Tailo r-m ad e solution s fo r the m i n ing se c to r

Operating in the mining and extractive sectors means finding both opportunities and risks in a highly regulated environment. Our dedicated Mining Team can help your organization seize potential by enhancing and preserving value through the pre-production and production stages of your operation. MNP’s services are tailored to your needs so you can proceed with confidence.

Maruf Raza, CPA , CA National Director, Public Companies maruf.raza@mnp.ca

Graeme Wedge, MBA , CET Mining Advisory Services Leader graeme.wedge@mnp.ca

The Mining Issue

CONTENTS

Letter from the Editor | 4

Welcome to the CSE | 8

Meet some of the recently listed mining and exploration companies pursuing opportunities across North America and beyond

Tune In | 12

Keep your finger on the pulse of the capital markets with the CSE’s content hub

Abitibi Metals | 24

Quiet market an opportunity rather than a hurdle for this Québec-focused explorer

Vortex Energy | 28

Synergy abounds when you put salt mining, hydrogen storage and ammonia cracking under one roof

EMP Metals | 32

A top-tier lithium project in Saskatchewan is just the start of this young company’s ambitions

First Phosphate | 16

Leading the charge to develop an integrated North American supply chain for LFP batteries

Nevada Lithium Resources | 20

Demand for North American lithium puts this sizable project into the spotlight

SPOTLIGHT ON

Anil Mall | 36

The CSE’s Director of Listed Company Services, shares his experiences in the capital markets and insights for CEOs

PUBLISHER

Sparx Publishing Group Inc.

sparxpg.com

For advertising rates and placements, please contact advertising@sparxpg.com

GROUP PUBLISHER

Hamish Khamisa

EDITOR-IN-CHIEF

James Black

EDITORS

Peter Murray

Libby Shabada

Michelle Baleka

ART DIRECTOR

Nicole Yeh

WRITERS

Stephen Gunnion

Emily Jarvie

Andrew Kessel

Sean Mason

Peter Murray

Libby Shabada

FREE DIGITAL SUBSCRIPTION

Published by Sparx Publishing Group on behalf of the Canadian Securities Exchange. To receive your complimentary subscription, please visit go.thecse.com/Magazine and complete the contact form. To read more about the companies mentioned in this issue, visit blog.thecse.com or proactiveinvestors.com

TERRITORY ACKNOWLEDGEMENT

The Canadian Securities Exchange acknowledges that our work takes place on traditional Indigenous territories.

Letter from the Editor

Mining and exploration professionals are no strangers to navigating complex landscapes. With significant political, social, economic and environmental uncertainty on the horizon, the business terrain will undoubtedly put the industry’s agility, resilience and innovation to the test.

As this edition of Canadian Securities Exchange Magazine goes to press, we’re on the cusp of welcoming the global mining and exploration communities to Toronto for the annual Prospectors & Developers Association of Canada (PDAC) Convention. This world-renowned forum offers a unique opportunity to learn about the most pressing issues facing the mining and exploration industry as well as to engage with investors and get their sentiment on market conditions.

FOLLOW US ON

CSE TV

From our vantage point at the CSE, mining continues to be a significant story. Over 50 mining and exploration firms went public on the CSE in 2023 despite one of the most challenging capital market environments in recent memory.

The remarkable influx of new listings, robust liquidity, and material capital raises by mining companies listed on the CSE underscore a clear message: even in the face of adversity, the mining and exploration sector’s pursuit of progress remains undeterred.

Certainly, the five firms featured in this edition of the magazine highlight resilience and innovation in action. Companies like EMP Metals and First Phosphate are not just surviving, they're thriving, capitalizing on the burgeoning demand for critical minerals and sustainable energy solutions. Similarly, Abitibi Metals is discovering deep value in the precious metals sector, demonstrating the diverse opportunities the industry presents. A notable trend among our featured companies this year is the focus on North American projects – a testament to the broader pivot toward stability and proximity in uncertain times.

As we look to 2024, there is cause for cautious optimism. The CSE is

Stay up to date on what's happening in the capital markets. Join our community of subscribers who tune in to CSE TV for insightful content about developments in mining and beyond.

Subscribe now: go.thecse.com/CSETV

poised to celebrate its 20th anniversary as a recognized stock exchange. This milestone is not just a testament to our own resilience and innovative spirit but also an example of our ongoing commitment to the entrepreneurial ethos.

The CSE has come a long way in the past two decades; however, the one constant over that time has been the alignment of the Exchange with the needs of the mining and exploration entrepreneurs. If there’s one thing that we’ve learned over this time it’s that the leaders at the helm of mining and exploration groups are second to none when it comes to surmounting big challenges.

Thank you to our readers and to the global community of mining and exploration entrepreneurs for your continued support of the CSE. We look forward to connecting with many of you in person at PDAC and to celebrating the adventures and milestones awaiting us all in the next 20 years.

James Black Editor-in-Chief james.black@thecse.comTHE EXCHANGE FOR ENTREPRENEURS PODCAST

Listen to a variety of in-depth conversations with thought leaders and innovators on Season 4 of The Exchange for Entrepreneurs Podcast. You can find it on Apple Podcasts, Google Play, Spotify, Stitcher, YouTube, and iHeartRadio. Tune in: blog.thecse.com/cse-podcasts

Content Creation & Video Interviews

Website Design & Development

Email Marketing & Distribution

Investor Webinars & Virtual Events

Global One Media is a full-service investor-focused digital marketing agency that delivers creative and effective solutions to raise digital market awareness and increase engagement with investors. Leveraging our global network, we help companies dominate their sector amid the digital and social media landscape, by telling their story in an engaging manner and reaching millions of investors around the world. Contact us today for a free consultation.

EMPOWERING YOUR INVESTMENT JOURNEY

Powered by Global One Media, Stocks To Watch is a digital forum for investors, offering exclusive interviews and in-depth discussions with company executives and industry leaders. Learn to navigate the intricacies of the capital markets and make informed investment decisions with our team of renowned, award-winning hosts. Join the #StocksToWatch conversation today on YouTube, TikTok, and Spotify.

WATCH US ON YOUTUBE

WELCOME TO THE CSE

Mining & Exploration Companies

Meet some of the recently listed mining and exploration companies pursuing opportunities across North America and beyond

Neotech Metals

CSE:NTMC (formerly CSE:CNRG)

Listed on March 17, 2023

Formerly “Caravan Energy Corporation,” Neotech Metals is a Canada-based mineral exploration company that holds options over the EBB Nickel-Cobalt Property and has acquired the TREO Rare Earth Element Property, both located in British Columbia.

