Edition September 2025

Edition September 2025

Welcometoourspecialedition,Top10MostInfluential LeadersMakingaDifference2025,wherewecelebrate visionarieswhoareredefiningleadershipthroughresilience, authenticity,andpurpose.

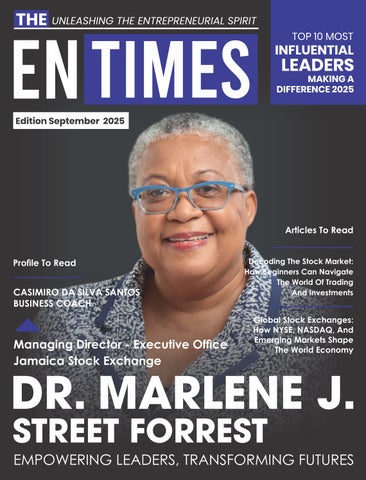

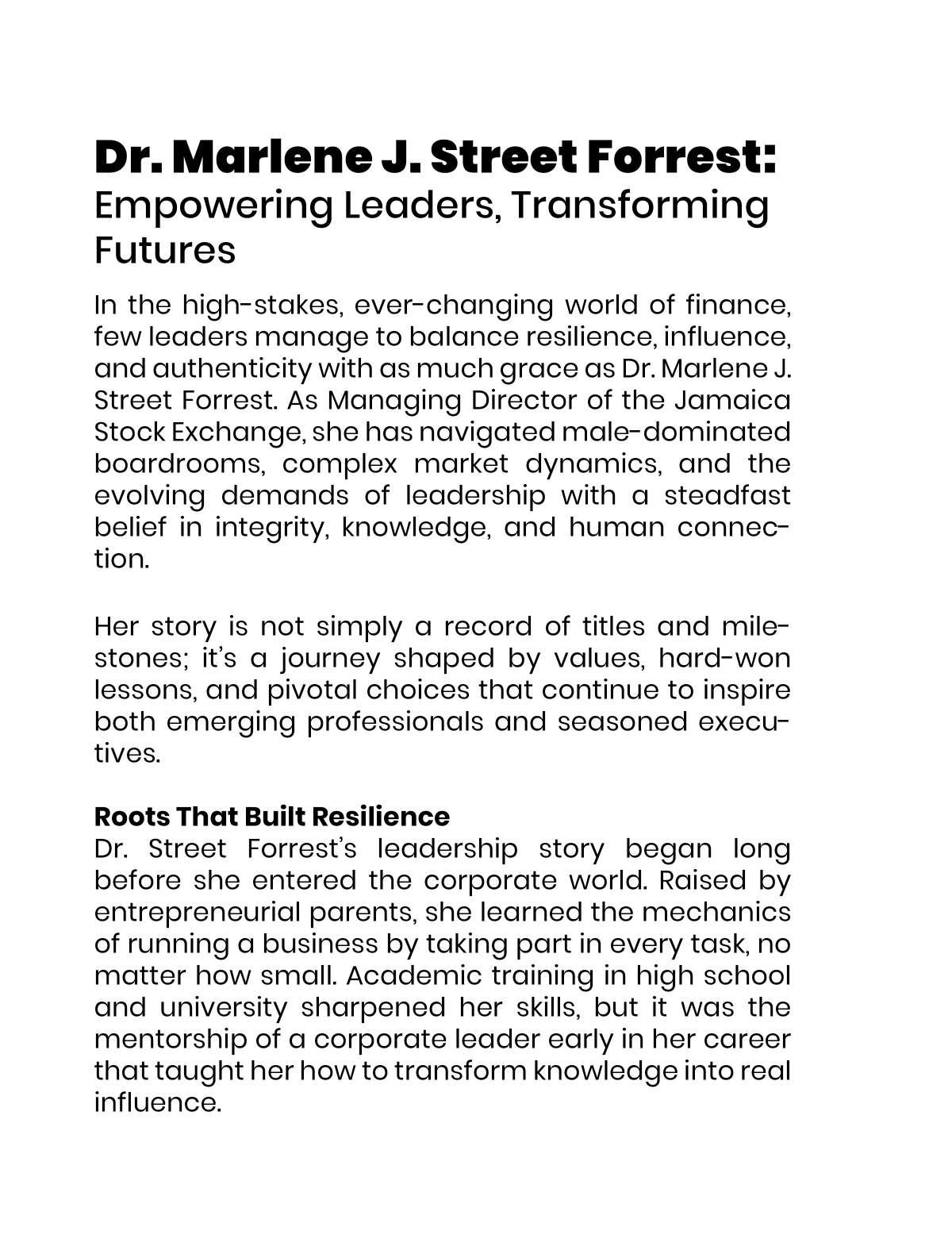

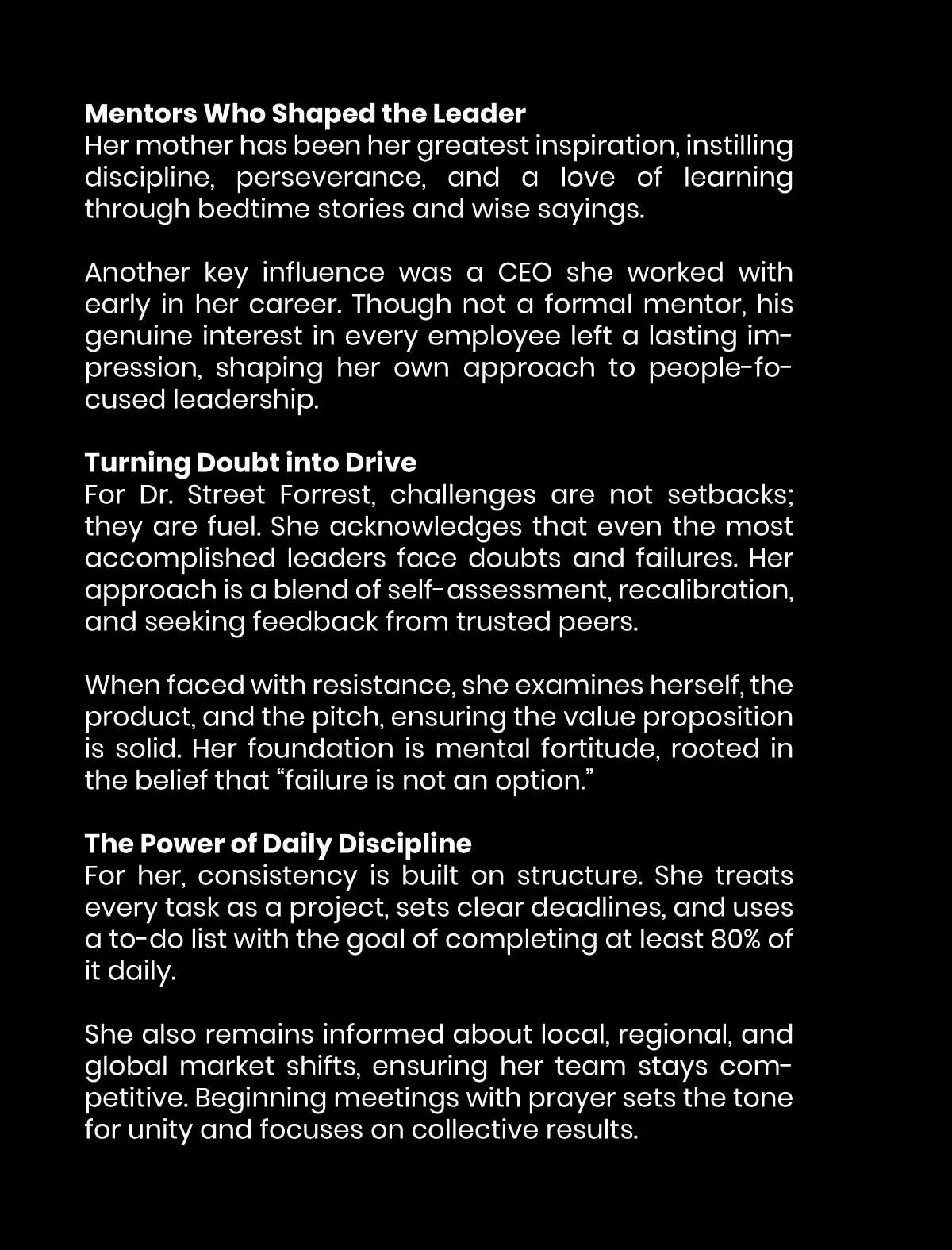

OurcoverstoryfeaturesDr.MarleneJ.Street,Managing DirectoroftheJamaicaStockExchange,whosejourneyfrom entrepreneurialrootstoboardroomleadershipreflectsthepower ofintegrity,discipline,andhumanconnectioninshapingthe futureoffinance.Herstoryremindsusthattrueleadershipis notjustaboutnavigatingmarkets,it’saboutbuildingpeople, breakingbarriers,andleavingalegacyofempowerment.

