HOW’S THE MARKET?

It feels like the seasons have changed now that it’s almost September. The kids are back to school, the mornings are becoming a bit chilly, and the ski resort has been advertising the start of ski season. It’s been an unusually hot and dry summer and we’re ready for autumn.

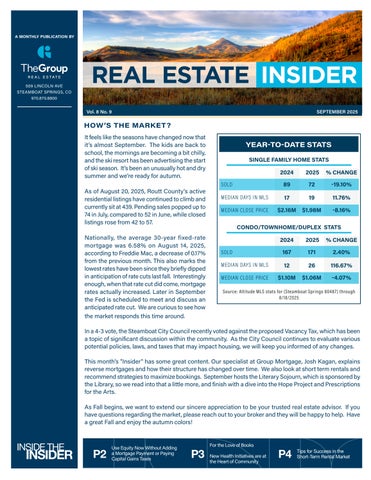

As of August 20, 2025, Routt County's active residential listings have continued to climb and currently sit at 439. Pending sales popped up to 74 in July, compared to 52 in June, while closed listings rose from 42 to 57.

Nationally, the average 30-year fixed-rate mortgage was 6.58% on August 14, 2025, according to Freddie Mac, a decrease of 0.17% from the previous month. This also marks the lowest rates have been since they briefly dipped in anticipation of rate cuts last fall. Interestingly enough, when that rate cut did come, mortgage rates actually increased. Later in September the Fed is scheduled to meet and discuss an anticipated rate cut. We are curious to see how

the market responds this time around.

In a 4-3 vote, the Steamboat City Council recently voted against the proposed Vacancy Tax, which has been a topic of significant discussion within the community. As the City Council continues to evaluate various potential policies, laws, and taxes that may impact housing, we will keep you informed of any changes.

This month's "Insider" has some great content. Our specialist at Group Mortgage, Josh Kagan, explains reverse mortgages and how their structure has changed over time. We also look at short term rentals and recommend strategies to maximize bookings. September hosts the Literary Sojourn, which is sponsored by the Library, so we read into that a little more, and finish with a dive into the Hope Project and Prescriptions for the Arts.

As Fall begins, we want to extend our sincere appreciation to be your trusted real estate advisor. If you have questions regarding the market, please reach out to your broker and they will be happy to help. Have a great Fall and enjoy the autumn colors!

USE EQUITY NOW WITHOUT ADDING A MORTGAGE PAYMENT OR PAYING CAPITAL GAINS TAXES

For homeowners with substantial equity — especially in highly appreciated properties — selling the home can trigger a large capital gains tax bill. Taking a traditional loan against the property can create unwanted payments. A Home Equity Conversion Mortgage (HECM) is a reverse mortgage that offers a way to access equity without immediately paying tax or adding additional payments. In some cases, it can also help erase the gain entirely for heirs. Proceeds from a HECM can be used for most purposes including helping with living expenses or even to purchase a second home.

Let’s say:

• You bought your home in 1990 for $150,000 (your tax basis).

• It’s now worth $1,000,000.

• You’re retired and would like to access $400,000 — partly for living expenses, partly for a vacation or second home.

1. Sale price: $1,000,000

4. IRS exclusion: $500,000 (married couple, if you qualify)

5. Taxable gain: $350,000

6. Capital gains tax (15% rate): $52,500 (plus possible state tax)

7. You now have to find a new primary residence.

Why This Works

Deferral: No sale now means no capital gains tax now.

1. Hypothetically, based on your age and home value, you qualify for a loan of about $400,000.

2. That $400,000 is loan proceeds, not income — so no capital gains tax is due now.

3. You stay in your home with no monthly mortgage payments, as long as you maintain the property and keep taxes and insurance current.

4. Interest accrues on the loan balance over time, but repayment isn’t required until you sell, move out, or pass away.

5. You can use the proceeds for any purpose — including buying a second home, such as:

• A vacation property.

• A condo in another state for seasonal living.

• A home near family.

Elimination: Step-up in basis for heirs can erase the gain entirely.

Flexibility: HECM proceeds can be spent in many ways, including the purchase of a second home without selling your first.

Key Considerations

• You must meet all HECM obligations (taxes, insurance, maintenance).