Learn more: thecse.com/listings/ neotech-metals-corp

Nuclear Fuels

CSE:NF

Listed on July 10, 2023

Nuclear Fuels is a uranium mineral exploration company, which focuses on exploration of district scale In-Situ Recovery (ISR) uranium projects. The company operates projects in the states of Wyoming and Arizona, as well as a project in Newfoundland and Labrador.

Learn more: thecse.com/listings/ nuclear-fuels-inc

Bayridge Resources

CSE:BYRG

Listed on November 27, 2023

Bayridge Resources is a Canada-based junior natural resource company engaged in the acquisition, exploration and development of mineral properties. Currently, the company operates a lithium exploration project in Ontario, the Sharpe Lake property.

Learn more: thecse.com/listings/ bayridge-resources-corp

KO Gold

CSE:KOG

Listed on October 11, 2023

KO Gold is a Canadian junior mining company. The company has four 100%-owned prospecting and exploration permits in the Otago Gold District and two exploration permits under option that comprise the Smylers Gold Project. Both projects are located in New Zealand.

Learn more: thecse.com/listings/ko-gold-inc

Mabel Ventures

CSE:MBL

Listed on November 30, 2023

Mabel Ventures is a resource company engaged in the exploration and development of mineral properties. It has an option to acquire interest in the Bonanza Gold Property that includes 92 map designated claims in the Abitibi region of Québec.

Learn more: thecse.com/listings/ mabel-ventures-inc

Hertz Energy

CSE:HZ

Listed on April 5, 2023

Formerly “Hertz Lithium,” Hertz Energy is a British Columbia–based mineral exploration company. The company currently has one material mineral property, the Lucky Mica Project, located in the Maricopa County of Arizona, which is in the exploration stage.

Learn more: thecse.com/listings/hertz-energy-inc

Red Canyon Resources

CSE:REDC

Listed on October 25, 2023

Red Canyon Resources is a mineral resource company with an objective to locate and develop copper and associated precious metals, focusing initially on the Peak Property in British Columbia. The company also holds a secondary property, the Scraper Springs Property.

Learn more: thecse.com/listings/red-canyon-resources-ltd

Resource Centrix Holdings

CSE:RECE

Listed on October 18, 2023

Resource Centrix Holdings is a Canadian-based mineral exploration company with a mandate of exploration and mineral development. It currently holds an option on the Sylvest Property Project located in north-central British Columbia and is focused on developing the property.

Learn more: thecse.com/listings/ resource-centrix-holdings-inc

Greenridge Exploration

CSE:GXP

Listed on December 13, 2023

Greenridge Exploration is a mineral exploration company focused on the acquisition, exploration and development of critical mineral projects in North America. The company is led by a team with significant expertise in capital raising and advancing large mining projects.

Learn more: thecse.com/listings/ greenridge-exploration-inc

MORE

Meet the CEOs of CSE-listed companies on CSE TV: youtube.com/CSETV

US Critical Metals

CSE:USCM

Listed on September 11, 2023

US Critical Metals is focused on mining projects in the United States that will further secure the U.S. supply of critical metals and rare earth elements, including lithium and cobalt, which are essential to fuelling the new age economy.

Learn more: thecse.com/listings/ us-critical-metals-corp

EV Minerals Corporation

CSE:EVM

Listed on June 19, 2023

EV Minerals is exploring to become one of the next domestic suppliers of critical metals for the ever-growing EV market through the development of its Nickel-Copper-Cobalt project in Québec, Canada.

Learn more: thecse.com/listings/ ev-minerals-corporation

Newsfile works with CSE listed companies to deliver personal care and global reach. Like our CSE clients, Newsfile is entrepreneurial, customer focused and Canadian!

Dig Deeper to Optimize Visibility.

Elevate your mining story with Newsfile. Highlight your property, maps, and results with images and affordable extras. Get unmatched visibility across top mining outlets like Kitco and Mining.com. Choose Newsfile for direct, impactful news distribution that digs deeper for your success.

Global Reach Unrivaled.

Amplify your presence on a global scale with Newsfile's press release services, strategically reaching influencers, media outlets, stock exchanges, key financial databases, and brokerage firms. Our expansive distribution network ensures unparalleled reach, connecting your story with the right audience, everywhere.

Tune In

Keep your finger on the pulse of the capital markets with the CSE’s content hub

Resource Centrix Holdings’ Market Open

Ron Ozols, CEO; Derrick Gaon, CFO; and the Resource Centrix Holdings (CSE:RECE) team opened the day's trading session from CSE HQ in Toronto late last year. Watch the replay of the Market Open and get exclusive insight into the company.

View the clip on YouTube via our CSE TV playlist, “The CSE Market Open.”

Abitibi Metals’ Listed Issuer Update

Jonathon Deluce, President and CEO of Abitibi Metals (CSE:AMQ), joined the CSE’s Anil Mall for a Listed Issuer Update interview to discuss the company’s acquisition of an option on the B26 Polymetallic Copper Deposit, operations in the Abitibi in Québec, and upcoming milestones.

Check out the episode on our YouTube channel, CSE TV.

The Exchange for Entrepreneurs Podcast

We kicked off the year with three timely episodes on The Exchange for Entrepreneurs Podcast: Gwen Preston from Resource Maven on resource trends for 2024, Jason Barnard from Foremost Lithium (CSE:FAT) and Scott Eldridge from United Lithium (CSE:ULTH) on all things lithium, and Thomas S. Caldwell from Caldwell Securities on the financial outlook for 2024.

Listen on Apple Podcasts, Google Play, Spotify, Stitcher, YouTube, and iHeartRadio.

Red Canyon Resources’ Newly Listed Interview

Get to know Red Canyon Resources (CSE:REDC), a mineral resource company focused on large copper and copper-gold assets. Wendell Zerb, Chairman and CEO, sat down with us to discuss the company’s two centres of interest in the Western U.S. and British Columbia and its upcoming milestones.

Check out the episode on our YouTube channel, CSE TV.

MORE CONTENT ON CSE TV

Subscribe to our YouTube channel to watch new episodes and replays: youtube.com/CSETV

First Phosphate

Leading the charge to develop an integrated North American supply chain for LFP batteries

By Stephen GunnionAround two-thirds of the batteries used to power new electric vehicles (EVs) in China are now of the lithium iron phosphate (LFP) variety, overtaking lithium-ion batteries as manufacturers aim for reliability and lower price points in the world’s fastest-growing EV market.