Inthisedition,you’llalsofindcompellingnarrativesof trailblazerswhoaretransformingindustrieswithcourageand clarity.Eachleaderfeatureddemonstratesthatsuccessisnot measuredsolelybymilestones,butbythevaluesupheld,the livestouched,andthefuturesinspired.

Wehopethesestoriesencourageyoutoembraceauthenticity, leadwithempathy,andpursueimpactthatextendsbeyondthe bottomline.Afterall,theleaderswecelebratetodayarenotjust shapingindustriestheyareshapingthefuture.

C ONTENT S T ABLE OF

08.

22.

30. 36.

Dr. Marlene J. Street Forrest

Managing Director - Executive Ofce |

Jamaica Stock Exchange

Decoding The Stock Market: How Beginners Can Navigate The World Of Trading And Investments

CASIMIRO DA SILVA SANTOS BUSINESS COACH

Global Stock Exchanges: How Nyse, Nasdaq, And Emerging Markets Shape The World Economy

The stock market has long been viewed as a mysterious world of numbers, charts, and jargon. To many beginners, it may feel overwhelming or even intimidating. However, the truth is that the stock market is not just for financial experts or Wall Street professionals, it’s a powerful tool for building wealth, and anyone with patience and curiosity can learn to navigate it successfully.

This guide is designed to break down the fundamentals of the stock market, provide beginner-friendly strategies, and help you build the confidence to begin your investment journey.

At its core, the stock market is a place where buyers and sellers come together to trade shares of publicly listed companies. When you buy a share, you’re essentially purchasing a small ownership stake in that company. If the company grows and its value increases, your investment grows too.

Capital Formation – Companies raise funds by selling shares, which allows them to expand and innovate.

Wealth Creation – Investors can grow their wealth by buying shares that appreciate in value.

Liquidity – The market allows easy buying and selling of shares, giving investors flexibility.

Price Discovery – Prices are determined by supply and demand, reflecting the value of companies.

Chooseonewithuser-friendlytools,lowfees, andeducationalresources.

Step4:LearntheBasicsofStockAnalysis

• FundamentalAnalysis–Studying financialhealth,earnings,revenue,and industryposition.

• TechnicalAnalysis–Analyzingprice charts,patterns,andtradingvolumes.

Step5:StartwithPaperTrading

Papertradingallowsyoutopracticewithout realmoney.It’sanexcellentwaytobuild confidence.

Step6:MakeYourFirstInvestment

Startsmall,perhapswithablue-chipstock (large,stablecompanieslikeApple,Microsoft, orReliance).Overtime,expandintoETFs (Exchange-TradedFunds)fordiversification.

CommonMistakesBeginnersShouldAvoid

• InvestingwithoutResearch–Neverbuya stockbasedsolelyontipsorhype.

• TimingtheMarket–Evenexpertsstruggle topredictshort-termmoves.Focusonlongtermgrowth.

• LackofDiversification–Puttingall moneyintoonestockincreasesrisk.Spread yourinvestments.

• EmotionalDecisions–Fearandgreedcan leadtopoorjudgment.Sticktoyour strategy.

• IgnoringFeesandTaxes–Brokeragefees andcapitalgainstaxescaneatintoprofitsif overlooked.

Ifyou’renew,youdon’thavetostartwith individualstocks.Saferoptionsinclude:

• ETFs(Exchange-TradedFunds):Bundles ofstocksthattrackanindex,offering instantdiversification.

• MutualFunds:Professionallymanaged poolsofmoneyfrommultipleinvestors.

• DividendStocks:Companiesthatregularly paypartoftheirprofitstoshareholders.

• IndexFunds:Low-costfundsthatreplicate amarketindexliketheS&P500.

Oneofthegreatestadvantagesoflong-term investingiscompounding.Thismeansyour earningsgeneratemoreearningsovertime.For example,investing$1,000ata10%annual returngrowstoover$6,700in20years.The earlieryoustart,themorepowerful compoundingbecomes.

WarrenBuffett,oneoftheworld’smost successfulinvestors,isknownforhissimple yeteffectiveapproach:

• Investinbusinessesyouunderstand.

• Buyandholdqualitystockslongterm.

• Focusonfundamentals,notshort-term marketnoise.

Hisphilosophyprovesthatyoudon’tneedto beamarketgeniustosucceed;youjustneed patience,discipline,andknowledge.

• Educate Yourself Continuously –Read books, follow financial news, and take online courses.

• Think Long Term – Short-term volatility is normal; stay focused on future growth.

