HOW’S THE MARKET?

May is a great month to be in Steamboat! In our yards, the flowers start to bloom, and the lawns begin to green. In the overall valley, the Yampa River begins to swell, and the peak of Mount Werner tends to remain snowy. What a perfect contrast! The town is relatively quiet, but there are great deals at restaurants, shops, and events. Some folks look to get away during this time, but others see it as one of the best times to be in Steamboat. Happy Spring!

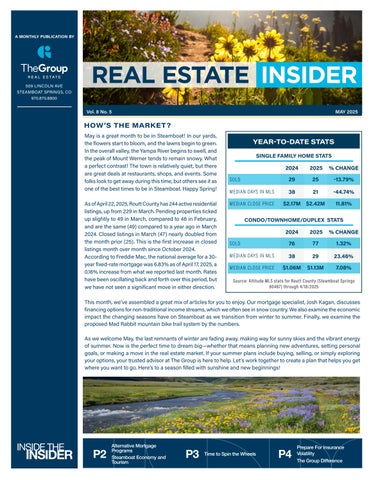

As of April 22, 2025, Routt County has 244 active residential listings, up from 229 in March. Pending properties ticked up slightly to 49 in March, compared to 46 in February, and are the same (49) compared to a year ago in March 2024. Closed listings in March (47) nearly doubled from the month prior (25). This is the first increase in closed listings month over month since October 2024. According to Freddie Mac, the national average for a 30year fixed-rate mortgage was 6.83% as of April 17, 2025, a 0.16% increase from what we reported last month. Rates have been oscillating back and forth over this period, but we have not seen a significant move in either direction.

Source: Altitude MLS stats for Routt County (Steamboat Springs 80487) through 4/18/2025

This month, we’ve assembled a great mix of articles for you to enjoy. Our mortgage specialist, Josh Kagan, discusses financing options for non-traditional income streams, which we often see in snow country. We also examine the economic impact the changing seasons have on Steamboat as we transition from winter to summer. Finally, we examine the proposed Mad Rabbit mountain bike trail system by the numbers.

As we welcome May, the last remnants of winter are fading away, making way for sunny skies and the vibrant energy of summer. Now is the perfect time to dream big—whether that means planning new adventures, setting personal goals, or making a move in the real estate market. If your summer plans include buying, selling, or simply exploring your options, your trusted advisor at The Group is here to help. Let’s work together to create a plan that helps you get where you want to go. Here’s to a season filled with sunshine and new beginnings!

ALTERNATIVE MORTGAGE PROGRAMS: FLEXIBLE OPTIONS FOR MODERN BORROWERS

In today’s evolving financial landscape, traditional income documentation doesn’t always capture the full picture of a borrower’s financial health. Recognizing this, many lenders are offering innovative mortgage programs that cater to self-employed individuals, retirees, investors, and others with non-traditional income sources. These programs rely on alternative forms of income verification such as asset depletion, bank statements, or profit and loss (P&L) statements.

1. ASSET DEPLETION MORTGAGES

Asset depletion loans allow borrowers to qualify for a mortgage based on their liquid assets rather than a steady paycheck. This is particularly beneficial for retirees or high-net-worth individuals who may not have regular income but maintain substantial savings or investments.

In an asset depletion scenario, the lender calculates a hypothetical income stream by dividing total assets by a set term (often between 84 and 240 months depending on the loan program). For example, a borrower with $2 million in assets might be deemed to have more than $20,000 in monthly "income" for underwriting purposes depending on the type of asset and loan guidelines.

2. BANK STATEMENT LOANS

Designed primarily for self-employed borrowers, bank statement loans evaluate personal or business bank statements over a 12- or 24-month period to estimate average monthly income. Instead of W-2s or tax returns, the lender looks at deposit activity to determine the borrower's earning capacity.

This method allows self-employed individuals to leverage their actual cash flow, which may be more favorable than what’s reflected after business deductions on tax returns. It may also be more favorable from a timing standpoint as a borrower does not need to wait until next year’s tax return filing to use current income.