The trend in North America is moving that way as well, spurred by the Inflation Reduction Act (IRA), which offers big incentives to manufacturers and consumers.

The IRA's clean vehicle tax credit, which has already attracted nearly US$100 billion in private-sector investment, according to the U.S. Department of the Treasury, supports consumers with savings on new clean vehicles while creating jobs and fostering a resilient domestic supply chain.

There are provisos, though. EVs made with minerals and materials from China won’t qualify for the credit.

Starting in 2024, EVs can't use battery components from a "foreign entity of concern," expanding to include minerals in 2025 and prompting a race for automakers to adapt or risk losing tax credits.

As companies reorganize supply chains for battery parts and minerals outside of China, First Phosphate (CSE:PHOS) is a step ahead. The mineral development company aims to transform the Saguenay-Lac-Saint-Jean region of Québec into North America’s LFP Battery Valley and believes it has a unique proposition.

First Phosphate holds and is actively developing over 1,500 square kilometres of district-scale land claims in the region. The properties host rare anorthosite igneous phosphate rock that can yield the high-purity phosphate required to create the materials used in the manufacture of LFP batteries.

A Preliminary Economic Assessment (PEA) on its flagship Lac à l’Orignal property featured a mineral resource estimate of 15.8 million tonnes at 5.18% phosphate (P2O5) in the Indicated

John Passalacqua Chief Executive Officer

John Passalacqua Chief Executive Officer

Company

First Phosphate

CSE Symbol

PHOS

Listing date

February 22, 2023

Website firstphosphate.com

category, 33.2 million tonnes at 5.06% P2O5 in the Inferred category, a pre-tax net present value of C$795.3 million and an internal rate of return (IRR) of 21.7% at a discount rate of 5%.

The project would produce an annual average of 425,000 tonnes of beneficiated phosphate concentrate at over 40% P2O5 content, 280,000 tonnes of magnetite and 97,000 tonnes of ilmenite over a mine life of 14.2 years.

Nearby at its Bégin-Lamarche property, First Phosphate is conducting a 25,000 metre drill program that should position the company to calculate a 43-101 resource estimate, with a PEA expected to follow.

Meanwhile, a geological reconnaissance program at its Larouche property, just 40 kilometres from the Port of Saguenay, also revealed strong assay results, including one sample grading 39.45% P2O5.

The company’s goal is to integrate material from these properties into the supply chains of major North American LFP battery producers that require battery-grade LFP cathode active material (CAM) from a consistent and secure supply source.

“What makes us unique is we are trying to set up a fully North American supply chain, and we're working and we're cooperating with those who are aligned with that vision,” says Chief Executive Officer John Passalacqua.

“We're the start of the supply chain; we're the critical minerals. So, if it starts clean in North America with us, then we make sure that all of our partners downstream, everything that goes into making the battery, the car or the storage system, will be North American-based as far as possible.”

With First Phosphate’s deposits forming the first pillar, Passalacqua explains that his team has established strategic partnerships and alliances with companies that

will complete the supply chain as it sticks to both the spirit and the letter of the law in the IRA.

These include Belgium’s Prayon, whose technology is used to produce over 50% of the world’s phosphoric acid. Prayon is looking at a long-term offtake agreement for First Phosphate’s phosphate rock as well as the potential for a purified phosphoric acid toll processing agreement.

The company has also entered a memorandum of understanding (MOU) with NorFalco, a division of Glencore Canada, to secure the supply of sulphuric acid needed to manufacture phosphoric acid.

A non-binding MOU with Sun Chemical Corporation to develop intermediates used to produce lithium iron phosphate-based cathode active material (LFP CAM) extends the potential supply chain even further.

“We have a number of companies that have processes to make LFP CAM that are interested in working with us,” says Passalacqua.

“Sun Chemical, one of the world's leading suppliers of inks and pressroom products, with a massive manufacturing footprint around the world, is available with their manufacturing facilities to partner with us to actually build LFP CAM, which is important because that saves on capital outlays.”

In December, First Phosphate signed an MOU with Las Vegasbased Ultion Technologies for the purchase of a non-exclusive, perpetual license for technology to produce LFP and lithium manganese iron phosphate (LMFP) cathode active materials.

A partnership with American Battery Factory aims to support the production of up to 40,000 tonnes of fully North Americanmanufactured LFP CAM annually.

Finally, the Port of Saguenay can provide access to overseas.

“In everything we do, we're looking to promote environ-

“ What makes us unique is we are trying to set up a fully North American supply chain.

— Passalacqua

mental stewardship, while doing it at home and creating jobs at home,” Passalacqua says.

“We're trying to get very integrated into the downstream activities so that it becomes a fluid process; it becomes a real supply chain.”

Passalacqua believes a number of factors will continue to drive the push to LFP batteries, including cost, as they are cheaper to manufacture than lithium-ion batteries that use cathode active material from nickel, manganese and cobalt (NMC), which are tougher to source and more toxic. Cobalt also has issues related to ethical supply.

Additionally, the NMC cathode contains available oxygen, making it more susceptible to thermal runaway, which can result in fires. That’s not the case with LFP batteries, which are much more stable.

Above all, Passalacqua says price is a big factor in choosing LFP batteries, as the cost to produce LFP CAM is generally much lower than for NMC CAM.

“Because of that, there has been a huge flock to LFP batteries,” he says.

“LFP batteries have been known to offer 25% to 30% less range than an

NMC battery but the technology is increasing on both of those batteries such that an LFP battery may now get you a 300 kilometre to 350 kilometre range in some models and generally without any associated memory issues.”

While more expensive vehicles that need range for out-of-city driving still veer towards NMC batteries, vehicles targeted for city driving are shifting to LFP due to the price factor.

Passalacqua says Tesla managed, at one point, to offer pricing below US$40,000 using LFP batteries.

With changes to the IRA, automakers, including Tesla, won’t be able to source their LFP batteries from China, which will work in favour of local companies like First Phosphate.

“In order to get the IRA subsidies, you need to have a retail price of under US$55,000 on passenger vehicles and one way to get there is with an LFP battery.

“The practical considerations around the LFP battery are cost, certainly the fire safety, and even though it has shorter range you can generally charge it at any point in its battery cycle due to the lack of memory issues.”

For now, though, fresh from an C$8.2 million financing, Passalacqua says the immediate priority is to further uncover the deposit at Bégin-Lamarche.

