HOW’S THE MARKET?

As August arrives, it's the perfect time to savor the last moments of summer. Go on that big hike you were waiting to do once the high alpine snow melted. Ride that extra long bike ride for which you’ve been training all season. Buy that special piece at the farmer’s market that you’ve been eyeing, and take that nap by the river that you’ve been hoping to do (wear bug spray though!). For families, August also marks the return to school. If you've been contemplating a move this summer but experienced "analysis paralysis", there's still time to embark on your next real estate journey before winter arrives.

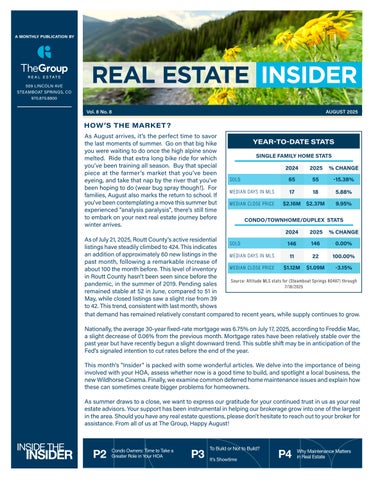

As of July 21, 2025, Routt County's active residential listings have steadily climbed to 424. This indicates an addition of approximately 60 new listings in the past month, following a remarkable increase of about 100 the month before. This level of inventory in Routt County hasn't been seen since before the pandemic, in the summer of 2019. Pending sales remained stable at 52 in June, compared to 51 in May, while closed listings saw a slight rise from 39 to 42. This trend, consistent with last month, shows

that demand has remained relatively constant compared to recent years, while supply continues to grow.

Nationally, the average 30-year fixed-rate mortgage was 6.75% on July 17, 2025, according to Freddie Mac, a slight decrease of 0.06% from the previous month. Mortgage rates have been relatively stable over the past year but have recently begun a slight downward trend. This subtle shift may be in anticipation of the Fed's signaled intention to cut rates before the end of the year.

This month's "Insider" is packed with some wonderful articles. We delve into the importance of being involved with your HOA, assess whether now is a good time to build, and spotlight a local business, the new Wildhorse Cinema. Finally, we examine common deferred home maintenance issues and explain how these can sometimes create bigger problems for homeowners.

As summer draws to a close, we want to express our gratitude for your continued trust in us as your real estate advisors. Your support has been instrumental in helping our brokerage grow into one of the largest in the area. Should you have any real estate questions, please don't hesitate to reach out to your broker for assistance. From all of us at The Group, Happy August!

CONDO OWNERS: TIME TO TAKE A GREATER ROLE IN YOUR HOA

Homeowners’ associations, or HOAs, that govern condominium projects are making headlines in recent months. And the news has not been kind.

The upshot from media reports is that an increasing number of condominium projects are not keeping up with standards for “warrantability” as set by Fannie Mae. That means Fannie Mae/Freddie Mac may not underwrite a conventional loan to buy a condo if it’s part of a non-warrantable project.

And since Fannie Mae/Freddie Mac are a party to roughly 70% of conventional loans, non-warrantable status can be a significant obstacle for both sellers and buyers. Without it, buyers would need to opt for cash purchases or more expensive rates for non-conventional loans. Local condo owners need to know that this is not simply an East Coast-West Coast concern. In its report, the Wall Street Journal listed Colorado as the state with the third-largest number of non-warrantable condo projects (210).

For condo owners, the takeaway is to take a greater interest in how your HOA is operating. For instance, make sure your HOA is adequately insured for the cost of repairing or replacing damaged property, and check to see that essential maintenance is up to date.

According to reports, the most likely reasons a condo project is tagged as nonwarrantable is that the responsible HOA lacks adequate insurance or has fallen behind on building repairs—often as a cost-saving measure. Another reason is that more HOAs, in the face of rising insurance costs, opted for policies with higher deductibles. The problem? Fannie Mae/Freddie Mac requires a maximum deductible of 5%.

Other issues that can cast clouds on a condo project include a lack of funds held in reserve by the HOA (it must be at least 10% of the HOA’s annual budget), if more than 15% of an HOA’s income is from non-residential leases (i.e., parking fees), and if unfunded repairs average more than $10,000 per unit.