• Interest and fees reduce eventual equity.

• Works best if your goals include aging in place, minimizing taxes, and strategically using your home equity to enhance your lifestyle — whether through travel, upgrades, or acquiring a second home.

Bottom line

A HECM can be more than just a retirement income tool — it can also be a tax-savvy way to access capital for big life goals, like buying a second property, without triggering capital gains now and possibly eliminating them for your heirs entirely. Be sure to consult your tax professional to consider all tax consequences and your mortgage professional for details about qualifying for a HECM.

A HECM is not a government benefit; it is an FHA mortgage loan program. This material is not provided by, nor was it approved by, any government agency including HUD or FHA and Cornerstone Home Lending is not affiliated with any U.S. government agencies. Borrower must be 62 or older. Not a commitment to lend.

FOR THE LOVE OF BOOKS

Pulitzer Prize winner, Anthony Doerr, author of the award-winning novel All the Light We Can Not See, is standing by a lectern in a ballroom at the Steamboat Grand talking about his writing habits and inspiration, and there was not a sound from the audience. He was the last of five speakers at the annual Literary Sojourn in Steamboat Springs and after a day seated around tables its likely people might have felt restless. However, the room of attendees listened so intently, they could have been turning the pages of the book itself, reading in silence.

Doerr is one of an impressive lineup of authors who have been invited to speak over the years at the coveted literary event.

Since the Sojourn’s inception in 1993, lovers of the written word have gathered in Steamboat for the day-long festival. Presented by Bud Werner Memorial Library, nationally recognized authors come to town to share their experiences through keynote addresses, panel discussions and book signings to an audience of over 550 ticket holders. Tickets at $75 per person tend to sell out online almost immediately with guests coming from around the country.

The Literary Sojourn’s enduring success is rooted in its history as a mission-driven festival, founded on the idea of promoting and inspiring an appreciation for literature. In the months leading up to the highly sought after event the library hosts a series of book studies and pre-event talks.

However, this local passion for books goes beyond the library’s sojourn and t’s substantial calendar of community events. Steamboat is home to its very own cherished independent bookstore and sponsor of the sojourn, Off the Beaten Path.

Started in 1989 as Boomtown Books by Dick and Leslie Ryan, the store sat in its longtime home in a quirky multi-story venue on 7th Street and was rebranded as Off the Beaten Path Bookstore Coffeehouse and Bakery. It changed hands in 2007 when the Ryan’s retired and was run for years by Ron and Sue Krall.

Despite the national downturn in book sales, the store has continued to thrive and is considered a downtown treasure for its huge array of texts, gifts and fabulous bakery. Before the Kralls retired in July 2022 and sold the business to Mike and Danielle Skov, the store moved once again to its current location on 9th Street.

On any given day the upper level serves as a go-to spot for book clubs, tutoring sessions, meeting spot for friends and venue for writers. The digital age may have the attention of many, but in Steamboat Springs, the lure of the old timey bookstore and appreciation for storytellers remains steadfast and true.

NEW HEALTH INITIATIVES ARE AT THE HEART OF COMMUNITY

As a mountain town, Steamboat Springs has always separated itself from its high-profile neighbors by its reputation for community first. Now more than ever that innate need to look after its people is our top priority when it comes to wellbeing.

Nearly 60 million Americans—around 23%—experience mental illness yearly, with mountain towns especially impacted by isolation and provider shortages. Two recently launched programs in Steamboat have come about as a result of the community’s push to do more to help those in need.

Prescription for the Arts is a groundbreaking program aimed at helping youth by replacing or supplementing traditional prescriptions with artistic experiences. In a partnership between Pediatrics of Steamboat Springs and Undiscovered Earth the program kicked off in October 2024. Local youth under 18 who are experiencing anxiety, depression, ADHD, isolation, emotional and mental health concerns have the option to work with a care partner specializing in an area of the arts. Prescriptions range from painting and visual arts to music and dance.

The benefits are intended to go both ways by aiding the local creative community to get more involved and be compensated for their time and services. As the program nears its first year in operation, there is an intent to expand into all of Northwest Colorado.