“We have to decide on a potential mine site, start feasibility studies, and take the purified phosphoric acid Prayon prepares for us and send it to potential clients for possible offtakes and partnerships,” he says.

“We also need to start planning for a purified phosphoric acid plant at the Port of Saguenay.”

Passalacqua says First Phosphate is sitting on perhaps one of the purest phosphate rock qualities in the world, and in one of the best jurisdictions in the world for mining and electrification.

“We want to have the ability to produce much of the phosphoric acid that is going to be needed in North America for the LFP battery in a clean, ethical, just-in-time fashion. We are 100% dedicated to that,” the CEO says.

“We’re well-managed, we’re wellcapitalized and we’re fully North American so that opens all the doors to great working relationships with North American companies and North American governments.”

Stephen Gunnion is a financial journalist and news anchor, with more than 25 years' experience in television, radio and print media. He has anchored on a number of television channels, including South Africa's Business Day TV, CNBC Africa and the South African Broadcasting Corporation, where he was the economics editor. He has worked for Daily Maverick, Bloomberg, Business Day newspaper and Investors' Chronicle.

Emily Jarvie began her career as a political journalist in Australia. After she relocated to Canada, she worked as a psychedelics journalist, reporting on business, legal and scientific developments before joining Proactive in 2022. Emily has worked as a reporter in Australia, Europe and Canada.

Nevada Lithium Resources

Demand for North American lithium puts this sizable project into the spotlight

By Andrew KesselSome 200 kilometres from Las Vegas sits Sarcobatus Flat.

It is a massive dry lakebed, similar to its nearby neighbour Area 51, the birthplace of generations of advanced U.S. aircraft and, according to some, home to who knows what else.

Sarcobatus Flat is part of the Nevada desert and you can see it for miles due to an eye-catching surface that looks like a dusting of snow. Underneath that white blanket of salts lies what Mining Intelligence ranks as the third-largest lithium clay and hard rock project in the world, Bonnie Claire.

This is the project proudly held by Nevada Lithium Resources (CSE:NVLH). The company has 18,300 acres of land at Bonnie Claire and has completed a Preliminary Economic Assessment (PEA). By the numbers, the project contains 18.37 million tonnes of Inferred lithium carbonate equivalent.

That’s all the more notable when one considers that the global lithium market is projected to hit sales of US$15.45 billion by 2028, according to data from Research and Markets.

Canadian Securities Exchange Magazine sat down with Chief Executive Officer Stephen Rentschler to discuss what’s coming next at Bonnie Claire and the future of lithium as a commodity.

Stephen Rentschler Chief Executive Officer

Stephen Rentschler Chief Executive Officer

Company

Nevada Lithium Resources

CSE Symbol

NVLH

Listing date

September 29, 2021

Website nevadalithium.com

Let's begin with an overview of Bonnie Claire. When you engage with new investors during presentations, how do you articulate what Bonnie Claire entails?

Bonnie Claire is an advanced lithium exploration project located in Nevada, two and a half hours northwest of Las Vegas. Our project gate is 50 metres from Interstate 95 and high voltage power wires traverse the entire length of our property, which is the size of Manhattan Island.

We've finished a PEA and have a robust project of substantial scale, projecting an annual output exceeding 30,000 tonnes over a mine life of 40 years. Even at conservative lithium prices, the PEA suggests a project with a net present value exceeding US$1.5 billion.

And while we have more than enough resource already, the prospect of discovering additional resources remains a distinct possibility.

I also tell investors that although Bonnie Claire is often referred to as a clay deposit, a nuanced understanding is required because sedimentary deposits are relatively new to the scene. The world has simply never needed the lithium they contain. South American salars (salt flats), and then the hard rock

deposits, had been forecasted to provide the needed lithium supply.

But now, with the world significantly increasing the projected number of electric vehicles (EVs) on the roads, a third category has entered the scene: the sedimentary deposits, often referred to as clays, which in the U.S. are predominantly found in Nevada. These sedimentary deposits tend to be of lower grade compared to many hard rocks, and even some brines. However, in Nevada, the size is the key. Lower grade is compensated for by vast tonnages.

Typically, I finish my presentation by telling investors that in just over two years, Nevada Lithium Resources has gone public on the CSE, acquired progressively larger percentages of this world-class project, and last summer consolidated 100% ownership of the property. Now, we are in the initial stages of introducing ourselves to the investing public, leveraging our new full ownership status.

Is the next step in this process a Preliminary Feasibility Study?

Yes, and ideally our Preliminary Feasibility Study (PFS) should be completed around the close of 2024, plus or minus a few months.

Following the PFS, we envision launching immediately into a Feasibility Study that we think will take two years to complete. Unlike the output of many of the lithium projects being developed globally, Bonnie Claire’s lithium will not need to go somewhere else for conversion into battery-grade material. Our lithium will be ready for immediate use, ideally in one of the many U.S. or Canadian battery plants that are currently being developed. This will allow end users of Bonnie Claire’s lithium to extract maximum value from the tax credits offered by the U.S. Inflation Reduction Act.

It's interesting to see different methods for exploring for lithium within the sector. How would you characterize your process and how does execution and cost differ when pursuing lithium at your project as compared to other approaches?

liberate the lithium. This is an important part of our ESG (environmental, social and governance) profile that we think differentiates us from our peers and makes our lithium particularly attractive to lithium end users.

Looking ahead, how do you position the company to emerge as a key player in the lithium space?

I am convinced that there is a secular supply-demand mismatch due to the global commitment to an EV future. Given the tremendous economic and geopolitical advantages of our Nevada location, we want to build a world-scale lithium mine, producing battery-grade lithium headed for the U.S. auto market. And we want to do that as quickly as possible.

“

We've finished a PEA and have a robust project of substantial scale, projecting an annual output exceeding 30,000 tonnes over a mine life of 40 years.

— Rentschler

Because of the expansive nature of the sedimentary deposits, a considerable amount of drilling is needed to adequately define the resource. In the case of Bonnie Claire, which has a massive footprint, the drilling is laterally expansive, already covering multiple kilometres. And because of the tremendous columns of lithium we’ve encountered, the drilling is very deep. Our latest assay results have shown even higher grades over almost an additional 200 metres below our deepest holes. So, for us, making sure we are not missing the best mineralization will cost additional money. This is not a small pegmatite field that we are drilling out.

