A CLOSER LOOK: WHAT’S REALLY HAPPENING IN NOCO REAL ESTATE

From The New York Times to Newsweek, reports on the state of the American housing market are all over the map. Housing prices are out of reach over here but slumping over there. One headline tells us that inventory is tight, while another insists that supply is ballooning. Sales are up. Sales are down.

The contradictions can be baffling. That’s because there is no monolithic real estate reality. Market conditions can differ from state to state, town to town, and even from one neighborhood to the next.

If the question is “how’s the market?” the answer is always going to be some version of “that depends” or “who’s asking?” Is it the first-time homebuyer hunting for a starter home, or the upperincome executive with the resources for a multi-milliondollar mansion?

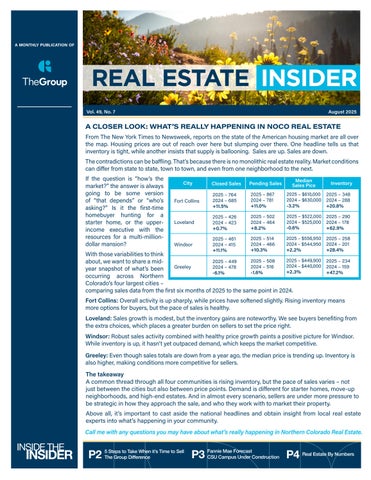

With those variabilities to think about, we want to share a midyear snapshot of what’s been occurring across Northern Colorado’s four largest cities –comparing sales data from the first six months of 2025 to the same point in 2024.

Fort Collins: Overall activity is up sharply, while prices have softened slightly. Rising inventory means more options for buyers, but the pace of sales is healthy.

Loveland: Sales growth is modest, but the inventory gains are noteworthy. We see buyers benefiting from the extra choices, which places a greater burden on sellers to set the price right.

Windsor: Robust sales activity combined with healthy price growth paints a positive picture for Windsor. While inventory is up, it hasn’t yet outpaced demand, which keeps the market competitive.

Greeley: Even though sales totals are down from a year ago, the median price is trending up. Inventory is also higher, making conditions more competitive for sellers.

The takeaway

A common thread through all four communities is rising inventory, but the pace of sales varies – not just between the cities but also between price points. Demand is different for starter homes, move-up neighborhoods, and high-end estates. And in almost every scenario, sellers are under more pressure to be strategic in how they approach the sale, and who they work with to market their property.

Above all, it’s important to cast aside the national headlines and obtain insight from local real estate experts into what’s happening in your community.

Call me with any questions you may have about what’s really happening in Northern Colorado Real Estate.

Fort Collins

Loveland

Vol. 49, No. 7

5 STEPS TO TAKE WHEN IT’S TIME TO SELL

The word is out: in most American communities, it’s gotten more competitive to sell a home in 2025. The notion that you can simply list a property and sit back and wait for bids to roll in is old news.

Even before the “For Sale” sign goes up in the yard, there’s work to do to make your home attractive to buyers. Here are five tips to help you make your house a hit:

• Work with a local Realtor. A local real estate professional not only knows how to stage your home for selling, but they also know your community – and that gives you the best chance to sell fast and for a better price.

• Set the right price. With the help of your Realtor, you can be sure you’re not asking too much (or too little). Set a price that will entice offers, and maybe you’ll even trigger a bidding war.

• Invest in the right improvements. Not all home improvements make a difference to buyers. Which upgrades are most likely to add value? Focus on the kitchen and bathrooms, otherwise known as “the money rooms.”

• Elevate your curb appeal. Make a good first impression for would-be buyers. From fresh paint on the front door to fresh flowers in the window box, look for ways to polish your property. Consider a garage door.

• Be prepared. The old Scout Motto applies here. Start with a pre-listing inspection, so you’re aware (before the buyers) of issues that might need fixing. Then make sure you’ve lined up all the paperwork – such as seller disclosures and receipts for recent repair and renovation work – to show buyers if they ask. If you’re not ready to respond, a buyer may decide to go elsewhere.

And here’s a bonus tip: Don’t let emotion get in the way of the sale. If a would-be buyer asks about concessions for repairs, take it in stride. Remember, your home is now a product with a price tag and you’re trying to make a sale. Let the logical side of your brain take over – be realistic about flaws in your home, and prepare to make concessions if necessary to close the deal.

GROUPGIVES BACK DAY: MAKING A DIFFERENCE TOGETHER

On June 19, 2025, more than 80 Group agents and staff rolled up their sleeves to serve Northern Colorado communities through a variety of volunteer projects. GroupGives Back Day is our collective opportunity to connect with the people and places we serve, creating meaningful impact beyond real estate. At The Group, we believe in giving back—and in building stronger, better communities for everyone.

Scan the QR Code to learn more about GroupGives!