In the last month another initiative launched, titled the HOPE Initiative, a peer-driven community support program. Triggered by the rising rates in death by suicide, a splinter group among local organizations who meet weekly on community needs, including Steamboat Springs Police Department, The Health Partnership, The Yampa Valley Community

Foundation, Warjorse Ranch, Recover Colorado and Reaching Everyone Preventing Suicide decided to take immediate action.

HOPE - Helping Others through Peer Engagement, is backed by an anonymous donation of $250K and will offer a peer-led crisis and resource hotline developed by the Yampa Valley Community Foundation in partnership with local health and community organizations.

Certified peer responders will staff a 24/7 hotline to answer calls from anyone in need whether they need assistance sourcing housing or food resources, a compassionate ear or mental health support. The goal is to provide one number for someone to call and be connected to the best local resource to fit their need at that time.

Both Prescription for the Arts and the HOPE Initiative are exemplary to Steamboat Springs’ compassionate and multifaceted approach to supporting its residents. The former offers proactive, healing through creative engagement; the latter provides immediate, peer-driven support when life feels overwhelming. Both reflect a commitment to nurturing the whole person—mind, body, and spirit—through community, connection, and care.

TIPS FOR SUCCESS IN THE SHORT-TERM RENTAL MARKET

You check into your vacation rental, no one can work the television or sound system with its three remotes, there is a list of things you cannot touch and the overhang of snow by the entryway is threatening to flatten your three-year-old. As a homeowner choosing to offer a property in the short-term rental market there are things to consider that may be overlooked at the onset and will end up affecting your investment.

Maximizing returns means going beyond compliance to create a property that stands out in a competitive, tourism-driven market with season implications.

The Group reached out for insider tips to two local longtime property management firms who specialize in vacation rentals at various budget levels, Condos in Steamboat and Moving Mountains.

1. REGULATORY COMPLIANCE AND COMMUNITY RULES

Buyers should confirm zoning allowances, licensing requirements, and occupancy restrictions before committing. Most homeowners’ associations and condominium boards also enforce strict rental guidelines. Failure to comply can lead to fines, disputes, or the loss of rental rights.

2. GUEST SAFETY

When a guest checks in to a vacation rental, they have made assumptions the home is fit for purpose. If there is a chimney, it will have been cleaned and does not pose as a fire hazard. Carbon monoxide and smoke detectors, heating and cooling systems, appliances and any electrical equipment are in working order. Walkways will be cleared of ice in winter and snow overhangs are clearly marked as dangerous (if they cannot be addressed with heat tape or cleared safely). As a rule of thumb, both companies advise using the time change as a reminder to change batteries and carry out annual maintenance.

3. SEASONAL MARKET POSITIONING

Mountain rentals attract different guest segments depending on the season. Buyers should prepare to market the property across seasons: ski-in/ski-out proximity is a premium differentiator in winter, while decks, patios, and trail access create appeal in summer. Year-round relevance is key to stabilizing occupancy and cash flow.

Two major shifts since COVID have affected seasonality, giving property owners the opportunity for longer term rentals, especially through quieter months. Location neutral workers and the increased popularity in renting versus buying, especially for 30–40-year-olds, offers a newer niche market to explore.

4. DESIGN AND FURNISHINGS

Guests expect both style and function. Keep family heirlooms locked away. Mountain aesthetics—warm textiles, fireplaces, and cozy common spaces—set the right tone, while durable finishes protect the investment from heavy wear. Mudrooms, bench seating, boot dryers, and dedicated storage for skis or bikes are highly valued by seasonal travelers. Quality beds, sofas, dining areas and a well-equipped kitchen further ensure strong guest reviews and repeat bookings. Office space and amenities like home gyms, hot tubs and saunas also enable premium pricing.

5. TECHNOLOGY AND CONNECTIVITY

Even in remote locations, guests expect strong Wi-Fi for work and entertainment. Smart thermostats and sensors can protect against frozen pipes in cold months, while smart TVs and streaming services are often times expected. Keeping technology as user friendly as possible reduces breakages and guest frustration.

Finally, remember the guest has the last word, and their review can affect whether your short-term rental will reap rewards or not. A smooth and secure booking process with accurate descriptions of the property will set the right tone. In condensed housing zones, staying in good graces with the neighbors will also go a long way to keeping everyone happy.