3. PROFIT & LOSS (P&L) STATEMENT LOANS

Some programs accept a CPA-prepared profit and loss statement— either alone or in conjunction with bank statements—to assess a borrower's income. This is another valuable tool for self-employed individuals who may have fluctuating monthly income but a healthy year-end bottom line.

Similar to Bank Statement loans, P&L loans allow borrowers to use the most recent 12 months of income as opposed to waiting until the next tax return is filed.

WHY THESE PROGRAMS MATTER

These alternative mortgage solutions offer greater flexibility, helping qualified borrowers access home financing when traditional income documentation might disqualify them. They are particularly useful in markets like Steamboat that has many borrowers who don’t fit in the normal boxes. Second home buyers, seasonal workers and selfemployed borrowers who are financially capable but historically found traditional lending difficult now have more favorable options available. To understand all options, it is important for borrowers to discuss their individual scenario with an experienced and informed loan originator.

GROU

TOURISM CONTINUES TO PACK A PUNCH ON THE STEAMBOAT ECONOMY.

An estimated one million people visit Steamboat Springs each year. Although summer tourism has seen a huge boost in recent years, winter still packs the greatest punch for the local economy.

"Ski season occupancy tends to average around 60%, while non-ski season is around 35%. The average daily rate that lodging properties charge is also about twice as high in the winter as we see in the summer, leading to higher sales, accommodations and short-term tax collections.” says Laura Soard, Senior Director of Destination Development and Communications at Steamboat Chamber.

The Group sat down with the Steamboat Chamber to take a deeper dive on winter versus summer tourism trends.

SKI SEASON (NOVEMBER-APRIL)

• Over the last three years, the occupancy rate has averaged 60%, but it fluctuates depending on multiple factors such as ski conditions and weather.

• Over the past three years, the average daily rate fluctuated throughout the year with an average low of $200 and a high of over $1000 for premium properties during the winter holidays.

• Peak visitation times are: Winter Break (12/22-1/5), President’s Weekend, and Spring Break (typically Mid-March).

NON-SKI SEASON (MAY-OCTOBER)

• The Steamboat Chamber estimates 400,000 to 500,000 visitors during the non-ski season months. This number does not fully capture visitors staying with friends and family or second homeowners.

• Average lodging occupancy during non-ski season is 35%.

• Over the past three years, average daily rate from May to October was $260, with lows in May and October and highs during July.

• Peak visitation times often coincide with events such as July 4 celebrations.

THE NON-SKI SEASON VISITOR (LATE APRIL- EARLY NOVEMBER)

• 79% of non-ski season visitors are overnight visitors.

• 40% of non-ski season visitors to Steamboat are from within Colorado.

• 7.1 % are from Texas, our second largest visitor state of residence, then California, Florida, Illinois and Wyoming.

• Most visitors are in the 35-65 age demographic.

• 64% of visitors stay in paid lodging.

• The average stay is 4.1 nights.

• Each group spends an average of $1,188 per trip.

TIME TO SPIN THE WHEELS

The stickers say it, and the locals know it, “Come for the winter, Stay for the summer.” While Steamboat may be an international ski destination, it is also a mecca for hiking, biking and a whole lot of summer fun. Among its many monikers is Bike Town USA, and across town skis and boards are being stored away to make room for two-wheeled toys.

As the snow melts and the dirt dries, mountain bikers have an everincreasing plethora of trails to ride, with more in the pipeline. On April 3, 2025, the US Department of Agriculture Forest Service approved the final notice for the Mad Rabbit Trails project, which gives the green light for 49 miles of new trails spanning Routt, Jackson and Grand counties including Mad Creek, Rocky Peak, Gunn Creek, Buffalo Pass, Fish Creek, Rabbit Ears Pass and Steamboat Resort area.