Another difference with our process goes back to the distinction between sedimentary and clay-hosted lithium mineralization. In simple terms, our recovery flow sheet is significantly different than most of the other Nevada-based projects because our localized geology is different. Our lithium is not bound in the clays, so we avoid the use of sulphuric or hydrochloric acid to

Part of our strategy is to use our management team’s collective experience to proactively mitigate the effects of obstacles that will always emerge during the development of a natural resource asset. At the same time, we are working to achieve important technical milestones as early as possible. An example of this is having already proved our ability to produce battery-grade lithium carbonate, which we believe differentiates us from many other lithium developers.

In my opinion, Nevada will emerge as the centrepiece of the future U.S. lithium supply chain, and our intent is to leverage Nevada’s location, history and culture. Nevada is perennially ranked as one of the very top mining jurisdictions in the world, with a rich history of gold, silver and copper production. A recent trip to Canada by Joseph Lombardo, Governor of Nevada, showcased his intent to extract maximum value from the lithium industry for his state. Concurrently, Nevada Lithium intends to extract part of that value for its shareholders through the responsible development of Bonnie Claire.

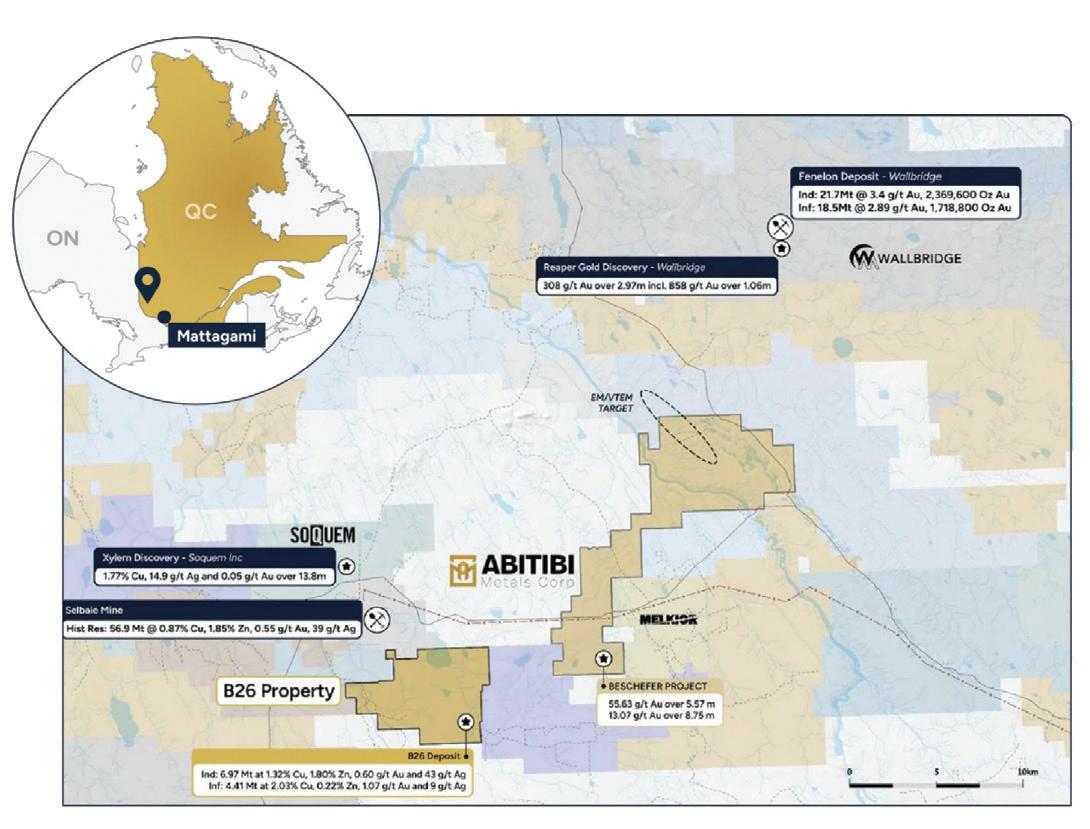

Abitibi Metals

Quiet market an opportunity rather than a hurdle for this Québec-focused explorer

By Emily JarvieAmid a challenging environment for junior miners, Abitibi Metals (CSE:AMQ) took an aggressive approach to acquisitions and financing in the fourth quarter of 2023 to put itself in a strong position for when resource stocks bounce back.

Notably, the company capitalized on the Canadian financing calendar, successfully securing over $14 million through a combination of charity flow-through and common shares in December.

Canadian Securities Exchange Magazine caught up with Jon Deluce, Abitibi Metals’ Founder and Chief Executive Officer, to talk about the company’s recent acquisition of the B26 polymetallic copper deposit and plans to put some of its newly raised capital to work on 30,000 metres of drilling.

Abitibi Metals is focused on the Abitibi Greenstone Belt in Québec. What opportunities does the company see in this region?

We see Québec as the best mining jurisdiction in Canada. The government support, positive relationships with First Nations groups, and the pro-mining sentiment

create a strong foundation for mining activities in the province.

We’re excited about the opportunity to be in Québec because we’re on the verge of a commodity cycle that’s starting to turn and accelerate. Having a copper-focused project like B26 in a strong jurisdiction like Québec significantly enhances the value and prospects for developing such an asset.

It was November of last year when you acquired the option to earn 80% of the B26 project. What does this mean for the company?

We had made the tough decision to reduce operations, and in turn cash burn, because we weren’t getting rewarded for our gold asset in what has been a very challenging market for the last one to two years in the junior mining sector. Our team decided not to wait for market conditions to come to us but to be aggressive and realize the opportunities that were at hand.

We looked at quite a few potential acquisitions to restart the pursuit of our exploration goals and provide a lower cost of capital. In the end, we landed on

the B26 deposit, an asset developed by SOQUEM, a private company funded by Investissement Québec. We view this as both a discovery and an acquisition given the fact that the majority of the market didn’t realize this was available because it was sitting in a private company.

We’re starting with a significant resource (Indicated resource of 7.0 million tonnes at 2.94% copper equivalent and Inferred resource of 4.4 million tonnes at 2.97% copper equivalent). This is a polymetallic deposit with a copper-gold stringer zone and parallel zinc-silver massive sulphide zone. These types of assets are rare, especially a polymetallic deposit with gold in the system. We believe this presents a strong starting resource with room for expansion.

Our plan for the year includes an ambitious drilling program of 30,000 metres to further develop and highlight the growth and upside potential of this asset, which is situated within 7 kilometres of our prior flagship asset, the Beschefer Gold Project.