• Diversify Across Sectors and Geographies – Don’t put all your eggs in one basket.

• Automate Investments – Set up SIPs (Systematic Investment Plans) or automatic contributions.

• Stay Disciplined – Stick to your plan regardless of market fluctuations.

Decoding the stock market may feel like learning a new language at first, but with the right mindset and approach, beginners can navigate it with confidence. The key is to start small, stay patient, and continuously educate yourself. Remember, investing is a journey; it’s not about getting rich overnight, but about building lasting wealth over time.

Whether you aim to trade actively or invest long term, the stock market can be a powerful ally in achieving financial freedom. So, take the first step today, and let your money start working for you.

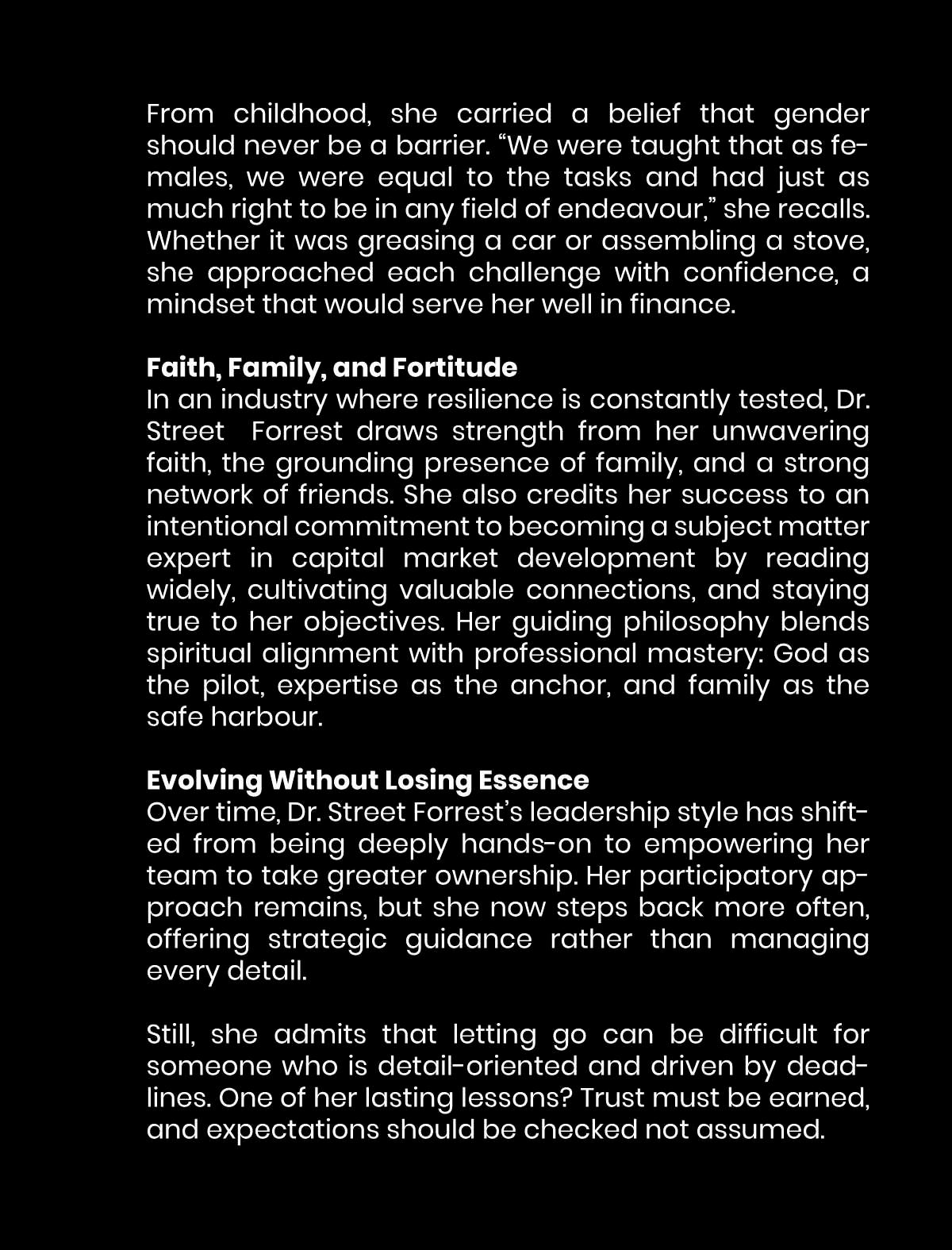

Afteryearsofdrivingresultsinhigh-levelcorporateroles,managingmulti-million-europortfolios,and leadingglobalteams,CasimirodaSilvaSantosorCoachCas,madeaboldpivot,asheisaffectionately knownintheindustry.Hechosetostepawayfromthetraditionalboardroomandstepintoamore transformativerole—thatofanexecutive,leadershipandbusinesscoach.

