu, retired CEO of MaRS Discovery District and Jennifer Barroll, Corporate Leadership and Communications Consultant. Attendees will learn about Innovation and Entrepreneurship in Canada, along with learning about collaboration and leadership. We will hold sessions on current topics such as affordable housing, case Law updates, and futureproofing the industry. We will also tackle CUSPAP for IMA members, Retail and Commercial Real Estate Outlook, conversions of offices into multi-residential, conflicts of interest in our industry, cross-examination tips, and more.

Attendees will benefit from interactive workshops and networking opportunities. We will gather on Sunday evening to celebrate the impact the IMA has had on our profession, the people who have made it all possible and the bright future new professionals are laying out. Monday, we will hold the IMA President’s Dinner at the beautiful Ravine Vineyard Estate Winery. Some attendees have signed up for our golf tournament, the off-site tour at Château des Charmes Winery and a historic walking tour of downtown Niagara-on-the-Lake.

This conference promises an invaluable opportunity for professional development, industry insights, and meaningful connections.

For more details on the IMA Conference, visit the IMA Conference website.

Reception: A Celebration of 65 years of in person conferences, IMA accomplishments and the people that made it possible

Join us for 9 holes at Royal Niagara Golf Course and show off your skills on the green

Garden View Patio / Grand Event Room (Rain Room

Join the IMA team as we celebrate the 65th Annual Conference A Celebration of 65 years of in person conferences IMA accomplishments and the people that made it possible

Garden View Patio / Grand Event Room (Rain Room) | Dinner will be provided

Wu, recently-retired CEO of MaRS Discovery District

by Ejona Balashi, IMA Executive Director & Drew Samuels, M I M A , IMA 1st VP

Session Chaired by IMA PresidentCarlos Resendes M I M A

Speakers: Tim Hudak, CEO, Ontario Real Estate Association, Ana Bailão, Head of Affordable Housing & Public Affairs, Former Deputy Mayor and candidate for Mayor of Toronto, Joe McFadden, M R I C S ManagerVaulation, Research & Advisory Services, MPAC, Michelle J T Cicchino, Associate, Gowling WLG

Presented by Greg Martino, M I M A , PLE, Charles Johnstone, M I M A , FRICS, AACI and André Pouliot, B Comm , DULE, MRICS, P App , AACI

Afternoon workshops:

In House Workshops: Attendees will be able to choose 2 of 3 available sessions

Off Site Tour:

Château des Charmes Winery Tour, chaired by Anali Cameron, M I M A , MPAC & Jason Wilson, BA, MRICS, MPAC

Historic Walking Town of Downtown Niagara-on-theLake, chaired by Chris Kaufman, MRICS, MPAC

Please note that you can only register for one option and registrations are on a first come, first served basis If you do not get a spot please sign up to our waiting list and you will be contacted if any spots become available

For In House workshops: 2:15 PM - 3:15 PM ET

(an hour to an hour and 15 min per session/workshop)

15 min break

3:30 PM - 4:30 PM ET for switch over

Off-site leaves at 2:30 (allowing time for transportation etc ) and back at 4:30 to 5:00)

In House Workshops:

IMA President Dinner: Join us for an evening at Ravine Vineyard Estate Winery in the beautiful Niagara-on-theLake Buses to and from the winery will be provided 6:00 PM - 9:00 PM ET

Canadian Case Law Update

Office-ally a Multi-Res Property

Chaired by Krista O’Brien, Affiliate

Speakers: Angela Severson, City of Ottawa, Matthew Kanter, MPAC, Jamie Walker, Walker Longo & Associates LLP, Karina Wong, Nixon Poole Lackie LLP

Chaired by Laura Muntz, M I M A & Amy Raycroft, M I M A

Speakers: Erin Johnston, M I M A , Licensed Paralegal, Principal, Senior Vice President, Property Tax Services, Avison Young, John Watling, MRICS, M I M A , Director at International Property Tax Institute (IPTI)

Chaired by Scott Powell, M I M A , AMAA

Future Proofing the Property Tax Industry

Speakers: Kristy Robbins, CHRL, MPAC, Cate Watt, AMAA, City of Edmonton, Kim van Vliet, A I M A , Ryan, Bryan Murao, BC Assessment

Buses to and from winery will be provided

Welcome Remarks 8:30 AM - 9:00 AM ET Co-Chairs & President

Opening KeynoteEmpowering Success Together 9:00 AM - 10:00 AM ET

Health Break 10:00 AM - 10:15 AM ET

Retail and Commercial Real Estate Outlook 10:15 AM -11:15 AM ET

Conflicts of Interest in Property Assessment - What it is and How to Avoid it 11:15 AM - 12:15 PM ET

Lunch Break 12:15 PM - 12:45 PM ET

Cross Examinations - Tips and How To’s - An Interactive Workshop 12:45 PM - 2:15 PM ET

Closing Remarks 2:15 PM - 2:30 PM ET

Tea/coffee and snacks will be provided

Jennifer Barroll, Corporate Leadership and Communications Consultant

Dr Tony Hernandez, MSc, PhD, Director, Centre for the Study of Commercial Activity | Professor, Toronto Metropolitan University

Chaired by Lynne Ashton, Walker Longo & Associates LLP

Speakers: Drew Samuels, M I M A , DMA, Rosalia Benvenuto, Paralegal, A I M A Georgia Ribeiro, A I M A , MPAC

Dan Rosman, Affiliate, Civil Litigation & Property Tax/Assessment Lawyer

Speakers: Lauren Lackie, Affiliate, Partner, Nixon Poole Lackie LLP, Rebecca Shoom, Partner, Lerners LLP, Noah Gordon, Associate, Miller Thomson LLP

IMA ANNOUNCEMENTS

ANNUAL GENERAL MEETING 2024

Please be reminded that the 2024 Annual General Meeting of the Institute of Municipal Assessors was called for and will be held as follows:

Date: Wednesday, June 5, 2024

Time: 1:00 PM – 2:00 pm EST

Location: Virtually (MSTeams)

CPD: 0.5 General Credits

Please register to attend the 2024 AGM as we welcome the 2024-25 Executive Committee and review the past year with the membership. https://lnkd.in/eE7g_ZpV

2023-24 WEBINAR SERIES

Join us on June 25 for the final webinar in the 2023-24 IMA/IPTI webinar series, Valuation of Excess Land and Surplus Land. Presented by Malcolm Stadig, AACI, P. App, CAE, MRICS, ASA, M.I.M.A. & Michael Lambrech AACI, P.App.

This webinar will identify and clarify the differences between excess and surplus land. The panelist will discuss the effect these differences have on calculating value using the income approach to value. The audience will gain an understanding of how to identify surplus or excess land and how to accurately estimate the value of each considering local zoning bylaws and the shape and placement of the structures on the land.

Session Flyer: Available here

CPD: 1.5 Learning Credits

Registration: Available here

2024-25 IMA SPONSORS

THANK TO THE FOLLOWING SPONSORS:

PRESIDENTIAL

DIAMOND