We also benefit from mining infrastructure still being in place, such as a power line that runs 3 kilometres north of the project. These are all factors that support this being a serious potential development opportunity.

What are some of the key targets you’ll be drilling as part of this year’s program?

We’re starting exploration right away and asking ourselves, ‘Where’s the low-hanging fruit?’ and ‘Where can we develop value for shareholders cost-effectively?’

The 2018 resource was almost solely an underground resource. We see the potential and we want to test the open pit bulk tonnage potential of the asset so that’s going to be a priority in the first quarter of 2024.

To break down the drilling plan: number one is testing the open pit with shallow drilling testing the north bedrock interface of the deposit; number two is testing the extension and expansion potential within the first 300 metres vertical, which hosts the majority of the copper-gold resource; and number three is testing the system at depth. There’s a

large infill area that needs to be drilled to define the full resource potential between 300 metres and 850 metres vertical.

There’s also about 5,000 metres of historical drilling that we believe needs to be assayed, that wasn’t previously, and it could help us assess the potential disseminated and bulk tonnage material around this high-grade core.

What else can investors expect from Abitibi Metals in 2024?

Beyond drilling activities, our plans include conducting a comprehensive gravity survey at B26, aimed at enhancing our understanding of the deposit's overall structure. We will also delve into downhole geophysics, adding another layer to our understanding of the structure.

In addition, an internal resource and updated 3D model will provide us with a strong exploration and growth framework. We aim to present our plans coherently to the market, ensuring that stakeholders can readily comprehend our results and grasp the growth potential.

In essence, our focus spans across drilling, modelling and geophysics, all converging to shape a compelling and comprehensible value proposition for the exciting year ahead.

Abitibi Metals recently raised just under $15 million. Tell us about those fundraising rounds.

The company was certainly a standout in the fourth quarter in what was still a very challenging market. We were able to complete a $4.4 million financing in December, immediately followed by a $10 million charity flow-through. And these financings were completed without issuing any warrants, which is a rare thing in this market and speaks to investor optimism about what we’ve put together.

So, our exploration budget for 2024 is $10 million, which will cover the objectives I have just outlined. In terms of our B26 option agreement, we are funded to clear phase one of the option, which we have four years to complete, in one year.

Jon

Deluce Founder and

Company Abitibi

names in the space and the start of what I think is a great shareholder registry.

We’re also assembling the right team. Recently announced were the first two team members of our advisory committee, namely Eric Kallio, a former senior vice president of exploration at both Agnico Eagle and Kirkland Lake Gold, and Shane Williams, formerly a vice president at Eldorado Gold and he oversaw a landmark Québec project from pre-development agreement through to commercial production.

My thesis going into the acquisition of B26 was that we needed to find a potentially world-class asset to assemble a world-class team, and we’re at the start of that.

What is your outlook on the junior mining sector more broadly in 2024?

I see the sector performing incredibly well in 2024. Timing is a hard thing to dictate – I wish I had a crystal ball – but all the factors are there: easing inflationary

“ Our focus spans across drilling, modelling and geophysics, all converging to shape a compelling and comprehensible value proposition for the exciting year ahead.

Deluce

pressures, the Fed pivoting on interest rate policy, and supply-demand imbalances for critical minerals like copper. Look what happened in other sectors when the supply-demand balance tipped, like it did with nickel a few years ago and what’s going on with uranium at the moment. It’s going to be very exciting.

We’re in a waiting period. But we didn’t want to wait for the market to come to us, so we were very aggressive in the fourth quarter with financing and acquisitions to be well-positioned for the market we believe is coming.

Emily Jarvie began her career as a political journalist in Australia. After she relocated to Canada, she worked as a psychedelics journalist, reporting on business, legal and scientific developments before joining Proactive in 2022. Emily has worked as a reporter in Australia, Europe and Canada.Vortex Energy

Synergy abounds when you put salt mining, hydrogen storage and ammonia cracking under one roof

By Sean MasonSalt was one of the most valuable commodities in ancient times. In fact, the phrase "worth its salt" is thought to have originated with the ancient Romans, who valued their sodium chloride highly.

Roman soldiers at the time received wages so they could purchase salt to preserve food such as meat and fish, in what was known as a monthly “salarium,” which has evolved into the English word “salary.”

Today, salt has a wide range of commercial and consumer applications, from water treatment, drilling fluids and winter road maintenance to food processing, condiments and preservatives.

Globally, the size of the salt market is projected to grow from US$34.1 billion in 2023 to $48.6 billion by 2030, according to Fortune Business Insights.

Canadian company Vortex Energy (CSE:VRTX) hopes to capture some of those sales through the

“

Where we are located is near one of the largest salt discoveries in eastern North America.

— Sparkes

advancement of its Robinsons River Salt Project located in Newfoundland and Labrador.

In doing so, it would help to reduce the 7-10 million tonne per year road salt shortfall that leads Canada and the U.S. to turn to the import market to top up their supplies, according to Mining.com.

"Where we are located is near one of the largest salt discoveries in eastern North America," Vortex Energy Chief Executive Officer Paul Sparkes tells Canadian Securities Exchange Magazine.

"We are also next to a large, proposed hydrogen project called World Energy, which will require storage not only for hydrogen but also for green energy."

Sparkes, an accomplished business leader and entrepreneur, is a former

director of operations under Canadian Prime Minister Jean Chrétien and has also served as a senior aide to two premiers of Newfoundland and Labrador.

Vortex Energy boasts an experienced and distinguished management and advisory team as well, which includes famed Yukon gold prospector Shawn Ryan, and George Furey, who served as speaker of the Senate of Canada from 2015 to 2023.

Robinsons River, which is comprised of 942 claims covering 23,500 hectares, contains two large-scale salt structures that were identified through geophysical and seismic exploration. The maximum thickness of the salt strata is estimated to be 1,700-1,800 metres in both structures.

As salt is extracted from the ground it leaves behind caverns or domes, which are ideal locations for storing

hydrogen, an increasingly popular clean fuel option.

Salt caverns feature some significant advantages when it comes to storing hydrogen. First, the caverns allow for safe storage of large quantities of hydrogen under pressure with minimal environmental disturbance at the surface. As well, they enable flexibility regarding injection and withdrawal cycles.

Vortex began drilling the Robinsons River project in November of last year, with the first occurrence of salt rock occurring at a depth of 581.5 metres at the Western Salt Structure, which has the potential to house an estimated amount of 250,000 tonnes of hydrogen in more than 25 caverns.