Just because you believe your HOA is historically well-run, doesn’t mean you shouldn’t stay on top of how your investment is managed. When you want to sell your condo is not the time to find out there’s a problem that could keep you from selling. Call your local Group Real Estate Agent to learn more about what steps you can take to assess your HOA’s financial health.

CONDO CONCERNS

Fannie Mae:

TO BUILD OR NOT TO BUILD?

It’s time to find your dream home but you question whether to build from scratch, or do you opt for something that ticks a lot of boxes but misses the mark in places? The Group sat down with Steamboat Springs-based design build firm, Gerber Berend to delve into the pros and cons of either option.

THE GROUP What is the average cost per square foot just now for a new build and what does that encompass?

GERBER BEREND It is a difficult one to answer as cost per square foot can vary significantly depending on the level of detail, finish quality, site complexity, and design ambition. A truly accurate cost must consider the full scope of work, including site access, grading, permitting, utility connections (like wells or septic), and exterior elements such as driveways and landscaping.

To help answer this question for our clients, we like to narrow down building costs on specific lots. We frequently work with our clients during “lot selection”, to help them understand the cost and time implications of building on different sites with different conditions. A certain lot may be very reasonable to build on, or it could push the budget out of their range.

TG How does the cost vary for a remodel?

GB Remodeling costs can vary just as widely as new construction, if not more, depending on the extent of the renovation, structural modifications, and existing condition of the home. In many cases, the cost per square foot may be equal to or even exceed that of a

COMMUNITY SPOTLIGHT: IT’S SHOWTIME

If you look through the glass windows of Wildhorse Cinema & Arts in Steamboat’s Wildhorse Plaza you can expect to see more than a simple movie theater foyer. The recently revamped space with its sofas and tables is now a venue for art-based workshops and community gatherings, thanks to the foresight of local investors.

In February 2025, local non-profit organization Undiscovered Earth took over the facility after Metro Theaters went bankrupt. Undiscovered Earth with its six-person strong team, had been trying to buy the now defunct Chief Theater in downtown Steamboat to no avail, and jumped on the opportunity to transform the original Wildhorse Cinema.

The group identified a need for an indoor performing arts space that was easily accessible for public hire, and affordable for nonprofit organizations to utilize. “It has become much more of a community home than we ever expected,” says executive director Dagny McKinley.

In a space of 10 days the team at Undiscovered Earth and a host of volunteers cleaned and re-painted the entire movie theater. They

new build. With remodels, we often encounter variables that are hidden until construction begins, which is why careful planning and thorough site investigation are so important. These variables can include structural surprises, outdated systems, hidden materials or construction methods, moisture and insulation, code and permitting, and design alignment.

TG What are some specific considerations for someone looking to build from scratch in Routt County?

GB Zoning, permitting, and planning can differ between the County and the City of Steamboat Springs, and timelines can be influenced by seasonal limitations and review schedules. Climate is another major consideration. Snow loads, insulation requirements, and solar orientation all shape design and construction.

Builders risk insurance is another key element to keep in mind. Because Colorado faces an increased risk of wildfires, obtaining builders risk insurance for construction projects can be more complex and expensive than in other regions. Often, distance to the nearest fire station or fire hydrant, can be very meaningful in the insurability of a home. Insurers often require additional safeguards or higher premiums to address the potential exposure, making it essential to work closely with your insurance providers early in the process. This careful coordination helps ensure your project remains protected against fire-related risks throughout the construction process.

removed the old ticket booth to create an open-plan, multi-purpose foyer and reconfigured two of the original screening rooms.

A “speak-easy” room can now hold anything from a cabaret jazz evening to a comedy show. The second largest theater with 131 seats was adapted for talks with an 8 by 24-foot stage, and has already hosted over 20 non-profit organizations.

A total of six rooms is available for rent ranging from $200 for nonprofits and $300 for the public. The facility still offers traditional movie showings, with staged events, workshops and art-based programming peppered in each week.

“Throughout the whole process we felt completely supported by the community and the city who among other things, helped with liquor licensing,” Dagny says. The group used the Routt County Economic Development Partnership to review their business plan and made a point of connecting with neighboring businesses to promote positive communication lines.

Undiscovered Earth has made accessibility a founding focus for the facility and welcomes donations to help with the ongoing cost of running affordable programming. Donations of all levels can be made through undiscoveredearth.org