Planning efforts span more than a decade after local voters approved a Steamboat’s 2A Trails ballot measure to receive dedicated funds from the existing 1% lodging tax back in 2013. It’s anticipated the funding source will exceed $5 million in over 10 years.

Some of the trail system is already in place and the project will include improvements and add restrictions to limit off-trail bike usage. A Forest Service order will be in place to minimize impact on fragile resources and protect wildlife.

The new mountain bike trails will join over 500 existing rides available in Routt County. Among the current favorite areas are Emerald Mountain, Buffalo Pass and Steamboat Resort, which boasts over 2,200 vertical feet

of cross country and downhill terrain.

Routt County is also a magnet for road and gravel riders with over 600 miles of dirt and hard-packed gravel roadways to explore. As a rural locale with a thriving agricultural industry, the rules of the road go beyond the regular highway rules.

RESPECT THE RURAL RIVERS & ROADS GUIDELINES:

• Yield to livestock – cows, sheep and horses all have right of way over people on foot, bike or in a vehicle.

• Be aware of farm and ranch equipment.

• Open range means cattle or sheep may be grazing on trails. Keep your distance and allow them time to move to the side.

• Mind the gate and leave it as you found it, where it was open or closed.

• Respect private property and do not trespass, always ask permission first and adhere to landowners’ directions. If you don’t know, don’t go.

• Leave no trash behind.

• Respect guardian dogs and do not ride into animal herds. Keep your distance and walk bikes around working dogs.

• Respect gets respect, so smile wave and be polite.

Source: The Community Agriculture Alliance and Routt County Colorado State University Extension

SCAN FOR DETAILS

In the aftermath of the Marshall Fire in Colorado and recent wildfires in California, homeowners in Colorado face evolving insurance challenges. The increasing number of natural disasters in Colorado, mainly due to fire, hail, and wind, has resulted in an average increase in homeowner’s premiums by approximately 57.9%. The frequency of these events has led some insurers to withdraw from high-risk areas, making it more difficult for homeowners to secure coverage. In rural areas of Colorado, like the Yampa Valley, many insurance companies are no longer writing new policies. Homeowners may face higher premiums, coverage restrictions, defensible space requirements, or may have to resort to purchasing insurance from surplus lines insurers if standard carriers are unwilling to write policies.

To navigate the changing conditions, homeowners should review policies regularly with a trusted insurance advisor, understand their policy details, consider additional coverage where appropriate, and implement mitigation measures if their homes are in high-risk areas.

Wildfire season is right around the corner. Now is the time to review your policy or shop for a new policy. The professionals at Collective Insurance Group would be happy to advise you. Scan the QR code at the right to connect with their knowledgeable team.

THE GROUP DIFFERENCE

• Compare Insurance Carriers and Policies

• Evaluate Entire Package, Including Replacement Coverage

• Inventory Personal Property

• Take Premium Reducing Measures

• Choose an Established Provider

Throughout the year The Group Gives picks an array of local non-profits to support. From year to date we have be able to support six organizations and we hope to support more. As we move into a new season, we’ve chosen two summer organizations to spotlight.

YAMPATIKA

For over 30 years, Yampatika has led environmental education in the Yampa Valley, connecting around 25,000 people of all ages to nature each year. Their offerings include schoolbased programs to hands-on learning at Legacy Ranch, summer camps, naturalist hikes, and seasonal events. Community favorites like the Fall Fest and Wild Edible Feast support this mission of environmental stewardship and literacy.

FREE SUMMER CONCERTS

Howelsen Hill comes alive each summer with its free concert series, a beloved tradition since 1993. What began with a few hundred fans now draws crowds of 3,500 to 7,000, totaling over 25,000 annually. Friends gather, music fills the air, and food trucks serve refreshments starting at 5:30 p.m., supporting this vibrant event. This year’s lineup features Andy Frasco & the UN (June 21), Julian Marley (July 19), Daniel Donato’s Cosmic Country (July 31), and The Brothers Comatose (August 31).