The company notes that based on available geological information, the East and West Salt Structures have

a conservatively estimated potential combined hydrogen storage capacity of up to 800,000 tonnes within more than 60 caverns.

Vortex Energy says its Robinsons River salt dome project could be as much as 127% larger in terms of hydrogen storage potential than the Fischell Salt Dome owned by privately held Triple Point Resources.

In addition, Robinsons River’s location in Newfoundland and Labrador positions the project as a potentially viable alternative for supplying the U.S. East Coast with hydrogen, due to ready port access and distance to U.S. customers.

European markets are a distinct possibility as well, particularly in light of the agreement Canadian Prime Minister Justin Trudeau signed with German Chancellor Olaf Scholz in August 2022 envisioning a hydrogen alliance between their two countries.

Good access to power and roads underpins favourable logistics for moving product from site to port.

Vortex also holds the licence and right to use ammonia cracking reactor technology and membrane separator technology for producing hydrogen from ammonia. According to Vortex, the technology causes the ammonia molecule to be “broken apart” in a process that creates inert nitrogen, which can be safely released into the atmosphere, and pure hydrogen, which is suitable for use as fuel.

Sparkes notes, though, that the technology is still in the “early stages,” reasserting that the company’s main focus is the salt resource and cavern storage opportunity.

But with a variety of end uses that include automobiles and maritime vessels, it is an important aspect of the company’s overall strategy and worth keeping an eye on as things progress. Once all R&D work is complete, plans call for building a commercial prototype facility to produce high-purity hydrogen at a customer site to validate the system’s operating performance in a commercial setting.

Looking ahead, Vortex Energy recently raised C$1 million in flow-through funds and $1.5 million of hard dollars in an equity private placement, which the company will use to advance its Robinsons River project.

"Our first drill hole was completed before the Christmas holidays in late 2023, in which salt was hit in the first hole," Sparkes says.

He added that the company has begun drilling its second hole, upon completion of which core from the two drill holes will be sent to the laboratory for analysis.

The drilling of the second hole is designed to confirm the depth of the salt rock structures at the project as well as to assess the geological properties of the salt and non-salt rocks.

Listed only since late December of 2022, Vortex Energy has assembled an impressively diverse team and proven its ability to raise capital and move expeditiously forward with project modeling and exploratory drilling. With completion of its second hole on the horizon, 2024 is shaping up to be an important year for the company as it enters a new phase of its multi-faceted growth strategy.

Paul Sparkes Chief Executive Officer Company

Paul Sparkes Chief Executive Officer Company

Listing date

December 28, 2022

Website vortexenergycorp.com

EMP Metals

A top-tier lithium project in Saskatchewan is just the start of this young company’s ambitions

By Peter MurrayThe need to enhance the reliability of supply chains for everything from parts for manufacturing to critical minerals is finally garnering the attention it deserves, and there is no better way to ensure this reliability than having all the stops along the way situated right in your own backyard.

While resource extraction has long been a forte of Canadian industry, an increasing number of companies are also now working to set up advanced domestic processing capacity, rather than simply shipping raw material overseas where other nations end up controlling the resource and keeping much of the value for themselves.

EMP Metals (CSE:EMPS) plans to be part of the solution for battery materials in North America, having recently released a Preliminary Economic Assessment (PEA) evidencing a robust lithium project in mining-friendly Saskatchewan. And while there is plenty of its acreage still to be explored, the company is moving quickly to determine the best path to processing the lithium in its brines all the way up to the grade needed to make the batteries for electric vehicles.

EMP Chief Executive Officer Rob Gamley sat down recently with Canadian Securities Exchange Magazine to discuss

accomplishments to date and the nearterm outlook for getting his company’s contribution to the supply chain up and running.

EMP Metals has not only identified an attractive lithium brine deposit but you are also intending to work with partners on processing the brine once you take it out of the ground. Walk us through the business plan at a high level.

Our main focus is being the first group to have a commercial Direct Lithium Extraction (DLE) facility up and running in Saskatchewan. We’ve taken a pragmatic approach by building an Inferred resource on our landholdings, which are also in the province, and followed that up recently with the release of a Preliminary Economic Assessment.

The next step is a four-month field pilot with Koch Technology Solutions to test 1,000 litres of feed brine from our project area. Downstream partner Saltworks Technologies will be a part of this test as well.

At the same time, we are doing a frontend engineering study, also with Saltworks, over a six-month period. All of these activities are designed to help us assess the

technical aspects of our projects on an industrial scale.

Talk to us about your landholdings and what you’ve found so far. We hear the existence of wellbores from historic oil drilling helps to keep capital costs under control.

There were some government datapoints that enabled us to vector in on the specific locations we chose and, obviously, there were certain things we were excited to see from a geological perspective. This is a large regional aquifer and the geology is relatively simple.

Our initial plan was to enter existing wellbores to test them and thereby reduce our capital spending requirements, and we were successful with that. We also drilled new wells where there were not enough suitable existing ones to re-enter and test.

As for the basics of the projects, we have holdings in southeastern Saskatchewan totaling approximately 200,000 acres. These are predominantly crown mineral dispositions and separated into three key project areas, with the highlight so far being the Viewfield portion.

We’ve tested what to our knowledge are the highest lithium brine concentrations proven so far in Canada, with concentrations up to 259 milligrams per litre. Our Inferred resource on the

Viewfield project is 747,526 tonnes of lithium carbonate equivalent (LCE), and at Mansur the Inferred resource is 399,364 tonnes of LCE.

What about processing the brines once they are out of the ground?

The plan is for brines to be processed and the lithium extracted through DLE technology from one of our partners. It would then be concentrated, refined and converted by the downstream service provider I mentioned earlier, Saltworks.

Like our company, Saltworks is based in Western Canada, so you have a world-class Canadian resource and a top-tier Canadian technology company teaming up on this. Saltworks is a global leader in wastewater treatment and lithium refining solutions and is able to take extracted lithium and refine it to the standard of battery-grade lithium carbonate. In our case, we were able to produce carbonate at 99.95% purity. That’s the triple nines that you’re looking for in order to have true battery-grade lithium.

I think with the trends we currently see of deglobalization, onshoring, bolstering supply chains, and with the Canadian and Saskatchewan governments supportive of these developments, what we are working on is timely and important. You can’t necessarily

rely on other sources in today’s world. With what we are advancing, it should be easier to assess the risk.

On that note, Saskatchewan is known as a particularly good jurisdiction for resource companies. Tell us about your experience.