IMPROVEMENTS UNDERWAY FOR CSU STUDENTS

It’s back-to-school time at Colorado State University, which means fall classes, football season, and … construction season. That’s because a number of landmark projects are underway across the campus. One of the most visible projects is the 213,000-square-foot addition to Colorado State University’s Veterinary Teaching Hospital – which doubles the size of the current facility built in 1978 – at 300 W. Drake Road in Fort Collins. The $230 million state-of-the-art Veterinary Health and Education Complex will increase veterinary student enrollment by 20% and allow the university to help meet the worldwide shortage of veterinarians. CSU’s veterinary staff already sees more than 47,000 patient visits and performs nearly 300,000 diagnostic tests annually.

The new facility, due for completion in time for the start of the 2026-27 school year, will also open up space on CSU’s main campus for more than 275 students in undergraduate biomedical sciences and other programs.

Almost all undergraduate students take a class at the venerable Andrew G. Clark Building, which is undergoing its own $130 million renovation. Built in 1968 and spanning 3.6 acres, the three-wing, dated building was constructed for a different generation of learners.

Clark B, which previously connected Clark A and C, was demolished and is being replaced by a four-story modern building with 120,000 square feet of classrooms, offices, meeting spaces, collaboration areas, and student success spaces. The A wing of Clark is scheduled to reopen in 2026, and Clark B is to reopen in 2027.

Shortly after the students moved out of Allison Hall in May, construction began on the addition of two floors – and 218 beds – to each of the existing three-story residential wings, increasing capacity to over 600 residents. The $82 million remodel will include intentionally designed common areas, expanded dining options, a full-service marketplace with a hot bar, grab-and-go meals, and a coffee shop. Built in 1958, the updated Allison is scheduled to reopen in the fall of 2027.

FANNIE MAE FORECAST: BET ON HOME PRICES TO KEEP CLIMBING

As home inventory trends higher in many communities across the country, signs point to a buyers’ market in the making. But don’t assume that means prices are bound to come down, or even flatten out.

With the results of its latest Home Price Expectations Survey (HPES), Fannie Mae tells us that housing experts are still banking on a continuing rise in average sales prices. The quarterly survey, which polls a panel of 100 industry and academic authorities on the real estate market, finds that even the most pessimistic observers expect at least some price growth between 2025 and 2029.

The latest survey, from the second quarter of 2025 (April-June), shows an average price growth expectation of 2.9% for 2025. Taking a longer look, the cumulative average price growth predictions are:

The most optimistic group of Fannie Mae panelists are projecting 27.4% growth by 2029, while the most cautious group of panelists are predicting 6.7% growth by 2029.

The bottom line: even the most bearish industry insiders see long-term price appreciation. For home buyers, which means you’re not only enjoying wider selection in the current housing market, but you can feel confident that your purchase is still a sound long-term investment.

Images Courtesy of CSU College of Veterinary Medicine and Biomedical Sciences

Harmony Office/Corporate Services 970.229.0700

2803 E. Harmony Road, Fort Collins, CO 80528

Mulberry Office

970.221.0700

Loveland Office 970.663.0700

Timnath Office 970.840.0700

Regional Office at Centerra 970.613.0700

www.thegroupinc.com

BY NUMBERS

$1.3 million. Approximate sale price for two apartment buildings in Evans. The two fourplexes are located at 3911 Central Street and 3925 Central Street.

17%. Average increase in escrow payments required of American homeowners last year, according to Cotality, a real estate research firm. Escrow payment trends reflect increases in insurance and property taxes.

128,000. Square footage for a new Target Store that’s under construction in Firestone. The store is part of the City Centre development, located at the southwest corner of Jake Jabs Boulevard and City Centre Road, just east of the American Furniture Warehouse store.

$15 million. Sale price for two industrial buildings at 1500 Boyd Lake Ave. in east Loveland. The two buildings have a combined 95,742 square feet.

$12 million. Total purchase price that the city of Loveland is planning to offer to buy two buildings at 1515 Cascade Ave. and 1615 Cascade Ave. on the city’s west side. The buildings, totaling 122,000 square feet, are currently used by Group Publishing.

10%. Portion of home purchases in Miami made by foreign buyers in the 12-month period between August 2023 and July 2024, according to a recent report by the Miami Association of Realtors. That’s the lowest share of foreign purchases in Miami since 2015, and down from 50% in 2018.

2%. Average home price increase between April 2024 and April 2025, according to a report by Cotality (formerly CoreLogic). Cotality forecasts that average prices will increase another 4.3% between April 2025 and April 2026.

$5 million. Approximate price that operators of St. John Paul II High School have agreed to pay for the former Monroe Elementary school building in east Loveland. Located at 1500 Monroe Ave., the building spans 53,000 square feet.

$3.5 million. Price paid by a Windsor developer to buy the former Carestream Health Inc. property on land just east of Windsor. The deal includes five buildings consisting of 1.4 million square feet, as well as 438 acres of surrounding development ground.

$3.495 million. Price paid by a grocery store company for the former automobile dealership site at 2839 S. College Ave. in

REAL ESTATE BY NUMBERS