Thistransitionwasn’tdrivenbyburnoutoracareerdetour.Amoreprofoundrealisationfueledit:the truelegacyofleadershipliesnotinprofitsbutinpeople.Casimirofoundhisgreatestfulfilmentinthe numbersandinwitnessingindividualsgrow,stepintotheirpower,andleadwithclarityandpurpose. Thatclaritysparkedhisjourneyintocoaching,wherehenowhelpsleadersandentrepreneursunlock theirfullpotential.

BUSINESS COACH

CoachCasalsoplaysavitalroleatActionCOACH,aplatform knownforitsstructuredbusinesssystems.CombinedwithBring TheBest,whichfocusesonmindsetandleadershipdepth,thetwo approachescreateacomprehensivegrowthformula.Oneprovides toolsandstrategies,andtheothernurturesleadershipfromwithin.

Reflectingonhiscorporatejourney,Casimirosharesthreelasting leadershiplessons:

• Peopledriveperformance–Investinginpeoplecreateslongtermvalue.

•

• Clarityismorepowerfulthancomplexity–Simple,focused strategiesoftenwin.

•

• Decisivenessiscritical–Momentummattersandstrong leaderstakeaction.

Theselessonsnowshapehiscoachingpractice,turningtheoryinto tangibleprogress.

Asartificialintelligencereshapestheworkplace,CoachCas believeshumanleadershipskillswillbecomeevenmorecritical. WhileAIcanofferdataandefficiency,itcannotreplaceemotional intelligence,humanconnection,orvision.Heseesthefutureof coachingasahybrid—combiningdigitaltoolswithdeeppersonal development.“Coachingwillevolve,anditsheartwillremainthe same—helpingpeoplegrow,”hesays.

CoachCas’sjourneyfromcorporateexecutivetotransformation coachisastoryofpurpose,passion,andimpact.Throughhiswork, hecontinuestoempowerleaderstobringoutthebestin themselves—andothers.

ByraisingfundsthroughIPOs,startupsandgrowingfirms scalequickly.NASDAQisaprimeexample,helpingtech giantstransformintogloballeaders.

Emergingmarketexchangesreflecttrendsincommodities, agriculture,andenergythatdirectlyinfluenceglobalsupply chains.

RisingU.S.indicesindicateglobalinvestorconfidence.

FluctuationsinChina’sexchangessignalsupplychainhealth andindustrialoutput.

Emergingmarketperformancehighlightsdeveloping economies’roleinglobalgrowth.

Despitetheirimportance,stockexchangesfaceseveral challenges:

• VolatilityandMarketCrashes–FromtheGreat Depression(1929)tothe2008financialcrisisand COVID-19shock,marketsremainvulnerabletoexternal shocks.

• GeopoliticalTensions–Tradewars,conflicts,and sanctionscandisruptinternationallistingsandinvestor flows.

• TechnologicalDisruption–High-frequencytrading,AI, andblockchainaretransformingmarketoperations.

• RegulatoryComplexity–Balancinginnovationwith investorprotectionisanongoingchallenge.

• CompetitionfromPrivateMarkets–Manyfirmsnow chooseprivatefundingoverpubliclistings,impacting IPOactivity.

Looking ahead, stock exchanges are expected to:

• Adopt Blockchain and Digital Assets: Exchanges are integrating crypto and tokenized assets.

• Promote Sustainable Investments: ESG (Environmental, Social, and Governance) stocks are gaining momentum.

• Global Integration: Cross-border trading and dual listings are expected to rise.

• Support Emerging Economies: Exchanges in Africa and Southeast Asia are poised to grow with increased globalization.

The NYSE and NASDAQ remain the anchors of the global financial system, influencing policies, innovation, and investor sentiment worldwide. Yet, the rise of emerging market exchanges signals a shift toward a more multipolar global economy. Together, these exchanges create an interconnected web where capital, ideas, and opportunities flow freely, shaping not just individual wealth but the very future of nations.

For investors, understanding the dynamics of global stock exchanges isn’t just about choosing where to buy shares, it’s about seeing the bigger picture of how economies evolve, industries transform, and the world economy moves forward.