Our experience in Saskatchewan has been nothing short of fantastic. The provincial government is highly supportive as it looks to further diversify its mining and energy sectors. We’ve received a lot of public support for our project as well. There are so many advantages. Not just the extensive infrastructure owing to years of oil and gas activity that means access to power and other project requirements, but also Saskatchewan being ranked third in the world, and first in Canada, for mining investment attractiveness by the Fraser Institute. There is no better place to be for this business in our opinion.

You came out with your PEA just after the start of the year. Walk us through the numbers.

We are very pleased with the Preliminary Economic Assessment. It shows that we have a large project which compares well vis-à-vis our peers.

I think it’s important to highlight that the numbers in the PEA represent only 14% of our overall landholdings.

Rob Gamley Chief Executive Officer Company

Rob Gamley Chief Executive Officer Company

EMP Metals

CSE Symbol

EMPS

Listing date

February 27, 2020

Website empmetals.com

The project life is 23.2 years, producing 282,090 tonnes of battery-grade lithium carbonate. Using an average selling price of US$20,000 per tonne of LCE, our after-tax Net Present Value (NPV) at an 8% discount rate is US$1.066 billion. The after-tax internal rate of return (IRR) is 45% and our payback period is 2.4 years at the after-tax number.

Reflected in that last point is that our operating expenditure (OPEX) estimate is one of the lowest in North America thanks to the concentration and quality of the brine.

In the third quarter of 2023, EMP announced an investment of just over C$9.7 million from a private equity group in the U.K., which is quite an accomplishment in this challenging market. We know you are in frequent touch with shareholders. Is there any feedback from the investment community you can share with us on the project or sector in general?

Obviously, the lithium price has not held up as well as the industry had hoped. But there is certainly a belief that the long-term outlook is robust, with EV sales globally up 30% last year. So, we see the electrification of the economy and green trends continuing.

Regarding the investment community, the mining-focused U.K. investor you mentioned conducted a lot of due diligence on our project and it held up fine, resulting in them taking an equity stake in EMP of almost 20% – it’s a huge endorsement of our company. Further, we clearly have caught the attention of major oil and gas players and strategics. They see our company as a good place to deploy capital owing to our asset quality and the regulatory environment in Canada.

Again, we’ve got a great reservoir with the highest concentrations we know of in Canada to date, low OPEX and an attractive IRR. And I can’t overstate how important it is to be working in a jurisdiction such as Saskatchewan where things are significantly

“

With the trends we currently see of deglobalization, onshoring, bolstering supply chains, and with the Canadian and Saskatchewan governments supportive of these developments, what we are working on is timely and important.

Gamley

de-risked from a permitting perspective and support from the government and public.

Is there anything we have missed?

I would say that EMP really differentiates itself with a pragmatic, economics-driven approach. We have done a significant amount of work to de-risk the project over the last 12 months, and our top-tier technical team enables us to advance things quite quickly. I would reiterate that our brine is of particularly high quality with no oil or hydrogen sulphides, and that translates into cost savings because little to no pre-treatment is required.

From a geological standpoint, we are in the Duperow formation, which is significantly shallower than the Leduc formation in Alberta, and this is another factor helping to keep costs under control. Add in our commitment to working with the best DLE companies and downstream refiners in the business and I believe things are lining up for us to make big strides in the months and years ahead.

Peter Murray oversees a national editorial and broadcasting team as President of Proactive Canada. He spent several years managing the English news desk at Nikkei’s head office in Tokyo and has worked with research teams at Asian and European investment banks. Peter is based in Vancouver.

SPOTLIGHT ON Anil Mall

The CSE’s Director of Listed Company Services shares his experiences in the capital markets and insights for CEOs

By Libby Shabada

You have an interesting background on how you got to the CSE. Can you share a little bit about your journey and your current role at the Exchange?

I started my learning process in the mining industry back in 2005, but since 2010 I have been deeply involved in the capital markets, with roles at Manex Resource Group, Cambridge House International, and Stockpools, before joining the CSE in 2017.

In my current role as the CSE’s Director of Listed Company Services, I regularly communicate with and support our listed issuer community, as well as the third-party service providers.

Even though I am stationed in Vancouver, an exciting part of my role also involves travelling to conferences and industry events to represent the Exchange and support our listed companies.

What’s your experience been like in the capital markets community, particularly in the mining space?

My experience interacting with the ecosystem of the capital markets has been very positive since the beginning. When I first started, it was a bit nerveracking because I didn’t have the contacts, but as I attended events and made connections, I realized that most people are willing to help as long as you ask questions and are genuine in fostering relationships.

From your experience on the investor relations side and as a frequent host of CSE TV interviews, what insights do you have for CEOs to consider in 2024?

Communicating with investors is more accessible now than ever before. While there are various methods of getting your company’s messaging across to a wide spectrum of investors, I have always been a believer that a good mining story includes information on “people, property, and price.”

From my time hosting CSE TV, I’ve learned a lot from the conversations I’ve had with company executives. One

important tip for new company leaders is to reach out to fellow CEOs. They have all started in a position where they're learning, so it might surprise people to know that they are actually very willing to help guide you in the right direction and share their story with you.

In terms of presenting, make sure to be yourself – the audience will catch if you’re inauthentic – and don’t oversell, as that will make your audience less receptive to your story.

Let’s talk about PDAC. Do you have any tips for companies on how to successfully navigate big conferences like this one?

PDAC is a big event – the days and nights are long, but you shouldn’t lose focus on the task at hand: connecting with investors and contacts who are in town for the show. With thousands of attendees from all over the world, be ready to be personable and have your pitch polished.

Following the show is when the real work begins as you follow up with the connections. Just be sure to try to do that right away, even if it’s just a brief nudge on LinkedIn and an email to say thanks for connecting.

What are you most excited about in 2024 in the mining sector and beyond?

Firstly, I’m excited about the young demographic of investors who are now getting into the capital markets and fostering relationships with them.

Secondly, with the global focus on energy decarbonization, there is increasing attention being paid to metals and renewed interest in seeing quality projects come to market. Canada has a lot of the resources, talent and jurisdictions that can put us in the spotlight as a region and a good steward of sustainable mining practices.

To end, I want to thank everyone over the years who helped me and provided guidance. You are appreciated!

THE WORLD’S PREMIER MINERAL EXPLORATION & MINING CONVENTION

Do you want to build a better world?

Marketing can make it happen.

Together, let’s create content to make the world better. Get in touch with us here: sparxpg.com